#understanding index universal life policies

Text

youtube

#The Miracle Money Vehicle: How to Make Money Make Babies#Financial Freedom Strategies with Randolph Love III | KAJ Masterclass LIVE Join Randolph Love III#a fractional CFO#franchise consultant#and author of the forthcoming book as he shares his wealth of knowledge on financial literacy and asset protection. In this insightful epis#Randolph delves into topics such as legally avoiding taxes#properly structuring businesses#understanding index universal life policies#and the benefits of trusts and tax strategies. Discover why life insurance policies may be a better retirement vehicle than traditional 401#Randolph's expertise promises to provide valuable insights into creating a secure financial future and achieving true wealth.

🔥*Empower#enhance your skills#or even appear as a special guest on my show! Schedule on my calendar at https://calendly.com/kajofficial Ready to take it further? Explore#Youtube

0 notes

Text

Finding Your Investment Path: A Simple Guide

In the vast ocean of financial opportunities, finding the right investment scheme can feel like searching for a needle in a haystack. Every individual's financial goal, risk tolerance, and investment horizon are unique, making it crucial to navigate through the diffrent of options available in the market. From fixed income to equity and everything in between, understanding the various investment schemes is key to building a robust and diversified portfolio tailored to your needs.

Fixed Income: Let's begin with the fundamentals. Your investment portfolio's fixed income investments are similar to the consistent beat of a drum. The traditional examples are bonds and certificates of deposit (CDs). They are the best option for people looking for stability because they provide predictable returns at a lower risk. And you can earn average 8-10% return.

Managed Portfolios: Do you like someone else to do the grunt work? You may want to consider managed portfolios. These expertly managed funds provide a hands-off approach to investing, catered to your financial objectives and risk tolerance.

Insurance: Although the main goal of insurance is to provide protection, several plans also include investment options. For example, life insurance policies give you coverage and the opportunity to gradually build up cash value; for the astute investor, this is a two-for-one offer.

Derivatives: At this point, things become a little more intricate. The value of derivatives is derived from underlying securities or indexes. This group includes swaps, futures, and options. They can be employed speculatively or for hedging, but they're not for the timid. but do not invest in derivatives until and unless you are expert in this field.

Credit Instruments: Now let's talk about credit instruments, which include peer-to-peer lending websites and corporate bonds. With the range of risk and return potential offered by these products, you can tailor your portfolio to your degree of risk tolerance.

Equities: Ah, the stock market, the global investor community's playground. Purchasing stock entails obtaining ownership of shares in publicly traded corporations. It's all about dividends and growth potential, but be prepared for market turbulence.

Keep it straightforward: align your investments with your time horizon, risk appetite, and goals. To distribute the risk, diversify between several programs. And keep up with market developments at all times. Recall that there isn't a single, universal strategy for investing. Discover what works for you and get to work accumulating wealth!

#invetment#wealth#fixed income#security#risk#return#instrument#financial planning#financial services#low risk high reward

15 notes

·

View notes

Text

Miss Hatchet, Kim Possible, the complexity of library classification, and technocratic libraries

Ms. Hatchett tells Kim that she has an overdue library book

Recently, I began watching Kim Possible for the first time, apart from one episode: "Overdue." I watched it before I began the series. When I first conceived this post, I thought that I would somehow change my opinion of Miss Hatchet. Long-time readers may recall I previously described her as a person who "rules the school library like a tyrant...[with] her own form of library organization." After watching the episode, I feel no differently about her as I did before. However, I would argue that her character and the plotline says a lot more about libraries than I had previously guessed, meaning that Hatchet is more than a smorgasbord of librarian stereotypes, especially when it comes to library classifications of materials within libraries themselves.

This post is reprinted from Pop Culture Library Review and Wayback Machine.

There is no doubt that this librarian is "wound pretty tight" as Ron, a friend of Kim Possible, and series protagonist with her, remarks later in the episode. She has strict rules, like having a zero tardiness policy when it comes to overdue books. She has an enormous amount of power in the school as she is able to suspend Kim from cheerleading because she has an overdue book! Yikes. All the students seem to fear her and she acts like a villain throughout the episode, first by making Kim shelve stacks upon stacks of books based on her own, and more complicated, library classification system, known as the Hatchet Decimal System (HDS). Second, she takes away Kim's communicator (equivalent to her cell phone) and makes her put adhesive labels on every book saying "property of MHS library." In the end, Ron appears to come to the rescue, returning the book, but it turns out that this is the incorrect one, as it releases evil spirits which terrify her and cause destruction to the library. Her fate after that is unknown. Presumably, Kim and Ron save her life, although that isn't shown on screen.

Even though she is one of the only Middleton High School staff employees shown in the show, Hatchet nothing much more than a basket of stereotypes harmful to librarians while acting like a supervillain of sorts, giving Kim busy work while in "library lockup," as she calls it. Nothing about her is redeemable. However, I would venture that the episode is pointing to something more: the complexity of library classification. This has been an argument that has been rightly pointed out about the Dewey Decimal Classification system (DDC) have made in the past. This is despite the fact that this library classification system organizes to materials by subject. It can be hard for those who don't know the intricacies of DDC, like ordinary library patrons, to understand how books are organized. [1]

In 2007, the Library of Congress warned of limiting the use of the number components field so that doesn't become "confusing and complicated." Some years earlier, scholars Luc Beaudoin, Marc-Antoine Parent, and Louis C. Vroomen described DDC as a huge and complex information hierarchy. [2] Additional classification systems have also been noted as complex. For instance, some said that the Library of Congress Classification System (LCC) [3] is more efficient and specific for new technical material and big collections but "more complex." Others described the effort by Belgians Paul Otlet and Henri La Fontaine, who used the DDC as a basis, to create the "complex multidimensional indexing system" known as the Universal Bibliographic Repertory (UBR). [4]

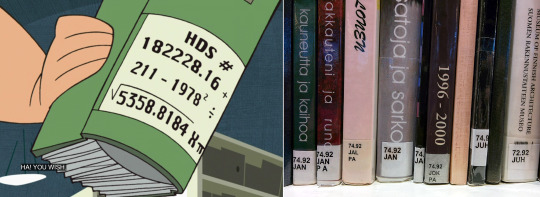

The Hatchet Decimal System on a book binding on the left and the DDC on a book bindings on the right. The latter is from this image on Wikimedia.

To come back to the episode, I would say that the focus on a classification system that Hatchet made by herself is meant to point to the complexity of library classification systems in general and how they can be confusing for ordinary people, in this case Kim. Her system is clearly more complex than the DDC and perhaps that is part of the point of this episode, which was written by Jim Peterson, directed by Steve Loter (who directs many of the episodes in the series), and storyboarded by Eugene Salandra, Jennifer Graves & Robert Pratt. It is incredible that Hatchet has enough authority that she can create her own system for organizing books in the library, which has become "her natural habitat" as it states on her short Kim Possible fandom page. Many librarians would not have that ability as their actions would be hemmed in by school administrators, school boards, national and state library associations, which have their own codes of ethics.

As Anne Gooding-Call has pointed out, "librarians of color don’t necessarily have the same support that white librarians enjoy," with the MLIS and middling wages as a barrier to many. This is undoubtedly the case for Hatchet, who the school probably would have treated differently had she been Black, Latine, or Asian, for instance, as most of the librarian field is composed of White female librarians. She would not have the social support of other White people, even if the students feared her. In one way, the library that Hatchet occupies appears to be a white space, meaning somewhere that Black people may be reluctant to ask questions or use resources. On another, since students generally fear her, no one, of any race, may be asking her questions or for any help. Instead, they are presumably trying to spend the least amount of time in the library as possible, as they are afraid of her. I would even argue that if she wasn't White, she couldn't be as mean and menacing to the students, at least I would hope that would be the case.

Beyond this, there is no doubt in my mind that Hatchet obviously blatantly violates tenets 1, 6, 7, 8, and 9, at minimum, of the ALA's Code of Ethics. This is not unique to her, as others are even worse offenders. [5] For instance, Francis Clara Censorsdoll in Moral Orel dipped "objectionable" books in kerosene and set them on fire. Cletus Bookworm in Rocky & Bullwinkle had no problem with an armed man taking two patrons of the library hostage. In fact, he encouraged their capture and applauded it. That's just two of the most egregious examples I can think of, although there are many others. Gooding-Call says that librarians are mostly "sincere people who mean well...eager to grow and improve" who can become "vehicles of empowerment." Hatchet does not seem to be this at all. Instead, she seems overly strict and harsh, not wanting to improve. She is the female equivalent of Steven Barkin, a former U.S. Army Ranger, who has a gruff, no-nonsense, attitude, and is abrasive with students in the series. Unlike Barkin, it is unlikely she has PTSD from wartime experiences.

There is the additional issue that the DDC system and other cataloging approaches were "designed in a racist and white-centered system," [6] building upon my post in May about fictional acceptance of the DDC. Hatchet probably didn't care much about this. Instead, what matters to her was lording this power over other people in a menacing way, or at least it appears that way. She says as much, as she declares to Kim that "There will come a day when you forget to return a book and I'll be waiting for you." It gives you the chills. Was she so self-centered that she created her own classification system? Did she care that DDC is, as Emily Ruth Brown points out, built around adult disciplines, is proprietary, and is negatively affected by changes in technology? We can't know for sure, as she is a one-time character who never re-appears in the series. This isn't surprising, given that Western animation has a habit of easily playing into librarian stereotypes, although this may be changing, with libraries shown much more positively in anime.

As I expected, not one person has written a fan fiction about Ms. Hatchet in Kim Possible on Archive of Our Own, even though it could make an interesting story to see things from her perspective. Clearly her actions toward Kim, and presumed other students, are irredeemable. Even so, she may be under a lot of stress as the only librarian of the entire Middleton High School library, at least the only one we see as the audience. If she had been trying to get Kim to do extra work, like shelving books, then this was definitely not the way to go about it. There are the other library scenes in the series, but she never re-appears. She is never given a chance to redeem herself or for the audience to see who she is as a person. She is just a bunch of stereotypes all shoved into one person. I admit that I may be reading too much into this 11-minute episode. At the same time, this episode may be more than what it appears to be on the surface and interconnects with issues surrounding library classification systems and even broader issues within the library field itself.

Ms. Hatchet pushes a book cart piled high with books

When I first composed and finished this post in later February 2022, my last paragraph was the end of the article. However, I see Hatchet's classification in a new light after reading a chapter by Rafia Marza and Maura Seale about White masculinity and "the technocratic library of the future" in Topographies of Whiteness. Although she is no technocrat, and neither are any of those on List of fictional librarians I have put together for this blog as most are either "old-school", "traditional", or "magical" for the most part, her complex HDS is akin to technocratic ideas. Marza and Seale note that as information technology has become a bigger part of librarianship in the 1990s and 2000s, the White female librarian has been replaced by ideas from Silicon Valley, with "technological solutions" which will supposedly free us. They further said that such a focus on technology as a "solution to complex social problems" is central to technocratic ideas, which is characterized by its "impartial, apolitical rationality," with those who are technocrats interests in politics rather than efficiency, thinking that technological fixes can be universal. However, this ideology is bound up in White supremacy because White men have historically claimed rationality and White masculinity has been able to function as the "universal form," while it can only claim to be neutral and objective due to Whiteness. At the same time it upholds patriarchy as well. [7] This interlinks with the historic investment of libraries in Whiteness and faulty notions such as rationality, objectivity, neutrality, and neoliberal tendencies. The latter is promoted by two ALA initiatives: Libraries Transform and the Center of the Future of Libraries (launched in 2015).

Such initiatives, Marza and Seale argue, engage internet-centrism, an idea described by Morozov as the idea that everything is changed and there needs to be fixes, while technology is permanent, fixed, has an inherent nature, and possess agency as it exists "outside of history." They are interconnected to technological solutionism, the idea that all complex social problems can be neatly defined and have definite solutions or processes that "can be easily optimized," even though this can undermine support for more demanding or stimulating reform projects. [8] This comes with the assumption that it is neutral and objective, even though it is anything but that. This is reinforced by a focus on digital and quantitative skills, with an individual and "entrepreneurial" worker as the default, who are often male and White, especially when it comes to those in Silicon Valley, who are used as a basis for these "necessary" skill sets. At the same time, care and emotion work, service work, manual labor, and so on are seen as "feminized labor" At the same time, libraries are seen as akin those businesses in the so-called sharing economy, with racial prejudice as ingrained in such an economy, and labor of people of color and White women not visible due to the emphasis on technology and de-emphasis on the labor behind the technology itself, with its deadly environmental and labor consequences. [9]

While labor of those causing the technological solutions to be workable is erased, so is any quiet or reflective work, like that portrayed in Kokoro Library, while fewer workers are told to take on more work, leading to burnout. Additionally, libraries are viewed as platforms, like the sites created by Silicon Valley, which ends up prioritizing monetization and obscures any libraries seen as "non-technological," pay is low, and librarianship itself is devalued while technocratic ideology is risen, and the value of library degrees has declined while information technology is seen as even more paramount. This is only strengthened with a focus on "short-term results," market demands, just-in-time services, efficiency, and "return on investment," even as emotional labor of women and physical labor of people of color is needed to make sure libraries, and society as a whole, function. In the end, such technocratic ideas are embedded in systems of privilege, while technology itself is subject to the same inequities as the rest of the world, with a necessary situated and historic understanding of technology and librarianship, and ways that both of those concepts "intersect with dominant conceptions of white masculinity." [10]

Hatchet clearly does not embody any of this technocratic ideology, nor has any librarian I've ever seen in any popular culture I've come across to date. However, her ideas would fit right in with today's technocratic push in librarianship, with their own inherent complexity. In fact, if the episode was to be done again today, it would not be a stretch to see Hatchet using robots to shelve the books in their own complex way, or even sitting at her desk while she ordered a robot to snatch Kim and bring her to the library in punishment for an overdue book. That may be a bit extreme, but the point is that her ideas fit within those who espouse technocratic ideas about libraries at the present. Ultimately, I enjoyed reexamining this episode and I look forward to your comments, criticisms, and anything else you'd like to leave in response to this post. Until next time!

© 2022 Burkely Hermann. All rights reserved.

Notes

[1] Erin Sterling, "The Case of the Clunky Classification: The Elusive Graphic Novel," May 2010, accessed February 25, 2022; "Dewey Decimal System," ScienceDirect, accessed February 25, 2022; "Information Literacy Tutorial: Finding Books," University of Illinois Library, University of Illinois, LibGuides, Aug. 7, 2018, accessed February 25, 2022; Melinda Buterbaugh, "Lesson Three: Dewey Decimal Classification (DDC) and Call Numbers," Library Practice 101, accessed February 25, 2022; "Teach Me How To Dewey," Hillsborough County, Florida, Dec. 13, 2017, accessed February 25, 2022; "Why I Would Use Dewey," Technical Processes for Education Media, Oct. 29, 2011, accessed February 25, 2022.

[2] Luc Beaudoin, Marc-Antoine Parent, and Louis C. Vroomen (1996), "Cheops: A Complex Explorer for Complex Hierarchies," IEEE, p. 87; "MARC DISCUSSION PAPER NO. 2007-DP06," Library of Congress, Jun. 6, 2007, accessed February 25, 2022.

[3] Not the same as the Library of Congress Subject Headings (LCSH) which has "been actively maintained since 1898 to catalog materials held at the Library of Congress" and said to be the "most widely adopted subject indexing language in the world." LCSH describes contents systemically, while LCC is a library classification system. Its also different from the Library of Congress Control Number (LCCN), a serially based system of numbering cataloged record.

[4] Robert McCoppin, "Who's killing the Dewey decimal system?," Chicago Tribune, Feb. 18, 2011, accessed February 25, 2022; Gerry le Roux, "Melvil Dewey and the classification of knowledge," Science Lens, Dec. 10, 2012, accessed February 25, 2022; ; "How the index card launched the information age," Multimediaman, Sept. 10, 2016, accessed February 25, 2022.

[5] Discounting the shushers, the most extreme include the librarian in multiple episodes of Kick Buttowski: Suburban Daredevil, Rita Loud in a Timon & Pumbaa episode ("Library Brouhaha"), Mr. Snellson in a Mysticons episode ("Happily Never After"), Librarian in a Big City Greens episode ("Quiet Please"), Librarian in a Courage the Cowardly Dog episode ("Wrath of the Librarian"), and Bat Librarian in Rise of the Teenage Mutant Ninja Turtles episode ("Mystic Library").

[6] "Conducting research through an anti-racism lens," University of Minnesota Libraries, University of Minnesota, Feb. 15, 2022, accessed February 25, 2022. Others have claimed that DDC can be reformed with librarians who have "deeply held values of equity, diversity, and inclusion" while others have pointed to racism within the DDC, by Dewey himself, noted Dewey was a sexual harasser and a clearly a bigot without any question. Even conservatives have pointed out that Dewey is ingrained in librarianship and there is no escaping him.

[7] Rafia Mirza and Maura Seale, "Who Killed the World?: White Masculinity and the Technocratic Library of the Future" within Topographies of Whiteness: Mapping Whiteness in Library and Information Science (ed. Gina Schlesselman-Tarango, Library Juice Press: Sacramento, CA: 2017), pp. 175-177. They also say on page 175 that in the early 20th century, librarians participated in "civilizing" and assimilating the "tired, huddled masses into American democracy" as long as those people could become White.

[8] Mirza and Seale, "Who Killed the World?", pp. 177-181. Libraries Transform describes itself as "spreading the word about the impact libraries and librarians make every day...[and] advocat[ing] for the value of librarianship" but the about page almost reads like a corporate webpage, and not surprising as Overdrive is the lead sponsor, with other big sponsors including Capital One, Dollar General, Biblioboard, and SAGE Publishing. The same can be said about the webpage of the Center of the Future of Libraries.

[9] Ibid, 181-5.

[10] Ibid, 186-192.

#kim possible#librarians#librarian stereotypes#stereotypes#library classification#libraries#fiction#pop culture#dewey decimal system#library of congress#loc#ethics#moral orel#rocky and bullwinkle#archive of our own#shushing

8 notes

·

View notes

Text

Why IUL is a Bad Investment: Debunking the Myths and Exploring Alternatives

In recent years, Indexed Universal Life (IUL) insurance has gained significant attention as a potential investment vehicle. Proponents of IUL often tout its unique features, such as the potential for market-linked growth and the ability to access the accumulated cash value. However, a closer examination reveals that IUL may not be the panacea it is often made out to be. In this comprehensive guide, we will explore the reasons why iul is a bad investment can be a poor investment choice and examine alternative options that may better suit your long-term financial goals.

The Complexity of IUL

One of the primary drawbacks of IUL is its inherent complexity. These policies are often laden with intricate features, fees, and fine print that can be challenging for even the most financially savvy individuals to fully understand. This complexity can make it difficult to assess the true costs and potential benefits of the IUL product, leading to a lack of transparency and potential misunderstandings.

Subheading: Excessive Fees and Charges

IUL policies are notorious for their high fees and charges, which can eat away at the potential growth of the cash value. These fees can include administrative fees, mortality and expense charges, and surrender fees, among others. The cumulative impact of these fees can significantly erode the returns generated by the policy, reducing the overall value of the investment.

Subheading: Limitations on Cash Value Accessibility

While IUL policies tout the ability to access the accumulated cash value, there are often strict limitations and restrictions on these withdrawals. Policyholders may face penalties, reduced death benefits, or other consequences when trying to access their cash value, limiting the true utility of this feature.

The Illusion of Guaranteed Returns

One of the most common misconceptions about IUL is the promise of guaranteed returns. While IUL policies may offer a minimum guaranteed interest rate, this rate is often extremely low and may not keep pace with inflation or other investment options. Furthermore, the actual returns on the cash value can be significantly lower than the projections provided by insurance agents, leaving policyholders disappointed and underperforming their expectations.

Subheading: Sensitivity to Market Conditions

The cash value growth of an IUL policy is directly linked to the performance of the underlying index, which can be highly volatile and susceptible to market fluctuations. During periods of economic downturn or market turmoil, the cash value may experience little to no growth, or even a decline, undermining the very purpose of the investment.

Alternatives to IUL

Given the limitations and drawbacks of IUL, it is essential to explore alternative investment options that may better serve your long-term financial goals. Here are a few alternatives worth considering:

Subheading: Traditional Life Insurance

For those primarily seeking life insurance protection, traditional whole life or term life insurance may be a more straightforward and cost-effective option. These policies typically have lower fees and offer more transparent and predictable death benefit coverage.

Subheading: Retirement Accounts (401(k), IRA, etc.)

Retirement accounts, such as 401(k) plans and individual retirement accounts (IRAs), can provide tax-advantaged growth opportunities and a diverse range of investment options to suit your risk tolerance and investment timeline.

Subheading: Taxable Investment Accounts

Taxable investment accounts, such as brokerage accounts, offer a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These accounts provide more control and flexibility over your investments, as well as the potential for higher long-term returns.

Conclusion

In conclusion, while Indexed Universal Life insurance may appear to be an attractive investment option, the reality is that it can be a poor choice for many individuals. The inherent complexity, excessive fees, and limitations on cash value accessibility make IUL a suboptimal investment compared to traditional life insurance, retirement accounts, and taxable investment accounts.

Before making any financial decisions, it is crucial to carefully evaluate your long-term goals, risk tolerance, and investment time horizon. By exploring alternative investment options, you can potentially achieve higher returns, greater transparency, and better alignment with your overall financial objectives. Remember, the key to successful investing is to understand the risks, fees, and limitations of any financial product before committing your hard-earned money.

0 notes

Text

Are you prepared for your best version of retirement?

Are you prepared for your best version of retirement?

We picture your future self, maintaining their income level in retirement that you have while working, enjoying life to the fullest & cherishing each moment with loved ones.

We can make that happen!

#LifeInsurance#retirement#Annuities#ThePolicyShop#FinancialPlanning#RetirementPlanning#wealthmanagement

Check them out now:

1 note

·

View note

Text

Canadian Immigration for Indians: Eligibility, Programs & Tips

Canada has emerged as one of the top destinations for Indian immigrants seeking better opportunities, quality of life, and a welcoming environment. With its robust economy, diverse culture, and progressive immigration policies, Canada continues to attract skilled professionals, students, and families from around the world, including India. In this blog, we'll explore the eligibility criteria, various immigration programs, and some tips for Indian individuals considering a move to Canada.

Eligibility for Canadian Immigration

Age, Education, and Work Experience

To be eligible for Canada immigration, applicants often need to meet certain criteria related to age, education, and work experience. Many immigration programs prioritize younger individuals with higher education and relevant work experience in occupations that are in demand in Canada.

Language Proficiency

Proficiency in English or French is crucial for most immigration pathways. Applicants are usually required to take language proficiency tests such as IELTS (International English Language Testing System) or CELPIP (Canadian English Language Proficiency Index Program) for English and TEF (Test d'Évaluation de Français) for French.

Health and Character Requirements

Immigrants must undergo medical examinations and provide police certificates to prove good health and character. Certain health conditions or criminal records may affect eligibility for immigration.

Canadian Immigration Programs for Indians

Express Entry System

The Express Entry system is a popular pathway for skilled workers to immigrate to Canada. It manages applications for three federal economic immigration programs: the Federal Skilled Worker Program (FSWP), the Federal Skilled Trades Program (FSTP), and the Canadian Experience Class (CEC). Candidates create an online profile and are ranked based on factors like age, education, work experience, and language proficiency.

Provincial Nominee Programs (PNPs)

PNPs allow Canadian provinces and territories to nominate individuals for immigration based on their specific labor market and economic needs. Many provinces have streams tailored for skilled workers, entrepreneurs, and students. Indian immigrants can explore PNPs like the Ontario Immigrant Nominee Program (OINP), British Columbia Provincial Nominee Program (BC PNP), and Alberta Immigrant Nominee Program (AINP), among others.

Family Sponsorship

Canadian citizens and permanent residents can sponsor their family members for immigration to Canada. This includes spouses, partners, dependent children, parents, and grandparents. Family sponsorship provides a pathway for Indian families to reunite and settle in Canada.

Study Permits

Indian students can pursue higher education in Canada by obtaining study permits. Canada's universities and colleges offer a wide range of programs and opportunities for international students. Upon graduation, students may be eligible for post-graduation work permits and pathways to permanent residency.

Tips for Indian Immigrants

Research Immigration Programs

Take the time to research and understand the various immigration programs available. Each program has its own requirements, eligibility criteria, and application processes. Choose the program that best suits your qualifications, skills, and goals.

Improve Language Skills

Language proficiency is a key factor in Canada immigration. Invest time in improving your English or French language skills by taking language courses and practicing regularly. Higher language scores can enhance your Express Entry profile and overall chances of success.

Obtain Educational Credential Assessments (ECAs)

For Express Entry and some provincial programs, applicants must obtain Educational Credential Assessments (ECAs) to evaluate their foreign educational credentials against Canadian standards. Ensure you have the necessary ECAs for your qualifications.

Build Canadian Experience

Gaining Canadian work experience through programs like the Canadian Experience Class (CEC) or post-graduation work permits can strengthen your profile and increase your points under Express Entry. Consider internships, co-op programs, or volunteer work to gain valuable experience.

Seek Professional Advice

Navigating the Canadian immigration process can be complex. Consider seeking guidance from licensed immigration consultants or lawyers who can provide personalized advice and assistance with applications, and help you understand your options.

In conclusion, Canada immigration offers promising opportunities for Indians seeking to build a better future in a diverse and inclusive society. By meeting eligibility criteria, exploring relevant immigration programs, and following these tips, Indian immigrants can embark on a successful journey to Canada. Remember to plan, stay informed, and make informed decisions to make your Canadian dream a reality.

0 notes

Text

Maximizing Cash Value Protector Premiums: An Online Training Guide

Title: “Unlocking the Power of Cash Value Protector Premiums: A Comprehensive Online Training Guide”

In today’s dynamic financial landscape, it’s crucial for individuals and businesses alike to understand the intricacies of cash value protector premiums. These premiums play a vital role in protecting and enhancing the value of various financial instruments, including life insurance policies, annuities, and investment vehicles. To navigate this complex terrain effectively, an online training guide can serve as an invaluable resource, offering insights and strategies to maximize the benefits of cash value protector premiums.

Understanding Cash Value Protector Premiums

At its core, a cash value protector premium is designed to provide a layer of security and growth potential to financial products that offer cash value accumulation. This includes whole life insurance policies, indexed universal life policies, and certain types of annuities. By allocating funds towards the cash value protector premium, policyholders can safeguard their investments from market volatility while potentially enjoying steady growth over time.

Key Components of Online Training

Fundamentals of Cash Value Protection: The training guide will start by laying down the fundamental concepts behind cash value protector premiums. Participants will learn about the mechanics of how these premiums work, their impact on policy performance, and the various factors that influence their effectiveness.

2. Optimizing Cash Value Growth: One of the primary goals of cash value protector premiums is to enhance the growth potential of underlying assets. Through in-depth training modules, participants will discover proven strategies to optimize cash value growth, including asset allocation techniques, dividend reinvestment strategies, and tax-efficient planning.

3.Risk Management Strategies: Mitigating risks is paramount in any financial strategy. The online training guide will delve into risk management strategies tailored specifically for cash value protector premiums. Topics will include hedging strategies, downside protection mechanisms, and ways to navigate changing market conditions effectively.

4. Policyholder Benefits: Beyond financial growth, cash value protector premiums offer additional benefits to policyholders. These can include options for accessing cash value through loans or withdrawals, potential tax advantages, and estate planning considerations. The training guide will explore these benefits comprehensively, empowering participants to make informed decisions.

5. Advanced Techniques and Case Studies: For those seeking a deeper understanding, the training guide will also cover advanced techniques and real-world case studies. Participants will gain insights from industry experts, learn from practical examples, and develop the analytical skills needed to navigate complex financial scenarios.

Conclusion

In a world where financial stability and growth are top priorities, mastering the nuances of cash value protector premiums is a strategic advantage. An online training guide tailored to this niche provides a structured and comprehensive learning experience, empowering individuals and businesses to harness the full potential of these valuable financial tools. Whether you’re a financial professional looking to expand your expertise or an individual seeking to optimize your financial portfolio, investing in knowledge through online training is a proactive step towards financial success.

CLICK HERE

1 note

·

View note

Text

Incorporating Life Insurance Into Your Retirement Plan

Retirement planning encompasses a variety of financial strategies aimed at ensuring a secure and comfortable future. While many people concentrate on savings and investments, integrating life insurance into your retirement plan can offer additional layers of protection and advantages. This guide will delve into the importance of incorporating life insurance into your retirement strategy and how it can complement your financial objectives.

Understanding Life Insurance in Retirement Planning

Financial Protection for Loved Ones: Life insurance guarantees that your loved ones are financially safeguarded in the event of your demise, providing them with a tax-free lump sum payment to cover expenses.

Estate Planning Tool: Life insurance serves as a tool for estate planning by facilitating the transfer of wealth to heirs and beneficiaries, thereby minimizing estate taxes and ensuring a seamless distribution of assets.

Supplemental Retirement Income: Certain life insurance policies, such as cash value or permanent life insurance, have the ability to accumulate cash value over time, serving as a source of supplemental income during retirement.

Types of Life Insurance Policies for Retirement Planning

Term Life Insurance: Term life insurance offers coverage for a specified term, featuring affordable premiums for individuals seeking temporary protection.

Permanent Life Insurance: This type of insurance provides lifelong coverage and accrues cash value over time, which can be accessed tax-free during retirement.

Indexed Universal Life Insurance: Indexed universal life insurance blends life insurance protection with the potential for cash value growth tied to market indexes, offering flexibility and the potential for higher returns.

Factors to Consider When Incorporating Life Insurance into Your Retirement Plan

Financial Goals: Evaluate your retirement goals and ascertain how life insurance can align with your objectives, whether it involves income replacement, estate planning, or legacy protection.

Health and Age: Consider your current health status and age when choosing a life insurance policy, as premiums and eligibility may vary based on these factors.

Risk Tolerance: Assess your risk tolerance and investment preferences to select the most suitable life insurance policy for your retirement needs.

Why Choose Life Insurance for Retirement Planning

Tax Advantages: Life insurance death benefits are generally tax-free, providing beneficiaries with a financial safety net without incurring tax liabilities.

Guaranteed Protection: Life insurance offers guaranteed protection, ensuring that your loved ones receive a predetermined amount regardless of market fluctuations or economic uncertainties.

Legacy Planning: Life insurance enables you to leave a lasting legacy for future generations, ensuring financial security and stability beyond your lifetime

Insurance Consultant from Mumbai offers assistance for inquiries and insurance requirements.

0 notes

Text

Securing Your Future: The Best Permanent Life Insurance Solutions with Steve Jones

In the realm of financial planning, few decisions hold as much weight as choosing the right life insurance policy. Among the myriad of options available, permanent life insurance stands out for its lifelong coverage and wealth-building potential. If you're considering permanent life insurance, you'll want to ensure you're making an informed decision. That's where Steve Jones comes in. As a seasoned expert in the field of insurance and financial planning, Steve Jones is dedicated to helping individuals and families secure their futures with the best permanent life insurance solutions available.

Understanding Permanent Life Insurance

Before diving into the specifics of the best permanent life insurance options, let's first understand what permanent life insurance entails. Unlike term life insurance, which provides coverage for a specific period, permanent life insurance offers lifelong protection. It comes in various forms, including whole life, universal life, and variable life insurance. What sets permanent life insurance apart is its ability to build cash value over time, providing a valuable asset that can be accessed during your lifetime.

The Benefits of Permanent Life Insurance

Permanent life insurance offers a range of benefits that make it an attractive option for many individuals and families:

Lifelong Coverage: Perhaps the most significant advantage of permanent life insurance is its lifelong coverage. Once you're insured, your policy remains in effect for the duration of your life, as long as premiums are paid.

Cash Value Accumulation: One of the distinguishing features of permanent life insurance is its cash value component. A portion of your premiums goes toward building cash value, which grows over time on a tax-deferred basis. This cash value can be accessed through policy loans or withdrawals to supplement retirement income, fund education expenses, or cover unexpected expenses.

Tax Advantages: Permanent life insurance offers several tax advantages that can benefit policyholders. The cash value growth is tax-deferred, meaning you won't pay taxes on the earnings until you withdraw them. Additionally, death benefits are generally paid out income tax-free to beneficiaries.

Estate Planning: Permanent life insurance can play a crucial role in estate planning by providing liquidity to cover estate taxes, pay off debts, or equalize inheritances among heirs. It can also serve as a valuable tool for transferring wealth to future generations.

The Best Permanent Life Insurance Solutions with Steve Jones

When it comes to selecting the best permanent life insurance policy, working with an experienced and knowledgeable advisor is essential. Steve Jones brings years of expertise to the table, helping clients navigate the complexities of permanent life insurance and find the right solution for their needs. Here are some of the top permanent life insurance options that Steve Jones offers:

Whole Life Insurance: Whole life insurance provides guaranteed death benefits, fixed premiums, and guaranteed cash value accumulation. With whole life insurance, you have the security of knowing that your coverage and premiums will remain consistent throughout your lifetime.

Universal Life Insurance: Universal life insurance offers flexibility in premium payments and death benefits, allowing policyholders to adjust their coverage and premiums to suit their changing needs. It also offers the potential for higher cash value accumulation through investment options.

Variable Life Insurance: Variable life insurance allows policyholders to invest their cash value in a variety of investment options, such as stocks, bonds, and mutual funds. While variable life insurance offers the potential for higher returns, it also comes with greater investment risk.

Indexed Universal Life Insurance: Indexed universal life insurance combines the flexibility of universal life insurance with the potential for cash value growth tied to the performance of a stock market index. Indexed universal life insurance offers downside protection with the opportunity for higher returns.

Survivorship Life Insurance: Survivorship life insurance covers two individuals under a single policy and pays out the death benefit upon the death of the second insured. Survivorship life insurance is often used in estate planning to provide liquidity for estate taxes or to leave a legacy for future generations.

Conclusion: Choosing the Best Permanent Life Insurance

When it comes to securing your future and protecting your loved ones, choosing the best permanent life insurance policy is paramount. With Steve Jones by your side, you can rest assured that you're making an informed decision based on your unique needs and financial goals. Whether you're looking for lifelong coverage, cash value accumulation, or estate planning solutions, Steve Jones offers the expertise and personalized service you need to navigate the world of permanent life insurance with confidence. Contact Steve Jones today to explore your options and take the first step toward securing your financial future.

0 notes

Text

The Value of Studying in Canada for a Global Education Experience

Certainly studying abroad can be a valuable experience for any student for many reasons, and Canada is often considered an attractive destination for international students. Here are some reasons why Study in Canada can be a worthwhile option for Indian students:

High-quality education Studying in Canada: Canada is famous for its high academic standards and quality education. The country has many world-class institutions that are consistently ranked highly in global education rankings.

Diverse Culture: By studying in Canada, the student becomes multicultural. Studying there provides an opportunity to interact with people from different backgrounds and cultures, enriching your overall experience.

Safe and peaceful environment: Canada is considered one of the safest countries in the world. Its commitment to maintaining peace and security contributes to a safe environment for international students.

Work Opportunities: Canada offers various work opportunities for international students during and after their studies. It can be beneficial to gain practical experience and potentially settle in the country after graduation.

Quality of Life: Canada consistently ranks high on global quality of life indexes. The country offers excellent health care, social services, and a high standard of living.

Natural Beauty: Canada is known for its breathtaking landscapes and natural beauty. From mountains to lakes, students have the opportunity to explore and appreciate the diverse geography of the country.

Research Opportunities: Canada is at the forefront of research and innovation. Many universities and research institutes offer cutting-edge programs and opportunities for students to engage in groundbreaking research.

Language: Canada is a bilingual country, with English and French as its official languages. Studying in an English-speaking environment can enhance language skills

Immigration Opportunities: Canada has favorable immigration policies, and many international students find it relatively easy to transition to permanent residence after completing their studies.

Global Perspective: The education system in Canada emphasizes a global perspective, preparing students for a rapidly changing global economy and promoting a broad understanding of different cultures and viewpoints.

It is essential for prospective international students to thoroughly research specific universities, programs, and eligibility criteria before deciding whether to study in Canada or any other country. Additionally, considering personal preferences and career goals will help in making an informed decision about pursuing education abroad.

#study abroad#study education abroad#ielts coaching#delhi#student#studies abroad#ielts coaching in delhi#study abroad in canada#antiques#nonprofits

0 notes

Text

Living on the Edge: The Coolest Trends in Modern Life Insurance

Hey there, reader! Have you ever wondered how life insurance has evolved to keep up with the fast-paced modern world? In this article, we will explore some of the coolest trends in modern life insurance that will leave you amazed and wanting to know more.

But first, let's dive into the table of contents to see what topics we will cover:

Topic 1: Dynamic Premiums

Topic 2: AI-Driven Underwriting

Topic 3: Cyber Insurance

Topic 4: Index Universal Life Policies

Topic 5: Personalized Coverage

Now that you know what awaits you, let's continue reading and explore these exciting trends in modern life insurance!

Topic 1: Dynamic Premiums

Topic 2: AI-Driven Underwriting

AI-driven underwriting is revolutionizing the insurance industry by using artificial intelligence to assess risk, streamline the underwriting process, and improve decision-making. This technology is transforming how insurers evaluate and price policies, leading to more accurate risk assessments and faster policy approvals.

With AI-driven underwriting, insurers can analyze vast amounts of data from various sources, including historical claims, demographics, and external data points, to make more informed decisions. By automating repetitive tasks, AI can free up underwriters' time, allowing them to focus on complex cases and strategic decision-making. This technology also helps reduce bias and human error, leading to fairer and more consistent underwriting decisions.

Topic 3: Cyber Insurance

The Importance of Cyber Insurance

With the increasing number of cyber attacks and data breaches, cyber insurance has become an essential component of any comprehensive risk management strategy. Cyber insurance provides financial protection against the costs associated with cyber security incidents, such as incident response, legal fees, and customer notification. It helps organizations recover from the financial losses and reputational damage that can result from a cyber attack. Without cyber insurance, businesses may face significant financial hardship and struggle to bounce back after a cyber security incident.

What Does Cyber Insurance Cover?

Cyber insurance policies vary, but they generally cover a range of expenses related to cyber security incidents. This can include costs such as forensic investigation, data restoration, legal fees, public relations, and business interruption. Some policies may also provide coverage for third-party liability, such as lawsuits resulting from a data breach. It's important for organizations to carefully review and understand the coverage provided by their cyber insurance policy to ensure it aligns with their specific needs and potential risks.

Factors to Consider When Choosing Cyber Insurance

When selecting a cyber insurance policy, there are several key factors to consider. First, organizations should assess their unique cyber security risks and vulnerabilities to determine the appropriate coverage limits and types of coverage needed. It's also important to review the policy's exclusions and limitations to understand any potential gaps in coverage. Additionally, organizations should evaluate the insurer's reputation and financial stability to ensure they will be able to pay out claims in the event of a cyber security incident.

Benefits of Cyber Insurance

Cyber insurance provides several benefits to organizations. Firstly, it provides financial protection and helps mitigate the financial risk associated with cyber security incidents. This can be especially valuable for small and medium-sized businesses that may not have the resources to easily absorb the costs of a cyber attack. Cyber insurance also helps organizations improve their cyber security posture by incentivizing risk management efforts and providing access to resources such as incident response and breach coaching. Lastly, having cyber insurance can enhance business resilience and reputation by demonstrating to customers and partners that the organization takes cyber security seriously and has measures in place to manage potential data breaches.

Topic 4: Index Universal Life Policies

Introduction

Index Universal Life (IUL) policies have gained popularity in recent years as a flexible and potentially lucrative form of life insurance. These policies combine the benefits of a traditional life insurance policy with the advantages of a linked investment account. The investment component of an IUL policy is tied to a stock market index, allowing policyholders to participate in market gains while also offering downside protection.

How IUL Policies Work

IUL policies typically have a fixed premium that is paid into the life insurance component of the policy. The excess premium, after deducting expenses and fees, is allocated to the investment account. This investment account is linked to a specified stock market index, such as the S&P 500. The policyholder's cash value grows based on the performance of the index, subject to a cap or participation rate set by the insurance company. At the same time, the policyholder is guaranteed a minimum rate of return, protecting against market downturns.

Benefits and Risks

One of the main benefits of an IUL policy is the potential for tax-free growth. The investment account grows without incurring tax liabilities as long as the policy remains in force. Additionally, the policyholder has the ability to access the cash value through loans or withdrawals, providing flexibility in financial planning. However, IUL policies come with risks, including the potential for underperformance of the linked index and the impact of fees on overall returns. It is important for policyholders to carefully review the terms and conditions of an IUL policy and consider their risk tolerance before purchasing.

Topic 5: Personalized Coverage

In today's fast-paced world, personalized coverage has become an essential aspect of our lives. With the advancement of technology and the availability of data, insurance companies are now able to tailor their offerings to meet the specific needs of individuals. This personalized coverage not only provides a sense of security and peace of mind, but also ensures that policyholders are adequately protected.

One of the key benefits of personalized coverage is the ability to choose the level of protection that best suits your needs. Whether it's home insurance, auto insurance, or health insurance, policyholders can now customize their coverage based on factors such as age, location, and lifestyle. This ensures that you are not paying for coverage that you don't need, while still providing comprehensive protection for the risks that are most relevant to you.

"Personalized coverage has revolutionized the insurance industry, allowing individuals to have greater control over their insurance policies and ensuring that they are getting the coverage they truly need."

Furthermore, personalized coverage also enables insurance companies to offer additional benefits and services that are tailored to the policyholder. This could include access to discounted rates for certain services, personalized advice and recommendations, or even wellness programs that promote a healthier lifestyle. These added perks not only enhance the overall insurance experience but also incentivize individuals to maintain their coverage and take proactive steps towards mitigating risks.

As we move further into the digital age, personalized coverage will continue to evolve and adapt to meet the changing needs of individuals. With the power of data analytics and machine learning, insurance companies will be able to refine their offerings even further, providing a level of customization that was previously unimaginable. This will not only benefit policyholders but also enable insurance companies to better manage risk and streamline their operations.

1 note

·

View note

Link

0 notes

Link

0 notes

Text

Is Term Life Insurance Right For 50 Years Old Male | Chris Antrim CLTC

Life insurance rates can change as you age, and turning 50 is a significant milestone that may impact your life insurance premiums. In this article, we will discuss how life insurance rates change when you turn 50 and what factors influence these changes.

First, it's essential to understand that life insurance premiums are based on several factors, including your age, health, gender, lifestyle, occupation, and hobbies. As you age, your life expectancy decreases, which means your life insurance premiums may increase.

Is Term Life Insurance Right For A 50 Years Old Male

Term life insurance is a kind of insurance that covers you for a set amount of time, like 10, 20, or 30 years. It is a popular choice for people who want cheap life insurance for a certain amount of time. But is term life insurance the right choice for a man who is 50 years old? We'll talk about the pros and cons of term life insurance for a 50-year-old man in this piece.

One of the best things about term life insurance is that it is cheap. Most of the time, the premiums for term life insurance are cheaper than those for permanent life insurance, like whole life or universal life. This can be especially important for a man who is 50 years old and has other bills to pay, like a home or college tuition for his kids.

Term life insurance plans come with coverage amounts that range from $100,000 to several million dollars. This lets a man who is 50 years old choose the amount of coverage that fits his financial wants and goals the best. A lot of term life insurance policies have premiums that stay the same for the whole time. This means that a man who is 50 years old can lock in a low premium rate for the whole length of the policy, giving him peace of mind and financial security.

How Life Insurance Rates Change When You Aged

When you turn 50, you may notice a significant increase in your life insurance premiums, particularly if you have a term life insurance policy. Term life insurance policies provide coverage for a specific period, such as 10, 20, or 30 years. The premiums for these policies are typically fixed for the duration of the term, but they may increase when you reach a certain age, such as 50 or 60.

The reason for the increase in premiums is that your risk of mortality increases as you age. The older you get, the more likely you are to experience health issues that could impact your life expectancy. Insurance companies take this into account when setting your premiums.

In addition to your age, your health is a critical factor in determining your life insurance premiums. As you get older, you may be more likely to develop health conditions such as high blood pressure, diabetes, or heart disease. These conditions could impact your life insurance rates, as insurance companies may consider you a higher risk.

The cost of life insurance varies greatly depending on a number of factors, including the policyholder’s age, health, and lifestyle. However, there are some general trends that can be used to estimate the average monthly cost of life insurance. For example, a 20-year-old non-smoking male can expect to pay an average of $20 per month for a basic life insurance policy. A 40-year-old non-smoking female can expect to pay $19 per month, and a 60-year-old male can expect to pay around $16 per month.

4 What Are the Different Types of Life Insurance

There are four main types of life insurance: term life, whole life, universal life, and indexed universal life.

Term Life Insurance. Term life insurance is the most basic and cheapest type of policy. It provides coverage for a specific period of time, typically 10-30 years. If you die during that time frame, your beneficiaries will receive a death benefit. If you live past the term, the policy expires and you get nothing.

Whole Life Insurance. Whole life insurance is more expensive than term because it covers you for your entire life. The death benefit is guaranteed, no matter when you die. Whole life also has a cash value component that builds up over time. You can borrow against the cash value or even surrender the policy for its cash value if you need to.

Universal Life Insurance. Universal life insurance (UL) is a type of permanent life insurance that gives a death payout and builds cash value. It is a combination product, like an IUL, because it has both a death benefit and a way to save money. With universal life insurance, customers pay premiums, from which the insurance company takes out the cost of the insurance and other fees. The rest of the premium goes into a cash value account, which gets interest at a rate set by the insurance company and made public. Flexibility is one of the most important things about UL. Policyholders can change their monthly payment and the amount of the death benefit as their finances change over time. Because of this, UL is a popular choice for people who want life insurance that can change as their needs do.

Indexed Universal Life. Indexed Universal Life Insurance (IUL) is a type of permanent life insurance that offers a death payout and the chance to build up cash thanks to an interest rate that changes with the market. It is a hybrid product that combines the best parts of standard universal life insurance and indexed investing. IUL is an easy idea to understand. When you buy an IUL policy, you pay premiums, and a part of those premiums are put into an index like the S&P 500 or the Nasdaq 100 by the insurance company. Your insurance company gives you an interest rate based on how well the index does, up to a cap and down to a floor. The floor makes sure that your policy's interest rate won't drop below a certain amount, even if the index does poorly.

Factors That Affect Life Insurance For Aged 50

The cost of life insurance goes up the older you get. Because of this, life insurance agents often tell people in their twenties and thirties to get a policy. But if you are in your 50s, you might still be able to get insurance. You just need to be ready to pay more for coverage and know that you may no longer be able to get some types of plans. Here are some of the main things that add to the cost of a policy:

Your age: Since life expectancy affects how much life insurance costs, it makes sense that prices can go up a lot for people over 50. As you get older, there is a greater chance that your life insurance company will have to pay out. On the other hand, even permanent life insurance plans with a guaranteed payout cost less when you buy them when you are younger because you have more time to pay into the policy.

Your health: In general, younger people are healthier than older people. As people age, their health tends to get worse. This makes it more likely that your life insurance company will have to pay out on your policy. The cost of life insurance is also affected by things like smoking and other risky habits.

Length of the policy: Term life insurance, which only covers you for a certain amount of time, usually costs less than a fixed policy. Short-term policies are usually cheaper than long-term policies, but you can be sure that the cost of your payment will go up when it's time to renew. In any case, a 30-year term life insurance policy will usually cost more than a 10-year term policy if you are over age 50.

Why A 50 Year Old Male Need Life Insurance

Life insurance is an important financial tool that provides financial protection for your loved ones in the event of your unexpected death. While many people believe that life insurance is only necessary for young families, it is just as important for 50-year-old men. In this article, we will discuss the reasons why a 50-year-old male needs life insurance.

Providing Financial Support for Dependents. If you have dependents, such as a spouse or children, they may rely on your income to cover their living expenses. If you were to pass away unexpectedly, your income would no longer be available to support them. Life insurance can provide a lump sum payment to your beneficiaries, which can help them pay for living expenses, such as mortgage payments, college tuition, and daily expenses.

Paying off Debts and Expenses. In addition to providing financial support for your dependents, life insurance can also help pay off any outstanding debts or expenses you may have. This can include mortgage payments, credit card debts, car loans, and other loans. If you were to pass away unexpectedly, your beneficiaries could use the life insurance payout to pay off these debts and expenses, which can help reduce the financial burden on your loved ones.

Covering End-of-Life Expenses. End-of-life expenses, such as funeral costs and medical bills, can be significant and add up quickly. Life insurance can help cover these expenses, so your loved ones do not have to bear the financial burden. Without life insurance, your family may have to dip into their savings or take out loans to cover these expenses, which can be stressful and overwhelming.

Leaving a Legacy. Life insurance can also help you leave a financial legacy for your loved ones. You can name your beneficiaries and decide how you want the life insurance payout to be distributed. This can include leaving a lump sum payment to your children or grandchildren, donating to a charity, or leaving funds to support a cause that is important to you.

Need Life insurance? Get In Touch With Chris Antrim Insurance

Life insurance is an important financial tool that protects your family's finances in case you die unexpectedly. Even if you're a 50-year-old man, life insurance can still help you in a lot of ways. It can support your dependents financially, pay off your bills and expenses, cover your end-of-life costs, and help you leave a financial legacy. Reviewing your life insurance needs on a daily basis is important to make sure you have the coverage you need to protect your family. If you need help regarding your policy or you are new to life insurance, Chris Antrim, Health, Life & Medicare Insurance Broker is happy to help you with your insurance needs!

Originally published here: https://www.goidahoinsurance.com/term-life-insurance-for-a-50-year-old-male

0 notes

Text

How Much Does Indexed Universal Life Insurance Cost? A Complete Breakdown

Indexed Universal Life Insurance (IUL) is a complex financial product that offers both life insurance coverage and a cash value component that can potentially grow over time. Understanding the costs associated with Indexed Universal Life Insurance is crucial for individuals considering this type of policy. In this comprehensive breakdown, we will delve into the various factors that influence the cost of Indexed Universal Life Insurance, providing insights into how much does indexed universal life insurance cost these costs are determined and what policyholders should consider when evaluating their options.

Introduction to Indexed Universal Life Insurance

Indexed Universal Life Insurance is a type of permanent life insurance that combines the death benefit protection of traditional life insurance with the potential for cash value growth linked to the performance of an underlying index, such as the S&P 500. Unlike traditional whole life insurance, which offers fixed interest rates on the cash value component, IUL policies provide the opportunity for higher returns based on the performance of the chosen index.

Factors Influencing the Cost of Indexed Universal Life Insurance

Several factors influence the cost of Indexed Universal Life Insurance:

Age and Health: Age and health are significant factors that impact the cost of life insurance premiums. Generally, younger and healthier individuals are offered lower premiums compared to older or less healthy individuals. Insurance companies assess the risk of mortality based on these factors when determining premium rates.

Coverage Amount: The amount of coverage, or death benefit, selected by the policyholder directly affects the cost of the policy. Higher coverage amounts typically result in higher premiums. Policyholders should carefully consider their insurance needs and financial objectives when choosing the coverage amount.

Premium Payment Structure: Indexed Universal Life Insurance policies offer flexibility in premium payment structures. Policyholders can choose to pay premiums for a specified period (e.g., 10, 15, or 20 years) or for the duration of the policyholder's life. The premium payment structure selected can impact the overall cost of the policy.

Cash Value Growth Potential: The potential for cash value growth linked to the performance of the underlying index is a key feature of IUL policies. While this feature offers the opportunity for higher returns, it also affects the cost of the policy. Policyholders should carefully consider the trade-offs between the cost of insurance and the potential for cash value accumulation.

Cost of Insurance (COI): The Cost of Insurance refers to the fees deducted from the cash value to cover the risk of providing the death benefit. COI rates vary based on factors such as age, gender, health, and coverage amount. Policyholders should review the COI structure and understand how it impacts the overall cost of the policy.

Administrative Fees: Indexed Universal Life Insurance policies often come with administrative fees, which cover the costs of policy administration, customer service, and other operational expenses. These fees are typically deducted from the cash value and can impact the policy's overall cost.

Indexing Fees: Since IUL policies are tied to the performance of an underlying index, such as the S&P 500, there may be indexing fees associated with tracking the index. These fees cover the cost of administering the indexed accounts and are reflected in the policy's overall cost.

Understanding Policy Illustrations

Insurance companies typically provide policy illustrations that project the potential growth of the cash value and death benefit based on various assumptions, including interest rates, market performance, and policy expenses. Policyholders should review these illustrations carefully to understand how changes in these assumptions can impact the cost and performance of the policy over time.

Considerations for Policyholders

When evaluating the cost of Indexed Universal Life Insurance, policyholders should consider the following factors:

Long-Term Financial Goals: Indexed Universal Life Insurance is a long-term financial commitment that requires careful consideration of one's financial goals and objectives. Policyholders should assess whether the cost of the policy aligns with their long-term financial plans.

Risk Tolerance: The potential for cash value growth linked to the performance of an underlying index introduces market risk into IUL policies. Policyholders should evaluate their risk tolerance and investment objectives when considering Indexed Universal Life Insurance as an option.

Policy Flexibility: Indexed Universal Life Insurance offers flexibility in premium payments, death benefit options, and investment allocations. Policyholders should leverage this flexibility to adapt to changing financial needs and market conditions over time.

Policy Review and Monitoring: As with any financial product, it's essential for policyholders to review their Indexed Universal Life Insurance policy regularly and monitor its performance. Policyholders should stay informed about changes in policy expenses, market conditions, and other factors that may impact the cost and performance of the policy.

Conclusion

In conclusion, the cost of Indexed Universal Life Insurance is influenced by various factors, including age, health, coverage amount, premium payment structure, cash value growth potential, Cost of Insurance, administrative fees, and indexing fees. Policyholders should carefully evaluate these factors, along with their long-term financial goals, risk tolerance, and policy illustrations, to determine whether Indexed Universal Life Insurance is the right choice for them. By understanding the costs and considerations associated with IUL policies, individuals can make informed decisions about their life insurance coverage and financial future.

0 notes

Link

The Downside of IUL: Understanding the Risks and Limitations of Indexed Universal Life Insurance Introduction Indexed Universal Life Insurance (IUL) is a type of life insurance policy that combines the benefits of traditional life insurance with the opportunity to grow cash value through investments. However, like any financial product, IUL....

0 notes