#valuable forex

Explore tagged Tumblr posts

Text

ForexJudge.com is a comprehensive platform that provides reviews and comparisons of forex brokers. Here’s a detailed point-by-point review:

1. Website Design and Usability

User Interface: ForexJudge.com boasts a user-friendly interface, making navigation easy even for beginners. The site layout is intuitive, with well-organized sections and quick access to key information.

Mobile Compatibility: The website is fully responsive, offering a seamless experience on both desktop and mobile devices.

2. Content Quality

In-Depth Reviews: ForexJudge.com offers detailed reviews of various forex brokers, covering aspects like fees, platforms, customer service, and regulatory compliance. The reviews are thorough, well-researched, and provide valuable insights.

Comparison Tools: The site features robust comparison tools that allow users to evaluate brokers side by side based on multiple criteria, helping traders make informed decisions.

Educational Resources: There is a rich library of educational materials, including articles, tutorials, and glossaries, which are beneficial for both novice and experienced traders

3. Expert Analysis

Professional Reviews: The reviews are crafted by seasoned forex professionals, ensuring knowledgeable and insightful evaluations. This expert input adds credibility and reliability to the content.

Regular Updates: ForexJudge.com frequently updates its content to reflect the latest trends and changes in the forex market, keeping users informed with the most current information.

4. Broker Coverage

Comprehensive Listings: The platform covers a wide range of brokers globally, offering a broad perspective on the forex market. This extensive coverage includes well-known brokers as well as emerging ones, providing options for different trading needs.

Unbiased Reviews: The reviews are presented in an unbiased manner, focusing on both the strengths and weaknesses of each broker. This balanced approach helps traders choose brokers that best match their requirements【12†source】.

5. Community and Support

Engagement: ForexJudge.com fosters a community of traders who rely on its reviews and insights. The platform encourages user feedback and interaction, enhancing the overall user experience.

Customer Support: The website offers excellent customer support, ensuring users can get assistance when needed. This includes answering queries and providing additional information upon request.

6. Trust and Reliability

Transparency: ForexJudge.com maintains high transparency in its operations, including how reviews are conducted and how they make money. This builds trust among users.

Industry Recognition: The platform is recognized in the forex trading community for its comprehensive and reliable reviews. Its reputation is built on years of consistent and accurate information delivery【14†source】.

7. Additional Features

Market Insights: The website provides market insights and analysis, helping traders stay updated with market movements and trends.

Broker Awards: ForexJudge.com hosts annual awards, recognizing top-performing brokers in various categories. These awards are based on rigorous criteria and extensive research.

Overall, ForexJudge.com is a valuable resource for anyone involved in forex trading, offering detailed broker reviews, educational content, and tools to aid in making informed trading decisions.

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

60 notes

·

View notes

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

144 notes

·

View notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

29 notes

·

View notes

Text

Join our Forex Telegram Channel to elevate your trading strategy and skills! Stay updated with expert analysis, market insights, and real-time trade signals. Our community of traders shares valuable tips, strategies, and resources to help you navigate the Forex market with confidence. Whether you're a beginner or an experienced trader, you'll find the support and information you need to enhance your trading performance. Don't miss out on the opportunity to learn, grow, and succeed in Forex trading. Click the link and join our channel now for a smarter trading journey. Visit our website - https://forextelegramgroup.com/forex-free-telegram-channels/

#ForexTrading#ForexSignals#ForexCommunity#ForexTips#ForexStrategies#TradingSkills#ForexEducation#ForexMarket#TradingSignals#ForexTraders#LearnForex#TradingSuccess#ForexAnalysis#ForexExperts#ForexJourney

4 notes

·

View notes

Text

Join Social Trade Copier Facebook Community!

As a trader, I know how crucial it is to stay connected and informed in the ever-changing world of Forex. That’s why I’m excited to invite you to join our dynamic Facebook community, STC Copier.

In this group, we come together to share experiences, strategies, and insights that can make a real difference in our trading journeys. Whether you’re just starting out or you’ve been trading for years, having a supportive network can elevate your game and help you navigate the complexities of the market.

Here’s what I’ve found to be incredibly valuable about our community:

Expert Insights: I’ve learned so much from others sharing their trading tips and strategies. It’s amazing to get different perspectives that can open up new opportunities.

Live Discussions: The real-time conversations about market trends and news keep me engaged and informed. It’s like having a trading desk full of knowledgeable friends!

Supportive Network: Trading can be isolating, but this group is a place where I can connect with others who understand the highs and lows we all face. The encouragement and motivation from fellow traders are invaluable.

Exclusive Content: I appreciate the access to special resources and tools that can enhance our trading skills and strategies.

If you’re looking for a place to learn, share, and grow, I highly recommend joining us. Click the link to become part of our community today: STC Copier Facebook Group.

Let’s elevate our trading game together! 🚀📈

#Social Trade Copier#STC#Facebook Community#Trade Copier#Signal Copier#Facebook#forextrading#forex education#currency markets#finance

2 notes

·

View notes

Text

Advanced Tips and Tricks for Global Market Trading

Trading in the global market can be both exciting and profitable if you employ the right strategies. Whether you're dealing with Forex, commodities, or other investments, these advanced tips will set you up for success.

Master Technical Analysis: Technical analysis is crucial for predicting market movements. Learn to read charts and use indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools help you identify trends and make informed trading decisions.

Choose the Best Trading Platform: Selecting the right trading platform is essential. Look for platforms that offer real-time data, analytical tools, and a user-friendly interface. Good platforms also provide educational resources and excellent customer support.

Diversify Your Investments: Diversification reduces risk. Spread your investments across different asset classes like Forex, commodities, and stocks. This approach ensures that your portfolio is protected from market volatility.

Stay Updated with Market News: Keeping up with global news, economic events, and market trends is vital. Regularly read financial news and reports. Use economic calendars to track important events that might impact your trades.

Implement Risk Management Strategies: Effective risk management is key to long-term success. Use stop-loss orders to limit potential losses and ensure no single trade can hurt your portfolio too much. This way, you can trade with confidence.

Follow Expert Insights: Industry experts and analysts provide valuable insights. Platforms like TradingView and social media channels can offer advanced strategies and techniques. Learning from these experts can enhance your trading approach.

Use Automated Trading Systems: Automated trading systems can execute trades based on pre-set criteria, helping you take advantage of market opportunities without constant monitoring. Understand the algorithms and monitor their performance regularly.

Focus on Continuous Learning: The trading world is always changing. Participate in webinars, attend workshops, and take online courses to stay updated with the latest strategies and trends. Continuous learning helps you stay ahead.

Monitor Your Performance: Regularly review your trades and performance. Keep a trading journal to track your decisions, outcomes, and lessons learned. This practice helps you improve your strategies and avoid repeating mistakes.

Partner with Reliable Brokers: Choosing a reliable broker is crucial. Look for brokers with competitive spreads, low fees, and robust security measures. A good broker provides the tools and support you need for successful trading.

Trust APM for more expert insights and trading solutions.

5 notes

·

View notes

Text

📈💰 Dive into the world of Forex trading with ease! Whether you're a seasoned trader or just starting out, navigating the complexities of the Forex market can be daunting. That's where HFT and Gold Bot comes in. Powered by cutting-edge algorithms and years of market data analysis, HFT and Gold Bot is your ultimate ally in the Forex market.

Imagine having a dedicated assistant working tirelessly for you, analyzing market trends, monitoring currency pairs, and identifying profitable opportunities—all in real-time. With HFT and Gold Bot you can say goodbye to the stress of manual trading and hello to automated success.

But HFT and Gold Bot isn't just about automation; it's about making informed decisions. Our bot is designed to provide you with valuable insights and recommendations, empowering you to make strategic choices that align with your trading goals.

Join the ranks of successful traders who rely on HFT and Gold Bot to navigate the Forex market with confidence and ease. Take the first step towards automated success today. #ForexTrading #AutomatedSuccess #FinanceTech 🤖💼

Whether it's scalping, swing trading, or long-term investing, HFT and Gold Bot adapts to your preferred trading style and helps you execute trades with precision and efficiency. Plus, with built-in risk management features, you can trade with confidence, knowing that your investments are protected.

2 notes

·

View notes

Text

Why Traders Choose PreferForex.com Signals for Their Trading Success

The smart money forex signals

In the fast-paced world of trading, success is often determined by making well-informed decisions at the right time. Traders are constantly seeking reliable sources of information and tools that can help them navigate the markets with confidence. This is where PreferForex.com Signals comes into play. With its comprehensive suite of trading signals and analysis, PreferForex has emerged as a trusted partner for traders looking to achieve their financial goals.

One of the key reasons why traders choose our Forex Signals is the accuracy and reliability of its signals. The team of experienced analysts at PreferForex.com employs a meticulous approach to market analysis, using a combination of technical indicators, fundamental analysis, and market sentiment to generate high-quality trading signals. These signals are then delivered to traders in real-time, ensuring that they have access to the latest market insights and opportunities.

Another factor that sets PreferForex.com Signals apart is its versatility. Whether you are a beginner or an experienced trader, PreferForex.com offers a range of signal packages tailored to suit your trading style and preferences. From short-term scalping signals to long-term trend-following signals, there is something for everyone. Traders can also choose from a variety of asset classes, including forex, stocks, commodities, and cryptocurrencies, allowing them to diversify their portfolios and take advantage of different market conditions. our signals examples-

In addition to its accuracy and versatility, PreferForex.com Signals also provides traders with valuable educational resources. The platform offers comprehensive market analysis reports, trading tutorials, and webinars that can help traders enhance their knowledge and skills. This commitment to education sets PreferForex.com apart from other signal providers, as it empowers traders to make informed decisions based on a deep understanding of the markets.

Traders also appreciate the user-friendly interface and intuitive design of PreferForex.com Signals. The platform is easy to navigate, with clear and concise signals that are easy to understand. Traders can access their signals on any device, whether it's a desktop computer, laptop, or mobile phone, ensuring that they never miss an opportunity to capitalize on market movements.

Furthermore, PreferForex.com Signals offers exceptional customer support. The team is available 24/7 to assist traders with any questions or concerns they may have. Whether it's technical support or general inquiries about trading strategies, traders can rely on PreferForex.com to provide prompt and helpful assistance.

Lastly, traders choose PreferForex.com Signals because of its track record of success. Over the years, PreferForex.com has built a reputation for delivering consistent and profitable signals. Many traders have achieved significant financial gains by following the signals provided by PreferForex.com, which further reinforces its credibility and trustworthiness.

youtube

In conclusion, traders choose PreferForex.com Signals for their trading success because of its accuracy, versatility, educational resources, user-friendly interface, exceptional customer support, and track record of success. With PreferForex.com Signals by their side, traders can navigate the markets with confidence and increase their chances of achieving their financial goals. Whether you are a novice trader or an experienced professional, PreferForex.com Signals is a valuable tool that can help you unlock your full trading potential.

Visit our YOUTUBE Channel

4 notes

·

View notes

Text

Brokfolio - Your Ultimate Guide to Ranking the Best Brokers Online in 2024

In the fast-paced world of online trading, finding the right broker can make all the difference between success and frustration. With a myriad of options available, it's crucial to navigate through the sea of choices to pinpoint the broker that best fits your trading style and preferences. Thankfully, Brokfolio.com has emerged as a beacon of light for traders seeking to make informed decisions. In this article, we delve into Brokfolio's comprehensive approach to ranking the best brokers online in 2024, focusing on the best high leverage brokers and ECN brokers.

Brokfolio.com: Your Trusted Resource for Brokerage Reviews

Brokfolio.com stands out as a premier platform dedicated to providing unbiased and thorough reviews of online brokers. With its commitment to transparency and accuracy, Brokfolio empowers traders with the knowledge they need to navigate the competitive landscape of online trading. Whether you're a seasoned trader or a newcomer to the world of finance, Brokfolio offers valuable insights to help you make informed decisions.

Best High Leverage Brokers: Maximizing Your Trading Potential

For traders seeking to amplify their potential returns, high leverage can be a powerful tool. However, navigating the world of high leverage brokers requires caution and diligence. Brokfolio meticulously evaluates high leverage brokers based on a range of factors, including regulatory compliance, trading platform features, customer support, and, most importantly, risk management protocols.

Brokfolio's rankings highlight high leverage brokers that strike the right balance between offering competitive leverage ratios and implementing robust risk management measures. By prioritizing the safety of traders' capital while still providing ample trading opportunities, these brokers earn their place among the best in the industry.

Best ECN Brokers: Unmatched Transparency and Execution

For traders who prioritize transparency, fairness, and lightning-fast execution, ECN (Electronic Communication Network) brokers are the go-to choice. ECN brokers provide direct access to the interbank forex market, ensuring optimal pricing and minimal slippage. However, not all ECN brokers are created equal, which is where Brokfolio's expertise comes into play.

Brokfolio meticulously evaluates ECN brokers based on their pricing models, liquidity providers, trading conditions, and overall reliability. By scrutinizing every aspect of an ECN broker's offering, Brokfolio ensures that traders can confidently choose a broker that aligns with their trading objectives and preferences.

Conclusion: Empowering Traders with Knowledge and Insight

In the ever-evolving landscape of online trading, having access to reliable information is paramount. Brokfolio.com serves as a beacon of trust and transparency, empowering traders with the knowledge they need to navigate the complexities of the financial markets. Whether you're in search of the best high leverage brokers or ECN brokers, Brokfolio's comprehensive rankings and reviews are your roadmap to success.

As you embark on your trading journey in 2024 and beyond, let Brokfolio be your trusted companion, guiding you towards the brokers that best suit your needs. With Brokfolio.com by your side, you can trade with confidence, knowing that you're backed by expertise and insight every step of the way.

2 notes

·

View notes

Text

Best Forex Risk Management Strategies

Discover the comprehensive insights into effective FX Risk Management strategies with Bartas Aleksandravicius. In his authoritative work, 'Fx Risk Management,' Aleksandravicius explores practical approaches to navigate and mitigate currency fluctuations, offering valuable guidance for businesses engaged in international trade. Gain a strategic advantage in the foreign exchange market by leveraging expert perspectives and proven risk management techniques.

4 notes

·

View notes

Text

Forex trading signals for part-time traders

Forex trading can be a lucrative venture, even for those with limited time on their hands. Part-time traders often face the challenge of managing their trades efficiently. In this article, we'll explore the world of Forex trading signals and how they can be a valuable tool for part-time traders.

What are Forex Trading Signals?

Forex trading signals are indicators or notifications that suggest optimal times to enter or exit a trade. These signals are generated through thorough market analysis by professional traders or automated systems. For part-time traders, relying on these signals can save time and provide valuable insights into the market.

Here are some tips for part-time traders:

Choose a Reliable Signal Provider: There are various signal providers in the market. Do your research and select a provider with a proven track record of accuracy.

Understand the Signals: It's essential to comprehend the signals you receive. This includes understanding the risk associated with each signal and how it aligns with your trading strategy.

Time Management: Part-time traders must efficiently manage their time. Set specific periods for analyzing signals, and stick to your trading plan.

Remember, while trading signals can be beneficial, they are not foolproof. It's crucial to combine them with your analysis and stay informed about market trends. Successful trading requires a combination of strategy, discipline, and continuous learning.

Happy trading!

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

22 notes

·

View notes

Text

Forex Trading is a Scam? How To Avoid Scams

Inspect the truth behind Forex trading scam perceptions with forexregulationinquiry and learn effective ways to steer clear of potential pitfalls . This guide equips you with valuable insights to distinguish legitimate opportunities from fraudulent schemes, empowering you to navigate the forex market safely and make informed decisions.

#stock broker#forex broker#forex market#online forex market#online forex trading#forex market news#forex trading#business#forexregulationinqury#stock market#forex trading scams

2 notes

·

View notes

Text

Safeguarding Success: The Crucial Role of Risk Management with Live Forex Signals

Introduction

The world of forex trading offers a realm of possibilities, from significant profits to rapid market shifts. Amidst this dynamic landscape, traders often turn to live forex signals to gain an edge in their trading decisions. These signals, sourced from experienced traders or advanced algorithms, can provide valuable insights into potential trade setups. However, the path to successful trading goes beyond just accurate signals – it requires effective risk management. In this blog post, we'll delve into why risk management is paramount when using live forex signals and how it can spell the difference between success and failure.

Understanding Risk Management

Risk management is the process of identifying, assessing, and mitigating potential risks to preserve capital and enhance the probability of successful trades. It's a set of strategies that traders employ to protect their investments and navigate the volatility of the forex market. While live forex signals can provide a clear roadmap for trading decisions, risk management ensures that traders don't fall into common pitfalls and face undue losses.

The Significance of Risk Management with Live Forex Signals

Preserving Capital: The primary goal of risk management is capital preservation. Even the most accurate signals can sometimes fail due to unpredictable market movements. By limiting the amount of capital risked on each trade, traders ensure that a single loss doesn't wipe out their entire account.

Mitigating Emotional Decisions: Emotional decisions often lead to impulsive actions, which can be detrimental to trading success. Implementing risk management strategies helps traders stick to their plan, even when market emotions run high.

Long-Term Sustainability: Forex trading is a marathon, not a sprint. Effective risk management ensures that traders can withstand losses and continue trading over the long term. Without risk management, a series of losses could lead to an account depletion, preventing traders from capitalizing on future opportunities.

Stress Reduction: Trading without proper risk management can be stressful, causing sleepless nights and anxiety. Knowing that you have a strategy in place to manage losses can significantly reduce stress levels and improve overall mental well-being.

Key Risk Management Strategies

Position Sizing:

Determine the appropriate size of your trades based on the size of your trading account and the level of risk you're comfortable with. A common rule of thumb is to risk only a small percentage of your account on each trade, such as 1-2%.

Setting Stop-Loss Orders:

Place stop-loss orders at strategic levels to limit potential losses. This ensures that if a trade goes against you, the damage is contained within a predetermined threshold.

Diversification:

Avoid putting all your eggs in one basket. Diversify your trades across different currency pairs and potentially other asset classes to spread risk.

Risk-Reward Ratio:

Assess the potential reward of a trade relative to the risk. A favorable risk-reward ratio, such as 1:2 or higher, ensures that winning trades can offset a series of losses.

Real-Life Example:

The Tale of Two Traders, Imagine two traders using the same live forex signals. Trader A ignores risk management, investing a significant portion of their capital in a single trade. When the trade goes sour, their account takes a massive hit, leaving them unable to recover. On the other hand, Trader B meticulously employs risk management strategies, risking only a small percentage of their capital on each trade. While they also face losses, their account remains intact, allowing them to capitalize on subsequent winning trades and eventually turn a profit.

Conclusion

Live forex signals offer a valuable shortcut to potentially profitable trading opportunities. However, they should be viewed as tools to assist rather than dictate trading decisions. Risk management serves as the guiding light that ensures traders stay on a sustainable path. It prevents impulsive actions, preserves capital, and maintains a trader's psychological well-being. Remember that while live forex signals can provide insights; it's your risk management strategies that ultimately determine your success in the volatile forex market. In a realm where uncertainty is constant, risk management becomes the beacon that leads to lasting profitability.

3 notes

·

View notes

Text

youtube

Automating Your Path to Financial Success || 6388030756

Forex trading robots, also known as Expert Advisors (EAs), are advanced software applications designed to automate trading activities in the foreign exchange market. These robots analyze market data, execute trades, and manage risk with precision and efficiency, all while eliminating the emotional biases that can hinder human traders. They operate 24/7, providing consistent trading strategies and valuable tools for both novice and experienced traders to explore the forex market.

For more Info- https://alitronzprofit.com/

3 notes

·

View notes

Text

Day Trading Forex: Everything You NEED To Know!

Are you interested in exploring the world of forex trading and want to take advantage of short-term price movements? Day trading forex might be the perfect strategy for you.

In this article, we will delve into the ins and outs of day trading forex, from understanding the forex market to developing effective strategies and managing risks. So let’s get started!

Introduction to Day Trading Forex

Benefits of Day Trading Forex

Day trading forex offers several advantages compared to other trading styles. Some of the benefits include:

Potential for quick profits: Day traders seek to profit from intraday price movements, aiming to close positions before the market closes.

High liquidity: The forex market is the largest and most liquid financial market globally, providing ample trading opportunities.

Flexibility: Traders can choose from a wide range of currency pairs and trade during different market sessions.

Lower capital requirements: Compared to other markets, forex trading allows for smaller initial investments, enabling traders to start with less capital.

Understanding Forex Market

To become a successful day trader in forex, it’s essential to have a solid understanding of the market dynamics.

Major Currency Pairs

The forex market consists of various currency pairs, but some major pairs dominate the trading volume. These include EUR/USD, GBP/USD, USD/JPY, and USD/CHF, among others. Familiarize yourself with these major currency pairs and their characteristics.

Market Hours

The forex market operates 24 hours a day, five days a week. However, certain trading sessions offer higher volatility and trading opportunities. The major sessions include the London, New York, Tokyo, and Sydney sessions. Knowing the active market hours can help you optimize your trading strategy.

Getting Started with Day Trading Forex

Before diving into day trading forex, you need to set up your trading infrastructure.

Setting Up a Trading Account

Choose a reputable forex broker that provides a user-friendly trading platform, competitive spreads, reliable execution, and comprehensive customer support. Ensure the broker is regulated by a recognized authority.

Selecting a Reliable Forex Broker

Research different forex brokers and compare their offerings, including trading costs, available currency pairs, leverage options, and deposit/withdrawal methods. Read reviews from other traders to gauge the broker’s reputation and reliability.

Funding Your Trading Account

Technical and Fundamental Analysis

Successful day trading forex relies on a combination of technical and fundamental analysis techniques.

Candlestick Patterns

Candlestick patterns provide valuable insights into price dynamics. Learn to identify patterns such as doji, engulfing, and hammer, which can signal potential reversals or continuations in the market.

Moving Averages

Moving averages help smooth out price fluctuations and identify trends. Experiment with different moving average periods, such as the 50-day and 200-day moving averages, to identify potential entry and exit points.

Support and Resistance Levels

Support and resistance levels are price levels at which the market tends to bounce or reverse. Identify key support and resistance levels using horizontal lines on your charts and incorporate them into your trading decisions.

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, and employment data, can significantly impact currency prices. Stay informed about major economic releases and their potential effects on the forex market.

News Events

Popular Day Trading Strategies

To succeed in day trading forex, you need to implement effective trading strategies that suit your trading style and risk appetite.

Scalping

Scalping involves making multiple trades within a short time frame, aiming to capture small profits from quick price movements. Scalpers often rely on tight spreads and fast execution to capitalize on these rapid price changes.

Breakout Trading

Breakout traders look for significant price breakouts above resistance or below support levels. They aim to enter trades early in a new trend to maximize profit potential. Breakout strategies often utilize technical indicators to confirm breakouts.

Momentum Trading

Risk Management in Day Trading Forex

Managing risk is crucial in day trading forex to protect your capital and preserve long-term profitability. Here are a few ways to help manage your risk:

Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. Determine an appropriate level for your stop-loss order based on your risk tolerance and the characteristics of the currency pair you are trading.

Implementing Proper Position Sizing

Calculate your position size based on the size of your trading account and the percentage of capital you are willing to risk per trade. Avoid overexposing your account by trading positions that are too large relative to your account size.

Managing Leverage

Emotions and Psychology in Day Trading

Controlling emotions and maintaining a disciplined mindset are crucial in day trading forex.

Controlling Greed and Fear

Greed and fear are common emotions that can cloud judgment and lead to irrational trading decisions. Develop self-awareness and discipline to overcome these emotions and make objective trading choices.

Maintaining Discipline

Stick to your trading plan and avoid impulsive trades driven by emotions. Follow your strategy and trading rules consistently, even when faced with market fluctuations.

Developing a Trading Plan

Building a Trading Routine

Establishing a structured trading routine can help you stay organized and make better trading decisions.

Pre-market Analysis

Before the market opens, conduct a thorough analysis of the currency pairs you are interested in trading. Review economic calendars, technical indicators, and news events that may impact the market.

Executing Trades

Once the trading day begins, execute your trades based on your predefined strategies and analysis. Stick to your risk management rules and avoid impulsive trades based on emotions.

Reviewing and Analyzing Trades

Resources and Tools for Day Traders

Several resources and tools can assist day traders in their trading activities.

Educate Yourself

It is important to stay up to date and learn constantly when you are day trading. It’s always a good idea to begin your journey with a day trading forex course such as the Cash on Demand Trades Education or The Ultimate Forex Strategy

Trading Platforms

Choose a user-friendly trading platform that provides real-time charts, technical indicators, order execution capabilities, and access to relevant news and analysis.

Charting Software

Utilize charting software to analyze price patterns, apply technical indicators, and identify potential trade setups. Popular charting platforms include MetaTrader, TradingView, and NinjaTrader.

Economic Calendars

Stay informed about upcoming economic events and news releases using economic calendars. These calendars provide information on scheduled economic indicators, central bank meetings, and other market-moving events.

Online Communities and Forums

Engage with other day traders through online communities and forums. Participate in discussions, share ideas, and learn from experienced traders. Collaborating with like-minded individuals can enhance your trading knowledge and skills.

Tips for Successful Day Trading

Consider the following tips to improve your day trading performance:

Stay Informed and Educated: Continuously update your knowledge about the forex market, trading strategies, and risk management techniques. Follow reputable sources of market analysis and stay informed about economic developments.

Practice Risk Management: Always prioritize risk management to protect your capital. Implement appropriate stop-loss orders, manage your position sizes, and avoid overtrading.

Start with Small Positions: When starting out, focus on small position sizes to minimize risk. Gradually increase your position sizes as you gain experience and confidence in your trading abilities.

Keep Emotions in Check: Emotions can cloud judgment and lead to poor trading decisions. Maintain emotional discipline, stick to your trading plan, and avoid impulsive actions driven by fear or greed.

Review and Learn from Your Trades: Regularly review your trading performance, analyze your trades, and identify areas for improvement. Learn from both successful and unsuccessful trades to refine your strategy.

Final Thoughts

Day trading forex offers exciting opportunities for traders to profit from short-term price movements in the forex market.

By understanding the market dynamics, implementing effective strategies, managing risks, and maintaining emotional discipline, you can increase your chances of success in day trading forex.

4 notes

·

View notes

Text

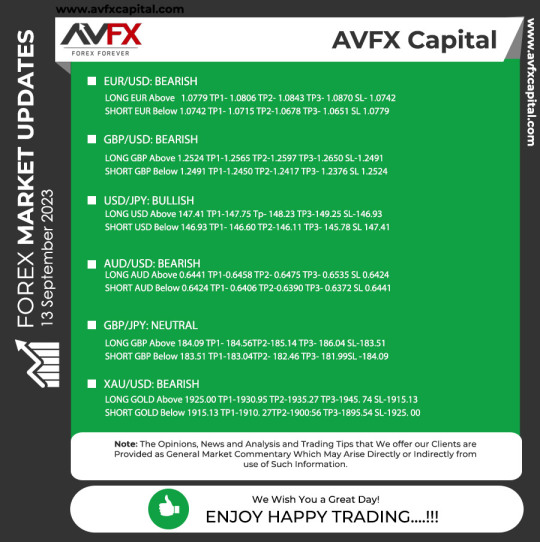

#AVFX DAILY FOREX UPDATE

Hello,

Our Valuable Traders,

Hope you are doing your best. Please have a look at the daily forex update.

#commodities#forexcommodities#forex#avfxcapital#avfx#forexmarkets#internationalforex#broker#tradeshow#forexmarket

2 notes

·

View notes