#therell be a jump for the next one

Explore tagged Tumblr posts

Photo

The One

part three - the one with mouse ears and turkey dinner

The transition from October to November wasn’t a difficult one.

Everyone was putting away their Halloween decorations and putting up the Thanksgiving ones. Everyone was out in stores buying their pumpkin flavor cookies and coffee creamers. Everyone was even going out of their way to get the pumpkin spice latte everyday from Starbucks.

Evie wasn’t into that whole trend, the everything has to be pumpkin spice. In fact, Evie didn’t even like the flavor of it, finding it too sweet for her liking. However, she ate pumpkin seeds like no other. Normally, she’d be making homemade, but this time it was store-bought.

The fall time was Evie’s favorite. She learned to love it when she was back in Seattle and when she moved to Chicago for school. She learned to love the colors and the cold felt like home. Not to mention all the outfits that fit that season, it was amazing.

Of course, in Los Angeles, there wasn’t much of a fall season. Sure, the weather was cooler, but it wasn’t as cool as it would be in Seattle or Chicago. To Evie, that was the biggest culture shock when she came to the hustling city. In fact, when she experienced her first fall and winter season in Los Angeles, she almost moved back to Chicago.

But, at the same time, the transition was difficult.

This whole month had been quiet without the presence of Niall. Her phone had gone off a few times a week, text messages talking about his plans for the following day and how much he had missed her. Evie wasn’t going to lie, she missed him too. Granted, she had only spent one night with him and that was over drinks. What she really missed was the smile and his laugh.

She hadn’t told him about her fight with Helena, because in her mind, she felt that he would back himself away from her. And that was the thing that Evie didn’t want to happen.

Niall called her a few nights too, and she would vent about work. Again, Evie didn’t mention the fight, because it was useless. But, Niall had seen the photos too, promising that when he got back to the States, they’d talk more about it.

Evie never asked how long until he came back. She was letting him do his thing like he had done so before. She didn’t want to intrude into his career, wanting him to come back when he had so much going on. If everyone had known better, they’d see that she was trying to be patient, despite her getting antsy as every day passed.

“Evie?”

Evie had looked up from her desk, eyeing someone at her door. Evie leaned back in her seat, crossing her arms and gave a nod, signaling for them to come in.

“It’s late, why are you still here?”

“Because it’s a Friday night and I have to finish off this plan before the meeting tomorrow?” Evie mused, looking over at the clock as it read ten PM.

“Or is it because you’re trying to keep yourself busy from thinking about lover boy?”

“You guys have fun messing with me about this, don’t ya?” Both girls had giggled by then.

“We’ve never seen you with a guy, that’s why we do. When does he get back?”

“Dunno.”

“Guess we’ll know when he does by your expression that day.” The girl winked, causing Evie to scoff.

“Don’t you got to go home or something?” Evie teased.

“Yes…. But don’t stay late, yeah?” The girl spoke, standing up from her seat as she made her way to the door, leaving Evie behind.

“Have a good weekend too, hopefully your boyfriend comes home.”

“He’s not -.” But it was no use, the girl was gone already.

Evie huffed, moving her attention back over towards her desk, the swatches of paint colors and patterns sitting in front of her. On her left, she had three idea booklets prepared for her meeting tomorrow, and she was working on her fourth. On her right, she had two cups of coffee and take out from an hour ago.

While playing with color swatches again, her phone buzzed. Evie reached out, bringing the phone in front of her and smiled at the name. She slid her finger on the screen and brought the phone to her ear.

“Hello sweet girl.” Evie sighed in relief, setting the paint swatches down and leaned back in her chair.

“Hey… Isn’t it late over there?”

“No Evie Burke, it’s six AM here.” Niall mused.

“Oh…. so what are your plans for the day then?”

“Hanging with my cousin since its one of me last few days here.” She could only imagine him shrugging his shoulders right now.

“Guess you’ll have to tell me all about your trip when you get back.”

“So go on, tell me about your day, Evie Burke. I’m dying to hear it since I haven’t talked to ya in a little bit.” Evie snorted then.

“Let’s see, it’s Friday night and I’m still at work figuring out paint swatches that would match together. I’m on my third cup of coffee because I can’t figure out what goes well together. I don’t want to go home without this not planned…. Do you think gold and light grey go together?”

“Is this for a wedding? And if so what season?” Niall asked.

“Yes and it’s to be determined. They want color schemes to help them choose. So for the springtime I have peach, gold and green. For the summertime I have navy, coral and gold. For fall, I have cranberry, orange and ivory - which is my favorite by the way. And i’m working on winter right now. Hence why I asked about grey and gold.” Evie sighed, running her free hand through her hair.

“Why not use copper or whats the word? Platinum? You have too much gold and oranges by the sound of it. Copper and uh…. Navy? Do they make such things? I’m not sure, Evie Burke. I’m guessing here.”

“I like the copper part…. I’ll go hunting for colors that match with copper. Thank you. I’m sorry you get to talk to me while i’m stressed like this.” Evie sighed, not liking how short this conversation was sounding.

“It’s kind of cute, to be honest. I’m imagining a frustrated scowl on your face and some hair strands out of place. But look, i’ll be home on Thursday and we’ll meet up then, okay?”

“That’s fine, I need to keep busy anyways. Thank you for letting me vent.”

“You’re welcome, sweet girl. Have a good night and I’ll see you soon.”

Once he had hung up, Evie sat her phone to the side again and went back looking through the paint. Copper, that was the main color that Evie was going to go with, but as for the other two, that was a different story.

She went through the reds, and yellows, and greens until she stopped at the blues. Niall had said something about navy, but what about a lighter color instead? Inbetween baby blue and sky blue, aqua was sitting right in front of her.

With determination on her face, Evie searched for another color to balance the copper and aqua. She went through the colors again, only this time she looked through the colors that no one else would think of. Meaning, that Evie went towards the browns and tans instead of the ideal colors. Throughout looking at the colors, the ultimate decision came down to mahogany. While it was unusual, Evie liked it the more she looked at it.

At the glance of the clock, Evie finished up the last booklet and packed her belongings. Her meeting was set up at a cafe, that way they could discuss and meet somewhere private. Evie cleaned up her desk and turned off the lights and locked her door.

\

“Hey… Evie?”

Evie had looked up from the stack of papers on her desk. It had been a good week so far, she didn’t have to stay late at all these past few nights. And her clients loved the winter booklet that she created - of course with the help of Niall. Not that they didn’t like the others, but her clients loved the look of the colors together and how unique they were.

She sucked in a deep breath as Helena entered the room and closed the door behind her.

They hadn’t talked in a while after the tiff they had; the silence that Evie had felt in her life from not talking to Helena had been killing her. She knew that there had been no harm, but the attack wasn’t pleasing when it happened.

“Can we talk? I mean… Can we clear the air? Or whatever that should be said?”

Evie exhaled and folded her arms together. She had mentally agreed, they needed to talk and figure out the animosity that was here in her office.

“Look, I’m sorry I attacked you verbally. I was frustrated that you didn’t tell me ANYTHING. I was hoping that it would be you telling me rather than the news and Twitter.” Helena ran a hand through her hair.

“You know, I was going to tell you the following day.” Evie scoffed, standing up from her chair and moved around the desk until she leaned on it.

“I know -”

“But, you came to the attack and I didn’t like that at all. You listened to every news outlet for the truth, and yet you decided to trust them instead of waiting for me to tell you.”

“And I get that, but -”

“No, you don’t get that. Knowing that you believed some news outlet that isn’t always reliable isn’t the greatest feeling in the world. I cried, Helena. It sucked, because instead of letting me share the news, I had the world tell it. It felt so normal and so nice that I wasn’t even out with a popular musician, I was out with a down-to-earth guy.”

She wasn’t going to lie, it was honestly one of the best dates that she’d gone on. She couldn’t compare this to her dates from college or high school. But nothing was going to be able to beat what she had felt that night. She got to meet Niall Horan, the boy who enjoyed talking about music instead of the boybander that everyone knew.

There was the elephant in the room, both girls could sense and feel it. The silence was even louder, both of them unsure where to begin to speak.

“So… is he a good kisser?”

Evie’s stone-cold look on her face turned into a little smile and a shrug from her shoulders.

“He is! Oh my god, Evie!” Helena cried of joy.

“I don’t know, Helena! I only kissed his cheek!” Evie’s hands flew to her face, hiding the rosy color on her cheeks.

“How do you not kiss on the first date!? Did he text you after a day? Come on, Evie, time for the actual details!”

Evie moved from her spot, going back around towards her chair behind her desk. She moved the papers out of her way and brought the coffee cup up to her lips, only to set it down a second later.

“Because I don’t play that way. And no, not right away.” Evie laughed a bit.

“Not right away?”

“He was on a plane. He hasn’t been back here in a month or so. Off touring that song of his, but I’ve kept in contact with him.”

“When’s he coming back?” Helena raised an eyebrow.

“Tomorrow. I’m really excited actually. I’m thinking we might get together on Friday, because he’d need the day to recuperate from the jetlag.”

“And… you know the holiday is coming up. Why not invite him?”

Evie hadn’t thought about that. While it would mean nice time with him, it also meant weirdness with her family and the fact of him not celebrating the holiday.

But, she was nominated last year to have the family over this year. Everyone, except Britt, would be at her place and that was already something that was stressing over.

“He doesn’t celebrate an American holiday, Helena. Plus that whole idea of meeting the parents? No way.”

“But, he’s your friend and thats how you should put it.”

“But, my family has also seen the news like you and already put together that we’re together.”

“And are you two together?”

“I don’t know? You normally don’t get into a relationship after the first date. I mean, we’ve talked a lot about each other, but I don’t know? A better word ]is seeing each other.”

“Just, don’t do that stupid instagram official thing.” Evie laughed.

“Okay, enough boy talk, you got work to do, go on now!” Evie laughed more, pointing over at the door.

Helena got up from her seat, going around the desk and pulled Evie up for a hug. At first, it surprised Evie, but after a moment of realizing what this was for, Evie hugged her back. It was better for them to hug out what had happened and to move on with their lives.

“Just ask about Thanksgiving and make sure you two talk! Okay, bye.”

\

Despite him coming home on Thursday, Evie convinced him to meet up on Friday. That way he could sleep off the jetlag. While he had protested, he gave in.

Evie had taken the Friday off, claiming it was for her to focus upon her house and get herself mentally prepared for the holiday. Honestly, everyone knew that it was actually for Niall, but they let Evie believe the story that she made up.

When Evie was fighting him and his jetlag, she suggested places to go like the zoo or Universal Studios or whatever he wanted to head off too. Before their conversation had ended, Niall had agreed to Disney instead. That way they weren’t going to be bombarded by people wanting photos or gossip.

That’s where Evie was this morning, standing at the entrance at Disney. Being that it was November, it was cooler outside and there weren’t that many lines to get into the park or even the rides.

Evie had to look dumb standing there, her legs crossed as she looked around looking for him. Maybe he was already there, but not noticed. Or he was walking up and she didn’t see. Hell, he could already be inside and didn’t tell her anything.

While that kept her distracted, she didn’t realize that someone was sneaking up on her. That had all changed though when Evie felt a pair of arms wrapping around her. Evie yelped, jumping away from the arms and turned to find Niall chuckling, not noticing the look of panic on her face until it finally clicked.

“That wasn’t funny! Don’t do that!” She smacked his shoulder.

“I’m sorry, I’m sorry!” Niall apologized, reaching out for her hand.

She had a slight pout on her face, still reeling into the surprise attack. Niall, while still holding onto her hand, pulled her closer to him and wrapped his arms around her for a hug.

It was the sense of comfort that reminded Evie that she had missed him. From the way he tugged her with his hand on hers, and the scent of his cologne that reminded her of the two nights they were together. It made the whole idea of him being back in Los Angeles feel much more real.

“Missed ya like crazy, Evie Burke.” Niall admitted, letting her out of the hug but still held onto her hand.

“Doubt it, you had tons of fans and your family. I bet you hardly thought of me.”

“That doesn’t mean I didn’t miss ya. With a huge timezone change, it was horrible. Plus, I rarely got to talk to you so.”

Together they walked into the park, blending in with the crowd. Niall made sure he had sunglasses on, covering his face from people as Evie showed her face. No one was going to recognize a girl they’ve only seen once with him.

And that was okay with her, because she didn’t want people to notice them.

“The real question, is if you missed me, Evie Burke.”

“Meh.”

“Ouch, sweet girl. That actually hurt.”

“I’d be lying if I said I didn’t.” Evie spoke, looking over at him with a grin. Without her even seeing, Niall smirked.

They weren’t smart when it came to getting fast passes, so they had to wait in lines. They were, however, lucky because the lines weren’t long and they were able to move quickly.

One by one, they did each ride that came into their view on the one side of the park. The crowds were moving smoothly, Evie not having to apologize every time she elbowed someone. Niall would chuckle, hearing Evie apologize when she would.

Evie stopped at one point, earning a look from Niall in confusion. Her eyes wandered the place, looking around until she spotted a restaurant. Niall, still with confusion on his face, looked towards where she was looking at, and then understood what she meant. She was hungry. And not to his surprise, so was he.

The pair went to Harbour Gallery, grabbing some food while sitting near the back. It was by Niall’s request to sit back there, so that no one could see and look at them with wide eyes.

“Are you having fun, Evie Burke?”

“A lot of fun, actually.”

“Good. Told ya our next adventure would be fun.” Niall winked, causing Evie to let out a laugh.

“And what about the next one?” Evie asked.

“Would you like to go on another one? Even if it might be chilling at the house?”

“As long as I’m with you, anything is fun.”

“Guess i’ll have to figure something out then. Which reminds me, how did that meeting go?”

Evie wiped her face with the napkin, setting it aside before shrugging her shoulders like it was nothing.

“They liked every booklet I made. It was difficult for them to choose because I did an incredible job. Ultimately, they loved the winter booklet. Thank you again.” Evie smiled.

“You’re welcome… Was I right though? You had that frustrated look on your face? I would’ve killed to see it.”

“I did, just about cried had you not called.”

“I’m glad it all went well though, serves them right for choosing you and liking one of your options. They won’t be disappointed after what I’ve seen you pull off.”

Evie’s cheeks turned a few shades of pink, having to hide her face with her hands.

She wasn’t used to much compliments, the compliments of loving her stuff and that she was the best at what she did. Sure, she got them from her friends who helped her build the idea. But from Niall? That made her feel embarrassed - in a good way of course.

“Anyways, theres a few more things we need to do, sweet girl.”

She peeked through her fingers, blinking as she wondered what were the few other things they had to do. She knew of the teacups, because thats what she was excited for the most. Niall reached out for her hands, lowering them from her face and sat them down on the table, holding onto them and smiled at her.

“We need to find you some Mickey Ears and go on more rides.”

“I’ll get Mickey Ears if you get Mickey Ears.”

“Deal, now lets go Evie Burke.”

They left their spots, heading off to find more rides and whatever else they could get into. Along the way, Niall would stop and let Evie get in line to get her photo taken with whoever was walking around. She was such a child when it came to this, letting the inner child-like feelings come through. This was something she hardly got to express, but being in Disney of all places made her feel at peace.

She returned back to him, kissing his cheek as they went on. Evie had looked high and low for a shop that sold the Mickey Ears. When she did, she nudged her shoulder and pointed in the direction of the shop (“Evie Burke, hasn’t your mum ever told you not to point”).

Entering the shop, Niall found simple black pair, nothing with a bow on it or nothing too ridiculous looking. Evie, took her time looking at each one, playing eeny meeny miny moe to choose the right one.

In all honesty, Niall found this to be cute. He imagined this is what she looked like when she worked, playing the choosing game, the one to figure out what she liked more. The determination on her face was telling him that this wasn’t the first time she had that look.

“Okay, do you like this one? Or do you like this one?” Evie held up two different ones; one was an Alice in Wonderland themed as the other was the official Mickey Ears, but with sequins on the ears and the bow.

“If you’re trying to hint for the teacups, then the Alice… but, if we’re considering that I’ve got plain ears here, get the shiny one.”

Niall paid for them both, and helped Evie get her ears on straight. He laughed at the face she made, giving a short nod before continuing off on their day.

“You’ve got some fans eyeballing you.” Evie whispered.

“How can you tell?”

“Theres some girls over there with their phones out, and one looks like they’re about to cry. Look.” Evie made a motion for Niall to look in the direction she was looking at.

Niall looked in the direction, making it seem like he was actually looking around the place with his eyes. He could see what Evie was on about, letting out a sigh before he looked at her.

“We’ve been busted.”

“No, more like you got busted. You can go talk to them if you’d like. The line for the teacups is a bit long, so you know where to find me.” Evie squeezed his hand before she let go, heading off towards the teacups.

Evie pulled out her phone from her pocket, checking the time. She wasn’t the one for social media -aside from Instagram, so she didn’t have much of the updates to see. However, she did check her email for clients or if work needed her.

As fast as she checked her phone, she placed it back into her pocket. She looked around, spotting Niall walking back towards her, a small grin appearing out of his that had to be because he found her.

“So, how was that meeting thing?”

“Asked if you were the girl I was with weeks ago and if this was a date.”

“What did you say?” Evie asked, biting down her lip.

“Said yes to both. I asked them though to not post anything until tomorrow.”

Evie turned that nervous look on her face to a smile. She felt better knowing that he was considering this as a date and he asked to not post anything, for the fear he’d get bombarded some more.

They spent the rest of the day doing different rides, from Evie screaming to Niall laughing at her. They stayed until it was after dark, watching the light show and everything glow throughout the park and in front of them. What Evie didn’t know, was that Niall had asked someone to get their photo taken from the behind, that way they couldn’t see their faces. Just as sneaky as Niall asked that, he got his phone back like nothing had happened.

“So, I know you don’t celebrate the holiday, but on the 24th would you like to come over for dinner?”

“Isn’t that a family thing? A family dinner thing?”

“Well yeah, but I thought… you know, if you wanted some dinner and company for a night, you can come over.”

“No, Evie Burke. The offer is nice and all, but I don’t celebrate an American holiday that isn’t even a good holiday and its a family thing more or less.”

“Alright, thought I’d ask.” Evie went quiet shortly after that.

“Now, do you need a ride home?”

“No… I drove Henry.”

“Henry?” Niall asked, looking at her weirdly.

“Yeah, my car.”

Evie walked Niall towards her car. He was proclaiming it was to make her safe knowing she got there, but, Evie wanted to prove she had a car in the first place. She leaned against her car, smiling at him for the longest of time.

“Goodnight, Evie Burke. Drive home safely, yeah?”

“Yes, Dad.” She giggled, causing Niall to shake his head.

“I’ll talk to you soon, alright?”

Niall stayed in his spot as Evie got into her car and he watched her drive away. Content that she was on her way home, Niall went to his own vehicle and drove back his place. His mind pondered on the thought of what she had asked before, if he wanted to come over for Thanksgiving. He scoffed then, shaking the thought out of his mind and traveled home, dead silence in the car.

\

Evie’s house was in complete ruckus.

All three of her guest bedrooms were in use, her two bathrooms were filled with other peoples toothbrushes and other things Evie didn’t want to know. Her refrigerator was completely stocked up with different foods and drinks, and her drive way was completely packed. But most importantly, her mind has gone off its chain.

Her mom and dad were in one room, Dan and Tori were in one room, her grandparents were in the last guest bedroom and Mitch was on the couch. Ginny was in Evie’s room, luckily. And since everyone had came over, Ginny had stayed hidden, despite Evie calling her name.

At night, Evie, her brothers and Tori would go outside in her backyard and play volleyball while her parents and grandparents sat by the firepit. This was their fun for the holiday, and each of them complained about Britt not being there. And late at night, it was always Evie and Mitch talking about everything, because everyone else had that “im going to bed at 8 PM feel”.

No one had brought up Evie being in the news. She had taken that as a sign that no one noticed or even cared. The anxiety over having to explain that was out the window.

With her family, Evie was able to let go and act silly. Like she was with Niall at Disney, she was able to be childlike and bring out that sassy Evie like when she was younger. There was even one point that Mitch and her went to the store just to buy onesies and wear them. If she was being honest, Mitch was her favorite brother, because he was only a year older than her.

“Evie, enlighten me on something.”

“Yeah, Mitch?” She looked up from her phone, raising an eyebrow at him.

“I wasn’t going to bring this up around family, since we’re here for another four days, but what’s with that guy you’ve been seen with?”

“Just someone I’ve been seeing. No big deal.” It was, very much a big deal.

“He’s famous, from that boyband and he’s gone solo. It’s a big deal, Evie.” Mitch shrugged his shoulders.

“And your point is?”

“Just to know what’s going on.”

“Nothing, we’re just… seeing each other.” Evie made sure her voice was serious.

“Is he your boyfriend? C’mon, Evie, we havent talked like this in forever.” Mitch was pleading.

“No, and you’re sounding like my coworker, Helena. Why are we discussing me, anyways? What about you?”

“Oh no, don’t change the subject. I’m not in a relationship with a famous person.” Evie glared at him, to which he started laughing.

“So, when do we get to see him?”

“Never.” Evie crossed her arms.

“Oh come on. Not even for a hey?”

“No, now if you don’t mind, I’m going to bed. We’ve got a long day tomorrow and I’m not going to get yelled at for being cranky.”

Evie got up from the couch, smiling widely at her brother before chucking a pillow at him. After that, she made a mad dash towards her room, closing the door so she wasn’t in the attack zone.

“C’mon Ginny, time for bed.”

The cat climbed her way onto Evie’s bed and onto the pillow that was for her. With a sigh, Evie got into her bed, shut the light off and went to bed.

But by the morning, Evie was already hearing people scramble in the kitchen. She got up from the bed and made her way towards her bathroom, and from there into the kitchen. Everyone was in there, eating their breakfast and trying to get ahold of Britt.

Evie made herself a cup of coffee and sat moved around to make some toast. As much as she loved her spacious house, people seemed to cram into the kitchen and her dining room.

“Calm down, you guys, she could be in class.” Evie muttered, rolling her eyes.

“How would you know?” Her dad asked, turning to look at her.

“The Spanish doesn’t celebrate Thanksgiving, Dad.”

“Someone’s chipper this morning.”

Evie rolled her eyes again, spreading the jam on her toast. She watched as everyone gave up on calling Britt, hoping that she’d call them later instead. One by one, Evie watched as they trailed to her living room, turning on the TV and gone straight away to football as some went to change. All of them had decided to not dress up, but to be more laid back and casual since they weren’t trying to impress anyone. That even meant Evie, changing into jeans and a t-shirt.

As the day dragged on with more football and snacks, Evie and the rest of the women stayed in the kitchen. Between the four of them, they were bustling around to make everything ready for dinner.

Her dad helped out with the turkey, because Evie refused to touch it (“Evie… its already dead… its not going to squawk at you.”).

“Mitch, can you help me set up the table, I’m going to stab myself at this rate of carrying all the knives.”

“That isn’t the answer to everything, Evie.” Mitch mocked, coming over to Evie to take the knives.

“And what is the answer to everything?” Evie asked, raising an eyebrow.

“What we talked about last night.” She glared as he smirked right at her.

“Never going to happen, Mitch.” Evie scowled while placing the plates on the table, Mitch following suit with the knives.

“You two are acting like you’re four and five again.” Dan leaned against the counter, watching the two of them.

“You’re acting like you’re eight again, being bossy as usual.” Mitch shot.

“Oldest is the bossiest, remember?” Dan teased.

“Here goes his ego.” Evie remarked, smirking at her brother.

“Watch it, Evie.” Dan warned as Evie stuck her tongue out.

“Calm down, you three. It’s time for dinner.”

“Yes, Mom.” All three of them said in unison.

Everyone bustled into Evie’s kitchen then, fighting over seats until they settled. One by one, Evie started bringing the food onto the table, giggling as her mom swatted everyone’s hands away. As soon as everything sat on the table and Evie sat in her seat to say Grace, her door knocked. Evie sighed as everyone questioned it.

“It’s probably Ms. Newby bringing over something for us. Hang on.”

The girl got up from her seat, setting the napkin down on the table and headed to the door.

“Hang on, Ms. Newby, I’m coming.” Evie yelled as she opened the door to not finding Ms. Newby, but Niall instead.

“You’re not Ms. Newby.”

“No…. I’m not. That’s your neighbor, isn’t she?” Evie only nodded her head.

“What are you doing here? Not that its a bad thing, I … remember you saying no.”

“I did say no. But, I thought about it… You said something about free meal and company, so I just… gave in I guess.” Niall shrugged his shoulders.

“You could’ve told me, I could’ve gotten a plate ready for you… whats that your holding?”

“Uh, this is Toffee Pudding and Guinness because I know you probably have shit beer. So, is it okay to join you, then?”

Evie smiled then, moving out of the way for him to enter into the house. Niall followed behind her as she made her way to the kitchen to join everyone again.

“So… I… uh.. I invited Niall a couple of days ago to join us, and he agreed to accompany us. Family, this is Niall and Niall, this is family. Except Britt isn’t here, because -”

“She’s in Spain, I remember you saying that.”

Evie smiled, biting down on her lip before jumping onto her next thought.

“Okay, I’ll take those from ya and follow me to get a plate.” Evie took everything from Niall and set it on her counter, him following behind her as she reached out for a plate. From a side glance, Evie looked over at Niall and smiled, only for him to grin back at her.

“Alright alright, I have a big enough table for people to make extra space, no one bites here.” Evie brought the extra chair over, sitting it down next to hers. From a glance up, she could see the smirk growing on Mitch’s face, making Evie turn away quickly despite him seeing the rose color on her cheeks growing.

“Alright Dad, you can say Grace.” Evie looked over at her dad, a little nod thrown at him. Her Dad stood up, looking around at everyone before giving his own short nod.

“Grace. Now lets eat.”

Niall looked over at Evie, raising an eyebrow at her. Evie laughed, looking on as plates started flying past them.

“Dad’s never been the Grace type. Just always said it, really. But there’s turkey, mash, cranberry sauce, stuffing, rolls, corn, green bean casserole and whatever is for dessert on the counter. Grab and go.”

“Did you make any of this?”

“The cranberry sauce and the stuffing. Mom did the mash and casserole and gran did the desserts.”

“Don’t try it, she’s not the best.” Mitch teased.

“Yeah? And what did you make here? Your plate thats what you made.” Evie shot back, making her own plate.

One by one, each dish passed and each of them were eating. Some even went back for seconds. She couldn’t help the seconds that she’d glance at Mitch and he’d keep smirking at her, and she flipped him off a couple of times.

“Can I ask how you met Evie? Not that its our business or anything, but I’m curious.”

Evie’s eyes turned wide and she tried to hide her face as Niall started laughing. Wiping whatever remaining crumbs off his face, Niall looked over at Evie, a cocky grin forming on his face.

“Yeah, Evie Burke, how did I meet you?”

“I bumped into him… with a glass of wine… and ruined the suit.”

“How do you bump into someone, Evie?”

“By drinking not only yours, but Helena’s white wine. It wasn’t my proudest moment.” Evie sighed.

Evie got up from her seat then, starting to take some of the bigger dishes off of the table. Tori had helped her while her mom and gran helped set up the dessert with little plates on if anyone wanted something. Everyone dispersed after that, leaving Evie in the kitchen and Niall sitting on the counter.

“Is this how you normally spend after dinner?”

“What? Doing dishes while everyone else does their own thing? Most times, but it’s my place so I feel like I should clean up.” Evie spoke, turning to the side and looked at him.

“Did you want to try a bite of this? I called my mum all the way from Ireland for this recipe and the first thing she says is ‘Are ya tryin to impress a girl’.” Niall handed a spoonful of the dessert towards her, letting her take a bite.

“Tell your mom i’m impressed.” Evie laughed.

“But really, you guys do this sort of thing? Just sit for dinner and then disperse?”

“The boys and Tori do football, my mom and gran sit in the dining room and talk. Normally, Britt and I are outside, but since she isn’t here, I’m stuck being a lost girl.”

Evie wiped her hands off then, setting the towel down by the sink and moved closer towards him, jumping her own way to sit on the counter next to him.

“So.. does this count as our next adventure?” Evie asked.

“It does, actually. Guess i’m back onto the drawing board.”

“Did you wanna borrow one of mine? I have six of them, five at work and one here in case I bring work home.”

“Funny, sweet girl, funny.”

Evie and Niall stayed in the kitchen for a little while longer, talking about aimless stuff that was brought up. Evie had warned him not to plan anything for December. That this was the worst month at her job with all those Christmas events. Niall had made a face, agreeing to the terms since he had his own busy schedule in December before heading home for the holidays.

Her family had bid Niall a goodnight and that it was nice to meet him. Evie had walked him outside to his car, leaning against it with her arms folded and a smile on her face.

“I’m really happy you came tonight… You didn’t have too and yet.”

“Your family gave me some good laughs.” She made a face and he laughed, reaching out for her hands.

His hands moved from her hands towards her waist as he brought her closer to him. He turned the both of them so that he was leaning onto the car and she was still wrapped up by him.

This silence was likeable. Both of them made faces at each other, earning laughter from both of them. This had to be Evie’s favorite sound, his laugh. She wondered if he’d say the same about her, and knowing him, it was.

What Evie didn’t realize was that both of them were getting closer, so much that their breaths were shorter and their noses were ready to touch. Niall was the one to close the gap, going in for the kiss. It wasn’t sloppy or wet, but dry and had the mixture of a guinness and toffee taste. Evie’s arms wrapped around his neck, resting on his shoulders with his hands still on her waist. It wasn’t a long kiss, but it also wasn’t a short kiss either.

Evie was the one to pull back, shades of pink forming on her cheeks. She looked away for a few seconds, trying to regain her composure and her breathing. When she looked back at him, he had a small smile on his face.

“I’ll call you tomorrow, okay?”

“Okay.” Evie breathed, nodding her head at the same time.

The place that Niall was holding onto felt bare once he let go. Her eyes watched as he got into his car and he left. She stood outside for a few minutes, letting her mind figure out what the fuck had happened.

When Evie went back into the house, she was greeted by Mitch with a smirk on his face.

“Wasn’t ever going to meet him?”

“Fuck off.”

Evie moved past him, sitting on the couch with everyone else. Her facial expression said she was paying attention, but her mind was somewhere in the clouds.

#good afternoon#i literally got on my laptop for this#therell be a jump for the next one#like not too much but a small one#anyways i hope you enjoy#theone#niall horan#niall fics#niall fanfiction#niall fic#niall horan fanfiction

15 notes

·

View notes

Text

The Ties That Bind

Thanks for all your feedback on the first chapter. I loved reading it all! I hope you enjoy the second chapter.

Once again thanks to @mo-nighean-rouge for the beta

Chapter 2 : A Recreational Activity (well, a few)

The power of a glance has been so much abused in love stories, that it has come to be disbelieved in. Few people dare now to say that two beings have fallen in love because they have looked at each other. Yet it is in this way that love begins, and in this way only. -Victor Hugo, Les Misérables

Jamie groaned and hoped that the banging inside his head would stop soon. This was the problem with drinking wine. Generally Jamie tried to steer clear of ‘grape’ and stick to ‘grain’. However, last night, he had supped copious quantities of both and now was suffering the consequences. He stretched his hand out hoping to find a glass of water and possibly even two aspirins left on the bedside table by his more responsible alter ego yesterday. There they were. Gratefully, he sank back onto the pillows and waited for them to do their work.

Parts of his alcohol-induced dreams came back to him… miles and miles of hotel corridors and he was chasing, chasing... a woman with the most gorgeous legs he had ever seen. He kept chasing her, but she wouldn’t stop and she wouldn’t turn round. A flash of wild dark curls and…

The banging in his head seemed to be louder now. “Unca,” a cross little voice added to the general cacophony. “Unca, get up now. Mam says now. ‘Tis beckfast and then ‘wimmin’. Mam says.”

Jamie forced himself out of bed. Fastening the towelling bath robe, he opened his door. His little nephew rushed past him and started jumping on the bed. Jenny stood in the doorway, her eyes darting all round the room.

“I go ‘wimmin’ with ye, Unca, wiv Spideyman shorts. What ye shorts, Unca?”

Jamie sighed and looked at his sister. “She’s no’ here. She didna stay. Nothing happened.” He grabbed Wee Jamie round his middle, lifting him high up in the air. “And who said I would take ye swimmin’, ye wee fishie?”

“Mam said so, she did.”

Jamie gently set his nephew on his feet. “Aye, well, yer mam makes an awfa’ lot o’ decisions fer the men in this family. But I guess I canna refuse, no’ if I ken what’s good fer me.”

**************

Claire lay on one of the day beds next to the swimming pool and wiggled her toes, admiring the newly applied scarlet polish. She set aside the copy of Hello! she had been skimming through and turned to Geillis.

“This was such a good idea of yours, G. Total battery recharge today… and we’ve even had the whole pool to ourselves. I don’t reckon we’ll be seeing any of that wedding party any time soon. Not if last night was anything to go by.”

“I am rather full of brilliant ideas,” Geillis agreed. “Although I feel we may have missed an opportunity last night. So many men...”

“... And no doubt so many wives and girlfriends!” Claire interrupted.

“Och, well,” Geillis dismissed Claire’s interruption. “Guess we’ll never know.”

“Anyway, so I’ve a body wrap, then hot stone massage in twenty minutes. I’m going to head into the sauna for ten minutes first. You coming?”

“Aye, may as weel. I don’t reckon there’ll be anything worth hangin’ round here fer today.” Geillis gathered up her belongings and followed Claire into the sauna.

**************

Jamie sat in the male changing room, blowing up his nephew’s armbands (Spider-Man, obviously a theme here) while Wee Jamie hopped excitedly from foot to foot.

“Now, afore we go in the pool, are ye sure you dinna need a wee? Ye ken what I told ye, as how if ye wee in the pool, the water turns bright blue?”

“Nah, Unca, c’mon now. Wanna go ‘wimmin’.” The little lad pulled his armbands up, grabbed Jamie’s hand and headed for the door. “C’mon, c’mon.” He paused and stared intently at his uncle. “Ye no Spideyman shorts?”

Jamie looked down at his blue checked board shorts and tried to look sad about this. “Sorry lad, I’m too big fer such a fine pair.”

As they entered the pool area together, Jamie looked around. It was totally deserted, which, Jamie thought, was hardly surprising based on the amount of alcohol that had been consumed the day before. An abandoned magazine lay on one of the day beds.

Wee Jamie pointed to a small passage way on the other side of the pool. “What’s ‘at?”

“Ah, nothing for ye. Just the sauna... it’s awfa hot and no’ fer children and the girls’ changing room is down there too. That’s definitely no’ fer us lads, eh?”

Following Jenny’s instructions to “wear the lad out, we want him tae sleep in the car going home,” Jamie stayed in the pool, playing with his nephew until he noticed the lad’s eyelids start to droop. He scooped him up and carried him back to the changing room, intending to just wrap him in a towel and leave the tricky drying and dressing to Jenny.

Wee Jamie held tightly to his uncle’s neck. “You fib, Unca. Ye did. I wee’d and I wee’d but no blue.”

Jamie chuckled. God, he loved this little lad something fierce and maybe someday, God willing...

**************

Claire picked up the two whiskies from the bar and made her way to the table where Geillis was sitting. The pub was quite empty at the moment, just a handful of people, like them, having a quick drink after work before heading home.

Geillis looked Claire up and down appraisingly. “Ye ken I love ye, Claire, but could you no’ wear something a bit, weel, more alluring when we’re out?”

Claire gazed down at her old jeans and plain black tee shirt. “G, I’ve been on my feet in theatre for the past 8 hours. I’m so knackered, you’re lucky I managed to change out of my scrubs and into this! Besides, however can I compete with your alllllluuure?” She drawled the last word out jokingly. “Maybe you have the allure for both of us? I can be your duff.”

Geillis raised a quizzical eyebrow.

“Designated ugly fat friend.” Claire explained with a smile. “According to the movie, every friendship group has one. You and me, we’re a friendship group, ergo, I must be it.”

“Claire, ye may be many things but fat or ugly never.” Geillis said, “Yer hair’s a wee bit wild, mind. Do ye no’ fancy a Brazilian blow dry?” She ran her fingers over her sleek strawberry blonde locks.

“And here’s me thinking a ‘brazilian’ was about a different part of my anatomy altogether!”

Geillis smiled, then a serious expression crept over her face. “But, Claire, ye dinna think ye’re fat or ugly really, do ye?”

Claire stared at the beer mat on the table, her fingers picking at it, ripping it into tiny shreds of paper. She really thought she’d outgrown that nervous habit.

“Well, no, but, it’s difficult to explain. Frank...” She could hear Geillis tutting at the mention of his name. “Frank had certain… er, expectations of how I should be. How I should behave, how I should look. The disapproval on his face if I took an extra roast potato, ordered dessert, poured myself another glass of wine. There was always someone younger, more self-controlled, thinner. So, for a while I tried to become the person he wanted me to be. I tried to see myself through his eyes and I saw the fat arse, the lack of control, the not-really good enough...”

Geillis leaned closer and gently placed her hand on Claire’s. “Thank God ye got out of there. That wasna a healthy place tae be, Claire. Ye know ye’re worth a lot more than that.”

“I know. And I am joking about that duff business but occasionally, old habits are hard to break. That’s why I’m not after a serious relationship. I’m not sure I’m ready to let someone see me as I really am.”

“But a fling will do ye no harm at all. It will do ye the world of good, let ye see how another man treats ye. In fact, we need a list. A checklist. When ye’re in theatre, ye dinna start cuttin’ till ye know everything is in place, all the boxes are ticked. So we make a list of what ye want and ye dinna start, er, flingin’ till a man ticks all the boxes.”

Claire finally put the mangled beer mat down. “A list, really?”

“Aye, it’s scientific, ye ken.” Geillis picked up her bag and rooted around for a piece of paper. Finding an unused paper napkin, she smoothed it flat on the table, extracted a pen from the depths of her bag and sat poised ready to write. “Ok. Point one…” She scribbled something down quickly.

“Come on, Let me read it.” Claire laughed, turning the napkin round. “Must look good in, and out of, a kilt. G, you have a one-track mind.”

“Och, it’s a fling we’re talking about, ye only need one track, I reckon. So, what about point two?”

“Well, I may as well play along. Point two must be no complications.”

Geillis obligingly wrote that down. “Next point. Enjoys a drink. Likes to let his hair down.”

Claire took the pen from her friend and added another line. Geillis read it upside down. “Really, it’s a fling ye’re after. Ye’re tellin’ me if they dinna like the X-Files, that’s it? Is that a deal breaker?”

“What can I say? The heart wants what the heart wants.”

“Fine, but I’m adding this one then. Fancies ye as ye are. No changing ye.”

The pub was starting to fill up. Most commuters had already made their way home, to be replaced by those heading out for the evening, coming into the pub for a quick drink before their evening plans properly began. Even on a drizzly Thursday evening, it was getting to be standing room only. Claire noticed several people eyeing their table enviously. She drained her whisky glass and stood up.

“I think that’s me done for this evening. Any more and I’ll have to be put to bed right here. I’ll just pop to the loo and meet you outside, G.”

As Claire crossed the room to the toilets, Geillis started to gather her stuff together to leave.

Immediately a woman rushed to the table, plonked herself in one chair, and stuffed her bag on the other chair. She eyed Geillis, willing her to hurry up and be on her way. Geillis ignored her and continued rifling through her bag, her movements deliberately slowing. Eventually, Geillis decided she’d had enough of the game, turned away and walked to the exit.

**************

Geneva caught Jamie’s eye as he moved away from the bar, drinks in hand, and pointed to the seats she had found for them. He sat down, taking a deep slug of his whisky as he put Geneva’s vodka, lime and soda on the table next to a tatty old napkin.

“Someone’s shopping list, no doubt.” Geneva dismissed it with a wave of her hand as Jamie picked it up and carried on telling Jamie about the difficulties in trying to find the correct colour for a new bedroom throw. “...Not really a teal, but not quite a cerulean colour either…”

Jamie knew his role in this. It was just to nod and murmur appreciatively at appropriate points in the story. That gave him time to think… unfortunately. Thinking made him realise that Jenny had been right three weeks ago at the wedding. Geneva was not the one, he didn’t need to try again just to see. And she did talk utter shite.

He groaned, which Geneva seemed to take as indication of his deep interest in her tale of home furnishing trials and tribulations. He should never have slept with her. He hadn’t intended to but last night, as the blood left his brain and migrated south, he had lost the capacity for rational, coherent thought and had followed his baser instincts. Which had been a very bad idea.

Jamie glanced at the napkin he was still holding. Straightening it between his fingers, he began to read. A woman with long strawberry blonde locks suddenly leaned over and gently took the napkin from his fingers.

“Thanks, it’s fer scientific research, ye ken.”

He watched as she walked to the door, to her waiting friend. Her friend with the long shapely denim clad legs and mad curly hair and her face, so full of life with sparkling eyes he longed to dive right into.

“What an odd thing to want.” Geneva interrupted his contemplation. “That couldn’t have been scientific research. On a used napkin. Some people are just strange.”

Jamie felt his breath catch in his throat. Jenny had been right - he recognised it. What to do now?

#outlander fanfic#outlander fan fiction#modern AU#Jamie Fraser#claire beauchamp#the ties that bind#chapter 2#fluff#bit of angst#first time writing#sorry i dont know how to add links to previous chapter here

88 notes

·

View notes

Text

The Local Government Godzilla: Should The CCC Be Taking A Closer Look At The Money-Grubbing Activities Of The LGAQ?

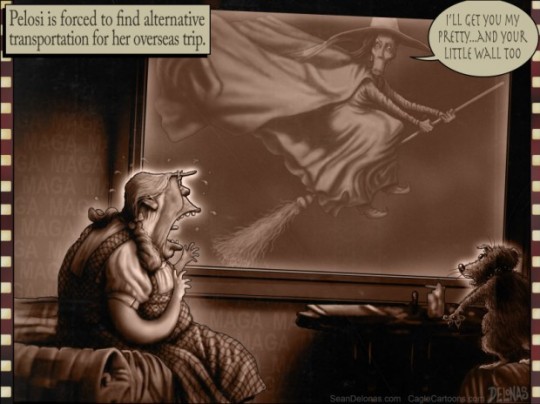

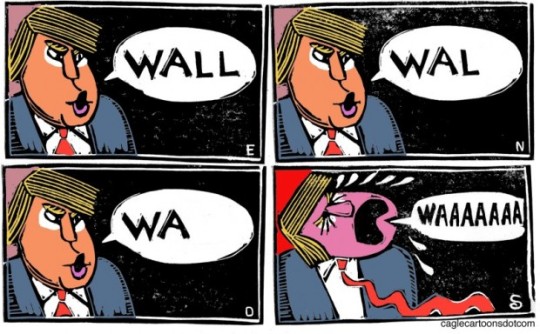

But even if the CCC isnt bothered, you should be. The Magpie has a beak around to warn of actual or threatened raids on the ratepayers piggy banks with money-spinning schemes that really benefit no one but the LGAQ itself. Also, a look back down memory lane at solicitor Barry Taylors efforts to bring to Townsville a business urger who is now awaiting sentence next month for corruption connected to the Ipswich Council. And not unrelated, in a moment of clarity, The Magpie realises that this sorry episode was the catalyst for Taylors pathological hatred of the old bird, which continues to this day with a spiteful legal vendetta. The Pie will explain how it all fits. Some sobering statistics about the real Real Estate situation in Townsville, with some graphs the Bulletin is too coy to share with you. And for those who enjoy our now regular Trump gallery, A BONUS a few select pictorial comments on Britains Brexit fiasco. But first Even Buffoons Can Occasionally Be Funny (as The Magpie Knows) Theres been a lot of huffing, puffing and posturing about Clive Colonel Blimp Palmer during the week. First there was the hissy fit by some over Palmers text message saying if he gets back onto the parliamentary plush, he will move to ban such political texting as this.

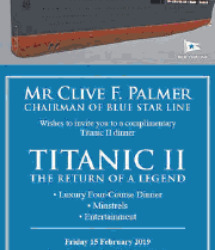

The Magpie got one, and the old birds instant reaction? Roaring laughter. Lets give Ol Lardarse a couple of brownie points the text is one of the funniest, and surely intentional, jokes of the current election campaign. Unsurprisingly, there was instant babble about hypocrisy which came thick and fast from the pompous chatterati navel gazers, but the Pie will take his laughs where he can get them, and salutes whoever thought up this one for Palmers doomed campaign (possibly someone called S. Sokolova, who authorised the text for the UAP). In fact, doomed causes seem to be a recurring theme this week for Clive, who announced he was giving a dinner dance for a select few Towns-villains to celebrate Titanic ll the return of the legend. Sad when someone has to promise free food and booze to get them to just turn up. And the general feeling is whatever sort of guest selection process that was bubbling around behind the Palmer brow, if you didnt get an invite, then you were not considered of merit or value to Clive.

But when it became known amongst our movers and shakers who was in and who was out, it was a matter of do we laugh or cry was it a hot ticket, or a hot potato ticket, to be dropped immediately? Being favoured by Palmer is something many would like to be quiet about, but then, neither is being left out of a fabulous free food fight, ones ego can be buffeted by such neglect. Many would have loved an invite if for no other reason it have the unlikely option to RSVP sod off. But Bentley for one believes it will a unique experience, with special attire for dancers.

The highlight of the night for Clive will be when the adoring and grateful throng gather around him to sing what he will think is a fitting tribute to him, a rousing rendition of the Titanic hymn, Nearer My God To Thee. What Starts Out As A Good Idea Doesnt Always End Up That Way.

The Local Government Association of Queensland has been around since 1896, and for the most part, has been a valuable and necessary lobby group for all Queensland councils. Councils pay an annual fee to belong to the LGAQ (Townsville pays around $250K annually), membership is voluntary but all 77 Queensland councils are members. In total, they pay $35million annually in membership fees. The smaller outfits get value from matters such as insurance deals and other areas where the Associations clout can be brought to bear. But about 10 years ago, under the leadership of former Townsville council executive and now the Association CEO Greg Hallam, it was decided that there were more lucrative fields in which the Associations leverage with such a captive (albeit voluntary) membership could be used to build a significant commercial operation. Put simply, the organisation decided to become commercial entrepreneurs.

LGAQ CEO Greg Hallam And boy, did they ever. Figures for 2016 show there was a massive bump in revenues, jumping from $46m to $73m, a goodly chunk of this coming from their commercial procurement arm Local Buy (that includes the $35m membership revenue). In simple terms, Local Buy has screened and listed (for a fee) various businesses from across the state, all of whom can then by-pass the tender process and submit direct quotes for contracts to any of the 77 council members. On the face of it, this saves councils money in avoiding the costly procurement work of tendering and so on. But it also sounds like an invitation to corruption on a grand scale. The Pie has no evidence of or suggesting there is, such activity, but looking at the process, there doesnt seem to be a foolproof safeguard against some expensive jiggery-pokery if someone wanted a new spinnaker for the yacht. But does it save councils money? Local Buy is anything but since it opens up work to the whole of Queensland, often bypassing truly local businesses in the highly selective process which requires a fee for ticking the right boxes (literally, apparently). Local Buy takes a cut of the contract amount of the winning quote usually 10% but The Pie is told sometimes more. Of course, since this is all above board and known, what do the quoters do? They of course factor the 10% in and add it on to their quote, in many cases wiping out any significant savings for the council involved, as well in some instances, as denying many a rate paying, money-spending locals a job . This has caused a great deal of angst here in Townsville, whose mayor is a $32K plus a year LGAQ director, and whose sidekick (now on what seems permanent leave), Stephen The Screaming Midget Beckett, is reported to have had loud abusive outbursts with local business people who have complained about the situation. And to what end is all this? Theres a great deal of money flowing into the coffers of the Association, and they arent shy of shouting themselves lavish overseas jollies disguised as work studies. Why does a lobby group want to be so entreprenurial? Do they want to reduce council membership to zero on the user pays basis (yeah, right), or some witty cynic might suggest, as a lobby group, for a bribery pool? (Just a joke, Mr Hallam, put down the phone.) But there is a more troubling aspect to this arrangement, apart from freezing out local contractors and permanent local workers rather than special workforce brought in for a set amount of time before disappearing back wherever they came from.

If you care about strong local voice in Townsvilles affairs, it would well to be wary of a crowd called Propel Partnerships, who appear to be getting into bed with the LGAQ. Propels buzz-word blurbs try to disguise their activities by describing themselves as a shared services company and pepper their media releases with such euphemisms as fully integrated customer services; Propel Partnerships is simply a profit-driven, out-sourcing business. Current (or possibly former by now) chairman Jim Soorley, that old Labor stager from way back in Brissy, had his mate Carl Wulff, the then CEO of Liverpool Council in Sydney (now awaiting sentence in chokey for bribery in the Ipswich scandal) enter into an agreement that has ended up with the NSW Crime and Corruption Commission. This sort of thing can cost local jobs and introduce a totally remote, sometimes hostile letter-of-the-law approach to dealings with staff and with the local community in such areas as rates, payroll services (shades of Qld Health yikes!) and licensing. And not a chance of a face-to-face session of negotiation. This is an extension of the popular Big Brother move in business, a model that even further removes the public from reasonable (and reasonably expected) interaction with their council. To understand what happens in both these centralisation scenario, one need look further than the dear old Townsville Bulletin, which has been so savagely ravished by Ruperts money-hungry minions and sloppy reporting staff directed from Holt Street in Sydney, a paper which hilariously subbed in NZ, Mumbai, the Phillipines or Brisbane. Of course, one attraction for councils in this model is that it does away with the necessity of either engagement or accountability with the people who elected them or provided their jobs. This is the rapidly emerging tip of a massive iceberg, with Greg Hallam and his board deciding rather than try and fight off a competitor in an money-sinkhole business battle, instead join forces and share a cut of a captive pie. This is obvious when Hallam gave this ringing endorsement : The work of Propel Partnerships ensured that councils were ableto realise efficiencies in their operations while remaining in touch with the needs of their communities. Im confident that Propel has the right formula to bring success to any local government wanting to havethe best customer service, he said. This type of service clearly does no such thing as remaining in touch with the needs of their communities quite the opposite . Mr Hallams self-serving ideas of best customer service and that of the general public may widely differ laughably so. Saving money, especially public funds, is in most instances an admirable goal, but in this case, it is just another legalised rort of dubious value: and it is actually doubtful that the average ratepayer gets a single cents benefit therell always be reasons found not to lower ratesand charges. So be wary of this sort of further alienation of individual communities by the robotic, rorting remote control of more aspects of our lives. More Lessons To Be Learned From Post-Pisasale Ipswich Before we leave this subject, check this out.

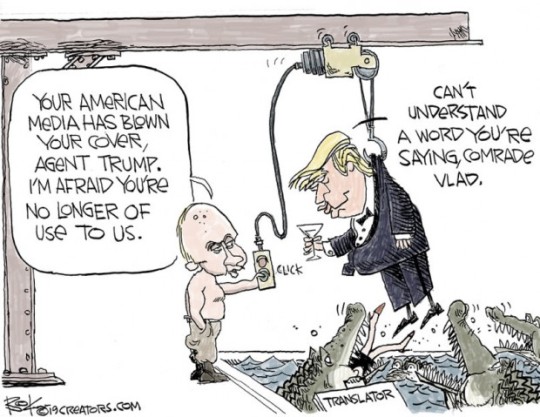

Those figures are mind-boggling and it could easily happen here unless we are on our toes after all, before his downfall, Pisasale was lionized by Jenny Hill, who said she wanted Townsville to be more like his Ipswich. It probably is, but the CCC just hasnt found out about it. And this sort of lark dovetails nicely with the cold, callous restructure advocated in the Jenny Hill-0commissioned Nous Report. And boy, hasnt that Ipswich decision put Hallams panties in a bunch. The LGAQ chief seems somewhat spooked by the Ipswich scandal coming so close to home, and used Trumps favourite trope to discourage any close examination of local government in Queensland.

That mentioned head is of course Hallam, and it could be said, on the evidence of other corruption in councils, that the word pinhead could also apply to him. Maybe the CCC might start taking an interest in the LGAQ and all those tens of millions. Now that would be interesting. Historical Snapshot: Barry Taylor And One Of His Mates Yesteryear

On the left, the bloke that looks like his got the loser of a cat fight on his head, thats the Carl Wulff that was Jim Soorlys pal at Liverpool Council before Wulff headed north to Ipswich. And of greater interest to us here in the ville is the bloke on the right. Thats Wayne Myers, a seriously well-connected go-between linking corporate life to a number of movers and shakers in the Queensland ALP. Mr Myers has pleaded guilty to corruption in connection with the Ipswich council he has admitted he facilitated bribes to go to his co-offenders who have also pleaded guilty. He will be sentenced next month when well see just how well connected he is. But heres an interesting little bit of nostalgia Mr Myers is no stranger to Townsville, or to legal fee gouger Barry the Legal Foghorn Taylor.

Back in the early noughties, maybe 2004, Meyers rode into Townsville with the hope of siphoning a good chunk of public money into his community telco business, which was being driven out of non-performing mining minnow Rennison. It was a classic case of the Mates Economy. Myer recruited local Labor fundraiser and Mooney confrere Barry Taylor to corral a bunch of bizoids into his boardroom to hustle the dollars. Each chipped in $20k (including apparently Mrs Foghorn more on that in a minute) and then Myers went about trying to convince His Radiance Mayor Mooney that the ratepayers should (1) chip in an interest-free loan of $250k, (2) $20k of straight-up equity, and (3) commit to a long-term deal for all of the Councils telecommunications needs to the new company.

As things transpired, His Radiance, in his pre-meltdown years, had the good sense to have the matter properly researched by his then IT chief Anthony Wilson, who quickly nixed the deal offered by Myers and Taylor. Despite a lot of aww, cmon, mate, old buddy, pal entreaties, Mooney said no. In fact, The Pie was told that Mooney thought the whole thing a bad joke. The deal on the table was a dud. Myers model guaranteed fees to Rennison first and before anyone else; would have delivered sub-par service and cost outcomes to Council (Council could and did do much better); never budgeted for a repayment of the proposed loan; and didnt have a cent of interest for Council. Poor old Richard Spiderman Ferry had become the chairman of a local business he knew nothing about. He was left carrying the can, when the business model proved a failure. There is no information about what happened to any monies that may have been handed over, but you can bet Bazza put in a bill for any legals. What Myers (and Taylor, who mustve surely twigged to what Myers was up to if he hadfnt twigged, doesnt say much for his legal or business radar) tried to get away with was an arrangement where Rennison re-sold Optus Services to NQ Telco, and took a clip. Too many layers with too thin a set of margins doomed the activity from day one. Myers went on his way, and Bazza carried on his hosting of other southern white shoe brigaders and their dubious schemes, notably the disgraced fraudster Craig Gore (currently fled to Sweden in the hope of avoiding jail on multiple charges of financial fraud), who risibly said he would put in a canal estate in the duck pond in front of the casino. Considering what happed later with Port Hinchinbrook, Townsville really dodged a bullet there when that all fell flat, but no thanks to Mr Taylor. But All This Has Led To A Personal Revelation For The Pie The Magpie has never fully understood the seething animosity that has driven Taylor on a vendetta against him that continues in the courts to this day. Barry on several occasions over the years, had threatened to sue me, but was never able to say for what (he was drunk on two occasions). Of course, he was all hot air at that stage because Bazza was never brave enough in his bluster to take on News Ltd, for whom I worked at the time. When Peter Gleeson came to town, he was in Barrys pocket even before he arrived, with his wife pre-promised a cushy job with Enema Legal. I was puzzled that a boisterous boofhead like myself could attract such venom. At one stage, Taylor had Gleeson direct me to delete a quite harmless mention of him he had heard I was to include in the Magpie column (the comment simply said he had bought a multi-million dollar property in Noosa, and Barry said it could damage his reputation in Townsville his what, you laugh?) that was only time any editor interfered in any of my opinion columns for personal and not legal reasons. In that incidence, Taylor sent in a handwritten letter which Gleeson showed me (appalling writing and grammar) that strangely said that I was waging a campaign against his family. I didnt, and dont know his family, and quickly proved in the papers computer system that I had mentioned Taylor a total of 7 times in 8 years, none of them derogatory. I mentioned his wife in passing once when I wrote that she was the director of a company THAT HAD PUT $20k INTO A DUBIOUS TELCO BUSINESS WITH THE COUNCIL! Nothing illegal or even untoward was suggested, except that I didnt think it was a good idea. So there we have it. That must have been the start of it all, Baz not only being caught out in the subsequently failed telco venture, but that I had revealed he had inveigled his missus to whack up some cash as well (through a company of which she was a director, as I remember). Totally harmless, just a bit of local gossip, but somehow, Barry became as jumpy as a long-tailed cat in a room full of rocking chairs. His bluster continued down the years, including threatening to arrange a boycott of Michels restaurant if they didnt drop their advertising on this blog. (They did drop the ads, he was a valuable albeit much disliked customer, but were happy to let me keep the couple of hundred they had paid.) And so it goes on still, he talked poor old Rabieh Krayem into suing me for alleged libel, knowing full well that I have no money or assets to pay 100th of the ludicrous $300,000 claimed. Well, Baz, hatred comes at a cost, because you didnt reckon on two highly principled and incensed lawyer friends who offered to defend me because they cannot abide bullying, especially legal bullying like trying to spuriously involve my daughter on a technicality in matters that dont even remotely concern her. That alone was a clear measure of your craven behaviour and that of the ninny Venesa Gleeson (Typos wife) as a mother herself, youd think she might have some scruples, but alas, she will use the Hitler excuse I was just following orders least the Court of Appeal has chucked out that bit of vicious nonsense. Rabieh, make sure you have it in writing that Barry is doing this for nothing for you, and that it really, as a mutual friend told me, purely Barrys show. Otherwise, those Nudgee fees for your two lads may well end in up in the Taylor bank account in Noosa. The Townsville Property Market Will Be Hunky Dory In 2019, Says The Astonisher. As the Hotels Combined teddy bear says on telly Really? Dont believe everything Mr Convincing tells you.

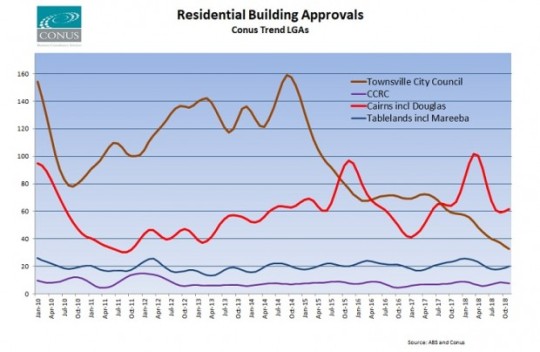

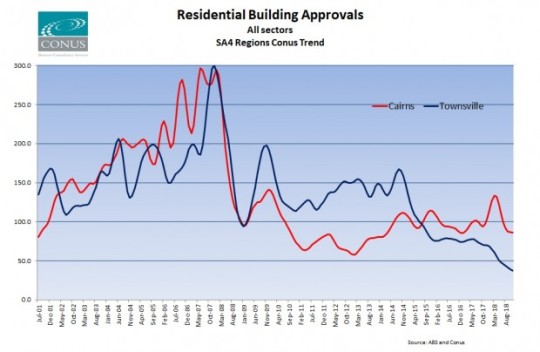

Since the City Economist, David Lynch, seems largely silent, heres a chart showing building approvals for 2018 (December numbers not available yet). The data is from the Councils own website.

One could do some extra work and show the comparisons for the previous year, or two for that matter, but why take work away from Lynchy. To summarise: to the 11 months, in 2017 there were 641 dwelling approvals. In 2018 there were 432. For those numerically inclined thats 209 fewer or 30.2% less in number. And gee, I thought the stadium was going to be the one catalyst that would turn the whole show around. The one catalyst claim came from none other than the muppets at Enterprise House (where Mr Lynch used to work.) And to cap things off, The Pie offers these self-explanatory charts.

However, the Astonisher persists with its cheery inanities, but raises an interesting pictorial question. One of the spangled cheer leaders of this self-serving guff is this bloke

Propertyology managing director Simon Presley A propertyologist sorely in need of a psychologist and some serious sartorial advice. Seriously, are you going to believe a bloke who decides to sit in the middle of a busy Brisbane road, with an empty chair next to him to signify that no one else is that dopey. Keep it up, Mr Presley and youll soon be joining your namesake. Captain Towns May Have Been A Blackbirder But At least we have tucked his statue away in a discreet corner, but not those right-wing race-baiters up in Cairns. They have even got Captain Cook throwing a big Nazi salute.

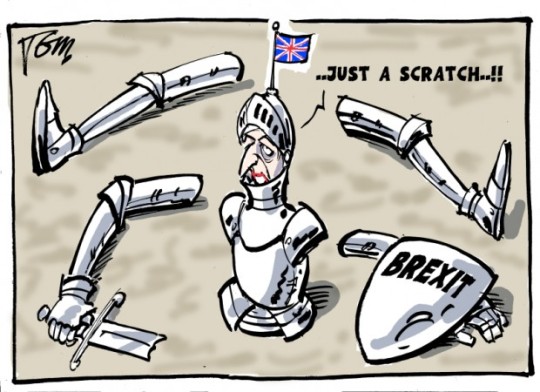

Finally, Not One But Two Mini-Galleries On Overseas Matters The first is the Brexit hullabaloo, which is far from over, but has been a cartoonists cornucopia. Heres four of the best.

And That Leads Us Into The Week In Trumpistan What a difference a few hundred metres makes. Because of his tantrum induced government shut-down, Trump was without catering services to entertain a visiting football team. So as a man addicted to whoppers, he called in Burger King to provide the food for the boys (he couldve just as easily gone with Maccas, asking his guests You want lies with that?)

And just down the road in DC at the very same time, there was a food line of Federal employees who havent been paid that stretched around the block of this massive federal building.

So its true what they say about America being a land of contrasts. That issue continued to dominate the visual commentary of the week, but the New Yorker knew who was needed to sort out demon Donny.

And so it goes .. Thats it for this week, Nesters, and remember that comments run throughout the week, have your say, there was a very lively thread on the council getting involved in the citys mental health work (some hilarious) and theres plenty of fodder in this weeks Nest. And The Pie is loathe to say it, but times are a bit skinny in the Nest at the moment, with a few blog bills hitting the deck since Christmas, so any help with a donation would be greatly appreciated. The how to donate button is below. http://www.townsvillemagpie.com.au/the-local-government-godzilla-should-the-ccc-be-taking-a-closer-look-at-the-money-grubbing-activities-of-the-lgaq/

0 notes

Text

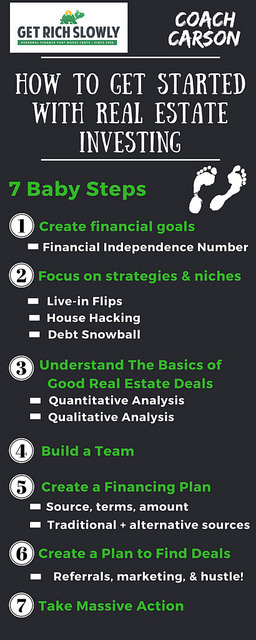

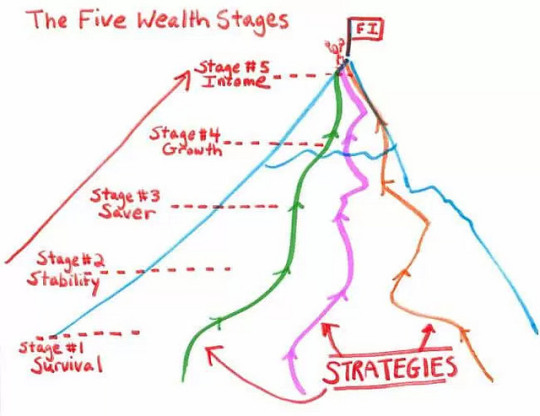

How to get started with real estate investing

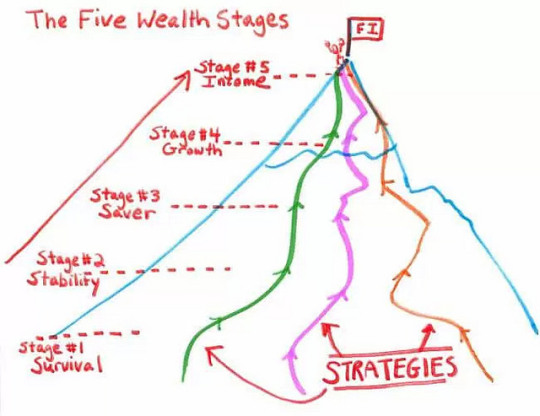

Todays article is from Chad Carson, who writes about real estate investing (and other money matters) at Coach Carson. Ive always been intrigued by real estate investing but overwhelmed by how much info available. I asked Chad if hed be willing to write an article that would help me (and other GRS readers) understand the basics of real estate investing. This is the result. I got started in real estate investing right after college. Because a young adult can basically sleep in a car if he has to (my 1998 Toyota Camry with cloth seats was comfortable), I had little to lose by launching a business. Unfortunately, as a Biology major, I also knew very little about business or real estate. But I did know how to hustle and to learn. That helped. Slowly, I learned to find good deals and to resell them for a small markup of profit (a.k.a. wholesaling). I also learned to buy, fix, and flip houses for a bigger profit (a.k.a. retailing). After a few years, my business partner and I began keeping some rental properties because we knew that was the path to generating regular, passive income. While my early business might sound like an exciting HGTV house-flipping show, its not for everyone. I experienced radical ups and downs of cash flow, and there were many unpredictable outcomes. I learned a lot being a full-time investor, but there are actually easier ways to get started. Most investors I know started with a full-time job. They became valuable at their job, earned good money, lived frugally, and started boosting their saving rate. With their extra savings, they began buying rental properties on the side. Im not saying you shouldnt begin as a real estate entrepreneur like I did youll know if youre called to make that leap but if you currently have a non-real estate job and youre saving money, youre already going down the easiest path. The next step is to learn how to invest that money profitably and safely. I personally think real estate investing is one of the best ways to do that. Ill show you why thats the case in the next section.

Why Real Estate Investing? Because Its Ideal! Ive yet to find a better way to describe the benefits of real estate than this. All you need to remember is the acronym I.D.E.A.L: Income. The biggest benefit of real estate is rental income. Even the worst rentals I find produce more income than a portfolio of other assets like stocks or bonds. For example, I often see unleveraged (no debt) returns of 5-10% from rental income. And with reasonable leverage, its possible to see these returns jump to 10-15% or higher. The dividend rate of the S&P 500, on the other hand, is only 1.99% as of 1/24/17. And the yield on a broad basket of US bonds as of the same date was only 2.41%.Depreciation. Our government requires rental owners to spread out the cost of an asset over multiple years (27.5 years for residential real estate). This produces something called a yearly depreciation expense that can shelter or protect your income from taxes and reduce your tax bill. (For more about this, check my article The Incredible Tax Benefits of Real Estate Investing over at Mad Fientist.)Equity. If you borrow money to buy a rental property, your tenant basically pays off your mortgage for you with their monthly rent. Trust me: Having somebody else pay your mortgage is a beautiful thing! Like a forced savings account, your equity in the property gets bigger and bigger over time.Appreciation. Over the long run, real estate has gone up in value about the same rate as inflation, roughly three to four percent a year. Combined with the three benefits above, appreciation can produce a very solid long-term return. But this passive style of inflation is not the whole story. Active appreciation is even more profitable. You get active appreciation when you force the value higher by doing something to the property, like with a house remodel or changing the zoning.Leverage. Debt leverage is readily available to buy real estate. This means your $100,000 of savings can buy five properties at $20,000 down instead of just one property for $100,000. Interest on this debt is deductible, so you also save on your taxes. (While this can be helpful, keep in mind that leverage also magnifies your losses if things go bad.) These IDEAL benefits are core reasons to invest in real estate. But as a Get Rich Slowly reader, I think youll appreciate another core real estate investing benefit: control! Controlling Your Financial Destiny

I love J.D.s message here at Get Rich Slowly: You are the boss of you! You can apply this lesson to so many parts of life, but it especially applies to your finances. Real estate investing fits very well with the GRS philosophy. Why? Because real estate gives you much more control than other more traditional investments. Im also a fan of low-cost index fund investing, for example, but do you have an impact on the returns of your stock portfolio? Not really. The 3500+ managers of the companies owned by the VTI total stock market index fund do impact your returns, but not you personally. You simply control when you buy, how much you buy, and when you sell. But with a rental duplex, for example, your decisions directly affect its profitability (for better or worse!). You can buy in certain neighborhoods and ignore others.You can negotiate with your bank, with the seller, and with your vendors to get better prices.You can choose the property manager and the types of tenants who will ultimately produce the returns for your investment. If this prospect of control excites you, then keep reading. But if your palms are clammy at the idea of hands-on investments, just focus on a different vehicle. Thats okay. There are options for everyone in this big investing universe! To make things manageable, were going to break things down a little. As a baby, you learned to walk by taking tiny steps. You also fell down a lot, but with a diaper four inches from the ground, whats the harm?! Well, youre no longer a baby. Financially you do have a lot to lose. Your family, your hard-earned savings, your plans for financial independence, and your pride would all suffer if you made bad investments. I get that. And thats why we still need to take safe, baby steps. Therell be plenty of time to run and grow faster once youre more confident. But in the beginning, just strive to move forward steadily. The seven baby steps below provide a simple path to follow. Ive taken each of these steps personally. You can use them as a blueprint to help you move forward with your own real estate investments. Step 1: Create Financial Goals Real estate is simply a financial vehicle. Before you begin to buy real estate, you have to have a clear picture financially where the vehicle will take you. If you havent done it already, read J.D.s Financial Independence in Plain English. Youll learn that a solid financial independence goal is to achieve a net worth equal to your current annual expenses multiplied by 25. In other words, if you spend about $50,000 per year, your goal should be to achieve a net worth of around $1,250,000. With this level of wealth, you could likely withdraw 4% of your net worth each year without completely depleting your money. While these assumptions are typically made for traditional portfolios of stocks and bonds, real estate works much the same. In fact, its much simpler. Lets say once again you spend about $50,000 per year. And lets assume you can produce a cash-on-cash return of 6% with your real estate investments. (This return or better is achievable once you get going.) This would mean you need a net worth of $833,000 ($50,000 .06) to achieve financial independence. (For more details, check out my article How Many Rental Properties Do You Need to Retire.) In case you didnt notice, real estates income producing ability allows you to become financially independent with a much smaller net worth than alternative investments. In other words, you get to financial independence sooner! Just another benefit of real estate investing! Now lets pick a real estate investing strategy and niche.