#title loans newfoundland

Explore tagged Tumblr posts

Text

Get Approved Today: Car Title Loans in Newfoundland & Labrador

Need quick cash in Newfoundland & Labrador? Snap Car Cash is here for you! Our Car Title Loans Newfoundland & Labrador offer a fast and easy solution to borrow money against your car. With our instant loans, you can get online approval without any credit checks. Don’t let financial stress weigh you down—turn your vehicle into cash today! Whether you need money for unexpected expenses or just a quick boost, we’ve got you covered. Get started now with Snap Car Cash and experience the convenience of borrowing with confidence.

#Car Title Loans Newfoundland & Labrador#Title Loans Newfoundland & Labrador#instant loans no credit checks online approval#quick cash loans no credit check#easy loans no credit check#quick loans online no credit check#borrow money instantly no credit check

0 notes

Text

Buying a Foreclosure Homes in Canada a Smart Investment?

Buying a foreclosure home in Canada offers a unique opportunity for investors and buyers to acquire properties at below-market prices. Foreclosed homes are properties that lenders sell after the previous owners fail to pay their mortgages. Though less common, these sales provide buyers with a chance to purchase properties at a discounted rate. With recent increases in mortgage interest rates, some Canadian homeowners have struggled with payments, potentially leading to more foreclosures and opportunities for savvy buyers.

Understanding Foreclosures in Canada

When a Canadian homeowner can’t make their loan payments, the lender has the right to take back and sell the property to recover their losses. This process, known as foreclosure, can begin as soon as a payment is missed. However, it’s not an immediate sale. The lender first issues a notice of default, giving the homeowner time to resolve the issue or sell the property themselves. If the homeowner fails to take action, the lender may proceed to sell the home, often through an auction.

It’s important to note that foreclosures are less frequent in Canada compared to the United States, making them a niche opportunity in the Canadian housing market.

Types of Foreclosures in Canada

There are two primary foreclosure methods used in Canada:

Judicial Sale: In provinces like British Columbia, Quebec, Alberta, Saskatchewan, and Nova Scotia, lenders must go through the courts to gain permission to sell the property. This method can be time-consuming and expensive, often taking several months or even up to a year. The court involvement ensures a fair process, but it also means the lender incurs legal costs, which they recover from the sale proceeds.

Power of Sale: In provinces such as Ontario, Prince Edward Island, New Brunswick, and Newfoundland and Labrador, lenders can sell the property without going through the courts. After the sale, they pay off the mortgage debt and any related fees. If the sale amount exceeds the debt, the remaining funds go to the borrower. However, if the sale falls short, the borrower remains responsible for the outstanding balance. This method is typically quicker and less costly than the judicial sale process.

Things to Know About Foreclosure Sales

Pre-Foreclosure Sales: Sometimes, homeowners attempt to sell their property before the lender takes control. This can present opportunities for buyers to purchase at a discounted price before the foreclosure process is finalized.

Auctions: Banks may sell foreclosed homes through auctions, either in person or online. It’s essential to understand the rules and costs associated with these auctions, as inspections are often only allowed after purchase.

Is Buying a Foreclosure Right for You?

Investing in a foreclosure property can be a great opportunity, but it also comes with risks. It’s essential to assess your financial situation, experience level, and comfort with potential challenges.

Benefits of Buying a Foreclosed Home:

Lower Price: Lenders often aim to sell quickly, which can result in discounted prices.

Investment Potential: Foreclosures can be an affordable entry point for those looking to buy, renovate, and rent or resell properties.

Clean Title: Lenders usually clear old debts or unpaid taxes before selling, simplifying the purchase process.

Renovation Opportunities: Purchasing below market value allows buyers to invest in improvements that could increase the property’s value and equity.

Buying a foreclosed home is often faster than a standard property purchase. Banks and homeowners eager to sell may offer better deals and expedited transactions, appealing to both investors and first-time buyers.

Challenges of Buying a Foreclosed Home

Despite the advantages, buying a foreclosed home has its downsides:

Competitive Market: Not all foreclosures are discounted significantly. In a competitive market, desirable properties may sell quickly, pushing prices higher.

“As-Is” Sales: Foreclosed homes are sold “as-is,” meaning buyers take on any necessary repairs and may need to remove belongings left behind.

Complex Legal and Financial Processes: Purchasing a foreclosed home often involves more stringent procedures, which can be complicated and time-consuming.

Liabilities and Taxes: Mortgage contracts may release lenders from any responsibility for property issues. Buyers may also face land transfer taxes, especially in Ontario, where rates range from 1% to 3% based on the property value.

Steps to Buying a Foreclosed Home in Canada

If you decide to pursue a foreclosure purchase, follow these steps:

Hire a Realtor: A professional REALTOR® with foreclosure experience is crucial. They can guide you through the complexities of buying a distressed property and answer any specific questions you may have.

Inspection and Appraisal: Conduct a thorough property inspection and appraisal to ensure you’re getting a fair deal and to understand the home’s true condition.

Budget for Costs: Foreclosures come with additional expenses, such as:

Reconnecting utilities

Renovations

Changing locks

Land transfer taxes

Administrative fees and permits for modifications

New appliances and repairs

Improve Your Finances: Boost your credit score, save for a substantial down payment, and pay off any existing debts to increase your chances of mortgage approval.

Make an Offer: Once you’ve done your research and decided to move forward, work with your realtor to make a competitive offer.

How to Find Foreclosure Homes in Canada

If you’re interested in exploring foreclosure options, here’s where to look:

Online Listings: Many real estate websites have foreclosure sections or filters to help you locate these properties.

Bank Websites: Some Canadian banks list foreclosed properties under “real estate owned” or “foreclosure” sections.

Real Estate Agents: Agents specializing in foreclosures can help you find and secure properties.

Government Websites: Occasionally, government listings include foreclosures, particularly those related to tax defaults.

Urban Team: Your Trusted Partner in Foreclosure Home Buying

With over 15 years of experience in the Canadian real estate market, Urban Team Homes is your trusted partner in buying foreclosure homes. Whether you’re searching for a primary residence or an investment opportunity, our expert team offers personalized support throughout the entire process, from property search to market analysis and negotiation. We ensure a smooth and successful transaction, making your investment in a foreclosure home a smart and rewarding decision.

Frequently Asked Questions (FAQs)

1. Can you buy foreclosure homes in Canada?

Yes, foreclosure homes are available in Canada, typically listed on the Multiple Listing Service (MLS) or through specialized real estate agents.

2. Why buy a foreclosure home?

They are often sold below market value, offering investment opportunities and quicker closing times.

3. What are the risks?

Risks include unexpected repairs, unpaid taxes, and legal complications. Proper research, inspections, and professional guidance are essential.

4. Where can I find foreclosure listings?

You can search on MLS, bank websites, or government platforms and work with real estate agents specializing in foreclosures.

5. Is buying a foreclosure home right for me?

It depends on your finances, investment goals, and willingness to navigate the complexities of foreclosure purchases. Professional advice is recommended to make an informed decision.

Considering buying a foreclosure? Contact Urban Team Homes for expert guidance and support in finding the best opportunities in the Canadian real estate market.

1 note

·

View note

Link

Sometimes despite managing our budget properly, we do face financial crises so, at that point of time, it becomes tough to fulfill our financial expenses. In such a situation Instant Loans Canada can provide you with the money through Car Title Loans Newfoundland when you are going through a tough phase. This loan is secured against your vehicle as collateral and the loan amount depends upon its market value and condition. You can borrow up to $35,000 with us.

#car title loans newfoundland#title loans newfoundland#car collateral loans newfoundland#car title loans no credit check#how to car title loans work#car title loans when you still owe

0 notes

Text

Use Your Car Get Cash With Car Title Loans Kamloops

Apply Car title loans kamloops and get quick fund with less interest rates. You can easily apply online and fulfill a little bit requirement and get cash in few hours. For more information you can call 1-844-586-6311

#car title loans kamloops#car title loans red deer#car title loans prince george#bad credit car loans red deer#bad credit car loans newfoundland

0 notes

Text

Rebuilt Your Dream With Car Title Loans Brampton

Get quick fund today up to $25,000! Rebuild your house and fulfill your dream. Real car cash provide quick funds in car title loans Brampton. You can get cash in simple steps. Use your car and get cash in hand For more Information Contact At 1-877-304-7344

#car title loans brampton#car title loans hamilton#car collateral loans#car title loans moncton#bad credit car loans newfoundland

0 notes

Link

Several people suggest this loan and also opt for this in their hard times and emergency. If you are certain about getting this loan in order to meet your sudden situations then you can consider getting Car Title Loans Newfoundland from us. For more information, you can call us at 1-844-512-5840.

#car title loans#car equity loans#car pawn loans#auto title loans#vehicle title loans#instant loans online#quick funds online#car title loans newfoundland#cash loans

0 notes

Text

Car Title Loans Newfoundland - Improve Money Shortage

Don’t let money shortage come in your way of enjoying your life to the fullest. Call us at (toll-free) 1-877-804-2742 today or apply online for your vehicle pawn loan with Car Title Loans Newfoundland.

#loans#bad credit car loans#car equity loans#car collateral loans#vehicle title loans#car title loans newfoundland#instant loans online#quick funds online

0 notes

Photo

To ask family members or friends for financial assistance is quite embarrassing. When you need cash immediately, getting a Car Title Loan Newfoundland is the best option. Call us at 1-855-653-5448 (toll-free) to get instant funds.

#car title loans canada#car title loans#loans against car title#bad credit car loans#car title loans newfoundland#title loans#car title loans vancuover

0 notes

Photo

Are you worried about financial expenses and medical emergencies? To get out of your problems, get instant cash by applying for bad credit car loans in New Brunswick. We help thousands of customers and provide them quick cash. Here you have flexible payment options, fast approval rate, loan terms upto 7 years and no bad credit checks etc. You can keep your car with you and keep the cash as well. For more information visit our site now.

#bad credit car loans victoria#bad credit car loans st john's#car title loans dartmouth#bad credit car loans new brunswick#bad credit car loans dartmouth#bad credit car loans mississauga#bad credit car loans ottawa#car collateral loans#bad credit car loans north york#bad credit car loans moncton#bad credit car loans newfoundland#bad credit car loans saint john#bad credit car loans saskatoon#bad credit car loans vancouver#bad credit car loans ontario#bad credit car loans kelowna#bad credit car loans barrie#bad credit car loans toronto#bad credit car loans#bad credit car loans nova scotia#bad credit car loans alberta#bad credit car loans london#bad credit car loans calgary

0 notes

Text

Solve Your Financial Stress with Pit Stop Loans.

Those who struggle can seek help from Pit Stop Loans. If you have a vehicle that is fully paid off, you can get a bad credit car loan and borrow up to $25,000 depending on the market value and condition of your car you can call us (Toll Free) 1-800-514-9399 or apply online now.

#car title loans moncton#car title loans victoria#car title loans saskatoon#car title loans london#car title loans ontario#car title loans toronto#bad credit car loans newfoundland#bad credit car loans kitchener#bad credit car loans red deer

0 notes

Link

Get best Car Loans in Newfoundland with Bad Credit Car Loans Newfoundland. Bad or Good Credit accepted. Quick and easy online application. Contact us today.

#bad credit car loans newfoundland#title loans with bad credit in newfoundland#collateral loans in newfoundland#car pawn with bad credit in Newfoundland

0 notes

Text

It Seems Like Nothing Changes

Paul Cussen

June 1919

In June 1919 the Cork Furniture Store, which had moved from Merchant Street to a new premises on Winthrop Street, took over London House on Saint Patrick’s Street and expanded to sell ladies clothes. The firm was owned by William Roche from Killavullen.

The Ford building on the marina covered a floor area of 330,000 square feet, just over 7.5 acres. The company employed 1,800 workers. John O’Neill, who joined Ford in 1919 and later became Managing Director of the plant (in 1932), described the plant as being ‘ahead of anything else in Europe’ in terms of layout and equipment.

In late June the lease on the Cork National Shell Factory was taken over from the Corporation of Cork by Richard Woodhead, acting on behalf of the Ford Company. In the 1930s it was leased to the Lee Motor Company.

Cork hurlers changed from blue jerseys with a large saffron C across the chest after British forces raided the County Board offices in Cook Street and confiscate their kits.

In June 1919 Michael Collins was made president of the IRB (Irish Republician Brotherhood).

Terence MacSwiney led an abortive raid to gain arms and ammunition at the Killeagh air ship base, a facility of the Royal Naval Air Service.

The 2nd Battalion of the Royal Munster Fusiliers remained in France until June 1919 when they returned to England.

From January to June 198 British soldiers in Ireland died: 118 from influenza/pneumonia, 55 died from other natural causes, 6 died from firearms accidents, 15 from accidents not involving firearms and 4 from suicide.

Martin Doyle, originally from New Ross in Wexford, received his Victoria Cross from King George V at Buckingham Palace. In October 1920 he joined the IRA in East Clare acting as an intelligence officer.

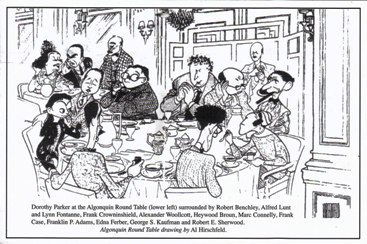

"The Vicious Circle" gathered at the Algonquin for the first time as the result of a practical joke carried out by theatrical press agent John Peter Toohey. It is only later, with their numbers growing, that they move to the now famous round table.

1 June

de Valera embarks on his tour of the USA with three aims:

· to ask for official recognition of the Irish Republic,

· to obtain a loan to finance the work of the new government, and

· to secure the support of the American people for the republic

2 June

New York City night watchman William Boehner is the only fatality as eight bombs detonate in eight cities across America. Each of the bombs is delivered with several copies of a pink flyer, titled "Plain Words", that read:

War, Class war, and you were the first to wage it under the cover of the powerful institutions you call order, in the darkness of your laws. There will have to be bloodshed; we will not dodge; there will have to be murder: we will kill, because it is necessary; there will have to be destruction; we will destroy to rid the world of your tyrannical institutions.

The bombings are carried out by Italian anarchist followers of Luigi Galleani.

3 June

Private Peter Asher dies of pneumonia at the military hospital in Buttevant.

Today’s Manchester Guardian review of Chekov’s The Seagull says:

“The Seagull” is a low-spirited play, and the sharpness of tragedy in it is blunted by Tchekov’s (sic) satire and irrelevances of other kinds. Tchekov, as we know from his stories, is a genial soul, and one missed somehow the feeling of sincerity in the climax to-day.

6 June

June Huband (who used the nom de plume Helen Forrester) is born in Hoylake on Merseyside (d.2011)

The United States Senate pass a resolution asking for the delegation appointed by Dáil Éireann to be given a hearing at the Paris Peace Conference, and expressing sympathy with the “aspirations of the Irish people for a government of their own choice”.

5-7 June

600-700 Armenian civilians are murdered by armed ethnic Azeri and Kurdish irregulars and Azerbaijani soldiers in the Khaibalikend massacre.

7 June

The Sette Giugno riots occur in Malta, as a crowd of thousands are shot at by British soldiers. Four die and over 50 are wounded in protests challenging the British presence on the island.

8 June

Constantine Fitzgibbon is born in The United States (d. 1983)

Coslett Herbert Waddell dies (b. 1858)

9 June

The City of Winnipeg Police Commission dismiss almost the entire city police force for refusing to sign a pledge promising to neither belong to a union nor participate in a sympathetic strike.

10 June

Kevin O’Flanagan is born in Dublin (d. 2006)

14 June

Walter Weedon Grossmith dies in London (b. 1854)

15 June

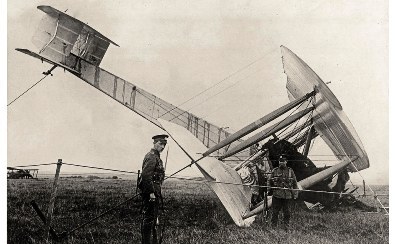

At 8.40 am after flying for 16 hours and 28 minutes and covering 1,900 miles without stopping, John Alcock and Arthur Brown mistook Derrigimlagh bog for a landing strip and landed their plane completing the first transatlantic flight.

“I’m Alcock – just come from Newfoundland”, the Vimy pilot told the Marconi technicians that had tried to warn them about the bog.

“Yesterday, I was in America, and I’m the first man in Europe ever to say that.” – Arthur Brown

16 June

Fourteen IRA volunteers from the Kilbrittain company ambush a six-man British Army-RIC patrol at Rathclarin, Co. Cork and seize 5 rifles, one revolver and 200 rounds of ammunition. Only 2 of the IRA men are armed for the ambush. Volunteer Mick O’Neill is injured in the raid which was not sanctioned by Brigade HQ. "The fact that it was completely successful had an immense effect on morale and on the whole direction of the volunteer military effort in West Cork."

Greek forces lose 20 men in the Malgaç Raid as Turkish forces destroy the railway bridge and capture weapons and ammunition.

17 June

Station-Sergeant Thomas Green is wounded in the Epsom Riot when 400 Canadian troops attack the police station after two soldiers had been arrested.

18 June

The Dáil establishes the National Arbitration Courts.

19 June

The Dáil approves the First Dáil Loan (for £500,000)

20-21 June

Greek forces suffer 30-80 killed and 40 wounded in the Turkish raid on Erbeyli. 72 Turkish civilians are abducted and executed by Greek troops as a warning against future raids.

22 June

A tornado kills 57 people in Fergus Falls, Minnesota.

Greek units suffer 30 killed and 40 wounded in the Turkish raid on Erikli. This causes Greek forces to retreat.

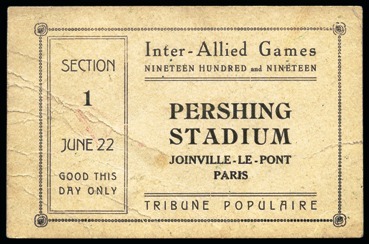

Approximately 1,500 servicemen or ex-sevicemen from 18 countries compete in the Inter-Allied Games in Le Stade Pershing outside of Paris.

23 June

RIC Detective D.I. Michael Hunt is shot twice in the back in a scuffle with IRA volunteers Jim Stapleton and James Murphy in Thurles, Co. Tipperary.

24 June

Two RIC officers are attacked and disarmed near Meenascarthy, Co. Kerry. Ten IRA volunteers are later arrested and five of them sentenced to gaol.

25 June

24 Americans are killed and 25 wounded repelling Red Army forces at the Battle of Romanovka. The Red army lose a similar number of men.

26 June

Castletownbere born William Martin Murphy dies in Dublin (b. 1845)

28 June

The Treaty of Versailles is signed in the Hall of Mirrors.

Two British soldiers are killed while on patrol by the Irish Republician Army.

Ion Dezideriu Sîrbu is born in Petrila (d. 1989)

29 June

Dáil Courts are established to hear civil cases.

Cork players wear red jerseys for the first time as they play against Tipperary in the Munster Hurling Semi-Final at the Cork Athletic Grounds in Ballintemple. The admission price is increased from sixpence to 1 shilling which results in protests that include sections of sheet iron being torn down at one end of the grounds. The result of the match is Cork 2-4 Tipperary 2-3.

1 note

·

View note

Photo

Why is Car title loans Newfoundland the most ideal decision for individuals?

Applying Car title loan in Newfoundland at Instant Loans Canada is easy now. It is the most ideal choice to get fast cash for individuals having a completely own vehicle and searching for speedy cash in a matter of moments. You can acquire up to $35,000 thoroughly depending on your vehicle condition, make year and model.

0 notes

Text

Easy Get ash In Your Hand With Car Title Loans Saskatoon

Choose Canadian Equity Loans For Car Title Loans saskatoon: All credit score accepted; Get quick cash with in minute, Easy method, Easy application process. For more information contact at 1-844-586-6311

#car title loans saskatoon#car title loans newfoundland#bad credit car loans red deer#car title loans vancouver#bad credit car loans saskatoon

0 notes

Text

Hassle Free Car Loans with Real Car Cash

Best car title loans that come with the benefits is, here with Real Car Cash you can get benefits like fast loan approval, Simple and fast approval process, Cash in hand in about 1 hour, Get cash on almost any make, any model, and any age vehicle etc. So let’s turn your title into cash.

#car title loans#bad credit car loans kitchener#car title loans kitchener#car collateral loans#bad credit car loans north york#car title loans toronto#bad credit car loans newfoundland

0 notes

Text

Selling Property in Canada

At the point when a non-inhabitant sells Canadian real estate, he/she is needed to pay the fitting measure of charges on any capital addition. The typical Canadian assessment rates will be applied to half of the addition.

Notwithstanding, a non-inhabitant is needed to pay a gauge of the assessment before the deal, a sum equivalent to 25% of the increase. This sum is to be held by the seller's attorney until such time as a freedom testament is gotten from the Canada Revenue Agency (CRA) regarding the offer of the property.

Upon installment, the CRA will give a freedom authentication to the seller, yet not until there has been an agreement of procurement and deal with all subjects (conditions) eliminated. The sit tight for the authentication is typically 6 two months. In the event that the authentication isn't acquired, the buyer is needed to retain from the deal continues, a level of the selling cost (normally 25-half).

Prior to the end date, the home loan cash is moved to the seller's legal counselor and afterward to the seller and the title is moved to the buyer's name.

The non-inhabitant seller should record a Canadian annual government form for the year in which the deal happens and ought to hope to get a discount of a part of the charges paid. The tax assessment from Canadian real estate relies upon whether the utilization of the property is for a central home, a functioning business or as an investment property. If you want to know the current trend and price of the pre-construction condo then enquire now.

On the off chance that it is utilized as an investment property, a 25% non-inhabitant charge should be paid on the gross lease an occupant pays. Notwithstanding, in the event that you utilize an expert property chief, the director will, by law, retain 25% of the gross rental income at source to be transmitted to the Canada Revenue Agency.

At that point prior to March 31 of the next year, the property chief issues a NR4 structure and you at that point reserve the privilege to record a Canadian government form. The government form is expected before June 30 and empowers you to guarantee costs against that pay and conceivably demand a discount.

Numerous nations, like the U.S., have charge arrangements with Canada that keep you from being burdened in both Canada and your nation of origin. It is prudent to contact an assessment bookkeeper in your country for more data.

Extra Costs and Fees when Buying and Selling Property

The accompanying addresses a considerable lot of the extra expenses and charges consolidated when buying property. Your realtor will actually want to tell you which are pertinent in your Province.

Duties

Non-inhabitants of Canada pay charge on pay got from sources in Canada. The sort of expense paid, and the prerequisite to document annual government forms, relies upon the kind of pay got.

Canada has charge arrangements with numerous nations, including the United States and the UK. An expense settlement is intended to stay away from twofold tax assessment for individuals who might somehow or another compensation charge on similar pay in two nations.

Property Transfer (or Purchase) Tax/Land Transfer Fees are determined between 0.5-2% of the property's all out esteem (not relevant in Alberta, country Nova Scotia or Saskatchewan). They are by and large 1% of the first $200,000 of the worth and 2% of the rest of.

Since the 2005 Provincial Budget, Property Transfer Tax (PTT) is currently excluded for people buying their first home as long as they meet certain rules, in particular that they are a Canadian resident or Permanent Resident and have never possessed a home anyplace on the planet; that they have lived in the area for at any rate one year before buy; that they have documented two Canadian assessment forms inside the most recent six years; and that they should involve the property as their essential home for the main year of proprietorship.

There are likewise corresponding exclusions to PTT for first-time home buyers which differ by locale dependent on the honest assessment of the property.

As of December 2007, the Ontario Provincial Land Transfer Tax exclusion for first time buyers (up to $2,000) presently applies to resale just as recently developed homes. Also, from February 2008, Toronto (and this may spread to other commonplace urban communities) has its own Land Transfer Tax which permits first time home buyers of both new and resale homes to fit the bill for a discount.

On the off chance that the property is empty land, the house should be developed inside one year of shutting and the buyer should live in the house for the equilibrium of the year.

There are different models required too to fit the bill for the PTT exception, so it is ideal to counsel a legal advisor or legal official.

Leeway Certificate The average charges related with getting ready and recording a freedom authentication, paid by the seller, range from $300-$1000, contingent upon the intricacy of the exchange.

Capital Gains Tax isn't appropriate on your important home.

Products and Ventures Tax (GST) of 5% is just payable on recently built homes and is regularly remembered for the provided deals cost estimate. New home buyers of homes costing $350,000 or less can apply for a fractional discount of the 5% GST material on the price tag as long as the house will be the buyer's essential spot of home. The refund is up to 36% of the GST to a greatest discount of $6,300.

For new homes evaluated somewhere in the range of $350,000 and $450,000 before GST, the GST discount diminishes proportionately. New homes estimated $450,000 before GST or higher don't get a discount. There is no GST on resale lodging except if the home has been generously remodeled, and afterward the duty is applied as though it were another home.

As of April 1, 2013, British Columbia (BC) supplanted the 12% HST with the GST at the pace of 5% and a commonplace deals charge. Temporary principles, including the BC change charge, apply to specific exchanges for lodging that ride that date. The BC change charge discount is accessible in specific circumstances where the progress charge applies.

GST questions are best replied at source ie: the Revenue Canada site, or by a bookkeeper who knows about real estate income tax assessment.

Commonplace Sales Tax (PST) in BC is 7% and once more, is typically remembered for the provided deal cost estimate.

Fit Sales Tax (HST) is 12% - a mix of GST and PST - and is utilized in British Columbia (see note underneath), Ontario, and the Atlantic territories of New Brunswick, Newfoundland and Labrador, and Nova Scotia. On July 1, 2010, Ontario presented a governmentally controlled Harmonized Sales Tax (HST) that applies to most buys and exchanges. The HST applies to recently built homes, yet doesn't have any significant bearing to resale homes. Buyers of new homes will get a discount of up to $24,000 paying little heed to the cost of the new home.

Kindly note, a submission was held in B.C. in the late spring of 2011 which brought about a nullification of the HST charge which will bring about a re-visitation of the previous 7% PST charge framework on April first, 2013. Meanwhile, on Friday, February seventeenth, B.C. Account Minister Kevin Falcon divulged a progression of HST help estimates which will give B.C. home buyers and manufacturers a more strong establishment to progress out of the questionable HST charge.

Beginning April first, 2012, the public authority will raise the HST refund edge for new home buyers to $850,000, up from the current $525,000, which means over 90% of recently assembled homes will presently be qualified for a common HST discount of up to $42,500. After the HST end date, the individuals who buy a home worked before April 1, 2013, will pay a 2% progress charge on the full house cost.

Property Tax is a yearly charge imposed inside neighborhood networks, which implies there are a wide range of rates inside every area. The contrast between Property Tax and Property Transfer Tax is that PTT is a one-time common expense which endless supply of property and Property Tax is paid yearly to the neighborhood tax collection specialists.

It is dictated by applying the estimation of the property as evaluated by the common appraisal power to the current assessment rates as expressed by the nearby expense authority. The sum can contrast every year except by and large Property Tax falls between 0.5-2.5% of the home's reasonable worth.

0 notes