#tire inflators amazon

Explore tagged Tumblr posts

Text

Only YOU Can Prevent Witchy Fires

Hello witches, workers, and all in between! Your friendly neighborhood Granny is here to teach you a few things about fire safety!

Yes, yes, I know. “But Buggy, this is tumblr! And you're on a boring witchcraft blog! What do we need a lesson on fire safety for? We aren’t in kindergarten!” But trust me! More than one witch has accidentally singed their hair or set their own altar on fire before! Sometimes we get so into the spiritual that we forget to be mindful of the reality around us.

I’m going to go over a bundle of good tips to keep in mind for making a wax seal over that spell jar or burning a few bay leaves or ingredients to release that nonsense into the air! Even a section for the kitchen witches!

Indoor Safety:

*Those annoying fire alarms? Make sure they are operational okay? Change those batteries at least once a year, preferably twice. (If it is something you are in control of.)

*Always use a fire-safe candle holder for candles! Trim down that wick before lighting! I know it seems silly to use a pair of scissors or a wick trimmer, but trimming down that wick will always make that flame much easier to manage. And that flame? If it gets big enough to cause black smoke ALWAYS put it out.

*Always keep the candle in your line of sight, no meditation with an open flame going okay? Also if your candle is big enough to burn for more than four hours...put it out at the 4 hour mark.

*The longer a candle burns the more carbon gathers on the wick itself and that can make the flame get bigger and more unstable. Those ultra-wobbly flames that flicker and waves like one of those wacky inflatable arm flailing tube men? That is something you don’t want.

*Putting out a candle: We don’t recommend putting it out with your fingers no matter how cool it looks. Use a candle snuffer, or blow it out. I promise blowing out a deity candle won’t insult them!

*Another crucial tip is to keep anything that could catch fire a minimum of three feet or 91 centimeters AWAY from the fire source. That includes carpeted flooring, cloth, hair, rugs, altar cloths, papers, books, all sorts of things! Always wear your hair back when working with fire, and wear close fitting clothing that won’t hang or drape into the fire with your movements.

*Another tip given straight from the NSC is to NEVER use candles or other fire sources while tired or inebriated! That means no 2 am spell jars if you are half asleep! ALSO never EVER leave a candle WARM or actively BURNING! Same goes for any items you are burning down like bay leaves. Burn them in a fire safe bowl that is much bigger than you think you need. Toss the debris around and soak in water to ensure they are safely doused.

*IF you are using wax to seal off spell jars I highly suggest getting a wax sealing kit! Wax sealing kits come with a little spoon that you drop bits of wax into and ‘melt’ them down over something like a tea candle. An example is this: Which you can find on Amazon for roughly $10 USD!

The spoon is perfect for pouring and there’s less likelihood of the candle you would sit on top of the jar from falling off because...there is no candle! If you only have a candle to work with...please don’t burn the candle on top of the object you are sealing, put the candle in a safe holder and hold it over the object once warm to let the wax drip down. Have the object you are sealing sitting on top of a safe ceramic plate or bowl in case of drippage!

But what do I do if a fire starts?

Good question! That depends on the type of fire it is! Here’s a breakdown of the types and methods to put them out: Ordinary Fire: An ordinary fire is caused by candles, papers, cloth, plastics, that sort of thing!

The good news is these types of fires respond amazingly well to plain old water! It’s always advised that you keep a bucket or pitcher full of water within reach whenever using candles just in case!

Electric Fire: Electric fires are caused by a source of electricity, like wires getting crossed and arching.

NEVER use water on an electrical fire! If you do, you'll just electrocute yourself. If it’s safe to do so...unplug the object from the outlet. Turn off the electricity in your house’s electric breaker box. Smother the flames by pouring baking soda onto them.

Chemical Fire: Chemical fires have a chemical as a fuel source, like rubbing alcohol, nail polish & polish remover. Even your nails near a candle can produce a small chemical fire if you aren’t careful! (Dry those nails up good before using candles.) These fires can only be put out with a fire blanket OR pouring a LARGE quantity of baking soda or sand onto the fire.

Cooking Fires: Cooking fires are the most common form of household fire. It can be caused by grease, burning food, or burning cooking oil. Water will NOT work on any fire oil or grease based, it may seem like a first instinct to grab the pan and toss it into a sink with water...DON’T.

That will cause the oil to splatter and can injure you and make any flames spread further! It the fire is small enough and contained within a pot or skillet, have a lid or baking sheet handy and throw that onto the top of the fire, this will smother it out. A fire blanket can also be used for this. Do NOT swat at the flames, this is just a fanning motion and will give the fire more oxygen to grow with! Pour a large amount of salt or baking soda on top of the fire. MAKE SURE it is not flour, as flour will cause the fire to grow quick enough to even explode! Turn off any heat source.

And if the fire is in the oven or microwave? Leave that door CLOSED. It seems super scary but the fire will smother itself out when trapped in a small box. (Of which both cooking items are.)

Outdoor Safety:

Never burn outdoors if it is windy or extra dry! Do not burn general trash, only burn natural dry vegetation/herbs. Always check your local ordinances and make sure there are no burn bans in your area currently active!

If you are going to burn outside, clear away a circular space for the burning items. Far enough away from overgrowth, houses, powerlines, and other such things. The burning site should have plenty of dirt or gravel around it, usually around 10 feet, 304 centimeters circular if burning a campfire-size burning space. Make sure the dirt and gravel is well doused in water to prevent any spreading.

Always stay around the fire until it is completely out. Turn the debris from your burn a few times and douse it hard with water. NEVER leave dry ash on the ground, embers could be still warm enough to catch on the inside of the ash! Keep checking on that burn area for a few days or a few weeks to make sure nothing is left, especially during warmer or dryer months. Don’t toss matches or other lighting instruments just anywhere! Those can still be warm and still catch grass alight.

And there you have it! A crash course on being safe with fire while doing your thing and slinging your spells!

#witchblr#psa#witchcraft#buggy's lessons#witchcraft for beginners#beginner witch#fire safety is important folks!

204 notes

·

View notes

Note

miss terra what’s ur opinion on taylor swift? i feel like her latest album was a huge disappointment compared to her others, but i also feel like people are only hating so much because they’re eager to see a successful woman fail. i think any artist worth their salt will eventually go through a “flop” phase. but at the same time, i do know she got to this place of privilege in an unethical way, & that the work of nonwhite artists is ignored in favor of hers. would you agree when people say she has a monopoly on the music industry?

Taylor is by no means a good musician/singer at all. it's the extent of her performance, on and off stage, that no one is better at. she's worked harder to build a fanbase which idol worships her and feeds into their obsession with a particular kind of quasi-religious parasocial relationship super consistently. She's never turned against them. Most artists aren't willing to feed into Celebrity Worship Syndrome. Taylor is insane enough to love it. She never gets tired and delves into her privacy, she genuinely loves stans and will keep giving them varieties of stuff forever, which is the actual thing that makes her famous. No singer can poach the swifties, because they aren't obsessed with music, they love Taylor.

Music itself does not matter to a layman, it hasn't in a century. Anti Taylors lie about caring about technical skill and composition and virtuosic singing ability, but they don't listen to Vivaldi or Paganini 🤷🏾♀️ It's all parasociality marketing! she could retire to sell lyric tshirts or go into perfume and all her fans will follow. And then people will complain that she destroyed the graphic tee industry.

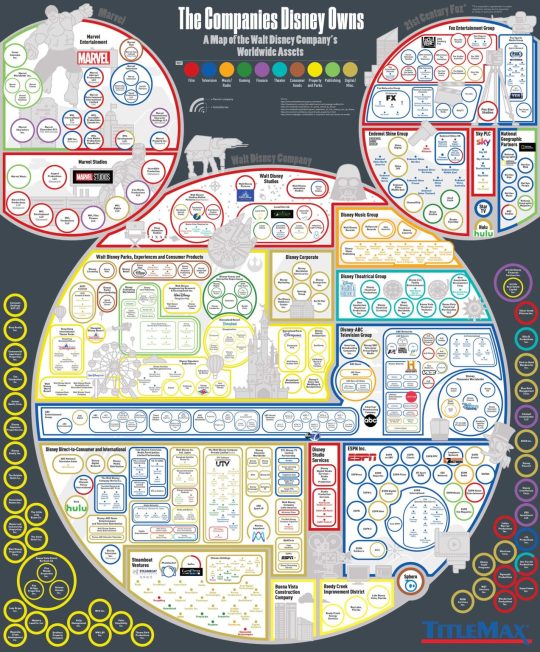

She's a hilariously out of touch awkward woman with every possible privilege available to women. But that doesn't shield her from misogyny. people blame her for ruining the garbage tiktokified music industry or swiftinomics for causing inflation or her high emissions for causing global warming. Or criticize her as if she's a major capitalist monopoly. Newsflash there are thousands of billionaire capitalist male CEOs doing 50x worse, on purpose, at a mass production scale for profits. if you're going to criticize her byproducts as the epitome of capitalism, then get rid of your iphone and amazon prime, go vegan, and boycott Disney first.

She isn't even doing the bare minimum of what she could to mitigate damages, but neither does the average person throwing stones, while ignoring the men who are much worse. Newsflash, monopolies and the declining "purity" of music isn't what they actually love hating on, though their criticism always manages to curiously land on women... Hmm! 🤔

All that to say I do not care about the modern music industry, or any American music, because I only listen to historically informed baroque music conservatories or 00s visual kei anyway! lol

18 notes

·

View notes

Note

COUGH does Casey have a (n)sfw alphabet yet??

If Casey has no more fans I'm dead I love him in an indescribable amount 😿☝️

Idk how many fans Casey has but it's not a lot lol

i love my blueberry jellybean boy though

NSFW UNDER CUT

A = Aftercare (what they’re like after sex)

He has very little experience- actually, none to be exact. So he’s quite nervous and doesn’t know what to do- he automatically cuddles you though. Probably asks for reassurance and provides some for you if you ask too.

B = Body part (their favorite body part of theirs and also their partner’s)

He really likes arms and legs- specially if you’re strong. But he doesn’t mind if you’re not. You’ll find him doodling on your arms or legs when he’s bored.

C = Cum (anything to do with cum, basically)

He won’t admit that he probably thinks about the taste of cum. To be fair he thinks about how everything would taste.

D = Dirty secret (pretty self-explanatory, a dirty secret of theirs)

Doesn’t want to admit he has a food fetish

E = Experience (how experienced are they? do they know what they’re doing?)

None. Never kissed anyone nor dated anyone. He’s too busy with his jobs.

F = Favorite position (this goes without saying)

He doesn’t know any positions but probably missionary

G = Goofy (are they more serious in the moment? are they humorous? etc.)

He’s giggling a lot out of nerves

H = Hair (how well groomed are they? does the carpet match the drapes? etc.)

He doesn’t know why he would shave.

I = Intimacy (how are they during the moment? the romantic aspect)

Very cuddly, if he’s not moaning a lot he’s praising his partner.

J = Jack off (masturbation headcanon)

Very rarely jacks off- usually too tired or not in the right place to do it.

K = Kink (one or more of their kinks)

Accidental stimulation, Amazons and authoritarians, Begging, Clothed sex, Crush fetish, Dirty talking, Food play, Furries, Internal cumshots, Intercrural or interfemoral sex, Jerk off instructions (JOI), Latex/rubber, Narratophilia, Pictophilia, Plushophilia, Quirofilia, Slime, Somnophilia, Stockings, Strap-On, Teasing, Telephonicophilia

L = Location (favorite places to do the do)

Bedroom preferably. Somewhere private.

M = Motivation (what turns them on, gets them going)

N = No (something they wouldn’t do, turn offs)

Unhygienic kinks, Feet, Inflation, Blood, Gore, Pain/BDSM (biting is okay though), Sounding, Non-Con/Dub-Con, Asphyxiation, Pet play, Age play, Exhibitionism, Voyeurism (unless in a poly), Cuckholding

O = Oral (preference in giving or receiving, skill, etc.)

He would rather give. He has no idea how to do it but he sure will try.

P = Pace (are they fast and rough? slow and sensual? etc.)

Slow and gentle if he tops (which is rare)

Q = Quickie (their opinions on quickies, how often, etc.)

Depends on the situation, but probably not that often. He doesn’t get horny frequently.

R = Risk (are they game to experiment? do they take risks? etc.)

He’s okay to experiment so long as it’s not painful or life-risking.

S = Stamina (how many rounds can they go for? how long do they last?)

Not long- he’s a virgin.

T = Toys (do they own toys? do they use them? on a partner or themselves?)

Bullet vibrator. He rarely uses it on himself.

U = Unfair (how much they like to tease)

He doesn’t tease

V = Volume (how loud they are, what sounds they make, etc.)

He can get loud but it’s not often. He typically whimpers and whines.

W = Wild card (a random headcanon for the character)

Curious about aphrodisiacs- more so how they taste not what they do.

X = X-ray (let’s see what’s going on under those clothes)

Scars from a lot of accidents, top surgery scars, and body hair

Y = Yearning (how high is their sex drive?)

Average

Z = Zzz (how quickly they fall asleep afterwards)

After 5 minutes

15 notes

·

View notes

Text

It bothers me to no end that prices for everything are still going up despite it being well-known by this point that it isn't inflation, that corporations are continuing to make increased profit and raising prices anyway. No amount of organizing or informing has done anything, only like 12 people between 4 continents are willing to stop buying from McDonald's, Walmart, and Amazon. I am so tired of this place.

#i have the capability to grow my own food and even raise an amount of cattle to feed myself and the other two adults i financially support#but this isn't about me. if i could completely remove myself from capitalism i would still want to keep these greedy corporations in check

9 notes

·

View notes

Text

My tire went flat over the weekend (completely flat) so I bought a portable tire inflator off Amazon. It arrived overnight. It powers up using your cigarette lighter port in the car.

I didn’t think this dinky little thing would inflate a completely flat tire but it did. It took only five minutes. After re-inflated my tire, I looked up reputable tire places nearby, drove my car to a shop four miles away, waited about thirty minutes for them to put on a new tire, and then skedaddled.

Car maintenance becomes easier over time with practice! It was actually someone on an online car maintenance forum that convinced me that portable tire inflators are essential if you have a car.

2 notes

·

View notes

Text

Da Deals TIME!

🚗✨ Learn how the Airmoto Tire Inflator Portable Air Compressor can save you time and hassle. Accurate, fast, and compact for all your inflating needs. Check our YouTube video for more!

See More: https://bit.ly/dadeals

#Airmoto #TireInflator #PortableAirCompressor #AutoCare #savenow #diggingupdeals #dadeals #digger #FYP #paidlink

*amazon associate link may earn commissions

youtube

#youtube#bendthetrend#healthylifestyle#positivity#mind body spirit#bendthetrend affiliates#wellness#home & lifestyle#da deals

0 notes

Text

let's look at the retirement expenses

Housing

Real Estate Taxes

Electric

Garbage

Water

Natural Gas

Internet

Cell Phone

Security System

Home Improvements

Furniture

Yard Maintenance

Loans & Liabilities

House Mortgage

Auto Loan

Boat Loan

Credit Card

RV / Camping Trailer

Food & Personal Care

Groceries

Restaurants

Spending Cash

Haircuts

Dry Cleaning

Gym Membership

Clothes and Shoes

Chiropractor

Insurance & Medical

Auto Insurance

Home Owners Insurance

Health Insurance

Dental Insurance

Life Insurance

Long Term Care Insurance

Medicare Supplemental Insurance

Vision & Eyecare

Medications

Vehicles & Transportation

Annual Tuneup

Fuel

Oil Change

Maintenance

Tires

Repairs

Memberships

License Renewal

Public Transportation

Travel & Entertainment

Vacations

Birthdays

Christmas

Amazon Prime

Hobbies & Lessons

Magazines and Newspapers

Software Subscriptions

Netflix

Movies

Giving & Miscellaneous

Tithes & Offerings

Missions

Charitable donations

Financial Adviser

Tax Preparation

Remember To Include Taxes include both state and federal taxes in your retirement spending planning.

There are a few ways to reduce the amount of taxes you'll owe in retirement. One is to consider doing ROTH contributions and conversions as you prepare for retirement. Another is to carefully plan your withdrawals from those accounts so that you don't end up in a higher than necessary tax bracket.

Essential vs Discretionary

-Essential expenses are those that you need to live, such as food, shelter, and clothing.

-Discretionary expenses are those that you can live without, such as entertainment and vacations.

The Goal Of Retirement

The goal of retirement is cash flow. It's all about making sure you have enough income to cover your expenses. You can start to project how much income you'll have in retirement and then compare your guaranteed income to your costs. Some of the most common sources of income in retirement are social security benefits , pensions, annuities, or rental income.

The Gap

Normally, your income sources will not cover all of your expenses in retirement. This is where your retirement savings come into play. You will likely need to supplement your income with withdrawals from a 401k, IRA, or other retirement accounts.

After entering all of your income and expenses into the calculator let's say you discover that you will have $50,000 dollars of income every year But your expenses are $90,000 per year. The gap in this scenario is $40,000. It is the difference between how much income you have compared to how much you plan to spend.

Have You Saved Enough To Cover The Gap?

The general rule of thumb is that you will take the gap number and multiply it by 25. This is based on the 4% rule that says you can safely withdraw up to four percent of your retirement savings each year without depleting your account. In the example above, you would need one million dollars saved to cover the forty thousand dollar gap.

Asset Allocation

If you are going to use the 4% rule you will want to make sure you have the correct asset allocation of your investments. The goal is to have a mix of stocks and bonds that will give you the best chance to not only cover your expenses but also keep up with inflation.

The research on the 4% rule found that a 60/40 mix of stocks and bonds is the sweet spot for most investors. This means that if you have a one million dollar portfolio, $600,000 would be in stocks and $400,000 would be in bonds.

Even though this combination has been shown to work, it does not factor in your risk tolerance and it's vital to note that past success is no indicator of future performance.

Withdrawal Order

How you choose to take money out of your different accounts could play a role in how long your money will last in retirement. The conventional wisdom is to withdraw from taxable accounts first and then move to tax-deferred accounts like a 401k or traditional IRA and save your tax-free accounts to last.

However, this is not always the best strategy because how much taxable income you have can impact other things such as how much you will pay for health insurance in the years leading up to age 65 or how much of your social security will be taxable.

Experiment with different withdrawal strategies to figure out what would be the best approach for you.

0 notes

Text

Worst New Motorcycles from EVERY Manufacturer https://themotorbikechannel.com/wp-content/uploads/2024/10/1728162021_maxresdefault.jpg Source: Worst New Motorcycles from EVERY Manufacturer by Yammie Noob. Please don’t forget to give the Video a “Like” on Youtube and subscribe to the channel! Fanttik is having a Prime Day Sale! Use code YAMMIEX9 to get Fanttik X9 Pro tire inflator now for only $39! Amazon: https://amzn.to/4eiYrqQ #Fanttik #FanttikX9Pro #FanttikTireInflator Win our GIVEAWAY […] https://themotorbikechannel.com/worst-new-motorcycles-from-every-manufacturer/?feed_id=12039&_unique_id=6701a929c6add

0 notes

Link

0 notes

Text

Optimizing PSI for Golf Cart Tires: A Comprehensive Guide to Golf Cart Tire Pressure

Are you looking to enhance the performance and longevity of your golf cart tires? Understanding and optimizing the PSI (pounds per square inch) for your golf cart tires is crucial for ensuring a smooth and safe ride on the course or around your community. In this comprehensive guide, we'll delve into the importance of maintaining the correct tire pressure for your golf cart, as well as practical tips to optimize PSI for maximum performance and durability.

Importance of Tire Pressure:

Maintaining the proper tire pressure is essential for several reasons:

Safety: Correct tire pressure ensures optimal traction, stability, and handling, reducing the risk of accidents or tire blowouts.

Performance: Properly inflated tires provide better fuel efficiency, smoother rides, and improved overall performance on various terrains.

Tire Longevity: Incorrect tire pressure can lead to uneven wear and tear, shortening the lifespan of your tires and requiring premature replacements.

Determining the Correct PSI:

The recommended PSI for golf cart tires can vary depending on factors such as tire size, load capacity, and terrain conditions. To determine the correct PSI for your specific golf cart tires, refer to the manufacturer's guidelines or consult your owner's manual.

Optimizing PSI for Golf Cart Tires:

Once you've determined the recommended PSI for your golf cart tires, follow these steps to optimize tire pressure:

Regular Inspections: Check tire pressure regularly using a reliable tire pressure gauge. Inspect tires for any signs of wear, damage, or leaks.

Adjust for Load: Consider the weight of passengers and cargo when adjusting tire pressure. Overloading your golf cart can increase tire wear and affect performance.

Terrain Considerations: Adjust tire pressure accordingly for different terrains. Lower PSI may provide better traction on softer surfaces like grass or sand, while higher PSI may be suitable for paved surfaces.

Temperature Effects: Tire pressure can fluctuate with temperature changes. Monitor tire pressure more frequently during extreme weather conditions and adjust as needed.

Even Distribution: Ensure even tire pressure across all tires to maintain balance and stability.

Product Information:

Introducing the 12" PREDATOR Machined/Black Aluminum Golf Cart Wheels and 23x10.5-12" Turf Golf Cart Tires Combo - Set of 4. Designed to elevate your golf cart experience, these captivating wheels not only enhance the aesthetics of your cart but also provide the versatility to navigate through various terrains with ease. With the PREDATOR on your side, you'll be ready to tackle any adventure, whether it's on the yard or the golf course.

Key Features:

Wheel Size: 12"x7" PREDATOR Machined/Black Aluminum

Tire Size: 23x10.5-12

Tire Height: 23"

Tire Width: 10.5"

Ply Rating: 4 Ply

Load Capacity/Tire: 1,340 lbs @ 20 PSI

TURF Safe: Yes

Wheel Offset: 3+4 (mounts 3" from the back of the wheel, 4" from the front)

Bolt Pattern: 4x4 (101.6mm measured diagonally)

Compatibility: Fits lifted EZ GO, Yamaha, Club Car, and more golf carts. Also fits any Golf Cart, UTV, or Trailer hub that is 4 bolt and measures 4x4" (101.6mm measured diagonally).

Customer Reviews:

"They look great and ride quiet. Very happy." - Jim Elbaor (5.0 out of 5 stars, Verified Purchase,)

"Wheels and rims are very high quality. Fit perfectly and look great. I'm very pleased with this purchase." - Amazon Customer (5.0 out of 5 stars, Verified Purchase, )

"Awesome looking wheels and tires, great ride and traction." - Amazon Customer (5.0 out of 5 stars, Verified Purchase, June 12, 2017)

Conclusion:

The 12" PREDATOR Machined/Black Aluminum Golf Cart Wheels and 23x10.5-12" Turf Golf Cart Tires Combo is a top choice for golf cart enthusiasts looking to upgrade their ride. With high-quality construction, versatile compatibility, and rave reviews from satisfied customers, this combo delivers both style and performance. Whether you're cruising on the golf course or exploring the local community, the PREDATOR combo is sure to turn heads and enhance your overall cart experience.

Remember, optimizing PSI for your golf cart tires is essential for maximizing performance and ensuring a smooth and safe ride. By following the tips outlined in this guide and investing in high-quality tire combos like the PREDATOR, you'll enjoy a superior golf cart experience for years to come.

0 notes

Text

Drive Smarter: Fleettrack's Premium Smart Tyre Inflator

Elevate your driving experience with Fleettrack's state-of-the-art Smart Tyre Inflator collection. Engineered for efficiency and convenience, this intelligent device ensures optimal tire pressure with precision. Compact and user-friendly, it simplifies tire maintenance, enhancing safety on the road. With automatic pressure monitoring and swift inflation, say goodbye to manual checks and unpredictable flats. Versatile and compatible with various vehicles, Fleettrack's smart tyre Inflator is a must-have for every driver. Prioritize safety, extend tire life, and experience worry-free journeys. Upgrade your driving routine today—explore the smart tyre Inflator at fleettrack and enjoy the benefits of a smoother, smarter ride.

For more info contact us -

Fleettrack

No 47, Sabari Towers, Pariyur Main Road, Gobichettipalayam, Erode - 638452

090924 88444

Follow us on Instagram: https://instagram.com/fleettrack.in Order online on Amazon: https://amzn.to/44yLGnE

0 notes

Text

[Amazon] Tire Inflator Portable Air Compressor with 20% off ($39.98)

http://dlvr.it/T1t6YS

0 notes

Text

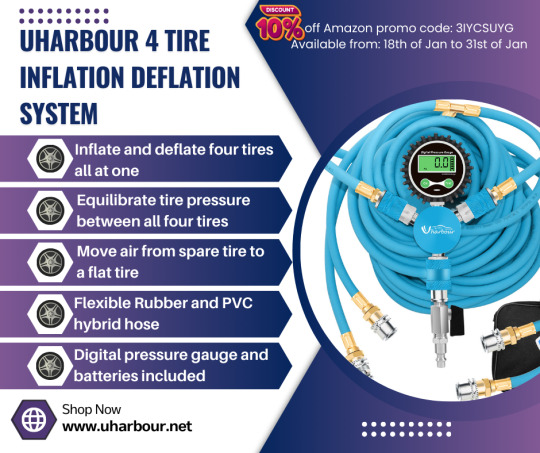

🌟 Exclusive Amazon Promo Alert! 🌟 Get 10% OFF on the Uharbour 4 Tire Inflation/Deflation System at uharbour.net! 🚗✨ Use code: 3IYCSUYG at checkout.

📆 Hurry, offer valid from Jan 18 to Jan 31! Don't miss out on this incredible deal to upgrade your tire care routine.

Features: 1️⃣ Inflate and deflate four tires simultaneously 2️⃣ Equilibrate tire pressure between all four tires 3️⃣ Move air from spare tire to a flat tire 4️⃣ Flexible Rubber and PVC hybrid hose for durability 5️⃣ Digital pressure gauge and batteries included

🔧 Keep your tires in top-notch condition effortlessly! Grab yours now and enjoy the convenience of a premium tire care system.

0 notes

Text

ENTRY FORTY

I was thinking a lot about my overspending. It's been happening a lot lately, both before and after the holiday season, so no placing blame there. So what is it with this lately?

Thankfully, I've just been eating into my weekly budget instead of my savings... but if I'm being completely honest here, digging into savings for nothing else other than unnecessary shopping has happened multiple times before. I need to have better control over it!

How do I achieve that? The initial step is figuring out where the overspending comes from, or what causes it. The foundation, the core!

I did some soul-searching and online researching. Ended up finding some things that I resonated with and wanted to explore them a little more here.

The first thing I came across talked about emotional impulse spending, which is exactly what it sounds like. Impulse spending triggered by emotion(s) like anxiety or depression. Looking into myself, my habits, and my motivations, it does seem that I am 10x more likely to overspend when I am going through some kind of emotional turmoil. When life is peaceful, I gather, I collect, and I save. Easy. Simple. It's the emotion that complicates everything!

I wondered why I was turning to things in those moments, especially since I'm not really what one would consider "materialistic." It's because people have hurt me with unreliability and/or cruelty. Things just decorate my home and give me something nice to look at. I'd prefer to buy myself something than to reach out to someone that may make the pain worse; I've grown rather tired of that, happens far too often.

Next, I found out about people who lack financial literacy. Financial literacy is the ability to effectively manage and make informed decisions about personal finances, including budgeting, saving, and investing. I may be a person who lacks financial literacy. I hate having to own up to that but there is no improvement without accountability, is there? The definition of financial literacy also states that there is a possession of skills, knowledge, and behaviors that enable individuals to manage their finances effectively. *sigh* Note to self, this is not for guilt but for change! I know the basics of course, but I also know I need to face the reality of lacking adequate financial literacy.

There's been no social pressure or having to "keep up appearances." The lack of a healthy self-image doesn't come from my finances, I know that is a definite fact. No blindness to inflation either. I am well aware that existence is just too damn expensive right now. Credit misconception is when people see their credit cards as "extra money," not something to be paid back. Yeah, none of that going on. I know the definitions and differences of credit, debit, and gift cards.

I did learn about lifestyle creeping. This is the process of expenses unintentionally creeping up as one's income increases. Maybe a pinch of that...? I do need to stay the hell off of GrubHub but it's more affordable with the hours I'm working. And let's not forget Amazon's eternal stronghold on my wallet. I am just going through the possibilities, trying to figure it all out.

Last thing I found that resonated with me is that many, if not the majority, of people with ADHD engage in impulse spending. The recently updated statistics I found were:

*58% of ADHDers spend impulsively.

*51% of ADHDers struggle with budgeting.

*49% of ADHDers struggle to save.

It all got narrowed down to achieving that nice rush of dopamine which the ADHD brain is constantly craving. This definitely gives me a reason to not beat myself up if I slip, but I never want to use it as an excuse to not do what I'm supposed to do in this life as a functional adult.

Doing that means the issue is behavioral, not cognitive. I need to try to be more self-aware, execute better planning, and utilize coping skills for the harder days. In many areas of my life, I need to take my power back and call all my efforts back to me. This is one of them.

More thoughts later.

0 notes

Text

let's look at the retirement expenses

Housing

Real Estate Taxes

Electric

Garbage

Water

Natural Gas

Internet

Cell Phone

Security System

Home Improvements

Furniture

Yard Maintenance

Loans & Liabilities

House Mortgage

Auto Loan

Boat Loan

Credit Card

RV / Camping Trailer

Food & Personal Care

Groceries

Restaurants

Spending Cash

Haircuts

Dry Cleaning

Gym Membership

Clothes and Shoes

Chiropractor

Insurance & Medical

Auto Insurance

Home Owners Insurance

Health Insurance

Dental Insurance

Life Insurance

Long Term Care Insurance

Medicare Supplemental Insurance

Vision & Eyecare

Medications

Vehicles & Transportation

Annual Tuneup

Fuel

Oil Change

Maintenance

Tires

Repairs

Memberships

License Renewal

Public Transportation

Travel & Entertainment

Vacations

Birthdays

Christmas

Amazon Prime

Hobbies & Lessons

Magazines and Newspapers

Software Subscriptions

Netflix

Movies

Giving & Miscellaneous

Tithes & Offerings

Missions

Charitable donations

Financial Adviser

Tax Preparation

Remember To Include Taxes include both state and federal taxes in your retirement spending planning.

There are a few ways to reduce the amount of taxes you'll owe in retirement. One is to consider doing ROTH contributions and conversions as you prepare for retirement. Another is to carefully plan your withdrawals from those accounts so that you don't end up in a higher than necessary tax bracket.

Essential vs Discretionary

-Essential expenses are those that you need to live, such as food, shelter, and clothing.

-Discretionary expenses are those that you can live without, such as entertainment and vacations.

The Goal Of Retirement

The goal of retirement is cash flow. It's all about making sure you have enough income to cover your expenses. You can start to project how much income you'll have in retirement and then compare your guaranteed income to your costs. Some of the most common sources of income in retirement are social security benefits , pensions, annuities, or rental income.

The Gap

Normally, your income sources will not cover all of your expenses in retirement. This is where your retirement savings come into play. You will likely need to supplement your income with withdrawals from a 401k, IRA, or other retirement accounts.

After entering all of your income and expenses into the calculator let's say you discover that you will have $50,000 dollars of income every year But your expenses are $90,000 per year. The gap in this scenario is $40,000. It is the difference between how much income you have compared to how much you plan to spend.

Have You Saved Enough To Cover The Gap?

The general rule of thumb is that you will take the gap number and multiply it by 25. This is based on the 4% rule that says you can safely withdraw up to four percent of your retirement savings each year without depleting your account. In the example above, you would need one million dollars saved to cover the forty thousand dollar gap.

Asset Allocation

If you are going to use the 4% rule you will want to make sure you have the correct asset allocation of your investments. The goal is to have a mix of stocks and bonds that will give you the best chance to not only cover your expenses but also keep up with inflation.

The research on the 4% rule found that a 60/40 mix of stocks and bonds is the sweet spot for most investors. This means that if you have a one million dollar portfolio, $600,000 would be in stocks and $400,000 would be in bonds.

Even though this combination has been shown to work, it does not factor in your risk tolerance and it's vital to note that past success is no indicator of future performance.

Withdrawal Order

How you choose to take money out of your different accounts could play a role in how long your money will last in retirement. The conventional wisdom is to withdraw from taxable accounts first and then move to tax-deferred accounts like a 401k or traditional IRA and save your tax-free accounts to last.

However, this is not always the best strategy because how much taxable income you have can impact other things such as how much you will pay for health insurance in the years leading up to age 65 or how much of your social security will be taxable.

Experiment with different withdrawal strategies to figure out what would be the best approach for you.

0 notes

Video

youtube

TOP 5 Best Portable Tire Inflators On Amazon 2024 - From Prilotte, KUXIS...

0 notes