#truck finance sydney

Explore tagged Tumblr posts

Text

Exploring Equipment Finance and Truck Finance Options in Sydney

For businesses in Sydney, managing cash flow while acquiring essential equipment is a common challenge. This is where equipment finance Sydney can offer a strategic solution. Whether you're in construction, logistics, or manufacturing, equipment finance enables businesses to access the necessary tools and machinery without the burden of a large upfront payment. Similarly, truck finance Sydney helps companies in the transport and logistics sector acquire the vehicles they need to maintain operations and grow.

What is Equipment Finance?

Equipment finance is a financial product that allows businesses to purchase or lease equipment over time rather than paying for it all at once. In Sydney, this type of financing is particularly beneficial for businesses looking to invest in expensive machinery, technology, or vehicles without impacting their working capital. With equipment finance, businesses can spread the cost of their purchase over a fixed term, making it easier to manage cash flow and focus on growth.

The types of equipment that can be financed include:

Construction machinery

Office technology

Medical equipment

Manufacturing tools

By using equipment finance Sydney, businesses can stay up-to-date with the latest technology while maintaining financial flexibility.

The Importance of Truck Finance in Sydney

For businesses involved in transportation or logistics, truck finance Sydney is a must. Whether you need to expand your fleet or replace outdated trucks, this type of financing allows businesses to acquire the vehicles they need without a large initial outlay. Truck finance can cover everything from light commercial vehicles to heavy-duty trucks used in long-haul transport.

Truck finance offers several advantages, including:

Preserved Cash Flow: Spreading the cost of new trucks over a longer period helps maintain liquidity.

Flexibility: Whether through leasing, hire-purchase, or loans, businesses can choose the financing option that best suits their needs.

Access to Modern Fleet: Financing enables businesses to invest in newer, more efficient vehicles, reducing operational costs and improving service quality.

In Sydney, truck finance helps businesses remain competitive in the logistics industry by ensuring they have reliable and efficient transportation solutions.

Choosing the Right Financing Option

Both equipment finance Sydney and truck finance Sydney offer flexibility, allowing businesses to tailor payment plans according to their budget and operational requirements. When selecting a financing option, it’s crucial to work with a reputable lender who understands your industry and can offer customized solutions.

In conclusion, whether your business needs new machinery or additional trucks, both equipment finance Sydney and truck finance Sydney provide valuable options to support business growth and operational efficiency.

For more information, please visit: https://www.netcorpfinance.com.au/

0 notes

Text

Blatantly Partisan Party Review VII (NSW 2023): Elizabeth Farrelly Independents

Prior reviews: none, this is a new party.

Where do I start with Elizabeth Farrelly. There was a point a few years ago where I would often sleep in of a weekend and log on to Twitter to find some baffling new discourse, which invariably turned out to be because Farrelly had published another ridiculous column in the Sydney Morning Herald. She had—and has—a particular propensity to piss off urbanists with her NIMBY anti-density views, but her takes on culture and lifestyle were equally good fodder for a solid day’s discourse and in-jokes. It’s hard to convey the depth of eye-rolling Farrelly induces if you didn’t participate in the social media banter about her columns of the late 2010s.

Farrelly’s tenure at the Sydney Morning Herald ended in bizarre circumstances in 2021. In the Strathfield local government elections, she registered for campaign finance purposes with the NSW Electoral Commission as a candidate for the Labor Party, although she was ultimately not chosen to be a Labor candidate; by her telling, she was simply interested in standing for the party either at that election or at state or federal level later. Farrelly did not run in the 2021 local elections, but she did criticise non-Labor candidates in her column without disclosing her affiliation, and the SMH’s editor Bevan Shields (another name to make you roll your eyes firmly if you’re SMH-adjacent) abruptly terminated her employment when he found out.

Ultimately, not only did Farrelly fail to get Labor preselection at local level, she stood against them as an independent at the 2022 by-election for the state seat also called Strathfield. She came third on primary votes—a distant third (9.85%) to the majors (41.05% ALP, 36.24% Liberal) but ahead of the Greens (6.67%). This seems to have made her sufficiently confident to attempt a tilt at state politics. After all, if she could replicate 9.85% statewide, she and her second candidate would both win seats—but rarely can anyone turn modest popularity in their home electorate into anything approximating statewide appeal.

What does Farrelly and her independent grouping actually stand for? They explicitly say they are “not a political party” (despite the fact they’re registered as one), but it is not clear the extent to which two hypothetical parliamentarians would be expected to work together. The platform that Farrelly and her independents share has three main planks: climate action, honest government, and liveable communities.

The climate action policy is pretty decent: net zero commitment for 2030, energy efficient building standards, moving away from mining fossil fuels, getting rid of draconian laws that stop climate protests, all that sort of stuff. The honest government policy is more mixed. Positively, it would strengthen ICAC’s ongoing financial position so that its base funding does not become subject to the whims of government. I’m concerned the proposal to stop “jobs for mates” goes too far—I’m happy with MPs being restricted from moving directly into jobs related to their former portfolios, but Farrelly also wants to stop them from taking any job in other specific sectors for three years: mining, energy, development, gambling, racing. These all just seem to be sectors she’s personally suspicious of, rather than any clear overarching rationale. It would mean an MP could get a job for a trucking company—despite how much the road lobby has skewed Australian transport policy towards unsustainable car-centric choices—but not with a renewable energy company.

The third plank, “liveable communities”, sounds nice until you realise that its contents are what you get when you have full-blown NIMBY brain. Farrelly proclaims to be a lover of cities, but it seems that what she loves is to put cities in aspic. She talks extensively about “over-development”, despite the fact Australia’s cities are horrendously sprawling and that it would be more efficient to start building up and to boost density along existing corridors. There’s a classic NIMBY trick of opposing public transport proposals because existing housing is insufficiently dense and opposing housing developments because there is no public transport, and Farrelly’s played both cards while also citing “heritage” to oppose a range of projects. I’m a historian by profession but I am no fan of how “heritage” often gets cited to protect vast swathes of wealthier suburbs—rather than protecting specific buildings and other historical objects of enduring value, it has often been used to boost property values, enforce certain aesthetic preferences, and keep out imagined "undesirables" (there is a part of the NIMBY brain that bafflingly equates apartments with slums).

It’s hard to imagine how NSW can boost its housing stock and make it affordable when Farrelly wants to implement every possible planning restriction and heritage overlay in the book. Planning processes already skew strongly towards the most conservative, change-averse local residents who have the time, money, and networks to participate, while younger, busier, and poorer residents are either unable to do so or unaware they even can—and prospective future residents get no say at all.

This is easily my longest review of the election, and I’m holding back from an even more sustained critique of the kind of regressive urban planning perspectives that Farrelly champions. I’m passionate about making cities better places to live: more walkable, more PT, more green spaces, more cafes and retail, and more homes, all in a more compact space. These things require density and a readiness to accept that the fabric of cities must keep evolving. Farrelly has some nice lingo but it is all in service to a NIMBY agenda that I do not believe would improve Sydney or any other part of NSW.

Farrelly would lean left on a range of environmental and social issues, and she and her associated independents would be much better than a lot of the rabble contesting the election, but I am on the whole unenthused.

Recommendation: Give Elizabeth Farrelly Independents a middling preference.

Website: https://www.elizabethfarrelly.com.au/

#auspol#NSWvotes#NSWvotes2023#NSW#Election 2023#NSW election#Elizabeth Farrelly Independents#Elizabeth Farrelly#emfarrelly#independent politics#your so-called independent party is still a party#upper house is always haunt#middling preference

2 notes

·

View notes

Text

Truck Loan in Sydney

Looking for a Truck Loan in Sydney? Blue Loans offers flexible options with quick approval to help you get the financing you need. For more details, call 0485 936 655

0 notes

Text

Vehicle and Equipment Finance for Businesses

Car and equipment finance Sydney empowers businesses to purchase or lease cars, trucks, utes, and other work equipment. Also known as business car and equipment loans, they offer flexible loan repayment terms.

Car Rental Services require a range of different equipment to maintain a high-quality service and stay competitive in the market. However, acquiring these assets can be expensive.

Flexibility

Whether it is for dental equipment in a private practice or a dump truck in construction, equipment finance offers businesses the capital they need to expand their operations without straining their resources. This financing option is available in multiple forms that can be tailored to the financial circumstances and tax requirements of a business, allowing it to grow and thrive.

Car rental services can utilise equipment finance to purchase vehicles, GPS systems, and reservation software to maintain a competitive edge in the market. They can also use it to invest in technology that enhances customer experience and improves operational efficiency.

Vehicle and equipment finance loans provide a range of flexible repayment options that can be matched to periods of high cash flow. This flexibility allows car rental services to avoid large upfront payments and conserve cash reserves for other expenses. Additionally, these loans often offer significant tax advantages. This makes them a cost-effective solution for many business owners.

Tax advantages

As the end of financial year (EOFY) approaches, business owners have a strategic opportunity to upgrade and enhance their equipment, vehicles, and operational capacity with equipment finance. This can be achieved by maximising allowable tax deductions and benefits.

Car rental services rely on a wide range of equipment for operations, from a fleet of vehicles to technological solutions for reservations and customer service. These requirements can often lead to a substantial upfront cost. However, acquiring the required equipment through equipment finance can save businesses cash and avoid exhausting their working capital.

Unlike personal car loans, novated leasing for equipment allows employees to make regular payments from their pre-tax salary. This can help reduce income tax and increase net income. It also allows businesses to acquire the latest technology and vehicles without making a large upfront investment. In addition, most leasing arrangements allow businesses to claim a percentage of depreciation and interest costs as a tax deduction, opens in new window.

Repayment options

When you need a car, truck, ute, or other equipment for your business, vehicle and equipment finance can help you secure the funds you need without having to pay upfront. You can choose from a variety of financing options, including Chattel Mortgages and Finance Leases, each with potential tax advantages. You can also structure the loan to include a residual or balloon payment at the end, which may reduce your repayments.

Our equipment finance specialists can assist you in determining which option is right for your business. They have access to a range of lenders and can provide a fast quote, with no impact on your credit. They can then tailor the financing package to your specific needs and cash flow. Talk to an ANZ Banker today to get started.

Cash flow

Car rental services rely on a range of equipment to operate efficiently and provide their customers with a high-quality experience. However, purchasing the right equipment can be expensive. Financing equipment and vehicles allows businesses to conserve their cash reserves for other purposes.

With vehicle and equipment finance, the business owner can acquire assets without having to make a large upfront payment. This is especially helpful for smaller and newer operations that may not have substantial cash reserves. This financing option also offers tax advantages, as repayments can be regarded as deductible expenses.

Business car and equipment finance loans empower businesses of all sizes to purchase the cars, trucks, utes, and other work equipment they need for daily operation. It’s important to select the best loan facility for your company, as there are many options available. A professional finance broker can help you find a facility that matches your needs and cash flow. They can also assist with structuring your payments to suit seasonal and other fluctuations in your business.

0 notes

Text

When to Seek Vehicle Finance in Sydney?

Purchasing a car is a big decision, and you may occasionally require financial support to complete the transaction. Sydney auto financing can assist you in obtaining the car of your dreams without having to pay the entire cost up front. Making wise decisions that fit your financial circumstances requires knowing when to look for auto financing. You can save money and streamline the procedure by choosing the appropriate time to investigate this alternative.

When Purchasing a New Vehicle

Purchasing a new car is one of the most popular occasions to look for auto financing in Sydney.

Since new cars can be costly, not everyone has the money to buy them all at once. Vehicle finance assists in dividing the expense of buying a car into affordable monthly installments, whether you're upgrading or buying your first one. You can spread out the payments over a time frame that suits your budget with the correct financing plan. Vehicle loan enables you to purchase your ideal car without having to wait years to accumulate the necessary funds for the entire purchase price.

When Investing in a New Car

Upgrading could be the best option if your existing car isn't fulfilling your needs.

Sydney auto financing can assist you in upgrading to a better, more dependable vehicle. Upgrading can have long-term advantages, regardless of whether your current vehicle is outdated, breaking down regularly, or no longer suits your needs. You don't need to wait till you have enough money saved up to purchase a new automobile outright if you choose auto financing. You can upgrade to a car that better fits your needs now and pay for it over time with this financial option.

When to Get Your Car Fixed

There are instances when replacing your car is more economical than repairing it.

It might be time to think about buying a new or used automobile if yours is breaking down a lot and the repairs are getting expensive. Vehicle finance in Sydney may be the best option in these circumstances. With a realistic finance plan, you can purchase a new or used car rather than spending more money on repairs. Long-term cost savings and increased dependability are two benefits of this choice. It's wise to assess the state of your car and decide if buying a new one is a better investment than keeping up with repairs.

When Establishing or Growing a Company

Securing a vehicle for company use is crucial for entrepreneurs or business owners.

Vehicle finance in Sydney can assist whether you require a work truck, a van for deliveries, or a fleet of automobiles for your staff. Buying a car can be a big upfront outlay for small company owners, but financing it helps spread the cost. Securing vehicle finance guarantees that you have the required transportation for operations without breaking the bank while you are establishing or growing your business. With this financial option, you can expand your firm and still have money left over for other needs.

When Your Income Is Consistent

Car financing may be a wise choice for major purchases when your income is consistent.

It is most advantageous to obtain auto financing when you have a steady and dependable source of income. Your chances of obtaining advantageous loan terms are increased if you have a consistent source of income, since lenders will evaluate your financial stability. Vehicle finance can assist you in investing in a car without putting a strain on your finances if you have a steady source of income or have been employed for a long time. You may comfortably make your monthly payments and adhere to your financing plan if you have a steady source of income.

In conclusion

Your car-buying process might be easier and more manageable if you know when to look for vehicle finance in Sydney. Financing offers affordability and flexibility whether you're managing cash flow, growing your business, or replacing your car. You may make an informed choice regarding auto financing and get the car that best meets your needs by taking your long-term objectives and existing financial status into account.

0 notes

Text

Eagers Automotive Limited Companies Back-Pay $16 Million and Sign Enforceable Undertaking

Australia’s largest car dealership business, Eagers Automotive Limited (EAL), has back-paid over $16 million, including interest and superannuation, to staff underpaid by five of its subsidiaries. These subsidiaries have also signed an Enforceable Undertaking (EU) with the Fair Work Ombudsman.

EAL, formerly known as AP Eagers, is an Australian public company operating automotive dealerships across all Australian states and territories, and in New Zealand. The five subsidiaries involved in the EU were acquired in 2019.

The underpaid employees were primarily based in Newcastle, Sydney, Brisbane, Melbourne, and Perth. EAL’s dealerships sell nearly all major vehicle brands, including Toyota, Ford, Mercedes-Benz, Kia, Volkswagen, and Hyundai.

In 2019, AP Eagers acquired Automotive Holdings Group Limited (AHG), the holding company for 19 businesses. This acquisition made EAL Australia’s largest car dealership business, with an annual revenue of $9.85 billion.

EAL self-reported the underpayments to the regulator in June 2021 after discovering anomalies during a payroll review following the acquisition. The review revealed that EAL subsidiaries had failed to pay in line with award progression, incorrectly classified employees, did not pay overtime, annual leave, annual leave loading, or for training, and failed to pay employees when sent home due to no work. Unauthorized deductions were also made.

Eagers Automotive Limited has back-paid $16.2 million to 13,277 current and former employees, including $12.1 million in wages, $1.1 million in superannuation, and $3 million in interest. The underpayments occurred between 2013 and 2021. Additionally, $1.9 million, including interest and superannuation, was back-paid to 701 current and former employees of 14 other subsidiary companies outside the EU requirements.

Approximately $200,000 is still owed to employees who cannot be located. Under the EU, payments must be completed within 120 days or be paid into the Fair Work Ombudsman’s unclaimed monies fund.

The employees affected by these breaches were full-time, part-time, and casual staff working across car and truck dealerships in finance, car sales, parts sales, and servicing roles.

The EU is with the five largest companies: AHG Newcastle Pty Ltd, AHG Services NSW Pty Ltd, AHG Services Qld Pty Ltd, AHG Services Vic Pty Ltd, and AHG Services WA Pty Ltd. These companies must also make a combined $450,000 contrition payment to the Commonwealth’s Consolidated Revenue Fund.

Fair Work Ombudsman Anna Booth stated that the EU was appropriate as the underpayments were largely due to past non-compliance identified by EAL following the acquisition of previously separate entities. The companies have cooperated with the FWO’s investigation and have committed to rectifying the underpayments and preventing future issues.

Under the EU, EAL’s subsidiaries have committed to implementing stringent measures to ensure correct payment of workers. These measures include commissioning an independent auditor to verify lawful entitlements are met.

Ms. Booth emphasized the importance of compliance with awards and enterprise agreements, noting that EAL’s breaches resulted from inadequate time and attendance systems, reliance on manual paper timesheets, a decentralized payroll system, and a lack of awareness of workers’ legal entitlements. She praised EAL for proactively identifying and rectifying issues after the acquisition.

Individual back-payments to employees ranged from less than $1 to $69,298, with an average back-payment of approximately $1,217, including superannuation and interest. The entitlements were owed under various awards and enterprise agreements, as well as the Fair Work Act.

The EU also requires the five companies to engage an independent provider to operate an employee hotline for three months at their own cost, inform affected staff about the EU, and provide evidence to the FWO of mechanisms in place to identify and rectify compliance issues in future acquisitions.

0 notes

Text

The Ultimate Truck Buyer’s Guide: Your Roadmap to Finding the Perfect Truck Buyer in Sydney

When buying a truck in Sydney, there are several factors to consider before purchasing. Finding the perfect one can be daunting whether you need a truck for commercial purposes or personal use. In this comprehensive truck buyer's guide, we will provide a roadmap to help you navigate a truck buyer in Sydney. From understanding your needs to exploring the market, we'll cover everything you need to know to make an informed decision.

Assess Your Needs

Before diving into the truck-buying process, assessing your needs is crucial. Consider the cash for trucks Sydney purposes, such as whether you need it for transporting goods, towing heavy loads, or off-road adventures. Determine the payload capacity, towing capacity, and size requirements based on your specific requirements. By identifying your needs upfront, you can narrow your options and focus on trucks aligning with your priorities.

Set a Budget: A budget is a vital step in truck buying. Consider not only the upfront cost of the truck but also ongoing expenses like fuel, maintenance, insurance, and registration fees. It's essential to balance your desired features and your budget constraints. Research the market prices of truck buyers in Sydney to understand better what you can expect to pay.

Research Truck Models:

Once you have determined your needs and budget, research different truck models available in Sydney.

Look for trucks that have the features and specifications you require.

Pay attention to engine power, fuel efficiency, safety features, towing capabilities, cargo space, and technology options.

Consider reading reviews, comparing specifications, and seeking recommendations from experts or truck owners to make an informed decision.

New or Used Trucks

Decide whether you want to purchase a new or used truck. Both options have their pros and cons. A new truck buyer offers the latest features, warranties, and customization options but comes at a higher price. On the other hand, a used truck buyer in Sydney is more affordable but may have higher maintenance costs. Assess your budget, preferences, and long-term plans to determine which option suits you best.

Find Reliable Dealerships:

Find a reputable truck buyer in Sydney to ensure a smooth truck-buying experience.

Look for dealerships that have a wide range of truck models, good customer reviews, and a reputation for excellent service.

Consider visiting multiple dealerships to compare prices, negotiate deals, and explore financing options.

A reliable dealership will guide you through the process and help you find the perfect truck that meets your requirements.

Test Drive: Once you have narrowed down your options, it's time to take the trucks for a test drive. Schedule test drives with different models to experience their performance firsthand. Pay attention to acceleration, braking, handling, and comfort factors. A test drive will help you determine whether the truck feels right for you and meets your expectations regarding the driving experience.

Consider Maintenance and Warranty

Before finalizing your purchase, consider the manufacturer's maintenance requirements and warranty coverage. Trucks, especially commercial ones, are subjected to heavy usage, so it's important to choose a truck that is known for its reliability and has a good track record of durability. Check the warranty details, including the coverage period and what components are included, to ensure you are protected in case of any issues.

Financing Options: If you need financing to purchase your truck, explore different financing options in Sydney. Compare various lenders' interest rates, loan terms, and down payment requirements. Getting pre-approved for a loan is advisable before visiting the dealership to understand your budget and negotiate better terms.

Insurance Considerations: Research and select the appropriate insurance coverage before hitting the road with your new truck. Contact insurance providers to obtain quotes and compare the coverage options they offer. Factors such as the truck's value, usage, and driving history will influence the insurance premium. Ensure you have adequate coverage to protect your investment and comply with legal requirements.

Finalize the Purchase: After completing all the necessary research, test drives, and considerations, you're ready to finalize your purchase. Review the purchase agreement carefully, ensuring that all agreed-upon terms, including pricing, warranties, and any additional accessories or services, are clearly stated. Take your time to read and understand the contract before signing.

Conclusion

Buying the perfect truck in Sydney requires careful consideration and research. You can confidently navigate the process by assessing your needs, setting a budget, conducting thorough research, and following the steps outlined in this ultimate truck buyer's guide. Remember to take your time, seek expert advice, and choose a reliable dealership to make your truck-buying experience successful. Good luck on your journey to finding the perfect truck in Sydney!

Reference URL: https://activepages.com.au/ultimate-truck-buyer%E2%80%99s-guide-your-roadmap-to-finding-the-perfect-truck-buyer-in-sydney

#sell my truck sydney#cash for truck sydney#cash for scrap truck sydney#truck wrecker sydney#truck wreckers sydney

0 notes

Text

"Discover Excellence in Car Selection at First Choice Carlingford"

When it comes to finding your dream car, a reliable and reputable dealership can make all the difference. If you're in the market for a top-quality vehicle, look no further than First Choice Carlingford. With a commitment to excellence, a diverse inventory, and a focus on customer satisfaction, First Choice Carlingford is the premier destination for car buyers in Sydney. In this article, we'll explore what sets First Choice Carlingford apart and why it's the ideal place to discover excellence in car selection.

A Reputation for Reliability

First Choice Carlingford has established itself as a trusted name in the automotive industry, known for its dedication to providing reliable, high-quality vehicles. Their reputation for reliability stems from a rigorous inspection and certification process that ensures every vehicle on their lot meets the highest standards.

One of the key factors that set First Choice Carlingford apart is their commitment to offering only the finest pre-owned vehicles. Each car, SUV, or truck in their inventory undergoes a comprehensive inspection, addressing everything from the engine's performance to the vehicle's appearance. This meticulous examination ensures that every vehicle they offer is in pristine condition, free of any hidden flaws or issues.

By choosing a vehicle from First Choice Carlingford, you can enjoy the peace of mind that comes with knowing that your new ride has been thoroughly examined and is ready for the road ahead. Whether you're in the market for a family car, a luxury vehicle, or a sporty sedan, you can trust that First Choice Carlingford has a wide range of options that meet their rigorous standards of reliability.

A Diverse Inventory to Suit Every Need

No two car buyers are the same, and First Choice Carlingford recognizes this by maintaining a diverse inventory that caters to a wide range of preferences and needs. Whether you're looking for a fuel-efficient compact car, a rugged SUV, a powerful pickup truck, or a luxury vehicle, First Choice Carlingford has a car to match your desires.

Their selection includes vehicles from various manufacturers, offering different sizes, styles, and features to meet the unique requirements of every customer. With a broad range of options, you're sure to find a vehicle that suits your lifestyle, budget, and driving preferences.

What makes First Choice Carlingford truly special is their expertise in curating a selection of cars that spans across makes and models. This diversity allows customers to explore various options, compare features, and make informed decisions about their purchase. Whether you're after a compact car for city commuting, a spacious SUV for family adventures, or a high-performance sports car for thrill-seekers, First Choice Carlingford is the place to discover a car that fits your aspirations.

A Customer-Centric Approach

First Choice Carlingford's dedication to customer satisfaction is evident in every aspect of their operations. They understand that purchasing a vehicle is a significant decision, and they aim to make the experience as smooth and enjoyable as possible. Their team of knowledgeable and friendly staff is always ready to assist you, providing expert guidance and answering your questions.

When you visit First Choice Carlingford, you'll be welcomed into a stress-free environment where the focus is on helping you find the perfect car to meet your needs. Their team is committed to understanding your requirements, preferences, and budget, ensuring that you drive away with a vehicle that exceeds your expectations.

Additionally, First Choice Carlingford offers financing options that make it easier to get behind the wheel of your dream car. Their experienced finance department works with various lenders to secure competitive rates and terms for your purchase, tailored to your financial situation.

Ells Auto Service: Your Trusted Partner in Car Maintenance

Just as finding the right car is crucial, keeping your vehicle in top condition is equally important. Ells Auto Service, a trusted name in automotive maintenance and repair, is your go-to solution in Sydney. Their expertise as suspension specialists in Sydney ensures that your car's suspension system remains in optimal condition.

A well-maintained suspension system is vital for your safety and comfort while driving. It plays a significant role in maintaining vehicle stability and handling. Whether it's routine maintenance, suspension repairs, or upgrades, Ells Auto Service has the knowledge, experience, and state-of-the-art equipment to keep your suspension system in excellent shape.

To learn more about Ells Auto Service and their suspension expertise, visit CarlingfordMechanic.com.au.

Conclusion

First Choice Carlingford is your gateway to excellence in car selection. With a solid reputation for reliability, a diverse inventory to meet various needs, and a customer-centric approach, they make the car-buying experience enjoyable and stress-free. Whether you're a family looking for a spacious SUV or a performance enthusiast seeking a thrilling ride, First Choice Carlingford has the right car for you.

When you purchase a vehicle from First Choice Carlingford, you're not just buying a car; you're investing in peace of mind and satisfaction. Visit First Choice Carlingford today and explore their outstanding inventory. Your dream car might be just a test drive away, waiting for you to discover it at First Choice Carlingford.

0 notes

Text

Pyjamas in North Sydney

The suburb of North Sydney bustles with people on a workday. While not as busy as downtown Sydney on the other side of the Harbour Bridge, you don’t want to be caught there in your pyjamas at lunch hour. Which is where I found myself.

It was one of those embarrassment dreams made real. I was lucky though to be wearing my semi-reputable pyjamas, rather than the undies I sometimes slept in on hot Sydney nights.. Thankfully too, this walk of shame was only 10-15 blocks or so.. Trying to play it casual, I entered a skyscraper and found the lift. Steadfastly avoiding eye contact with the office workers around me, I stared at my now-grimy bare feet instead..

DING!

The other occupants breathed a sigh of relief as the barefooted loon in his jammies exited the lift. I was relieved too, that the very fellow I’d rented my flat from a few months ago was in the office, and could identify me. It would have been much worse if nobody knew me in there (real estate agents don’t lend spare keys to barefooted strangers in pyjamas with no ID). Worse still, if their office had been miles away, and harder to get to, in barefeet with no cash. So this awkward situation was at least not an utter catastrophe, and I had a (somewhat) sympathetic ear as I explained my tale of woe -

I was at home, heard a delivery at the mailbox in the building entranceway just outside my flat, and went out to see if it was a cheque I’ve been waiting for. Only to hear my front door slam in a gust of wind. Leaving me stranded in my PJs with no key (AND no cheque). Although my window was ajar, it was unreachable from the ground. So, VOILA, pyjama loon.. Ha ha..

I was given a spare key and retraced the cringe-walk back to the small block of flats I lived in. It was an absolutely cracking location, just around the corner from North Sydney station, literally the last residential building on Blues Point Road before the high-rise towers of commercial North Sydney began on Miller Street. The building faced spectacular views of Sydney Harbour on one side, but my flat was on the other side, in the perpetual shadow of a looming skyscraper.

Despite world class views nearby, mine was of the alley where noisy garbage trucks came by daily to clear out multiple office tower rubbish bins. Consequently I always kept the curtains closed, and friends all joked about my dark cave. It was somewhat shabby, but it was the first place I’d ever found 100% on my own and I was stupidly happy about it. I honestly loved the place.

My building seen from North Sydney station (when under construction).

Prior to moving in, I’d had prolonged bad luck in finding somewhere to live. Every weekend I’d get the newspaper, circle ads of shared apartments, then traipse from interview to interview. Like speed dating, I’d get a moment to impress a household of strangers, keen on knowing my finances, my habits, my occupation, my vibe.. Try as I might, I simply could not display enough of the certain something wanted by each house. I was too vanilla for goth house, not financially secure enough for accountant house. Too much of a country bumpkin for posh house, and so on. For weeks, I failed each interview, and slouched slump shouldered back to the grotty Kirribilli private hotel I was living in (falling asleep to the warbling old lady two doors down - “There’ll be Bluebirds over the white cliffs of Dover..”) Gawd.

Finally, I saw an ad for a 2 bedroom flat in an area convenient to work. Lo & behold, I could actually afford all the rent on my own (even though I was barely scraping by financially). No more grilling by judgy flatmates! This seemed too good to be true.. When I showed up, the real estate agent explained that the rent was so low as some construction was planned in a year or two. This didn’t bother me, as I planned to go abroad soon anyway. Though somewhat dark, my flat was paradise after sleeping on some friends’ couch, and staying in The Sad Loser Hotel.

This block of flats was one of the most sociable buildings I’ve ever lived in, and I met many neighbours immediately upon moving in. While unpacking boxes in the lounge room, my front door slammed open, and someone boomed a hearty “hello!” as she came clomping down the corridor. She did a double take at the sight of me and burst into raucous & infectious laughter. “Oh sorry, you’re clearly not (so & so)!!” I explained that the person she'd expected had moved out, & I’d just moved in. She introduced herself as Carmel, warmly welcomed me to the building, and explained the lay of the land - telling me who was who and what was what. The bloke next door was a truck driver who was barely ever there, and she introduced me to the tenant living on the far side side of my floor, Catherine, who had one of the utterly speck-tack-you-LAH views of Sydney Harbour.

The invite I drew for Catherine’s NYE party, attended by many in the building.

It was a year when I did a lot of freelance working from home, so I got to know several residents & their various entourages, and socialized frequently with them all. My flat was near the mailboxes, and when working at my drawing table in the spare bedroom I’d hear people come & go, and they often came in for tea & a natter. Catherine two doors over had an infant boy who I sometimes babysat. Carmel worked in a bar/restaurant near Wynyard (where she played the room like a theatrical Diva). There was also a fellow whose name escapes me now (a flatmate of the ever-absent truckie? Or perhaps of Carmel?) Who’d come by and bend my ear about the merits of EST and other 1980s self-help bollox.

The fly in the feel-good community ointment was a cranky old Polish bloke living right beneath me, who’d constantly thump on his ceiling. Screaming obscenities through my floor boards, he accused me of making a horrendous din. To hear him tell it, a death metal band was practicing upstairs, though I was quiet as a mouse. Carmel claimed his 'bark was worse than his bite', & he was 'a lovely man', etc, but to me he was like an angry troll living under the bridge. Plus, he made the communal laundry unusable by making blood sausage in the wash tubs. bleurgh.

However, I was soon to get my own lessons in building acoustics. Late one night, I was woken to the sounds of someone being beaten up in the alley outside. I stuck my head out the window.. and realised the moaning and groaning was coming not from the alley below, but from the apartment above.. rhythmic groaning? Ohhhhhh.. Carmel (always up on the building scuttlebutt) soon confirmed that newlyweds had moved in upstairs. I’d be in my lounge room, when there'd be sounds of rambunctiousness on the sofa above. Giggling soon segued to moaning & groaning. I subsequently heard them shagging in every room. The bathroom, the bedroom, everywhere. Good lord. It can be difficult to get to sleep in Sydney on hot summer nights, but especially when the Sex Olympics is happening upstairs. (I participated too, in the Celibacy Marathon, scoring a gold medal for Australia). So the Pole had been right after all. Without carpet/insulation, simply walking to & fro made a hell of a racket on my ceiling (and they got up to a lot more than walking, the randy monkeys).

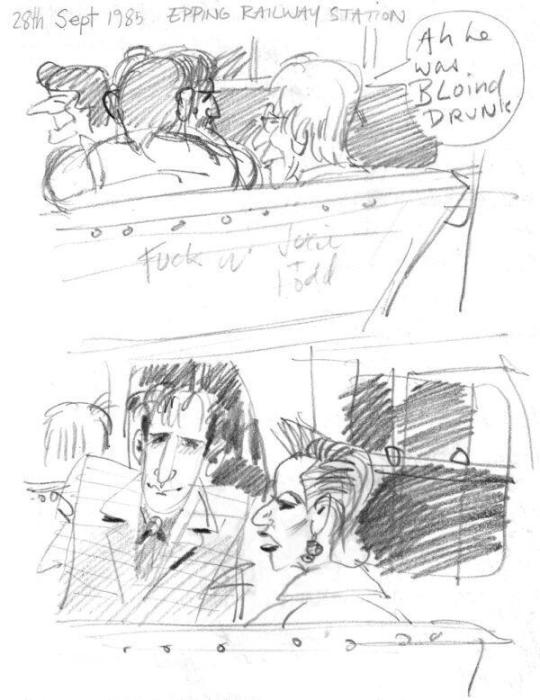

Yobbos & Trendies, sketched on train to North Sydney, 1985.

From my wonderfully located flat, I could easily walk to animation studios in St. Leonards, go to Milson’s Point for a swim in the spectacular North Sydney pool, or ride my bicycle across the Sydney Harbour Bridge to meet pals in town.. As always during this era I had no phone, but had finally inherited a telly when my pal Chris left OZ. With the sound turned down it was often the visual accompaniment while playing my LP records (or the mixtapes we made & swapped in those days).

While living in this flat, there were several visits from hometown family, including Dad. The first time was soon after I moved in, and I prepared for the ridicule that my flat typically inspired.. but Dad absolutely loved it. He wandered from room to room as if awed, impressed that I’d found it all on my own. His reaction genuinely made me happy. I hadn’t yet got much furniture, so Dad slept on the bed and I took the floor, but I barely slept at all, because Dad seemed to continuously choke in his sleep. I learned later that this was his (eventually diagnosed & treated) sleep apnea. Dad’s last visit coincided with my 22nd birthday, and we went out to celebrate with one of his workmates, who I’d known for years. It was a fun evening, where I was treated to the sight of Dad giggly drunk. I only ever saw him drunk twice in my entire life, and both times he was giggly silly, not a mean drunk at all. Anyway, I had to help him to bed that night, laughing like a loon.

In that last year before I went abroad, there was a dramatic uptick in tour buses containing international tourists. I began to see them in the lower North Shore area, where I'd not noticed them before. Sydney finally was on the international travel map. Travel was on my mind too. I gave my few sticks of crummy furniture (& sold my hi-fi) to a coworker, who also took over my lease (he habitually wore army boots, so I’m sure the old Pole loved that). The general idea when I left Australia was that I’d come back and share the place. As it turned out, I’ve lived abroad for the rest of my life.. My understanding was that this block of flats would eventually be demolished, to build another high-rise tower like the one next door, but it is still there:

211 Blues Point Road (AKA, 1 Miller Street)

The owners/property managers had been letting it go when I lived in the building, but now it is now posh, and known as ‘THE CITADEL’. (Lah-di-dah). For reasons unclear, the addressing in that block have changed. What used to be '1 Miller Street' is now '211 Blues Point Road' (which was confusing when plugging my old address into Google Maps). My rent was $55 a week, but the same flat goes for about $900 per week now.

I was very lucky to live in Sydney just before it became unaffordable for the average shmo. On spotty & low pay, I managed to live twice right by the harbour, when it was still possible to have fun in Sydney without being rich. Anywhere is fun when you have cash, but truly wonderful cities are lovely even when you’re broke. To me, that is the definition of a livable city.

from www.James-Baker.com

1 note

·

View note

Text

Commercial Finance Sydney, Asset Finance Sydney NSW Commercial Finance Sydney offers businesses tailored financial solutions to fuel growth and manage cash flow effectively. Whether you need equipment financing, working capital, or invoice factoring, our experts provide the right funding options for your needs. Get fast, flexible, and competitive commercial finance in Sydney to take your business to the next level. For more information, please visit: https://www.netcorpfinance.com.au/

0 notes

Text

What Are the Initial Costs Associated With A Mortgage?

The initial costs of buying a house can vary depending on several factors, including the location, the price of the home, and the type of mortgage you choose. It is also important to note that financing these initial costs through aussie home loans Sydney can increase the overall cost of your mortgage.

Here are some common initial costs included in a home loan:

Down Payment

Depending on the type of loan you qualify for, you may be able to finance your down payment through your home loan. This is the initial amount you pay towards the purchase of the house. The amount of the down payment can vary, but it is typically between 3% and 20% of the purchase price.

You should consider the cost of a down payment when budgeting for a home purchase, as it can have a significant impact on the overall cost of your loan.

Closing Costs

These are the fees and expenses associated in aussie home loans with finalizing the purchase of the home, including appraisal fees, title search fees, and attorney fees. These costs can vary but typically range from 2% to 5% of the purchase price.

Some lenders offer what is called a no-closing-cost mortgage, which means that the closing costs are rolled into the loan amount. However, keep in mind that this can result in a higher interest rate or monthly payment.

Home Inspection

In general, a home inspection is not included in your home loan and must be paid for separately. But it is essential to note that the cost of a home inspection is a relatively small price to pay compared to the potential cost of repairing hidden or unknown issues after purchasing a home. Therefore, while it may seem like an additional expense, it is well worth the investment to ensure the safety and soundness of your future home.

Property Taxes and Homeowners Insurance

Property taxes and homeowners insurance are typically included in the monthly mortgage payment of aussie home loans. The specific cost of property taxes and homeowners insurance can vary depending on a few factors, such as the location and value of the home.

Property taxes are assessed by the local government and are usually based on the value of the property. The cost of property taxes can range from a few hundred dollars to several thousand dollars per year. On the other hand, homeowners insurance is designed to protect the property and its contents against damage or loss due to events such as fire, theft, and natural disasters. The cost of homeowners insurance can also vary, depending on the location of the home and the amount of coverage required.

Moving Expenses

Moving expenses are not typically included in aussie home loans.

But, once you buy the house, you typically need to move in. If you hire a professional moving company, you will need to pay for their services. The cost can vary depending on the distance of the move, the size of your home, and the amount of belongings you have. If you plan to move your belongings yourself, you will need to rent a moving truck. The cost can vary depending on the size of the truck and the distance of the move.

0 notes

Text

The Best Truck Finance Deals in Sydney

We want to help you achieve your dreams by offering financial support. Our company specializes in a variety of finance brokerage services, including truck finance in Sydney, equipment finance brokers, and truck finance brokers in Sydney. In addition, we also offer business loans to both start-ups and established businesses.

0 notes

Text

What is the Low Doc Truck Finance All about?

If you are looking for a good truck finance then check out the different financing institutes that are offering good loans. Many of us don’t have the required documents and this tends to pose a problem when it comes to taking the loan. But now with the low doc truck finance you can apply for the loan even when you don’t have all the documents. All that you need to do is apply for the loan and wait for it to get approved.

Once you get the approval, you can use the loan amount to buy the truck. It is really a very simple and hassle free process. What are you waiting for? Get in touch with the experts and get the needful one at the earliest. Don’t let the lack of documents stand in your way of getting the loan. Just fill up the application form and wait for it to get approved.

In the meantime check out the different models of trucks. Have you decide which one you would like to buy and how many of them? Select the one that you would like to purchase. Once you get the loan amount, go ahead and buy the truck without any worry in the world. What are you waiting for? Apply for the low doc truck finance today and make the most of this. If you know of someone who is facing problems due to the lack of documents, do recommend the low doc truck finance to them as well.

0 notes

Text

Car and Equipment Finance For Businesses

Whether it's a car, truck or machinery, business vehicle and equipment finance provides flexible loan repayment terms to help you buy the assets your business needs. It can also be structured with an end balloon or residual payment to lower the regular payments if you need to manage cash flow.

Commercial Vehicles

Whether you need a new fleet of commercial vehicles or specialised equipment for your business, our team can help. We work with a wide range of lenders that offer car and equipment finance Sydney products that can be tailored to your needs.

Generally, all businesses from large companies to sole traders can get business car loans, provided you have an ABN, use the vehicle for business purposes, and can meet the lender’s criteria. Business loans can also include additional features like tax deductions and flexible repayment options like weekly, fortnightly or monthly.

ANZ offers various options to finance your business assets, including chattel mortgage, hire purchase and lease purchase. We can assist you, in conjunction with your accountant or tax advisor, in determining which financing type will be most beneficial to your business operations and cash flow. The best option is based on several factors including:

Construction Equipment

Whether you need a dental chair for your practice or a dump truck for your construction company, equipment and vehicle finance allows businesses to acquire the tools they need without exhausting their existing lines of credit. This loan type usually involves financing 80% to 100% of the equipment cost with monthly repayments (including interest) over a set term.

Lenders typically ask for an active ABN or ACN, federal tax file number and financial records to assess a business’s health and cash flow. This compilation streamlines the application process and instils confidence in lenders that a business is ready to access equipment.

Providing security for an equipment loan helps to minimise risk and lower interest rates. This could be the equipment itself, a deposit or other forms of security such as a personal guarantee. Generally, businesses that offer equipment finance are required to hold an Australian credit licence unless they are exempt. However, this isn’t always necessary.

Machinery

Equipment finance (also known as commercial loans or business leases) can be used to finance any tangible assets you need for your operations. This includes vehicles, machinery, technology and tools.

Depending on the size of your business, you might need specialised equipment to meet your needs. These can range from earthmoving machines to medical and dental equipment. These costs can add up quickly and put a dent in your cash reserves.

Business equipment finance is designed to allow you to update your fleet and increase your productivity without a large upfront cost. Our team will assist you as you explore your options.

We can help you choose the best option for your business, including chattel mortgages and hire purchase. These options let you keep your other assets and cash flow debt-free, and also enable you to claim GST back in the BAS cycle of each purchase.

Agricultural Equipment

Agricultural equipment is any type of machinery used in agriculture to perform tasks like cultivating, harvesting, planting, and even transporting. Some examples include tractors, harvesters, animal feed mixers, field-wide weed removers and more. These machines help farmers grow more food in less time, which is essential for feeding a growing world population.

Purchasing equipment can be expensive and often requires substantial cash reserves. To reduce the impact on your business and cash flow, equipment finance offers a flexible repayment structure. Repayments can be matched to periods of higher business activity and you only own the equipment once it’s paid off.

From vehicles to coffee machines and everything in between, ANZ has a range of equipment financing options for businesses of all shapes and sizes. To find out more, talk to one of our local business bankers today.

0 notes

Text

BRIAN KERNICK, P.Eng, MBA Greenview Developments Ltd.

Brian was born and raised in the small town of Canmore, Alberta. His father owned Restwell Trailer Park just off main street Canmore. As Restwell Trailer Park expanded and grew, Brian developed interest and learned the basics of carpentry and development. As a kid, he learned to drive a backhoe and dump truck and how to hammer and paint.

His first development project was in Canmore, called Grotto Mountain Village. Grotto Mountain Village was a highly successful 125 manufactured housing community. After finishing the project, Brian decided to get his Masters in Business Administration (MBA) in Australia. Brian completed his MBA in 1998 and then worked in several large real estate consulting firms working for blue chip companies. He provided strategic evaluation advice and hands on development management services to companies and institutions looking to make direct property investments, engage in real estate development projects or alternatively undertaking the divestment of property.

Brian is an efficient, innovative, tenacious, performance-driven and methodical real estate developer with extensive multi-industry experience both across North America and abroad. He is well versed in Project Development and Management, Economic and Financial analysis, Acquisition and Disposal Strategies, Site Assessment, Town Planning, Engineering and Building design, Market geographic and demographic analysis.

Brian incorporated Greenview in 1988 with the intention of moving closer to his family and friends in Canada. Under Brian’s leadership, Greenview Developments has been involved in the construction, development and management of low-rise and high-rise residential and commercial properties, mixed-use developments and hotels. These developments have led to economic success, bottom-line results and award-winning projects.

Greenview’s model is based on understanding the entire life cycle of the development of a project and partnering with other experts that have varied and complimentary backgrounds and have the shared experience of working well together. Using this life cycle view, we aim to deliver the best possible results to all stakeholders involved.

CURRENT ON-GOING PROJECTS

1. HARBOUR LANDING BUSINESS PARK (REGINA)

Harbour Landing Business Park is a campus style office development consisting of four buildings each spanning 40,000 square feet (3-storey office building and a Tim Hortons coffee) in Regina, Saskatchewan. It is located near Regina International Airport. Buildings 1, 2 & 3 have been fully completed and phase 4 has commenced. It is a suburban office park that is located on the corner of Parliament Avenue and Lewvan Drive just north of the new Grasslands retail development. Three of the four office buildings have been completed and are occupied. They are located within minutes of the Regina Airport and the new Global Transportation Hub. They offer excellent access / egress from Lewvan Drive and access to acres of parks and walking paths. The tenant mix consists of Saskatchewan Cancer Agency, Association of Professional Engineers & Geoscientists of Saskatchewan (APEGS), Porchlight, Saskatchewan Healthcare Employees’ Pension Plan (SHEPP) and Chartered Professional Accountants Saskatchewan (CPA).

2. AVLI ON ATLANTIC (CALGARY)

AVLI is a private intimate building located in historic Inglewood, adjacent to the longest park pathway system in North America, in Calgary, Alberta. A home to 65 units of luxury residences with 7 floorplans for every buyer, budget and investor with boutique and cutting-edge interiors. It is comfortable in its setting, proud of its attributes and home to those who have an appreciation for remarkable art. AVLI on Atlantic features the finest in contemporary custom-made cabinetry and the stylish gourmet kitchens offer ultra-modern flat panel doors in a white high-gloss overlay finish with metallic edging.

Greenview Developments is the managing partner in this $36MM project which is nearly complete.

3. WILLIAM OFF WHYTE (EDMONTON)

It is a 44 unit, four-storey condo building that believes in bringing style and aesthetics to your life. It is rated one of the top streets in Canada providing a home you can really live in and admire. The project is located in central Edmonton, in the community of Garneau, and just off the popular and lively Whyte Avenue. William Off Whyte was completed in early 2020 with sales ongoing. Being near the University of Alberta main campus and Hospital also makes it ideal for students who want a stylish place to live. William Off Whyte has nine-foot ceilings, beautiful modern exterior, Italian cabinetry, soft close drawers, quartz counters, underground parking and bike storage and a choice of three colour schemes to suit your style.

PAST COMPLETED PROJECTS

1. Sage.Stone (Calgary)

Sage.Stone is a project in NW Calgary with total sales revenue of $40 million. Phase 1 (88 units) is 100% complete and Phase 2 (90 units) finished closings by March 2015.

2. Bordeaux in Hawkstone (Regina)

76 townhomes in North Regina with total sales revenue of $22 million has been completed.

3. Skyy Townhomes (Regina)

Sales of 116 units commenced in June 2010 with total sales revenue of $22 million and the project was completed January 2012.

4. Luxstone Landing (Calgary)

12 unit Townhome developments with a value of $3.3 million was completed in 2012.

5. Sage Townhomes (Regina)

The sales of 176 townhomes commenced in December 2009 with sales revenue of $35 million and the project was completed in early 2011.

6. Advantage West Inns & Suites (Fort McMurray)

This hotel was built from pre-fabricated modular units rather than standard stick-built construction. The 83‑room hotel opened in July 2004. After 3 ½ years of operation, Greenview Developments sold it in 2008 for $19,400,000 or $234,000 / room, a record price in Canada.

7. Spring Pastures (Australia)

Completed 72-acre rural residential project worth $10m in Mapleton, Queensland within 2 years.

8. Grotto Mountain Village (Canmore)

Grotto Mountain Village was a $15 million project, consisting of a 125-lot turn-key manufactured housing community on 24 acres, which won the mayors award for Urban Design, Community Neighbourhood Enhancement & Facility Construction in 1994.

EDUCATION/ TRAINING

· Masters of Business Administration – AGSM / University of Sydney, 1998

· Graduate Diploma in Business Administration – AGSM / University of Sydney, 1997

· Bachelor of Science in Engineering – University of Calgary, 1992

WORK EXPERIENCE

SENIOR PROJECT MANAGER | WESTCORP – LONDON AT HERITAGE STATION – CALGARY, AB 2006 - 2008

Responsible for the construction of four 20+ story residential towers, 80,000 ft2 of commercial space, an 1,800-car parkade, and a pedestrian bridge connecting the development with light rail rapid transit. The residential towers include high line amenities and ample common facilities. Started this project from the early concept stages and set up a construction and management team, operational and procurement processes, budgets, and construction schedules. Oversaw all aspects of this large construction project.

PROJECT MANAGER | POINTE OF VIEW DEVELOPMENTS – CALGARY, AB 2005 - 2006

Tendered and negotiated all scopes of work, monitor construction milestones, budgets and costs.

Planned and designed new projects, customer walkthroughs and completion of deficiencies.

SENIOR EXECUTIVE | KPMG NATIONAL REAL ESTATE SERVICES – SYDNEY, AUSTRALIA 2001 - 2002

· Provided strategic property advice and off-balance sheet finance solutions to developers, financiers, government agencies and major blue-chip corporations

· Feasibility and divestment advice on HIH Insurance. HIH, and its 18 controlled entities, was Australia’s largest insurance company and it went into liquidation in March 2001. I acted on behalf of the provisional liquidator to maximize the proceeds from the sale of the properties.

· Development and feasibility advice for the redevelopment of Bathurst Mount Panorama Precinct, one of the top three motor racing circuits in the world. Bathurst 1000 is the Australian equivalent of Indy 500 in terms of motor racing and the event is broadcast to over 400 million homes in 54 countries. The Panorama Precinct is a multi-use tourism destination featuring restaurants, tourist attractions, cultural facilities, sporting and recreational facilities such as motocross, educational facilities, residential properties and nature park areas.

· Facilitated the revision and expansion of Commonwealth Property Principles document for the Australian Department of Finance. This provided an appropriate discount rate and methodology for real estate decisions.

· Reviewed feasibility and business case for NRMA (affiliated with the Canadian Automobile Association and American Automobile Association), to divest their existing operations in multiple locations and consolidate their staff within a new 38,000 m2 ‘Village’ campus style development.

· Prepared a feasibility and highest and best use study for ABC (Australian Broadcasting Corporation) Television’s Gore Hill site as well as planning and offering council advice.

DEVELOPMENT MANAGER |APP PROPERTY PTY LIMITED – SYDNEY, AUSTRALIA 2000 - 2001

· We had to seek out, assess and convert development opportunities. This role encompassed feasibility analyses, negotiation and deal closures with clients, sourcing and arranging property finance.

· Development Representative for C+BUS (an RRSP company with over 320,000 members) in its $1.5B, residential development of over 1,600 lots, units and townhouses, called Breakfast Point. This role included feasibility assessment, project management, risk management, planning, sales and marketing advice

· Managed feasibility analysis for a new World Headquarters for TAB Ltd. (Australia’s largest gambling firm)

· Provided Property and E-commerce advice for Australia Post (equivalent of Canada Post)

· Business plan and property advice for a 100,000m2 regional business park on the Central Coast (north of Sydney) for Festival Development Corporation (a division of the Department of Urban Affairs and Planning)

· Venue Management analysis for the Sydney Cove Passenger Terminal Upgrade Circular Quay. (The Sydney Cove Overseas Passenger Terminal receives around 50 cruise ships a year as well as housing numerous restaurants and events).

2 notes

·

View notes

Text

Navigating Your Options: Vehicle Finance and Asset Finance in Sydney

For businesses and individuals in Sydney, finding the right financing options for vehicles and assets is essential for growth and operational efficiency. Whether you are looking to expand your business fleet or acquire critical assets for your operations, understanding the benefits and options for vehicle finance in Sydney and asset finance in Sydney is crucial. This article will guide you through these financing options and help you make an informed decision.

Understanding Vehicle Finance in Sydney

Purchasing a vehicle, whether for personal use or business purposes, often requires a significant financial outlay. Vehicle finance in Sydney offers a practical solution for those who wish to avoid the upfront cost of buying a new or used vehicle. With multiple lenders and financing products available, vehicle finance provides several benefits:

Flexible Repayment Options: Most financial institutions in Sydney offer flexible repayment terms tailored to your budget and financial situation. This flexibility allows you to manage your cash flow effectively.

Lower Initial Costs: With vehicle finance, you can drive away with your desired vehicle without the burden of a large upfront payment.

Access to Newer Models: Financing allows you to upgrade to newer models with better features and fuel efficiency, which can be particularly beneficial for businesses that rely on vehicles for operations.

Sydney's diverse financial market ensures that you have access to a wide range of vehicle finance options, including car loans, novated leases, and chattel mortgages, each with its own set of benefits and conditions.

What is Asset Finance in Sydney?

Asset finance in Sydney goes beyond just vehicles; it encompasses financing for various types of assets that businesses require, such as machinery, equipment, and technology. Asset finance helps businesses acquire essential equipment without the need for substantial capital outlay. The benefits of opting for asset finance include:

Improved Cash Flow: Instead of paying a large sum upfront, businesses can spread the cost of the asset over a fixed period, preserving cash flow for other critical needs.

Access to the Latest Equipment: Financing allows businesses to invest in the latest technology and equipment, which can improve productivity and efficiency.

Tax Benefits: Depending on the type of asset finance, businesses may benefit from tax deductions, making it a cost-effective solution.

Like vehicle finance, asset finance in Sydney comes in various forms, such as leases, hire purchases, and commercial loans. This variety enables businesses to select the most suitable financing option based on their operational needs and financial goals.

Choosing Between Vehicle Finance and Asset Finance in Sydney

When it comes to deciding between vehicle finance in Sydney and asset finance in Sydney, it's important to assess your specific needs and financial situation. Here are some steps to guide your decision:

Identify Your Requirements: Determine whether your business needs revolve around vehicles or other types of equipment. If you need vehicles for logistics or service delivery, then vehicle finance is the right choice. For specialized machinery or technology, asset finance may be more appropriate.

Analyze the Costs: Compare the interest rates, fees, and repayment terms associated with both types of finance. Understanding the total cost of financing will help you choose the most cost-effective option.

Consult Financial Experts: Engaging with financial advisors in Sydney can provide you with insights tailored to your business. They can help you understand the various options available and select the best solution for your needs.

Conclusion

Both vehicle finance in Sydney and asset finance in Sydney offer valuable options for individuals and businesses looking to invest in their future. By carefully assessing your requirements, comparing costs, and consulting with experts, you can choose the best financing solution that aligns with your financial goals and business strategy. Make a smart financial decision today to drive growth and efficiency in Sydney. For more information, please visit: https://www.netcorpfinance.com.au/

0 notes