#xero scenario

Explore tagged Tumblr posts

Note

I just got an image in my head-

What if Gemini pulls their cape off their shoulders and puts it around Lunar's? What if they give him a forhead kiss, and disappear without explanation-

I am going insane about them I'm sorry-

YOU SENT THIS LITERALLY IN FEBRUARY BUT I'M GETTING TO IT NOW TO TELL U THAT'S THE CUTEST THING EVER AOAUAGHH

I can just imagine 1) how insanely flustered Lunar would be after it and 2) how much bigger Gemini's cape would be oh them..... I wanted to draw all of this but I only got this so here's a doodle for this adorable ass idea 👍

#asks#anon#xero creations#IMAGINE IF IT WAS IN THE MIDDLE OF A VIDEO TOO. earth just being like hey u want quiet r u okay ??#and lunar is like (quietly) /im so great you have no idea/#lunar and earth show#the lunar and earth show#tlaes#lumini#gemini x lunar#lunar x gemini#sams lunar#lunar laes#laes gemini#< not in the art but blatantly in the scenario HSJAHS

150 notes

·

View notes

Text

So I have an idea, I don't know if I will use it, but I am certainly going to play around with the idea.

What if Lurien and Xero are related?

In my stories, I base Lurien's design on a Scarlet Tiger Moth while I base Xero's design on a Madagascan Sunset Moth and baldfaced hornet, but that side of his heritage isn't as prominent. Anyway, I was looking at both moths and thought they looked similar enough with the majority of their bodies being black with spots of colors on their wings that they could be related. It would certainly be an interesting dynamic.

So timeline wise how would this work?

[TW: violence, character deaths(by murder and childbirth)]

I always imagined Lurien to be way older than many others in Hallownest as he is an important figure and the Pale King would like to keep him as long as possible so he placed spells to make him age way slower. I have also been playing with the idea that moths have a longer lifespan than many other bugs. So, a moth could physiology and mentally be in its yearly adulthood, while many bugs could be halfway through it. I am making this point to create an understanding of where everyone is in life.

So Lurien's grandparents would be Xero's great-grandparents. The family already had fertility issues, so it was a surprise when Lurien came to his parents as early as he did. Lurien was the only grandkid/kid/nephew of the family for a long while until he was almost around adulthood when his aunt and uncle had their daughter. This child would eventually become Xero's mom.

Lurien was ecstatic with this new family member and offered to help with babysitting as fertility issues weren't the only health issue they had, and still had to work. At the time, Lurien was currently working and slowly getting his education. The aunt and uncle see this and pay Lurien, but not as much as if he were to work normally. That didn't matter as the child was a bright light in his life. (I don't have a name for Xero's mom yet, so I'll just refer to her as Xero's mom or the child or Lurien's cousin)

Lurien was basically a third parent to this child, feeding her, helping her with her homework, and taking her to outings. He watched her grow up and even got close to some of her friends, taking care of them when they visited him(the most noticeable friend being the Seer).

As the years went on, Lurien got further into his education and everything seemed well.

One night changed that.

Lurien was at home along with his parents when intruders broke into his home. These intruders have been staking Lurien, unhappy with his successes. They intended to hurt him and take away those he loves. During this attack, they killed his parents and cut off his wings. Before even more could be done, the Seer intervened, attacking the intruders. She was able to get damaged before she was overpowered, but before any serious injuries came to her, Lurien's cousin came in and helped defend her cousin and friend. As soon as the intruders realized more bugs were getting involved, they escaped, never facing justice.

The experience was degrading, but the aftermath of the event was even more so. Wings are everything in moth culture, and if you don't have wings or broken wings, then you have no value.

He only stayed in the Resting Grounds for a week more until he made a decision he would regret for the rest of his life and leave the life he has known behind. Not even contacting anyone about his departure. Not even his cousin.

Lurien changed his name to what it is now and purchased many clothes and masks that hid his identity as a moth and almost started anew. At this point, his knowledge surpassed the education he was receiving and decided to take a placement test to get him further along and actually receive a position at one of the government buildings in the city.

Lurien was efficient in his job and got a promotion after his promotion. He was one of the few government officials who didn't care about profits for himself but cared about the citizens of Hallownest even if they didn't like what he is.

It wasn't until many years later that he became Watcher of the City.

At this point, he became brave enough to try to contact his cousin. That is how he found out that she died mere weeks before.

Heartbroken, Lurien searched up all he could about his cousin. He found out that her parents died and inherited their house, that she got a job as a dancer-she always had the prettiest wings, she got married, then died of childbirth.

Lurien looked deeper, looked into her husband- a wasp, and found him living in her house with a nymph who survived. This nymph is of course Xero.

It then became an obsession, checking in on the family, checking in on the last of his bloodline, but never visiting him.

This would go on for years, looking from afar, getting information as much as he could.

If you guys read my backstory for Xero[Here is the link which also has every Dream Warrior backstory] he eventually got betrayed and attacked by many bugs, getting burned alive and almost dying. He lost part of his wings and was shunned just like Lurien. Despite knowing that his cousin was in much pain, Lurien didn't reach out.

Now that this is the point where the timeline can deviate between what happens in AU's.

In the timeline where Xero gets infected by the Radiance and attempts to assassinate the King killed, Lurien is devastated. He blames himself. He knows he is cowered and should have supported his cousin as those who are vulnerable and emotional are more likely to get infected. He keeps this guilt, sealed away with it when the Vessel plan is set into motion.

If I were to incorporate this idea for my other AU's/fics Lurien just keep it a secret and would not reveal it to anyone. His only problem would be the Seer. She has met him on multiple occasions and if she were to listen to his voice for a long time she would surely know it would be her friends cousin.

After writing down this idea, I think this is a nice idea to play around with. I don't know how much I would actually get to use it as there is already so much going on in my stories.

#daydreaming scenarios with characters with barely any in-game information#hollow knight#hollow knight fanart#hk fanart#hk xero#hk lurien#hk oc#well mentions of them#hk cwhp#split family au

11 notes

·

View notes

Note

OC ASKS: Your OCs are in a room and suddenly lights are turned off. Who are they reaching for first? Will they reach to hold someone at all?

OOH THIS IS A CUTE ONE THANK YOU!! Answering for the characters on my Toyhou.se, but feel free to follow up with any specific characters you might remember from my past blogs if I didn’t mention them :D

In most cases the characters would just reach for whoever is closest to them rather than anyone specific (since I use them across various settings and their interactions change from AU to AU), under the pretense they’re familiar with their company. This is kinda long also, so I’m putting it under a read-more o7

OCs who are more likely to reach for someone than not:

Eve, using it as an excuse to grope the nearest well-built man (often Velo since they work together)

Rex, also using it as an excuse to grope the nearest cute and petite girl 🤦 I think he would get reached for by his FWB (later boyfriend), Kais, though

Dimitri, who’s equal parts protective over whoever is with him due to a strong sense of responsibility and wanting to make sure they don’t fuck anything in the room up; Minkyu comes to mind, though Xero is an exception since he trusts them to take care of themself and stay out of the way

Reis… but with malicious intent :((( He is absolutely using the blackout as an opening to infect someone near him with an otherworldly pathogen/parasite :(((

Tarou, with similar reasoning as Dimitri, but he’d also make sure to grab Reis so he does NOT give hapless people the Alien chestburster experience

Luca, mostly just being silly and dramatically pretending to be scared, though if it’s a more perilous scenario he’d reach for someone to ground himself, not wanting to be alone

Navid, not wanting to be separated from his friends

OCs who are less likely to reach for someone:

Kee, who doesn’t want to burden others so she’s more likely to just curl in on herself—though if it’s a dire situation and she thinks she can help keep the other party from harm, she might make an exception

Velo, since he usually does NOT gaf about the people around him—they can take care of themselves!—but he would make an exception for people/creatures that are so pathetic/defenseless he’d feel guilty about leaving them in the lurch (such as Haruki)

Junta, since I imagine this scenario with him would be a silly one more often than not; he wouldn’t be concerned about the blackout, though he might sneak up and scare his friends

Verrine is probably just turning the lights off herself to wish one of her sons (or “playthings”) goodnight… It’s hard to imagine her being caught off-guard; if the blackout is malicious she probably expects it and is either alone or with protection 🤔

Cherry would rather go for a weapon than grasp for a friend, though against his survival instinct he would feel more comforted holding onto someone (particularly Ram’s OC Harris, whom he has an unspoken crush on)

V. Aster (who people are probably more familiar with under the name “Vivie” aha) is another character who’s indifferent to the safety of those around them—reaching for someone or being clung to would just hinder their mobility; they can see in the dark and they’re going to be productive about it

OCs who don’t reach for anyone, but get reached for:

Xero can see in the dark (and beyond that is an otherworldly entity), so they wouldn’t be bothered even if the blackout is a precursor to danger; by default, their eyes glow like embers, so they’d be a visible beacon for nearby company to cling onto for protection (especially Minkyu…)

Ein is a renegade bioweapon with lowlight vision—he’d be kind of excited for danger to spring out and have a toussle! But otherwise he’s being reached for by a cautious Lavender (his mostly-human roommate who sometimes is sucked into his and Acheron’s nonsense)

Lillie would reach for a weapon and get reached for by her gooner roach of a NOT-boyfriend, Oswald (erectroswing’s OC), much to her chagrin cuz she KNOWS his ass is not scared and he’s just using it as an excuse to wrap around her and scream and squeal

Jet would just stand there in confusion (bro has the survival instinct of a middle-aged corporate worker who wants to kill himself, cuz he is LMAO), but Zeta would take the opportunity to grope grab him for fruity reasons

Anyway, thank you so much for sending this in—OC asks genuinely make my whole day ;w; <3 !!!

#📧OC Q&A#Eve info#Rex info#Dimitri info#Reis info#Tarou info#Luca info#Navid info#Kee info#Velo info#Junta info#Verrine info#Cherry info#Aster info#Xero info#Ein info#Lillie info#Jet info

8 notes

·

View notes

Note

hornet + holly + wl in the weregrimm au? bonus: werewolf form pk perhaps???

Hornet and Holly are part of it! They don't live with Vyrm and Grimm, since they stayed back in Hallownest. They even have unique outfits just for this AU, which kinda show that they don't have a rich celebrity father figure who'd buy them fancy outfits in this timeline haha

Here's the post with their designs and a link to a detailed summary, I think it's worth a read if you're interested in what they're like there, there's some good stuff for both of them.

As for the White Lady, she's more or less the same in the Weregrimm AU as in the main one. Her relationship with Vyrm progressed in pretty much the same way, though I'd love to explore possible differences resulting from the fact it was Vyrm who visited Grimm, not vice versa like in the main timeline. But other than that, her role post-infection is basically the same.

And I did actually consider Vyrm to be the werewolf in this AU, but I thought the idea with Grimm's "werewolf" curse being a result of him merging his forms was too good to not explore. Not to say there was no potential in Vyrm being the one, he did have the fear of hurting others due to his instincts for most of his life, not to mention the Xero incident, both of which could be explored further. But he also already has a "wilder" side whenever he goes out hunting; Grimm, meanwhile, is such a confident, elegant and composed individual in the main AU, that throwing him into this werewolf scenario offered a very interesting outlook on how he'd behave if those traits were taken from him.

5 notes

·

View notes

Text

Essential Steps to Future-proof Your Business Finances

Future-proofing your business finances means setting up strong, flexible systems that help you weather economic shifts, scale with confidence, and make smart decisions. Here's a practical, no-fluff guide to the essential steps you need to take:

Essential Steps to Future-Proof Your Business Finances

1. Build a Solid Financial Foundation

Use cloud-based accounting software (e.g., QuickBooks, Xero) to keep real-time books.

Automate daily transactions (bank feeds, invoicing, payroll).

Create monthly financial statements: P&L, cash flow, balance sheet.

Why it matters: You can’t improve what you don’t measure.

2. Create Cash Flow Forecasts (and Update Them)

Forecast income, expenses, and runway for 6–12 months.

Run “what-if” scenarios: What happens if revenue drops 20%? Or if you hire an accountant for business?

Use tools like LivePlan, Finmark, or Jirav for easier modeling.

Why it matters: Cash is king — and forecasting helps you avoid surprise shortages.

3. Build an Emergency Fund

Aim for 3–6 months of operating expenses in reserves.

Keep it liquid, but separate from your main account to avoid casual use.

Why it matters: A buffer keeps you from panicking (or borrowing) in a crisis.

4. Streamline and Automate Financial Tasks

Automate payroll (Gusto), AP/AR (Bill.com, Melio), tax reminders (TaxJar).

Set up recurring invoices and payment reminders.

Outsource bookkeeping or use managed services like Bench or Pilot.

Why it matters: Saves time, reduces error, and keeps your books clean year-round.

5. Engage a Fractional CFO or Financial Advisor

You don’t need a full-time CFO to get strategic help.

Use platforms like Paro, Toptal, or CFOShare to find on-demand financial experts.

Why it matters: Strategic financial advice is crucial during growth, funding, or pivots.

6. Regularly Review KPIs and Business Metrics

Track your burn rate, gross margin, customer acquisition cost (CAC), lifetime value (LTV).

Set benchmarks and review monthly or quarterly.

Why it matters: Helps you make better, faster decisions — and spot issues early.

7. Stay Compliant and Tax-Ready

Use tools like Avalara, Taxfyle, or Collective to stay on top of tax filings.

Keep personal and business finances separate (get that business bank account).

Stay ahead of sales tax nexus and state-specific rules.

Why it matters: Avoid fines and penalties that can eat into your bottom line.

8. Plan for Scalable Growth

Use clean, accurate financials to impress investors or lenders.

Align your financial strategy with your long-term goals: expansion, new markets, hiring.

Build systems that grow with you — not ones you'll outgrow in 6 months.

Why it matters: You’re not just surviving — you’re building to scale.

Final Thought:

Future-proofing is proactive finance — not reactive fixing. Whether you're running lean or scaling fast, the best time to set your business up for long-term resilience is now.

0 notes

Text

K-38 Consulting LLC: Outsourced CFO Services for High-Growth SaaS Startups

K-38 Consulting provides outsourced CFO services tailored for high-growth SaaS startups. We help founders optimize cash flow, extend runway, and track key SaaS metrics like MRR, ARR, CAC, and LTV. Our expertise includes financial forecasting, fundraising support, and scalable growth strategies to attract investors and drive sustainable expansion. By streamlining financial operations and delivering forward-looking insights, we empower SaaS startups to scale efficiently and achieve long-term success.

In the fast-paced world of Software as a Service (SaaS), financial management is a critical aspect of success. High-growth SaaS financial model template startups often face unique challenges, from revenue recognition and cash flow management to strategic financial planning and investor relations. For many startups, hiring a full-time Chief Financial Officer (CFO) may be impractical due to budget constraints. This is where K-38 Consulting steps in, offering outsourced CFO services tailored specifically to the needs of SaaS businesses.

What is an Outsourced CFO?

An outsourced CFO is a financial expert who provides strategic financial leadership on a part-time, interim, or project-based basis. Unlike a full-time CFO, an outsourced CFO offers flexibility and cost-efficiency, making them an ideal solution for early-stage and scaling SaaS Valuation Calculator. These professionals bring deep expertise in financial modeling, fundraising, compliance, and overall financial strategy.

Why SaaS Startups Need an Outsourced CFO

SaaS startups operate on unique business models that require specialized financial oversight. Here are some key reasons why outsourcing CFO services from K-38 Consulting can be beneficial:

1. Optimized Financial Strategy & Planning

High-growth MRR Calculator SaaS startups need robust financial forecasting and scenario planning to navigate market volatility. K-38 Consulting helps SaaS companies build financial models that account for:

Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR)

Customer Acquisition Cost (CAC) vs. Customer Lifetime Value (LTV)

Burn rate and runway calculations

Break-even analysis and profitability projections

2. Cash Flow & Working Capital Management

SaaS revenue forecasting template companies often deal with deferred revenue and long sales cycles, making cash flow management a top priority. K-38 Consulting assists with:

Revenue recognition compliance (ASC 606)

Subscription billing optimization

Managing accounts receivable and payable

Ensuring sustainable cash flow to support growth

3. Fundraising & Investor Relations

For many SaaS startups, raising capital is crucial for scaling operations. K-38 Consulting provides expert guidance on:

Investor pitch decks and financial storytelling

Venture capital (VC) and private equity negotiations

Equity vs. debt financing strategies

Due diligence preparation and financial audits

4. SaaS-Specific KPI Tracking & Performance Metrics

SaaS businesses LTV calculator must track industry-specific key performance indicators (KPIs) to assess growth and profitability. K-38 Consulting helps define and analyze:

Churn rate and customer retention

Net Revenue Retention (NRR) and Gross Margin

Expansion MRR and Contraction MRR

Sales pipeline efficiency and conversion rates

5. Regulatory Compliance & Risk Management

Navigating financial regulations and compliance standards can be challenging for SaaS startups. K-38 Consulting ensures adherence to:

GAAP and IFRS accounting standards

Tax planning and compliance strategies

Data security and financial risk assessments

State and international SaaS tax regulations (e.g., VAT, GST, Sales Tax)

6. Scalable Financial Systems & Automation

K-38 Consulting integrates modern financial technologies to enhance efficiency, including:

Cloud-based accounting software (QuickBooks, Xero, NetSuite)

Billing and subscription management tools (Stripe, Recurly, Chargebee)

Automated financial reporting dashboards

ERP and CRM system integrations

The K-38 Consulting Advantage

K-38 Burn rate calculator Consulting differentiates itself from other outsourced CFO service providers through:

1. Industry-Specific Expertise

Unlike generalist financial consultants, K-38 Consulting specializes in SaaS business models, ensuring tailored solutions that align with subscription-based revenue structures and growth challenges.

2. Custom-Tailored Solutions

Every SaaS startup is unique. K-38 Consulting offers personalized financial strategies based on business size, funding stage, and long-term goals.

3. Cost-Effective CFO Services

Hiring a full-time CFO can cost upwards of $250,000 per year. K-38 Consulting provides the same high-level financial expertise at a fraction of the cost, allowing SaaS founders to allocate resources efficiently.

4. Hands-On Execution & Strategic Advisory

Beyond financial strategy, K-38 Consulting takes a hands-on approach, assisting with day-to-day financial operations, investor meetings, and financial decision-making.

5. Proven Track Record

With a portfolio of high-growth SaaS clients, K-38 Consulting has a track record of successfully optimizing financial performance, securing funding, and driving profitability.

Case Study: How K-38 Consulting Scaled a SaaS Startup

Client: A Series A SaaS startup offering AI-powered marketing automation tools.

Challenges:

Poor cash flow management despite strong MRR growth

Struggled to close a $5M VC funding round

Inefficient pricing model impacting profitability

K-38 Consulting's Approach:

Implemented revenue forecasting and cash flow optimization strategies

Rebuilt financial models and investor reports, leading to successful fundraising

Advised on tiered pricing strategy, improving gross margins by 20%

Results:

Secured $5M in funding within six months

Reduced cash burn by 35%

Achieved 3x revenue growth in 12 months

How to Get Started with K-38 Consulting

SaaS startups looking to streamline their financial operations, optimize cash flow, and scale efficiently can benefit from K-38 Consulting’s outsourced CFO services. Here’s how to get started:

Initial Consultation: Discuss your startup’s financial challenges and goals.

Financial Assessment: K-38 Consulting evaluates current financial health and KPIs.

Customized Strategy: Develop a tailored financial roadmap for growth.

Implementation & Ongoing Support: Get hands-on execution and continuous strategic advisory.

Conclusion

For high-growth SaaS startups, financial leadership is crucial to achieving scalability and long-term success. K-38 Consulting provides outsourced CFO services designed to help SaaS businesses navigate complex financial landscapes, secure funding, and optimize profitability. With industry expertise, cost-effective solutions, and strategic execution, K-38 Consulting is the go-to financial partner for SaaS startups aiming for sustainable growth.

Ready to elevate your SaaS startup’s financial strategy? Contact K-38 Consulting today!

0 notes

Text

Cash Flow Management Market Future Trends and Technological Advancements 2032

TheCash Flow Management Market Size was valued at USD 834.34 Million in 2023 and is expected to reach USD 5126.65 Million by 2032 and grow at a CAGR of 22.4% over the forecast period 2024-2032

Cash Flow Management has become a critical aspect of financial planning for businesses worldwide. As organizations navigate economic uncertainties and evolving market conditions, managing cash flow efficiently has become more important than ever. With technological advancements and automation, businesses are leveraging innovative solutions to optimize their financial operations.

Cash Flow Management continues to gain prominence as companies seek real-time insights, better forecasting, and improved liquidity management. The increasing adoption of AI-powered financial tools, cloud-based accounting platforms, and automated invoicing systems is revolutionizing the sector. As financial risks grow, businesses are prioritizing effective cash flow strategies to maintain stability and sustain long-term growth.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3736

Market Keyplayers:

Intuit (QuickBooks Cash Flow, QuickBooks Online)

Xero (Xero Cash Flow, Xero Business Finance)

Anaplan (Anaplan for Finance, Anaplan Cash Flow Planning)

Sage (Sage Intacct Cash Management, Sage 50cloud Cash Flow Manager)

Float (Float Cash Flow Forecasting, Float Budgeting & Scenario Planning)

Panguru (Planguru Budgeting, Planguru Forecasting)

Dryrun (Dryrun Cash Flow Forecasting, Dryrun Scenario Planning)

Caflou (Caflou Business Management, Caflou Cash Flow Management)

Pulse (Pulse Cash Flow Software, Pulse Forecasting Tool)

Cash Analytics (CashAnalytics Cash Flow Forecasting, CashAnalytics Liquidity Planning)

Fluidly (Fluidly Intelligent Cash Flow, Fluidly Credit Control)

Finagraph (Finagraph CashFlowTool, Finagraph Financial Analysis)

Cashflowmapper (Cashflowmapper Forecasting, Cashflowmapper Planning Tool)

Finsync (Finsync Cash Flow Management, Finsync Accounting)

Cashflow Manager (Cashflow Manager Gold, Cashflow Manager Accounting Software)

Agicap (Agicap Cash Flow Management, Agicap Liquidity Planning)

Calqulate (Calqulate Cash Flow Forecasting, Calqulate SaaS Financial Planning)

Cashbook (Cashbook Cash Flow Automation, Cashbook Treasury Management)

Cash Flow Mojo (Cash Flow Mojo Business Planning, Cash Flow Mojo Budgeting)

Cashforce (Cashforce Smart Cash Flow, Cashforce Liquidity Forecasting)

Market Trends Driving Growth

1. AI and Automation in Financial Management

The integration of artificial intelligence (AI) and machine learning (ML) is transforming cash flow management. AI-driven analytics provide predictive insights, helping businesses anticipate financial gaps and optimize cash reserves. Automated invoicing and expense tracking tools are reducing human errors and enhancing financial accuracy.

2. Cloud-Based Cash Flow Solutions

Cloud technology has enabled businesses to manage their cash flow remotely and in real time. Cloud-based financial tools offer seamless integration with accounting software, providing companies with better control over their cash movements and working capital. The growing preference for SaaS-based financial solutions is accelerating digital transformation in the sector.

3. Real-Time Financial Analytics

Businesses are increasingly relying on real-time financial data to make strategic decisions. Cash flow management platforms now offer real-time dashboards, forecasting models, and automated alerts to help businesses address liquidity challenges promptly. These tools are crucial for managing cash surpluses and deficits effectively.

4. Blockchain for Secure Transactions

Blockchain technology is enhancing transparency and security in cash flow management. Smart contracts and decentralized finance (DeFi) solutions are streamlining payment processing, reducing transaction costs, and minimizing fraud risks. As blockchain adoption grows, businesses are leveraging its capabilities for financial security and efficiency.

5. Increased Adoption Among SMEs

Small and medium-sized enterprises (SMEs) are increasingly adopting cash flow management solutions to improve financial stability. Cloud-based accounting software, digital invoicing, and AI-powered cash flow forecasting tools are enabling SMEs to manage their financial health more effectively. As financial technology becomes more accessible, SMEs are gaining better control over their cash flow operations.

Enquiry of This Report: https://www.snsinsider.com/sample-request/3736

Market Segmentation:

By Component

Solution

Services

By Deployment Mode

Cloud Based

On-Premise

By End-User

SME’s

Professionals

By Vertical

BFSI

IT & Telecom

Media

Entertainment

Healthcare

Retail

Manufacturing

Government

Market Analysis and Current Landscape

Key factors driving this growth include:

Demand for financial transparency: Businesses are seeking more accurate, real-time financial insights to manage cash flow effectively.

Adoption of AI and automation: Intelligent financial tools are enabling companies to optimize cash flow processes with minimal human intervention.

Shift toward digital payments: The decline of traditional banking processes and the rise of digital payment ecosystems are reshaping financial operations.

Regulatory compliance requirements: Governments and financial institutions are implementing stricter financial reporting standards, encouraging businesses to adopt advanced cash flow management solutions.

Despite the market’s strong growth, challenges remain, including data security concerns, integration complexities with existing financial systems, and the need for specialized financial expertise. However, advancements in cybersecurity and AI-driven automation are helping businesses overcome these obstacles.

Future Prospects: What Lies Ahead?

1. Expansion of AI-Powered Financial Forecasting

AI-driven cash flow forecasting tools will become more sophisticated, providing businesses with deeper insights into future financial trends. Predictive analytics will help companies prepare for potential cash shortages and optimize working capital strategies.

2. Growth of Embedded Finance Solutions

Embedded finance—where financial services are integrated directly into business platforms—will revolutionize cash flow management. Businesses will increasingly use integrated payment processing, lending, and investment solutions to enhance financial efficiency.

3. The Rise of Decentralized Finance (DeFi) in Business Finance

DeFi platforms will offer businesses new opportunities for decentralized lending, smart contract-based financial agreements, and instant cross-border payments. These innovations will reduce reliance on traditional banking and offer greater flexibility in cash management.

4. Expansion into Emerging Markets

The adoption of cash flow management solutions is expected to grow rapidly in emerging markets, driven by increased digitalization, fintech expansion, and government initiatives promoting financial inclusion. SMEs in developing regions will benefit from affordable cloud-based financial solutions.

5. Integration of ESG (Environmental, Social, and Governance) in Financial Planning

Companies are increasingly incorporating ESG factors into their financial strategies. Sustainable cash flow management will become a priority, with businesses focusing on ethical investment, green financing, and socially responsible financial planning.

Access Complete Report: https://www.snsinsider.com/reports/cash-flow-management-market-3736

Conclusion

The cash flow management market is evolving at a rapid pace, driven by technological advancements, shifting financial strategies, and increasing demand for real-time financial insights. Businesses that embrace AI, automation, and digital financial solutions will gain a competitive edge in managing liquidity and sustaining growth. As financial innovation continues, companies must adapt to emerging trends and leverage cutting-edge cash flow management tools to navigate an increasingly complex economic landscape.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#cash flow management market#cash flow management market Analysis#cash flow management market Scope#cash flow management market Growth

0 notes

Text

The Best Software Solutions for Accurate Invoicing and Tax Filing

In today’s fast-paced business world, accuracy and efficiency are key to staying ahead of the competition. When it comes to managing finances, businesses must ensure that they are accurately invoicing customers and filing taxes on time. This is where the right software solutions come into play. With the advancements in technology, there are a variety of tools that make invoicing and tax filing easier, faster, and more accurate. In this article, we’ll explore the best software solutions that can help streamline your invoicing and tax filing processes.

1. QuickBooks Online

Best for: Small to medium-sized businesses

QuickBooks Online is one of the most popular accounting software solutions for small and medium-sized businesses. It offers robust features for invoicing, expense tracking, and tax filing. QuickBooks Online enables users to create professional invoices, track sales and payments, and even integrate with your bank account for automatic transaction categorization.

Key Features:

Customizable invoices and estimates

Automatic tax calculations based on your location

Integration with tax filing services

Payment tracking and reminders

Why Choose QuickBooks Online? QuickBooks Online is perfect for businesses looking for an all-in-one solution that offers both invoicing and tax filing. With its user-friendly interface and ability to integrate with other tools, QuickBooks ensures that your financial processes are streamlined and accurate.

2. Xero

Best for: Growing businesses with complex needs

Xero is another powerful accounting software that simplifies invoicing and tax filing. It's ideal for businesses that need more customization and reporting options. Xero’s cloud-based platform offers excellent tools for invoicing, managing payroll, and handling taxes.

Key Features:

Multi-currency support

Automatic bank feeds and expense tracking

Integration with over 800 third-party apps

Easy tax filing with tax return templates

Why Choose Xero? Xero offers flexibility and scalability, making it an ideal choice for growing businesses. It has a more extensive set of features compared to other software solutions, which can help businesses tackle more complex tax filing and invoicing scenarios.

3. FreshBooks

Best for: Freelancers and service-based businesses

FreshBooks is a great option for freelancers, consultants, and service-based businesses. Known for its ease of use, FreshBooks simplifies the invoicing process with intuitive features that save time and ensure accurate billing.

Key Features:

Customizable invoices and late payment reminders

Automated tax calculations

Expense tracking and reporting

Integration with PayPal, Stripe, and other payment gateways

Why Choose FreshBooks? FreshBooks is perfect for businesses that prioritize ease of use and efficiency. Its simple interface and automation features ensure that invoicing and tax filing are handled accurately without requiring extensive accounting knowledge.

4. Zoho Books

Best for: Small businesses and startups

Zoho Books is a cloud-based accounting software designed for small businesses and startups. With a focus on automation and integration, Zoho Books simplifies both invoicing and tax filing by providing an easy-to-use platform.

Key Features:

Invoice creation with tax calculations

Automatic payment reminders

Integration with payment gateways and banks

GST filing (for Indian businesses)

Why Choose Zoho Books? Zoho Books stands out for its affordability and ease of use. For small businesses that need basic but powerful invoicing and tax filing tools, Zoho Books is an excellent option. It provides a seamless experience and integrates with the other tools in the Zoho suite, offering a complete business management solution.

5. Wave Accounting

Best for: Small businesses and solopreneurs on a budget

Wave Accounting is a free accounting software solution that provides basic invoicing and tax filing tools for small businesses and solopreneurs. It’s an ideal solution for businesses that are just starting out and need a cost-effective way to manage their finances.

Key Features:

Free invoicing and accounting tools

Automatic tax calculations

Integration with bank accounts

Simple tax report generation

Why Choose Wave Accounting? Wave Accounting is the best choice for businesses on a tight budget that still want to maintain accurate invoicing and tax filing. It offers a solid set of features for free, making it a great starting point for solopreneurs and small businesses.

6. SlickPie

Best for: Small businesses needing automation

SlickPie is a cloud-based accounting software that automates many aspects of invoicing and tax filing. It’s especially beneficial for small businesses looking to reduce manual work and increase efficiency.

Key Features:

Automated data entry with MagicBot

Customizable invoices with tax calculations

Expense tracking and reporting

Sales tax management

Why Choose SlickPie? SlickPie’s automation features make it a great choice for businesses that want to save time and reduce the chances of human error. The platform is straightforward and user-friendly, making it ideal for small business owners who don’t have an accounting background.

7. Sage Business Cloud Accounting

Best for: Businesses seeking flexibility and scalability

Sage Business Cloud Accounting is a flexible solution for businesses that need more control over their invoicing and tax filing. It offers advanced features for tax management and invoicing, making it suitable for businesses that are scaling.

Key Features:

Automated invoicing and payment reminders

Tax management and reporting

Multi-currency support

Cloud access from anywhere

Why Choose Sage Business Cloud Accounting? Sage Business Cloud Accounting is designed for businesses that require more customization and scalability. Its advanced features for tax filing and invoicing make it an ideal choice for growing businesses that want a comprehensive solution.

8. Smaket Billing Software

Best for: Businesses looking for a comprehensive billing and accounting solution

Smaket Billing Software is a powerful and efficient tool designed for businesses that need an all-in-one solution for invoicing, billing, and tax filing. With a focus on ease of use and automation, Smaket Billing Software makes managing your invoices, payments, and taxes simple and accurate.

Key Features:

Automated invoicing with tax calculations

Integration with accounting and payment systems

Multi-currency support

GST and tax filing features for various regions

Why Choose Smaket Billing Software? Smaket Billing Software is ideal for businesses that need a user-friendly platform with advanced capabilities for both billing and accounting. Whether you're dealing with simple transactions or complex tax filing, Smaket Billing Software ensures everything is accurate and streamlined.

Conclusion

Choosing the right invoicing and tax filing software can significantly improve the efficiency and accuracy of your financial processes. Whether you're a freelancer, a small business owner, or managing a growing company, the right software solution can save you time, reduce errors, and ensure compliance with tax regulations.

QuickBooks Online, Xero, FreshBooks, Zoho Books, Wave Accounting, SlickPie, Sage Business Cloud Accounting, and Smaket Billing Software are all excellent options to consider based on your business needs. By selecting a software solution that fits your business, you can focus more on growing your company and less on administrative tasks like invoicing and tax filing.

So, which software will you choose to streamline your invoicing and tax filing process? Explore these options and find the one that works best for you!

0 notes

Text

A Complete Guide to SaaS Integration Platforms

If you're juggling too many apps and still struggling to keep things streamlined, you're not alone. SaaS apps are lifesavers, but if they're not talking to each other, they're just more hassle. The solution? SaaS integration platforms. This guide will walk you through everything you need to know, step by step.

What Exactly is a SaaS Integration Platform?

A SaaS integration platform lets your cloud-based apps share data effortlessly. Think of it as the glue holding your apps together, ensuring smooth, automatic communication without any manual hassle.

Why Do You Need SaaS Integrations?

Let's keep it simple. Without integrations:

You manually enter data repeatedly.

Errors pile up quickly.

Processes slow down.

Your team becomes frustrated.

With integrations, apps sync automatically, workflows are smooth, and life becomes much easier.

Key Benefits of Using SaaS Integration Platforms

Here’s how integration platforms change your business:

Saves You Time

By automating repetitive tasks, integration platforms let your team focus on bigger things—like growing your business.

Keeps Data Clean

No more duplicates or inconsistencies. Data flows smoothly between platforms, always staying accurate and updated.

Boosts Productivity

With fewer manual tasks, productivity skyrockets. Your team is happier and more efficient.

Cost-Effective

Cutting down manual tasks reduces labor costs. Your budget, thank you.

Different Types of SaaS Integrations

Let’s look at three common integration types:

App-to-App Integration

Connecting two apps directly for instance, linking Salesforce to Slack, so your sales team instantly gets notifications about new leads.

Data Integration

Synchronizes data between platforms. Imagine your CRM data always matching your marketing database—no effort required.

Workflow Automation

Automates complete business processes. A customer fills a form, triggering automatic actions like CRM updates, email campaigns, and billing.

Common Use Cases for SaaS Integration

Here are the scenarios businesses most often use integrations for:

CRM Integration: Connect Salesforce or HubSpot with email marketing apps for automatic follow-ups.

Billing Automation: Automatically link Stripe with accounting apps like QuickBooks or Xero.

Customer Support: Sync Zendesk with your CRM to track customer interactions seamlessly.

How SaaS Integration Platforms Actually Work

APIs

APIs let software communicate. SaaS platforms use APIs to send and receive data automatically.

Triggers and Actions

Something happens in one app (trigger), prompting another app to respond automatically (action).

Middleware

Middleware translates information between apps, ensuring smooth communication even when apps aren’t designed to work together.

Top SaaS Integration Platforms in 2025

Some integration platforms are game-changers. Here’s a quick rundown:

Zapier: Easy to use, perfect for small businesses.

Workato: Ideal for larger teams needing advanced integrations.

Konnectify: Great for embedding integrations directly into your app.

Tray.io: Offers extensive customization with low coding effort.

MuleSoft: Robust platform for enterprises requiring complex integrations.

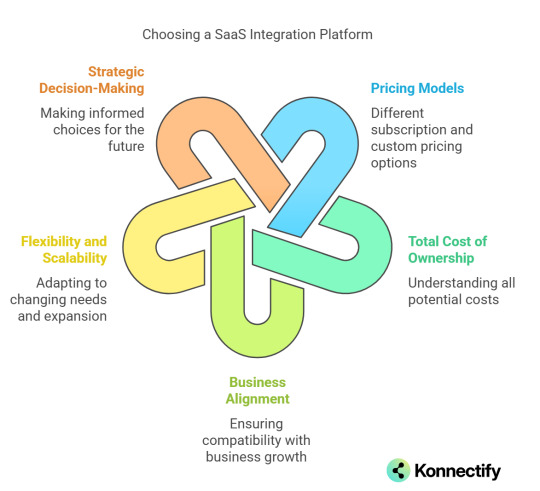

Choosing the Best SaaS Integration Platform

When picking a platform, ask yourself these questions:

Ease of use: Can non-tech folks use it?

Scalability: Will it grow with your business?

Security: Does it meet standards like GDPR or HIPAA?

Cost: Does it fit your budget?

Steps to Implement SaaS Integrations

Ready to get started? Follow these easy steps:

Identify Your Needs: List your apps and figure out what you want to automate.

Choose Your Platform: Pick the integration tool that fits your needs.

Configure the Integration: Set up triggers and actions clearly.

Test and Launch: Test thoroughly, then roll it out to your team.

Common Challenges (and How to Avoid Them)

Integrations aren’t always perfect. Watch out for:

Limited APIs: Some apps might restrict access.

Data Issues: Different formats can create chaos.

Security Concerns: Always pick secure platforms.

Scalability Problems: Make sure your chosen platform can grow alongside you.

Best Practices for Smooth SaaS Integration

Keep things smooth by:

Clearly defining what you need.

Regularly updating and maintaining your integrations.

Monitoring your integrations frequently to catch issues early.

How to Measure the Success of Integrations

Look at these metrics:

Reduction in manual workload

Data accuracy improvements

Productivity boosts

Decreased error rates

Using analytics tools (like Google Analytics) helps you track these changes clearly.

The Future of SaaS Integrations

Integration platforms are constantly evolving. Here’s what's coming next:

AI-driven Integrations: AI will soon predict your integration needs.

Low-code/no-code Solutions: Platforms anyone can use, even without coding skills.

Hybrid Integrations: Seamless links between cloud and traditional on-premise software.

Real-Life Examples of Successful SaaS Integrations

Real-world companies doing integrations right:

Uber: Integrates payment systems, maps, and user ratings effortlessly.

Netflix: Connects billing, user data, and recommendations flawlessly.

Conclusion

SaaS integration platforms aren't just convenient—they're essential. They transform your business from scattered apps into one streamlined, efficient machine. Ready to get started?

FAQs

1. Is SaaS integration expensive? Not always. Pricing varies widely—small businesses have affordable, scalable options.

2. Do integrations require coding knowledge? No! Most modern platforms require minimal to zero coding knowledge.

3. Can integrations improve my customer experience? Definitely. Faster responses and accurate data sharing mean happier customers.

4. How secure are integrations? Leading platforms have robust security measures, so pick a trusted provider.

5. Can SaaS integration platforms scale with my business? Yes—most quality platforms offer flexible, scalable plans suitable for growth.

Please don’t forget to leave a review.

#it services#saas#saas development company#saas platform#information technology#software#b2b saas#saas technology#software development#ipaas

1 note

·

View note

Text

The Importance of Financial Planning & Analysis: Finding the Right Local CPA for Small Business

Small businesses in Cleveland, financial stability and strategic growth depend on solid financial planning and analysis. Whether you’re launching a startup or running an established company, a skilled Certified Public Accountant (CPA) can make all the difference. Local CPAs offer tailored financial strategies to ensure your business remains profitable and compliant with regulations. This article explores the importance of financial planning and analysis and how to find the best local CPA for small business owners.

Understanding Financial Planning & Analysis (FP&A)

What is Financial Planning & Analysis?

Financial Planning & Analysis (FP&A) is a crucial component of business success. It involves budgeting, forecasting, and evaluating financial performance to ensure long-term sustainability. FP&A professionals analyze financial data, identify trends, and provide insights that help businesses make informed decisions.

Why is FP&A Important for Small Businesses?

Many small business owners focus on daily operations but often overlook financial forecasting. Effective FP&A ensures:

Better Cash Flow Management — Helps monitor revenue and expenses to maintain liquidity.

Informed Decision-Making — Provides insights on where to allocate resources for maximum growth.

Risk Mitigation — Identifies potential financial pitfalls before they become major issues.

Improved Profitability — Helps businesses optimize pricing, reduce costs, and enhance overall performance.

Key Components of FP&A

Budgeting & Forecasting — Creating financial plans based on historical data and market trends.

Variance Analysis — Comparing projected results with actual performance to identify gaps.

Financial Modeling — Simulating different business scenarios to anticipate future performance.

Key Performance Indicators (KPIs) — Measuring financial health using metrics like revenue growth, profit margins, and return on investment.

The Role of a Local CPA for Small Business Owners

A local CPA is more than just a tax preparer; they serve as a financial advisor, ensuring small businesses achieve long-term success. Here’s why working with a local CPA is beneficial:

Expertise in Local Regulations and Compliance

Cleveland CPAs are well-versed in Ohio tax laws and business regulations. They ensure your business remains compliant with state and federal requirements, avoiding costly penalties.

Personalized Financial Strategies

A local CPA understands the specific challenges of running a small business in your area. They provide customized financial advice that aligns with your industry and business goals.

Tax Planning and Optimization

Small businesses need to maximize deductions and credits to minimize tax liabilities. A CPA helps develop tax-saving strategies and ensures accurate filings, reducing the risk of audits.

Business Growth and Financial Advisory

Beyond taxes, CPAs offer strategic guidance on:

Business expansion plans

Investment decisions

Cost-cutting measures

Cash flow optimization

Accounting and Bookkeeping Support

Managing finances can be overwhelming for small business owners. A CPA provides bookkeeping support, ensuring accurate record-keeping and financial reporting.

How to Choose the Right CPA for Your Small Business

Finding the right CPA is essential for long-term financial success. Here are key factors to consider:

1. Experience and Specialization

Look for a CPA with experience in working with small businesses. Some CPAs specialize in specific industries, offering tailored expertise.

2. Credentials and Licensing

Ensure the CPA is certified and licensed in Ohio. Check their professional affiliations with organizations like the American Institute of CPAs (AICPA) and the Ohio Society of CPAs.

3. Technology and Software Proficiency

Modern CPAs use accounting software like QuickBooks, Xero, or Sage. Ensure they are proficient in digital tools that streamline financial management.

4. Reputation and Reviews

Read online reviews and ask for client references. A reputable CPA should have positive testimonials from satisfied small business owners.

5. Accessibility and Communication

Choose a CPA who is responsive and available for consultations. Clear communication is crucial for financial planning and decision-making.

6. Pricing and Fee Structure

CPAs charge differently based on services provided. Some work on an hourly basis, while others offer fixed-rate packages. Understand the pricing model before committing.

The Impact of a CPA on Small Business Success

Hiring a local CPA can transform your business by providing expert financial guidance. Here’s how they contribute to business success:

Enhanced Profitability — Helps identify cost-saving opportunities and revenue growth strategies.

Time-Saving — Allows business owners to focus on operations while CPAs handle financial management.

Reduced Financial Stress — Ensures compliance, accurate tax filings, and financial stability.

Better Decision-Making — Provides data-driven insights for informed business strategies.

Conclusion

For small business owners in Cleveland, financial planning and analysis are critical to long-term success. Partnering with a knowledgeable local CPA ensures your business remains financially stable and compliant. From tax planning to strategic financial advice, a CPA plays a crucial role in helping small businesses thrive. Take the time to find the right CPA who aligns with your business needs and watch your company grow with confidence.

0 notes

Text

Mastering Budgeting and Forecasting for Medium-Sized Businesses in the UK, USA, and Australia

In today’s fast-paced business environment, medium-sized businesses must anticipate challenges and opportunities. However, budgeting and forecasting can often feel like an overwhelming process, with fluctuating market conditions and uncertain economic trends complicating financial planning. Many businesses struggle to maintain accurate budgets, causing cash flow issues and missed growth opportunities.

This article provides practical, research-based strategies to improve budgeting and forecasting processes, helping businesses make better financial decisions, minimize risks, and drive sustainable growth.

Why Budgeting and Forecasting Are Critical for Medium-Sized Businesses

Effective budgeting and forecasting are essential to managing financial performance. Without these tools, businesses risk overspending, poor cash management, and missed opportunities for expansion.

1. Budgeting provides a structured financial framework by setting expected revenue and expenses over a specified period.

2. Forecasting allows businesses to predict their future financial performance based on historical data and market trends.

A report by PwC highlights that companies with strong budgeting and forecasting practices are 30% more likely to meet long-term financial goals. When businesses align budgeting with forecasting, they gain visibility into cash flow and can adjust strategies to stay competitive during economic changes.

Key Challenges in Budgeting and Forecasting

Medium-sized businesses often face unique obstacles:

• Limited Resources: Unlike larger corporations, medium-sized firms often have smaller finance teams, limiting their ability to build complex financial models.

• Market Uncertainty: Economic changes such as interest rate hikes or supply chain disruptions make it difficult to predict future financial performance accurately.

• Technological Gaps: Many businesses still rely on outdated tools like spreadsheets, increasing the risk of errors and inefficiencies.

Practical Strategies to Improve Budgeting and Forecasting

1. Adopt Technology-Driven Solutions

Implementing cloud-based financial tools such as QuickBooks, Xero, or Odoo ERP can streamline the budgeting and forecasting process. These platforms offer:

• Real-time financial data for up-to-date decision-making

• Automated reporting to reduce manual errors

• Scenario analysis features to forecast multiple business outcomes

A McKinsey report emphasizes that businesses using automated tools experience a 20-25% improvement in financial forecasting accuracy.

2. Integrate Rolling Forecasts

Instead of relying solely on annual budgets, businesses should adopt rolling forecasts to stay agile. A rolling forecast is updated regularly—typically every quarter—based on real-time performance data. This approach enables businesses to:

• Adjust spending as market conditions change

• Identify potential shortfalls early

• Better allocate resources to high-growth areas

Rolling forecasts provide a competitive edge, especially during uncertain economic times, by ensuring that financial plans remain relevant throughout the year.

3. Use Historical Data to Drive Forecast Accuracy

Leveraging historical financial data improves the accuracy of forecasts. Medium-sized businesses should analyze previous income statements, balance sheets, and cash flow reports to spot trends. This approach helps predict future revenues, seasonal fluctuations, and cash needs more accurately.

Companies that build forecasts based on historical data are better equipped to handle unexpected shifts in revenue streams, ensuring their financial planning is resilient.

4. Align Forecasts with Business Objectives

Successful forecasting is not just about numbers—it involves aligning forecasts with strategic business goals. This can include:

• Expansion into new markets

• Launching new product lines

• Improving profitability through cost-cutting initiatives

By tying financial forecasts to business objectives, companies ensure that financial planning supports long-term growth strategies. This alignment also enhances the visibility of potential risks and rewards.

5. Collaborate Across Departments

Budgeting and forecasting should not be confined to the finance team. Collaboration between departments—such as operations, sales, and marketing—provides a more comprehensive view of business performance.

For instance, sales forecasts can influence budgeting decisions around staffing and inventory, while marketing teams can adjust campaigns based on budget constraints. According to Deloitte, companies that foster cross-departmental collaboration achieve more accurate budgets and forecasts by up to 18%.

Benefits of Accurate Budgeting and Forecasting

Medium-sized businesses that invest in effective budgeting and forecasting practices can expect several advantages:

• Improved Cash Flow Management: By anticipating expenses and revenue fluctuations, businesses can avoid cash shortages and maintain operations smoothly.

• Informed Decision-Making: Data-driven insights enable business owners to make strategic decisions confidently.

• Stronger Stakeholder Confidence: Transparent financial planning enhances trust among investors, lenders, and employees.

• Risk Mitigation: Forecasts allow businesses to proactively address financial risks and adapt to changing market conditions.

Tools and Resources for Medium-Sized Businesses

To ensure success, businesses should explore tools and frameworks designed specifically for financial planning:

• QuickBooks Online: Ideal for budgeting and expense tracking

• Xero: Suitable for multi-currency budgeting for international operations

• Odoo ERP: Provides advanced forecasting and reporting features

Additionally, businesses can access external resources such as government grants, industry benchmarks, and online courses to stay updated on best practices in budgeting and forecasting.

Conclusion:

In today’s competitive markets, mastering budgeting and forecasting is critical for the sustainable growth of medium-sized businesses. By adopting technology-driven solutions, leveraging historical data, and aligning financial forecasts with strategic goals, businesses can improve financial management and remain resilient during economic fluctuations.

If you’re ready to elevate your business’s financial planning, consult with experts who can tailor solutions to your needs. At Sami and Co, we specialize in budgeting, forecasting, and financial advisory services that empower businesses to achieve long-term growth.

Take the next step toward financial success—contact us today for a consultation.

0 notes

Text

guys can i be so honest. jack is genuinely one of the most fascinating characters to me. i need to study him under a microscope

#xero says things#he's so......#idk how to put it. he knows how... niave? he seems? and utilizes it for certain scenarios#people expect him to be bad at social cues because they think he can't read them#but he Can. he just ignores them bc his existence is being committed to the bit BDJSBD#<- the fact he knew sun was uncomfortable in the amanda crossover video and decided to try and remove the issue via acting obnoxious-#-FASCINATES ME.#i love his comedic potential /and/ his actual potential sm#sun and moon show#the sun and moon show#tsams#sams jack o moon#sams jack

40 notes

·

View notes

Text

Top Finance Management Software Solutions for Small Businesses in 2025

The financial software market has seen a big change. There are now many new solutions to help small businesses manage their cash flow and track expenses. Cloud-based accounting and AI-powered budgeting tools are just a few examples. These options are designed to meet the specific needs of small businesses.

Key Takeaways

Zero-based budgeting is revolutionizing financial precision with budgets within +/- 5% accuracy.

Financial software market offers a wide range of solutions, from cloud-based accounting to AI-powered budgeting.

Small businesses can leverage these advanced finance management tools to streamline operations and boost profitability.

Integrated platforms like Anaplan and Prophix One provide powerful financial planning and reporting capabilities.

Emerging technologies, such as blockchain and AI, are making financial software more secure, automated, and insightful.

Understanding Financial Management Software

Financial management software is key for small businesses. It automates financial tasks like expense tracking, payroll, and invoicing. It also helps with tax compliance and financial reporting. With small business budgeting tools, treasury management systems, and funds management software, businesses can better manage their finances.

Key Benefits for Small Businesses

Financial management software offers many benefits. It helps monitor financial health and automates data. It also improves decision-making by tracking finances and managing data in one place. This reduces errors and ensures rules are followed.

It also helps with planning by using past and future data. This way, businesses can make better plans for the future.

Types of Financial Software Solutions

There are many financial software options for small businesses. These include accounting software, budgeting tools, and financial planning platforms. Each offers unique features like tracking expenses and financial modeling.

Using these software solutions, small businesses can improve their finances. They can make better decisions and grow their profits.

Critical Features and Capabilities of Modern Finance Software

When picking a treasury management software, cash management software, or integrated system, small businesses should look for key features. These features help streamline financial operations and offer deeper insights. Modern finance software has tools for monitoring financial health, modeling scenarios, and planning strategically.

Key capabilities of advanced finance software include:

Financial statement generation, reporting, and analysis

Integrated accounting and tax management functionalities

Automated payroll processing and expense tracking

Multi-currency support and centralized formula/KPI management

User-based access controls and drill-down functionality for detailed insights

By using top-notch treasury management solutions, cash management software, or integrated systems, small businesses can manage their finances better. They can make smarter decisions and grow sustainably.

Top 3 Finance Management Software Solutions for Small Businesses

Small businesses face many challenges in managing their finances. The right software can greatly help their success. Three top finance management software options are known for their features, ease of use, and flexibility.

1. Kosh AI

Kosh AI uses artificial intelligence to simplify financial tasks for small businesses. It automates invoicing, expense tracking, and financial reports. This saves time and improves financial data accuracy.

Kosh AI has an easy-to-use dashboard and customizable features. It helps small businesses make informed decisions and stay financially healthy.

2. Xero

Xero is a cloud-based finance management software popular among small businesses. It has over 4.2 million users worldwide. Xero lets small business owners access financial data anytime, anywhere.

Xero also integrates well with other apps, like payroll and inventory systems. This makes it even more valuable for small businesses.

3. Sage Intacct

Sage Intacct is a well-known name in accounting software for small and medium-sized businesses. Its cloud-based software offers many features, including accounting, payroll, and tax compliance. Sage also helps with financial forecasting.

Sage is easy to use and integrates well with other systems. It helps small businesses manage their finances better and make informed decisions.

Budgeting and Financial Planning Solutions

Small businesses need strong budgeting and financial planning tools. These help them manage money well. They can estimate income and costs, use resources wisely, and make smart choices.

There are many ways to budget, like zero-based and activity-based. Small business tools fit different needs. They help entrepreneurs plan better.

Advanced financial planning software does even more. It has features like automated workflows and customized reports. It helps businesses cut down on mistakes and improve predictions.

By using these tools, entrepreneurs can manage money better. They can focus on growing their business.

Integration Capabilities and Technology Requirements

Small businesses are looking to improve their financial management. Modern finance software solutions are key in this area. They often connect with popular CRM, ERP, and HRIS systems. This makes it easy to share and update data across different business areas.

Cloud vs. On-Premise Solutions

Finance management software comes in two main types: cloud-based and on-premise. Cloud-based options are flexible and accessible from anywhere with internet. They let small business owners manage their finances easily.

On-premise solutions give more control over data and infrastructure. They are best for businesses needing strong security or meeting specific compliance rules.

Security and Compliance Features

Choosing the right finance management software is critical for small businesses. They need strong security and compliance features. Look for encryption, single sign-on (SSO), and support for standards like SOC2 and ISO 27001.

These features protect sensitive financial data and help meet regulatory needs.

Data Migration and Synchronization

Smooth data migration and real-time synchronization are essential. They help small businesses switch to new software without disruption. Being able to import old data and keep records up-to-date is key.

Understanding the integration, deployment, security, and data management of finance software helps small businesses choose wisely. This ensures they find a solution that fits their needs and IT setup.

Conclusion

The world of finance management software has changed a lot. Now, small businesses have many powerful tools to help them manage their money better. These tools include automated workflows, predictive analytics, and integrated reporting.

These features help small businesses make smart choices based on data. They can improve how they work and grow in a healthy way.

Using finance management software is now key for small businesses. It helps them work better, be more efficient, and grab new chances in the business world.

By using these new software tools, small businesses can become more agile and successful. They can face the future with confidence and achieve great things.

Also Read: How a Treasury Management System Helps Businesses Scale with Efficiency

0 notes

Text

Top 5 Financial Management Software Of 2023

When you think of counting, a dozen universally means twelve, whether it's eggs or zodiac signs. Yet in the baking world, a baker’s dozen adds a twist with thirteen! Imagine a scenario where everyone followed their own set of numerical rules—financial management would be a total mess. Thankfully, that’s where Financial Management Software steps in!

This article dives into the top 5 Financial Management Software of 2023—tools designed to smooth out your financial tasks like a bakery blending flavors for the perfect loaf.

The Top Contenders:

QuickBooks: Established in 1983 by Intuit, QuickBooks reigns supreme, with around 7 million businesses relying on it for their financial needs. With features like invoicing, expense tracking, and payroll management, it’s the trusty sidekick for any small or medium-sized enterprise looking to keep their finances in check.

Xero: This cloud-based marvel, founded in 2006, has won the hearts of over 2.7 million users. Xero’s charm lies in its accessibility—you can manage your finances from anywhere, any time! Plus, with connectivity to over 800 third-party apps, it’s like having a personal financial assistant at your fingertips.

Zoho Books: A part of the Zoho family since 2011, Zoho Books combines functionality with user-friendliness. It offers tools for invoicing and expense management, all while allowing you to take control of your finances on the go with its mobile app. It’s like having your very own financial cake recipe!

FreshBooks: Fresh out of Toronto in 2003, this software is a dream for small businesses and freelancers alike. With its award-winning interface and a host of features from invoicing to time tracking, FreshBooks makes managing finances feel effortless—even with a busy schedule!

Wrike: Founded in 2006, Wrike has quickly become a go-to for over 20,000 customers. With robust features for task management and collaboration, it enhances team efficiency. Wrike’s intuitive design and ability to integrate with popular tools make it a delightful choice for businesses across various sectors.

Final Thoughts

In the ever-evolving world of finance, staying ahead means embracing the right Financial Management Software. The tools listed here bring unique strengths to the table, helping you optimize your financial workflows and make savvy decisions. With the right software, you can bake your way to financial success!

0 notes

Note

I’ve been away for a few days and was just catching up with what I missed on this page, and I need confirmation that I read what you wrote correctly and I’m not crazy.

PK almost ate Xero?!

hi, welcome back hahaha

well, he did eat some of him, and he's not proud of it, even though he did not do it intentionally

the way i imagine it happened, was that pk and hornet were approached by xero while they were away from the palace. he challenged pk to a duel, and when pk told him to stand down, he attacked. with the radiance's influence, he was a difficult opponent even for pk (especially as pk at that point, pk was alreasy physically weak due to the lack of proper nutrition), and on top of that, pk was not only trying to defend himself, but also keep hornet away from the line of fire, so he was already at a disadvantage. unfortunately, his daughter was more feisty than he thought, and tried to help her dad by grabbing xero's cloak and attempting to distract him. that didn't end well, as she was quickly kicked away like a little spider ball. right as xero was about to land a killing blow on her, pk felt himself blacking out, and without thinking pounced on him. he doesn't remember anything, except the sight of xero's mangled, half eaten corpse that he was greeted by once he regained control. he quickly ran to scared hornet, grabbed her and returned to the palace, covered in the blood of xero and his own, trying not to think of what just happened

that whole incident left him shaken for a good while, as he was already worried about his instincts and losing control. yes, he was acting in self defense and to protect hornet, but he didn't just kill him. at that point he already avoided eating actual food but this made him even more paranoid, and is the main reason for why he is extremely careful not to hurt any sapient beings now that he's 'feral', on top of having nightmares of losing control and harming his loved ones. granted, nothing like this happened to him since, as it was an incredibly specific scenario which would be difficult to repeat now, but he's still worried. always so worried

"cursed be those who turn against the king" indeed

30 notes

·

View notes

Text

Best Xero Training Institutes in Mohali: Master Cloud Accounting

Xero has emerged as one of the leading cloud-based accounting software, used by businesses globally for managing financial operations. Whether you are a business owner looking to streamline your accounting processes or an aspiring accountant aiming to boost your skills, learning Xero can give you a significant edge in today's competitive market. If you’re looking for the best Xero training institute in Mohali, you’ve come to the right place!

In this blog, we will explore the importance of Xero training, what you can expect from a quality training institute, and highlight the top Xero institutes in Mohali to help you achieve your career goals.

Why Learn Xero?

Xero is widely known for its user-friendly interface and powerful features that simplify accounting tasks such as bookkeeping, invoicing, inventory management, payroll, and financial reporting. Here are a few reasons why learning Xero can be beneficial:

1. Growing Demand for Cloud Accounting

With the shift towards cloud-based software, Xero is rapidly being adopted by small and medium enterprises.

Proficiency in Xero opens up opportunities in accounting firms, financial departments, and freelance bookkeeping.

2. Automation and Efficiency

Xero allows automation of manual accounting tasks, enabling faster invoicing, expense tracking, and reconciliation.

Learning Xero can make you more efficient in managing a business's finances, saving time and reducing errors.

3. International Recognition

Xero is used in over 180 countries, which means having expertise in this software enhances your job prospects both locally and globally.

4. Integration with Other Software

Xero integrates with more than 800 apps, including CRM systems, payment gateways, and inventory management tools. Understanding how to work with these integrations can expand your technical skill set.

5. Streamlined Financial Reporting

Xero provides real-time reports, which help businesses make informed decisions. As a Xero-trained professional, you’ll be able to assist organizations in analyzing financial data efficiently.

What to Expect from a Good Xero Training Institute?

Before diving into the list of the best Xero training institutes in Mohali, it's important to understand what makes an institute stand out. Here's what you should look for:

1. Comprehensive Curriculum

The course should cover all aspects of Xero, including setting up an account, managing invoicing, handling payroll, bank reconciliation, and generating financial reports.

The curriculum should also include real-world scenarios for better understanding.

2. Experienced Trainers

A good institute will have trainers with extensive experience in accounting and cloud-based software, especially Xero.

Trainers should provide hands-on learning and personalized attention to ensure that all your doubts are cleared.

3. Practical Learning Approach

Practical learning with real-life examples and case studies is crucial for mastering Xero.

Institutes that offer live projects or simulations can significantly improve your learning experience.

4. Certification

Ensure the course provides industry-recognized certifications, ideally from Xero itself, which adds value to your resume.

Certifications demonstrate your proficiency and can boost your employability.

5. Job Assistance and Support

Many top institutes offer job placement support or internships to help you kickstart your career after completing the course.

Institutes with good industry connections can also offer guidance on career growth.

Top Xero Training Institutes in Mohali

Here’s a curated list of some of the best Xero training institutes in Mohali:

1. Mohali Career Point (MCP)

Mohali Career Point offers a well-structured Xero course aimed at both beginners and professionals. Their Xero training includes step-by-step guidance on setting up and managing accounts, payroll processing, invoicing, and financial reporting.

Course Features:Hands-on experience with real-world accounting scenarios.

Comprehensive coverage of Xero’s features, including bank reconciliation, invoice management, and multi-currency transactions.

Trainers with in-depth knowledge of accounting and cloud-based software.

Certification upon completion, recognized in the industry.