#wbk 166

Explore tagged Tumblr posts

Text

no one:

me & class 1-1: bookmarked, saved, etched into my brain

#wind breaker#wbk#sakura haruka#haruka sakura#wb#wbk sakura#wbk 166#wbk spoilers#wb spoilers#wbk manga#wbk manga spoilers#wb manga spoilers#wind breaker spoilers#wind breaker manga#wind breaker sakura#wind breaker (satoru nii)#mangacap#bofurin#class 1-1#manga screencap#winbre#mangaedit#nanaqueue(♡´͈༝`͈)ฅ˒˒

183 notes

·

View notes

Text

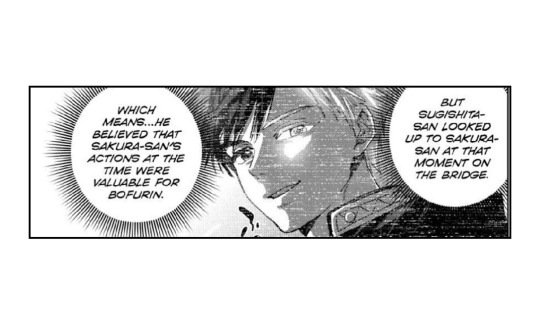

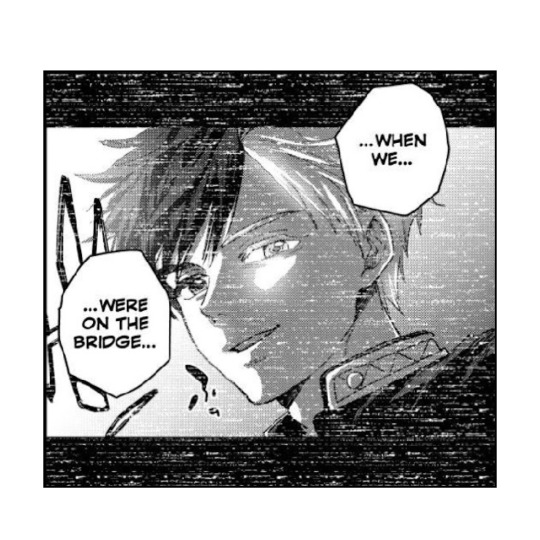

when you're in a sakura haruka glazing competition and your opponent is nirei akihiko😥😂

he’s so cute AHHHHHー🥰🥰🥰

#wind breaker#wbk#wbk 166#wbk spoilers#wb spoilers#wbk manga spoilers#nirei akihiko#wb#wbk nirei#wind breaker nirei#wbk manga#mangaedit#mangacap#wind breaker (satoru nii)#winbre#wbk official#wind breaker edit#nireisaku#sakunirei

247 notes

·

View notes

Text

WIND BREAKER CHAPTER 166 ⭐

↳ by @/lmswiwpl_18 on twitter

24 notes

·

View notes

Text

⌕. WIND BREAKER

⟳. “ DID I IMPRESS YOU? ”

how would the wbk boys impress you to catch your attention or they want you to praise them?

character/s : sakura haruka , suo hayato , togame jo , kaji ren , umemiya hajime , kiryu mitsuki .

warning/s : suo’s part is like 50/50 so uhm !! you can decide if it’s part of it or not ! , ooc characters ( im sorry sighs )

word count : 100+ each

note : i have motivation to write so might as well make the best of it !! i’m also planning to make suo’s part a separate fic uhm..

sakura haruka — 119 words

i don't know but i think sakura would try to impress you by showing how he’s good at fighting but when you praise him for that or he got your attention because of that he gets flustered easily and tries to brush it off saying he’s not doing it to impress you when it’s clearly written on his face.

you can only laugh when he says that you’ll probably won't even believe anything he says and just look at his face to see if he meant it or not.

“ where have you been all these years my knight in shining armor? ” you teased him, your hands clasped together in return he looked away with a blush on his face.

suo hayato — 165 words

bro doesn't even need to impress you because you’re already impressed by him !! he’s a gentleman everyone knows and that’s also how you're already impressed because why is he so gentle? so whenever you two are together people will mistake that you and suo are dating because of how considerate suo whenever he’s with you.

you’ll never even catch him irritated whenever you let him carry your school bag or the things you bought, he’s just there following you with a smile on his face.

“ why are you doing this every time we are together? ” you asked as you take a spoonful of ice cream in your cup and eat it. “ i’m close to falling for you, you know. ” you said half jokingly when he chuckled as he wiped the ice cream from the side of your mouth. “ i’ll wait for the day you fall for me. ” he replied making you speechless and a blushing mess as you just continue to eat your ice cream.

togame jo — 118 words

did a bit of research and seems like he plays go and shogi so uh he would probably invite you to watch him play with shogi with someone.

he knew he would win it and obviously you are in awe saying how good he was at shogi so you invite him to play with you after he plays a couple of rounds. you weren't good at playing shogi but you wanna test out your skills.

he beat you once or twice then after that then lets you win every round. “ wow, togame i didn't know i’m the only one who can beat you! ” you quip making him chuckle as he nodded. ” guess you're too good at this game. ”

kaji ren — 166 words

you heard that the music playing in his headphones are something that can damage his eardrums but it seems like his ears don't even hurt so you would let him try one of your favorite music to see if he likes it.

when you two were taking a walk around the town, you were rambling about your favorite band and how cool and good their music are. kaji didn't let that slip in his mind and listened to their music when he got home.

the next day, you suggested one of their songs and his response was he had listen to it and taking a liking to the song and it was now on his playlist. your eyes widen and smiled. “ really? its a good music isn’t? you got a good taste in music! ” you praise as you pat his back as if he’s choking on something. it just made you more even happy that he has one of your very favorite song in his playlist.

umemiya hajime — 195 words

you helped him plant some seeds in the rooftop since you don’t have anything to do and everybody knows that umemiya is a man that cares for everyone. let’s imagine umemiya has like one of those portable stove hidden in the rooftop 😭😭 so you were flabbergasted when you just saw him casually take out a portable stove. he remembers that he doesn't have enough ingredients to cook something so he apologizes for that and quickly run into kotoha’s cafè to get a few ingredients. when he got the ingredients you just watched him.

you watch the white haired man cook something in front of you — you didn't even know he has the skills to cook! clearly you’re impressed since you can’t cook to save your life. ( if you would even cook it’s burnt. ) he probably learned it with kotoha. when he finished cooking he gave you a portion of food he had cooked for you two. you gave it a ten out of ten. it was delicious as you thanked him for it.

“ never knew you could cook, maybe i’ll hire you as my personal chef in the future. ” you said jokingly making umemiya snort.

kiryu mitsuki — 145 words

if you invite him to play a game with him he will accept it without hesitation even if you're bad at it or you just started playing he would help you and will still play with you even if you’re the worst player in the game.

would probably try to impress you to fish out some compliments from you and it works like a charm. “ damn, didn’t knew you’re so good at this! ” you would say as he just laughed wholeheartedly.

he probably won’t even try to hide that he’s trying to impress you. “ i should be good at all these games so i can carry you and impress you, y’know. ” he says that with a smile plastered on his face.

if you two are not talking about games or anything you’re gonna comment about how good he smells because of the perfume he uses.

date posted 062324

#wind breaker x reader#wbk x reader#sakura haruka x reader#suo hayato x reader#suo x reader#togame jo x reader#togame x reader#kiryu mitsuki x reader#umemiya hajime x reader#umemiya x reader#kaji ren x reader#kaji x reader#wbk fluff#wind breaker fluff

915 notes

·

View notes

Text

⌕. WIND BREAKER

“ WHAT DID YOU SAY.. ? ”

. . . your sibling telling you to shut up in front of them as a prank .

characters : sakura haruka , nirei akihiko , toma hiiragi , umemiya hajime .

warning : none.

note : this has been in my notes for a MONTH. huhu plz

꒰ the request | wbk masterlist | masterlist ꒱

sakura haruka — 166 words

it was unexpected that you and sakura babysit your little sister — only planning to hang out in your room that turns into babysitting.

“ can you come here for a second? ” your sister walks towards you and sakura with her hands on her hips. “ what is it? ” you smiled at her as you pointed at the flowing trash can. “ do you mind taking that trash out? ” she raises an eyebrow and crosses her arms in front of her chest and looks away. “ no thank you, you have your own pair of hands right? ” sakura’s eyes widen at her words as he looks at you as if he’s hearing it right.

you raised an eyebrow. “ i do have my own but do it or i’ll tell mom about this! ” you said as your sister just stick her tongue out at you “ shut up! do it yourself. ” the black and white haired boy puts a hand over his mouth — speechless that your sister had the guts to say that.

“ hey, i don’t think you should speak to your sister like that.. ” sakura finally said looking at your younger sister with a serious look. she didn’t utter another word as she walks off, taking the trash out.

a couple of hours later, she explained to sakura that it was a prank of hers, wanting to see a reaction from him if she ever answered you and tells you to shut up.

she can say that he passed as she gave him a thumbs up.

nirei akihiko — 184 words

he was playing with your brother on the living room while you cook in the kitchen. you called for you brother but he didn't answer so you called him once more.

“ shut up, sis! i’m playing with nirei! ” your eyebrows furrowed at what you heard, nirei on the other hand his eyes are wide like someone has seen some paranormal activities.

you pretend to be angry as your eyebrows furrowed pointing at your brother. you were about to speak but nirei was quickly to come at your side, putting a hand on your shoulder.

“ hahaha, kids right? do you need me to buy something? ” he asked you nervously as you sigh brushing it off and smile. “ no, it’s fine. i will be back. ” nirei was the one to sigh as he walks back to where your brother is currently playing.

not long after the three of you finished eating and is now watching tv, your brother explained everything to nirei and how it was a prank.

“ i don’t have the guts to talk back to her when she takes care of me almost everyday! ”

toma hiiragi — 212 words

the two of you planned to hang out with your brother, wearing your shoes and giving your brother’s shoes to him. checking your bag to see if you have everything in you and your phone was nowhere insight.

“ go upstairs and grab my phone for me, please? ” you asked your brother as he finished tying his shoes. he grumbled a few words before he walks upstairs taking your phone with him as he hands it over.

“ there you go. ” your brother said as he pointed at you before acting that he’s zipping his mouth, smiling as hiiragi couldn't help but raise an eyebrow. is that his way of telling you to shut up?

the three of you started eating at your little brother’s favorite eating place. at that time all of you finished eating as hiragii began to speak.

“ hey, i saw you pointing at your sister while acting that you’re zipping your mouth. are you telling her to shut up..? ” the male asked, looking at your brother as he almost choke at the water he’s drinking.

your brother obviously admitted it which resulted hiiragi to tell him that's not okay and your brother can't take it anymore and said it was just a prank because he wouldn't do that to you.

“ my sister says you have a weak stomach! i wanna test it out and see your reaction. ” hiiragi looked at you which you avoided tending to your brother to finish his food.

the mention of him having a weak stomach just made him sigh as he just watched the two of you bicker at each other once more.

umemiya hajime — 247 words

you were helping out an orphanage, umemiya insisting he comes with you wanting to play with kids.

someone called you as you turned your head seeing a girl waving you to come at her as you did excusing yourself to umemiya and the kids before walking up to the girl.

“ he’s your boyfriend right? ” she pointed at umemiya smiling with the kids as you nodded and smiled. “ he is, do you need something from him? ” the girl shakes her head as she signaled you to come closer — which you did as she whispered something at you making you laugh and nod at her words.

you walk back with the kid holding your hand as she played with the other kids while you goes into umemiya’s side, wrapping your arms around his waist.

someone throws a candy wrapper as you called out for the girl to pick it up and throw it into the trash can. she raised her eyebrow at you and runs up to you.

“ no, shut up and pick it up yourself! ” umemiya’s jaw dropped, blinking at the words he heard. she was about to walk away when umemiya was quickly to call her, kneeling the same height as her. “ hey, who taught you to say that? ” he asked, unexpectedly she pointed at you which made you inhale sharply.

you got a lecture for that before the kid admitted that it was all a prank and just to test out what his reaction would be.

date posted : 081124

#wbk x reader#wind breaker x reader#sakura haruka x reader#wbk fluff#umemiya x reader#umemiya hajime x reader#nirei akihiko x reader#nirei x reader#toma hiragi x reader#hiragi x reader

197 notes

·

View notes

Text

Stock daily Filter Report for 2021/05/27 05-40-12

*******************Part 1.0 Big Cap Industry Overiew********************* big_industry_uptrending_count tickers industry Basic Materials 12 Communication Services 14 Consumer Cyclical 5 Consumer Defensive 16 Energy 12 Financial Services 31 Healthcare 27 Industrials 10 Real Estate 10 Technology 18 Utilities 6 unknown 2 **************************************** big_industry_downtrending_count tickers industry Basic Materials 2 Communication Services 5 Consumer Cyclical 6 Consumer Defensive 5 Energy 3 Financial Services 5 Healthcare 4 Industrials 3 Real Estate 1 Technology 4 Utilities 3 *******************Part 1.1 Big Cap Long Entry SPAN MACD********************* big_long_signal_entry_span_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 178 KEP 3 4.91 big-cap Long NaN 3.0 1.875532e+06 3.0 Utilities Mean Return: 4.91 Mean Day/Week: 3.0 Accuracy:1.0 *******************Part 1.2 Big Cap Short Entry SPAN MACD********************* big_short_signal_entry_span_macd Empty DataFrame Columns: [Symbol, Day, Return, Market Cap, Long/Short, score, MACD Signal Count, Market Value, Span Signal Count, industry] Index: [] Mean Return: nan Mean Day/Week: nan Accuracy:nan *******************Part 1.3 Big Cap Long Entry SPAN********************* big_long_signal_entry_span Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 178 KEP 3 4.91 big-cap Long NaN 3.0 1.875532e+06 3.0 Utilities Mean Return: 4.91 Mean Day/Week: 3.0 Accuracy:1.0 *******************Part 1.4 Big Cap Short Entry SPAN********************* big_short_signal_entry_span Empty DataFrame Columns: [Symbol, Day, Return, Market Cap, Long/Short, score, MACD Signal Count, Market Value, Span Signal Count, industry] Index: [] Mean Return: nan Mean Day/Week: nan Accuracy:nan *******************Part 1.5 Big Cap Long Entry MACD********************* big_long_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 4 NVDA 2 0.33 big-cap Long NaN 2.0 4.959720e+09 36.0 Technology 0 FB 2 -0.04 big-cap Long NaN 2.0 3.147256e+09 54.0 Communication Services 34 TGT 5 2.38 big-cap Long NaN 5.0 7.148467e+08 48.0 Consumer Defensive 9 PEP 5 0.73 big-cap Long NaN 5.0 6.017922e+08 43.0 Consumer Defensive 131 IAC 1 0.00 big-cap Long NaN 1.0 5.207942e+08 7.0 Communication Services 24 BLK 3 0.50 big-cap Long NaN 3.0 4.991759e+08 43.0 Financial Services 166 CZR 2 -0.43 big-cap Long NaN 2.0 2.895647e+08 78.0 Consumer Cyclical 52 BX 3 0.99 big-cap Long NaN 3.0 2.752607e+08 78.0 Financial Services 143 WDC 4 3.35 big-cap Long NaN 4.0 2.722955e+08 9.0 Technology 108 MXIM 4 2.24 big-cap Long NaN 4.0 2.629884e+08 6.0 Technology 63 EA 1 0.00 big-cap Long NaN 1.0 2.317899e+08 15.0 Communication Services 66 IDXX 2 0.39 big-cap Long NaN 2.0 2.156901e+08 10.0 Healthcare 127 EPAM 2 -0.30 big-cap Long NaN 2.0 2.155474e+08 56.0 Technology 49 EW 3 0.59 big-cap Long NaN 3.0 2.151401e+08 34.0 Healthcare 78 IQV 3 -1.23 big-cap Long NaN 3.0 1.554549e+08 78.0 Healthcare 174 BXP 5 4.96 big-cap Long NaN 5.0 1.517353e+08 66.0 Real Estate 182 OSH 4 2.24 big-cap Long NaN 4.0 1.398124e+08 29.0 Healthcare 104 CPRT 4 0.70 big-cap Long NaN 4.0 1.171958e+08 35.0 Industrials 191 BAH 3 -0.05 big-cap Long NaN 3.0 1.159244e+08 22.0 Industrials 87 PAYX 4 -0.15 big-cap Long NaN 4.0 1.135604e+08 56.0 Industrials 188 BSY 5 7.18 big-cap Long NaN 5.0 1.120995e+08 40.0 Technology 202 CPT 2 0.37 big-cap Long NaN 2.0 1.116563e+08 78.0 Real Estate 149 HZNP 3 -1.58 big-cap Long NaN 3.0 1.104809e+08 9.0 Healthcare 80 CTAS 2 -0.37 big-cap Long NaN 2.0 1.039566e+08 43.0 Industrials 152 WAT 2 -0.44 big-cap Long NaN 2.0 8.826454e+07 44.0 Healthcare 138 CHKP 3 -0.66 big-cap Long NaN 3.0 7.616169e+07 19.0 Technology 67 TRI 1 0.00 big-cap Long NaN 1.0 6.565797e+07 66.0 Industrials 156 SUI 2 -0.46 big-cap Long NaN 2.0 6.496890e+07 53.0 Real Estate 192 ELS 3 0.24 big-cap Long NaN 3.0 5.511984e+07 53.0 Real Estate 12 SAP 2 0.40 big-cap Long NaN 2.0 4.594104e+07 35.0 Technology 185 WPC 2 -0.21 big-cap Long NaN 2.0 4.304300e+07 44.0 Real Estate 190 WTRG 3 0.28 big-cap Long NaN 3.0 2.324963e+07 33.0 Utilities 126 GIB 3 -0.08 big-cap Long NaN 3.0 9.678038e+06 56.0 Technology 106 NWG 3 -1.04 big-cap Long NaN 3.0 6.096881e+06 78.0 Financial Services 167 SHG 1 0.00 big-cap Long NaN 1.0 4.753427e+06 58.0 Financial Services 178 KEP 3 4.91 big-cap Long NaN 3.0 1.875532e+06 3.0 Utilities 45 WBK 1 0.00 big-cap Long NaN 1.0 1.376390e+06 78.0 Financial Services Mean Return: 0.804375 Mean Day/Week: 3.21875 Accuracy:0.5625 *******************Part 1.6 Big Cap Short Entry MACD********************* big_short_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 111 EC 2 -1.34 big-cap Short NaN -2.0 8.826204e+06 -7.0 Energy Mean Return: -1.34 Mean Day/Week: 2.0 Accuracy:1.0 *******************Part 1.7 Big Cap Long Maintainance********************* big_long_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 3 JPM 9 -1.31 big-cap Long NaN 14.0 1.589828e+09 78.0 Financial Services 33 CVS 21 15.01 big-cap Long NaN 53.0 1.256680e+09 45.0 Healthcare 5 PG 13 0.36 big-cap Long NaN 13.0 1.117588e+09 38.0 Consumer Defensive 19 C 11 4.40 big-cap Long NaN 12.0 1.076885e+09 78.0 Financial Services 28 INTU 7 5.98 big-cap Long NaN 7.0 8.843274e+08 12.0 Technology 2 WMT 7 0.19 big-cap Long NaN 47.0 8.307030e+08 10.0 Consumer Defensive 22 CHTR 23 6.34 big-cap Long NaN 29.0 6.114139e+08 30.0 Communication Services 13 COST 10 1.62 big-cap Long NaN 46.0 5.841931e+08 36.0 Consumer Defensive 18 MS 15 3.01 big-cap Long NaN 18.0 5.490770e+08 78.0 Financial Services 96 MPC 15 3.30 big-cap Long NaN 17.0 5.209401e+08 78.0 Energy 43 FDX 20 5.14 big-cap Long NaN 20.0 5.174124e+08 50.0 Industrials 107 CERN 13 2.20 big-cap Long NaN 48.0 5.063689e+08 20.0 Healthcare 56 COF 21 10.64 big-cap Long NaN 21.0 4.716197e+08 78.0 Financial Services 36 MDLZ 21 4.46 big-cap Long NaN 55.0 4.212377e+08 50.0 Consumer Defensive 73 DOW 16 2.29 big-cap Long NaN 16.0 4.208986e+08 78.0 Basic Materials 29 RTX 10 3.85 big-cap Long NaN 23.0 4.156857e+08 78.0 Industrials 53 NEM 18 12.95 big-cap Long NaN 55.0 4.076929e+08 39.0 Basic Materials 83 ALL 44 17.03 big-cap Long NaN 60.0 3.968262e+08 62.0 Financial Services 70 GOLD 18 10.43 big-cap Long NaN 53.0 3.607757e+08 30.0 Basic Materials 193 DVN 11 3.69 big-cap Long NaN 16.0 3.512899e+08 24.0 Energy 164 NUE 17 12.46 big-cap Long NaN 17.0 3.212763e+08 72.0 Basic Materials 39 EQIX 10 3.19 big-cap Long NaN 48.0 3.125209e+08 30.0 Real Estate 100 BNTX 14 10.85 big-cap Long NaN 39.0 2.924048e+08 41.0 Healthcare 37 ZTS 6 2.37 big-cap Long NaN 46.0 2.787942e+08 33.0 Healthcare 68 EXC 6 -0.78 big-cap Long NaN 6.0 2.604791e+08 45.0 Utilities 7 NVS 7 0.53 big-cap Long NaN 13.0 2.526245e+08 15.0 Healthcare 48 DD 16 3.38 big-cap Long NaN 17.0 2.450174e+08 31.0 Basic Materials 196 UHS 35 15.96 big-cap Long NaN 57.0 2.446328e+08 39.0 Healthcare 42 PBR 9 -1.27 big-cap Long NaN 43.0 2.439300e+08 13.0 Energy 16 AZN 24 8.02 big-cap Long NaN 54.0 2.296235e+08 30.0 Healthcare 129 IP 25 11.96 big-cap Long NaN 66.0 2.281016e+08 63.0 Consumer Cyclical 44 APD 10 -0.78 big-cap Long NaN 61.0 2.224573e+08 48.0 Basic Materials 40 CL 19 4.56 big-cap Long NaN 50.0 2.194378e+08 33.0 Consumer Defensive 181 NLOK 11 10.01 big-cap Long NaN 11.0 2.157210e+08 40.0 Technology 79 CNC 6 3.66 big-cap Long NaN 15.0 2.089314e+08 20.0 Healthcare 125 SYF 19 6.87 big-cap Long NaN 19.0 2.087901e+08 78.0 unknown 81 ALXN 29 7.39 big-cap Long NaN 30.0 2.061798e+08 30.0 Healthcare 88 KMI 20 6.12 big-cap Long NaN 20.0 1.941816e+08 78.0 Energy 145 ET 21 17.97 big-cap Long NaN 21.0 1.776682e+08 78.0 Energy 41 CME 10 0.45 big-cap Long NaN 10.0 1.662239e+08 78.0 Financial Services 105 WMB 18 5.05 big-cap Long NaN 18.0 1.644717e+08 78.0 Energy 147 INVH 10 4.34 big-cap Long NaN 52.0 1.603740e+08 55.0 Real Estate 187 NLY 7 -0.54 big-cap Long NaN 7.0 1.567186e+08 53.0 Real Estate 115 AVB 8 3.31 big-cap Long NaN 8.0 1.473573e+08 78.0 Real Estate 92 MSI 13 1.26 big-cap Long NaN 13.0 1.469923e+08 78.0 Technology 163 EXPD 16 9.10 big-cap Long NaN 16.0 1.382905e+08 62.0 Industrials 141 AKAM 15 3.93 big-cap Long NaN 47.0 1.359897e+08 16.0 Technology 69 KHC 15 2.47 big-cap Long NaN 15.0 1.328482e+08 78.0 Consumer Defensive 95 NOK 9 1.14 big-cap Long NaN 34.0 1.299678e+08 20.0 Technology 86 AIG 18 4.84 big-cap Long NaN 18.0 1.292457e+08 78.0 Financial Services 27 TD 21 6.49 big-cap Long NaN 21.0 1.249202e+08 78.0 Financial Services 90 HSY 19 6.44 big-cap Long NaN 19.0 1.200815e+08 55.0 Consumer Defensive 148 PKI 9 0.20 big-cap Long NaN 42.0 1.193934e+08 16.0 Healthcare 97 NTR 11 1.78 big-cap Long NaN 17.0 1.192286e+08 17.0 Basic Materials 175 IT 28 20.16 big-cap Long NaN 28.0 1.119766e+08 78.0 Technology 151 HES 18 9.27 big-cap Long NaN 18.0 1.111104e+08 78.0 Energy 46 BAM 8 1.94 big-cap Long NaN 8.0 1.100523e+08 78.0 Financial Services 124 DB 11 7.43 big-cap Long NaN 20.0 1.100339e+08 24.0 Financial Services 194 LKQ 24 11.96 big-cap Long NaN 24.0 1.080581e+08 78.0 Consumer Cyclical 157 LNG 19 8.74 big-cap Long NaN 19.0 1.072208e+08 78.0 Energy 179 LUMN 9 -1.91 big-cap Long NaN 13.0 1.063662e+08 15.0 Communication Services 195 HWM 6 1.28 big-cap Long NaN 6.0 1.042728e+08 78.0 Industrials 54 BMO 21 9.45 big-cap Long NaN 21.0 9.895665e+07 78.0 Financial Services 51 ITUB 13 3.89 big-cap Long NaN 51.0 9.848212e+07 25.0 Financial Services 136 NTRS 23 10.45 big-cap Long NaN 23.0 9.778384e+07 78.0 Financial Services 130 WPM 15 10.64 big-cap Long NaN 53.0 9.347089e+07 30.0 Basic Materials 189 CNP 9 1.03 big-cap Long NaN 9.0 9.310000e+07 53.0 Utilities 21 RY 20 6.57 big-cap Long NaN 20.0 9.240693e+07 78.0 Financial Services 144 TRU 10 2.01 big-cap Long NaN 53.0 8.452569e+07 39.0 Industrials 112 ANET 10 6.40 big-cap Long NaN 43.0 8.388257e+07 36.0 Technology 109 YUMC 8 3.92 big-cap Long NaN 21.0 7.174143e+07 10.0 Consumer Cyclical 158 BPY 6 1.19 big-cap Long NaN 6.0 7.075215e+07 78.0 Real Estate 14 UL 16 3.88 big-cap Long NaN 55.0 7.018906e+07 30.0 Consumer Defensive 114 FNV 34 10.52 big-cap Long NaN 54.0 6.858633e+07 40.0 Basic Materials 146 AEM 13 6.20 big-cap Long NaN 50.0 6.818803e+07 18.0 Basic Materials 10 NVO 13 5.26 big-cap Long NaN 32.0 6.508271e+07 28.0 Healthcare 30 DEO 11 4.35 big-cap Long NaN 37.0 6.172629e+07 61.0 Consumer Defensive 58 ABEV 15 5.44 big-cap Long NaN 15.0 5.755265e+07 31.0 Consumer Defensive 74 BCE 21 5.88 big-cap Long NaN 21.0 5.461521e+07 58.0 Communication Services 110 MPLX 17 5.01 big-cap Long NaN 20.0 5.449384e+07 78.0 Energy 75 CM 20 8.31 big-cap Long NaN 20.0 5.445552e+07 78.0 Financial Services 17 BUD 28 11.07 big-cap Long NaN 52.0 5.328945e+07 34.0 Consumer Defensive 173 ELAN 9 2.60 big-cap Long NaN 26.0 5.311702e+07 14.0 Healthcare 198 KL 14 7.80 big-cap Long NaN 50.0 5.029088e+07 30.0 Basic Materials 123 CCEP 30 10.06 big-cap Long NaN 30.0 4.643644e+07 78.0 Consumer Defensive 20 SNY 14 4.02 big-cap Long NaN 55.0 4.632012e+07 34.0 Healthcare 8 TM 8 3.34 big-cap Long NaN 8.0 3.790404e+07 11.0 Consumer Cyclical 26 HSBC 10 1.20 big-cap Long NaN 20.0 3.667201e+07 24.0 Financial Services 55 STLA 8 2.30 big-cap Long NaN 8.0 3.230255e+07 16.0 unknown 101 TU 13 3.20 big-cap Long NaN 20.0 2.790771e+07 16.0 Communication Services 61 AMX 14 2.48 big-cap Long NaN 14.0 2.132316e+07 35.0 Communication Services 169 IMO 20 17.04 big-cap Long NaN 20.0 2.055503e+07 78.0 Energy 102 GMAB 8 5.33 big-cap Long NaN 38.0 1.950185e+07 16.0 Healthcare 99 BSBR 10 5.70 big-cap Long NaN 29.0 1.579723e+07 16.0 Financial Services 65 NGG 19 7.15 big-cap Long NaN 53.0 1.534543e+07 39.0 Utilities 137 FTS 9 0.19 big-cap Long NaN 15.0 1.478522e+07 54.0 Utilities 82 CRH 15 2.00 big-cap Long NaN 15.0 1.476425e+07 44.0 Basic Materials 50 SAN 11 3.83 big-cap Long NaN 21.0 1.420920e+07 78.0 Financial Services 84 LYG 20 7.01 big-cap Long NaN 20.0 1.375810e+07 78.0 Financial Services 203 RDY 20 4.37 big-cap Long NaN 43.0 1.222749e+07 30.0 Healthcare 91 BBVA 14 4.62 big-cap Long NaN 20.0 1.002457e+07 23.0 Financial Services 116 RCI 18 3.65 big-cap Long NaN 34.0 7.927645e+06 39.0 Communication Services 85 WIT 7 5.03 big-cap Long NaN 28.0 7.645674e+06 30.0 Technology 113 TEF 9 2.84 big-cap Long NaN 18.0 5.951213e+06 22.0 Communication Services 184 NTCO 10 3.23 big-cap Long NaN 35.0 4.860923e+06 16.0 Consumer Defensive 23 PTR 10 2.02 big-cap Long NaN 16.0 3.293656e+06 21.0 Energy 59 AMOV 13 1.86 big-cap Long NaN 14.0 5.026190e+04 27.0 Communication Services 155 VAR 14 0.27 big-cap Long NaN 14.0 0.000000e+00 49.0 Healthcare Mean Return: 5.349907407407407 Mean Day/Week: 14.99074074074074 Accuracy:0.9444444444444444 *******************Part 1.8 Big Cap Short Maintainance********************* big_short_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 1 BABA 13 -3.30 big-cap Short NaN -13.0 1.968155e+09 -53.0 Consumer Cyclical 6 DIS 9 1.63 big-cap Short NaN -51.0 1.277060e+09 -24.0 Communication Services 25 ABNB 15 -12.60 big-cap Short NaN -64.0 1.099787e+09 -36.0 Communication Services 93 EDU 13 -26.18 big-cap Short NaN -13.0 8.473785e+08 -52.0 Consumer Defensive 57 TAL 15 -28.90 big-cap Short NaN -15.0 6.496727e+08 -55.0 Consumer Defensive 31 MELI 14 -6.16 big-cap Short NaN -14.0 5.482997e+08 -61.0 Consumer Cyclical 38 CNI 9 0.53 big-cap Short NaN -27.0 4.087625e+08 -12.0 Industrials 128 VIPS 12 -11.87 big-cap Short NaN -44.0 3.949125e+08 -40.0 Consumer Cyclical 161 QS 22 -30.27 big-cap Short NaN -45.0 3.876131e+08 -137.0 Consumer Cyclical 139 DISCA 8 -6.00 big-cap Short NaN -44.0 3.582931e+08 -38.0 Communication Services 134 OXY 6 0.97 big-cap Short NaN -12.0 3.483495e+08 -29.0 Energy 64 CTSH 8 0.85 big-cap Short NaN -15.0 2.567843e+08 -15.0 Technology 60 CP 9 2.08 big-cap Short NaN -9.0 2.274813e+08 -9.0 Industrials 133 KMX 6 -0.93 big-cap Short NaN -15.0 1.908378e+08 -12.0 Consumer Cyclical 172 OPEN 15 -9.96 big-cap Short NaN -15.0 1.901795e+08 -46.0 Real Estate 183 CHGG 18 -7.95 big-cap Short NaN -18.0 1.569464e+08 -60.0 Consumer Defensive 62 RKT 15 -8.01 big-cap Short NaN -47.0 1.532623e+08 -31.0 Financial Services 121 HOLX 20 -5.30 big-cap Short NaN -21.0 1.369411e+08 -27.0 Healthcare 140 DISCK 11 -4.48 big-cap Short NaN -43.0 1.284124e+08 -37.0 Communication Services 122 WISH 10 3.99 big-cap Short NaN -10.0 1.281977e+08 -111.0 Consumer Cyclical 154 CTXS 18 -7.07 big-cap Short NaN -28.0 1.069025e+08 -20.0 Technology 200 NRG 27 -13.06 big-cap Short NaN -50.0 9.651571e+07 -50.0 Utilities 89 PCAR 6 -0.51 big-cap Short NaN -6.0 6.762203e+07 -8.0 Industrials 176 SQM 6 -1.40 big-cap Short NaN -11.0 6.254775e+07 -8.0 Basic Materials 171 ATHM 6 -7.86 big-cap Short NaN -6.0 5.808326e+07 -57.0 Communication Services 165 APPN 19 -32.38 big-cap Short NaN -19.0 5.745083e+07 -60.0 Technology 199 DNB 6 -0.71 big-cap Short NaN -14.0 4.032326e+07 -16.0 Technology 94 RPRX 10 -0.31 big-cap Short NaN -14.0 3.989351e+07 -20.0 Healthcare 98 IBKR 10 -0.12 big-cap Short NaN -50.0 3.737295e+07 -21.0 Financial Services 180 ERIE 19 -9.05 big-cap Short NaN -19.0 1.712987e+07 -59.0 Financial Services 186 ENIA 19 -1.75 big-cap Short NaN -31.0 1.285523e+07 -26.0 Utilities 162 SUZ 7 -6.72 big-cap Short NaN -60.0 4.591655e+06 -25.0 Basic Materials 201 BCH 11 -11.07 big-cap Short NaN -25.0 3.075617e+06 -14.0 Financial Services Mean Return: -7.390000000000001 Mean Day/Week: 12.484848484848484 Accuracy:0.8181818181818182 ************************************** ************************************** ************************************** *******************Part 2.0 Small Cap Industry Overiew********************* small_industry_uptrending_count tickers industry Basic Materials 5 Communication Services 3 Consumer Cyclical 5 Consumer Defensive 2 Energy 6 Financial Services 4 Healthcare 6 Industrials 6 Real Estate 10 Technology 4 Utilities 3 unknown 3 **************************************** small_industry_downtrending_count tickers industry Communication Services 4 Consumer Cyclical 5 Consumer Defensive 2 Financial Services 5 Healthcare 11 Industrials 1 Technology 5 Utilities 1 *******************Part 2.1 Small Cap Long Entry SPAN MACD********************* small_long_signal_entry_span_macd Empty DataFrame Columns: [Symbol, Day, Return, Market Cap, Long/Short, score, MACD Signal Count, Market Value, Span Signal Count, industry] Index: [] Mean Return: nan Mean Day/Week: nan Accuracy:nan *******************Part 2.2 Small Cap Short Entry SPAN MACD********************* small_short_signal_entry_span_macd Empty DataFrame Columns: [Symbol, Day, Return, Market Cap, Long/Short, score, MACD Signal Count, Market Value, Span Signal Count, industry] Index: [] Mean Return: nan Mean Day/Week: nan Accuracy:nan *******************Part 2.3 Small Cap Long Entry SPAN********************* small_long_signal_entry_span Empty DataFrame Columns: [Symbol, Day, Return, Market Cap, Long/Short, score, MACD Signal Count, Market Value, Span Signal Count, industry] Index: [] Mean Return: nan Mean Day/Week: nan Accuracy:nan *******************Part 2.4 Small Cap Short Entry SPAN********************* small_short_signal_entry_span Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 209 MNSO 2 -1.05 small-cap Short NaN -13.0 1.457329e+07 -2.0 Consumer Cyclical Mean Return: -1.05 Mean Day/Week: 2.0 Accuracy:1.0 *******************Part 2.5 Small Cap Long Entry MACD********************* small_long_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 255 KRC 2 0.21 small-cap Long NaN 2.0 9.547654e+07 66.0 Real Estate 234 PAAS 4 -0.85 small-cap Long NaN 4.0 7.776439e+07 8.0 Basic Materials 228 SYNH 3 -1.39 small-cap Long NaN 3.0 5.643388e+07 35.0 Healthcare 235 ARW 5 0.83 small-cap Long NaN 5.0 5.305638e+07 58.0 Technology 283 FR 2 -0.08 small-cap Long NaN 2.0 5.105200e+07 77.0 Real Estate 212 CONE 5 0.83 small-cap Long NaN 5.0 4.985947e+07 33.0 Real Estate 267 LSI 1 0.00 small-cap Long NaN 1.0 4.768991e+07 78.0 Real Estate 237 MANH 1 0.00 small-cap Long NaN 1.0 3.882795e+07 22.0 Technology 286 LESL 2 1.62 small-cap Long NaN 2.0 2.803305e+07 25.0 Consumer Cyclical 263 AIRC 3 2.17 small-cap Long NaN 3.0 2.640655e+07 15.0 Real Estate 227 ALV 3 -0.59 small-cap Long NaN 3.0 2.276312e+07 41.0 Consumer Cyclical 210 WTRU 3 -0.09 small-cap Long NaN 3.0 4.870365e+06 15.0 unknown 245 ICL 3 0.16 small-cap Long NaN 3.0 1.690433e+06 78.0 Basic Materials 247 JSM 2 1.50 small-cap Long NaN 2.0 5.242902e+05 37.0 unknown Mean Return: 0.36000000000000004 Mean Day/Week: 3.25 Accuracy:0.5833333333333334 *******************Part 2.6 Small Cap Short Entry MACD********************* small_short_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 219 CIB 4 -0.61 small-cap Short NaN -4.0 3.875569e+06 -69.0 Financial Services Mean Return: -0.61 Mean Day/Week: 4.0 Accuracy:1.0 *******************Part 2.7 Small Cap Long Maintaiance********************* small_long_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 221 AGNC 9 2.18 small-cap Long NaN 50.0 1.180230e+08 78.0 Real Estate 272 MTZ 22 12.35 small-cap Long NaN 22.0 1.144813e+08 78.0 Industrials 215 GFI 14 15.64 small-cap Long NaN 14.0 1.079988e+08 39.0 Basic Materials 274 PRGO 12 5.40 small-cap Long NaN 30.0 9.307513e+07 15.0 Healthcare 214 KGC 10 8.00 small-cap Long NaN 53.0 8.465364e+07 37.0 Basic Materials 254 VRT 8 5.48 small-cap Long NaN 8.0 8.322673e+07 39.0 Industrials 258 DXC 24 15.20 small-cap Long NaN 41.0 8.092934e+07 44.0 Technology 231 JLL 17 6.98 small-cap Long NaN 17.0 7.706664e+07 78.0 Real Estate 206 IRM 14 5.01 small-cap Long NaN 14.0 7.337191e+07 78.0 Real Estate 240 CLR 12 5.07 small-cap Long NaN 16.0 6.529079e+07 23.0 Energy 269 PAA 13 6.46 small-cap Long NaN 20.0 5.353912e+07 24.0 Energy 278 CCJ 14 -1.71 small-cap Long NaN 16.0 5.138638e+07 78.0 Energy 218 JAZZ 14 2.21 small-cap Long NaN 15.0 4.976280e+07 16.0 Healthcare 281 PSXP 15 16.70 small-cap Long NaN 65.0 4.833064e+07 60.0 Energy 256 CACC 8 2.03 small-cap Long NaN 23.0 3.941812e+07 23.0 Financial Services 238 ADT 6 6.25 small-cap Long NaN 6.0 3.840656e+07 33.0 Industrials 217 PHYS 13 3.59 small-cap Long NaN 38.0 3.810014e+07 18.0 unknown 280 VNT 11 4.95 small-cap Long NaN 31.0 3.571190e+07 15.0 Technology 241 RGLD 15 4.45 small-cap Long NaN 42.0 3.005086e+07 40.0 Basic Materials 244 SC 37 31.33 small-cap Long NaN 37.0 2.977982e+07 78.0 Financial Services 279 CHH 10 3.16 small-cap Long NaN 14.0 2.522072e+07 45.0 Consumer Cyclical 270 SRCL 21 12.31 small-cap Long NaN 40.0 2.474026e+07 33.0 Industrials 225 CHE 10 2.61 small-cap Long NaN 47.0 2.196192e+07 22.0 Healthcare 257 TFII 22 16.46 small-cap Long NaN 22.0 1.863083e+07 78.0 Industrials 232 MBT 7 -1.73 small-cap Long NaN 29.0 1.778054e+07 15.0 Communication Services 277 JHG 26 12.94 small-cap Long NaN 54.0 1.508491e+07 38.0 Financial Services 282 MPLN 7 5.37 small-cap Long NaN 35.0 1.472142e+07 10.0 Healthcare 287 KT 12 9.65 small-cap Long NaN 12.0 1.256180e+07 73.0 Communication Services 243 BSMX 8 1.92 small-cap Long NaN 8.0 7.733675e+06 43.0 Financial Services 211 KOF 9 -0.88 small-cap Long NaN 10.0 5.463993e+06 37.0 Consumer Defensive 293 SBS 10 1.21 small-cap Long NaN 51.0 5.146424e+06 33.0 Utilities 213 EBR 10 8.67 small-cap Long NaN 66.0 3.278790e+06 40.0 Utilities 222 PSO 14 0.90 small-cap Long NaN 14.0 2.835006e+06 78.0 Communication Services Mean Return: 6.974545454545455 Mean Day/Week: 13.757575757575758 Accuracy:0.9090909090909091 *******************Part 2.8 Small Cap Short Maintaiance********************* small_short_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 248 MSTR 29 -32.90 small-cap Short NaN -65.0 3.225757e+08 -46.0 Technology 288 VNET 21 -27.43 small-cap Short NaN -71.0 1.366922e+08 -59.0 Technology 230 RNR 6 -3.74 small-cap Short NaN -18.0 1.039007e+08 -13.0 Financial Services 233 YY 21 -13.39 small-cap Short NaN -58.0 9.928285e+07 -43.0 Communication Services 224 NYT 36 -13.33 small-cap Short NaN -59.0 7.341543e+07 -55.0 Communication Services 260 PFGC 7 3.11 small-cap Short NaN -32.0 7.097285e+07 -13.0 Consumer Defensive 226 IONS 15 -4.68 small-cap Short NaN -15.0 7.061937e+07 -60.0 Healthcare 251 TGTX 18 -22.33 small-cap Short NaN -45.0 6.964092e+07 -53.0 Healthcare 207 BFAM 19 -5.20 small-cap Short NaN -33.0 6.903298e+07 -28.0 Consumer Cyclical 259 IOVA 12 -22.38 small-cap Short NaN -12.0 6.554680e+07 -67.0 Healthcare 216 ARMK 6 0.35 small-cap Short NaN -46.0 6.406673e+07 -19.0 Consumer Cyclical 249 ONEM 13 -7.85 small-cap Short NaN -13.0 5.670866e+07 -59.0 Healthcare 271 HUYA 20 -20.78 small-cap Short NaN -62.0 4.839821e+07 -46.0 Communication Services 291 ARRY 12 -28.81 small-cap Short NaN -12.0 4.787576e+07 -70.0 Technology 223 GNTX 6 1.32 small-cap Short NaN -48.0 4.433295e+07 -13.0 Consumer Cyclical 236 MLCO 14 -4.51 small-cap Short NaN -45.0 3.676375e+07 -20.0 Consumer Cyclical 250 TTEK 12 -3.97 small-cap Short NaN -28.0 3.428055e+07 -23.0 Industrials 275 HAE 28 -27.49 small-cap Short NaN -28.0 2.900665e+07 -59.0 Healthcare 252 KOD 15 -15.99 small-cap Short NaN -15.0 2.017629e+07 -70.0 Healthcare 204 BSAC 8 2.00 small-cap Short NaN -44.0 1.440846e+07 -14.0 Financial Services 284 CERT 10 4.59 small-cap Short NaN -10.0 8.816532e+06 -19.0 Healthcare 294 ENIC 20 -13.63 small-cap Short NaN -22.0 2.095271e+06 -70.0 Utilities Mean Return: -11.683636363636365 Mean Day/Week: 15.818181818181818 Accuracy:0.7727272727272727 ************************************** ************************************** ************************************** *******************Part 3.0 Penny Cap Industry Overiew********************* penny_industry_uptrending_count tickers industry Basic Materials 28 Communication Services 6 Consumer Cyclical 22 Consumer Defensive 11 Energy 19 Financial Services 35 Healthcare 22 Industrials 17 Real Estate 16 Technology 17 Utilities 2 unknown 3 **************************************** penny_industry_downtrending_count tickers industry Basic Materials 3 Communication Services 2 Consumer Cyclical 12 Consumer Defensive 9 Energy 6 Financial Services 29 Healthcare 52 Industrials 12 Real Estate 8 Technology 27 unknown 1 *******************Part 3.1 Penny Cap Long Entry SPAN MACD********************* penny_long_signal_entry_span_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 345 CELH 1 0.00 penny-cap Long NaN 4.0 5.251760e+07 5.0 Consumer Defensive 384 BRFS 2 -0.82 penny-cap Long NaN 5.0 2.997851e+07 5.0 Consumer Defensive 636 ALGS 2 0.62 penny-cap Long NaN 4.0 3.921433e+06 5.0 Healthcare Mean Return: -0.09999999999999998 Mean Day/Week: 2.5 Accuracy:0.5 *******************Part 3.2 Penny Cap Short Entry SPAN MACD********************* penny_short_signal_entry_span_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 490 NGM 3 -4.85 penny-cap Short NaN -3.0 14467888.0 -4.0 Healthcare Mean Return: -4.85 Mean Day/Week: 3.0 Accuracy:1.0 *******************Part 3.3 Penny Cap Long Entry SPAN********************* penny_long_signal_entry_span Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 345 CELH 1 0.00 penny-cap Long NaN 4.0 5.251760e+07 5.0 Consumer Defensive 384 BRFS 2 -0.82 penny-cap Long NaN 5.0 2.997851e+07 5.0 Consumer Defensive 636 ALGS 2 0.62 penny-cap Long NaN 4.0 3.921433e+06 5.0 Healthcare 595 GHG 2 5.47 penny-cap Long NaN 17.0 2.356604e+06 4.0 Consumer Cyclical Mean Return: 1.7566666666666666 Mean Day/Week: 2.3333333333333335 Accuracy:0.6666666666666666 *******************Part 3.4 Penny Cap Short Entry SPAN********************* penny_short_signal_entry_span Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 490 NGM 3 -4.85 penny-cap Short NaN -3.0 14467888.00 -4.0 Healthcare 484 BANF 2 1.62 penny-cap Short NaN -7.0 8610550.75 -3.0 Financial Services Mean Return: -1.6149999999999998 Mean Day/Week: 2.5 Accuracy:0.5 *******************Part 3.5 Penny Cap Long Entry MACD********************* penny_long_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 391 CVLT 3 1.11 penny-cap Long NaN 3.0 7.961761e+07 78.0 Technology 340 SWAV 5 1.76 penny-cap Long NaN 5.0 7.327810e+07 41.0 Healthcare 336 PGNY 5 7.55 penny-cap Long NaN 5.0 5.752270e+07 34.0 Healthcare 423 HGV 3 -0.37 penny-cap Long NaN 3.0 5.481672e+07 78.0 Consumer Cyclical 316 SLG 5 2.61 penny-cap Long NaN 5.0 5.339780e+07 67.0 Real Estate 473 IDCC 1 0.00 penny-cap Long NaN 1.0 5.299885e+07 36.0 Communication Services 345 CELH 1 0.00 penny-cap Long NaN 4.0 5.251760e+07 5.0 Consumer Defensive 580 CORE 5 -3.41 penny-cap Long NaN 5.0 4.543829e+07 67.0 Consumer Defensive 302 DEI 4 0.69 penny-cap Long NaN 5.0 4.231913e+07 66.0 Real Estate 550 DEN 5 4.73 penny-cap Long NaN 5.0 4.186467e+07 78.0 Energy 346 HIW 1 0.00 penny-cap Long NaN 1.0 3.794645e+07 78.0 Real Estate 575 MSEX 1 0.00 penny-cap Long NaN 1.0 3.440108e+07 44.0 Utilities 319 NOMD 3 -0.92 penny-cap Long NaN 3.0 3.296234e+07 52.0 Consumer Defensive 300 STAA 1 0.00 penny-cap Long NaN 1.0 3.006736e+07 40.0 Healthcare 384 BRFS 2 -0.82 penny-cap Long NaN 5.0 2.997851e+07 5.0 Consumer Defensive 360 HPP 2 1.29 penny-cap Long NaN 2.0 2.930397e+07 66.0 Real Estate 356 VIAV 1 0.00 penny-cap Long NaN 4.0 2.919653e+07 10.0 Technology 460 NAVI 1 0.00 penny-cap Long NaN 1.0 2.704276e+07 78.0 Financial Services 489 BDN 3 -0.76 penny-cap Long NaN 3.0 2.630132e+07 67.0 Real Estate 516 DRNA 3 5.41 penny-cap Long NaN 3.0 2.585323e+07 9.0 Healthcare 373 AQUA 4 2.86 penny-cap Long NaN 4.0 2.555805e+07 34.0 Industrials 357 SEM 1 0.00 penny-cap Long NaN 1.0 2.433445e+07 63.0 Healthcare 504 ABR 1 0.00 penny-cap Long NaN 1.0 2.219331e+07 78.0 Real Estate 392 EBC 4 -0.60 penny-cap Long NaN 4.0 2.104474e+07 78.0 Financial Services 480 PGRE 2 1.30 penny-cap Long NaN 2.0 1.854376e+07 66.0 Real Estate 456 FSK 3 -0.68 penny-cap Long NaN 3.0 1.621445e+07 78.0 Financial Services 612 ESTA 3 -0.42 penny-cap Long NaN 3.0 1.357363e+07 78.0 Healthcare 471 NVMI 1 0.00 penny-cap Long NaN 1.0 9.916573e+06 7.0 Technology 619 BUSE 1 0.00 penny-cap Long NaN 1.0 9.876123e+06 10.0 Financial Services 510 RVNC 1 0.00 penny-cap Long NaN 1.0 8.730369e+06 26.0 Healthcare 632 EXTR 5 -3.01 penny-cap Long NaN 5.0 7.992185e+06 36.0 Technology 478 SHEN 4 -0.84 penny-cap Long NaN 4.0 7.587151e+06 18.0 Communication Services 376 NAD 5 0.52 penny-cap Long NaN 5.0 7.327165e+06 36.0 Financial Services 561 MEI 3 0.17 penny-cap Long NaN 3.0 7.195648e+06 44.0 Technology 622 TVTY 4 1.99 penny-cap Long NaN 4.0 7.168635e+06 27.0 Healthcare 335 NEA 2 0.00 penny-cap Long NaN 2.0 7.151316e+06 37.0 Financial Services 532 GAB 1 0.00 penny-cap Long NaN 1.0 5.314456e+06 63.0 Financial Services 359 NVG 1 0.00 penny-cap Long NaN 1.0 4.576919e+06 37.0 Financial Services 587 HYT 2 0.08 penny-cap Long NaN 2.0 3.964548e+06 10.0 Financial Services 636 ALGS 2 0.62 penny-cap Long NaN 4.0 3.921433e+06 5.0 Healthcare 499 ETY 5 0.81 penny-cap Long NaN 5.0 3.086628e+06 55.0 Financial Services 476 GDV 3 -0.49 penny-cap Long NaN 3.0 2.768754e+06 78.0 Financial Services 566 FPF 2 0.12 penny-cap Long NaN 2.0 2.757138e+06 44.0 Financial Services 643 ETW 4 1.82 penny-cap Long NaN 4.0 1.970740e+06 56.0 Financial Services 650 AWF 2 0.00 penny-cap Long NaN 2.0 1.959894e+06 41.0 Financial Services 590 ETG 1 0.00 penny-cap Long NaN 1.0 1.549706e+06 78.0 Financial Services Mean Return: 0.7458064516129033 Mean Day/Week: 3.935483870967742 Accuracy:0.5806451612903226 *******************Part 3.6 Penny Cap Short Entry MACD********************* penny_short_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 400 BXS 2 1.28 penny-cap Short NaN -2.0 1.903980e+07 -27.0 Financial Services 490 NGM 3 -4.85 penny-cap Short NaN -3.0 1.446789e+07 -4.0 Healthcare 433 MEOH 2 1.98 penny-cap Short NaN -5.0 1.082259e+07 -13.0 Basic Materials 634 ZGNX 3 -0.61 penny-cap Short NaN -3.0 1.074486e+07 -38.0 Healthcare 597 CHRS 4 -2.50 penny-cap Short NaN -4.0 9.186963e+06 -71.0 Healthcare 526 NWBI 2 1.46 penny-cap Short NaN -3.0 8.218556e+06 -27.0 Financial Services 578 AROC 2 0.89 penny-cap Short NaN -5.0 6.489138e+06 -37.0 Energy 630 STRO 5 1.59 penny-cap Short NaN -5.0 6.245269e+06 -46.0 Healthcare 513 CFFN 2 0.71 penny-cap Short NaN -2.0 6.158736e+06 -32.0 Financial Services 649 TMP 1 0.00 penny-cap Short NaN -1.0 4.034048e+06 -7.0 Financial Services 635 RES 5 -2.87 penny-cap Short NaN -5.0 3.170778e+06 -29.0 Energy 652 CONX 4 -0.31 penny-cap Short NaN -4.0 1.323422e+06 -108.0 Financial Services 627 APSG 5 -0.31 penny-cap Short NaN -5.0 4.698648e+05 -61.0 Financial Services 560 MSC 2 1.83 penny-cap Short NaN -2.0 5.363600e+02 -137.0 Consumer Cyclical Mean Return: -0.1315384615384615 Mean Day/Week: 3.230769230769231 Accuracy:0.46153846153846156 *******************Part 3.7 Penny Cap Long Maintainance********************* penny_long_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 317 AMC 6 47.94 penny-cap Long NaN 9.0 3.960815e+09 12.0 Communication Services 431 EAF 10 2.11 penny-cap Long NaN 21.0 1.479002e+08 78.0 Industrials 518 UFS 23 33.83 penny-cap Long NaN 23.0 8.409740e+07 78.0 Basic Materials 348 HL 13 22.44 penny-cap Long NaN 15.0 7.926089e+07 15.0 Basic Materials 304 AUY 15 3.00 penny-cap Long NaN 53.0 7.758134e+07 30.0 Basic Materials 416 SWN 13 13.00 penny-cap Long NaN 16.0 7.674325e+07 22.0 Energy 308 EQT 14 3.41 penny-cap Long NaN 20.0 7.202059e+07 23.0 Energy 438 RRC 11 14.87 penny-cap Long NaN 18.0 6.820519e+07 18.0 Energy 353 SGMS 22 22.42 penny-cap Long NaN 30.0 6.747901e+07 26.0 Consumer Cyclical 326 CC 18 14.42 penny-cap Long NaN 43.0 6.254259e+07 43.0 Basic Materials 421 BNL 20 7.77 penny-cap Long NaN 39.0 5.922613e+07 30.0 Real Estate 414 ELY 12 9.90 penny-cap Long NaN 26.0 5.826180e+07 15.0 Consumer Cyclical 497 MUR 11 7.08 penny-cap Long NaN 15.0 5.807748e+07 23.0 Energy 388 COMM 14 5.74 penny-cap Long NaN 14.0 5.207473e+07 78.0 Technology 486 AR 14 16.98 penny-cap Long NaN 14.0 4.896970e+07 78.0 Energy 296 DAVA 7 13.99 penny-cap Long NaN 23.0 4.891961e+07 26.0 Technology 297 BPOP 17 6.70 penny-cap Long NaN 17.0 4.677929e+07 78.0 Financial Services 608 FOE 12 -0.81 penny-cap Long NaN 12.0 4.423451e+07 76.0 Basic Materials 370 HRB 13 4.20 penny-cap Long NaN 13.0 4.420521e+07 78.0 Consumer Cyclical 367 IGT 12 18.39 penny-cap Long NaN 21.0 4.371464e+07 12.0 Consumer Cyclical 492 MTDR 17 12.43 penny-cap Long NaN 17.0 4.229321e+07 78.0 Energy 338 IMAB 8 9.02 penny-cap Long NaN 30.0 4.133626e+07 25.0 Healthcare 411 MED 13 12.06 penny-cap Long NaN 16.0 3.972487e+07 15.0 Consumer Cyclical 312 WEN 9 0.68 penny-cap Long NaN 55.0 3.956501e+07 37.0 Consumer Cyclical 487 DDS 9 6.64 penny-cap Long NaN 9.0 3.939622e+07 24.0 Consumer Cyclical 647 PLCE 8 8.02 penny-cap Long NaN 8.0 3.907643e+07 9.0 Consumer Cyclical 333 SWCH 9 4.35 penny-cap Long NaN 40.0 3.823597e+07 31.0 Technology 410 RRR 21 12.62 penny-cap Long NaN 21.0 3.740772e+07 78.0 Consumer Cyclical 350 AM 13 3.80 penny-cap Long NaN 16.0 3.640981e+07 26.0 Energy 408 HMY 9 7.37 penny-cap Long NaN 58.0 3.627546e+07 39.0 Basic Materials 320 NCR 10 4.00 penny-cap Long NaN 38.0 3.457496e+07 44.0 Technology 540 HOME 16 17.93 penny-cap Long NaN 23.0 3.446530e+07 78.0 Consumer Cyclical 377 UNVR 24 16.55 penny-cap Long NaN 43.0 3.401109e+07 58.0 Basic Materials 554 CNR 7 6.66 penny-cap Long NaN 7.0 3.355771e+07 78.0 Industrials 428 SUM 14 9.56 penny-cap Long NaN 14.0 3.345828e+07 78.0 Basic Materials 403 MIME 12 8.27 penny-cap Long NaN 32.0 3.237330e+07 14.0 Technology 418 MDRX 9 3.33 penny-cap Long NaN 30.0 3.213590e+07 12.0 Healthcare 315 JOBS 15 1.99 penny-cap Long NaN 37.0 3.143864e+07 17.0 Industrials 498 EPC 15 3.49 penny-cap Long NaN 15.0 2.842610e+07 53.0 Consumer Defensive 511 GTN 10 5.69 penny-cap Long NaN 29.0 2.837468e+07 78.0 Communication Services 389 CHX 11 6.06 penny-cap Long NaN 16.0 2.817266e+07 26.0 Energy 459 MLHR 13 4.06 penny-cap Long NaN 13.0 2.716718e+07 78.0 Consumer Cyclical 531 PAGP 14 11.85 penny-cap Long NaN 21.0 2.697232e+07 24.0 Energy 440 CIM 7 2.19 penny-cap Long NaN 7.0 2.561944e+07 78.0 Real Estate 466 BCRX 8 -5.38 penny-cap Long NaN 15.0 2.553733e+07 15.0 Healthcare 323 VVV 30 19.38 penny-cap Long NaN 30.0 2.530053e+07 78.0 Energy 364 LEGN 8 20.92 penny-cap Long NaN 24.0 2.489675e+07 27.0 Healthcare 347 SSRM 9 6.42 penny-cap Long NaN 52.0 2.420006e+07 21.0 Basic Materials 341 WCC 22 16.48 penny-cap Long NaN 22.0 2.399378e+07 78.0 Industrials 514 RLGY 13 11.33 penny-cap Long NaN 20.0 2.387877e+07 20.0 Real Estate 491 CRC 7 3.90 penny-cap Long NaN 14.0 2.338435e+07 8.0 Energy 434 COKE 9 17.27 penny-cap Long NaN 9.0 2.308723e+07 58.0 Consumer Defensive 609 FRO 6 2.68 penny-cap Long NaN 19.0 2.226128e+07 31.0 Energy 381 AGI 9 5.20 penny-cap Long NaN 56.0 2.133009e+07 36.0 Basic Materials 502 VSTO 11 12.50 penny-cap Long NaN 17.0 2.102659e+07 18.0 Consumer Cyclical 425 CBT 18 11.38 penny-cap Long NaN 24.0 2.015416e+07 78.0 Basic Materials 443 FCFS 24 11.38 penny-cap Long NaN 32.0 1.983999e+07 59.0 Financial Services 417 EXLS 16 4.59 penny-cap Long NaN 16.0 1.980935e+07 60.0 Technology 589 XPEL 13 19.42 penny-cap Long NaN 13.0 1.913987e+07 39.0 Consumer Cyclical 396 NUS 13 2.11 penny-cap Long NaN 31.0 1.801182e+07 15.0 Consumer Defensive 552 AAWW 10 2.68 penny-cap Long NaN 40.0 1.767119e+07 70.0 Industrials 439 MD 14 -0.85 penny-cap Long NaN 14.0 1.743494e+07 39.0 Healthcare 467 SGRY 23 13.56 penny-cap Long NaN 23.0 1.719726e+07 78.0 Healthcare 495 CSTM 17 6.29 penny-cap Long NaN 23.0 1.689542e+07 58.0 Basic Materials 448 PLXS 9 -0.05 penny-cap Long NaN 9.0 1.685172e+07 78.0 Technology 623 RGR 12 7.19 penny-cap Long NaN 13.0 1.677740e+07 15.0 Industrials 583 NGD 6 10.14 penny-cap Long NaN 37.0 1.665083e+07 18.0 Basic Materials 386 GOLF 15 2.48 penny-cap Long NaN 15.0 1.655237e+07 15.0 Consumer Cyclical 435 PRMW 9 -0.42 penny-cap Long NaN 9.0 1.634971e+07 39.0 Consumer Defensive 374 CWK 18 6.61 penny-cap Long NaN 18.0 1.576308e+07 58.0 Real Estate 596 CASH 20 2.87 penny-cap Long NaN 20.0 1.537135e+07 78.0 Financial Services 522 IRWD 14 8.97 penny-cap Long NaN 26.0 1.530199e+07 33.0 Healthcare 310 HLI 11 4.75 penny-cap Long NaN 11.0 1.505411e+07 11.0 Financial Services 528 GOL 14 8.41 penny-cap Long NaN 38.0 1.500414e+07 25.0 Industrials 493 PRFT 20 11.31 penny-cap Long NaN 20.0 1.438722e+07 78.0 Technology 525 IAG 8 0.86 penny-cap Long NaN 14.0 1.431092e+07 15.0 Basic Materials 603 WIRE 23 12.33 penny-cap Long NaN 23.0 1.348513e+07 78.0 Industrials 520 VRTS 7 0.13 penny-cap Long NaN 7.0 1.333813e+07 78.0 Financial Services 472 PBH 13 5.97 penny-cap Long NaN 13.0 1.320225e+07 18.0 Healthcare 331 CEF 11 4.10 penny-cap Long NaN 34.0 1.270510e+07 18.0 unknown 470 PVG 8 -2.80 penny-cap Long NaN 8.0 1.200988e+07 18.0 Basic Materials 382 SXT 10 2.20 penny-cap Long NaN 31.0 1.122326e+07 58.0 Basic Materials 581 PACK 7 2.42 penny-cap Long NaN 7.0 1.115244e+07 8.0 Consumer Cyclical 450 MTX 15 2.86 penny-cap Long NaN 15.0 1.113034e+07 78.0 Basic Materials 507 MGRC 8 -0.72 penny-cap Long NaN 8.0 1.087852e+07 10.0 Industrials 397 JJSF 20 5.18 penny-cap Long NaN 26.0 1.086358e+07 29.0 Consumer Defensive 430 EVTC 17 7.45 penny-cap Long NaN 39.0 1.058326e+07 39.0 Technology 585 FFG 17 0.38 penny-cap Long NaN 17.0 1.006335e+07 17.0 Financial Services 594 SAND 12 4.86 penny-cap Long NaN 57.0 9.492691e+06 39.0 Basic Materials 565 HNI 10 3.05 penny-cap Long NaN 20.0 9.327275e+06 62.0 Industrials 351 TIGO 11 2.12 penny-cap Long NaN 18.0 8.421658e+06 20.0 Communication Services 521 PIPR 10 3.76 penny-cap Long NaN 10.0 8.371944e+06 78.0 Financial Services 409 USM 12 0.94 penny-cap Long NaN 12.0 7.851892e+06 58.0 Communication Services 512 MNR 7 1.68 penny-cap Long NaN 16.0 7.607621e+06 16.0 Real Estate 648 CTS 9 9.89 penny-cap Long NaN 23.0 7.367623e+06 16.0 Technology 446 ENBL 21 17.72 penny-cap Long NaN 21.0 7.266823e+06 74.0 Energy 375 CNS 13 4.02 penny-cap Long NaN 39.0 7.001705e+06 24.0 Financial Services 441 ANAT 15 21.91 penny-cap Long NaN 15.0 6.204502e+06 60.0 Financial Services 385 NG 10 8.84 penny-cap Long NaN 15.0 6.028489e+06 35.0 Basic Materials 599 NMRK 14 -0.58 penny-cap Long NaN 14.0 6.003257e+06 78.0 Real Estate 483 OR 18 12.07 penny-cap Long NaN 53.0 5.512118e+06 36.0 Basic Materials 607 BPMP 16 5.77 penny-cap Long NaN 23.0 4.830205e+06 60.0 Energy 638 AUDC 10 4.45 penny-cap Long NaN 35.0 4.443844e+06 16.0 Technology 422 EXG 7 2.53 penny-cap Long NaN 7.0 4.333055e+06 58.0 Financial Services 534 DKL 9 7.98 penny-cap Long NaN 33.0 3.251971e+06 11.0 Energy 616 ARKO 6 -1.67 penny-cap Long NaN 6.0 2.852834e+06 60.0 Consumer Cyclical 640 CLNC 10 2.91 penny-cap Long NaN 15.0 2.453232e+06 10.0 Real Estate 628 SNEX 8 -3.05 penny-cap Long NaN 11.0 2.362350e+06 62.0 Financial Services 574 BTZ 6 1.00 penny-cap Long NaN 39.0 1.827923e+06 20.0 Financial Services 556 VCTR 7 -0.23 penny-cap Long NaN 7.0 1.283604e+06 58.0 Financial Services 413 CIXX 10 6.17 penny-cap Long NaN 36.0 1.085325e+06 78.0 Financial Services 545 KEN 7 5.77 penny-cap Long NaN 38.0 4.057614e+05 29.0 Utilities 404 TDI 8 0.27 penny-cap Long NaN 8.0 1.978884e+05 38.0 unknown 464 IBA 8 2.33 penny-cap Long NaN 39.0 6.526300e+04 32.0 Consumer Defensive 503 SIM 10 13.37 penny-cap Long NaN 32.0 2.655500e+04 32.0 Basic Materials Mean Return: 7.545739130434782 Mean Day/Week: 12.57391304347826 Accuracy:0.9043478260869565 *******************Part 3.8 Penny Cap Short Maintainance********************* penny_short_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 591 RIOT 13 -2.53 penny-cap Short NaN -46.0 4.557701e+08 -30.0 Technology 309 SHAK 19 -16.04 penny-cap Short NaN -64.0 3.561316e+08 -35.0 Consumer Cyclical 324 TRIP 7 0.69 penny-cap Short NaN -45.0 1.033927e+08 -21.0 Consumer Cyclical 295 ALLO 19 -19.48 penny-cap Short NaN -20.0 8.613151e+07 -21.0 Healthcare 325 NOVA 17 -6.64 penny-cap Short NaN -17.0 8.300263e+07 -61.0 Technology 523 HRTX 9 -1.16 penny-cap Short NaN -10.0 5.794871e+07 -10.0 Healthcare 303 SAGE 15 -2.98 penny-cap Short NaN -15.0 5.263399e+07 -17.0 Healthcare 458 REAL 13 -10.98 penny-cap Short NaN -13.0 4.336842e+07 -19.0 Consumer Cyclical 455 EAR 15 -22.03 penny-cap Short NaN -15.0 4.246437e+07 -49.0 Healthcare 305 NARI 13 -1.89 penny-cap Short NaN -17.0 3.891129e+07 -17.0 Healthcare 339 YALA 6 -4.68 penny-cap Short NaN -66.0 3.789143e+07 -46.0 Technology 463 CLNE 20 -32.82 penny-cap Short NaN -65.0 3.737966e+07 -38.0 Energy 379 NNOX 6 1.86 penny-cap Short NaN -71.0 3.734264e+07 -67.0 Healthcare 352 GOOS 10 5.10 penny-cap Short NaN -52.0 3.326781e+07 -19.0 Consumer Cyclical 349 INSM 16 -19.21 penny-cap Short NaN -16.0 3.188221e+07 -52.0 Healthcare 365 VCYT 21 -21.17 penny-cap Short NaN -28.0 2.719562e+07 -51.0 Healthcare 602 ICPT 15 -0.64 penny-cap Short NaN -15.0 2.567699e+07 -67.0 Healthcare 362 CNNE 12 -0.54 penny-cap Short NaN -20.0 2.509913e+07 -17.0 Consumer Cyclical 468 KURA 16 -9.17 penny-cap Short NaN -16.0 2.485082e+07 -137.0 Healthcare 369 IRBT 20 -15.07 penny-cap Short NaN -66.0 2.467508e+07 -54.0 Technology 313 CCMP 8 0.62 penny-cap Short NaN -22.0 2.395221e+07 -15.0 Technology 436 RCUS 8 -12.99 penny-cap Short NaN -16.0 2.302290e+07 -45.0 Healthcare 380 NSTG 12 -6.43 penny-cap Short NaN -15.0 2.132153e+07 -17.0 Healthcare 390 NHI 11 1.44 penny-cap Short NaN -33.0 2.109690e+07 -17.0 Real Estate 405 GDOT 12 -4.53 penny-cap Short NaN -12.0 2.051295e+07 -137.0 Financial Services 519 EB 6 3.31 penny-cap Short NaN -44.0 2.043173e+07 -12.0 Technology 549 PAR 10 15.66 penny-cap Short NaN -14.0 2.001304e+07 -16.0 Technology 298 GSHD 12 -5.81 penny-cap Short NaN -12.0 1.992321e+07 -49.0 Financial Services 343 LOPE 13 -3.58 penny-cap Short NaN -40.0 1.966481e+07 -15.0 Consumer Defensive 354 EGHT 18 -29.08 penny-cap Short NaN -18.0 1.925373e+07 -20.0 Technology 344 GKOS 13 -2.22 penny-cap Short NaN -14.0 1.898320e+07 -15.0 Healthcare 488 MTOR 12 -4.28 penny-cap Short NaN -47.0 1.843994e+07 -40.0 Consumer Cyclical 601 MODN 12 -1.14 penny-cap Short NaN -16.0 1.820023e+07 -20.0 Technology 307 ALRM 16 -3.01 penny-cap Short NaN -16.0 1.682785e+07 -21.0 Technology 342 CCXI 17 -64.59 penny-cap Short NaN -17.0 1.626011e+07 -59.0 Healthcare 462 YEXT 18 -7.77 penny-cap Short NaN -18.0 1.587150e+07 -59.0 Technology 332 DOYU 20 -20.19 penny-cap Short NaN -60.0 1.573189e+07 -46.0 Communication Services 449 STRA 20 -5.48 penny-cap Short NaN -31.0 1.541409e+07 -28.0 Consumer Defensive 368 SLQT 11 -5.24 penny-cap Short NaN -27.0 1.534851e+07 -13.0 Financial Services 399 LGND 21 -23.35 penny-cap Short NaN -69.0 1.494895e+07 -46.0 Healthcare 371 FORM 19 -11.27 penny-cap Short NaN -20.0 1.464456e+07 -20.0 Technology 559 PRIM 6 -0.79 penny-cap Short NaN -48.0 1.430544e+07 -25.0 Industrials 536 SLP 17 -8.65 penny-cap Short NaN -17.0 1.422131e+07 -51.0 Healthcare 426 DCPH 16 -8.96 penny-cap Short NaN -16.0 1.393059e+07 -18.0 Healthcare 633 MORF 16 -1.58 penny-cap Short NaN -43.0 1.380275e+07 -32.0 Healthcare 378 TRN 7 0.28 penny-cap Short NaN -7.0 1.365315e+07 -49.0 Industrials 571 OCUL 12 -8.95 penny-cap Short NaN -12.0 1.336935e+07 -19.0 Healthcare 508 SVC 12 1.33 penny-cap Short NaN -46.0 1.308407e+07 -19.0 Real Estate 451 PUBM 15 -9.56 penny-cap Short NaN -57.0 1.248208e+07 -30.0 Technology 321 NEU 7 -2.03 penny-cap Short NaN -26.0 1.247799e+07 -69.0 Basic Materials 588 JRVR 15 0.19 penny-cap Short NaN -23.0 1.159766e+07 -27.0 Financial Services 543 ATSG 15 -2.90 penny-cap Short NaN -33.0 1.150370e+07 -26.0 Industrials 530 HMN 8 -0.25 penny-cap Short NaN -34.0 1.129016e+07 -25.0 Financial Services 432 ESE 11 -4.58 penny-cap Short NaN -20.0 1.124105e+07 -13.0 Technology 453 AVNS 18 -7.77 penny-cap Short NaN -18.0 1.104411e+07 -49.0 Healthcare 482 ARCE 9 3.78 penny-cap Short NaN -9.0 1.018937e+07 -76.0 Consumer Defensive 584 PLT 8 3.49 penny-cap Short NaN -59.0 9.951388e+06 -10.0 Technology 562 IMGN 16 -20.77 penny-cap Short NaN -59.0 9.717089e+06 -42.0 Healthcare 592 CEVA 19 -18.34 penny-cap Short NaN -63.0 9.508710e+06 -46.0 Technology 393 ALXO 11 1.15 penny-cap Short NaN -11.0 9.392902e+06 -75.0 Healthcare 539 LTC 14 -3.25 penny-cap Short NaN -46.0 9.377161e+06 -18.0 Real Estate 361 SEER 17 -25.63 penny-cap Short NaN -17.0 9.332680e+06 -119.0 Healthcare 358 SPSC 12 -0.84 penny-cap Short NaN -17.0 9.131259e+06 -22.0 Technology 481 PRAX 10 -0.37 penny-cap Short NaN -10.0 9.107645e+06 -64.0 Healthcare 501 TBIO 6 5.56 penny-cap Short NaN -11.0 9.009884e+06 -49.0 Healthcare 641 AKRO 15 0.44 penny-cap Short NaN -15.0 8.988657e+06 -19.0 Healthcare 586 CVGW 11 -1.65 penny-cap Short NaN -22.0 8.976979e+06 -19.0 Consumer Defensive 355 NKTR 12 -6.44 penny-cap Short NaN -57.0 8.824411e+06 -43.0 Healthcare 420 XNCR 15 -0.84 penny-cap Short NaN -15.0 8.671020e+06 -49.0 Healthcare 506 ACMR 20 -12.93 penny-cap Short NaN -20.0 8.636045e+06 -45.0 Technology 394 ROCK 12 -1.46 penny-cap Short NaN -16.0 8.632724e+06 -16.0 Industrials 582 ASTE 7 -5.82 penny-cap Short NaN -32.0 8.129985e+06 -8.0 Industrials 621 TPGY 14 -22.42 penny-cap Short NaN -14.0 7.371915e+06 -60.0 Financial Services 614 LOTZ 12 -19.05 penny-cap Short NaN -12.0 7.277246e+06 -101.0 Consumer Cyclical 546 HTLD 6 -2.29 penny-cap Short NaN -26.0 6.677073e+06 -12.0 Industrials 651 VITL 15 -1.63 penny-cap Short NaN -15.0 6.383549e+06 -48.0 Consumer Defensive 579 ALX 11 1.17 penny-cap Short NaN -42.0 6.320208e+06 -25.0 Real Estate 598 OMER 8 -16.32 penny-cap Short NaN -64.0 6.123055e+06 -42.0 Healthcare 642 KRA 6 -1.48 penny-cap Short NaN -19.0 5.920076e+06 -20.0 Basic Materials 604 ADVM 20 -6.23 penny-cap Short NaN -20.0 5.918510e+06 -61.0 Healthcare 593 TRIL 9 -10.25 penny-cap Short NaN -9.0 5.692582e+06 -137.0 Healthcare 558 UPLD 15 0.98 penny-cap Short NaN -16.0 5.574007e+06 -17.0 Technology 569 KNSA 17 -17.01 penny-cap Short NaN -50.0 5.493307e+06 -47.0 Healthcare 542 ARQT 8 2.62 penny-cap Short NaN -10.0 5.179622e+06 -12.0 Healthcare 548 LKFN 12 -1.89 penny-cap Short NaN -47.0 5.132215e+06 -22.0 Financial Services 646 PASG 9 -6.52 penny-cap Short NaN -9.0 5.058865e+06 -137.0 Healthcare 461 ADCT 12 -0.93 penny-cap Short NaN -12.0 4.974785e+06 -137.0 Healthcare 572 MRSN 13 -2.91 penny-cap Short NaN -13.0 4.556388e+06 -137.0 Healthcare 541 HY 8 -2.09 penny-cap Short NaN -66.0 4.405050e+06 -35.0 Industrials 568 VCRA 19 -6.53 penny-cap Short NaN -19.0 4.272682e+06 -53.0 Technology 620 QNST 17 -8.03 penny-cap Short NaN -17.0 4.027171e+06 -48.0 Communication Services 563 CSGS 7 -0.28 penny-cap Short NaN -41.0 3.799042e+06 -22.0 Technology 564 MASS 13 -16.04 penny-cap Short NaN -13.0 3.795223e+06 -109.0 Healthcare 576 WMK 6 -4.34 penny-cap Short NaN -6.0 3.621178e+06 -27.0 Consumer Defensive 644 DHC 17 -14.56 penny-cap Short NaN -44.0 3.582728e+06 -27.0 Real Estate 551 BCAB 13 -13.20 penny-cap Short NaN -42.0 3.402726e+06 -35.0 Healthcare 475 STTK 11 -9.45 penny-cap Short NaN -11.0 3.017789e+06 -67.0 Healthcare 611 LXRX 21 -15.69 penny-cap Short NaN -71.0 2.576820e+06 -46.0 Healthcare 535 PNTG 21 -25.45 penny-cap Short NaN -91.0 2.149279e+06 -67.0 Healthcare 615 RMAX 27 -1.90 penny-cap Short NaN -49.0 1.959720e+06 -32.0 Real Estate 505 SPNS 16 -4.91 penny-cap Short NaN -17.0 1.820140e+06 -17.0 Technology 618 FDMT 15 -24.79 penny-cap Short NaN -15.0 1.690335e+06 -49.0 Healthcare 398 TARO 6 -0.68 penny-cap Short NaN -20.0 1.534402e+06 -13.0 Healthcare 555 KNTE 6 -1.80 penny-cap Short NaN -46.0 1.387148e+06 -120.0 Healthcare 617 PRPB 7 -0.20 penny-cap Short NaN -7.0 1.381199e+06 -60.0 Financial Services 645 BSA 6 0.38 penny-cap Short NaN -12.0 4.126475e+05 -12.0 unknown 653 IH 9 -1.06 penny-cap Short NaN -9.0 3.633379e+05 -137.0 Consumer Defensive 494 ITCB 8 -10.71 penny-cap Short NaN -22.0 1.762547e+05 -14.0 Financial Services 544 HLG 46 -25.42 penny-cap Short NaN -46.0 1.324171e+05 -137.0 Consumer Defensive 454 GB 15 -10.76 penny-cap Short NaN -33.0 1.004530e+05 -71.0 Technology Mean Return: -7.355636363636362 Mean Day/Week: 13.281818181818181 Accuracy:0.8272727272727273 ************************************** ************************************** ************************************** Error: []

0 notes

Text

Stock daily Filter Report for 2021/05/11 05-40-07