#the rise of bitcoin is it still a good investment capital

Explore tagged Tumblr posts

Text

The Rise of Bitcoin: Is It Still a Good Investment?

Introduction: Rise of Bitcoin, Since its inception, Bitcoin, the world’s first decentralized digital currency, has experienced significant growth and volatility. As Bitcoin continues to capture mainstream attention, many investors wonder whether it is a viable investment option. In this blog post, we will delve into the rise of Bitcoin, explore the factors behind its popularity, and analyze…

View On WordPress

#best investment in cryptocurrency 2022#bitcoin will crash more#bitcoin will never rise again#btc is going up#crypto rising star#does bitcoin rise#is bitcoin beneficial#the rise and rise of bitcoin#the rise of bitcoin#the rise of bitcoin is it still a good investment advisor#the rise of bitcoin is it still a good investment and why#the rise of bitcoin is it still a good investment app#the rise of bitcoin is it still a good investment bank#the rise of bitcoin is it still a good investment banker#the rise of bitcoin is it still a good investment book#the rise of bitcoin is it still a good investment business#the rise of bitcoin is it still a good investment capital#the rise of bitcoin is it still a good investment company#the rise of bitcoin is it still a good investment country#the rise of bitcoin is it still a good investment country in the world

0 notes

Text

Crypto Market Cap: What It Means & Why It Matters

Imagine stepping into a massive digital marketplace where thousands of cryptocurrencies compete for attention. Each coin has a different price, but how do you determine which ones hold real value? This is where market capitalization comes in.

Market cap isn’t just about price—it’s about the total worth of a cryptocurrency in the market. It helps investors understand which coins are well-established, which are growing, and which ones carry higher risks.

What Is Market Cap in Crypto?

In the crypto world, market cap (or market capitalization) is the total market value of a cryptocurrency. It’s calculated by multiplying the price of a single coin by the total number of coins in circulation.

📌 Formula: Market Cap = Current Price × Circulating Supply

This number tells investors how big and influential a cryptocurrency is. The higher the market cap, the more significant the coin’s presence in the industry.

🔹 Example: If a coin is priced at $5 and has 10 million coins in circulation, then: Market Cap = $5 × 10,000,000 = $50 million

This value helps compare different cryptocurrencies beyond just looking at their price per coin.

Why Does Market Cap Matter?

Market cap helps in evaluating:

✅ Investment Stability – Coins with a higher market cap tend to be more stable, while smaller ones are riskier. ✅ Growth Potential – Mid and small-cap coins often have more room for price increases. ✅ Market Trends – A rising market cap shows strong investor interest, while a falling market cap can indicate declining confidence.

💡 Did You Know? The highest total crypto market cap ever recorded was $3 trillion in November 2021, driven by Bitcoin, Ethereum, and the rise of DeFi projects.

Types of Cryptocurrencies by Market Cap

1️⃣ Large-Cap Cryptocurrencies

🔹 Market Cap: Over $10 billion 🔹 Examples: Bitcoin (BTC), Ethereum (ETH) 🔹 Characteristics: These are the most established and trusted coins with strong investor confidence and high liquidity.

2️⃣ Mid-Cap Cryptocurrencies

🔹 Market Cap: Between $1 billion and $10 billion 🔹 Characteristics: These coins offer a balance between stability and growth potential. They may experience higher price swings but can provide strong returns if they gain traction.

3️⃣ Small-Cap Cryptocurrencies

🔹 Market Cap: Under $1 billion 🔹 Characteristics: These coins are high-risk, high-reward. They are more volatile, meaning their prices can surge dramatically or crash quickly.

Does Market Cap Affect Crypto Price?

No, market cap doesn’t directly impact price, but it does influence how investors perceive a coin’s stability and potential.

🔹 Large-cap coins like BTC and ETH are less volatile and attract long-term investors. 🔹 Small-cap coins can experience sudden price changes due to news, investor hype, or market sentiment.

Another crucial factor is trading volume, which shows how actively a cryptocurrency is bought and sold.

🔸 Example: A coin with a high market cap but low trading volume may have limited liquidity, making large transactions harder.

What Is Fully Diluted Market Cap?

A fully diluted market cap estimates the total value of a cryptocurrency if all possible coins were in circulation.

📌 Formula: Fully Diluted Market Cap = Current Price × Maximum Supply

This metric is useful for predicting the future potential of a cryptocurrency, especially for projects that still have coins waiting to be mined or released.

What Is a Good Volume-to-Market Cap Ratio?

The volume-to-market cap ratio shows how actively a cryptocurrency is traded compared to its total market value.

🔹 High ratio (>1.0): Strong liquidity, high interest, often seen in speculative assets. 🔹 Medium ratio (0.1 - 1.0): Steady trading, common in established cryptos like BTC & ETH. 🔹 Low ratio (<0.1): Low liquidity, limited investor interest, potential price stagnation.

💡 Example: A coin with a $5 billion market cap but only $10 million in daily trading volume may have low liquidity, meaning fewer people are actively trading it.

Final Thoughts

Market cap is one of the most important indicators for evaluating cryptocurrencies. Whether you're a beginner or an experienced trader, understanding market cap can help you:

✔ Compare different cryptocurrencies ✔ Identify investment opportunities ✔ Assess risk levels

While market cap isn’t the only factor to consider, it plays a crucial role in making informed decisions in the fast-changing world of crypto. 🚀

0 notes

Text

Cryptocurrency Basics: What You Need to Know 🪙✨

Cryptocurrency, or "crypto," is a digital currency used for payments, investments, and financial transactions without relying on banks or governments. Whether you're interested in Bitcoin (BTC), Ethereum (ETH), or other cryptocurrencies, understanding how they work is key before jumping in.

🔍 What is Cryptocurrency?

Cryptocurrency is a digital asset secured by encryption technology, allowing people to trade, buy, or store value without needing traditional banks. Instead of physical coins or paper money, crypto exists entirely online, stored in digital wallets.

Some well-known cryptocurrencies include:

➡ Bitcoin (BTC) – The first and most valuable cryptocurrency, originally designed for peer-to-peer payments without a central bank.

➡ Ethereum (ETH) – More than just a currency, Ethereum powers smart contracts and decentralized apps (DeFi), making it the foundation of a financial system without intermediaries.

➡ Altcoins – Thousands of other cryptocurrencies exist, each with unique functions, from privacy coins to blockchain-based gaming tokens.

💰 Why Do People Invest in Crypto?

Crypto is often seen as a high-risk, high-reward investment. People invest in cryptocurrencies for several reasons:

✔ Price Growth Potential – If demand increases, prices can rise, leading to potential profits.

✔ Decentralization – Many believe in crypto’s vision of a financial system without banks or government control.

✔ Blockchain Innovation – Ethereum and similar platforms enable new financial systems, digital ownership, and decentralized apps.

✔ Hedge Against Inflation – Some investors use Bitcoin as a hedge against traditional currency inflation.

However, crypto prices are highly volatile, and investments can lose value quickly. It’s essential to do thorough research before investing.

⚙️ How Does Cryptocurrency Work?

Cryptocurrency operates on a technology called blockchain, a decentralized ledger that records transactions securely. This prevents fraud and double-spending without needing a bank.

Crypto is not printed or controlled by governments. Instead, it is:

🔹 Mined – Bitcoin and some other cryptos are created through mining, where powerful computers solve complex puzzles to validate transactions.

🔹 Bought & Sold – Most people buy crypto from exchanges or individuals rather than mining it themselves.

🔹 Stored in Wallets – Digital wallets (software or hardware) store your private keys, which act as proof of ownership. Losing access means losing your funds forever.

📈 Pros & Cons of Cryptocurrency

✅ Pros:

✔ Decentralization – No government control or central authority. ✔ Potential for High Returns – Crypto prices can rise significantly. ✔ Global & Fast Transactions – Send money worldwide quickly. ✔ Blockchain Security – Transparent, secure, and tamper-resistant transactions. ✔ Earning Through Staking – Some cryptocurrencies allow users to earn passive income by staking.

❌ Cons:

⚠ Volatility – Prices can drop suddenly, leading to big losses. ⚠ Security Risks – Hacking, scams, and lost wallet access can result in lost funds. ⚠ Regulatory Uncertainty – Governments are still deciding how to regulate crypto. ⚠ Environmental Impact – Bitcoin mining consumes huge amounts of energy. ⚠ Limited Adoption – Many businesses still don’t accept crypto as payment.

📜 Is Crypto Legal & Taxed?

✔ In most countries, cryptocurrency is legal, but regulations vary. ✔ Crypto is taxed as property in some places, meaning you pay capital gains tax when selling at a profit. ✔ Unlike government money, crypto is not legal tender, meaning businesses aren’t required to accept it.

🔐 Crypto Safety Tips

✅ Use a Secure Wallet – Consider hardware wallets for long-term storage. ✅ Enable 2FA – Always use two-factor authentication on crypto accounts. ✅ Beware of Scams – Avoid fake projects, phishing emails, and “too good to be true” investment offers. ✅ Back Up Private Keys – Store them securely. If you lose them, your funds are gone. ✅ Do Your Research – Before investing, understand how the cryptocurrency works and its risks.

Cryptocurrency is a revolutionary technology, but it comes with risks. Whether you're investing or just curious, always stay informed and prioritize security. 🚀💡

0 notes

Text

Accounting for Virtual Goods and Digital Currency: Challenges and Opportunities

The rise of virtual goods and digital currencies, particularly in online gaming, social media, and financial markets, has brought forth new challenges for accountants and businesses. As digital assets like cryptocurrencies and in-game currencies grow in popularity, the need for robust accounting systems that can handle these intangible assets has become more critical. For Chartered Accountants (CAs) and aspiring professionals, understanding the complexities surrounding the accounting of virtual goods and digital currencies is essential. In this article, we delve into the challenges and opportunities in accounting for virtual goods and digital currency, highlighting the role of CAs and key study resources such as CA Entrance Exam Books, Scanner CA Intermediate Books, Scanner CA Foundation Books, and Scanner CA Final Books for CA students.

What Are Virtual Goods and Digital Currency?

Virtual goods are digital items or assets that exist solely in virtual environments, such as online games, social media platforms, and virtual marketplaces. Examples include in-game currency, avatars, skins, and digital assets in virtual reality platforms. These goods typically have value within their respective platforms, but they may or may not be convertible into real-world currency.

Digital currency, on the other hand, refers to money that exists only in digital form. Cryptocurrencies, like Bitcoin and Ethereum, are examples of digital currencies that use blockchain technology for decentralized transactions. Digital currencies can be traded, held as investments, and even used for real-world transactions in certain situations.

Challenges in Accounting for Virtual Goods and Digital Currency

Accounting for virtual goods and digital currencies presents several unique challenges, primarily due to their intangible nature and the lack of clear, uniform accounting standards. Some of the key challenges include:

1. Valuation and Recognition

One of the most significant challenges in accounting for virtual goods and digital currencies is determining their value. Virtual goods often do not have a standardized market price, which makes it difficult to establish a fair value for reporting purposes. For example, in-game items or virtual currency might be priced differently across platforms or based on supply and demand within a game.

Similarly, digital currencies can experience high volatility. Cryptocurrencies like Bitcoin have demonstrated extreme price fluctuations, making their valuation for accounting purposes complex. Unlike traditional assets, these digital assets may not have a direct correlation to fiat currency values or tangible goods, creating challenges in recognizing and measuring their value accurately.

2. Revenue Recognition

Revenue recognition is another challenge when accounting for virtual goods and digital currencies. Businesses often generate revenue from the sale of virtual goods, in-game purchases, or trading of cryptocurrencies. However, under traditional accounting principles, recognizing revenue from these digital transactions is not straightforward.

For instance, when a player purchases virtual goods in a game, should the revenue be recognized immediately, or should it be deferred until the goods are used or consumed? The treatment of digital currency transactions presents similar challenges, especially if the cryptocurrency is traded as an investment rather than used for goods or services. Accounting standards such as IFRS 15 or ASC 606 provide guidelines for revenue recognition, but their application to virtual goods and cryptocurrencies is still evolving.

3. Regulatory and Tax Issues

Virtual goods and digital currencies are subject to varying regulations depending on the jurisdiction. The lack of consistent global regulations complicates the accounting treatment for tax purposes. While some countries treat cryptocurrencies as taxable assets or capital gains, others may classify them as commodities or currency.

Similarly, the tax treatment of virtual goods is complex. In some cases, in-game purchases may be subject to sales tax, while in other jurisdictions, they may not be. CAs must ensure that businesses comply with local tax laws regarding the sale and exchange of digital assets, while also keeping an eye on global regulatory trends.

4. Internal Control and Fraud Prevention

The digital nature of virtual goods and cryptocurrencies presents security concerns, especially regarding fraud, money laundering, and cybercrime. The anonymous nature of many digital currency transactions can make it difficult for businesses to track and monitor financial activities. Additionally, virtual goods may be sold through third-party platforms, raising concerns about the legitimacy of transactions.

Accountants must develop strong internal control systems to mitigate these risks. This involves implementing safeguards to detect fraudulent transactions, ensuring that digital assets are accurately recorded and safeguarded, and monitoring any transactions that could potentially violate anti-money laundering (AML) regulations.

Opportunities in Accounting for Virtual Goods and Digital Currency

While there are challenges, accounting for virtual goods and digital currencies also presents several opportunities for businesses and accounting professionals alike.

1. Growth in Digital Economy

The rise of virtual goods and digital currencies has given birth to new industries, creating opportunities for businesses to tap into growing markets. As the digital economy expands, companies that deal in virtual goods or cryptocurrencies will need professional accountants to navigate the complexities of financial reporting, compliance, and tax planning. This opens up new career paths for Chartered Accountants who specialize in these areas.

2. Blockchain Technology and Smart Contracts

Blockchain technology, which underpins many digital currencies, offers new possibilities for accounting. Smart contracts—self-executing contracts where the terms are directly written into code—can automate and streamline accounting processes. CAs can leverage blockchain technology to improve transparency, reduce fraud, and ensure secure transactions in the digital space. Blockchain could revolutionize accounting practices, making transactions more efficient and tamper-proof.

3. Advisory Services for Digital Asset Management

With increasing interest in digital currencies, businesses and individuals need professional advice on managing digital assets. Chartered Accountants can offer advisory services on how to handle digital currencies as investments, guide clients on regulatory compliance, and help with strategies for revenue recognition related to virtual goods. This creates an additional avenue for accountants to provide value-added services to businesses.

4. Global Expansion of Digital Markets

Virtual goods and digital currencies are not confined to a single geographic region. They transcend borders, which means companies dealing with them can access a global marketplace. Chartered Accountants will play a vital role in helping businesses expand into international markets while ensuring compliance with varying tax regulations, local laws, and accounting standards related to virtual goods and digital currencies.

How CA Students Can Prepare

As the digital economy grows, CA students must prepare themselves for the emerging trends in virtual goods and digital currency accounting. Key study resources like CA Entrance Exam Books, Scanner CA Intermediate Books, Scanner CA Foundation Books, and Scanner CA Final Books are invaluable tools in this preparation.

CA Entrance Exam Books – These provide foundational knowledge of accounting principles and financial reporting that can be applied to digital assets.

Scanner CA Foundation Books – These resources help students build a strong base in accounting and taxation, which is crucial when dealing with virtual goods and digital currency.

Scanner CA Intermediate Books – At the intermediate level, students can explore more specialized topics related to taxation, auditing, and revenue recognition, all of which are relevant to digital currency transactions.

Scanner CA Final Books – These books provide advanced case studies and scenarios involving complex financial reporting and accounting for intangible assets like virtual goods and cryptocurrencies.

CA Foundation Scanner, CA Intermediate Scanner, and CA Final Scanner – These scanners offer practice questions on emerging topics such as blockchain, digital currencies, and virtual goods, helping students stay up-to-date with evolving trends.

Conclusion

The accounting for virtual goods and digital currency presents both challenges and exciting opportunities for businesses and accounting professionals. While issues such as valuation, revenue recognition, regulatory compliance, and fraud prevention require careful attention, the rise of digital assets also creates new career paths and business opportunities. Chartered Accountants must adapt to these changes by staying updated on new developments in digital finance, leveraging resources like CA Entrance Exam Books, Scanner CA Intermediate Books, and Scanner CA Final Books. As digital markets continue to evolve, CAs will play an increasingly vital role in ensuring proper accounting and compliance for virtual goods and digital currencies.

This article incorporates the requested keywords while providing an overview of the challenges and opportunities in accounting for virtual goods and digital currencies, with specific reference to CA exam preparation materials.

0 notes

Text

Coinbase CEO Urges Global Strategic Reserves as Bitcoin Skyrockets to $100K

Key Points

Brian Armstrong, Coinbase CEO, advocates for global adoption of Bitcoin as a strategic reserve.

Bitcoin hits the $100,000 mark, with its growth over the years hailed as the best-performing asset.

Brian Armstrong, CEO of Coinbase, is encouraging governments globally to consider Bitcoin as a strategic reserve.

He expressed this view on his X page on December 4, sharing insights into Bitcoin’s performance over the last 12 years. This comes after Bitcoin reached a milestone of $100,000.

Bitcoin’s Impressive Growth

Armstrong demonstrated that a $100 investment in Bitcoin in June 2012 would now be worth $1.5 million. Conversely, $100 held in cash would have depreciated due to inflation, now purchasing just $73 worth of goods.

This impressive growth led Armstrong to proclaim Bitcoin as the best-performing asset over the last 12 years. He suggested that Bitcoin is still in its early days, indicating more potential. He urged all governments, especially those looking to hedge against inflation, to establish a Bitcoin strategic reserve.

Global Adoption of Bitcoin

Countries like El Salvador have accepted Bitcoin as legal tender. As of November 22, 2024, the government holds 5,942 Bitcoins. Similarly, Bhutan owns more than 12,000 BTC as of last month, showing that countries are gradually entering the Bitcoin space.

Spencer Hakimian, founder of Tolou Capital Management, supported Armstrong’s views, recognizing Bitcoin’s unparalleled ability to generate wealth. He commented that Bitcoin has generated more wealth than any other asset in history.

Bitcoin’s Rise to $103K

Bitcoin’s price has been on the rise recently, hitting a new all-time high of $103,000. This sudden surge can be attributed to the selection of crypto supporter Paul Atkins as the next SEC chairman by newly elected president Donald Trump.

The appointment of a pro-crypto chairman has been well-received in the crypto community. Ripple CEO Brad Garlinghouse commended the appointment, stating it would bring ‘common sense’ back to the agency. He noted that the team of Paul Atkins, Hester Peirce, and Mark Uyeda would end the prohibition era on crypto, promoting freedom, economic growth, and innovation.

SEC commissioner Hester Peirce expressed that the agency has a lot of work to do to promote free markets, facilitate capital formation, enhance investor choice, and support innovation. She was pleased with the return of Paul Atkins as the next SEC chair, describing him as ideal to lead these efforts.

The leadership of a pro-crypto person at the SEC could provide more freedom to crypto, potentially boosting its value. Cryptocurrencies are still in their early stages, and there is high optimism that their prices can increase even further. Robert Kiyosaki, author of the Rich Dad Poor Dad series, predicted that Bitcoin could reach around $250,000 in 2025.

0 notes

Text

With Low Volatility in the Options Market, Twaao Exchange Recommends a Medium to Long-Term Investment Strategy

After a week of soaring prices, the crypto market has entered an adjustment phase, with the Bitcoin $90,000 level becoming a crucial point of contention. Amid the weak performance of the U.S. tech stocks, the focus of the crypto market is gradually shifting towards meme coins, contrasting with the stability in market volatility and the options market. Twaao Exchange analysis indicates that although short-term macroeconomic expectations are lukewarm, historical data shows that the fourth quarter remains a favorable period for positioning in crypto assets.

$90,000 Becomes the Market Focal Point

Twaao Exchange has observed that the Bitcoin price has been hovering around the $90,000 mark, a level critical to market confidence and the core battleground for bulls and bears. Following the recent price surge, signs of market adjustment are becoming more apparent, especially as the activity in large transactions declines, challenging the confidence in further upward movement.

Although current market volatility has somewhat subsided, this level still holds the potential to trigger significant fluctuations. Investors need to closely monitor the Bitcoin performance around the $90,000 mark and the changes in related capital flows. Twaao Exchange provides users with the latest market dynamics through real-time market data and analytical tools, aiding them in better assessing trend changes.

Potential Risks of Rising Meme Coin Popularity

Against the backdrop of weak U.S. tech stocks, some crypto market funds have flowed into meme coins, increasing their popularity. However, the high volatility and speculative nature of meme coins could heighten overall market risk. While the short-term performance of meme coins has attracted some speculative capital, this trend often comes with substantial price retracement risks.

Using market sentiment analysis tools, Twaao Exchange assists investors in evaluating fund flow trends across different asset classes. The platform research team suggests that investors seeking stable returns should focus more on long-term value assets rather than highly speculative meme coins in the current market environment to mitigate potential risks.

Options Market and Medium to Long-Term Opportunities

The current options trading in the crypto market remains stable, with implied volatility (IV) at relatively low levels, offering investors a good cost-benefit ratio for medium to long-term strategies. Historical data shows that the fourth quarter is typically a strong period for the crypto market, particularly highlighting the cost-effectiveness of medium to long-term contracts.

Twaao Exchange advises investors to pay attention to medium to long-term opportunities in the options market, using reasonable positioning to diversify risks and capture potential upward trends. The options trading tools of the platform support users in real-time tracking of IV changes and provide efficient trading support through flexible risk management strategies.

The crypto market is currently in an adjustment phase, with the $90,000 price of Bitcoin becoming a pivotal level, while the rise of meme coins and low volatility in the options market bring more uncertainty and opportunity. Twaao Exchange, with its professional market analysis and tool support, helps users formulate effective investment strategies in a complex market environment, offering investors a comprehensive trading experience and market insights.

0 notes

Text

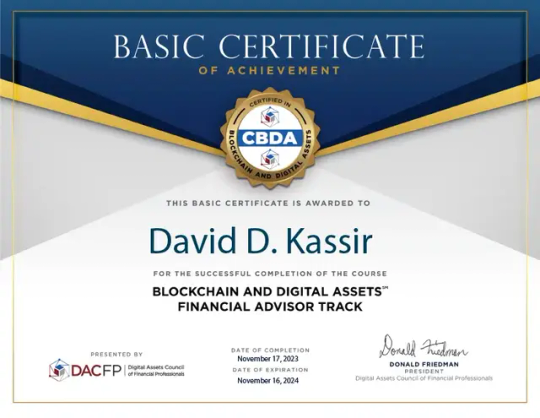

The Role of a Crypto Financial Advisor

The rise of cryptocurrency has introduced a new frontier for investors, but navigating the crypto world can be tricky. This is where a crypto financial advisor becomes invaluable. These advisors bring expertise and strategic insight to help investors safely grow their digital assets.

Let’s explore the benefits of working with a crypto financial advisor, the services they offer, and how to find a reputable advisor.

Why Work with a Crypto Financial Advisor?

Investing in cryptocurrency is more complex than traditional assets like stocks or bonds. Here’s why a crypto financial advisor can make all the difference:

Specialized Knowledge The crypto market is dynamic, with constant changes in technology, regulations, and token trends. Crypto advisors stay on top of these changes, providing insights into market shifts, tax implications, and risk management.

Risk Management Crypto markets are highly volatile. Advisors help balance the potential for high returns with strategies to mitigate risk. With their expertise, you can develop a portfolio that aligns with your goals without overexposing yourself to unnecessary risks.

Diversified Portfolio A good advisor can help diversify your investments beyond mainstream cryptocurrencies like Bitcoin or Ethereum, introducing you to promising altcoins or DeFi projects. This can reduce volatility and increase potential returns.

Long-Term Strategy Many investors enter the crypto space with short-term goals, hoping for quick profits. An advisor encourages a long-term view, developing strategies that can withstand market fluctuations and lead to sustainable growth over time.

Tax Planning Tax implications for crypto investments are still evolving, and it’s easy to make mistakes. Crypto advisors are familiar with tax regulations surrounding digital assets, helping you plan and avoid costly surprises.

For more detailed cryptocurrency advisory services, you can also visit Manna Wealth Management’s Cryptocurrency Advisory Services.

Key Services Offered by Crypto Financial Advisors

Crypto financial advisors offer a range of services tailored to each client’s needs. Here are some of the most common services to expect:

1. Portfolio Management

Advisors help you build and maintain a balanced crypto portfolio. This involves asset allocation, rebalancing strategies, and managing risk through diversification.

2. Investment Strategy Development

Advisors assess your financial goals and create a custom strategy, whether you’re interested in long-term growth, stablecoin income, or high-risk trading.

3. Market Analysis and Research

Crypto advisors keep up with trends, token performance, and market analysis. They provide insights into promising investments, helping you make data-driven decisions.

4. Tax Planning and Compliance

Advisors guide you on tax obligations for crypto transactions. This includes capital gains taxes, reporting requirements, and tax-loss harvesting strategies to reduce your tax burden.

5. Security and Custody

Advisors can assist in selecting secure wallets and custodians for your assets, helping you protect your investments from hacks and fraud.

6. Education and Training

Many advisors also offer educational resources, helping clients understand blockchain, DeFi, and emerging crypto technologies so they can make informed decisions.

How to Choose a Reputable Crypto Financial Advisor

Choosing the right crypto financial advisor is crucial for success in the crypto world. Here are some tips for finding a reputable advisor:

1. Verify Credentials and Experience

Look for advisors with certifications or financial planning licenses, like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). It’s also beneficial if they have experience in digital assets or blockchain technology.

2. Check Their Background and Track Record

Research the advisor’s history. Check for reviews, testimonials, and any disciplinary actions. A good reputation and proven track record in crypto markets are essential.

3. Ensure Transparency with Fees

Make sure you understand the fee structure—whether it’s hourly, a flat rate, or a percentage of assets managed. Reputable advisors are transparent and upfront about costs.

4. Look for Specialized Knowledge in Cryptocurrency

The best crypto advisors are immersed in the digital asset market and understand its nuances. Look for advisors who are knowledgeable about DeFi, blockchain, and emerging crypto trends.

5. Communication and Availability

Crypto markets move quickly, so it’s essential to work with an advisor who is responsive and available. They should be reachable when you have questions or need advice during market fluctuations.

6. Use Trusted Referrals and Networks

If possible, get referrals from trusted networks, especially if they have experience in the crypto space. Online forums, professional networks, or wealth management firms like Manna Wealth Management can be good sources.

Final Thoughts

Working with a crypto financial advisor can streamline your crypto investing journey, giving you the confidence and insight to make smarter decisions. From risk management and tax planning to education and portfolio diversification, a crypto advisor offers invaluable support to help you succeed in the fast-evolving world of digital assets.

FAQs

1. Why do I need a crypto financial advisor? Crypto advisors help you navigate the complex and volatile crypto markets, offering expertise in risk management, tax planning, and investment strategy.

2. What should I look for in a crypto financial advisor? Look for advisors with financial credentials, crypto experience, a good reputation, and transparent fees. Ensure they communicate well and are available when needed.

3. Can a crypto advisor help with taxes? Yes, crypto advisors assist with tax planning, reporting, and compliance, which can prevent costly mistakes.

4. How do crypto advisors manage risk? They help you diversify your investments, set appropriate risk levels, and develop strategies to manage market volatility effectively.

5. Where can I find trusted crypto advisory services? Manna Wealth Management offers reputable cryptocurrency advisory services with a team experienced in managing digital assets. Visit their site for more information.

1 note

·

View note

Text

Latest Crypto ICOs: Diversifying Beyond Bitcoin and Ethereum

As the cryptocurrency market continues to grow and evolve, investors are increasingly looking beyond the two largest cryptocurrencies, Bitcoin and Ethereum, to diversify their portfolios. One of the most effective ways to achieve this diversification is through investing in Initial Coin Offerings (ICOs). In this blog, we will explore how participating in the latest crypto ICOs can help investors spread their risk and potentially reap significant rewards.

Understanding ICOs

Initial Coin Offerings (ICOs) are fundraising mechanisms used by new cryptocurrency projects to raise capital by selling tokens to investors. ICOs allow investors to buy tokens at an early stage, often at a lower price than they would be available on the market once the project launches. This presents a unique opportunity for investors to get in on the ground floor of promising new projects.

The Importance of Diversification

Investing solely in Bitcoin and Ethereum can expose investors to significant risks, particularly given the volatility of the cryptocurrency market. Diversification helps mitigate these risks by spreading investments across different assets. By exploring upcoming ICOs, investors can gain access to a variety of projects that may offer unique value propositions and growth potential.

Benefits of Investing in the Latest Crypto ICOs

1. Access to Innovative Projects

ICOs often introduce groundbreaking technologies and concepts that can disrupt traditional industries. By investing in new ICO projects in 2024, investors can support innovative solutions that address real-world problems, from decentralized finance (DeFi) to supply chain management.

2. Potential for High Returns

Early investors in successful ICOs have the potential to see significant returns on their investments. For example, projects like Ethereum and Binance Coin started with ICOs that offered tokens at a fraction of their current value. Identifying the best crypto ICOs can lead to substantial financial gains.

3. Participation in Emerging Trends

The cryptocurrency landscape is constantly evolving, with new trends emerging regularly. By keeping an eye on the ICO calendar and participating in upcoming ICO token sales, investors can position themselves to take advantage of these trends, such as the rise of NFTs or advancements in blockchain technology.

4. Building a Diverse Portfolio

Investing in ICOs allows investors to build a more balanced cryptocurrency portfolio. By including a mix of established coins like Bitcoin and Ethereum alongside promising new tokens, investors can reduce their overall risk exposure while still participating in the growth of the crypto market.

How to Identify Promising ICOs

To successfully diversify through ICOs, investors should conduct thorough cryptocurrency research. Here are some tips for identifying promising projects:

Review the Project’s Whitepaper: A well-written whitepaper outlines the project’s goals, technology, and roadmap. It should provide clear information about how the project plans to use the funds raised during the ICO.

Analyze the Team Behind the Project: The experience and track record of the project’s team can significantly impact its success. Look for teams with a history of successful projects and relevant industry experience.

Check Community Engagement: A strong community can be a good indicator of a project’s potential. Engage with the project on social media platforms and crypto forums to gauge community sentiment and support.

Utilize an Upcoming ICO List: Keeping track of an upcoming ICO list can help investors stay informed about new opportunities. Many platforms provide curated lists of upcoming ICOs, making it easier to find promising projects.

Conclusion

Investing in the latest crypto ICOs presents a valuable opportunity for diversifying beyond Bitcoin and Ethereum. By exploring the best upcoming ICOs and participating in upcoming ICO token sales, investors can access innovative projects that may offer significant returns. However, due diligence is essential; thorough research and analysis will help identify the most promising opportunities in the ever-evolving cryptocurrency landscape.

0 notes

Text

White Green: Analyzing 2023's Digital Currency Market

White Green: Summary of the digital currency trading market in 2023 and outlook for the digital currency market in 2024.

In 2023, the crypto world will witness some very interesting developments, while certain other events are likely to occur in 2024. We conclude this year with an overall optimistic sentiment in the entire market - something we couldn't say in 2022. On the other hand, according to some reliable sources, the adoption rate of cryptocurrencies did not increase last year, but it still holds some hope for the future.

According to Chainalysis, the global cryptocurrency adoption landscape is mainly dominated by Central Asia and South Asia. Their Global Cryptocurrency Adoption Index takes into account factors such as the value of cryptocurrencies traded on centralized exchanges in different countries and decentralized finance (DeFi) protocols to reach this conclusion.

What happened in the cryptocurrency world in 2023?

It can be said that the United States is a contradictory country, with different states having different laws. For example, Wyoming is considered the most cryptocurrency-friendly destination worldwide, while the U.S. Securities and Exchange Commission (SEC) has filed lawsuits against over 150 cryptocurrency projects and brands since 2013. Last year was no exception.

In June 2023, the SEC sued both Binance and Coinbase, the two largest cryptocurrency exchanges by trading volume. Considering their lawsuit against Ripple began in 2020 and concluded just this year, it may take some time to see the conclusions of these proceedings for these cryptocurrency companies, which achieved favorable results in July.

However, in November of last year, Zhao Changpeng (former CEO of Binance) admitted to charges of violating US anti-money laundering laws. Binance is expecting to pay a fine of over $4 billion for the violations, and Zhao will face trial in the country. The new CEO of Binance is Richard Teng, and the brand's products continue to operate normally.

Similarly in the United States, the notorious cryptocurrency exchange FTX's former CEO, Sam Bankman-Fried (SBF), was found guilty in a fraud trial. He is expected to serve decades in prison, while Zhao is facing only a few months behind bars.

After leaving the United States, Terra (LUNA) founder Do Kwon was arrested in Montenegro in March. El Salvador remains the only country with Bitcoin as its legal tender, still planning to issue new Bitcoin 'volcano bonds' by 2024 and passing a law offering citizenship to foreigners investing in Bitcoin in the country. In the European Union, the MiCA law (Markets in Crypto-Assets) has finally been approved and is set to come into effect in April, with full enforcement scheduled for June 2024.

Overall, the total market capitalization of cryptocurrencies grew by over 101% in 2023 (according to CMC data). Additionally, cryptocurrencies are now legalized in 119 countries/regions, which represents the majority of countries/regions worldwide (according to CoinGecko). Investors can expect to hear some good news at the beginning of 2024.

The Cryptocurrency Trends of 2024

We can never be certain about the future, but some early trends can provide us with clues about the next steps in the crypto world. According to the 2024 Cryptocurrency Trends Report by Gemini, we might see some interesting developments. For example, they expect a higher intersection between artificial intelligence (AI) and cryptocurrency systems.

This integration is expected to completely change various aspects, including smart contracts, secure data solutions, transparent large language models, cryptographic security (auditing), and combating misinformation. Meanwhile, the prices of tokens related to artificial intelligence are significantly rising, indicating growing interest and confidence in the market.

On the other hand, speculation is rife regarding the potential approval of a spot Bitcoin ETF in the United States. The launch of this product, along with the next Bitcoin halving scheduled for April 2024 (aimed at reducing supply inflation), could have a positive impact on the price of Bitcoin, thereby influencing the overall cryptocurrency market capitalization.

However, more regulatory measures are set to be introduced globally. Despite the legalization of cryptocurrencies in most countries, only 52.1% of countries have implemented specific frameworks (according to CoinGecko). The MiCA law is the first to simultaneously cover multiple aspects of cryptocurrencies across multiple countries. With regulatory clarity, more institutions and companies can adopt cryptocurrencies for investment or to provide services to users, or even create their own stablecoins.

In summary, 2023 was a year of development for the cryptocurrency market, laying the groundwork for 2024. Cryptocurrencies will continue to evolve globally and gradually become an integral part of the financial system. However, investors should remain vigilant and exercise caution when participating in the cryptocurrency market. Understanding market dynamics and investment risks is key to success.

White Green is a highly regarded investment analyst renowned in the industry for his outstanding macro-strategic investments. His unique investment philosophy and excellent investment strategies have made him a rising star and pride of the Australian federal market.

As an outstanding investment analyst, White Green excels in quantitative portfolio management and data analysis to guide investment decisions. He focuses on value growth and utilizes portfolio diversification for risk hedging management. He successfully led teams and clients through the financial crises of 2008 and 2020, generating substantial returns for clients.

White Green's investment achievements are not only attributed to his excellent investment strategies but also to his forward-thinking market insights. He deeply understands the behavior patterns of market participants and excels at capturing market trends and opportunities. His global macro strategy enables him to grasp the pulse of the global economy, providing unique insights for investment decisions.

White Green is a prominent figure in today's investment community, and his macro-strategic investment approach and outstanding investment results make him a role model for many investors. Whether professional or individual investors, they can draw valuable experience from his investment philosophy and strategies to guide their investment journey.

0 notes

Text

White Green: Understanding the Future of Cryptocurrency in 2024

White Green: Understanding the Future of Cryptocurrency in 2024

In 2023, the crypto world will witness some very interesting developments, while certain other events are likely to occur in 2024. We conclude this year with an overall optimistic sentiment in the entire market — something we couldn’t say in 2022. On the other hand, according to some reliable sources, the adoption rate of cryptocurrencies did not increase last year, but it still holds some hope for the future.

According to Chainalysis, the global cryptocurrency adoption landscape is mainly dominated by Central Asia and South Asia. Their Global Cryptocurrency Adoption Index takes into account factors such as the value of cryptocurrencies traded on centralized exchanges in different countries and decentralized finance (DeFi) protocols to reach this conclusion.

What happened in the cryptocurrency world in 2023?

It can be said that the United States is a contradictory country, with different states having different laws. For example, Wyoming is considered the most cryptocurrency-friendly destination worldwide, while the U.S. Securities and Exchange Commission (SEC) has filed lawsuits against over 150 cryptocurrency projects and brands since 2013. Last year was no exception.

In June 2023, the SEC sued both Binance and Coinbase, the two largest cryptocurrency exchanges by trading volume. Considering their lawsuit against Ripple began in 2020 and concluded just this year, it may take some time to see the conclusions of these proceedings for these cryptocurrency companies, which achieved favorable results in July.

However, in November of last year, Zhao Changpeng (former CEO of Binance) admitted to charges of violating US anti-money laundering laws. Binance is expecting to pay a fine of over $4 billion for the violations, and Zhao will face trial in the country. The new CEO of Binance is Richard Teng, and the brand’s products continue to operate normally.

Similarly in the United States, the notorious cryptocurrency exchange FTX’s former CEO, Sam Bankman-Fried (SBF), was found guilty in a fraud trial. He is expected to serve decades in prison, while Zhao is facing only a few months behind bars.

After leaving the United States, Terra (LUNA) founder Do Kwon was arrested in Montenegro in March. El Salvador remains the only country with Bitcoin as its legal tender, still planning to issue new Bitcoin ‘volcano bonds’ by 2024 and passing a law offering citizenship to foreigners investing in Bitcoin in the country. In the European Union, the MiCA law (Markets in Crypto-Assets) has finally been approved and is set to come into effect in April, with full enforcement scheduled for June 2024.

Overall, the total market capitalization of cryptocurrencies grew by over 101% in 2023 (according to CMC data). Additionally, cryptocurrencies are now legalized in 119 countries/regions, which represents the majority of countries/regions worldwide (according to CoinGecko). Investors can expect to hear some good news at the beginning of 2024.

The Cryptocurrency Trends of 2024

We can never be certain about the future, but some early trends can provide us with clues about the next steps in the crypto world. According to the 2024 Cryptocurrency Trends Report by Gemini, we might see some interesting developments. For example, they expect a higher intersection between artificial intelligence (AI) and cryptocurrency systems.

This integration is expected to completely change various aspects, including smart contracts, secure data solutions, transparent large language models, cryptographic security (auditing), and combating misinformation. Meanwhile, the prices of tokens related to artificial intelligence are significantly rising, indicating growing interest and confidence in the market.

On the other hand, speculation is rife regarding the potential approval of a spot Bitcoin ETF in the United States. The launch of this product, along with the next Bitcoin halving scheduled for April 2024 (aimed at reducing supply inflation), could have a positive impact on the price of Bitcoin, thereby influencing the overall cryptocurrency market capitalization.

However, more regulatory measures are set to be introduced globally. Despite the legalization of cryptocurrencies in most countries, only 52.1% of countries have implemented specific frameworks (according to CoinGecko). The MiCA law is the first to simultaneously cover multiple aspects of cryptocurrencies across multiple countries. With regulatory clarity, more institutions and companies can adopt cryptocurrencies for investment or to provide services to users, or even create their own stablecoins.

In summary, 2023 was a year of development for the cryptocurrency market, laying the groundwork for 2024. Cryptocurrencies will continue to evolve globally and gradually become an integral part of the financial system. However, investors should remain vigilant and exercise caution when participating in the cryptocurrency market. Understanding market dynamics and investment risks is key to success.

White Green is a highly regarded investment analyst renowned in the industry for his outstanding macro-strategic investments. His unique investment philosophy and excellent investment strategies have made him a rising star and pride of the Australian federal market.

As an outstanding investment analyst, White Green excels in quantitative portfolio management and data analysis to guide investment decisions. He focuses on value growth and utilizes portfolio diversification for risk hedging management. He successfully led teams and clients through the financial crises of 2008 and 2020, generating substantial returns for clients.

White Green’s investment achievements are not only attributed to his excellent investment strategies but also to his forward-thinking market insights. He deeply understands the behavior patterns of market participants and excels at capturing market trends and opportunities. His global macro strategy enables him to grasp the pulse of the global economy, providing unique insights for investment decisions.

White Green is a prominent figure in today’s investment community, and his macro-strategic investment approach and outstanding investment results make him a role model for many investors. Whether professional or individual investors, they can draw valuable experience from his investment philosophy and strategies to guide their investment journey.

0 notes

Text

The US Treasury Yield has reached levels not seen since 2007 thereby denting the demand for riskier assets such as Bitcoin and altcoins. After a strong start to October and Q4 2023, Bitcoin (BTC) price has dropped by 3% in the last 24 hours moving under $28,000. This happened amid some profit-taking as well as the global macro setup and the rising bond yield. Cryptocurrency markets experienced a Monday rally driven by optimism surrounding ETFs, which traders hoped would inject fresh enthusiasm and capital into an otherwise lackluster environment. Some even referenced the historical pattern of price surges in October, hoping for a recurrence of this phenomenon. However, skeptics argue that such optimism always carries the risk of disappointment. In a message to CoinDesk, Lucas Kiely, chief investment officer of Yield App, said: “October is also typically a good month for the cryptocurrency market. Indeed, it is dubbed “uptober” by market insiders. Only twice since 2013 has bitcoin closed at a loss in October, and hopefully, this year will see a continuation of that trend.” Maro Environment Dampens Bitcoin Price Rally The surge in the US bond yields has significantly dampened the demand for riskier investments. The 10-year US Treasury yield is approaching levels not seen since 2007, indicating increasing anticipation of an extended period of elevated Federal Reserve interest rates aimed at curbing inflation. These tighter financial conditions pose challenges for assets such as stocks and cryptocurrencies. Speaking to Bloomberg, Cici Lu McCalman, founder of blockchain adviser Venn Link Partners said: “The price pop was short lived as the macro environment is still hawkish on rates. The rise in US Treasury yields weighed on Bitcoin”. Cleveland Fed President Loretta Mester has suggested that there might be a need to increase the Fed funds rate once more this year. She emphasized that policy decisions should be driven by real progress regarding their dual mandate goals. Specifically, they will closely monitor whether the recent positive momentum in inflation over the past three months is sustained and if labor market conditions remain healthy even as they moderate. Bitcoin in Q4 2023 Historically, the last quarter of the year has always been bullish for Bitcoin and the broader cryptocurrency market. Bitcoin has experienced a 67% surge this year, a notable recovery from its downturn in 2022, although it’s still distant from its peak during the pandemic. Historical data enthusiasts find comfort in Bitcoin’s seasonal trends, especially in October, where it typically shows strength. Over the past ten years, Bitcoin has averaged a 24% increase in October, based on Bloomberg’s data. According to Kaiko, Bitcoin’s dominance in US crypto trading is growing, accounting for 71% of trading volumes on American exchanges in September. This surpasses the 66% level seen during the financial turmoil in March. One possible reason for this shift is institutional traders turning to Bitcoin due to rising real yields and increasing global risk concerns, as suggested by Kaiko. Thank you! You have successfully joined our subscriber list.

0 notes

Text

Best Crypto to Buy Now August 16 – SEI, THORChain, Toncoin

Best Crypto to Buy Now August 16 – SEI, THORChain, Toncoin

Cryptocurrency markets fell on Wednesday, with total market cap dropping by around $16 billion to around $1.1 trillion, Bitcoin (BTC) dropping 1.5% to around $28,700 and Ether (ETH) dropping 1.1% to just above $1,800, where it is now finding support from its 200DMA.

Downward moves in the crypto market come amid macro headwinds, with US stock markets falling while long-dated US government bond yields and the US dollar rise in wake of the latest Fed minutes release.

The minutes showed that officials at the US central bank remain concerned about potential upside risks to US inflation and said that more hikes might be needed unless conditions change.

That being said, US interest rate futures market pricing implies little change in the market’s perceived risk of another 25 bps rate hike in September.

As per the CME’s Fed Watch Tool, the likelihood of a September rate hike was last seen at 12.5%, up only slightly from 10% one day ago.

Perhaps more concerning for the crypto market is that Bitcoin has just snapped its 2023 uptrend and could now drop all the way to the mid-$20,000s again, while Ether looks to be on the verge of dropping below its 200DMA.

While technicals are turning negative for some of the blue-chip coins, things are not all bad.

Here are some of the top coins to buy on August 16th.

Sei (SEI)

SEI, the token that powers the just launched Sei blockchain that is specifically designed to facilitate trading, is up around 20% from its Tuesday closing price around $0.18, making it one of the top-performing cryptocurrencies in the top 100 by market capitalization.

SEI was last changing hands on major exchanges just above $0.21, well below earlier Wednesday peaks in the $0.28 area.

The cryptocurrency remains in a state of price discovery and will remain very volatile in the coming days and weeks.

However, at a still very modest market cap of under $400 million, there is a lot of potential upside for the Sei token.

THORChain (RUNE)

RUNE, the token that powers THORChain’s cross-chain decentralized exchange blockchain, is down just over 6% on Wednesday.

However, RUNE remains in a strong uptrend, having rallied 55% in just the last 10 days and broken convincingly to the north of all of its major moving averages in the process.

A retest of resistance around $2.0, and then of long-term support-turned-resistance around $3.0 remains a strong possibility in the weeks and months ahead, meaning possible near-term gains of as much as 40-100%.

Toncoin (TON)

Toncoin (TON) dropped 6.5% on Wednesday but is still up over 12% in the last seven days, making it one of the best-performing cryptos in the top 100 by market cap over this time period.

The cryptocurrency, which powers a layer 1 blockchain that was initially developed by the same team behind hugely popular encrypted messaging app Telegram, tried and failed to break above resistance at $1.52 in the form of the July highs and 100DMA.

But if it can find support above its 50 and 21DMAs around $1.30, then it still stands a good chance of pushing above this level in the coming days and weeks.

Crypto Alternatives to Consider

For crypto investors looking to diversify, an alternative high-risk-high-reward investment strategy to consider is getting involved in crypto presales.

This is where investors buy the tokens of up-start crypto projects to help fund their development.

These tokens are nearly always sold very cheap and there is a long history of presales delivering huge exponential gains to early investors.

Many of these projects have fantastic teams behind them and a great vision to deliver a revolutionary crypto application/platform.

If an investor can identify such projects, the risk/reward of their presale investment is very good.

The team at Cryptonews spends a lot of time combing through presale projects to help investors out.

Here is a list of 15 of what the project deems as the best crypto presales of 2023.

See the 15 Cryptocurrencies

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The Information contained in or provided from or through this website is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice.

New Post has been published on https://crynotifier.com/best-crypto-buy-now-august-16-sei-thorchain-toncoin-htm/

0 notes

Text

Maximizing Profits and Minimizing Losses: Understanding Stop-Loss Orders in Cryptocurrency Trading

youtube

Are you interested in the world of cryptocurrency trading? If so, then you've probably heard about a stop-loss order. But what is it exactly, and how can it be used to protect your investments?

Simply put, a stop-loss order is a tool used in trading to automatically sell a cryptocurrency asset when it reaches a certain price point. This can be incredibly useful for traders who want to limit their potential losses in case the market takes a turn for the worse.

Let's say, for example, you've invested in Bitcoin at $50,000 per coin. You're feeling pretty good about your investment, but you're also aware that the market can be volatile. So, you decide to set a stop-loss order at $45,000 per coin. If the price of Bitcoin drops to $45,000, your stop-loss order will trigger and automatically sell your coins, limiting your losses.

But stop-loss orders can also be used in more complex ways. For instance, you can use them to lock in profits by setting a stop-loss order at a higher price point than your initial investment. This way, if the market continues to rise, you'll be able to sell your coins and secure a profit.

Another strategy is to use a trailing stop-loss order. This type of order automatically adjusts the sell price as the market price fluctuates. This can be useful in a rapidly changing market, as it allows you to capitalize on any gains while still protecting your investments.

Of course, it's important to remember that stop-loss orders are not foolproof. In a highly volatile market, prices can sometimes fluctuate so rapidly that stop-loss orders may not trigger at the desired price point. Additionally, sudden market crashes can sometimes cause prices to plummet past the stop-loss price, leading to larger losses than expected.

In conclusion, stop-loss orders can be an incredibly useful tool for cryptocurrency traders. They allow you to limit your losses and protect your investments in a rapidly changing market. But it's important to use them wisely and in conjunction with other trading strategies. With the right approach, however, stop-loss orders can be a valuable addition to any trader's toolkit.

cryptocurrency trading #stop-loss orders #bitcoin #investing #trading strategies

0 notes

Text

A Guide to Understanding Volatility in the Cryptocurrency

Over the years, if there is a market that has immensely grown by its market capitalization or by its popularity, then it is, ‘Cryptocurrency.’ It is one of the most rapidly-growing markets in the world and has very high volatility. Undoubtedly, investing in cryptos yields a much higher return than investing in any other market; however, this market also requires investors to bear significant losses when it falls. This shows how much volatility this market has.

One of the basic reasons for their highly volatile nature is their newness. Along with this, there are a couple of things that need to be unpacked about this cryptocurrency. So, let’s delve into the detailed information below to have a proper understanding of crypto volatility and what factors lead to the large volatility in the crypto market.

What is Cryptocurrency Volatility?

To comprehend cryptocurrency volatility, first, we need to understand what this volatility means. It means how much the price of a particular asset has moved up and down over time. Generally, the more volatile an asset is, the riskier it becomes to choose it for investment. It can either provide the best return or the worst loss. Thus, cryptocurrency volatility means the fluctuation in the value of digital currencies.

What Factors Determine the Trajectory Of Crypto market?

In the last month of 2020, one of the most popular digital currencies, bitcoin, was trading around $20,000, which is roughly 14.85 lakh INR. Just after a month, meaning in January, it crossed $40,000 and kept on rising till it reached $65,000 in the next 3–4 months. However, it then crashed suddenly, and its value went down to $30,000. It then rose again, reaching $45,000. The reason for providing this information is to demonstrate how bitcoin, the first and most important cryptocurrency, fluctuated.

The entire market for crypto is correlated to the movement of bitcoin. If it rises, the market cap of cryptocurrencies will also increase, and if it falls, the market will also go down. As a result, bitcoin price analysis is critical for understanding the crypto market cycle. Apart from this, several other coins have shown the same ups and downs. There are some factors that collectively determine this fluctuation in the market. Let’s look at the point below:

● Emerging market Cryptocurrency is still a nascent market that is rapidly gaining popularity across the world. However, despite all the media attention, this market is still small compared to traditional currencies or even gold. It signifies that this market can be influenced by even a small group of investors who have a good amount of crypto coins. If investors keep other coins aside and only sell bitcoins, the market could crash.

● It runs on speculation This cryptocurrency market runs on speculation. A group of investors come together and bet on the ups or downs of its prices to make a profit. Because of this, the market suddenly reaches new heights and then suddenly goes down. There is no longer any crypto volatility as the prices keep fluctuating.

● No physical existence Almost every cryptocurrency, including bitcoin and ether, is completely digital. No backing of physical commodities and currency. It means that their prices depend on the law of supply and demand. This means that if there is no firm factor, any reason can cause this market to rise or fall.

● Short-term investors In comparison to the share market, the crypto market does not have many long-term investors. It means part-timers come here and make investments with the hope of making a profit quickly, but when their expectations fall short, they lose patience and withdraw the amount. The market is therefore unstable.

Conclusion

It is advisable to first analyze the market's current condition, consider all the different factors, and then choose where to invest. We have given you sufficient information about the volatility in the crypto world so that you can invest with proper understanding.

0 notes

Text

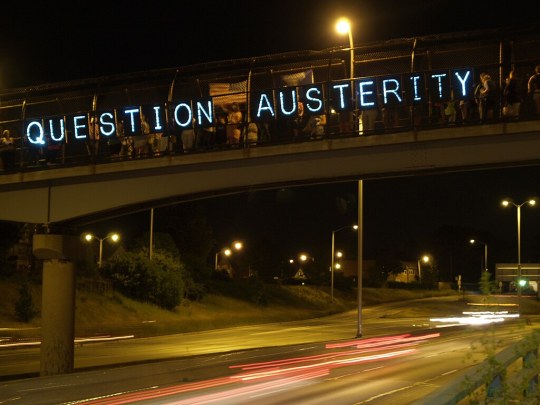

Political economy vs inflation

As Biden lays out ambitious plans to stimulate the US economy and fight inequality with new money creation (spending) and money destruction (higher taxes on corporations, capital gains and the right), a firing squad of economists assembled to issue dire inflation warnings.

They're repeating the economic doctrine of the pasty 40 years, an austerity doctrine that focuses on the inflationary risks of "deficit spending" (when governments don't tax as much money out of the economy as they inject in the same year).

It's a doctrine that made a pretense to being a science, going to far as to create a fake "Nobel Prize" in economics in a bid for scientific credibility (the Nobel administrators eventually folded the economics prize into its administrative remit).

The "neoclassicals" used abstract equations to "prove" a bunch of economic truths that - purely coincidentally - made rich people much, much richer and poor people much, much poorer.

Tellingly, the most exciting development in economics of the past 50 years is "behavioral economics" - a subdiscipline whose (excellent) innovation was to check to see whether people actually act the way that economists' models predict they will.

(they don't)

It's this vain, discredited and shambolic group who have assembled behind leaders like Larry Summers to decry Biden's stimulus spending plans, insisting that we are flirting with hyperinflation and the collapse of the USD as a global reserve currency.

But economists aren't the last word in understanding stimulus and inflation. If you're trying to figure out whether Summers is right and inequality, poverty and crumbling infrastructure are the price of American stability, it's worth checking out the *political* economists.

Here's a great place to start: Brown University economist Mark Blyth's interview with The Analysis, available in audio, video, and as a transcript:

https://theanalysis.news/interviews/mark-blyth-the-inflated-fear-of-inflation/

Blyth doesn't dismiss Summers' inflationary fears out of hand, but he does say that Summers is vastly overestimating the likelihood that stimulus spending will trigger inflation - Summers says there's a 1-in-3 chance of inflation, while Blyth says it's more like 1-in-10.

To understand the difference, it's useful to first understand what we mean by inflation: "a general, sustained rise in the level of all prices."

It's not a short-term spike (like we saw with GPUs when everyone upgraded their gaming rigs at the start of the pandemic).

It's also not an asset-bubble. House prices in Toronto are high, but that's not inflation. They're high because "Canada stopped building public housing in the 1980s and turned it into an asset class and let the 10 percent top earners buy it all and swap it with each other."

For inflation to happen in the wake of the stimulus, the spending would have to lead to too much money chasing not enough goods. Blyth gives some pretty good reasons to be skeptical that this will happen.

Start with the wealthy: they don't spend much, relative to their income. Their consumption needs are already met (that's what it means to be rich). You can only own so many Sub-Zero fridges, and even after you fill them with kobe beef and Veuve Cliquot, you're still rich.

What rich people do with extra money is *speculate*. That's why top-level giveaways generate socially useless, destructive asset bubbles. Remember, these aren't inflation, which is good, because everyone agrees that inflation is hard to stop once it gets going.

They're speculative bubbles. We have a much better idea of how to prevent bubbles: transaction taxes, hikes to the capital gains tax, and high marginal tax rates at the top bracket.

Okay, fine, so the rich won't be able to spend us into inflation after a broad stimulus, but what about poor people? Well, the bottom 60% of the US is grossly indebted, suffocating under medical debt, student debt and housing debt. A *lot* of that will disappear.

That will transfer a lot of stimulus money from poor people to rich people (who own the debt), which is why we need high capital gains and top-bracket taxation. But it will also sweep away a vast swathe of the financialized economy.

The point of long-term debt isn't to get paid off - it's to generate ongoing cash-flows that can be securitized and turned into bonds. Securitization converted "advanced" economies into shambling, undead debt-zombies.

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

It's securitization that led to the 2008 financial crisis, and it's securitization that sustains Wall Street's speculative acquisition of every single-family dwelling for sale in America as part of a bid to turn every home into an extractive slum.

Blythe explains that if the rich have nothing to buy and the poor use most of their stimulus to get out of debt, it will likely reorient the US economy to useful things: creating jobs to make stuff that people want to buy.

But what about the dollar's status as a global reserve currency? Won't all that stimulus send other countries scurrying around for another form of national savings? Blyth's answer is pretty convincing.

First, because there aren't any great alternatives: the European economy is growing at half the rate of the US. The Chinese economy is booming, but if you buy Chinese assets, there's a good chance you'll never be able to get them out of China.

Gold? Bitcoin? Leave aside the deflationary risk of pegging your currency to an inelastic metal or virtual token, leave aside the environmentally devastating effect of cryptocurrency (cryptos consume enough energy to offset the entire planetary solar capacity!).

Instead, think of the volatility of these assets, with their drunken, wild swings - countries that dump USD due to inflationary fears are hardly likely to switch to a crypto that can lose 20% of its value in a day.

And remember how much of that volatility is driven by out-and-out fraud, with major crypto exchanges and gold schemes imploding without warning, taking hundreds of millions of dollars with them. This is not a stable alternative to the dollar!

Beyond the lack of an alternative, there's another reason to believe that the USD will remain a global reserve, as Blyth elegantly explains.

Think of a Chinese company supplying the US market. Chances are, that's actually US company's subcontractor, getting paid in USD.

These end up swapped with the Chinese central bank for Chinese money, because Chinese companies need to pay salaries, rent, and other expenses in Renminbi, not dollars. The Chinese central bank holds onto the USDs, using them as a national savings, a reserve currency.

If China were to dump all its USD holdings into the world economy, it would tank the US dollar - which is to say, it burn China's own national savings. China's central bank needs to do something with those dollar savings, so they buy 10-year US T-bills.

Same goes for Germany - net exporters depend on a net importer to buy their stuff, and primarily that's the USA. They are stuck in a form of "monetarily assured destruction," and a crisis of confidence is unlikely "because you’ve got nowhere else to take your confidence."

Next, Blyth takes up is the proposed increase in the corporate tax rate, and he says that investors are actually surprisingly okay with this - he reminds us of Buffett's maxim, "Only when the tide goes out do you discover who's been swimming naked."

A hike in the corporate tax rate has the potential to reveal which of the "great" firms "are just really good at tax optimization" rather than efficient production. It'll smash those unproductive firms to pieces that can be bought by good firms for pennies on the dollar.

The final issue that Blyth takes up is an excellent one for this May Day: the relationship of higher wages to inflation. When the US had large, centrally managed industries with large, centralized unions, there was the risk that higher prices would trigger higher wages.

But the US doesn't have a unionized workforce with guaranteed COLA inflationary rises - there's no "wage-price spiral" risk of higher prices leading to higher wages and then higher prices.

The neoclassical theory of wages is based on the "marginal productivity" and "higher than outside option" theories: wage-levels are the product of how much money they stand to make from your work, and how much someone else is willing to pay you to work for them.

But economists like Suresh Naidu describe how high-tech surveillance can disrupt this equilibrium: you can spy on workers instead of paying them more, can impose onerous conditions on them that wring them of everything they can produce.

This kind of bossware was once the exclusive burden of low-waged, precarious workers, but thanks to the shitty technology adoption curve, it is working its way up the privilege gradient to increasingly elite workforce segments.

Digital micromanagement went from the factory floor to remote customer-support reps to office workers who are minutely surveilled by Office 365, all the way up to MDs and other elite professionals:

https://pluralistic.net/2021/02/24/gwb-rumsfeld-monsters/#bossware

This has led to increased profits for firms - firms now take a larger share of their productivity gains, and workers see stagnant or declining wages. That excess profit represents slack in the system.

It means that even if companies' costs go up, they can hold prices steady - all they need to do is reduce their retained profits.

We've had 40 years of price stability at the expense of a living wage for working people.

Higher wages are only inflationary if we assume that the 1% will continue to extract vast sums from their investments and use them to kick off destructive asset bubbles.

Image: badsci https://www.flickr.com/photos/7941730@N06/8625213990/

CC BY-SA: https://creativecommons.org/licenses/by-sa/2.0/

52 notes

·

View notes

Text

Why you have to collect a Crypto loan in 2021

Do you have a lot of bitcoin in your wallet, and are you thinking of selling your coins to solve a need or invest in your business? I’ve got good news for you.

When you need liquidity, there’s no need to sell your coins; Crypto loans are a better option, and I will show you exactly why. Recently, crypto loans have become more and more common.

These forms of loans make the procedure of borrowing capital much simpler than standard approaches.

The notion of crypto loans sounds dangerous for certain individuals and as if it’s too good to be real.

We want these concerns to be dispelled and let you know that crypto loans live up to the hype.

Reasons for a crypto loan:

To Invest in your business.

The most obvious reason for considering a small business loan is probably to invest in an opportunity for your company to expand. Continuing to grow your company when business is booming can help ensure that your profits do not plateau or shrink.

To avoid selling your crypto.

Some of us have spent years of labor and expertise gathering crypto, and you wouldn’t want to sell them off just because you are in dare need of cash.

Why sell when you can borrow?

If you believe in the long-term growth of your crypto, you should know that investing against it is more valuable than selling it. Because without abandoning your investments and their ability to rise in interest, you will access the value of your investment.

Meanwhile, Crypto loan interest rates are so tiny that individuals are stunned! Imagine where you’re getting cash and remain the owner of your coins. That is to say; your coins become the loan collateral. That is possible because of the Blockchain business model.

Why Crypto loans?

They are readily available.

If you have ever applied for a standard loan, you should probably know how long the procedure takes. Your credit report would be a big factor in deciding how much money you are eligible to borrow for regular loans.

If you have a poor credit score, likely, you will not get the funds you need. Some more variables are going to be taken into accounts, such as wages and credit records.

Crypto loans are readily available to whosoever that have crypto. Irrespective of their wages and credit scores. With applications like Smart credit, you can get real finance for your needs.

No need for fixed asset collaterals

Your crypto income is enough to obtain a crypto loan. No need for a house, land, or any fixed asset anywhere to serve as your collateral. Smartcredit needs your Bitcoin, Etherum, etc., as collateral to get you real cash.

Instant fund transfer

Some regular loan firms make you wait weeks. While some banks are accelerating their processes, many are still not. If you need a loan as soon as possible, Crypto Lending is a better choice.

In Crypto lending, within a short time, several platforms like Smartcredit will accept the loan. No hassles, just your Crypto and ID. As soon as you are approved, Crypto loans are converted, so you can quickly satisfy your real financial needs.

Save your tax

Most countries don’t tax your digital currencies. Hence you can lend or borrow crypto in smart credit without worrying about taxes. Meanwhile, if you chose to sell them, the likes of a DEX can tax you.

Multiplying Your Crypto