#vantagescore 3.0 calculation

Text

The Future of Shopping - Vantage score 0 offers an innovative shopping experience that is sure to make your shopping trips a breeze!

Introduction

Introduction:

If you're looking for a shopping experience that is sure to make your shopping trips a breeze, look no further than Vantage score 0. This innovative shopping platform offers an innovative shopping experience that is sure to make your shopping trips a breeze. For one, Vantage score 0 features an intuitive interface that makes it easy to find what you're looking for. Additionally, the platform offers ample search options so you can quickly and easily find the best deals on the items you need. Finally, the platform offers a variety of payment options so you can get your Shopping spree on without spending a fortune!

What is Vantage score 0.

Vantage score 0 is a new shopping experience that allows users to save on their shopping trips by rating and reviewing products. This innovative system offers customers an innovative shopping experience that is sure to make their shopping trips a breeze! By rating and reviewing products, Vantage score 0 helps shoppers find the perfect product for them and saves them money on their next purchase. There are many benefits of using Vantage score 0, including:

- Saving time - By rating and reviewing products, shoppers can save time on their shopping trips. This allows them to shop more efficiently and stay within their budget.

- Finding the best deal - By rating and reviewing products, shoppers can find the best deals on products. This allows them to save money while still enjoying their Shopping trip.

- feeling like they own the product - by ratings and reviews, shoppers feel like they own the product they are purchasing. This allows them to feel like they are making a real difference in the product they are buying and helping others enjoy it too!

How to Get Started with Vantage score 0.

To start shopping with Vantagescore 0, you first need to set up your shopping accounts. You can create an account for free or use a subscription model. In either case, you will need to enter your personal information and select your shopping preferences. Once you have set up your accounts, you can start shopping!

Shop from Anywhere in the World

As mentioned earlier, Vantagescore 0 offers a revolutionary shopping experience that is sure to make your shopping trips a breeze! You can shop from any location in the world, and get a free shipping code if you want! Simply enter the code at checkout when placing your order.

Get a Free Shipping Code

If you're looking to save even more on your next purchase, be sure to add Vantagescore 0 to your cart and receive a free shipping code! Just enter the code at checkout and enjoy standard shipping rates as well!

Tips for Enjoying the Best Shopping Experiences with Vantagescore 0.

When planning your shopping trip, try to schedule time for shopping. This will help you find the best deals and enjoy the experience of Shopping with Vantagescore 0. By heading to one or more designated stores, you can save a lot of money on your shopping trips.

Cookiecutter Shopping Sheets

To make your shopping experiences even easier, use cookiecutter shopping sheets. These templates will help you plan your favorite shopping trips in a snap! Just print out the sheet and cut out the items you need for each visit. You’ll be ready to go from there!

Find the Right Place to Shop

If you’re looking for an amazing shopping experience but don’t have time to spend in a store, consider finding a place to shop online. With Vantage score 0, there are plenty of options available that will let you shop without feeling rushed or stressed out. Check out our website or use our search bar to find what you’re looking for quickly and easily! More information can be found on the website

Conclusion

Vantage score 0. is a powerful shopping platform that allows you to shop from anyplace in the world. By setting up your accounts and shopping from anywhere, you can enjoy the best shopping experiences possible. Additionally, Cookie cutter Shopping Sheets make it easy to find the best deals on products online. Finally, make sure to check out our other posts for more helpful tips!

#fico score#New vantagescore 0#vantagescore 3.0#vantagescore 3.0 calculation#vantagescore 3.0 scoring system#vantagescore 4.0#Post navigation

0 notes

Text

How to Fix Your Credit Score in 3 Simple Steps

A poor credit score can make it difficult to get a loan, rent an apartment, or even get a job. Luckily, there are ways to fix your credit score in 3 simple steps.

Credit scores are calculated by looking at factors such as how much debt you owe and how often you’ve missed payments on those debts. You can easily improve your credit score by paying off your debt, paying your bills on time, and not missing any payments.

What is a credit score?

A credit score is a numerical representation of your creditworthiness. It is calculated by taking into account your payment history and other factors such as how much debt you have, how long it has been since you last made a payment, and the length of your credit history.

The higher the score, the more likely it is that you will be approved for loans or credit cards. There are three major types of scores used in the United States: FICO score, VantageScore 3.0, and TransUnion Empirica Score.

What are Your Options for Fixing Your Credit Score?

There are many ways to improve your credit score. These include paying down debt, using a credit card wisely, and being careful with your spending. However, if you're looking for a quick fix, there are also some options that can help you get back on track and improve your score fast.

Credit repair services

Credit monitoring services

Debt consolidation loans

Step 1: Get a Personal Loan with Bad Credit

If you have bad credit, it can be difficult to get a personal loan. However, there are some lenders who are willing to offer personal loans with bad credit.

Some of the lenders will require you to provide collateral in order for them to offer the loan. This means that they will want you to put up something of value such as your car or your house as collateral against the loan.

A lot of people use personal loans with bad credit when they need a quick cash flow and don't have time for waiting for an approval from a bank or other financial institution.

Step 2: Improve your Credit Score by Making Smart Money Moves

As the credit score becomes more and more important in our everyday lives, it is important to know how to improve your credit score. Here are some smart money moves that you can make to increase your chances of getting a good credit score.

- Pay off all debts in full. This will show that you have a consistent track record of paying off your debts and that you are not carrying any debt around.

- Make sure that you are making timely payments on your loans and other debts. This shows good management skills and that you may be able to get a loan in the future if needed.

- Make sure that all of your accounts have a zero balance, which means no overdraft fees or interest charges on those accounts at all times.

Step 3 - Finding the Right Settlement or Debt Consolidation Option

When it comes to settling a debt, people usually focus on how much they can save in interest. They don’t think about the long-term consequences of the debt settlement and what it means for their credit score.

In this, we will discuss some of the most common ways in which people can improve their credit score. We will also talk about how to find the right settlement option for your particular situation.

Credit scores are important when you are looking at settling a debt or getting a loan from your bank or from any other institution. You should know what factors contribute to your credit score and make sure that you have a good one before applying for any loans or getting a settlement from your creditors.

How to Monitor Your Credit Score on a Monthly Basis and Track Progress Over Time

Monitoring your credit score on a monthly basis is a good way to track progress over time. It also helps you identify any changes that need to be made.

There are various credit monitoring services available online, such as Credit Repair in my area.

Monitoring your credit score on a monthly basis is important because it provides you with an overview of your financial situation. That way, if you see any changes in your score, you can take the appropriate steps to improve it.

Conclusion - The Benefits of Getting Corrected

The benefits of getting corrected are pretty obvious. It gives you a chance to learn and grow as a writer while also focusing on what you are good at - creativity and emotions.

Call on(888) 804-0104 & Fix your credit score now!

#fix your credit score#credit score#improve your credit score#credit monitoring services#debt consolidation loans

1 note

·

View note

Text

How to get a credit card with no credit

CNN

–

CNN Underscored checks financial products like credit cards and bank accounts based on their total value. We may receive a commission through the LendingTree partner network when you apply for a card and are approved, but our reporting is always independent and objective.

Credit building can seem impossible when you are just starting out, and this is especially true when you have no credit at all. That’s because credit card issuers and lenders, by and large, shy away from consumers with no credit history because they cannot assess your creditworthiness and have no idea how to handle credit if you had access to it.

Fortunately, there are some unique credit card products aimed at consumers with limited credit history or no credit history at all. So, if you don’t have a credit history but want to get a credit card, it is time to learn more about your options. Let’s see how to get a credit card with no credit history and what other steps you can take to build credit over time.

For the latest list of the best credit cards for those with no credit history, click here.

Not having a credit history is different from having bad credit. Bad credit means you have had a history of credit abuse, while a lack of credit history means you never had access to credit, so your credit report will not include any credit movements. Without information about your credit reports, lenders will not know enough about you to assess your creditworthiness.

Also, having no credit history doesn’t mean you have a zero credit score. This is an important difference as a zero credit rating is not even possible based on the most popular credit rating systems. If you don’t have a credit history then you simply don’t have a credit history.

However, once you start using credit, the credit bureaus have information that they can use to calculate a credit score for you. The most widely used type of credit score is the FICO score, which ranges from 300 to 850, with higher scores being far superior:

Exceptional: 800 and higher

Very good: 740 to 799

Good: 670 to 739

Mass: 580 to 669

Bad: 579 and lower

If you’re not sure whether you have a credit history or a credit score, you can find out for free on AnnualCreditReport.com, which provides a free report once a year from each of the three major credit bureaus. This is the only official website that offers free credit reports. So make sure you use the correct link when requesting a report.

After reviewing your credit report, if you have information about it, you can determine whether there is enough data to calculate a credit score for you. While there is no official creditworthiness website as there is for credit reports, luckily there are many ways you can do a credit check for free.

You can start by signing up with a credit monitoring service that offers a free credit score or a program that offers free credit tracking tools. For example, Capital One’s CreditWise gives consumers a free look at their TransUnion VantageScore 3.0, and you don’t have to be a customer to use it.

Connected: How can you check your credit score for free?

Without any credit history, you are only eligible for a select few types of credit cards. The first is a secured credit card, which is a credit card that requires a cash deposit as security.

When you apply for a secured credit card, your initial deposit is typically $ 200 or more and the money you put on deposit will be used to secure your line of credit. This also means that your initial credit limit is usually low. In fact, a $ 200 deposit usually means an initial line of credit of $ 200, a deposit of $ 500 means an initial credit limit of $ 500, and so on.

iStock

Even people without a credit history have options for obtaining a credit card.

The good news is, with a secured credit card, you will get your deposit back if you close your account in good condition (i.e. you have paid back any funds used up to that point). This applies regardless of whether you close your credit card account with a balance of USD 0 or upgrade your card to an unsecured option from the same issuer.

There are also some unsecured card options for those with no credit history, which means you don’t have to deposit any cash, but they are few and far between. Unsecured credit cards for those with no credit history usually come with low credit limits and potential fees, although this is not always the case. However, if you don’t have a credit history and are looking for an unsecured credit card, make sure you choose one that doesn’t come with high fees.

Check to see if you qualify for one of these credit cards for those with no credit history.

Before applying for a credit card without a credit history, there are a few key questions you need to ask yourself:

Have I checked my credit report and score? Don’t assume that you don’t have a credit history without taking the time to check it out. It is possible that you have information about your credit report from financial institutions that you have worked with in the past and that you have a credit rating as a result.

Am I willing to leave a cash deposit as security? A secured credit card is often the easiest way to start building a loan, although you will have to put up with collateral. If you don’t have a lot of cash to spare, look for secure card options that only allow you to deposit $ 49.

Am I ready to take construction loans seriously? Before getting a credit card, make sure that you are ready to prove your creditworthiness. This usually means that you are able and willing not to hit your credit card limit and pay your credit card bill on time and ideally in full each month.

Another way to build your credit score is to make someone else with an existing credit card – such as a family member – an authorized user for their account. This means your account will appear on your credit report and you will benefit from their good credit history.

However, if that person abuses their credit, the resulting negative mark may appear on your report as well. So make sure you choose a person who will be responsible for their own credit.

Save money with these credit card offers for those with no credit history.

Without any credit history, your credit card options are limited and, frankly, not that great. However, it is important to know that some credit card offers are exceptionally better than others for those without credit. When comparing all of your options, here are some pitfalls to avoid:

fees: Avoid credit cards that charge registration fees, monthly maintenance fees, or high annual fees. There are many secured credit cards with no annual fee as well as unsecured credit cards that you may be eligible for and that do not have an annual fee.

High annual percentage rateCredit cards for bad or no credit usually have much higher interest rates or annual percentage rates. Choosing a card with a high APR may be fine, but you should strive to pay off your credit card balance in full each month so that you can avoid interest charges altogether.

Yourself: Make sure you are ready to avoid serious credit mistakes in the first place. Most importantly, you have to pay your credit card bills early or on time each month. Also, avoid exhausting your available credit.

Compare available credit card offers for those with limited credit history.

iStock

A new credit card can help you build a credit history and open the doors to new credit options.

Whether you choose a secured credit card or an unsecured credit card, you want to know how best to use your card to your advantage so that you can start building a credit history. Your first step is to know and understand the factors that go into determining your creditworthiness. Here are the factors used by the credit reporting agencies to calculate a FICO credit score:

Payment history: 35%

Amounts owed: 30%

Loan History Duration: 15%

New credit: 10%

Credit mix: 10%

As you can see, your payment history is the largest part of your credit score at 35%. So the most important thing you can do is pay your credit card bill early or on time each month. No exceptions!

The second most important factor is the amount you owe in relation to your credit limit – this is 30% of your creditworthiness. In general, it’s best to use 10% or less of your available credit at any given time, but no more than 30% if you want good credit.

This means that you won’t have more than $ 50 to $ 150 in debt if you have a credit card limit of $ 500, and only $ 20 to 60 in debt if your credit limit is $ 200. Since your first credit card is likely to have a low credit limit, you should take extra care to keep your balance very low or $ 0 for the best results.

The next factor – the length of your credit history – is one that you can only improve on over time. New loan is based on how many lines of credit you have applied for in the recent past, and you can do well in this category by avoiding opening too many new accounts at once.

After all, your credit mix is another factor that can take care of itself over time. Once you have a credit history and good credit score, you can expand the range of credit products you need to include revolving accounts, installment loans, and maybe even a mortgage or car loan.

In the end, it can feel like a chicken-and-egg situation – how can you get a credit card to build your credit history when lenders don’t give you a credit card with no credit? History? But by strategically using secured credit cards, unsecured cards, and maybe even an authorized user account owned by a friend or family member, you can be on the right track and soon you will have a solid credit history and many more credit options to choose from.

Learn about the best credit cards you can get with no credit history.

Check out CNN Underscored’s list The best credit cards in 2021.

Get the latest in personal finance offers, news and advice at CNN Underscored Money.

source https://www.cassh24sg.com/2021/06/29/how-to-get-a-credit-card-with-no-credit/

0 notes

Text

FICO vs. VantageScore: What's the Difference?

You probably know your credit score, but you may or may not know the details of credit score calculation or the scoring model. In fact, according to a recent survey, 4 in 10 Americans have no idea what factors determine their credit score.

But even though it’s important to understand the factors that determine your score, that’s only one piece of the puzzle. There are actually different types of credit scores that come from different scoring models.

Have you ever noticed that your score is slightly different depending on when and where you check it? Even though it’s normal to see slightly different numbers when you check your score, part of the reason for the discrepancy in numbers is due to different credit scoring models.

Here’s what you need to know about scoring models and the ways they can affect your score.

What is a scoring model?

Credit scoring is a mathematical process that lenders and other businesses use to decide credit eligibility and loan terms. The factors used in the process can include payment history, amount and type of accounts you have, timeliness, outstanding debts and more.

After they collect the information, creditors input the information into an automated system that creates an individual score. But here’s where it gets interesting — not all scoring systems are exactly the same. Creditors and other companies can create their own scoring models based on risk.

Different companies have different models

The Federal Trade Commission clearly states that every company can use a unique scoring model. In addition, companies can use different scoring models for different types of credit or loans. And lastly, companies may also use a generic model developed by a scoring company. In other words, companies have the choice to create their own scoring model or use a scoring model created by a third-party like FICO or VantageScore.

But even though credit scoring models can change from one company to the next, they all must adhere to similar standards. According to the Federal Trade Commission, all credit scoring models must adhere to the guidelines from the Equal Credit Opportunity Act (ECOA):

“Under the ECOA, a creditor’s scoring system may not use certain characteristics — for example, race, sex, marital status, national origin, or religion — as factors. The law allows creditors to use age, but any credit scoring system that includes age must give equal treatment to applicants who are elderly.”

Why companies use scoring models

Lenders use credit scoring models because they are a simple and fair way to determine how risky it is to lend to a potential customer. Lenders want to reduce risk because lower risk means that the customer is more likely to repay the loan. For lenders, credit scoring models are an important part of doing business.

Barry Paperno, credit expert and writer, explains why scoring models are important for lenders.

“Credit scores enable lenders to make automated credit decisions that are objective, faster, and more consistent and accurate than decisions made subjectively without credit scores.”

FICO vs. VantageScore

Whether or not you know what it stands for, you’ve probably heard of “FICO” before, and there’s a good reason for that. Until VantageScore entered the credit scoring marketplace about ten years ago, FICO was the primary credit scoring company in the United States. Founded by Bill Fair and Earl Isaac in 1956, the Fair Isaac Corporation was the first credit scoring company.

Today, lenders use both credit scoring models for lending decisions. Even though FICO and VantageScore aren’t the only scoring models, they are the most popular. Because of that, it’s important to understand the differences.

What you need to know about VantageScore

VantageScore uses a credit scoring model developed by the company. In earlier VantageScore versions, the credit scores ranged from 501 to 990. However, the VantageScore 3.0 model updated the score ranges so they more closely resemble other credit scoring models. Today, the credit scores range from 300 to 850.

Factors that impact your VantageScore

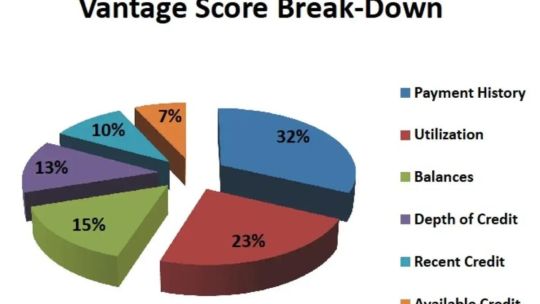

According to VantageScore, different factors impact your VantageScore credit score and some factors are more important than others. Here are the factors that influence your credit score,ranked in order of importance by VantageScore:

Total credit usage, balance and available credit: This is the most important factor for VantageScore and it essentially looks at the total amount of credit you’re able to use, the total amount you’re actually using and how much is leftover. Total credit mix and experience: This is about the type of credit you have — credit cards, car loans, mortgage — and how long you’ve had the accounts. Payment history: This factor focuses on whether you pay your bills on time.Age of credit history: Although this is second to last, the length of your credit history is still important.New accounts: This factor is about how many new accounts you have, how recently you opened them and how many hard credit inquiries are on your report.

In reality, both scoring models are similar and use the same information. For example, both penalize you for late payments or missed payments. But even beyond that, you can get access to credit scores from both companies through the three major credit bureaus: Equifax, TransUnion and Experian.

“Most FICO and VantageScore models are offered by all three bureaus. FICO score models are custom-developed for each of the three credit bureaus. With VantageScore, a single model is developed and applied at each bureau,” says Paperno.

The main difference

The main factor that distinguishes VantageScore from FICO is how long you have to build credit before you have a credit score.

Paperno explains that FICO requires at least one account opened more than six months ago, while VantageScore requires only one month of history.

This is significant because it means that more customers are able to receive a score and as a result, those consumers are able to get access to credit. In fact, according to VantageScore, millions of additional consumers have been able to receive a score as a result of their scoring model:

“The VantageScore 3.0 model, which is the most recently introduced model, provides a score to 30–35 million adult consumers who otherwise would be virtually invisible to mainstream lenders. So when lenders use the VantageScore model, they can provide credit to more consumers at the most appropriate terms.”

How to check your VantageScore

Thanks to innovations in technology, it’s easier than ever to check your VantageScore for free. In fact, if you check your credit score through CapitalOne, Chase or Self Lender, you’ve seen your VantageScore. If you’re interested in checking your score, VantageScore has a complete list of free credit score providers.

What you need to know about FICO

Like VantageScore, FICO is a company that provides credit scores that range from 300 to 850. In other words, a FICO score is a particular brand of credit score. Historically, FICO scores have been the gold-standard for credit scores and according to Paperno, that’s still true today:

“FICO claims their scores are used in more than 90% of credit card, auto, mortgage and other credit decisions. VantageScore, the newer product, does not appear to have been adopted by many lenders for their lending decisions.”

The Consumer Financial Protection Bureau echoes Paperno and explains:

“Today, other companies also have credit scoring formulas (‘models’), but most lenders still use FICO scores when deciding whether to offer you a loan or credit card, and in setting the rate and terms.”

Factors that impact your FICO score

Even though the factors that impact your FICO and VantageScore are the same, the order of importance is slightly different.

Here are the factors that impact your FICO score ranked in order of importance.

Payment history: This factor looks at whether you pay your bills on time. Amounts owed: For this, the FICO model looks at how much you owe on your various accounts in relation to how much credit you have available. Length of credit history: This is about how long you’ve had credit or loan accounts. Credit mix: This factor is about the types of credit you have — installment accounts, mortgage loans, auto loans and more. New accounts: For this, FICO looks at how recently you’ve opened new accounts and during what time frame.

Something that’s interesting to note is that everyone actually has three different FICO scores, one from each credit bureau. This is because FICO score models are custom-developed for each credit bureau.

According to Paperno, lenders choose which score they use to make a lending decision based on their own past experience. Lenders tend to use the scores that have been most reliable in predicting future risk.

How to check your FICO score

Checking your FICO score is a little complicated because the scores online are often different from the scores that lenders use. This is partly because FICO scores change regularly, and they’re not free to get.

According to FICO, it’s best to find out exactly what score a lender is using so you know which score you need to buy from FICO:

“If you're planning on making a major purchase, you probably want to check your FICO Score and not just any credit score. If you really want to be sure that you are seeing the same information that your lender is judging you by, then ask the lender which score they are using and then purchase that exact score, or set of scores.”

Bottom line

The truth about FICO and VantageScore is that they are very similar.

“Since most credit scoring models essentially do the same thing — predict risk — lenders tend to use the models and credit bureaus that over time have proven to be most reliable in their experience,” Paperno explains.

This is good news for your credit because if you work to improve your credit score or build credit for one model, you’ll probably improve your credit for the other model as well.

About the author

Dion Rostamian is a personal finance writer who has also written for Credit Karma, Chime, Acorns and Policy Genius, among others.

Read the full article

0 notes

Text

Hard vs. Soft Inquiries

What is a soft inquiry?

Soft inquiries (also known as “soft pulls”) typically occur when a person or company checks your credit as part of a background check. This may occur, for example, when a credit card issuer checks your credit without your permission to see if you qualify for certain credit card offers. Your employer might also run a soft inquiry before hiring you.

Unlike hard inquiries, soft inquiries won’t affect your credit scores. (They may or may not be recorded in your credit reports, depending on the credit bureau.) Since soft inquiries aren’t connected to a specific application for new credit, they’re only visible to you when you view your credit reports.Common Question

Will checking my own credit scores result in a hard inquiry?

Yes it can. Even though this is reported as a soft inquiry, it may not lower your credit score, however, some bureaus report “excessive soft pulls” and will decline as they feel you are looking and being turned down...SO CAUTION on how many soft pills you do. You can check your VantageScore 3.0 credit scores from two major credit bureaus, TransUnion and Equifax, for free at creditkarma.

Examples of hard and soft credit inquiries

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didn’t, it should be reported as a soft inquiry, again, many soft pulls can cause a lender to decline your application.

Let’s look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

Common hard inquiries

Mortgage applications

Auto loan applications

Credit card applications

Student loan applications

Personal loan applications

Apartment rental applications

Common soft inquiries

Checking your credit scores

“Pre-qualified” credit card offers

“Pre-qualified” insurance quotes

Employment verification (i.e. background check)

Keep in mind, there are other types of credit checks that could show up as either a hard or soft inquiry. For example, utility, cable, internet and cellphone providers will often check your credit.

If you’re unsure how a particular inquiry will be classified, ask the company, credit card issuer or financial institution involved to distinguish whether it’s a hard or soft credit inquiry.

How to dispute hard credit inquiries

We recommend checking your credit reports often. If you spot any errors, such as a hard inquiry that occurred without your permission, consider disputing it with the credit bureau. You may also contact the Consumer Financial Protection Bureau (CFPB) for further assistance.

This could be a sign of identity theft according to Experian, one of the three major credit bureaus. At the very least, you’ll want to look into it and understand what’s going on.

Keep in mind, you can only dispute hard inquiries that occur without your permission. If you’ve authorized a hard inquiry, it generally takes two years to fall off your credit reports.How to dispute an error on your credit report

How to minimize the impact of hard credit inquiries

When you’re buying a home or car, don’t let a fear of racking up multiple hard inquiries stop you from shopping for the lowest interest rates.

FICO gives you a 30-day grace period before certain loan inquiries are reflected in your FICO® credit scores. And FICO may record multiple inquires for the same type of loan as a single inquiry as long as they’re made within a certain window. For FICO scores calculated from older versions of the scoring formula, this window is 14 days; for FICO scores calculated from the newest versions of the scoring formula, it’s 45 days.

Similarly, the VantageScore model gives you a rolling two-week window to shop for the best interest rates for certain loans. “That way, they only impact your credit score once,” the company says.

Bottom line

Your credit scores play a big role in your financial well-being. Before applying for credit, take time to build your credit scores. With stronger credit, you may improve your chances of being approved for the financial products you want at the best possible terms and rates.

To help you keep track of hard inquiries that may influence your credit scores, check your credit reports from TransUnion and Equifax . While one hard inquiry may knock a few points off your scores, multiple inquiries in a short amount of time may cause more damage.

https://lendingcapital.net

The post Hard vs. Soft Inquiries appeared first on .

0 notes

Text

What is a Good Credit Score?

Most financial decisions you make can be summarized into a three-digit number.

That one number can cost, or save, you hundreds of thousands of dollars over your life.

Lenders not only decide whether to give you a loan based on this number, it also determines how good your interest rate is. Lower interest rates means you can pay off loans a lot faster.

When buying a home, this has a huge impact on how much you ultimately pay.

This critical number is called your credit score.

Improving it is one of the big wins of personal finance.

So what’s a good score anyway? And how do they work?

How Credit Scores Work

A credit score takes personal data and uses the information to determine a number ranging from 300 to 850. It’s a summary of how likely you are to pay your loans back. Credit reporting agencies use an algorithm to analyze all the information they have on you ad give you a credit score.

Credit scores are broken down into several levels:

Very Poor = 300-580

Fair = 580-670

Good = 670-740

Very Good = 740-800

Exceptional = 800 and above

Every time you make a payment, miss a payment, take out a new loan, or even have your credit report checked, that information gets added to your credit report. From there, your score gets calculated.

Credit scores tend to increase slowly over time. You’ll need a long history of flawless payments on several different types of loans in order to get an amazing score. That doesn’t happen overnight.

But your score can drop pretty quickly. All it takes is one missed payment and you’ll get hit. And a default on a loan is even worse, that will immediately tank your score and won’t get dropped from your credit report for years.

In college, I had to see a bunch of doctors for a herniated disk of mine. I was also moving around a lot at the time and one of the bills never made it to me. It went to collections and I paid it as soon as the collections agency got a hold of me. But it had already been added to my credit report and took 7 years for it to get dropped. My score took a huge hit during that period. Luckily I wasn’t trying to get a mortgage at the time.

Who Decides Your Credit Score

Your credit score is the result of an algorithm created by the Fair Isaac Corporation (now called FICO). While FICO is not the only credit scoring tool, it is the most popular. The exact math formula used to determine an individual’s credit score is kept under extreme secrecy.

What many people don’t realize is that FICO has multiple versions of your credit score which is why you might get two different results when applying for a store card verses a mortgage loan. Additionally, some lenders prefer to get your credit score from Vantage, Community Empower, Experian, Equifax or TransUnion.

Depending on who your lender uses to pull your score, it might be slightly different. The differences between the scores are trivial, it’s not worth spending time learning how they each work. You’ll use the same methods to improve them all.

Factors That Impact a Credit Score

Your credit score focused primarily on:

Payment history

Amount owed

Credit age

New credit

Type of credit used

Payment History

Your payment history makes up 35% of your total credit score. That means late payments or non-payment will have the largest impact on your credit score. This factor looks at whether you make your payments on time if you have any bankruptcies or accounts with a collection agency. And how long it’s been since you’ve had credit issues.

Amount owed

This factor makes up roughly 30% of your total credit score. The amount of money you owe is primarily concerned with the amount of money you owe debtors relative to your income and the amount of credit you have available. For example, if someone has a credit card with a $5,000 limit and they have a balance of $2,500, they’re total utilization score is 50%. Lenders like to see a total utilization score of less than 30%. Your credit utilization score includes all of your debt including credit cards, student loans, auto loans, home loans, and personal loans.

Credit Age

Your credit age makes up 15% of your credit score. This number just refers to how long you’ve had credit accounts open. The longer your credit history, the higher your score. This is why you’ll see advice to keep your oldest credit card open. That lengthens your credit age and improves your credit score a bit.

New Credit

This portion of your score looks at how many new lines of credit you’ve obtained in recent months as well as how many times you’ve applied for loans or lines of credit. This section makes up 10% of your credit score. The one time you want to worry about this is when you’re applying for a major loan like a mortgage. Don’t apply for any new credit cards or other loans in the months before you apply for the mortgage.

Type of Credit

Your mix of credit types comprises the last 10 percent of your credit score. A mix of credit types (revolving, installment, and open) looks better on your credit score than a focus on one type of loan. Revolving credit includes credit cards that have a balance limit. This just means that you have continuous access to the line of credit as you pay off your total owed. Installment debt refers to loans or lines of credit that have a single balance you pay off. Open debt refers to open lines of credit that you can access indefinitely.

FICO vs. VantageScore

The FICO credit score is the most popular choice for most lenders, but it’s not the only score that lenders can access.

Fair Isaac (now FICO) launched the FICO credit score in the 1980s. The design of this score was to help lenders identify potentially risky borrowers. FICO held the market on the credit scoring industry for more than 20 years. In March of 2006, Equifax, Experian, and TransUnion worked together to launch VantageScore.

Both VantageScore and FICO provide the same service to lenders, but there are some differences between the two companies.

The biggest difference that consumers will notice is the credit score range and percentage that each component of the credit score considers. The FICO score ranges from 300 to 850, as mentioned above. VantageScore 3.0 recently adopted the 300 to 850 credit score range, but earlier versions used a 500-990 range.

Another major difference that affects the ending credit score is the factors that the credit scoring company considers. As mentioned above, FICO looks at five major components: payment history, amount of debt, credit history age, type of credit and new credit.

VantageScore looks at six different categories: payment history, age and type of credit, percent of credit used, total debt, recent credit behavior, and available credit. It’s also important to note that VantageScore weighs payment history heavier (40%) than FICO. Recent credit behavior and inquiries only make up 5% of the total credit score for VantageScore compared to the 10% FICO factors.

Neither score is better and I wouldn’t stress these details. Getting a few types of loans and paying them off flawlessly over a long period of time is going to be the best way to improve both scores.

Why Credit Scores Matter

Credit scores are important for several reasons. While many people think the credit score only matters if you’re applying for a home loan or car loan, your score can actually affect other areas of your finances.

A few other common uses of your credit score:

Getting a cell phone

Renting an apartment

Purchasing insurance

Applying for a job

Opening a utility account

Getting an auto loan

Getting a home loan

Applying for public assistance

Not only does it determine if you get a loan in the first place, your credit score also affects how much you have to pay in interest.

If you have a higher credit score you can get better interest rates on loans and credit cards. You may also get better terms on your insurance and phone bill. Having a low credit score could result in a higher down payment for a rental property or utility account.

Credit scores impact you the most when you apply for a mortgage. If you don’t have a good score, you might not be able to get a mortgage at all. And a great credit score can get you a much lower interest rate. You’ll save tens of thousands of dollars easily.

When you start saving for a down payment for a home, also check your credit score and do anything you can to start improving it. It’s definitely worth the effort.

Improving Your Credit Score

Time is a major player when it comes to raising your credit score. It takes time for your current lenders to report payments to the credit bureaus, so your score may not change for weeks or even a few months after you’ve made significant changes.

A few things you can do to help improve your credit score include:

Get current on your payments

If you’re behind on credit card bills or loan payments, make it a priority to get your payments back on track. Make your payment on time, every month, for every bill. If all you can afford is the minimum payment, pay that every month. If you’re struggling with paying your bills, you can call your lenders and ask for a reduced payment plan or consider consolidating your debt into one payment.

On-time payments make the biggest impact on your credit score, so this should be a top priority if your goal is to increase your score.

Pay off debt

Reduce the amount of money you owe and your score will go up. If you have any bills in collections, pay them quickly and ask the collection agency to note that they were paid in full on your credit report.

Aim to keep the balances on your credit cards lower than 30% of the total available balance to reduce negative effects on your credit score. If you have an account with a good payment history you could ask your lender to increase your credit line. Since your amount of available credit will go up, your credit utilization could decrease, helping you add a few points to your score. To really optimize your score, call your credit card companies every 6 months and ask for a higher limit. Even if it’s small, it’ll add up over time giving you a really low credit utilization.

Don’t close old accounts

Keeping old accounts open (even those you don���t use) is more beneficial than closing them. When you close a credit card account you reduce your available credit (which raises your credit utilization score) and you reduce your average credit age.

Even if you want to close a few accounts to simplify your life, try to keep the oldest account open.

Limit credit applications

Don’t apply for new lines of credit unless you need them. When you apply for a lot of credit cards or loans, each lender checks your credit. Hard pulls (when a lender has your permission to pull your credit information) can ding your score by a few points.

Apply for new loans when you need them but definitely avoid applying for anything before a major loan like a mortgage or a car loan.

Apply for a credit boost

Some companies, like Experian, offer a credit boosting service. This service allows you to add a bank account so that you can report positive payment history on most bills (like utilities, rent, and phone bills) to your account. These on-time payments will help give your score a bump within days instead of weeks.

What is a Good Credit Score? is a post from: I Will Teach You To Be Rich.

What is a Good Credit Score? published first on https://justinbetreviews.tumblr.com/

0 notes

Text

What is a Good Credit Score?

Most financial decisions you make can be summarized into a three-digit number.

That one number can cost, or save, you hundreds of thousands of dollars over your life.

Lenders not only decide whether to give you a loan based on this number, it also determines how good your interest rate is. Lower interest rates means you can pay off loans a lot faster.

When buying a home, this has a huge impact on how much you ultimately pay.

This critical number is called your credit score.

Improving it is one of the big wins of personal finance.

So what’s a good score anyway? And how do they work?

How Credit Scores Work

A credit score takes personal data and uses the information to determine a number ranging from 300 to 850. It’s a summary of how likely you are to pay your loans back. Credit reporting agencies use an algorithm to analyze all the information they have on you ad give you a credit score.

Credit scores are broken down into several levels:

Very Poor = 300-580

Fair = 580-670

Good = 670-740

Very Good = 740-800

Exceptional = 800 and above

Every time you make a payment, miss a payment, take out a new loan, or even have your credit report checked, that information gets added to your credit report. From there, your score gets calculated.

Credit scores tend to increase slowly over time. You’ll need a long history of flawless payments on several different types of loans in order to get an amazing score. That doesn’t happen overnight.

But your score can drop pretty quickly. All it takes is one missed payment and you’ll get hit. And a default on a loan is even worse, that will immediately tank your score and won’t get dropped from your credit report for years.

In college, I had to see a bunch of doctors for a herniated disk of mine. I was also moving around a lot at the time and one of the bills never made it to me. It went to collections and I paid it as soon as the collections agency got a hold of me. But it had already been added to my credit report and took 7 years for it to get dropped. My score took a huge hit during that period. Luckily I wasn’t trying to get a mortgage at the time.

Who Decides Your Credit Score

Your credit score is the result of an algorithm created by the Fair Isaac Corporation (now called FICO). While FICO is not the only credit scoring tool, it is the most popular. The exact math formula used to determine an individual’s credit score is kept under extreme secrecy.

What many people don’t realize is that FICO has multiple versions of your credit score which is why you might get two different results when applying for a store card verses a mortgage loan. Additionally, some lenders prefer to get your credit score from Vantage, Community Empower, Experian, Equifax or TransUnion.

Depending on who your lender uses to pull your score, it might be slightly different. The differences between the scores are trivial, it’s not worth spending time learning how they each work. You’ll use the same methods to improve them all.

Factors That Impact a Credit Score

Your credit score focused primarily on:

Payment history

Amount owed

Credit age

New credit

Type of credit used

Payment History

Your payment history makes up 35% of your total credit score. That means late payments or non-payment will have the largest impact on your credit score. This factor looks at whether you make your payments on time if you have any bankruptcies or accounts with a collection agency. And how long it’s been since you’ve had credit issues.

Amount owed

This factor makes up roughly 30% of your total credit score. The amount of money you owe is primarily concerned with the amount of money you owe debtors relative to your income and the amount of credit you have available. For example, if someone has a credit card with a $5,000 limit and they have a balance of $2,500, they’re total utilization score is 50%. Lenders like to see a total utilization score of less than 30%. Your credit utilization score includes all of your debt including credit cards, student loans, auto loans, home loans, and personal loans.

Credit Age

Your credit age makes up 15% of your credit score. This number just refers to how long you’ve had credit accounts open. The longer your credit history, the higher your score. This is why you’ll see advice to keep your oldest credit card open. That lengthens your credit age and improves your credit score a bit.

New Credit

This portion of your score looks at how many new lines of credit you’ve obtained in recent months as well as how many times you’ve applied for loans or lines of credit. This section makes up 10% of your credit score. The one time you want to worry about this is when you’re applying for a major loan like a mortgage. Don’t apply for any new credit cards or other loans in the months before you apply for the mortgage.

Type of Credit

Your mix of credit types comprises the last 10 percent of your credit score. A mix of credit types (revolving, installment, and open) looks better on your credit score than a focus on one type of loan. Revolving credit includes credit cards that have a balance limit. This just means that you have continuous access to the line of credit as you pay off your total owed. Installment debt refers to loans or lines of credit that have a single balance you pay off. Open debt refers to open lines of credit that you can access indefinitely.

FICO vs. VantageScore

The FICO credit score is the most popular choice for most lenders, but it’s not the only score that lenders can access.

Fair Isaac (now FICO) launched the FICO credit score in the 1980s. The design of this score was to help lenders identify potentially risky borrowers. FICO held the market on the credit scoring industry for more than 20 years. In March of 2006, Equifax, Experian, and TransUnion worked together to launch VantageScore.

Both VantageScore and FICO provide the same service to lenders, but there are some differences between the two companies.

The biggest difference that consumers will notice is the credit score range and percentage that each component of the credit score considers. The FICO score ranges from 300 to 850, as mentioned above. VantageScore 3.0 recently adopted the 300 to 850 credit score range, but earlier versions used a 500-990 range.

Another major difference that affects the ending credit score is the factors that the credit scoring company considers. As mentioned above, FICO looks at five major components: payment history, amount of debt, credit history age, type of credit and new credit.

VantageScore looks at six different categories: payment history, age and type of credit, percent of credit used, total debt, recent credit behavior, and available credit. It’s also important to note that VantageScore weighs payment history heavier (40%) than FICO. Recent credit behavior and inquiries only make up 5% of the total credit score for VantageScore compared to the 10% FICO factors.

Neither score is better and I wouldn’t stress these details. Getting a few types of loans and paying them off flawlessly over a long period of time is going to be the best way to improve both scores.

Why Credit Scores Matter

Credit scores are important for several reasons. While many people think the credit score only matters if you’re applying for a home loan or car loan, your score can actually affect other areas of your finances.

A few other common uses of your credit score:

Getting a cell phone

Renting an apartment

Purchasing insurance

Applying for a job

Opening a utility account

Getting an auto loan

Getting a home loan

Applying for public assistance

Not only does it determine if you get a loan in the first place, your credit score also affects how much you have to pay in interest.

If you have a higher credit score you can get better interest rates on loans and credit cards. You may also get better terms on your insurance and phone bill. Having a low credit score could result in a higher down payment for a rental property or utility account.

Credit scores impact you the most when you apply for a mortgage. If you don’t have a good score, you might not be able to get a mortgage at all. And a great credit score can get you a much lower interest rate. You’ll save tens of thousands of dollars easily.

When you start saving for a down payment for a home, also check your credit score and do anything you can to start improving it. It’s definitely worth the effort.

Improving Your Credit Score

Time is a major player when it comes to raising your credit score. It takes time for your current lenders to report payments to the credit bureaus, so your score may not change for weeks or even a few months after you’ve made significant changes.

A few things you can do to help improve your credit score include:

Get current on your payments

If you’re behind on credit card bills or loan payments, make it a priority to get your payments back on track. Make your payment on time, every month, for every bill. If all you can afford is the minimum payment, pay that every month. If you’re struggling with paying your bills, you can call your lenders and ask for a reduced payment plan or consider consolidating your debt into one payment.

On-time payments make the biggest impact on your credit score, so this should be a top priority if your goal is to increase your score.

Pay off debt

Reduce the amount of money you owe and your score will go up. If you have any bills in collections, pay them quickly and ask the collection agency to note that they were paid in full on your credit report.

Aim to keep the balances on your credit cards lower than 30% of the total available balance to reduce negative effects on your credit score. If you have an account with a good payment history you could ask your lender to increase your credit line. Since your amount of available credit will go up, your credit utilization could decrease, helping you add a few points to your score. To really optimize your score, call your credit card companies every 6 months and ask for a higher limit. Even if it’s small, it’ll add up over time giving you a really low credit utilization.

Don’t close old accounts

Keeping old accounts open (even those you don’t use) is more beneficial than closing them. When you close a credit card account you reduce your available credit (which raises your credit utilization score) and you reduce your average credit age.

Even if you want to close a few accounts to simplify your life, try to keep the oldest account open.

Limit credit applications

Don’t apply for new lines of credit unless you need them. When you apply for a lot of credit cards or loans, each lender checks your credit. Hard pulls (when a lender has your permission to pull your credit information) can ding your score by a few points.

Apply for new loans when you need them but definitely avoid applying for anything before a major loan like a mortgage or a car loan.

Apply for a credit boost

Some companies, like Experian, offer a credit boosting service. This service allows you to add a bank account so that you can report positive payment history on most bills (like utilities, rent, and phone bills) to your account. These on-time payments will help give your score a bump within days instead of weeks.

What is a Good Credit Score? is a post from: I Will Teach You To Be Rich.

from Finance https://www.iwillteachyoutoberich.com/blog/what-is-a-good-credit-score/

via http://www.rssmix.com/

0 notes

Text

What is a Good Credit Score?

Most financial decisions you make can be summarized into a three-digit number.

That one number can cost, or save, you hundreds of thousands of dollars over your life.

Lenders not only decide whether to give you a loan based on this number, it also determines how good your interest rate is. Lower interest rates means you can pay off loans a lot faster.

When buying a home, this has a huge impact on how much you ultimately pay.

This critical number is called your credit score.

Improving it is one of the big wins of personal finance.

So what’s a good score anyway? And how do they work?

How Credit Scores Work

A credit score takes personal data and uses the information to determine a number ranging from 300 to 850. It’s a summary of how likely you are to pay your loans back. Credit reporting agencies use an algorithm to analyze all the information they have on you ad give you a credit score.

Credit scores are broken down into several levels:

Very Poor = 300-580

Fair = 580-670

Good = 670-740

Very Good = 740-800

Exceptional = 800 and above

Every time you make a payment, miss a payment, take out a new loan, or even have your credit report checked, that information gets added to your credit report. From there, your score gets calculated.

Credit scores tend to increase slowly over time. You’ll need a long history of flawless payments on several different types of loans in order to get an amazing score. That doesn’t happen overnight.

But your score can drop pretty quickly. All it takes is one missed payment and you’ll get hit. And a default on a loan is even worse, that will immediately tank your score and won’t get dropped from your credit report for years.

In college, I had to see a bunch of doctors for a herniated disk of mine. I was also moving around a lot at the time and one of the bills never made it to me. It went to collections and I paid it as soon as the collections agency got a hold of me. But it had already been added to my credit report and took 7 years for it to get dropped. My score took a huge hit during that period. Luckily I wasn’t trying to get a mortgage at the time.

Who Decides Your Credit Score

Your credit score is the result of an algorithm created by the Fair Isaac Corporation (now called FICO). While FICO is not the only credit scoring tool, it is the most popular. The exact math formula used to determine an individual’s credit score is kept under extreme secrecy.

What many people don’t realize is that FICO has multiple versions of your credit score which is why you might get two different results when applying for a store card verses a mortgage loan. Additionally, some lenders prefer to get your credit score from Vantage, Community Empower, Experian, Equifax or TransUnion.

Depending on who your lender uses to pull your score, it might be slightly different. The differences between the scores are trivial, it’s not worth spending time learning how they each work. You’ll use the same methods to improve them all.

Factors That Impact a Credit Score

Your credit score focused primarily on:

Payment history

Amount owed

Credit age

New credit

Type of credit used

Payment History

Your payment history makes up 35% of your total credit score. That means late payments or non-payment will have the largest impact on your credit score. This factor looks at whether you make your payments on time if you have any bankruptcies or accounts with a collection agency. And how long it’s been since you’ve had credit issues.

Amount owed

This factor makes up roughly 30% of your total credit score. The amount of money you owe is primarily concerned with the amount of money you owe debtors relative to your income and the amount of credit you have available. For example, if someone has a credit card with a $5,000 limit and they have a balance of $2,500, they’re total utilization score is 50%. Lenders like to see a total utilization score of less than 30%. Your credit utilization score includes all of your debt including credit cards, student loans, auto loans, home loans, and personal loans.

Credit Age

Your credit age makes up 15% of your credit score. This number just refers to how long you’ve had credit accounts open. The longer your credit history, the higher your score. This is why you’ll see advice to keep your oldest credit card open. That lengthens your credit age and improves your credit score a bit.

New Credit

This portion of your score looks at how many new lines of credit you’ve obtained in recent months as well as how many times you’ve applied for loans or lines of credit. This section makes up 10% of your credit score. The one time you want to worry about this is when you’re applying for a major loan like a mortgage. Don’t apply for any new credit cards or other loans in the months before you apply for the mortgage.

Type of Credit

Your mix of credit types comprises the last 10 percent of your credit score. A mix of credit types (revolving, installment, and open) looks better on your credit score than a focus on one type of loan. Revolving credit includes credit cards that have a balance limit. This just means that you have continuous access to the line of credit as you pay off your total owed. Installment debt refers to loans or lines of credit that have a single balance you pay off. Open debt refers to open lines of credit that you can access indefinitely.

FICO vs. VantageScore

The FICO credit score is the most popular choice for most lenders, but it’s not the only score that lenders can access.

Fair Isaac (now FICO) launched the FICO credit score in the 1980s. The design of this score was to help lenders identify potentially risky borrowers. FICO held the market on the credit scoring industry for more than 20 years. In March of 2006, Equifax, Experian, and TransUnion worked together to launch VantageScore.

Both VantageScore and FICO provide the same service to lenders, but there are some differences between the two companies.

The biggest difference that consumers will notice is the credit score range and percentage that each component of the credit score considers. The FICO score ranges from 300 to 850, as mentioned above. VantageScore 3.0 recently adopted the 300 to 850 credit score range, but earlier versions used a 500-990 range.

Another major difference that affects the ending credit score is the factors that the credit scoring company considers. As mentioned above, FICO looks at five major components: payment history, amount of debt, credit history age, type of credit and new credit.

VantageScore looks at six different categories: payment history, age and type of credit, percent of credit used, total debt, recent credit behavior, and available credit. It’s also important to note that VantageScore weighs payment history heavier (40%) than FICO. Recent credit behavior and inquiries only make up 5% of the total credit score for VantageScore compared to the 10% FICO factors.

Neither score is better and I wouldn’t stress these details. Getting a few types of loans and paying them off flawlessly over a long period of time is going to be the best way to improve both scores.

Why Credit Scores Matter

Credit scores are important for several reasons. While many people think the credit score only matters if you’re applying for a home loan or car loan, your score can actually affect other areas of your finances.

A few other common uses of your credit score:

Getting a cell phone

Renting an apartment

Purchasing insurance

Applying for a job

Opening a utility account

Getting an auto loan

Getting a home loan

Applying for public assistance

Not only does it determine if you get a loan in the first place, your credit score also affects how much you have to pay in interest.

If you have a higher credit score you can get better interest rates on loans and credit cards. You may also get better terms on your insurance and phone bill. Having a low credit score could result in a higher down payment for a rental property or utility account.

Credit scores impact you the most when you apply for a mortgage. If you don’t have a good score, you might not be able to get a mortgage at all. And a great credit score can get you a much lower interest rate. You’ll save tens of thousands of dollars easily.

When you start saving for a down payment for a home, also check your credit score and do anything you can to start improving it. It’s definitely worth the effort.

Improving Your Credit Score

Time is a major player when it comes to raising your credit score. It takes time for your current lenders to report payments to the credit bureaus, so your score may not change for weeks or even a few months after you’ve made significant changes.

A few things you can do to help improve your credit score include:

Get current on your payments

If you’re behind on credit card bills or loan payments, make it a priority to get your payments back on track. Make your payment on time, every month, for every bill. If all you can afford is the minimum payment, pay that every month. If you’re struggling with paying your bills, you can call your lenders and ask for a reduced payment plan or consider consolidating your debt into one payment.

On-time payments make the biggest impact on your credit score, so this should be a top priority if your goal is to increase your score.

Pay off debt

Reduce the amount of money you owe and your score will go up. If you have any bills in collections, pay them quickly and ask the collection agency to note that they were paid in full on your credit report.

Aim to keep the balances on your credit cards lower than 30% of the total available balance to reduce negative effects on your credit score. If you have an account with a good payment history you could ask your lender to increase your credit line. Since your amount of available credit will go up, your credit utilization could decrease, helping you add a few points to your score. To really optimize your score, call your credit card companies every 6 months and ask for a higher limit. Even if it’s small, it’ll add up over time giving you a really low credit utilization.

Don’t close old accounts

Keeping old accounts open (even those you don’t use) is more beneficial than closing them. When you close a credit card account you reduce your available credit (which raises your credit utilization score) and you reduce your average credit age.

Even if you want to close a few accounts to simplify your life, try to keep the oldest account open.

Limit credit applications

Don’t apply for new lines of credit unless you need them. When you apply for a lot of credit cards or loans, each lender checks your credit. Hard pulls (when a lender has your permission to pull your credit information) can ding your score by a few points.

Apply for new loans when you need them but definitely avoid applying for anything before a major loan like a mortgage or a car loan.

Apply for a credit boost

Some companies, like Experian, offer a credit boosting service. This service allows you to add a bank account so that you can report positive payment history on most bills (like utilities, rent, and phone bills) to your account. These on-time payments will help give your score a bump within days instead of weeks.

What is a Good Credit Score? is a post from: I Will Teach You To Be Rich.

from Finance https://www.iwillteachyoutoberich.com/blog/what-is-a-good-credit-score/

via http://www.rssmix.com/

0 notes

Text

What is a Good Credit Score?

Most financial decisions you make can be summarized into a three-digit number.

That one number can cost, or save, you hundreds of thousands of dollars over your life.

Lenders not only decide whether to give you a loan based on this number, it also determines how good your interest rate is. Lower interest rates means you can pay off loans a lot faster.

When buying a home, this has a huge impact on how much you ultimately pay.

This critical number is called your credit score.

Improving it is one of the big wins of personal finance.

So what’s a good score anyway? And how do they work?

How Credit Scores Work

A credit score takes personal data and uses the information to determine a number ranging from 300 to 850. It’s a summary of how likely you are to pay your loans back. Credit reporting agencies use an algorithm to analyze all the information they have on you ad give you a credit score.

Credit scores are broken down into several levels:

Very Poor = 300-580

Fair = 580-670

Good = 670-740

Very Good = 740-800

Exceptional = 800 and above

Every time you make a payment, miss a payment, take out a new loan, or even have your credit report checked, that information gets added to your credit report. From there, your score gets calculated.

Credit scores tend to increase slowly over time. You’ll need a long history of flawless payments on several different types of loans in order to get an amazing score. That doesn’t happen overnight.

But your score can drop pretty quickly. All it takes is one missed payment and you’ll get hit. And a default on a loan is even worse, that will immediately tank your score and won’t get dropped from your credit report for years.

In college, I had to see a bunch of doctors for a herniated disk of mine. I was also moving around a lot at the time and one of the bills never made it to me. It went to collections and I paid it as soon as the collections agency got a hold of me. But it had already been added to my credit report and took 7 years for it to get dropped. My score took a huge hit during that period. Luckily I wasn’t trying to get a mortgage at the time.

Who Decides Your Credit Score

Your credit score is the result of an algorithm created by the Fair Isaac Corporation (now called FICO). While FICO is not the only credit scoring tool, it is the most popular. The exact math formula used to determine an individual’s credit score is kept under extreme secrecy.

What many people don’t realize is that FICO has multiple versions of your credit score which is why you might get two different results when applying for a store card verses a mortgage loan. Additionally, some lenders prefer to get your credit score from Vantage, Community Empower, Experian, Equifax or TransUnion.

Depending on who your lender uses to pull your score, it might be slightly different. The differences between the scores are trivial, it’s not worth spending time learning how they each work. You’ll use the same methods to improve them all.

Factors That Impact a Credit Score

Your credit score focused primarily on:

Payment history

Amount owed

Credit age

New credit

Type of credit used

Payment History

Your payment history makes up 35% of your total credit score. That means late payments or non-payment will have the largest impact on your credit score. This factor looks at whether you make your payments on time if you have any bankruptcies or accounts with a collection agency. And how long it’s been since you’ve had credit issues.

Amount owed

This factor makes up roughly 30% of your total credit score. The amount of money you owe is primarily concerned with the amount of money you owe debtors relative to your income and the amount of credit you have available. For example, if someone has a credit card with a $5,000 limit and they have a balance of $2,500, they’re total utilization score is 50%. Lenders like to see a total utilization score of less than 30%. Your credit utilization score includes all of your debt including credit cards, student loans, auto loans, home loans, and personal loans.

Credit Age

Your credit age makes up 15% of your credit score. This number just refers to how long you’ve had credit accounts open. The longer your credit history, the higher your score. This is why you’ll see advice to keep your oldest credit card open. That lengthens your credit age and improves your credit score a bit.

New Credit

This portion of your score looks at how many new lines of credit you’ve obtained in recent months as well as how many times you’ve applied for loans or lines of credit. This section makes up 10% of your credit score. The one time you want to worry about this is when you’re applying for a major loan like a mortgage. Don’t apply for any new credit cards or other loans in the months before you apply for the mortgage.

Type of Credit

Your mix of credit types comprises the last 10 percent of your credit score. A mix of credit types (revolving, installment, and open) looks better on your credit score than a focus on one type of loan. Revolving credit includes credit cards that have a balance limit. This just means that you have continuous access to the line of credit as you pay off your total owed. Installment debt refers to loans or lines of credit that have a single balance you pay off. Open debt refers to open lines of credit that you can access indefinitely.

FICO vs. VantageScore

The FICO credit score is the most popular choice for most lenders, but it’s not the only score that lenders can access.

Fair Isaac (now FICO) launched the FICO credit score in the 1980s. The design of this score was to help lenders identify potentially risky borrowers. FICO held the market on the credit scoring industry for more than 20 years. In March of 2006, Equifax, Experian, and TransUnion worked together to launch VantageScore.

Both VantageScore and FICO provide the same service to lenders, but there are some differences between the two companies.

The biggest difference that consumers will notice is the credit score range and percentage that each component of the credit score considers. The FICO score ranges from 300 to 850, as mentioned above. VantageScore 3.0 recently adopted the 300 to 850 credit score range, but earlier versions used a 500-990 range.

Another major difference that affects the ending credit score is the factors that the credit scoring company considers. As mentioned above, FICO looks at five major components: payment history, amount of debt, credit history age, type of credit and new credit.

VantageScore looks at six different categories: payment history, age and type of credit, percent of credit used, total debt, recent credit behavior, and available credit. It’s also important to note that VantageScore weighs payment history heavier (40%) than FICO. Recent credit behavior and inquiries only make up 5% of the total credit score for VantageScore compared to the 10% FICO factors.

Neither score is better and I wouldn’t stress these details. Getting a few types of loans and paying them off flawlessly over a long period of time is going to be the best way to improve both scores.

Why Credit Scores Matter

Credit scores are important for several reasons. While many people think the credit score only matters if you’re applying for a home loan or car loan, your score can actually affect other areas of your finances.

A few other common uses of your credit score:

Getting a cell phone

Renting an apartment

Purchasing insurance

Applying for a job

Opening a utility account

Getting an auto loan

Getting a home loan

Applying for public assistance

Not only does it determine if you get a loan in the first place, your credit score also affects how much you have to pay in interest.

If you have a higher credit score you can get better interest rates on loans and credit cards. You may also get better terms on your insurance and phone bill. Having a low credit score could result in a higher down payment for a rental property or utility account.

Credit scores impact you the most when you apply for a mortgage. If you don’t have a good score, you might not be able to get a mortgage at all. And a great credit score can get you a much lower interest rate. You’ll save tens of thousands of dollars easily.

When you start saving for a down payment for a home, also check your credit score and do anything you can to start improving it. It’s definitely worth the effort.

Improving Your Credit Score

Time is a major player when it comes to raising your credit score. It takes time for your current lenders to report payments to the credit bureaus, so your score may not change for weeks or even a few months after you’ve made significant changes.

A few things you can do to help improve your credit score include: