#vantagefx review

Explore tagged Tumblr posts

Text

VantageFX Broker

Introduction:

In a competitive trading landscape, choosing the right broker can significantly enhance a trader's journey, offering a streamlined platform for robust trading opportunities. VantageFX Broker has been a notable player in the market, drawing attention with its tight spreads, fast execution, and a variety of trading instruments. This review aims to delve into the various aspects of Vantage FX, providing an insightful look at its offerings and operational efficiency based on user experiences and thorough analysis.

Vantagefx Trading Platform and Tools:

Vantage FX boasts a sophisticated yet user-friendly trading platform, leveraging the power of MetaTrader 4 and MetaTrader 5. This offers traders an intuitive interface, paired with powerful analytical tools and superior execution speeds. The integration of these platforms is smooth, offering both novice and seasoned traders a robust trading environment.

Additionally, traders can take advantage of the mobile trading feature, which is a boon for those who prefer to trade on the go. Vantage carves a niche for itself amidst other MetaTrader-centric brokers by presenting a myriad of additional add-ons and endorsing the integration of compatible third-party platforms and tools like TradingView. This strategic diversification has propelled Vantage into the Best in Class cadre in our 2023 assessment of the best MetaTrader brokers.Platform Synopsis: At its core, Vantage operates as a MetaTrader broker, extending a comprehensive suite of desktop and web trading platforms encompassing MetaTrader 4 (MT4) and MetaTrader 5 (MT5), users can download vantagefx trading apps on the mobileCharting Capabilities: Beyond the conventional charting facilitated on MT4 and MT5, Vantage also integrates the CHARTS platform from TradingView. This integration is seamless, allowing traders to access it directly using their MetaTrader credentials, thereby expanding the graphical analysis horizon.Tool Assortment:Enhancing the MetaTrader experience, Vantage introduces the SmartTrader Tools, part of FX Blue LLP’s plethora of platform augmentations. Moreover, a continuous stream of forex news headlines from FxWire Pro and FxStreet enriches the trading milieu, making Vantage's MetaTrader offerings notably robustSocial and Copy Trading Expanding beyond MetaTrader's inherent Signals market, Vantage brings forth three platforms dedicated to social copy trading. This ensemble of auto-trading platforms - ZuluTrade, DupliTrade, and Myfxbook’s AutoTrade, bolsters the social trading ecosystem, albeit these platforms are not accessible to Australian tradersThis well-rounded offering makes Vantage not just a platform for trading but a conducive environment for learning, analyzing, and strategizing, significantly enriching the trader's journey from inception to execution.

VantageFx Broker Asset Coverage:

VantageFX provides a broad spectrum of trading instruments, including Forex, Indices, Commodities, and Share CFDsIn total Vantage can trade up to 57 Currency pairs, 26 Indices , 51 ETFs , 22 Commodities and 800+ Share CFDsThis diverse range of assets allows traders to diversify their portfolio, thereby managing risks while maximizing potential gainsThe extensive market coverage is indeed a highlight, catering to the varied interests of the trading community

Account Types and Customer Suppor

VantageFX offers multiple account types catering to different trader preferences, including Standard STP, Raw ECN, and Pro ECN accounts. This segmentation helps in accommodating traders with varying levels of expertise and investment capabilities. When it comes to customer support, Vantage FX provides a responsive and knowledgeable team. The support is available via live chat, email, and phone, ensuring that traders' inquiries and issues are addressed promptly.

VantageFx PAMM

In forex markets, staying ahead of the curve is essential. And now, with the innovative VantageFX PAMM Copy Trade feature, you can transform your trading experience and maximize your profits like never before. Imagine having access to the strategies of some of the most skilled and successful traders in the industry, all at your fingertips. That's precisely what VantageFX PAMM Copy Trade brings to the table. It's a game-changer, a paradigm shift in how traders can harness the wisdom of experts without having to become one themselves. Check how to invest with Vantagefx PAMM to maximize your trading profit.

Education and Research Resources:

The broker provides various educational resources, including webinars, tutorials, and market analysis. These resources are invaluable for traders keen on honing their skills and staying updated with market trends. The emphasis on education and empowering traders is a commendable aspect of Vantage FX.

Fees and Spreads:

VantageFX is known for its competitive spreads, which is a significant advantage for cost-sensitive traders. The transparent fee structure with no hidden charges provides a fair trading environment, which is appreciated by its user base. At Vantage FX, the trading costs are primarily determined by the type of account you opt for, coupled with the specific Vantage entity managing your account. The broker presents three distinct account options: the spread-only Standard STP account, alongside the commission-based RAW ECN, and PRO ECN accounts. Generally, the pricing structure at Vantage aligns well with the industry norms.

Comparing Standard and Raw Accounts: For traders utilizing the spread-only Standard account, Vantage recorded typical spreads of 1.22 pips on the EUR/USD pair (as observed in August 2021). On the other hand, the Raw account showcased average spreads of 0.15 pips, along with a commission fee of $3 per side (amounting to $6 per round turn), bringing the total to 0.75 pips during the identical timeframe.Exploring the PRO Account: Vantage's PRO account emerges as a competitively priced offering, with a per-side commission of merely $2 (or $4 per round turn). However, the requisites for inaugurating a PRO ECN account vary across Vantage's regulating entities. For instance, under its Australian entity, traders need to qualify as a wholesale client, while under the Cayman Islands entity, an initial account funding of at least $10,000 is mandated. Meeting these varied account prerequisites renders the PRO ECN account as the most cost-effective option provided by Vantage.Incentives for Active Traders: Vantagefx extends an active trader program, presenting rebates ranging from $2 to a lofty $8 per standard lot, contingent on your account balance and monthly trading volume. The rebate tiers commence at $10,000, escalating to the apex tier necessitating a minimum of $300,000 in equity. It's notable, however, that this program is exclusively accessible to Standard account holders, which inherently possess the highest spreads among all available account options. This arrangement is something active traders might want to weigh against the potential rebates when deciding on the account type that best fits their trading strategy and financial standing.

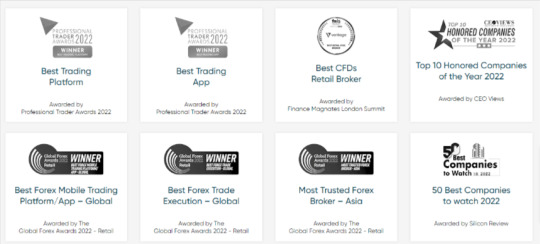

Award & Regulatory Compliance

Vantagefx Markets has won a variety of awards across a wide range of categories, including Best CFD Broker and Best MT4/MT5 Broker, and Lowest Trading Costs.

Vantagefx is one of the best broker that obtained fews international broker licenses and strickly followed the broker's regulations and requirements.Being regulated by the Australian Securities and Investments Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA), Vantage FX adheres to high standards of operation, ensuring a secure and trustworthy trading environmen

Conclusion:

VantageFX has made a positive impression in the trading community with its comprehensive trading environment, a wide range of assets, and strong regulatory framework. While there is always room for improvement, especially in expanding educational resources, the broker stands as a reliable choice for individuals keen on navigating the financial markets. With its client-centric approach, Vantage FX is well-positioned to continue growing its presence in the global trading arena. Read the full article

#vantagefx#vantage fx#vantagefx broker review#vantagefx review#forex broker#vantage fx broker review#best forex broker#vantage review

0 notes

Text

Best Forex Brokers Thailand 2021

If you are interested in getting involved in the trillion-dollar a day foreign exchange market, then choosing a top forex broker is extremely important. Finding the best forex brokers in Thailand with the best commissions, fees, platforms and customer support can be difficult as well as time-consuming. This is why we have done the work for you!To get more news about best forex brokers in thailand, you can visit wikifx.com official website.

How do you find the best forex broker in Thailand? Which Thai forex broker offers the best commissions and fees? Are they regulated to ensure your capital is safe?

Find the best Thai forex broker isn’t as easy as it seems. It requires detailed research, testing and analysis which can take some time. Fortunately, we have done this for you! Below we review the 5 best forex brokers in Thailand.

eToro – Overall Best Forex Broker in Thailand with Largest Copy Trading Service etoro best forex broker thailandIf you want to trade with the best forex broker in Thailand then eToro should be at the top of your list. The broker boasts the best and largest social trading platform in the world with more than 20 million users.

If you’re not familiar with social or copy trading, it basically means that you can view the performance of other traders and have their trades copied onto your own account. It’s the fastest-growing trend in the forex industry and one you seriously want to think about – take a look at some of the results below. 2. VantageFX – Best Forex Broker for ECN Trading Accounts vantagefx broker thailandVantageFX is considered one of the best forex brokers in Thailand for ECN trading accounts. ECN stands for ‘electronic communication network.’ It allows you to trade directly with the interbank market with no middleman, thereby accessing raw spreads. 3. Capital – Best Forex Broker in Thailand with Low Minimum Deposit ($20) capital best forex brokers in thailandCapital is the best Thailand forex broker for beginner traders. To open an account you only need a minimum deposit of $20 to start trading on more than 3,000+ global markets including foreign exchange, stocks, indices, commodities and cryptocurrencies. 4. Libertex – Best Forex Broker in Thailand with Tight Spreads forex broker thailand libertexLibertex is one of the best forex brokers in Thailand because it allows you to trade with tight spreads! The spread is the difference between the buy and sell price of an asset. It’s a cost every broker will charge – unlike Libertex which is considered a top-quality low spread broker. 5. AvaTrade – Best Broker for Account Types (CFD, Copy, Options) avatrade forex broker thailandAvaTrade is one of the best forex brokers in Thailand due to the range of account types they provide. For example, you can trade forex from a CFD, options or copy trading account. The options trading account is particularly useful as it’s not provided by many brokers.

1 note

·

View note

Text

0 notes

Video

Vantage FX Review 😱 (Warning) Here's what I REALLY think... https://youtu.be/6_S8ThCSqqI via @YouTube #vantagefxreview #vantagefxscam #vantagefx

0 notes

Text

VantageFX Broker Review LP

Read the full article

0 notes

Link

Vantage FX was founded in 2009 as MXT Global, before rebranding as Vantage FX Pty Ltd (Vantage FX) in 2015. Today Vantage FX is a member of Vantage Global Prime Pty Ltd, which owns the Australian Financial Services License from the Australian Securities and Investment Commission.

0 notes

Text

Top 10 Forex Brokers 2023: Unbiased Reviews & Expert Insights

Navigating the Currency Waves: A Review of the Top 10 Forex Brokers Criteria for Ranking On Each Forex Broker Brief Overview Of Top 10 Forex Broker Vantagefx: GMI Edge Broker: FBS Broker: Pepperstone: IC Markets: OctaFX: Tickmill: TMGM: Lirunex: FXCM (Forex Capital Markets): Summary

Navigating the Currency Waves: A Review of the Top 10 Forex Brokers

The world of foreign exchange trading, or Forex, is a realm where currency pairs are traded 24 hours a day, offering a dynamic and lucrative avenue for seasoned traders and newcomers alike. The pulse of the global economy resonates through the Forex market, where over $6 trillion of currency exchanges hands each day. At the core of this bustling marketplace is an array of Forex brokers, the linchpins that connect individual traders to the vast currency exchange network. Choosing a reliable and well-suited broker is a crucial stepping stone on the path to trading success, as the right broker can significantly enhance the trading experience, offering superior platforms, insightful market analysis, and robust customer support. The essence of this article unfolds as a meticulous review of the top 10 Forex brokers specified in Asian region, shining a spotlight on the brokerage firms. Through a prism of defined criteria encompassing trading platforms, trading conditions, regulatory adherence, and customer support, we embark on a quest to sieve through the brokerage landscape and present a curated list of elite brokers. Whether you are a novice trader setting sail on your trading voyage, or a seasoned trader looking to switch brokers, this article aims to provide a well-rounded perspective to aid in making an informed decision.

As we delve deeper into the intricacies of each broker, we'll explore their unique selling propositions, evaluate their service offerings, and analyze user reviews to paint a vivid picture of what traders can expect. The culmination of this exploration is a comprehensive compilation that not only reviews but ranks these brokers, offering a beacon of insight in the stormy seas of Forex trading. So, without further ado, let’s navigate through the waves of the Forex brokerage world, and set a course towards finding a broker that’s the perfect co-pilot on your trading journey.

Criteria for Ranking On Each Forex Broker

These criteria serve as the yardstick to gauge the competence, reliability, and overall excellence of the brokers in question. Let’s navigate through the key parameters that will steer the evaluation and ranking of the top 10 Forex brokers: - Trading Platforms: - A broker's trading platform is the trader's gateway to the Forex markets. The evaluation will consider the user-friendliness, stability, and technological prowess of the trading platforms offered. - Features like charting tools, market analysis, order execution speed, and mobile trading capabilities will be scrutinized. - Trading Conditions: - Trading conditions encapsulate aspects like spreads, leverage, and order types available. - The transparency and competitiveness of a broker's trading conditions are paramount for ensuring traders can maximize their potential profits while minimizing costs. - Regulation and Licensing: - A broker's adherence to regulatory standards and licensing by reputable financial authorities is a testimony to its credibility and the safety of traders' funds. - The geographical extent of regulation and compliance with international financial standards will also be assessed. - Customer Support: - Exceptional customer support is the backbone of a satisfactory trading experience. - The availability, responsiveness, and expertise of the customer support team, alongside the variety of channels available for support (e.g., live chat, email, phone), will be evaluated. - Educational Resources: - An array of educational resources is crucial for helping traders hone their skills and stay updated with market trends. - The quality, accessibility, and variety of educational materials, including webinars, articles, and interactive learning tools, will be assessed. - Asset Variety: - A diverse offering of tradable assets, including currency pairs, commodities, indices, and cryptocurrencies, provides traders with ample opportunities to diversify their trading portfolio. - The evaluation will also consider the market access and the ease of trading different assets. - Deposit and Withdrawal Options: - Seamless and flexible deposit and withdrawal options enhance the overall trading experience. - The security, speed, and variety of payment methods, alongside the transparency of the fee structure, will be examined. - User Reviews and Reputation: - The reputation of a broker within the trading community and the overall user satisfaction are indicative of the broker's quality and reliability. - Authentic user reviews and testimonials, alongside ratings on reputable review platforms, will be taken into account. - Additional Features: - Brokers that offer additional features like social trading, automated trading, or personalized account management services add a layer of value to their offerings. - The usability and benefits of these additional features will be evaluated. The meticulous examination of these criteria aims to provide a holistic insight into the brokers' service quality, reliability, and potential to provide a conducive trading environment. Each of the aforementioned parameters will be dissected and analyzed, laying the foundation for a comprehensive and enlightening review of the top 10 Forex brokers that aim to steer traders towards a rewarding trading journey.

Brief Overview Of Top 10 Forex Broker

Vantagefx:

- Country of Operation: Headquartered in Sydney, Australia, and operates in 172 countries. - Regulatory Status: Regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Authority (FSA). - Trading Platform: Offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Vantage FX app for trading. - Trading Conditions: - Minimum Deposit: £200. - Maximum Leverage: 1:30 for retail clients on major forex currency pairs, and up to 1:500 for professional clients. - Spreads: As low as 1 pip for EUR/USD. - Commission: Offers commission-free trading account. - Negative Balance Protection: Available for both retail and pro clients. - Asset Variety: - Offers trading on a wide variety of assets including forex, indices, metals, energies, cryptocurrencies, commodities, and shares. - Deposit and Withdrawal Options: - Deposit Methods: The specific methods aren't mentioned, but they offer a wide range of deposit methods according to their official website. - Withdrawal Fees: Neteller withdrawals incur a 2% fee; Skrill withdrawals incur a 1% fee. A Neteller deposit fee covered by Vantage of 4.9% + 0.29 USD will be deducted from the withdrawal amount for clients residing in Vietnam. - Customer Support: - Award-winning 24/5 customer support is available to assist traders, although 24/7 support is not provided. - Copy Trade Features: - Copy Trading Program: Vantage has a program where experienced traders (League Traders) share their portfolio, and other traders (Copiers) can follow these experienced traders’ portfolios via PAMM technology.. - AutoTrade: An account mirroring service where only successful FOREX traders are available for auto copying. All traders must be verified and have a proven successful track record before being approved by AutoTrade. - DupliTrade: An automatic trade copying service where traders can copy experienced traders by connecting to DupliTrade with a minimum account funding of $2,000. - Upgraded Copy Trading Features: Vantage has upgraded its copy trading features allowing traders to copy trades from signal providers at the click of a button or apply to become signal providers themselves. - Users Review and Reputation: - BrokerChooser awarded VantageFX a rating of 4.2 out of 5, highlighting the pros such as low non-trading fees, quick account opening, and smooth deposit and withdrawal processes. However, they also mentioned some cons like a limited product selection and room for improvement in customer service. - VantageFX has garnered a reputable standing in the forex trading community based on various reviews and ratings from different platforms. Here's a summary of the reviews and reputation of VantageFX: - Global Reputation: - VantageFX is recognized as a top forex broker with an excellent global reputation. Having commenced operations in 2009 based out of Australia, it has since expanded to numerous locations and has built a substantial worldwide trader base. - Customer Reviews: - On Trustpilot, a user praised VantageFX for being a good broker with friendly customer support and prompt payout processes. They also appreciated the sufficient range of trading instruments provided by the broker. - Regulatory Standing: - Forex Peace Army mentions that Vantage Markets (VantageFX) is regulated by ASIC (Australia), FCA (UK), and CIMA (Cayman Islands), which is a strong indicator of its legitimacy and adherence to international financial standards. - Industry Recognition: - VantageFX, noted for being a well-established and often awarded Australian FX/CFD broker, has undergone evolution over the years to foster a more serious and reputable appearance within the trading community.

VantageFX seems to provide a well-rounded trading environment with a variety of trading conditions, a broad spectrum of assets, multiple deposit and withdrawal options, responsive customer support, and robust copy trading features to cater to different types of traders. Read more details review for Vantagefx broker to learn more. Register Vantagefx GMI Edge Broker:

- Country of Operation: Initially established in Shanghai, it expanded to have offices within China, Auckland, and London. - Regulatory Status: Regulated by the Financial Conduct Authority (FCA) and the Financial Services Commission (FSC) of Mauritius. - Trading Platform: Offers MT4, Alpine Trader, ClearPro, MTF, and Currenex platforms for trading. - Trading Conditions: - Minimum Deposit: The minimum deposit required to open a standard trading account is $25, and for social trading, the minimum deposit is $500. - Leverage: Up to 1:2000 leverage is available for trading. - Commission: There is no commission charged on trades, and the broker offers contract sizes of 100,000 base currency. - Asset Variety: - GMI Broker provides over 40 forex currency pairs, indices, energy, gold, and silver for trading. - Deposit and Withdrawal Options: - The broker facilitates simple and secure deposit and withdrawal methods. Deposit top-ups are quick, especially during low margin calls, and withdrawals are processed within 24 hours without any extra fees. - Deposit methods include Local Bank Transfer, Neteller, Skrill, Perfect Money, DragonPay, and FasaPay. - Customer Support: - GMI Broker offers online customer support available 24/5 to assist traders with account management and other queries. - Copy Trade Features: - Platform: GMI Social Trading Edge platform is used for copy trading with MAM technology , which allows traders to copy the trades of master traders directly. - Master Traders: A global community of experienced 'Master Traders' are available to be followed. - Profit Sharing: Traders share a percentage of their profits with the Master Traders they choose to follow, with the percentage agreed upon in advance. - Control: Traders have complete control over which trades they want to copy, with real-time monitoring of Master Traders’ performances to help decide when to start and stop following their trades. - User Reviews and Reputation: GMI edge broker is well trusted and have a good reputation in overall in markets according to our research and analysis with more than ten years of history in the forex market. - User Reviews: User reviews can provide a glimpse into the experiences of individuals who have used GMI broker. You can find reviews on platforms like Trustpilot, Forex Peace Army, wikifx or similar review sites. - Global Reputation: GMI egge broker, or Global Market Index, seems to have established a presence in the Forex trading industry. They may have a strong reputation in certain regions, but like many brokers, their reputation may vary across different geographic locations. - Regulatory Standing: GMI brokers is regulated by financial authorities like FCA and VFSC. Regulatory information can be found on the broker's official website or through financial regulatory authorities' websites. - Industry Recognition: GMI broker has received industry awards, including recognition as the Best Liquidity Provider Platform, Best Broker Support for Traders, Best Trading Platform for Traders, and Best Trading Environment for Traders within the financial trading industry, which can be indicative of their standing within the industry.

The GMI Broker's offering seems to cater to a wide range of traders from beginners to advanced, providing various trading conditions and features to enhance the trading experience, read more details review for GMI Edge broker to learn more. Register GMI Broker Read more review here https://eagleaifx.com/best-forex-broker-for-trading-2023/ Read the full article

0 notes

Text

VantageFX Review – A Thorough Look At This Forex Broker

Looking for good day trading Forex Broker Reviews? Check out this recent review from Forex Reviewz posted on Wed, 08 Apr 2020 05:55:12 +0000: VantageFX Review – A Thorough Look At This Forex Broker

0 notes

Link

See VantageFX review for those who want to learn about this forex broker

#forex broker reviews#forex#forex course#forex trading#forex currency trading#forex analysis#trader#traders#trading view#robot trading

1 note

·

View note

Link

VantageFX is indeed a major brokerage based in Australia, operating under one of the strictest regulatory jurisdictions and thriving. Vantage FX is an innovative Australian financial services provider that strives to offer the best in online Forex and Binary Options trading solutions to Australian traders and globally. As an award winning company

0 notes

Text

VantageFX PAMM: Step-by-Step Guide For Copy Trade

Introduction Vantagefx PAMM: Step-by-Step Guide to Copy Trading with PAMM on VantageFX: Summary:

Introduction Vantagefx PAMM:

This article we will guide you to start with Vantagefx PAMM cop trade. VantageFX is a reputable broker regulated by multiple financial authorities worldwide , including the VFSC, CIMA, ASIC, and the FCA, ensuring a secure and transparent trading environment. It offers a range of trading services, including the opportunity to engage in copy trading through its Percent Allocation Management Module (PAMM) accounts. PAMM accounts allow investors to pool their funds together under the management of a professional trader, known as the PAMM manager, who executes trades on behalf of the investors.

Step-by-Step Guide to Copy Trading with PAMM on VantageFX:

- Sign Up for a Vantagefx : Begin by signing up for a Vantagefx account here. If you are new to VantageFX, you must create an investor account first. Register Vantagefx PAMM Account - Setup PAMM Investor Account : Once your account is fully verified, log in to your Vantagefx account, and setup Vantagefx Investor MT4 account: - Select a PAMM manager you wish to copy trade from. Here is the steps details : - Click on the ‘Offer link’ provided by your PAMM Master - (Example: https://pamm.vantagemarkets.com/app/join/1/offername) - Here is two Vantagefx PAMM offer you can join : - Offer 1 : EagleAIFx Vantage PAMM - Offer 2: FxMaster Vantage PAMM - Use your Investor MT4's Username and Password in the email to join the offer.

- Link Your Vantagefx Account To PAMM Manager: After joining a PAMM manager, your account will be linked, and you can view your current investments. Here is the steps details. - Click ‘Invest’ after reading and checking the box of the terms. - Once successful, you will see a notification on the bottom right corner.

- Check Your Account Linking: Click on the investment you want to check.

- Deposit & Withdraw Funds: Deposit the funds you wish to allocate for copy trading into your PAMM account. These funds will be managed by the PAMM manager you selected. You can make withdrawal from the account also. Here are the steps.

- Monitor Your Investments: You can monitor your investments' performance and your PAMM manager's trading activities through the VantageFX platform. - Communicate: If you have any further questions or need assistance with your PAMM account, reach out to VantageFX's support team for help. With these steps, you are well on your way to exploring the benefits of copy trading on VantageFX using PAMM accounts. By aligning with skilled PAMM managers, you can potentially enhance your trading outcomes while learning from seasoned traders.

Summary:

Explore the realm of copy trading on VantageFX through its PAMM accounts, overseen by regulated financial authorities like VFSC, CIMA, ASIC, and FCA for secure trading endeavors, check the Vantagefx review. Kickstart your journey by signing up for a PAMM account, linking it to a chosen PAMM manager, and depositing funds for trade activities. Stay updated with your investment's performance and have the liberty to deposit or withdraw funds as needed. With VantageFX's support team at your beck and call, navigate through the PAMM trading landscape, aligning with adept managers for potential lucrative trading experiences. Read the full article

0 notes