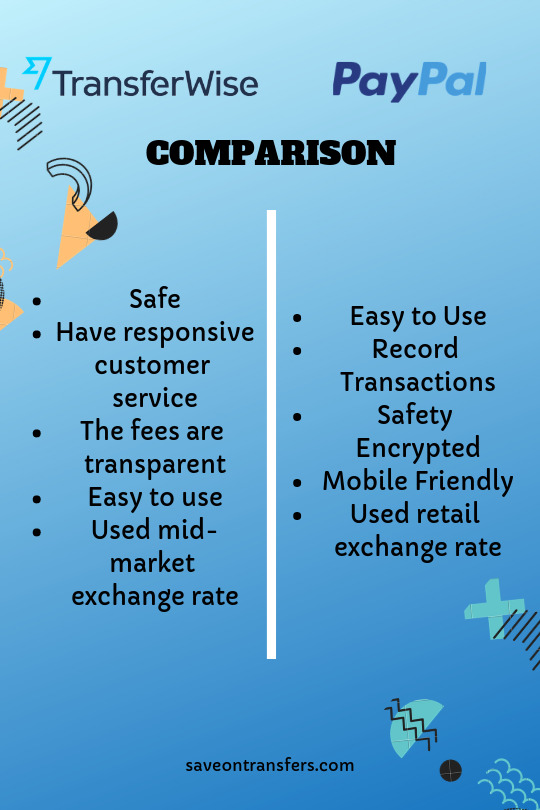

#transferwise vs paypal

Explore tagged Tumblr posts

Text

2 notes

·

View notes

Text

UAE Dirham to INR: How to Get the Best Conversion Rates in 2024

The UAE Dirham (AED) to Indian Rupee (INR) exchange rate is crucial for travelers, expats, and businesses dealing between the UAE and India. With evolving currency markets, finding the best conversion rates can help save a significant amount. Whether you’re planning to buy UAE dirham online or manage funds while working abroad, this guide provides you with top tips and methods to secure the best exchange rates in 2024.

1. Monitor Exchange Rates Regularly

Currency values fluctuate daily based on economic events, geopolitical factors, and market demand. Keeping an eye on these fluctuations can help you decide the right time to convert UAE dirhams to INR for maximum value.

Use Currency Monitoring Tools: Websites and apps offer real-time rate monitoring, which allows you to track changes throughout the day. Some platforms even offer notifications when rates reach your preferred levels.

Understand Daily Trends: Currencies like the AED and INR often fluctuate within predictable ranges. Observing daily trends can help you spot when the rates are better.

2. Compare Different Money Exchange Providers

Many exchange providers in India and the UAE offer various rates, fees, and margins. Compare rates across multiple platforms before making a decision.

Banks vs. Forex Platforms: Banks often charge higher fees than specialized forex platforms. Forex providers may offer better rates, especially when dealing with large amounts.

Currency Exchange Apps: Apps like PayPal, Remitly, and Western Union allow you to send and convert currency online, often at competitive rates. Just ensure you read all the fine print regarding fees.

3. Consider Buying UAE Dirham Online

In 2024, there are various platforms that allow you to buy UAE dirham online, often at better rates than physical locations. Online platforms generally provide transparent pricing with lower overhead costs, making them ideal for quick conversions and rate comparisons.

Look for Platforms with Low Fees: Fees can vary significantly between providers, so prioritize platforms with low or no hidden charges.

Use Trusted Platforms Only: Reputable online services like BookMyForex, Wise (formerly TransferWise), and CurrencyFair have established credibility and offer favorable rates.

4. Choose the Right Time of Day for Your Transaction

Currency conversion rates can differ based on the time of day. Major financial centers like London, New York, and Dubai impact currency values during their active trading hours.

Convert During Overlapping Trading Hours: For AED to INR, converting during hours when both UAE and Indian markets are active may offer better rates.

Avoid Converting on Weekends: Many platforms set higher rates on weekends due to limited forex market activity.

5. Use Currency Conversion Lock-In Services

Some providers allow you to lock in exchange rates for a specific period, securing a favorable rate despite future fluctuations.

Benefits of Rate Locking: This can be helpful if you’re expecting market volatility but want to ensure you get the best rate now.

Where to Find Rate Locks: Banks, forex apps, and some online forex brokers offer rate-locking services. Just confirm any fees involved with locking in a rate.

6. Opt for Foreign Currency Cards

If you frequently travel between India and the UAE, foreign currency cards can help you avoid the hassle of multiple conversions and get more favorable rates.

Prepaid Forex Cards: These cards allow you to preload AED and use it in UAE without constantly converting AED to INR and vice versa.

Multi-Currency Cards: Some cards support multiple currencies, including AED, which can be handy for travelers covering multiple countries.

7. Avoid Airport and Hotel Currency Exchanges

Airport and hotel exchange counters typically offer lower rates with high fees. For better value, use city-based exchange providers or online services before departure.

Tips to Keep in Mind When Buying AED Online

When you decide to buy UAE Dirham online, it’s essential to keep certain tips in mind to ensure a secure and cost-effective transaction.

Read Customer Reviews: Reliable online platforms will have positive reviews and testimonials. This can give you an idea of the service quality.

Check for Transaction Limits: Some platforms may impose minimum or maximum limits, so be sure to confirm them if you have specific conversion needs.

Understand the Exchange Platform’s Policies: Be sure to read through their terms and conditions to understand any additional fees, delivery times, and policies.

How to Track UAE Dirham to INR Rates in 2024

In 2024, keeping up with real-time exchange rates is easier than ever. Here are some useful resources to monitor UAE Dirham to INR rates.

Mobile Apps: Apps like XE, Currency Converter Plus, and Google Finance allow you to check AED to INR rates anytime.

Currency Websites: Websites like BookMyForex and Wise provide daily rate updates and conversion calculators.

Subscription Alerts: Many forex sites and apps allow you to set alerts so you’re notified when the rate hits your preferred level.

Conclusion

Getting the best UAE Dirham to INR conversion rates in 2024 requires a combination of timing, market awareness, and using the right tools. By following the tips above, you can make the most out of your conversions, whether you need a small amount for travel or are handling larger sums as an expat or business. Remember, the best rate is one that aligns with your needs, whether that’s a low fee, high rate, or a quick transaction.

0 notes

Text

How Do Venmo Limits Compare With Other Payment Services?

Venmo is a popular payment service that offers a variety of features and benefits, including fast and easy money transfers, social payment options, and low fees. However, when it comes to limits, Venmo has some limitations compared to other payment services.

Venmo vs PayPal Limits

Venmo has a weekly transaction limit of USD 7,000 for personal accounts and USD 25,000 for business accounts (assuming you have verified your Venmo identity). Corresponding limits for verified PayPal personal and business accounts are USD 10,000 and USD 60,000.

Venmo vs Wise (formerly TransferWise) Limits

Wise (formerly Transfer Wise) is a payment service that offers international money transfers with competitive exchange rates and low fees. Transfer Wise have no minimum or maximum limits, although some transfers may require additional verification or documentation.

It is important to note that Venmo transfer limits are just one factor when choosing a payment service. Other factors to consider include fees, exchange rates, delivery options, and security features.

Ultimately, the best payment service for you will depend on your specific needs and preferences, as well as the features and limitations of each platform.

What Are Venmo Limits For Personal Accounts?

Venmo limits for personal accounts apply to purchases as well as sending and receiving money on the platform.

Here are Venmo transaction limits1 for personal accounts:

For unverified Venmo personal accounts (when identity verification has not been completed yet), there is a Venmo weekly spending limit of USD 299.99. Venmo limit includes payments made for purchases as well as sending money to others. The good news is that you can easily increase this limit by verifying your Venmo account. To do so, go to the "Me" tab and then Settings and then "Identity Verification".

If you have successfully verified your Venmo account, you can make weekly purchases of up to USD 7,000 and send up to USD 60,000 via your account.

If you wish to withdraw money from your Venmo account to your bank account, here are Venmo's withdrawal limits to be aware of:

If you are an unverified Venmo account holder, you can send up to USD 999.99 per week to your bank account.

If your Venmo account is verified, you can send up to USD 19,999.99 to your account every week. Just be aware that there is a cap of USD 5,000 per transfer so you may need to do multiple transfers if you wish to send more than that amount per week.

Finally, it is also possible to send money to your Venmo account. If you wish to do so, below are Venmo's deposit limits:

Up to USD 10,000 per week via a bank account.

Up to USD 2,000 per week via a debit card.

Venmo limits for various transaction types depend on whether your account is verified or not. Verify your identity to enjoy higher limits.

What Are Venmo Limits For Business Accounts?

Venmo limits for business accounts are structured similar to those for personal accounts but with some important differences. Business accounts have higher limits to accommodate larger transaction volumes and higher account balances.

Here are the main Venmo transaction limits 3 for business accounts:

If you have an unverified Venmo business account, the limit is USD 2,499.99 per week. Similar to personal accounts, you can easily verify your Venmo business account by going to Settings and then "Identity Verification" from your business profile on the Venmo app.

If you verify your business account, the limit is USD 25,000 per week.

If you wish to withdraw money from your Venmo business account3 to your bank account, here are the pertinent limits:

Unverified account - USD 999.99 per week.

Verified account - USD 49,999.99 per week.

Note that there is also a limit of USD 10,000 per withdrawal for Instant Transfers to your debit card, and USD 50,000 per withdrawal for Instant Transfers to your bank account.

Finally, if you want to fund your Venmo business account using your bank account or debit card, here are Venmo's deposit limits:

Up to USD 10,000 per week using your bank account.

Up to USD 2,000 per week using your debit card.

Venmo limits for business accounts vary depending on whether your account is verified or not. Make sure to verify your business' identity to enjoy higher limits.

0 notes

Text

Sending Money From Canada to Italy: A Comprehensive Guide

In today's interconnected world, the need to send money across borders has become a common and essential financial transaction. Whether it's for supporting family members, paying for services, or conducting international business, the process of sending money from one country to another can be quite intricate. For those looking to send money from Canada to Italy, it's crucial to understand the available options, costs, and considerations to ensure a smooth and cost-effective transfer.

Traditional Banking vs. Online Money Transfer Services: Traditionally, people have relied on banks to facilitate international money transfers. While banks offer a sense of security, they often come with higher fees and less favorable exchange rates. To save both time and money, many individuals and businesses have turned to online money transfer services like TransferWise (now known as Wise), PayPal, and specialized international money transfer companies such as OFX and XE Money Transfer. These online platforms typically offer more competitive exchange rates and lower fees than banks.

Exchange Rates: One of the most significant factors affecting the cost of sending money from Canada to Italy is the exchange rate. Exchange rates fluctuate constantly, and it's essential to compare rates offered by different service providers. Keep in mind that banks and traditional financial institutions tend to offer less favorable rates compared to online money transfer platforms. Look for a service that offers real-time exchange rate information, so you can make an informed decision.

Fees and Hidden Costs: When sending money internationally, it's essential to consider the fees associated with the transfer. Banks often charge high fees, which can significantly reduce the amount the recipient receives. Online money transfer services are known for their transparent fee structures, and some may even offer fee-free transfers for certain amounts. However, it's crucial to read the fine print and be aware of any hidden costs, such as correspondent bank fees or intermediary charges that may apply.

Transfer Speed: The speed of the transfer can vary depending on the service you choose. If you need the money to reach Italy quickly, consider using services that offer same-day or next-day transfers. However, faster transfers may come with slightly higher fees. If speed is not a primary concern, you can opt for standard transfer options that are more cost-effective but may take a few days to complete.

Security and Regulation: When sending money internationally, it's essential to ensure the safety and security of your funds. Choose a reputable money transfer service that is regulated and compliant with financial regulations in both Canada and Italy. Reputable providers have robust security measures in place to protect your financial information and funds during the transfer process.

Transfer Limits: Different service providers may have varying transfer limits, so be sure to check whether your intended transfer amount falls within the limits of your chosen platform. Some providers may require additional documentation or verification for larger transfers, so plan accordingly.

Customer Support: Good customer support is vital, especially when dealing with international transfers. Choose a service provider that offers reliable customer support to assist you with any questions, concerns, or issues that may arise during the transfer process.

For More Info :-

Send Money From Italy to Canada

0 notes

Text

Comment se faire payer sur Internet (Payoneer Vs PayPal)

https://owl2business.com/payoneer-vs-paypal/

Si vous travaillez en ligne ou envisagez de le faire depuis chez vous, vous devez évidemment savoir comment être payé sur Internet. Devriez-vous utiliser PayPal ou Payoneer ?

Le tableau ci-dessous présente une comparaison rapide entre les 2 services.

[table id=2 /]

Cet article va comparer les 2 services afin d'aider les lecteurs à choisir le service qu'ils veulent utiliser pour se faire payer sur internet. Mais d'abord…

L'une des méthodes pour être payé en ligne consiste donc à relier votre compte bancaire à l'entreprise, ce qui lui permet de déposer l'argent directement sur votre compte bancaire.

La deuxième méthode, qui est plus populaire, consiste à utiliser un service financier qui gérera et sécurisera les paiements entre vous et toutes les entreprises en ligne.

Parlons donc des 6 points à prendre en compte pour choisir entre PayPal et Payoneer.

Collecte des paiements sur votre site Web

Si vous souhaitez acheter un produit sur la boutique owl2business, vous devrez payer sur le site Web. Lors de votre achat, vous verrez que vous pouvez payer avec PayPal. PayPal vous permet d'être payé directement sur votre site web.

Remarque : Payoneer ne dispose pas d'une option permettant d'obtenir des paiements à l'intérieur d'un site Web.

Accepter les paiements des entreprises

Si vous entrez dans systeme.io, un logiciel qui vous permet de créer des tunnels de vente et des campagnes d'email marketing, vous verrez qu'il peut activer PayPal ou Payoneer pour accepter les paiements. Si cette fonctionnalité vous intéresse, vous ne manquerez de rien, quel que soit le service choisi.

https://youtu.be/FkZbe7fYyRU

Comment recevoir son argent depuis l'Afrique grâce à Payoneer ?

Créez un compte bancaire virtuel

Si vous ne le saviez pas, un logiciel qui vous permet de créer des tunnels de vente et des campagnes d'email marketing et de gagner de l'argent en ligne avec son programme d'affiliation.

Compte bancaire virtuel Payoneer

Si vous allez dans "Paiements" sur mon tableau de bord systeme.io, vous verrez que lors de la gestion de vos méthodes de paiement, il vous permet de connecter un compte bancaire créé en utilisant.

Vous permet de créer des comptes bancaires virtuels en dehors de votre pays, vous pouvez ensuite retirer l'argent qui s'y trouve vers le compte bancaire de votre pays en toute simplicité.

Avec PayPal, vous pouvez connecter directement votre compte bancaire pour obtenir de la monnaie sur Internet, mais vous ne pouvez pas créer de nouveaux comptes bancaires virtuels.

Créer une Mastercard

Vous pouvez créer des cartes Mastercard et retirer de l'argent partout dans le monde en utilisant les deux services.

Disponibilité

Payoneer est disponible presque partout dans le monde alors que l'autre n'est disponible que dans une liste de pays. Ainsi, si vous vivez dans un pays où PayPal n'est pas disponible, vous n'aurez pas d'autre choix que d'opter pour lui si vous voulez être payé sur Internet.

Politiques

Payoneer a des politiques plus strictes, comme l'interdiction de transférer de l'argent pour les cadeaux, tandis que l'autre est moins strict et autorise effectivement le transfert d'argent pour les cadeaux. En conclusion, les deux ont des politiques plus strictes.

Comme alternative, vous avez aussi Wise. Voici une petite revue sur ma chaine YouTube.

https://youtu.be/FEeuJtaBfhg

Comment recevoir son argent depuis l'Afrique grâce à Transferwise ? Avis Wise

Vous pouvez maintenant être payé

Comme vous pouvez le constater, les deux services financiers ont leurs avantages et il est facile de voir comment les propriétaires d'entreprises en ligne et les personnes qui cherchent à être payées en ligne en général peuvent bénéficier de l'utilisation d'au moins un de ces services, voire des deux.

Nous espérons que cet article vous a aidé à faire votre choix. Vous avez des questions ? Répondez ci-dessous !

0 notes

Text

Santander launches PagoFX in the UK, a money transfer app to take on TransferWise and other fintechs

A leaked Santander internal memo in 2017 likely set wheels in motion. Reportedly written by the bank’s head of innovation, the missive warned that a large chunk of the Spanish incumbent’s profits were at risk — specifically, those generated via international money transfers – because of the growing success of fintech challengers, such as London-headquartered TransferWise.

Fast-forward three years, and today Santander is launching a standalone money transfer app, presumably in a bid to avoid the trappings of innovator’s dilemma. The new proposition is open to Santander and non-Santander customers and has been developed by a team working largely outside of the bank — a startup within a multi-national corporation, if you will — and has grown to around 50 team members working across Madrid, London, and Brussels.

Dubbed “PagoFX” and launched in the U.K. first, the mobile app lets anyone with a U.K. debit card send money abroad at claimed mid-market FX rates and with a low transparent fee. In addition, it offers “bank-level” security and customer support via in-app chat, web and e-mail.

In a virtual press briefing, Pago’s CMO Victoria Yasinetskaya explained that Pago’s unique positioning is that it effectively offers the best of both worlds: bank level security and trust (the app is co-branded alongside Santander) combined with the price competitiveness, convenience and user experience of a modern fintech solution. The thinking is that a segment of customers still trust an incumbent bank more than a challenger, and therefore a Santander-backed standalone money transfer app will be able to find room in the market.

During the same press briefing, Pago CEO Cedric Menager explained that PagoFX is essentially an open-market version of Santander’s existing international money transfer service “One Pay FX,” which offers competitive international transfers to existing Santander customers in various countries in Europe and the Americas. He also revealed that the Pago team was mainly big tech and fintech in its background, with various team members having worked at companies such as Amazon, PayPal and Intuit, and a number of unnamed startups.

On price, and without doing a forensic comparison, PagoFX looks to be broadly competitive with challengers, though not necessarily the very cheapest, depending on how you value payment method (e.g. card vs bank transfer) or speed.

“Transferring money to the eurozone, Switzerland, Norway, Sweden and the Czech Republic is 0.70% of the sent amount. For transfers to the U.S., Poland and Denmark, the fee is 0.80% of sent amount,” explains Pago. (At launch, however, fees are being waived on transactions up to a limit of 3,000 GBP per user to help support customers during the coronavirus crisis).

youtube

Cue statement from Ana Botín, Group executive chairman of Banco Santander (who is rumoured to have given the project the green light after being shown a demonstration of TransferWise by her son): “PagoFX makes it possible to transfer money internationally easily, at low cost, and with the security and peace of mind that comes from a regulated entity backed by an international bank. This is a unique proposition and we hope it will help many people and businesses. It draws on our world-class technology and talent to deliver a new and highly relevant service for everyone in the open market”.

Meanwhile, I pinged two U.K. fintech money transfer competitors for comment.

“It’s great to see a large legacy financial institution moving to give customers a better deal as they play catch-up with the fintech sector,” Azimo co-founder and Chairman Michael Kent told me over WhatsApp message. “By improving their product and moving prices closer to ours and other digital players they can finally save their customers money at an uncertain time when everyone is watching the pennies and cents”.

He also pointed out that, as it stands, Pago isn’t the most direct competitor since it doesn’t cover developing and emerging markets, which is Azimo’s main corridor focus.

In a statement given to TechCrunch, Kristo Kaarmann, CEO and co-founder of TransferWise, says: “Banks and brokers have been misleading customers about the true cost of making international payments for decades, advertising transfers as ‘free’ or ‘0% commission’ then adding a high mark-up on the exchange rate. But there are promising signs that PagoFX signals a more transparent approach from Santander. If so, it’s evidence that the transparency and low-prices we’ve been pioneering are on the way to becoming the new industry standard as customers demand a better service”.

Kaarmann also issued a warning to existing Santander customers with regards to the FX rate they are offered within Santander’s existing banking apps. “If it’s necessary to download PagoFX separately to achieve transparency, customers using Santander’s standard service will continue to be short changed,” he says.

His argument is that PagoFX, like One Pay FX before it, will only benefit the most price conscious consumers. “We urge Santander to go a step further and adopt full transparency across all their international money transfer services as the standard, not just on specific products and currency routes,” he adds.

0 notes

Text

Santander launches PagoFX in the UK, a money transfer app to take on TransferWise and other fintechs

A leaked Santander internal memo in 2017 likely set wheels in motion. Reportedly written by the bank’s head of innovation, the missive warned that a large chunk of the Spanish incumbent’s profits were at risk — specifically, those generated via international money transfers – because of the growing success of fintech challengers, such as London-headquartered TransferWise.

Fast-forward three years, and today Santander is launching a standalone money transfer app, presumably in a bid to avoid the trappings of innovator’s dilemma. The new proposition is open to Santander and non-Santander customers and has been developed by a team working largely outside of the bank — a startup within a multi-national corporation, if you will — and has grown to around 50 team members working across Madrid, London, and Brussels.

Dubbed “PagoFX” and launched in the U.K. first, the mobile app lets anyone with a U.K. debit card send money abroad at claimed mid-market FX rates and with a low transparent fee. In addition, it offers “bank-level” security and customer support via in-app chat, web and e-mail.

In a virtual press briefing, Pago’s CMO Victoria Yasinetskaya explained that Pago’s unique positioning is that it effectively offers the best of both worlds: bank level security and trust (the app is co-branded alongside Santander) combined with the price competitiveness, convenience and user experience of a modern fintech solution. The thinking is that a segment of customers still trust an incumbent bank more than a challenger, and therefore a Santander-backed standalone money transfer app will be able to find room in the market.

During the same press briefing, Pago CEO Cedric Menager explained that PagoFX is essentially an open-market version of Santander’s existing international money transfer service “One Pay FX,” which offers competitive international transfers to existing Santander customers in various countries in Europe and the Americas. He also revealed that the Pago team was mainly big tech and fintech in its background, with various team members having worked at companies such as Amazon, PayPal and Intuit, and a number of unnamed startups.

On price, and without doing a forensic comparison, PagoFX looks to be broadly competitive with challengers, though not necessarily the very cheapest, depending on how you value payment method (e.g. card vs bank transfer) or speed.

“Transferring money to the eurozone, Switzerland, Norway, Sweden and the Czech Republic is 0.70% of the sent amount. For transfers to the U.S., Poland and Denmark, the fee is 0.80% of sent amount,” explains Pago. (At launch, however, fees are being waived on transactions up to a limit of 3,000 GBP per user to help support customers during the coronavirus crisis).

youtube

Cue statement from Ana Botín, Group executive chairman of Banco Santander (who is rumoured to have given the project the green light after being shown a demonstration of TransferWise by her son): “PagoFX makes it possible to transfer money internationally easily, at low cost, and with the security and peace of mind that comes from a regulated entity backed by an international bank. This is a unique proposition and we hope it will help many people and businesses. It draws on our world-class technology and talent to deliver a new and highly relevant service for everyone in the open market”.

Meanwhile, I pinged two U.K. fintech money transfer competitors for comment.

“It’s great to see a large legacy financial institution moving to give customers a better deal as they play catch-up with the fintech sector,” Azimo co-founder and Chairman Michael Kent told me over WhatsApp message. “By improving their product and moving prices closer to ours and other digital players they can finally save their customers money at an uncertain time when everyone is watching the pennies and cents”.

He also pointed out that, as it stands, Pago isn’t the most direct competitor since it doesn’t cover developing and emerging markets, which is Azimo’s main corridor focus.

In a statement given to TechCrunch, Kristo Kaarmann, CEO and co-founder of TransferWise, says: “Banks and brokers have been misleading customers about the true cost of making international payments for decades, advertising transfers as ‘free’ or ‘0% commission’ then adding a high mark-up on the exchange rate. But there are promising signs that PagoFX signals a more transparent approach from Santander. If so, it’s evidence that the transparency and low-prices we’ve been pioneering are on the way to becoming the new industry standard as customers demand a better service”.

Kaarmann also issued a warning to existing Santander customers with regards to the FX rate they are offered within Santander’s existing banking apps. “If it’s necessary to download PagoFX separately to achieve transparency, customers using Santander’s standard service will continue to be short changed,” he says.

His argument is that PagoFX, like One Pay FX before it, will only benefit the most price conscious consumers. “We urge Santander to go a step further and adopt full transparency across all their international money transfer services as the standard, not just on specific products and currency routes,” he adds.

from RSSMix.com Mix ID 8204425 https://ift.tt/2RHXG2y via IFTTT

0 notes

Text

0 notes

Text

Santander launches PagoFX in the UK, a money transfer app to take on TransferWise and other fintechs

New Post has been published on https://magzoso.com/tech/santander-launches-pagofx-in-the-uk-a-money-transfer-app-to-take-on-transferwise-and-other-fintechs/

Santander launches PagoFX in the UK, a money transfer app to take on TransferWise and other fintechs

A leaked Santander internal memo in 2017 likely set wheels in motion. Reportedly written by the bank’s head of innovation, the missive warned that a large chunk of the Spanish incumbent’s profits were at risk — specifically, those generated via international money transfers – because of the growing success of fintech challengers, such as London-headquartered TransferWise.

Fast-forward three years, and today Santander is launching a standalone money transfer app, presumably in a bid to avoid the trappings of innovator’s dilemma. The new proposition is open to Santander and non-Santander customers and has been developed by a team working largely outside of the bank — a startup within a multi-national corporation, if you will — and has grown to around 50 team members working across Madrid, London, and Brussels.

Dubbed “PagoFX” and launched in the U.K. first, the mobile app lets anyone with a U.K. debit card send money abroad at claimed mid-market FX rates and with a low transparent fee. In addition, it offers “bank-level” security and customer support via in-app chat, web and e-mail.

In a virtual press briefing, Pago’s CMO Victoria Yasinetskaya explained that Pago’s unique positioning is that it effectively offers the best of both worlds: bank level security and trust (the app is co-branded alongside Santander) combined with the price competitiveness, convenience and user experience of a modern fintech solution. The thinking is that a segment of customers still trust an incumbent bank more than a challenger, and therefore a Santander-backed standalone money transfer app will be able to find room in the market.

During the same press briefing, Pago CEO Cedric Menager explained that PagoFX is essentially an open-market version of Santander’s existing international money transfer service “One Pay FX,” which offers competitive international transfers to existing Santander customers in various countries in Europe and the Americas. He also revealed that the Pago team was mainly big tech and fintech in its background, with various team members having worked at companies such as Amazon, PayPal and Intuit, and a number of unnamed startups.

On price, and without doing a forensic comparison, PagoFX looks to be broadly competitive with challengers, though not necessarily the very cheapest, depending on how you value payment method (e.g. card vs bank transfer) or speed.

“Transferring money to the eurozone, Switzerland, Norway, Sweden and the Czech Republic is 0.70% of the sent amount. For transfers to the U.S., Poland and Denmark, the fee is 0.80% of sent amount,” explains Pago. (At launch, however, fees are being waived on transactions up to a limit of 3,000 GBP per user to help support customers during the coronavirus crisis).

[embedded content]

Cue statement from Ana Botín, Group executive chairman of Banco Santander (who is rumoured to have given the project the green light after being shown a demonstration of TransferWise by her son): “PagoFX makes it possible to transfer money internationally easily, at low cost, and with the security and peace of mind that comes from a regulated entity backed by an international bank. This is a unique proposition and we hope it will help many people and businesses. It draws on our world-class technology and talent to deliver a new and highly relevant service for everyone in the open market”.

Meanwhile, I pinged two U.K. fintech money transfer competitors for comment.

“It’s great to see a large legacy financial institution moving to give customers a better deal as they play catch-up with the fintech sector,” Azimo co-founder and Chairman Michael Kent told me over WhatsApp. “By improving their product and moving prices closer to ours and other digital players they can finally save their customers money at an uncertain time when everyone is watching the pennies and cents”.

He also pointed out that, as it stands, Pago isn’t the most direct competitor since it doesn’t cover developing and emerging markets, which is Azimo’s main corridor focus.

In a statement given to TechCrunch, Kristo Kaarmann, CEO and co-founder of TransferWise, says: “Banks and brokers have been misleading customers about the true cost of making international payments for decades, advertising transfers as ‘free’ or ‘0% commission’ then adding a high mark-up on the exchange rate. But there are promising signs that PagoFX signals a more transparent approach from Santander. If so, it’s evidence that the transparency and low-prices we’ve been pioneering are on the way to becoming the new industry standard as customers demand a better service”.

Kaarmann also issued a warning to existing Santander customers with regards to the FX rate they are offered within Santander’s existing banking apps. “If it’s necessary to download PagoFX separately to achieve transparency, customers using Santander’s standard service will continue to be short changed,” he says.

His argument is that PagoFX, like One Pay FX before it, will only benefit the most price conscious consumers. “We urge Santander to go a step further and adopt full transparency across all their international money transfer services as the standard, not just on specific products and currency routes,” he adds.

0 notes

Photo

Take a look for a simple comparison of TransferWise vs Paypal. See how they differ.

0 notes

Text

TransferWise zet chatbot in voor betalingen

Het Londense TransferWise faciliteert voortaan betalingen via Facebook Messenger met behulp van een chatbot. Het gaat om onderlinge betalingen in de VS, Engeland, Canada, Australië en Europa. TransferWise werd in 2011 opgericht door Taavet Hinrikus en Kristo Käärmann, beiden uit Estland, uit frustratie over hoge kosten voor geldtransacties. Het bedrijf heeft bekende investeerders aangetrokken als Andreessen Horowitz, Richard Branson en PayPal oprichters Max Levchin en Peter Thiel. TransferWise wil verder kijken dan Facebook Messenger, maar heeft nog geen andere producten aangekondigd. https://goo.gl/W3xg5E

0 notes

Video

youtube

Sign Up Transferwise To Get Your First Transfer For FREE ►http://bit.ly/transferwise-send-money

Transferwise vs Payoneer - Which is Better?

In this video, we want to share our favorite money transfer service, Transferwise! I would find myself using Paypal to transfer money either for purchases, to friends, or whatever reason you'd need to transfer money. The thing that would always realize though, is sending money usually incurs massive fees!

Not only with Paypal, but using Payoneer also, sending money via bank transfer then taking money out of an ATM. Now though, TransferWise has alleviated all of that pain with extremely low fees, a direct debit card that automatically gets you the best exchange rates worldwide, and an instant sharing money service between friends.

It's safe to say if you don't have Transferwise and you transfer money between currencies or send money overseas, you need to sign up for an account now - http://bit.ly/transferwise-send-money You'll save hundreds if not thousands per year!

#transferwise #transferwisemoneytransfer #transferwisepayoneer #transferwisepaypal

☑️ Check out this playlist about Great All-in-Marketing Tool Kartra ► https://www.youtube.com/watch?v=DB9IpNVlQSg&list=PLk5-2FF4D1Hzn5YGp0236J_1NgxKD0RJN&ab_channel=MastersInDigitalMedia

☑️ Try SEMRush for FREE now: https://bit.ly/2WfvN2U ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

👩🏫About this video► Transferwise vs Payoneer - Which is Better? ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

🎥 Free Masterclasses

💰Affiliate Marketing Training 👉 https://bit.ly/john-crestani-super-aff

💰Make Money Online 👉 http://bit.ly/Millionaire-Mindset-System

#transferwise#transfer money#money transfer#money transfer with transferwise#paypal#payoneer#send money#send money with transferwise#send money abroad#international money transfer#transwise payoneer#transfereise paypal

0 notes

Link

Transferwise vs Payoneer - Which is Better?

In this video, we want to share our favorite money transfer service, Transferwise! I would find myself using Paypal to transfer money either for purchases, to friends, or whatever reason you'd need to transfer money. The thing that would always realize though, is sending money usually incurs massive fees! Not only with Paypal, but using Payoneer also, sending money via bank transfer then taking money out of an ATM.

Now though, TransferWise has alleviated all of that pain with extremely low fees, a direct debit card that automatically gets you the best exchange rates worldwide, and an instant sharing money service between friends.

It's safe to say if you don't have Transferwise and you transfer money between currencies or send money overseas, you need to sign up for an account now - http://bit.ly/transferwise-send-money You'll save hundreds if not thousands per year!

#transferwise #transferwisemoneytransfer #transferwisepayoneer #transferwisepaypal

#transferwise#paypal#payoneer#send money#send money abroad#transfer money#transfer money abroad#transfer money with transferwise#money transfer#money transfer with transferwise#international money transfer

0 notes

Video

youtube

STF vs Facebook, Sari Corte Real (caso Miguel) e Manifestação em Brasília 💚SEJA MEMBRO: https://bit.ly/3efKTxV 💚Vaquinha Equipamentos do Canal: http://vaka.me/835265 💚Apoie: https://ift.tt/2BXMdXA 💚Inscreva-se no canal de Tecnologia: GANOLI TECH: https://bit.ly/2y1zTUd 💚Doações via Paypal: https://bit.ly/2Chb73U 💚PicPay: https://ift.tt/2AuaJz8 (cadastre-se com meu código: CSSCWC) 💚Depósito bancário: Caixa Econômica Agencia 3025 Conta 14122-0 - Op 013 (poupança) 05829400448 / Diego B. B. Oliveira 💟 Nubank: https://ift.tt/3dYNY3U VIAGENS ■ 🔰 Seguro Viagem: https://bit.ly/2T2oUBQ ■ 🔰 Passagens Aéreas: https://bit.ly/32uAmt3 ■ 🔰 Viaje Conectado (Chip Internacional): https://bit.ly/2viEuAg ■ 🔰 Hospedagem Mais BARATO que Hostel / Hotel: https://bit.ly/2PD6LbC ■ 🔰 TransferWise Envie e receba dinheiro com a melhor taxa: https://bit.ly/2wiR1nB REDES SOCIAIS ✅ Instagram: https://ift.tt/2ZzrLEm ✅ Twitter: https://ift.tt/3irzbCo ✅ PEOOPLE: https://ift.tt/3eY75fN ✅ Facebook: https://ift.tt/2AuaLae ✉️ Contato: [email protected] ✅ GRUPO de WhatsApp: https://bit.ly/2xTv8MP ✅ CANAL no Telegram: https://ift.tt/31INw7p -- SETUP DO CANAL Luz: Natural / Led: https://amzn.to/2AMvLIU CAPTAÇÃO DE ÁUDIO iPhone 6s Plus: https://amzn.to/2WVtLXv BY-BM3031: https://amzn.to/2XnLHZF Headset Onikuma K2 na Amazon: https://amzn.to/36nXATI Headset Onikuma K2 na AliExpress: https://bit.ly/38QtAAr Headset Onikuma K2 na GearBest: https://bit.ly/2SUCpDv Rode Wireless GO na AliExpress: https://bit.ly/39VV6fr Rode Wireless GO na Amazon (Brasil): https://amzn.to/2Ucp75w Rode Wireless GO na Amazon (Espanha): https://amzn.to/2JRbOC0 - Adaptador para carregar os dois juntos: https://bit.ly/3aWeNVB - Maleta Hard Case para Rode Wireless Go: https://bit.ly/39VxQyf CAPTAÇÃO DE VÍDEO Canon t7i 1080p 24FPS: https://amzn.to/2XuR4aR LogiTech C920: https://bit.ly/2XjoZCe GoPro Hero 6 Black: https://amzn.to/3eP0ELv iPhone 8 Plus: https://amzn.to/2XzRA7I EXTRA - MELHOR FONE DE OUVIDO SEM FIO DO MERCADO COMPRE seu AirBuds Syllable S101 no AliExpress: https://bit.ly/2T7L0Sf COMPRE seu AirBuds Syllable S101 na Amazon (Brasil): https://amzn.to/3dD2i2I #DiegoGanoli by Diego Ganoli

0 notes