#trading prop firms in australia

Explore tagged Tumblr posts

Text

Find Your Edge with Prop Trading Firms in Australia

In the dynamic world of trading, finding your edge can be the key to success. Proprietary trading (prop trading) firms offer traders the opportunity to maximize their potential by providing access to capital, cutting-edge technology, and expert support. Australia, with its robust financial market and growing trading community, has become a hotspot for trading prop firms in australia. If you’re looking to elevate your trading game, here’s why prop trading companies in Australia are worth exploring.

What Are Prop Trading Firms?

Proprietary trading firms are organizations that allow traders to trade with the firm’s capital instead of their own. In return, the firm takes a share of the profits. These firms typically seek skilled traders who can generate consistent returns, offering them the tools and resources to succeed.

Unlike retail trading, where traders rely on personal funds, the prop trading in Australia significantly reduces the financial risk while enhancing the scope for larger gains. With access to sophisticated stock trading platforms in Australia, competitive commissions, and robust risk management systems, traders can focus on refining their strategies without the burden of substantial personal investment.

Why Choose a Prop Trading Firm in Australia?

Australia’s financial ecosystem is thriving, supported by a stable economy and advanced regulatory framework. Here are some reasons why choosing a prop firm in Australia could be your pathway to trading success:

Access to Diverse Markets

Australian prop trading companies often provide access to global markets, including equities, forex, futures trading in Australia, and derivatives. This enables traders to diversify their portfolios and capitalize on opportunities worldwide.

Comprehensive Training and Support

Many Australian prop trading companies offer training programs to help traders hone their skills. These programs include mentorship, risk management techniques, and insights into market dynamics, making them ideal for both beginners and experienced traders.

Favorable Profit Sharing Models

Australian prop trading firms typically offer competitive profit-sharing arrangements, ensuring that traders are rewarded proportionately for their performance. This creates a win-win scenario for both the trader and the firm.

Regulated Environment

Australia’s financial regulations are among the most stringent globally, providing traders with a secure and transparent trading environment. Prop firms in Australia adhere to these regulations, ensuring ethical practices and financial stability.

Steps to Join a Prop Trading Firm in Australia

If you’re ready to take the leap, here’s how you can join a prop firm in australia:

Research and Select a Firm

Identify reputable prop trading companies in australia that align with your trading style and goals. Look for firms with strong reviews, competitive profit-sharing models, and access to the markets you’re interested in.

Build a Track Record

Most prop trading firms require evidence of consistent trading performance. Develop and document a strong track record, showcasing your ability to manage risk and generate profits.

Apply and Complete Assessments

Many firms conduct evaluations or simulations to assess your trading skills. Be prepared to demonstrate your knowledge of market strategies and risk management.

Start Trading with Firm Capital

Once accepted, you’ll receive access to the firm’s resources, including capital and online trading platform in Australia. This is your chance to scale up and refine your strategies in a supportive environment.

Conclusion

Best prop trading firms in Australia provide a powerful platform for traders to unlock their full potential. By offering access to capital, cutting-edge tools, and comprehensive support, these firms create an environment where traders can thrive. Additionally, programs like funded trader program in Australia, atf funded in Australia, and apex trader funding in australia cater to aspiring traders, ensuring they have the financial backing to succeed. With access to trading website in australia, best trading apps in australia, and advanced platforms, traders can navigate markets effectively. If you’re determined to find your edge in the competitive world of trading, consider joining a funded trader in Australia program and take the first step toward achieving your financial goals.

#stock trading platforms in Australia#best trading apps in australia#online trading platform in Australia#trading website in australia#funded trader in Australia#best prop trading firms in australia#the prop trading in Australia#prop trading companies in australia#prop firm in Australia#trading prop firms in australia#futures trading in Australia#prop firm in australia#funded trader program in Australia#atf trader in australia#atf funded in Australia#apex trader funding in australia.

0 notes

Text

APAC Stocks Show Mixed Signals Amid Trade Tensions and Capex Surge APAC Markets: The Drama Unfolds with Mixed Results Well, it seems the APAC stock markets are putting on a bit of a show, with performances ranging from stellar comebacks to a few, well, uninspired flops. It's like watching a talent competition where some participants shine, and others clearly need a little more rehearsal. Let’s get into the nitty-gritty and uncover the hidden opportunities amidst the mixed vibes. The Aussie Swagger The ASX 200 strutted its stuff, propped up by the strength in sectors like healthcare, tech, financials, and utilities. Australia’s recent quarterly capex data also came in strong—it's like they brought the right size shoes to the dance and ended up leading the pack. Healthcare was leading the charge, almost like it had a secret health potion to power up, while tech and financials joined in, showing some swagger as well. Advanced traders, you might want to keep an eye on the undercurrents here—the utilities sector isn’t usually flashy, but steady gains could signal a more stable play. Nikkei’s Comeback Story Over in Japan, the Nikkei 225 played the comeback kid, clawing back opening losses and rising above the 38,000 mark. The market's strength came after the recent currency moderation. Imagine opening the day like you forgot your lucky socks, but then finding that perfect pair halfway through—the Nikkei definitely turned things around. For those looking to trade on sentiment, these turnarounds can be opportunities to ride waves others overlook. China’s Shadows and Setbacks Meanwhile, Hang Seng and Shanghai Comp took a hit—we're talking a pullback from recent highs, the type of move you might expect when Uncle Sam starts talking about more restrictions. Yes, the U.S. is rumored to be preparing fresh curbs on Chinese chip technology, targeting AI memory chips and adding 100 firms (including Huawei’s partners) to the entity list. It’s like watching two big players trying to one-up each other—traders need to watch this space, as these tensions can spell hidden opportunities for those looking into sectors that benefit from supply chain shifts. A Slow Day in the U.S. Amid Thanksgiving Calm The U.S. equity futures are barely making a move, just nursing some of yesterday’s losses in quiet Thanksgiving trade. It’s like the entire market decided to take a post-turkey nap. Not exactly fireworks here, but, remember, low-volume days can sometimes create unique opportunities for those with an appetite for volatility—but only if you’re trading smart. Europe’s Optimistic Start Meanwhile, across the Atlantic, European equity futures are looking brighter—the Euro Stoxx 50 futures show a positive start, up by 0.6% after a drop of the same amount on Wednesday. It’s almost like Europe woke up, had a good breakfast, and decided to tackle Thursday with fresh vigor. This is a classic case where contrarian traders might find value—the optimists are stepping in, and you might just ride that wave. Hidden Patterns in Market Sentiment The mixed nature of these markets reveals a bigger picture—a divergence in sentiment that seasoned traders should take as a cue. Emerging market tensions (particularly involving China) often coincide with quiet Western holidays, leading to asymmetric risk exposures. This is where the advanced strategy of analyzing intermarket relationships comes into play. For example, when APAC markets move on news about U.S. policy towards China, look for parallel shifts in commodities and currencies—oil and metals in particular might hint at the next domino to fall. Ride the Comeback Waves Consider this your whispered reminder—often, pullbacks driven by broad macro concerns (like those affecting Hang Seng and Shanghai Comp) offer individual sector opportunities. Utility companies in the ASX 200 that are riding high are worth a look not just because of their numbers, but also because of underlying stability—one that could benefit as the world finds a middle ground amidst all this macro tension. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Learn about commodity trading with NP Financials Pty Ltd

N P Financials is an Australia regulated Prop Trading Firm providing Training and Funding to Forex, Shares, Commodities, Indices, and Crypto Traders, with a high rate of client retention due to successful trades yielding 762 points per month.

0 notes

Text

Walker Capital Australia | Prop Trading in Sydney

Proprietary Trading or Prop Trading in Sydney offers huge opportunities for profit and also for losses and should never be done by an inexperienced trader or firm. Before looking to invest in a firm that engages in prop trading, be sure to speak with an independent expert first. We, Walker Capital are one of the best financial advisors. Call on +61 2 8076 2210, and we’ll see how we can help you achieve your investment goals.

Read more details on Proprietary Trading

Walker Capital

Level 57 19-29 Martin Place, Sydney NSW 2000

Contact No - +61 2 8076 2210

Level 40, 140 William Street, Melbourne VIC 3004

Contact No - +61 3 8103 3082

Urgent Enquiry - +61 2 8076 2210

Email: [email protected]

#Prop Trading#prop trading companies#prop trading internship#Prop Trading Sydney#proprietary trading#proprietary trading firms#Prop Trading in Sydney#Walker Capital Australia

1 note

·

View note

Text

The US Dollar Has Surged This Year. the World's Largest Wealth Manager Explains Why That Dizzying Rally Isn't Done yet.

New Post has been published on https://medianwire.com/the-us-dollar-has-surged-this-year-the-worlds-largest-wealth-manager-explains-why-that-dizzying-rally-isnt-done-yet/

The US Dollar Has Surged This Year. the World's Largest Wealth Manager Explains Why That Dizzying Rally Isn't Done yet.

Happy Friday, readers. Hallam Bullock here, reporting from London.

There’s a key US jobs report dropping at 8:30 a.m. today. It may seem like nonfarm payrolls have been a B-list macro datapoint since the Consumer Price Index has taken the spotlight all year, but the September report is of particular importance.

The Fed will be watching very closely for signs the labor market, and thus the economy, is cooling off, feeding into its decision making over the path of rate hikes. Economists are expecting 250,000 new jobs added in September, which would be down from 315,000 in August.

While we wait for the jobs report, let’s turn our attention to the dollar, which according to UBS, isn’t done rising yet.

Let’s see what they have to say.

If this was forwarded to you, sign up here. Download Insider’s app here.

1. The surging US dollar has yet to peak. That’s according to UBS, which thinks the Federal Reserve is unlikely to start cutting interest rates any time soon, keeping the dollar rising against rival currencies globally.

The greenback has already flown up 16.7% this year, bolstered by Fed rate hikes and weaknesses among major counterparts. But hopes of a pivot in the Fed’s policy pumped the brakes on its rise recently, with the US dollar index, which measures the buck against a basket of six currencies, retreating on the speculation fueled by a fall in US job openings and a lower-than-expected rate increase in Australia.

However, UBS’s analysts, led by CIO Mark Haefele, said in a note to clients this week that it’s too early to call a peak in both Fed hawkishness and the US dollar.

“The number of job openings in the US remains much higher than those unemployed, while the latest core personal consumption expenditure price index showed that inflation is still elevated,” the note read.

“Fed officials including Chair Jerome Powell have stressed that the central bank’s job is not yet done.”

Against a backdrop of global uncertainty amid the war in Ukraine, the pressure weighing on the euro is likely to prop up the dollar in the near future, UBS says.

The monthly jobs report today will give more insight into the labor market and what the Fed might do — and the likely future path of the dollar.

Do you think the dollar still has room to rise? Let me know at [email protected] or tweet @hallam_bullock

In other news:

2. US stock futures rise early Friday, ahead of the key nonfarm payroll preview data. Meanwhile, hackers have stolen at least $100 million in tokens from crypto exchange Binance. Here are the latest market moves.

3. Earnings on deck: Apollo Global Management Inc, National Beverage Corp, and Tilray, all reporting.

4. Watch for these three key events that will determine if stocks are headed for a dramatic decline or a “lights-out rally.” David Keller, the chief market strategist at StockCharts.com, shared critical trading levels and possible catalysts to watch right now.

5. Wells Fargo says a single massive options trade fueled a 2% positive reversal in the S&P 500 on Wednesday. The firm said the options trade was worth $31 million and is a bet that stocks will rally into year-end. Here’s the full story.

6. Saudi Arabia is lowering oil prices for Europe, but raising them for the US. Last month, it was a similar story: prices down for Europe, but up for the US. It comes after the White House accused OPEC+ of “aligning with Russia” in cutting its production quota. Read more here.

7. Ex-Treasury chief Larry Summers warned the Fed may need to hike rates above 5% to defeat inflation. He also predicted the cost would be a severe recession, and unemployment surging to about 6%.

8. David Rubenstein sees Warren Buffett as the ultimate investor. Rubenstein interviewed 22 of the world’s best investors for his new book, “How to Invest: Masters on the Craft,” but dedicated the entire compilation to Buffett. He laid out the 12 traits and habits that are key to Buffett’s success.

9. A personal finance expert shared his top financial advice for women in their 20s, 30s, 40s, 50s and 60s. As women are moving up in their careers, starting businesses, investing and making more money, their financial goals and needs are constantly changing. Ernest Burley, CFP, who has been in the financial planning industry for over 25 years, laid out some of the biggest financial moves a woman can make in her life, decade-by-decade.

10. Middle Eastern powers are pushing the price of oil higher right before crucial midterm elections. OPEC+ is adding political pressure on the Biden administration by slashing its oil production by 2 million barrels per day — and the White House is not happy about it.

Keep up with the latest markets news throughout your day by checking out The Refresh from Insider, a dynamic audio news brief from the Insider newsroom. Listen here.

Curated by Hallam Bullock in London. (Feedback or tips? Email [email protected] or tweet @hallam_bullock).

Edited by Max Adams (@maxradams) in New York.

Read the full article here

0 notes

Text

Tuesday, July 20, 2021

Global surveillance (Washington Post) Military-grade spyware licensed by an Israeli firm to governments for tracking terrorists and criminals was used in attempted and successful hacks of 37 smartphones belonging to journalists, human rights activists, business executives and two women close to murdered Saudi journalist Jamal Khashoggi, according to an investigation by The Washington Post and 16 media partners. The phones appeared on a list of more than 50,000 numbers that are concentrated in countries known to surveil their citizens and to have been clients of the Israeli firm, NSO Group, a worldwide leader in the growing and largely unregulated private spyware industry, the investigation found. The list does not identify who put the numbers on it or how many of the phones were targeted or surveilled. Reporters were able to identify more than 1,000 people on the list spanning more than 50 countries: several Arab royal family members, at least 65 business executives, 85 human rights activists, 189 journalists, and more than 600 politicians and government officials. The software, called Pegasus, is marketed as a counterterrorism tool, but appears to have abused by some governments—those in Azerbaijan, Bahrain, Hungary, India, Kazakhstan, Mexico, Morocco, Rwanda, Saudi Arabia, and the United Arab Emirates in particular.

Huge Oregon blaze grows (AP) The largest wildfire in the U.S. torched more dry forest landscape in Oregon on Sunday, one of dozens of major blazes burning across the West as critically dangerous fire weather loomed in the coming days. The destructive Bootleg Fire just north of the California border grew to more than 476 square miles (1,210 square kilometers), an area about the size of Los Angeles. Erratic winds fed the blaze, creating dangerous conditions for firefighters, said John Flannigan, an operations section chief on the 2,000-person force battling the flames. Authorities expanded evacuations that now affect some 2,000 residents of a largely rural area of lakes and wildlife refuges. The blaze, which was 22% contained, has burned at least 67 homes and 100 outbuildings while threatening thousands more.

Haiti’s acting prime minister says he will step down (Washington Post) Claude Joseph, who has nominally led Haiti as acting prime minister since the assassination of President Jovenel Moïse, has agreed to step down and hand over power to challenger Ariel Henry, who has been backed by the international community. The agreement ends a power struggle between two men appointed by Moïse who had been courting support internationally and domestically for their rival claims as Haiti’s interim leader. It’s aimed at defusing a political crisis that has left the troubled Caribbean nation rudderless since the July 7 assassination. Civil society leaders, meanwhile, decried what they say has been U.S. and other foreign interference in propping up an interim leader whom none of them support. Critics say both men were too closely associated with Moïse, who they say was linked to violent street gangs and growing increasingly authoritarian.

Pingdemic in England (Washington Post) Employers in Britain are raising fears that a “pingdemic” could cause a major economic disruption this summer, after more than half a million people in a single week were pinged by the government’s contact-tracing app, alerting them they may have been exposed to the coronavirus and should stay home for up to 10 days. Already, factories, pubs, restaurants and schools are reporting staff shortages resulting from quarantine guidance, which in England and Wales, for at least another month, still applies to people who are fully vaccinated. At a Nissan factory in northern England, the largest car factory in the country, up to 900 employees—15 percent of the workforce—are quarantining after exposure or isolating after a positive test, according to the BBC. Rolls-Royce has said it won’t rule out having to shut down production. In the hospitality sector, which was already struggling with vacancies, 1 in 5 workers are reportedly quarantining or isolating. There were scenes of chaos this week at Heathrow Airport, as long queues of passengers overwhelmed the sparser-than-usual security staff. The Guardian newspaper reported that garbage collections have been disrupted because of staff shortages in several English cities “amid a warning that services are unsustainable due to rising infections and a high ‘ping’ rate.”

Death toll in European floods climbs above 180 (NYT/Washington Post) More than 180 people have been confirmed dead, with hundreds still missing, as rescue crews worked through the aftermath of deadly flooding in Western Europe. The waters were preceded by historic rainfall in eastern Belgium, the Netherlands, and western Germany (see map), with the city of Cologne measuring more than 6 inches of precipitation in a 24-hour period. Meteorologists said the amount of rain equaled a full month’s worth in a single day in many locations. In a region that rarely sees such heavy rains, the situation was exacerbated by general unpreparedness. The European Flood Awareness System issued a warning early last week, but officials were reportedly slow to respond. Visiting the village of Schuld on Sunday, German Chancellor Angela Merkel called the devastation “terrifying” and stressed the need for the world to “be faster in the battle against climate change.”

Indonesia’s pandemic suffering (Washington Post) In Indonesia, the delta variant has overwhelmed hospitals and depleted oxygen supplies. The highly transmissible strain is fueling a wave of suffering across the region, including in Thailand, Vietnam and Malaysia. In Indonesia, health workers are among the hardest hit, despite being prioritized for vaccinations. Some 1,311 have died of covid-19 since March last year, according to the Indonesian Medical Association’s risk mitigation team. Total cases stand at 2.8 million, according to the Health Ministry, with 72,000 fatalities. The country on Saturday reported 51,952 new infections and 1,092 deaths, having overtaken India in daily cases to become the epicenter of the pandemic in Asia.

Japan girds for a surreal Olympics (AP) After a yearlong delay and months of hand-wringing that rippled across a pandemic-inflected world, a Summer Games unlike any other is at hand. No foreign fans. No local attendance in Tokyo-area venues. A reluctant populace navigating a surge of virus cases amid a still-limited vaccination campaign. Athletes and their entourages confined to a quasi-bubble, under threat of deportation. Government minders and monitoring apps trying—in theory, at least—to track visitors’ every move. Alcohol curtailed or banned. Cultural exchanges, the kind that power the on-the-ground energy of most Games, completely absent. All signs point to an utterly surreal and atomized Games, one that will divide Japan into two worlds during the month of Olympics and Paralympics competition. On one side, most of Japan’s largely unvaccinated, increasingly resentful populace will continue soldiering on through the worst pandemic to hit the globe in a century, almost entirely separated from the spectacle of the Tokyo Games aside from what they see on TV. Illness and recovery, work and play, both curtailed by strict virus restrictions: Life, such as it is, will go on here. Meanwhile, in massive (and massively expensive) locked-down stadiums, vaccinated super-athletes, and the legions of reporters, IOC officials, volunteers and handlers that make the Games go, will do their best to concentrate on sports served up to a rapt and remote audience of billions.

Diplomatic repercussions for undiplomatic remarks (Reuters) South Korean President Moon Jae-in will not visit Tokyo for the Olympics, scrapping plans for what would have been his first summit with Prime Minister Yoshihide Suga. The announcement came after Seoul lodged a protest over a news report that a senior diplomat at Japan's embassy in Seoul had said Moon was "masturbating" when describing his efforts to improve relations between the two countries.

North Korean trade problems (Nikkei Asia) North Korea’s trade with China, its only major trading partner, fell to $65.72 million over the first half of 2021, a decline of 84 percent, and down 95 percent from the same period of 2019. In June, North Korean trade with China amounted to just $14.13 million, which was a far cry from the over $200 million notched in every single month of 2019. China is responsible for over 90 percent of North Korea’s trade.

Australia prolongs COVID-19 lockdown in Victoria amid Delta outbreak (Reuters) Australian authorities said Victoria state would extend a COVID-19 lockdown beyond Tuesday to slow the spread of the highly infectious Delta variant, despite a slight drop in new infections in the state and nationwide. Victoria state Premier Daniel Andrews said lockdown rules would not be lifted as cases were still being detected in the community. Victoria, the country’s second most populous state, on Monday reported 13 locally acquired cases, down from 16 a day earlier. Nearly half of Australia’s 25 million people are living under lockdowns imposed to quell an outbreak fuelled by the highly transmissable Delta variant, which has become the worst this year.

Biden hosts Jordan’s king (AP) President Joe Biden is set to host King Abdullah II of Jordan during one of the most difficult moments of the Jordanian leader’s 22-year rule and at a pivotal time in the Middle East for Biden. Abdullah arrives Monday afternoon at the White House. Last week a Jordanian state security court sentenced two former officials to serve 15 years in prison over an alleged plot against the king uncovered earlier this year that involved Abdullah’s half-brother. Meanwhile, Biden is dealing with stepped-up attacks against U.S. troops in Iraq and Syria by Iranian-backed militias at the same moment that his administration is trying to nudge Iran back to the negotiating table to revive the nuclear agreement that Donald Trump abandoned during his presidency. The two leaders are expected to discuss the situation in Syria—more than 1 million Syrian refugees have fled the war-ravaged nation for Jordan—and a wobbly security situation in Iraq, the official said. At least eight drone attacks have targeted the U.S. military presence in Iraq since Biden took office in January, as well as 17 rocket attacks. Abdullah is the first Arab world leader to meet face-to-face with Biden.

0 notes

Text

What is the impact of Coronavirus on Gutta Percha Market Growth?| Key players- Diadent Group International, Quanzhou Taifeng Machinery Technology Co., Ltd. and more

Gutta Percha market report is the major research for those who look for an entire analysis of markets. The report covers all information on the Global and regional markets including old and future trends for market demand, size, trading, supply, competitors, and prices as well as Global predominant vendors’ information. We have provided CAGR, value, volume, sales, production, revenue, and other estimations for the global as well as regional markets. The market is designed to serve as a ready-to-use guide for developing accurate pandemic management programs allowing market players to successfully emerge from the crisis and retract numerous gains and profits. The players included in this report are chosen in terms of their product portfolio, market share, brand value, and the well-being of the organizations. Our report based on current situations across the globe. You can get a sample copy of the report here @ https://www.datalabforecast.com/request-sample/17996-gutta-percha-market **Note: Don’t miss the trading opportunities on Gutta Percha Market. Talk to our analyst and gain key industry insights that will help your business grow as you create sample reports. Note- This report sample includes: • Brief Introduction to the research report • Table of Contents (Scope covered as a part of the study) • Research framework (Structure of The Report) • Top players in the market • The research methodology adopted by Data Lab Forecast

Asia Pacific and Europe are projected to be Gutta Percha markets during the forecast period. This is primarily due to the presence of prominent industry in China, Germany, Japan, and India.

Gutta Percha Market: Dynamics Based on the current scenario, the industry has a fairly positive impact on the Gutta Percha Market, owing to increasing use and adoption of Gutta Percha during COVID-19. The spread of COVID-19 has forced the industry to drive both a stronger online presence and discover new ways to provide analysis. Hence, end users are adopting market to overcome business challenges. This is increasing spending on Gutta Percha across the globe. The research study offers a substantial knowledge platform for entrants and investors as well as veteran companies, manufacturers functioning in the global Gutta Percha market. The report includes CAGR, market shares, sales, gross margin, value, volume, and other vital market figures that give an exact picture of the growth of the global Gutta Percha market. We have also focused on SWOT, PESTLE, and Porter’s Five Forces analyses of the global Gutta Percha market.

We are currently offering Quarter-end Discount to all our high potential clients and would really like you to avail the benefits and leverage your analysis based on our report.

Avail 30-50% Discount on various license type on immediate purchase (Use Corporate email ID to Get Higher Priority) @ https://www.datalabforecast.com/request-discount/17996-gutta-percha-market

Gutta Percha Market

Thinking One Step Ahead In today’s competitive world you need to think one step ahead to pursue your competitors, our research offers reviews about key players, major collaborations, union & acquisitions along with trending innovation and business policies to present a better understanding to drive the business in the correct direction. Gutta Percha Market: Impact of COVID-19 The Coronavirus (COVID-19) pandemic has affected every aspect of life worldwide. The report considers the impact of COVID-19 on market growth. The study provides full coverage of the impact of the COVID-19 pandemic on the Gutta Percha market and its key segments. Furthermore, it covers the present and future impact of the pandemic and offers a post-COVID-19 scenario to provide a deeper understanding of the dynamic changes in trends and market scenarios. Gutta Percha Market: Key Players The major market players that are operating in the Gutta Percha market are Diadent Group International, Quanzhou Taifeng Machinery Technology Co., Ltd., Kraiburg - Tpe Italia, Acoma S.R.L., Mazzantini Giuseppe S.R.L., Alpingomma S.R.L., Der - Gom S.R.L., Guangzhou Ecoateen Mannequin Props Co., Ltd., Co.Me.T. S.R.L., Toscana Gomma S.P.A., Gommagomma S.P.A., Rimpex Rubber Detailed Segmentation: Global Gutta Percha Market, By Product Type: ⇛ Anti-drop Teether, Pacifier Teether, Water Glue, Vocal Melody Teether, Others. Global Gutta Percha Market, By End User: ⇛ Household, Commercial, Others. Do You Have Any Query or Specific Requirement? Drop Your Query Here @ https://www.datalabforecast.com/request-enquiry/17996-gutta-percha-market The Gutta Percha Market report incorporates the detailed analysis of the leading organizations and their thought process and what are the methodologies they are adopting to maintain their brand image in this market. The report aides the new bees to understand the level of competition that they need to fight for to strengthen their roots in this competitive market. Gutta Percha Market: Prominent Regions • Asia-Pacific (Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia) • Europe (Turkey, Germany, Russia UK, Italy, France, etc.) • North America (United States, Mexico, and Canada.) • South America (Brazil etc.) • The Middle East and Africa (GCC Countries and Egypt.) What benefits does DLF research studies provide? 1. Supporting company financial and cash flow planning 2. Latest industry influencing trends and development scenario 3. To resize powerful market opportunities 4. A key decision in planning and to further expand market share 5. Identify Key Business Segments, Market proposition & Gap Analysis 6. Assisting in allocating marketing investments Buy Now this Premium Report to Grow your Business @ https://www.datalabforecast.com/buy-now/?id=17996-gutta-percha-market&license_type=su In conclusion, the Gutta Percha Market report is a genuine source for accessing the research data which is projected to exponentially grow your business. The report provides information such as economic scenarios, benefits, limits, trends, market growth rates, and figures. SWOT analysis and Porters Five analysis is also incorporated in the report. About Us Transforming Information into Insights We pride ourselves in being a niche market intelligence and strategic consulting and reporting firm driven towards resulting in a powerful impact on businesses across the globe. Our accuracy estimation and forecasting models have earned recognition across majority of the business forum. We source online reports from some of the best publishers and keep updating our collection to offer you direct online access to the world’s most comprehensive and recent database with skilled perceptions on global industries, products, establishments and trends. We at ‘Data Lab Forecast’, wish to assist our clients to strategize and formulate business policies, and achieve formidable growth in their respective market domain. Data Lab Forecast is a one-stop solution provider right from data collection, outsourcing of data, to investment advice, business modelling, and strategic planning. The company reinforces client’s insight on factors such as strategies, future estimations, growth or fall forecasting, opportunity analysis, and consumer surveys, among others. Contact: Henry K Data Lab Forecast Felton Office Plaza 6375 Highway 8 Felton, California 95018, United States Phone: +1 917-725-5253 Email: [email protected] Website: https://www.datalabforecast.com/ Follow Us on: LinkedIN | Twitter | Data Lab Forecast, Gutta Percha, Gutta Percha Market, Gutta Percha Market 2021, Gutta Percha Market Analysis, Gutta Percha Market By Application, Gutta Percha Market By Type, Diadent Group International, Quanzhou Taifeng Machinery Technology Co., Ltd., Kraiburg - Tpe Italia, Acoma S.R.L., Market Strategies, DLF

0 notes

Text

Reach Your Goals with Apex Trader Funding in Australia

In the ever-evolving world of trading, having access to sufficient capital can be the key to unlocking your true potential as a trader. For Australian traders looking to elevate their trading careers, Apex Trader Funding in Australia provides an innovative solution to access funding and achieve their goals. Whether you are an experienced trader or just starting, trading website in australia offers opportunities tailored to your skills and aspirations.

What is Apex Trader Funding?

Apex Trader Funding in Australia is a proprietary trading firm that provides traders with access to funding without the need for significant upfront capital. Their unique approach allows traders to focus on executing their strategies effectively while mitigating the financial risks associated with traditional trading methods. With trading prop firms in australia, traders can qualify for funding by demonstrating their trading skills and discipline through evaluation programs. Apextrader Funding stands out for its ability to provide unmatched support to traders in Australia.

Why Choose Apex Trader Funding in Australia?

Australian traders face unique challenges and opportunities in the global trading landscape. Apex Trader Funding in Australia understands these dynamics and provides solutions that align with the needs of Australian traders. Here are some reasons why funded trader in australia is a great choice:

Flexibility and Support

Apex Trader Funding in Australia provides traders with the freedom to use their preferred trading strategies and platforms. This flexibility empowers traders to stick to what works best for them while enjoying support from a team that understands the complexities of the prop trading in australia. Apextrader Funding also ensures a seamless trading experience for its users.

Cost-Effective Evaluation Programs

Unlike traditional funding methods, prop firm in Australia offers affordable evaluation programs designed to test your trading skills. Once you pass the evaluation phase, you can access fully funded accounts without incurring high costs, making it one of the best prop trading firms in australia. Apextrader Funding ensures traders have access to top-tier evaluation programs.

Fast and Simple Process

Apex Trader Funding in Australia streamlines the process of qualifying for funding. Australian traders can quickly start their journey by signing up, completing the evaluation, and accessing their funded accounts in just a few steps. Apextrader Funding simplifies the journey to becoming a funded trader.

How to Get Started with Apex Trader Funding in Australia

Getting started with futures trading in Australia is straightforward and designed to accommodate traders of all levels. Here’s a step-by-step guide:

Choose Your Evaluation Account

Select an evaluation account that aligns with your goals and trading preferences. prop trading companies in Australia offers a range of account sizes to suit different traders.

Pass the Evaluation Phase

Demonstrate your trading skills by meeting the profit targets and adhering to the rules during the evaluation. This phase tests your ability to trade consistently and manage risks effectively, which is vital in trading prop firms in australia.

Receive Your Funded Account

Once you pass the evaluation, you’ll receive access to a fully funded trading account. From here, you can start trading with real capital while enjoying a share of the profits as a funded trader in australia.

Conclusion

Apex Trader Funding in Australia provides traders with the opportunity to unlock their potential and achieve their financial goals. By offering access to substantial capital, a supportive environment, and flexible evaluation programs, atf funded in Australia empowers Australian traders to excel in the competitive world of trading. Whether you’re a seasoned professional or a budding trader, best prop trading firms in australia could be the key to reaching your trading aspirations. Take the first step today and transform your trading journey with the prop trading in australia! With the backing of Apextrader Funding, your trading potential is limitless.

#trading website in australia#funded trader in australia#best prop trading firms in australia#the prop trading in australia#prop trading companies in australia#prop firm in australia#trading prop firms in australia#futures trading in australia#futures funding in australia#funded trader program in australia#atf trader in australia#atf funded in australia#apex trader funding in australia

0 notes

Text

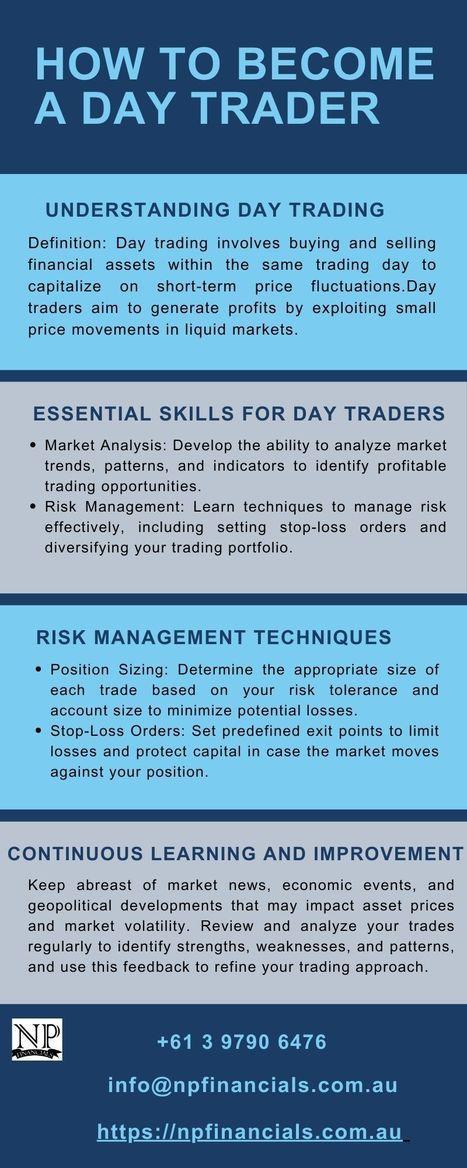

How To Become A Day Trader

NP Financials is an Australia regulated Prop Trading Firm providing Training and Funding to Forex, Shares, Commodities, Indices, and Crypto Traders, with a high rate of client retention due to successful trades yielding 762 points per month.

0 notes

Text

Walker Capital - Best prop trading companies in Sydney

If you are looking for a top financial advisor in Sydney to your investment purpose then your search is over. Walker Capital is the Best prop trading companies in Sydney. There are a number of companies that offer prop trading in Sydney but Before looking to invest in a firm that engages in prop trading, be sure to speak with an independent expert first. We welcome you to give our team a call to discuss your investment goals and objectives. You can call us on +61 2 8076 2210 for an urgent inquiry.

Walker Capital Australia:

Level 57 19-29 Martin Place, Sydney NSW 2000

Contact No - +61 2 8076 2210

Level 40, 140 William Street, Melbourne VIC 3004

Contact No - +61 3 8103 3082

Urgent Enquiry - +61 2 8076 2210

Email: [email protected]

#prop trading#prop trading companies#prop trading internship#prop trading Sydney#proprietary trading#proprietary trading firms

3 notes

·

View notes

Text

Japan still has great influence on global financial markets

IT IS the summer of 1979 and Harry “Rabbit�� Angstrom, the everyman-hero of John Updike’s series of novels, is running a car showroom in Brewer, Pennsylvania. There is a pervasive mood of decline. Local textile mills have closed. Gas prices are soaring. No one wants the traded-in, Detroit-made cars clogging the lot. Yet Rabbit is serene. His is a Toyota franchise. So his cars have the best mileage and lowest servicing costs. When you buy one, he tells his customers, you are turning your dollars into yen.

“Rabbit is Rich” evokes the time when America was first unnerved by the rise of a rival economic power. Japan had taken leadership from America in a succession of industries, including textiles, consumer electronics and steel. It was threatening to topple the car industry, too. Today Japan’s economic position is much reduced. It has lost its place as the world’s second-largest economy (and primary target of American trade hawks) to China. Yet in one regard, its sway still holds.

Get our daily newsletter

Upgrade your inbox and get our Daily Dispatch and Editor's Picks.

This week the board of the Bank of Japan (BoJ) voted to leave its monetary policy broadly unchanged. But leading up to its policy meeting, rumours that it might make a substantial change caused a few jitters in global bond markets. The anxiety was justified. A sudden change of tack by the BoJ would be felt far beyond Japan’s shores.

One reason is that Japan’s influence on global asset markets has kept growing as decades of the country’s surplus savings have piled up. Japan’s net foreign assets—what its residents own abroad minus what they owe to foreigners—have risen to around $3trn, or 60% of the country’s annual GDP (see top chart).

But it is also a consequence of very loose monetary policy. The BoJ has deployed an arsenal of special measures to battle Japan’s persistently low inflation. Its benchmark interest rate is negative (-0.1%). It is committed to purchasing ¥80trn ($715bn) of government bonds each year with the aim of keeping Japan’s ten-year bond yield around zero. And it is buying baskets of Japan’s leading stocks to the tune of ¥6trn a year.

Tokyo storm warning

These measures, once unorthodox but now familiar, have pushed Japan’s banks, insurance firms and ordinary savers into buying foreign stocks and bonds that offer better returns than they can get at home. Indeed, Japanese investors have loaded up on short-term foreign debt to enable them to buy even more. Holdings of foreign assets in Japan rose from 111% of GDP in 2010 to 185% in 2017 (see bottom chart). The impact of capital outflows is evident in currency markets. The yen is cheap. On The Economist’s Big Mac index, a gauge based on burger prices, it is the most undervalued of any major currency.

Investors from Japan have also kept a lid on bond yields in the rich world. They own almost a tenth of the sovereign bonds issued by France, for instance, and more than 15% of those issued by Australia and Sweden, according to analysts at J.P. Morgan. Japanese insurance companies own lots of corporate bonds in America, although this year the rising cost of hedging dollars has caused a switch into European corporate bonds. The value of Japan’s holdings of foreign equities has tripled since 2012. They now make up almost a fifth of its overseas assets.

What happens in Japan thus matters a great deal to an array of global asset prices. A meaningful shift in monetary policy would probably have a dramatic effect. It is not natural for Japan to be the cheapest place to buy a Big Mac, a latté or an iPad, says Kit Juckes of Société Générale. The yen would surge. A retreat from special measures by the BoJ would be a signal that the era of quantitative easing was truly ending. Broader market turbulence would be likely. Yet a corollary is that as long as the BoJ maintains its current policies—and it seems minded to do so for a while—it will continue to be a prop to global asset prices.

Rabbit’s sales patter seemed to have a similar foundation. Anyone sceptical of his mileage figures would be referred to the April issue of Consumer Reports. Yet one part of his spiel proved suspect. The dollar, which he thought was decaying in 1979, was actually about to revive. This recovery owed a lot to a big increase in interest rates by the Federal Reserve. It was also, in part, made in Japan. In 1980 Japan liberalised its capital account. Its investors began selling yen to buy dollars. The shopping spree for foreign assets that started then has yet to cease.

This article appeared in the Finance and economics section of the print edition under the headline "Made in Japan"

0 notes

Text

New Post has been published on Forex Blog | Free Forex Tips | Forex News

!!! CLICK HERE TO READ MORE !!! http://www.forextutor.net/upbeat-australia-1q-consumer-price-index-cpi-to-curb-audusd-losses/

Upbeat Australia 1Q Consumer Price Index (CPI) to Curb AUD/USD Losses

– Australia CPI to Climb Annualized 2.2%- Fastest Pace of Growth Since 3Q 2014.

– Core Inflation to Rebound from 1.6%- Lowest Reading Since the Series Began in 1983.

Trading the News: Australia Consumer Price Index (CPI)

A material pickup in Australia’s headline and core Consumer Price Index (CPI) may alter the monetary policy outlook and heighten the appeal of the aussie should the data prints put pressure on the Reserve Bank of Australia (RBA) to start normalizing monetary policy.

Why Is This Event Important:

Signs of heightening price pressures may push the RBA to change its tune over the coming months, and the central bank may show a greater willingness to move away from its easing-cycle as inflation approaches the 2% to 3% target band. However, the RBA may continue to endorse a wait-and-see approach at the April 4 meeting as the central bank warns ‘global inflation had increased, driven by the rise in oil prices over 2016,’ and Governor Philip Lowe and Co. may retain the record-low cash rate throughout 2017 as ‘wage growth and broader measures of labour cost pressures remained subdued.’

Have a question about the currency markets? Join a Trading Q&A webinar and ask it live!

Expectations: Bullish Argument/Scenario

Release

Expected

Actual

Employment Change (MAR)

20.0K

60.9K

Participation Rate (MAR)

64.6%

64.8%

Westpac Consumer Confidence s.a. (MoM) (MAR)

—

0.1%

Improved confidence accompanied by the ongoing expansion in Australia’s labor market may generate a stronger-than-expected CPI print, and a positive development may prop up AUD/USD as it encourages the RBA to normalize monetary policy sooner rather than later.

Risk: Bearish Argument/Scenario

Release

Expected

Actual

Home Loans (MoM) (FEB)

0.0%

-0.5%

Retail Sales (MoM) (FEB)

0.3%

-0.1%

Private Sector Credit (YoY) (FEB)

5.3%

5.0%

However, Australian firms may offer discounted prices amid the slowdown in private-sector consumption, and another below-forecast reading may spur a bearish reaction in the aussie as it drags on interest-rate expectations.

How To Trade This Event Risk(Video)

Bullish AUD Trade: Headline & Core Inflation Picks Up in 1Q 2017

Need a green, five-minute candle following the CPI report to consider a long AUD/USD trade.

If market reaction favors a bullish aussie position, buy AUD/USD with two separate lots.

Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish AUD Trade: Australia CPI Report Continues to Disappoint

Need red, five-minute candle to favor a short aussie position.

Carry out the same setup as the bullish AUD trade, just in reverse.

Potential Price Targets For The Release

AUD/USD Daily

Chart – Created Using Trading View

Broader outlook for AUD/USD remains relatively flat as the pair preserves the range from 2016, but the pair may continue to give back the advance from earlier this year following the failed attempt to test the December high (0.7778); the Relative Strength Index (RSI) also highlights a similar dynamic and keeps the near-term bias tilted to the downside as it preserves the bearish formation carried over from February, with the first downside area of interest coming in around 0.7500 (50% retracement) followed by 0.7450 (38.2% retracement).

Interim Resistance: 0.7730 (61.8% retracement) to 0.7770 (61.8% expansion)

Interim Support: 0.7150 (161.8% expansion) to 0.7180 (61.8% retracement)

Make Sure to Check Out the DailyFX Guides for Additional Trading Ideas!

Impact that Australia CPI report has had on AUD/USD during the previous release

Period

Data Released

Estimate

Actual

Pips Change

(1 Hour post event )

Pips Change

(End of Day post event)

4Q

2016

01/25/2017 0:30 GMT

1.6%

1.5%

-45

-20

4Q 2016 Australia Consumer Price Index (CPI)

AUD/USD 10-Minute

Australia’s Consumer Price Index (CPI) climbed an annualized 1.5% during the last three-months of 2016 after expanding 1.3% in the third-quarter, while the core rate of inflation narrowed to 1.6% from 1.7% during the same period. The softer-than-expected CPI report may encourage the Reserve Bank of Australia (RBA) to keep the official cash rate at the record-low throughout 2017 as the central bank warns ‘the rise in underlying inflation is expected to be a bit more gradual with growth in labour costs remaining subdued.’ The Australian dollar struggled to hold its ground following the release, but the market reaction was short-lived, with AUD/USD regaining its footing during the day to close at 0.7571.

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

— Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David’s e-mail distribution list, please follow this link.

Upbeat Australia 1Q Consumer Price Index (CPI) to Curb AUD/USD Losses Upbeat Australia 1Q Consumer Price Index (CPI) to Curb AUD/USD Losses https://rss.dailyfx.com/feeds/forex_market_news $inline_image

0 notes

Text

Saudi-Russian Alliance Is Strained as Coronavirus Saps Demand for Oil

An alliance between Saudi Arabia and Russia has helped prop up oil prices for the last three years. But the two big oil producers were not in perfect harmony this week, as they have tried to recalibrate production targets to cope with reduced demand from China, whose economy has been crippled by the coronavirus epidemic.

Saudi Arabia’s oil minister, Abdulaziz bin Salman, wanted to move ahead quickly with a meeting to consider new production cuts, but he has struggled to persuade Moscow, even after his father, King Salman, made a call to President Vladimir V. Putin of Russia on Monday.

Instead, the Organization of the Petroleum Exporting Countries this week convened three long days of meetings of a technical group that produced a recommendation to cut output by 600,000 barrels, an almost 30 percent addition to curbs agreed upon in December but probably less than the Saudis wanted, according to some analysts.

Still, Russia’s representatives told the group that while they found the recommendations reasonable they needed more time to consider them, according to a person briefed on the matter.

The inability to reach a quick consensus inevitably raised concerns about whether Saudi Arabia, the de facto leader of OPEC, and Russia were still able to work together to coordinate oil policy.

“The real question is whether the Russians and the Saudis are on the same page on the necessity for collective action,” said Helima Croft, head of global commodity strategy at RBC Capital Markets, an investment bank, who monitored the meeting in the OPEC press room.

Ms. Croft speculated that Russia might be “slow-walking” on cuts, though she figures that Moscow will come around in time.

Still, the fact that meetings did occur, and the prospect that further cuts might be on the way, was enough to at least temporarily halt what had been a steep fall in oil prices since the outbreak of the coronavirus, which has now killed more than 600 people in China. Brent crude, the international benchmark which exceeded $70 a barrel in early January, was trading at about $55 a barrel on Friday.

In an interview, Bjornar Tonhaugen, head of oil market research at Rystad Energy, a research firm, said the 600,000-barrel-a-day cut being discussed was “quite a reasonable number.”

Updated Feb. 10, 2020

What is a Coronavirus? It is a novel virus named for the crown-like spikes that protrude from its surface. The coronavirus can infect both animals and people, and can cause a range of respiratory illnesses from the common cold to more dangerous conditions like Severe Acute Respiratory Syndrome, or SARS.

How contagious is the virus? According to preliminary research, it seems moderately infectious, similar to SARS, and is possibly transmitted through the air. Scientists have estimated that each infected person could spread it to somewhere between 1.5 and 3.5 people without effective containment measures.

How worried should I be? While the virus is a serious public health concern, the risk to most people outside China remains very low, and seasonal flu is a more immediate threat.

Who is working to contain the virus? World Health Organization officials have praised China’s aggressive response to the virus by closing transportation, schools and markets. This week, a team of experts from the W.H.O. arrived in Beijing to offer assistance.

What if I’m traveling? The United States and Australia are temporarily denying entry to noncitizens who recently traveled to China and several airlines have canceled flights.

How do I keep myself and others safe? Washing your hands frequently is the most important thing you can do, along with staying at home when you’re sick.

As OPEC ponders what to do, it faces a difficult calculation. The degree of impact that the coronavirus outbreak will have on demand for oil is not yet known, though it is expected to be substantial. Several Chinese cities have been seemingly shut down, with some factories idled and flights canceled.

The curtailment of economic activity will result in a major reduction of energy consumption — a huge concern for OPEC because China is the world’s largest energy importer and a key customer. Wood Mackenzie, a market research firm, figures that oil demand for the first three months of this year will be slashed by about 900,000 barrels a day, or nearly 1 percent of global consumption.

The effects of reduced energy use are already being seen in the market for liquefied natural gas, a chilled fuel used in industry and power generation.

Rystad Energy estimates that Chinese imports of liquefied natural gas fell 10 percent in January from a year earlier. Analysts say that with customers not needing as much fuel as they thought, Chinese buyers are trying to stop or reschedule shipments with some of them going to the extreme option of declaring force majeure — a legal term for unforeseen circumstances that invalidate a contract.

Total, the French oil company, said it had recently rejected a force majeure claim by a Chinese buyer of liquefied natural gas. Analysts say the situation is likely to worsen, as vessels laden with gas are forced to go elsewhere — all while the liquefied natural gas market is already amply supplied and prices are at rock bottom.

“There is clearly a major issue in China with its ability to take L.N.G.,” said Frank Harris, head of liquefied natural gas consulting at Wood Mackenzie.

In the oil market, there are offsetting factors. The output of the Libyan oil industry is down by about one million barrels a day, or about 1 percent of world demand, because of political turmoil. While it is widely assumed that Libyan oil will come back on the market soon, no one is certain when that will be.

With the oil industry just beginning to come to terms with the implications of the coronavirus, there is an argument for waiting until the next OPEC meeting, scheduled for early March, to make decisions.

“I don’t know why the urgency,” said Bill Farren-Price, director of intelligence at RS Energy group, a market research firm. “It looks slightly panicky to me.”

Whether the split between Russia and the Saudis will widen will become clear only over time, but some analysts say Russia has good reason to continue to coordinate policy with OPEC.

Analysts say Mr. Putin benefits from playing along with the Saudis. Working with OPEC gives Russia a seat at the table at which many of the world’s largest oil producers negotiate output decisions that have an impact on prices.

Ties to the Saudis also fit with Mr. Putin’s efforts to expand Russia’s influence in the Middle East, in countries like Syria and Iraq, as well as in Libya. A web of business relationships is forming between Russian companies and Riyadh and its allies like Abu Dhabi, where Lukoil recently became the first Russian firm to gain participation in natural gas production.

The Russians “seem to be content to be part of this coalition and maintain this political role even if their implementation of cuts is very limited,” Mr. Farren-Price said.

from WordPress https://mastcomm.com/business/saudi-russian-alliance-is-strained-as-coronavirus-saps-demand-for-oil/

0 notes

Text

Eight+ Things to Read About China and Other Things, Part 5

This is part 5 of our series on eight+ things to read about China and a lot more. We constantly get emails from readers asking what to read on China and all sorts of things related and even barely related to China and this series is intended to constantly and consistently answer these questions.

As I said in our initial post on this, our plan is to list out eight (or so) articles we benefitted from reading and think you our readers would also benefit from reading, along with a very brief explanation why the particular article was included. More specifically:

The articles will likely include many on China and on Asia and a few on international trade, international politics, Spain and Latin America, economics and really just anything else we believe might benefit our readers or even that we just want people to read. We do not plan to choose articles that push our or any other political agenda or any other agenda for that matter, but having said that, we are not objective and our views may creep through. Our goal though is to focus on articles that are important or helpful or — most importantly — that make you think. Our posting of an article will NOT mean we agree with all of it or even any of it. Most of the articles will be from the week preceding the post but we will also sometimes throw in older articles (classics if you will) as well.

Please do not hesitate to comment at the end of this or any other post. We cannot tell you how much we appreciate your comments, good, bad and indifferent.

Here we go, in absolutely no particular order.

1. Hong Kong Is on the Frontlines of a Global Battle For Freedom. Time Magazine. Because it is and because the war between freedom and authoritarianism is a never-ending one and because this article fairly and accurately summarizes the issues. Because the world needs to know what is happening in the Sudan and the U.S. media has utterly failed to cover this story. Because China and Russia are helping to prop up the dictatorial regime there. See also Ivan Golunov’s Russian release: Why this case matters if you want further proof that even authoritarian regimes

2. China Is Bluffing in the Trade War: Chinese leaders say they can effectively retaliate against Trump’s tariffs. They’re wrong. Foreign Policy. Because “the simple fact is that China needs the United States more than the United States needs China. In itself, that’s no reason to start a trade war. But if the trade war really does heat up, there’s little doubt who will win.” See also The price of apples is soaring in China, and Beijing is showing concern.

3. Saudi Teen Faces Death Sentence for Acts When He Was Ten. New York Times. What kind of country would execute a teenager for having attended a political rally at the age of ten?

4. Kalamazoo Central high school performs “My Shot” from “Hamilton” at graduation. 105.3fm. Because this is my high school and because the video has gone viral (well over 100,000 views so far) and because it is an urban high school that has a long history of struggles but also a long history of successes. See Obama at Kalamazoo Central High School: How did it win the honor? Because it is, in many ways, a microcosm of race in America. See A Flashback to Kalamazoo, Summer of 1967.

5. If Trump Wants to Take On China, He Needs Allies. And He Should Start with Europe. New York Times. Because we may be heading towards a bi-polar world divided between the United States and China and Europe likely will side with the United States. Because I like having allies and I see big differences between countries like Spain, France, Germany, Poland, Japan, Vietnam, Thailand, Mexico, Canada, Chile, Colombia, Kenya, Ghana, Nigeria, South Africa, Israel, New Zealand, Denmark, Morocco, Rwanda, and Australia on the one hand and countries like Russia, North Korea, Iran and China on the other hand and it is not clear to me that President Trump sees such distinctions.

6. A $100M Bet That Online Coaching Can Make a Better Manager. Wired Magazine. See also Delta saves 41 stranded students with a private flight after American Airlines cancels trip. Fox. Because as my law firm continues to grow (we’ve doubled in size in the last two years) I’m becoming ever more convinced that employee happiness correlates with client satisfaction. Because Jeff Bezos always says that “the number one thing is to be customer obsessed; figure out how to delight them” and in the law business, a delighted (not just satisfied) client is a lifetime referral source. Yet law firms are notoriously bad (compared to other industries) at customer satisfaction.

7. Rage Rooms are all the rage. NBC. Because they are. Because after walking past an axe-throwing establishment in my eldest daughter’s neighborhood I realized the apocalypse is upon us and when my daughter then told me about rage rooms, I became even more certain that the world as we know it will soon be no more.

9. Russian Doll: How Female Mentors Helped Natasha Lyonne Tell Her Story. Vanity Fair. Because Russian Doll is unique and very good and because Natasha Lyonne is uber-talented.

10. The official candy bar power rankings. LA Times. Because it matters. Because one of the ways we would divide teams for pick-up basketball games while I was in high school was between those who liked Heath bars and those who didn’t — I’m not kidding on this. Because I still think of one of my best friends from my hometown (see above) every time I see a . Reese’s Peanut Butter Cup because that was all he would buy.

11. The Secrets of Food Marketing. YouTube. This video has nearly 10 million views and there is a reason for that; the power of willful ignorance can never be underestimated. It really is quite fascinating. See also Cocoa’s child laborers.

Your thoughts?

Eight+ Things to Read About China and Other Things, Part 5 syndicated from https://immigrationattorneyto.wordpress.com/

0 notes

Text

New Post has been published on All about business online

New Post has been published on http://yaroreviews.info/2018/12/world-stocks-and-oil-try-to-scrabble-higher-after-plunge

World stocks and oil try to scrabble higher after plunge

LONDON (Reuters) – Global fairness & crude oil markets attempted on Wednesday to claw their way out of a three-day long plunge that saw investors seek out the safety of bonds amid mounting pessimism over world growth.

FILE PHOTO: Men look at stock quotation boards external a brokerage in Tokyo, Japan, December 5, 2018. REUTERS/Issei Kato

Oil’s spectacular fall – down nearly 10 percent since final Thursday – & world stocks’ plunge to 19-month lows have spurred speculation the U.S. Federal Reserve might be done with tightening after its policy assembly after in the day.

While Brent crude inched up 0.5 percent to $56.5 a barrel after plunging 6 percent overnight, its 35 percent fall since October is sending a disinflationary pulse through the world just as trade & profitable activity are cooling LCoc1.

The latest jolt on the growth front came from Japan which said its export growth slowed to a crawl in November, an ominous sign for the trade-focused economy.

And on Tuesday, logistics & delivery firm FedEx, considered a bellwether for the world economy, slashed its 2019 forecasts, noting “ongoing deceleration” in global growth.

European shares rose 0.3 percent & MSCI’s global fairness index firmed a touch, though it has fallen 6 percent since the start of this month .MIWD00000PUS, given the fragile nature of the Sino-U.S. tariff truce & signs that company earnings worldwide are slowing.

While fairness futures sign a stronger opening on Wall Street, U.S. stocks are set for their worst December since 1931, the depths of the Great Depression. tmsnrt.rs/2A3z5ML

“It’s a confluence of several meaningful factors: the market is adjusting its outlook on growth & there is a consensus we will see a slowdown. More importantly, the market is adjusting to the idea this will translate into lower earnings growth,” said Norman Villamin, chief investment officer for private banking at Union Bancaire Privee in Zurich.

“It’s being complicated by the tightening liquidity situation with the Fed expected to move nowadays & the ECB having signaled the end of its (stimulus)”.

Futures <0#FF:> are sticking with a two-in-three chance of a rate rise on Wednesday & Villamin expects the Fed to move twice in 2019. That’s a more hawkish call than the broader market which is pricing less than one rise in 2019, down from three not long back.

The expectations of a Fed pause & the fairness selloff sent 10-year Treasury yields to the lowest since August at 2.799 percent US10YT=RR – down 20 basis points in December – while two-year yields US2YT=RR touched a three-month trough of 2.629 percent, sliding from November’s 2.977 percent peak.

Yields in Japan & Australia in addition reached multi-month lows.

Reasons for the bond rally were effortless to find. Bank of America Merrill Lynch’s closely watched monthly survey found more than half of its participants now flagging a global profitable slowdown next year. It in addition showed the third biggest decline in inflation expectations on record.

The poll in addition revealed the largest ever one-month rotation into fixed-income assets, their gains coming at the expense of equities.

The steep drop in Treasury yields undermined one of the U.S. dollar’s major props & pulled its index back 0.3 percent to 96.8 .DXY, from a recent top of 97.711.

Against the yen, the dollar fell 0.15 percent to 112.37 yen JPY=, while the euro nudged up to $1.1383 EUR= from a $1.1266 low.

Villamin of UBP said that while uncertainty had grown approximately the Fed’s rate rise path, other currencies from the yen to the euro still lacked interest rate support.

“Why the dollar won’t be too weak is that the alternatives are not attractive,” he said. “The only real appealing currency out there is the dollar … we think dollar strength will stay another 3-6 months.”

U.S. futures pointed to a firmer Wall Street opening ESc1.

The bright spot on world markets is Italy where bond yields continued their fall after Rome struck a deal with the EU Commission over its contentious 2019 budget, signaling an end to weeks of wrangling.

The Italian/German 10-year bond yield gap – a degree of Italian risk – narrowed to around 255 bps, the tightest since late September DE10IT10=RR. That spread had been over 300 bps as recently as end-November.

“Everyone was expecting an agreement to be reached, yet many people were expecting this to come in Q1 or Q2 next year,” said Commerzbank rates strategist Michael Leister.

“With risk sentiment stabilizing this morning, it looks like the momentum can increase in Italian bonds.”

Additional reporting by Wayne Cole in Sydney & Dhara Ranasinghe in London; Editing by Andrew Heavens

Our Standards:The Thomson Reuters Trust Principles.

#affiiate marketing#article marketing#business online#businessNews#internet marketing#make money online#mobile marketing#video marketing#web marketing

0 notes

Text

Accelerate Your Trading with Instant Funding from a Prop Firm

In the trading world, securing capital is often a big hurdle. Whether you're an experienced trader or a beginner, access to sufficient funds is crucial to execute your strategy and grow your trading business. This is where instant funding prop firm in australia comes into play, providing a quick and efficient way to get the funds you need without the lengthy approval process that typically accompanies traditional funding sources.

What is Prop Corporate Finance?

A prop firm is a company that provides capital to traders, allowing them to trade using the company's funds rather than their own funds. In exchange for funding, traders share a portion of their profits with the company.

Instant Lending Through Prop Companies: A Quick Solution

Traditionally, getting funding from a prop company took weeks and involved multiple applications, interviews, and assessments. But with the advent of instant funding prop firm in Australia, traders can now access funds quickly, often within hours or days.

Fast Application Process

The first big advantage of ApexTraderFunding is that the application process is simplified and fast. Many companies have streamlined their onboarding process, allowing merchants to submit their application online and receive approval within hours.

No Personal Capital Required

One of the biggest advantages of funding for traders in australia is that you don't need your own capital to start trading. This opens up opportunities for traders who don't have the capital to trade independently, but have the skills and knowledge to succeed in the market. With an instant funding prop firm in australia, you can get started right away.

Flexible Loan Amounts

Funded trading accounts in australia often offer flexible loan options to suit traders with different risk appetites and goals. Depending on your experience and trading track record, you may be eligible to receive different funding amounts. Whether you are looking for a small amount of capital to test your strategy or a large amount to make a large deal, ApexTraderFunding will give you the flexibility you need.

Profit Sharing Without Hidden Fees: With an instant funding prop firm in australia, you can focus on making a profit without worrying about hidden fees or high-interest rates. Most companies offer a transparent profit-sharing model where you receive a large portion of the profits from your deal.

No Personal Guarantee Required

Unlike traditional loans or lines of credit, ApexTraderFunding does not require a personal guarantee. Traders are not personally liable for losses, which significantly reduces financial risk compared to traditional lending methods.

Ongoing Support

Many prop firms offer ongoing support, including training, resources, and risk management tools to help you succeed.

Why Choose Instant Prop Firm Funding?

The quick and easy access to funds that ApexTraderFunding offers is one of the most compelling reasons why traders turn to this prop firm. Additionally, the flexibility and ease of getting started make the fundedtrader in australia ideal for both novice traders and experienced professionals.

When choosing a prop company, it is important to focus on the best online trading platforms in australia or the best trading platform in australia. The tools and resources the company offers will make a big difference in your trading success. Look for a company that offers a reliable, easy-to-use, and well-equipped stock trading platforms in australia for professional traders.

Conclusion:

If you are a trader looking to step up your game and access funds without the usual hurdles, a prop company with instant funding in Australia will be a game changer. With fast approval, no capital required, and flexible funding options, it is the perfect solution to accelerate your trading career. Seize the opportunity to trade with confidence and realize your full potential with the funded trader in australia or thefundedtrader in australia.

#funding for traders in australia#the funded trader in australia#apex trader funding in australia#thefundedtrader in australia#funded trading accounts in australia#instant funding prop firm in australia#the fundedtrader in australia#best online trading platforms in australia#best trading platform in australia#stock trading platforms in australia

0 notes