#theyre going to be half the price of my current pieces so more people can get them too

Explore tagged Tumblr posts

Text

new commission type debuts tomorrow! it's going to be my only available type for the foreseeable future and I'll keep consistent slot info pinned with deals running on fridays! 👐

#i am realizingni cant juggle two jobs and maintain the level of detail i want for my current coms#so im doing a much simpler geometric chibi style for now! i hope you like it ✨#theyre going to be half the price of my current pieces so more people can get them too#were all broke i know i know. my big poeces just stent in the cards rn snd thats okay since i am now dual employed

6 notes

·

View notes

Note

I saw your bell commissions and goodness your art is so cute! I hope you don't mind me asking, but I was wondering, from one artist to another, if you have any tips for setting up bell commissions? How did you determine the price? And do people pay in advance or after you made the art? Keep up the wonderful work and have a lovely day! 💖

firstly i want to say i’d die for you anon.........................

secondly, in regards to pricing and setting up? the first thing id say is dont do it like i did???? like give it a lil layout! ill use my commission listing as an example!

https://vancecongdon.tumblr.com/post/613060307391315968/i-made-a-new-commission-sheet-with-updated

so dont go into as far detail as me, but just make it look a lil more presentable than a simple lil text post like i did!

to determine a price i’d say try and guesstimate? the reason i put 200k bells for new horizons is 1) the game is very new (only been out for like, 2 and a half weeks) so people aren’t really gonna be “swimming in fortune”, and 2) i didnt want it to be “dirt cheap” by current bell standards. (im basically giving away free art at this point lets be real GKJDSHGJDSF) i also make sure to make it 200k bells per character, unless its a complex piece, then it’d be like 300k-500k per character!

you also want to use the typical tags so people can find it in the acnh tag, so tags like “animal crossing”, “acnh”, and “animal crossing new horizons” are the ones i use typically, as those are the tags the crossing tumblr is gonna check frequently! i’d be happy to promo it once u make it, just shoot me a dm!

lastly my plan of action is:1. go the their island/the commissioner goes to your island to pay upfront2. sketch the concept/idea i have for the person and get any feedback if they need any changes3. if theyre happy with it, then line and colour it! (if they want changes, repeat step 2)4. show them in the dms/ims before uploading it!#

hope this helps anon!!

6 notes

·

View notes

Text

HOOOOOWOWOAH BOY

ART ASKS

when i walk into a building i get to eat everybodys pencils and they cant say no

do it

( also thanks for asking ! )

itd bother me a lot less if everybody came to my apartment and took one of these beautiful eggs

YEAH UNFORTUNATELY IM STILL..... WORKING THROUGH THE SAME WAITLIST but im comparatively REAL CLOSE to being done with it and i should be opening up sometime later in...... the Year

Boy Have I

theres This messy thing from a while back and then also

THIS, from even FURTHER back, when i didnt realize how fucking RED all the outlines on my things were because of the monitor i was using, two for the price of one

why not both

i do Not but it you ever see me walking on the street please throw handfuls of teeth at me theyre the only things my wretched body can digest and im always hungry

OH MAN ok so, an art telephone game is based on, of course, the game telephone, where one person says a phrase and then whispers it to the next person, and so on and on until the person at the very end says whatever they heard and if its done right the final sentence is wildly different than what you started with

an ART telephone game is the same kind of concept, except one person draws out a scene or character, and then other artists draw THEIR interpretation of whats going on, and so forth until the last person can end up with something COMPLETELY different than what the first scene was

youd think thered be less room for error with drawings, but as each person ONLY sees what the person ahead of them has made, they can get PRETTY OUT THERE - im gonna be a part of pythosarts game, and theyve done a couple of em before - for example one round started with THESE as the first two drawings

and then fourteen interpretations later, ended up with these as the final two

its good its real good

I Cant Control Where Bigfoot Goes, I Can Only Take Note Of Where Hes Been

YEAH, sort of ! on the main, iguanamouth, i have a bunch of different tags for art depending on what they are but not really a catchall one, BUT i do have an art only blog where everything gets tossed over !

HONESTLY THE ADVICE i got is basically what all art advice is gonna boil down to eventually - you gotta just. do it. you gotta DO it

absolutely nobody you know who draws things well started out at the level theyre currently at, and putting down the things youre visualizing onto paper is a combination of getting the the technical aspects down as much as getting the idea in your head

and that goes with figuring out anatomy and how bodies are put together ! ive got to use references for a Million things,. especially the dragon hoards - theres absolutely nothing wrong with using references for your drawings ! and being able to create accurate representations of things without looking is something that comes more with drawing something over and over and memorizing the body shape more than just, feeling like you should KNOW how to do something

so dont beat yourself up for needing references. if youre trying to shy away from them a little bit but still cant make something look nice without em, try using several different reference photos to put together an entirely different pose ?

theres ALSO the SHRIMP METHOD, which is great for practicing and getting good at one particular thing - this probably isnt SUPER HELPFUL but good luck !

god i tried. exactly ONCE maybe fourish years ago but it wasnt art, i was trying to stream the lion king movie and i had no idea what i was doing, i didnt realize i needed to wear headphones so the sound wouldnt snowball into a feedback loop of my own voice that never ended but i kept laughing and it kept distorting worse and worse, like the audio version of saving and resaving something as a jpeg

it was just me and my friend ronni in the stream and ONE other person who never left and never said anything and i kept addressing them out loud like WHO ARE YOU and that only compounded the noise problem and eventually i gave up

anyway i havent tried since

i uhhhhh dont think i COULD, really - fear especially is something thats kind of subjective and one persons Big Terror could be neutral or even cute to another person

like for me i used to have a lot of childhood fears about the ocean, and how deep and dark and vast it was, to the point where i couldnt play a lot of water levels in video games, even ( but i had almost drowned several times when i was Very young which probably had, a little somethin to do with that )

maybe sometime ill try to explore things IM afraid of, but its hard to encompass a psychological response in an image !! could be a fun experiment, though ! !

a few PLANT ANIMAL AZKZ, HUH, DONT HAVE A WORKING Z KEY

SHIT DUDE THESE ARE... SO GOOD thats the official name EVEN IF i didnt use. a daffodil as the flower base. it doesnt matter

yes

i got A BUNCH of flower and plant themed suggestions and theyre all REALLY GOOD ( way more than these ) but straight up im taking a break from em for a while - if anybody is else is reading this though you should definitely tackle one of em

WASABI ASKS

Do Not Feed Animals The Paste

i keep going back to read this ask because you could replace wasabi with my name and its the exact same. its the same. i feel like i have to hide somewhere

this was real and this is the award they gave us

there were other awards but the judges refused to give them out. they burned them in front of the other dogs. we won

it depends on the age ! wasabis pretty much an adult, so her sheds are pretty infrequent ( usually once every 7-8 months ) BUT when she was still growing back like 6 years ago, she would do a full-body shed every other month !

wasabi accepts tokens of appreciation in the form of : fruit, green beans. No Exceptions

i would never seperate wasabi from her hands

absolutely..... not. not even a little bit h h hh a this isnt a disney animal companion, i dont even know what “kind of like a dog” means with , a lizard who cant make any vocalizations or get up on their hind legs or NOTHIN sometimes if i hold a piece of fruit on my hand and she reaches for it she gets confused on whats what and tries to bite my fingers instead

ONCE WHEN SHE was attacking her reflection in a mirror i put my hand in front of her face to break eye contact and she SUNK HER TEETH RIGHT IN THERE but immediately let go like “oh whoops”

lissten . . . wasabi is so sharp, just absolutely everywhere, and these are the sharpest. the grabbers

heres a lil battle damage from earlier today actually

this is pretty tame BUT the long long lines are from claws, and the thinner, closer together ones are from holding her and her scales scraping against the skin. so not even just the Body is completely safe ! this is not an animal youre gonna wanna get your face real close to if theyre in a walkin mood

she doesnt even MEAN to scratch the shit outta me, its just kind of a byproduct of being a big tree lizard. her tail is absolutely the worst thing to get hit by though. the WORST. lucky me she doesnt attack anything that isnt a dog or a vacuum cleaner or her own reflection

ahhh i got her when i was 16 ! and i dont know her exact age but she was somewhere between 3-6 months when i get her - SHES probably closer to 9 years, but ive had her for about 8

LENGTH THOUGH...... the last time i measured her she was just barely under four and a half feet, but that was a few months ago and its possible shes. Just Slightly larger. shes currently sleeping as i type this so i guess we will never know

duel me

too late for coats..... its all tail action now

ROCK ASKS AND ALSO ASKS ABOUT PUTTING ROCKS IN YOUR MOUTH

oh MAN i feel you . . . . . . . . . . i dont think i could actually Bear To Eat any for real but some of em. just. they. i gotta. just. bite on em a LITTLE just a little bit, a tiny bit, a nibble

when i was real young i used to tap things against my teeth to tell what kind of substance they were made of based on the feeling/hardness/density WHATEVER and i still sometimes do it when im checking stuff out and. it uhhhhh sure is interesting finding out not a lot of people did that

a handful of these delicious raw agates, just for you

please stop spying on me

i DO NOT but you may eat this piece of bornite

meet me at the airport and ill cover your bus fair

theres a lotta different ways to figure out what kind of rocks you got but when you have absolutely no clue on where to start your best bet is to search for the biggest distinctive features of it, and try to narrow it down based on the results

like for something like these pieces of chalcedony, you could try “waxy green translucent mineral”, and from the search results find a few candidates that might be what you have on hand, and then look into each one to see if you can get a definite answer

ive got a handful of rock and mineral guide books that i always pick through whenever i snag something im not sure of, and if youre REAL into it those are always something you could start keeping an eye out for

now this is a REAL superficial way to telling what something is and wont be useful for a good chunk of minerals ( as a lot of samples can look really close to something else ) and THIS is a much more in depth way of telling something apart, but its also a lot more time consuming ! so good luck. and good eating.

Just Try And Fucking Stop Me

ANIMAL ASKS THAT ARENT............ ABOUT MY LIZARD

im married to this one actually

fuck. ok. heres. a secret. a In the ask Post secret. wasabi goes through a period that lasts a month every single year where she carries eggs in her gut, and spends that month not eating and digging around in everything, trying to find the right spot to lay these eggs. and. when it happens i never know what to do with them, and i dont want to just THROW THEM AWAY so i. eat them. i eat the eggs. i fuckin eat the eggs dude

Theyre All Goddesses

unless you plan on having your lizard roam around outside whenever they want, the outside environment doesnt really matter much for most reptiles as long as you set their habitat up right ! BUT i do know that australia has bans on certain reptiles ( iguanas are one of them ) and so youre gonna have to look up whats actually available in that area

bearded dragons are native and those are always a good option, but so are a lot of geckos - its really gonna depend on what youre into ( but i dont really recommend anoles if thats an option, because theyre fast as Hell and dont like being handled )

what the fuck is a bee

oh geez im sorry ! i remember going through this with spiders a lot when i was younger to the point where looking at photos of em used to be a fuckin, TRIAL

you could try a really gradual exposure deal, where you start off with getting comfortable with just images, and slowly working your way to dealing with one in a controlled setting ( like a petstore, maybe ? not HANDLING em or anything, but just being near one in a way where its absolutely impossible for them to touch you )

the shitty thing about this kind of phobia is that even if you KNOW its irrational theres sometimes not a lot you can do about it, but if you can stand looking at photos of them you could try learning up about them, and finding out the types of species youre likely to encounter around your house, and seeing how many ( if any ) are ones you should avoid ?

i know some people that have major problems with snakes are because theyre unsure if the ones they find are poisonous or not, and it might go a long way to confirm that the reptiles you meet wont be able to harm you even if they TRIED ( which is gonna be the case with a lotta house geckos, they cant do SHIT youre a GIANT )

very VERY few lizards have venomous bites, and the worst most of em can do is give you a bloody finger if theyre large enough, and even then its usually not much worse than a cat scratch !

still though, if youre really serious about trying to get past this, dont force yourself too quick into what you think you SHOULD be, and take tiny steps outta your comfort level when you can

this probably isnt uhhh SUPER helpful hh hhah but good luck ! shit im going through this post and its like ALL reptile photos. im sorry

i feel about them, with my hands

MMM it shouldnt HURT them unless theres something Really wrong, considering its a natural procession of growth, BUT its definitely itchy as hell, to the point where reptiles trying to remove it will drag their bodies over stones or walls tryin to get it off

sometimes wasabi drags her whole hind foot over her head like a dog to get it off and it is. a Sight

ahhh honestly there arent a lotta reptiles thatre gonna do much more than TOLERATE the touch and not really, enjoy it, like a dog or cat or bird

but speaking from experience with wasabi, youll probably want to avoid most the head and stick with the top of the back near the sides - wasabi doesnt enjoy having her tail messed with much either, but shes ok with her dewlap and feet being touched

the most important thing to keep an eye out for when youre touching one is their body language, because THATS gonna be a dead giveaway for whether you need to back off or not

closing their eyes is a sign of stress, not enjoyment ! same with tilting the head back, but if thats ALL theyre doing then youre probably not gonna face any retaliation

B U T if theyve got an extended dewlap with a raised body or tail off the ground, not a good idea to interact with em ! thats a defensive posture, and you risk getting hit with a tail or even bitten if your hand gets too close

youve got more to risk with males, who are way more territorial and generally larger, but if they seem pretty chill when you approach and dont stand up and stare at you, youre probably in the clear

COCK of the ROCK

I HAVE im so jealous of anybody whos got to see one in person - actually handling one is a level beyond that which i could even comprehend

OTHER THINGS.....

no but i was bit by a pigeon once

this is the only joke i know

i fuckin WISH !!!!!!!!!!!!!!!!!!!!!!!!

ayy im into it - honestly i havent been following the band so much as just kinda, picking up whatever anybody else mentions and so my knowledge on Gorillaz Lore is pretty uhhhh h hh h scattered but im definitely interested in seeing where this goes

i remember watching the first and second season and it being pretty good - some of the episodes and jokes are hit and miss but you absolutely got me with the creature and alien design

havent seen any of the third season yet though !

i mean the fruit ones could be pretty up there

how bout. an abstract concept. who cares about physical forms wheres the dragon of melancholy

why come theres nothing to eat in my apartment but bread. im good otherwise but its all just bread

i havent watched either of em in YEARS and YEARS but i distinctly remember. these lil dancing mushrooms

oh wait FUCK

FUCK !!!!!!!!!

no... NO.... she is not allowed to eat ANYTHING from the plan shelf, try as she MIGHT

im a little mad that this sill isnt bigger because the only other one that gets sun is in my room and wasabi WIll... absolutely eat those. no doubt. a convenient and expensive salad, for my awful gremlin

god im looking at these and its all jade plants isnt it

little golden books taste the best but they can make you sick if you have too many at once. my favorite genre for snacking is sci fi fantasy but anything over 300 pages tends to get a little tough if you dont break it up with smaller chunks. non fictions always a gamble because the taste is wildly different each time but you can usually tell how ripe it is by the cover color

ayy im already a big fan of some of their stuff, ive got a couple songs from them in my music tag - im especially into i miss you and their shut up and bring it here remix

TOP FIVE THINGS

1

2

3

4

5

this is barely related but once i filled up a bathtub with water and then dumped about ten bags worth of mint tea into it and then just. soaked around in the tea. listen it was really nice. id try the cheese

i dont have any ships but i was on one of those model pirate boats once for a school trip. our boat was named naruto and the other one was named sasuke and the captains shouted “make them kiss” and ran them into each other. everybody on board drowned

youre trying to trick me into googling yoshi without shoes and its not going to work

me reading this message from the safety of my apartment :

nice try, but wrong again ! : )

THIS IS GOOD info, thank you

oh SHIT the other side of paradise, take a slice, life itself, and season 2 episode 3 are all my Big Faves

the way you phrased this makes me think you already have a strong opinion on it

hey uh. coming from a person who was absolutely CONVINCED that theyd be dead in the future when they were 12, a not insignificant part of that was me feeling that there was something irreversibly wrong with me for not behaving or acting in certain ways based on what was going downstairs

and obviously im still HERE but it means i can understand how devastatingly terrible it can feel when youre that young and it seems like the way you behave and feel are flawed, or dirty, and anything that can lessen that feeling and make you comfortable in your own body is huge, can save your life

not that im saying its always a LIFE OR DEATH decision !

i guess if youre viewing it as adults forcing a child into making decisions that you dont think theyre capable of understanding its easy to be hesitant about getting behind it, but nobody is forcing a child to be trans. nobody has tricked them into feeling this way. you cant just walk in and get started on treatment on an immediate whim - some programs require 2 YEARS of concrete evidence before theyll even consider it

i feel like you should try speaking to the parents of trans children before you really put down a concrete opinion on whether this is a good or bad thing, and seeing the difference ( if any ) its made in their lives

people whove detransitioned, or found they had ultimately a different identity than the one they were exploring could also be an avenue to look intto ! i have several acquaintances who, after a period of years, found they werent trans but wouldnt take back the time where they were figuring out if they were, and i know this doesnt invalidate the friends i have who ARE

ultimately this is what it boils down to for me : Its Sure Gotta Beat Being Dead

i WILL give you that ive definitely seen a lot of overreactions to seemingly innocuous topics on this website

but youve also got to keep in mind that everybody who is saying these things MEANS them, and to them theres a completely reasonable explanation to why they feel that way

im not saying you should blindly accept any criticism you get, but to instead try to get a grasp on WHY theyre responding the way they are instead of immediately dismissing it

its because i cant drive and they wont let me sit in the front on account of the smell

NICE THINGS

AHHHH I GOT.. a bunch of other really sweet messages to the point where id feel weird about putting em ALL UP BUT... IF YOU SENT ME SOMETHING i can promise i absolutely saw it and it made my day better and just, holy shit, thank you for taking time out of your life to say anything to me at all

because you didnt have to, even a little bit

youre all beautiful and im kissing you on the mouths all at once. no take backs

63 notes

·

View notes

Text

"How much house can I afford?"

How much house can I afford? Answering this question correctly is one of the keys to building a happy, wealthy life. Unfortunately, theres a vast housing industry in the U.S. thats geared toward providing the wrong answer. You see, housing is by far the largest expense in most peoples budgets. According to the U.S. governments 2016 Consumer Expenditure Survey, the average American family spends $1573.83 on housing and related expenses every month. Thats more than they spend on food, clothing, healthcare, and entertainment put together! Too many folks struggling to make ends meet focus their attention on fine-tuning their budget. They try to save big bucks by clipping coupons, growing their own food, and/or making their own clothes. While theres nothing wrong with frugal habits I applaud everyday thriftiness! all of these actions combined wont (and cant) have the same impact on your budget as keeping your housing payments affordable. Part of the problem is what I call the Real-Estate Industrial Complex, each piece of which has a vested interest in convincing consumers that bigger, more expensive homes are better. Real-estate agents, mortgage brokers, home-shopping shows, and glossy magazines all encourage folks to buy at the top end of their budget. But buying at the top end of your housing budget is dangerous. Buying a home is a huge decision, financially and otherwise. If youre going to purchase a place, its important to know how much house you can truly afford.

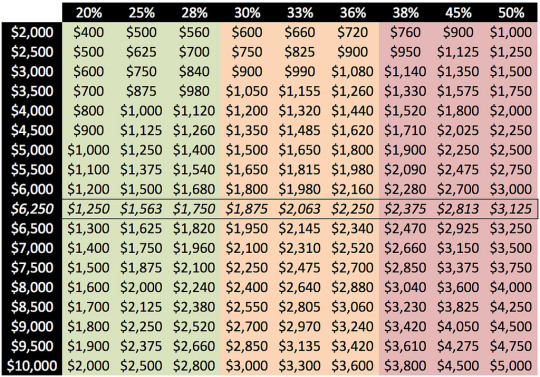

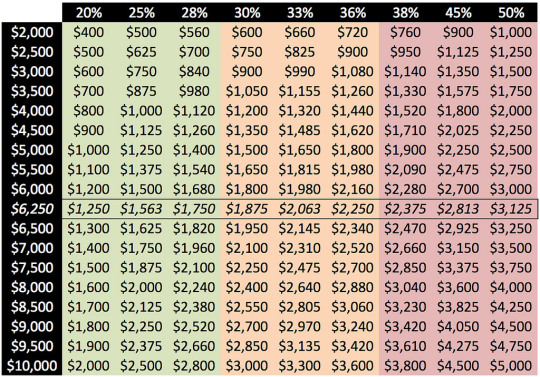

Debt-to-Income Ratio Economists have used decades of financial stats to create computer models to predict how much people can afford to spend on housing and debt. Banks use these models to figure out how much they think you can afford to spend on housing. Traditionally, lenders use whats called a debt-to-income ratio (or DTI ratio) a measure of how much of your income goes toward debt every month to estimate how much you can afford to pay for a home without risk of defaulting. This might sound complicated, but its not. To find this ratio, divide your monthly debt payments by your gross (pre-tax) income. So, for example, if you pay $400 toward debt every month and you have an income of $4000, then your DTI ratio is 10%. If you pay $800 toward debt on a $4000 income, your DTI ratio is 20%. The lower your debt-to-income ratio, the better. Banks and mortgage brokers look at two numbers when deciding how much to loan: The front-end DTI ratio (sometimes called the housing expense ratio), which includes only your housing expenses: mortgage principle, interest, taxes, and insurance.The back-end DTI ratio (also known as the total expense ratio), which include all of the above plus other debt payments like auto loans, student loans, and credit cards. The key thing to understand about debt-to-income ratios is that theyre used to estimate the lenders risk, not yours. That is, your mortgage company uses them to check whether they think youll be able to make the payments not whether you can comfortably make the payments. If you want room in your budget for fun, you should opt for a lower debt-to-income ratio than your real-estate agent and mortgage broker say you can use. If youre a money nerd, you can read more about debt-to-income ratios at Fannie Maes website. How Much House Can You Afford? During the 1970s (before credit-card debt was common), DTI wasnt split between front-end and back-end. There was only one ratio, and it was 25%. If your mortgage, taxes, and insurance costs were less than 25% of your income, people assumed you could make the payment. This is still an excellent rule of thumb: Spend no more than 25% of your budget on housing. (In fact, this is the number that money guru Dave Ramsey advocates.) That said, debt-to-income guidelines have relaxed over the years. When my ex-wife and I bought our first home in 1993, our mortgage broker told us that our front-end DTI ratio had to be 28% or lower, meaning we couldnt pay any more than 28% of our gross income toward housing. The back-end DTI ratio was capped at 36%, which meant that our housing expenses and other debt payments combined couldnt be more than 36% of our income.When my ex-wife and I bought a new home in 2004, the accepted DTI ratios had grown by 5%. That 28% figure is outdated, we were told. Most people can go as high as 33%. The back-end ratio had been raised to 38%.According to the Fannie Mae website, in 2018 maximum back-end DTI ratios are up to 45% (and sometimes even 50%). These numbers are insane. Nobody should be spending half of their gross income on debt not even mortgage debt! Thats a recipe for financial disaster. Heres a little table I whipped up to show what sort of housing payment youd be looking at based on your pre-tax income (the left-hand column) and various debt-to-income ratios (the header row):

A 5% increase in your debt-to-income ratio might not seem like a big deal. But when youre talking about a house payment, its huge. In 2016, the average American household earned $74,664 before taxes. Using this, a 5% change would be $3733.20 per year or $311.10 per month. Many folks lost their homes during the housing crisis because they took on mortgage payments that were just $300 more than they could afford each month. Real-Life Examples When my ex-wife and I moved in 2004, our housing payments went from around $1200 per month to roughly $1600 per month. This $400 per month difference was enough to make me panicked about money. Similarly, my youngest brother made the mistake of believing the banks when they told him he could afford a big housing payment. He could at first. But when the financial crisis hit in 2008 and 2009, he was screwed. Because hed bought at the top end of his budget, when his income faltered, so did his ability to pay his mortgage. He lost his home to foreclosure. For the most part, banks are happy to lend you as much money as you want. (Within reason, of course, and if your credit is good.) Theyre not going to stop you from taking on more debt if their computer models say you can afford it. Its up to you to exercise caution. In The Automatic Millionaire Homeowner, David Bach writes [emphasis is mine]: You should generally assume that the amount the bank or mortgage company will loan you is more than you should borrowDont fool around with this. Do the math. Be realistic about your situation. Dont pretend youre in better shape than you are. Remember: Nobody cares more about your money than you do. Your real-estate agent, mortgage broker, and bank all have a vested interest in encouraging you to buy as much house as possible their incomes depend on it. Listen to what they have to say, but make your decision based on whats best for you. Playing House If you think youre ready to buy a house, take a few months to do a trial run. In The Money Book for the Young, Fabulous, and Broke, Suze Orman says that you should play house before you buy a house. I like this idea. Heres how it works: Figure out how much you think you can afford to pay for a home every month, including mortgage and maintenance. Lets use $1750 as an example.Subtract the amount youre currently paying for housing. If your rent (or current mortgage) is $1000 per month, youd subtract this from our hypothetical $1750 to get $750 per month.Open a new, separate savings account. On the first day of each of the next six months, stick $750 into this account. This exercise lets you experience what its like to make a higher housing payment. If you cant make these numbers work, Orman says you need to wait: If you miss one payment, or if you are consistently late in making the payments, you are not ready to buy a home. If you can handle the extra payments, then youve got the thumbs-up to start looking for a home to buy. Generally speaking, once youve saved 20% for a down payment and you can afford monthly mortgage payments, youre ready to start looking for a home. Yes, you can buy a home with a smaller down payment I bought my first place with a 2% down payment! but itll cost you in the long run. Youll need to carry private mortgage insurance (PMI), youll pay more in interest, and you could put yourself in a position where you cant afford to keep your home.

The Bottom Line Homebuyers are often told to buy as much house as you can afford. But the problem with this advice is that it leaves you without a buffer. What if you lose your job? What if youre forced to sell your home after housing prices have dropped? Instead of buying as much house as you can afford, buy only as much house as you need. Think of conventional debt-to-income ratios as ceilings, not targets. Give yourself margin for error. Instead of basing your home-buying budget on a 36% front-end DTI ratio, consider dropping that to 28%. Or, better yet, 25% (just like the olden days!). If you have an average U.S. household income of around $75,000, a 36% DTI ratio would lead you to budget $2250 per month for housing (assuming you have no other debt). If you were to go with a more conservative 25% DTI ratio, that budget would be $1563 per month. Thats a savings of $687 per month over $8000 per year! Just think: What could you do with a chunk of change like that? Another way to create a buffer is to base your budget on your net (take-home) pay instead of your gross pay. Or, if youre in a relationship where both partners work, run the numbers for only one of the two incomes. No, you wont be able to afford a big mortgage if you do what Im recommending. But you know what? You wont feel pinched by your mortgage payments. And youll be at much less risk the next time the housing market implodes. Best of all, you can plow all of the money youve saved on housing into a building a ginormous wealth snowball! https://www.getrichslowly.org/how-much-house/

0 notes

Text

The Silicon Valley paradox: one in four people are at risk of hunger

Exclusive: study suggests that 26.8% of the population qualify as food insecure based on risk factors such as missing meals or relying on food banks

Karla Peralta is surrounded by food. As a line cook in Facebooks cafeteria, she spends her days preparing free meals for the tech firms staff. Shes worked in kitchens for most of her 30 years in the US, building a life in Silicon Valley as a single mother raising two daughters.

But at home, food is a different story. The regions soaring rents and high cost-of-living means that even with a full-time job, putting food on the table hasnt been simple. Over the years she has struggled to afford groceries at one point feeding her family of three with food stamps that amounted to $75 a week, about half what the government describes as a thrifty food budget. I was thinking, when am I going to get through this? she said.

outside in america

In a region famed for its foodie culture, where the well-heeled can dine on gold-flecked steaks, $500 tasting menus and $29 loaves of bread, hunger is alarmingly widespread, according to a new study shared exclusively with the Guardian.

One in four people in Silicon Valley are at risk of hunger, researchers at the Second Harvest food bank have found. Using hundreds of community interviews and data modeling, a new study suggests that 26.8% of the population almost 720,000 people qualify as food insecure based on risk factors such as missing meals, relying on food banks or food stamps, borrowing money for food, or neglecting bills and rent in order to buy groceries. Nearly a quarter are families with children.

We call it the Silicon Valley paradox, says Steve Brennan, the food banks marketing director. As the economy gets better we seem to be serving more people. Since the recession, Second Harvest has seen demand spike by 46%.

data

The bank is at the center of the Silicon Valley boom both literally and figuratively. It sits just half a mile from Ciscos headquarters and counts Facebooks Sheryl Sandberg among its major donors. But the need it serves is exacerbated by this industrys wealth; as high-paying tech firms move in, the cost of living rises for everyone else.

Food insecurity often accompanies other poverty indicators, such as homelessness. San Jose, Silicon Valleys largest city, had a homeless population of more than 4,000 people during a recent count. They are hungry, too: research conducted by the Health Trust, a local not-for-profit, found food resources available to them are scattered and inadequate.

These days Peralta earns too much to qualify for food stamps, but not enough not to worry. She pays $2,000 a month or three-quarters of her paycheck to rent the small apartment she shares with her youngest daughter. Even just the two of us, its still a struggle. So once a month, she picks up supplies at the food bank to supplement what she buys at the store.

She isnt one to complain, but acknowledges the vast gulf between the needs of Facebook employees and contract workers such as herself. The first thing they do [for Facebook employees] is buy you an iPhone and an Apple computer, and all these other benefits, she laughs. Its like, wow.

The scale of the problem becomes apparent on a visit to Second Harvest, the only food bank serving Silicon Valley and one of the largest in the country. In any given month it provides meals for 257,000 people 66m pounds of food last year. Inside its cavernous, 75,000 sq ft main warehouse space, boxes of produce stretched to the ceiling. Strip lights illuminated crates of cucumbers and pallets of sweet potatoes with a chilly glow. Volunteers in PayPal T-shirts packed cabbages and apples that arrived in boxes as big as paddling pools, while in the walk-in freezer turkeys waited to defrost.

Inside a warehouse belonging to Second Harvest food bank in San Jose, California, where PayPal staff volunteered for the day. Photography: Talia Herman

Because poverty is often shrouded in shame, their clients situations can come as a surprise. Often we think of somebody visibly hungry, the traditional homeless person, Brennan said. But this study is putting light on the non-traditional homeless: people living in their car or a garage, working people who have to choose between rent and food, people without access to a kitchen.

He added, Youre not thinking when you pick up your shirts from dry cleaning, or getting your landscaping done, or going to a restaurant, or getting your child cared for, is that person hungry? Its very easy to assume they are fine.

Matt Sciamanna is the sort of person you would assume is fine. Hes young, clever, and a recent graduate from San Jose State University. Yet here on campus, he says, food insecurity is a daily problem. Students, and even part-time professors, have been known to sleep in their cars or couch surf to save money. Sciamanna, who works on the Student Hunger Committee, says a survey of more than 4,000 students found about half have skipped meals due to the cost.

His investment in the issue is informed by his own experience. With his parents unable to finance all his living costs, Sciamanna worked in a restaurant while studying full time. But at 20 he was hit with a life-changing diagnosis: multiple sclerosis, a disease that left his grandmother bedridden. Unable to keep up with the pressures of restaurant work, he took a job on campus that paid just $400 a month.

Matt Sciamanna studying. Photo: Jeromy Cesea

My weekly food budget, after other expenses, was $25-$30, he says. Trips to the grocery store became a game of numbers: a bag of apples and bananas cost less than $5 and would last a week. A bag of frozen vegetables, another $5. Sometimes I would see a ripe peach, and I would want it, but then Id think, damn, theyre $1.50 each. Its not like Im asking for a car. Im just talking about a peach. That feeling leaves a scar.

While Sciamanna says his food situation has improved, another fear looms: healthcare costs. His father, a garbage man in San Francisco, has already postponed retirement so that his son can stay on the familys insurance. Without it, Sciamanna says he could face out-of-pocket costs of thousands of dollars a month for his medication. In that scenario, obtaining food would become even more difficult. His parents live in Clear Lake, three hours outside San Francisco, meaning a six-hour daily commute for his father. You feel like youre this dead weight, youre trying to advance yourself but you dont have the money. Its a shitty feeling.

Hunger and the housing crisis go hand-in-hand. In Santa Clara County, the median price of a family home has reached a new high of $1.125m, while the supply of homes continues to shrink. A family of four earning less than $85,000 is now considered low income. These realities mean food insecurity cuts across lines of race, age and employment status.

On a cold, bright afternoon at an elementary school in Menlo Park, kids trickled out of their classrooms and onto the playground. A food distribution was being arranged in the school gymnasium, and adults lined up outside with strollers and shopping carts, waiting for the doors to open. Most were women, many of them mothers whose children attend the school. Once inside they moved slowly and quietly around tables filled with bags of fresh produce, milk and bread, canned goods and beans.

A food distribution taking place at an elementary school in Menlo Park. Bottom right, Vicky Avila-Medrano, a food connection specialist with Second Harvest. Photography: Talia Herman

The Latino community is passing through a hard time, says Vicky Avila-Medrano, a food connection specialist. She runs a program that sends current and former food bank users out into the community, which has been disproportionately affected by the cost-of-living crisis.

Here in Silicon Valley, we have a big problem. This is a beautiful place to live for people in the tech industry, but we are not working in that industry.

Even people who have full-time jobs can find themselves with no way to put food on the table. Outside the gym, Martina Rivera, a 52-year-old mental health nurse, explained that her troubles began when her entire building was evicted last year. (Mass evictions have swept the area as landlords seek higher-paying tenants). Issues in her personal life, which she preferred not to detail, left her separated from her two children and their father. She thought about moving in with family, but worried about the burden. My brother was recovering from a stroke, and my mother is old, she says. I couldnt put more struggle on them. So what I found was my car.

Martina Rivera, 52, originally from Peru, lived in her car for six months while working as a nurse.

She told herself it was only temporary. I work night shifts at a veterans hospital, so I would go to my moms house to shower, and wait until it was time to work. I waited and waited for the storm to pass. Eventually she found a room without a private bathroom or kitchen. She shopped for food at 99 cent stores, ate mainly canned food, and cooked in a microwave. It took a toll on her health, she says; she gained weight.

I was having panic attacks. My body was like the walking dead. But I thought, I need to keep strong. And I never quit my job.

Rivera says that for many working people, pride is a barrier to admitting need. People dont have money to buy food, but they are shy to ask. But there is no reason to feel ashamed.

The day before Thanksgiving, Karla Peralta invited me to her home. She loves to cook, and prides herself on pulling together a healthy meal even when resources are scarce. I have to cook with what I have. Even if I only have a piece of chicken, a little bit of this and that, I am a cook. I make it work.

Karla Peralta, who works in the cafeteria at Facebook, demonstrates in her kitchen how she cooks with ingredients she picks up from the food bank. Photography: Charlotte Simmonds

That evening she worked with ingredients from the food bank: potatoes and chicken, cans of beans, corn and tomatoes. Dignified and good humored, Peralta says her current job is one of the best shes ever had, even though she still needs help.

As we sat down at her kitchen table to share a meal, we talk about her plans for tomorrows holiday meal. Shell be making ham with pineapples, her daughters favorite. There will be turkey and mashed potatoes, and her niece is bringing bread. And we got some rice from the food bank, she said. Ill probably make that, too.

Do you have an experience of homelessness to share with the Guardian? Get in touch

Sign up to Chronicling Homelessness, our monthly Outside in America newsletter

Read more: http://ift.tt/2AvII9h

from Viral News HQ http://ift.tt/2C9Fm9g via Viral News HQ

0 notes

Text

"How much house can I afford?"

How much house can I afford? Answering this question correctly is one of the keys to building a happy, wealthy life. Unfortunately, theres a vast housing industry in the U.S. thats geared toward providing the wrong answer. You see, housing is by far the largest expense in most peoples budgets. According to the U.S. governments 2016 Consumer Expenditure Survey, the average American family spends $1573.83 on housing and related expenses every month. Thats more than they spend on food, clothing, healthcare, and entertainment put together! Too many folks struggling to make ends meet focus their attention on fine-tuning their budget. They try to save big bucks by clipping coupons, growing their own food, and/or making their own clothes. While theres nothing wrong with frugal habits I applaud everyday thriftiness! all of these actions combined wont (and cant) have the same impact on your budget as keeping your housing payments affordable. Part of the problem is what I call the Real-Estate Industrial Complex, each piece of which has a vested interest in convincing consumers that bigger, more expensive homes are better. Real-estate agents, mortgage brokers, home-shopping shows, and glossy magazines all encourage folks to buy at the top end of their budget. But buying at the top end of your housing budget is dangerous. Buying a home is a huge decision, financially and otherwise. If youre going to purchase a place, its important to know how much house you can truly afford.

Debt-to-Income Ratio Economists have used decades of financial stats to create computer models to predict how much people can afford to spend on housing and debt. Banks use these models to figure out how much they think you can afford to spend on housing. Traditionally, lenders use whats called a debt-to-income ratio (or DTI ratio) a measure of how much of your income goes toward debt every month to estimate how much you can afford to pay for a home without risk of defaulting. This might sound complicated, but its not. To find this ratio, divide your monthly debt payments by your gross (pre-tax) income. So, for example, if you pay $400 toward debt every month and you have an income of $4000, then your DTI ratio is 10%. If you pay $800 toward debt on a $4000 income, your DTI ratio is 20%. The lower your debt-to-income ratio, the better. Banks and mortgage brokers look at two numbers when deciding how much to loan: The front-end DTI ratio (sometimes called the housing expense ratio), which includes only your housing expenses: mortgage principle, interest, taxes, and insurance.The back-end DTI ratio (also known as the total expense ratio), which include all of the above plus other debt payments like auto loans, student loans, and credit cards. The key thing to understand about debt-to-income ratios is that theyre used to estimate the lenders risk, not yours. That is, your mortgage company uses them to check whether they think youll be able to make the payments not whether you can comfortably make the payments. If you want room in your budget for fun, you should opt for a lower debt-to-income ratio than your real-estate agent and mortgage broker say you can use. If youre a money nerd, you can read more about debt-to-income ratios at Fannie Maes website. How Much House Can You Afford? During the 1970s (before credit-card debt was common), DTI wasnt split between front-end and back-end. There was only one ratio, and it was 25%. If your mortgage, taxes, and insurance costs were less than 25% of your income, people assumed you could make the payment. This is still an excellent rule of thumb: Spend no more than 25% of your budget on housing. (In fact, this is the number that money guru Dave Ramsey advocates.) That said, debt-to-income guidelines have relaxed over the years. When my ex-wife and I bought our first home in 1993, our mortgage broker told us that our front-end DTI ratio had to be 28% or lower, meaning we couldnt pay any more than 28% of our gross income toward housing. The back-end DTI ratio was capped at 36%, which meant that our housing expenses and other debt payments combined couldnt be more than 36% of our income.When my ex-wife and I bought a new home in 2004, the accepted DTI ratios had grown by 5%. That 28% figure is outdated, we were told. Most people can go as high as 33%. The back-end ratio had been raised to 38%.According to the Fannie Mae website, in 2018 maximum back-end DTI ratios are up to 45% (and sometimes even 50%). These numbers are insane. Nobody should be spending half of their gross income on debt not even mortgage debt! Thats a recipe for financial disaster. Heres a little table I whipped up to show what sort of housing payment youd be looking at based on your pre-tax income (the left-hand column) and various debt-to-income ratios (the header row):

A 5% increase in your debt-to-income ratio might not seem like a big deal. But when youre talking about a house payment, its huge. In 2016, the average American household earned $74,664 before taxes. Using this, a 5% change would be $3733.20 per year or $311.10 per month. Many folks lost their homes during the housing crisis because they took on mortgage payments that were just $300 more than they could afford each month. Real-Life Examples When my ex-wife and I moved in 2004, our housing payments went from around $1200 per month to roughly $1600 per month. This $400 per month difference was enough to make me panicked about money. Similarly, my youngest brother made the mistake of believing the banks when they told him he could afford a big housing payment. He could at first. But when the financial crisis hit in 2008 and 2009, he was screwed. Because hed bought at the top end of his budget, when his income faltered, so did his ability to pay his mortgage. He lost his home to foreclosure. For the most part, banks are happy to lend you as much money as you want. (Within reason, of course, and if your credit is good.) Theyre not going to stop you from taking on more debt if their computer models say you can afford it. Its up to you to exercise caution. In The Automatic Millionaire Homeowner, David Bach writes [emphasis is mine]: You should generally assume that the amount the bank or mortgage company will loan you is more than you should borrowDont fool around with this. Do the math. Be realistic about your situation. Dont pretend youre in better shape than you are. Remember: Nobody cares more about your money than you do. Your real-estate agent, mortgage broker, and bank all have a vested interest in encouraging you to buy as much house as possible their incomes depend on it. Listen to what they have to say, but make your decision based on whats best for you. Playing House If you think youre ready to buy a house, take a few months to do a trial run. In The Money Book for the Young, Fabulous, and Broke, Suze Orman says that you should play house before you buy a house. I like this idea. Heres how it works: Figure out how much you think you can afford to pay for a home every month, including mortgage and maintenance. Lets use $1750 as an example.Subtract the amount youre currently paying for housing. If your rent (or current mortgage) is $1000 per month, youd subtract this from our hypothetical $1750 to get $750 per month.Open a new, separate savings account. On the first day of each of the next six months, stick $750 into this account. This exercise lets you experience what its like to make a higher housing payment. If you cant make these numbers work, Orman says you need to wait: If you miss one payment, or if you are consistently late in making the payments, you are not ready to buy a home. If you can handle the extra payments, then youve got the thumbs-up to start looking for a home to buy. Generally speaking, once youve saved 20% for a down payment and you can afford monthly mortgage payments, youre ready to start looking for a home. Yes, you can buy a home with a smaller down payment I bought my first place with a 2% down payment! but itll cost you in the long run. Youll need to carry private mortgage insurance (PMI), youll pay more in interest, and you could put yourself in a position where you cant afford to keep your home.

The Bottom Line Homebuyers are often told to buy as much house as you can afford. But the problem with this advice is that it leaves you without a buffer. What if you lose your job? What if youre forced to sell your home after housing prices have dropped? Instead of buying as much house as you can afford, buy only as much house as you need. Think of conventional debt-to-income ratios as ceilings, not targets. Give yourself margin for error. Instead of basing your home-buying budget on a 36% front-end DTI ratio, consider dropping that to 28%. Or, better yet, 25% (just like the olden days!). If you have an average U.S. household income of around $75,000, a 36% DTI ratio would lead you to budget $2250 per month for housing (assuming you have no other debt). If you were to go with a more conservative 25% DTI ratio, that budget would be $1563 per month. Thats a savings of $687 per month over $8000 per year! Just think: What could you do with a chunk of change like that? Another way to create a buffer is to base your budget on your net (take-home) pay instead of your gross pay. Or, if youre in a relationship where both partners work, run the numbers for only one of the two incomes. No, you wont be able to afford a big mortgage if you do what Im recommending. But you know what? You wont feel pinched by your mortgage payments. And youll be at much less risk the next time the housing market implodes. Best of all, you can plow all of the money youve saved on housing into a building a ginormous wealth snowball! https://www.getrichslowly.org/how-much-house/

0 notes

Text

A brief history of U.S. homeownership

During the month of May at Get Rich Slowly, were going to turn our attention to home and garden topics. To start, I want to take a brief look at the history of the U.S. housing market. Some folks might find this dry. I think its fascinating. Private land ownership is baked into the U.S. culture and Constitution. Its part of the material plenty we expect from the American Dream. For most Americans, homeownership implies success and freedom and wealth. But for a long time, homeownership was the exception rather than the rule. Only farmers were likely to own land and a house during the countrys early days. With the coming of the Industrial Revolution, homeownership became more common for urban dwellers. Still, less than half of all Americans owned their homes until the late 1940s. Heres how U.S. homeownership rates of changed over the past 128 years according to the U.S. Census Bureau and the Federal Reserve Bank of St. Louis:

The current U.S. homeownership rate as of January 2018 is 64.2%. Im sure you could write a doctoral thesis on the reasons for the growth of homeownership over time. Im not going to do that. After several hours of research into the history of mortgages and the real-estate industry, I feel like we can summarize everything in a few paragraphs. This article which is information-only will serve as background for future Get Rich Slowly discussions about homeownership. In the Beginning During the 1800s, most folks had no way to own a house. They didnt have the lump sum required to make the purchase, and banks wouldnt lend money for average people to buy homes. Mortgages didnt become common until the U.S. banking system was stabilized following the National Bank Acts of the 1860s. After this reform, banks began to experiment with lending money for homes, and by the 1890s, mortgages were popular across the U.S although not precisely as we know them today. A typical mortgage in the early 1900s might have a term of five years and require a 50% down payment. Plus, they were usually structured with interest-only monthly payments and a balloon payment for the entire principal at the end of the term. Borrowers could (and did) renegotiate their loans every year. Compare this to modern mortgages, which usually have 30-year terms and require a down payment of only five to twenty percent. (I bought my first home in 1993 with a down payment of less than one percent!)

These early mortgages worked fine until the Great Depression. When that crisis hit, banks had no money to lend and the average borrower had no cash either. As a result, potential homeowners couldnt afford to buy, and many existing homeowners defaulted. (At one point during the 1930s, nearly 10% of all homes were in foreclosure!) Note: This article originally appeared at Money Boss in April 2016. Ive updated text-based stats through 2018, but graphics-based data is two years old. However, nothing material has changed in the past 24 months. Bubbles and Booms To stabilize the housing market, the U.S. government created the Home Owners Loan Corporation in 1933, the Federal Housing Administration in 1934, and the Federal National Mortgage Association (now Fannie Mae) in 1938. These institutions helped to arrest the housing crash and, eventually, spur homeownership to new heights. But it was the G.I. Bill of 1944, which provided subsidized mortgages for World War II veterans, that changed the face of the housing industry and the American economy. From encyclopedia.com: The GI Bills mortgage subsidies led to an escalated demand for housing and the development of suburbs. One-fifth of all single-family homes built in the 20 years following World War II were financed with help from the GI Bills loan guarantee program, symbolizing the emergence of a new middle class. As homebuying became more common (and more complicated), real-estate brokers helped sellers find buyers for their homes. The National Association of Real Estate Boards adopted the term Realtor in 1916. As the housing market boomed during the 1940s and 1950s, so did the real-estate profession. By 1950, for the first time in American history, more than half of all Americans owned their homes. As demand for housing increased, so did prices. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. What caused the housing bubble during the last decade? And whats feeding the current buying frenzy? Thats a great question, and its open to debate. Some folks blame loose lending standards. Some blame a lack of government oversight. Some blame real-estate speculators. Some blame the American propensity for consumption. Some blame cheerleading from the real-estate industry. Me? I think its a little of everything.

Bigger Everything! Naturally, increased home prices and increased ownership rates brought increased mortgages. During the past fifty years, long-term mortgages with large balances became more common until now theyre the standard. Between 1949 and the turn of the twenty-first century, mortgage debt relative to total income of the average household rose from 20% to 73%, and from 15% to 41% relative to total household assets. One reason mortgage sizes have increased is that housing sizes have increased. According to the U.S. Census Bureau, the median size for a new home built in 1973 was 1525 square feet. By 2016, that number had jumped to 2422 square feet. In those forty years, kitchen sizes have doubled, ceilings have risen more than a foot, and bedrooms have grown by more than 50 square feet. But home sizes are ballooning even as households are shrinking! The average household had 2.9 people in 1973. In 2016, the average household had 2.5 people. Lets run the numbers: Forty years ago, we had 526 square feet of living space per person; today, we have 969 square feet of living space per person. To me, this seems crazy. Why do we need such huge houses? Whats the point? And do homeowners truly consider the costs when they choose to buy big? A larger home doesnt just carry a larger purchase price. It costs more to maintain. It costs more to light, to heat, and to furnish. For too many people, big homes are the destroyer of dreams. (Im not joking. I truly believe this.) Full disclosure: In the past, Ive been guilty of pursuing home-size inflation myself, although I eventually came to see the error of my ways. My first house (purchased in 1993) had 1383 square feet. My second house (purchased in 2004) had 1814 square feet. That was peak bigness for me. The condo I sold last year had 1547 square feet. And the house we moved into last July has 1235 square feet. I think about 1000 square feet is ideal, but Kim likes having the extra room. Im not saying you should live in a shack. Nor am I suggesting everyone should own a tiny home. But I believe its important to be logical when it comes to housing. Remember that size comes with a price. If you need the space, buy it. If you dont, youre better off saving your money for something else. The Bottom Line Housing is by far the largest expense in the typical budget. According to the U.S. governments 2016 Consumer Expenditure Survey, the average American family spends $1573.83 on housing and related expenses every month. Thats more than they spend on food, clothing, healthcare, and entertainment combined! Here at Get Rich Slowly, Im adamant that one of the best ways if not the best way to improve your cash flow is by cutting your costs on housing. Remember, your goal is to manage your financial life as if you were managing a business. If you were looking to balance the budget at a company you owned, you wouldnt do it by trying to trim the small expenses. No, youd tackle your biggest expenses first. If you reduce your labor costs by 5%, for instance, you might be able to save $50,000 per year. But saving 5% on office supplies would probably only save you $50 per year. The same principle applies in your personal life. If the typical American household cut their grocery budget by 5%, theyd save only $200 per year. If they cut housing by 5%? Well, theyd save $900 per year. So why do so many people put so much effort into clipping coupons while continuing to shell out for more home then they can afford (or need)? Good question. In the weeks ahead, Im going to explore different pieces of the housing equation. When does it make sense to rent? When does it make sense to buy? Is it better to prepay your mortgage or to keep it forever? How can you determine how much home you can afford? If you have a specific question about housing and money, please let me know! https://www.getrichslowly.org/homeownership/

0 notes

Text

The Silicon Valley paradox: one in four people are at risk of hunger

Exclusive: study suggests that 26.8% of the population qualify as food insecure based on risk factors such as missing meals or relying on food banks

Karla Peralta is surrounded by food. As a line cook in Facebooks cafeteria, she spends her days preparing free meals for the tech firms staff. Shes worked in kitchens for most of her 30 years in the US, building a life in Silicon Valley as a single mother raising two daughters.

But at home, food is a different story. The regions soaring rents and high cost-of-living means that even with a full-time job, putting food on the table hasnt been simple. Over the years she has struggled to afford groceries at one point feeding her family of three with food stamps that amounted to $75 a week, about half what the government describes as a thrifty food budget. I was thinking, when am I going to get through this? she said.

outside in america

In a region famed for its foodie culture, where the well-heeled can dine on gold-flecked steaks, $500 tasting menus and $29 loaves of bread, hunger is alarmingly widespread, according to a new study shared exclusively with the Guardian.

One in four people in Silicon Valley are at risk of hunger, researchers at the Second Harvest food bank have found. Using hundreds of community interviews and data modeling, a new study suggests that 26.8% of the population almost 720,000 people qualify as food insecure based on risk factors such as missing meals, relying on food banks or food stamps, borrowing money for food, or neglecting bills and rent in order to buy groceries. Nearly a quarter are families with children.

We call it the Silicon Valley paradox, says Steve Brennan, the food banks marketing director. As the economy gets better we seem to be serving more people. Since the recession, Second Harvest has seen demand spike by 46%.

data

The bank is at the center of the Silicon Valley boom both literally and figuratively. It sits just half a mile from Ciscos headquarters and counts Facebooks Sheryl Sandberg among its major donors. But the need it serves is exacerbated by this industrys wealth; as high-paying tech firms move in, the cost of living rises for everyone else.

Food insecurity often accompanies other poverty indicators, such as homelessness. San Jose, Silicon Valleys largest city, had a homeless population of more than 4,000 people during a recent count. They are hungry, too: research conducted by the Health Trust, a local not-for-profit, found food resources available to them are scattered and inadequate.

These days Peralta earns too much to qualify for food stamps, but not enough not to worry. She pays $2,000 a month or three-quarters of her paycheck to rent the small apartment she shares with her youngest daughter. Even just the two of us, its still a struggle. So once a month, she picks up supplies at the food bank to supplement what she buys at the store.

She isnt one to complain, but acknowledges the vast gulf between the needs of Facebook employees and contract workers such as herself. The first thing they do [for Facebook employees] is buy you an iPhone and an Apple computer, and all these other benefits, she laughs. Its like, wow.

The scale of the problem becomes apparent on a visit to Second Harvest, the only food bank serving Silicon Valley and one of the largest in the country. In any given month it provides meals for 257,000 people 66m pounds of food last year. Inside its cavernous, 75,000 sq ft main warehouse space, boxes of produce stretched to the ceiling. Strip lights illuminated crates of cucumbers and pallets of sweet potatoes with a chilly glow. Volunteers in PayPal T-shirts packed cabbages and apples that arrived in boxes as big as paddling pools, while in the walk-in freezer turkeys waited to defrost.

Inside a warehouse belonging to Second Harvest food bank in San Jose, California, where PayPal staff volunteered for the day. Photography: Talia Herman

Because poverty is often shrouded in shame, their clients situations can come as a surprise. Often we think of somebody visibly hungry, the traditional homeless person, Brennan said. But this study is putting light on the non-traditional homeless: people living in their car or a garage, working people who have to choose between rent and food, people without access to a kitchen.

He added, Youre not thinking when you pick up your shirts from dry cleaning, or getting your landscaping done, or going to a restaurant, or getting your child cared for, is that person hungry? Its very easy to assume they are fine.

Matt Sciamanna is the sort of person you would assume is fine. Hes young, clever, and a recent graduate from San Jose State University. Yet here on campus, he says, food insecurity is a daily problem. Students, and even part-time professors, have been known to sleep in their cars or couch surf to save money. Sciamanna, who works on the Student Hunger Committee, says a survey of more than 4,000 students found about half have skipped meals due to the cost.

His investment in the issue is informed by his own experience. With his parents unable to finance all his living costs, Sciamanna worked in a restaurant while studying full time. But at 20 he was hit with a life-changing diagnosis: multiple sclerosis, a disease that left his grandmother bedridden. Unable to keep up with the pressures of restaurant work, he took a job on campus that paid just $400 a month.

Matt Sciamanna studying. Photo: Jeromy Cesea

My weekly food budget, after other expenses, was $25-$30, he says. Trips to the grocery store became a game of numbers: a bag of apples and bananas cost less than $5 and would last a week. A bag of frozen vegetables, another $5. Sometimes I would see a ripe peach, and I would want it, but then Id think, damn, theyre $1.50 each. Its not like Im asking for a car. Im just talking about a peach. That feeling leaves a scar.

While Sciamanna says his food situation has improved, another fear looms: healthcare costs. His father, a garbage man in San Francisco, has already postponed retirement so that his son can stay on the familys insurance. Without it, Sciamanna says he could face out-of-pocket costs of thousands of dollars a month for his medication. In that scenario, obtaining food would become even more difficult. His parents live in Clear Lake, three hours outside San Francisco, meaning a six-hour daily commute for his father. You feel like youre this dead weight, youre trying to advance yourself but you dont have the money. Its a shitty feeling.

Hunger and the housing crisis go hand-in-hand. In Santa Clara County, the median price of a family home has reached a new high of $1.125m, while the supply of homes continues to shrink. A family of four earning less than $85,000 is now considered low income. These realities mean food insecurity cuts across lines of race, age and employment status.

On a cold, bright afternoon at an elementary school in Menlo Park, kids trickled out of their classrooms and onto the playground. A food distribution was being arranged in the school gymnasium, and adults lined up outside with strollers and shopping carts, waiting for the doors to open. Most were women, many of them mothers whose children attend the school. Once inside they moved slowly and quietly around tables filled with bags of fresh produce, milk and bread, canned goods and beans.

A food distribution taking place at an elementary school in Menlo Park. Bottom right, Vicky Avila-Medrano, a food connection specialist with Second Harvest. Photography: Talia Herman

The Latino community is passing through a hard time, says Vicky Avila-Medrano, a food connection specialist. She runs a program that sends current and former food bank users out into the community, which has been disproportionately affected by the cost-of-living crisis.

Here in Silicon Valley, we have a big problem. This is a beautiful place to live for people in the tech industry, but we are not working in that industry.

Even people who have full-time jobs can find themselves with no way to put food on the table. Outside the gym, Martina Rivera, a 52-year-old mental health nurse, explained that her troubles began when her entire building was evicted last year. (Mass evictions have swept the area as landlords seek higher-paying tenants). Issues in her personal life, which she preferred not to detail, left her separated from her two children and their father. She thought about moving in with family, but worried about the burden. My brother was recovering from a stroke, and my mother is old, she says. I couldnt put more struggle on them. So what I found was my car.

Martina Rivera, 52, originally from Peru, lived in her car for six months while working as a nurse.

She told herself it was only temporary. I work night shifts at a veterans hospital, so I would go to my moms house to shower, and wait until it was time to work. I waited and waited for the storm to pass. Eventually she found a room without a private bathroom or kitchen. She shopped for food at 99 cent stores, ate mainly canned food, and cooked in a microwave. It took a toll on her health, she says; she gained weight.

I was having panic attacks. My body was like the walking dead. But I thought, I need to keep strong. And I never quit my job.

Rivera says that for many working people, pride is a barrier to admitting need. People dont have money to buy food, but they are shy to ask. But there is no reason to feel ashamed.

The day before Thanksgiving, Karla Peralta invited me to her home. She loves to cook, and prides herself on pulling together a healthy meal even when resources are scarce. I have to cook with what I have. Even if I only have a piece of chicken, a little bit of this and that, I am a cook. I make it work.

Karla Peralta, who works in the cafeteria at Facebook, demonstrates in her kitchen how she cooks with ingredients she picks up from the food bank. Photography: Charlotte Simmonds

That evening she worked with ingredients from the food bank: potatoes and chicken, cans of beans, corn and tomatoes. Dignified and good humored, Peralta says her current job is one of the best shes ever had, even though she still needs help.

As we sat down at her kitchen table to share a meal, we talk about her plans for tomorrows holiday meal. Shell be making ham with pineapples, her daughters favorite. There will be turkey and mashed potatoes, and her niece is bringing bread. And we got some rice from the food bank, she said. Ill probably make that, too.

Do you have an experience of homelessness to share with the Guardian? Get in touch

Sign up to Chronicling Homelessness, our monthly Outside in America newsletter

Read more: http://ift.tt/2AvII9h

from Viral News HQ http://ift.tt/2C9Fm9g via Viral News HQ

0 notes