#uk financial trustee services

Explore tagged Tumblr posts

Text

The Long Covid Groups say patients are being abandoned as dedicated clinics close despite a rise in UK cases - Published Sept 8, 2024

As the UK Covid-19 Inquiry resumes with a focus on healthcare systems in each of the four nations, the Long Covid Groups (comprising Long Covid Support, Long Covid SOS, Long Covid Physio and Long Covid Kids) are shocked and deeply concerned to learn that Long Covid clinics are being closed at a time when reported cases are continuing to rise.

Charities and many medical experts have long maintained we are in the midst of a global health crisis. Without a concerted effort to address this issue, the closures will only add to the significant burdens already being faced by healthcare systems and economies.

Recent data from the US has suggested that Long Covid may affect up to 7% of the population and prevalence could rise further. The latest ONS updates have shown that incidence of long-term sickness is at record levels and has been on an upward trajectory since early 2020. Staff shortages and high levels of school absenteeism are frequently reported across the UK. The annual productivity loss in the UK resulting from Long Covid is currently estimated to be £1.5 billion.

This stark picture contrasts with the lack of support Long Covid patients are receiving. At the start of the year, there were close to 100 Long Covid clinics for adults and 13 hubs for children and young people (CYP) in England. Earlier this year however, the highly regarded NHS England national programme was stood down with responsibility for Long Covid services being delegated to each of the Integrated Care Boards (ICBs). In recent months, patients and staff have reported the closure and a severe scaling back of clinics including Devon, Hampshire, Hertfordshire, Lancashire and Surrey. Key personnel and resources are being subsumed into other NHS services and, in some cases, staff are leaving the NHS altogether. Some CYP hubs are being forced to take on patients from those that have already closed with no extra funding.

In the other UK nations, the provision of Long Covid services is individual to each health board with no centrally agreed model on what Long Covid clinics should look like. They mostly focus on therapies designed to help patients manage their conditions rather than being clinician led. There is only one service dedicated to paediatrics in Scotland with none in Northern Ireland and Wales.

The Long Covid Groups urge all governments and healthcare providers to adopt a service model that prioritises dedicated clinics supported by experienced clinician-led, multidisciplinary teams. Given the complexity and multi-faceted nature of the condition, the Long Covid Groups stress that specialists from each of the relevant disciplines should work collaboratively. In partnership with patients, they call for a healthcare framework that is dedicated to successfully diagnosing, treating and preventing Long Covid; this will contribute towards relieving the operational and financial pressures on the NHS.

Amitava Banerjee, Professor of Clinical Data Science and Honorary Consultant Cardiologist & Long Covid SOS Trustee

“The evidence for the health, healthcare and economic effects of Long Covid, whether on individuals or societies, is unequivocal. Therefore, we must ensure that coordinated research and care are prioritised for Long Covid."

Sammie McFarland, CEO & Founder, Long Covid Kids

"Appropriate funding and resources would provide clinicians with the best possible opportunity to improve patients' lives, but this hasn't been forthcoming. Rising school absenteeism and Long Covid in children are red flags demanding immediate action. Closing specialised clinics risks creating a healthcare vacuum with far-reaching consequences for healthcare, education, families, and the future workforce."

Professor Mark Faghy, Vice-Chair of Long Covid Physio

“The scaling back and closure of services around the UK at a time when the prevalence of Long Covid is rising seems counterintuitive. Before these decisions were made, there were calls from patients and healthcare workers to grow services and ensure consistency across the UK but it seems to be going the other way.”

Nikki Smith, Founding Member, Long Covid Support

“With many people now getting Covid-19 multiple times, the risk of having on-going symptoms of Long Covid is increasing, which will result in more pressure on the NHS, fewer people able to work and an even bigger hit on the economy. It must be a priority of our new public service Government to ensure effective Long Covid clinics that are up to date with the latest research, are accessible by all.”

#mask up#covid#pandemic#covid 19#wear a mask#public health#coronavirus#sars cov 2#still coviding#wear a respirator#long covid

13 notes

·

View notes

Text

"...So what is Choose Love, who is behind it – and why are they leaving Calais? To find out, Corporate Watch has spoken to a number of former Choose Love employees, to people who have worked with the organisations it funded, and to others who have been active in Calais charity and solidarity. We have maintained all our sources’ anonymity, at their request.

Josie Naughton (2nd left) and some friends. Choose Love publicity photo.

A GROUP OF MATES MEETS A GROUP OF BANKERS

Choose Love’s origin story has been well publicised. In August 2015, at the height of the “long summer of migration”, a “group of mates” made a Twitter hashtag #HelpRefugees, asking for donations. They filled a London warehouse with supplies and drove to the Calais Jungle. This was a particularly well-connected group of mates: Josie Naughton worked as PA to the manager of Coldplay, radio DJ Lliana Bird’s partner is comedian Noel Fielding, while Dawn O’Porter was a TV presenter. A year on they had raised “£2 million and another £1 million worth of goods and services, with close to zero overheads”. Naughton had quit her day job to run the operation, then called Help Refugees, assisted by another friend Nico Stevens (now Sanders).

Explaining this overnight success, Naughton has said their “naivety was an asset”, and that working with Coldplay she “learned about how to use branding, speak to a community and run a business.” They certainly had enthusiasm and drive – but then so did many people rushing to help in the Jungle at that point. What others didn’t have were their networks, the ability to pull in big-name celebrity backers and social media influencers.

Less well-known – but just as consequential – is Choose Love’s relationship with an organisation called Prism the Gift Fund. Scroll down to the small print at the bottom of the Choose Love website, and we are told Choose Love is operating “under the auspices of Prism the Gift Fund”. Choose Love is not run as an independent charity but as a “collective fund” managed by Prism, which is itself a charity. Prism says it helps organisations like Choose Love with legal and financial issues, and “back-office support”. Prism says this allows groups like Choose Love to “focus on the cause whilst we provide the administration, governance and charitable expertise to support your charitable endeavours all over the world.”

This underplays the control Prism has over “collective funds” like Choose Love. Prism’s annual report says: “Founders [of Collective Funds] are accountable to Prism in all their activities, and Prism has full control of all financial flows”.

So who is behind Prism? Its CEO is Anna Josse, who also runs the private equity fund Regent Capital, which “specialises in investment products/services to UK-based high net worth investors” (i.e., rich people). She is supported by a board of trustees, most of whom are investment bankers and fund managers, also specialising in “wealth management” for rich clients. The exception is Lord Dolar Popat, a Conservative life peer and former junior government minister.

As well as running “collective funds” like Choose Love, Prism also manages donation funds for rich people, who want to give to charity without the trouble of setting up their own private foundations (while still maintaining the “tax benefits” from charitable giving, naturally).

Josse has done well from the fees Prism charges its clients and funds (in Choose Love’s case, 2% of its expenditure). While Prism’s activities are not for profit, it pays its staff through a private, for profit company: Prism Administration Ltd. This is co-owned by Josse and her fellow Prism co-founder businessman Gideon Lyons. Its accounts show it has made £740,000 in profit in the last four years and has paid out £610,000 to Josse and Lyons in dividends.

Anna Josse (centre) and the Prism team at the “Luxury Briefing Awards 2019”. Photo from Prism social media.

“DEFENSIVE AND SECRETIVE”

With Prism’s support Choose Love grew far beyond its Calais origins. In 2020 it raised £11.8 million and spent £9.7 million. Just over £1 million went on programmes in France, with more than £5 million in Greece, £1 million in the UK, £617,000 in Syria, and smaller amounts in another 13 locations, from Brazil to Bangladesh.

In Calais, Choose Love has supported around 10 “partner” groups. These have included aid distribution organisations like Calais Food Collective and Collective Aid, as well as projects like the Refugee Women’s Centre, Human Rights Observers, Refugee Infobus, or Maison Sesame which provides emergency accommodation. Many of these organisations, like Choose Love itself, were quite recent “start-ups” often created by British volunteers. For this reason, a lot of the funding and administrative infrastructure went through Choose Love’s major French partner, the more established local association L’Auberge des Migrants.

At the start of 2021, Josie Naughton (CEO) and Nico Sanders (deputy CEO) were now rarely seen in Calais. But there was no hint of quitting. Daily operations were run by locally-based French-speaking field managers, and Choose Love was developing a new long-term strategy for its work in the north of France.

Then came two developments, both in February 2021. First, a former Choose Love employee in Greece published allegations that she had been raped by another employee there, and accused Choose Love of failing to adequately investigate or respond. These allegations alarmed a number of the “partner” groups in Calais, who wrote a joint letter to Choose Love.

One former Choose Love employee told Corporate Watch the intention of the letter, and other demands for clarification, was “to stimulate more discussion and accountability”. But instead it “triggered a defensive reaction by top management”:

“They eventually accepted to provide answers to partners on some questions, while maintaining confidentiality on sensitive information about the case. But some people hoped for a larger discussion between Choose Love and partner organisations to learn lessons. They decided not to facilitate this, but instead to opt for a very defensive and secretive approach. This created a lot of frustration and unease amongst partner organisations, who felt like a split emerged between Choose Love and the rest of the Calais network.”

CROSSING THE LINE

In the same month, Choose Love bosses in London found out charities they funded were handing out safety information for refugees trying to cross the channel. They were mainly concerned by the “Safety at Sea” leaflets, produced by Watch the Channel. This is a small activist group linked to Calais Migrant Solidarity, the “No Borders” solidarity network which has been active in Calais since 2009, as well as to the Alarm Phone network which runs an emergency phone line for sea rescue in the Mediterranean.

Written in several of the main languages used in Calais, the leaflets give basic lifesaving information such as emergency numbers, how to send GPS coordinates to rescuers, and what to do if your engine breaks down. There are no tips on how to evade police or coastguards, just how to call them in case of shipwreck. The leaflet was checked by both French and British legal experts. It may well have saved some people’s lives.

But according to another person familiar with Choose Love’s approach on this issue:

“Choose Love’s approach and policy on this, was that volunteers from partner organisations were never to give ‘advice’ to refugees in Calais. For example, volunteers could give out emergency coastguard phone numbers, but if people asked anything more than that they should say nothing. Volunteers were also told, specifically, not to help if anyone asked about where to get life jackets. These leaflets were seen as crossing that line.”i

In May, as Calais organisations continued to share the leaflets, Choose Love got tough. It wrote a formal email to its partner associations warning them that distributing the leaflets – or even just “discussing” them – could be “regarded as criminal offences”.ii Organisations were told they had to sign a “Memorandum of Understanding” promising not to “carry out activities which risk breaching the law.”

Why did Choose Love feel the leaflets were so dangerous? The email said this position came following “a general risk review carried out by our host charity, Prism the Gift Fund.” And when Watch the Channel wrote to Choose Love disputing its position, Nico Sanders replied saying they were following legal advice “sourced from [barristers] Garden Court chambers”. Her reply also ended with a blunt statement: “We are unable to fund organisations distributing leaflets of this nature.”

The funded organisations in Calais were not happy. According to people we spoke to, none refused outright to sign the memorandum. But some held off signing, while at least one wrote back to Choose Love protesting. Some started to talk about the issue in public, including L’Auberge des Migrants, Choose Love’s main French partner. Its president François Guennoc publicly defended the leaflets, saying:

“With the other associations, we all agreed about these leaflets. They are legal, we checked this before giving them out. They are documents that save human lives.”

At the start of June, Choose Love and Prism asserted their authority. They told their partners that, from now on, they would only issue funding agreements for a month at a time. People we spoke to saw this as sending a clear message: back down over the leaflets, or lose the money. Then, at the end of June, Choose Love told all their Calais partners that their funding would end in December.

What further enraged many partners is that Choose Love ordered them to keep the news secret: a gag that held until November. The rationale for this, according to a former Choose Love employee, was that publicising the withdrawal from Calais might negatively impact Choose Love’s ongoing fundraising activities. But this meant that the Calais groups faced even greater problems: not only was their funding about to end, but they couldn’t explain their situation to potential new donors.

When we asked Choose Love about this, they told us: “This decision was communicated to partner organisations as early as possible, and grant agreements were in fact extended, to enable those affected to find alternative sources of funding should they require it.”

Also at the end of June, Choose Love axed its London-based “Advocacy” team, which had been set up to work on policy interventions. For the former employees we spoke to, this seemed a clear signal that Choose Love wasn’t just retreating from Calais, but from anything beyond the narrowest definition of humanitarian aid.

Forced camp evacuation in Grande-Synthe in November. Picture: Utopia 56.

IS IT REALLY A CRIME TO HELP PEOPLE SURVIVE AT SEA?

Did Choose Love have significant cause to fear legal risks from the sea safety leaflets? It’s hard to see how. Choose Love’s email to partners mentioned a section of immigration law (Section 25) on “facilitating entry”, i.e., helping people enter the country illegally. But there are no cases of this law being used in anything like the situation of handing out a safety leaflet.

Indeed, as the recent acquittal of Iranian refugee Fouad Kakaei shows, even actually steering a boat across the Channel isn’t in itself illegal. If the aim is to claim asylum, people are openly heading to a British port not trying to evade the coast guards, and it’s not being done for financial gain, then this is not “facilitating illegal entry”. It seems even less likely that someone could be successfully prosecuted just for giving out safety information, aiming to save people’s lives. And less likely still that Choose Love or Prism would be prosecuted just because they give unconnected funding to others who give out these leaflets.

Choose Love’s managers have refused to discuss the legal advice they received from Garden Court, citing “legal privilege”.iii They did not answer our questions about this legal advice or how it affected their decision to end funding. It seems possible that Garden Court, as is typical in barristers’ advice, may have identified the theoretical possibility of a prosecution. Which is not the same thing as saying it was at all likely. Ultimately, any legal advice would still leave the responsibility with the clients – Choose Love, or Prism – to decide what level of risk they were willing to face. The answer is apparently: not much at all.

The law may get tougher in future. Responding to the media hysteria about boat crossings, the government’s new Nationality and Borders Bill could potentially criminalise even people trying to reach a port to claim asylum. But there should still remain a defence for people giving out information to try and save lives.

And, of course, this law hasn’t yet been passed. As a group has written on the Oxford University Law Faculty’s Border Criminologies blog:

“Given the hostile agenda at the heart of the Nationality and Borders Bill, caution around criminalisation is understandable. But rather than minimising this chance, the actions of Choose Love risk making it even more likely. Without prompting or legal precedent, they took it upon themselves to define certain forms of support as (potentially) criminal, signaling their own distance from, and disapproval, of this work. This pre-emptive move in effect enforces the border on the UK’s behalf, criminalising particular routes to the UK, and anyone even seen to be supporting those travelling on them.”

UNDER PRESSURE?

Choose Love’s only public statement on the decision to leave Calais is a handwritten note posted on Instagram on 2 November. It says: “this year we find ourselves in a place where we have had to make some difficult decisions and we have news which we are delivering with heavy hearts.” But no explanation. Just: “as a result of many contributing factors, including the pandemic, we initiated an internal and external review of our strategy.”

When we asked Choose Love if they could explain further, they sent us a very similar statement: “The decision to end funding for some projects in northern France was not taken lightly. It followed in-depth internal and external reviews into how we carry out our work […]”.iv

Some people in Calais we spoke to believe the Home Office may have deliberately exerted pressure to break Choose Love’s backing for groups supporting migrants there. Boat crossings from Calais have become a central political issue – and massive media headache – for Home Secretary Priti Patel.

Choose Love’s top management was in contact with the Home Office. In February, as the rape allegations and leaflet issues kicked off, Josie Naughton was preparing for a meeting with members of Priti Patel’s policy team about unaccompanied children in Calais. Another possible conduit is Prism’s Tory Lord, Lord Popat. He has worked with Priti Patel before, including on a major trade mission to India in 2013. There were certainly opportunities for ministers or officials to “lean on” Choose Love – but no evidence that this ever happened.

How involved was Prism in the decision to quit Calais? We have already seen it has significant formal power over Choose Love. This appears to have been exercised in practice. One former Choose Love employee told Corporate Watch:

“Prism played a very big role in Choose Love’s decision-making. Prism employees attended many of the Choose Love internal meetings and had a very close relationship with the top management team. After the rape allegation, it was Prism who carried out the investigation on behalf of Choose Love. I think that says a lot about their dynamics.”

Another recalls how:

“when Choose Love announced the funding was being cut, there were hints that they didn’t really want to do this, it was coming from Prism and their hands were tied. Of course all of that was very vague, they never disclosed what the risk review actually concluded.”

We asked both Choose Love and Prism what discussions they had with the Home Office, and whether these had influenced their decision. We also asked both to explain the decision-making relationship between them. Choose Love did not directly answer the question about discussions with the Home Office, but told us:

Our decision was ours and ours alone. All financial decisions are fully audited by Prism the Gift Fund, who oversee Choose Love to provide the highest levels of financial oversight and governance, ensuring we meet the highest regulatory standards, and it is independently audited and fully compliant with the Charity Commission.”

Prism told us:

“Choose Love’s decision to end funding for some projects in northern France was entirely its own decision.” It also said: “We were aware of the decision but our involvement was rightly limited to overseeing the highest standards of financial oversight and governance.”v

Priti Patel and Lord Dolar Popat, Prism trustee, together at the Conservative Party conference 2015. Patel and Popat are immediately on either side of the banner. Picture: Bob Blackman MP.

LOVE WITHOUT COMMITMENT

In Calais, Choose Love’s managers faced several pressures. They faced new demands for accountability from their funded organisations; some perceived legal risk, however low; and, possibly, political pressure from the Home Office. We don’t know exactly what factors shaped their decision. What we do know is that, as these pressures mounted, they quit their commitment to Calais.

Perhaps that’s hardly surprising. Choose Love and Prism came to dominate the supply of humanitarian funding to Calais almost overnight. This put considerable power over vulnerable people into the hands of two groups of decision-makers. One was Choose Love: a “group of mates” from the London media world, who openly admitted their “naivety”. The other was Prism: a charity manager for the rich, run by investment bankers and a Conservative Lord.

One person who worked with Choose Love reflects: “my first impression when I realised how they worked was that they were ill prepared, just not competent. But then, there is only a certain amount you can justify as lack of preparedness or poor leadership.”

Maybe it wouldn’t matter so much if all people needed in Calais were deliveries of food and other aid. But Calais has never been just a “humanitarian crisis” – if there is ever such a thing. The desperation and death here is a direct result of the border, created by media and politicians, enforced by police and security guards. When even sharing basic sea safety information becomes a political battleground, showing solidarity means being called to make a stand. If standing with refugees means choosing love, that love also requires commitment.

IF YOU WANT TO SEND MONEY TO NORTHERN FRANCE:

Calais Migrant Solidarity / Watch the Channel:

The Calais Migrant Solidarity network has been active in Calais since 2009, practising solidarity not charity. Watch the Channel shares sea safety information and monitors the UK and French authorities “to ensure that the coastguards fulfil their duties under international maritime law to rescue people in distress.” It doesn’t have its own bank account but donations can be sent via CMS.

https://calaismigrantsolidarity.wordpress.com/donate/

Calais Appeal:

Calais Appeal is a group of seven humanitarian aid organisations working in Calais: Calais Food Collective, Collective Aid, Human Rights Observers, Refugee Women’s Centre, Refugee Info Bus, Woodyard and Project Play. They have set up this joint emergency appeal fund after having their funding cut by Choose Love.

https://www.calaisappeal.co.uk/

iThere is a distinction in UK law between giving “immigration advice”, e.g., advising an individual on their specific case, and sharing general “information”. In an email exchange with Choose Love, Watch the Channel pointed this out and asked that Choose Love stop referring to their leaflet as giving “advice”.

"We understand that some civil society organisations in Calais may, as of recently, be carrying out activities (such as, non-exhaustively, creating, distributing and discussing leaflets giving advice on making Channel crossings) which might be regarded as criminal offences under section 25 [of the Immigration Act 1971].”

In an email to Watch the Channel, Nico Sanders of Choose Love wrote: “We can confirm we received legal advice

which we are unable to share in order for it to remain legally privileged.” When we also asked them about the legal advice, they did not respond to the question.

Choose Love’s statement in full: “The decision to end funding for some projects in northern France was not taken lightly. It followed in-depth internal and external reviews into how we carry out our work, and was made to ensure we can continue to achieve positive change for the people we support through the organisations we fund.

“As a result of these reviews, we made the decision to focus funding on two charities working with unaccompanied minors in northern France. We look forward to continuing our work with them to support children and young people. This decision was communicated to partner organisations as early as possible, and grant agreements were in fact extended, to enable those affected to find alternative sources of funding should they require it.

“Our decision was ours and ours alone. All financial decisions are fully audited by Prism the Gift Fund, who oversee Choose Love to provide the highest levels of financial oversight and governance, ensuring we meet the highest regulatory standards, and it is independently audited and fully compliant with the Charity Commission.”

Prism’s responses in full:

“Choose Love is a restricted funds operating under the auspices of Prism the Gift Fund (Prism). Our Trustees oversee all income and expenditure of the Collective, ensuring it operates to the highest regulatory standards. We are therefore fully aware of all decisions taken by Choose Love and fully aware of its projects.

“The decision to focus funding in northern France on two charities supporting unaccompanied minors was a decision made by Choose Love...."

Choose Love, in a nutshell.

4 notes

·

View notes

Text

Armin Ordodary and FSM Smart’s Scam Exposed

Armin Ordodary and FSM Smart have received allegations of being involved in major fraudulent operations. Find out if those allegations are true or not.

There was a huge network of scam brokers surrounding FSM Smart and the so-called Lau Scheme. Armin Ordodary, a Cypriot of Iranian descent, is at its core. He has run a network of frauds and boiler rooms with associates that stretches from Georgia to the Balkans and Italy. Regulators from all around the world may have issued more warnings in relation to the FSM Smart broker fraud than any other. It is also known that in certain jurisdictions, law enforcement agencies are conducting investigations. Desperately, Ordodary keeps contacting Google to request DMCA takedown in an effort to block media reporting.

The Lau Scheme of FSM Smart

Lau Global Services Corp was an offshore company registered in Belize and licensed by the International Financial Services Commission under licence number IFSC/60/402/TS/15. The Lau Scheme operated at least the following broker brands:

MXTrade (www.mxtrade.com)

LGS Corp (www.lgs-corp.com)

TradingBanks (www.tradingbanks.com)

Trade12 (www.trade12.com)

MTI Markets (www.mtimarkets.com)

Grizzly (www.grizzly-ltd.com)

The media team has been able to identify a variety of legal entities connected with the Lau Scheme:

Lau Global Services Corp (Belize)

Upmarkt d.o.o. (Serbia), now BizServe d.o.o.)

Exo Capital Markets Ltd (Marshall Islands)

Global Fin Services Ltd (UK)

MTI Investments LLC or MTI Markets Ltd (Marshall Islands)

Grizzly Ltd (Malta)

R Capital Solutions Ltd (Cyprus)

Benrich Holdings Ltd (Cyprus)

Eyar Financial Corp Limited (Vanatu)

SIAO Ltd (Cyprus)

The majority of the companies don’t have a website or are no longer active on social media, although Lau Global Service Corp.’s Facebook page is still accessible. Lau Global Services is also a shareholder in Grizzly Ltd., a Malta-based company that formerly served as a payment services provider for such dishonest and unlawful broker schemes, according to Offshore Leaks Database. Shlomo Matan Shalom Avshalom, an Israeli, is listed as a director of Grizzly Ltd.

Up until 2015, MXtrade was owned and operated by R Capital Solutions Limited, which is currently Eightcap EU Ltd, a CySEC-regulated CIF. After that, the brand and its clientele were moved to the Lau Scheme.

Armin Ordodary’s FSM Scheme

The FSM Smart (www.fsmsmart.com) scam broker, Armin Ordodary (shown on the left), is involved in the Lau Scheme. Through its Serbian boiler room Upmarkt d.o.o. (formerly Bizserve d.o.o.), of which Benrich Holdings Ltd., a company registered in Cyprus, is the only stakeholder, it has been actively courting clients. Armin Ordodary, a resident of Cyprus, serves as the director of both companies. With Kyiv, Ukraine, serving as something of a hotspot, more boiler chambers have already been discovered in other jurisdictions.

According to a leak, Upendo Limited in Cyprus runs a boiler room in Paphos and is also a member of the network. In December 2018, Upendo was officially registered with the company number HE392291. Christoforos Andreou and AMF Global Services Limited are listed as directors. These seem to be trustees on behalf of the beneficial owners.

1 note

·

View note

Text

Armin Ordodary and FSM Smart’s Scam Exposed

Armin Ordodary and FSM Smart have received allegations of being involved in major fraudulent operations. Find out if those allegations are true or not.

There was a huge network of scam brokers surrounding FSM Smart and the so-called Lau Scheme. Armin Ordodary, a Cypriot of Iranian descent, is at its core. He has run a network of frauds and boiler rooms with associates that stretches from Georgia to the Balkans and Italy. Regulators from all around the world may have issued more warnings in relation to the FSM Smart broker fraud than any other. It is also known that in certain jurisdictions, law enforcement agencies are conducting investigations. Desperately, Ordodary keeps contacting Google to request DMCA takedown in an effort to block media reporting.

The Lau Scheme of FSM Smart

Lau Global Services Corp was an offshore company registered in Belize and licensed by the International Financial Services Commission under licence number IFSC/60/402/TS/15. The Lau Scheme operated at least the following broker brands:

MXTrade (www.mxtrade.com)

LGS Corp (www.lgs-corp.com)

TradingBanks (www.tradingbanks.com)

Trade12 (www.trade12.com)

MTI Markets (www.mtimarkets.com)

Grizzly (www.grizzly-ltd.com)

The media team has been able to identify a variety of legal entities connected with the Lau Scheme:

Lau Global Services Corp (Belize)

Upmarkt d.o.o. (Serbia), now BizServe d.o.o.)

Exo Capital Markets Ltd (Marshall Islands)

Global Fin Services Ltd (UK)

MTI Investments LLC or MTI Markets Ltd (Marshall Islands)

Grizzly Ltd (Malta)

R Capital Solutions Ltd (Cyprus)

Benrich Holdings Ltd (Cyprus)

Eyar Financial Corp Limited (Vanatu)

SIAO Ltd (Cyprus)

The majority of the companies don’t have a website or are no longer active on social media, although Lau Global Service Corp.’s Facebook page is still accessible. Lau Global Services is also a shareholder in Grizzly Ltd., a Malta-based company that formerly served as a payment services provider for such dishonest and unlawful broker schemes, according to Offshore Leaks Database. Shlomo Matan Shalom Avshalom, an Israeli, is listed as a director of Grizzly Ltd.

Up until 2015, MXtrade was owned and operated by R Capital Solutions Limited, which is currently Eightcap EU Ltd, a CySEC-regulated CIF. After that, the brand and its clientele were moved to the Lau Scheme.

Armin Ordodary’s FSM Scheme

The FSM Smart (www.fsmsmart.com) scam broker, Armin Ordodary (shown on the left), is involved in the Lau Scheme. Through its Serbian boiler room Upmarkt d.o.o. (formerly Bizserve d.o.o.), of which Benrich Holdings Ltd., a company registered in Cyprus, is the only stakeholder, it has been actively courting clients. Armin Ordodary, a resident of Cyprus, serves as the director of both companies. With Kyiv, Ukraine, serving as something of a hotspot, more boiler chambers have already been discovered in other jurisdictions.

According to a leak, Upendo Limited in Cyprus runs a boiler room in Paphos and is also a member of the network. In December 2018, Upendo was officially registered with the company number HE392291. Christoforos Andreou and AMF Global Services Limited are listed as directors. These seem to be trustees on behalf of the beneficial owners.

0 notes

Text

Armin Ordodary and FSM Smart’s Scam Exposed

There was a huge network of scam brokers surrounding FSM Smart and the so-called Lau Scheme. Armin Ordodary, a Cypriot of Iranian descent, is at its core. He has run a network of frauds and boiler rooms with associates that stretches from Georgia to the Balkans and Italy. Regulators from all around the world may have issued more warnings in relation to the FSM Smart broker fraud than any other. It is also known that in certain jurisdictions, law enforcement agencies are conducting investigations. Desperately, Ordodary keeps contacting Google to request DMCA takedown in an effort to block media reporting.

The Lau Scheme of FSM Smart

Lau Global Services Corp was an offshore company registered in Belize and licensed by the International Financial Services Commission under licence number IFSC/60/402/TS/15. The Lau Scheme operated at least the following broker brands:

MXTrade (www.mxtrade.com)

LGS Corp (www.lgs-corp.com)

TradingBanks (www.tradingbanks.com)

Trade12 (www.trade12.com)

MTI Markets (www.mtimarkets.com)

Grizzly (www.grizzly-ltd.com)

The media team has been able to identify a variety of legal entities connected with the Lau Scheme:

Lau Global Services Corp (Belize)

Upmarkt d.o.o. (Serbia), now BizServe d.o.o.)

Exo Capital Markets Ltd (Marshall Islands)

Global Fin Services Ltd (UK)

MTI Investments LLC or MTI Markets Ltd (Marshall Islands)

Grizzly Ltd (Malta)

R Capital Solutions Ltd (Cyprus)

Benrich Holdings Ltd (Cyprus)

Eyar Financial Corp Limited (Vanatu)

SIAO Ltd (Cyprus)

The majority of the companies don’t have a website or are no longer active on social media, although Lau Global Service Corp.’s Facebook page is still accessible. Lau Global Services is also a shareholder in Grizzly Ltd., a Malta-based company that formerly served as a payment services provider for such dishonest and unlawful broker schemes, according to Offshore Leaks Database. Shlomo Matan Shalom Avshalom, an Israeli, is listed as a director of Grizzly Ltd.

Up until 2015, MXtrade was owned and operated by R Capital Solutions Limited, which is currently Eightcap EU Ltd, a CySEC-regulated CIF. After that, the brand and its clientele were moved to the Lau Scheme.

Armin Ordodary’s FSM Scheme

The FSM Smart (www.fsmsmart.com) scam broker, Armin Ordodary (shown on the left), is involved in the Lau Scheme. Through its Serbian boiler room Upmarkt d.o.o. (formerly Bizserve d.o.o.), of which Benrich Holdings Ltd., a company registered in Cyprus, is the only stakeholder, it has been actively courting clients. Armin Ordodary, a resident of Cyprus, serves as the director of both companies. With Kyiv, Ukraine, serving as something of a hotspot, more boiler chambers have already been discovered in other jurisdictions.

According to a leak, Upendo Limited in Cyprus runs a boiler room in Paphos and is also a member of the network. In December 2018, Upendo was officially registered with the company number HE392291. Christoforos Andreou and AMF Global Services Limited are listed as directors. These seem to be trustees on behalf of the beneficial owners.

1 note

·

View note

Text

What is Living Trust Inheritance Tax?

Living trusts are a powerful tool in estate planning, allowing individuals to manage and distribute their assets efficiently. However, understanding the inheritance tax implications of living trusts in the UK is essential to ensure that the estate is managed in a tax-efficient manner. This article will explore the concept of living trust inheritance tax through eight question types, providing a comprehensive guide on the subject.

1. What is a Living Trust?

A living trust, also known as an intern vivos trust, is a legal arrangement created during a person's lifetime in which a trustee is appointed to manage assets on behalf of the beneficiaries. The creator of the trust, known as the settlor, transfers assets into the trust, which are then managed according to the terms of the trust deed. Unlike a will, a living trust can help avoid probate and provide privacy in the administration of the estate.

2. How Does a Living Trust Affect Inheritance Tax?

In the UK, assets held within a living trust can have significant inheritance tax implications. While transferring assets into a living trust can help manage and protect them, it does not necessarily exempt those assets from inheritance tax. The tax treatment depends on the type of trust and the timing of the transfer. For instance, transfers into certain types of trusts may be subject to inheritance tax if they exceed the nil-rate band.

3. Why Consider a Living Trust for Inheritance Planning?

There are several reasons to consider a living trust for inheritance planning:

Avoiding Probate: Assets in a living trust do not go through probate, allowing for quicker distribution to beneficiaries.

Privacy: Unlike a will, a living trust is not a public document, providing privacy for the settlor and beneficiaries.

Control: The settlor can specify how and when assets are distributed, providing greater control over their estate.

Flexibility: Living trusts can be amended or revoked during the settlor’s lifetime, offering flexibility to adapt to changing circumstances.

4. What Types of Living Trusts are There?

There are various types of living trusts, each with different implications for inheritance tax:

Bare Trusts: Simple trusts where the beneficiary has an absolute right to the assets. These are often used for minors.

Interest in Possession Trusts: Beneficiaries have a right to the income generated by the trust assets, but not the assets themselves.

Discretionary Trusts: Trustees have discretion over how to distribute income and capital among beneficiaries.

Accumulation and Maintenance Trusts: Used for minors, these trusts allow income to be accumulated or used for the maintenance of beneficiaries until they reach a certain age.

5. Who Can Benefit from a Living Trust?

Living trusts can benefit a variety of individuals, including:

Parents: Who wish to provide for minor children or dependents.

Couples: Looking to ensure their partner is cared for while preserving assets for other beneficiaries.

Individuals with Significant Assets: Seeking to manage and protect their wealth.

Those with Complex Family Situations: Who need flexible arrangements to accommodate various family dynamics.

6. Where Can You Get Advice on Living Trusts and Inheritance Tax?

Professional advice is crucial when setting up a living trust and planning for inheritance tax. In the UK, several professionals can offer guidance:

Solicitors: Specializing in estate planning and trust law.

Financial Advisors: With expertise in inheritance tax planning.

Accountants: Providing detailed advice on the tax implications of trusts.

Trust Companies: Offering trust administration services and advice.

7. What are the Tax Implications of Transferring Assets into a Living Trust?

Transferring assets into a living trust can trigger immediate and future tax implications:

Potential Chargeable Lifetime Transfers (CLT): If the value of transferred assets exceeds the nil-rate band, a CLT may be payable.

Periodic Charges: Some trusts are subject to periodic inheritance tax charges every ten years.

Exit Charges: Tax payable when assets are distributed from the trust to beneficiaries.

8. How Can You Minimize Inheritance Tax Using a Living Trust?

To minimize inheritance tax through a living trust, consider the following strategies:

Utilize the Nil-Rate Band: Structure transfers to stay within the nil-rate band limits.

Gifts and Exemptions: Use annual gift allowances and other exemptions to reduce the value of the estate.

Careful Planning: Work with professionals to create a trust that meets your specific needs and complies with tax laws.

Regular Reviews: Periodically review and adjust the trust to account for changes in tax laws and personal circumstances.

Conclusion

Understanding the inheritance tax implications of living trusts in the UK is essential for effective estate planning. By answering key questions about what a living trust is, how it affects inheritance tax, and why it might be beneficial, individuals can make informed decisions to protect their assets and provide for their beneficiaries. Seeking professional advice and carefully planning can help minimize tax liabilities and ensure that the estate is managed according to the settlor’s wishes.

0 notes

Text

Armin Ordodary and FSM Smart’s Scam Exposed (2024)

Armin Ordodary and FSM Smart have received allegations of being involved in major fraudulent operations. Find out if those allegations are true or not.

There was a huge network of scam brokers surrounding FSM Smart and the so-called Lau Scheme. Armin Ordodary, a Cypriot of Iranian descent, is at its core. He has run a network of frauds and boiler rooms with associates that stretches from Georgia to the Balkans and Italy. Regulators from all around the world may have issued more warnings in relation to the FSM Smart broker fraud than any other. It is also known that in certain jurisdictions, law enforcement agencies are conducting investigations. Desperately, Ordodary keeps contacting Google to request DMCA takedown in an effort to block media reporting.

The Lau Scheme of FSM Smart

Lau Global Services Corp was an offshore company registered in Belize and licensed by the International Financial Services Commission under licence number IFSC/60/402/TS/15. The Lau Scheme operated at least the following broker brands:

MXTrade (www.mxtrade.com)

LGS Corp (www.lgs-corp.com)

TradingBanks (www.tradingbanks.com)

Trade12 (www.trade12.com)

MTI Markets (www.mtimarkets.com)

Grizzly (www.grizzly-ltd.com)

The media team has been able to identify a variety of legal entities connected with the Lau Scheme:

Lau Global Services Corp (Belize)

Upmarkt d.o.o. (Serbia), now BizServe d.o.o.)

Exo Capital Markets Ltd (Marshall Islands)

Global Fin Services Ltd (UK)

MTI Investments LLC or MTI Markets Ltd (Marshall Islands)

Grizzly Ltd (Malta)

R Capital Solutions Ltd (Cyprus)

Benrich Holdings Ltd (Cyprus)

Eyar Financial Corp Limited (Vanatu)

SIAO Ltd (Cyprus)

The majority of the companies don’t have a website or are no longer active on social media, although Lau Global Service Corp.’s Facebook page is still accessible. Lau Global Services is also a shareholder in Grizzly Ltd., a Malta-based company that formerly served as a payment services provider for such dishonest and unlawful broker schemes, according to Offshore Leaks Database. Shlomo Matan Shalom Avshalom, an Israeli, is listed as a director of Grizzly Ltd.

Up until 2015, MXtrade was owned and operated by R Capital Solutions Limited, which is currently Eightcap EU Ltd, a CySEC-regulated CIF. After that, the brand and its clientele were moved to the Lau Scheme.

Armin Ordodary’s FSM Scheme

The FSM Smart (www.fsmsmart.com) scam broker, Armin Ordodary (shown on the left), is involved in the Lau Scheme. Through its Serbian boiler room Upmarkt d.o.o. (formerly Bizserve d.o.o.), of which Benrich Holdings Ltd., a company registered in Cyprus, is the only stakeholder, it has been actively courting clients. Armin Ordodary, a resident of Cyprus, serves as the director of both companies. With Kyiv, Ukraine, serving as something of a hotspot, more boiler chambers have already been discovered in other jurisdictions.

According to a leak, Upendo Limited in Cyprus runs a boiler room in Paphos and is also a member of the network. In December 2018, Upendo was officially registered with the company number HE392291. Christoforos Andreou and AMF Global Services Limited are listed as directors. These seem to be trustees on behalf of the beneficial owners.

1 note

·

View note

Text

Without Prejudice Mervelee Myers Report Housing Ombudsman Fail Tenants Cover Rogue Landlords Pay Solicitors To Deny Vulnerable Persons Of Our Rights To Have Concerns Addressed When We Are Asked In Surveys, I Was Rescued From Homelessness Domestic Violence By Housing For Women I Meet Rev Rose Hudson-Wilkin At AGM Learned Her Grandmother My Mum Related She Refused To Mediate On My Behalf I Was Minute Taker Customer Panel My Life With H4W Did Not Start When My Neighbour Break Glass To Communal Door 13/12/21 Led To Hate Crimes Samantha Gibbs Join H4W April 22 Sent Me Invite To ASBO Meeting May Trina Philbert Visited With Candy Smith Southwark Adult Social Care June A Month After She Started Mimi Owusu Witness Statement Of Scamming Sent Police To Do Welfare Checks In Bundle Why Should I Allow HMCTS To Add Violent Nuisance Behind My Back When I Had A Crisis Brother Spent 60th Birthday Intensive Care One Died Of Cancer Am Online Seeking Help To Deal With Stress Carer For 100 Year Old Traumatised From Jaw Broken Walworth Road Made 1st Video About Police Racism In Which I Mentioned Ms Gilchrist How Relevant Is Being Made A Criminal Need Emotional Regulation Treatment Cover LEYF A-Z Of Abuses Ofsted Turn Blind Eyes As Are June O'Sullivan's Friends In High Places I Beg South London Press To Publish Barclays Defraud Me Financial Ombudsman Emma Martin-Hamilton Colluded 2nd Time Get YouTube Trustpilot To Remove Posts PC Edward Allen Of Peckham Police Station Troll Me Sent Email I Call Him BB PC James Murphy Left Husband For Dead With Hypo Stephen Agera Advised Solicitors Who Contacted Me On Behalf Of H4W Request Mediation In July To Discriminate Sir Mark Rowley Nigel Pearce Seb Adjei-Addoh Must Answer About A New Met For London Whilst My Videoes Monitize Police On Live Breach Equality Act Protected Characteristics Am The Face Of Windrush 70 Composer Brixton Market I Started Fundraising After Death Of BYRON Age 56 Colon Cancer I Write For Therapy Father Stricken With Parkinson's Website From Scratch Stolen Guy Lawfull Trustee Oxfordshire Association For The Blind Court Enforcement Services Ltd Sending Letters 4 Years Failure To Collect Ryan Clement Judgement I Pay For My WordPress Google My Business Am Not Benefitting From Any Of My Platforms So Why Should Those That Break The Law Gag Me To Cover Up 23 Years Hate Crimes By Ms Gilchrist Who Install Camera To Harass Bully Intimidate Me Inside Communal Area Police Come To Tell Me I Am Making Allegations Because I Will Be Evicted But They Still Investigating Incident That Did Not Happen 10/1/23 I Had To Attend Croydon Magistrates 3 Times Interview WPS When Husband I Separated H4W Claim I Was Reported For ASB 2 Miscarriages Of Justice 3rd Must Not Happen I Am A Writer Experienced PTSD 24/1/2024

Without Prejudice Mervelee Myers MAPS 31 Years In UK Animals Treated More Favourably Than 100 Year Old Arnold E. Tomlinson Whose Jaw Was Broken In East Street Walworth Road Made 1st YouTube Incident A New Met For London Social Media Harvesting IP/CR/I/CPPDP Build Brands 18 Facebook Pages LinkedIn Stole 3 Accounts Oxeyes Guy Lawfull 1st Website I Built From Scratch There Are Richard Harty MIC June…

View On WordPress

#http://www.actionfraud.police.uk/#http://www.justgiving.com/Mervelee-Myers#http://www.justice.gov.uk/tribunals/employment/claims/responding#https://fght4justiceadvocacy.business.site#https://www.parkinsons.org.uk/#https://www.ryanclement.com#See https://www.facebook.com that think they can brainwash me ON THIS DAY 4 years ago Mervelee Ratty Nembhard is feeling emotional in Lond#United Kingdom. Shared with Public Thanks 1Son http://worldreferee.com/referee/valdin-legister/bio for bringing me back the Memories! Vald

0 notes

Text

The Benefits of Betting With a Spread 먹튀사이트Betting Firm.

There are several key advantages of spread 먹튀사이트 betting because it is a regulated activity. Customers have access to the Financial Ombudsman Scheme if they have a complaint against the spread betting firm and they have access to The Financial Services Compensation Scheme should the firm go bust. Spread Betting Firms are also subject to the FSA's Client Asset Regime.

The Client Asset Regime is contained within s.139 of the FSMA 2000. It is designed to make a distinction between clients money and firms money, s.139(1)(a) states that the ?Rules relating to the handling of money held by an authorised person in specified circumstances ("clients money") may - (a) make provision which results in that clients" money being held on trust in accordance with the rules".

This provision creates a statutory trust in respect of client money. The firm never becomes the owner of the money, it holds it as trustee, and therefore it cannot be claimed by creditors in the event of the firm going into liquidation. Unless there is a case of fraud client money will be safe.

These provisions were highlighted in a letter to the Racing Post in the wake of the collapse of Netbetsports from Compton Hellyer. He reiterates, "spread betting firms have to maintain a capital balance similar to that of a bank, they also have to retain clients" funds as segregated balances.

Such deposits cannot be used for working capital purposes, or indeed at all by the business. Consequently, clients" deposited funds are sacrosanct". He also highlights that the operating costs of running a spread betting firm are higher than an ordinary bookmaker because of greater compliance costs, but the fact that the punter doesn't have to worry about how his deposits are being looked after is a price worth paying.

Paul Moorhouse's comments "that directors should be personally liable for customers" account funds are a good suggestion. If the Government were to seriously take this option on board, you would find that directors would start lobbying for the ringfencing of client's assets.

The Legal Position In Australia.

Australia is a federation, this means that there are both national laws and laws in each state and territory in Australia in relation to gambling regulation.

In 2001 the Interactive Gambling Act (!IG Act") was passed. This is a piece of federal legislation that sets out to prohibit the provision of internet gaming, such as casinos and other games, to ordinary Australians. It does not apply to ordinary sports betting, this is left for the State and Territory regulators.

In Australia internet bookmakers are required by law to keep clients assets separate from the rest of the business regardless of whether or not they engage in spread betting. Under the Australian Capital Territory Race and Sports Bookmaking Act 2001 subsection 23(1) (Rules for sports bookmaking) ("ACT Regulations") the rules relating to handling money held on behalf of a client are put forward clearly and simply:

?E Handling of money held on behalf of clients

1. Bank Account

1.1 Sportsbookmakers shall establish a segregated bank account specifically for the purpose of holding money on behalf of clients

1.1.1 All moneys provided by clients are to be maintained in the segregated client accounts

1.1.2 For the purposes of this section, a segregated account means an account, established for the purpose, that holds all client moneys.

1.1.3 Funds standing to the credit of the segregated bank accounts shall be treated in accordance with the provisions of the Trustee Act 1957.

These are the provisions that are in place in the Australian Capital Territory but similar provisions also exist in this regard in the other States and Territories. The rules are very similar to those that are in place in the UK with regards to spread betting.

Many of the Australian internet bookmakers, such as Canbet and Centrebet, are regarded as amongst the best operating online. This is because punters know that they are safe when dealing with Australian firms.

The UK Government has unveiled plans, detailed above, with the aim of making the UK an attractive place to establish a global gambling operation. If the Government is truly serious about these plans, then strict financial regulations must be put in place across the whole of the betting industry.

To some extent these goals have been achieved, in April 2003 the Australian bookmaker Canbet announced that it was moving part of its operation to the UK.

The main reasons Canbet has moved part of its operation to the UK is to take advantage of:

� the way bookmakers are taxed in the UK,

� better time zones to serve their North American customers,

� a good communications infrastructure and

� a better legislative environment.

They feel that the 15% gross profits tax will give them "a big opportunity to be part of the consolidation that is going to take place in the global betting market." They plan to still comply with the ACT regulations regarding client deposits etc. and with the UK betting legislation.

0 notes

Text

Bank of India Company Market Analysis Report - Company Market size - Company profile

Bank of India (BOI) is a provider of a range of retail and corporate banking and related financial solutions. Its retail banking products offered to individuals include comprise of current and savings accounts, term deposits, and deposit schemes; lending solutions, which consist of loans for personal usage, agricultural, commercial purpose, car purchase and housing; and term insurances. The bank offers cash management services, export finance, channel credit, trade and project finance, and syndication services to corporate clients. Bank of India market analysis Bank of India Company Profile

It provides rural banking services, and loans to micro, small and medium enterprises. In addition to these, BOI also provides e-trade, cards, internet banking, depository services, remittance services, debenture trustee services, and mutual fund products. The bank operates through its branches in India and foreign countries including Hong Kong, South Africa, Vietnam, Kenya, Japan, New Zealand, Uganda, Botswana, Tanzania, Singapore, France, the UK, and the US. BOI is headquartered in Mumbai, Maharashtra, India.

Subscribe to access Bank of Indi… interactive dashboard for 12 months get access to premium industry data, predictive signals and more

Subscribe to access Bank of Indi… interactive dashboard for 12 months get access to premium industry data, predictive signals and more

0 notes

Note

Pepsi Co board of directors -

In addition to being a member of the PepsiCo Board of Directors, Ramon Laguarta also currently serves as a director of Visa Inc.

Segun Agbaje also currently serves as a director of MasterCard Advisory Board Middle East and Africa.

SHONA L. BROWN served as a Senior Advisor to Google Inc. Dr. Brown served as Senior Vice President of Google.org, Google Inc.’s philanthropic arm, from 2011 to 2012. Dr. Brown served as Google Inc.’s Senior Vice President, Business Operations from 2006 to 2011 and Vice President, Business Operations from 2003 through 2006, leading internal business operations and people operations in both roles. Dr. Brown also currently serves on the boards of Atlassian Corporation plc, an enterprise software company, DoorDash Inc., an on-demand prepared food delivery service, and several non-profit organizations (including Code for America, the Center for Advanced Study in the Behavioral Sciences at Stanford University, and the John S. and James L. Knight Foundation).

CESAR CONDE has served as named Chairman of the NBCUniversal News Group, part of a global media and entertainment company, since 2020. In this role, Mr. Conde has oversight of NBC News, MSNBC and CNBC, including editorial and business operations for the television and digital properties. Mr. Conde also currently serves on the boards of Walmart Inc. and several non-profit organizations, including the Paley Center for Media and The Aspen Institute.

Edith W. Cooper spent over two decades of her career with The Goldman Sachs Group, Inc., most recently serving as Executive Vice President and Global Head, Human Capital Management from 2011 to 2017 and Managing Director and Global Head, Human Capital Management from 2008 to 2011.

DINA DUBLON served as Executive Vice President and Chief Financial Officer at JPMorgan Chase & Co., a leading global financial services company, from 1998 until her retirement in 2004.

MICHELLE GASS has served as Chief Executive Officer and a director of Kohl’s Corporation, a leading omnichannel retailer, since 2018. Prior to joining Kohl’s, Ms. Gass served in a variety of management positions with Starbucks Corporation from 1996 to 2013, including most recently as President, Starbucks EMEA (Europe, Middle East and Africa) from 2011 to 2013; President, Seattle’s Best Coffee; Executive Vice President, Global Marketing and Category; and various leadership roles in other brand, marketing, product management and strategy functions. Prior to Starbucks, Ms. Gass was with The Procter & Gamble Company. Ms. Gass currently serves on the boards of the Retail Industry Leaders Association, the National Retail Federation, and Children’s Wisconsin.

SIR DAVE LEWIS served as Group Chief Executive Officer of Tesco PLC, a multinational grocery and general merchandise retailer, from 2014 until 2020. Sir Dave currently serves as Chairman of Xlinks and Non-Executive Chair Designate for GlaxoSmithKline plc's new consumer healthcare company. Sir Dave also serves on the boards of several non-profit and charitable organizations, including as Chair of World Wildlife Fund – UK and as a trustee of Leverhulme Trust, a UK charitable foundation. He was also chair of Champions 12.3, a UN program seeking to add momentum to the achievement of the UN Sustainable Development Target 12.3 by 2030.

I swear if she does a Pepsi commercial to thank them for the Doritos I will die.

11 notes

·

View notes

Text

Award Winning & Experienced Financial Advisers Firm in Oxfordshire - Contact Now.!

Experienced and independent financial advisers in Oxfordshire guide you on how to manage, invest, and build in the right way. They place a high focus and long-term relationship with their clients and ensure them how they can make the right financial decisions throughout their lifetimes. Like the Strategic Vision Wealth Management in Oxfordshire. Here we are one of the best and experienced financial advice firms in the UK. We provide independent financial planning, investment, pension, retirement advice and wealth management services to individuals, couples, families, private, corporate, trustees and attorney clients. Our headquarter is based in Kidlington, Oxfordshire, but we assist the client all over the UK.

With this, our team will also review your existing investment and pension planning plans and to make them great and more powerful give you beneficial advice as well. To know more about our services and work feel free to contact us anytime on 01865 664 066 or visit our website.

#financial#finance#investment#wealth#Business#personal income#money#financial advice#Financial advice Oxfordshire#Financial advisers Oxfordshire#Independent financial advice Oxfordshire#Independent financial advisers Oxfordshire

2 notes

·

View notes

Text

Tips from my College Counsellor/Teachers

These are some handy-dandy tips from my college counsellor and teachers regarding medicine/science courses but can also be applied to more general majors/degrees:

Quick Disclaimer: Not all these facts may apply to you or your situation. It’s always best to directly ask your teacher and college counsellor whats best for you. This is just some food for thought.

1. It is competitive.

Medical school is highly competitive and often offer limited places, most colleges are like that as well. For entry to Oxford in 2019, around 23,000 people applied for around 3,300 undergraduate places. That meant Oxford received, on average, over 7 applications for each available place (https://www.ox.ac.uk/about/facts-and-figures/full-version-facts-and-figures#:~:text=Undergraduate%20admissions%20and%20access,applications%20for%20each%20available%20place.). You have to make sure you stand out, often grades were just the preliminary way of rejecting applications but in order to be more likely to receive the place you have to be an all-rounder (clubs, sports, cultural events, student leadership, community service, etc.). Remember: “Universities are always looking for a way to say no, not yes.”

https://www.ivycoach.com/2020-ivy-league-admissions-statistics/

2. Don’t be afraid to take a gap year

Travel, have experiences, volunteer at hospitals or doctors’ offices, take this time to beef up your resume, learn a language, learn a skill, take time to be sure that not only if college is the right choice for you but if the major you’re taking is truly the one for you, etc. Gap years are incredibly important if you personally don’t feel like you’re ready to jump into university. Not to mention it gives you time to mature and gain experience (referring to Point 1).

This incredible website has some more general ideas: https://www.oysterworldwide.com/news/gap-year-ideas/

These are specifically medical ideas: https://www.themedicportal.com/blog/5-things-to-do-on-your-gap-year-to-boost-your-med-school-application/

3. Finances can be tricky

Scholarships. Scholarships. Scholarships. There is no reason to start your adult and working life in debt, not to mention with a mediocre credit score. Besides financial aid, it’s always best to consider what you could do to lower your expenses when going to college (e.g. buying the textbooks second hand vs. brand new).

Oxford: https://www.ox.ac.uk/students/fees-funding/assistance

Cambridge: https://www.cambridgestudents.cam.ac.uk/cambridgebursary

Edinburgh: https://www.ed.ac.uk/student-funding/financial-support/student-loans/usa/apply

etc.

You can always ask your college counsellor what scholarships are available/relevant to you, but often taking a look at the university sites gives you an idea of what they offer.

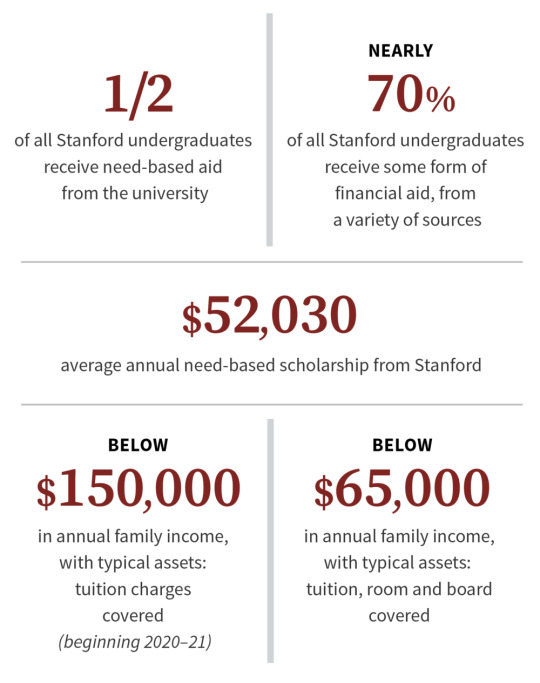

(some stats from Stanford: https://news.stanford.edu/2019/12/03/trustees-set-2020-21-tuition-expand-financial-aid-middle-income-families/)

4. Don’t always go for big universities like Oxford or Cambridge

Whilst I’m not encouraging in any way to not apply to these universities after all ‘you can never be admitted if you don’t apply’, I am saying keep in mind that you may be unsuccessful as admission rates are low and you should have several ‘backup’ options in case.

5. Hard work + extracurriculars all the way

Most top universities get thousands of applications each year, it is not only important to get good grades, but be a well-rounded individual. Clubs, Community Service, Jobs/Internships, Sport, Cultural, Student Leadership, etc. are all important things to have when applying for university.

6. Be organised but have fun!

Being organised is so important when it comes to applying to universities and attending class at university. Universities often appreciate those who are organised at all times, it also makes your life one thousand times easier! However, if you work too hard you could experience burn out! Don’t be afraid to take some time for yourself and relax.

9. Be careful of your online history

This may sound a little ominous, but be careful what you post online, it could come back to haunt you. This person:https://www.independent.co.uk/life-style/gadgets-and-tech/news/nasa-intern-job-loss-twitter-homer-hickam-space-council-a8503241.html lost their internship at NASA because of a tweet, and this 17-year old: https://www.bbc.co.uk/news/uk-england-22083032 lost their job because of their tweets between the ages of 14-16. Take care what you post online, it may be the reason you lose your spot at a top university.

(This is Paris Brown in case you were wondering)

Thanks for reading! Please remember that these were just some general tidbits of advice given to me throughout my ongoing high school career and is food for thought. Everyone’s situation is different and it is always best to find out from a college counsellor/teacher what is best for you. Thank you!

#tips#college tips#please read the disclaimer#food for thought#always ask your college counsellor#college#university#good luck

8 notes

·

View notes

Text

Livestream the summer solstice: my big survival plan for English Heritage

The charity is set to lose as much as £70 million this year, but its chairman, Princess Anne’s husband, Tim Laurence, won’t be beaten, he tells Richard Morrison of The Times.

Watching the sun rise at Stonehenge on the summer solstice, seeing those ancient stones perfectly aligned to the first rays of dawn; that has to be one of the world’s most magical heritage experiences. In any normal year more than 20,000 people, not all of them card-carrying druids, would gather to see it.

There’s nothing normal, though, about this year. On June 21 the 4,500-year-old monument will be deserted — by government decree. Instead, English Heritage (EH) will live-stream sunrise at Stonehenge. In the words of Tim Laurence, EH’s chairman, it will be a “self-isolating solstice”. And he’s doing his best to put a brave face on it. “For once the stones will be totally peaceful,” he says. “And nobody has to get up at 3am and get very cold.”

True, but if any one event symbolised how much coronavirus has wrecked Britain’s cultural calendar, this “self-isolating solstice” is surely it. That must be particularly painful for Laurence. Just turned 65, he had a highly successful career in the Royal Navy, where he ended up as a vice-admiral. And by the royal family’s eventful standards he enjoys a remarkably untroubled private life as Princess Anne’s husband. He took on EH in 2015 with instructions from government to wean it off public subsidy (which is being tapered down from £15.6 million a year in 2016 to nothing by 2023) and turn it into a self-supporting charity. And until two months ago he seemed to be steering his sprawling new ship very well.

“We’d had five terrific years,” he says. “We now have over a million members. Last year we had 6.4 million visits to our 420-odd sites. And from starting off in a negative financial position when we took the charity on, we had built up a financial reserve. So we were able to invest in some brilliant projects. We spent £3.6 million restoring Iron Bridge in Shropshire, which now looks fantastic and is secure for another century — despite all the terrible flooding on the Severn — and £5 million to build the new bridge to Tintagel Castle in Cornwall, which provides a much better visitor experience.”

Then the pandemic struck. Along with every other heritage organisation, EH closed all its staffed properties on March 19 (though 200 free-to-roam landscapes remained open). “We have to put this into perspective,” Laurence says. “Our problems are very significant, but as nothing compared to the challenge facing the health and care sectors.” Nevertheless, the result of what Laurence calls “putting everything into mothballs” has been, he admits, “a very serious loss of income”. He won’t put a figure on it, claiming with reason that the situation is too fluid, but even if all of EH’s recovery plans go well the charity seems set to lose between £50 million and £70 million this year. And if coronavirus refuses to be subdued, the outcome could be far worse.

In the context of the £200 million loss apparently run up by the National Trust in the past two months, EH’s problems might seem minor. Unlike the National Trust, however, EH doesn’t have £1.3 billion of reserves stashed away for a rainy day.

It didn’t help that lockdown started just before Easter, the precise moment when many heritage attractions traditionally open for the summer. EH has lost not only millions of paying visitors, but also the revenue they generate in its shops and tearooms. Laurence also decided to offer a three-month extension of subscriptions to the million-plus supporters, who are paying £63 a year for individual membership, or £109 a year for a family. “We wanted to thank them for staying with us,” he explains, “and to recognise that they aren’t getting as much value as normal out of their membership.” Probably a necessary public-relations move, especially in view of the reported mass exodus of members from the National Trust, but it put another big dent in EH’s revenues.

Those members haven’t been entirely deprived of EH’s services. Like many cultural organisations, EH has had a big surge in online visitors during lockdown. “Things like Victorian cookery lessons from Audley End [near Saffron Walden in Essex] or dance lessons for VE Day are getting massive attention this year,” Laurence says. So, he hopes, will an 80th-anniversary online commemoration of Dunkirk, designed to retell the story of the evacuation via a daily Twitter feed. That will provide a virtual experience for the thousands who would otherwise have visited Dover Castle, one of EH’s most popular sites, from where D-Day was masterminded.

Yet even the most vivid online experience can’t compensate for the visceral excitement of a physical visit to a dramatic historic site such as ghostly Witley Court in Worcestershire or the gaunt remains of Whitby Abbey. What if EH couldn’t reopen this year? Will there be another extension of membership? “I’d like to think that won’t happen,” Laurence replies. “We have a tentative date for reopening from government, and all our focus now is on getting things going again, rather than fearing the worst.”

That tentative date is July 4, but EH will take things slowly. “Our plan is to open a relatively small number of our staffed sites then, focusing on those that have lots of outdoor space,” Laurence says. “Stonehenge, for instance. The key is making sure that people feel safe, and we are putting in a huge amount of work — in close conjunction with other heritage bodies — to devise procedures to keep staff and visitors totally protected.”

One-way systems for visitors and PPE for staff? “Yes, and limiting visitor numbers, probably by having pre-booked time slots,” Laurence says. “I know it’s a bit of a bore for people, but I think visitors will appreciate the certainty of knowing they can get in. Then it’s about enabling social distancing to be maintained, and very high standards of hygiene wherever people have to touch things.”

Laurence won’t put a date on when a second wave of reopenings might happen. “The thing about the government’s guidance that I am most in tune with is the step-by-step approach,” he says. “We have to see what works and change it if it doesn’t.”

Is he convinced, though, that the public is ready to come back? Recent research suggests a high degree of fear about returning to any cultural activity. “Not everyone thinks the same way,” Laurence says. “What’s clear is that visiting places where there’s a degree of freedom and open air will be much more attractive than enclosed spaces at first. Of course we have a lot of enclosed spaces as well, so we have to find ways of overturning people’s reluctance to enter them.”

Even if people do flock back, however, EH is still left with an enormous black hole in its finances. The government is advancing funds that EH would be due to receive later this year, and there are discussions about bringing forward next year’s grant as well. These, however, are small sums (£8.8 million next year) compared with a possible £70 million loss. Will Laurence be asking for an additional bailout?

“It seems likely that we will be operating under [social distancing] limitations through the whole of this year and possibly next,” he says. “In that case, inevitably, our visitor income will be reduced. If we can’t get the income, we won’t be able to do all the conservation work and projects we’ve put on hold for the moment. Therefore we will have to ask government for more support.”

And an extra two or three years to be added on to EH’s planned transition from quango to independent trust? “That is also a discussion we need to have,” he says.

Could philanthropy help EH through its troubles? In the past five years Laurence has had some success at attracting private money, notably bagging a £2.5 million donation from Julia and Hans Rausing to help to build the Tintagel bridge. The trouble is that, as Laurence points out, “almost everyone who has got money to spare at the moment is thinking first about supporting health charities and care homes”. The Rausings’ recent decision to give nearly £20 million to charities tackling the pandemic is an obvious case in point. Nevertheless, if EH is to get back on track as an independent charity, it needs those big donors on board as well as the subscriptions of its million members.

Laurence spent his final navy years in charge of the Defence Estate, responsible for nearly 2,000 historically important buildings and monuments, so he was well aware of the challenges of conserving old buildings before joining EH. Even so, he admits he was a “slightly strange choice” to be its chairman. “I’m not an academic, not a historian, not an archaeologist,” he says. “Yet in some ways I represent a lot of our members. I’m a fascinated amateur. I absolutely love the history of this country. I love the sites we look after, and the story each tells.”

Tells to whom, though? The biggest challenge facing the whole heritage sector is arguably an urgent need to widen its demographic appeal. Can Laurence, in many ways the ultimate establishment insider, relate to that? Can he recognise that EH, like the National Trust, has an image problem? The perception that it’s a club for white middle-class people?

“There’s an element of truth in that,” he admits. “We are putting a great deal of effort into appealing more to — I hate using these categories — BAME [black and minority ethnic] people, who represent something like 14 per cent of the UK’s population. We have made a very strong statement by recruiting two outstanding representatives of those communities to our trustee board: David Olusoga [the historian] and Kunle Olulode [director of Voice4Change England]. They are helping our gradual transition towards being more appealing to non-white people. The important point is that we reflect not just the bricks-and-mortar history of England, but waves of immigration into this country over thousands of years. We have a story to tell to everybody.”

EH’s online output can be accessed through english-heritage.org.uk

33 notes

·

View notes

Text

Pay Pensions And Also Incentive

What Is Pension Trustee Responsibility Insurance?

Content

System Trustees.

What You Can Do With Your Pension Pot.

Funding Uni.

Illness Retirement And Also Your Pension.

Enhance Your Revenue.

Please see for more on how we are aiding our clients to react, consisting of a message from our management team about our company connection arrangements. Several years back, I was really fortunate to find a good example in an extremely appreciated and effective businesswoman-- Yvonne-- who appeared to have struck the best balance in between job and family members.

youtube

The people that comprise the Trustee Board are volunteers from throughout business. Click here for as much as date information on COVID-19 as well as your pension. Had by our Expert Trustees, we ensure real independence from any supplier to the UK pension market. Where they are triggered, these conditions can allow an administrator or other company to stop offering solutions or to avoid service level requirements. If such a provision could use in the present scenarios, consider the problems and what you would do if the company seeks to count on it. Examine that your numerous consultants and various other service providers have a service connection plan and also will be able to follow it.

Scheme Trustees.