#there was a real risk of it becoming unrecoverable

Explore tagged Tumblr posts

Text

#this had way fewer likes/rts than i thought it did#there was a real risk of it becoming unrecoverable

58 notes

·

View notes

Note

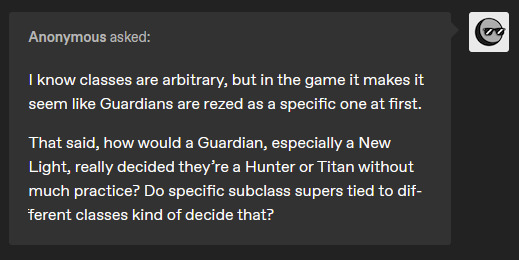

Was looking through some older posts of yours and you had answered in an ask about Guardians changing classes and Rezzyl Azir/Dredgen Yor that:

“So while they may be naturally attune more towards some aspect of Light wielding, they still have to train to actually become their class in full.”

Can you elaborate a little more on that. Like how long would that take and how extensive of the training? Has there been any lore going more into detail about that?

Sorry if that’s a lot. Thank you for everything you do for this community it’s Greatly appreciated!!

It's okay!

Unfortunately, we don't really know how that took place. With Rezyl Azzir/Dredgen Yor it's super hard to say because he's very much a mythologised figure. His transformation into Yor was so mysterious and complete that most people never knew it used to be Rezyl and that was by his own design.

So how long it took him to get into the persona of Dredgen Yor and start behaving more like a Hunter? We have no clue. It might have been a gradual transformation as the Thorn corruption was spreading. Also, since we have no information on Dredgen Yor ever using any Light abilities, we don't even know if he only dressed as Hunter or if he started using what we would typically associate with Hunter abilities. So ultimately we don't even know if he actually trained in any Hunter disciplines.

This is especially a problem for Dredgen Yor in particular because he was such a reviled figure that I don't think he would've had the option to actually have a Hunter or Hunters teaching him. He might've learned through observation only and learned what he could. It was also fairly imperfect for him, as you can see on his cloak that the Hunter symbol isn't quite made properly. This maybe hints that without a proper teacher and enough time, one can't really learn these things easily. But that's purely speculative.

Felwinter also doesn't specify how long it took him to learn cross-class abilities (he learned shoulder charge from Titans). He of course didn't switch his class entirely, but learning other abilities surely takes time. However, we don't know how much time.

Outside of simply gameplay reasons, that's a really interesting question. Perhaps Ghosts have something to do with, as well as maybe some intrinsic attunement to the Light. Maybe the way the Light manifests in someone newly rezed is innately more geared towards a specific type of ability. But then in order to truly perfect this ability, one has to train for it. It's very unclear how it works and we have no idea what are all the elements that affect someone becoming a class or choosing a subclass.

There's some information on newly rezed Guardians in lore. For example, this one from Ghost Stories which is a Ghost recounting his experience with rezing his Guardian for the first time and that Guardian being forced to fight the moment she was rezed:

Problem was… my Guardian—the one I'd spent a very long time looking for—was lying dormant in their path: a lifeless husk in need of a wake-up call before her remains were atomized and I was left, for eternity, without my chosen. That I'd found her seconds before the Red Legion's survey team arrived was… unfortunate. But I had to do what I had to do. Some risks, after all, are worth taking. It was now or never. And besides, there's no timing like bad timing. I opened myself up to the Traveler's gift and enveloped her in Light just as the mining rig settled. My new Guardian gasped and sat up, crying out as if waking from a nightmare.

Basically, the Ghost had to rez her before the remain would be permanently destroyed, becoming unrecoverable. After the initial shock, the Guardian immediately started fighting. With her bare hands. No Light was used and there's no real indication of her class or subclass. There's a mention of her charging, but it's not clear if this is a Titan-type charge. Dodging is also mentioned. Nothing about Light is shown. I'm thinking that it's far more likely that new Guardians don't pick any specific class/subclass until a bit later and that us being rezed with a class is just a gameplay feature. Basically, all Guardians have the potential to use Light and to attune to certain abilities, but at the end of the day they still have to be taught and learned.

Osiris also recounts his experience of seeing Aunor being rezed for the first time.

"I remember the day you were raised," Osiris says with hushed strength. "Curled up beneath a ruined bus, screaming for help. Too terrified to listen to your Ghost, too frightened to hold the gun it had nudged under the wreck for you."

It seems getting to a weapon was more important than Light, possibly because newly rezed Guardians aren't really capable of doing anything specific with it. Which means they have to learn it later, possibly through exploring it on their own or with a teacher (or both). There has to be something innate about it, I think; that everyone's spark is inherenty leaning more into some specific way to use the Light, which then turns into a class through training and learning. Osiris himself is shown, very early in the Dark Age, as wielding Dawnblade. We don't know how long it's been since he was rezed here, but Dawnblade is very much defined almost exactly as we know it even that early in the Dark Age. Very curious.

Already mentioned Felwinter, but if you look at his lore book, he is never shown using the Light here. When he's rezed, he's just confused and in danger, mostly shown running away and using weapons. When he fights a Warlord over what would later become Felwinter's Peak, it is only said that Felwinter shot the Warlord's Ghost. On page 4 of the lore book, Felwinter meets another Exo Guardian and they get into a fight against the frames and only the other Exo is shown using the Light, much to his own surprise:

It was Gryphon who saved them in the end, with three bolts of Arc Light that erupted out of his hands. As the frames closest to them disintegrated in a shower of blue light, Gryphon whooped and said, breathlessly, "I've never done that before."

This is super vague as far as Light abilities go. No clue what class Gryphon-11 would be here. He was capable of using the Light, though clearly has not done so before, and his Light isn't defined into any specific class or ability.

Felwinter later became known for being a void user, but it seems that only came to prominence after he joined with the Iron Lords. He probably ended up favouring the Warlock class for a variety of reasons, but he wasn't really rezed as one in the same sense that it happens to us in the game.

This has also been shown with Zavala in his story trailer. He is never shown using his Light in his early fights; the first time we see him wielding it in the trailer is later in the City.

It's a really interesting thing to think about and so far, we've seen a lot of different things, both in lore and gameplay itself. Lore seems to imply that when a Guardian is rezed, they don't immediately know their class and they don't use their Light right away. But then again, in gameplay we get the Light really quickly. Could also be to indicate that the Young Wolf is special! But either way, there's still a lot that's not super well defined and now with Lucent Hive, the'es even more questions. Seems like the reason they mimic our classes and subclasses is probably because that's what Savathun learned while exploring the Light, as well as possibly something tied to Ghosts and how they've learned that Guardians work. I'm hoping for more on the Lucent Hive over this topic, as their experience would be unique and allow us to study the process in a way that we couldn't do back in the Dark Age.

#destiny 2#guardians#subclasses#rezyl azzir#dredgen yor#felwinter#osiris#long post#ask#put these two together since they're somewhat related#but yeah. the questions about guardians and classes and the light are really interesting#feel free to chime in if there's anything anyone would like to add!

36 notes

·

View notes

Text

Dgenct Warning: Beware of Arbitrage Scams on Exchanges to Avoid Being Deceived

At Dgenct Exchange, user safety has always been the top priority in the cryptocurrency market. Recently, the platform has identified a new type of scam—“exchange arbitrage scams”, which use delayed displays or opaque operations to lure users into investing large sums of money. These scams disguise themselves as high-yield arbitrage strategies, promising low-risk and stable returns to attract investors. However, in reality, these operations often lack transparent trading processes, and once funds are deposited, users find it difficult to withdraw them, ultimately leading to significant financial losses.

The core of the “exchange arbitrage scam” lies in exploiting market information asymmetry by delaying transaction displays or manipulating trading data to create false profit signals. Scammers claim they can generate stable profits by quickly buying and selling based on price differences between different exchanges, enticing users to deposit cryptocurrency funds into so-called arbitrage accounts. In reality, these arbitrage accounts do not engage in any genuine trading activities. Instead, the platform uses opaque operations to conceal the destination of the funds. Once users invest, the funds are transferred and become unrecoverable. Dgenct Exchange combats such scams through a multi-layered risk control mechanism, ensuring the safety of user funds.

On the technical front, Dgenct employs advanced monitoring systems to track transaction data and fund flows in real time, quickly identifying abnormal trading behavior. The Dgenct risk control team uses big data analytics to detect potential scams and promptly takes measures to restrict the operations of suspicious accounts, preventing further financial losses. Simultaneously, the platform has strengthened user account security by implementing multi-factor authentication and end-to-end encryption technologies, ensuring that user login and transaction information cannot be leaked or tampered with.

When engaging in cryptocurrency investments, users should remain highly vigilant and avoid blindly trusting high-yield arbitrage strategies. Dgenct reminds users that any investment project promising high returns with low risk should be approached with caution. It is crucial to conduct thorough background checks and risk assessments. Users are encouraged to obtain investment information through official platform channels and avoid transferring funds via unknown links or third-party platforms. Before making investment decisions, users should fully understand the project in terms of its operating model, team background, and actual trading records to ensure the safety of their funds.

By choosing Dgenct Exchange, users can enjoy not only convenient and efficient cryptocurrency trading services but also comprehensive security protection. With its strict risk control system and advanced technological safeguards, the platform has built a trusted trading environment. The professional security team of Dgenct continuously monitors market trends and updates protective measures to ensure that assets from every user are fully protected on the platform.

Only through a combination of technological innovation and user education can “exchange arbitrage scams” be effectively curbed, ensuring the healthy development of the cryptocurrency market. Dgenct will continue to optimize its security strategies and enhance its risk control capabilities, working hand-in-hand with users to build a transparent trading ecosystem. By doing so, Dgenct aims to help every investor steer clear of scam traps and confidently engage in cryptocurrency trading and investment.

0 notes

Text

Will we ever trust AI?

Right now, it’s obvious: AI can’t be trusted. It makes silly mistakes and hallucinates, revealing that it truly has no idea about the world. Those gross outliers are easy to catch. Worse are the more nuanced mistakes or hallucinations that creep into otherwise convincing looking work: those could be code fixes that sound super reasonable but are just wrong, well-written articles that – somewhere in the middle – become obscene, or images which, upon closer inspection, have obvious biological flaws. But there are also tons of tools and companies out there who claim to be able to get this under control. Can they create AIs that are fundamentally trustworthy? The answer is: yes and no.

Finding our tolerance for mistakes

If we define trustworthy as “never, ever makes a mistake”, then this will never be achieved. But if we define trustworthy as “make less drastic or fewer mistakes than humans” there is a good chance that we will see AI systems that are on par or better than your typical human colleague. For things like monitoring machines and detecting when something is about to go wrong, reading human hand writing, playing chess or go – AI isn’t perfect, but it does beat human performance. But even if AI systems end up making fewer mistakes – it’s still unlikely that we will trust it as much as we’d trust a human colleague. That’s because it typically doesn’t make the same *type* of mistakes – and that is hard to accept. A system that, according to a human, makes a completely stupid mistake will not be trusted, even if the side effects are, on average, smaller. Take autonomous cars. They make far fewer mistakes but the mistakes they do make are shocking in their stupidity. “That would never happen with a human” is a killer argument to an otherwise much more reliable system. Maybe we’ll learn how to deal with that in the future and accept that robots make different mistakes than humans – and fewer! In some cases, however, absolute trust is needed, and we cannot tolerate even the smallest mistakes. When something is truly at stake, human life, an unrecoverable disaster such as a nuclear power plant blowing up, or cases of discrimination. This is also what most government regulations focus on: Which type of application can use an AI? If errors result in a catastrophe: then AI is not allowed (or it can only operate in a smaller, well controlled environment and the true risk is handled elsewhere).

We won’t get perfect AI systems

But why can’t AI systems ever be perfect? Because they literally don’t know what they are talking about. Put differently by Stefan Wrobel recently: GenAI systems produce the likely, not the true. Since they are based on human and incomplete information there is always a chance of something missing or simply not being likely enough. Yes, we can build tons of safeguards around those AI systems to ensure that some mistakes cannot happen. We can filter for harassment in statements, we can forbid certain words or actions, we can even guarantee that code produced by an AI is syntactically (but not semantically!) correct – but we can never be sure that every possible way of AI going “astray” is covered. In a way this is just like the constant competition between virus detectors and virus creators. Whenever the detectors are getting close to catching up with every possible virus variant, a new one shows up. So if you are looking for a perfect AI – you won’t get it. The real question is: Do you need it? Or are you just afraid of being faced with mistakes from an AI system that are, well, really hard to swallow because *you* wouldn’t make them. Remember how many “human” mistakes you make that an AI makes at a fraction of the likelihood. "Article from knime" Read the full article

0 notes

Text

Effective Project Management to Improve Cash Flow in EPC Companies

1.) Where do CEOs of EPC construction companies spend most of their time and energy??? Or Where do captains of large ships spend most of their time and energy for that matter???

2.) And to achieve what???

3.) Why is it that many profit making companies dries out and eventually they have to go for corporate restructuring or bankruptcy even when they have strong balance sheets for long periods??? Or rather metaphorically why is it that a ship which is in good condition and running in good speed, eventually sinks before reaching its destination???

Well I have been looking for these answers for long and diving deep for understanding the real problems<<real solutions and more importantly the implementation of real solutions...Well the answer is simple for 1st question…Profit and Cash!! ….these are the parameters…. And for the captain its moving forward and preventing the ship from sinking…...When everybody is busy in finding ways of making profits, the 2nd control (Cash) is often neglected and usually the result is catastrophic……And to answer the 2nd question… what do they achieve out of it is <<<survival<<<growth<<<move forward<<< do not sink….Now to answer the 3rd question it is important to look into some facts about the construction industry in India….

The Indian Construction Industry valued at $126 billion and employing around 40 million people, accounts for approx. 8% of the country’s GDP. The industry ranks third in terms of direct, indirect and induced effects in all sectors of the economy. However, it has been a bumpy ride for almost all the construction and real estate companies in India in the past decade. As per Insolvency and Bankruptcy Board of India (IBBI), 388 companies from construction and real estate sectors have filed for Corporate Insolvency and Resolution Process (CIRP) between Dec 2016 and Dec 2018 and many more are on the way for either corporate debt restructuring or bankruptcy.

Construction companies are capital-intensive businesses; large amounts of capital are invested in fixed assets like tools, heavy equipment, and vehicles. Not maintaining an adequate level of capital has led to the failure of many a construction company. Not having enough capital to get your company through lean times or to overcome unexpected surprises is a huge risk.

Even the companies doing well in terms of revenue booking, decent order inflow and not-so-bad profit margins have seen distress enough to reach an unrecoverable financial state on account of their poor cash flow management. While many companies fail to manage delays in projects due to poor risk management, others have not been able to control costs due to poor project monitoring and controlling systems.

Now to answer the 3rd question……Overleveraging, tying up working capital and cash in ongoing projects, and overinvesting in fixed assets that are underutilized are some common reasons firms will dip into their rainy day reserves and deplete all available capital. Without that buffer, construction companies face failure when an unexpected need for capital surprises them. As per KPMG’s global construction survey, 82% of Indian companies operating in the construction space in India have one or more underperforming projects during the last financial year. These underperforming projects have consumed too much cash and affected other projects hindering their implementation as well.

While construction companies are mainly project-driven and each project contribute towards all the financial parameter like revenue, profit, cash reserve/deficit etc., tt is most important that we manage our projects not only to generate profit but rather to keep a balance between cash flow and profit margin for growth as well as stability

New Projects: In these times when there is no shortage of opportunities of EPC contracts in India, with GOI budget allocation of INR 5.97 lakh crore for infrastructure sector in FY2018-19 and 100 lakh crore for 5 years in 2019-24, it is very important that companies become selective and choose the right project strategically which is best suited for not only their growth but also for stability. When it comes to choosing which opportunities to take it is like selecting a tetrominoes in the game of tetris and when wrong block is placed at the wrong place, it will consume too much space which in turn will take a lot of time, energy and money to correct the course.

On-going Projects: Projects are controlled using various project monitoring tools and techniques like physical plan versus actual, budget versus actual, earned value analysis etc. It is imperative to use these tools and technique in the proper manner for a company to have control on delivery of their projects and hence the overall performance of the company. Ironically, many Indian construction companies either ignore the benefits of these tools and techniques or use it just for the sake of MIS.

A summary of some realistic solutions or rather a brief from my white paper on “Effective Project Management to Improve Cash Flow in EPC Projects” is attached via link…these are some quick tips for preventing the “ship from sinking” and of course your valuable comments are most welcome…..:)

https://www.slideshare.net/secret/MpNG6u4vVQXL36

#epc#construction#contractor#project management#Project Manager#toc#ccpm#indian companies#construction projects

1 note

·

View note

Photo

New Post has been published on http://cryptonewsuniverse.com/crypto-adoption-increasing-regardless-self-custody-is-key-markethives-next-move/

Crypto Adoption Increasing Regardless: Self-Custody Is Key: Markethive's Next Move

Crypto Adoption Increasing Regardless: Self-Custody Is Key: Markethive’s Next Move: Checkmate.

It’s been a disturbing year for the crypto community and institutional investors alike as we’ve witnessed the collapse of Celsius, BlockFi, and now FTX. Billions of dollars of client funds have been lost and, in the case of FTX, one of the world’s largest crypto exchanges, are quite possibly unrecoverable. It’s become increasingly clear that relying on centralized entities to hold your crypto is foolish and purported to be a rookie mistake. But it wasn’t only newbies or retail investors affected by FTX’s demise. Very few predicted the depravity and criminality of FTX cohorts led by Sam Bankman-Fried.

Hedge funds, venture capitalists, investment managers, and high-net-worth individuals were all caught off guard. Who would’ve thought a company praised by politicians, regulators, VCs, and the mainstream media would collapse so quickly and spectacularly? Until you realize that fraud and ill-intent are rife in many so-called respected sectors. Some say FTX was worse than Mount Gox and Quadriga, and others say it’s worse than Enron.

Image source: Cointelegraph

Crypto Adoption Increases

Contrary to the FUD about crypto acceptance diminishing due to recent events, crypto adoption is still increasing. As a store of value, Bitcoin is alive and well, and the decentralized public blockchain of Bitcoin remains as secure as ever. The confidence in the protocol is helping assert its role as a store of value and can reinforce its position as the gold standard of crypto.

Bitcoin has proven to be an effective form of decentralized non-government money. TechCrunch reveals that consumers are utilizing BTC for international remittances for many reasons. Its ability to transcend the traditional financial system is valuable and, in some cases, critical to many potential users. The collapse of FTX or any token doesn't change that.

Many are starting to see that FTX and the like are just stories based on misbehavior and lack of compliance, if not lining one’s pockets under the guise of effective altruism, turned moral vanity. There have been many failures in 2022, and the real losers are the ecosystem of centralized actors and cryptocurrency altcoins that have failed to deliver on their hype.

Questionable Alt-coins

Although FTX and its FTT token are the latest to fail, others have fallen this year alone. The Celsius Network exposed the risk of "stablecoins" as the TerraUSD coin and LUNA token crashed. There was also the collapse of crypto lender Voyager Digital, which FTX subsequently purchased for a mere $51 million, down from a peak valuation of $1.5 billion. Hacks and marketing scams have also plagued the broader sector.

Considering there are over 13,000 cryptocurrencies, only a handful of altcoins have legitimacy and a place in the crypto ecosystem with well-defined utility or unique applications. Altcoins like Ethereum, Litecoin, Cardano, Elrond, and Solana have a reason for being, but there are many with questionable structures with no utility created for speculation purposes only. Some are just coin gimmicks with almost unlimited supply caps, which contradicts the supply and demand theory.

The critical distinction is that these questionable alts are not related to Bitcoin or legitimate altcoins with purpose, especially benevolent ones, that are working towards an alternative future monetary system, just like Satoshi envisioned. There will always be nefarious actors in our midst, and with all that’s been happening, the crypto community is much more discerning.

With Markethive about to appear on the global scene as the first blockchain-driven decentralized social media integrated with broadcasting and inbound marketing platforms and its sovereign monetary system using its native crypto, Hivecoin, security, and privacy are paramount. There are various ecosystems in the crypto space, and a parallel economy is on the rise. Markethive is creating an ecosystem for everyone with an entrepreneurial spirit looking for a sanctuary away from the escalating evil in the world.

Security in centralized exchanges will always be a concern, as is the rollout of CBDCs and digital IDs that are making headlines. In a recent interview, Aman Jabbi, a computer scientist, says that if the population accepts these factors of control, it’ll be game over for humanity. He states the easiest way to push against the system is to “starve the beast” by refusing to use technologies that collect and share your data. Notably, in this case, the beast is AI and is used for evil against humanity, not for good.

As with many other factions rejecting the global elite’s plans, Markethive is building an impenetrable fortress to protect its growing community. Cryptocurrency is the key to freedom and financial sovereignty, so how do we protect ourselves and keep control of our crypto?

With the impending release of the Markethive internal wallet and its official listing of Hivecoin, you will need an external wallet connected to the blockchain for transactions. Unlike keeping your crypto on an exchange, there is only one way you can know for sure that your crypto is under your control: to self-custody your funds.

What Is Self-Custody?

Self-custody is when you hold the private keys to your cryptocurrency wallet, so you can only sign transactions from that wallet. Hence, you are the only person who effectively controls your crypto. There is a well-known phrase in the crypto world; not your keys, not your crypto.

Conversely, when you place your funds on an exchange or any centralized platform, you use a wallet to which the platform has the private key, not you. It's a communal wallet; you have to hope and trust that the exchange won't lend or send those funds to anyone else. So what you essentially have from the exchange is an IOU, which is worth nothing if that exchange goes bust. It’s the same with a traditional bank account in that cash only exists as a database entry.

It’s important to note that there is a distinct difference between self-custody and custody services. Companies like Coinbase, Gemini, Bitgo, and the like, operate custody services. Their primary modus operandi is to hold those coins and tokens for you in a supposedly safe manner. They're much safer than an exchange but are still not the gold standard when controlling your crypto. What you need is a self-hosted wallet.

There are various self-hosted wallets, so the wallet you choose will depend on what you want to use it for and the coins and tokens you want to store.

Image source: Exodus

Non-custodial Wallets

Desktop or software wallets are software programs that you install on your PC and to which you can send your crypto. The private keys themselves are stored on your device in an encrypted fashion, and whenever you want to send a transaction out, they are used to decrypt and sign that transaction.

A reputable wallet, and the one I use is the Exodus Wallet. Exodus has wide-ranging coin support and an intuitive, easy-to-use AI. It’s important to note that no exchange integration in any of the self-custody crypto wallets would ever allow an exchange to hold your private keys.

Exodus also has a mobile wallet for smartphone users and a Web3 wallet that connects you to dApps, DeFi, and all of Web3. The Exodus Web3 Wallet is also a self-custody crypto wallet. It allows you to send, receive, and swap crypto and interact with NFTs on all supported networks.

Other multi-coin wallets to consider are the Atomic wallet or Jaxx wallet. Because of the Markethive and Solana Integration, as long as any of these wallets recognize Solana, they will accept Hivecoin going forward.

Forewarned is Forearmed

It’s also notable that Exodus has never been hacked. If you’ve heard of any reports about Exodus users getting hacked, it stems from where they downloaded the software. When downloading these desktop wallets, check that you download them from the official site. There are thousands of phishing sites that try to impersonate official wallet websites.

Sometimes they'll have a dodgy domain that’s easily overlooked. There have been instances of phishing sites paying for Google ads to have their sites placed above those of the official sites. Once you go on these phishing sites, you may accidentally download a wallet jammed with malware that could be used to steal your private keys.

As with desktop wallets, ensure you download the correct mobile wallet app from the Apple or Google Play store. There have been examples where hackers have uploaded malicious apps and wallets with predictably unpleasant results. It’s also critical to keep your crypto wallet a secret, especially if you have any on your phone. The more people know about your holdings, the more of a target you are for the $5 wrench attack.

It’s also essential to distinguish between crypto company mobile apps and mobile wallets. Smartphone apps like Coinbase, Binance, Nexo, and Crypto.com are just mobile versions of exchanges allowing you to access your crypto accounts. You don't hold the keys; the exchange does.

Once you've downloaded and installed any of these wallets, you'll be asked to generate a collection of seed words. These words are the keys to your crypto kingdom, so be sure to keep them in a safe and secure place and make backups. Remember, anyone with the seed words can regenerate your wallet and exfiltrate your crypto.

All the self-custody wallet solutions mentioned above are free to download and use. The next level option is hardware wallets, like Trezor or Ledger. They store your private keys in a cold environment, which means they are never exposed to the internet as they're always kept on the device itself.

Image source: Exodus

In terms of functionality, hardware wallets will be connected to your computer and operated with software that the device manufacturer has produced. Therefore from a simplicity perspective, they should be relatively easy to use as the software wallet. Furthermore, Exodus has a Trezor integration on its desktop wallet, which adds an advanced layer of security.

Not only is your crypto much more secure with self-custody, but you also have complete control of what you do with that crypto. No permission is needed to withdraw, no limits, and no KYC. It's your wallet, keys, crypto, and your financial freedom.

Moving Forward

2022 will arguably go down as one of the worst years in the crypto ecosystem; however, it is a turning point for the industry as we adapt to weed out bad actors. It'll also be the year where nearly everyone, from big money to average retail users, truly appreciates the importance of decentralization and having total control of their crypto assets.

As we enter 2023 and witness the storm of catastrophic events worldwide and the unveiling of unscrupulous entities, the crypto industry is evolving, realizing and addressing issues borne from a nascent technology.

Markethive is in the eye of the storm, where it’s calm and peaceful, diligently working to bring a blockchain-driven multi-media network to the crypto space. People worldwide who have suffered the tyranny of big tech and social media elite or been displaced or scammed by bad actors are being enlightened.

We can consider all these adverse occurrences as blessings in disguise. The time is right for Markethive to distinguish itself and bring to light its purpose of delivering a broadcasting platform, marketing systems, and communication interface foundational to God’s law, the universal spiritual law where truth, freedom, and liberty are upheld for all of humanity.

Come to our Sunday meetings at 10 am MST as we approach massive significant upgrades and the wallet launch. See and hear explanations, ask questions, and witness the ever-evolving technology and concepts of Markethive. The link to the meeting room is located in the Markethive Calendar.

Editor and Chief Markethive: Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my Markethive Profile Page | My Twitter Account | and my LinkedIn Profile.

0 notes

Text

Humans vs Uber: Will Blockchain Help?

Uber managed to gain a remarkable market share in the transport industry by implementing a simple but powerful idea. The company didn’t invest in a technology from scratch, but selected an industry with great demand and built an ecosystem with a broader supply chain. Uber realized that the difference of quality and cost expectation assurance to be competitive depending on the market dynamics.

Many believe that Uber’s surge-price algorithm which adjusts fare price according to demand is a brilliant example of supply and demand at work. It could possibly be the literal realization of every economist’s fantasy that is catalyzed by the mobile Internet. However, is “uberizing” possible for every single sector of the modern economy? While the concept seems attractive to many sectors as a promise for developing a more equitable supply-chain, whether “Uberization” will gain ground as a popular development model for startup enterprises remains a question.

As blockchain is co-opted into the infrastructure of traditional business the world will see how well the concept of “Uberization” fares. In real-world applications, blockchain might be the only technology which can solve the issue of trust and minimizing excessive middlemen costs. Blockchain platforms provide participants with the agency to self-organize, and communities governed by blockchain will need to prove their value and efficacy beyond the mere theoretical premise that there is no need for middlemen in markets that are decentralized and self-regulated.

Currently, many initiatives and projects are trying to grab a slice of the Uberization vertical markets pie. The concept of eliminating the need and cost of a third-party through the use of blockchain technology is very attractive to many corporations and could also help to better protect data against data breaches. Among the key “opponents” of Uberization, is the concept of humanization, a blockchain specific term which can be defined as ‘ensuring the integrity of a supply chain by guaranteeing the integrity and provenance of the transacting community.’ Within this decentralized realm, the conceptual strength and communal belief in ‘humanization’ are essential as everybody is accountable to everyone. While blockchain provides total immutability and security, humanization bolsters each participants’ belief that all interactions also occur within an environment governed by a mutually accepted moral scope.

The Current Mania Surrounding Uberization

Uberization of services is primarily focused on addressing markets that are geographically hyper-local and a fragmented market composed of many small providers tends to be plagued by quality control issues such as unpredictable customer experiences. Uber’s model attacks this issue simply because of its simplicity. By listing all of the available suppliers, or more specifically 3 million drivers across the globe, customers are able to access a database of verified providers and communicate with each other in a safe environment.

Among the highlights of Uber’s tech is the “surge-price” policy – when there is a lack of available cars and the demand for rides is increased, the price is higher than the average. The combination of real-time market dynamics evaluation through the user’s smartphone creates a real case study where the free market wins. The fare calculation process is the sum of the base rate, the rate for the estimated time and distance of the route, and the current demand for rides in the area.

Another economic issue attracting companies to the Uberization concept is the slack hurdle in economic relations. In places dealing with a rising unemployment rate, the high demand for flexible and entrepreneurial jobs is driving more people looking for work into “crowdworking”. Uberization increases the monetization of valuable assets like cars and effectively boosts the productivity of their owners. As the concept of Uberization expands to new vertical markets “personal” assets become commercially productive and there is the opportunity for ‘uberized’ companies to reduce their operating costs as the employees’ private assets are used to deliver products and services.

For these reasons, it’s easy to see why the Uber model is attractive as it combines mobile technology, dynamic pricing, and dynamic supply to develop a disruptive and delightful user experience. Uberization is actually quite similar to Saul Kaplan’s definition of innovation as “a better way to deliver value.”

Successful industries that have been Uberized

A slew of major industries have already adopted Uber’s business model and the question is how long can the trend continue?

Airbnb: Airbnb is one of the most successful Uber-like business model startup, which allows property owners to rent their properties through peer-to-peer contracts brokered over Airbnb’s secure platform. The result of Airbnb’s practice has accepted a lot of criticism all around the world. Deliveroo / Zomato / Uber Eats / Wolt: Food and personal items delivery has grown to be a huge business and sophisticated vehicle fleets utilize complex routing algorithms to arrange efficient delivery schedules that ensure every customer receives their product as quickly as possible. Postmates aims to be the ‘Uber’ of goods and their delivery service sends couriers to deliver local goods to customers in under one hour.

Doctor Anytime / StyleBee / Uber Healthcare: This Uber-like tool allows people who need health-related service to get a provider to visit them, and take care of their health. The same is extended for beauty service providers, making the appointment process less complicated and efficient.

HouseCall / Handy: It is generally proved by experience that finding a good technician or house-related services provider is not such an easy task. Today there are several Uberized startups that are aggregating service providers as an on-demand mobile service and establishing some service standards.

Risks of Uberization

First, it is possible that the Uberization of goods and services introduces a new degree of uncertainty about the amount of slack remaining in the economy and the true potential for above-trend growth. For instance, Uber’s model may increase the potential value of private vehicles but may reduce the necessity of car ownership. The above shows a problematic issue regarding the traditional measures of economic slack.

Secondly, there are several risks to the human side of the Uber model. There are major questions revolving whether Uber-like startups’ workers in the new age have a sense of commitment. In the process of simplifying labour routines companies must question whether potential employees possess the right skills and training to do the job, or even if they have the appropriate level of judgment and discretion to take the lead from the retiring generation Baby Boomers. Third, another important issue that may arise is related to the safety standards stemming from a workforce that might be less committed than professional taxi drivers. There are already a number of examples of drivers mistreating customers during Uber routes despite the grading practice of the company. Fourth, there are concerns about the economic benefits of employees under an Uber-like working schedule and there are some severe drawbacks that may happen if the model expands rapidly. A recent report from the International Labour Organization calculated that an average American crowd worker earns less than $5 per hour. Lastly, rapid Uberization may lead to unsustainable migration to big cities by workers with hopes of better living conditions and job opportunities. Over the long-term, this could result in unrecoverable changes to climate conditions, health, infrastructure, and social stability.

Instances of failure in Uberization

Many competitors have been inspired by Uber and tried adopting their business model over the past couple of years. However, there were a lot of failures among them.

Homejoy

Homejoy is an on-demand cleaning service for homes and offices spaces by making use of independent cleaning contractors. The major problems that faced Homejoy were the following:

Customer Retention – As the only marketing aspect that the company adopted was Groupon deals, the heavy use of sign up promotional codes by the customers led to few monthly purchases. Simultaneously, competitors managed to retain customers and eventually Homejoy failed to corner any portion of the market.

Unsustainable Expansion – In its initial phase, the startup raised around $30M and investors expected a rapid growth rate. To please investors, the company quickly expanded its service to around 30-36 cities in 6-months. Since customer retention was low, the expansion turned out to be very costly for the company.

Lack of Quality Control –: Homejoy was unable to follow up on the quality of services rendered by independent contractors, thus the customer experience was uneven. This led to many customers uninstalling the app and leaving bad rating.

Exec

Exec is an on-demand service for providing workers to do any kind of random work. The major problems with Exec were the following:

High Demand, Limited Supply – Exec aimed to provide workers for all kinds of jobs but struggled to provide enough works skilled in each particular field. Expensive overhead costs and high demand for workers during holidays and weekends meant errand workers were unavailable during this period. This resulted in employees being sent to serve the customers.

Budget issues – Most of the expenses for Exec went to software engineers who were constantly working to improve the quality of the application. The commission they charged was 20% and the costs for customer acquisition, customer service, and recruiting sufficient supply had to be paid from this considerable amount.

Rivet and Sway

Rivet and Sway was an on-demand service for providing fashionable, bespoke eyeglasses to the women. The major problems with the startup were the following:

High Customer Acquisition Cost – Although they were targeting a fashion-conscious audience, they failed to notice that they had to deal with persnickety customers as well. Customers wanted to try the glasses before the purchase, something that increased shipping costs. As a consequence, the company struggled to attract additional capital despite an admirable idea.

Fierce Competition – Warby Parker gave tough competition to Rivet and Sway in terms of investments. If Rivet and Sway had been properly funded they could have supported a system allowing customers to trial the product and return it if it wasn’t satisfactory. Alternatively, the company could have gone hyper-efficient in launching online showrooms.

What’s the alternative: Humanization

Although Uberization brings a lot of benefits to the table, there is still a need for humanization in business. Apart from the first association aroused by the term – acting like a human in business – the term is widely applicable.

Airbnb and Uber customers feel as if they are part of a community of peers, and the model between the service provider and the client has changed drastically. Modern clients desire to interact with a service provider in a trusted relationship similar to the type they would have with a friend or a peer. While current companies’ service is personalized, trust and transparency in the concept of humanization are implanted in business relationships.

Many companies are trying to transition into the era of humanization by making their policies and operations more “human-oriented” instead of turning their workers into algorithmic “masses”. It’s a very challenging situation considering that many companies have used AI to automate processes that were once handled by humans. Within the concept of Humanization, all the procedures of the company are customer-oriented and tied to each other as interacting parties.

Despite the trend being relatively new, with most enthusiasts attempting to approach humanization from a theoretical point of view, its real potential is widely recognized by large companies who view humanization as a game-changing business model. For example, Humans.net – a global game-changer in the freelancing market promises no fee, peer-to-peer marketplace where job seekers can connect with job providers. The company has already run a $10 million initial seed funding round, which lead to participation from more than 200,000 users in four U.S. states. Essentially, Humans aims to solve the majority of problems which are byproducts of the Uberization process.

How Blockchain fits in this scope

The world has witnessed “dehumanizing” technology that seems to diminish people’s ability to communicate with others or to function effectively in the world. This kind of technological progress creates new boundaries between people, rather erasing old ones. Humanizing technologies are those that meet one of three core human needs:

Safety and Security

Human Relationships

Personal Growth

A number of CEOs, researchers, academics and analysts are aware of the dehumanization brought about by technology. The following views attempt to connect the capacity of blockchain with the needs to be addressed by the humanization of businesses.

Decentralization in a blind-trust environment

“Transformative services like Uber and others have evolved into gigantic centralised corporations, keeping around 35% of all transactions at the expense of the people that make the service work. Blockchain as an immutable ledger allowing for the very first time in modern tech revolution the creation of truly decentralized indices to facilitate transaction and business execution in a blind trusted environment rewarding human creativity, without the pains of centralized services.”

— Vlad Dobrynin, Founder and CEO of Humans.net

Durability and Robustness

“As revolutionary as it sounds, Blockchain truly is a mechanism to bring everyone to the highest degree of accountability. No more missed transactions, human or machine errors, or even an exchange that was not done with the consent of the parties involved. Above anything else, the most critical area where Blockchain helps is to guarantee the validity of a transaction by recording it not only on a main register but a connected distributed system of registers, all of which are connected through a secure validation mechanism.”

— Ian Khan, TEDx Speaker, Author, Technology Futurist

Transparent and incorruptible

“Blockchain solves the problem of manipulation. When I speak about it in the West, people say they trust Google, Facebook, or their banks. But the rest of the world doesn’t trust organizations and corporations that much — I mean Africa, India, Eastern Europe, or Russia. It’s not about the places where people are really rich. Blockchain’s opportunities are the highest in the countries that haven’t reached that level yet.”

— Vitalik Buterin, inventor of Ethereum Growth

“2017 will be a pivotal year for Blockchain tech. Many of the startups in the space will either begin generating revenue – via providing products the market demands/values – or vaporize due to running out of cash. In other words, 2017 should be the year where there is more implementation of products utilizing Blockchain tech, and less talk about Blockchain tech being the magical pixie dust that can just be sprinkled atop everything. Of course, from a customers viewpoint, this will not be obvious as Blockchain tech should dominantly be invisible – even as its features and functionality improve people’s’/business’ lives.

I personally am familiar with a number of large-scale Blockchain tech use cases that are launching soon, 2017. This implementation stage, which 2017 should represent, is a crucial step in the larger adoption of Blockchain tech, as it will allow sceptics to see the functionality, rather than just hear of its promise.”

— George Howard, Associate Professor Brown University

It seems that there has been little attention to the human adoption of Blockchain so far. The humanization of Blockchain technology explains how it can create applications and tools which can impact our daily lives positively.

“The humanization of blockchain technology explains how it can create applications and tools which can impact our daily lives positively: catering to consumers needs for rewarding experiences, trust and reliance, convenience, security, belonging, lower costs and instant gratification.”

— Alexander Johnson, co-founder of Everus Technologies

Taking Humanization to the Next Level

Another example of a company taking measures to integrate humanization to uberized business practice is Humans.net. Unlike Google which searches for information, Humans.net searches for people by enabling them to enhance the way they relate to each other in many ways. Humans.net is a truly decentralized platform, run by the people, for the people. There are no middleman, no fees, and a greater share of the platform’s revenue is redistributed to contributors, unlike transformative services like Uber which keep around 35% of all transactions at the expense of the people that make the service work.

As Humans.net CEO Vlad Dobrynin explained, Humans.net gives back to its users, by returning a significant part of its revenue to active users that make the platform possible, unlike large conglomerates such as Facebook that make billions of dollars from selling the data of their users.

Eliminating Uber-like model fees

Some would say that the advent of Uberization was the proletarian response to an unfair supply chain market in endless sectors of the job market. The resulting increase in competition has created new opportunities for workers and improved the quality and variety of services available to customers while also reducing the price. On the other hand, these cost savings were absorbed from the enormous fees of “Uberized markets” which account for nearly 20 percent of the revenue generated by service providers. This producing a cyclical conundrum where providers see their income reduced, while their job is becoming more and more difficult.

Today the Uberization model is being gradually replaced by the concept of humanization and the integration of blockchain and artificial intelligence could eventually lead to markets that are more decentralized. While the Uberization model remains one of the most profitable business models for large businesses, humanization can enhance the application of this model across a wide array of sectors where social interaction between users is the primary driver of transactions.

source: https://ift.tt/2QIKfwH

The post Humans vs Uber: Will Blockchain Help? appeared first on BTC News Today.

from WordPress https://ift.tt/2FEcTxE via IFTTT

1 note

·

View note

Text

Six Tools Used by Hackers to Steal Cryptocurrency: How to Protect Wallets

In the early July, it was reported that Bleeping Computer detected suspicious activity targeted at defrauding 2.3 million Bitcoin wallets, which they found to be under threat of being hacked. The attackers used malware — known as “clipboard hijackers” — which operates in the clipboard and can potentially replace the copied wallet address with one of the attackers.

The threat of hacking attacks of this type has been predicted by Kaspersky Lab as early as November of last year, and they did not take long to become reality. For the time being, this is one of the most widespread types of attacks that is aimed at stealing users’ information or money, with the overall estimated share of attacks to individual accounts and wallets being about 20 percent of the total number of malware attacks. And there’s more. On July 12, Cointelegraph published Kaspersky Lab’s report, which stated that criminals were able to steal more than $9 million in Ethereum (ETH) through social engineering schemes over the past year.

Image source: Carbon Black

Briefly about the problem

The already mentioned Bleeping Computer portal, which works on improving computer literacy, writes about the importance of following at least some basic rules in order to ensure a sufficient level of protection:

“Most technical support problems lie not with the computer, but with the fact that the user does not know the ‘basic concepts’ that underlie all issues of computing. These concepts include hardware, files and folders, operating systems, internet and applications.”

The same point of view is shared by many cryptocurrency experts. One of them, Ouriel Ohayon — an investor and entrepreneur — places the emphasis on the personal responsibility of users in a dedicated Hackernoon blog:

“Yes, you are in control of your own assets, but the price to pay is that you are in charge of your own security. And since most people are not security experts, they are very much often exposed — without knowing. I am always amazed to see around me how many people, even tech savvy ones, don’t take basic security measures.”

According to Lex Sokolin — the fintech strategy director at Autonomous Research — every year, thousands of people become victims of cloned sites and ordinary phishing, voluntarily sending fraudsters $200 million in cryptocurrency, which is never returned.

What could that tell us? Hackers that are attacking crypto wallets use the main vulnerability in the system — human inattention and arrogance. Let’s see how they do it, and how one can protect their funds.

250 million potential victims

A study conducted by the American company Foley & Lardner showed that 71 percent of large cryptocurrency traders and investors attribute theft of cryptocurrency to the strongest risk that negatively affects the market. 31 percent of respondents rate the hackers’ activity threat to the global cryptocurrency industry as very high.

Image source: Foley & Lardner

Experts from Hackernoon analyzed the data about hacking attacks for 2017, which can be conditionally divided into three large segments:

– Attacks on the blockchains, cryptocurrency exchanges and ICOs;

– Distribution of software for hidden mining;

– Attacks directed at users’ wallets.

Surprisingly, the article “Smart hacking tricks” that was published by Hackernoon didn’t appear to get wide popularity and warnings that seem to be obvious for an ordinary cryptocurrency user must be repeated again and again, as the number of cryptocurrency holders is expected to reach 200 million by 2024, according to RT.

According to research conducted by ING Bank NV and Ipsos — which did not consider East Asia in the study — about nine percent of Europeans and eight percent of U.S. residents own cryptocurrencies, with 25 percent of the population planning to buy digital assets in the near future. Thus, almost a quarter of a billion potential victims could soon fall into the field of hacking activity.

Apps on Google Play and the App Store

Tips e – Don’t get carried away with installing mobile applications without much need; -Add Two Factor Authorization-identification to all applications on the smartphone; -Be sure to check the links to applications on the official site of the project.

Victims of hacking are most often smartphone owners with Android operating system, which does not use Two Factor Authentication (2FA) — this requires not only a password and username, but also something that user has on them, i.e., a piece of information only they could know or have on hand immediately, such as a physical token. The thing is that Google Android’s open operating system makes it more open to viruses, and therefore less safe than the iPhone, according to Forbes. Hackers add applications on behalf of certain cryptocurrency resources to the Google Play Store. When the application is launched, the user enters sensitive data to access their accounts and thereby gives hackers access to it.

One of the most famous targets of a hacking attacks of this type were traders of the American cryptocurrency exchange Poloniex, which downloaded mobile applications posted by hackers on Google Play, pretending to be a mobile gateway for the popular crypto exchange. The Poloniex team didn’t develop applications for Android, and its site doesn’t have links to any mobile apps. According to Lukas Stefanko, a malware analyst at ESET, 5,500 traders had been affected by the malware before the software was removed from Google Play.

Users of iOS devices, in turn, more often download App Store applications with hidden miners. Apple was even forced to tighten the rules for admission of applications to its store in order to somehow suspend the distribution of such software. But this is a completely different story, the damage from which is incomparable with the hacking of wallets, since the miner only slows down the computer operation.

Bots in Slack

Tips: -Report Slack-bots to block them; -Ignore bots’ activity; -Protect the Slack-channel, for example, with Metacert or Webroot security bots, Avira antivirus software or even built-in Google Safe Browsing.

Since mid-2017, Slack bots aimed at stealing cryptocurrencies have become the scourge of the fastest-growing corporate messenger. More often, hackers create a bot that notifies users about problems with their cryptos. The goal is to force a person to click the link and enter a private key. With the same speed with which such bots appear, they are blocked by users. Even though the community usually reacts quickly and the hacker has to retire, the latter manages to make some money.

Image source: Steemit @sassal

The largest successful attack by hackers through Slack is considered to be the Enigma group hack. The attackers used Enigma’s name — which was hosting its presale round — to launch a Slack bot, and ended up defrauding a total of $500,000 in Ethereum from credulous users.

Add-ons for crypto trading

Tips -Use a separate browser for operations with cryptocurrencies; -Select an incognito mode; -Do not download any crypto add-ons; -Get a separate PC or smartphone just for crypto trading; -Download an antivirus and install network protection.

Internet browsers offer extensions to customize the user interface for more comfortable work with exchanges and wallets. And the issue is not even that add-ons read everything that you are typing while using the internet, but that extensions are developed on JavaScript, which makes them extremely vulnerable to hacking attacks. The reason is that, in recent times — with the popularity of Web 2.0, Ajax and rich internet applications — JavaScript and its attendant vulnerabilities have become highly prevalent in organizations, especially Indian ones. In addition, many extensions could be used for hidden mining, due to the user’s computing resources.

Authentication by SMS

Tips: -Turn off call forwarding to make an attacker’s access to your data impossible; -Give up 2FA via SMS when the password is sent in the text, and use a two-factor identification software solution.

Many users choose to use mobile authentication because they are used to doing it, and the smartphone is always on hand. Positive Technologies, a company that specializes in cybersecurity, has demonstrated how easy it is to intercept an SMS with a password confirmation, transmitted practically worldwide by the Signaling System 7 (SS7) protocol. Specialists were able to hijack the text messages using their own research tool, which exploits weaknesses in the cellular network to intercept text messages in transit. A demonstration was carried out using the example of Coinbase accounts, which shocked the users of the exchange. At a glance, this looks like a Coinbase vulnerability, but the real weakness is in the cellular system itself, Positive Technologies stated. This proved that any system can be accessed directly via SMS, even if 2FA is used.

Public Wi-Fi

Tips: -Never perform crypto transactions through public Wi-Fi, even if you are using a VPN; -Regularly update the firmware of your own router, as hardware manufacturers are constantly releasing updates aimed at protecting against key substitution.

Back in October last year, in the Wi-Fi Protected Access (WPA) protocol — which uses routers — an unrecoverable vulnerability was found. After carrying out an elementary KRACK attack (an attack with the reinstallation of the key) the user’s device reconnects to the same Wi-Fi network of hackers. All the information downloaded or sent through the network by a user is available to attackers, including the private keys from crypto wallets. This problem is especially urgent for public Wi-Fi networks at railway stations, airports, hotels and places where large groups of people visit.

Sites-clones and phishing

Tips: -Never interact with cryptocurrency-related sites without HTPPS protocol; -When using Chrome, customize the extension — for example, Cryptonite — which shows the addresses of submenus; -When receiving messages from any cryptocurrency-related resources, copy the link to the browser address field and compare it to the address of the original site; -If something seems suspicious, close the window and delete the letter from your inbox.

These good old hacking methods have been known since the “dotcom revolution,” but it seems that they are still working. In the first case, attackers create full copies of the original sites on domains that are off by just one letter. The goal of such a trick — including the substitution of the address in the browser address field — is to lure a user to the site-clone and force them to enter the account’s password or a secret key. In the second case, they send an email that — by design — identically copies the letters of the official project, but — in fact — aims to force you to click the link and enter your personal data. According to Chainalysis, scammers using this method have already stolen $225 million in cryptocurrency.

Cryptojacking, hidden mining and common sense

The good news is that hackers are gradually losing interest in brutal attacks on wallets because of the growing opposition of cryptocurrency services and the increasing level of literacy of users themselves. The focus of hackers is now on hidden mining.

According to McAfee Labs, in the first quarter of 2018, 2.9 million samples of virus software for hidden mining were registered worldwide. This is up by 625 percent more than in the last quarter of 2017. The method is called “cryptojacking” and it has fascinated hackers with its simplicity in such away that they massively took up its implementation, abandoning the traditional extortion programs.

The bad news is that the activity of hacking has not decrease in the least bit. Experts of the company Carbon Black — which works with cybersecurity — revealed that, as of July 2018, there are approximately 12,000 trading platforms on the dark web selling about 34,000 offers for hackers. The average price for malicious attack software sold on such a platform is about $224.

Picture source: Carbon Black

But how does it get on our computers? Let’s return to the news with which we started. On June 27, users began leaving comments on Malwarebytes forum about a program called All-Radio 4.27 Portable that was being unknowingly installed on their devices. The situation was complicated by the impossibility of its removal. Though, in its original form, this software seems to be an innocuous and popular content viewer, its version was modified by hackers to be a whole “suitcase” of unpleasant surprises.

Of course, the package contains a hidden miner, but it only slows down the computer. As for the program for monitoring the clipboard, that replaces the addresses when the user copies and pastes the password, and it has been collecting 2,343,286 Bitcoin wallets of potential victims. This is the first time when hackers demonstrated such a huge database of cryptocurrency owners — so far, such programs have contained a very limited set of addresses for substitution.

After replacing the data, the user voluntarily transfers funds to the attacker’s wallet address. The only way to protect the funds against this is by double-checking the entered address when visiting the website, which is not very pleasant, but reliable and could become a useful habit.

After questioning of victims of All-Radio 4.27 Portable, it was discovered that malicious software got on their computers as a result of unreasonable actions. As the experts from Malwarebytes and Bleeping Computer found out, people used cracks of licensed programs and games, as well as Windows activators like KMSpico, for example. Thus, hackers have chosen as victims those who consciously violated copyright and security rules.

Well-known expert on Mac malware Patrick Wardle often writes in his blog that many viruses addressed to ordinary users are infinitely stupid. It’s equally silly to become a victim of such hacking attacks. Therefore, in conclusion, we’d like to remind you of the advice from Bryan Wallace, Google Small Business Advisor:

“Encryption, anti-virus software, and multi-factor identification will only keep your assets safe to a point; they key is preventive measures and simple common sense.”

window.fbAsyncInit = function() { FB.init({ appId : '1922752334671725', xfbml : true, version : 'v2.9' }); FB.AppEvents.logPageView(); }; (function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_US/sdk.js"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '1922752334671725'); fbq('track', 'PageView'); This news post is collected from Cointelegraph

Recommended Read

Editors' Picks

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

User rating:

9.5

Demo & Pro Version Get It Now Hurry!

Read full review

The post Six Tools Used by Hackers to Steal Cryptocurrency: How to Protect Wallets appeared first on Legit or Scam.

Read more from → https://legit-scam.review/six-tools-used-by-hackers-to-steal-cryptocurrency-how-to-protect-wallets-4

0 notes

Text

The 7 Inevitable Stages of Pain Before You Succeed

Success is a climb. It’s a journey. It’s lifelong and built with undulating and unpredictable ups and downs. Success is always built upon risk, change, and personal development. The journey teaches you to cope with failure. You learn to get up anyway, and to push onward towards your dreams. Many start their journey with pie-in-the-sky, smooth-road ideals, yet, success is rarely, if ever, that type of journey. If you want to succeed you must have the resilience to face the inevitable.

1. You will feel pain.

Every successful person travels a painful journey. Suffering is an integral and essential part of any real pursuit of success. Nothing about success comes easy, but every painful story has the potential to have a successful ending. You may as well accept suffering as a traveling companion, rather than resist it and create more struggle. See each day as a day that you are blessed with new chances and opportunities to start from the place you find yourself. Uncertainty and stress are inevitable. Both prompt you to make adjustments to mitigate their effects, mentoring you toward further success. A little stress can push you in a positive direction.

2. You will want to give up prematurely.

As you wonder through your more directionless times on your journey, you will experience intense moments of feeling lost and hopeless. It is during these times you must hold tight to your vision and take back control of your motivation. You must prepare yourself mentally to fight that little voice inside your head that becomes a force to reckon with when you have to push yourself to keep going when you don’t feel like it. The quickest way to derail your dreams is to quit when things look bleak. Quitting, when you are on the front lines of these critical moments, keeps you living amongst the average. The successful persevere and rise.

3. You will lose relationships.

As you succeed, there will be a handful of people who will not be willing to support you. Success takes a tremendous amount of effort and sacrifice. The effort and time you need to put into your journey will not be tolerable to some who feel you owe them more of your time, effort or energy. The successful sacrifice an enormous amount to get to where they want to go, trusting that the people meant to travel their journey with them will accept and support the sacrifices which need to be made. You will likely lose relationships with those who do not passionately share in your vision. As you succeed your path will narrow; there are fewer people at the top.

4. People will discourage you.

There is a popular thought that you should keep your dreams close to your chest because if you share them you may pillage them to dream-stealers and naysayers. The human mind is programmed to believe the negative. Negative thoughts are extremely contagious and when you set out on the Road Less Traveled you will have an audience full of small-minded people trying to scare you and discourage you from chasing your dreams. These are the people who want to instill so much fear in you that you shrink. You have to make yourself immune to these influences when you set out on your quest for success. Work quietly and let your success do the talking.

5. You will be hated for no reason.

Reality is, people don’t tend to like other successful people. There is a jealousy that comes along with being different, standing out and humbly chasing your dreams. Small people hate those who have or do everything they lack. Dealing with jealousy can be difficult, especially if you want to maintain your relationships with certain people, or if they are a big part of your life. You may need to let them go. In reality there will always be a certain percentage of people who will not like you no matter who you are or what you do. Use these people and experiences as resiliency training, and reasons to fuel your drive. Success is always the greatest revenge. Learn to let your haters make you greater.

6. You will doubt yourself.

Nine times out of ten, when you start a new venture you will go in and out of feeling utterly paralyzed. It’s because you doubt yourself. Sometimes you may doubt your knowledge, decisions you have already made and you may doubt your instincts. All of this doubt creates an internal conflict over what you need to do to move forward. You doubt because you don’t want to make the wrong decisions and end up in an unrecoverable mistake. Keep in mind there are no unrecoverable mistakes, there are only new directions. You must push through your self-doubt and not allow it to partner up with delay. Doubt and delay, when paired, derail success. On your journey, trust there is no such thing as wrong. The only wrong choice is not making one. You will likely always feel some level of self-doubt, but you can choose not to doubt your choice to stretch yourself and grow. Doubts are an inevitable part of succeeding.The important thing is that you act in spite of them.

7. You will fail.

Risk taking is at the very heart of any quest for success. You must leap into the void of the unknown and see what happens. When striving for success you will consistently face choices which involve risk. Risk is, by nature, scary. You may lose your life savings or lose your reputation. You risk criticism and humiliation. You will likely have to pick up the pieces and start all over again, time and again. On any path towards success you give up what you know for what could be. Hope is your dope. The rewards can be great, but so can the cost. You will fail and you will have to rise. Each risk gone wrong is really a risk gone well because it leads you in a new direction to take a new risk. Failure helps cultivate the virtue of resiliency which you will need for your long-term success. Failure’s purpose is to fine-tune your efforts towards success.

8. It will all be worth it.

To achieve anything you have to think positive about what you are doing. You have to know that what you are doing is right. You have to believe that you will succeed, and you have to trust the process. When the right thoughts and actions are combined there is nothing you cannot achieve. With the right idea, attitude, and thoughts a struggle really is nothing but another essential component of your success. It all starts with you. When you fall in love with a great idea, fate will push you to follow that path. Your vision can impact the world, but you have to really want it. The vision is the prize, not the money or the end results. That is what you are really here for, isn’t it? To have an impact, to make a difference? You can only know your significance through the impact you have upon others. When you see that your success improves and positively influences the lives of others, it will all be worth it. I don’t believe “destination” to be a place. I believe destination is a feeling. It is the experience of what it feels like to deeply move, help, and contribute to the world at large. That type of destination makes the struggle of the journey well worth it.

- Sherrie Campbell

0 notes

Text

Ways To Create An Efficient And Successful Real Estate Business

A single owner building a successful and lucrative real estate business from the ground up is undoubtedly an impressive accomplishment. Choosing tools to increase your market share can also be quite a challenge. Look at what your most successful competitors are doing to market their products and services. Increase your real estate business by implementing the following general rules we've put together for you.

The best experience you can get with real estate business is real world working experience. If you want to learn the ropes, you may need to work in that industry before starting you own real estate business. You can make use of the knowledge you picked up on the job when you own your real estate company. Even though you can pick up some interesting tips and hints from real estate business books, the foundation of your career in real estate business is built by skills you learn through personal work experience.

Be cautious when you hire someone new to start working at your real estate business. The new candidate being considered ought to be well-versed in all of the duties expected to be performed and have all prerequisites for the job. When new employees are hired into your real estate agency, it becomes your responsibility to be sure that they have received their full training in order to guarantee that they'll have no problems when it comes to finishing the assignments given to them. Happy employees are motivated and can make a real estate business successful and can stimulate growth.

You will need to develop a customer base if you want to win with your real estate business. Employees will as a rule be fulfilled and stay faithful to the real estate agency for quite a very long time to come when it has been passed down from era to era. A single negative review online can damage your real estate company's reputation a lot more than you think. Always address negative customer reviews you may receive and see how you could improve on the situation, possibly with the assistance of a professional reputation management service.

A real estate business is likely to fail if the owner persists in making snap decisions without taking the time to complete a thorough risk analysis. It can be seriously devastating to even the very best managed real estate business to take huge risks. The bigger the risk is, the more likely it's that your real estate business will suffer unrecoverable losses if things do not go your way. Conduct a risk analysis each and every time you are dealing with difficult real estate business decisions; it'll help you protect your real estate company's assets.