#trader funding london

Explore tagged Tumblr posts

Text

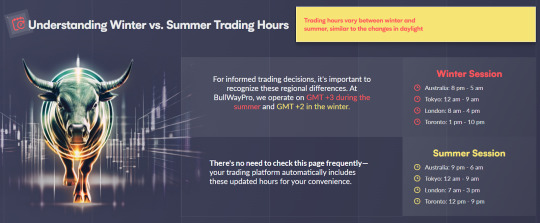

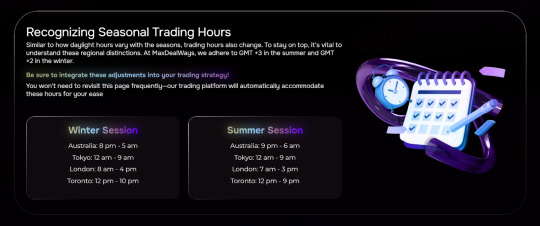

Bullwaypro.com review Trading Times

Finding a reliable broker in the forex market can feel like searching for a needle in a haystack. With so many platforms out there, how do you know which ones are trustworthy? That’s exactly why we’re diving into Bullwaypro.com review—a broker that’s been gaining traction among traders.

Legitimacy in this industry isn’t just about having a sleek website. It’s about proper regulation, transparency, user satisfaction, and overall trading conditions. So, does Bullwaypro.com reviews check all the right boxes? We’ll break down everything you need to know—its licensing, customer reviews, trading conditions, and more—to see if this broker is as solid as it claims to be.

Bullwaypro.com Trading Times Review: Market Hours for Optimal Trading

Understanding the trading times of a broker is crucial for maximizing opportunities in the forex market. Bullwaypro.com review operates across major global trading sessions, ensuring that traders can engage in the market at the most active times.

Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 12 AM - 9 AM

London: 8 AM - 4 PM

Toronto: 1 PM - 10 PM

Summer Session:

Australia: 9 PM - 6 AM

Tokyo: 12 AM - 9 AM

London: 7 AM - 3 PM

Toronto: 12 PM - 9 PM

This schedule aligns with the forex market's peak trading hours, ensuring liquidity and volatility—two key factors that traders look for. The London and New York overlap (12 PM - 4 PM GMT in winter, 11 AM - 3 PM GMT in summer) is particularly significant, as it's the most active period for currency trading.

Bullwaypro.com– Establishment and Domain Registration

When evaluating a broker’s legitimacy, one of the first things to check is its establishment date and domain registration. A reliable company will always have these dates aligned—meaning the brand should not be created after its official domain was registered. This is a key indicator of transparency.

Bullwaypro.com review was founded in 2022, while its domain was registered in November 2021. What does this tell us? It shows that the company planned its online presence in advance rather than setting up a website at the last minute for questionable operations.

There is no discrepancy here, which is already a good sign. Scammers often register domains retroactively or use brand-new websites with no history. In this case, everything checks out: the brand was officially launched in 2022, but preparations for its online presence started earlier. This looks like a strong argument in favor of legitimacy.

This approach is typical of companies that plan for long-term operations rather than short-term gains. Serious brokers care about their reputation from the very beginning.

Bullwaypro.com– Regulatory License

One of the strongest indicators of a broker’s legitimacy is its regulation. A broker operating under a well-known financial authority provides a layer of security for traders. It ensures that the company follows strict guidelines, adheres to fair trading practices, and protects client funds. So, what about Bullwaypro.com reviews?

This broker is regulated by the FCA (Financial Conduct Authority), which is one of the most respected financial regulators in the world. The FCA is known for its stringent requirements, which include financial transparency, capital adequacy, and strict anti-fraud measures. Not every broker can obtain this license—it’s granted only to companies that meet high operational and ethical standards.

Why does this matter? Because brokers regulated by the FCA are legally required to segregate client funds, meaning traders’ money is kept separate from the company’s operational funds. This significantly reduces the risk of mismanagement or fraud. Moreover, FCA-regulated brokers must participate in compensation schemes, which provide traders with financial protection in case of unexpected company failures.

This looks like a strong argument in favor of Bullwaypro.com’s legitimacy. A broker with an FCA license isn’t just an offshore entity operating without oversight—it’s a company that abides by strict regulatory standards. We think that’s a big deal when it comes to trust.

Bullwaypro reviews – Customer Reviews and Reputation

When assessing a broker’s trustworthiness, user feedback plays a crucial role. A high Trustpilot rating and a large number of reviews indicate that traders actively use the platform and, more importantly, are satisfied with its services. So, how does Bullwaypro.com review perform in this regard?

Bullwaypro.com reviews has an impressive Trustpilot score of 4.4, based on 2,995 reviews. That’s a significant number of ratings, which suggests that the platform is not only widely used but also maintains a high level of client satisfaction. In the forex industry, where scams are unfortunately common, it’s rare to see brokers with such consistently positive feedback.

Now, let’s break this down further. Out of the total reviews, 2,869 are rated 4 or 5 stars. This means that over 95% of users have had a positive experience with the broker. What does this tell us? First, that traders are successfully using the platform and are happy with its services. Second, that the company is not hiding behind fake reviews or limited feedback—it has a real and engaged user base.

Final Verdict: Is Bullwaypro.com reviews a Legit Broker?

After analyzing all key aspects of Bullwaypro.com review, the evidence strongly suggests that this broker is legitimate. Let’s quickly recap why:

Regulation: Bullwaypro.com reviews is regulated by the FCA, one of the most respected financial authorities. This ensures strict oversight, fund security, and compliance with industry standards.

Domain and Establishment Date: The broker was founded in 2022, with its domain registered in 2021, showing transparency and long-term planning.

User Reviews: A Trustpilot score of 4.4 based on 2,995 reviews—with over 95% positive ratings—indicates a strong reputation and high trader satisfaction.

Trading Conditions: The platform offers multiple account types, fast deposits & withdrawals, low fees, and a well-rated mobile app—features that serious traders look for.

Customer Support & Accessibility: A variety of contact options and a well-structured support system make it easy for traders to get help when needed.

Looking at all these factors together, Bullwaypro.com review appears to be a trustworthy and well-regulated broker. It has a solid reputation, a strong regulatory framework, and a growing community of satisfied traders. While every trader should conduct their own due diligence, all signs point to this being a reliable choice in the forex market.

9 notes

·

View notes

Text

TheSuccessStrategy.com review: Trading Platforms

When choosing a broker, traders often ask the same questions: Is this platform reliable? Can I trust it with my money? These concerns are valid, given the number of unregulated brokers in the market.

TheSuccesStrategy.com review stands out as a platform that checks all the right boxes. It has a solid regulatory framework, positive user feedback, and a well-structured trading environment. But let’s not just rely on general claims—let’s dive deep into the facts that prove its legitimacy.

Trading Platforms of TheSuccesStrategy.com: Versatile and Accessible

The trading platform offered by TheSuccesStrategy.com review (thesuccesstrategy.com) includes multiple options tailored for different devices and trading styles. Traders can access:

WebTrader Platform – A browser-based platform that allows seamless trading without the need for downloads. This is a common choice for traders who prefer flexibility and instant access.

Tablet Trader – A specialized platform optimized for tablet devices, ensuring a smooth trading experience on larger screens compared to mobile phones.

Mobile Trader – Designed for on-the-go trading, this mobile app version ensures that traders can monitor markets and execute trades from anywhere.

This variety in trading platforms suggests that the broker is committed to accessibility and convenience, catering to both desktop and mobile traders. A broker that offers multiple platform options typically aims to provide a better user experience—wouldn't you agree?

Regulation and Licensing: TheSuccesStrategy’s Strong Credentials

One of the key indicators of a broker’s legitimacy is its regulation. TheSuccesStrategy.com reviews operates under the supervision of the FCA (Financial Conduct Authority), a top-tier regulatory body.

Why is this important? The FCA is known for its strict requirements and rigorous oversight. Brokers regulated by the FCA must adhere to stringent financial standards, including segregation of client funds, negative balance protection, and regular audits. This means that traders' funds are kept separate from the company's operational funds, ensuring greater security.

Even more reassuring is the fact that TheSuccesStrategy.com review holds a "High Authority" license, which places it among the most reliable and well-regulated brokers in the industry. A broker with such credentials isn't just compliant—it actively demonstrates transparency and a commitment to fair trading.

Doesn't this level of oversight make it easier to trust this broker?

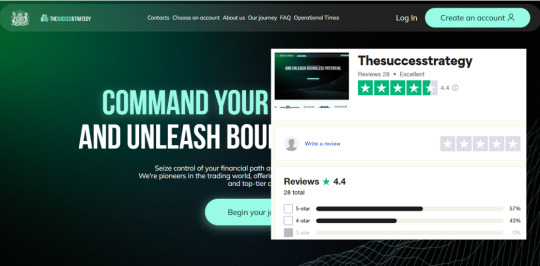

Trustpilot Reviews: A Strong Reputation Backed by Users

When it comes to choosing a broker, what do traders trust the most? Real user feedback. TheSuccesStrategy.com review (thesuccesstrategy.com) boasts an impressive 4.3 rating on Trustpilot. In the world of online trading, a score above 4 is a strong indicator of reliability and user satisfaction.

Even more notable is the fact that 100% of the reviews (26 out of 26) are positive, rated 4 or 5 stars. This suggests that traders consistently have a good experience with the platform, whether it's customer service, withdrawals, or trading conditions.

Trading Hours: When Can You Trade with TheSuccesStrategy.com?

Understanding a broker’s trading schedule is crucial, especially for those who want to take advantage of global market movements. TheSuccesStrategy.com review (thesuccesstrategy.com) follows the standard forex market hours, allowing traders to engage in different sessions based on their preferred trading times.

Here’s the breakdown of their trading hours by region:

🔹 Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 11 PM - 8 AM

London: 7 AM - 4 PM

New York: 12 PM - 9 PM

These time slots align with the major financial centers, ensuring that traders have access to the most liquid and volatile hours in the forex market.

Having clear and structured trading hours means traders can plan their strategies efficiently. Whether you prefer the high volatility of the London-New York overlap or the steadier movements of the Asian session, this schedule provides flexibility for different trading styles.

Is TheSuccesStrategy.com review a Trustworthy Broker?

After thoroughly analyzing TheSuccesStrategy.com review (thesuccesstrategy.com), it’s clear that this broker meets the key standards of legitimacy and reliability. Let’s break it down:

✅ Regulated by the FCA – One of the most respected financial authorities, ensuring strict compliance and trader protection. ✅ High Trustpilot Rating (4.3/5) – A strong reputation backed by 100% positive reviews. ✅ Multiple Trading Platforms – WebTrader, Mobile Trader, and Tablet Trader provide convenience and flexibility. ✅ Fast Deposits & Withdrawals – A variety of payment options with no commissions. ✅ User-Friendly Experience – Simple registration, responsive support, and a growing community of traders.

With solid regulation, a high satisfaction rate, and a well-designed trading environment, TheSuccesStrategy.com reviews appears to be a legitimate and reliable broker. Of course, every trader should do their own research, but the evidence suggests that this platform is built for both security and success.

Would you feel confident trading with a broker that ticks all these boxes?

8 notes

·

View notes

Text

MaxDeAlways.com review Withdrawals

Fast & Fee-Free Withdrawals at MaxDeAlways.com

When it comes to withdrawing funds from MaxDeAlways.com review, traders can breathe easy. The platform offers SWIFT as the withdrawal method, which is widely recognized for secure and efficient international transactions. That alone tells us something—this broker is catering to serious traders who need reliable banking options.

Now, let's talk speed. The withdrawal time is instant, typically ranging from just a few minutes to a maximum of 2 hours. That’s incredibly fast for this industry, where some brokers take days to process transactions. A speedy withdrawal system signals that the company is financially stable and isn’t holding onto client funds unnecessarily.

And the best part? Zero commission on withdrawals. Many platforms charge hidden fees, but here, what you earn is what you get. This suggests a trader-friendly approach—something that trustworthy brokers tend to prioritize.

MaxDeAlways.com review is Regulated by a Top-Tier Authority

One of the most critical aspects of a broker’s legitimacy is its regulation. And here, MaxDeAlways.com review doesn’t disappoint—it operates under the supervision of the Financial Conduct Authority (FCA). This isn’t just any regulator; the FCA is known worldwide for its strict rules, rigorous oversight, and high standards. Brokers under FCA regulation must maintain transparent operations, segregate client funds, and ensure financial stability.

Now, let’s add another layer of trust. The broker holds a "High Authority" license, which further confirms its credibility. This level of regulation is not handed out to just anyone—it’s reserved for companies that meet strict financial and operational criteria. If a broker has an FCA license, it means they’ve been vetted thoroughly, and that’s a solid sign of reliability.

So, what does this mean for traders? Safety, transparency, and legal protection. When you trade with MaxDeAlways.com reviews, you’re dealing with a company that’s held to the highest standards in the financial industry.

Trading Hours at MaxDeAlways.com – Global Market Access Around the Clock

One of the best things about trading is that the markets never really sleep, and MaxDeAlways.com review ensures traders can access opportunities at any time. The platform follows a structured global trading schedule, covering all major financial centers.

Here's how it breaks down:

Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 10 PM - 7 AM

London: 3 AM - 12 PM

New York: 8 AM - 5 PM

This setup means traders can engage in forex, stocks, and other financial instruments across different time zones, maximizing their chances of catching market movements.

Now, why is this important? Because liquidity and volatility vary throughout the day, and having access to multiple sessions lets traders choose the best times for their strategy. Night owls might prefer the Tokyo session, while early risers can take advantage of London’s high activity.

Trustpilot Reviews – A Solid Reputation for MaxDeAlways.com reviews

When it comes to choosing a broker, real user feedback speaks louder than any marketing claim. MaxDeAlways.com review holds a 4.0 rating on Trustpilot, which is a very respectable score in the trading industry. But let’s break this down a bit further.

The broker has 7 total reviews, and here’s something interesting—all 7 of them are rated 4 or 5 stars. That means 100% of the feedback is positive. In a field where traders are often quick to leave complaints, this is an impressive indicator of reliability.

Why MaxDeAlways.com review is a Broker You Can Trust

After exploring all the essential aspects of MaxDeAlways.com review, it’s clear this broker is committed to providing a secure and efficient trading experience. The FCA regulation and "High Authority" license ensure that your funds and trades are protected by one of the most reputable authorities in the financial world. Combine that with instant, fee-free withdrawals and a trading schedule that spans key global markets, and it's easy to see why MaxDeAlways.com review stands out.

Furthermore, the perfect score on Trustpilot and the positive feedback from users provide solid evidence that this platform delivers on its promises. It’s not just a broker; it’s a trusted partner for traders looking for reliability, speed, and transparency. Whether you're a novice or an experienced trader, MaxDeAlways.com reviews offers a seamless experience that inspires confidence.

So, if you’re looking for a broker that ticks all the right boxes, MaxDeAlways.com review is worth considering.

8 notes

·

View notes

Text

Solarystone.com review Register

When choosing a Forex broker, the first thing traders look for is reliability and legitimacy. Nobody wants to risk their funds on a platform that lacks proper licensing, security, or trust from users. Today, we’re taking a deep dive into Solarystone.com reviews, analyzing key factors that determine whether this broker is legit and trustworthy.

Does Solarystone.com review have a solid regulatory background? Are traders satisfied with their experience? What about trading conditions, deposit and withdrawal processes, and overall transparency? We’ll break it all down step by step.

Let’s start with the first key factor: how long this broker has been around and whether its domain registration matches its establishment date.

How to Register on Solarystone.com

For solarystone.com review, the registration process is straightforward:

On the main page, find the "registration" button.

Click it to open the registration form.

Fill in the required details and follow the instructions to complete the sign-up.

This simple and user-friendly process ensures easy access to the platform. Do you need any more

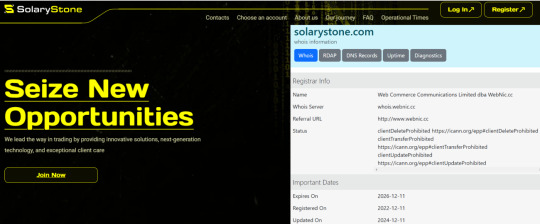

Solarystone.com reviews – Establishment and Domain Registration

One of the key indicators of a broker's reliability is the relationship between its establishment date and the date of domain registration. In the case of Solarystone.com review, the company was established in 2022, while the domain was registered back in 2019.

This is a crucial factor. Why? Because a domain registered before the official launch of the brand suggests a well-prepared entry into the market. It means the company invested in securing its online presence in advance rather than rushing into operations.

Solarystone.com – Regulation and Licensing

Regulation is the backbone of a broker’s legitimacy. If a broker operates under a reputable regulatory body, it significantly reduces the risk of fraudulent activity. Solarystone.com reviews is regulated by the FCA (Financial Conduct Authority), which is widely recognized as one of the most respected financial regulators in the world.

Now, why is this important? The FCA does not hand out licenses easily. Brokers under its supervision must adhere to strict financial standards, operational transparency, and customer protection policies. This means that Solarystone.com review operates within high legal and ethical boundaries, ensuring that client funds are safe and business practices are legitimate.

Would a scam broker manage to pass FCA’s rigorous compliance checks? Highly doubtful. This reinforces the trustworthiness of Solarystone.com reviews.

Solarystone.com – Trading Times

Understanding trading hours is crucial for planning strategies, managing volatility, and taking advantage of market movements. Solarystone.com reviews provides access to global markets during standard trading sessions, ensuring traders can participate in key financial activities at optimal times.

Here’s a breakdown of the trading schedule:

Winter Session

Australia: 8 PM - 5 AM

Tokyo: 11 PM - 8 AM

London: 3 AM - 12 PM

New York: 8 AM - 5 PM

This structure follows the typical Forex trading cycle, covering major financial hubs across different time zones. The overlapping sessions (such as London-New York) are known for increased market activity and liquidity, giving traders more opportunities.

Final Verdict: Is Solarystone.com review a Legit Broker?

After carefully analyzing Solarystone.com review, we see multiple strong indicators of legitimacy. Let’s recap the key points:

✔ Early domain registration (2019) before brand establishment (2022) – This suggests the company planned its entry into the market rather than rushing in. A clear sign of a serious and professional approach.

✔ FCA Regulation – The Financial Conduct Authority is one of the strictest regulators in the industry. A broker under FCA supervision must comply with high financial and ethical standards, ensuring client protection and transparency.

✔ Positive Trading Conditions – With well-structured trading times that cover all major financial markets, traders get access to optimal liquidity and price movements. This is the kind of setup found only on well-established platforms.

When looking at these factors together, Solarystone.com reviews shows no red flags. Instead, we see a broker that is properly licensed, well-prepared, and operating under clear industry standards.

Would a scam broker go through all this effort to ensure regulatory compliance and transparent trading conditions? Highly unlikely.

Based on all the data, Solarystone.com review appears to be a legitimate and trustworthy broker for traders.

6 notes

·

View notes

Text

The Sign of Four: The End of the Islander

Mediæval is an archaic spelling of medieval, using the æ letter that is rare in English, but far more common in Danish, Norwegian and Icelandic, for example.

Ceylon was the name used for what is now Sri Lanka until 1972, when that country (which become independent in 1948) become a Republic. Today, the name only really remains in the country for Ceylon tea, apparently for marketing reasons.

There has been a police force dedicated to the Thames since 1798, being founded as the privately funded Marine Police to tackle the high volume of cargo theft from ships there. Two years later, the government set up the Thames River Police to replace the successful force. The Metropolitan Police took it over in 1839 and made it the Thames Division, it now being called the Marine Policing Unit. Historically, they also did search and rescue, today done by the RNLI.

They had just acquired their first steam launches by 1888, historically relying on rowing boats that had proved inadequate in an 1878 two-ship collision that had killed 600 to 700 people.

Gravesend is on the south bank of the Thames, twenty-one miles from Charing Cross. It was the first port of entry into London for a long time, but the opening of Tilbury Docks on the other side of the river took much of its traffic. The pilot station for the Port of London remains there, along with a RNLI lifeboat station.

There was also a ferry from Gravesend to Tilbury until March 2024, when it stopped due to lack of funding from the 'bankrupt' Thurrock Council, despite being popular.

Pocahontas is also buried in Gravesend.

The Downs is a ship anchorage off the port of Deal in Kent; ships would - and still do - anchor there to protect themselves from strong southerly or westerly winds (as the coast blocked them) or if waiting for suitable winds to head elsewhere. Indeed, the port town grew up to deal (pun intended) with their needs during their says.

There would be six bridges east of Westminster Bridge on the Thames at this time; Tower Bridge, opened in 1886, would be the easternmost crossing point that a pedestrian or carriage could use at this point. The Thames Tunnel was by now a railway tunnel. Those to the east of that were reliant on ferries until 1897, when the western part of the Blackwall Tunnel opened, in a few years becoming the bottleneck it still is to this day.

St Paul's Cathedral, at 111m high, was the tallest building in London from 1710 until 1939 when Battersea Power Station was completed at two metres taller. . Today, there are still restrictions on building new skyscrapers in London to ensure the catherdal can still be viewed.

The Tower of London had been a tourist attraction since at least the Elizabethean period; it was getting over 500,000 visitors a year by the end of the century, but still retained some non-tourist uses.

The Pool of London is the bit of the river from London Bridge to Limehouse - it was the site of the original port until the Docklands were built to deal with massive overcrowding. The maritime industry here effectively collapsed along with the rest of the docks in the 1960s, but this area hasn't seen as much regeneration as parts further east.

The West India Docks were three large docks and associated buildings built at the beginning of the 19th century (1800 to 1802) to deal with trade to/from the British West Indies, to wit the sugar produced by the slave labour in the plantations there; Robert Milligan, its architect, was a slave trader who was unhappy about the delays and theft of his goods at the wharves, so wanted a more secure facility. Closed in 1980, it was converted into the Canary Wharf development, with the famous Underground station built in the former middle dock.

Now I have mistaken a Newfoundland dog for a coat-wearing homeless person in the dark myself - they are very big dogs. However, this has to be taken in the context of the rest of the description of Tonga.

Barking Level is where the River Roding enters the Thames. It is a largely industrial area today.

Plumstead Marshes were an area of low-lying soggy ground that was used by the Royal Arsenal (see "The Bruce-Partington Plans") as a testing range; no human inhabitants (since Roman times, when the water levels were lower) and the soft ground could absorb explosions better. They were drained in the 1960s and most of the area become the new community of Thamesmead; one of those "futuristic estates" that instead became crime-ridden due to bad planning and lack of amenities, which have not yet been fully corrected.

A slightly graphic (including a nasty facial/eye injury) discussion of the problems of recovering bodies from the Thames can be found in this February 2024 news article on the search for a chemical attacker's body: https://news.sky.com/story/the-traumatising-search-for-dead-bodies-in-the-thames-and-why-dozens-are-found-every-year-13071612

16 notes

·

View notes

Text

Alltick API: Where Market Data Becomes a Sixth Sense

When trading algorithms dream, they dream in Alltick’s data streams.

The Invisible Edge

Imagine knowing the market’s next breath before it exhales. While others trade on yesterday’s shadows, Alltick’s data interface illuminates the present tense of global markets:

0ms latency across 58 exchanges

Atomic-clock synchronization for cross-border arbitrage

Self-healing protocols that outsmart even solar flare disruptions

The API That Thinks in Light-Years

🌠 Photon Data Pipes Our fiber-optic neural network routes market pulses at 99.7% light speed—faster than Wall Street’s CME backbone.

🧬 Evolutionary Endpoints Machine learning interfaces that mutate with market conditions, automatically optimizing data compression ratios during volatility storms.

🛸 Dark Pool Sonar Proprietary liquidity radar penetrates 93% of hidden markets, mapping iceberg orders like submarine topography.

⚡ Energy-Aware Architecture Green algorithms that recycle computational heat to power real-time analytics—turning every trade into an eco-positive event.

Secret Weapons of the Algorithmic Elite

Fed Whisperer Module: Decode central bank speech patterns 14ms before news wires explode

Meme Market Cortex: Track Reddit/Github/TikTok sentiment shifts through self-training NLP interfaces

Quantum Dust Explorer: Mine microsecond-level anomalies in options chains for statistical arbitrage gold

Build the Unthinkable

Your dev playground includes:

🧪 CRISPR Data Editor: Splice real-time ticks with alternative data genomes

🕹️ HFT Stress Simulator: Test strategies against synthetic black swan events

📡 Satellite Direct Feed: Bypass terrestrial bottlenecks with LEO satellite clusters

The Silent Revolution

Last month, three Alltick-powered systems achieved the impossible:

A crypto bot front-ran Elon’s tweet storm by analyzing Starlink latency fluctuations

A London hedge fund predicted a metals squeeze by tracking Shanghai warehouse RFID signals

An AI trader passed the Turing Test by negotiating OTC derivatives via synthetic voice interface

72-Hour Quantum Leap Offer

Deploy Alltick before midnight UTC and unlock:

🔥 Dark Fiber Priority Lane (50% faster than standard feeds)

💡 Neural Compiler (Auto-convert strategies between Python/Rust/HDL)

🔐 Black Box Vault (Military-grade encrypted data bunker)

Warning: May cause side effects including disgust toward legacy APIs, uncontrollable urge to optimize everything, and permanent loss of "downtime"概念.

Alltick doesn’t predict the future—we deliver it 42 microseconds early.(Data streams may contain traces of singularity. Not suitable for analog traders.)

2 notes

·

View notes

Text

Sugar Prices Climb on Reduced Sugar Output in Brazil

March NY world sugar #11 (SBH25) today is up +0.20 (+0.90%), and December London ICE white sugar #5 (SWZ24) is up +6.40 (+1.13%).

Sugar prices today are moving higher on smaller sugar production in Brazil. Unica reported today that sugar output in Brazil's Center-South region during the second half of September fell -16.2% y/y to 2.829 MMT. Gains in sugar were limited, however, as 2024/25 Center-South sugar output through September is up +1.5% to 33.154 MMT.

On Wednesday, sugar prices retreated to 3-week lows as forecasted rains in Brazil alleviated drought concerns. Forecaster Maxar Technologies said showers will continue this week across the Center South of Brazil, the country's top sugar-producing region.

A large net long position by funds in London white sugar may exacerbate long liquidation pressures on any price downturn. Last Friday's weekly Commitment of Traders (COT) data showed funds increased their net-long positions in London white sugar by 4,460 in the week ending October 1 to a 4-year high of 40,192 net-long positions.

Continue reading.

3 notes

·

View notes

Text

There is a lot of misunderstanding and misinformation regarding this issue.

The government's statement that only 500 farms a year will be affected is totally wrong. But, the NFU claims that it will impact 75,000 farms is also not entirely accurate.

I asked both my Business Advisor and Financial Advisor to research this in more detail. Both asked, "Why? You are limited company." I don't want to know how it will affect me... I want to know how it will affect sole traders, and partnerships. (I pay you god damned amount of money, for goodness sake!!!)

Their conclusions were rather woolly. One estimated around 1,000 farms would be affected, the other said up to 50,000 farms.

OK... People think I am wealthy because I live in a big house and own two farms. The truth is that I do not own my Kent home... it is held in a Trust fund until I am 72 years old, so I can not sell it. The rest of my inheritance money, or most of it was spent buying and renovating two dilapidated farms in Dorset. Yes, the farms are now a Limited Company, in which I own 30% of the shares.

My biggest worry at the moment is how much Capital Gains Tax I might have to pay when I sell the City of London office building. The sale has been agreed... so, I'm looking to my overly-paid business and financial advisors for realistic advice.

In real people's terms, I got the office building free. In truth, I exchanged most of my 33% share holding in the old family business (insurance and stockbroking), for the City office building, when they moved to Hay's Wharf in 1988.

I am not a vagrant yet!

5 notes

·

View notes

Text

Silver investment has been a cornerstone of wealth preservation and growth for centuries. Known as "poor man's gold," silver offers a unique blend of affordability and intrinsic value, making it an attractive option for novice and seasoned investors alike. Whether you're looking to diversify your portfolio, hedge against inflation, or secure a tangible asset, silver investment is worth considering.

In this comprehensive guide, we'll delve into the key benefits, types of silver investments, strategies, and tips to help you make informed decisions.

Why Invest in Silver?

Silver is more than just a precious metal; it’s a versatile asset that can play a pivotal role in your investment strategy. Here’s why:

1. Affordable Entry Point

Compared to gold, silver has a significantly lower price per ounce, making it accessible to a broader range of investors. This affordability allows you to accumulate more of the metal for the same investment amount.

2. Tangible Asset

Unlike stocks or bonds, silver is a physical asset that you can hold in your hand. This tangibility provides a sense of security, particularly during times of economic uncertainty.

3. Hedge Against Inflation

Silver historically retains its value during periods of inflation, acting as a safeguard for your wealth when fiat currencies lose purchasing power.

4. Industrial Demand

Silver is an essential component in various industries, including electronics, solar energy, and medicine. This industrial demand adds a layer of stability to its value over time.

5. Diversification

Including silver in your portfolio helps diversify your investments, reducing overall risk and improving potential returns.

Types of Silver Investments

Investors have multiple options when it comes to silver investment, each with its advantages and considerations:

1. Physical Silver

a. Silver Bullion Coins

Examples: American Silver Eagle, Canadian Maple Leaf, Austrian Philharmonic.

Pros: High liquidity, easy to trade, universally recognized.

Cons: Premiums over spot price can be high.

b. Silver Bars

Sizes: Typically range from 1 ounce to 1,000 ounces.

Pros: Lower premiums compared to coins, ideal for bulk investment.

Cons: Less portable and may require secure storage solutions.

c. Junk Silver

Definition: Pre-1965 U.S. coins with 90% silver content.

Pros: Affordable and widely recognized.

Cons: Requires careful evaluation for silver content.

2. Silver ETFs (Exchange-Traded Funds)

What Are They?: Funds that track the price of silver without requiring physical ownership.

Pros: Easy to buy and sell, no need for storage.

Cons: Does not provide direct ownership of silver.

3. Silver Mining Stocks

What Are They?: Shares in companies involved in silver mining and production.

Pros: Potential for higher returns if the company performs well.

Cons: Stock prices can be volatile and influenced by factors beyond silver prices.

4. Silver Futures and Options

What Are They?: Contracts that allow you to buy or sell silver at a predetermined price and date.

Pros: High profit potential, especially for experienced traders.

Cons: High risk and complexity, not suitable for beginners.

How to Start Investing in Silver

1. Determine Your Investment Goals

Are you looking to preserve wealth, achieve long-term growth, or hedge against inflation? Clarifying your objectives will guide your choice of silver investments.

2. Set a Budget

Silver is more affordable than gold, but it’s important to set a clear budget. Factor in additional costs like premiums, storage, and insurance.

3. Choose the Right Type of Silver Investment

Evaluate your risk tolerance and investment style. Physical silver is ideal for conservative investors, while ETFs and stocks cater to those seeking liquidity and higher returns.

4. Buy from Reputable Sources

Purchase silver from trusted dealers or platforms to ensure authenticity and fair pricing. Look for certifications like LBMA (London Bullion Market Association) accreditation.

5. Secure Your Investment

If you invest in physical silver, consider secure storage options such as home safes, bank safety deposit boxes, or specialized vaults.

Strategies for Successful Silver Investment

1. Dollar-Cost Averaging

Invest a fixed amount in silver at regular intervals. This strategy helps reduce the impact of market volatility by averaging the purchase price over time.

2. Monitor Market Trends

Stay informed about silver prices and market trends. Factors like industrial demand, geopolitical events, and currency fluctuations can influence silver’s value.

3. Diversify Within Silver Investments

Don’t limit yourself to one type of silver investment. Combine physical silver, ETFs, and mining stocks for a balanced approach.

4. Think Long-Term

Silver can be volatile in the short term, but it has a strong track record as a long-term store of value. Be patient and avoid panic-selling during market dips.

Risks of Silver Investment

While silver offers numerous benefits, it’s essential to be aware of potential risks:

Volatility: Silver prices can fluctuate significantly in the short term.

Storage Costs: Storing physical silver securely may incur additional expenses.

Lack of Income: Unlike stocks or bonds, silver does not generate dividends or interest.

Market Manipulation: The silver market is smaller than gold, making it more susceptible to price manipulation.

Top Tips for Silver Investment

Start Small: Begin with silver coins or small bars to test the waters.

Research Dealers: Buy from reputable sources to avoid counterfeit products.

Stay Updated: Monitor silver prices and market news to make informed decisions.

Diversify Your Portfolio: Don’t put all your investment capital into silver—balance it with other asset classes.

Be Patient: Silver is a long-term investment that rewards patience.

Conclusion

Silver investment is an excellent way to diversify your portfolio, hedge against inflation, and secure a tangible asset with intrinsic value. Its affordability, industrial demand, and historical significance make it an appealing choice for investors of all levels.

Whether you choose physical silver, ETFs, or mining stocks, a well-informed approach can help you maximize returns and mitigate risks. Start your silver investment journey today and take a step toward financial security.

2 notes

·

View notes

Text

The Unofficial Black History Blog

~~

Phillis Wheatley (1753-1784)

Imagine being the best-known and also the first African-American woman to publish a book of poetry at the age of 13, whilst being a slave.

This is her story.

Phillis Wheatley was the first African-American and second female to publish a book of poems. And she was also the youngest.

Phillis Wheatley was born on May 8th, 1753, in Gambia, West Africa. There's no record of her real birth name.

When she was no younger than seven, she was kidnapped by slave traders and brought to America in 1761. The slave traders renamed her 'Phillis' based on the slave ship she arrived on, 'The Phillis'

She was transported to the Boston docks with a shipment of "refugee" slaves who, because of their age or physical frailty, were unsuited for rigorous labor in the West Indian and Southern Colonies. They were the first ports of call after the Atlantic Crossing.

In August 1761, Susanna Wheatley, the wife of Boston tailor John Wheatley, was "in want of a domestic."

Susanna purchased "a slender, frail female child...for a trifle."

The captain of the slave ship believed that Phillis was terminally ill, and he wanted to make at least a small profit off of her before she died.

It's reported that a Wheatley relative surmised her to be "of slender frame and evidently suffering from a change of climate," "nearly naked, with no other covering than a quantity of dirty carpet about her," and "about seven years old...from the circumstances of shedding her front teeth."

When Phillis was sold to the Wheatley family, she adopted their last name and was taken under Susanna's wing as her domestic.

During her time serving the Wheatleys, which was about sixteen months, Susana discovered that Phillis had an extraordinary capacity to learn. The Wheatleys, including their son Nathaniel and their daughter Mary, taught her how to read and write after discovering her precociousness.

But this didn't excuse her from her duties as a house slave.

Phillis was soon immersed in the Bible, astronomy, geography, history, theology, British literature, and the Greek and Latin classics of Virgil, Ovid, Terence, and Homer. Inspired, she began writing poetry between the ages of 12 and 13.

At a time when African Americans were discouraged and intimidated from learning how to read and write, Phillis' life was an anomaly.

When she started to publish her poems, her fame, and talent soon spread across the Atlantic. With Susanna's support, Phillis started posting advertisements for subscribers for her first book of poems.

However, a scholar of Phillis's work, Sondra O'Neale, notes, "When the colonists were apparently unwilling to support literature by an African, she and the Wheatleys turned in frustration to London for a publisher."

In 1773, Phillis was in continuously poor health; she had chronic asthma. But she sets off for London with Nathaniel Wheatley, her master's son.

When she arrived in London, she was accepted and adored for both her poise and her literary work. And during her time there, she also received medical treatment for the ailments she was battling.

She met Selina Hastings, a friend of Susanna Wheatley and the Countess of Huntingdon. Eventually, Hastings funded the publication of Phillis's book. "Poems on Various Subjects, Religious and Moral." Was the first book of poetry published by an enslaved African American in the United States.

Her book includes many elegies as well as poems on Christian themes, even dealing with race, such as the often-anthologized "On being brought from Africa to America."

Phillis was also a strong supporter of America's fight for independence; she penned several of her poems in honor of George Washington, who was Commander of the Continental Army. She sent him one of her works that was written in 1775, and it eventually inspired an invitation to visit him in Cambridge, Massachusetts. In March 1776, she traveled to Washington.

Phillis eventually had to return to Boston to tend to Susanna Wheatley, who was gravely ill.

After the elder Wheatleys’ died, Phillis was left with nothing and had to support herself as a seamstress.

We don’t know exactly when she was freed by the Wheatleys, but some scholars suggest that she was freed between 1774 and 1778. And during that time, most of the Wheatley family had died.

Even with her literary popularity at its all-time high and being manumitted, freedom in 1774 Boston proved to be incredibly difficult.

Phillis was unable to secure funding for another publication or even sell her writing.

In 1778, she was married to a free African American man from Boston named John Peters. They had three children, but sadly, none of them survived infancy.

Their marriage proved to be a struggle due to the couple's battle with constant poverty. Phillis was then forced to find work as a maid in a boarding house, where she lived in squalid, horrifying conditions.

Even through all her misfortune, Phillis continued to write. But, with the growing tensions between the British and the Revolutionary War, she lost enthusiasm for her poems.

Although she continued to contact various publishers, she was unsuccessful in finding support for a second volume of poetry.

On December 5th, 1784, Phillis Wheatley died alone in a boarding house at 31 years old, without a penny to her name.

Many of her poems for her second volume disappeared and have never been recovered.

___

Next Chapter

The 16 Street Baptist Church Bombing

_____

My Resources

#the unofficial black history book#black history matters#black history 365#black history#black history is american history#black culture#black tumblr#black tumblr writers#black female writers#black female poets#know your history#learn your roots#black figures#herstory#history#black writblr#phillis wheatley#black activism#discrimination#writers on tumblr#black stories#black authors#women in history

7 notes

·

View notes

Text

Day Trading Forex: Everything You NEED To Know!

Are you interested in exploring the world of forex trading and want to take advantage of short-term price movements? Day trading forex might be the perfect strategy for you.

In this article, we will delve into the ins and outs of day trading forex, from understanding the forex market to developing effective strategies and managing risks. So let’s get started!

Introduction to Day Trading Forex

Benefits of Day Trading Forex

Day trading forex offers several advantages compared to other trading styles. Some of the benefits include:

Potential for quick profits: Day traders seek to profit from intraday price movements, aiming to close positions before the market closes.

High liquidity: The forex market is the largest and most liquid financial market globally, providing ample trading opportunities.

Flexibility: Traders can choose from a wide range of currency pairs and trade during different market sessions.

Lower capital requirements: Compared to other markets, forex trading allows for smaller initial investments, enabling traders to start with less capital.

Understanding Forex Market

To become a successful day trader in forex, it’s essential to have a solid understanding of the market dynamics.

Major Currency Pairs

The forex market consists of various currency pairs, but some major pairs dominate the trading volume. These include EUR/USD, GBP/USD, USD/JPY, and USD/CHF, among others. Familiarize yourself with these major currency pairs and their characteristics.

Market Hours

The forex market operates 24 hours a day, five days a week. However, certain trading sessions offer higher volatility and trading opportunities. The major sessions include the London, New York, Tokyo, and Sydney sessions. Knowing the active market hours can help you optimize your trading strategy.

Getting Started with Day Trading Forex

Before diving into day trading forex, you need to set up your trading infrastructure.

Setting Up a Trading Account

Choose a reputable forex broker that provides a user-friendly trading platform, competitive spreads, reliable execution, and comprehensive customer support. Ensure the broker is regulated by a recognized authority.

Selecting a Reliable Forex Broker

Research different forex brokers and compare their offerings, including trading costs, available currency pairs, leverage options, and deposit/withdrawal methods. Read reviews from other traders to gauge the broker’s reputation and reliability.

Funding Your Trading Account

Technical and Fundamental Analysis

Successful day trading forex relies on a combination of technical and fundamental analysis techniques.

Candlestick Patterns

Candlestick patterns provide valuable insights into price dynamics. Learn to identify patterns such as doji, engulfing, and hammer, which can signal potential reversals or continuations in the market.

Moving Averages

Moving averages help smooth out price fluctuations and identify trends. Experiment with different moving average periods, such as the 50-day and 200-day moving averages, to identify potential entry and exit points.

Support and Resistance Levels

Support and resistance levels are price levels at which the market tends to bounce or reverse. Identify key support and resistance levels using horizontal lines on your charts and incorporate them into your trading decisions.

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, and employment data, can significantly impact currency prices. Stay informed about major economic releases and their potential effects on the forex market.

News Events

Popular Day Trading Strategies

To succeed in day trading forex, you need to implement effective trading strategies that suit your trading style and risk appetite.

Scalping

Scalping involves making multiple trades within a short time frame, aiming to capture small profits from quick price movements. Scalpers often rely on tight spreads and fast execution to capitalize on these rapid price changes.

Breakout Trading

Breakout traders look for significant price breakouts above resistance or below support levels. They aim to enter trades early in a new trend to maximize profit potential. Breakout strategies often utilize technical indicators to confirm breakouts.

Momentum Trading

Risk Management in Day Trading Forex

Managing risk is crucial in day trading forex to protect your capital and preserve long-term profitability. Here are a few ways to help manage your risk:

Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. Determine an appropriate level for your stop-loss order based on your risk tolerance and the characteristics of the currency pair you are trading.

Implementing Proper Position Sizing

Calculate your position size based on the size of your trading account and the percentage of capital you are willing to risk per trade. Avoid overexposing your account by trading positions that are too large relative to your account size.

Managing Leverage

Emotions and Psychology in Day Trading

Controlling emotions and maintaining a disciplined mindset are crucial in day trading forex.

Controlling Greed and Fear

Greed and fear are common emotions that can cloud judgment and lead to irrational trading decisions. Develop self-awareness and discipline to overcome these emotions and make objective trading choices.

Maintaining Discipline

Stick to your trading plan and avoid impulsive trades driven by emotions. Follow your strategy and trading rules consistently, even when faced with market fluctuations.

Developing a Trading Plan

Building a Trading Routine

Establishing a structured trading routine can help you stay organized and make better trading decisions.

Pre-market Analysis

Before the market opens, conduct a thorough analysis of the currency pairs you are interested in trading. Review economic calendars, technical indicators, and news events that may impact the market.

Executing Trades

Once the trading day begins, execute your trades based on your predefined strategies and analysis. Stick to your risk management rules and avoid impulsive trades based on emotions.

Reviewing and Analyzing Trades

Resources and Tools for Day Traders

Several resources and tools can assist day traders in their trading activities.

Educate Yourself

It is important to stay up to date and learn constantly when you are day trading. It’s always a good idea to begin your journey with a day trading forex course such as the Cash on Demand Trades Education or The Ultimate Forex Strategy

Trading Platforms

Choose a user-friendly trading platform that provides real-time charts, technical indicators, order execution capabilities, and access to relevant news and analysis.

Charting Software

Utilize charting software to analyze price patterns, apply technical indicators, and identify potential trade setups. Popular charting platforms include MetaTrader, TradingView, and NinjaTrader.

Economic Calendars

Stay informed about upcoming economic events and news releases using economic calendars. These calendars provide information on scheduled economic indicators, central bank meetings, and other market-moving events.

Online Communities and Forums

Engage with other day traders through online communities and forums. Participate in discussions, share ideas, and learn from experienced traders. Collaborating with like-minded individuals can enhance your trading knowledge and skills.

Tips for Successful Day Trading

Consider the following tips to improve your day trading performance:

Stay Informed and Educated: Continuously update your knowledge about the forex market, trading strategies, and risk management techniques. Follow reputable sources of market analysis and stay informed about economic developments.

Practice Risk Management: Always prioritize risk management to protect your capital. Implement appropriate stop-loss orders, manage your position sizes, and avoid overtrading.

Start with Small Positions: When starting out, focus on small position sizes to minimize risk. Gradually increase your position sizes as you gain experience and confidence in your trading abilities.

Keep Emotions in Check: Emotions can cloud judgment and lead to poor trading decisions. Maintain emotional discipline, stick to your trading plan, and avoid impulsive actions driven by fear or greed.

Review and Learn from Your Trades: Regularly review your trading performance, analyze your trades, and identify areas for improvement. Learn from both successful and unsuccessful trades to refine your strategy.

Final Thoughts

Day trading forex offers exciting opportunities for traders to profit from short-term price movements in the forex market.

By understanding the market dynamics, implementing effective strategies, managing risks, and maintaining emotional discipline, you can increase your chances of success in day trading forex.

4 notes

·

View notes

Text

How Smart Money Masters NFP: Insider Tactics the Pros Don't Share The Market Doesn't Wait for You to Catch Up Imagine missing the NFP release because you were busy reheating leftover pizza, only to return and see your trade plummet like your motivation on a Monday. Ouch. The "nfp non farm payrolls" report isn't just a fancy acronym with Wall Street street cred; it's one of the most market-shaking news releases in the game. But what if I told you the pros aren't reacting to the news—they're already positioned before the headlines even hit? Enter: Smart Money Concepts. Why Everyone Freaks Out During NFP (Except Smart Money) Every first Friday of the month, traders gather around their charts like it's a ritual. Non-farm payroll numbers drop, and chaos ensues. Spikes, slippage, emotional damage—you name it. But smart money? They're sipping espresso, watching retail traders react like they just discovered fire. Smart Money Concepts (SMC) are built on the idea that institutional players — hedge funds, banks, prop firms — manipulate price zones on purpose. Retail traders get played like background extras in a thriller. The real money's in the story behind the chart. The Hidden Blueprint: How Smart Money Preps for NFP Before the NFP report hits the fan, institutions have: - Engineered Liquidity Pools: Think of these as honey traps. Areas above equal highs or below equal lows are prime hunting grounds. - Created Fakeouts (a.k.a. inducement moves): Retail jumps in, thinking it’s a breakout. Institutions eat their stops, reverse price, and profit. - Stacked Buy/Sell Stops: These aren't just casual orders. They're mapped zones to exploit volatility. Case in Point: On March 8th, 2024, just before NFP, EUR/USD tapped into a 4-hour order block formed days prior. Retail traders saw a bearish engulfing pattern and shorted. Result? Price exploded upwards 80+ pips post-release. Textbook smart money trap. Where Retail Traders Get It Wrong (And How You Won’t) Here's where most traders faceplant: - Chasing NFP After the Fact: Like arriving to a house party after the pizza's gone. - Ignoring Liquidity: If you're not trading where the big money is, you're just noise. - Overleveraging into News: That's not bravery; that's begging your broker to margin call you. Elite Tactic: Instead of placing market orders before NFP, mark institutional zones (order blocks, fair value gaps) on the daily and 4H charts the day before. Let price come to you. The Dirty Little Secret of Smart Money Entries During NFP Institutions love volatility because it allows them to mask their positions. They enter within: - Order Blocks (OB) - Imbalance Zones (FVG – Fair Value Gaps) - Breaker Blocks These are their sniper nests. You don’t see them on your MACD or RSI. Step-by-Step SMC Playbook for NFP: - Mark Key Liquidity Zones (above/below prior highs/lows) - Identify Premium/Discount Levels (based on recent structure) - Spot Order Blocks on 1H/4H charts - Wait for Price Reaction – no chasing - Enter on a Confirmation (like a change of character - CHoCH) - Set SL just beyond engineered liquidity - Target inefficiencies or next major liquidity pool What They Don’t Teach You on YouTube YouTube may tell you to scalp the initial 5-minute NFP candle. That’s like trying to pet a wild lion because it looks sleepy. Don’t. Contrarian Insight: Often, the first move post-NFP is a fakeout. Institutions use this to trap breakout traders. The real move happens 15-30 minutes later. Why? Because that's when the manipulation ends and real flow begins. Pro Tip: Use the 15-minute timeframe with a session separator. Mark Asia & London range, then see where NFP breaks structure relative to smart money zones. Smart Money Doesn’t React to NFP—They Script It According to Michael J. Huddleston (aka Inner Circle Trader), institutions don't chase price, they create it. NFP is their playground. The trick isn't predicting the number—it's following the setup. As per a 2023 BIS study, over 80% of major Forex volatility events are preceded by institutional order flow accumulation. That means while you're watching Bloomberg, smart money is already pulling the strings. The Forgotten Metric: Time & Price Confluence SMC isn’t just about zones. It's about when price reaches those zones. For NFP: - Time Window: 8:15AM to 8:45AM EST (pre & post release) - Confluence Tools: Use Fibonacci extensions + OB alignment for sniper precision Real-World Gem: On June 2nd, 2023, GBP/USD dropped into a bullish FVG right at 8:18AM, tapped a 0.786 Fib extension, then rallied 120 pips by 9:30AM. How to Practice This Without Blowing Your Account Demo it like your future depends on it—because it does. Use replay mode, tag each NFP setup using this checklist: - Liquidity sweep? - OB/FVG respected? - CHoCH present? - Time alignment correct? Refine until your entries look like you knew the outcome before the release. Bonus: Want the Blueprint? We Got You. If you're hungry for exclusive data, next-gen tools, and hidden smart money gems, you need to explore: - Forex News Hub – Real-time updates that institutions follow. - Free Forex Courses – Master SMC with examples and edge cases. - StarseedFX Community – Elite analysis, alerts, and live trading breakdowns. - Smart Trading Tool – Automate your sizing and reduce the chaos. Don't just trade. Trade smart. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

My Crypto Funding Wins Best Trading Conditions Among Crypto Prop Firms

London, Greater London, April 11th, 2025, Chainwire As the crypto trader funding market grows rapidly, My Crypto Funding (MCF) has established itself as the leading crypto prop firm in the space. The firm was recently honored with the 2024 award for Best Crypto Trading Conditions by The Trusted Prop, a notable review platform in the prop trading evaluation space. Image of the trophy shared on…

0 notes

Text

SolaryStone.com review Trading Hours

When considering a forex broker like SolaryStone.com reviews, it’s important to dive deeper into various aspects of the platform to assess its credibility. One of the most telling factors is the broker's Trustpilot rating, which reflects the experiences and opinions of real users. But what do those numbers really mean? How trustworthy is this broker in comparison to others?

In this review, we will explore SolaryStone's reputation, starting with its Trustpilot reviews, before moving on to other critical factors such as licensing, platform features, and user experiences. By the end of this review, you'll have a clearer understanding of whether this broker is a good fit for your trading needs. Let’s take a closer look.

SolaryStone Trading Session Times

The trading hours for "SolaryStone.com reviews" are specified in the "Trading Times" column. They follow the "Winter Session" and are as follows:

Australia: 8 PM - 5 AM

Tokyo: 4 PM - 1 AM

London: 12 PM - 9 PM

New York: 7 AM - 4 PM

These hours represent the primary trading sessions for different regions, and they seem to cater to the most active trading hours.

This information is crucial because it provides clarity on when users can expect the market to be most liquid and active, which is often a key consideration for traders.

SolaryStone Domain Purchase and Brand Establishment Dates

For SolaryStone.com reviews, the brand was established in 2022, while the domain was purchased on 2019-12-11.

This means that the domain was secured three years prior to the brand’s establishment. This is unusual because it suggests that the domain might have been reserved in advance, potentially for future plans or to ensure that the desired domain name was available.

This early domain purchase could indicate foresight on the part of the company, showing that they were preparing for the brand launch well in advance. While it is uncommon to register a domain so early before establishing the brand, it doesn’t necessarily raise concerns if the brand did eventually launch with a legitimate and clear structure. In this case, it looks like the broker had long-term plans for its operations and secured the domain in preparation for future development.

Broker's License and Regulation

One of the most important factors to establish the legitimacy of any forex broker is the regulation and licensing it holds. SolaryStone.com review is regulated by the FCA (Financial Conduct Authority), which is one of the most respected regulatory bodies in the financial world. The FCA is known for its strict standards and rigorous oversight, ensuring that only those brokers who meet the highest requirements can obtain and maintain their license.

Why does this matter? A broker regulated by the FCA is subject to regular checks and must comply with stringent rules to protect investors and maintain market integrity. The fact that SolaryStone.com reviews is under FCA regulation signals that it operates within the legal framework and is held to high standards of transparency, fairness, and financial responsibility. This makes it a lot less likely for them to engage in fraudulent practices or operate without oversight.

This is a solid argument in favor of the broker's legitimacy. With such a reputable regulator, traders can have a much higher degree of confidence that their funds and personal information will be protected and that the broker is operating within the law.

SolaryStone Trustpilot Reviews and Rating

Trustpilot Rating: 3.7 The broker has a Trustpilot rating of 3.7, which is a moderate score. In the context of the financial industry, a score like this might indicate that while the broker is receiving a fair number of positive reviews, there could be some areas of improvement in its services or customer experience. A score of 3.7 is not bad but certainly leaves room for more growth and customer satisfaction.

Total Number of Reviews: 2 SolaryStone.com reviews has received only 2 reviews on Trustpilot, which is a relatively low number. This can indicate that the broker is either new to the market or hasn't yet gained significant user attention. A low number of reviews makes it harder to form a strong conclusion based solely on this metric.

Count of Good Reviews (4-5 stars): 2 All 2 reviews for SolaryStone.com review are positive, meaning they were rated 4 or 5 stars. While it’s a good sign that the existing reviews are positive, it is important to note that such a small sample size does not provide a complete picture of the overall customer experience. With only 2 reviews, it’s difficult to assess how consistent the broker’s performance is over time.

In summary: The 3.7 Trustpilot rating is decent but not exceptional, and the fact that both reviews are positive does indicate that users have had favorable experiences. However, the low number of reviews (just 2) should be taken into consideration when evaluating the broker’s overall reputation and legitimacy. A larger volume of reviews would provide more insight and a better picture of the broker’s overall service quality.

Conclusion: Is SolaryStone.com reviews a Trustworthy Broker?

Based on the available information, SolaryStone.com review appears to be a broker with a moderate Trustpilot rating of 3.7, accompanied by only 2 reviews—both of which are positive. While this is a good sign in terms of user satisfaction, the low number of reviews makes it difficult to draw definitive conclusions about the broker’s overall reputation and reliability.

The 3.7 rating suggests that while the broker is providing adequate services to its users, there may still be areas for improvement. It’s important to note that the small review count may not fully represent the experience of a larger user base, meaning further feedback and a more significant number of reviews would be essential to provide a comprehensive view.

Given these factors, it’s crucial for potential traders to proceed with caution and conduct more research before committing to SolaryStone.com reviews. While the positive reviews are promising, the low review count means that more evidence is needed to establish its legitimacy in the long term.

0 notes

Text

My Crypto Funding Wins Best Trading Conditions Among Crypto Prop Firms

London, Greater London, April 11th, 2025, Chainwire As the crypto trader funding market grows rapidly, My Crypto Funding (MCF) has established itself as the leading crypto prop firm in the space. The firm was recently honored with the 2024 award for Best Crypto Trading Conditions by The Trusted Prop, a notable review platform in the prop trading evaluation space. Image of the trophy shared on…

0 notes

Text

What is Forex Trading? A Beginner's Guide to the Foreign Exchange Market (2025 Update)

Keywords: forex trading for beginners, what is forex trading, how does forex trading work, forex market explained, currency trading, learn forex trading, forex trading basics 2025

✅ What is Forex Trading?

Forex trading, short for foreign exchange trading, is the process of buying and selling currencies with the aim of making a profit. The forex market is the largest financial market in the world, with more than $7.5 trillion traded daily in 2025.

🔍 How Does Forex Trading Work?

Forex trades occur in currency pairs, such as:

EUR/USD – Euro vs US Dollar

GBP/JPY – British Pound vs Japanese Yen

USD/CHF – US Dollar vs Swiss Franc

When you buy a pair like EUR/USD, you’re buying euros while simultaneously selling U.S. dollars. If the euro gains value against the dollar, you profit.

Forex markets are open 24 hours a day, 5 days a week, across major financial centers like:

London

New York

Tokyo

Sydney

💡 Why is Forex Trading So Popular in 2025?

1. High Liquidity

With trillions traded daily, forex offers quick order execution and tight spreads.

2. Low Barrier to Entry

You can start trading with as little as $100 and access the market from anywhere.

3. 24-Hour Market

Unlike stocks, forex markets run around the clock, giving traders flexibility.

4. Profit in Any Market Direction

You can make money when currencies go up or down by going long or short.

📈 What Influences the Forex Market?

To succeed in forex, it's important to understand the key factors that move currencies:

Interest rates

Inflation and economic growth

Geopolitical events

Central bank policies

News and global economic indicators

🚀 How to Start Forex Trading in 2025 (Step-by-Step)

Step 1: Choose a Regulated Forex Broker

Look for brokers licensed by:

CFTC/NFA (USA)

FCA (UK)

ASIC (Australia)

CySEC (Europe)

Step 2: Open a Free Demo Account

Practice trading risk-free with virtual funds before using real money.

Step 3: Learn Forex Basics

Understand key concepts like:

Pips & lots

Bid/ask spreads

Leverage & margin

Stop-loss & take-profit

Step 4: Build a Trading Strategy

Choose a method that suits your personality:

Day trading

Swing trading

Scalping

Position trading

Use tools like:

Technical indicators (RSI, MACD, Moving Averages)

Economic calendars

Chart patterns

Step 5: Start Trading with Real Money

Begin small, manage your risk, and stay disciplined.

🧠 Forex Trading Tips for Beginners (2025 Edition)

✅ Use a demo account until you’re confident

✅ Never risk more than 1–2% per trade

✅ Stick to a simple strategy and master it

✅ Always use stop-losses

✅ Keep a trading journal to track wins and losses

✅ Avoid trading during high-impact news if you’re unsure

🛑 Is Forex Trading Risky?

Yes, forex trading involves substantial risk and is not suitable for everyone. Most beginners lose money, but with the right education and strategy, success is possible.

It’s not a get-rich-quick scheme—it’s a skill you must learn and refine over time.

🔍 FAQs About Forex Trading (2025)

❓ Can You Make Money Trading Forex?

Yes, but it requires skill, discipline, and time. The best traders treat it like a business.

❓ Is Forex Trading Legal in 2025?

Yes, it's legal in most countries, as long as you use a licensed broker.

❓ What Time is Best to Trade Forex?

The best times are during major session overlaps:

London/New York (8am–12pm EST) for high liquidity

Tokyo/London for volatility in Asian pairs

🧭 Is Forex Trading Right for You?

If you’re looking for a flexible way to trade the financial markets and you’re willing to learn and practice, forex trading can be a rewarding path. Whether you’re a complete beginner or someone switching from stocks or crypto, forex offers unique opportunities for income and growth.

🎯 Want to Learn More?

Get Started with our Forex Copy Trade Program. Use $100K of someone else's money to trade. We would do the trading for you. Could make $3000-$5000 a Month Passive Income. Start with as little as $1500.

Contact us to learn more and to get started-https://prestigebusinessfinancialservices.com

Email - [email protected]

✅ Final Takeaway

Forex trading in 2025 is more accessible than ever. With the right mindset, tools, and risk management, you can become a confident trader and take full control of your financial future.

Get Started with our Forex Copy Trade Program. Use $100K of someone else's money to trade. We would do the trading for you. Could make $3000-$5000 a Month Passive Income. Start with as little as $1500.

Contact us to learn more and to get started-https://prestigebusinessfinancialservices.com

Email - [email protected]

Get Started now and Start earning Passive Income

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#forex trading for beginners#what is forex trading#how does forex trading work#forex market explained#currency trading#learn forex trading#forex trading basics 2025#Forex#forextrading

1 note

·

View note