lesbian southern transplant living in new york city for grad school in theatre management // producing

Don't wanna be here? Send us removal request.

Text

Have you ever just randomly cried because you’ve been holding shit in for too long?

545K notes

·

View notes

Text

Long time no post but I AM SO STOKED I am getting marrrrrrieedddddd on Friday! Fucking YASS

5 notes

·

View notes

Text

you: stranger things season 2 me, an intellectual: strangerer things

132K notes

·

View notes

Photo

because nothing starts ur day off right like darth vader crying heavily over ur naked body

555K notes

·

View notes

Text

bears have absolutely no right to be as cute as they are. i want to hug them and pet them. big fluffy dogs, supersized

440K notes

·

View notes

Quote

I do not fear death. I had been dead for billions and billions of years before I was born, and had not suffered the slightest inconvenience from it.

Mark Twain (via purplebuddhaquotes)

3K notes

·

View notes

Conversation

me: puts forth minimal effort in an attempt to solve a problem

me: ive tried EVERYTHING

322K notes

·

View notes

Text

ACA Enrollment Cheat Sheet!

so it’s open enrollment time, which means you need to pick a health insurance plan from the exchanges! it can be daunting as shit, for sure, especially if you don’t live in the filthy weeds that are the business side of our garbage health care industry like yours truly does.

so! here’s a quick rundown of some of the vocabulary:

premiums: this is what you pay per month for the glorious honor of having insurance coverage. it does not count towards your deductible or out of pocket maximum. depending on your income, you may be eligible for a subsidy or other financial assistance to make your premiums more affordable.

deductible: this is how much in health care costs you have to pay before your insurance starts really kicking in. for example, my insurance through work had a $1,500 deductible, so the copays and coinsurances and lab costs that i had to pay early in the year, before i had another surgery, were fully my responsibility until i’d paid out $1,500; after that, my insurance started covering a flat 80% of everything, including copays. basically, the deductible is how many actual dollars you have to pay out for medical costs before your insurance takes over.

if you’re someone who goes to the doctor a lot, like me, you’re probably going to want a plan with a lower deductible, which will have a higher premium; however, in the long run, you’ll come out more ahead with a high premium/lower deductible.

on the flip side, if you’re generally healthy and just need an annual checkup, flu shot, ob-gyn annual, etc., then you probably want a lower premium/higher deductible plan.

out of pocket maximum: this is the cap on how much– aside from premiums– you should have to pay in health care costs in a year. most plans on the exchanges right now have a high deductible and higher OOP max.

network: this is the collection of providers (doctors, surgeons, urgent care facilities, imaging facilities, etc.– any clinical medical care or medical service provider) that are contracted with the insurance plan. this means that they have an agreement with the plan to accept payment from that plan for services. you can still see out of network providers, but your plan may have a separate out of network deductible that is higher and that you pay separately from your main deductible (for example, if your plan deductible if $5,000, you might have a separate out of network deductible of $5,500; even if you’ve already paid of $4,950 of your regular deductible, if you see an out of network doctor, you’re going to have to hit the $5,500 deductible in copays and whatnot before the insurance covers them fully).

most insurers have their own website that identifies what doctors are in network. sometimes you can access this without being on the plan already, sometimes you can’t. a decent, though inconsistent, workaround is to use zocdoc, where you can put in the plan type you’re thinking about switching to and see what doctors are in network. the drawback to zocdoc is that contract status is doctor-reported, so if the doctor’s office in question is slow to update, the records may be out of date.

another option to determine network availability for a specific doctor or care group is, if you’re okay hopping on the phone, to just give them a call and ask outright if they’re going to be in network for plan ___ in 2018.

if you’re like me and hate talking on the phone, the other option is that large provider groups, and a good number of smaller groups and individual providers, will often also have accepted insurances on their websites. in my experience almost all providers who have privileges at a hospital will have that listed on their pages on the hospital’s website.

copay: this is a flat fee you pay to a provider when you see them. it’s like the cover charge at a bar: you pay $20 to get in the door, and then you get the dubious honor of also paying for the drinks and food you buy inside on top of that.

coinsurance: this is a percentage charge for seeing a provider. instead of a $20 copay for the cost of the visit to see doctor bob, you’re charged, say, 10% of the total cost of all charges associated with you visit to see doctor bob. if you don’t get much done, this may only like $10; if you get a full metabolic panel run and a bunch of xrays, it might be $100.

and the plan types:

hmo: health management organization. the concept of this plan is that you have a pcp (primary care provider - your regular doctor) who functions as your primary point of contact for all medical care. if you want to see a non-pcp doctor, you have to first see your pcp, who will write you a referral to see said specialist. specialists include orthopedists, physical therapists, neurologists, ob-gyns, etc. - any provider who isn’t your pcp, basically.

hmos tend to be cheaper for you, the beneficiary

this is because of how they’re paid out: pcp doctors receive a capitation (aka, a set flat amount) payment from the insurer for each beneficiary (you) who has them as a pcp.

so, if i’m a primary care doc and i have 200 blue cross hmo patients and i get $100 per patient, i get $20,000 from blue cross, ostensibly for the cost of care provided, but the provider keeps all $20,000 even if they only end up incurring $15,000 in costs. the downside of this for you as a patient is that this encourages pcps to get a lot of people to sign up as their patients, and then to see them as little as possible/push them out to specialists for actual care, as this lowers their costs and increases their revenues.

you may end up feeling like you’re going in circles trying to get actual care because you’re getting pushed from one doctor to another.

note: hmo plans sometimes do not cover out of network providers at all.

ppo: preferred provider organization. this plan is a free for all: if they’re in network, you can go to whomever you want. they tend to be a bit pricier (almost always on premiums, 50/50 on deductibles) than hmo plans, but you’re basically paying for ease of access. you can make an appointment directly with any specialist you so choose. these plans are ideal for people like me, since i have to see orthopedists and hematologists and physical therapists pretty regularly, and going through a pcp for each of those would be a pain.

you’ll tend to have relatively low copays within the network and higher ones outside of it

unlike some hmo plans, most ppo plans will provide coverage for out of network providers, just at a less favorable rate

epo: exclusive provider organization. this is the bastard child of the hmo and ppo and is also an increasingly common option on most of the exchanges. like a ppo, no pcp or referrals are provided; however, the network tends to be narrower and you have less choice of in-network providers and, crucially, they don’t tend to cover any out of network providers except for emergencies

important note: the classification of “emergency” isn’t just “emergency situation”, but generally is limited to a proven medical emergency in which you go to an actual emergency room or emergency department.

insurers will frequently challenge ER/ED bills to confirm medical necessity because–

in their defense, since they’re meant to cover almost the entirety of emergency bills and also because one of the quantifiable measures of success in moving to value-based care that the ACA established is lowering avoidable ER/ED admissions

–they don’t want to encourage people to go the ER/ED for just anything

high deductible/catastrophic: these are exactly what they sound like– plans for healthy young people who are pretty much only going to wind up with medical costs if something terrible and, well, catastrophic, like a car accident, happens. they have low premiums and very high deductibles (often approaching ~$10,000). these are only available to people under the age of thirty, because clearly as soon as you turn thirty you must turn into a total drain on all healthcare resources :|

so what does all of this boil down to for you and your enrollment?

start by figuring out what financial help you’re eligible for! the exchanges generally have an option at the front end of the process for you to identify your annual income and number of dependents on your plan. this will let you know if you’re eligible for a subsidy or other financial help, and, if so, how much; you should also have an option when searching through plans on the exchanges to input estimated financial help, which will adjust the premiums in the search engine.

after that, start digging into the individual plan options. every exchange plan should provide a summary of benefits and coverage. it’ll be a pdf and will look like this:

that red circle in the top right there? that’s where you can identify what type of plan you’re looking at. the first page in the summary of benefits will always look the same– it’s the basic overview of the costs and definitions.

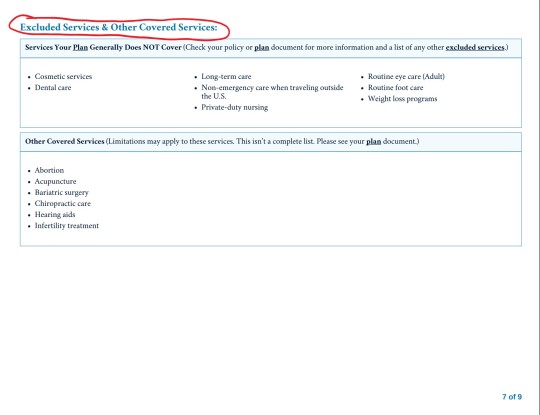

this document will also list excluded services. it’ll generally be somewhere in the middle/back half of the document and will have a clear header like this:

for me, this is the first thing i look for after verifying premium and deductible amounts. as the above picture indicates, you can find more information in the plan documents. these aren’t always directly linked to on the exchange website, but you can generally find them on the insurance providers website. these will be a lot more detailed and can be anywhere between twenty and 200 pages. ctrl + f your heart out: as frustrating and complicated as insurers can be, they can’t actually fail to disclose if they, for example, don’t cover all forms of contraceptives. they’ll disclose it in the plan documents, even if they don’t, unfortunately, have to be clear and up front about it.

NOTE: MINIMUM VALUE STANDARDS

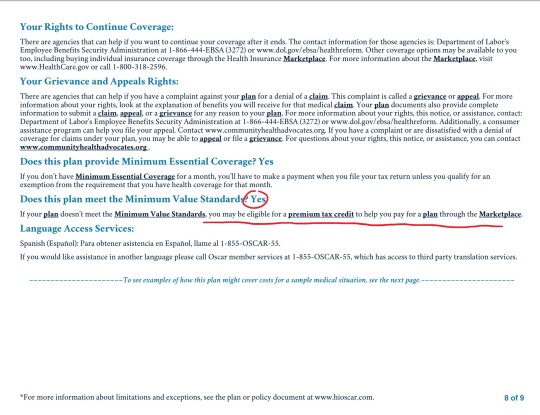

towards the end of the summary of benefits document will be a page that looks like this:

minimum value standards roughs out to basically meaning that at least 60% of all medical charges are covered. if the plan you’re on does not meet minimum value standards, you might be able to get a tax credit to help you buy another marketplace plan. always check for this verification when you’re researching plans.

what does all of this shit mean?

it means start here and then find your state’s exchange from there. the garbage carrot in chief established “maintenance times” on this website throughout the open enrollment period (sunday afternoons, i believe), so schedule around that. sit down on a monday or wednesday or saturday with some snacks and a cup of your favorite beer/wine/tea/whathaveyou and crank up some good music to jam to and do some research:

start with figuring out what you can afford monthly and if something terrible happens and you have to cover ER and/or surgery bills

if you have a specific doctor you want to stay with, figure out which insurances they’ll be accepting

check for coverage info in the summary of benefits documents and, if you want more detail, in the plan documents

narrow it down to a few and compare the prices

take a break and have a cookie, you deserve it at this point

pick a plan! if you’re not feeling super certain about it, go for a walk, do some laundry, pet your cat– just take a break, walk away, come back to it with fresh eyes. this is a big deal, so you don’t want to wear your brain out and give yourself a headache and then just pick one at random because you have eye strain and want to be done. open enrollment goes until december 15, so don’t rush yourself.

sign up for your plan

have another cookie and pat yourself on the back, because you just signed up for health insurance for 2018!

now take a nap because that was fucking exhausting and you deserve it

as always, i’m here for any questions you might have!

if i don’t know the answer, i can point you towards someone or some resource that will. don’t be afraid to ask me or anyone else for help! this is a complicated situation and even though the current administration is trying really hard to make it worse, there are still always resources available to you for help and guidance. all you have to do is ask :)

16K notes

·

View notes

Photo

This is not anti-Nicole Kidman but more of a spotlight on the ones in control of the Emmys. The ones who softly played off others, allowed Nicole to speak on to her liking with no orchestra to play her off, but then cut a historic moment and equally important speech with blaring music and a mic cut. Luckily, however, Sterling was able to finish his speech backstage [x].

58K notes

·

View notes

Photo

Exclusive: Star Wars’ seventh episode goes Shakespeare in The Force Doth Awaken excerpt

255 notes

·

View notes