#web3 banking

Explore tagged Tumblr posts

Text

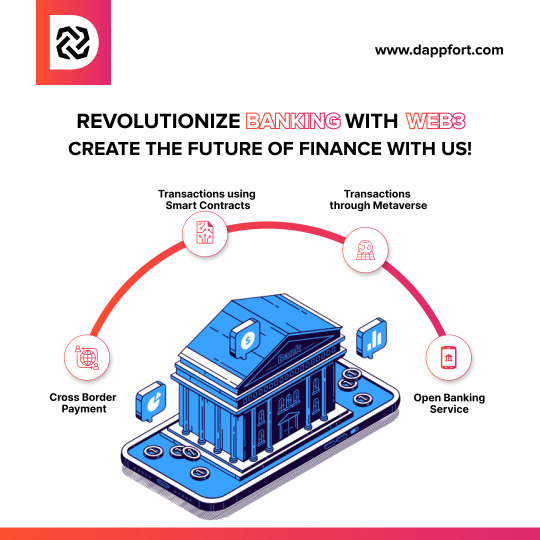

With dappfort , you can create a Web3 banking app that offers a wide range of financial services, including savings accounts, lending & borrowing, investments, insurance, and more, all facilitated by smart contracts.

To know more - >

2 notes

·

View notes

Text

Web3 Banking: The Future of Decentralized Finance

The evolution of the internet from Web1, a read-only environment, to Web2, where users could both read and create content, has been transformative. However, the dawn of Web3 is set to change the landscape even further, particularly when it comes to financial services. Web3 banking represents a decentralized, permissionless, and trustless financial system that operates on blockchain technology, offering an alternative to traditional banking methods.

What Is Web3 Banking?

Web3 banking refers to financial services built on decentralized networks that leverage blockchain technology and smart contracts. Unlike traditional banks that are centralized and controlled by financial institutions, Web3 banking is decentralized, meaning it operates without intermediaries or central authorities.

Web3 banking is part of the broader Web3 movement, which seeks to give users more control over their data, digital assets, and interactions by using cryptographic technologies. In the context of finance, Web3 banking allows individuals to hold, trade, and manage assets in a decentralized manner, often using cryptocurrency wallets instead of traditional bank accounts.

Key Components of Web3 Banking

Cryptocurrencies: Digital assets like Bitcoin and Ethereum are at the core of Web3 banking. They act as mediums of exchange and store of value, offering an alternative to fiat currencies.

DeFi (Decentralized Finance): DeFi platforms offer decentralized versions of traditional financial services such as lending, borrowing, and trading without intermediaries. These platforms use smart contracts to automate transactions and eliminate the need for banks or financial institutions.

Blockchain Technology: At the foundation of Web3 banking is blockchain, a distributed ledger that records transactions across a network of computers. This ensures transparency, security, and immutability of transactions.

Smart Contracts: Smart contracts are self-executing contracts where the terms are encoded into the blockchain. These contracts eliminate the need for intermediaries and automatically execute transactions when predefined conditions are met.

Decentralized Identity: Web3 banking allows users to retain control of their identities and personal information. Using decentralized identities, users can access financial services without revealing unnecessary personal data, enhancing privacy and security.

Benefits of Web3 Banking

1. Decentralization

One of the core principles of Web3 banking is decentralization. Unlike traditional banks, which are centralized and controlled by a handful of financial institutions, Web3 banking operates across a decentralized network of computers. This allows for a more transparent and democratized system where users have direct control over their assets and data.

2. Financial Inclusion

Web3 banking has the potential to bring financial services to the billions of people around the world who are unbanked or underbanked. Traditional banking systems often exclude individuals who lack access to identification, credit history, or stable infrastructure. With Web3 banking, all you need is an internet connection and a cryptocurrency wallet, providing financial services to anyone, anywhere.

3. Lower Fees and Faster Transactions

In traditional banking, intermediaries such as banks, payment processors, and remittance companies charge fees for processing transactions. These fees can be high, particularly for cross-border payments. Web3 banking eliminates the need for intermediaries, significantly reducing transaction fees and enabling near-instantaneous transfers, even across international borders.

4. Enhanced Privacy and Security

Web3 banking allows users to maintain control over their data through decentralized identities and cryptographic encryption. Unlike traditional banks that store customer data in centralized databases (which are prone to breaches), Web3 banking operates on a blockchain, making it highly secure. Users don’t have to provide sensitive personal information to third parties, reducing the risk of identity theft or data breaches.

5. Transparency and Trustlessness

In Web3 banking, all transactions are recorded on a public ledger (blockchain), which ensures transparency. This system is also “trustless,” meaning users don’t need to rely on a central authority or institution to facilitate transactions. Instead, smart contracts automate processes, ensuring that agreed-upon terms are executed without human intervention.

How Web3 Banking Differs from Traditional Banking

1. Centralization vs. Decentralization

Traditional banking relies on central authorities like banks or government-regulated financial institutions to manage transactions, hold funds, and provide services. In contrast, Web3 banking is decentralized, with no single entity controlling the system. Instead, a network of nodes maintains the blockchain and ensures the integrity of the system.

2. Intermediaries vs. Direct Control

In traditional banking, intermediaries like banks, payment processors, and clearinghouses facilitate transactions. These intermediaries are responsible for ensuring the legitimacy of transactions and providing a trusted network for the transfer of funds. Web3 banking eliminates intermediaries, allowing users to have direct control over their assets using decentralized wallets and smart contracts.

3. Accessibility and Inclusivity

Traditional banking systems require identification, credit scores, and access to specific financial institutions. In contrast, Web3 banking is open to anyone with an internet connection, offering financial inclusion to the unbanked and underbanked populations.

4. Privacy and Data Ownership

In traditional banking, users must provide personal information to banks and financial institutions, which store it in centralized databases. Web3 banking shifts the power of data ownership to the individual. Using decentralized identities, users control their own data and only share it when absolutely necessary.

The Future of Web3 Banking

Web3 banking is still in its infancy, but its potential to disrupt traditional banking is immense. As decentralized finance (DeFi) continues to grow, we will likely see more sophisticated financial services that rival or even surpass those offered by traditional banks. These could include decentralized savings accounts, lending platforms, and even decentralized insurance products.

Regulation will be a key factor in the future development of Web3 banking. While the decentralized nature of Web3 is one of its strengths, governments and financial regulators may impose rules that could shape the future of the space. However, as more users and institutions embrace Web3 technologies, it’s clear that the financial world is on the cusp of a significant transformation.

Conclusion

Web3 banking represents a paradigm shift in how financial services are delivered and accessed. By leveraging blockchain, smart contracts, and decentralized networks, Web3 banking offers a more transparent, inclusive, and secure alternative to traditional banking systems. As the Web3 ecosystem continues to evolve, we are likely to see further innovation in decentralized finance, making financial services more accessible and efficient for everyone.

The future of banking is decentralized, and Web3 banking is leading the way.

0 notes

Text

Digital Currencies in 2024: The Future of Money and Technology

Description

Digital currencies, often referred to as cryptocurrencies, have revolutionized the financial landscape. As we move into 2024, their influence continues to expand, reshaping everything from international trade to individual financial empowerment. In this article, we’ll explore the evolution of digital currencies, highlight their most prominent features, and delve into the future trends that could shape the world of finance

Understanding Digital Currencies

Digital currencies are decentralized, internet-based forms of money that use cryptographic technology to ensure secure, peer-to-peer transactions. Unlike traditional fiat currencies controlled by central banks, cryptocurrencies such as Bitcoin, Ethereum, and Ripple (XRP) operate on blockchain technology—a transparent ledger that records all transactions.

The Rise of Bitcoin and Altcoins

Bitcoin, introduced in 2009, is the first and most widely known cryptocurrency, often dubbed “digital gold.” Over the years, Bitcoin has grown in both value and adoption, serving as a store of value and an investment vehicle.

Other digital currencies, called altcoins, have emerged to challenge Bitcoin's dominance. Ethereum, for instance, introduced smart contracts that automate processes and revolutionized decentralized applications (DApps). In 2024, DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens), primarily built on Ethereum, continue to attract attention, reshaping the way digital assets are traded and owned

"Unlock your next big opportunity—click the link now and take the first step toward success!"

Top Benefits of Digital Currencies

Digital currencies offer several advantages over traditional financial systems, making them an appealing choice for both investors and everyday users.

Decentralization: Cryptocurrencies are not controlled by any government or financial institution. This ensures users have full control over their assets and are not subject to centralized authorities.

Security: Blockchain technology makes it extremely difficult to alter transaction records, providing a high level of security against fraud and hacking.

Low Transaction Costs: Traditional cross-border payments often involve high fees, especially for international transfers. Cryptocurrencies offer much lower transaction fees, making them attractive for global transactions.

Financial Inclusion: Digital currencies provide access to financial services for people without access to traditional banking. In 2024, millions of unbanked individuals globally are benefiting from using digital wallets and decentralized platforms.

The Most Popular Cryptocurrencies in 2024

In addition to Bitcoin and Ethereum, several other cryptocurrencies are making waves in 2024, including:

Ripple (XRP): Known for its efficient cross-border payment solutions.

Cardano (ADA): Gaining popularity due to its focus on sustainability and scalability in blockchain technology.

Solana (SOL): A fast, scalable platform for decentralized apps and crypto services.

Polygon (MATIC): Enhancing Ethereum’s scalability and enabling cheaper transactions

"Unlock your next big opportunity - click the link now and take the first step towards success!"

The Role of Central Bank Digital Currencies (CBDCs)

Another significant trend in 2024 is the rise of Central Bank Digital Currencies (CBDCs). Unlike decentralized cryptocurrencies, CBDCs are issued and regulated by central banks. Governments across the globe are now exploring their own digital currencies to improve financial efficiency, transparency, and inclusivity. Countries like China with its Digital Yuan, and the European Union with the Digital Euro, have made substantial progress.

CBDCs aim to combine the benefits of cryptocurrency—such as faster, cheaper transactions—with the security and stability of traditional fiat currencies.

Key Trends for Digital Currencies in 2024

As digital currencies continue to evolve, here are some of the key trends shaping their future:

Mass Adoption: In 2024, businesses and institutions worldwide are increasingly accepting cryptocurrencies as a legitimate form of payment, with more retailers integrating crypto-payment solutions.

Web3 and Decentralized Apps (DApps): With the growth of Web3, digital currencies are playing a crucial role in decentralized applications, creating new ways for users to interact with the internet, without intermediaries.

Regulation: Governments are paying more attention to regulating cryptocurrencies, ensuring consumer protection while promoting innovation in the space.

Sustainability Initiatives: The environmental impact of cryptocurrency mining has been a concern, but newer cryptocurrencies like Cardano and Solana are making strides in energy-efficient blockchain solutions

"Unlock your next big opportunity - click the link now and take the first step towards success!"

The Future of Digital Currencies

Looking ahead, digital currencies are likely to continue their upward trajectory, integrating further into everyday life. We can expect advancements in privacy coins like Monero (XMR), which prioritize user anonymity, and growth in interoperability between different blockchain platforms.

Another development to watch in 2024 is the expansion of tokenization, where real-world assets like real estate, stocks, and commodities are being digitized and traded on blockchain platforms.

Investing in Cryptocurrencies in 2024

For investors, digital currencies offer both opportunities and risks. The cryptocurrency market is known for its volatility, but long-term believers view it as a hedge against inflation and a chance to participate in the future of finance. Experts advise diversifying one’s portfolio, researching projects carefully, and staying informed about regulatory changes.

Conclusion

Digital currencies are more than just a trend—they represent a fundamental shift in how we perceive and use money. As we move through 2024, the continued development of blockchain technology, increased adoption of cryptocurrencies, and the integration of digital assets into financial systems will shape the future of the global economy.

For those looking to stay ahead, understanding the potential of digital currencies, exploring opportunities for investment, and adapting to this fast-evolving world are key steps to navigating the new financial landscape

"Unlock your next big opportunity - click the link now and take the first step towards success!"

#cryptocurrency#bitcoin#Ethereum#Blockchain technology#Decentralized finance (DeFi)#Central Bank Digital Currency (CBDC)#Digital wallet#Smart contracts#altcoins#tokenization#web3#DeFi applications#nfts#Crypto regulation#Cryptocurrency exchange

0 notes

Text

Web3 & Crypto Technology

The rise of cryptocurrency and Web3 technologies has ushered in a new era of empowerment for individuals worldwide. These revolutionary technologies have the potential to break down traditional power structures, democratize access to financial resources, and give individuals greater control over their digital identities. In this essay, I will explore how crypto and Web3 technologies are…

View On WordPress

0 notes

Text

💳 BRINGING FINANCE ACROSS DIFFERENT CULTURES 🌍🗺️

🔥 Different languages, diverse cultures, and various views on finance, however, FlipMe is connecting all of us by providing a global platform for payment solutions 💁♀️

🤝 By partnering with local providers worldwide, FlipMe will not only enable access to financial services but it will deliver an equal financial experience for all ✅

🚨 Join FlipMe today and get ready for seamless global payment solutions 👉 https://flip-me.com/

0 notes

Text

The Ultimate Beginner's Guide to Stablecoins

Stablecoins represent a revolutionary development in the cryptocurrency landscape, providing a stable alternative to the highly volatile nature of traditional digital assets like Bitcoin. By pegging their value to fiat currencies, commodities, or other assets, stablecoins offer a reliable means of transaction and investment within the crypto ecosystem. Fiat-backed stablecoins such as Tether (USDT) and USD Coin (USDC) are supported by real-world reserves, ensuring their stability. Meanwhile, crypto-collateralized stablecoins like DAI are backed by other cryptocurrencies, offering greater decentralization and transparency. Despite their benefits, stablecoins are subject to regulatory scrutiny and technological risks, as demonstrated by past incidents like the Terra UST collapse.

Stablecoins bridge the gap between cryptocurrencies and traditional finance by providing a stable and liquid asset that can be used for trading, payments, and as a buffer against market volatility. They are integral to the functioning of decentralized finance (DeFi) platforms, enabling activities such as lending, borrowing, and yield farming. However, the success and reliability of stablecoins depend on robust regulatory frameworks, security measures, and technological advancements. As these aspects continue to evolve, stablecoins are expected to play an increasingly important role in the global financial system.

Intelisync is at the forefront of this financial innovation, offering services to help you navigate and leverage stablecoin technology effectively. Whether you are an investor, builder, or consumer, we can assist you in understanding Learn more....

#Algorithmic Stablecoins#Benefits of stablecoin#Can stablecoins lose their value#Challenges and Risks Crypto-collateralized stablecoins#FIAT-backed Vs Algorithmic Stablecoins#Fiat-Collateralized Stablecoinsn#How to Store Stablecoins Safely#How to Use Stablecoins in DeFi Platforms#Popular Stablecoins in the Market#The future of stablecoins#Types of Stablecoins#What is a Stablecoin A Complete Guide for Beginner#What is a stablecoin#What is the difference between Stablecoins vs. Central Bank Digital Currencies (CBDCs)?#Why Are Stablecoins So Important Intelisync blockchain development intelisync web3 agency

0 notes

Text

SMEDAN Sterling Bank Loan Application Guide for Business Owners (Get up to N2.5M For Your Business)

The Sterling Bank of Nigeria and the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) have partnered to launch a N5 billion loan program that is designed to empower small and medium-sized enterprises (SMEs) across Nigeria. The SMEDAN Sterling Bank Loan is an offer of single-digit interest rates and flexible repayment terms, making it an attractive option for SMEs looking to…

View On WordPress

#CAC#Call for Applications#Grants#loan#naij#naija#NaijaBullet#Nigeria#SMEDAN#SMEDAN Sterling Bank Loan#Startup WISE Guys#Sustainability Acceleration Program#web3#Web3 Business Grant

0 notes

Text

dynajet - d and j letter, growth, data, arrow, fly by Artology ✅ https://lnkd.in/d5-8gGx6

Contact us to get your logo design or branding project done: 📩 [email protected]

#Arrow#DataCenter#Growth#Web3#Logo#lettering#Analytics#simple#Creative#finance#financelogo#banking#technology#modern#logodesign#logos

0 notes

Text

Top5 Crypto Events

Be part of this top 5 crypto events on 1st May 2023!!!!

0 notes

Text

#technology#tech#business#enterprenuership#figma#creative#webdevelopment#web3 development#ui ux design#content creation#technical writing#blockchain#new post#news#tech news#banks#finance#crypto

0 notes

Photo

Hey guys, check out our latest video- #Banks on digital wallet | #MakerDAO deploys $100m on #YearnFinance | Floor acquires WGMI | #Tesla 🔰Credits to the original news content sources- 1- Crypto Wallets On Crosshair of Major Banks As They Take On #PayPal, Apple Pay- https://bitcoinist.com/crypto-wallets-on-crosshair-of-major-banks 2- MakerDAO Approves Deployment of $100M USDC on #DeFi Protocol Yearn Finance- https://www.coindesk.com/tech/2023/01/23/makerdao-approves-deployment-of-100m-usdc-on-defi-protocol-yearn-finance 3- #NFT price tracker #Floor acquires #web3 analytics firm #WGMI- https://www.theblock.co/post/204629/nft-price-tracker-floor-acquires-web3-analytics-firm-wgmi 4- Bitcoin overtakes #Tesla as $40 billion flows into BTC market cap in a week- https://finbold.com/bitcoin-overtakes-tesla-as-40-billion-flows-into-btc-market-cap-in-a-week —————————————————————————————————————— 🔰If you Want to get 100 USDT, Register on the world's biggest crypto exchange- Binance and deposit more than $50 into your account. We'll both get a 100 USDT cashback voucher! 👉 https://bit.ly/bobinance #️⃣ Let's connect on Social Media:🌎 : 👍All links here (IG, Twitter, etc) - https://linktr.ee/cryptoikonmedia 📼 Also Streaming on Theta: https://www.theta.tv/cryptoikonmedia 💼 Business Inquiries: [email protected] 😎 Common username on all other major platform: @cryptoikonmedia 🔰About us: Crypto Ikon Media is a full-service Interactive #Crypto Media Agency. We provide 360-Degree Digital Branding & Marketing services to (Crypto, Defi, NFT, Web3, Metaverse & Blockchain) projects and companies. ——————————————————————————————————————— Disclaimer: Our content is not financial advice, legal advice or tax advice in any way, shape or form. Please do your own research. DM for credit or removal request (no copyright intended) ©️ All rights and credits reserved to the respective owner(s) . . . . . . #cryptonews #cryptocurrency #crypto #bitcoin #cryptotrading #blockchain #ethereum #btc #cryptocurrencies #bitcoinnews #bitcoins #cryptoworld #cryptoinvestor #eth #cryptocurrencynews ============= bob, bobasheesh, bobasheesh, cim, cryptoikonmedia, cryptoikonmedia, (at Delhi, India) https://www.instagram.com/p/Cnz1egMIZcP/?igshid=NGJjMDIxMWI=

#banks#makerdao#yearnfinance#tesla#paypal#defi#nft#floor#web3#wgmi#crypto#cryptonews#cryptocurrency#bitcoin#cryptotrading#blockchain#ethereum#btc#cryptocurrencies#bitcoinnews#bitcoins#cryptoworld#cryptoinvestor#eth#cryptocurrencynews

0 notes

Photo

Hey guys, check out our latest video- #Banks on digital wallet | #MakerDAO deploys $100m on #YearnFinance | Floor acquires WGMI | #Tesla 🔰Credits to the original news content sources- 1- Crypto Wallets On Crosshair of Major Banks As They Take On #PayPal, Apple Pay- https://bitcoinist.com/crypto-wallets-on-crosshair-of-major-banks 2- MakerDAO Approves Deployment of $100M USDC on #DeFi Protocol Yearn Finance- https://www.coindesk.com/tech/2023/01/23/makerdao-approves-deployment-of-100m-usdc-on-defi-protocol-yearn-finance 3- #NFT price tracker #Floor acquires #web3 analytics firm #WGMI- https://www.theblock.co/post/204629/nft-price-tracker-floor-acquires-web3-analytics-firm-wgmi 4- Bitcoin overtakes #Tesla as $40 billion flows into BTC market cap in a week- https://finbold.com/bitcoin-overtakes-tesla-as-40-billion-flows-into-btc-market-cap-in-a-week —————————————————————————————————————— 🔰If you Want to get 100 USDT, Register on the world's biggest crypto exchange- Binance and deposit more than $50 into your account. We'll both get a 100 USDT cashback voucher! 👉 https://bit.ly/bobinance #️⃣ Let's connect on Social Media:🌎 : 👍All links here (IG, Twitter, etc) - https://linktr.ee/cryptoikonmedia 📼 Also Streaming on Theta: https://www.theta.tv/cryptoikonmedia 💼 Business Inquiries: [email protected] 😎 Common username on all other major platform: @cryptoikonmedia 🔰About us: Crypto Ikon Media is a full-service Interactive #Crypto Media Agency. We provide 360-Degree Digital Branding & Marketing services to (Crypto, Defi, NFT, Web3, Metaverse & Blockchain) projects and companies. ——————————————————————————————————————— Disclaimer: Our content is not financial advice, legal advice or tax advice in any way, shape or form. Please do your own research. DM for credit or removal request (no copyright intended) ©️ All rights and credits reserved to the respective owner(s) . . . . . . #cryptocurrency #crypto #cryptocurrencies #cryptotrading #cryptonews #cryptomining #cryptoworld #cryptolife #cryptotrader #cryptoinvestor #cryptocurrencynews #cryptomemes #cryptomarket #cryptos #cryptotrade #cryptocurrencytrading #cryptoexchange #cryptozoology (at Delhi, India) https://www.instagram.com/p/Cnz3S-fIF3Y/?igshid=NGJjMDIxMWI=

#banks#makerdao#yearnfinance#tesla#paypal#defi#nft#floor#web3#wgmi#crypto#cryptocurrency#cryptocurrencies#cryptotrading#cryptonews#cryptomining#cryptoworld#cryptolife#cryptotrader#cryptoinvestor#cryptocurrencynews#cryptomemes#cryptomarket#cryptos#cryptotrade#cryptocurrencytrading#cryptoexchange#cryptozoology

0 notes