#they introduced their own coins for trade and commerce

Explore tagged Tumblr posts

Text

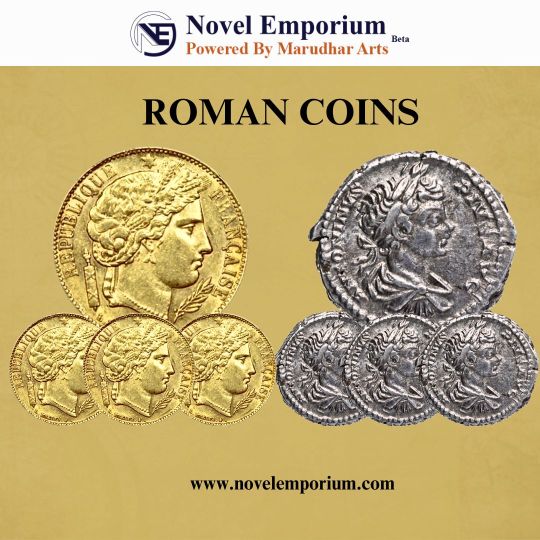

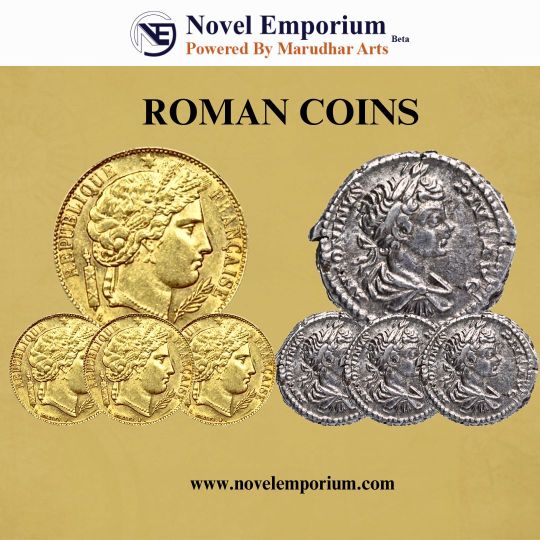

Ancient Indian Coins of Foreign Rulers

#Introduction:#Ancient India is a land rich in history#culture#and diversity. Throughout the centuries#it witnessed the rise and fall of various empires#attracting foreign rulers from distant lands. One of the intriguing aspects of this period is the numismatic heritage left behind by these#their interactions with Indian society#and the fascinating blend of local and foreign influences. In this blog#we will embark on a numismatic journey#exploring the ancient Indian coins of foreign rulers and unraveling the stories they tell.#In ancient times#various foreign empires#such as the Romans#Portuguese#British Empire also ruled over India. During the Roman rule#they introduced their own coins for trade and commerce#known as Roman Empire coins. We possess a collection of currencies from different foreign kingdoms of Portuguese#British#Roman#and others. We have rare currencies and ancient coins such as the Silver Denarius in their period.#1.The Indo-Greeks: The Indo-Greeks were among the first foreign powers to establish their presence in India. Their coins#issued during the 2nd century BCE#serve as a testament to the cultural fusion that occurred during this period. We will delve into the designs#inscriptions#and artistic influences that characterize these coins#shedding light on the cross-cultural interactions between the Greeks and the Indians.#2.The Kushanas: The Kushan Empire#originating from Central Asia#had a significant impact on ancient Indian history. Their coins#minted from the 1st to the 3rd century CE

0 notes

Text

bitcoin

Bitcoin, introduced in 2009 by the mysterious figure known as Satoshi Nakamoto, has profoundly altered the global financial landscape. At its core, Bitcoin is a decentralized digital currency that allows peer-to-peer transactions without relying on a central authority such as a government or bank. Unlike traditional fiat currencies that are issued and regulated by national governments, Bitcoin operates on a decentralized ledger called the blockchain, which is maintained by a network of computers (nodes) across the globe. Each transaction is verified by network participants through a process known as mining, which involves solving complex mathematical problems in exchange for newly created coins.

The creation and growth of Bitcoin have revolutionized the way people think about money, security, and privacy. It has also sparked a broader movement toward decentralization and digital ownership. Bitcoin’s limited supply—capped at 21 million coins—has attracted comparisons to gold, earning it the nickname “digital gold.” Many investors view Bitcoin as a hedge against inflation, particularly during times of economic uncertainty. As more people seek alternatives to traditional banking systems, Bitcoin's appeal as an independent and non-inflationary store of value continues to grow.

One of the key features that sets Bitcoin apart from traditional currencies is its independence from centralized control. This characteristic makes it immune to government manipulation or interference. Transactions on the Bitcoin network are transparent and immutable, meaning once a transaction is recorded on the blockchain, it cannot be altered or erased. This level of transparency increases trust among users and makes fraudulent activities more difficult. Moreover, Bitcoin transactions can be conducted across borders with minimal fees and delays, making it an attractive option for international remittances and commerce.

In addition to its role as a digital currency, Bitcoin has become an asset class in its own right. It is traded on various cryptocurrency exchanges and has gained attention from institutional investors, hedge funds, and even publicly traded companies. This growing institutional adoption has helped to legitimize Bitcoin in the eyes of the public and has contributed to its price volatility and growth. As with any investment, the value of Bitcoin is subject to market fluctuations, and its price can be influenced by a wide range of factors including regulatory developments, macroeconomic trends, and technological advancements.

Another important aspect of Bitcoin is its security. The Bitcoin network is considered highly secure due to its decentralized structure and the use of cryptographic protocols. Each transaction is verified by network participants through consensus mechanisms, which prevents double-spending and other types of fraud. Additionally, Bitcoin wallets, which store users’ private keys, offer varying levels of security depending on the type—ranging from online wallets for convenience to hardware wallets for maximum protection.

Despite its many advantages, Bitcoin also faces a number of challenges and criticisms. One common concern is its environmental impact, particularly the energy consumption associated with mining. Bitcoin mining requires significant computational power, which in turn demands substantial electricity. Critics argue that this energy usage is unsustainable and contributes to environmental degradation. In response, some in the Bitcoin community have advocated for the use of renewable energy sources or alternative consensus mechanisms to mitigate these effects.

Regulation is another area of concern. Governments around the world have taken varying approaches to Bitcoin, with some embracing it as a financial innovation and others seeking to restrict or ban its use. Regulatory uncertainty can have a significant impact on Bitcoin’s market value and adoption rate. At the same time, clearer regulations could help reduce illegal activities and increase consumer confidence in the digital asset. As the regulatory environment evolves, it will play a crucial role in shaping the future of Bitcoin and other cryptocurrencies.

Bitcoin also faces competition from other digital currencies, including Ethereum, Litecoin, and a growing list of altcoins. While Bitcoin was the first and remains the most well-known cryptocurrency, newer projects often offer additional features such as smart contracts or faster transaction speeds. These innovations challenge Bitcoin to evolve and adapt in order to maintain its dominance in the digital asset space. Nonetheless, Bitcoin's first-mover advantage, strong brand recognition, and widespread adoption continue to reinforce its position as the leader in the cryptocurrency market.

Public perception and awareness of Bitcoin have shifted dramatically over the years. Initially dismissed as a fringe concept, Bitcoin is now a topic of mainstream discussion and debate. Media coverage, educational content, and social media have played significant roles in spreading awareness and understanding of Bitcoin. As more people learn about its benefits and potential risks, adoption continues to grow across different demographics and regions.

Bitcoin's impact extends beyond finance. It has influenced movements related to decentralization, individual sovereignty, and technological innovation. Developers and entrepreneurs around the world are building new applications and services that leverage Bitcoin’s underlying technology. This has led to the creation of decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain-based innovations that aim to reshape industries ranging from art and gaming to supply chain management.

In conclusion, Bitcoin represents a transformative shift in how we perceive and interact with money. It challenges traditional financial systems by offering an alternative that is decentralized, transparent, and secure. While it is not without its drawbacks and uncertainties, Bitcoin continues to gain traction as a legitimate form of digital currency and investment asset. As technology and regulation evolve, the role of Bitcoin in our global economy is likely to expand, influencing the future of finance and beyond.

0 notes

Text

Evolution of the Indian Monetary System

The history of the Indian monetary system is an eclectic tapestry, interlinked with threads from ancient traditions, colonial interventions, and modern economic policies. Indeed, it covers several millennia, reflecting the economic, political, and cultural shifts that shaped this subcontinent. This blog will try to delve into the evolution of the Indian monetary system, tracing its journey right from the very earliest forms of trade in the country to the contemporary era of digital money.

Ancient and Medieval Periods

Ancient India: The Birth of Coinage

The history of the monetary system of India dates back to Indus Valley Civilization, circa 2500-1900 BCE. The trade, in that period, was barter-based. With increasing exchange, people reached a stage where a common medium of exchange had to be adopted in practice. The first known coins in India were punch-marked coins, dating back to the 6th century BCE. They were silver and copper, made of various janapadas—kingdoms—bearing symbols, not inscriptions, characteristic of the local culture and economy.

Mauryan Empire: Standardization and State Control

The Mauryan Empire (322-185 BCE) operated based on principles that were monumental with respect to the monetary system in India. Standards were laid during Emperor Ashoka's times, and it has been said that a set of standardized coins issued by the state with specified inscriptions contributed to uniformity and facilitated all the trade transactions taking place across the vast empire. The Arthashastra is an ancient Indian treatise concerning statecraft, written by Chanakya. It gives knowledge about all kinds of economic policies practiced at that time and includes those policies related to the management of currency.

Gupta Empire: The Golden Age of Indian Coinage.

The Gupta Empire, approximately 320-550 CE, is often called the Golden Age of India due to the high cultural and intellectual potentials and their advanced money system. Fine carvings and inscriptions in Sanskrit adorned their dinaras or gold coins. That the gold coins were to be in circulation with the silver and copper coins was one of the most important things in promoting trade and commerce nationally and internationally.

Medieval India: Different Kingdoms and Money Systems

Sultanate Period: Islamic Coinage

The Delhi Sultanate (1206-1526 CE) took the Indian monetary system from its inspiration in Islamic coinage. The Sultans minted silver tankas and copper coins with Arabic scripts, making the imprints of culture and religion of the time. During this period, the "rupee" originated in Sanskrit, derived from the word "rupya.".

Later developments on this system of Indian money were accomplished under the Mughal Empire, 1526-1857 AD. Emperor Sher Shah Suri introduced silver rupee that became standard currency of the empire. Various varieties of gold, silver, and copper coins with Persian inscriptions and highly designed motifs were issued by the Mughal emperors. Indeed, the stability and uniformity which the Mughal currency offered made wide trade and commerce possible across the empire and beyond.

Colonial Period: Transition and Transformation

British East India Company: Dual Currency System

It was actually with the coming of the British East India Company in the 17th century that changes in the monetary system of India began. Though initially it started operations within the framework of the existing system, striking coins along with that of the Mughal currency, with the rising influence, it began to introduce its own currency, resulting in a dual currency system.

British Raj: Establishment of Modern Monetary System

The British takeover in 1858 brought radical changes in the Indian monetary system. Directly relating an official Indian rupee currency with the British pound, the British introduced it into circulation. This currency system was standardized and regularized through the Indian Coinage Act in the year 1835, and in 1935, the Reserve Bank of India was established, actually laying down the base for both modern monetary policy and central banking.

Period of Post-Independence: Building an Independent Economy

1947-1991: Command Economy with Controlled Currency

Independent India in 1947 inherited a colonial monetary system, which required numerous reforms. The new regime embarked on planned economic development with an emphasis on industrialization and self-reliance. At the core of currency and monetary management was the central banker, the RBI. There was first anchoring to the British pound and then to the US dollar; several devaluations were, however, done to correct the trade imbalances and to give a fillip to exports.

1991-Present: Liberalization and Global Integration

The economic liberalization of 1991 has altered the fate of India's monetary system. The then-government took up market-friendly reforms, which liberalized trade and investment and paved the way for gradual movement toward flexibility in the exchange rate regime. In due course, modern monetary policy tools were adopted by the RBI to attain control over the inflationary pressures and ensure stability in the economy. 1994 was the year of full convertibility of the rupee on the current account, and this really set firmly in stone India's integration into the international playing field.

Digital Era: Will the Digital Revolution Survive the Test of Time?

E-payments: Replacing Cash at an Unprecedented Scale

The monetary system in India has undergone a sea change in the last decade with the rapid diffusion of digital technologies. While the Centre emphasised a less-cash economy, more so in the aftermath of demonetisation in 2016, it indeed spread the system of digital payments. From UPI to mobile wallets and other online banking transactions, the way to easier and safe transactions was formed. This digital payment ecosystem has been growing fast; with progress in financial inclusion, quite apparently, it has altered the way people transact today.

Cryptocurrencies and Central Bank Digital Currency (CBDC)

The surge of cryptocurrencies brings both opportunities and challenges to the potential transformation of India's monetary system. Though the RBI has always been raising red flags on the associated risks with these cryptocurrencies, it is still exploring the possibilities that a Central Bank Digital Currency may offer. A central bank digital currency can improve effectiveness in the payment system, lower transaction costs of it, and provide an appropriately regulated alternative to private cryptocurrencies. The future of the monetary system in India will probably observe a thin line between innovation and regulation that can be achieved with digital currency for bringing down associated risks.

Conclusion: A Dynamic Journey

The evolution of the Indian monetary system depicts a saga of strength and resilience of the Indian economy. The monetary history of India, from bartering systems of yore to digital payments in modern times, mirrors the dynamism and diversity that characterizes its socio-economic landscape. Entrenched in the midst of growth and further opening-up to the rest of the world economy, the monetary system shall continue changing, impelled by technology and economic policy. Leaving aside the rich history presented here, there is a lot of useful insight into the challenges and opportunities that give one a window into the future of money for one of the world's most extensive and vibrant economies.

0 notes

Text

Navigating the Metaverse: A Deep Dive into Metaverse Game Development Services

In the ever-evolving landscape of gaming, a new frontier has emerged, transcending traditional boundaries and introducing players to immersive virtual worlds. Welcome to the metaverse, a dynamic digital universe where reality and fantasy seamlessly intertwine. In this exploration, we delve into the intricate realm of metaverse game development services, uncovering the metaproalne and the innovative metaverse products that redefine the gaming experience.

The Rise of Metaverse Development Services

Unlocking the Virtual Potential

Metaverse Development Services have become the linchpin in creating virtual realities that captivate and engage players on an unprecedented scale. This transformative field encompasses a spectrum of services, from conceptualization to execution, pushing the boundaries of what's possible in the gaming universe.

Metaproalne: Shaping the Future

At the heart of metaverse game development services lies the concept of metaproalne, a term coined to represent the metaverse's evolution and its potential impact on the gaming industry. Metaproalne goes beyond virtual reality, encapsulating the holistic integration of technologies like augmented reality, artificial intelligence, and blockchain within the metaverse.

Crafting the Metaverse Experience

Innovative Gameplay Mechanics

Metaverse development services focus on creating gameplay mechanics that transcend the limitations of traditional gaming. The integration of metaproalne allows for a dynamic and adaptive gaming environment, where player actions shape the virtual world and influence the overarching narrative.

Immersive Storytelling

One hallmark of metaverse game development services is the emphasis on immersive storytelling. The metaverse becomes a canvas for narrative exploration, with players actively participating in the unfolding storylines. From epic quests to interactive dialogues, the metaproalne-infused metaverse products offer a level of engagement previously unseen in gaming.

Dynamic Environments

Metaverse development services leverage advanced technologies to craft dynamic and responsive virtual environments. These environments evolve based on player interactions, ensuring that no two experiences are alike. The metaproalne element introduces real-time changes, weather patterns, and day-night cycles, heightening the sense of immersion.

The Metaverse Product Revolution

Beyond Traditional Gaming

Metaverse products extend far beyond conventional gaming experiences. They encompass a diverse array of applications, from social interactions and educational platforms to virtual commerce and collaborative workspaces. Metaproalne enriches these products by integrating user-friendly interfaces and facilitating seamless transitions between virtual and real-world activities.

Virtual Economies and Blockchain Integration

Metaverse development services are pioneering the integration of blockchain technology to establish virtual economies within the metaverse. The use of blockchain ensures secure and transparent transactions, enabling players to own, trade, and monetize virtual assets. Metaproalne takes this a step further by creating interconnected economies that transcend individual metaverse environments.

Social Dynamics and Connectivity

Metaverse products prioritize social connectivity, allowing players to forge meaningful relationships within virtual spaces. The metaproalne aspect enhances social dynamics by introducing AI-driven NPCs (non-player characters) that respond intelligently to player interactions, fostering a sense of community within the metaverse.

The Future of Metaverse Game Development Services

Innovation at the Core

As technology continues to advance, metaverse game development services stand at the forefront of innovation. The metaproalne evolution promises to bring about even more sophisticated virtual experiences, blurring the lines between reality and the metaverse. From haptic feedback systems to neurofeedback integration, the future holds limitless possibilities.

Cross-Platform Integration

Metaverse development services are actively working towards seamless cross-platform integration, enabling players to transition effortlessly between various metaverse products. The metaproalne vision involves creating a cohesive metaverse ecosystem that accommodates different platforms, devices, and technologies.

User-Generated Content and Decentralization

The metaverse of tomorrow embraces user-generated content, allowing players to actively contribute to the creation of virtual worlds. Metaverse development services are exploring decentralized frameworks that empower the gaming community to take ownership of their experiences. Metaproalne supports these initiatives by ensuring secure and transparent governance structures.

Conclusion: Embracing the Metaverse Evolution

In conclusion, metaverse game development services, driven by the metaproalne evolution, are reshaping the gaming landscape. The integration of advanced technologies, dynamic storytelling, and innovative metaverse products paves the way for a future where the boundaries between reality and the virtual realm blur. As we navigate the metaverse, the journey unfolds with endless possibilities, promising a gaming experience that transcends imagination and brings players closer to the limitless potential of the digital universe. The metaverse is not just a destination; it's an ongoing evolution, and metaverse game development services are the architects shaping its future.

0 notes

Text

[ad_1] Whereas 2023 was a so-so 12 months for crypto, specialists anticipate bullishness for 2024. Some say the brand new VC Spectra (SPCT) might show to be the very best coin to spend money on in comparison with BNB (BNB) and Aave (AAVE). With just a few months of 2023 remaining earlier than its presale concludes, now could be the proper probability to become involved in time for 2024. Let’s take a look at this declare and examine the prospects of VC Spectra earlier than contemplating the most recent for BNB and Aave. Abstract VC Spectra introduces a decentralized asset administration platform for blockchain and tech startups; its utility token will probably be valued at $0.080, possible by 2024. Binance ‘burns’ 2.13 million BNB tokens; BNB may commerce at a minimal excessive of $300 for 2024. A spike in derivatives buying and selling additional boosts Aave; AAVE might peak to a minimum of $150 in 2024. VC Spectra (SPCT) Capitalizes On Thriving Blockchain and Tech Adoption Whatever the 12 months, blockchain and tech adoption will proceed to thrive. Curiously, VC Spectra (SPCT) presents a decentralized hedge fund for promising startups in these industries to capitalize on this profitable potential. Concurrently, customers will probably be immersed in a seamless and trustless investing platform due to sensible contracts. This innovation removes intermediaries on VC Spectra (SPCT) by automating features like storing funds and allocating income. Key advantages of such a system embody customers having management over their property and decentralized governance. VC Spectra (SPCT) goals to fund a variety of latest tasks curated via meticulous due diligence. Furthermore, it would handle dangers and maximize features via a number of superior buying and selling methods and machine studying algorithms. One in every of VC Spectra’s targets is to offer quarterly dividends to customers, which can occur with the utility token SPCT. Different advantages of proudly owning SPCT embody voting rights in governance proposals and entry to unique discounted pre-ICOs. You should purchase SPCT in Stage 4 of VC Spectra’s presale for $0.055, set to leap by 45% to $0.080 in Stage 6, the final section. This will likely happen by the beginning of 2024 or sooner, judging by the rising charge of token purchases. Let’s now cowl the trending developments for BNB and BNB worth prediction forecasts. Binance Burns $450 Million Price Of BNB The BNB coin worth is up virtually 15% from its yearly low of $202 to $232. Binance just lately carried out the 25th BNB auto-burn, the place the trade ‘burned’ or eliminated 2.13 million tokens price about $450 million. Burning tokens is a value-appreciating technique for a lot of prime altcoins, particularly inflationary ones like BNB. This transfer was obligatory for the BNB coin worth, given the continued authorized issues with Binance. The trade has burned 50.29 million BNB in whole, with the subsequent occasion scheduled someday earlier than the top of the 12 months. Most BNB coin worth forecasts recommend a conservative minimal of $250 for the beginning of 2024, with a minimal peak of $300 for the top. Lastly, let’s examine Aave and Aave worth prediction estimates. AAVE Derivatives Quantity Rises Over 100% In Two Days The worth of the Aave crypto undertaking has been on a surge prior to now few months, up 66% since August 16, 2023, from $50.40 to $83.60. The huge lending activity is the primary catalyst that has made Aave among the many best-performing prime DeFi tasks. Knowledge from IntoTheBlock indicated that the worth of loans exceeded $100 million in early September 2023, a file excessive for the Aave crypto protocol. IntoTheBlock’s quantity indicator additionally notes trade inflows of $21 million towards outflows of $15 million, suggesting much less promoting stress. Lastly, information from Coinglass evidences the current surge as an increase in buying and selling quantity for derivatives. This was an improve

of 100% between October 21 and October 22, 2023, additional fueled by a good lengthy/quick ratio. Brief positions confronted liquidations price practically $770,000, a lot decrease than these for lengthy positions at virtually $60,000. Aave crypto estimates recommend that the worth might be a minimum of $100 by the beginning of 2024, probably reaching a minimal of $150 by the top. Be taught extra in regards to the VC Spectra presale right here: Purchase Presale: https://invest.vcspectra.io/login Web site: https://vcspectra.io Telegram: https://t.me/VCSpectra Twitter: https://twitter.com/spectravcfund Disclaimer: This can be a paid-for sponsored article. The views and opinions introduced on this article don't essentially replicate the views of CoinCheckup. The content material of this text shouldn't be thought of as funding recommendation. At all times do your individual analysis earlier than deciding to purchase, promote or switch any crypto property. [ad_2]

0 notes

Text

Tugrik (MNT) Definition

What Is the Tugrik (MNT)?

The Tugrik (MNT) is the official currency of Mongolia. It serves as the medium of exchange for goods and services within the country and is used for various financial transactions. The Tugrik is named after a historical unit of weight used in Mongolia's past.

Key characteristics and information about the Mongolian Tugrik (MNT) include:

Currency Code: MNT is the currency code used to represent the Mongolian Tugrik in international financial markets.

Subunits: The Tugrik is subdivided into smaller units called "Mongo," with one Tugrik being equal to 100 Mongo. However, in everyday transactions, prices are typically quoted in Tugrik, and Mongo is not commonly used.

Denominations: The Tugrik is available in various denominations in the form of banknotes and coins. Banknotes are issued in denominations of 1, 5, 10, 20, 50, 100, 500, 1,000, 5,000, 10,000, and 20,000 Tugrik notes. Coins come in smaller denominations, including 20, 50, 100, and 200 Tugrik coins.

Central Bank: The issuance and regulation of the Mongolian Tugrik are managed by the Bank of Mongolia, which serves as the country's central bank.

Exchange Rate: Like other currencies, the value of the Tugrik can fluctuate relative to foreign currencies, and its exchange rate is determined by supply and demand in the foreign exchange market. Various factors, including economic conditions, government policies, and global market forces, can influence its exchange rate.

Symbol: The symbol for the Mongolian Tugrik is often represented as "₮" in Latin script or "ᠮ" in the Mongolian script.

Use in Mongolia: The Tugrik is the official and sole legal tender in Mongolia, and it is used for all types of financial transactions within the country, including buying goods, paying for services, and conducting business.

International Acceptance: While the Tugrik is the official currency of Mongolia, it is not widely accepted outside the country. Travelers visiting Mongolia may need to exchange their own currency for Tugrik upon arrival or rely on international payment methods like credit cards in larger cities and tourist areas.

Overall, the Mongolian Tugrik plays a crucial role in the country's economy, facilitating domestic commerce and financial activities. Its value can vary over time, and its stability is important for both domestic and international trade in Mongolia.

Understanding Tugrik (MNT)

Understanding the Tugrik (MNT), the currency of Mongolia, involves considering its history, denominations, exchange rates, and its role in the Mongolian economy. Here's a more detailed explanation:

Historical Context: The Tugrik has a history dating back to the Mongolian People's Republic, which declared its independence from China in 1921. The Tugrik was introduced as the country's official currency, replacing other currencies like the Chinese Yuan.

Denominations: The Tugrik is available in various denominations. Banknotes are commonly used and come in denominations of 1, 5, 10, 20, 50, 100, 500, 1,000, 5,000, 10,000, and 20,000 Tugrik notes. Additionally, there are coins in denominations of 20, 50, 100, and 200 Tugrik.

Subunits: While there is a subunit called "Mongo," it is not widely used in everyday transactions. Prices are typically quoted and transactions are conducted in Tugrik.

Central Bank: The Bank of Mongolia, also known as "Mongol Bank," is the central bank of Mongolia and is responsible for issuing and regulating the Tugrik.

Exchange Rate: The exchange rate of the Tugrik can fluctuate against other currencies. Like most currencies, its value is determined in the foreign exchange market. Factors that influence exchange rates include economic conditions, inflation, interest rates, government policies, and global market forces.

Symbol: The symbol for the Mongolian Tugrik is often represented as "₮" in Latin script or "ᠮ" in the Mongolian script.

Usage: The Tugrik is the official and sole legal tender in Mongolia. It is used for all types of transactions within the country, including buying goods and services, paying bills, and conducting business.

International Acceptance: While the Tugrik is the official currency in Mongolia, it is not widely accepted outside the country. If you are traveling to Mongolia, it's advisable to exchange your own currency for Tugrik upon arrival or use international credit and debit cards in larger cities and tourist areas.

Economic Impact: The stability of the Tugrik is crucial for the Mongolian economy. Exchange rate fluctuations can impact trade and foreign investment in the country. The central bank plays a role in managing the currency to promote economic stability.

In summary, the Mongolian Tugrik (MNT) is the official currency of Mongolia and plays a central role in the country's economy. Its value can fluctuate based on various factors, and it is primarily used for domestic transactions within Mongolia. Travelers to Mongolia should be prepared to exchange their currency for Tugrik when visiting the country.

History of the Tugrik (MNT)

The history of the Tugrik (MNT), the official currency of Mongolia, is closely tied to Mongolia's historical and political developments. Here's an overview of the currency's history:

Early Currency Systems: Prior to the introduction of the Tugrik, Mongolia had various currency systems in use. These included Chinese coins, Russian rubles, and other forms of barter and trade. Mongolia was under Chinese and later Soviet influence during different periods of its history, and these influences also affected its monetary systems.

Independence and Introduction of the Tugrik: Mongolia declared its independence from China in 1921. Shortly thereafter, in 1925, the Mongolian People's Republic was established, and the Tugrik was introduced as the official currency to replace other currencies that were previously in circulation. This marked an important step in Mongolia's nation-building process.

Soviet Influence: During the early years of its independence, Mongolia was closely aligned with the Soviet Union. The Tugrik was initially pegged to the Soviet ruble, reflecting Mongolia's economic and political ties to the USSR.

Changes in the Exchange Rate System: Mongolia underwent economic changes over the years, and its exchange rate system evolved. At various points, the Tugrik was pegged to different foreign currencies, including the Soviet ruble and the Russian ruble. Later, Mongolia adopted a floating exchange rate system, allowing the Tugrik's value to be determined by market forces.

Currency Reforms: In the 1990s, Mongolia underwent significant economic reforms as it transitioned from a centrally planned economy to a market-oriented one. This period included currency reforms, and the Tugrik experienced fluctuations in value.

Modern Tugrik: Today, the Tugrik is Mongolia's official currency, and it is managed by the Bank of Mongolia (Mongol Bank). The currency has denominations in banknotes and coins, as mentioned earlier.

Economic Challenges: Mongolia's economy has faced challenges, including fluctuations in commodity prices (such as minerals), which have had an impact on the Tugrik's exchange rate and the country's overall economic stability.

International Recognition: While the Tugrik is the official currency of Mongolia, it is not widely recognized or accepted outside the country. Travelers to Mongolia often need to exchange their currency for Tugrik upon arrival or use international payment methods.

The history of the Tugrik reflects Mongolia's journey from a region with diverse currency influences to a sovereign nation with its own official currency. It has experienced changes in its exchange rate regime and economic reforms as Mongolia has evolved economically and politically over the years. The currency continues to play a vital role in the country's economy and financial system.

Read more: https://computertricks.net/tugrik-mnt-definition/

0 notes

Text

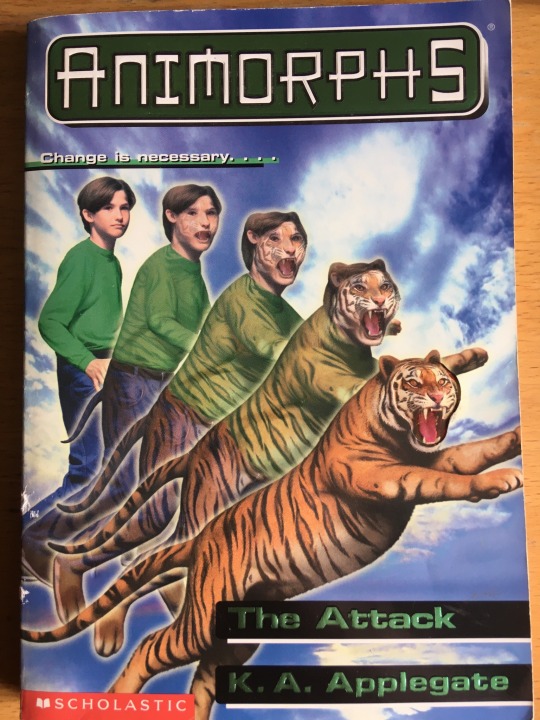

106. The Attack, by K A Applegate

Owned: Yes Page count: 145 My summary: The Ellimist is back with a task for the Animorphs. The six of them plus Erek, versus seven Howlers, powerful aliens who live only to kill. If they lose, an entire species will be wiped out. But the Howlers are fierce fighters, more than a match for the Animorphs. Can Jake use his brain to get them out of this fight alive? My rating: 3.5/5 My commentary:

The Crayak! I believe I’d heard of the Crayak before, or possibly encountered it in a later book, but I could never quite remember what it was or what its deal was, so I’m glad of this book to fill in that gap in my Animorphs knowledge. There’s so much in this middle books that’s kind of Wild, where before the draw was very much ‘aliens in my regular American town’, we’ve now switched to more intergalactic adventures. Which is not bad, just to clarify! I’ve just noticed that this sort of shift has happened, where the stories aren’t afraid to introduce more aliens or take the Animorphs out to space.

So the Ellimist and Crayak are basically two sides of the same coin - where the Ellimist is sort-of benevolent, the Crayak is definitely not, and is completely okay with destroying whole cultures and civilisations just to entertain itself. It created the Howlers, aliens designed to kill who are supposedly completely unstoppable, and now it’s got beef with Jake, and by extension the other Animorphs. The Ellimist is a bastard, but the Crayak is straight up a monster. I’m so worried about what it might do in later books.

We are also introduced to the Iskoort, a new alien race! It seems at first that their whole deal is just money and trade and commerce, but as it turns out, they’re Yeerk symbiotes. Specifically, they were created by the Yeerks (or at least a Yeerklike species) to be a species they could live in without needing to make Controllers. The Iskoort can’t live without the Yeerk, the Yeerk cannot live without the Iskoort. It’s an interesting moral idea and I hope it comes back again in the future, because as Cassie says, this is pretty much the ideal solution to the Yeerk problem. Not a host/parasite relationship, but true symbiosis, where both parties benefit.

One small point in the evolution of the Animorphs’ tactics - here we see Jake weaponising acquiring, using it to pacify a Howler so he can deal with it. It’s a clever tactic, and really shows how far these kids have come, able to think on their feet like this and use all the tools they have; particularly noteworthy as they’re so outgunned in this particular adventure. I don’t think this is the first time we’ve seen this sort of tactic, but it’s the first time I think that it’s been used against an enemy like this, an intelligent enemy that isn’t just a dumb animal, so kudos.

So in this one we get a confirmed romantic thing! Specifically, Cassie kisses Jake. I really like how this goes down. I’m not fond of the overemphasis dating and romantic relationships has in YA/kid media - it’s like, sure, that’s a part of kids’ lives, but at the same time you’re 12 go play Pokémon or something, you know? This strikes that balance really well; we’ve had many hints that Jake and Cassie are into each other, and here Cassie kisses him in a moment of relief, but we don’t really dwell on it too much. There are other things going on, but also, this is happening! The right amount of romantic relationship, I feel.

Lastly...boy, does this one get a bit dark. Jake discovers that the Howlers are all children, deliberately created to treat killing as a game, and decides he can’t kill them. Instead, he plugs all of their memories into a Howler - they have a hivemind, so all Howlers would be able to access these memories, and learn that their prey are in fact people with feelings and lives and such. So the Crayak destroys them all. The Animorphs win, but they don’t feel good about it - especially not Jake, who killed one of the Howlers. He didn’t know, and it was self-defence, but still. He killed a child. That kind of thing stays with you. Sure, the conclusion of this was a bit cheesy (the only memory that stayed with the Howlers was Jake and Cassie’s kiss! It was love!) but I’ll allow it. It’s an interesting way for this to develop and I’d like to see if it has any lasting impact on the kids, and Jake in particular, in later books.

Next up, back to Rachel, and the Chee have a bit of a problem.

3 notes

·

View notes

Text

Ancient Indian Coins of Foreign Rulers

Introduction:

Ancient India is a land rich in history, culture, and diversity. Throughout the centuries, it witnessed the rise and fall of various empires, attracting foreign rulers from distant lands. One of the intriguing aspects of this period is the numismatic heritage left behind by these foreign powers. Coins minted by these rulers provide valuable insights into their reigns, their interactions with Indian society, and the fascinating blend of local and foreign influences. In this blog, we will embark on a numismatic journey, exploring the ancient Indian coins of foreign rulers and unraveling the stories they tell.

In ancient times, various foreign empires, such as the Romans, Portuguese, British Empire also ruled over India. During the Roman rule, they introduced their own coins for trade and commerce, known as Roman Empire coins. We possess a collection of currencies from different foreign kingdoms of Portuguese, British, Roman, and others. We have rare currencies and ancient coins such as the Silver Denarius in their period.

1.The Indo-Greeks: The Indo-Greeks were among the first foreign powers to establish their presence in India. Their coins, issued during the 2nd century BCE, serve as a testament to the cultural fusion that occurred during this period. We will delve into the designs, inscriptions, and artistic influences that characterize these coins, shedding light on the cross-cultural interactions between the Greeks and the Indians.

2.The Kushanas: The Kushan Empire, originating from Central Asia, had a significant impact on ancient Indian history. Their coins, minted from the 1st to the 3rd century CE, showcase a blend of Indian, Greek, and Persian artistic elements. We will examine the unique features of Kushana coins, such as the portrayal of rulers, deities, and the introduction of the Brahmi script.

3.The Indo-Scythians: The Indo-Scythians, also known as the Sakas, ruled parts of North India during the 1st century BCE to the 1st century CE. Their coins display a distinct Scythian influence while incorporating Indian motifs and deities. We will explore the fascinating iconography and historical context behind these coins, highlighting the cultural amalgamation that occurred under the Indo-Scythian rule.

4.The Gupta Empire: The Gupta Empire is often regarded as the Golden Age of ancient India. The Gupta coins, minted between the 4th and 6th centuries CE, exemplify the pinnacle of artistic and metallurgical achievements. We will analyze the intricate Gupta coinage, which features Gupta rulers, mythological figures, and elaborate inscriptions, and discuss its significance in the context of Gupta society and culture.

5.The Islamic Dynasties: With the advent of Islamic rule in India, a new chapter unfolded in numismatic history. Coins issued by various Islamic dynasties, such as the Delhi Sultanate and the Mughals, showcased a unique blend of Islamic calligraphy, Persian influences, and Indian artistic elements. We will explore the evolution of Islamic coinage in India and its role in shaping the socio-cultural landscape.

Importance of Ancient Indian Coins of Foreign Rulers:

1.Historical Documentation: Ancient coins provide valuable historical documentation about foreign rulers who held sway over different parts of Ancient India. These coins bear inscriptions, symbols, and portraits that help in identifying and understanding the rulers, their dynasties, and their political influence in the region.

2.Cultural Exchange: Coins issued by foreign rulers reflect the cultural exchange and interaction between Ancient India and other civilizations. They often incorporate elements of both the ruling civilization and the local Indian traditions, showcasing a fusion of artistic styles, religious symbolism, and linguistic influences.

3.Trade and Commerce: Coins played a vital role in facilitating trade and commerce in Ancient India. Foreign rulers minted their coins to assert their authority and facilitate economic transactions. The presence of foreign coins in Ancient India suggests the existence of trade networks and economic ties with other regions.

4.Economic History: The study of ancient coins provides insights into the economic history of Ancient India. The types of metals used, their purity, and the denominations reflect the prevailing economic systems, monetary policies, and the economic prosperity of the time.

5.Numismatic Research: Ancient coins serve as essential artifacts for numismatic research, which involves the study of coins. Scholars and collectors analyze these coins to determine their minting techniques, metal compositions, and design evolution over time. Such research contributes to a deeper understanding of ancient technology, craftsmanship, and artistic traditions.

6.Preservation of Heritage: Ancient coins are invaluable archaeological artifacts that preserve the heritage of Ancient India. By studying and preserving these coins, we can gain insights into the social, political, and economic structures of ancient societies, helping us reconstruct and appreciate our historical roots.

7.Educational and Cultural Value: Ancient coins have educational and cultural value. They provide a tangible connection to the past, allowing individuals to learn about and appreciate the history, art, and cultural diversity of Ancient India.

Advantages of Ancient India Coins of Foreign Rulers:

1.Historical Significance: Coins issued by foreign rulers in Ancient India provide valuable historical evidence about the political, cultural, and economic interactions between India and other regions. They offer insights into the periods of foreign rule and their impact on the Indian subcontinent.

2.Numismatic Value: Ancient coins, especially those from foreign rulers, have high numismatic value. Collectors and enthusiasts often seek out these coins for their rarity, craftsmanship, and historical significance. They can be valuable additions to coin collections and can appreciate in value over time.

3.Cultural Exchange: Coins from foreign rulers reflect the influence of different cultures and civilizations on Ancient India. They often feature unique designs, symbols, and inscriptions that represent the artistic traditions and ideologies of the ruling empire. They provide a glimpse into the diverse cultural heritage of the time.

4.Trade and Economic Relations: Coins issued by foreign rulers can offer insights into the trade and economic relations between Ancient India and other regions. They can provide information about the circulation of different currencies, the prevalence of specific trade routes, and the economic policies of foreign powers.

Disadvantages of Ancient India Coins of Foreign Rulers:

1.Loss of Sovereignty: Coins issued by foreign rulers signify a period of foreign domination and loss of political autonomy for Ancient India. They remind us of the subjugation and control exerted by outside powers, which can be a sensitive topic for some individuals or communities.

2.Fragmented History: Ancient coins, including those of foreign rulers, often present a fragmented historical narrative. They provide glimpses into specific rulers or periods but may not offer a comprehensive understanding of the broader historical context or the experiences of the local population.

3.Limited Information: While coins can provide valuable historical information, their inscriptions and designs may not always reveal detailed or complete information about the ruler, the ruling empire, or the events of the time. Some coins may lack inscriptions altogether, making their interpretation challenging.

4.Lack of Preservation: Ancient coins face the risk of damage, deterioration, and loss over time. Due to their age and historical significance, it can be difficult to preserve and protect these coins adequately. This poses a challenge for historians, archaeologists, and collectors interested in studying or appreciating them.

Conclusion:

Ancient Indian coins of foreign rulers provide a glimpse into the multicultural tapestry of India's past. From the Indo-Greeks to the Islamic dynasties, each coinage reflects the dynamic interplay between different civilizations, religions, and artistic traditions. By studying these numismatic artifacts, we gain a deeper understanding of the historical, cultural, and economic interactions that shaped ancient India.

#Roman Empire Coins#Silver Denarius Coins#Rare Roman Currency Coins.Silver Denarius Coins#Rare Roman Currency Coins#Ancient Roman Coins#Ancient Roman Denarius Coins#Denarius Coins#Roman Currency Coins.

0 notes

Text

Golden Gateway : Cryptocurrency News: 07/14/16

In a day and age when customers and companies no longer trust lending institutions for making their investments because of bailouts, identification theft, plunging interest charges and skyrocketing fees, blockchain innovation seeks to bypass an institution or third occasion in any respect. It's a decentralised digital foreign money created by a small group of hackers and builders in 2008. Their id largely stays unknown. The business is still small however has the potential to be on par with the massive alcohol trade we see within the US. These are solely a small variety of the choices bitcoin users have. Less Scammy - should you decide to get an hosted bitcoin mining contract, than you could examine if the provider is a registered venture. In fact, darkish internet criminal utilization might be the smallest utilization bracket bitcoin sees lately. Coinbase - As one of the vital world’s most popular Bitcoin providers, including a really good and user-pleasant wallet in addition to an trade, Coinbase is a protected guess to recommend to newbies, offering them with everything they should get started with Bitcoin multi functional place. As mentioned above, Paragon is aiming to boost funds to proceed the challenge by launching their very own token referred to as “PRG.” You’ll be able to purchase one PRG token for $1 USD starting on September fifteenth, lasting for precisely a month.

latest cryptocurrency news of the cryptocurrency in Canadian dollars on the time of the transaction

Notes Sync

CryptoMiningFarm: 1 TH/s 0.077 BTC + FREE 50 GH/s SignUp Bonus: Click on Here

2 years in the past from USA

Texts that do not provide a digital copy

The receipts of buy or switch of cryptocurrency

Safe - The cryptographic key makes it inconceivable for outsider to breach the system

The Restoration Firm uses distinctive methods to help recuperate funds with no authorized issues, this has been experienced bcos because the Monetary Supervisor of my company, I needed to work intently with The Recovery Firm. First, they allow you to decide miners primarily based on profitability, which is all the time an important spec. Huobi Pool has introduced to launch a devoted trade to EOS, which can follow after its collaboration with the EOS group to build the EOS test chain (Crypto Kylin Testnet), wherein the tasks could be examined. Assist and improvement of the Bitcoin Non-public venture will depend on continued treasury fund assortment in a way aside from mining pool donations. But depending on how a lot it's a must to spend, BitPremier can be more than just one thing cool to have a look at, which it's, by the way. Expect the identical appear and feel of other on-line procuring sites. Bitcoin forums became my finest pal, especially websites that had Critiques, How-To guides, Comparison charts, and other instruments that helped me familiarize myself more to the bitcoin tradition. Since bitcoin's market capitalization is lower than $200 billion, fans level out the digital forex could rise dramatically if it attracts even a tiny fraction of the world's $200 trillion in conventional monetary market property. From DVDs and gifts, to apparel and even weapons, you can find all of it, and even buy it with bitcoin.

How can I buy bitcoin in the UK? Sales approached $7 billion in 2016, and the number is predicted to triple by the top of the decade. Charges of up to 1 per cent can apply on gross sales. Like with many on-line cost techniques, bitcoin customers can pay for their coins anywhere they have Internet entry. Tech-savvy and finance-savvy traders are placing in numerous emphasis on this coin because of its improbable block one technology which helps it develop up the ladder at a faster tempo. Bitcoin is the first implementation of a concept called "cryptocurrency", which was first described in 1998 by Wei Dai on the cypherpunks mailing list, suggesting the idea of a new type of money that uses cryptography to manage its creation and transactions, moderately than a central authority. Customers commerce Bitcoin on exchanges reminiscent of San Francisco-based mostly Coinbase, with all transactions recorded on a public ledger, known as the blockchain.

The drop to test the $4200s was sudden and violent: It occurred over a couple of short hours, and the amount propelling the drop was massive.Figure 2: BTC-USD, 6-Hour Candles, GDAX, Macro Bear FlagPrior to the breakout, the BTC-USD market spent per week forming a bearish continuation pattern known as a Bear Flag (the small print concerning a Bear Flag was mentioned earlier in this week’s ETH-USD article). Coinmap isn’t really a spot the place you may spend your newly gotten bitcoin, nevertheless it does let you find local bitcoin pleasant companies. Bitcoin investor and analysis analyst Tuur Demeester doesn’t see the coin going under … It is the first decentralized peer-to-peer fee community that's powered by its customers with no central authority or middlemen. While pot continues to be thought-about a schedule one managed substance below federal regulation, many states are exercising their right to disagree with the laws of the national government and legalize cannabis consumption both medically and recreationally.

Returns differ drastically, but with a good-to-average miner and the right setup, you could be taking a look at around a $a hundred revenue in a sturdy month - that ought to provide you with an concept of how lengthy it is going to take to recoup the initial value. Do you assume this platform solves an actual drawback within the nation right now? Now you want to pick your mining software program, or a client that permits you to control the mining process and take a look at the specs in your mining rig to make sure every part is perfect. Banks can be reluctant to use public crypto belongings for their very own goal preferring to maintain a tight leash on any coin tasks that that launch. Our present worth level is sitting on an historically significant assist level so whether or not we handle to break this support stays to be seen. This assist has robust historic significance and will must be damaged in order for the Bear Flag’s price goal to be realized.

#cryptocurrency news#crypto news#cryptocurrency news today#latest cryptocurrency news#breaking crypto news#crypto coin news#crypto latest news#crypto news now#latest crypto news#best cryptocurrency news

1 note

·

View note

Text

From Ban to Creating Own Crypto Coin “Libra”

Facebook made a press release in January 2018 by banning all ads related to bitcoin, specifically targeting the cryptocurrency. But with in less than a year they uplifted the ban

Mark Zukerberg started admiring the blockchain technology and value of virtual currencies and also he got advice from Bank Of England and US treasury stating that to go for virtual currencies in a social media for payments. Later Mark starting realizing that if the payments are processed quickly by using blockchain technology then the traffic will increase. Just imagining that if Facebook kind of giant introduces cryptocurrencies which are having more than 2.4 billion users then the global economy will also start regulating the crypto and blockchain technology

Mark Zukerberg as Investor?

We all know that Zuckerberg is a successful investor who is having a vision. The takeover of whatsapp by facebook is the best example. Mark Zuckerberg is also an angel investor who invests in potential startups, recently it started investing globally in India they have an investment in Meesho.

Just think about the current scenario a successful investor making footsteps towards cryptocurrency which means globally change will start soon.

What are the main reasons behind this transformation?

As we have seen initially there is a ban on the crypto from facebook but now facebook is trying to have its own cryptocurrency and wallets, so what might be the main reasons behind transformation.

· Decentralizing and restoring the power in the hands of the common man.

· Conversion of facebook from a social media platform to market place as well.

· Quick access to wallets and payments which can drag the attention of new users.

· Changing with advanced technology like blockchain.

· Competitive advantage and to become globally high ranked.

· Eradication of fraudulent activities like terrorism etc from facebook

Curtain raiser of Facebook own Crypto Tokens

South American online marketplace Mercado Libre is working with Facebook on the social network’s Libra cryptocurrency project.

The executive stated that it was likely the company would operate as a node in Facebook’s footsteps forthcoming blockchain network.

Facebook’s journey started with the users and chat platform also with business promotions and market place added to its rage. Eventually, Mark Zuckerberg is trying to bring some revolutionary ideas and bringing all together at users feet. Now he is behind introducing wallets.

This can be revealed on the 18th June 2019 as a social media giant, they mentioned cryptocurrency as Libra, Mercado Libre is one of the most popular e-commerce platforms in South America with operations in 19 countries is going to be a partner with Facebook. For this to make successful and useful for every user of Facebook, Mark Zuckerberg met the governor of the Bank of England

According to a recent report, Facebook’s Libra platform will be unveiled later this week. It is found on everywhere that social media platform has reportedly gathered support from dozens of firms including Visa, Mastercard, PayPal, and Uber.

Another indication that the Facebook currency will be different from its predecessors is the fact that it will be pegged to several government-issued currencies, in a bid to avoid the vast value fluctuations that have dogged other digital currencies.

That inconsistency in valuation is best illustrated by the price of Bitcoin, which was initially sold for a few cents before it reached a record high of just under $20,000 per coin in December 2017. Each one now sells for just over $8,300.

This Project might cost nearly $1Billion in a year. With this sheer dominance, facebook can make easily its 2.4 billion users to test with the crypto wallets in facebook kind of social apps. This can change the phase of the global economy

A phase of the Global economy

Many of the developed countries started accepting cryptocurrencies for merchant purpose and also they made regulations according to the nature of cryptocurrencies

India is still playing a neutral part in crypto trading and exchange but in the future, this global economy will force to make a change in regulations of the crypto trading and exchange in India.

This article is taken reference from independent.co.uk and cointelegraph.

1 note

·

View note

Text

Bitcoin: What's It, and Can It Be Right for Your Small Business?

RedStreet It is not a genuine coin, it is"cryptocurrency," an electronic type of payment that's made ("mined") by plenty of people globally. It permits peer-to-peer trades instantly, globally, at no cost or at very reduced price.

RedStreet

Bitcoin was devised after decades of study into cryptography by applications programmer, Satoshi Nakamoto (considered to be a pseudonym), who made the algorithm and also introduced it into 2009. His true identity remains a puzzle.

This money isn't backed by a concrete commodity (such as gold or silver); bitcoins are traded on line that makes them a commodity in themselves.

Bitcoin is a open-source solution, accessible by anybody who's an individual. All you require is the email address, Internet accessibility, and cash to begin.

Where does this come from?

Bitcoin is mined to a distributed computer system of consumers conducting specialized applications; the system simplifies specific mathematical signs, and hunts for a particular data arrangement ("block") that generates a specific pattern as soon as the BTC algorithm is employed to it. A game creates a bitcoin. It is complicated and time- and - energy-consuming.

Just 21 million bitcoins are to be mined (roughly 11 million are now in circulation). The mathematics issues the network computers resolve get progressively more challenging to maintain the mining operations and provide in check.

This system also supports all of the trades through cryptography.

How can Bitcoin work?

Internet users move electronic assets (pieces ) to each other on a community. There's not any online bank; instead, Bitcoin was described as a Internet-wide spread ledger. Users purchase Bitcoin with money or by simply selling a good or service for Bitcoin. Bitcoin pockets shop and utilize this electronic money. Users can sell from the digital ledger by trading their Bitcoin to somebody else that would like in. Everyone can do this, any place on earth.

You will find smartphone programs for running cellular Bitcoin trades and Bitcoin trades are populating the world wide web.

What's Bitcoin appreciated?

Bitcoin isn't controlled or held by a bank; it is totally decentralized. Unlike real cash it cannot be devalued by banks or governments.

Rather, Bitcoin's worth lies only in its own endorsement involving users as a kind of payment and since its supply is restricted. Its worldwide currency values fluctuate based on demand and supply and market speculation; consequently more individuals create wallets and maintain and invest bitcoins, and much more companies accept it, Bitcoin's worth will rise. Banks are currently hoping to appreciate Bitcoin and a few investment sites forecast the cost of a bitcoin will likely be a few thousand dollars in 2014.

What are its advantages?

There are advantages to consumers and retailers looking to utilize this payment option.

1. Quick transactions - Bitcoin is moved instantly over the net.

2. No fees/low charges -- Contrary to credit cards, Bitcoin may be used at no cost or very reduced prices. With no centralized association as middle person, there are not any authorizations (and penalties ) required. This enhances profit margins earnings.

3. Eliminates fraud threat -Just the Bitcoin proprietor can send payment to the intended receiver, who's the only person who will receive it. The system knows the transfer has happened and trades are supported; they can't be contested or removed. This is large for internet retailers that are frequently subject to credit card processors' evaluations of whether a transaction is fraudulent, or companies that cover the high cost of charge card chargebacks.

4. Info is protected -- As we've seen with current hacks on federal merchants' payment processing methods, the world wide web isn't necessarily a safe spot for personal data. Together with Bitcoin, users don't give up personal information.

a. They've got two keys - a public key that functions as the bitcoin address along with a personal key with private information.

B. Transactions are"signed" digitally by blending the private and public keys; a mathematical function is implemented along with a certification is generated demonstrating that the user initiated the trade. Digital signatures are unique to each transaction and can't be re-used.

c. The merchant/recipient never sees that your confidential information (title, number, physical address) so it is somewhat anonymous but it's traceable (into the bitcoin speech on the public key).

5. Suitable payment method -- Merchants can use Bitcoin completely as a payment method; they don't need to hold any Bitcoin money since Bitcoin could be converted into dollars. Consumers or retailers can trade in and from Bitcoin and other monies at any moment.

6. International obligations - Bitcoin is utilized around the globe; e-commerce retailers and service providers can quickly accept international obligations, which open up new possible marketplaces for them.

7. Simple to monitor -- The system monitors and permanently logs each trade in the Bitcoin block series (the database). In the event of potential wrongdoing, it's easier for law enforcement officials to follow these trades.

8. Micropayments are potential - Bitcoins could be broken down to a single one-hundred-millionth, therefore running little obligations of a buck or less a complimentary or near-free trade. This might be a real blessing for convenience stores, coffee stores, and subscription-based websites (movies, books ).

Still a bit confused? Listed below are a Couple of examples of trades:

Bitcoin from the retail environment

At checkout, the Legislature utilizes a smartphone program to automatically scan a QR code including all the trade information required to move the bitcoin into the merchant. Tapping the"Verify" button finishes the trade. In the event the user does not have any Bitcoin, then the system converts dollars in his accounts to the electronic money.

The merchant can convert that Bitcoin into bucks if it needs to, there were no very low processing charges (rather than 2 to 3% ), no hackers could steal private consumer data, and there's absolutely no probability of fraud. Really slick.

Bitcoins in hospitality

Hotels can take Bitcoin for dining and room obligations on the premises for guests who would like to pay by Bitcoin with their mobile pockets, or PC-to-website to cover a booking online. A third party BTC merchant chip can help in tackling the transactions that it simplifies within the Bitcoin network. These processing customers are set up on tablets in the institutions' front desk or at the restaurants for consumers with BTC smartphone programs. (These payment processors can also be available for laptops, in retail POS systems, and incorporated into foodservice POS systems.) No credit cards or cash have to change handson.

These cashless transactions are quickly and the chip can convert bitcoins into money and produce a daily deposit to the institution's bank accounts. It was declared in January 2014 two Las Vegas hotel-casinos will take Bitcoin payments in front desk, in their own restaurants, and at the gift store.

It seems great - so what is the catch?

Business owners must consider issues of involvement, cost and security.

• A comparatively few of ordinary customers and retailers currently use or know Bitcoin. But, adoption is growing worldwide and technologies and tools have been developed to make participation easier.

• It is the world wide web, so hackers are risks to the trades. The Economist reported that a Bitcoin market was murdered in September 2013 and $250,000 from bitcoins was stolen from consumers' online vaults. Bitcoins could be stolen as with other money, so cautious network, database and server protection is paramount.

• Users need to carefully protect their bitcoin pockets that contain their personal keys. Safe copies or printouts are very crucial.

• Bitcoin isn't controlled or insured by the US authorities so there's absolutely no insurance for your accounts in the event the trade goes out of business or has been robbed by hackers.

• Bitcoins are comparatively pricey. Present-day prices and selling prices can be found the internet exchanges.

The digital money isn't yet worldwide but it is gaining market awareness and approval. A company may opt to try out Bitcoin to save credit card and bank charges, as a consumer advantage, or to see whether it helps or hinders earnings and profitability.

1 note

·

View note

Text

What Lies Ahead for the Hong Kong Economy in 2023?

Hong Kong is a bustling global financial hub with one of the most open and vibrant economies in the world. In recent years, however, its economic growth has been hampered by political instability, a clampdown on media freedom, and the global recession caused by Covid-19. As we look ahead to 2023, it is important to consider what lies ahead for Hong Kong’s economy. In particular, Hong Kong must find ways to manage international trade relations with other countries as well as maintain its status as an attractive destination for foreign investors. Additionally, technological advancement could be key in boosting economic activity while at the same time reducing costs associated with labor and production. Finally, there are concerns that businesses may shift their operations from Hong Kong to Singapore due to more favorable tax policies there. These factors will play a major role in determining whether or not Hong Kong can sustain its current level of economic success over the next few years or if it risks being left behind by other regional economies such as China and Singapore.

Hong Kong Money, Notes and Coins. Photo by Neerav Bhatt. Flickr.

Hong Kong Economy in 2023

Hong Kong’s economy in 2023 looks to be more resilient than ever even with its own unique set of challenges. The Hong Kong government is working hard to capitalize on its strengths while addressing the changes it faces in the economic environment with new policies and initiatives. These changes are resulting in Hong Kong gaining a competitive edge, with trade and tourism seeing some growth. Hong Kong’s largest export sector, financial services, is still strong due to the city’s reputation as a hub for international commerce. It remains well-connected to the mainland economic market through both its airport and trading links, which are expected to provide additional economic investment opportunities in Hong Kong. Hong Kong is continuing to develop its infrastructure and digital capabilities, enabling it to remain a major center for business and information technology innovation. All these factors have Hong Kong poised for a healthy outlook in the near future.

Early Adopters of the Peace Plus One - Sustainability Symbol Hong Kong 3 Finger salute. Photo by Philip McMaster. Flickr.

Political Instability and Clampdown on Media

Hong Kong is in the midst of political and social unrest, perpetuated by an increasingly hostile attitude from Beijing towards Hong Kong's autonomy. For the past few years, Hong Kong citizens have been protesting their deteriorating freedom of expression rights and facing increasing levels of suppression from local media. This includes denying Journalists proper accreditation to cover the protests, cracking down on independent media outlets and reporters, and introducing laws that punish alleged disinformation. Furthermore, with Hong Kong losing its independence due to tightening control from the Chinese Government's attempts at interfering with Hong Kong’s elections, many Hongkongers are voicing their intent to protect universal suffrage and safeguard Hong Kong’s freedoms from further erosion.

Economic Impacts of Global Recession & Covid

Hong Kong has felt the devastating effects of both the global recession and COVID-19. Hong Kong is a trade center that relies heavily on growing export and import activity, making it particularly vulnerable in times of economic downturn. When the pandemic hit, Hong Kong's unemployment rate climbed to a six-year high of 6.4%. The Hong Kong Monetary Authority estimates that Hong Kong's economic growth will slow to 1% in 2020, almost four times below its projected 3.7%. The government also announced over a $60 billion stimulus package in order to provide relief to individuals and businesses. Hong Kong will likely have difficulty recovering from this double economic shock on its own; international aid and support are essential for Hong Kong's long-term fiscal health and economic recovery.

Attracting investment at Hong Kong trade and investment office. Photo by BC Gov Photos. Flickr.

International Trade Relations

The city has emerged as a major player in international trade in recent years. The Hong Kong Special Administrative Region of China is highly integrated with the global economy, and its role in international trade is only expected to grow. Hong Kong is an important entrepôt hub for trade from mainland China and has a number of preferential agreements with foreign countries, especially in Asia that make it a more attractive destination for many businesses who want to take advantage of lower tariffs and easier access to markets abroad. The city also has the potential to be an attractive center for research and development into new trading methods, thanks to the Hong Kong government's commitment to innovation and integrating new technologies into existing models of world economics. Hong Kong is certainly proving itself as an invaluable asset to international trade now, and there are no doubts that its economic future will benefit even further as time goes on.

Financial Hub Status

Hong Kong is well-known as a world-renowned financial hub and the Hong Kong Monetary Authority emphasizes revitalizing Hong Kong’s status as an international financial center. It has made use of Hong Kong’s strategic location in Asia, well-developed infrastructure, sound legal system, and sophisticated professional services to further Hong Kong’s position in the global economy. Hong Kong also benefits from a relatively low tax rate, an independent currency backed by strong foreign exchange reserves, and access to large fund management services. The Hong Kong government has set up conventions for the development of capital market products and legislation for e-commerce and online trading that provides investors with a level of security ensuring safe transactions. In addition, Hong Kong has built up relationships with numerous countries throughout the world granting companies here access to the respective markets in Bangladesh, Bhutan, Cambodia, India, Indonesia & more. All of these features mean Hong Kong stands out as one of the most attractive markets around the world in terms of financial services – essential to any business operating globally today.

Hong Kong 5G. Photo by Mohamed Hassan. Pixabay.

Technological Advancement

Hong Kong is among the world leaders in technological advancement. Hong Kong powered ahead of its peers when it spearheaded the adoption of 5G technology earlier than many other countries, enabling Hong Kong to become one of the first smart cities in the world. Hong Kong also has a high level of digitization across different economic sectors, including banking and finance, tourism, and retail industries. Hong Kong’s drive for digital solutions has resulted in over 6 million online banking accounts as of 2020. This is a figure that rivals that of many advanced countries around the world which demonstrate Hong Kong’s rapid embrace of technology. It will be necessary for Hong Kong to continually invest in new technologies to remain competitive in a rapidly changing environment.

Business Exodus to Singapore

Singapore has become an increasingly attractive hub for international businesses. Recently, Hong Kong’s status as a premier financial center has been under strain due to civil unrest and the implementation of China’s new national security law. This has resulted in many Hong Kong-based companies seeking to relocate operations, with Singapore emerging as the top destination choice. The allure of Singapore lies in its tax benefits, welcoming immigration policy, and attractive incentives for foreign businesses. Global tech giants such as Facebook, Google, and Twitter have already made moves towards setting up office spaces in the city-state. With a long list of advantages that Hong Kong can no longer offer, it's easy to see why so many companies are making the choice to pack their bags and fly eastward over the horizon to Singapore.

Court of Final Appeal Hong Kong. Photo by Cheung Yin. Unsplash.

Hong Kong Legal Reforms

Hong Kong has taken steps to protect its human rights as they continue to expand its legal system. In particular, Hong Kong aligns with the United Nations' International Covenant on Civil and Political Rights by continuously ensuring that residents’ freedom of religion and belief is protected. The city authorities have also worked to protect equality before the law, the right to participation in government, much greater procedural requirements for police searches, protection from arbitrary detention, and the right to a fair trial. Hong Kong has adopted multiple reforms over the past several years in order to keep up with its rapidly expanding legal system as well as to ensure fundamental human rights are adequately safeguarded. These reforms serve not only as a powerful symbol of Hong Kong’s commitment to democracy but also act as an encouraging example for other countries in the world.

Conclusion

Hong Kong has become an attractive market for businesses looking to expand internationally, thanks in part to its access to other markets and high level of technological advancement. Despite this, the city-state of Singapore is increasingly becoming a popular destination choice due to its tax benefits and welcoming immigration policy. Hong Kong authorities have taken steps towards ensuring that fundamental human rights are protected through legal reforms such as aligning with the United Nations' International Covenant on Civil and Political Rights. While there may be some challenges ahead for Hong Kong’s financial sector, it remains one of the most desirable destinations for global business operations today. With an array of advantages ranging from technology advancements and legal protection all the way to international collaboration opportunities, companies will continue turning their attention towards Hong Kong – making it essential for any company operating globally today. Sources: THX News, Wikipedia & Hong Kong TDC. Read the full article

0 notes

Text

Indian Coin Set: The Perfect Addition to Your Collection

I. Introduction

A. Brief history of Indian coins

The history of Indian coins can be traced back to ancient times, with the earliest known examples dating back to the 6th century BCE. These early coins were made of precious metals such as gold and silver, and featured various designs such as the image of a king or a symbol of the ruling dynasty. During the mediaeval period, the coins of India were influenced by Islamic designs and motifs, as many areas of the country were ruled by Muslim dynasties. With the arrival of the British colonial powers in the 18th century, Indian coins began to feature the image of the British monarch. After India gained independence in 1947, the government introduced new coinage featuring the national emblem and symbols of the country's cultural heritage. Today,old coin Indian buyers continue to be produced and used as a medium of exchange, with various denominations and designs that reflect the country's rich history and cultural diversity.

B. Importance of Indian coins in history and culture