Don't wanna be here? Send us removal request.

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on https://www.undervaluedstocks.info/central-bank-monitor-9112017/

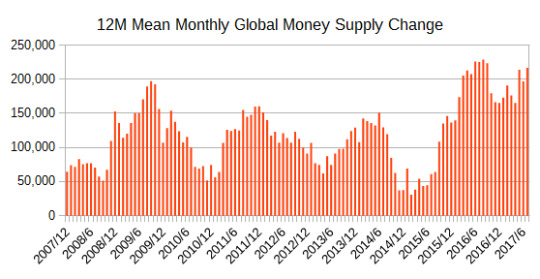

Central Bank monitor as of 9/11/2017

Each month, we track the monetary base for the world’s major central banks. Changes in the monetary base may have an effect on the prices of financial assets such as stocks and bonds.

Notwithstanding a modest retrenchment in October and November (2016), the central banks we cover continue to create money at an astonishing rate. We think the most profligate money printers are Europe and China.

Here is the data through the end of the last month:

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/what-we-are-reading-on-9122017/

What we are reading on 9/12/2017

Here’s what we are reading today. We do not necessarily agree with the opinions expressed therein and we disavow any actual or implied investment advice therein. In no particular order: Book Review: Big Money Thinks Small The Implications Of Low Implied Correlations How To Start A Blog In The Most Cluttered Marketplace In History Med School Grads Go To Work For Hedge Funds What is Escheatment? The College That Produces Founders At 3 Times The Rate Of Stanford This Is Why Wework Thinks Its Worth 20 Billion Gridiron Grit Hedge funds trading Irma John Boyd Yet Again by Howard Marks Americans Are Losing Faith In College Degrees Klarman Returns Money? The world is becoming desperate about deflation Catalonia’s Independence Showdown Nears, Investors Fret Finally the Contrarian Warning from Small Investors ‘Contango Killer’ ETFs Planned Research Affiliates: Time Diversification Redux Behind the Potemkin Village Are You Sabotaging Your Portfolio?

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/ar-reading-952017/

What we ar reading on 9/5/2017

Here’s what we are reading today. We do not necessarily agree with the opinions expressed therein and we disavow any actual or implied investment advice therein. In no particular order: Where Money Goes to Die Competition and Cooperation in Mutual Fund Families Global Equities Profit Margin Trends Why Don’t Fund Investors Sell Winners And Hold Losers Reasons Not To Own The Market Portfolio The Most Dangerous Trap For Stock Pickers The Purpose Imperative Sell disciplines for value investors The coding bootcamp shakeout… The Great Equity For Debt Swap Valuations and mean reversion Why We Should Really Stop Trying To Contact Aliens Why Fake News Spreads So Fast On Facebook A Simple Way To Be More Assertive Without Being Pushy Be Different Winner Takes All How Solar Panels Got So Cheap Winning The Battle Against Smartphone Addiction How You Walk Could Flag Mental Decline Anti-Inflammatory Drugs May Lower Heart Attack Risk Study Finds Why You Need Be Doing Burpees Work Out Early New Neuroscience Reveals 3 Secrets That Will Make You Emotionally Intelligent The Correlation Structure of Anomaly Strategies The August jobs report smacked of late cycle deceleration What Will Markets Do if Congress Pushes US into Default? Now Capex? Let’s Talk About Shrinkage (Again)

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/inflation-monitor-8302017-2/

Inflation monitor as of 8/30/2017

Inflation has been trending downwards for decades. We think the following factors have created this long-term trend:

an aging population that buys less

wage competition from third-world countries, due to globalization.

With talk of border taxes and rolling back globalization (at least partially), can we assume that the downward inflation trend will continue from here? We don’t know, but we intend to track the numbers. This post reviews a wide range of market-based and statistically derived measures of inflation.

Recent indicators suggest some softening of inflation.

Our takeaway: the annual rate of inflation is probably 1.5%-2.5%.

Backward-Looking Measures

Consumer Price Index (CPI) – changes

The CPI is calculated by the government. More than a few investors view the index with a degree of skepticism.

CPI: +1.77%

Median CPI: +2.08%

Core CPI: +1.71%

PCE deflator: +1.46%

GDP deflator: +1.25%

Sticky CPI: +2.14%

Trimmed Mean PCE: +1.25%

Producer Price Index (PPI) – changes

The PPI is calculated by the government. Some investors regard it with suspicion:

Finished Goods: +2.34%

Wages

Wages are very important because they account for such a large portion of the cost of goods and services.

Average hourly earnings: +2.46%

An increase in average hourly earnings does not translate into an equal amount of inflation. Increases in productivity can offset (entirely or partially) the inflationary effect of higher wages.

Billion Prices Project

The billion prices project estimates the annual rate of inflation by using prices posted by online merchants.

As of the last publicly available data point, BPP estimates the U.S. inflation rate at annualized rate of about +0%.

Purchasing Manager’s Index

The Institute for Supply Management publishes the results of a monthly survey of their members, including a price diffusion index. A diffusion index doesn’t tell us the rate of inflation, but rather what percentage of the survey respondents are seeing prices go up or down.

The survey results suggest no significant inflationary pressures.

Manufacturing Prices: 62.0

Services Prices: 55.7

Forward-Looking Measures

Treasury Inflation Protected Securities

In addition to ordinary bonds, the U.S. Treasury issues inflation-protected securities (TIPS). By comparing the yields, one can infer the inflation forecast of the capital markets.

Ordinarily one should assign high credibility to this type of information. However, caution may be appropriate given extensive central bank manipulation of the credit markets.

Five Year Forecast: +1.56% per annum (5Y Treasury Yield – 5Y TIPS Yield)

Ten Year Forecast: +1.75% per annum (10Y Treasury Yield – 10Y TIPS Yield)

5-Year, 5-Year Forward Inflation Expectation Rate

Inflation expected from 5 years from now to 10 years from now: +1.94%

Michigan Consumer Sentiment

1-Year Expected Rate of Inflation: +2.6

5-Year Expected Rate of Inflation: +2.6

ECRI U.S. Future Inflation Gauge

ECRI -0.1

Trend-based indicators

Crude Oil: Downtrend = deflationary pressure

Copper: Uptrend = inflationary pressure

U.S. Dollar: Downtrend = inflationary pressure

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/inflation-monitor-8302017/

Inflation monitor as of 8/30/2017

Inflation has been trending downwards for decades. We think the following factors have created this long-term trend:

an aging population that buys less

wage competition from third-world countries, due to globalization.

With talk of border taxes and rolling back globalization (at least partially), can we assume that the downward inflation trend will continue from here? We don’t know, but we intend to track the numbers. This post reviews a wide range of market-based and statistically derived measures of inflation.

Recent indicators suggest some softening of inflation.

Our takeaway: the annual rate of inflation is probably 1.5%-2.5%.

Backward-Looking Measures

Consumer Price Index (CPI) – changes

The CPI is calculated by the government. More than a few investors view the index with a degree of skepticism.

CPI: +1.77%

Median CPI: +2.08%

Core CPI: +1.71%

PCE deflator: +1.46%

GDP deflator: +1.25%

Sticky CPI: +2.14%

Trimmed Mean PCE: +1.25%

Producer Price Index (PPI) – changes

The PPI is calculated by the government. Some investors regard it with suspicion:

Finished Goods: +2.34%

Wages

Wages are very important because they account for such a large portion of the cost of goods and services.

Average hourly earnings: +2.53%

An increase in average hourly earnings does not translate into an equal amount of inflation. Increases in productivity can offset (entirely or partially) the inflationary effect of higher wages.

Billion Prices Project

The billion prices project estimates the annual rate of inflation by using prices posted by online merchants.

As of the last publicly available data point, BPP estimates the U.S. inflation rate at annualized rate of about +0%.

Purchasing Manager’s Index

The Institute for Supply Management publishes the results of a monthly survey of their members, including a price diffusion index. A diffusion index doesn’t tell us the rate of inflation, but rather what percentage of the survey respondents are seeing prices go up or down.

The survey results suggest no significant inflationary pressures.

Manufacturing Prices: 62.0

Services Prices: 55.7

Forward-Looking Measures

Treasury Inflation Protected Securities

In addition to ordinary bonds, the U.S. Treasury issues inflation-protected securities (TIPS). By comparing the yields, one can infer the inflation forecast of the capital markets.

Ordinarily one should assign high credibility to this type of information. However, caution may be appropriate given extensive central bank manipulation of the credit markets.

Five Year Forecast: +1.56% per annum (5Y Treasury Yield – 5Y TIPS Yield)

Ten Year Forecast: +1.75% per annum (10Y Treasury Yield – 10Y TIPS Yield)

5-Year, 5-Year Forward Inflation Expectation Rate

Inflation expected from 5 years from now to 10 years from now: +1.94%

Michigan Consumer Sentiment

1-Year Expected Rate of Inflation: +2.6

5-Year Expected Rate of Inflation: +2.6

ECRI U.S. Future Inflation Gauge

ECRI -0.1

Trend-based indicators

Crude Oil: Downtrend = deflationary pressure

Copper: Uptrend = inflationary pressure

U.S. Dollar: Downtrend = inflationary pressure

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/what-we-are-reading-on-8292017/

What we are reading on 8/29/2017

Here’s what we are reading today. We do not necessarily agree with the opinions expressed therein and we disavow any actual or implied investment advice therein. In no particular order: When There Is Blood In The Streets EBITDA, EBITA or EBIT? Asset Allocation In A Low Yield Environment A Half Century Of Macro Momentum Why Housing Has Outperformed Equities Over The Long Run Time to take a social media vacation? High equity valuations and retirement finance. Who Really Owns American Farmland Why The Secret To Your Success Is Who You Marry Using Goals to Motivate College Students: Theory and Evidence from Field Experiments Exercise Has A Cascade Of Positive Effects Study Finds Colleges cut the luxuries A Happy Spouse Can Make You Healthier How Rich Roll Overcame Addiction To Become A World Class Endurance Athlete Building Expertise Beyond The 10,000 Hours 7 Secrets That Will Make You Build Good Habits How To Increase Motivation: 4 Secrets From Research The Definitive Guide To Momentum Investing and Trading Academic Research Insight: Global Equities and Overreaction Bottom-Up Economics Effective Networking It Can All Change In A Day Business-Loan Growth Continues To Slide The Conceit of Central Bankers and the Brief Illusion of Wealth A magic bullet to restore our brain’s plasticity?

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/global-deep-value-letter-20170831/

The Global Deep Value Letter

As of August 31, 2017

Table of Contents

Overview

Current Research

Overview

The Global Deep Value Letter is designed to provide its readers with a workable (i.e., short) list of deeply undervalued stocks. Our concise overview of value investing may be helpful to understand why this strategy may improve investment returns.

To make the best use of our research, read about portfolio construction and trading strategies. New or confused subscribers should read the guide.

If you are a U.S. resident or citizen, you should be aware of certain tax and other considerations. Other investors should obtain qualified tax advice.

Please also review the disclosures and terms of service.

Current Research

We are finding a lot of deep value stocks in Japan. We have set up a page to explain why we think this might work well.

The following stocks are rated BUY:

Country Symbol Company Name BB FT M* Rating VF Japan 1381 Axyz BB FT M* BUY 5.6 Japan 7989 Tachikawa BB FT M* BUY 5.0 Japan 3822 Minori Solutions BB FT M* BUY 3.9 Japan 8249 Techno Associe BB FT M* BUY 3.1 Japan 6013 Takuma BB FT M* BUY 3.5 Japan 7856 Hagihara Industries BB FT M* BUY 3.4 Japan 1808 Haseko BB FT M* BUY 3.9 Japan 7871 Fukuvi Chemical Industry BB FT M* BUY 3.6 Japan 6485 Maezawa Kyuso Industries BB FT M* BUY 2.2 Japan 8057 Uchida Yoko BB FT M* BUY 3.2 United Kingdom SUBC Subsea 7 SA BB FT M* BUY 4.6 Japan 5956 Toso BB FT M* BUY 2.2 Japan 1766 Token BB FT M* BUY 5.5 Japan 8117 Central Automotive Products BB FT M* BUY 4.6 Japan 9414 Nippon BS Broadcasting BB FT M* BUY 3.0 Italy SO Sogefi SpA BB FT M* BUY 7.0 Japan 7260 Fuji Kiko BB FT M* BUY 5.9 United Kingdom FCA Fiat Chrysler Automobiles NV BB FT M* BUY 5.9 Japan 9628 San BB FT M* BUY 4.6 Japan 1973 NEC Networks & System Integrat BB FT M* BUY 3.9 Japan 3847 Pacific Systems BB FT M* BUY 4.1 Japan 2795 Nippon Primex BB FT M* BUY 2.8 Japan 8059 Daiichi Jitsugyo BB FT M* BUY 3.8 Belgium SIP Sipef NV BB FT M* BUY 2.8 Japan 2300 Kyokuto BB FT M* BUY 2.3 Japan 7251 Keihin BB FT M* BUY 3.0

The following stocks are rated HOLD:

Country Symbol Company Name BB FT M* Rating VF Japan 6364 Hokuetsu Industries BB FT M* HOLD 4.8 Japan 1770 Fujita Engineering BB FT M* HOLD 4.0 Japan 4955 Agro-Kanesho BB FT M* HOLD 3.8 Japan 1931 Nippon Dentsu BB FT M* HOLD 4.0 Japan 9934 Inaba Denki Sangyo BB FT M* HOLD 2.5 Japan 7643 Daiichi BB FT M* HOLD 2.8 Japan 1605 Inpex BB FT M* HOLD 3.8 Japan 4624 Isamu Paint BB FT M* HOLD 2.2 Japan 1716 Dai-Ichi Cutter Kogyo KK BB FT M* HOLD 2.8 Japan 4957 Yasuhara Chemical BB FT M* HOLD 3.4 Japan 5909 Corona BB FT M* HOLD 1.9 Japan 3171 Maxvalu Kyushu BB FT M* HOLD 1.0 Japan 4556 Kainos Laboratories BB FT M* HOLD 3.2 Japan 4620 Fujikura Kasei BB FT M* HOLD 1.8 Switzerland GBMN Goldbach Group AG BB FT M* HOLD 2.7 Japan 4027 Tayca BB FT M* HOLD 5.2 Japan 7256 Kasai Kogyo BB FT M* HOLD 4.5 Japan 5237 Nozawa BB FT M* HOLD 4.6 Japan 9964 Itec BB FT M* HOLD 4.8 Japan 1949 Sumitomo Densetsu BB FT M* HOLD 4.5 Japan 2121 Mixi BB FT M* HOLD 5.3 Japan 7313 TS Tech BB FT M* HOLD 3.5 Japan 9889 JBCC BB FT M* HOLD 3.5 Japan 9824 Senshu Electric BB FT M* HOLD 3.6 Japan 5161 Nishikawa Rubber BB FT M* HOLD 3.9 Japan 9428 Crops BB FT M* HOLD 3.3 Japan 8066 Mitani BB FT M* HOLD 3.6 Japan 1896 Obayashi Road BB FT M* HOLD 3.7 Japan 7438 Kondotec BB FT M* HOLD 3.1 Japan 7703 Kawasumi Laboratories BB FT M* HOLD 3.0 Japan 7504 Kohsoku BB FT M* HOLD 2.7 Japan 6379 Shinko Plantech BB FT M* HOLD 3.0 Japan 6496 Nakakita Seisakusho BB FT M* HOLD 2.5 Japan 4685 Ryoyu Systems BB FT M* HOLD 3.9 Japan 6870 Fenwal Controls of Japan BB FT M* HOLD 2.6 Japan 4464 Soft99 BB FT M* HOLD 2.7 Japan 9996 Satoh&Co BB FT M* HOLD 2.5 Japan 6459 Daiwa Industries BB FT M* HOLD 3.5 Japan 2708 Kuze BB FT M* HOLD 3.6 Japan 1898 Seikitokyu Kogyo BB FT M* HOLD 3.3 Japan 8198 Maxvalu Tokai BB FT M* HOLD 1.8 Japan 4671 Falco BB FT M* HOLD 2.0

The following stocks are rated SELL. After this letter, we will not cover them again (unless they merit a new buy rating):.

Country Symbol Company Name BB FT M* Rating VF Japan 5388 Kunimine Industries BB FT M* SELL 4.4 Japan 3953 Ohmura Shigyo BB FT M* SELL 2.7 Japan 3104 Fujibo BB FT M* SELL 2.8 Japan 2196 Escrit BB FT M* SELL 4.2 Japan 7239 Tachi-S BB FT M* SELL 3.8 Japan 3646 Ekitan & BB FT M* SELL 3.7 Japan 9799 Asahi Intelligence Service BB FT M* SELL 1.4 Japan 4295 Faith BB FT M* SELL 2.8 Japan 9036 Tohbu Network BB FT M* SELL 2.7 United States UTHR United Therapeutics BB FT M* SELL 3.5 Japan 5446 Hokuetsu Metal BB FT M* SELL 1.8 United States IDCC InterDigital BB FT M* SELL 3.4 Japan 1720 Tokyu Construction BB FT M* SELL 2.4 Japan 1881 Nippo BB FT M* SELL 2.3

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

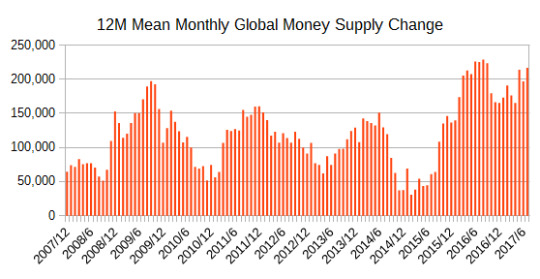

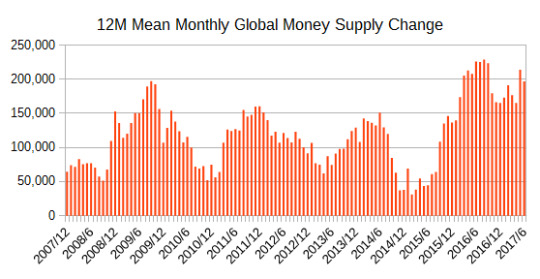

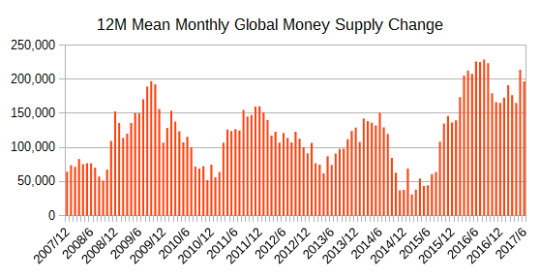

New Post has been published on http://www.undervaluedstocks.info/central-bank-monitor-august-2017/

Central bank monitor as of August, 2017

Each month, we track the monetary base for the world’s major central banks. Changes in the monetary base may have an effect on the prices of financial assets such as stocks and bonds.

Notwithstanding a modest retrenchment in October and November (2016), the central banks we cover continue to create money at an astonishing rate. We think the most profligate money printers are Europe and China.

Here is the data through the end of the last month:

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/what-we-are-reading-on-8222017/

What we are reading on 8/22/2017

Here’s what we are reading today. We do not necessarily agree with the opinions expressed therein and we disavow any actual or implied investment advice therein. In no particular order: The “advice-only” financial advisory model Self improvement ideas A replacement to cremation Youth sports and concussions Why college grads don’t know how to write The Next Quant Meltdown How Driscolls Reinvented The Strawberry The Electric Bike Conundrum The falling wage of the equity researcher Pension padding with overtime Will US debt spike in October? What Ford’s New Guy Said about the Future of Self-Driving Cars Single Country ETFs Superior To Regions Imaginary growth assumptions and the steep adjustment ahead How Filter Bubbles Distort Reality: Everything You Need to Know Attrition Warfare: When Even Winners Lose Seven Sell Side Shortcuts

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/what-we-are-reading-on-8162017/

What we are reading on 8/16/2017

Here’s what we are reading today. We do not necessarily agree with the opinions expressed therein and we disavow any actual or implied investment advice therein. In no particular order: Institutions are interested in BDCs Credit Spreads Tell Bullish Story Why Early Retirement Isn’t As Awesome As It Sounds The Biggest Mental Shift After Retiring Early The Quant Quake 10 Years On The Ambivert This One Ritual Made Me Much Happier Meditation has been mainstreamed About the recent volatility spike About ETF valuation ratios The Federal Reserve’s Portfolio and its Effect on Interest Rates Trend Following Research Stocks Are Pricey Lets Buy More Leveraged Loan issuers have been extending maturities Why Cryptocurrencies Will Never Be Safe Havens Can Bond Portfolios Be Factorized? Diversification Benefits of Time Series Momentum What’s Happening? What the Heck’s Going On with Vintage Automobiles? Consumer credit delinquencies are rising Secular Supertrends – BIS says 30-year cycle set to reverse Broadening internal dispersion

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/what-we-are-reading-on-882017/

What we are reading on 8/8/2017

Here’s what we are reading today. We do not necessarily agree with the opinions expressed therein and we disavow any actual or implied investment advice therein. In no particular order: Why is the Stock Market So High? The ABC’S of Bitcoin and Everything You Need To Know About “Forks” Why 5G Will Transform Much More Than Telecommunications Can humans beat software? What happens when a company reaches 25 employees? Should Silicon Valley hire from outside? Are Investors Running Out Of Cash Imagining The Next Bear Market Ignore financial noise Okay You Can Start Worrying About Robots Now The Benefits Of Saying Nice Things About Your Colleagues A Smart Beta For Sustainable Growth James Montier Is Still Bearish Academic Research Insight: Diagonal Models versus 1/N Diversification Counting Boxes Bubble Risk When The Bubble Doesn’t Burst Parsing The Finer Points Of Why Trend Following Endures Shiller throwing in the towel? Gundlach Is Quietly Heading For The Exit: “Volatility Is About To Go Up” Whiff of Reality at Crazy Super High-End Housing Market? Emerging Market ETFs Defy Consensus Tracking the Amazing Junk Bond Bubbles in the US and Europe Estimating losses at a market extreme Emerging Value And Margin Of Superiority And Why Are Stock Market Prices So High New Research Affiliates forecasts Emerging Markets: What has Changed The Coming Financial Volatility

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on https://www.undervaluedstocks.info/does-past-performance-repeat/

Does past performance repeat

At some point, every investor with at least a little experience owning securities has heard a warning along the lines of, “past performance may not repeat.” Nonetheless, most investors at least consider past results in forming expectations about what might happen in the future. What are the potential analytical pitfalls about which one should be aware when studying the past return statistics?

First, one should consider not just the performance but the volatility of performance. Consider these two investments.

earning a +4% return on average over ten years, with the worst year of the ten being a +3% return; or,

earning a +4% return on average over ten years, with the worst year of the ten being a -40% return?

Both investments have the exact same average historical return; but the second investment achieves the return with much greater volatility than the first. It would be easier to assume that the first will continue to generate the same 4% return in the future because the past returns were so consistent. The same cannot be said of the second.

Next, one should consider the amount of assets invested in the strategy. Rapid asset growth could mean that it may be impossible for the money manager to sustain past performance into the future. Consider three observations:

Most professional investors will agree to manage ever larger sums of money, because of the fees that can be charged.

A sophisticated investor managing $10 million can avail himself of niche opportunities that aren’t worth the time of someone managing $100 billion.

People with money tend to place their funds with investment professionals who have successful track records (as opposed to the opposite).

Taken together, it is easy to imagine the following happening. A professional investor starts a small fund and builds a good track record by investing in niche opportunities that are too small for his biggest competitors. As the public discovers his track record, the professional investor’s funds under management increase dramatically. With so much more money to manage, the professional investor cannot find enough of the niche opportunities to sustain his track record. Performance then slips into mediocrity. In this case, past performance is unlikely to not repeat.

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on https://www.undervaluedstocks.info/investing-and-prediction/

Investing and prediction

To many people, successful investing requires correctly predicting the future. In that light, here are some memorable quotations about the pitfalls of prediction:

Niels Bohr: “Prediction is very difficult, especially about the future.”

Lao Tzu, “Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.”

George Savile, “The best qualification of a prophet is to have a good memory.”

Winston Churchill, “I always avoid prophesying beforehand because it is much better to prophesy after the event has already taken place.”

Mark Twain, “Prophesy is a good line of business, but it is full of risks. ���

Given the great difficulty of predicting the future, it might be worthwhile for investors to minimize the use of predictions in their investment process. What might that look like? In general, it means focusing less on what might happen in the future and focusing more on what is happening right now.

As a practical matter, it could mean for an investor in common stocks:

Focusing on stocks that are undervalued on a current assessment of the intrinsic net worth of the company, rather than on an assessment of the company’s intrinsic value two, three or five years in the future.

Not assigning much credibility to a management team’s vision for the future.

Ignoring either partially or entirely analyst earnings estimates one or two years out in the future.

Assuming that growth rates in the future will converge towards the growth rate of the economy overall.

In short, reducing the amount of forecasting in an investment process designed to build stock portfolios may mean adopting the behavior of a value investor. It is not possible to eliminate all predictions from investing. But where predictions must be made, the prediction-averse value investor should choose adopt a conservative (i.e., either pessimistic or worst-case) view of what might happen.

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on https://www.undervaluedstocks.info/recency-bias/

Recency bias

People often use their past experiences as a guide to developing expectations about what might happen in the future. But people have many past experiences from which to choose. In attempting to understand what might happen in the future, do people select the past experiences that are most relevant? Or do they use some other criteria?

The evidence suggests that when in doubt, people tend to turn to their experiences in the recent past. Psychologists refer to this phenomenon as recency bias.

For example, in evaluating the future prospects of stocks, the average investor will tend to assume that recent performance will continue. Thus, if the stock market recently has been moving up, then the average investor will tend to think that the stock market will continue to move up. If recent experience shows unusual volatility, then the investor will tend to assume that the unusual volatility will continue.

Experienced investors can be influenced by recency bias. Most experienced investors know that future stock returns are shrouded in uncertainty. Such investors may think in terms of a range of outcomes rather than in a simple extrapolation of past results into the future. But even for experienced investors, recency bias can cloud judgment. This bias may cause investors to shift the range of expectations according to recent experience. For example, if stocks have performed well recently, the experienced investor may continue to acknowledge the risk of losing money while adjusting downward his subjective assessment of the likelihood of such losses.

An awareness of recency bias may be beneficial for investors. Recent performance may or may not tell us much about future performance. Knowing this may help the investor avoid becoming overconfident in his expectations about the future, and thus avoid committing too much capital to an investment idea with uncertain prospects.

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/what-we-are-reading-on-7312017/

What we are reading on 7/31/2017

Here’s what we are reading today. We do not necessarily agree with the opinions expressed therein and we disavow any actual or implied investment advice therein. In no particular order: Why sleep patterns change as we age Here come the bugs Sweets affect men’s mental health differently than women’s What Sets College Thrivers and Divers Apart? A Contrast in Study Habits, Attitudes, and Mental Health Chicago’s (and Illinois’) downward spiral… The college bubble may be coming to an end New results on assortative mating by education Robots on the trading desk Investing in the Misunderstood Hot Potatoes and Dutch Tulips How to find stocks on the move using exponential regression Building an Unconstrained Sleeve How Round Number Bias and Psychological Pricing Affect Your Gains and Spending

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/inflation-monitor-7282017/

Inflation monitor as of 7/28/2017

Inflation has been trending downwards for decades. We think the following factors have created this long-term trend:

an aging population that buys less

wage competition from third-world countries, due to globalization.

With talk of border taxes and rolling back globalization (at least partially), can we assume that the downward inflation trend will continue from here? We don’t know, but we intend to track the numbers. This post reviews a wide range of market-based and statistically derived measures of inflation.

Recent indicators suggest some softening of inflation.

Our takeaway: the annual rate of inflation is probably 1.5%-2.5%.

Backward-Looking Measures

Consumer Price Index (CPI) – changes

The CPI is calculated by the government. More than a few investors view the index with a degree of skepticism.

CPI: +1.62%

Median CPI: +2.14%

Core CPI: +1.68%

Sticky CPI: +2.12%

Trimmed Mean PCE: +1.48%

Producer Price Index (PPI) – changes

The PPI is calculated by the government. Some investors regard it with suspicion:

Finished Goods: +2.07%

Wages

Wages are very important because they account for such a large portion of the cost of goods and services.

Average hourly earnings: +2.46%

An increase in average hourly earnings does not translate into an equal amount of inflation. Increases in productivity can offset (entirely or partially) the inflationary effect of higher wages.

Billion Prices Project

The billion prices project estimates the annual rate of inflation by using prices posted by online merchants.

As of the last publicly available data point, BPP estimates the U.S. inflation rate at annualized rate of about +1%.

Purchasing Manager’s Index

The Institute for Supply Management publishes the results of a monthly survey of their members, including a price diffusion index. A diffusion index doesn’t tell us the rate of inflation, but rather what percentage of the survey respondents are seeing prices go up or down.

The survey results suggest no significant inflationary pressures.

Manufacturing Prices: 55.0

Services Prices: 52.1

Forward-Looking Measures

Treasury Inflation Protected Securities

In addition to ordinary bonds, the U.S. Treasury issues inflation-protected securities (TIPS). By comparing the yields, one can infer the inflation forecast of the capital markets.

Ordinarily one should assign high credibility to this type of information. However, caution may be appropriate given extensive central bank manipulation of the credit markets.

Five Year Forecast: +1.68% per annum (5Y Treasury Yield – 5Y TIPS Yield)

Ten Year Forecast: +1.83% per annum (10Y Treasury Yield – 10Y TIPS Yield)

5-Year, 5-Year Forward Inflation Expectation Rate

Inflation expected from 5 years from now to 10 years from now: +1.98%

Michigan Consumer Sentiment

1-Year Expected Rate of Inflation: +2.6

5-Year Expected Rate of Inflation: +2.6

ECRI U.S. Future Inflation Gauge

ECRI +0.3

Trend-based indicators

Crude Oil: Downtrend = deflationary pressure

Copper: Uptrend = inflationary pressure

U.S. Dollar: Downtrend = inflationary pressure

0 notes

Text

New Post has been published on UNDERVALUED STOCKS

New Post has been published on http://www.undervaluedstocks.info/global-deep-value-letter-20170731/

The Global Deep Value Letter

As of July 31, 2017

Table of Contents

Overview

Current Research

Overview

The Global Deep Value Letter is designed to provide its readers with a workable (i.e., short) list of deeply undervalued stocks. Our concise overview of value investing may be helpful to understand why this strategy may improve investment returns.

To make the best use of our research, read about portfolio construction and trading strategies. New or confused subscribers should read the guide.

If you are a U.S. resident or citizen, you should be aware of certain tax and other considerations. Other investors should obtain qualified tax advice.

Please also review the disclosures and terms of service.

Current Research

We are finding a lot of deep value stocks in Japan. We have set up a page to explain why we think this might work well.

The following stocks are rated BUY:

Country Symbol Company Name BB FT M* Rating VF Japan 6364 Hokuetsu Industries BB FT M* BUY 5.2 Japan 7989 Tachikawa BB FT M* BUY 5.2 Japan 1381 Axyz BB FT M* BUY 5.6 Greece KYRM BB FT M* BUY N/A Japan 4955 Agro-Kanesho BB FT M* BUY 4.0 Japan 5388 Kunimine Industries BB FT M* BUY 4.3 Japan 1931 Nippon Dentsu BB FT M* BUY 4.0 United Kingdom SUBC Subsea 7 SA BB FT M* BUY 4.6 Japan 6013 Takuma BB FT M* BUY 3.2 Japan 3104 Fujibo BB FT M* BUY 2.6 Japan 8249 Techno Associe BB FT M* BUY 2.9 Japan 7643 Daiichi BB FT M* BUY 2.8 Japan 1808 Haseko BB FT M* BUY 3.9 Japan 8057 Uchida Yoko BB FT M* BUY 3.1 Japan 4624 Isamu Paint BB FT M* BUY 2.2 Japan 7871 Fukuvi Chemical Industry BB FT M* BUY 1.9 Japan 1716 Dai-Ichi Cutter Kogyo KK BB FT M* BUY 2.5 Japan 3171 Maxvalu Kyushu BB FT M* BUY 1.3 Japan 4556 Kainos Laboratories BB FT M* BUY 3.2 Japan 3822 Minori Solutions BB FT M* BUY 4.1 Japan 1770 Fujita Engineering BB FT M* BUY 3.4 Japan 1605 Inpex BB FT M* BUY 4.3 Russian Federation GAZ Gazprom Neft’ PAO BB FT M* BUY 4.1 Kazakhstan KMG Razvedka Dobycha KazMunayGaz A BB FT M* BUY 3.8 Japan 5956 Toso BB FT M* BUY 2.0 Japan 7856 Hagihara Industries BB FT M* BUY 3.1 Japan 4957 Yasuhara Chemical BB FT M* BUY 3.4 Japan 1881 Nippo BB FT M* BUY 2.3 Japan 6485 Maezawa Kyuso Industries BB FT M* BUY 2.1 Japan 9934 Inaba Denki Sangyo BB FT M* BUY 2.4 Japan 3953 Ohmura Shigyo BB FT M* BUY 2.7 Switzerland GBMN Goldbach Group AG BB FT M* BUY 2.7 Japan 5909 Corona BB FT M* BUY 1.9 Japan 4620 Fujikura Kasei BB FT M* BUY 1.9

The following stocks are rated HOLD:

Country Symbol Company Name BB FT M* Rating VF Japan 4027 Tayca BB FT M* HOLD 5.4 Japan 9964 Itec BB FT M* HOLD 4.6 Japan 6496 Nakakita Seisakusho BB FT M* HOLD 2.5 Japan 8117 Central Automotive Products BB FT M* HOLD 4.6 Japan 2121 Mixi BB FT M* HOLD 5.5 Japan 5237 Nozawa BB FT M* HOLD 4.7 Japan 1766 Token BB FT M* HOLD 5.1 Japan 4685 Ryoyu Systems BB FT M* HOLD 3.9 Japan 7256 Kasai Kogyo BB FT M* HOLD 4.4 Japan 8066 Mitani BB FT M* HOLD 3.4 Japan 6459 Daiwa Industries BB FT M* HOLD 3.5 United States IDCC InterDigital BB FT M* HOLD 4.3 Japan 5161 Nishikawa Rubber BB FT M* HOLD 4.3 Japan 2708 Kuze BB FT M* HOLD 3.7 Japan 1949 Sumitomo Densetsu BB FT M* HOLD 4.0 Japan 2196 Escrit BB FT M* HOLD 4.6 Japan 9824 Senshu Electric BB FT M* HOLD 3.6 Japan 1896 Obayashi Road BB FT M* HOLD 3.7 Japan 9889 JBCC BB FT M* HOLD 2.8 Japan 9996 Satoh&Co BB FT M* HOLD 2.7 Japan 7313 TS Tech BB FT M* HOLD 3.5 Japan 6870 Fenwal Controls of Japan BB FT M* HOLD 2.8 Japan 4464 Soft99 BB FT M* HOLD 2.6 Japan 9414 Nippon BS Broadcasting BB FT M* HOLD 2.6 Japan 7438 Kondotec BB FT M* HOLD 3.1 Japan 7703 Kawasumi Laboratories BB FT M* HOLD 2.7 Japan 6379 Shinko Plantech BB FT M* HOLD 2.8 Japan 7504 Kohsoku BB FT M* HOLD 2.6 Japan 7239 Tachi-S BB FT M* HOLD 3.8 Japan 8198 Maxvalu Tokai BB FT M* HOLD 1.7 United States UTHR United Therapeutics BB FT M* HOLD 3.5 Japan 9428 Crops BB FT M* HOLD 2.8 Japan 4671 Falco BB FT M* HOLD 2.1 Japan 3646 Ekitan & BB FT M* HOLD 3.7 Japan 1898 Seikitokyu Kogyo BB FT M* HOLD 2.8 Japan 9799 Asahi Intelligence Service BB FT M* HOLD 1.4 Japan 4295 Faith BB FT M* HOLD 2.9 Japan 9036 Tohbu Network BB FT M* HOLD 2.7 Japan 5446 Hokuetsu Metal BB FT M* HOLD 1.6 Japan 1720 Tokyu Construction BB FT M* HOLD 2.7

The following stocks are rated SELL. After this letter, we will not cover them again (unless they merit a new buy rating):.

Country Symbol Company Name BB FT M* Rating VF Japan 6928 Enomoto BB FT M* SELL 6.3 Japan 7444 Harima-Kyowa BB FT M* SELL 5.5 Japan 5941 Nakanishi MFG BB FT M* SELL 5.2 Greece MOH Motor Oil Hellas Corinth Refin BB FT M* SELL 5.3 Japan 7435 Nadex BB FT M* SELL 5.4 Japan 4224 Lonseal BB FT M* SELL 4.9 Japan 5184 Nichirin BB FT M* SELL 4.8 Japan 5982 Maruzen BB FT M* SELL 4.4 Japan 1736 Otec BB FT M* SELL 5.2 Japan 7879 Noda BB FT M* SELL 4.7 Japan 5903 Shinpo BB FT M* SELL 4.8 Japan 6791 Nippon Columbia BB FT M* SELL 4.4 Japan 7292 Murakami BB FT M* SELL 4.1 Japan 3892 Okayama Paper Industries BB FT M* SELL 3.2 France GRVO Graines Voltz SA BB FT M* SELL 4.2 Japan 5949 Unipres BB FT M* SELL 4.4 Japan 5900 Daiken BB FT M* SELL 5.7 Japan 1968 Taihei Dengyo Kaisha BB FT M* SELL 4.5 Japan 3954 Showa Paxxs BB FT M* SELL 3.6 Japan 4696 Watabe Wedding BB FT M* SELL 4.6 Japan 1930 Hokuriku Electrical Constructi BB FT M* SELL 3.5 Japan 9408 Broadcasting System of Niigata BB FT M* SELL 2.5 Japan 4246 DaikyoNishikawa BB FT M* SELL 4.1 Greece EYDAP Athens Water and Sewerage SA BB FT M* SELL 2.4

0 notes