Don't wanna be here? Send us removal request.

Text

Current state of the impending housing downturn

You may have noticed some headlines suggesting that real estate prices are experiencing their first year-over-year declines in over a decade.

This is true, to an extent.

Most such assertions are based on the most recently released S&P Case Shiller Home Price Index, with it’s most recent update for the month of April.

Zillow’s more granular breakdown of median price by zip code tells a slightly different story.

Of the 12,753 zip codes that Zillow has been tracking since January 2000, the average YoY growth for the month of April was 1%. For May it’s 0%. Sales price growth has been on a downward trend since May 2022 (15%) to this point.

Regarding the same series of zip codes, average median prices hit a peak in August 2022 of 450k, after which point we started seeing month over month declines in absolute terms. That downward trend in absolute prices reversed itself in April, where we saw the first month-over-month increase in median prices since August last year. That upward trend continued into may.

So, are we in a downturn?

We are certainly at a crucial moment in time whereby the next few months will reveal the answer to that question. While growth has certainly declined to a stall, the fact that month-over-month positive growth has emerged over the past few months suggest we may have already bottomed out. We know that inventory is still persistently low, so the idea that downward price trends can continue for a prolonged period is tenuious. Still, interest rates are at a decades high, tempering demand.

How can one identify a “bottom”

Previous research I’ve done on the housing crisis and recovery suggests that during the great recession, a handful of false bottoms emerged (real estate prices increased month-over-month) only for the downward trend to continue in earnest. It only became apparent that a bottom emerged after 3 consecutive quarters of positive growth.

So have we already seen the bottom? Or, are we in the midst of a double dip downturn, with the worst yet to come?

We will see what the coming months bring us. Stay tuned!

0 notes

Text

Inflation and Real Estate Prices

The Nexus Between Inflation and Home Prices: Unraveling the Complex Interplay

In the intricate web of economic phenomena, the connection between inflation and home prices stands as a compelling subject for scrutiny. Delving into this relationship reveals a dynamic interplay where both variables exert influence on each other. Through a meticulous examination, we can begin to unravel the driving forces behind this nexus.

Acknowledging the Dual Influence: Inflation and Home Prices

The intricate dance between inflation and home prices becomes apparent upon closer analysis. It becomes evident that these two phenomena engage in a mutual tango, with each partner taking turns leading the way.

Supply and Demand Dynamics: A Key Driver

To comprehend the surge in house prices, one must consider the fundamental aspects of supply and demand. Following the great recession, the construction of homes by builders significantly dwindled, leading to a scarcity in supply. Simultaneously, the ever-changing demographics have driven an increased demand for homeownership, exacerbating the situation. This demand surge, coupled with historically low interest rates, has undeniably contributed to the upward trajectory of home prices. Hence, it becomes clear that the surge in prices can be primarily attributed to the dynamics of supply and demand, without necessarily relying on the fluctuations of general inflation.

Unveiling the Impact of Inflation on Home Prices

While exploring this complex interplay, it becomes crucial to scrutinize the role of inflation. During the period under examination, inflation remained relatively subdued. The extraordinary circumstances surrounding the pandemic ushered in a significant idle capacity within the economy, with both manufacturing facilities and service providers operating at only a fraction of their potential. However, with the implementation of stimulus measures, factories reopened, and underutilized capacity was tapped into. Consequently, inflation was contained as supply costs remained stable, and manufacturers were able to meet the growing demand without significant adjustments to their existing infrastructure.

Nevertheless, as the economy neared full capacity prior to the change in administration, a new wave of legislation ushered in record-breaking levels of government spending as part of the build-back-better agenda. Unlike the previous scenario, this additional stimulus lacked the advantage of idle capacity, making it challenging to swiftly expand manufacturing and service capacity in a cost-effective manner. Consequently, in the short term, prices experienced an inevitable increase. In simpler terms, when there is a surge in demand (accompanied by an influx of money) and a dearth of changes in supply, price hikes become an inescapable reality.

Uncovering the Inherent Relationship: Home Prices and Inflation

To ascertain the presence of an inherent relationship between real estate prices and inflation, an extensive examination of data was undertaken. By isolating the Home Price Index provided by the Federal Housing Finance Administration against the consumer price indexing excluding housing, it was possible to explore their connection.

Upon statistical correlation analysis, a noteworthy correlation emerged. Home Price Appreciation was found to exert an influence of approximately 36% on inflation, while inflation increases were observed to impact home prices by approximately 22%. These findings substantiate the existence of an inherent link between these two variables. Although both are subject to various individual factors, their interdependence remains significant.

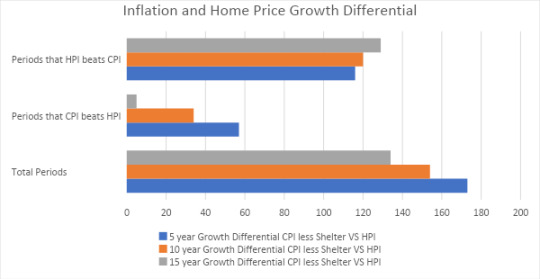

Compelling Evidence: Home Price Appreciation Outpacing Inflation

The most intriguing aspect lies in the frequency with which home price appreciation surpasses inflation. An empirical examination conducted over 5, 10, and 15-year periods sheds light on this phenomenon:

1. 5-year periods: Out of 173 5-year periods since 1975, Home Price Appreciation exceeded Consumer Price Inflation in 116 instances, accounting for an impressive 67% of the time.

2. 10-year periods: Out of 154 10-year periods since 1975, Home Price Appreciation outperformed Consumer Price Inflation in 120 instances, accounting for a remarkable 78% of the time.

3. 15-year periods: Out of 134 15-year periods since 1975, Home Price Appreciation surpassed Consumer Price Inflation in 129 instances, accounting for an astonishing 96% of the time.

These findings unequivocally illustrate that Home Price Appreciation inherently outpaces inflation, particularly over the long term. Consequently, real estate emerges as a reliable mechanism for wealth preservation, safeguarding and augmenting one's assets over time.

Beyond the wealth accumulation potential, it is important to highlight the abundant cash flow opportunities presented by real estate investments, further solidifying its appeal.

In Conclusion: Real Estate as a Stable Investment

In summary, real estate stands as a steadfast and stable investment avenue. While it may not promise rapid wealth accumulation, it possesses the potential to generate substantial long-term prosperity. Real estate serves as a predictable and secure method for wealth preservation, effectively shielding one's assets and providing considerable downside protection when approached strategically.

In other words, there’s never a bad time to buy real estate. Just a bad time to sell.

0 notes

Text

The Recession Resistant Vacation Rental Investing Thesis

The short-term rental industry, exemplified by platforms such as Airbnb, has experienced significant growth over the past decade. Originating in 2007, when a group of individuals devised a website to rent out their living room air mattresses to transient individuals, known as "air bed and breakfast," this disruptive innovation posed a challenge to the established vacation rental market.

During the ensuing years, virtually any listing placed on Airbnb.com would yield profitable returns. However, when rates reached a nadir in 2020, this already burgeoning market witnessed accelerated expansion, leading to what is commonly referred to as "saturation." It is worth noting, though, that this saturation predominantly affects homes of mediocre quality, characterized by limited amenities, staging, and design. The saturation issue primarily resides within this segment of the market.

It is indisputable that the short-term rental space has become more precarious, with a higher propensity for financial losses than ever before. However, when managed by proficient operators, the profit potential remains well above the average. Demand for quality homes boasting ample amenities remains robust. Moreover, the cost associated with establishing such high-quality rentals acts as a deterrent, inhibiting many potential investors from participating in this market. For instance, while the demand for a three-bedroom, two-bathroom rental exhibits relative stability year over year, in the face of increasing supply, the demand for larger properties, such as a five-bedroom residence with a heated pool, has outpaced supply. It is within these upper-tier dwellings that substantial financial gains can be realized.

Furthermore, larger rental spaces offer a multitude of utilization opportunities, ranging from hosting wedding parties and birthday celebrations to accommodating corporate retreats. However, amidst the specter of an impending recession, the age-old adage of "location, location, location" assumes even greater significance. Undoubtedly, if the economy undergoes a significant downturn and one finds themselves in possession of a luxury property with waning appeal to potential travelers, the consequences are far from desirable.

The collapse of real estate prices in regions such as coastal California, Phoenix, and Las Vegas, among others, which had previously witnessed sustained upward spirals in property valuations, commenced around mid-2006. The ensuing decline accelerated rapidly, subsequently exacerbating the financial implications and culminating in a far-reaching impact on the global economy. Consequently, significant declines in employment figures reverberated across all sectors, including the hospitality industry—an area of particular interest to short-term rental investors.

While it is conceivable to locate a property in a locale boasting a historical track record of steady appreciation and resilience in the face of national housing downturns, it remains crucial to ensure that this locale garners sufficient vacationer footfall. After all, no investor harbors an affinity for negative cash flow resulting from an underperforming vacation home investment. Once again, it is evident that hospitality-driven economies represent localized phenomena.

Therefore, by amalgamating relevant metrics and scrutinizing markets that exhibited resistance to housing downturns and broader economic recessions, we can identify the ideal combination of recession-resistant short-term rental markets. Subsequently, the ensuing pursuit predominantly revolves around balancing real estate prices against their respective rental potential.

My mission, through 20Plus Capital, lies in the discovery of high-performing short-term rentals within recession-resistant markets. At present, an incredible opportunity awaits those seeking to partake in this endeavor.

References:

Bureau of Economic Analysis. (n.d.). Gross Domestic Product (GDP) by County, Metro, and Other Areas. Retrieved from https://www.bea.gov/data/gdp/gdp-county-metro-and-other-areas

Federal Housing Finance Agency. (n.d.). House Price Index. Retrieved from https://www.fhfa.gov/DataTools/Downloads/Pages/House-Price-Index-Datasets.aspx

Note: Please ensure to check for the most up-to-date information and specific datasets available on the respective websites of the Bureau of Economic Analysis and the Federal Housing Finance Agency.

1 note

·

View note

Text

Single Family Investing that resists housing Downturns

Introduction

In this article, we will explore the relationship between price growth and housing market downturns, focusing on the concept of relative change. By analyzing how different local housing economies performed before, during, and after the Great Recession, we can gain valuable insights into the indicators of a severe downturn and identify regions that are more resilient to market fluctuations. Understanding this phenomenon can help real estate investors make informed decisions and mitigate potential risks. Let's delve into the details and unravel the significance of price appreciation in predicting housing downturns.

Examining Housing Price Appreciation

During my research on home prices leading up to the Great Recession, I divided regions into two distinct categories based on their housing market performance from 2000 to 2007. The first category comprised regions that experienced slower-than-average home price appreciation, while the second category consisted of regions with faster-than-average growth. Analyzing the price appreciation trends in these regions provides valuable insights into their respective performances before, during, and after the recession.

The Role of Pre-Downturn Price Appreciation

The extent of housing downturn in a specific region is strongly correlated with the degree of price appreciation it experienced prior to the downturn. To illustrate this, let's consider the example of the Great Recession on a national scale. Home prices peaked in Q2 2007 before beginning their decline until reaching their lowest point in Q2 2012. If one had purchased a property at its peak and sold it at the bottom, on average, they would have incurred a capital loss of 19%, highlighting the severity of the downturn.

However, it is crucial to note that certain locales exhibited above-average home price appreciation compared to the national average. These regions experienced price declines starting in Q1 2007, preceding the broader market downturn. Locations like coastal California, Las Vegas, and Phoenix were among the early indicators of the impending recession. If an investor had bought at the top and sold at the bottom in these locales, they would have suffered a substantial loss of 30% on average during the recessionary period.

Resilient Locales: Slow and Steady Price Appreciation

In contrast, locales that demonstrated slower-than-average price appreciation before the recession followed a different trajectory. These regions did not experience price declines until Q1 2008, a year or more after the nation as a whole had entered a housing downturn. The downturn in these locales bottomed out in Q2 2011, a full year before the greater nation.

If an investor had purchased a property at the peak and sold it at the bottom in these resilient locales, their loss would have been limited to 7.5%. This suggests that buying real estate in regions with a history of slow and steady price appreciation compared to the national average significantly reduces the likelihood of a severe downturn or, in some cases, entirely avoids it.

Consistency in Behavior: Before, During, and After the Recession

Interestingly, the same resilient locales that exhibited slow price growth during the Great Recession continued to display similar trends after the recession. As the housing economy started to recover in 2012, these regions demonstrated consistent, gradual price appreciation. They behaved in a manner reminiscent of their pre-recession performance. Consequently, it is reasonable to expect these locales to exhibit similar resilience during future downturns, experiencing mild to no negative price appreciation.

The Statistical Measure of Relative Change

A technical look at the statistical analysis reveals that relative change accounts for 68% of a housing downturn in any given locale. This means that when a housing downturn occurs, 68% of the collapse in real estate prices can be attributed to how

prices behaved leading up to the downturn. In other words, regions that consistently exhibit slow and steady price increases during stable market conditions are 68% more likely to experience milder downturns when faced with nationwide housing challenges.

Conclusion

Understanding the relationship between price growth and housing market downturns is invaluable for real estate investors seeking to make informed decisions. By analyzing the extent of price appreciation before a downturn, we can gauge the potential severity of a housing crisis in a particular region. Regions with slower-than-average price growth tend to be more resilient, experiencing milder downturns or even avoiding them altogether. This knowledge empowers investors to navigate the real estate market with greater confidence and adapt their strategies to minimize risks.

#investment#real estate#short term rental#passive income#realestate#real estate investment#real estate investing for beginners#real estate investor

1 note

·

View note

Text

Self Directed IRAs

A self-directed Individual Retirement Account (IRA) is a type of retirement account that allows the account holder to have more control over their investment choices. With a self-directed IRA, the account holder can invest in a wide range of assets beyond traditional stocks, bonds, and mutual funds. These assets can include real estate, private companies, precious metals, and more.

To open a self-directed IRA, the account holder must first find a custodian that specializes in self-directed IRAs. The custodian will hold the assets and help the account holder manage their investments. The custodian may charge fees for their services, so it’s important to research and compare custodians before choosing one.

Once the self-directed IRA is opened, the account holder can fund it with contributions or transfers from other retirement accounts. The contribution limits for self-directed IRAs are the same as for traditional and Roth IRAs.

With a self-directed IRA, the account holder has the flexibility to invest in a wide range of assets. Some of the most common investments made through self-directed IRAs include:

Real estate: The account holder can invest in rental properties, commercial real estate, and other real estate assets through a self-directed IRA. Real estate can be an attractive investment because it can provide steady income and long-term appreciation.

Private companies: The account holder can invest in private companies through a self-directed IRA. This can be a high-risk, high-reward investment, as many private companies fail or never go public. However, if the account holder chooses the right company, they could see significant returns on their investment.

Precious metals: The account holder can invest in gold, silver, and other precious metals through a self-directed IRA. Precious metals can be a good hedge against inflation and can provide a store of value during times of economic uncertainty.

Cryptocurrency: The account holder can invest in Bitcoin, Ethereum, and other cryptocurrencies through a self-directed IRA. Cryptocurrency can be a high-risk investment, as the value of cryptocurrencies can be volatile and subject to regulatory risks.

When investing through a self-directed IRA, the account holder needs to be aware of the rules and restrictions that apply. For example, if the account holder invests in real estate through a self-directed IRA, they cannot use the property for personal use, and they cannot engage in certain types of transactions with certain parties, such as their spouse, children, or parents.

Self-directed IRAs offer several benefits over traditional IRAs and Roth IRAs:

More investment options: With a self-directed IRA, the account holder has the flexibility to invest in a much wider range of assets beyond traditional stocks, bonds, and mutual funds. This can allow for a more diversified portfolio and potentially higher returns.

More control over investments: With a self-directed IRA, the account holder has more control over their investments. They can choose which assets to invest in, how much to invest, and when to buy and sell.

Tax advantages: Like traditional IRAs and Roth IRAs, self-directed IRAs offer significant tax benefits. Contributions to a traditional self-directed IRA are tax-deductible, and the earnings in the account grow tax-free until the account holder begins making withdrawals in retirement. Roth self-directed IRAs are funded with after-tax dollars, but the earnings in the account grow tax-free and qualified withdrawals in retirement are tax-free.

While self-directed IRAs offer many benefits, they also come with some potential drawbacks that investors should be aware of before opening one. Here are some of the main drawbacks of self-directed IRAs:

Complexity and time commitment: Self-directed IRAs can be more complex to manage than traditional IRAs and may require more time and effort on the part of the account holder. The account holder will need to research potential investments and manage the ongoing maintenance and upkeep of those investments. This can be especially true for assets like real estate or private companies, which require active management and ongoing due diligence.

Higher fees: Self-directed IRAs may come with higher fees than traditional IRAs or Roth IRAs. This is because custodians of self-directed IRAs often charge higher fees due to the added complexity of managing a wider range of investments. Additionally, some assets like real estate may come with additional transaction fees, such as closing costs or property management fees.

Risk and illiquidity: Some self-directed IRA investments, like real estate or private companies, may be more risky than traditional IRA investments like stocks or bonds. Additionally, some investments may be illiquid, meaning they cannot be easily sold or converted to cash if needed. This could be a problem if the account holder needs to access their funds quickly for an unexpected expense or emergency.

#shorttermrental #realestate #realestatetips #realestateinvesting #investment #propertyinvestment #propertyfacts #housingcrisis #housingaffordability #affordabilitycrisis #rent #success #entrepreneur #realtor #lasvegasrealestate #IRA #IndividualRetirementAccount

0 notes

Text

How to make sure the real estate syndication you're considering is not a Ponzi scheme

Investing in a real estate syndication can be a great way for limited partners to gain access to real estate investments that would otherwise be out of reach. However, there is always a risk of fraud or ponzi schemes. Here are the three best things that a limited partner can do to verify that the syndication they are investing in is not a ponzi scheme:

Research the General Partner: The first step in verifying the legitimacy of a real estate syndication is to research the general partner. The general partner is the individual or group responsible for managing the investment. It is essential to verify that they have a track record of successful real estate investments and that they have a reputation for being honest and trustworthy. Limited partners can research the general partner's background, experience, and credentials to ensure that they are investing with a reputable individual or group.

Analyze the Investment Structure: The investment structure of a real estate syndication can provide important clues about the legitimacy of the investment. Limited partners should review the offering memorandum carefully and pay attention to the fees, return projections, and exit strategy outlined in the document. Ponzi schemes often promise high returns with little to no risk, and they may have complicated fee structures that are difficult to understand. Limited partners should also verify that the investment structure is in compliance with all applicable securities laws.

Review the Underwriting Process: Limited partners should review the general partner's underwriting process to ensure that it is thorough and comprehensive. They can ask for a detailed explanation of the general partner's underwriting process and ask for examples of previous underwriting reports. Limited partners can also ask for information on how the general partner evaluates and mitigates risks associated with the investment.

In conclusion, limited partners should research the general partner, analyze the investment structure, and conduct due diligence on the Underwriting Process before investing in a real estate syndication. These steps can help verify that the investment is not a ponzi scheme and that it is a legitimate investment opportunity. By taking the time to research and analyze the investment, limited partners can minimize the risk of fraud and make informed investment decisions.

4 notes

·

View notes