#they say there's a 120% of inflation only in this first month

Text

I'm actually about to cry because 1 lemon is going to cost me $100 when I go back home when last year 6 lemons costed me less than $200

I feel so stupid for being this sad

#they say there's a 120% of inflation only in this first month#really scary#I don't know what's going to happen with the rest of the year#an is venting#would be nice to get commissions during the year#I'll keep promoting it

4 notes

·

View notes

Text

Farmers of color plan to appeal a recent federal court judge’s ruling, which they say is a continuation of Jim Crow and erases their commitment to right the historical wrongs against them.

Six months ago, John Boyd Jr., Kara Boyd, Lester Bonner, and Princess Williams filed a class-action lawsuit against the U.S. government, including the United States Department of Agriculture. The farmers alleged the government broke its promise when it failed to pay the eligible debt for farmers of color because Congress repealed a $4 billion debt relief program for socially disadvantaged farmers and ranchers — which includes Black, Native American, Hispanic, and Asian communities.

Instead, they created a race neutral program to replace it, which the plaintiffs say was a “blatant attempt to skirt its contractual commitments” to them and other farmers. As a result, farmers can’t pay off their debts, according to the lawsuit.

“They have to know that this is a continuation of Jim Crow, and a continuation of what free Black men and women went through in this country. This is a continuation of that because we see it as another broken promise,” Boyd Jr., president of the National Black Farmers Association, said last week. “Just like my forefathers, I ain’t giving up the fight.”

The U.S. Justice Department argued in a March 10 filing that the legislation established the financial assistance program, “not contractual undertakings.” The department asked for the complaint to be dismissed for “failure to state a plausible claim for relief.”

Senior Judge Edward J. Damich for the United States Court of Federal Claims agreed in an April 27 opinion, saying there wasn’t an expressed or implied-in-fact contractual agreement between the farmers and the federal agency.

“Instead, the program reflects Congress’ intent only to “declare a policy to be pursued until the legislature shall ordain otherwise,” not an intent “to create private contractual or vested rights,” Damich wrote.

The original loan forgiveness program at the center of the complaint passed in March 2021 as part of the American Rescue Plan Act, offering up to 120% of the outstanding indebtedness to address historical inequities and funding disparities by the USDA.

Black farmers saw this as the first step to repair the broken relationship with the federal government, especially after the landmark Pigford v. Glickman, a class-action lawsuit alleging the USDA discriminated against Black farmers from 1983 to 1997 when they applied for federal financial assistance, and failed to respond to complaints of discrimination. The court approved a settlement in 1999. While some Black farmers received payments, thousands did not because of confusing paperwork, filing deadlines, denials of claims, processing issues and attorney malpractice, NPR reported.

In June 2021, the same month the USDA planned to start loan payments to eligible borrowers, a judge issued a restraining order on the program in response to a lawsuit brought by a group of white farmers alleging that debt relief racially discriminated against them.

“The discrimination is just not with the USDA. It also goes deep into the court system,” farmer Corey Lea told Capital B in December. “It’s crazy how the white farmers got it done within 30 days and Black farmers, if they get any justice at all — most of the time, no — they’re in [the courtroom] for years. It’s a systemic problem.”

Rather than implement the existing loan forgiveness program, the Inflation Reduction Act, which was signed into law last year, replaced it with assistance for a broader group of “distressed borrowers.”

The act provides $125 million for technical assistance regarding food, agriculture, and agricultural credit to underserved farmers, ranchers, or forest landowners, including those living in high poverty areas. Another program provides $2.2 billion for farmers who have experienced discrimination prior to January 2021 by the Agriculture Department’s farm lending programs. Recipients can receive up to $500,000 each.

In September, all parties agreed to dismiss the lawsuit in response to the Inflation Reduction Act. A month later, Boyd Jr. filed suit. He said the relief from the original program in the American Rescue Plan Act would’ve made a big difference in helping farmers to wipe their slate clean — especially for Bonner and Williams, who have struggled to make ends meet or pay off mounting bills.

“This administration … just abandoned us, left us out there high and dry. That’s why I turned to the courts,” Boyd Jr. said.

#Black Farmers Matter#Black Farmers#Black Farms#Black Lives Matter#Black Farmers Refuse to Back Down After Federal Judge Dismisses Suit

9 notes

·

View notes

Text

Costco, the retail giant renowned for offering a wide range of products at discounted prices, has recently added an unexpected item to its inventory: 1-ounce gold bars.

While the exact price is available only to Costco members, online discussions suggest that the bars were priced at just under $1,900. As of 1:30 p.m. UTC on 28 September 2023, the spot gold price stood at $1,874.50 per ounce.

On 26 September 2023, during Costco’s Q4 2023 Earnings Call, Richard Galanti, who is Costco’s Executive Vice President and Chief Financial Officer, had this to say:

“I’ve gotten a couple of calls that people have seen online that we’ve been selling one-ounce gold bars, yes, but when we load them on the site, they’re typically gone within a few hours and we limit two per member.“

The gold bars are exclusively available online and can be purchased only by Costco members. Membership fees for the retail giant range from $60 to $120 per year, depending on the chosen program.

According to a report by CNBC published yesterday, Jonathan Rose, co-founder of Genesis Gold Group, sees this move as a strategic promotion that could attract a specific segment of Costco’s customer base. According to Rose, Costco has recently expanded its range of survivalist goods, including a 150-serving emergency food preparedness kit and he addition of gold bars aligns well with these products, especially at a time when concerns about economic stability are high:

“They’ve done their market research. I think it’s a very clever way to get their name in the news and have some great publicity. There is definitely a crossover of people living off the land, being self-sufficient, believing in your own currency. That’s the appeal to gold as a safe haven as people lose faith in the U.S. dollar.“

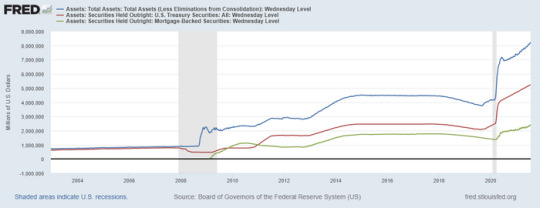

Earlier this month, during a recent discussion with Michelle Makori, the Editor-in-Chief at Kitco News, Michael Lee, founder of Michael Lee Strategy, forecasted that gold prices could escalate to $5,000 per ounce within the next three years. Lee attributes this prediction to the current recessionary state of the U.S. economy and the impending wave of defaults. He pointed out that the yield curve has inverted, a historically reliable sign of an upcoming recession, and noted that both businesses and consumers are already overleveraged, making defaults likely.

Lee also questioned the current gold price, which remains under the significant psychological threshold of $2,000 per ounce. He suspects market manipulation by banks and financial institutions, citing the buying activities of BRICS nations and past manipulations in the silver market. Lee further speculated that China and Europe would be the first regions to seek safety in gold, driving its price up. He views gold as a long-term investment, serving as a hedge against inflation and economic instability.

Additionally, Lee expressed skepticism about the accuracy of labor market data, noting that reports have consistently been revised downward. He questioned whether this pattern is due to government bureaucracy, flawed models, or intentional manipulation. Finally, Lee criticized the Federal Reserve’s decision to raise interest rates, arguing that it would exacerbate the recession and that other methods, like quantitative easing, should be employed to control inflation.

[embed]https://www.youtube.com/watch?v=2Ic70nqCqpI[/embed]

Featured Image via Unsplash

Source

0 notes

Text

Shot to Hell

Writing finally worked again! I thought of using this for Whumptober but then I was like, screw it, who’s gonna wait a month? So here have the Spider-Man content you’ve been asking me for, plus Tony and Bruce father-henning Peter.

Major thanks to @whumphoarder for beta-reading.

*

Peter fades back into consciousness right in the middle of a heated debate between Tony and Nat over the best method of peeling hard boiled eggs.

“Wha’ happ’nd?” he croaks, prompting Tony to stop mid-sentence (“No, you don’t crack them on a flat surface, you gotta hit em with a–”) and both of them to turn their heads in his direction.

“Oh, look who decided to wander back to the land of the living,” Tony teases, but even in his still-dazed state, Peter can see relief blooming on his mentor’s face.

“I passed out, didn’t I?” he asks.

“Bingo. 10 points.” Tony raises a mocking eyebrow before asking in a more sober tone, “How are you feeling?”

“...Shot,” Peter deadpans, eliciting an eye roll from Tony and a grin from Nat.

“Do you remember what happened?” she chips in.

“Uhm… kind of?” Peter tries to think through the fog in his pounding head. He recalls the impact of the bullet with his body, and then someone―Dr. Banner?―plucking said bullet out again in an increasingly painful procedure that must have led to him blacking out. It’s the in-between that he’s kind of fuzzy about. For example, how he moved from the intersection of 77th and 164th to a room with the most hideous, peeling lilac-coloured wallpaper he’s ever seen and three venus fly trap plants on the windowsill.

“Where am I?”

“Bruce’s humble abode,” Tony explains, gesturing around to the sparsely adorned room. “Very humble, actually. Not even sure he has indoor plumbing.”

Nat rolls her eyes and hits his arm with a playful backhand.

Peter frowns. “Why are we at Dr. Banner’s?”

Tony shrugs. “It was closest, and we had to get that bullet out of you before your freaky spider DNA started knitting itself back together.”

“Bruce has all kinds of medical equipment here,” Nat explains. “He sometimes treats undocumented citizens.”

Tony raises an eyebrow. “How do you know that? I didn’t even know that.”

Nat shrugs mysteriously, then pushes herself away from the edge of the desk she was sitting on top of. “I’m gonna tell him that your disaster kid woke up.”

“I’m not–” Peter starts at the same moment Tony asserts, “He’s not–”

“Yeah, yeah, save your breath.” Nat’s smile is amused and a little bit fond.

Once she’s left the room, Peter pulls the blanket off his bare chest to try and get a look at the bandaged wound in his abdomen, but even lifting his head a little sends jolts of pain through his body and a groan escapes before he can stop it.

“Easy, easy,” Tony says, pushing him back down. “No moving just yet for anyone with holes in them.”

“Is it really bad?” Peter asks, trying hard to mask the worry in his voice. He’s been injured in countless other ways since getting his powers, but it’s his first time getting shot. Somewhere in the back of his mind, he wonders whether there will be any lasting damage.

Tony’s expression goes soft as he seems to read his thoughts. “Bruce says you’re already healing. The bullet missed all the vital organs. With your healing factor, you should be back on the streets in a couple days.”

At Peter’s relieved sigh, Tony then launches into an explanation of the very painful things Clint and Steve did to the Hydra agent who fired the gun after the other left to get Peter to safety. Peter nods along, feeling his eyes growing heavy. He doesn’t even realise that they’ve slipped shut until he feels Tony lightly rest a hand on his shoulder, but opening them again seems like way too much work. The wound is pulsing in time with his heartbeat, and he’s suddenly exhausted.

“...Peter? I thought you said he was awake.”

“Yeah, he was until five minutes ago. Come on, kid, the doctor’s in.”

“Ngph,” Peter grunts, blinking his eyes open again to see Bruce swim into focus, the doctor’s brows knitting in concern. “‘M awake.”

“That’s good.” Bruce gives a small, encouraging smile. “I just want to check your vitals and see if there’s anything we can do for pain management. I know that normal painkillers don’t work on you, but there are some alternatives we could try.”

“No, no it’s fine. It’s not hurting that much,” Peter lies.

“Uh-huh,” Bruce says, obviously not buying it. He fixes a blood pressure cuff to Peter’s upper arm and inflates it.

"Yeah, that's still pretty low, but moving in the right direction. You probably shouldn't try to get up just yet."

"Probably?” Tony interrupts. "If he tries to leave this bed any time before tomorrow morning, I'll confiscate the suit for a month."

"Alright, Tony. Calm down." That's Nat, seated in a chair at the foot of the bed.

Tony flashes Peter a warning look before sticking his tongue out at Nat.

"I'm gonna take your pulse.” Bruce puts two fingers onto Peter's wrist and looks at his watch for a while. "120―Your heart's racing. Not much pain, you said?"

"I've had worse," Peter mumbles. That's not a lie, at least. The two-day migraine he had after getting bitten still ranks on top of that list, closely followed by the time he ruptured his Achilles tendon during a triple backflip in the Spider-Man suit from the roof of the gym.

(The video Ned took of this particular incident still circulates on TikTok).

Tony huffs out a breath and mutters something that sounds a lot like god, this kid.

"Alright." Bruce lifts the blanket to check the bandages and seems to be content with what he's seeing. "Just try to rest like this, but if you can't sleep, we can think of trying some cannabis drops."

“Thanks, Dr. Banner,” Peter says.

"Oh, and you should eat and drink something if you feel up to it. You lost quite a bit of blood back there."

"Uhm." He definitely doesn’t feel up to that―he’s been lightheaded and slightly queasy since the time he woke up, and the mere thought of food turns Peter's stomach. "Maybe drink something?"

“We can start with that.” Bruce removes the blood pressure cuff and starts to put it back into its bag. “I’ll bring you some juice.”

“I’ll get it,” Nat offers and leaves the room. She returns a minute later with a small bottle of orange juice and a pink straw that she passes to Bruce.

“Oh, organic and fairtrade,” Tony comments, eyeing at the label. “You’re in for a treat today, kid.”

Peter chuckles, but cuts himself off abruptly when he makes to sit up and the pain in his abdomen flares to the point that his vision greys out. “Ow,” he mumbles.

Tony shoots out a hand when Peter lists towards him and carefully lowers him back down onto the mattress. “What did we say about not getting up yet?” the engineer pronounces through gritted teeth. “There’s a straw in that.”

“Oh. Yeah.” Peter awkwardly takes a few sips from the bottle while lying back, and then stops to draw in a breath.

His unsuccessful attempt at sitting left him even more dizzy than before. The juice settles uneasily in his stomach and he puts the bottle down after finishing half of it before turning onto his uninjured side with Tony’s help. Nat and Tony restart their quibble about egg-boiling behind Peter while Bruce, sitting right next to him, starts to scroll through something on his phone.

Peter closes his eyes and attempts to fall asleep, but the longer he tries, the more the pain radiating from the bullet wound seems to increase. On top of that, there’s a growing sick feeling in his gut that’s impossible to ignore. He slowly draws his legs up to his stomach, but it doesn’t help, so he stretches them back out and surreptitiously rests a hand on his belly. Adjusting his head on the pillow, he tries to carefully breathe through his nose.

“You doing okay?” Bruce asks quietly, looking up from his phone after another few attempts by Peter at finding a comfortable position. Peter nods, then lifts his hand to stifle a sick burp that carries the taste of orange juice. Cold sweat has broken out all over his body and he can feel himself starting to tremble minutely.

Bruce regards him with a frown, then addresses Tony and Nat, who are still caught up in their banter. “Why don’t you two take this outside?”

Tony starts to protest, but Bruce gives him a pointed look that the other man seems to understand, because he closes his mouth again and gets up from the far side of the bed. "See you later, buddy," he says, giving Peter’s shoulder a squeeze.

Once the two of them have left the room, Bruce turns back to Peter. “What’s going on?” he asks.

“I, uhm, I kind of feel like throwing up,” Peter admits in a whisper.

“It’s alright, that happens,” Bruce assures him calmly. “I’ll get you a bowl, okay?”

“I don’t want anyone to see–”

“I get it,” Bruce reassures. “Don’t worry.”

He disappears out of the door and Peter keeps swallowing thickly against the nausea rising up in his throat. The only thing worse than throwing up in front of the Avengers would probably be throwing up onto an Avenger’s bed. Luckily, Bruce reappears quickly with a basin in his hands that he sets down within Peter’s reach. “Try to breathe through it,” he advises. “But if you need to get sick, it’s okay.”

Peter nods miserably. He tries to follow the scientist’s advice of breathing calmly, but it doesn’t do much to quell the nausea. A few minutes later, he has to reach for the basin, saliva already pooling in his mouth.

"Here." Bruce helps him prop himself on his elbow. Peter shakily spits a few strings of saliva into the basin until a gag rises in his throat and he brings up a gush of orange juice. He barely manages to draw a breath before a second wave forces its way up. Peter can’t stop a whimper from escaping his lips between retches when his wound protests the sudden movement.

“Hey.” Bruce pats his shoulder awkwardly. “You’ll be alright. Just get it all up.”

Peter is panting and shaking all over when he finishes. Bruce passes him some water to rinse his mouth.

“That sucked,” Peter croaks after swirling and spitting it back out. He more crashes than lies back down on the pillow, pain radiating in waves through the lower half of his body, making his head spin.

Bruce gives him a slightly sad, sympathetic look. “I’m sorry it’s hurting.” He gestures at the basin. “Are you okay if I take this away?”

Peter nods, closing his eyes. A part of him is absolutely mortified at the idea of one of the world’s best scientists cleaning out his puke bowl, but the pain has taken most of the embarrassment away, and if there is anyone of the team he feels least uncomfortable seeing him like this, it’s probably Bruce with his slight shyness and calm down-to-earth attitude.

The man returns a few minutes later, bringing along a cold cloth for Peter to wipe his face, a small box of mints, and Tony.

“Day just keeps getting better, huh?” Tony remarks.

“Ugh.” Peter buries his head in his pillow. “This is such a disaster. And I was looking forward to the mission. And the team.”

“Hey.” Tony’s tone softens. He strokes some of Peter’s sweaty hair away from his forehead and then brushes his eyes shut. “We’re still here. Go to sleep now, kid. You’ll feel better when you wake up.”

So Peter does.

_________

All my fics

Taglist: @toomuchtoread33 @yepokokfine

#peter whump#hurt peter parker#irondad fic#tony stark#bruce banner#fluff#this one is soft#hurt/comfort#vomiting#it's 2012 and everyone's friends and they have collectively adopted Spider-Man#cat writes irondad again

116 notes

·

View notes

Text

Today is a very special day, it’s Marilyn’s Birthday! Can you believe that if she were still alive, Marilyn would have been turning 94 years old today – just two months younger than the Queen herself! With each year I always try and write a special post about this amazing woman, who has helped me so much and achieved more than anyone could have imagined in her 36 years. Therefore, I decided to write 94 facts about the Birthday Girl – some you may know, some you may not, all in the hope that genuine things will be learnt and the real Marilyn will be more understood and appreciated.

Gladys and baby Norma Jeane spend some quality time together on the beach in 1929.

Little Norma Jeane, aged seven, in 1933.

Norma Jeane photographed by David Conover whilst working at the Radio Plane Munitions Factory in either the Fall of 1944 or Spring of 1945.

Norma Jeane by Andre de Dienes in late 1945.

Marilyn by Richard Miller in 1946.

Marilyn on Tobey Beach by Andre de Dienes on July 23rd 1949.

Marilyn by Ed Clark in Griffith Park in August 1950.

Marilyn attends a Party in Ray Anthony’s home, organized by 20th Century Fox on August 3rd 1952.

Marilyn filming The Seven Year Itch on location in New York City by Sam Shaw on September 13th 1954.

Marilyn by Milton Greene on January 28th 1955.

Marilyn by Cecil Beaton on February 22nd 1956. This was her favourite photo of herself.

Marilyn attending the Premiere of The Prince In The Showgirl at the Radio City Music Hall on June 13th 1957.

Marilyn by Carl Perutz on June 16th 1958.

Marilyn by Philippe Halsman for LIFE Magazine in October 1959.

Marilyn attends a Benefit for The Actors Studio at the Roseland Dance City on March 13th 1961.

Marilyn on Santa Monica Beach for Cosmopolitan Magazine by George Barris on July 1st 1962.

______________________________________________________________________________

1. Stood at a height of 5’5½”

2. Born in the charity ward of the Los Angeles County Hospital at 9:30 AM on June 1st 1926.

3. Married three times;

– Jim Dougherty: (June 19th 1942 – September 13th 1946)

– Joe Dimaggio: (January 14th 1954 – 31st October 1955) (Temporary divorce granted on October 27th 1954)

– Arthur Miller: (June 29th 1956 – January 20th 1961).

4. Suffered two confirmed miscarriages; an ectopic pregnancy on August 1st 1957 and miscarriage in December 16th 1958.

5. Suffered with endometriosis very badly, so much so that she had a clause in her contract which stated she would be unable to work whilst menstruating.

6. Starred in 30 films – her last being uncompleted.

7. Favourite of her own performances was as Angela Phinlay in The Asphalt Jungle (1950)

8. Winner of three Golden Globes; two for World Film Favourite – Female in 1954 and 1962 and one for Best Actress in a Motion Picture – Comedy or Musical for her performance as Sugar Kane in Some Like It Hot (1959) in 1960.

9. Her idol was the first Platinum Blonde Bombshell, Jean Harlow.

10. Amassed a collection of over 400 books in her library, ranging from Russian Literature to Psychology.

11. Favourite perfume was Chanel No.5

12. Had two half siblings; Robert “Jackie” Baker (1918 – 1933) and Bernice Miracle (1919) – the former she would never have the chance to meet and Bernice was not informed about Marilyn until she was 19 years old.

13. Former Actor and 20th Century Fox Studio Executive, Ben Lyon created the name Marilyn Monroe in December 1946 – Marilyn after fellow Actress, Marilyn Miller and Monroe after Marilyn’s mother’s maiden name. Ironically enough, Ben starred with Jean Harlow, in her breakout movie, Hell’s Angels (1930).

14. Legally changed her name to Marilyn Monroe ten years later, on February 23rd 1956.

15. Attended The Actors Studio.

16. Third woman to start her own Film Production Company – the first being Lois Weber in 1917 and the second being Mary Pickford in 1919.

17. First had her hair bleached in January 1946 at the Frank & Joseph Salon by Beautician Sylvia Barnhart, originally intended for a Shampoo Advert.

18. Contrary to popular belief, she was technically a natural blonde, not a redhead or brunette. She was born with platinum hair and was very fair until just before her teen years. Her sister described her with having dark blonde hair upon their first meeting in 1944.

19. Another myth debunked – she had blue eyes, not brown.

20. Was one of the few women in the 1950s to use weights when exercising.

21. Wore jeans before it was considered acceptable for women.

22. Her famous mole was real – albeit skin coloured, so she emphasized it using a brown eye pencil.

23. Was a Step-Mother in two of her three marriages to three children – Joe Dimaggio Jr. and Bobby and Jane Miller.

24. Found out she landed the lead role in Gentlemen Prefer Blondes (1953) on her 26th Birthday.

25. Another huge myth dispelled – only actually met President Kennedy four times from 1961 – 1962. Three of them were at public events, with the last being her performance at Madison Square Garden. One of them was at Bing Crosby’s Palm Spring house with various people, so at most (which again, is very unlikely) they had a one night stand – nothing more and nothing less.

26. Was the first Playboy Cover Girl, although she did not actually pose for them, nor give permission for them to be used. Hugh Hefner bought the photograph from a Chicago Calendar Company for $500 and the two never met.

27. Speaking of Playboy, the photo was taken by Photographer Tom Kelley on May 27th 1951 and Marilyn made a total of $50 for the photo shoot. The most famous photo then went on to cause a national sensation after being sold to the Calendar Baumgarth Company and became known as, “Golden Dreams“.

28. In 1955 it was estimated that over four million copies of the Calendar had been sold.

29. Favourite singers were Frank Sinatra and Ella Fitzgerald.

30. Attended the Academy Awards Ceremony only once on March 29th 1951 and presented the award for “Best Sound Recording” to Thomas Moulton for All About Eve (1951) which she also starred in.

31. Performed ten shows over four days to over 100,000 soldiers and marines in Korea in February 1954 – she actually ended up catching pneumonia because it was so cold.

32. Was one of the few Stars who had Director Approval in their Contracts. Some of the names included were, John Huston, Elia Kazan, Alfred Hitchcock, George Stevens, William Wyler, Joshua Logan and Sir Carol Reed.

33. Was pregnant during the filming of Some Like It Hot (1959) – filming finished on November 7th 1958 and she miscarried the following month on December 16th.

34. Featured on the cover of LIFE Magazine seven times during her lifetime;

– April 7th 1952

– May 25th 1953

– July 8th 1957 (International Edition)

– April 20th 1959

– November 9th 1959

– August 15th 1960

– June 22nd 1962

35. Favourite bevarage was Dom Perignon 1953 Champagne.

36. By the time of her death, her films had grossed over $200 million, when adjusted for inflation that is the equivalent of $2 billion in 2019.

37. Designer, William Travilla dressed Marilyn for seven of her films, two (*) of them received Oscar Nominations in, “Best Costume/Design, Color“;

– Monkey Business (1952)

– Gentlemen Prefer Blondes (1953)

– How To Marry A Millionaire (1953) *

– River Of No Return (1954)

– There’s No Business Like Show Business (1954) *

– The Seven Year Itch (1955)

– Bus Stop (1956)

38. Spent 21 months of her childhood at the Los Angeles Orphanage, from September 13th 1935 until June 7th 1937.

39. Was one of the first Stars to speak out about child abuse, with her story appearing in movie magazines as early as 1954.

40. Fostered by her grandmother’s neighbours, Ida and Albert Bolender, for the first seven years of her life.

41. Lived in England for four months, during the period of filming for The Prince and The Showgirl (1957) from July 14th 1956 – November 20th 1956.

42. Her Production Company, Marilyn Monroe Productions produced only one film, The Prince and The Showgirl (1957) based on Terrance Rattigan’s play, The Sleeping Prince.

43. Was photographed by Earl Theisen in October 1952 wearing a potato sack dress after being criticized by the press for her outfit choice at The Henrietta Awards in January 1952. A journalist wrote that Marilyn was “insignificant and vulgar“and “even in a potato bag, it would have been more elegant.“

44. Was a huge supporter of LGBT+ rights, saying the following quote about fellow actor and friend, Montgomery Clift to journalist W.J. Weatherby in 1960,

“I was remembering Monty Clift. People who aren’t fit to open the door for him sneer at his homosexuality. What do they know about it? Labels–people love putting labels on each other. Then they feel safe. People tried to make me into a lesbian. I laughed. No sex is wrong if there’s love in it.”

45. Her measurements were listed as the following by her Dressmakers; 35-22-35 and 36-24-24 by The Blue Book Modelling Agency. For the majority of her life she weighed between 117-120 pounds, with her weight fluctuating around 15 pounds, during and after her pregnancies (1957-1960), although her waist never ventured past 28.5 inches and her dress size today would be a UK Size 6-8 and a US Size 2-4 as she was a vintage Size 12.

46. Her famous white halter dress from The Seven Year Itch (1955) sold for $4.6 million ($5.6 million including auction fees) on June 18th 2011, which was owned by Debbie Reynolds. The “Happy Birthday Mr. President Dress” originally held the record for the most expensive dress, when it was sold on October 27th 1999 for $1.26 million. It then went on to be resold for $4.8 million on November 17th 2016, thus regaining it’s original achievement.

47. Was discovered by Photographer, David Conover, whilst working in The Radio Plane Munitions Factory in the Fall of 1944 or Spring of 1945, depending on sources.

48. Now known as the, “Me Too” movement, Marilyn was one of the first Stars to speak out on the, “Hollywood Wolves” in a 1953 article for Motion Picture Magazine entitled, “Wolves I Have Known”. The most famous incident being with the Head of Columbia Studios, Harry Cohn, who requested Marilyn join him on his yacht for a weekend away in Catalina Island. Marilyn asked if his wife would be joining them, which, as you can imagine – did not go down well and her contract was not renewed with the Studio. Marilyn made only one film with Columbia during her six month contract, this being Ladies Of The Chorus (1948) which was shot in just ten days!

49. Loved animals dearly and adopted a variety of pets over the years. These included a basset hound called Hugo and parakeets, Clyde, Bobo and Butch with Husband Arthur Miller. A number of cats including a persian breed called Mitsou in 1955 and Sugar Finney in 1959. Her most famous pet was gifted to her in March or April of 1961 by friend, Frank Sinatra, a little white maltese named Maf. His full name was Mafia Honey, as a humorous reference to Sinatra’s alleged connections to the Mob. After Marilyn’s death, Maf went to live with Frank Sinatra’s secretary, Gloria Lovell.

50. The book she was reading at the time of her death was Harper Lee’s, To Kill A Mocking Bird.

51. One of the movies she starred in was nominated for the Academy Award for Best Picture and won, this being All About Eve (1950) at The 23rd Academy Awards on March 29th 1951. It ended up being nominated for 14 Oscars, a record at the time and has only been matched by Titanic (1997) and La La Land (2016).

52. Her first magazine cover was photographed by Andre de Dienes in December 1945 for Family Circle, released on April 26th 1946.

53. Joined The William Morris Agency on December 7th 1948.

54. Was right handed, not left as often believed.

55. Third Husband Arthur Miller wrote the screenplay for Marilyn’s last completed film, The Misfits (1961) which was originally written as a short story for Esquire Magazine in 1957. After the tragic ectopic pregnancy Marilyn endured in August of 1957, friend and Photographer, Sam Shaw suggested to Miller he alter his short story specifically for her. Ironically the making of this film culminated in their divorce and Marilyn stating,

“He could have written me anything and he comes up with this. If that’s what he thinks of me then I’m not for him and he’s not for me.”

56. Was Author, Truman Capote’s original choice for the role of Holly Golightly in Breakfast At Tiffany’s (1961) however, she was advised to turn it down by her Acting Coach, Paula Strasberg, who did not think the role of a prostitute would be good for her image. Writer George Axelrod, who wrote the Screenplay for Bus Stop (1956) and the play, The Seven Year Itch, ironically ended up being the Screenwriter for this movie.

Capote said this regarding Marilyn,

“I had seen her in a film and thought she would be perfect for the part. Holly had to have something touching about her . . . unfinished. Marilyn had that.”

57. Second Husband Joe Dimaggio had The Parisian Florists deliver red roses on Marilyn’s grave twice a week, for twenty years, from August 1962 until September 1982. Marilyn had told him how William Powell used to do this for Jean Harlow after her death and he reportedly vowed to do the same after their Wedding Ceremony. After the 20 years he then donated to a children’s charity, as he thought it would be a nice way to honour her memory. They also created the flower arrangements for her casket at her funeral.

58. The following five Directors directed Marilyn in more than one movie;

– John Huston; The Asphalt Jungle (1950) and The Misfits (1961)

– Richard Sale; A Ticket To Tomahawk (1950) and Let’s Make It Legal (1951)

– Howard Hawks; Monkey Business (1952) and Gentlemen Prefer Blondes (1953)

– Billy Wilder; The Seven Year Itch (1955) and Some Like It Hot (1959)

– George Cukor; Let’s Make Love (1960) and Something’s Got To Give (1962)

59. Was an illegitimate child, which unfortunately was attached with a lot of stigma in the 1920s. Her mother, Gladys, listed her then husband Edward Mortenson on the Birth Certificate, although it is commonly accepted that her real father was Charles Stanley Gifford, as Gladys left Edward on May 26th 1925. Gladys had an affair with him, which ended when she announced her pregnancy and he never acknowledged or met Marilyn, although she tried multiple times over the years to speak with him.

60. Stayed in a number of foster homes during her childhood,

– George and Emma Atkinson; February 1934 – September 1934

– Enid and Sam Knebelcamp; Fall of 1934

– Harvey and Elsie Giffen; January 1935 – March 1935

– Grace and “Doc” Goddard; April 1935 – September 1935 and June 1937 – November 1937 and end of 1940 – February 1942

– Ida Martin; November 1937 – August 1938

– “Aunt Ana” Lower; August 1938 – End of 1940 and February 1942

61. Had her hand and footprints immortalized in cement at Graumans Chinese Theatre on June 26th 1953, with Gentlemen Prefer Blondes (1953) co-star, Jane Russell. Marilyn would place a rhinestone in the dot of the letter “i” as a reference to her character, “Lorelei Lee” but it was sadly stolen. This was an incredibly special moment for her, as she often talked about placing her hands and feet in the many prints there, when she spent her weekends at the Theatre as a child, especially in 1933 and 1934.

“When I was younger, I used to go to Grauman’s Chinese Theatre and try to fit my foot in the prints in the cement there. And I’d say “Oh, oh, my foots too big. I guess that’s out.” I did have a funny feeling later when I finally put my foot down into that wet cement, I sure knew what it really meant to me, anything’s possible, almost.”

62. The famous gold lamé dress worn in Gentlemen Prefer Blondes (1953) and designed by William Travilla, was deemed too risqué by the censors. Unfortunately for fans, this meant that the musical number, “Down Boy” was cut from the film and we only glimpse a few seconds of the dress from behind, on screen.

63. Due to the censors, the original, “Diamond’s Are A Girl’s Best Friend” costume was changed to the now iconic pink dress with black bow. Originally it was to be a diamond encrusted two piece, which was extremely daring for the then Motion Picture Hays Code.

64. Loved Erno Lazlo Skin Cream, Vaseline and Nivea Moisturizer.

65. Had she completed Something’s Got To Give (1962), Marilyn would have been the first Star in a major Motion Picture to appear nude on film. As she passed before it was completed the achievement went to fellow Blonde Bombshell, Jayne Mansfield in, Promises! Promises (1963).

66. Met Queen Elizabeth II in England at the Empire Theater in Leicester Square whilst attending the Premiere of, “The Battle Of The River Plate“ on October 29th 1956.

67. The Misfits (1961) was both Marilyn and Clark Gable’s last completed films. Clark died 12 days after filming finished, on November 16th 1960. The film was released on Clark’s would be 60th Birthday, February 1st 1961 and Marilyn passed 18 months later.

68. As Marilyn died before the completion of Something’s Got To Give (1962) it ended up being remade with Doris Day and James Garner, entitled, Move Over Darling! (1963). The film was originally intended to be a remake of, My Favourite Wife (1940) which starred Cary Grant.

69. Signed a recording contract with RCA Records on September 1st 1953. One of her songs from River of No Return (1954) entitled, “File My Claim” sold 75,000 copies in its first three weeks of release.

70. Was admitted to the Payne Whitney Psychiatric Clinic on February 10th 1961 by her then Psychiatrist, Marianne Kris. Originally thought to be for rest and rehabilitation, following her divorce from Arthur Miller and the strain of filming The Misfits. However, Marilyn was placed on the security ring and held against her will. Thankfully, she was able to contact ex Husband, Joe Dimaggio, who stated he would, “Take the hospital apart brick by brick” if she was not released and after three days of emotional trauma, she left.

71. Visited the following Countries;

– Canada – (July – August 1953)

– Japan (February 1954)

– Korea (Feburary 1954)

– England (July – November 1956)

– Jamaica (January 1957)

– Mexico (February 1962)

72. Purchased her only home, 12305 Fifth Helena Drive on February 8th 1962, where she would tragically pass just under 6 months later.

73. The home had the following tile located on the front paving entrance saying, “cursum perficio” meaning, “my journey ends here.” The title is still there to this day.

74. Her final interview was published in LIFE Magazine on August 3rd 1962 and was written by Richard Meryman.

75. Aside from her millions of fans, had a staunch group of supporters affectionately known as, “The Monroe Six” who followed Marilyn around New York during her time there. Their nickname for Marilyn was, “Mazzie” and they became so acquainted that Marilyn actually once invited them for a picnic at her home.

76. First married at just sixteen years old, this was to avoid returning to the Orphanage she had spent almost two years in as a child.

77. Supported numerous charity events, most famously riding a pink elephant in Madison Square Garden, to support the Arthritis and Rheumatic Affections Association on March 30th 1955.

78. Left 25% of her Estate to her then Psychiatrist, Marianne Kris and 75% to mentor and friend, Lee Strasberg. For reference, her Will was last updated on January 1961 – a month before she entered the Payne Whitney Hospital on the advice of Marianne Kris.

79. At the time of it’s release, The Misfits (1961) turned out to be the most expensive black and white movie ever made, costing a budget of $4 million dollars.

80. The Premiere of The Seven Year Itch was held on her 29th Birthday, on June 1st 1955, she attended with ex Husband, Joe Dimaggio.

81. Laid to rest at Westwood Village Memorial Park Cemetery on August 8th 1962 at 1:00 PM, with friend and mentor Lee Strasberg delivering the Eulogy.

82. Although so often associated with diamonds, actually wasn’t that fond of jewellery stating, “People always ask me if I believe diamonds are a girl’s best friend. Frankly, I don’t.”

83. Spent her 36th Birthday filming Something’s Got To Give (1962) and then attending a Charity Event for muscular dystrophy at the Chavez Ravin Dodger Stadium, which also happened to be her last public appearance.

84. Whilst recovering in hospital from an appendectomy in April 1952, Marilyn asked long time Makeup Artist and friend, Allan “Whitey” Snyder to do her makeup, should she pass before him. She gave him a gold money clip with the inscription, “Whitey Dear, while I’m still warm, Marilyn” and he did fulfill this promise to her.

85. Converted to Judaism for third husband, Arthur Miller on July 1st 1956.

86. Despite appearing in 30 films, she only actually dies in one, that being her breakout movie, Niagara (1953) where her character Rose Loomis, is strangled by her Husband George, played by Joseph Cotten.

87. Moved to New York City in 1955 and attended The Actors Studio, after breaking her Film Contract with 20th Century Fox. This was for a number of reasons, mainly years of low pay, unsatisfactory scripts and lack of creative control. A new contract would finally be reinstated on December 31st.

88. Repurchased a white Baby Grand Piano that her mother, Gladys, owned during their time living together in 1933. After Marilyn passed it would then be sold at the Christies Auction of her Estate in 1999 to none other than, Mariah Carey for $632,500.

89. Wore long hair pieces in River of No Return (1954) and a medium length wig in The Misfits (1961). The first I can only assume was due to the time period and setting of a Western and the second was due to the bleach damage her hair had suffered. After the filming in 1960, she wore the wig a couple of times in public events and then reverted back to her normal hair.

90. Like all students, it was tradition to perform in front of each other in The Actors Studio and on February 17th 1955, Marilyn acted out a scene from “Anna Christie” with Maureen Stapleton. Although it was an unwritten rule that students were not meant to applaud one another, an eruption of cheers and clapping happened after Marilyn had finished.

“Everybody who saw that says that it was not only the best work Marilyn ever did, it was some of the best work ever seen at Studio, and certainly the best interpretation of Anna Christie anybody ever saw. She achieved real greatness in that scene.”

– Actor Ellen Burstyn, on recalling Marilyn’s performance.

91. Used the pseudonym, “Zelda Zonk“, when trying to remain incognito.

92. Marilyn’s mother, Gladys Baker, suffered from Paranoid Schizophrenia and after various stays in institutions, was declared insane on January 15th 1935, when Marilyn was just 8 years old. After 10 years she was released and managed to retain various cleaning jobs and had developed an intense interest in Christian Science. However, by 1951 she was back in various institutions and would stay in the Rockhaven Sanitarium until 1967. Even after death, Marilyn continued to cover her mother’s care payments and Gladys would go on to outlive her for 22 years.

93. Favourite photograph of herself was taken by Cecil Beaton on February 22nd 1956.

94. Last professional photos were taken by Bert Stern, famously known as “The Last Sitting” for Vogue Magazine on June 23rd, July 10th and 12th 1962. Allan Grant took the LIFE Magazine interview pictures in her home, on July 4th and 9th 1962. Whilst George Barris took his photos for Cosmopolitan Magazine, the previous weekend on the 29th and 30th of June, until July 1st 1962.

______________________________________________________________________________

To those of you who took the time to read through all 3000+ words, thank you! It truly means more to me than you know and I really hope it’s shed some light on the truly special person Marilyn was and made you hold a good thought for her on her big day.

Follow me at;

BLOGLOVIN

INSTAGRAM

TUMBLR

TWITTER

YOUTUBE

For inquiries or collaborations contact me at;

Happy 94th Birthday Marilyn! Today is a very special day, it's Marilyn's Birthday! Can you believe that if she were still alive, Marilyn would have been turning 94 years old today - just two months younger than the Queen herself!

#1940s#1950s#1960s#angel#blonde bombshell#classic hollywood#hollywood#icon#legend#marilyn#marilyn monroe#norma jeane#norma jeane baker#old hollywood

199 notes

·

View notes

Video

Finance Options & Strategies

https://u109893.h.reiblackbook.com/generic11/the-storage-stud/finance-options-strategies/

In this video, Fernando would like to talk about finance options and strategies when it comes to self-storage.

Starting from the end then move his way to the beginning.

The last on the list for Fernando’s finance options is to have stabilized senior debt that is non-recourse.

A non-recourse loan means that even though you are signing for it, if anything happens, for instance, if the market goes down you are not liable for that loan.

This is one of the best types of loans to get to limit your liability.

Usually, to get these seniors loans or “the stabilized debt”, the property has to be at its maximum potential. It has to be fully occupied, it’s bringing a high revenue and net operating income as much as possible.

A non-recourse type of loan is one of the most favorable because it has longer terms and has lower interest rates.

Your next finance option for your property can be a bank loan. This is a recourse loan meaning that you are fully liable regardless of what happens in the market.

If you want to learn more about the other types of financing options and strategies that Fernando is willing to share just continue watching this video.

Fernando O. Angelucci is Founder and President of Titan Wealth Group. He also leads the firm’s finance and acquisitions departments. Fernando Angelucci and Steven Wear founded Titan Wealth Group in 2015, and under his leadership, the firm’s revenue has grown over 100% year over year. Today,

Find out more at

https://www.TheStorageStud.com

https://titanwealthgroup.com/

Listen to our Podcast:

https://thestoragestud.podbean.com/e/finance-options-strategies/

------------------------------------------

Hi! This is Fernando Angelucci, I'm The Storage Stud. Today, I'd like to talk about some finance options and strategies when it comes to self storage. So, I guess we should start from the end and move our way to the beginning. You know, the end of be all is, to have stabilized senior debt. That is non-recourse. So, when a loan is non-recourse, that means that even though you're signing for it, if anything happens, you know, let's say the market turns or there's some type of Black Swan event. You're not on the hook for that loan. If there is a loss to the property, or if, say for example, you have to fire sale it and you can't get more than, what the loan amount is for. So, that's a non-recourse loan. Now, there are what they call carve-outs, primarily bad boy carve-outs. So, you're not, you know, purposely defrauding anybody, you know, you're not engage in illegal activity.

If that were the case, then it would become recourse. But, if it's just something that has to do with, you know, factors that are out of your control that's where you'd have a non-recourse loan. So, those are always, you know, the best types of loans to get, just to limit your liability. But usually to get these senior loans or these stabilized debt, the property has to be at it's maximum potential. It's already stabilized. It's fully occupied. It's bringing in as much revenue as possible. The net operating income is as high as it's going to be, you know, aside from maybe growth in inflation. But those types of loans are usually the most favorable because of how long they are and how low the interest rates are. For example, a senior loan on a stabilized property might come from a life insurance company, or it might come from the Commercial Mortgage-Backed Securities market or CMBS as some call it.

It may even come from some of the big lenders such as you know, JP Morgan and Morgan Stanley and Barclays. So, these types of loans are typically up to a 10 year balloon. So, you have up to 10 years to either sell or refinance. And they're usually amortized over a longer schedule, usually 25 to 30 year amortization. Recently, in the last few months, I've been seeing quotes as low as 3.3% interest with some options going, you know, allowing for interest only, through either a portion or the entire balloon periods all the way up to 10 years paying only the interest with no principal pay down. These loans are typically, they're a little bit more difficult to get. You need to know, kind of people in the space. We typically go through brokers that have these relationships in the CMBS markets with the life insurance companies that will lend on these types of assets.

So, those are kind of the goal that you're trying to get to always is, you know, stabilize the property, get some senior debt on it, take it off your balance sheet. So, it's no longer, you know, it's no longer recourse. Now, one step ahead of that is, let's say a like a bank loan, a local bank may finance a property. These are typically recourse, which means you're on the hook for that loan amount, regardless of what happens in the market. And they typically have shorter, not only balloon schedules, but also amortization schedule. So, a typical bank loan that we see and we use, are you know five-year balloon with a 20 or a 25 year amortization. Typically these loans are going to require about 20 to 25% down. Now, there's a caveat because self storage is a business that also qualifies for SBA financing, which we'll get to in a little bit here.

And these are good loans for property that already shows income. It already shows that it's producing positive cashflow. It has a solid debt service coverage ratio or debt covers. Some people say your debt service coverage ratio is the amount of payments that you have to make, or the dollar figure per year, your debt service divided by your net operating income. And that will, I'm sorry, it's the other way around your net operating income divided by your debt service. And then that will come out as a ratio. It's usually, you know, banks want to see a 1.2 or 1.25, that covers. So, that means that your net operating income is 120 to 125% of what the debt service is. Again, so that's really good loan. If you can show financials from the seller, now let's go even one step ahead of that.

Say you are working with a seller that, decided that instead of paying taxes on his property, he was going to hide the income by taking cash and not reporting that income. So, his tax returns do not reflect what the property's actually bringing in. This is very typical, especially with smaller operators. These mom and pop owners, we find that, you know, one in three chance that the income that they're showing is not the true income potential, but here's the problem. These sellers, they want to get the value based off of all the income that it's producing, even the income that they can't prove on their tax returns. So, they basically chose, you know, Hey, do I want to make my money now, by not paying the, my proper fair share of taxes on these returns? Or do we want to make my money later by actually showing the income so that when the bank appraises it, or when a seller comes and looks at my last two to three years of tax returns, that the true value is represented.

The true net operating income is represented in those tax returns, and then you get a higher purchase price, but most of the time people want to have their cake and eat it too. So, they'll hide income, but they still want to get the value at where it was if all of the income was actually shown. So, there's two ways or three ways that you can handle those types of situations. The first is, to ask the seller to finance the property for you. Saying, hey, Mr. Seller, you know I understand you want a million bucks for your property, but based on what your tax returns are showing, I can only pay you 500,000 and that's what the bank will allow me to buy it at. So, we're at an impasse here, unless you are willing to be the bank for two to three years, for me, as the seller financer.

And that way I can properly, you know, show the income that this property is producing on a couple of tax returns. And once I'm at two to three years worth of showing the proper income, then I could refinance you out with the bank. So, that's option number one. Typically, it goes 50 50, you know, it's, if the seller needs the cash immediately. They usually won't go for that type of strategy. But if, you know, they, they still like to receive passive income and residual income by getting those interest payments. And they don't need all the cash right now, then we'll structure something like, you know, 15% down or 20, 25% down, you carry the mortgage for us for, you know, three years. And we'll have an amortization schedule over 25 or 30 years. And I like seller finance deals because you can dictate all the terms.

Usually when you go with a bank there's very little, you can really negotiate on because of the golden rule. The golden rule is he who has the gold makes the rules. So, I do like seller financing. Now, if the seller is unwilling to do that, another option you can do is go with an asset based lender or a hard money lenders as they're called colloquially the hard money lenders. They're going to look at asset value and they're going to lend up to a certain amount of that value. These lenders are typically experienced with real estate investors. They understand that we buy things at a discount, and we do a value add to raise the value of the property over two to three years, and then either refinance or sell. So, these hard money lenders are a good option when you have tight timelines.

And maybe you don't have as much down payment money as you need, but you do pay for it on rate. So, as opposed to say, you know, CMBS or senior debt life co companies, or you know, Morgan Stanley or some of these big firms where they're, you know, you're paying 3.3 to 3.5% interest, a bank might give you a loan anywhere between four to 5.2% interest in today's world, but a hard money lender. You're going to be paying anywhere between 10 to 14% after all the points and fees are included in this, because it truly is one of those situations where, you know, they're taking a risk and they want to be compensated for that risk. Typically these loans are short-term and they're not amortized or they're interest only loans. They will be one, two years, maybe three years interest only with the whole point of you taking them out as soon as possible, because those interest rates that they charge are pretty high. Now, suddenly between the bank and the hard money lenders or the asset-based lenders are the bridge lenders.

So, the bridge lenders are there specifically to be a bridge, bridge you from where you are now to the debt. That's going to be a little bit longer term. These are also typically interest only. I have seen them amortize as well. They're a little bit cheaper than the hard money loans, but a little bit more expensive than the bank loan. So, we have seen bridged at anywhere from, six and a half to 9% interest storage. So, the last couple of months these are typically they come from private equity firms or hedge funds. There are some banks that do bridge lending, but it's not very common. So, those are some of the options that we use as far as like traditional real estate financing. But as I alluded to before, there's also a caveat that self storage is also considered a business.

So, you can qualify for SBA loans, which are the Small Business Administration. These loans are pretty favorable, but they just come with a ton of extra documentation and rules. The two that we typically look at are the SBA 7 A and then the other one is the SBA 504 loans with these types of loans, you can get into a property with 15% down. And the amortization schedule is usually very favorable. 25 to 30 years, the rates are also decent. You know, they're going to be comparable to bank debt, maybe even a little bit cheaper than bank debt. And I won't get into it now because it's a whole other conversation, but the way they structure it is by having participation from other banks on one of the loans. And the other one is direct, a direct loan from the SBA.

So these, types of loans are great. If you have a lot of time on your hands, you know, if typically SBA lenders say they can get deals done in about 60 days. I have not seen that in my experience with storage, especially on the types of properties you're purchasing with these SBA loans. Typically, the documentation is not real good, let's say from the seller side. So, I usually will tell the seller, Hey, I'm going to need 90 to 120 days to close if I'm going to be using an SBA loan. So, those are some of the options that we use when it comes to financing self storage properties, and each loan has kind of its own little bucket. And they kind of blur a little bit at the very edges. So, when you're going from bank that a senior debt stabilized that there's a little bit of blurb on the edge of each same thing from bridge debt to bank debt, same thing from, you know bridge to hard money.

And then, you know, our favorite of course, is the seller financing. And one of the main reasons we really like it is cause it's a win-win not only do we get to set a terms, the underwriting is almost non-existent. The seller also takes advantage because now they're making interest on their purchase price and they're able to spread their capital gains and depreciation recapture taxes across multiple years, instead of just taking it in a, you know, a one-off transaction where you may have to pay two, $300,000 in capital gains in depreciation recapture. So, if you can spread that over time, that really helps with the sellers. So, let me know if you guys have any questions on, you know, financing options and strategies, when it comes to self storage, feel free to leave a comment below or reach out to us on our website or social media. And until next time, you know, it's good to see you.

#Real estate#Real Estate Investing#the storage stud#storage stud#Fernando Angelucci#self storage#alternative funds

14 notes

·

View notes

Photo

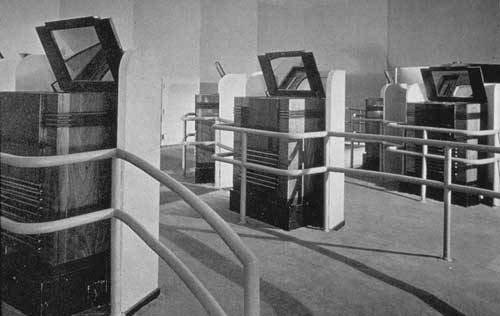

Pre-WWII Television

Mid-1930s to 1945

In the last month, I’ve read no-less-then THREE separate fics referencing Steve and/or Bucky having more than a passing knowledge or experience of television pre-21st century — and I really wanted to clear that misinformation up.

Television, like most new technologies, existed for some time before being adopted by the wider public, and early models were prohibitively expensive for the everyday person. While yes, I think the boys would have seen a television demonstration at least once, they would not have owned one, nor would anyone they knew have owned one (except Howards, but when would they have seen it?).

First Commercial Televisions

The first ‘electro-mechanical’ televisions of the mid-to-late-1930s were grand, expensive affairs. The two of the main producers in the US were RCA with their TRK-12, TRK-9, TRK-5 and TT-5 models, and DuMont with their Model 180, and Model 181. These set would be handcrafted, with polished wooden cabinets modelled in the popular Art Deco “streamline” style of the times. Rather than an accessory, televisions of the 1930s and 1940s were large pieces of furniture and had little resemblance to today’s sets. Despite the large bodies, the screens themselves were only some 10-15″ wide diagonally.

These sets were sold in large, high-end New York department stores like Macy’s, Bloomingdale’s, and Wanamaker’s. They went for anything from $199.50 to $600 per unit, which when calculated for inflation, is about $3,500 to $11,000 in today’s money.

Around 7,000 sets were made in the US before WWII, and with such a massive price-tag, only around 2,000 sets were actually sold and in use across America. Most of the unsold units went into storage until after the end fo the war.

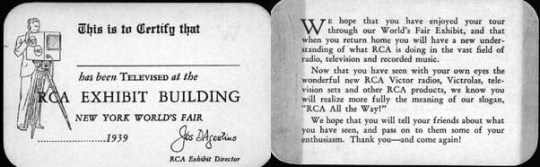

The first practical demonstration of television sets outside of those high-end department stores was the 1939-40 New York World’s Fair. There, visitors could visit the RCA Pavillion to see the “Hall of Television” with its thirteen TRK-12′s in action; as well as the “Radio Living Room of Tomorrow” and “Radio Living Room of Today,” which showed the technology at home in domestic settings. There were also live NBC broadcasts and opportunities for guests to be televised and see themselves on television — a unique novelty that came with an “I was televised” souvenir care to go with the experience. Other manufacturers at the World’s Fair also had their own television demonstrations, including General Electric, Westinghouse, General Motors, and Crosley.

So, what could those lucky 2,000 Americans watch? Well, televisions of this period could receive channels 1 through 5, and New York City had the only broadcast station. NBC began broadcasting regularly scheduled programming in 1939, along with CBS and Don Lee. Broadcasts ran for around 2-hours of content in the afternoon and 1-hour in the evenings. Programming during this time included all manner of content: sports, plays, operas, cartoons, cooking demonstrations, travelogues, fashions shows, skaters at Rockefeller Centre, and numerous live telecasts. The rest of the time viewers would only see the station’s test pattern.

WWII

All this slow progress came to a grinding halt when the US joined WWII. While some broadcasts continued, they were on a limited basis and included civil defence programming. All production of televisions was ceased, with engineers instead using their expertise for the production of radar and communications equipment for the military instead.

Post-WWII Growth

It wasn’t until after the end of WWII that television really got its explosion in popularity and became a household item for any aspiring middle-class family. At the end of the war, most people still didn’t know what a television even was, but only four years later, the majority had not only heard of them but wanted one. By 1949, the price of television sets had dropped and people were buying then at a rate of 100,000 a week! In addition to the drop in cost due to mass-production, families also benefited from suddenly having disposable income thanks to the post-war economic boom. By 1954 55.7% of households owned a television.

Steve, Bucky, and Pre-21st Century Television

So, realistically, how familiar would our boys have been with television before post-thaw/deprogramming? Well, going on my own favourite headcanon than the 1939-40 New York World’s Fair can be used as an almost direct analogue to the 1942 Stark Expo, I think there were two scenarios in which the boy would have even come across a television in the US:

Manhattan Department Store — Now I say Manhattan specifically, as despite Brooklyn having its own high-end department stores in Abraham & Straus and Frederick Loeser & Co., however, it doesn’t mean that they stocked televisions. My research seems to indicate that they were pretty exclusive products and only specific department stores stocked them — kind of the same way only certain car dealerships will sell you a Ferrari. Thus, I think if you were to go with the idea they say one in a department store display, you would have to assume they were inside one of the those gig-name Manhattan stores to even catch a glimpse. Seriously, they would not be catching a glace walking past a storefront, these would be deep inside for the distinguished partons.

Stark Expo — Again, assuming a degree of similarity between the real World’s Fair and the fictional Stark Expo, I think it’s fair to assume there would have been some sort of television demonstration. Now, whether the boys would have seen it is another thing. Bear in mind that these World Fair style attractions were MASSIVE, covering hundreds of acres of land, requiring internal transportation and remaining open for at least a year. Now, even if the Stark Expo was on a smaller scale, I doubt they saw even close to everything in just the evening they were there. So really I’d say its a 50/50 chance they saw a television there or not.

The only other place I think they would have possibly come in contact with television might be during the war, either:

While in Britain — Both Steve and Bucky would have (at least briefly) been in Britain during the war. Bucky, prior to deployment on the continent, and Steve with the Howlies during meetings with higher-ups. Television was actually more widely adopted in the UK, than in the US. Around 19,000 sets (compared to the US’s 7,000) were made in the UK, which assuming the rates of sale were similar would mean more than twice the number of sales. Broadcasting also started some years before those in the US. So, which all broadcasts were suspended the moment the war started, there is a chance that they would have come across a set sitting dormant somewhere or another.

Steve while on the USO tour in the home of a rich/famous donor — So one thing to consider is that Steve would have spent a while before Azzano hob-nobbing with the rich and famous as part of attempts to raid money for the war effort. And it’s not too outrageous to think that at least one of them would have owned a television and shown it off.

Other Points of Note

The first colour televisions did not come onto the scene until 1954.

There were, of course, no remote controls — not until 1950.

Image Sources

TRK-12 Promotional Photo, two women and one man | Source

RCA TRK-12/120 (1939-40) | Source

RCA TRK-9 (1939) | Source

DuMont 180 (1939) | Source

Working 1939 Art Deco Television Set | Source

World’s Fair “Hall of Television” from the back w/o guests, 1939-40 | Source

World’s Fair “Hall of Television” from the front w/ guests, 1939-40 | Source

“I was Televised” Souvenir card (Front and Back), 1939-40 | Source

The full research document for this topic is available on the Discord’s “Patreon Clubhouse” channel ($3+ donors)

This post has been sponsored by my much loved and long-time Patreon supporter Joanna Daniels. She and I would like to dedicate the post to the loving memory of her mother Joan Daniels. She will be sorely missed.

[ Support SRNY through Patreon and Ko-Fi ]

And join us on Discord for fun conversation!

I also have an Etsy with upcycled nerdy crafts

#Steve Rogers#captain america#Television#History#history of technology#History of Television#Vintage Television#World War II Recipes#new york world's fair#WWII#WW2#New York#american history#historically accurate#Art Deco#fanfiction#fanfic#fanfic writing#Fanfic references#fanfic research#writing#writing resources#writing reference#fan fic writing#Captain America: The First Avenger#CAPTAIN AMERICA REFERENCE#captain america tfa#Bucky#Bucky Barnes#Brooklyn Boys

65 notes

·

View notes

Text

Stress-based sickness, psychosomatic disorders, and the F word. Fibromyalgia.

Read up or listen up @t-mfrs.com (podcast available wherever you stream.)

Waking up, like I didn’t sleep for weeks. Falling asleep after five minutes on my feet. A pounding head. That sense of dread. Sticky sharp pains through in my shoulders and neck. Brain short on energy, missing a few cards from the deck. Waves of nausea and stomach cramps. Chills and sweats, depending on the body amps. Swollen lymph nodes. Muscle weakness poorly bodes. Insatiable hunger but nothing sounds edible - shit, now desire to throw up is incredible. Eyes shriveling, dry, back into my skull. The aches in my legs, pulsing and dull. Foggy thoughts. Racing heart. When will this end, why did this start?

Did I finally catch the ‘rona? Or am I just past my limit for being stressed out again? Well, I just moved, so this time I know that the answer is very likely… stressed.

So who wants to talk about getting sick? Yeah, among this group, the answer might be surprising. A lot of us do.

Why? Not because we love bitching and complaining when we feel less than ideal - spoilers, that’s every day, there’s really nothing left to say about the raging shit storms inside of us after a few years of it. We’re tired of hearing about it, too… just like we’re tired of living it, feeling it, and fearing it.

No, for us, it’s because it feels like there’s always a surprising ailment right around the corner when we least expect it. One that seemingly has no logical basis or reasonable solution. One that no one else understands. One that feels like it’s born of mental illness, somehow, while being very physically present. One that we don’t even bother bringing to doctors anymore, because no one needs to be shamed and shoved out the door again by their flippant disinterest in anything we say after the words, “Yes, I have anxiety.”

Yep. If you haven’t tried to mingle mental health with western medicine before, let me give you a quick disclaimer: unless you’re missing an arm, don’t bother. In my experience, the only thing you’ll get is an eye roll, possibly a prescription bandaid that somehow makes you feel worse, and a bored recommendation to see a psychiatrist - even if you already do.

All of this, of course, has the effect of only making you feel more upset. First, mentally, as you ruminate over the disrespect of essentially being called a liar just because the doctor doesn’t have enough training. Then, physically, as your increased stress and systemic arousal pushes your body into a new level of overdrive.

Oh, was it a mindfuck just to make the doctor appointment, get yourself there, and deal with the social anxiety of a waiting room for 30-120 minutes? I bet it felt great for someone to then invalidate your health concerns, recommend you calm down, and send you out the door without even looking you in the eye. Feeling more upset, now on a highly emotional basis? Enjoy the shame, hypertension, and lost sleep, as if you needed any more of that.

Today, I want to talk about the stress-central area of my health that hasn’t been completely figured out… and the label that I - embarrassingly - just recently learned is highly applicable to my physical condition.

But also, the outrage that I feel over said label, because, well, it explains nothing. In fact, if anything, it probably does all of us a huge disservice after we’re granted this diagnosis by pushing us into the express lane for being written off. It also separates two issues that are poorly explained, rather than combining them into one full picture that might actually yield answers. Oh, and should I mention that I think this is a larger problem of gender bias in the healthcare system? Yeah, why the fuck not. Might as well air all my grievances as a nice lead-in to another upcoming episode; is mental illness diagnosis skewed by gender?

I don’t want to let my pounding head and aching shoulders deter me too much, so let’s just get started.

History of ailments

I’ve talked about this before, but to briefly cover how fucked up this body is… let’s take a trip back to 2013 when my system failed me out of the blue. And by “out of the blue,” I mean that I had chronically overworked myself running on anxiety, obligation, and starvation for 2 years, leading to physiological revolt.

So, looking back, “duh.”

But at the time? This was all-new. It was crisis-inducing and beyond comprehension that I went from a perfectly healthy, physically resilient, surprisingly strong and low maintenance specimen to a chronically pained, systemically ill, digestively impaired, and constantly exhausted sack of wallowing self-hated.

After a lifetime of zero health concerns, I found myself bedridden and obsessed with every weird thing my body was doing to me. Which, as you’ve probably guessed, came hand in hand with the new weird things my brain was doing to me.

After a lifetime of zero health concerns, I found myself bedridden and obsessed with every weird thing my body was doing to me. Which, as you’ve probably guessed, came hand in hand with the new weird things my brain was doing to me.

You’ve probably heard the “What IS CPTSD?” episode by now, so I’m guessing you’re not a stranger to the details about the common emergence of complex trauma symptoms. Yes, that’s based on a lot of research, but it’s also a throwback to my own experience. I was a long time depression and anxiety lurker, first time complex trauma contributor around age 23, when my brain was suddenly uprooted by a series of new social and therapy-based traumas.

My depression became debilitating negative self-regard and stronger suicidal ideation. Suddenly, my social anxiety became agoraphobia. My new health issues became topics of obsessive and intrusive thoughts… you know, when I wasn’t ruminating about my role in every trauma, my worthlessness as a human, and my recently-unsettled childhood memories. My early twenties were a great time.

And with all the mental strain, came the unresolvable insomnia. Which fed right into the health problems. Which circled back to spark more mental duress. Health anxiety is not a fun way to live.

So, to call my illnesses psychosomatic is completely appropriate. But, also, completely insulting when a western medicine practitioner utters the phrase as if it was a turd slowly coming out the wrong end. And that’s exactly what happened every time I tried to seek help.

So, to call my illnesses psychosomatic is completely appropriate. But, also, completely insulting when a western medicine practitioner utters the phrase as if it was a turd slowly coming out the wrong end. And that’s exactly what happened every time I tried to seek help.

To be clear - back in the day I had some very easily detectable physical problems. I understand that doctors have a difficult job when it comes to interpreting the immeasurable inner experiences that their patients detail, but that wasn’t entirely the case here. When your body stops digesting food, well, there’s some evidence to prove that it’s a fact. When a 96oz medical grade laxative used for colonoscopy prep results in zero percent colon cleanse… uh… somebody isn’t doing their duty (pun intended). And boy, did my digestive system just decide that it was DONE doing its only job.

Everything I ate seemed to spark unpleasant physical responses, but moving materials through my guts and extracting nutrients wasn’t one of them. After months of garbage disposal failure, I was basically a walking sewer mixed with a compost pile. I found myself chronically starving, exhausted, puffy, distended, intestinally inflamed, and generally sickly. Your body doesn’t fare so well when it has no sustenance, it turns out.

At the same time, or maybe slightly predating my digestive protests, I started getting ill in weird ways. Things I had never experienced before started popping up, like chronic respiratory tract infections, sinus infections, and gum infections. I was having what seemed like allergic responses to something in my inner or outer environment. I was often covered in hives or my face and stomach were inflating like balloons for no apparent reason. I had near-constant pain in my continually-locked shoulders and neck. My actual skin, itself, hurt, as if I was being stretched to the brink of bursting. My lifelong migraines transformed into something new - disorienting tension migraines that came with horrifying loss-of-vision auras and feverish shakes.

Generally speaking, I was so tired all the time that I could barely get out of bed for more than a few moments before retreating back to my safe place to feel like garbage. My limbs felt like someone had tied weights to them and extracted several major muscle groups. I struggled even showering or washing my face, because both required holding my arms up higher than I was capable of enacting. I was so deliriously tired that I couldn’t see straight, think, or complete basic tasks.

Generally speaking, I was so tired all the time that I could barely get out of bed for more than a few moments before retreating back to my safe place to feel like garbage. My limbs felt like someone had tied weights to them and extracted several major muscle groups. I struggled even showering or washing my face, because both required holding my arms up higher than I was capable of enacting. I was so deliriously tired that I couldn’t see straight, think, or complete basic tasks.

On top of giving up my impressive life trajectory in the aftermath of the physical breakdown - because I was too fucking exhausted to consider the next steps I needed to take for grad school - this is also where I’ve previously mentioned my drive-aphobia coming into play. When you can’t count on your own faculties, you definitely don’t want to be behind the wheel. And suddenly, life gets very restricted.

I gave up my… anything life trajectory at that point. I went from a wildly social and focused student with a fantastic sense of humor about life and stronghold of self-determination to… Hiding indoors. Keeping isolated. Obsessing over my health. Googling the most embarrassing things late at night. Having no answers. Feeling like a crazy person. Hating myself. Fearing that this was the end. Assuming that my future was over. Guilting myself for fucking up my past. Replaying my tragic story of a rapid flight and a crash, after everything I had fought so hard to accomplish. Giving up.