#transfer pricing cyprus

Text

Master Your Transfer Pricing With Confidence!

Dive deep into the world of transfer pricing with our seasoned experts. From diagnosing hidden risks to crafting foolproof policies, we've got you covered:

1.Diagnosis On Transfer Pricing Risks

Our team can review your company's procedures and transactions to identify areas with embedded transfer pricing risk. Being proactive will save time and money further down the road.

2.Design Of Transfer Pricing Policy

Our team can prepare the transfer pricing policy of your group which will provide guidelines on how prices will be set for transactions between related parties.

3.Transfer Pricing Documentation

Our team can assist in preparing a properly documented transfer pricing study enabling your company to meet its transfer pricing documentation obligations.

Address: Office 204 Akamantis Business Center 10 Egypt Street, 1097 Nicosia

Phone: +357 22558873

Website URL: https://www.tpalfa.com/

Follow On:

linkedin-

instagram-

#transfer pricing cyprus#transfer pricing study cyprus#transfer pricing study#transfer pricing methods#international transfer pricing

0 notes

Text

Plus500: Online CFD Trading | Trading the Markets

Plus500 has solidified its position as a leading CFD trading platform, offering a robust and user-friendly environment for traders worldwide. With a wide range of financial instruments, competitive spreads, and advanced trading tools, Plus500 caters to the needs of both novice and experienced traders. Whether you are looking to trade forex, stocks, or cryptocurrencies, Plus500 provides the resources and support you need to succeed in the markets. Plus500’s educational resources and mobile trading app further enhance the trading experience, making it a comprehensive solution for traders

What is Plus500?

Plus500 is an online trading platform that specializes in Contracts for Difference (CFDs). CFDs allow traders to speculate on the price movements of a wide range of financial instruments, including stocks, indices, commodities, cryptocurrencies, and forex, without owning the underlying asset. Founded in 2008, Plus500 is regulated by several top-tier financial authorities, ensuring a secure and transparent trading environment.

Why Choose Plus500 for CFD Trading?

User-Friendly Interface

One of the standout features of Plus500 is its intuitive and easy-to-navigate platform. Whether you are a seasoned trader or a beginner, the platform is designed to make your trading experience as seamless as possible. With a clean layout and customizable dashboards, Plus500 allows you to monitor your trades, analyze market trends, and execute orders with minimal effort.

Wide Range of Financial Instruments

Plus500 offers access to over 2,500 financial instruments, making it one of the most diverse platforms in the industry. Traders can choose from various asset classes, including forex, commodities, indices, stocks, and cryptocurrencies. This extensive range ensures that traders have ample opportunities to diversify their portfolios and capitalize on market movements across different sectors.

Competitive Spreads and Leverage

Plus500 provides competitive spreads, which means lower costs for traders. Additionally, the platform offers leverage options, allowing traders to amplify their positions with a relatively small capital outlay. However, it is important to note that while leverage can enhance profits, it also increases the risk of significant losses.

Regulation and Security

Regulation is a key factor in choosing a trading platform, and Plus500 does not disappoint. The platform is authorized and regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies ensure that Plus500 adheres to strict standards of operation, providing traders with peace of mind regarding the safety of their funds and personal information.

How to Get Started with Plus500

Account Registration

Getting started with Plus500 is straightforward. The registration process is quick, requiring only basic personal information and identity verification. Once your account is verified, you can deposit funds and begin trading.

Demo Account

For those new to CFD trading, Plus500 offers a demo account. This feature allows traders to practice their strategies and familiarize themselves with the platform without risking real money. The demo account replicates the live trading environment, providing a risk-free way to build confidence before transitioning to a live account.

Deposit and Withdrawal Options

Plus500 supports a variety of deposit and withdrawal methods, including credit/debit cards, bank transfers, and e-wallets like PayPal and Skrill. Deposits are processed quickly, allowing traders to fund their accounts and start trading almost immediately. Withdrawals are also efficient, with most requests processed within 1–3 business days.

Trading Strategies on Plus500

Technical Analysis

Technical analysis is a popular strategy among traders on Plus500. By analyzing historical price data and using charting tools provided by the platform, traders can identify patterns and trends that may indicate future price movements. Plus500 offers a range of technical indicators, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI), to assist traders in making informed decisions.

Fundamental Analysis

Fundamental analysis involves evaluating the financial health and performance of an asset to determine its intrinsic value. Traders on Plus500 can access real-time financial news, economic calendars, and market analysis to stay informed about events that may impact the markets. By combining fundamental analysis with technical analysis, traders can develop a well-rounded approach to trading.

Risk Management

Effective risk management is crucial in CFD trading, especially when using leverage. Plus500 offers several tools to help traders manage their risk, including stop-loss orders, guaranteed stop orders, and trailing stops. These tools allow traders to set predetermined exit points, minimizing potential losses in volatile markets.

Plus500 Mobile Trading

In today’s fast-paced world, the ability to trade on the go is essential. Plus500 offers a mobile trading app that is available on both iOS and Android devices. The app provides full functionality, allowing traders to open and close positions, monitor the markets, and manage their accounts from anywhere. With real-time push notifications, traders can stay updated on market movements and act quickly on trading opportunities.

Education and Support

Educational Resources

Plus500 recognizes the importance of education in successful trading. The platform offers a range of educational resources, including video tutorials, webinars, and a comprehensive trading guide. These resources are designed to help traders of all levels improve their skills and develop effective trading strategies.

Customer Support

Customer support is available 24/7 on Plus500, ensuring that traders can get assistance whenever they need it. Support is offered through live chat, email, and an extensive FAQ section on the website. The support team is knowledgeable and responsive, helping to resolve issues quickly and efficiently.

Conclusion

Plus500 has solidified its position as a leading CFD trading platform, offering a robust and user-friendly environment for traders worldwide. With a wide range of financial instruments, competitive spreads, and advanced trading tools, Plus500 caters to the needs of both novice and experienced traders. Whether you are looking to trade forex, stocks, or cryptocurrencies, Plus500 provides the resources and support you need to succeed in the markets.

#Plus500#Plus500 Review#Plus500 Scam#Plus500 CFD trading#CFD trading Forex#Plus500 regulation#Forex Trading#CFD trading platform#wide range of financial instruments#trade forex

0 notes

Text

Effortless Luxury Travel: Your VIP Experience from Larnaca Airport with CyprusWeb-Taxi

Planning a visit to the vibrant city of Larnaca, Cyprus? While the excitement of discovering a new destination is unmatched, dealing with transportation can sometimes be a hassle. That’s where CyprusWeb-Taxi comes in—your ultimate solution for a seamless journey from Larnaca Airport to your chosen destination.

Larnaca Airport Cab Service

Picture this: You step off the plane and are immediately greeted by the lively ambiance of Larnaca Airport. Waiting just outside the terminal, a reliable cab service stands ready to whisk you away. With CyprusWeb-Taxi, you can expect nothing less than prompt service, professional chauffeurs, and a fleet of well-maintained vehicles that guarantee a journey brimming with comfort and style.

Larnaca Airport Taxi Transfer

No more dealing with long lines or the stress of arranging transportation upon arrival. Our Larnaca Airport taxi transfer service ensures a smooth transition from air to land. Whether you’re headed to a luxury hotel, a coastal resort, or a hidden gem in Larnaca and beyond, our fleet is at your service. Sit back, relax, and take in the scenic views and warm hospitality of Cyprus while we take care of all the details.

Larnaca Airport Taxi Service

At CyprusWeb-Taxi, your satisfaction is our highest priority. Our Larnaca Airport taxi service is tailored to meet your specific needs, whether you’re traveling alone, with family, or in a group. With a range of vehicle options available, we can accommodate different group sizes and luggage requirements, ensuring your journey is both personalized and convenient.

Why Choose CyprusWeb-Taxi?

Reliability: Count on us for punctual pick-ups and drop-offs, ensuring your schedule stays intact.

Comfort: Indulge in the luxury of our modern fleet, featuring plush seating and amenities designed to elevate your travel experience.

Safety: Our seasoned drivers prioritize your safety throughout your journey.

Affordability: Enjoy competitive rates and transparent pricing with no hidden fees, making our Larnaca Airport cab service accessible to all discerning travelers.

In summary, CyprusWeb-Taxi is your premier choice for stress-free transportation to and from Larnaca Airport. Experience the convenience of our dependable cab service, effortless taxi transfers, and personalized care from start to finish. Book your journey with us today and set off on an adventure that combines luxury, convenience, and peace of mind.

0 notes

Text

Atob Transfer

Address

Ayiou Nikolaou 33, Egkomi 2408, Cyprus

Phone

+32 489 1736 31

Description :

Atob Transfer is a company providing airport transfer services worldwide. We have a fixed price, a wide range of vehicle classes and professionally trained drivers.

Website

1 note

·

View note

Text

FP Markets Review: Forex Broker & Trading Markets — Legit or a Scam?

Introduction to FP Markets

In this comprehensive review, we delve into whether FP Markets is a legitimate broker or if there are any red flags that potential traders should be aware of.

Company Background and Regulatory Status

FP Markets operates under the stringent regulatory oversight of the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies are known for their rigorous standards, which enhance the broker’s credibility in the global market. ASIC’s regulatory framework ensures that FP Markets adheres to high standards of financial conduct, including segregation of client funds and regular audits.

Trading Platforms and Technology

MetaTrader 4 and MetaTrader 5

FP Markets provides access to two of the most popular trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are renowned for their user-friendly interfaces and advanced trading features. MT4 is particularly favored for its extensive range of technical indicators and automated trading capabilities via Expert Advisors (EAs). MT5, the more recent iteration, offers enhanced charting tools, a broader array of order types, and an economic calendar.

FP Markets’ Proprietary Platform

In addition to MT4 and MT5, FP Markets offers its proprietary trading platform, which boasts a sleek design and intuitive navigation. This platform is designed to cater to both novice and experienced traders, featuring advanced charting tools, real-time data, and customizable interfaces.

Account Types and Trading Conditions

FP Markets offers a variety of account types to suit different trading styles and preferences. These include:

Standard Account

The Standard Account is ideal for traders seeking no commission on trades. Instead, the broker makes its earnings from the spread, which starts from 1.0 pips. This account type is suited for those who prefer a straightforward trading experience without the added complexity of commissions.

Raw ECN Account

For traders who prefer tighter spreads and are comfortable with paying a commission, the Raw ECN Account provides spreads starting from 0.0 pips with a commission of $3.5 per lot per side. This account type is ideal for high-frequency traders and those who engage in scalping strategies.

Islamic Account

FP Markets also offers an Islamic Account compliant with Sharia law, which means it does not involve swap or interest charges, catering to traders who adhere to Islamic finance principles.

Trading Instruments and Markets

FP Markets provides access to a wide range of trading instruments across multiple asset classes:

Forex

With over 60 currency pairs available, FP Markets caters to both major and exotic forex pairs, offering traders ample opportunities to diversify their portfolios.

Commodities

Traders can access various commodities, including gold, silver, oil, and agricultural products, enabling them to take advantage of price movements in the global commodities markets.

Indices

FP Markets offers trading on a variety of global indices, including the S&P 500, Dow Jones, and NASDAQ, providing exposure to major equity markets worldwide.

Cryptocurrencies

The broker also features a selection of cryptocurrencies, allowing traders to participate in the highly volatile digital currency markets.

Customer Support and Service

FP Markets is known for its responsive and knowledgeable customer support team. The broker offers assistance through multiple channels, including live chat, email, and phone support. Customer service is available 24/5, ensuring that traders can get help during trading hours.

Deposits and Withdrawals

FP Markets supports a wide range of deposit and withdrawal methods, including bank transfers, credit/debit cards, and popular e-wallets such as Skrill and Neteller. Deposits are typically processed instantly, while withdrawals are handled efficiently, with most requests processed within 24 hours.

Educational Resources and Research Tools

FP Markets is committed to providing traders with the resources they need to make informed decisions. The broker offers an extensive range of educational materials, including webinars, eBooks, and video tutorials. Additionally, FP Markets provides access to a variety of research tools, such as market news, economic calendars, and in-depth analysis reports.

Is FP Markets Legitimate or a Scam?

Based on our detailed review, FP Markets stands out as a reputable and reliable forex broker. The broker’s robust regulatory oversight by ASIC and CySEC, combined with its wide range of trading platforms, account types, and trading instruments, indicates that FP Markets operates with transparency and integrity. There have been no significant complaints or red flags suggesting that FP Markets is a scam.

Conclusion

In summary, FP Markets is a well-established forex broker with a solid reputation in the trading community. The broker offers a comprehensive range of trading services, competitive trading conditions, and reliable customer support. Whether you are a novice trader or an experienced investor, FP Markets provides the tools and resources necessary for a successful trading experience

0 notes

Text

0 notes

Text

What Are The Benefits Of Larnaca Car Hire In Cyprus?

Introduction

Traveling to Larnaca, Cyprus, is a fantastic way to escape to the Mediterranean, but without a dependable form of transportation, exploring the city’s attractions and beyond can be difficult. In order to help you get the most out of your trip, this guide explores the many advantages of using Larnaca Car Hire service in Cyprus.

Flexibility Car hire in Larnaca, Cyprus

Travelers may create their own route at their own leisure with a car hire in Larnaca, as they are not restricted by public transportation schedules. Having wheels allows you to control the pace of your trip, whether your goal is to explore a secluded village or ride along a rocky coastline till night.

When you have a rental car, getting around Larnaca’s winding streets is simple. Forget about the inconvenience of figuring out bus schedules or standing in line for taxis, Larnaca Car Hire gives you the freedom to discover every corner of this interesting place, from its busy city center to its remote countryside.

Cost-Effective Travel in Larnaca

Actually, renting a car in Larnaca may be a reasonably priced alternative, especially for those who want to venture off the usual route. Hiring a car frequently turns out to be more cost-effective than depending on other forms of transportation, especially for families or bigger groups, because of the affordable rental rates and the opportunity to divide costs among fellow travelers.

Take off on an amazing tour through the picturesque surroundings of Larnaca, where there is a picture-perfect scene waiting to be snapped around every corner. Experience the region’s varied landscape from the luxury of your rental car, from the beautiful Mountains to the charming small towns.

More Comfort with Car Rental in Larnaca Airport

Forget about going through full bus terminals or specific train stations with big baggage. When you rent a car, your trip starts as soon as you exit the airport, providing unmatched convenience and doing away with the need for pricey taxi services or public transportation.

Say goodbye to the hassle of making travel arrangements from the airport and welcome the ease of picking up your rental car as soon as you get to Larnaca. Offer departure to long lines at the taxi stand and enjoy a smooth transfer from the airport to your lodging, enabling you to begin your journey right away.

The benefits of Larnaca car hire in Cyprus.

Flexibility:

Explore Larnaca and its surroundings at your own pace, without being tied to public transportation schedules.

Have the freedom to stop and explore attractions spontaneously, without worrying about missing the next bus or train.

Convenience:

Enjoy the convenience of having a vehicle readily available upon arrival at Larnaca Airport or at various rental locations throughout the city.

Skip the hassle of waiting in long taxi queues or navigating unfamiliar bus routes.

Access to Remote Areas:

Venture off the beaten path and discover remote villages, scenic viewpoints, and hidden gems that are inaccessible by public transport.

Explore the rugged countryside and pristine beaches of Cyprus without limitations, allowing for a more immersive travel experience.

Cost-Effectiveness:

Despite common misconceptions, car rental in Larnaca can be a cost-effective option, especially for families or groups traveling together.

Splitting the cost of rental and fuel among multiple travelers often works out to be more economical than purchasing individual tickets for public transportation.

Comfort and Convenience:

Enjoy the comfort and privacy of your own vehicle, complete with air conditioning and ample storage space for luggage and souvenirs.

Avoid the crowds and cramped conditions of public transport, particularly during peak tourist seasons.

Customized Itineraries:

Tailor your itinerary to suit your interests and preferences, whether you’re seeking adventure, relaxation, or cultural immersion.

Take advantage of the flexibility offered by car hire to explore off-the-beaten-path attractions and create unforgettable memories.

24/7 Assistance:

Benefit from round-the-clock assistance provided by reputable car hire companies, ensuring peace of mind in case of emergencies or breakdowns.

Rest assured knowing that help is just a phone call away, allowing you to focus on enjoying your journey through Cyprus.

Car hire in Larnaca offers a plethora of benefits, ranging from flexibility and convenience to access to remote areas and cost-effectiveness, making it the ideal choice for travelers seeking to explore Cyprus on their terms.

Conclusion

The benefits of car hire in Larnaca, Cyprus, are as diverse as the landscapes that await exploration. From unparalleled flexibility and convenience to immersive cultural experiences and eco-conscious travel, opting for a rented vehicle unlocks a world of possibilities, allowing you to embark on a truly unforgettable journey through this captivating corner of the Mediterranean.

FAQs

Q: Is it necessary to book a rental car in advance in Larnaca?

While it’s not essential, booking your rental car in advance can offer peace of mind, particularly during peak tourist seasons when availability may be limited.

Q: What type of driving license do I need to rent a car in Cyprus?

Visitors from EU countries can use their national driving license, while those from non-EU countries may need an International Driving Permit (IDP) in addition to their valid driver’s license.

Q: Are there any age restrictions for renting a car in Larnaca?

Most car hire companies in Larnaca require drivers to be at least 21 years old, although some may impose additional fees or restrictions for drivers under 25.

Q: Can I pick up my rental car at Larnaca Airport?

Yes, many car hire companies have desks at Larnaca Airport, making it convenient to pick up your rental vehicle upon arrival.

Q: Are there any additional fees associated with renting a car in Larnaca?

While rental rates typically include basic insurance coverage, additional fees may apply for optional extras such as GPS navigation systems, child seats, or additional drivers.

Q: What should I do in case of an emergency or breakdown with my rental car?

In the event of an emergency or breakdown, contact the car hire company’s 24/7 assistance hotline for prompt support and guidance.

0 notes

Text

Selecting a Right Forex Broker: What You Need to Know

Introduction:

Choosing the right Forex broker is not only important but also directly related to the success of trading. Catering to diverse preferences, a huge variety is offered, and settling down on the right item is the ultimate goal. Cyprus ranked 3rd globally in a survey of Forex brokers and it has a favorable regulatory environment. Prepare for discussing what features should be paid attention to while choosing a broker for trading on the Forex broker set up Cyprus.

Regulation: One of those that should be seriously included is the one that is related to the regulation of brokers. They are under the supervision of a high regulatory authority. Regulation forces the brokerage to follow a set of securities standards and rules, which in turn may help you as an online investor.

Trading Platform: The Trading Platform is the Programme that you will use to place trades and Manage all the activities in your account. The broker is not only responsible for providing trading services but also for the platform whether it is intuitive and stable or not. However, you should take a step of exploring various platforms to see which one matches your situation.

Spreads and Fees: In forex trading, you will confront spreads, the variance between the best-asking price and the best offer. Besides, brokers may also charge different fees, including commissions and interest rates for these positions kept for the following night. Find out the sovereign and the commissions offered by the different brokers to select the one with a fair rate.

Customer Support: Professional customer service can be very important, particularly if you start trading recently. If you have queries, search for brokers that have different kinds of support - like phone, email, and live chat. Moreover, it will be beneficial to investigate the standing of the broker for client support by reading reviews or asking other traders for advice.

Educational Resources: Trading forex is complex and therefore you will need to have some educational resources like books or articles to help you in the learning and the improving of your skills. Search for brokers who offer training sessions, online classes, and other educational materials.

Account Types: Some brokers can offer regular trading accounts as well as mini-account options or even virtual money accounts for practicing. Taking into account the type of trading account that will be suitable for your style of trading and the level of your experience.

Deposit and Withdrawal Options: Make sure that you the payment methods they provide and if these have fees or not. You will need to decide on a broker that facilitates the transfer of funds to and from your account, so you can withdraw your initial investment as well as your profits.

Conclusion:

Choosing a legal partner like AGP Law would, once and for all, guarantee that each of your companies meets every regulation and works normally. Using the processes outlined and robust research, traders can make intelligent trades and prosper within the Forex broker set up Cyprus.

#Corporate Services Cyprus#Family Law & Matrimonial in Cyprus#Corporate Lawyers in Cyprus#Lawyers in Cyprus#Litigation lawyer Cyprus#Family lawyer Cyprus#Limassol Lawyers#Cyprus Company Formation#Forex Company License Cyprus#EMI Registration Cyprus#Ship Registration Cyprus#Cyprus Shipping Company

0 notes

Text

Effortless Car Selling in Cyprus: Connect with Reliable Dealers

Selling a car can be a daunting task, but in Cyprus, the process has been simplified thanks to the presence of reputable car dealerships. With their expertise and resources, individuals looking to sell their vehicles can navigate through the process smoothly and efficiently. This article explores how you can sell your car in Cyprus with ease, leveraging the services of trusted car dealers.

Finding the Right Dealership:

One of the first steps in sell car cyprus is to identify reliable car dealerships. These dealers specialize in buying and selling vehicles, offering a range of services to assist sellers throughout the process. Whether you're selling a used car or looking to trade in for a new one, partnering with a reputable dealership can make all the difference.

Evaluation and Appraisal:

Once you've chosen a dealership, they will conduct a thorough evaluation and appraisal of your vehicle. This step involves assessing the condition, mileage, and market value of the car to determine an appropriate selling price. Car dealers in Cyprus have the expertise to accurately assess the worth of your vehicle, ensuring you receive a fair and competitive offer.

Streamlined Selling Process:

Selling your car through a dealership in Cyprus offers a streamlined process compared to private sales. Dealerships handle all the paperwork and administrative tasks, saving you time and hassle. From transferring ownership to handling legal documentation, they take care of everything, allowing you to sell your car with peace of mind.

Market Exposure:

By selling your cars dealers cyprus, you benefit from their extensive network and market exposure. These dealerships have a wide reach, attracting potential buyers through various channels such as online listings, advertisements, and showroom displays. This increased visibility enhances your chances of selling your car quickly and at a favorable price.

Professional Guidance:

Throughout the selling process, car dealers in Cyprus provide professional guidance and assistance. Whether it's answering your questions, addressing concerns, or negotiating with potential buyers, they are there to support you every step of the way. Their expertise ensures a smooth and hassle-free selling experience, allowing you to focus on other priorities.

Selling your car in Cyprus is a straightforward process with the assistance of reputable car dealerships. By partnering with trusted dealers, you can benefit from their expertise, market exposure, and streamlined selling process. If you're looking to sell your car effortlessly, consider connecting with a reliable dealership today. For more information, visit mattheosioannoumotors.com.cy.

0 notes

Text

FP Markets Review: Forex Broker & Trading Markets — Legit or a Scam?

Introduction to FP Markets

In this comprehensive review, we delve into whether FP Markets is a legitimate broker or if there are any red flags that potential traders should be aware of.

Company Background and Regulatory Status

FP Markets operates under the stringent regulatory oversight of the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies are known for their rigorous standards, which enhance the broker’s credibility in the global market. ASIC’s regulatory framework ensures that FP Markets adheres to high standards of financial conduct, including segregation of client funds and regular audits.

Trading Platforms and Technology

MetaTrader 4 and MetaTrader 5

FP Markets provides access to two of the most popular trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are renowned for their user-friendly interfaces and advanced trading features. MT4 is particularly favored for its extensive range of technical indicators and automated trading capabilities via Expert Advisors (EAs). MT5, the more recent iteration, offers enhanced charting tools, a broader array of order types, and an economic calendar.

FP Markets’ Proprietary Platform

In addition to MT4 and MT5, FP Markets offers its proprietary trading platform, which boasts a sleek design and intuitive navigation. This platform is designed to cater to both novice and experienced traders, featuring advanced charting tools, real-time data, and customizable interfaces.

Account Types and Trading Conditions

FP Markets offers a variety of account types to suit different trading styles and preferences. These include:

Standard Account

The Standard Account is ideal for traders seeking no commission on trades. Instead, the broker makes its earnings from the spread, which starts from 1.0 pips. This account type is suited for those who prefer a straightforward trading experience without the added complexity of commissions.

Raw ECN Account

For traders who prefer tighter spreads and are comfortable with paying a commission, the Raw ECN Account provides spreads starting from 0.0 pips with a commission of $3.5 per lot per side. This account type is ideal for high-frequency traders and those who engage in scalping strategies.

Islamic Account

FP Markets also offers an Islamic Account compliant with Sharia law, which means it does not involve swap or interest charges, catering to traders who adhere to Islamic finance principles.

Trading Instruments and Markets

FP Markets provides access to a wide range of trading instruments across multiple asset classes:

Forex

With over 60 currency pairs available, FP Markets caters to both major and exotic forex pairs, offering traders ample opportunities to diversify their portfolios.

Commodities

Traders can access various commodities, including gold, silver, oil, and agricultural products, enabling them to take advantage of price movements in the global commodities markets.

Indices

FP Markets offers trading on a variety of global indices, including the S&P 500, Dow Jones, and NASDAQ, providing exposure to major equity markets worldwide.

Cryptocurrencies

The broker also features a selection of cryptocurrencies, allowing traders to participate in the highly volatile digital currency markets.

Customer Support and Service

FP Markets is known for its responsive and knowledgeable customer support team. The broker offers assistance through multiple channels, including live chat, email, and phone support. Customer service is available 24/5, ensuring that traders can get help during trading hours.

Deposits and Withdrawals

FP Markets supports a wide range of deposit and withdrawal methods, including bank transfers, credit/debit cards, and popular e-wallets such as Skrill and Neteller. Deposits are typically processed instantly, while withdrawals are handled efficiently, with most requests processed within 24 hours.

Educational Resources and Research Tools

FP Markets is committed to providing traders with the resources they need to make informed decisions. The broker offers an extensive range of educational materials, including webinars, eBooks, and video tutorials. Additionally, FP Markets provides access to a variety of research tools, such as market news, economic calendars, and in-depth analysis reports.

Is FP Markets Legitimate or a Scam?

Based on our detailed review, FP Markets stands out as a reputable and reliable forex broker. The broker’s robust regulatory oversight by ASIC and CySEC, combined with its wide range of trading platforms, account types, and trading instruments, indicates that FP Markets operates with transparency and integrity. There have been no significant complaints or red flags suggesting that FP Markets is a scam.

Conclusion

In summary, FP Markets is a well-established forex broker with a solid reputation in the trading community. The broker offers a comprehensive range of trading services, competitive trading conditions, and reliable customer support. Whether you are a novice trader or an experienced investor, FP Markets provides the tools and resources necessary for a successful trading experience.

#FP Markets#FP Markets Review#FP Markets Scam#FP Markets Forex Broker#FP Markets Trading#FP Markets Review 2024

0 notes

Text

In-Depth Review Of HYCM - Is This Broker Good?

HYCM is a licensed CFD and forex broker with headquarters in Hong Kong, London, Cyprus, and other cities across the globe. It offers traders a wide range of trading instruments (asset classes), including currency pairs, equities, indices, cryptocurrencies, and ETFs. To accommodate every trading style and level of experience, HYCM provides a number of trading accounts, such as Fixed, Classic, and Raw.

With more than 40 years of experience in the industry and a wide range of tradable products, it is currently one of the top forex brokers. HYCM offers low forex and CFD trading costs. It provides a vast array of high-quality teaching resources. Opening an account is simple and entirely digital. On the other hand, the range of products offered by HYCM is restricted to forex and CFDs. Popular asset classes are absent, like actual stocks. The broker makes use of relatively dated-looking MetaTrader trading interfaces.

Features

The company HYCM has made a name for itself as one of the top suppliers of online CFD and FX trading services.HYCM is a component of the Henyep Capital Markets Group, a global conglomerate of businesses that serves crucial industries like finance, real estate, education, and nonprofits. One of the special features that HYCM customers can use to prevent losing money when trading CFDs is negative balance protection. Due to its complexity, cryptocurrency CFDs have a very high risk of financial loss.

Thanks to negative balance protection, customers are prohibited from ceasing CFD trading before their accounts reach a negative balance. Despite the risks involved, consumers worldwide are drawn to HYCM because of its extremely competitive price policy. Clients aren’t charged any pointless fees, such as the inactivity fee. Stocks, indexes, commodities, ETFs, FX pairings, and cryptocurrencies are just a few of its many items. All other traded items are organised as CFDs, with the exception of trading forex (foreign currency).

To safeguard the security and protection of its clients’ money and data, HYCM employs cutting-edge security measures. Additionally, 128-bit SSL certificates offered by VeriSign encrypt all client data. Unlike other CFD brokers, HYCM’s servers and clients always maintain secure, encrypted connections that adhere to all applicable banking regulations.

Spreads And Commissions

Although the Fixed and Classic account types provide commission-free trading, the spreads are too wide, according to numerous research reports. While the Classic account has a minimum (variable) spread of 1.2 pips, the Fixed account offers a fixed spread of 1.8. On the other hand, the Raw account has a rather competitive price structure (spreads), with a minimum spread cost of 0.2 pips and a commission of 4 USD per round lot (round).

According to research, HYCM has very reasonable CFD and forex trading fees. Most of the time, clients are not charged for trading their deposits or making withdrawals, except for a few circumstances where a specific withdrawal fee applies. Retail forex traders are charged a $30 withdrawal fee on bank wire transfers under $300.According to numerous HYCM reviews (user reviews), swap rates on different overnight positions and a $10 monthly inactivity fee may be applicable, which are somewhat irksome to clients.

Leverage

Different leverage ratios are available to its clients based on their jurisdictions, according to broker reviews: - Metals, indices (US cash and futures), and exotic currency trading firm HYCM Ltd.

1:500 Indices for FX majors and minors (India or China futures) – 1:33 Other cash indices, EU, HK, and JK futures indexes, and commodities (soft) – 1:50

Oil prices and US stocks – 1:20 Oil prices (Natural gas) Stocks (Germany, France, and Spain): 1:67 Stocks: 1:10

Pros

Low CFD fees and forex

Competitive Pricing

Excellent selection of education tools

A wide range of currency pairs are available

Live chat, email, and phone are all ways to contact helpful customer care

Traders get access to the MT4 and MT5 platforms and a free HYCM demo account.

Cons

Cryptocurrency trading is not supported in all countries

Some low-tiered accounts have a limited selection of products.

Inactivity fee may be levied

Only CFD and forex products are available

There are no proprietary platforms

The designs of trading platforms are outdated

Mobile App

The MT4 and MT5 trading apps are available on normal Android and iOS devices because HYCM is a MetaTrader(only) broker. But unlike other brokers (brokerage businesses), HYCM does not support proprietary trading software; the HYCM app simply permits registered traders to access the client site. Therefore, the HYCM app only offers the standard MetaTrader app, which is quite a disadvantage compared to its rivals. This is because other MetaTrader-only forex brokers support their own proprietary app, unlike the HYCM app.

Customer Care

On the broker platform, a specialised HYCM customer care centre is available in several languages (12 languages) and open all day (24 hours), five days a week. The HYCM customer service team can be reached by live chat, fax, phone, email, or fax. It is simpler for clients residing in many international locations to access the platform thanks to the availability of customer support in several different languages, and this makes it one of the finest forex brokers on the market.

Conclusion

In order to wrap up our HYCM review, one investment tip for traders is to conduct their own thorough study into the regulation of any online trading platform (CFD broker) before choosing it, such as verifying the regulation processes, etc. The broker seems legitimate based on the available HYCM reviews and studies.

It provides traders worldwide with a dependable platform for trading forex and CFD brokers with the integration of market-leading technology, assuming smooth trading with HYCM and faster transaction execution.HYCM is a broker for people who value a wide selection of trading tools and quick service. The firm is a reliable broker for novice and seasoned traders who can operate on desktop computers and mobile devices.

1 note

·

View note

Text

Effortless Luxury Travel- Your VIP Experience from Larnaca Airport with CyprusWeb-Taxi

Planning a trip to the vibrant city of Larnaca, Cyprus? While exploring a new destination is always thrilling, transportation hassles can put a damper on your experience. Enter CyprusWeb-Taxi: your golden ticket to a seamless journey from Larnaca Airport to your destination.

Larnaca Airport Cab Service

Imagine stepping off the plane into the lively atmosphere of Larnaca Airport, where a reliable cab service is ready to whisk you away. Our experienced drivers are strategically stationed outside the terminal, eager to take you to your chosen destination. With CyprusWeb-Taxi, expect prompt service, courteous chauffeurs, and a fleet of meticulously maintained vehicles ensuring a journey filled with comfort and style.

Larnaca Airport Taxi Transfer

Say goodbye to long queues and transportation headaches upon arrival. Our Larnaca Airport taxi transfer service guarantees a smooth transition from air to land as soon as you arrive. Whether you're heading to a luxury hotel, a seaside resort, or any hidden gem in Larnaca and beyond, our fleet of taxis is at your command. Sit back, relax, and enjoy the picturesque views and warm hospitality of Cyprus while we handle all the logistics.

Larnaca Airport Taxi Service

At CyprusWeb-Taxi, your satisfaction is our top priority. Our Larnaca Airport taxi service is designed to cater to your unique preferences, whether you're traveling solo, with loved ones, or in a group. Choose from a variety of vehicle options to accommodate different party sizes and luggage needs, ensuring a personalized and convenient journey just for you.

Why Choose CyprusWeb-Taxi?

Reliability: Count on us for timely arrivals and departures so you can stay on schedule without any disruptions.

Comfort: Enjoy the luxury of our modern fleet, complete with plush seating and amenities designed to enhance your travel experience.

Safety: Our drivers are seasoned professionals who prioritize your safety at every step.

Affordability: Benefit from competitive rates and transparent pricing with no hidden costs, making our Larnaca Airport cab service accessible to all discerning travelers.

In summary, CyprusWeb-Taxi is your premier choice for seamless transportation to and from Larnaca Airport. Experience the convenience of our reliable cab service, effortless taxi transfers, and personalized attention from start to finish. Book your journey with us today and embark on an adventure filled with luxury, convenience, and peace of mind.

0 notes

Text

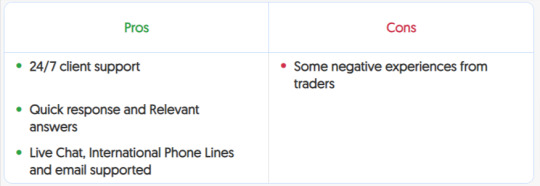

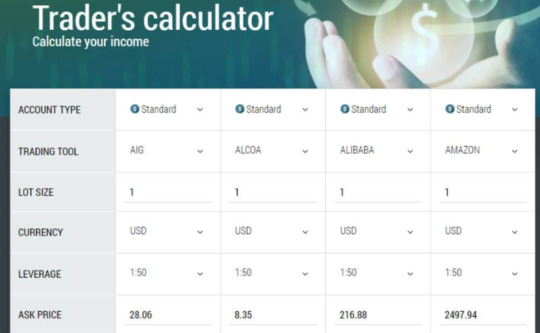

FBS Broker Review

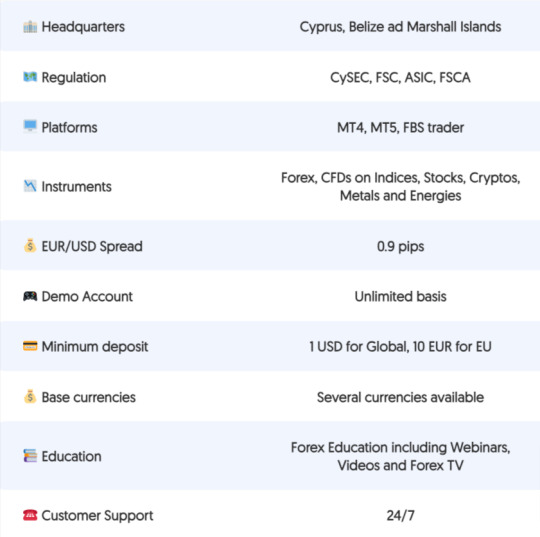

FBS Broker: Empowering Traders Since 2009 FBS, a renowned Forex and CFD trading platform, emerged in 2009 when a group of passionate investors united their expertise in trading research and technical analysis. Today, FBS stands as a global brand with a footprint spanning 150+ countries. It amalgamates various entities, offering traders the chance to engage in Margin FX and CFD trading.FBS comprises several regulated entities, including FBS Markets Inc. (licensed by IFSC), Tradestone Ltd. (licensed by CySEC), Intelligent Financial Markets Pty Ltd. (licensed by ASIC), and TRADE STONE SA (PTY) LTD. (licensed by FSCA). Forex regulation is essential to ensure trading safety all the time, regulatory compliance has enhanced trading capabilities and bolstered FBS's reputation as a trusted broker.

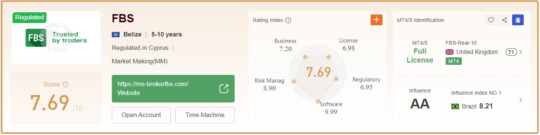

FBS Broker Summary Overview

As a regulated broker, FBS broker ensures compliance with various legislative environments, resulting in favorable trading conditions and a suite of valuable tools. Wikifx comprehensive review rates FBS at 7.69 out of 10, based on rigorous testing compared to over 500 brokers in the industry.

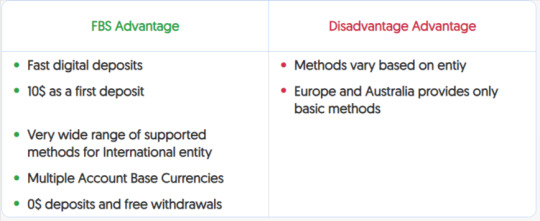

FBS Broker Banking

After careful analysis and a comprehensive review, we believe that FBS presents an appealing opportunity for both novice traders and those with regular trading experience. Notably, FBS offers competitive fees for Currency trading, with the added advantage of a minimal deposit requirement starting at just $1. Overall, the trading conditions are highly favorable.

FBS Broker Awards and Recognition

FBS's commitment to excellence has not gone unnoticed, as it has received over 60 international awards. These accolades recognize FBS as a transparent broker with top-notch customer service, solidifying its position as one of the most acclaimed brands in the industry.

Is FBS a Safe Broker?

FBS is not a scam but a reputable brand. It operates under Tradestone Limited, a Cyprus-registered company and an EU-regulated investment firm licensed by CySEC. FBS also holds licenses from ASIC in Australia and FSCA in South Africa. While FBS has an entity in Belize, it's essential to note that Belize's local regulator, the Financial Service Commission (FSC), mainly registers companies rather than actively regulating them. However, when combined with the regulatory oversight of European CySEC, FBS offers reliable trading conditions.

FBS Broker Leverage

FBS provides varying leverage options depending on the entity and instrument. European and Australian entities offer a maximum of 1:30 leverage for major currency pairs, while international FBS entities offer higher leverage ratios, reaching up to 1:1000 or even 1:3000. It's crucial to use leverage wisely to manage risk effectively.

FBS Account Types

FBS broker offers Standard, Crypto, and Cent accounts, catering to traders of all experience levels. These accounts come with demo and live trading options, allowing traders to choose based on their preferences and risk tolerance.

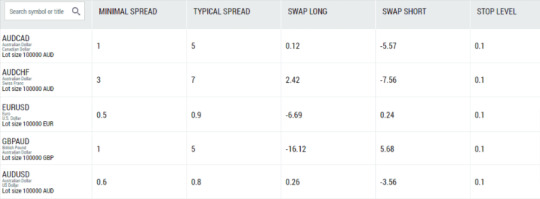

Fees and Spreads

FBS's pricing structure typically involves spreads, with overnight fees, inactivity fees, and withdrawal fees, if applicable. Overall, FBS offers competitive fees, with some deposit and withdrawal methods available free of charge. Spreads vary based on the account type and entity.

Payment Methods

FBS supports a vast range of payment methods, with over 100 options available for the international entity. Major cards, e-wallets, wire transfers, and crypto wallets are among the choices. However, European and Australian entities may have more limited payment options due to regulatory requirements.

How to Open an FBS Account

Opening an account with FBS is a straightforward process, involving registration, document verification, and deposit. Traders can choose from various account types based on their preferences and trading goals.

Follow below steps to open an FBS broker account :

- Sign Up For FBS account from our register link

- Enter your personal details, including name, email, phone, etc.

- Receive a confirmation link in your email to proceed.

- Access your online account management and begin with a Demo Account if desired.

- Define the account type you wish to open and select your base currency.

- Specify your trading experience and expectations through an online questionnaire.

- Upload necessary documents to verify your address and identity, complying with regulatory requirements.

- Click "Submit" and allow a few working days for document verification and account activation.

- Proceed with your initial deposit.

- Decide whether you want to trade FX products, stocks, or other assets, and commence trading.

Trading Instruments

FBS broker offers a selection of trading instruments, including Forex, metals, indices, and energies. While Forex trading is the primary focus, the range of instruments may be limited compared to some other brokers.

Customer Support

FBS provides 24/7 customer support through live chat, international phone lines, email, and social media. While customer support is generally responsive, it's essential to consider feedback from other traders.

Education and Research

FBS offers a comprehensive education center with webinars, guidebooks, video lessons, tips for traders, and a glossary. Traders can access daily technical and fundamental analysis, an economic calendar, and a currency converter. The platform also features a Forex calculator and Forex TV for the latest news updates.

Conclusion

In conclusion, FBS is a trusted Forex and CFD trading platform that caters to traders of all levels. Its range of account types, powerful trading platforms, and convenient customer support contribute to a favorable trading environment. While FBS offers low trading costs and a solid execution model, traders should carefully consider their preferences and the entity they choose when trading with FBS.

Read the full article

0 notes

Text

As Mark Twain might say, reports of the death of G-7 Russian oil price cap have been greatly exaggerated.

Devised by the U.S. Treasury Department and adopted by all the G-7 and European Union countries, the novel oil price cap was designed following Russia’s invasion of Ukraine to limit the price of Russian crude oil to $60 per barrel while simultaneously ensuring global market stability. Over the past several weeks, a flood of media and expert commentators have argued that the Russian oil price cap is effectively dead. One opinion piece in Bloomberg was unambiguous, titled: “It’s Time to Scrap the Russian Oil Price Cap.”

We helped advise the U.S. Treasury Department in setting up the oil price cap and strongly disagree. Sure, there is no question there has been some reduction in the efficacy of the price cap from when it worked so well at the start of this year, as Treasury Secretary Janet Yellen recently acknowledged and as leading economists from the Kyiv School of Economics helped expose.

The reasons why are hardly a secret. With global oil prices on the rise, and as U.S. policymakers have long expected, Russian President Vladimir Putin is becoming increasingly creative in devising ways to get around the price cap, including by building a Russian “shadow fleet” of ocean tankers that fall outside G-7 jurisdiction. As a result, since the summer, Russian energy revenues are up, and Russian oil is now trading closer to global oil prices—referred to as the Brent benchmark—than the price cap’s $60 ceiling.

The price cap worked very well for the first eight months of its implementation but now requires some rapid adjustments to enter a second phase. Here’s how it can still be made to work.

1. Focus on enforcement.

With global oil prices up around 30 percent since June, buyers are increasingly desperate to get their hands on oil however they can. Consequently, they are taking greater risks, and price cap evasion is increasing. That requires a regulatory focus on stricter enforcement, with clear public punishment of violators.

Research from top economists at the Kyiv School of Economics (KSE) suggests that there may be significant unpunished price cap evasion. The linchpin of the price cap has always been the middlemen—the G-7 and EU shippers and insurers who move Russian oil. These insurers, shipping companies, and shipowners are required to self-attest that they are not moving Russian oil priced above $60.

Yet although Russian oil is now trading at well above $60, European insurers and shippers, particularly from Greece but also Cyprus and Malta, remain deeply involved in moving Russian oil. KSE researchers recently found that half the oil being exported from Russia’s Pacific port of Kozmino is either shipped or insured by G-7 or EU companies—even though 96 percent of exports from Kozmino were priced above the $60 price cap.

Likewise, we reviewed data that suggests at least 40 percent of vessels still exporting crude oil from Russia’s Baltic ports were owned by G-7 or EU companies. In addition, satellite tracking systems have detected significant “spoofing”—ships turning off or manipulating their location-tracking transponders—as well as shadowy ship-to-ship transfers of Russian oil on the high seas to evade jurisdictional boundaries.

It is not too late to enforce regulations that ought to have been enforced long ago. The U.S. Treasury’s enforcement arm has issued already evasion warnings, but this is not enough. Both European regulators and U.S. Office of Foreign Assets Control should step up enforcement dramatically and publicly, and more severe punishment of violators is desperately needed, whether via fines, regulatory scrutiny, or revocation of licenses.

2. Continue leveraging the price cap to drive up Putin’s costs.

For all the focus on Putin’s increased revenues from higher oil prices, what is often missing from commentators’ analysis is the other side of the equation—that the G-7 price cap has already meaningfully increased Russia’s costs to drill and transport that oil. So even as Putin continues to sell oil to nonprice cap countries such as China and India, albeit at a significant discount, the price cap has cut meaningfully into his profits.

It is impossible to know exactly how much Russia is paying in the absence of key economic data that country has withheld, but we can arrive at a very rough, back-of-the-envelope approximation by considering just some of the many additional costs already imposed on Putin by the price cap:

Since global transport companies largely refuse to touch Russian oil, shipping experts estimate Putin has had to add 600 ocean tankers to Russia’s shadow fleet in just one year, at a cost of at least $2.25 billion—a cost that is still rising as ships are retired and replaced. Russia exports around 1 billion barrels of crude oil annually, so this amounts to roughly $2 of additional expenses for every barrel of Russian crude oil exported.

Whereas it took ocean tankers just two to seven days to reach European ports from Russian ports on the Baltic Sea, it takes around 35 days for Russian tankers to reach China and India, now the largest buyers of Russian oil. The average Russian oil tanker is now traveling more than three times the distance it used to, from an average 2,862 miles at the start of 2022 to 9,271 miles now. Each voyage costs at least $10 million more for an average sized tanker carrying about 150,000 tons of cargo, adding approximately $10 to the cost of every barrel of Russian oil exported.

Since credible, fully capitalized insurers largely refuse to insure the Russian shadow fleet, those voyages need Russian-underwritten insurance. Assuming typical insurance premiums of about 5 percent of a ship’s cargo, including a “war-risk premium,” that amounts to approximately $4 million more in insurance costs per voyage, adding approximately $4 to the cost of every barrel of Russian oil exported.

The exodus of more than 1,000 Western companies, including energy and oil field service companies, means that Russian energy companies have had to expend significant more in capital expenditures to keep their oil wells running. It’s impossible to say exactly how much, but oil giant Rosneft alone has spent nearly $10 billion more on capital expenditure over the last year by its own disclosure, which amounts to roughly $10 of additional expenses for every barrel of Russian oil exported.

The price cap has forced Russia to expand and modify its port capacity. Again, no precise cost is possible, but for example, Russia is now building a new port for its Vostok oil project, increasing the planned capacity post-price cap and increasing expected costs to $120 billion from $100 billion pre-price cap, which amounts to at least $10 of additional expenses for every barrel of Russian oil exported.

We estimate these price cap-driven expenses add an extra roughly $36 per barrel in transaction costs, eating into the oil profits that Putin would have otherwise funneled toward funding his invasion of Ukraine, on top of the fact that Russia is already the least economical oil producer. According to Saudi Aramco, the fiscal breakeven for drilling Russian oil is a whopping $44 per barrel, twice as much as the cost of Saudi Arabia, United Arab Emirates, Iran, and other major oil producers.

So between his elevated breakeven cost of $44 per barrel to drill oil and price-cap driven expenses of $36 per barrel to get that oil to market, Putin might not draw much profits until Russian oil prices surpass $80 per barrel. Unfortunately for Putin, even though Russian oil prices have increased, they still trade at a meaningful discount to global oil benchmarks, with Russian Urals oil trading at around $15 less than Brent and Russian ESPO oil trading at around $7 less than Brent, suggesting that Putin is hardly swimming in excess profits with Russian oil selling around $80. Russian Urals is the benchmark for Russian oil traded from its western ports on the Baltic, while Russian ESPO is the benchmark for Russian oil sold to Asia via the Eastern Siberia – Pacific Ocean pipeline.

Stronger enforcement of the price cap will only add to these expenses and further erode Putin’s profit margin moving forward. Better that Putin fund tankers rather than tanks.

3. Impose novel sanctions and measures to plug regulatory gaps.

Putin has adapted to the price cap, and thus global policymakers need to adapt as well through the imposition of additional price cap-adjacent sanctions.

Novel sanctions proposals we have been pitching to global policymakers include: imposing financial penalties on sellers of oil tankers to Russia; sanctioning fly-by-night Russian insurance companies and shadow fleet shippers; leveraging certain geographic choke points for maritime oil trade, such as the Danish Straits which all Russian oil sent from Baltic ports must pass through; working with major Indian and Chinese ports to refuse to dock well-known problematic oil tankers; working with the intelligence community to continue to improve regulatory visibility into the maritime oil trade; and, as sanctions expert Eddie Fishman proposed, imposing full-blocking sanctions on key nodes in Russia’s energy trade, such as Rosneft and Gazprombank.

4. Continue driving down global oil prices.

One of the most underappreciated successes of the price cap has been its role in bringing down global oil prices while ensuring that the oil market remains amply supplied. The price cap, when working at its best, actually drives oil prices down, not up—since the costs of the price cap are entirely borne by Putin, not by global buyers, who benefit from increased bargaining leverage.

How does this work? Even countries that did not sign on to the price cap, such as China and India, are leveraging it to drive a hard bargain with Russia, with Russian oil trading at a persistent discount and some buyers securing discounts of up to $30 a barrel. Stronger, airtight enforcement of the price cap would further solidify the strength of this de facto buyer’s cartel. Similarly, the costs of additional price cap-adjacent sanctions would be borne by Putin.

To be sure, the price cap is only one policy tool of many to bring down global oil prices—and one that pales in comparison to the potential sweeping bilateral agreement between Saudi Arabia and the United States being hammered out right now, which might include Israeli normalization, civilian nuclear assistance, and new security guarantees on top of potential increases in oil supply from Saudi Arabia. Nevertheless, a more airtight oil price cap can play a role in delivering on U.S. President Joe Biden’s promise to “get those prices down again.”

These improvements to the price cap are unlikely to satisfy all critics. One particularly sticky and compelling critique of the price cap is that the existence of the sizable Russian shadow fleet increases the risk of environmental disaster from a major oil spill, since the Russian tankers are usually old and barely seaworthy.

While these concerns are valid, this is the least bad choice amidst a sea of worse alternatives, since critics ignore the political reality that Europe would just ban the servicing of Russian oil outright if the price cap were scrapped, further enlarging the shadow fleet and exacerbating the environmental risk. Advocates for scrapping the cap may be focusing on the wrong target, ignoring the fact that Russian oil is already the dirtiest of any country, with extreme carbon dioxide and methane leakage, as our research team has documented, producing annual emissions already equivalent to that of major oil spills.

For most of the first year of its existence, the oil price cap has been far more successful than anyone thought possible, cutting into Putin’s oil profits by hundreds of millions while ensuring that the oil market remained flush and well-supplied, bringing oil prices down by 30 percent from the time that G-7 countries started discussing the price cap last year.

Despite some reversals in recent weeks, with stronger enforcement and a renewed focus on driving up Putin’s costs of doing business, the price cap can and will come back stronger and more potent than ever.

0 notes

Text

Buying a villa in Alanya, or anywhere else, involves several steps to ensure a smooth and successful transaction. Here's a general guide on how to buy a villa in Alanya:

Define Your Requirements: Determine your budget, preferred location, size of the villa, amenities, and any other specific features you desire in your villa. This will help you narrow down your options.

Research: Research the real estate market in Alanya. Look for information on property prices, trends, and the legal and regulatory framework for property ownership by foreigners.

Engage a Real Estate Agent: Consider hiring a local real estate agent who specializes in properties in Alanya. They can provide you with listings that match your criteria, arrange property visits, and guide you through the buying process.

Property Viewing: Visit the villas that match your criteria. This will give you a better understanding of the property, its condition, and its surroundings.

Due Diligence: Conduct thorough due diligence on the property. This includes verifying the legal status of the property, checking for any existing liens or encumbrances, and ensuring that the property has all the necessary permits.

Negotiation: If you're satisfied with a particular villa, you can start negotiating the price with the seller. Your real estate agent can assist you in this process.

Legal Assistance: Hire a local lawyer who specializes in real estate transactions in Turkey. They will help you navigate the legal aspects of the transaction, review contracts, and ensure a smooth transfer of ownership.

Purchase Agreement: Once the price is agreed upon, a purchase agreement is drafted. This document outlines the terms and conditions of the sale, including the price, payment schedule, and other relevant details.

Title Deed Transfer: To transfer ownership, you'll need to apply for a military clearance for the property (to confirm it's not located in a restricted area). Once clearance is obtained, you can proceed with the title deed transfer (TAPU) at the Land Registry Office.

Payment: Fulfill the payment terms as outlined in the purchase agreement. Payments are usually made in installments, with a down payment upfront.

Title Deed Transfer Completion: After the final payment is made, the title deed transfer is completed. You'll receive the TAPU, which is the official document proving your ownership of the property.

Registration: Ensure that the property is properly registered in your name with the local Land Registry Office.

Additional Fees and Taxes: Be aware of additional fees and taxes associated with property purchase in Turkey, such as property transfer tax, notary fees, and legal fees.

Maintenance and Services: If you're buying a villa within a complex, inquire about maintenance and services provided by the homeowners' association or management company.

Remember that the process can vary based on individual circumstances and local regulations. It's important to work with qualified professionals, such as real estate agents and lawyers, to ensure a successful and legally sound property purchase in Alanya or any other location.

0 notes