#union finance minister nirmala sitharaman

Explore tagged Tumblr posts

Video

youtube

Rs 12 Lakh Tax Exemption Explained

#youtube#In the Union Budget 2024-25 Finance Minister Nirmala Sitharaman announced significant changes to the income tax structure under the new tax

0 notes

Text

Stop levying tax on uncertainties of life

Union Minister of Road Transport and Highways Nitin Gadkari has urged Union Finance Minister Nirmala Sitharaman to consider withdrawing 18 per cent goods and services tax (GST) on life and medical insurance premiums. It is really a great move that should be supported by everyone, both those who buy insurance policies and those who intend to buy, and even those who sell, should back the suggestion of Gadkari.

0 notes

Text

Government Allocates Rs 1.48 Lakh Crore for Education and Employment Initiatives.

New Delhi: In the Union Budget 2024, Finance Minister Nirmala Sitharaman has announced a significant allocation of Rs 1.48 lakh crore towards education, employment, and skill development. This funding is aimed at enhancing the quality and reach of educational and training programs across the country.

ALSO READ MORE- https://apacnewsnetwork.com/2024/07/government-allocates-rs-1-48-lakh-crore-for-education-and-employment-initiatives/

#Education#Education and Employment Initiatives#Employment#Finance Minister Nirmala Sitharaman#Government Allocates Rs 1.48 Lakh Crore#Nirmala Sitharaman#Skill Development#Union Budget 2024

0 notes

Video

youtube

What can salaried employees expect from Budget 2024? #unionbudget2024 ... What to expect from Budget 2024 for salaried employees? * Finance Minister Nirmala Sitharaman to present the Union Budget for 2024-25. * Sitharaman becomes the first Finance Minister to present seven consecutive Union Budgets. * Budget expected in the second half of July. * High expectations for taxpayers, especially salaried employees seeking tax relief. * Key demands include lower tax rates, revised slabs, and higher deductions. * Call for expansion of the 50% HRA exemption to more non-metro cities. * Expectation of an increase in the Section 80C deduction limit for investments in life insurance, PPF, FD, and ELSS. * Prediction of a rise in the new tax regime’s exemption limit. * Deduction under Section 24(b) for home loan interest expected to increase from Rs 2 lakhs to Rs 3 lakhs. Join us at demiumresearch.com, or call 7030916716 today. Let's make your money work smart! . . . . . . #unionbudget #financeminister #nirmalasitharaman #invest #nifty #investor #sharemarket #financialfreedom #trader #sensex #stock #wealth #nse #bse #stockmarketindia #stockmarketnews #salariedemployees #employee #insurance

#youtube#What to expect from Budget 2024 for salaried employees? * Finance Minister Nirmala Sitharaman to present the Union Budget for 2024-25. * Si

0 notes

Text

Union Budget: No change in tax structure, FM sticks to path of fiscal consolidation

Union Finance Minister Nirmala Sitharaman presented the Modi 2.0 government’s last Budget before the general elections on Thursday. The interim budget has a mix of measures for the economy and significant segments for women that are important from the point of voters’ pull. The Finance Minister, in her budget speech, said the government was focused on Poor, Women, Youth and Farmers, and it was…

View On WordPress

0 notes

Text

Nirmala Sitharaman | finance minister nirmala sitharaman | nirmala sitharaman news | nirmala sitharaman union budget | Finance Bill

Government gave a strong shock to investors, now debt will have to be paid on mutual funds. Tax like FD The bill proposed that from April 1, mutual funds associated with investment in bonds or fixed-income products would incur short-term capital gains tax. The Finance Bill has passed in the Lok Sabha on Friday amid uproar in Parliament। The government has made several major changes in this…

View On WordPress

#Finance Bill#finance minister nirmala sitharaman#Nirmala Sitharaman#nirmala sitharaman news#nirmala sitharaman union budget

0 notes

Text

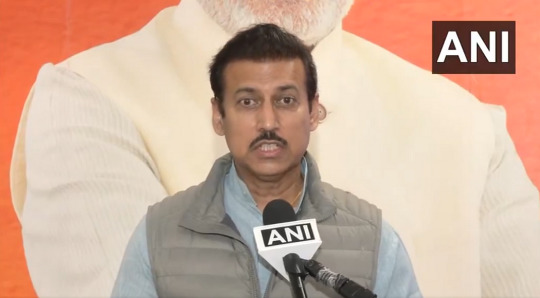

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

Nirmala Sitharaman to make history with her 7th Budget, surpasses Morarji Desai

Union Finance Minister Nirmala Sitharaman is set to make history by presenting her seventh consecutive Budget on Tuesday, surpassing the record of former Prime Minister and Finance Minister Morarji Desai.

Sitharaman, who holds the record for the longest budget speech delivered on February 1, 2020, which lasted two hours and 40 minutes before being cut short, will now also hold the record for the maximum consecutive budget presentations.

Source: bhaskarlive.in

2 notes

·

View notes

Text

On which date budget is declared?

India. The Union Budget of India, referred to as the Annual Financial Statement in Article 112 of the Constitution of India, is the annual budget of the Republic of India, presented each year on the very first day of February by the Finance Minister of India in Parliament

Union Budget 2023: Where and when to watch FM Nirmala Sitharaman's speech LIVE. Finance Minister Nirmala Sitharaman will present the Union Budget 2023 on 1 February ( Wednesday) at 11 am. This will be Sitharaman's fifth straight budget for the fiscal year beginning April 1.01-Feb-2023

2 notes

·

View notes

Text

New Income Tax Bill 2025: Simplified Taxation, Reduced Litigation, and Economic Impact

The New Income Tax Bill is now available and will be presented to the Lok Sabha by Union Finance Minister Nirmala Sitharaman. The decades-old Income Tax Act of 1961 will be replaced by this. With 536 sections and 16 (XVI) schedules, the bill is expected to become the Income Tax Act of 2025. Read also: “Income Tax” Slightly Over ₹12 Lakh Salary? Do You Pay Full Tax? During the Budget 2025 Speech,…

View On WordPress

0 notes

Text

Jaya Bachchan Appeals to Finance Minister Nirmala Sitharaman for Support to Struggling Film Industry

Jaya Bachchan Appeals to Finance Minister Nirmala Sitharaman for Support to Struggling Film Industry...

KKN Gurugram Desk | In a heartfelt appeal during a Rajya Sabha discussion about the Union Budget, veteran actress and Member of Parliament Jaya Bachchan urged Finance Minister Nirmala Sitharaman to extend support to the struggling film industry. She accused the government of neglecting the sector and unfairly targeting it while highlighting the difficulties faced by daily wage workers and the…

0 notes

Text

New Income Tax Bill 2025: This may still undergo several changes sooner than later

Union Finance Minister Nirmala Sitharaman to Present New Income Tax Bill in Parliament on Thursday Union Finance Minister Nirmala Sitharaman is set to present the new income tax bill in the Parliament on Thursday. The bill, which is already being circulated on social media, is receiving reactions from taxpayers and experts alike. However, it’s important to note that the current bill is expected…

0 notes

Text

The Future of Global Metal Supply with PLI Scheme for Speciality Steel

On February 1, 2025, Finance Minister Nirmala Sitharaman presented her eighth consecutive Union Budget, marking a decisive step towards strengthening India’s manufacturing sector. A key highlight of the budget was the significant financial allocation to the Production Linked Incentive (PLI) scheme for speciality steel, underscoring the government’s commitment to boosting domestic production, fostering technological innovation, and reducing import dependency. With this robust backing, the Indian steel industry is poised to advance in both quality and capacity, aligning with the vision of Atma Nirbhar Bharat (self-reliant India). This strategic financial endorsement not only reaffirms the confidence of the Government of India in its domestic steel manufacturing capabilities but also signals a transformative shift in the global metal supply chain.

Overview of the PLI Scheme for Speciality Steel

In 2021, the Government of India launched the PLI scheme for speciality steel with a financial commitment of ₹6,322 crore. The initiative was designed with several core objectives:

1. Promotion of Value-Added Manufacturing: Encouraging the production of advanced, high-performance steel grades.

2. Technological Upgradation: Adopting cutting-edge technologies to elevate the manufacturing process.

3. Import Substitution: Reducing the country’s reliance on imported steel by bolstering domestic production.

During the recent Union Budget presentation, the Centre allocated additional funds to further this initiative, reinforcing the commitment to develop a self-sustaining and competitive steel industry on the global stage.

Recent Steel Manufacturing Developments: PLI Scheme 1.1

In January 2025, in response to constructive industry feedback and evolving market dynamics, the Union Minister of Steel and Heavy Industries, HD Kumaraswamy, introduced the second phase of the initiative, PLI Scheme 1.1. This revised scheme aims to expand participation and strengthen the framework of its predecessor. Notable enhancements include:

1. Broader Eligibility Criteria: Allowing a wider array of industry participants by relaxing certain restrictions.

2. Increased Domestic Production: Further investments will boost local manufacturing capabilities, assuring a reliable, high-quality steel supply.

3. Focused Product Categories: The scheme supports five critical categories of speciality steel products: Coated/Plated Steel Products High Strength/Wear Resistant Steel Specialty Rails Alloy Steel Products Steel Wires and Electrical Steel

These product categories have diverse applications across industries such as white goods, transformers, automotive, and other niche sectors, reinforcing this initiative’s strategic importance.

Technical Insights into Speciality Steel Grades

Speciality steel is distinguished by its superior mechanical and chemical properties, which are critical for high-performance applications. Key technical attributes include:

1. High Tensile and Yield Strength: Essential for components operating under high stress and pressure.

2. Superior Corrosion Resistance: Vital for maintaining structural integrity in corrosive environments.

3. Tailored Alloy Compositions: Incorporation of elements such as chromium, nickel, and molybdenum to upgrade performance and durability.

For instance, austenitic stainless steels like SS 304 and SS 316 are widely used in plumbing and chemical processing industries due to their exceptional corrosion resistance. Similarly, duplex stainless steels are increasingly preferred in offshore and high-pressure applications, offering a balanced combination of strength and corrosion resistance.

Compliance with rigorous international standards ensures that the speciality steel produced under the PLI scheme consistently meets the highest quality benchmarks, thereby providing reliable raw materials for downstream industries. Notably, while the 2024 budget laid a crucial foundation for this growth, the 2025 budget represents a decisive escalation in financial commitment to the speciality steel sector.

At Online Fittings, we are committed to facilitating your access to superior speciality steel products that adhere to global standards. Our expertise and strategic sourcing capabilities are designed to support your operations in an increasingly competitive market. Please contact our team for further information or to discuss your specific requirements.

0 notes

Text

NITI Aayog announces revised composition.

New Delhi: The National Institution for Transforming India (NITI Aayog) has unveiled its revised composition, aimed at enhancing its strategic leadership and effectiveness. The Indian government has reconstituted the National Institution for Transforming India (NITI Aayog), with Prime Minister Narendra Modi remaining as the chairperson and economist Suman K Bery continuing as the vice-chairperson.

ALSO READ MORE- https://apacnewsnetwork.com/2024/07/niti-aayog-announces-revised-composition/

#Amit Shah home#Annapurna Devi Women and Child Development#Arvind Virmani#Chirag Paswan Food Processing#H D Kumaraswamy Heavy Industries#J P Nadda Health#Jitan Ram Manjhi MSMEs#Jual Oram Tribal Affairs#K R Naidu Civil Aviation#National Institution for Transforming India#Nirmala Sitharaman Finance#NITI Aayog#NITI Aayog announces revised composition#Nitin Gadkari Road Transport and Highways#Rajiv Ranjan Singh Fisheries#Ramesh Chand#Rao Inderjit Singh Statistics and Programme Implementation#Shivraj Singh Chouhan Agriculture#Union Minister Rajnath Singh#VK Paul#VK SaraswatVirendra Kumar Social Justice

0 notes

Text

'Institutionalised corruption, gutted institutions': Nirmala Sitharaman's jab at TMC in Lok Sabha address | India News

Nirmala Sitharaman in Lok Sabha NEW DELHI: Finance Minister Nirmala Sitharaman on Tuesday accused the Trinamool Congress (TNC) administration of fostering systematic corruption and weakening governmental institutions.During her reply to the debate on Union Budget 2025-26 in the Lok Sabha she said, “It is ironical that Trinamool Congress, a party which prides itself on being rooted in the…

0 notes

Text

Grameen Credit Score to Enhance Rural Women's Access to Loans and Empower Self-Help Groups

Grameen Credit Score to Enhance Rural Women’s Access to Loans and Empower Self-Help Groups In the Union Budget 2025-26, Finance Minister Nirmala Sitharaman announced the development of the ‘Grameen Credit Score’ (GCS) framework. The initiative will be implemented by public sector banks. It aims to address the credit needs of Self-Help Group (SHG) members. The framework is designed to benefit…

0 notes