#traciedemars

Explore tagged Tumblr posts

Photo

Upcoming Free (& non-promotional) Home Buyer Classes: Home Showings 101...home buyer & seller education www.traciedemars.com Saturday, February 8th, from 9am-12pm (ish) Marshall Community Center, conference room 1009 E. McLoughlin Blvd, Vancouver WA (kitty corner from Clark College) Tuesday, February 11th, from 5pm - 8pm (ish) Marshall Community Center, Conference room 1009 E McLoughlin Blvd, Vancouver WA (kitty corner from Clark College) Saturday, February 22nd, from 12pm-3pm (ish) Vancouver YMCA, conference room 11324 NE 51st Circle, Vancouver WA (corner of SR500 & Gher Road/112th Ave). If these class dates and/or times don't work for you, please let us know. We understand that you have lives, and families, and work. We will work something out that works better with your schedule. Just let us know.... ....we also have home seller classes available too...look for link on top of website Happy February! Finally....January is over...not that it was the longest month ever, or anything like that... The beginning of the year is a good time to sell your home (if you've been thinking about it), and it's a time where a lot of folks who have been thinking about buying a home start the pre-approval process. This months blog is going to address something that is important for both sellers, and buyers....showing homes. Let's talk about this...the funnest, and the scariest part... As we've talked about in the past, there's a process to buying (and even selling) a home.... first, you take a home buyer (or home seller) class, second, you move on to getting pre-approved. Yes, even if you are selling a home, you want to get pre-approved before you go looking for your next home. For a seller (who is going to be a homebuyer when their home sells) part of the information you will be giving to your lender is the guesstimated amount that you'll receive from the sale of your current home...your Realtor will help with this. When you are buying a home, your Realtor is here to help you with your home adventure, and while yes, this is kind of scary...it is a lot of fun. Whether this is your first home, or your 3rd, or 5th, or whatever...with a pre-approval & your Realtor, you are ready for the 'fun' part.....LOOKING AT HOMES! :-) This is always an exciting time for buyers, and it should be! Every home you pull up to has the possibility to be 'the one'....The one you make an offer on, the one that you buy, the ONE that becomes YOUR HOME...and it is very exciting, and yes, kind of scary too. For the sellers though, it is very stressful because currently this IS their home, and they're leaving so that strangers can come in. As a Realtor, we are trying to make this as easy as possible for both the buyer and seller, but we need help... From the homeowners (sellers), we are asking that the home be available to show, that the home be clean, nothing of value is being left out, all medicines are put away and out of sight (not left in bathrooms or kitchen cabinets), anything that a seller wants excluded from the sale is noted, that sweet pups are either removed or kenneled, that sweet kitties are noted as inside only or inside/outside ok, and that please, please... homeowners (sellers) be gone for showings. Before you go on the market, talk to your Realtor about HOW the showings will work with your home. Some folks are cool with a few hours notice, some need more time. Most of my clients need a bit more time for showings. If you have kids and/or pets, it's ok to ask for 24 hour notice. That way you have time to prepare your home to be seen in its best possible condition. You are still living in your home, and the buyers and buyers Realtor will (or should) respect that. A lockbox will be put on your home, and during a showing the buyers agent will access the box for the key. An email and/or a text will be sent to the sellers Realtor to let them know that a Realtor with XYZ company has accessed the home, and for how long we were there. Before a seller puts their home on the market there is preparation, and usually some 'honey-do's' that need to be done. As always, there is more to it than this, but that is a different class....and email. You can always call me for more information when you are selling your home. From the buyers....it gets a bit more complicated... before we go house shopping, we are asking that you have a pre-approval letter with a solid lender, we are asking that you do not look at homes above your price range, we are asking that you have thought about the Top Three things you want in a home (so we can show you homes that have those items you value most), and that you help us help you.... When a Realtor opens the lockbox to show you the home, we are taking responsibility for everything that happens from that moment on....until we lock up the house and put the key back into the lockbox. As I say all the time... Real Estate is NOT like HGTV... you don't just get to wander the home while your Realtor sits outside... we must be with you at all times when touring your potential new home. Sometimes this can be like herding cats, but we understand your excitement... just please, please as you are touring the home, and we know you have your family with you, please...we must all stay together. Don't make me sing to you here..... As cool as those toys look, I'm sorry but the kiddos can't play with them, and sorry...but you can't jump on the beds either. It's ok to open cupboards, and closets, but we can't open dressers, or go through someone else's personal items. Touring a home is a VISUAL thing....sorry. Yes, you can use the bathroom. When it's wet out (and lately it's been VERY wet), it's always a good take off our shoes before we enter someone else's home so be sure to wear easy on & off shoes, or use shoe booties. When we are looking at homes, often we have more than one home to look at, and many homes are owner occupied so your Realtor makes appointments. We do the best we can to make sure we have enough time to look at the homes, but we need to stay within our timeframes as the sellers are waiting to come home after we leave, or there are other Realtors waiting to show the home. I promise we are not trying to 'rush' you through the home...we are just trying to stay within the timeframes so that you can see the other homes on your list. With the real estate market starting to pick up for spring, it's important that if a home comes up that you like, you need to let your Realtor know as soon as possible so we can make an appointment for you to see it. Your Realtor should be sending you a list of homes as they come on the market for you to check....drive by the homes...check out those neighborhoods....and let's make an appointment to go see the inside of the home. Do not trust Internet photos! Realtors hire professional photographers for our listings for a reason. :-) Internet photos are a lot like internet dating...you don't know what you're going to get when you get there Like the neighborhood, but not sure about the house? Let's at least go check out the inside! You never know as you can't judge a book (or a house) by its cover. ASK QUESTIONS!! For heavens sake...this is a home you are thinking about buying... ask questions! As your Realtor, we are here to help! If we can't answer your questions, we can at least set up in the right direction to get those answers. Buying a home is a very emotional experience. Your Realtor is here to point out pros/cons, and to help you.... Trust your heart, but use your head... or your Realtor. :-) Remember that we work FOR you. Once you find THE home it's time to talk about making an offer, and those pesky timelines that you need to know, and that we need to abide by. So, let's talk about that....next month! Thank you, as always, for reading this. I hope this helps you this week! Please, if you have any questions, please feel free to call, email, text, or even facebook me anytime. I am always here to help! Information is power, and I hope that I am help you! Good luck, and as always...May the odds be ever in your favor out there.... If you are looking for a real estate agent, I would love to be able to help you. I hope that explains this a bit, but if you have any questions, or comments please call or email me anytime! Please remember that while I mean these emails/blogs to be helpful, and educational, I am still hoping that you will call, or email me. I would love to help you with your home buying, or home selling adventure! :-) As always....this is just a quick overview.... again...and I can't say this enough...please remember that your agent is NOT a salesperson, and should not be acting like one. Real Estate is not really about houses, it is about relationships. Your agent, and your lender work for YOU. You drive the bus...we are merely GPS to help you get to your goals. Like the classes, this weekly blog email is to help you with your home adventure. The goal is to be informative and non-promotional. :-) We are, however, hoping you will call and want us to help with your adventure. Thank you again for your business and your referrals!! ...and thank you for referring these classes to your friends, family, and co-workers. ....disclaimer...if you have already purchased a home, or would no longer like to receive these emails, please let me know and I will be happy to remove you from any further mailings... Upcoming Topics: How long is the home buying process... aka....when do I GET Keys? Last Month: New Year...New Home? Maybe? Where to Start? Have a great day, and I will talk to you soon, ;-D Tracie DeMars Real Estate broker Re/Max - Van Mall 360/ 903-3504 cell 360/ 882-3600 fax www.traciedemars.com [email protected] “Interested in free and non promotional home education classes? Go to www.freehomebuyerclasses.com for local upcoming home buyer and home SELLER classes, or facebook: Tracie DeMars Real Estate for my home buyer education blog.” "Listen to the mustn'ts, child. Listen to the don'ts. Listen to the shouldn'ts, the impossibles, the won'ts. Listen to the never haves, then listen close to me... Anything can happen, child. Anything can be." - Shel Silverstein, American poet, cartoonist and composer, (1930 - 1999).

#traciedemars#traciedemarsrealestate#traciedemarsremax#remax#traciedemarsrealtor#traciedemarsdotcom#learningtobuyahome#learningtobuyahomedotcom#buyingahome#sellingahome#traciedemarsbuyersagent#traciedemarssellersagent#learntobuyahome#learntosellahome#knowledgeispower#knowingishalfthebattle#howcanihelp#letsdothis

3 notes

·

View notes

Photo

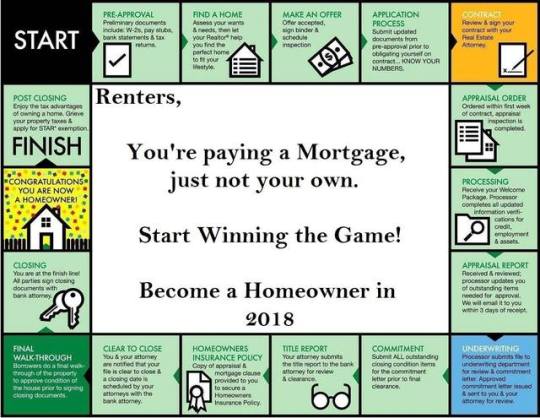

Pre-approvals....what you need to know, Upcoming Free (& non-promotional) Home Buyer Classes: Saturday, September 22nd, from 12pm-3pm (ish) Vancouver YMCA, conference room 11324 NE 51st Circle, Vancouver WA (corner of SR500 & Gher Road/112th Ave) Saturday, October 6th , from 9am-12pm (ish) Marshall Community Center, conference room 1009 E. McLoughlin Blvd, Vancouver WA (kitty corner from Clark College) Saturday, October 20th, from 5pm-8pm (ish) Marshall Community Center, conference room 1009 E. McLoughlin Blvd, Vancouver WA (kitty corner from Clark College) If these class dates and/or times don't work for you, please let us know. We understand that you have lives, and families, and work. We will work something out that works better with your schedule. Just let us know.... ....we also have home seller classes available too...link on left on website Remember...with reservation...we will throw in lunch, or dinner! :-D ~~~~~~~~~Happy ...well, whatever day it is! What a month! Yesterday, my youngest child started 3rd grade. I think I have started and stopped this email about 4 times in the last couple of weeks, but what with everything going on... it kind of went on the back burner. It's a different world from when I went to school... when I was at school, teachers had the last word on everything. If a teacher called home, you were in trouble....if a teacher needed something... it happened. When my older kids were young, teachers still got what they needed … now, I am not going to lie to you... I did have it out with my older daughters high school principal a few times! Teachers though... teachers I have the utmost respect for them. When I was young, I wanted to be a teacher... I wanted to teach high school history and English. Yep, that was my goal when I was young... not a singer or a movie star... a teacher! Of course, I am not a teacher... I am a Realtor, but I still teach....and I still help. So, here we are... another school year started, and all of the sudden we are in the last trimester of the year. So here's to 'Happy Hallowthankmas' period time. So this week let's talk about the what the steps are to buying a home? This is where it gets crazy because most of us just don't know....you just kind of 'fall into it'... You meet up with someone, and like a whirlwind romance, next thing you know you are in a 30 year commitment called a mortgage loan! So....if you are thinking about buying a home, what are your steps? What do you need to know before you start? Well, that is what the Free Home Buyer Education Classes are for! ....that, and this weekly blog anyhow! :-D The first step to buying a home is the home buyer education classes. Did you know that more people will get education when buying a car than when buying a home? The classes are non-promotional, free, and meant to give home buyers a head start on the information they need to buying a home, and taking advantage of the state loan programs that are out there to HELP people buy a home! Real Estate & Lending is all about 'verbiage' as we are 'taught' scripts to make things sound good for you, when in actuality...it may not be that great at all. We do go over all of that, and try to make everything as clear as possible considering it starts off as mud. :-) As instructors of the classes we are volunteers, so while we HOPE that you will call us to help you with your homebuying adventure, by no means do you have to. :-)Buying a home, especially your first home, is such a big thing that sometimes it is hard to wait when we get the bug. Buying a home is still the American dream, and gives us roots in a community. It is the place where we raise our children, plant our gardens, paint our rooms, and show our personality. A house isn't just a place of four walls and a door, but a home....and a place of dreams. Knowing all of this as we do, when it comes to buying a home, patience isn't always our biggest virtue! :-D The second step in the home buying process is talking with a lender to help you get pre-approved for a loan. The reason why we say that talking to a lender is your second step is because while you don't go grocery shopping without knowing how much is in your bank account, you should never go looking at homes without knowing how much you can afford. A lenders job is to pre-approve you for as much as they can, but that doesn't always mean that you can, or that you should, spend that much on purchasing a home. We all have lives, and you don't want to be housepoor. Make sure that you know your budget, and what is a comfortable amount for you to spend monthly on a mortgage. Remember to make sure that you have enough for small things like eating out (ok....if you have my family it isn't a 'small' thing at all to eat out!), going to the movies, maybe going on a family trip....and let's not forget buying groceries and gas! Also...as a homeowner, now you have other additional expenses and potential repairs to put aside for. I always tell all my clients to put aside some money from every check into a 'special' account at a banking institution that you don't regularly frequent. Maybe it is a credit union across town that is only open for 4 hours a day, but make sure you don't have a checkbook or a debit card for it. It doesn't have to be a lot of money....maybe only $10-$20 per check, but this is your 'rainy day' fund...or really, the funds for any home repairs that will, eventually, come up. Being a home owner does mean being prepared for home repairs that always happen at the worst possible time! Home Warranties really are your best friend when buying a home...and yes, this is different than Homeowners Insurance (aka Hazard Insurance). That will be a topic for another week. :-) The rule of thumb though is to make sure that when you are looking for homes, after you get pre-approved, to make sure you are looking at homes with your buyers agent that you can afford, and not max out your budget! Remember that not all lenders can access the downpayment assistance loans, so make sure that you are going through someone who can. If you have any questions about that, please feel free to call, or email, Chris Berg @ Pinnacle Mortgage...503-320-0925 (he is local), and [email protected] . When getting pre-approved, make sure to ask your lender if your pre-approval has already gone through the manual underwriters. We are seeing more, and more people lately who, thinking they are pre-approved, go out and find a home, only to find out days before signing, that the manual underwriters are declining their loan! This is terrible as this means that this family who have already packed up, given notice, and are ready to move....now have no loan, and therefore, no home! I don't want that to happen to any of my clients, so as a buyers agent, when I am speaking with a lender, I always ask their lender if the buyers loan approval was sent to the manual underwriter, or if it is just a computer approval. Having your pre-approval go through the manual underwriters, instead of just a computer approval, does take some more time, usually up to a week more, but in the end it is always better to be safe rather than sorry! Please remember that your pre-approval is only good for 90 days, and yes, you will have to update it at the end of the process...usually when your file goes to underwriting for the final documents to sign. Please continue to pay your bills (on time), please do not change work hours, please do not go out and buy appliances, do not get a personal loan for 'stuff for the house', do not go buy a car/truck/boat/etc. If you have any questions, please talk with your lender first as all of these things can cause your loan to be declined...at the final step....which is awful for everyone. Your pre-approval is NOT set in stone.... A pre-approval is a snap-shot of your 'current' financial situation, and if that changes...so can your pre-approval. Your financial situation will be looked at by a myriad of different people, and scrutinized about 2-3 times by the underwriters...which are actually the people with the power. Please remember to talk with your lender and real estate agent...we are here to help! :-) A pre-approval is good for a monthly mortgage payment amount...not a purchase price. Your interest rate can not be locked in until about 30-45 days from closing/keys. What this means is that the interest rate you are quoted at the time of pre-approval is merely a 'guesstimate'. This part is always a bit strange, but your lender can't even start your actual loan process until you have a signed around contract on a home...signed (and agreed to) by the person with the legal authority to sell that home. If interest rates go up in the process of buying your home, and your rate is not locked in, then your monthly mortgage payment will change...and so can your pre-approval. Your buyers agent, and your lender should work together, and communicate with each other to help you through this process! I know I say this all the time, but we work for YOU! By working together we help you achieve your goal of your own home where you can kick your shoes off, turn on some football (ok, maybe that is just my house!), and relax! A buyers agent and a lender should work together as a team, communicating with each other, and with you, every step of the way....that is what we are here for! :-) I also asked Chris Berg for some information on this email...There are three forms of approvals that you will see when you purchase a home. Prequalification, preapproval, and approval. A prequalification is not worth the paper it's printed on and most if not all sellers will not except a prequalification when you make an offer on a home. The reason for this is that a prequalification is basically just checking your credit but not verifying income or down payment or any of the other thousand things that can go wrong during the transaction. A preapproval covers all the things they seller needs to see. Not only does it verify your credit but also verifies your income, tax returns, W-2s, down payment, employment and address history, and rent payments. A preapproval is what you need in order to make an offer on a home. An approval is generally not achieved until you were under contract on a home. It verifies all the items in a preapproval but also includes the appraisal and preliminary title report on all borrowers and sellers. In order to get a preapproval you need to bring your lender your last two years tax returns, W-2s, last 30 days pay stubs, ID, and two months bank statements if you have a down payment. If you are seriously considering buying a home a preapproval, with most lenders, will not cost you any money and will allow you to deal with any issues well before you spend the money to make an offer on a home. No animals were harmed during the writing of this email. Thank you, Chris BergMortgage Advisor with Pinnacle Capital MortgageMLO-198082503-320-0925 [email protected] Information is power, and as always...May the odds be ever in your favor out there.... If you are looking for a real estate agent, I would love to be able to help you. If you have any questions, or comments please get a hold of me anytime. You can call, text, email, or even facebook me. Please remember that while I mean these emails/blogs to be helpful, and educational, I am still hoping that you will call, or email me as I would be honored to help you with your home buying, or home selling adventure! :-) As always....this is just a quick overview.... again...and I can't say this enough...please remember that your agent is NOT a salesperson, and should not be acting like one. Real Estate is not really about houses, it is about relationships. Your agent, and your lender work for YOU. You drive the bus...we are merely GPS to help you get to your goals. Like the classes, this weekly blog email is to help you with your home adventure. The goal is to be informative and non-promotional. :-) We are, however, hoping you will call and want us to help with your adventure. Thank you again for your business and your referrals!! ...and thank you for referring these classes to your friends, family, and co-workers. ....disclaimer...if you have already purchased a home, or would no longer like to receive these emails, please let me know and I will be happy to remove you from any further mailings... Upcoming Topics: What do I need to buy a home, Hiring a Realtor...questions to ask, What if I don't have a Down Payment? ..... &....What does an Agent do for me? Debt to Income Ratios....What is this? Last Week: Why take a home buyers (or sellers) class? Have a great day, and I will talk to you soon, ;-D Tracie DeMars Real Estate broker Re/Max - Van Mall 360/ 903-3504 cell 360/ 882-3600 fax www.traciedemars.com [email protected] “Interested in free and non promotional home education classes? Go to www.freehomebuyerclasses.com for local upcoming home buyer and home SELLER classes, or facebook: Tracie DeMars Real Estate for my home buyer education blog.” "Listen to the mustn'ts, child. Listen to the don'ts. Listen to the shouldn'ts, the impossibles, the won'ts. Listen to the never haves, then listen close to me... Anything can happen, child. Anything can be." - Shel Silverstein, American poet, cartoonist and composer, (1930 - 1999

#traciedemars#realestate#traciedemarsrealestate#pnwrealtor#traciedemarsrealtor#learningtobuyahome#learningtosellahome#freehomebuyereducation#freehomesellereducation#preapprovals#traciedemarsremax#remax#chrisberg#chrisbergpinnaclemortgage#helpinghomebuyers#helpinghomesellers#homebuyerbuyereducation#homesellereducation

3 notes

·

View notes

Photo

Home Inspections & Seller Disclosures (part one) Home Buyer/Seller Education... free & non-promotional

Upcoming Free (& non-promotional) Home Buyer Classes: Saturday, October 20th, from 11am-2pm (ish) Vancouver YMCA, conference room 11324 NE 51st Circle, Vancouver WA (corner of SR500 & Gher Road/112th Ave) Monday, October 22nd , from 5pm-8pm (ish) Marshall Community Center, conference room 1009 E. McLoughlin Blvd, Vancouver WA (kitty corner from Clark College) Saturday, November 3rd, from 9am-12pm (ish) Marshall Community Center, conference room 1009 E. McLoughlin Blvd, Vancouver WA (kitty corner from Clark College) If these class dates and/or times don't work for you, please let us know. We understand that you have lives, and families, and work. We will work something out that works better with your schedule. Just let us know.... ....we also have home seller classes available too...link on left on website Remember...with reservation...we will throw in lunch, or dinner! :-D ~~~~~~~~~Happy ...Sunday night I love Sundays... I really do, and especially a drizzly and gray one. Granted I'm only doing laundry and cleaning house, but still ... a gray and drizzly Sunday calls out for pj's all day, my comfy couch, a cozy blanket, and football on the TV. It's a glorious day I tell you... glorious. I even took a short nap! When the day is gray and drizzly, I don't feel guilty for a 'down' day. :-) We do have an exciting event coming up though.... Winter Client Appreciation! Saturday, November 17th, from 3pm-6pm, Chris Berg & I are thrilled to be hosting the NEW, 'Fantastic Beasts & Where to Find Them' movie!! You know the drill... let me, or Chris Berg ([email protected]) know how many adults & kids tickets you need.... and yes, there are some 21+ tickets available as well. Limit of 6 tickets please unless you have talked to me or Chris Berg about it first. We are excited to see you soon!! :-) ...and Thank YOU.. Thank you for your referrals! Thank you for recommending us, or the classes to those you know (and on Facebook too), and THANK YOU for letting us to be part of your home adventures. We appreciate you so much So this week I do want to talk about something that has come up a couple of times recently... Inspections, Repairs, and what happens AFTER.. What do I mean about 'after' though? Well, first let's talk about Inspections for just a bit... It is my opinion that you shouldn't waive the home inspection... it doesn't matter if the home is brand new, or a 100 years old, you should ALWAYS have a home inspection done. After mutual acceptance of the offer (where both buyer & seller have agreed to all terms), the home goes into 'pending' status, and this is where your timelines start. In real estate we have a lot of timelines that we need to make sure we are meeting, and the inspection is a BIG one. From mutual acceptance you have 10 CALENDAR days to have the home inspection done, and to request any repairs from the seller. 'Calendar Days' being the key word words here. A few things to remember about the home inspection... the home inspector does need to be licensed in the state of Washington, but he's usually not a contractor. What this means is that if you have something about the home that you have a concern about, we would want to request a licensed contractor to come look at it. If you are buying a used car, you would take that car to a mechanic to take a look at it, right? Is that mechanic going to find everything wrong with the car? Most likely not, but that mechanic can usually tell you pretty quickly if there is anything seriously wrong with vehicle in the short period they're checking it out. As a potential buyer this will help you decide if you want to purchase that vehicle in its current condition, if you want to go back to the seller and re-negotiate, or if you maybe don't want to buy that car at all. This is a lot like a home inspection. You are purchasing a 'used' home ... nothing more, and nothing less. This is not 'Holmes on Homes', and the inspector can't do anything invasive to the home. During the home inspection you are having a 'house mechanic' take a quick look at the home to see what they can find about it that you can use to decide if you want to continue with the purchase of the home with the home in its current condition, if you want to go back to the seller and re-negotiate for some repairs, or if you want to back out of the purchase of the home inspection. Just like a mechanic though there are good ones out there and some ... well....some not so good. You can always ask your Realtor if they have any inspectors they could refer you to, or ask family/friends. I will give you a list of questions to ask too. Just like a vehicle mechanic though, even with good ones... sometimes they don't catch things. Most inspections are only a couple of hours and again, it's visual. You will find more things as you live in the home... just like you find things once you actually start driving the car regularly. You are going to live in that home differently than the last home owner did...just like you are going to drive the car differently than the last owner did. The goal of BOTH inspections is to hopefully catch anything 'major'...anything that could affect the health and/or safety of the home or the occupants, and anything that could require the assistance of a licensed contractor. During the home inspection there is a very good chance the home inspector IS going to talk with you about things in the home that you should be aware of as a homeowner. Some of these items are going to be things to 'keep an eye on' for future repair, some of these items may just be things you 'need to know'...informational things..., and some of these things may be items that need repair now. YOU should be at the home inspection, and your AGENT should be at the home inspection as well. We can't help you if we aren't there... and we are here to help you. You, and your agent, will talk about the home inspection and what (if any) repair requests you would like to send to the sellers for their consideration. There are going to be things that you will be needing (or wanting) to do as a homeowner when you move in, so what we're looking for at the home inspection is anything that (again) is going to affect the health/safety of the home, or the occupants... or that is going to need to be looked at/repaired by a licensed contractor. After the home inspection (I usually advise my clients to respond with the inspection repairs within 24 hours at the most), you need to decide if you are ok with the home in its current condition and what to continue forward to closing, if you just want to back out of the purchase based on the information from the home inspection, or if you want to request any repairs from the seller. In 99% of the cases, this is what happens.... you have talked to the inspector,you have seen the report, you have talked with your agent and you are ok with some things at the home inspection, but there are some items you want repaired. Your agent then sends that form with the information of those items to the sellers agent to go over with the seller. The seller has 3 days to respond. The seller may come back and say, 'we will do no repairs...buy as-is, or back out', or the seller may say, "we will do all the repairs and we move forward to closing', or the seller (as usually happens) might say, " we will repair items 1, 2, and 4, but not 3, 5, and 6...and we'll do item #7, but changing it to this". The sellers agent will send this information back to your agent, and then You and your agent will discuss your response.... Are you ok with the sellers response? Are you not ok? Do you want to continue forward to closing? Do you want to back out? ...or maybe you want to counter their response? See... re-negotiating.... However, if both parties can not come to an agreement then the deal does fall apart and dies. You will get your earnest money back as that is a legal reason to back out (as long as you didn't waive your home inspection), but you will lose the money you paid to the home inspector for the inspection. One thing you want to talk about with your agent before the home inspection is the sellers disclosures. The sellers disclosures are a 6 page form where the sellers are 'supposed' to disclose everything they know about the home during their home ownership. Again... key words.. 'during their home ownership'. The sellers are supposed to disclose anything that has happened, and been repaired, and/or anything that they are aware of... during their ownership of the home. If it is, or was, something that was prior to their ownership? Well... should they disclose? Yes...if they are aware of it, but one thing to remember is that most sellers do not really know anything about their home. The sellers disclosures are filled out by the sellers, and their agents can't really help them fill them out. Personally, when I am listing a home, I explain what the sellers disclosures are, and what the questions mean. Many sellers disclosures are just randomly filled out by the sellers who have no idea what they are doing. So look at the sellers disclosures, ask questions about it. Your buyers agent can ask the sellers for more information on anything, and as always, you can ask the home inspector to take a look at anything that you have concerns about. Sellers disclosures are difficult because sometimes... a lot of times actually... they are not filled out correctly. I have had to send them back to the sellers agents a couple of times requesting they be filled out correctly, and/or asking for more information from the sellers. This is frustrating for the sellers, and for the buyers...and yes, for me as well. As with ALL legal forms, and yes, Realtor forms used when buying and/or selling a home, ARE legal forms... don't fill out, or sign anything without being certain what you are signing. Ask questions....ASK for clarification...ASK, ASK, ASK... Your Realtor is here to help you. I am going to talk about sellers disclosures more next week because we have had some issues with them recently after closing.... So, home inspectors and home inspections... remember that this wet and rainy weather is a GREAT time for home inspections! We get a lot of rain here so this weather is the best time to see if there are any water/moisture issues in, or UNDER the home. When hiring a home inspector some good questions to ask them are:How long have you been licensed? Licensing for home inspectors in the State of Washington has only has only been required since September of 2009. Many inspectors were in business, unlicensed, before that. Some inspectors took the initiative and were licensed way before that. Your inspector should be bonded, insured, and carry E&O (errors and omissions) insurance. How long will the inspection take? How much is it? The average home inspection should take about 2-3 hours. The average cost is about $400-$450...now to be honest, you can get an inspection for cheaper, but sometimes you get what you pay for. Make sure your inspector is inspecting what is important to you. Remember, as a buyer, the inspector works for you...not the buyers agent, the sellers agent, or the sellers. YOU, the buyer, are hiring this contractor to perform a service for you. Ask the inspector what their inspection entails, and what is included...or not. What does your home inspection entail? What will you do? A home inspector should be walking and checking the roof. A roof must have 2+ year certificate for state or government grants/loans, VA loans, and FHA loans. A home inspector should be walking around the exterior and checking the siding, and looking at the housing vents for broken/missing screens. The home inspector will also be looking at vegetation around the home, and look at the water meter on the curb for current activity.Inside the home, the inspector will crawl the crawlspace looking for leaks, groundwater, evidence or signs of current, or past animal activity, etc. The inspector should also be checking the atticspace for signs of current or past leakage and/or mold. The inspector will also be looking at all water faucets and toilets for leakage, drainage, and more. The inspector should also be checking all windows, electrical outlets and the main electric box for safety hazards, vents and heating units, and more. Do you (the inspector) have a water reader? Some inspectors have a water reader that reads moisture 1 inch into a surface, be it wall or floor. These are wonderful for finding such things as leaking wax seals in toilets (very common), moisture in a wall around a window that hasn't had its' weep seals cleaned, moisture in walls or flooring around such places as washer/dryers, fridges, dishwashers, showers, toilets, and bathtubs. What paperwork will be included at this cost? Some inspectors will charge you extra for a FHA Dry Rot and Pest Report, or for a print out of your inspection. You will need a FHA Dry Rot Pest Report for the state loans, VA loans, and FHA loans. Make sure your cost includes a copy of this. Also, ask how the inspector will get you a copy of your inspection, in what form will it come to you, and how soon can you expect it. The average cost for a home inspection is around $400, but the cost can vary with the size of the home you are purchasing. Some other inspections that you might want to consider is a sewer scope. This is where a plumber comes out and puts a camera down the sewer/septic lines to make sure they are clear of obstructions. It is an additional cost of usually about $150. If the home is on septic, request a septic report/inspection that is one year or less of age. Another inspection you may want to consider (especially in a home with a basement, or any part of the home under ground like a split level, or daylight basement) is a radon test. Many people ask me why there aren't more homes with basements....and there are 2 reasons why that is.... water/moisture and radon. Most of Clark County has a high water table ...not like New Orleans or anything... but we do have a lot of moisture in the ground and clay....which holds water. There are many areas of Clark County where homes will have sump pumps, or extra drainage in the crawlspace to help with this, but if a home has a basement, or some form of it...that is an area you want the inspector to be checking out. Then there is Radon... radon is a gas that comes from the ground that can make people very sick. Some areas have high levels of radon and some areas...not so much. I have a client buying a home right now with a very high level of radon read in the daylight basement. There are contractors who come out for radon remediation, and they are having that done. Lots of information this week... sorry! Part 2 of this will be coming next week or so. :-) Information is power, and as always...May the odds be ever in your favor out there.... If you are looking for a real estate agent, I would love to be able to help you. If you have any questions, or comments please get a hold of me anytime. You can call, text, email, or even facebook me. Please remember that while I mean these emails/blogs to be helpful, and educational, I am still hoping that you will call, or email me as I would be honored to help you with your home buying, or home selling adventure. As always....this is just a quick overview.... again...and I can't say this enough...please remember that your agent is NOT a salesperson, and should not be acting like one. Real Estate is not really about houses, it is about relationships. Your agent, and your lender work for YOU. You drive the bus...we are merely GPS to help you get to your goals. Like the classes, this weekly blog email is to help you with your home adventure. The goal is to be informative and non-promotional. :-) We are, however, hoping you will call and want us to help with your adventure. Thank you again for your business and your referrals!! ...and thank you for referring these classes to your friends, family, and co-workers. ....disclaimer...if you have already purchased a home, or would no longer like to receive these emails, please let me know and I will be happy to remove you from any further mailings... Upcoming Topics: What happens AFTER the home inspection? Delayed Possession... What is this & what does it mean to you Interest Rates (information from Chris Berg, Pinnacle Mortgage) What do I need to buy a home, Hiring a Realtor...questions to ask, What if I don't have a Down Payment? ..... &....What does an Agent do for me? Debt to Income Ratios....What is this? Last Week: Pre-Approvals... what, why...and getting one Have a great day, and I will talk to you soon, ;-D Tracie DeMars Real Estate broker Re/Max - Van Mall 360/ 903-3504 cell 360/ 882-3600 fax www.traciedemars.com [email protected] “Interested in free and non promotional home education classes? Go to www.freehomebuyerclasses.com for local upcoming home buyer and home SELLER classes, or facebook: Tracie DeMars Real Estate for my home buyer education blog.” "Listen to the mustn'ts, child. Listen to the don'ts. Listen to the shouldn'ts, the impossibles, the won'ts. Listen to the never haves, then listen close to me... Anything can happen, child. Anything can be." - Shel Silverstein, American poet, cartoonist and composer, (1930 - 1999).

#traciedemars#traciedemarsrealestate#traciedemarsrealtor#traciedemarsremax#real estate#realestatevancouverwa#learningtobuyahome#homebuyers#homesellers#homesellereducation#homebuyereducation#clarkcountywa#clarkcountywarealestate#helpinghomebuyers#helpinghomesellers#homeadventures#adventuresinrealestate#knowledgeispower#knowingishalfthebattle

1 note

·

View note

Video

youtube

Tuesday's Tips with Tracie Be aware.. Showing Homes with Big Brother & Covid

www.learningtobuyahome.com

www.freesellerclasses.com

#traciedemarsrealestate#traciedemarsrealtor#traciedemars#traciedemarsremax#remax#vancouverwa#learningtobuyahome#learningtosellahome#learningtobuyahomedotcom#homebuyereducation#homesellereducation

0 notes

Video

youtube

Tuesday's Tips with Tracie www.learningtobuyahome.com Selling your home and building a home

#TracieDeMars#TracieDeMarsRealEstate#TracieDeMarsReMax#TracieDeMarsRealtor#LearningToBuyAHome#LearningToBuyAHomeDotCom#LearningToSellAHome#FreeSellerClasses#HowToBuyAHome#HowToSellAHome

0 notes

Video

youtube

Tuesday's Tips with Tracie www.learningtobuyahome.com

#TracieDeMars#TracieDeMarsRealEstate#TracieDeMarsRealtor#TracieDeMarsReMax#LearningToBuyAHome#LearningToBuyAHomeDotCom#FreeSellerClasses#SellingAHome#SellingMyHome#HowToBuyAHome#HowToSellAHome

0 notes

Video

youtube

Tuesday's Tips with Tracie: selling & buying contingent

0 notes

Video

youtube

Tuesday's Tips with Tracie: Explaining Closing Costs www.learningtobuyahome.com

www.traciedemars.com

#traciedemars#traciedemarsrealestate#learningtobuyahome#sellingahome#homebuyereducation#homesellereducation#traciedemarspnwrealtor#traciedemarsrealtor#traciedemarsremax#realestate#buyingahome#pnwrealtor

0 notes

Photo

COVID & buying or selling...Education

Home Buyer & Seller Education & Virtual Classes

Please remember that, currently, ALL BUYER & SELLER classes are being held virtually. We look forward to teaching at the community centers again, once they open.

For the virtual classes, they are TWO hours long, and will start at the scheduled starting time. Please email [email protected] for link & password

Upcoming Home BUYER Classes

Saturday, August 8, from 10am-12pm (ish)

Saturday, August 15, from 11am-1pm (ish)

Saturday, August 22nd, from 12pm-2pm (ish)

Monday, August 24th, from 5pm - 7pm (ish)

Saturday, August 29th, from 10am - 12pm (ish)

Upcoming Home SELLER Classes

Saturday, August 8th, from 12:30-2:30pm

Saturday, August 22nd, from 9am-11am

Thursday, August 27th, from 5:30pm-7:30pm

Happy August!

I have to admit.. I am sad today. Today is the day before the Clark County Fair would have started. Today I should be at the fairgrounds setting up our booth and getting ready for the fair to start tomorrow morning. We are at the fair every year, and as exhausting as it is, it is also fun, exciting...and honestly... I absolutely love it when our friends, family, clients (both past, present, and future) come and visit us. I love seeing everyone and visiting with them. I also love being able to give little gifts to everyone. I am also looking at the projected weather forecast for the next week, and honestly, I am crying a bit as it is really a PERFECT fair forecast.....of course it is, right? Remember how at the beginning of this year we were so excited? All the holidays that were going to fall on the weekends? 4th of July on a Saturday? Rock on! Halloween on a Saturday AND with a Full Moon? AWESOME! Christmas? New Years? On Saturdays? Score!! It's like the stars all lined up for a perfect year....and well, it's like that piece of cake you are so excited to come home to eat, and that you have been thinking about ALL day...and you come home, and it is GONE!!! Someone else ate it!! You know what I mean...right? That is what 2020 feels like to me... crazy.. but here we are.

HEADS UP, if you are a CLIENT, please check your mail boxes! We couldn't do a Client Appreciation this spring, but there is something in your mailbox that should be a little fun. We are also trying to plan something for the end of summer... we will see how that shakes out... stay tuned!

This month I am going to talk about showing a home and a few of those 'hidden' fees that people don't think about. Whether you are thinking about selling (because it is definitely a sellers market), or you are buying a home... how does that work right now with COVID and everything else going on? Well, hopefully, this should help. As always...feel free to reach out with any questions! Thank you!!

While showing homes, we go over lots of 'little' things that otherwise people don't think about. Some of these items are the 'hidden' costs of buying a home....those things that you weren't planning on, but probably should be. Not too long ago, I was on one of the facebook swap/free/sale sites, and I was reading how some people were upset with the home buying process and the 'hidden' fees they weren't told about. It is true that there are a LOT of fees and other expenses involved with buying a home. The point of these blogs, and of course, the home buyer classes is to give folks this information. There shouldn't be anything 'hidden' about the home buying process. As you know, I am a big fan of not sugarcoating anything....I believe that an ugly truth is better than a pretty lie every day of the week. You might not always like what I have to say (and that is ok), but I am not going to hold anything back from you on the off chance you might not ask me to help you buy, or sell, your home. Personally I don't just want to hear about the 'good' things about a loan, or process....I want to hear it all...the good, the bad, and the ugly, so that I can make the best decision for me and my family based on the pros and the cons....not just the good. So....yes, I am not going to just agree with what you read on the internet, or saw on HGTV, or heard from your direct and personal circle....I am going to give you the pros and cons because this is YOUR home buying (or selling) adventure, and YOU need to make the decisions. My job is to help you find, and have, all the information I can get you so that you can make those choices based on a full picture....not just half of one. Last month we talked about the 'basic' fees of earnest money, home inspection (including the possibility of radon & sewer scope), and appraisal. However there are a few other 'fees' that you might want to think about.

Other fees?

Changing out locks

...I always advise my clients to change out the locks of their new homes. Why? Well, even if the sellers give you all the keys they have...there is not guarantee that there isn't more keys running around somewhere. I used to change out my house locks every couple of years because my kids were always losing keys. Finally....last year... I went and purchased the the house locks that have the key pad. It is awesome!! I don't worry about lost keys anymore. Every family member has a code, and what is the best is that I can add and delete codes as needed. So...go away for a couple of days, and have a house sitter? Give them a code,and when you get back you simply delete the code. I tell you....worth it!

Mailbox key

...yes, legally you are not supposed to copy the mailbox key, but a lot of people do. Mail is not something you want to mess with. Take your HUD form down to the post office, and have them re-key the box, and get a new key. Cost is about $100, but for peace of mind...that isn't much. When you are changing out locks, talk with the locksmith... she/he may be able to help with this as well.

Paint

...you will probably want to paint some, or all, the rooms of your new home. Each gallon of paint runs about $25. Paint is the easiest thing you can do to make the home 'yours', and it's fun! Paint can change the entire feel of a room, or home. Personally, I am a fan of semi-gloss. I like the shine to it, and most importantly, it cleans up easy....with kids and big dogs, this is my go-to.

Minor repairs

...during the home inspection the inspector will probably point out repairs that the home may need. Some of these repairs may be cosmetic repairs that will be part of your 'honey-do list' with your new home. Remember that, at the home inspection, we are looking for any repairs that will affect the safety of the home, or occupants...or anything that may need a contractor to repair. The 'big' areas that we usually see repairs for are roofs, attic spaces, crawlspaces, and siding. These are the places that usually get called out during the repair process for a licensed contractor to come in Remember that home inspectors are licensed for home inspections. It is during this period that we will request a second opinion by a licensed contractor...who can give a better, more thorough inspection/repair for the item that the inspector called out. All homes have some repairs that will need to be done by the (new) homeowner....it is part of being a homeowner. Don't forget that the worst thing a homeowner can do is to defer maintenance. If you need help with that, give me a call or email... I always have a 'guy' that you can call for help. Anytime you need work done around the home that you can't do, give me a holler...I know people. I tease, but it is true. I know excellent contractors that will usually give you a better deal because I refer them out. I refer them out because they do a good job...and give better deals. Just like in Real Estate... referrals are the name of the game. :-)

Lawn supplies

...did you come from an apartment? Well, most likely now you have a yard. You will need a lawnmower to start with. There will be other lawn equipment that will follow...weed eaters, trimmers, wheel barrels, shovels, and a myriad other things that come with having a yard.

Appliances

...don't forget that washer, dryer, and fridges don't come with the home. If you don't already have these appliances then you may also be purchasing a washer, dryer, and/or a fridge. Just please, please, please wait until AFTER you get keys for the home before you go purchase these things.

Curtains/Blinds

...if your new home doesn't already have some then this may be on your 'to buy' list. Sometimes even if your home does have some, you may want new ones. Honestly, I have had very good luck with curtains at places like Target, or Fred Meyer, or even Wal-Mart. I think I've gotten all my curtains from Target. They have blinds as well.

House Cleaner/Carpet Cleaner

...when a home is vacant you know exactly what you're going to be walking into when your buyers agent (hopefully me LOL) gives you keys, but... when the home is owner occupied, you don't. Yes, you can and will do a walk thru of the home before closing, but it will still be occupied. In many cases, when the home is owner occupied the (soon to be) previous owner doesn't vacate the property until day of closing, or sometimes even a couple of days after closing. With cases like this, you really don't know what condition the home will be upon closing. We have to have faith that the (soon to be) previous owner will leave the home in a clean condition, but sometimes...well, sometimes, they don't. Also, one persons idea of clean is not another persons idea of 'clean'. :-) Many times, whether the home is vacant or owner occupied, a buyer will book a professional carpet cleaning, or house cleaning after closing....simply for peace of mind.

Insurance

...wait..you already have insurance, don't you? Well...yes, you have mortgage insurance, title insurance, and homeowners insurance, but what about earthquake insurance? You don't...

When I purchased my home my homeowners insurance included earthquake insurance. About 10 years ago though we received a letter that no longer would homeowners insurance include earthquake insurance....why? Because we live in the #1 high danger area for earthquakes. Because of that earthquake insurance must now be purchased separately. So, AFTER you buy your home, call your insurance company and add on earthquake insurance. Cost isn't too much, but it is important....just in case.

Toilet Seats

Yeah, I know you probably didn't think of that, but really....if it were me, I would change out the toilet seats when you buy your new home. Why? Well, since now you are thinking about it....I'm sure you can see why. LOL Toilet seats are not expensive, and really...having new seats just makes you feel better! :-D

As we've talked about, once you hire a Realtor to help you with your home adventure, you are ready for the 'fun' part.....LOOKING AT HOMES! :-) This is always an exciting time for buyers, and it should be! Every home you pull up to has the possibility to be 'the one'....The one you make an offer on, the one that you buy, the ONE that becomes YOUR HOME...and it is very exciting. For the sellers though, it is very stressful because currently it is THEIR home, and they're leaving so that strangers can come in. As a Realtor, we are trying to make this as easy as possible for both the buyer and seller, but we need help... especially right now...

We are in the world of COVID, and it has changed how we look at homes.

For the homeowners (sellers), we are asking that the home be available to show, that the home be clean, nothing of value is being left out, all medicines are put away and out of sight (not left in bathrooms or kitchen cabinets), anything that a seller wants excluded from the sale is noted, that sweet pups are either removed or kenneled, that sweet kitties are noted as inside only or inside/outside ok, and that please, please... homeowners (sellers) be gone for showings. Selling your home means opening up your home to strangers. Please note that anytime a Realtor shows your home, that Realtor is responsible for the buyers they bring into your home. If you have any COVID concerns, please bring them up with, and talk about them with your Realtor. As always, there is more to it than this, but that is a different class....and email. You can always call me for more information when you are selling your home.

For the buyers....it gets a bit more complicated... before we go house shopping, we are asking that you have a pre-approval letter with a solid lender, we are asking that you do not look at homes above your price range, we are asking that you have thought about the Top Three things you want in a home (so we can show you homes that have those items you value most), and that you help us help you.... We are currently in Phase 2 which means that we can't have more than 3 people (including the Realtor) in the house at a time, and yes, masks are currently required when we are showing homes. Many homes will request that we take off shoes so be sure to wear easy on/off shoes.

When a Realtor opens the lockbox to show you the home, we are taking responsibility for everything that happens from that moment on....until we lock up the house and put the key back into the lockbox. As I say all the time... Real Estate is NOT like HGTV... you don't just get to wander the home while your Realtor sits outside... we must be with you at all times when touring your potential new home. Sometimes this can be like herding cats, but we understand your excitement... just please, please as you are touring the home, and we know you have your family with you, please...we must all stay together. Don't make me sing to you here.....

As cool as those toys look, I'm sorry but the kiddos can't play with them, and sorry...but you can't jump on the beds either. It's ok to open cupboards, and closets, but we can't open dressers, or go through someone else's personal items. Touring a home is a VISUAL thing....sorry. However, yes, you can use the bathroom....usually.. sometimes we do have requests from sellers that bathrooms are NOT used. I showed a home last week where the sellers literally taped the toilets shut on days they were showing. I thought it was funny...

When we are looking at homes, often we have more than one home to look at, and many homes are owner occupied so your Realtor makes appointments. We do the best we can to make sure we have enough time to look at the homes, but we need to stay within our timeframes as the sellers are waiting to come home after we leave, or there are other Realtors waiting to show the home. I promise we are not trying to 'rush' you through the home...we are just trying to stay within the timeframes so that you can see the other homes on your list.

Looking at homes is exciting, and many of you will send your Realtor a long list of homes to go see, but what you don't know.....yet...that looking at homes is exhausting, and they quickly starts to blend together. Don't look at more than 6-8 in one appointment. I've had clients look at up to 10 at once, and that is a lot. We can do it....just be prepared. Your Realtor should give you a print out for each home we see, so be sure to take notes on each of the houses because they will blend together and you will not remember what you liked, or didn't like, about the first couple of homes by the time we get to the last couple of homes. :-)

With the real estate market being so crazy right now, it's important that if a home comes up that you like, that you let your Realtor know as soon as possible so we can make an appointment for you to see it. Many homes are receiving multiple offers and go pending within a few days. Your Realtor should be sending you a list of homes as they come on the market for you to check....drive by the homes...check out those neighborhoods....and let's make an appointment to go see the inside of the home.

Do not trust Internet photos! Realtors hire professional photographers for our listings for a reason. Smile Internet photos are a lot like internet dating...you don't know what you're going to get when you get there

Like the neighborhood, but not sure about the house? Let's at least go check out the inside! You never know as you can't judge a book (or a house) by its cover.

ASK QUESTIONS!! For heavens sake...this is a home you are thinking about buying... ask questions! As your Realtor, we are here to help! If we can't answer your questions, we can at least set up in the right direction to get those answers.

Buying a home is a very emotional experience. Your Realtor is here to point out pros/cons, and to help you.... Trust your heart, but use your head... or your Realtor. :-) Remember that we work FOR you.

As always....this is just a quick overview.... again...and I can't say this enough...please remember that your agent is NOT a salesperson, and should not be acting like one. Real Estate is not really about houses, it is about relationships. Your agent, and your lender work for YOU. You drive the bus...we are merely GPS to help you get to your goals. Like the classes, this weekly blog email is to help you with your home adventure. The goal is to be informative and non-promotional. :-) We are, however, hoping you will call and want us to help with your adventure.

If you have any questions about this, or something you have heard...or if you would like me to help you with your home adventure, please call, email, text, or facebook me anytime. I am, as always, happy to help!

Thank you again for your business and your referrals!! ...and thank you for referring these classes to your friends, family, and co-workers.

. ..disclaimer...if you have already purchased a home, or would no longer like to receive these emails, please let me know and I will be happy to remove you from any further mailings...

Information is power, and as always...May the odds be ever in your favor out there.... If you are looking for a real estate agent, I would love to be able to help you.

If you have any questions, or comments please get a hold of me anytime. You can call, text, email, or even facebook me. Please remember that while I mean these emails/blogs to be helpful, and educational, I am still hoping that you will call, or email me as I would be honored to help you with your home buying, or home selling adventure.

Upcoming Topics:

What if I don't have a Down Payment?

How do I hire a Realtor, & do I have to sign anything?

Heating Types (but I want AC)

Last Week: Can you buy a home with ZERO out of pocket?

Have a great day, and I will talk to you soon,

;-D

Tracie DeMars

Real Estate broker

Re/Max - Van Mall

360/ 903-3504 cell

360/ 882-3600 fax

www.traciedemars.com

“Interested in free and non promotional home education classes? Go to www.learningtobuyahome.com or www.freesellerclasses.com for local upcoming home BUYER and home SELLER classes, or facebook: Tracie DeMars Real Estate for my home buyer education blog.”

"Listen to the mustn'ts, child. Listen to the don'ts. Listen to the shouldn'ts, the impossibles, the won'ts. Listen to the never haves, then listen close to me... Anything can happen, child. Anything can be."

- Shel Silverstein, American poet, cartoonist and composer, (1930 - 1999).

#traciedemars#traciedemarsrealestate#buyingahome#sellingahome#learningtobuyahomedotcom#learningtobuyahome#learningtosellahome#buyersagent#sellersagent#traciedemarsremax#remax#traciedemarsrealtor#pnwrealtor

0 notes

Photo

Let's talk about CLOSING COSTS! Upcoming Free (& non-promotional) Home Buyer & Seller Classes: Until further notice, all classes are going to be held virtually due to the Coronavirus. Please email [email protected], or [email protected] for a link & password to the classes. Thank you! Home Buyer Classes: Saturday, May 9th, from 9am-11am Saturday, May 16th, from 12pm-2pm Tuesday, May 19th, from 5pm-7pm Saturday, May 30th, from 11am-1pm Seller Classes: Saturday, May 16th, from 9am-11am Thursday May 21st, from 5pm-7pm If these class dates and/or times don't work for you, please let us know. We understand that you have lives, and families, and work. We will work something out that works better with your schedule. Just let us know.... Good morning... or afternoon? I have lost all sense of time, and dates. It's a weird time in our lives right now. A few weeks ago when I wrote up the 'Forbearance and what it really means' blog, I thought that we would all be back to 'normal' by now...whatever 'normal' is... However, I think we can all agree that 2020 is the year that time forgot, and here we were all excited about holidays falling on weekend days... Chris & I are getting used to the virtual classes, and people seem to like them. It is a shorter time frame though so there are things we simply do not have time to cover, and that's why I need to step these up again to at least every other week instead of just once a month as I've been doing. Please, if you have any questions, send them over to me, and I will be happy to help! Chris and I are both still working. I am still showing homes, and writing up offers, but showing homes is a bit trickier right now as we do want everyone to be safe, and we have to work within the guidelines that we have been given. Who says an old dog can't learn new tricks??? Just a quick message... usually about now we would be having our Client Appreciation Event where we THANK YOU for your friendship, your referrals, your continued business & support...and well, just for being part of our lives! We LOVE YOU. Let's be honest...that's not happening this year, so be on the lookout for a little something-something from me and Chris Berg in your mailbox in the next few weeks. When you get it you just have to tag us on the social media of your choice...Facebook? Instagram? ...and maybe leave us a glowing review somewhere?? We miss you!! I want to go over Closing costs this time, and 'hopefully' I will be able to get a short video out on this too. I am working on that one... Let me know what you think! Closing costs are an important part of the home buying (or selling) process, but no one really knows what they are, are often how much they're going to be....and why is that? Well, first you need to know that there are 28 people involved in the purchase/sale of a home. You will most likely only ever see four of them.... your lender, your agent, your inspector, and your title officer at the end. You'll hear a lot about appraisers, and underwriters, but that is a different blog. Everyone has a job to do in the transfer of the property from the seller to the buyer....and everyone needs to get paid. Your buyers agent is FREE (don't get caught by 'buyers agency fees' as those are not common), but that may be the only free thing you get. Seriously... you don't have to pay for a buyers agent! There is your good news. :-D So what the heck is closing costs then? Lots of people talk about closing costs, but most people don't understand what they are...or how they're paid. Closing costs have two separate parts really...1....the part associated with your loan, and 2...the part associated with the title company and changing the ownership of the home to you.. One thing you need to know is that closing costs are not set...in other words...one persons closing costs will not be the same as another persons closing costs. Why? Because ...1....every person has a different loan based on their credit scores, type of loan, amount of home buying, amount (if any) of downpayment, what day they're closing (keys) on, interest rate, APR rate, lender they're using (some have more fees than others), etc... See how complicated that can get? So what about the second part? Well, that can differ as well based on the title company since not every title company charges exactly the same for their individual costs. Then there is also the costs for the property taxes of the home, time of year you are buying based on when the taxes are due/have been paid, cost of your home owners insurance, amount of loan interest, and more. Even more confusing, yes? Ok...now I know you are thinking that this weeks post is pointless then, but really, I have a point! :-) My point is that closing costs are variable based on you, your loan, your lender, your (soon to be) new home, and on the title company. So how do you figure that out? Well, really no one can figure out HOW much your closing costs are going to be until you have an accepted offer on a home...then we can figure out what your closing costs will be because you will have a home to base numbers off of, a loan chosen, a lender, and the title company picked out. Most numbers in real estate are a guesstimate until you have all the pieces in place...all the ducks in order...so to speak. When you are getting pre-approved, your lender will base all your numbers on a guesstimate...what we think your costs are going to be. Most times lenders, etc will guess high so that the numbers will come in smaller and more affordable for you. It is always better to look like a hero than a zero! :-) I know, I know...still not very helpful is it? I am sorry. Closing costs are as individual as you are. However, 98% of buyers will request the seller to pay for 2%-3% of their closing costs. Where does that number come from though as even this number changes depending on the person, their loan, the home involved, etc. Well, to start... a FHA loan requires 3.5% downpayment. FHA is the most common loan type for buyers as it is very forgiving, and easier for the majority of folks to get pre-approved for. There are some loans, and yes, grants too, that can take care of that down payment for you....meaning a ZERO down loan for you, the buyer. There are some additional fees to using these down payment assistance programs that is part of your closing costs. There is also a zero down USDA loan that has other fees associated with it. On average, the costs between title, loan, lender, taxes, interest, insurance, etc....run about 2%-3% of the homes purchase price....rarely does it run more. When listing a home, I (and many other agents) include at least some seller paid closing costs to the sales price of the home. This is done because so many buyers request those from the seller, and this way it isn't a surprise to the seller. So, yes, some sellers will pay for your closing costs when buying a home...of course, that depends on if there are other offers involved. In a multiple offer situation the seller may not pay any closing costs. One thing you need to know though is that if you ask for 3% in closing costs, and the lender only needs 2%, you don't get that other 1%....it goes back to the seller. You can't get cash back from buying a home....unless you are having your earnest money &/or appraisal fee returned to you...this happens if you are using a loan that covers your costs and fees. Usually your appraisal is part of your closing costs (but paid for at time of appraisal), and your earnest money is applied toward your down payment, or your closing costs. Again, 85% of the time a buyer will request some of the closing costs to be paid for by the seller. The other 15% of the time a buyer will pay their own closing costs so they don't have to finance them. Right there is the REALITY of closing costs. The seller never actually 'pays' for your closing costs... the buyer is financing them into the purchase price of the home...adding the closing costs to their loan. The seller is merely accepting less than the purchase price so that the buyer can do this. If you remember ANYTHING about this email...that is what you should remember.So, if a buyer has their own down payment, the lender can also help pay closing costs, and this can be done a couple of different ways. If a buyer is using one of the down payment assistance loans or grants, or the USDA loan, the lender can't help pay those closing costs. The buyer can use their earnest money towards these though. Not asking a seller for help with closing costs does make for a 'stronger' offer, but let's be honest...that isn't always an option for a lot of people. However, if able to do so, sometimes people will use the zero down loan or the down payment assistance loans, and use the money they have for their own closing costs, but asking the seller for help with closing costs is quite common. Really it depends on many things. In short....buyers responsibility for closing costs are:* Lender's Title Insurance Policy* Half of the escrow fee* Home Inspection (paid for at time of inspection)* Recording fees* First year Homeowners Insurance Premium* First year Flood Insurance (if applies)* Pro-rated property taxes* Appraisal fee (paid for when appraisal is ordered)* Survey fee (if required)* HOA fees (if applies)* Pro-rated HOA fees (if applies)* Lender fees; appraisal fee (see above), credit report, loan origination fee, pre-paid interest, private mortgage insurance All of these fees can change depending on the title company, the lender you've hired (closing costs can differ between lenders as some charge more & some charge less), the home insurance company you are using, the home inspector you've hired, the appraisers and what they're charging (and if you need a rush), etc.. Let me see if I can't make that part a bit easier... I am going to give you 2 loans to choose from, and we are going to PRETEND that I am loaning you $1,000 for a year First loan is 0% interest. Second loan is 5% interest. What loan do you want? The 0% one, right? Most people (in the class) always choose this one, but frankly, there's not enough detail here for you choose a loan, so let's take it a step further.... I have to charge you (the buyer) closing costs. Closing costs is to pay for all those 28 people that are involved in the purchase/sale of a home. The seller has their own portion of closing costs to pay as well. On 'average', the closing costs for the seller are going to be about 8%-9% of the purchase price. Yep... there's a cost to buy a home, and a cost to sell a home too. First loan at 0% Second loan at 5% Remember...closing costs.... Bank one charges $200 Bank two charges $100 So, what happens a year from now? How much of your money do I have a year from now when you come back and pay me back my $1000 that I loaned to you? Well....let's break that down... Remember that the original $1000 doesn't count because it was already my money. I loaned it to you, and now you are paying it back to me... First loan at 0% Second loan at 5% Closing costs.... Bank one charges $200 Bank two charges $100 Interest... Bank one has 0% Bank two has $50 ---------- ------------ How much of your money do I have? With Bank one I have $200 Wit h Bank two I have $150

So with bank one it's going to cost you 20% to borrow that money for a year, & with bank two it's going to be 15%... which one is better now? This is a very simplified example, but you get it. There is a lot more to closing costs & buying a home than just interest rate. You could have an amazing, unheard of interest rate, but the costs to get that rate could end up being astronomical, and not worth it over the length of your ownership. Remember that interest rates are NOT controlled or governed by the lenders....it is by the GOVERNMENT. All lenders are very close to each other because the interest rate is not in their control. Realistically speaking it is how much they are going to CHARGE you for the loan and the interest rate that is going to matter. as always....I am available for questions...as is Chris Berg with Cardinal Financial ([email protected] or [email protected] & 503-320-0925 cell) One last thing you need to remember is that a real estate agent is not a sales person. It is not our job to 'sell' you anything. We are assistants, advisers, guidance, and help. You should not feel as if your agent is trying to sell you a home, or anything else, our job should be to help you in getting the home you want. This being said remember that you do not get T-Bone steaks for the price of hamburger...Look ONLY at homes within your budget. ALWAYS ask questions, and expect answers without a lot of lingo. I was always told that if you can't explain something in a way that the other person can understand clearly, it is because you don't understand it yourself. :-) Information is power, and I hope that I am able to help you. Good luck, and as always...May the odds be ever in your favor out there.... AND If you are looking for a real estate agent, I would love to be able to help you. As always....this is just a quick overview.... again...and I can't say this enough...please remember that your agent is NOT a salesperson, and should not be acting like one. Real Estate is not really about houses, it is about relationships. Your agent, and your lender work for YOU. You drive the bus...we are merely GPS to help you get to your goals. Like the classes, this weekly blog email is to help you with your home adventure. The goal is to be informative and non-promotional. :-) We are, however, hoping you will call and want us to help with your adventure. If you have any questions about this, or something you have heard...or if you would like me to help you with your home adventure, please call, email, text, or facebook me anytime. I am, as always, happy to help! Thank you again for your business and your referrals!! ...and thank you for referring these classes to your friends, family, and co-workers. . ..disclaimer...if you have already purchased a home, or would no longer like to receive these emails, please let me know and I will be happy to remove you from any further mailings... Upcoming Topics: Can you buy a home with ZERO out of pocket??What are the costs of buying a home? ALL of them??Buyers Agency...what are they really, and do you have to sign one? Last Month: What does forbearance really mean? Have a great day, and I will talk to you soon, ;-D Tracie DeMars Real Estate broker Re/Max - Van Mall 360/ 903-3504 cell 360/ 882-3600 fax www.traciedemars.com [email protected] “Interested in free and non promotional home education classes? Go to www.learningtobuyahome.com or www.freesellerclasses.com, for local upcoming home buyer and home SELLER classes, or facebook: Tracie DeMars Real Estate for my home buyer education blog.” "Listen to the mustn'ts, child. Listen to the don'ts. Listen to the shouldn'ts, the impossibles, the won'ts. Listen to the never haves, then listen close to me... Anything can happen, child. Anything can be." - Shel Silverstein, American poet, cartoonist and composer, (1930 - 1999).

#realestate#traciedemars#traciedemarsrealestate#traciedemarsrealtor#traciedemarsremax#remax#closingcosts#traciedemarspnwrealtor#homebuyereducation#learningtobuyahome#learningtobuyahomedotcom#sellingahome#buyersagent#sellersagent

0 notes

Photo

Want to buy a home? Where to Start?