#union budget 2017-18

Explore tagged Tumblr posts

Text

Welcome To Neoliberalism: Be Free To Pay Forever

Welcome to Neoliberalism. Bienvenida. Here in downtown Neoliberalis there is a new kind of freedom. You are free to pay for everything. User pays, you see. There are no evil socialist institutions, none left anyway. No universal healthcare. No social security, no welfare from the government. Indeed, we are doing away with the whole concept of government. Business can do it better. Business can do it cheaper and much more efficiently. Then, we don’t need public servants, do we? Non, monsieur. Only honest, salt of the earth billionaires to run the show. Welcome to Neoliberalism: Be free to pay forever.

Neoliberalism What Does It Mean?

Neo means new. Liberal means “relating to or denoting a political and social philosophy that promotes individual rights, civil liberties, democracy, and free enterprise.” https://languages.oup.com/google-dictionary-en/ Neoliberal economics refers to: “Three senior economists at the IMF, an organisation not known for its incaution, published a paper questioning the benefits of neoliberalism. In so doing, they helped put to rest the idea that the word is nothing more than a political slur, or a term without any analytic power. The paper gently called out a “neoliberal agenda” for pushing deregulation on economies around the world, for forcing open national markets to trade and capital, and for demanding that governments shrink themselves via austerity or privatisation. The authors cited statistical evidence for the spread of neoliberal policies since 1980, and their correlation with anaemic growth, boom-and-bust cycles and inequality.” - (https://www.theguardian.com/news/2017/aug/18/neoliberalism-the-idea-that-changed-the-world)

Photo by Jerome Govender on Pexels.com

My Own Brush With Neoliberal Labor Governments

Recently, due to my own economic crisis, I took a labouring job under the auspices of the Queensland Department of Agriculture & Fisheries (DAF). My work and the program was funded from the budgets of both federal and state governments. At the time I joined in 2024, both of these governments were Labor governments. Despite this I had been hired by a labour hire company and the entire program was run in this way. Many hundreds of workers were on labour hire contracts. I found this strange under Labor governments. This is another example of how all governments, no matter their political colour, have been in thrall to neoliberalism since the early 1980s. Running government programs via private enterprises, which minimise worker’s rights by offering casual hourly rates for ostensibly full time jobs. Therefore, depriving workers of sick days, paid holidays and a host of other basic rights. Workers can be dismissed immediately without notice and knocked off when the weather doesn’t suit management. Union power is virtually non-existent within labour hire workforces. Welcome to Neoliberalism: Be free to pay forever. Neoliberal Labor Governments Governments of both persuasions love not being directly responsible for the performance of services and institutions. Being at one remove from the organisations running the operation gives these politicians the freedom to simply be mouth pieces for policies. Australian politicians have never been so highly paid in our history and actually do less real stuff than ever before. It is all piss and wind, served up in the media. Prime Minister would you like to comment … blah blah blah. This is why we have no social housing stocks any more. Why they spend tens of billions of dollars, tax payer dollars on private consultants who are not public servants and are not transparent or accountable, it seems. This generation of politicians are too scared to change the settings and probably glad not to be responsible for actually getting stuff done. “Neoliberalism is an old term, dating back to the 1930s, but it has been revived as a way of describing our current politics – or more precisely, the range of thought allowed by our politics. In the aftermath of the 2008 financial crisis, it was a way of assigning responsibility for the debacle, not to a political party per se, but to an establishment that had conceded its authority to the market. For the Democrats in the US and Labour in the UK, this concession was depicted as a grotesque betrayal of principle. Bill Clinton and Tony Blair, it was said, had abandoned the left’s traditional commitments, especially to workers, in favour of a global financial elite and the self-serving policies that enriched them; and in doing so, had enabled a sickening rise in inequality.” - (Stephen Metcalf, The Guardian, 2017)

Neoliberalism & Corruption Are Close Mates Neoliberalism is invariably accompanied by corruption, as business skirts onerous regulatory controls in the name of greater efficiency. Privatisation of services and institutions creates oligarchs and billionaires. The examples are everywhere in the US, Russia of course, and here at home. Jobs for the boys, inside running for mates to get tenders, and investors profiting from government decisions. The way Donald Trump wants to run things, where everything is for sale with no exceptions, will see endemic corruption flourish. The people who vote for this way of doing things do so in the hope that they will somehow get on the gravy train. And that the economy will grow on the back of unchecked greed and deregulated markets. Flattened tax rates, also, accompany neoliberal economic governments. The rich get much richer and the poor stay poor. We are in the midst of this already and have been for decades. The divide between the wealthy and everybody else has never been wider, it a chasm. Welcome to Neoliberalism: Be free to pay forever. I do not see any brave politicians on the horizon with the guts to change anything. The current crop are neoliberals themselves, as are all the economists with jobs working for the banks, the RBA, the IMF and so on. They all sing from the same song sheet, written for them by the Austrians and served up by Reagan and Thatcher. “The moniker “neoliberalism” was coined by Austrian economists Friedrich von Hayek and Ludwig Von Mises in 1938. Each elaborated his own version of the notion in 1944 books: “The Road to Serfdom” and “Bureaucracy,” respectively.” - (https://theconversation.com/what-is-neoliberalism-a-political-scientist-explains-the-use-and-evolution-of-the-term-184711 ) It was the economic and government demise of the lasting appeal of the New Deal. Roosevelt’s Keynesian cure to the Great Depression in the US.

Photo by Josh Withers on Pexels.com Generations of economists and government policy apparatchiks have grown up believing that governments should stay out of running things in the real world. Let the market take care of it – is the mantra. Well, the market has not taken care of housing in Australia, as people have been forced to live in tents for the last few years. The market cyclically gives us all high inflation and a cost of living crisis of which the only answer, according to central bankers is monetary policy and steeply rising interest rates. More punishment for the poorest of us all. These are tired old answers to very real concerns involving the lives of human beings. It seems we can be kind and helpful to citizens during a pandemic but not when economic forces turn the wheel of fortune – then it is all hands off the government levers and folk fending for themselves. Whilst the rich grow ever richer and the poor? You know the rest. Welcome to Neoliberalism. Bienvenida. Here in downtown Neoliberalis there is a new kind of freedom. You are free to pay for everything. User pays, you see. There are no evil socialist institutions, none left anyway. No universal healthcare. No social security, no welfare from the government. Indeed, we are doing away with the whole concept of government. Business can do it better. Business can do it cheaper and much more efficiently. Then, we don’t need public servants, do we? Non, monsieur. Only honest, salt of the earth billionaires to run the show. The leering face of Tony Abbott. The many lies of Scott Morrison. The mock innocent face of Alan Tudge and the Robodebt betrayal of the Australian people- half a million Aussies falsely accused of owing money to Centrelink. These are the images and memories left by neoliberalism and its staunchest defenders of the faith. Trickledown effect? A bitter effluent that stinks and leaves a bad taste in the mouth. Lest we forget. Robert Sudha Hamilton is the author of America Matters: Pre-apocalyptic Posts & Essays in the Shadow of Trump. ©MidasWord

On sale products

Read the full article

0 notes

Text

Union Budget 2024 Industry impact: Life Sciences and Health Care

Key highlights

The following are the salient features of the pharma and life science sector:

A commitment to boost research and development.

Certain cancer drugs will be exempt from customs fees, and there will be a reduction in Basic Customs Duty (BCD) for some life-saving treatments, pharmaceuticals, and medical equipment.

The removal of the angel tax is expected to provide a significant boost to the pharmaceutical start-up world.

Union Budget 2024 industry impact: Introduction

Union Finance Minister Nirmala Sitharaman presented the union budget on Tuesday, July 23rd. All eyes were keenly focused on the healthcare and pharma sectors, anticipating significant developments. However, no significant proposals were made, as expected by the industry leaders.

The Union Budget 2024-25 for the Pharma and Healthcare Industry did not fully meet the high expectations set for it. The Finance Minister addressed the government's increase in health expenditure from 1.4% of GDP in FY 19 to 2.1% of GDP in FY 23, but little else was covered.

The Interim Budget 2024–2025 introduced several significant healthcare initiatives. Notably, a new campaign was launched to promote immunisation against cervical cancer in girls aged 9 to 14, aimed at lowering the prevalence of this preventable disease.

The speech also discussed plans to establish new medical colleges in Bihar. It is also highlighted, exempting three crucial cancer drugs from custom duty and reducing duties on specific components used in medical X-ray tubes and digital detectors to boost domestic manufacturing capacity.

Healthcare Budget 2024 Policy priorities

In order to attain social justice, the government will provide education and health programs to all eligible individuals.

The government will create digital public infrastructure (DPI) apps for the general public to boost productivity, generate business opportunities, and promote innovation in the private sector. This initiative covers various sectors, including healthcare.

The government is committed to accelerating the integration of technology to drive the digital transformation of the economy across all sectors.

New medical colleges and sports infrastructure will be established in Bihar, demonstrating a significant investment in the region's educational and athletic facilities.

Budget 2024 Allocation to Life Sciences & health

The Union Health Ministry has been allotted a budget of Rs 90,658.63 crore in the interim Budget for the fiscal year 2024-2025. This Budget allocation reflects a substantial increase of 12.59 percent from the revised estimates of Rs 80,517.62 crore for the previous fiscal year 2023-2024.

Healthcare Budget 2024: Significant difference in treatment costs between private and public sectors

The 75th Round of the National Sample Survey highlighted a significant disparity in out-of-pocket treatment costs between public and private hospitals. In 2017-18, the average medical cost of hospitalisation was much lower in government hospitals compared to private hospitals, with both rural and urban areas showing substantial gaps. Additionally, the survey revealed that individuals financed a significant percentage of hospitalisation cases in both rural and urban areas through borrowings.

In budget 2024 healthcare sector, FM proposes changes in essential custom duty for X-ray devices

The Finance Minister, Nirmala Sitharaman, has proposed modifications to the fundamental customs duty for X-ray tubes and flat panel detectors utilised in medical X-ray machines. The alterations are in line with the gradual production plan and intend to coordinate with the increase in domestic capacity.

Customs duty exemptions for individuals with cancer

During her presentation on the Union Budget For Health Care Sector 2024, Finance Minister Nirmala Sitharaman proposed the complete exemption of three cancer treatment medications from basic customs duty.

Need to enhance expenditures in primary healthcare

The urgent need to increase investments in primary healthcare to improve health outcomes is highlighted, with a focus on the NHM setting targets for indicators such as Infant Mortality Rate (IMR) and prevalence of anaemia. The IMR target set by NHM is less than 25 per 1000 live births, but as of the latest data from the Sample Registration System in 2020, the IMR in India is analysed to be 28 per 1000 live births.

Anaemia is a crucial sign of women's nutrition and health as it can have serious negative effects on the health of both women and children. However, it can be tackled through primary healthcare. According to NFHS 2019-21, 53% of women aged 15 to 49 are affected by anaemia, which is significantly higher than the global rate of 30% for this age group.

Improvement required in the primary healthcare infrastructure

The primary healthcare system in India comprises Sub-Centres (SCs), Primary Healthcare Centres (PHCs), and Community Healthcare Centres (CHCs). However, there is a deficiency in the number of operational centres to effectively cover the population as per the Indian Public Health Standards (IPHS), 2022.

Conclusion

The Indian healthcare sector is experiencing rapid growth due to a combination of factors. These include an ageing population, the expanding middle class, an increase in lifestyle diseases, a greater focus on public-private partnerships, and the widespread adoption of digital technologies such as telemedicine. Additionally, there has been notable interest from investors and an influx of foreign direct investment (FDI) over the past two decades.

0 notes

Text

FUGITIVE ECONOMIC OFFENDERS (FEO) ORDINANCE, 2018 – APPREHEND THE DEFAULTERS

“The Fugitive Economic Offenders Ordinance, 2018”. was approved by the union cabinet and then promulgated by the President on April 21st, 2018. This ordinance is brought with a clearly defined approach in mind that is to make sure that no economic offender can leave the country and even if they leave their assets can be seized and confiscated by the government without any hiccups, for this reason, the ordinance vests many special powers to the courts and the directors.”

With the assent of the President of India, the Fugitive Economic Offenders (FEO) Ordinance, 2018 gets promulgated; the new law lays down the measure to empower Indian authorities to attach and confiscate the proceeds of crime associated with economic offenders and the properties of the economic offenders. The earlier legislation that empowered GoI to deal with economic offenders is largely an amalgamation of various laws, and is, therefore, riddled with procedural delays and loopholes.

These loopholes allowed big-ticket tax and loan defaulters to circumvent the law and delay, or indefinitely hold off, the confiscation of their assets against their debt. Moreover, laws such as the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (Sarfaesi) Act, 2002, the Recovery of Debts Due to Banks and Financial Institutions Act, 1993, and the Prevention of Money Laundering Act, 2002, conceptualize the attaching of assets as a punitive measure, rather than as a deterrent.

Need for Implementation of Ordinance

The need for the Ordinance had arisen as there have been many instances of economic offenders fleeing the jurisdiction of Indian courts, anticipating the commencement, or during the pendency, of criminal proceedings. The absence of such offenders from Indian courts has several deleterious consequences — first, it hampers investigation in criminal cases; second, it wastes precious time of courts of law, third, it undermines the rule of law in India. The existing civil and criminal provisions in law are not entirely adequate to deal with the severity of the problem. In view of the above context, a Budget announcement was made by the Government in the Budget 2017–18 that the Government was considering to introduce legislative changes or even a new law to confiscate the assets of such absconders till they submit to the jurisdiction of the appropriate legal forum. Pursuant to the above announcement, the Fugitive Economic Offenders Bill, 2018 was introduced in LokSabha on the 12th March, 2018. The Fugitive Economic Offenders Bill, 2018 was listed for…

Read more: https://www.acquisory.com/ArticleDetails/73/Fugitive-Economic-Offenders-(FEO)-Ordinance_-2018-%E2%80%93-Apprehend-The-Defaulters

0 notes

Text

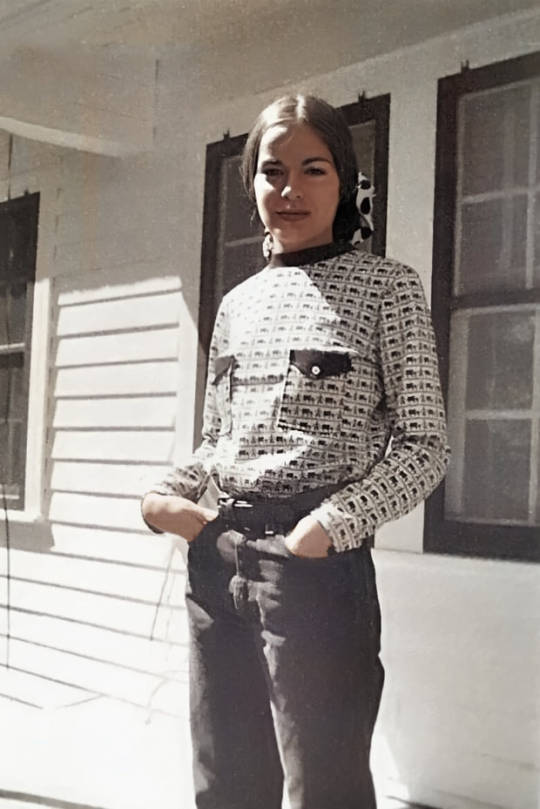

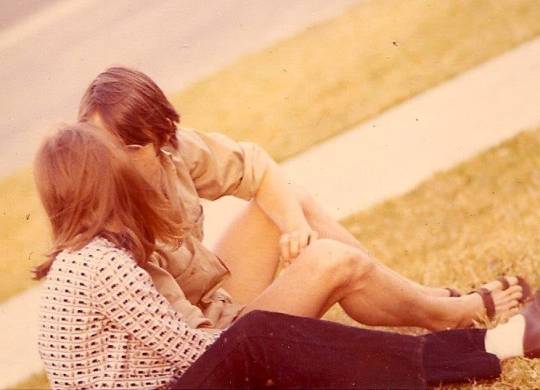

👄 Pam, The O'riginal Chainsaw Gal

Flower Child

March 1971 - when I was a free-spirited little hippie gal, all of 19. My boyfriend of 8 months, George, was taking my picture in front of the house he shared with Gunner Hansen. It was on Avenue G in Central Austin, near the UT campus. Gunner and I were sworn enemies. He was relentless in making sure I was left out while he and George went out to hunt chicks, drink beer, and smoke pot. George was quite easily encouraged in all three cases. After 13 months with philandering George, the incessant liar, I’d had my fill. I got out the back, Jack didn’t look in the rearview and happily lost track of both of them. George would try to talk to me on campus, but I was done. I’d taken the cure. Ah, love. Good riddance I said. I hoped.

This was two years and four months before Gunner’s and my paths would cross again. It was on July 18, 1973, the first day on the set where we were beginning filming what would become the cult horror classic, "The Texas Chainsaw Massacre," 1974. The TCM cast, crew, producers, et all were gathered in Quick Hill, just outside Austin, Texas, at what would be called, “The Sawyer house”. It was located across a dirt road from what we came to think of as “the old Hardesty house”.

I was in for a big surprise that morning. Unbeknownst to either Gunner, or myself, we'd both been cast in this little non-union (aka ’scab’) local horror film, "HEADCHEESE”, a working title. I was standing outside the Sawyer house on that muggy, hot Texas morning, chit-chatting with my acting colleagues, ‘Sally’, ‘Kirk’, ‘Jerry’, and ‘Franklin’ (you know them). We were getting to know one another. We were all dressed in our costumes, all our own clothes that they’d picked out from different outfits we’d brought from home for them to choose from, for us to wear in the film, a strictly low-budget affair. Nearby, parked in the yard of the Sawyer house, was the Vortex RV/trailer/office, a no frills, no AC job, where we were soon to sign our first contracts. Everyone was pretty excited and a bit lost.

Producer-writer, Kim Henkel, stuck his head out the open RV door and excitedly called over to me, “Hey, Teri!! Come over here! I want to introduce you to 'Leatherface!” OK, I’m ready. Kim seemed thrilled, proud as punch for us to meet. As I stepped inside, I made my way down the narrow aisle, walking toward a very large figure, a man with a head full of brown curly hair, who was sitting with his back to me. He took up one of the two banquette seats. Someone was seated across from him, but I can’t remember who. As I got even with him, I noted he was almost as tall sitting down as I was standing up. This guy was big. I was feeling an eery sense of deja vu. Kim said, “Leatherface, meet Pam!” Ta-da! He turned toward me and cocked his head to look at me, both of us prepared to say, “Hey, nice to meet ya!!” Instead, we both looked at one another in sheer horror. We each jerked back with our mouths wide open. Simultaneously, we both blurted out, "WHAT ARE YOU DOING HERE??!!!” They call them "excited utterances."

Well, we got through the moment, gathered our wits, quickly cooled our heels, and shared little with those around us. (Ai-yi-yi!! What have I gotten myself into? ) Toward the end of the day, on a break, we had coffee together. Turns out, George and Gunner had had a falling out. George had parted the G-Avenue house owing Gunner money, just as good ol’ George had also owed me money when we’d parted. Gunn and I buried the proverbial hatchet and the rest, my friends, is history.

Rest In Peace

Gunnar Hansen 1947-2015

George 1945-2017

**Thanks to my friend Eric Goode for the cleanup and colorization on these 50-year-old B&W photos.

Teeny-Tiny Addendum - It would be grossly unfair to posterity not to list GRWB’s many good qualities. Gunner would want me to do that. Over the years, they managed to reconcile. In 2012 Gunner invited me to meet him at El Mercado in S Austin, to interview me for his book. At the end, he asked if I ever talked to George, and had a few choice tidbits to tell me… but that’s a whole other story!

GB and I moved back in together after he moved from Ave G, however he never told me why he left Ave G and Gunner, or even that they’d had a falling out. He could be sneaky! All I knew was that I didn’t have to ever see my sworn mortal enemy, Gunner Dang Hansen, ever again! Pretty sure GB moved out at the end of the spring semester of ’71, (after that picture above taken of me at their house). Then, we moved back in together (again!) to a cool house in Tarrytown in Austin.

George was charming, imaginative, smart, witty, spontaneous, creative, LOVED good music, laughing, and was often thoughtful, kind, crazy/wild, very sweet, positive, complimentary, expert at apologizing, remorseful, loving, adventurous, a true dreamer. We had electric chemistry and loads of fun times together. We went to Willie’s first picnic together in ’71. I believe we broke up 13 times in 12 months, usually getting back together within 48 hours. Incredibly talented, and, he had an absolute genius for finding new places for us to live. #credit

Thanks for reading.

Sending love to all. Posted on Pam's FB page: Saturday, 6 PM, January 22, 2022. Fair to Midland, partly cloudy, clear skies ahead.

#thecircuitousrouteissometimesbest #lifeislong

#lifeisshort

3 notes

·

View notes

Text

[[VOSTFR]] Raya et le dernier dragon Streaming vf gratuit

Regarder Raya et le dernier dragon en streaming vf 100% gratuit, voir le film complet en français et en bonne qualité.

### Voir Raya et le dernier dragon en streaming version française directement sur Films VF . Film gratuit en streaming

### Regarder Raya et le dernier dragon en streaming vf 100% gratuit, voir le film complet en français et en bonne qualité.

Regarder {Raya et le dernier dragon} 2021 Streaming VF Complet en Film FR

Raya et le dernier dragon Et de cette façon, j’aime tout. {~ HD] !Film>Streaming vf ## Voir!! Raya et le dernier dragon streaming vf :: 2021 }}

Regarder un film ~ Raya et le dernier dragon “”” Film Complet”” 2021 [STREAMING VF] ~ Gratuitement

####Voir film complet sous-titre français@@@ 2021

image Raya et le dernier dragon film complet gratuit en Français REGARDER ▶️▶️ http://flixfrance.site/fr/movie/527774/raya-and-the-last-dragon

Télécharger ▶️▶️ http://flixfrance.site/fr/movie/527774/raya-and-the-last-dragon

SYNOPSIS ET DÉTAILS Bruce Wayne est déterminé à faire en sorte que le sacrifice ultime de Superman ne soit pas vain; pour cela, avec l'aide de Diana Prince, il met en place un plan pour recruter une équipe de métahumains afin de protéger le monde d'une menace apocalyptique imminente. La tâche s'avère plus difficile que Bruce ne l'imaginait, car chacune des recrues doit faire face aux démons de son passé et les surpasser pour se rassembler et former une ligue de héros sans précédent. Désormais unis, Batman, Wonder Woman, Aquaman, Cyborg et Flash réussiront-ils à sauver la planète de Steppenwolf, DeSaad, Darkseid et de leurs terribles intentions ?

18 mars 2021 / 4h 02min / Fantastique, Action, Aventure De Zack Snyder Avec Ben Affleck, Henry Cavill, Gal Gadot

Raya et le dernier dragon : tout ce qu’il faut savoir sur la nouvelle version du film Deux heures pour la version cinéma, quatre heures pour le Snyder Cut (découpé en six parties, plus un épilogue) : Justice League déborde sans surprise de scènes rajoutées, rallongées, modifiées, remontées, et bien sûr retirées. Beaucoup de mauvaises choses ont été coupées, beaucoup de scènes attendues (et vues dans la promo en 2017) sont revenues, et beaucoup d'éléments nouveaux rectifient le tir dans l'intrigue. De quoi transformer un film médiocre en grande réussite ? Non.

Zack Snyder et le studio n'ont pourtant pas lésiné sur les moyens pour recoller les morceaux (70 millions pour reprendre la post-production et tourner quelques nouvelles scènes, sur un budget estimé à 300 millions pour la version cinéma). Mais Raya et le dernier dragon garde les cicatrices d'une bataille perdue d'avance, et d'une défaite programmée. Entre le projet d'origine d'un Justice League en deux parties, et l'ambition affichée dans le Snyder Cut d'un univers étendu rangé depuis au placard, cette version longue devrait donner autant de raisons de se réjouir que de se lamenter.

Car tout n'a pas été sauvé dans le chantier de cette version longue, qui restera comme un cas d'école. L'intrigue des Boîtes-mères reste très plate, malgré un Steppenwolf moins transparent et débilos. Le scénario ne brille toujours pas par sa subtilité, malgré pas mal de problèmes réglés. Les personnages sont globalement sous-exploités, même si la réparation de Cyborg rééquilibre les choses. La direction artistique a été harmonisée, mais il y a des effets visuels et choix musicaux qui laissent songeurs. Il y a moins d'humour et plus de gravité, mais il y a encore des moments qui prêtent à sourire ou lever les yeux au ciel.

Raya et le dernier dragon est-il moins pire, ou véritablement mieux que Justice League version cinéma ? C'est la question qui plane sur ces quatre longues heures, et pas sûr que la réponse soit celle espérée.

QU’EST-CE QUE LA SNYDER CUT DE JUSTICE LEAGUE ? À l’origine de la Snyder Cut, on retrouve une campagne de lobbying orchestrée par des fans, et soutenue par les acteurs de Justice League pour obtenir réparation après la sortie en salle du film. En l’occurence : le Justice League tel que l’avait imaginé Zack Snyder, et pas celui rafistolé par Joss Whedon à la demande de Warner Bros.. Mieux, le réalisateur a obtenu une enveloppe de quelques millions de dollars pour tourner de nouvelles scènes et affirmer un peu plus sa vision (plus de 70 millions de dollars selon Screen Rant, soit un budget énorme pour une version Director’s Cut).

À l’origine, Raya et le dernier dragon devait être découpé en quatre portions d’une heure. Ce format a finalement été abandonné et c’est bien un (très) long métrage de quatre heures qui sera proposé aux spectateurs. Un record pour un film de superhéros.

QUELS SONT LES PRINCIPAUX CHANGEMENTS INTÉGRÉS PAR LA SNYDER CUT DE JUSTICE LEAGUE ? Les quelques images de Raya et le dernier dragon confirment qu’il n’aura rien à voir avec le Justice League original, hormis peut-être sur les bases de l’intrigue. La version de Joss Whedon aborde les enjeux avec un ton plus léger, là où Zack Snyder entend offrir un souffle divin, quasi mythologique, à l’alliance entre Batman, Superman, Wonder Woman, Flash, Cyborg et Aquaman. Le blockbuster sera plus sombre et plus violent, avec des affrontements qui devraient gagner en fureur et en intensité.

Autre changement de taille, Raya et le dernier dragon va intégrer l’antagoniste Darkseid à l’équation. Dans le Justice League de Joss Whedon, il est à peine mentionné et les superhéros doivent combattre Steppenwolf, un lieutenant d’Apokolips qui sera dans la version de Snyder aux côtés de DeSaad. Dans l’univers DC Comics, il n’est pas interdit de penser que Darkseid est l’équivalent de Thanos chez Marvel — c’est dire la tâche qui attend les justiciers.

Par ailleurs, l’intrigue devrait se recentrer sur certains personnages très mal mis en avant. Par exemple, Cyborg sera beaucoup plus important dans l’histoire.

CRI DU CŒUR Raya et le dernier dragon démarre sur un cri de douleur qui résonne à travers la planète : celui de Superman à la fin de Batman v Superman : L’Aube de la justice. Cette vague donne la première note mélancolique d'un film qui, cette fois, assume plus simplement la noirceur de la situation. L'Homme d'Acier a disparu et avec lui, une certaine idée de l'espoir s'est envolée. Ce désespoir ronge Lois et Martha, motive Bruce à réparer ses erreurs, et ouvre une brèche pour Steppenwolf : sans kryptonien à l'horizon, sans union entre les peuples et les héros, l'émissaire de Darkseid a un boulevard pour terrasser la Terre.

Dans les meilleurs moments, Zack Snyder s'attarde sur la tristesse de ce monde. Dans un simple effet de montage qui relie un chant islandais mélancolique à un silence de Martha, ou dans un frisson collectif lorsque le plan des méchants touche à sa funeste fin, il installe un univers entier, et connecte des points un peu partout sur le globe pour créer une symphonie entre ces personnages, humains ou surhumains. C'est la solitude qui les relie (ils sont tous orphelins ou presque, au fond), et c'est elle qui doit être vaincue pour affronter Steppenwolf (les inévitables tensions dans le groupe, malheureusement à peine plus creusées ici).

Si la durée de ce Snyder Cut pourra largement être remise en question, elle permet ainsi une chose trop rare dans ce type de programme : s'arrêter sur des regards et des visages, pour laisser un peu d'espace aux silences.

Au jeu des bonus, Cyborg est évidemment le grand gagnant de la version longue. De carrosserie de luxe encombrante, il passe à personnage à part entière, avec un passé, un présent et un futur contrarié. Au-delà du flashback attendu sur le terrain de football sous la neige, Victor Stone gagne une dimension humaine grâce à sa rage et sa douleur. L'étendue dangereuse de ses pouvoirs est explicitée, tout comme sa relation avec son père.

Et Silas Stone, incarné par Joe Morton, est largement remis sur le devant de la scène dans le Snyder Cut : le père du héros a un rôle majeur dans l'intrigue, ce qui permet de rectifier au moins une aberration de la version cinéma.

Steppenwolf est l'autre vainqueur de la version longue. Le vilain n'a pas simplement gagné un relooking ferrailleux pour habiller sa tronche de cake à moitié cuit (qui reste bien là) : il a désormais une identité, et une autre dimension que celle du guignol de série B, avec même quelques babioles pour avoir plus de caractère. L'oncle de Darkseid dans les comics est encore trop générique pour marquer les mémoires, mais il a au moins une raison d'exister dans Justice League. Il gagne des motivations plus personnelles (qui passent largement par des conférences Zoom avec la dimension des enfers), et a droit à un climax digne de ce nom pour remplacer l'odieux sketch de la version cinéma.

Du côté des héros Batman, Wonder Woman et Aquaman, rien de très notable hormis quelques répliques nouvelles. Flash a droit à des changements plus notables, et pas juste avec le personnage d'Iris, interprété par Kiersey Clemons : pas mal de petites choses qui accentuaient son inexpérience ont été retirées, et surtout il a un rôle différent dans plusieurs moments-clés.

Superman, lui, devra se contenter d'un lissage. Hormis son joli costume noir, le super-héros reste en arrière-plan, et bénéficie surtout de quelques mauvaises scènes en moins. Plus sobre, plus simple, plus efficace.

L'HISTOIRE SANS FINESSE Mais même rafistolé avec des rustines de tous les côtés, le scénario reste un problème. Cette histoire de Boîtes-mères que les héros doivent protéger, et que les méchants doivent voler, avance sur un chemin trop classique et tranquille pour réellement emballer. Malgré quelques gros changements et ajouts (notamment dans le climax), cette partie de l'aventure reste la moins excitante. La formule a les mêmes limites qu'avec Avengers : Infinity War (les gentils veulent protéger les Pierres d'infinité, Thanos veut les récupérer).

Entre ces étapes, Zack Snyder empile les scènes autour des héros : Aquaman célébré par la population locale, Barry qui sauve Iris, Mera qui se défend bien contre Steppenwolf, ou encore l'apparition d'un autre super-héros classique de DC. Mais trop souvent, il y a la sensation que tout ça ne sert pas le film dans sa globalité. Comme si ces parties étaient d'abord des bonus et des cadeaux (plus d'action, plus sur les personnages, plus de visions apocalyptiques), avant d'être les parties d'un récit.

Zack Snyder abuse en plus des flashbacks, posés comme de gros pavés dans le film. Un long cours d'histoire de Diana à Bruce avec une voix off théâtrale, un long flashback sur le passé de Victor et un autre sur les origines d'une Boîte-mère offrent une foule de détails et d'images fortes, mais sans toujours servir le dessein global. Que le film montre deux accidents de voiture, aussi ordinaires l'un que l'autre, donne l'impression que les parties ont été collées les unes après les autres, et rien de plus.

Ce sentiment de non-harmonie est accentué (ou assumé) par le découpage en chapitre, mais aussi par l'humour. Car Joss Whedon ou pas, Justice League a une part de légèreté particulièrement lourde. Barry qui va déposer un CV et récupère une saucisse en plein moment héroïque, Bruce qui frôle la main de Diana en prenant la souris de son super-ordi, Alfred qui panique en voyant Diana se préparer un thé, le scientifique qui raconte une blague sur son érection le soir du bal de promo, sans oublier un paquet de répliques gardées de la version cinéma (notamment avec Flash) : la drôlerie est en place, souvent pour le pire - et parfois dans des endroits inattendus, comme avec un placement de produit Mercedes quasi parodique.

Enfin, le film n'évite pas les pires écueils du genre. Plusieurs personnages ont des problèmes avec papa ou maman lourdement explicités pour leur donner un peu de consistances, et beaucoup de scènes sont écrites à la truelle (notamment la niaiserie de Wonder Woman et la colère “Fuck the world” de Cyborg). Réécrit ou pas, Justice League reste globalement dans le moyen.

Mots clés : Raya et le dernier dragon Raya et le dernier dragon france Raya et le dernier dragon date de sortie Raya et le dernier dragon stream Raya et le dernier dragon blu ray Raya et le dernier dragon itunes Raya et le dernier dragon download Raya et le dernier dragon amazon prime Raya et le dernier dragon 4 3 Raya et le dernier dragon review Raya et le dernier dragon 2021 Raya et le dernier dragon srt Raya et le dernier dragon vf Raya et le dernier dragon critique Raya et le dernier dragon bande annonce Raya et le dernier dragon actrice Raya et le dernier dragon avis Raya et le dernier dragon rotten tomatoes Raya et le dernier dragon streaming vf Raya et le dernier dragon casting Raya et le dernier dragon synopsis Raya et le dernier dragon acteur Raya et le dernier dragon cast Raya et le dernier dragon release date Raya et le dernier dragon film complet Raya et le dernier dragon film complet en français

1 note

·

View note

Text

[FILM=COMPLET] Promising Young Woman (!2021'Film!) en Version Français

### Voir Promising Young Woman en streaming version française directement sur Films VF . Film gratuit en streaming

### Regarder Promising Young Woman en streaming vf 100% gratuit, voir le film complet en français et en bonne qualité.

Regarder {Promising Young Woman} 2021 Streaming VF Complet en Film FR

Promising Young Woman Et de cette façon, j’aime tout. {~ HD] !Film>Streaming vf ## Voir!! Promising Young Woman streaming vf :: 2021 }}

Regarder un film ~ Promising Young Woman “”” Film Complet”” 2021 [STREAMING VF] ~ Gratuitement

####Voir film complet sous-titre français@@@ 2021

Promising Young Woman film complet gratuit en Français

REGARDER ▶️▶️ https://metroflixs.com/en/movie/582014/promising-young-woman

Télécharger ▶️▶️ https://metroflixs.com/en/movie/582014/promising-young-woman

SYNOPSIS ET DÉTAILS

Bruce Wayne est déterminé à faire en sorte que le sacrifice ultime de Superman ne soit pas vain; pour cela, avec l'aide de Diana Prince, il met en place un plan pour recruter une équipe de métahumains afin de protéger le monde d'une menace apocalyptique imminente. La tâche s'avère plus difficile que Bruce ne l'imaginait, car chacune des recrues doit faire face aux démons de son passé et les surpasser pour se rassembler et former une ligue de héros sans précédent. Désormais unis, Batman, Wonder Woman, Aquaman, Cyborg et Flash réussiront-ils à sauver la planète de Steppenwolf, DeSaad, Darkseid et de leurs terribles intentions ?

18 mars 2021 / 4h 02min / Fantastique, Action, Aventure De Zack Snyder Avec Ben Affleck, Henry Cavill, Gal Gadot

Promising Young Woman : tout ce qu’il faut savoir sur la nouvelle version du film Deux heures pour la version cinéma, quatre heures pour le Snyder Cut (découpé en six parties, plus un épilogue) : Justice League déborde sans surprise de scènes rajoutées, rallongées, modifiées, remontées, et bien sûr retirées. Beaucoup de mauvaises choses ont été coupées, beaucoup de scènes attendues (et vues dans la promo en 2017) sont revenues, et beaucoup d'éléments nouveaux rectifient le tir dans l'intrigue. De quoi transformer un film médiocre en grande réussite ? Non.

Zack Snyder et le studio n'ont pourtant pas lésiné sur les moyens pour recoller les morceaux (70 millions pour reprendre la post-production et tourner quelques nouvelles scènes, sur un budget estimé à 300 millions pour la version cinéma). Mais Promising Young Woman garde les cicatrices d'une bataille perdue d'avance, et d'une défaite programmée. Entre le projet d'origine d'un Justice League en deux parties, et l'ambition affichée dans le Snyder Cut d'un univers étendu rangé depuis au placard, cette version longue devrait donner autant de raisons de se réjouir que de se lamenter.

Car tout n'a pas été sauvé dans le chantier de cette version longue, qui restera comme un cas d'école. L'intrigue des Boîtes-mères reste très plate, malgré un Steppenwolf moins transparent et débilos. Le scénario ne brille toujours pas par sa subtilité, malgré pas mal de problèmes réglés. Les personnages sont globalement sous-exploités, même si la réparation de Cyborg rééquilibre les choses. La direction artistique a été harmonisée, mais il y a des effets visuels et choix musicaux qui laissent songeurs. Il y a moins d'humour et plus de gravité, mais il y a encore des moments qui prêtent à sourire ou lever les yeux au ciel.

Promising Young Woman est-il moins pire, ou véritablement mieux que Justice League version cinéma ? C'est la question qui plane sur ces quatre longues heures, et pas sûr que la réponse soit celle espérée.

QU’EST-CE QUE LA SNYDER CUT DE JUSTICE LEAGUE ?

À l’origine de la Snyder Cut, on retrouve une campagne de lobbying orchestrée par des fans, et soutenue par les acteurs de Justice League pour obtenir réparation après la sortie en salle du film. En l’occurence : le Justice League tel que l’avait imaginé Zack Snyder, et pas celui rafistolé par Joss Whedon à la demande de Warner Bros.. Mieux, le réalisateur a obtenu une enveloppe de quelques millions de dollars pour tourner de nouvelles scènes et affirmer un peu plus sa vision (plus de 70 millions de dollars selon Screen Rant, soit un budget énorme pour une version Director’s Cut).

À l’origine, Promising Young Woman devait être découpé en quatre portions d’une heure. Ce format a finalement été abandonné et c’est bien un (très) long métrage de quatre heures qui sera proposé aux spectateurs. Un record pour un film de superhéros.

QUELS SONT LES PRINCIPAUX CHANGEMENTS INTÉGRÉS PAR LA SNYDER CUT DE JUSTICE LEAGUE ?

Les quelques images de Promising Young Woman confirment qu’il n’aura rien à voir avec le Justice League original, hormis peut-être sur les bases de l’intrigue. La version de Joss Whedon aborde les enjeux avec un ton plus léger, là où Zack Snyder entend offrir un souffle divin, quasi mythologique, à l’alliance entre Batman, Superman, Wonder Woman, Flash, Cyborg et Aquaman. Le blockbuster sera plus sombre et plus violent, avec des affrontements qui devraient gagner en fureur et en intensité.

Autre changement de taille, Promising Young Woman va intégrer l’antagoniste Darkseid à l’équation. Dans le Justice League de Joss Whedon, il est à peine mentionné et les superhéros doivent combattre Steppenwolf, un lieutenant d’Apokolips qui sera dans la version de Snyder aux côtés de DeSaad. Dans l’univers DC Comics, il n’est pas interdit de penser que Darkseid est l’équivalent de Thanos chez Marvel — c’est dire la tâche qui attend les justiciers.

Par ailleurs, l’intrigue devrait se recentrer sur certains personnages très mal mis en avant. Par exemple, Cyborg sera beaucoup plus important dans l’histoire.

CRI DU CŒUR

Promising Young Woman démarre sur un cri de douleur qui résonne à travers la planète : celui de Superman à la fin de Batman v Superman : L’Aube de la justice. Cette vague donne la première note mélancolique d'un film qui, cette fois, assume plus simplement la noirceur de la situation. L'Homme d'Acier a disparu et avec lui, une certaine idée de l'espoir s'est envolée. Ce désespoir ronge Lois et Martha, motive Bruce à réparer ses erreurs, et ouvre une brèche pour Steppenwolf : sans kryptonien à l'horizon, sans union entre les peuples et les héros, l'émissaire de Darkseid a un boulevard pour terrasser la Terre.

Dans les meilleurs moments, Zack Snyder s'attarde sur la tristesse de ce monde. Dans un simple effet de montage qui relie un chant islandais mélancolique à un silence de Martha, ou dans un frisson collectif lorsque le plan des méchants touche à sa funeste fin, il installe un univers entier, et connecte des points un peu partout sur le globe pour créer une symphonie entre ces personnages, humains ou surhumains. C'est la solitude qui les relie (ils sont tous orphelins ou presque, au fond), et c'est elle qui doit être vaincue pour affronter Steppenwolf (les inévitables tensions dans le groupe, malheureusement à peine plus creusées ici).

Si la durée de ce Snyder Cut pourra largement être remise en question, elle permet ainsi une chose trop rare dans ce type de programme : s'arrêter sur des regards et des visages, pour laisser un peu d'espace aux silences.

Au jeu des bonus, Cyborg est évidemment le grand gagnant de la version longue. De carrosserie de luxe encombrante, il passe à personnage à part entière, avec un passé, un présent et un futur contrarié. Au-delà du flashback attendu sur le terrain de football sous la neige, Victor Stone gagne une dimension humaine grâce à sa rage et sa douleur. L'étendue dangereuse de ses pouvoirs est explicitée, tout comme sa relation avec son père.

Et Silas Stone, incarné par Joe Morton, est largement remis sur le devant de la scène dans le Snyder Cut : le père du héros a un rôle majeur dans l'intrigue, ce qui permet de rectifier au moins une aberration de la version cinéma.

Steppenwolf est l'autre vainqueur de la version longue. Le vilain n'a pas simplement gagné un relooking ferrailleux pour habiller sa tronche de cake à moitié cuit (qui reste bien là) : il a désormais une identité, et une autre dimension que celle du guignol de série B, avec même quelques babioles pour avoir plus de caractère. L'oncle de Darkseid dans les comics est encore trop générique pour marquer les mémoires, mais il a au moins une raison d'exister dans Justice League. Il gagne des motivations plus personnelles (qui passent largement par des conférences Zoom avec la dimension des enfers), et a droit à un climax digne de ce nom pour remplacer l'odieux sketch de la version cinéma.

Du côté des héros Batman, Wonder Woman et Aquaman, rien de très notable hormis quelques répliques nouvelles. Flash a droit à des changements plus notables, et pas juste avec le personnage d'Iris, interprété par Kiersey Clemons : pas mal de petites choses qui accentuaient son inexpérience ont été retirées, et surtout il a un rôle différent dans plusieurs moments-clés.

Superman, lui, devra se contenter d'un lissage. Hormis son joli costume noir, le super-héros reste en arrière-plan, et bénéficie surtout de quelques mauvaises scènes en moins. Plus sobre, plus simple, plus efficace.

L'HISTOIRE SANS FINESSE Mais même rafistolé avec des rustines de tous les côtés, le scénario reste un problème. Cette histoire de Boîtes-mères que les héros doivent protéger, et que les méchants doivent voler, avance sur un chemin trop classique et tranquille pour réellement emballer. Malgré quelques gros changements et ajouts (notamment dans le climax), cette partie de l'aventure reste la moins excitante. La formule a les mêmes limites qu'avec Avengers : Infinity War (les gentils veulent protéger les Pierres d'infinité, Thanos veut les récupérer).

Entre ces étapes, Zack Snyder empile les scènes autour des héros : Aquaman célébré par la population locale, Barry qui sauve Iris, Mera qui se défend bien contre Steppenwolf, ou encore l'apparition d'un autre super-héros classique de DC. Mais trop souvent, il y a la sensation que tout ça ne sert pas le film dans sa globalité. Comme si ces parties étaient d'abord des bonus et des cadeaux (plus d'action, plus sur les personnages, plus de visions apocalyptiques), avant d'être les parties d'un récit.

Zack Snyder abuse en plus des flashbacks, posés comme de gros pavés dans le film. Un long cours d'histoire de Diana à Bruce avec une voix off théâtrale, un long flashback sur le passé de Victor et un autre sur les origines d'une Boîte-mère offrent une foule de détails et d'images fortes, mais sans toujours servir le dessein global. Que le film montre deux accidents de voiture, aussi ordinaires l'un que l'autre, donne l'impression que les parties ont été collées les unes après les autres, et rien de plus.

Ce sentiment de non-harmonie est accentué (ou assumé) par le découpage en chapitre, mais aussi par l'humour. Car Joss Whedon ou pas, Justice League a une part de légèreté particulièrement lourde. Barry qui va déposer un CV et récupère une saucisse en plein moment héroïque, Bruce qui frôle la main de Diana en prenant la souris de son super-ordi, Alfred qui panique en voyant Diana se préparer un thé, le scientifique qui raconte une blague sur son érection le soir du bal de promo, sans oublier un paquet de répliques gardées de la version cinéma (notamment avec Flash) : la drôlerie est en place, souvent pour le pire - et parfois dans des endroits inattendus, comme avec un placement de produit Mercedes quasi parodique.

Enfin, le film n'évite pas les pires écueils du genre. Plusieurs personnages ont des problèmes avec papa ou maman lourdement explicités pour leur donner un peu de consistances, et beaucoup de scènes sont écrites à la truelle (notamment la niaiserie de Wonder Woman et la colère “Fuck the world” de Cyborg). Réécrit ou pas, Justice League reste globalement dans le moyen.

Mots clés :

Promising Young Woman Promising Young Woman france Promising Young Woman date de sortie Promising Young Woman stream Promising Young Woman blu ray Promising Young Woman itunes Promising Young Woman download Promising Young Woman amazon prime Promising Young Woman 4 3 Promising Young Woman review Promising Young Woman 2021 Promising Young Woman srt Promising Young Woman vf Promising Young Woman critique Promising Young Woman bande annonce Promising Young Woman actrice Promising Young Woman avis Promising Young Woman rotten tomatoes Promising Young Woman streaming vf Promising Young Woman casting Promising Young Woman synopsis Promising Young Woman acteur Promising Young Woman cast Promising Young Woman release date Promising Young Woman film complet Promising Young Woman film complet en français

#Promising Young Woman Francais Version#Promising Young Woman Streaming VF#Promising Young Woman Film en Complet

1 note

·

View note

Text

[FILM=COMPLET] Envole-moi (!2021'Film!) en Version Français

### Voir Envole-moi en streaming version française directement sur Films VF . Film gratuit en streaming

### Regarder Envole-moi en streaming vf 100% gratuit, voir le film complet en français et en bonne qualité.

Regarder {Envole-moi} 2021 Streaming VF Complet en Film FR

Envole-moi Et de cette façon, j’aime tout. {~ HD] !Film>Streaming vf ## Voir!! Envole-moi streaming vf :: 2021 }}

Regarder un film ~ Envole-moi “”” Film Complet”” 2021 [STREAMING VF] ~ Gratuitement

####Voir film complet sous-titre français@@@ 2021

Envole-moi film complet gratuit en Français

REGARDER ▶️▶️ https://metroflixs.com/en/movie/783558/envole-moi

Télécharger ▶️▶️ https://metroflixs.com/en/movie/783558/envole-moi

SYNOPSIS ET DÉTAILS

Bruce Wayne est déterminé à faire en sorte que le sacrifice ultime de Superman ne soit pas vain; pour cela, avec l'aide de Diana Prince, il met en place un plan pour recruter une équipe de métahumains afin de protéger le monde d'une menace apocalyptique imminente. La tâche s'avère plus difficile que Bruce ne l'imaginait, car chacune des recrues doit faire face aux démons de son passé et les surpasser pour se rassembler et former une ligue de héros sans précédent. Désormais unis, Batman, Wonder Woman, Aquaman, Cyborg et Flash réussiront-ils à sauver la planète de Steppenwolf, DeSaad, Darkseid et de leurs terribles intentions ?

18 mars 2021 / 4h 02min / Fantastique, Action, Aventure De Zack Snyder Avec Ben Affleck, Henry Cavill, Gal Gadot

Envole-moi : tout ce qu’il faut savoir sur la nouvelle version du film Deux heures pour la version cinéma, quatre heures pour le Snyder Cut (découpé en six parties, plus un épilogue) : Justice League déborde sans surprise de scènes rajoutées, rallongées, modifiées, remontées, et bien sûr retirées. Beaucoup de mauvaises choses ont été coupées, beaucoup de scènes attendues (et vues dans la promo en 2017) sont revenues, et beaucoup d'éléments nouveaux rectifient le tir dans l'intrigue. De quoi transformer un film médiocre en grande réussite ? Non.

Zack Snyder et le studio n'ont pourtant pas lésiné sur les moyens pour recoller les morceaux (70 millions pour reprendre la post-production et tourner quelques nouvelles scènes, sur un budget estimé à 300 millions pour la version cinéma). Mais Envole-moi garde les cicatrices d'une bataille perdue d'avance, et d'une défaite programmée. Entre le projet d'origine d'un Justice League en deux parties, et l'ambition affichée dans le Snyder Cut d'un univers étendu rangé depuis au placard, cette version longue devrait donner autant de raisons de se réjouir que de se lamenter.

Car tout n'a pas été sauvé dans le chantier de cette version longue, qui restera comme un cas d'école. L'intrigue des Boîtes-mères reste très plate, malgré un Steppenwolf moins transparent et débilos. Le scénario ne brille toujours pas par sa subtilité, malgré pas mal de problèmes réglés. Les personnages sont globalement sous-exploités, même si la réparation de Cyborg rééquilibre les choses. La direction artistique a été harmonisée, mais il y a des effets visuels et choix musicaux qui laissent songeurs. Il y a moins d'humour et plus de gravité, mais il y a encore des moments qui prêtent à sourire ou lever les yeux au ciel.

Envole-moi est-il moins pire, ou véritablement mieux que Justice League version cinéma ? C'est la question qui plane sur ces quatre longues heures, et pas sûr que la réponse soit celle espérée.

QU’EST-CE QUE LA SNYDER CUT DE JUSTICE LEAGUE ?

À l’origine de la Snyder Cut, on retrouve une campagne de lobbying orchestrée par des fans, et soutenue par les acteurs de Justice League pour obtenir réparation après la sortie en salle du film. En l’occurence : le Justice League tel que l’avait imaginé Zack Snyder, et pas celui rafistolé par Joss Whedon à la demande de Warner Bros.. Mieux, le réalisateur a obtenu une enveloppe de quelques millions de dollars pour tourner de nouvelles scènes et affirmer un peu plus sa vision (plus de 70 millions de dollars selon Screen Rant, soit un budget énorme pour une version Director’s Cut).

À l’origine, Envole-moi devait être découpé en quatre portions d’une heure. Ce format a finalement été abandonné et c’est bien un (très) long métrage de quatre heures qui sera proposé aux spectateurs. Un record pour un film de superhéros.

QUELS SONT LES PRINCIPAUX CHANGEMENTS INTÉGRÉS PAR LA SNYDER CUT DE JUSTICE LEAGUE ?

Les quelques images de Envole-moi confirment qu’il n’aura rien à voir avec le Justice League original, hormis peut-être sur les bases de l’intrigue. La version de Joss Whedon aborde les enjeux avec un ton plus léger, là où Zack Snyder entend offrir un souffle divin, quasi mythologique, à l’alliance entre Batman, Superman, Wonder Woman, Flash, Cyborg et Aquaman. Le blockbuster sera plus sombre et plus violent, avec des affrontements qui devraient gagner en fureur et en intensité.

Autre changement de taille, Envole-moi va intégrer l’antagoniste Darkseid à l’équation. Dans le Justice League de Joss Whedon, il est à peine mentionné et les superhéros doivent combattre Steppenwolf, un lieutenant d’Apokolips qui sera dans la version de Snyder aux côtés de DeSaad. Dans l’univers DC Comics, il n’est pas interdit de penser que Darkseid est l’équivalent de Thanos chez Marvel — c’est dire la tâche qui attend les justiciers.

Par ailleurs, l’intrigue devrait se recentrer sur certains personnages très mal mis en avant. Par exemple, Cyborg sera beaucoup plus important dans l’histoire.

CRI DU CŒUR

Envole-moi démarre sur un cri de douleur qui résonne à travers la planète : celui de Superman à la fin de Batman v Superman : L’Aube de la justice. Cette vague donne la première note mélancolique d'un film qui, cette fois, assume plus simplement la noirceur de la situation. L'Homme d'Acier a disparu et avec lui, une certaine idée de l'espoir s'est envolée. Ce désespoir ronge Lois et Martha, motive Bruce à réparer ses erreurs, et ouvre une brèche pour Steppenwolf : sans kryptonien à l'horizon, sans union entre les peuples et les héros, l'émissaire de Darkseid a un boulevard pour terrasser la Terre.

Dans les meilleurs moments, Zack Snyder s'attarde sur la tristesse de ce monde. Dans un simple effet de montage qui relie un chant islandais mélancolique à un silence de Martha, ou dans un frisson collectif lorsque le plan des méchants touche à sa funeste fin, il installe un univers entier, et connecte des points un peu partout sur le globe pour créer une symphonie entre ces personnages, humains ou surhumains. C'est la solitude qui les relie (ils sont tous orphelins ou presque, au fond), et c'est elle qui doit être vaincue pour affronter Steppenwolf (les inévitables tensions dans le groupe, malheureusement à peine plus creusées ici).

Si la durée de ce Snyder Cut pourra largement être remise en question, elle permet ainsi une chose trop rare dans ce type de programme : s'arrêter sur des regards et des visages, pour laisser un peu d'espace aux silences.

Au jeu des bonus, Cyborg est évidemment le grand gagnant de la version longue. De carrosserie de luxe encombrante, il passe à personnage à part entière, avec un passé, un présent et un futur contrarié. Au-delà du flashback attendu sur le terrain de football sous la neige, Victor Stone gagne une dimension humaine grâce à sa rage et sa douleur. L'étendue dangereuse de ses pouvoirs est explicitée, tout comme sa relation avec son père.

Et Silas Stone, incarné par Joe Morton, est largement remis sur le devant de la scène dans le Snyder Cut : le père du héros a un rôle majeur dans l'intrigue, ce qui permet de rectifier au moins une aberration de la version cinéma.

Steppenwolf est l'autre vainqueur de la version longue. Le vilain n'a pas simplement gagné un relooking ferrailleux pour habiller sa tronche de cake à moitié cuit (qui reste bien là) : il a désormais une identité, et une autre dimension que celle du guignol de série B, avec même quelques babioles pour avoir plus de caractère. L'oncle de Darkseid dans les comics est encore trop générique pour marquer les mémoires, mais il a au moins une raison d'exister dans Justice League. Il gagne des motivations plus personnelles (qui passent largement par des conférences Zoom avec la dimension des enfers), et a droit à un climax digne de ce nom pour remplacer l'odieux sketch de la version cinéma.

Du côté des héros Batman, Wonder Woman et Aquaman, rien de très notable hormis quelques répliques nouvelles. Flash a droit à des changements plus notables, et pas juste avec le personnage d'Iris, interprété par Kiersey Clemons : pas mal de petites choses qui accentuaient son inexpérience ont été retirées, et surtout il a un rôle différent dans plusieurs moments-clés.

Superman, lui, devra se contenter d'un lissage. Hormis son joli costume noir, le super-héros reste en arrière-plan, et bénéficie surtout de quelques mauvaises scènes en moins. Plus sobre, plus simple, plus efficace.

L'HISTOIRE SANS FINESSE

Mais même rafistolé avec des rustines de tous les côtés, le scénario reste un problème. Cette histoire de Boîtes-mères que les héros doivent protéger, et que les méchants doivent voler, avance sur un chemin trop classique et tranquille pour réellement emballer. Malgré quelques gros changements et ajouts (notamment dans le climax), cette partie de l'aventure reste la moins excitante. La formule a les mêmes limites qu'avec Avengers : Infinity War (les gentils veulent protéger les Pierres d'infinité, Thanos veut les récupérer).

Entre ces étapes, Zack Snyder empile les scènes autour des héros : Aquaman célébré par la population locale, Barry qui sauve Iris, Mera qui se défend bien contre Steppenwolf, ou encore l'apparition d'un autre super-héros classique de DC. Mais trop souvent, il y a la sensation que tout ça ne sert pas le film dans sa globalité. Comme si ces parties étaient d'abord des bonus et des cadeaux (plus d'action, plus sur les personnages, plus de visions apocalyptiques), avant d'être les parties d'un récit.

Zack Snyder abuse en plus des flashbacks, posés comme de gros pavés dans le film. Un long cours d'histoire de Diana à Bruce avec une voix off théâtrale, un long flashback sur le passé de Victor et un autre sur les origines d'une Boîte-mère offrent une foule de détails et d'images fortes, mais sans toujours servir le dessein global. Que le film montre deux accidents de voiture, aussi ordinaires l'un que l'autre, donne l'impression que les parties ont été collées les unes après les autres, et rien de plus.

Ce sentiment de non-harmonie est accentué (ou assumé) par le découpage en chapitre, mais aussi par l'humour. Car Joss Whedon ou pas, Justice League a une part de légèreté particulièrement lourde. Barry qui va déposer un CV et récupère une saucisse en plein moment héroïque, Bruce qui frôle la main de Diana en prenant la souris de son super-ordi, Alfred qui panique en voyant Diana se préparer un thé, le scientifique qui raconte une blague sur son érection le soir du bal de promo, sans oublier un paquet de répliques gardées de la version cinéma (notamment avec Flash) : la drôlerie est en place, souvent pour le pire - et parfois dans des endroits inattendus, comme avec un placement de produit Mercedes quasi parodique.

Enfin, le film n'évite pas les pires écueils du genre. Plusieurs personnages ont des problèmes avec papa ou maman lourdement explicités pour leur donner un peu de consistances, et beaucoup de scènes sont écrites à la truelle (notamment la niaiserie de Wonder Woman et la colère “Fuck the world” de Cyborg). Réécrit ou pas, Justice League reste globalement dans le moyen.

Mots clés :

Envole-moi Envole-moi france Envole-moi date de sortie Envole-moi stream Envole-moi blu ray Envole-moi itunes Envole-moi download Envole-moi amazon prime Envole-moi 4 3 Envole-moi review Envole-moi 2021 Envole-moi srt Envole-moi vf Envole-moi critique Envole-moi bande annonce Envole-moi actrice Envole-moi avis Envole-moi rotten tomatoes Envole-moi streaming vf Envole-moi casting Envole-moi synopsis Envole-moi acteur Envole-moi cast Envole-moi release date Envole-moi film complet Envole-moi film complet en français

#Envole-moi Francais version#Envole-moi Streaming VF#Envole-moi Streaming#Envole-moi Film en Complet

1 note

·

View note

Text

[FILM=COMPLET] Mangrove (!2021'Film!) en Version Français

### Voir Mangrove en streaming version française directement sur Films VF . Film gratuit en streaming

### Regarder Mangrove en streaming vf 100% gratuit, voir le film complet en français et en bonne qualité.

Regarder {Mangrove} 2021 Streaming VF Complet en Film FR

Mangrove Et de cette façon, j’aime tout. {~ HD] !Film>Streaming vf ## Voir!! Mangrove streaming vf :: 2021 }}

Regarder un film ~ Mangrove “”” Film Complet”” 2021 [STREAMING VF] ~ Gratuitement

####Voir film complet sous-titre français@@@ 2021

Mangrove film complet gratuit en Français

REGARDER ▶️▶️ https://metroflixs.com/en/movie/789344/mangrove

Télécharger ▶️▶️ https://metroflixs.com/en/movie/789344/mangrove

SYNOPSIS ET DÉTAILS

Bruce Wayne est déterminé à faire en sorte que le sacrifice ultime de Superman ne soit pas vain; pour cela, avec l'aide de Diana Prince, il met en place un plan pour recruter une équipe de métahumains afin de protéger le monde d'une menace apocalyptique imminente. La tâche s'avère plus difficile que Bruce ne l'imaginait, car chacune des recrues doit faire face aux démons de son passé et les surpasser pour se rassembler et former une ligue de héros sans précédent. Désormais unis, Batman, Wonder Woman, Aquaman, Cyborg et Flash réussiront-ils à sauver la planète de Steppenwolf, DeSaad, Darkseid et de leurs terribles intentions ?

18 mars 2021 / 4h 02min / Fantastique, Action, Aventure De Zack Snyder Avec Ben Affleck, Henry Cavill, Gal Gadot

Mangrove : tout ce qu’il faut savoir sur la nouvelle version du film Deux heures pour la version cinéma, quatre heures pour le Snyder Cut (découpé en six parties, plus un épilogue) : Justice League déborde sans surprise de scènes rajoutées, rallongées, modifiées, remontées, et bien sûr retirées. Beaucoup de mauvaises choses ont été coupées, beaucoup de scènes attendues (et vues dans la promo en 2017) sont revenues, et beaucoup d'éléments nouveaux rectifient le tir dans l'intrigue. De quoi transformer un film médiocre en grande réussite ? Non.

Zack Snyder et le studio n'ont pourtant pas lésiné sur les moyens pour recoller les morceaux (70 millions pour reprendre la post-production et tourner quelques nouvelles scènes, sur un budget estimé à 300 millions pour la version cinéma). Mais Mangrove garde les cicatrices d'une bataille perdue d'avance, et d'une défaite programmée. Entre le projet d'origine d'un Justice League en deux parties, et l'ambition affichée dans le Snyder Cut d'un univers étendu rangé depuis au placard, cette version longue devrait donner autant de raisons de se réjouir que de se lamenter.

Car tout n'a pas été sauvé dans le chantier de cette version longue, qui restera comme un cas d'école. L'intrigue des Boîtes-mères reste très plate, malgré un Steppenwolf moins transparent et débilos. Le scénario ne brille toujours pas par sa subtilité, malgré pas mal de problèmes réglés. Les personnages sont globalement sous-exploités, même si la réparation de Cyborg rééquilibre les choses. La direction artistique a été harmonisée, mais il y a des effets visuels et choix musicaux qui laissent songeurs. Il y a moins d'humour et plus de gravité, mais il y a encore des moments qui prêtent à sourire ou lever les yeux au ciel.

Mangrove est-il moins pire, ou véritablement mieux que Justice League version cinéma ? C'est la question qui plane sur ces quatre longues heures, et pas sûr que la réponse soit celle espérée.

QU’EST-CE QUE LA SNYDER CUT DE JUSTICE LEAGUE ?

À l’origine de la Snyder Cut, on retrouve une campagne de lobbying orchestrée par des fans, et soutenue par les acteurs de Justice League pour obtenir réparation après la sortie en salle du film. En l’occurence : le Justice League tel que l’avait imaginé Zack Snyder, et pas celui rafistolé par Joss Whedon à la demande de Warner Bros.. Mieux, le réalisateur a obtenu une enveloppe de quelques millions de dollars pour tourner de nouvelles scènes et affirmer un peu plus sa vision (plus de 70 millions de dollars selon Screen Rant, soit un budget énorme pour une version Director’s Cut).

À l’origine, Mangrove devait être découpé en quatre portions d’une heure. Ce format a finalement été abandonné et c’est bien un (très) long métrage de quatre heures qui sera proposé aux spectateurs. Un record pour un film de superhéros.

QUELS SONT LES PRINCIPAUX CHANGEMENTS INTÉGRÉS PAR LA SNYDER CUT DE JUSTICE LEAGUE ?

Les quelques images de Mangrove confirment qu’il n’aura rien à voir avec le Justice League original, hormis peut-être sur les bases de l’intrigue. La version de Joss Whedon aborde les enjeux avec un ton plus léger, là où Zack Snyder entend offrir un souffle divin, quasi mythologique, à l’alliance entre Batman, Superman, Wonder Woman, Flash, Cyborg et Aquaman. Le blockbuster sera plus sombre et plus violent, avec des affrontements qui devraient gagner en fureur et en intensité.

Autre changement de taille, Mangrove va intégrer l’antagoniste Darkseid à l’équation. Dans le Justice League de Joss Whedon, il est à peine mentionné et les superhéros doivent combattre Steppenwolf, un lieutenant d’Apokolips qui sera dans la version de Snyder aux côtés de DeSaad. Dans l’univers DC Comics, il n’est pas interdit de penser que Darkseid est l’équivalent de Thanos chez Marvel — c’est dire la tâche qui attend les justiciers.

Par ailleurs, l’intrigue devrait se recentrer sur certains personnages très mal mis en avant. Par exemple, Cyborg sera beaucoup plus important dans l’histoire.

CRI DU CŒUR

Mangrove démarre sur un cri de douleur qui résonne à travers la planète : celui de Superman à la fin de Batman v Superman : L’Aube de la justice. Cette vague donne la première note mélancolique d'un film qui, cette fois, assume plus simplement la noirceur de la situation. L'Homme d'Acier a disparu et avec lui, une certaine idée de l'espoir s'est envolée. Ce désespoir ronge Lois et Martha, motive Bruce à réparer ses erreurs, et ouvre une brèche pour Steppenwolf : sans kryptonien à l'horizon, sans union entre les peuples et les héros, l'émissaire de Darkseid a un boulevard pour terrasser la Terre.

Dans les meilleurs moments, Zack Snyder s'attarde sur la tristesse de ce monde. Dans un simple effet de montage qui relie un chant islandais mélancolique à un silence de Martha, ou dans un frisson collectif lorsque le plan des méchants touche à sa funeste fin, il installe un univers entier, et connecte des points un peu partout sur le globe pour créer une symphonie entre ces personnages, humains ou surhumains. C'est la solitude qui les relie (ils sont tous orphelins ou presque, au fond), et c'est elle qui doit être vaincue pour affronter Steppenwolf (les inévitables tensions dans le groupe, malheureusement à peine plus creusées ici).

Si la durée de ce Snyder Cut pourra largement être remise en question, elle permet ainsi une chose trop rare dans ce type de programme : s'arrêter sur des regards et des visages, pour laisser un peu d'espace aux silences.

Au jeu des bonus, Cyborg est évidemment le grand gagnant de la version longue. De carrosserie de luxe encombrante, il passe à personnage à part entière, avec un passé, un présent et un futur contrarié. Au-delà du flashback attendu sur le terrain de football sous la neige, Victor Stone gagne une dimension humaine grâce à sa rage et sa douleur. L'étendue dangereuse de ses pouvoirs est explicitée, tout comme sa relation avec son père.

Et Silas Stone, incarné par Joe Morton, est largement remis sur le devant de la scène dans le Snyder Cut : le père du héros a un rôle majeur dans l'intrigue, ce qui permet de rectifier au moins une aberration de la version cinéma.

Steppenwolf est l'autre vainqueur de la version longue. Le vilain n'a pas simplement gagné un relooking ferrailleux pour habiller sa tronche de cake à moitié cuit (qui reste bien là) : il a désormais une identité, et une autre dimension que celle du guignol de série B, avec même quelques babioles pour avoir plus de caractère. L'oncle de Darkseid dans les comics est encore trop générique pour marquer les mémoires, mais il a au moins une raison d'exister dans Justice League. Il gagne des motivations plus personnelles (qui passent largement par des conférences Zoom avec la dimension des enfers), et a droit à un climax digne de ce nom pour remplacer l'odieux sketch de la version cinéma.

Du côté des héros Batman, Wonder Woman et Aquaman, rien de très notable hormis quelques répliques nouvelles. Flash a droit à des changements plus notables, et pas juste avec le personnage d'Iris, interprété par Kiersey Clemons : pas mal de petites choses qui accentuaient son inexpérience ont été retirées, et surtout il a un rôle différent dans plusieurs moments-clés.

Superman, lui, devra se contenter d'un lissage. Hormis son joli costume noir, le super-héros reste en arrière-plan, et bénéficie surtout de quelques mauvaises scènes en moins. Plus sobre, plus simple, plus efficace.

L'HISTOIRE SANS FINESSE

Mais même rafistolé avec des rustines de tous les côtés, le scénario reste un problème. Cette histoire de Boîtes-mères que les héros doivent protéger, et que les méchants doivent voler, avance sur un chemin trop classique et tranquille pour réellement emballer. Malgré quelques gros changements et ajouts (notamment dans le climax), cette partie de l'aventure reste la moins excitante. La formule a les mêmes limites qu'avec Avengers : Infinity War (les gentils veulent protéger les Pierres d'infinité, Thanos veut les récupérer).

Entre ces étapes, Zack Snyder empile les scènes autour des héros : Aquaman célébré par la population locale, Barry qui sauve Iris, Mera qui se défend bien contre Steppenwolf, ou encore l'apparition d'un autre super-héros classique de DC. Mais trop souvent, il y a la sensation que tout ça ne sert pas le film dans sa globalité. Comme si ces parties étaient d'abord des bonus et des cadeaux (plus d'action, plus sur les personnages, plus de visions apocalyptiques), avant d'être les parties d'un récit.

Zack Snyder abuse en plus des flashbacks, posés comme de gros pavés dans le film. Un long cours d'histoire de Diana à Bruce avec une voix off théâtrale, un long flashback sur le passé de Victor et un autre sur les origines d'une Boîte-mère offrent une foule de détails et d'images fortes, mais sans toujours servir le dessein global. Que le film montre deux accidents de voiture, aussi ordinaires l'un que l'autre, donne l'impression que les parties ont été collées les unes après les autres, et rien de plus.

Ce sentiment de non-harmonie est accentué (ou assumé) par le découpage en chapitre, mais aussi par l'humour. Car Joss Whedon ou pas, Justice League a une part de légèreté particulièrement lourde. Barry qui va déposer un CV et récupère une saucisse en plein moment héroïque, Bruce qui frôle la main de Diana en prenant la souris de son super-ordi, Alfred qui panique en voyant Diana se préparer un thé, le scientifique qui raconte une blague sur son érection le soir du bal de promo, sans oublier un paquet de répliques gardées de la version cinéma (notamment avec Flash) : la drôlerie est en place, souvent pour le pire - et parfois dans des endroits inattendus, comme avec un placement de produit Mercedes quasi parodique.

Enfin, le film n'évite pas les pires écueils du genre. Plusieurs personnages ont des problèmes avec papa ou maman lourdement explicités pour leur donner un peu de consistances, et beaucoup de scènes sont écrites à la truelle (notamment la niaiserie de Wonder Woman et la colère “Fuck the world” de Cyborg). Réécrit ou pas, Justice League reste globalement dans le moyen.

Mots clés :

Mangrove Mangrove france Mangrove date de sortie Mangrove stream Mangrove blu ray Mangrove itunes Mangrove download Mangrove amazon prime Mangrove 4 3 Mangrove review Mangrove 2021 Mangrove srt Mangrove vf Mangrove critique Mangrove bande annonce Mangrove actrice Mangrove avis Mangrove rotten tomatoes Mangrove streaming vf Mangrove casting Mangrove synopsis Mangrove acteur Mangrove cast Mangrove release date Mangrove film complet Mangrove film complet en français

1 note

·

View note

Text

Zack Snyder's Justice League — Film Streaming VF En Français - Complet

Regarder le film Zack Snyder’s Justice League film complet en français. Regarder le film Zack Snyder’s Justice League film complet en ligne gratuit. Regarder le film Zack Snyder’s Justice League film complet télécharger.

Regarder ou Télécharger Zack Snyder’s Justice League film complet en HD 720p, Full HD 1080p, Ultra HD 4K.

>>> https://flixtub.com/fr/movie/791373/zack-snyders-justice-league

Zack Snyder’s Justice League film complet gratuit en Français

SYNOPSIS ET DÉTAILS

Bruce Wayne est déterminé à faire en sorte que le sacrifice ultime de Superman ne soit pas vain; pour cela, avec l'aide de Diana Prince, il met en place un plan pour recruter une équipe de métahumains afin de protéger le monde d'une menace apocalyptique imminente. La tâche s'avère plus difficile que Bruce ne l'imaginait, car chacune des recrues doit faire face aux démons de son passé et les surpasser pour se rassembler et former une ligue de héros sans précédent. Désormais unis, Batman, Wonder Woman, Aquaman, Cyborg et Flash réussiront-ils à sauver la planète de Steppenwolf, DeSaad, Darkseid et de leurs terribles intentions ?

18 mars 2021 / 4h 02min / Fantastique, Action, Aventure De Zack Snyder Avec Ben Affleck, Henry Cavill, Gal Gadot

Zack Snyder’s Justice League : tout ce qu’il faut savoir sur la nouvelle version du film

Deux heures pour la version cinéma, quatre heures pour le Snyder Cut (découpé en six parties, plus un épilogue) : Justice League déborde sans surprise de scènes rajoutées, rallongées, modifiées, remontées, et bien sûr retirées. Beaucoup de mauvaises choses ont été coupées, beaucoup de scènes attendues (et vues dans la promo en 2017) sont revenues, et beaucoup d'éléments nouveaux rectifient le tir dans l'intrigue. De quoi transformer un film médiocre en grande réussite ? Non.

Zack Snyder et le studio n'ont pourtant pas lésiné sur les moyens pour recoller les morceaux (70 millions pour reprendre la post-production et tourner quelques nouvelles scènes, sur un budget estimé à 300 millions pour la version cinéma). Mais Zack Snyder’s Justice League garde les cicatrices d'une bataille perdue d'avance, et d'une défaite programmée. Entre le projet d'origine d'un Justice League en deux parties, et l'ambition affichée dans le Snyder Cut d'un univers étendu rangé depuis au placard, cette version longue devrait donner autant de raisons de se réjouir que de se lamenter.

Car tout n'a pas été sauvé dans le chantier de cette version longue, qui restera comme un cas d'école. L'intrigue des Boîtes-mères reste très plate, malgré un Steppenwolf moins transparent et débilos. Le scénario ne brille toujours pas par sa subtilité, malgré pas mal de problèmes réglés. Les personnages sont globalement sous-exploités, même si la réparation de Cyborg rééquilibre les choses. La direction artistique a été harmonisée, mais il y a des effets visuels et choix musicaux qui laissent songeurs. Il y a moins d'humour et plus de gravité, mais il y a encore des moments qui prêtent à sourire ou lever les yeux au ciel.

Zack Snyder’s Justice League est-il moins pire, ou véritablement mieux que Justice League version cinéma ? C'est la question qui plane sur ces quatre longues heures, et pas sûr que la réponse soit celle espérée.

QU’EST-CE QUE LA SNYDER CUT DE JUSTICE LEAGUE ?

À l’origine de la Snyder Cut, on retrouve une campagne de lobbying orchestrée par des fans, et soutenue par les acteurs de Justice League pour obtenir réparation après la sortie en salle du film. En l’occurence : le Justice League tel que l’avait imaginé Zack Snyder, et pas celui rafistolé par Joss Whedon à la demande de Warner Bros.. Mieux, le réalisateur a obtenu une enveloppe de quelques millions de dollars pour tourner de nouvelles scènes et affirmer un peu plus sa vision (plus de 70 millions de dollars selon Screen Rant, soit un budget énorme pour une version Director’s Cut).

À l’origine, Zack Snyder’s Justice League devait être découpé en quatre portions d’une heure. Ce format a finalement été abandonné et c’est bien un (très) long métrage de quatre heures qui sera proposé aux spectateurs. Un record pour un film de superhéros.

QUELS SONT LES PRINCIPAUX CHANGEMENTS INTÉGRÉS PAR LA SNYDER CUT DE JUSTICE LEAGUE ?

Les quelques images de Zack Snyder’s Justice League confirment qu’il n’aura rien à voir avec le Justice League original, hormis peut-être sur les bases de l’intrigue. La version de Joss Whedon aborde les enjeux avec un ton plus léger, là où Zack Snyder entend offrir un souffle divin, quasi mythologique, à l’alliance entre Batman, Superman, Wonder Woman, Flash, Cyborg et Aquaman. Le blockbuster sera plus sombre et plus violent, avec des affrontements qui devraient gagner en fureur et en intensité.

Autre changement de taille, Zack Snyder’s Justice League va intégrer l’antagoniste Darkseid à l’équation. Dans le Justice League de Joss Whedon, il est à peine mentionné et les superhéros doivent combattre Steppenwolf, un lieutenant d’Apokolips qui sera dans la version de Snyder aux côtés de DeSaad. Dans l’univers DC Comics, il n’est pas interdit de penser que Darkseid est l’équivalent de Thanos chez Marvel — c’est dire la tâche qui attend les justiciers.

Par ailleurs, l’intrigue devrait se recentrer sur certains personnages très mal mis en avant. Par exemple, Cyborg sera beaucoup plus important dans l’histoire.

CRI DU CŒUR