#the cycling federation of india

Explore tagged Tumblr posts

Text

Dandelion News - December 15-21

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles for 50% off this month!

1. 7 good things humanity did to combat climate change in 2024

“The UK […] closed its final coal power plant in October. [… In India,] the share of power provided by coal dropped below 50% for the first time since the 1960s. [… A non-profit] has provided solar energy to more than 6,000 of the poorest Nigerians.”

2. California Voters Said Yes to Prop 4, a Win for Birds, People, and Our Shared Future

“[…] Prop 4 will direct millions of dollars for water conservation and habitat restoration [… and] includes a requirement that at least 40% of its funding go to lower-income and climate-vulnerable communities.”

3. This Pennsylvania school is saving big with solar and EV school buses

“Steelton-Highspire’s solar arrangement will save it about $3.6 million over the next 20 years. As for the electric school buses, Steelton-Highspire is one of thousands of districts able to access federal rebates from a $5 billion program created by the 2021 Bipartisan Infrastructure Law.”

4. Autism Speaks Canada shuts down in January. Good.

“As Canada’s autistic-led advocacy group […] we are relieved that Autism Speaks Canada will be shutting down in January of 2025. This is an opportunity for autistics and our families to collaborate locally to build new, neuro-affirming spaces and projects.” [If you don’t know why this is a good thing, please click here]

5. LA Zoo hatches first-ever perentie lizards, one of largest lizard species in the world

“The LA Zoo is one of only three institutions accredited by the Association of Zoos and Aquariums that have successfully reproduced them[….] Adult perentie lizards can reach more than 8 feet (2.4 meters) in length and can weigh more than 40 pounds (18 kilograms), the zoo said.”

6. Research reveals an inexpensive fix for California's struggling wildflowers

“[… R]aking [“dead, invasive grasses”] is decidedly less labor-intensive and more ecologically friendly [than other management techniques…, but doing so] increased plant diversity overall, reducing invasive grasses […] while increasing both native and exotic wildflowers[….]”

7. A new EV battery could last more than 8 times longer, travel farther

“[… A] typical battery lasts 2,400 cycles, while the new battery lasted more than 20,000 cycles. [… Used batteries could be repurposed] for grid storage on wind and solar farms, the study notes.”

8. Women who are homeless in Boston find safe space and care at 'HER Saturday'

“Women can get lots of other care on the spot — from sick visits and basic health screenings to Pap smears and contraception. [… They also come for] "The makeup, the snacking and the girl talks. And ... picking out a new outfit," said Pinky Valentine [“a homeless transgender woman”].”

9. ‘It absolutely took off’: five UK biodiversity success stories

“[…N]ew methods are emerging to preserve, improve and generate new habitat and, in many cases, attract back or reintroduce species not seen for decades. After a nudge, ecosystems are often doing much of the heavy work themselves.“

10. Personalized gifts really do mean that little bit more to your loved ones, says research

“Research has also shown that receivers of personalized gifts are more likely to take care of them. […] In this sense, gift-giving can be not just an emotional exchange, but also a more sustainable one. A carefully preserved [personalised] gift avoids waste and brings long-term satisfaction.”

December 8-14 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#clean energy#world news#california#birds#habitat restoration#pennsylvania#school#electric vehicles#solar power#actually autistic#autism speaks#canada#autistic community#lizard#zoo#wildflowers#battery#technology#boston#homelessness#unhoused#biodiversity#christmas gift#uk#unique gifts#holiday#christmas#community

58 notes

·

View notes

Text

A Paradigm Shift: Understanding One Nation One Election Concept

In recent years, the concept of "One Nation One Election" (ONOE) has emerged as a potential paradigm shift in the electoral landscape of India. This ambitious idea proposes to synchronize the electoral cycles of all levels of government - central, state, and local - to ensure that elections are held simultaneously across the country. Proponents argue that such a move could bring about several benefits, ranging from cost savings to increased political stability. However, the proposal has also sparked intense debate and skepticism, with critics pointing to potential challenges and questioning the fundamental principles of federalism. This article explores the key aspects of the One Nation One Election concept and the implications it carries for the world's largest democracy.

Historical Context:

The idea of synchronizing elections at various levels is not entirely new. Historically, India followed a simultaneous election cycle during the initial years post-independence. However, as the political landscape evolved, different states started adopting their own electoral calendars, leading to a situation where elections were held almost every year in some part of the country. The revival of the One Nation One Election concept is seen as an attempt to restore order and efficiency to the electoral process.

Advantages:

1. Cost Efficiency: Conducting elections is an expensive affair, and the frequency at which they occur in India puts a significant strain on the financial resources of the nation. Proponents argue that simultaneous elections would lead to substantial cost savings, as the expenses related to security, logistics, and campaigning would be consolidated into a single event.

2. Stability and Governance: Frequent elections can disrupt governance, diverting the attention of policymakers away from crucial matters. One Nation One Election aims to provide a stable and consistent government at both the central and state levels, allowing for better long-term planning and execution of policies.

3. Reduced Campaigning Fatigue: With elections happening less frequently, political parties and candidates would have more time to focus on governance and policy issues instead of being in a perpetual state of election campaigning.

Challenges and Concerns:

1. Constitutional Implications: Critics argue that the One Nation One Election concept may undermine the federal structure enshrined in the Indian Constitution. State governments fear that their autonomy and independence could be compromised, as their electoral cycles would be synchronized with the central government.

2. Logistical Challenges: India is a vast and diverse country with varying climatic conditions. Conducting elections simultaneously across all states would pose significant logistical challenges, especially in terms of security and the deployment of election machinery.

3. Political Opposition: Opposition parties argue that the One Nation One Election concept could be used to stifle dissent and opposition voices, as it might create a scenario where a single party dominates both the central and state governments for extended periods.

Conclusion:

The One Nation One Election concept is undoubtedly a radical proposal with the potential to reshape India's electoral landscape. While its proponents emphasize the benefits of cost savings, stability, and reduced campaign fatigue, critics raise legitimate concerns about its impact on federalism and the practical challenges of implementation. As India grapples with the complexities of its diverse political and social landscape, the debate surrounding One Nation One Election will likely continue, requiring a careful examination of both its merits and potential pitfalls. Ultimately, any decision regarding the adoption of this concept must strike a delicate balance between streamlining the electoral process and upholding the principles of democracy and federalism.

#One Nation One Election#One Nation One Election essay#One Nation One Election debate#One Nation One Election pros and cons#what is One Nation One Election#Indian Election

2 notes

·

View notes

Text

VIDEO: Russia receives another batch of Su-35S fighters

Fernando Valduga By Fernando Valduga 07/13/2023 - 19:50m In Military

The Russian Ministry of Defense recently received an additional batch of new Su-35S aircraft that were manufactured at the Komsomolsk-on-Amur Aviation Plant, the second batch this year.

Judging by the video released today by the United Aircraft Corporation (UAC), the Aerospace Forces received two Su-35S fighters, and the photos of the corporation indicate that the transfer took place on June 30.

"The Komsomolsk-on-Amur Aviation Plant produces aviation equipment under the state defense order within the terms stipulated by the contracts, including before the delivery schedules, ensuring the needs of the Russian Aerospace Forces in modern aviation complexes," said Yuri Slyusar, General Director of the UAC conglomerate.

youtube

“The 4++ Su-35S generation multifunctional fighters underwent a cycle of ground and flight tests in various modes of operation and flew from the KnAAZ airfield to the service site,” UAC said.

Previously, at the end of June, KnAAZ delivered other Su-35S fighters to the Aerospace Forces. The number of aircraft was also not specified.

“We will continue to fulfill our obligations under the contracts concluded. The Su-35 aircraft of the next batches are in production. In addition, this year, the volume of supplies of fifth-generation Su-57 fighters to the Russian Aerospace Forces will increase,” said Yuri Slyusar.

On June 10, the first deputy general director of the Rostec State Corporation, Vladimir Artyakov, said in an interview with the Russia 24 TV channel that the aviation factories in Irkutsk, Komsomolsk-on-Amur and Novosibirsk doubled the production of Su-30SM and Su-35S fighters, as well as Su-34 frontline bombers.

Tags: Military AviationRFSAF - Russian Federation Aerospace Force/Russian Aerospace ForceSukhoi Su-35S (Flanker-E)

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, has participated in several events and air operations, such as Cruzex, AirVenture, Daytona Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work around the world of aviation.

Related news

MILITARY

Indonesian Air Force receives its second C-130J-30 Super Hercules

14/07/2023 - 17:51

MILITARY

Leonardo reveals the next package of updates for the Eurofighter Typhoon's survival capacity

14/07/2023 - 16:00

MILITARY

DARPA asks Northrop Grumman to design autonomous VTOL aircraft deployable on warships

14/07/2023 - 14:00

MILITARY

India agrees to acquire the 26 Rafale fighters and three Scorpene submarines from France

14/07/2023 - 08:51

MILITARY

USAF increases presence of bombers in the Pacific: B-52s arrive in Guam, B-1s in Japan

14/07/2023 - 08:15

MILITARY

Metrea announces the first commercial air refueling of USAF aircraft

13/07/2023 - 16:00

3 notes

·

View notes

Text

Which electric scooter is the greatest one, do you know? Here are the top 10 electric scooters in India:

Due to the rising cost of fuel, electric scooters have become a viable alternative to petrol scooters. The best electric scooters on the market in India are listed below.

Electric scooters come in a wide range of sizes and designs in India. To help you in your quest, we've compiled a list of the best electric scooters currently on the market in India. E-scooters are included on the list from both established and new businesses. These scooters are not only cost-effective but also environmentally benign because their operating and maintenance costs are lower than those of their ICE counterparts. Additionally, many electric scooters, if not all, now match their fuel-powered equivalents, and you can further lower the cost with government incentives from the federal and state governments, subject to change. Here are the best 10 electric scooter in our opinion:

1)Hero Electric Optima CX (dual-battery):

Currently, Hero Electric continues to rank among the most well-known brands in the EV sector, which should not be confused with Hero Motocorp. One of the brand's most dependable workhorses is the Hero Electric Optima CX, and the Sohinder Singh Gill-led business is one of the most well-known producers of electric scooters on Indian roads. We highly recommend the dual-battery model of the scooter, which has a wonderful certified range of 140 km each charge cycle. Additionally, the battery is detachable, making it even more useful as you can charge it at home without necessarily having a mobile charging station. The scooter is the ideal option for city commuting because of its top speed of 45 kmphYou also receive comforts like a computerised instrument display and a USB port for charging your smartphone. See (https://heroelectric.in/bike/optima-cx-dual-battery/) for additional details.

Hero Electric Optima CX price in India: The EV is priced in India at Rs 77,490.

Benefits

Great riding range

Detachable battery for charging

Has all the essential features

2) Bajaj Chetak:

In the past, Bajaj Chetak was among the most well-known and well-liked scooter brands. The business is now bringing it back in an electric version. The scooter's design is a stunning fusion of its historical tradition and contemporary elegance. In terms of specifications, it has a range of up to 108 km, and the battery is expected to last 70,000 km, or 7 years. The battery features a rapid charging capability that allows for a 25 percent charge in only one hour and a full charge in just five. Its steel body is made to last and has an IP67 rating for water and dust resistance. It is without a doubt a high-end scooter, but the price is still too much. For more information (https://www.chetak.com/)

Bajaj Chetak EV price in India: The Bajaj Chetak starts at a price of Rs 1,21,000 (ex-showroom).

Benefits

Good durability

Charges fast

Iconic brand

3) TOYA:

The TOYA electric scooter, which is gorgeous and sporty-looking, was just released in the Indian market in 2021–2022. It is produced by West Burdwan's DEEDEV Motors. The TOYA is powered by a 48v/60v battery and has a top speed of 25 km/h. It is said to have an all-day range of 80 km in power mode. The most popular model is this one. The scooter comes with two riding modes: City and Eco. Batteries are created by combining lead acid with lithium ion. The battery can be charged for up to 3-4/6-8 hours. Other characteristics of this scooter include: 1-2-3 gear, reverse gear, alarm system, LED light, remote control, USB, auto pilot mode, among others. The customization of battery options, etc. For more information (https://deedavmotors.com/)

TOYA price in India: The Toya at a price of Rs 49,999.

Benefits

Reverse mode

Modern and flashy looks

Push foot rest

4) Simple One:

The Simple One is a new electric scooter that looks similar to the Ather 450X and Hero Vida V1 in that it is sleek and athletic. The official website of the business now offers Simple One for sale after various delays. The e-scooter's features and drivetrain include an 8.5kW motor with a maximum torque output of 72Nm. A 3.3kWh Lithium-ion battery powers the engine, and a fifth removable battery under the seat brings the overall capacity to 5kWh. The scooter's advertised range on a single charge is 212 km. A combi braking system, connectivity options, a 7-inch TFT display, LED lighting, alloy wheels, disc brakes, and many more useful features are also included. For more information (https://www.simpleenergy.in/)

Simple One price in India:

The Simple One’s standard variant can be purchased for Rs 1,45,000 (ex-showroom) while the top model is available for Rs 1,50,000 (ex-showroom) in India.

Benefits

Distinctive look and design

Good riding range

Great set of features

5) MIMI:

The MIMI, which is made by DEEDEV Motors, is one of the most reasonably priced electric scooters available today. The motor can propel the bike at up to 25 kph, though this speed can change based on which of the three riding modes you choose, Eco, City, or Sports. The battery's stated range is 80 kilometres, and it can take 3–4–6–8 hours to fully charge it using the charger. Other features include an alarm system, 1-2-3 gear, reverse gear, unique battery, LED headlamp, and more. Visit DEEDEV Motors for more information. (https://deedavmotors.com/)

MIMI price in India: The MMI at a price RS. 49,999.

Benefits

One of the most affordable e-scooty

Multiple riding modes

Best for girl’s

6) Hero Vida V1:

HereThe Vida V1 is the first electric scooter that Vida, a division of Motocorp, has produced. The scooter comes in two different models: Vida V1 Plus and Vida V1 Pro. Both versions have a top speed of 80 kmph, although the V1 Pro accelerates from 0 to 40 kmph in 3.2 seconds compared to the V1 Plus' 3.4 seconds. In accordance with the stated range, the new EV two-wheelers will be able to deliver a range of 163 km for the V1 Pro and 143 km for the V1 Plus, respectively. Both electric scooters are run by a portable battery pack that can be charged from empty to 80% capacity in about 65 minutes. Both Vida V1 models' 7-inch touch displays give users access to a variety of intelligent capabilities, including as trip statistics, riding simulators, parking help, and navigation. Visit(https://www.vidaworld.com) for additional information.

Hero Vida V1 price in India:

The Vida V1 Plus and V1 Pro come at an ex-showroom price of Rs 1,28,000 and Rs 1,39,000 respectively which includes the FAME II and state subsidy. Additionally, the reservation price is set at Rs 2,499.

Benefits

Portable battery for charging

All round robust design

Decent pickup times

7) TVS iQube ST:

The TVS iQube ST electric scooter sticks out for having a more traditional appearance, but that has advantages of its own. For starters, the iQube ST features one of the largest boot compartments, allowing you to fit two full-sized helmets to protect both you and your travelling companion. That's not all, though. The scooter has a maximum riding range of 110 km in performance mode and 145 km in economy mode. The scooter is one of the best-performing electric scooters on the market because it can reach a respectable riding speed of 82 kmph when used in the latter. Additionally, you get a 7-inch touchscreen with Bluetooth audio playback, Amazon Alexa voice assistant integration, and even social media notification screens that adhere to all safety precautions to keep you from being distracted. For more details (https://www.tvsmotor.com/iqube/tvs-iqube-st-variant-details)

TVS iQube ST price in India:

The TVS iQube ST comes with a sticker price of Rs 1,09,256 in Delhi.

Benefits

Excellent range

Rich set of features

Four body colours

8) Toper:

The Simple One is a brand-new electric scooter that boasts a sporty design much. It’s also manufactured by DEEDEV Motors. DEEDEV Motors company is one of the most well-known manufacturers of electric scooters. Simple One is now finally available to purchase through the company’s official website (https://deedavmotors.com/). The battery can take upto 3-4/6-8 hours to charge. Running under the hood is a 48v/60v Lithium-ion battery. The scooter is able to provide 80km of claimed range on a single charge. Apart from that, there are several handy features packed in as well such as a combi braking system, alarm system, LED lighting, alloy wheels (black), remote control, customise the battery choice, USB and many more.

Toper price in India: The Toper at a price RS. 49,999.

Benefits

Distinctive look and design Good riding range Great set of features

9) Bounce Infinity E1:

Even if you do not pay the full retail price, the Bounce Infinity E1 scooter is still available to you through the company's Battery-as-a-service, or BAAS, agreements at a much cheaper cost. The plans include a switchable battery option for Rs 35 each switch and a monthly membership charge that starts at Rs 849. The actual cost of the Bounce Infinity E1 is thus reduced to Rs 0.65 per kilometre.

The 85-kilometer maximum range and 65-kilometer top speed of the Bounce Infinity E1 are both on a single charge. Three different driving modes are offered: Drag, Eco, and Power. Aside from being IP 67 rated, adaptable, and portable, the 2kWhr 48V battery pack for the electric scooter is also available. For more information (https://bounceinfinity.com/infinity_e)

Bounce Infinity E1 price in India:

The Bounce Infinity E1 is retailing in India at Rs 68,999 (with battery) and Rs 36,099 (without battery).

Benefits

Cost

Swappable battery

Regenerative braking system

10) Okaya Fast F2F:

One of the most reasonably priced electric scooters on the market right now is the Okaya Fast F2F. The Fast F2F has an 800W BLDC hub motor that can reach high speeds of up to 55kmph. high speeds may also vary according on the riding modes, which include Eco, City, and Sports. The battery, which has an advertised range of 80 km, can take up to 5 hours to fully charge using the included charger. A remote key, digital instrument cluster, and LED headlamp are a few other highlights. For more information (https://okayaev.com/faast-f2f/)

Okaya Fast F2F price in India:

The Okaya Fast F2F is available at starting price of Rs 83,999 (ex-showroom) in India

Benefits

Very affordable compare to others

Multiple riding modes

Many features are available

#electric vehicles#west bengal#scooter#electric scooter#top electric scooter in india#top electric scooter2023

4 notes

·

View notes

Text

In the millennia that humans have roamed the earth, the world has cycled through a number of obscure, even unusual, currencies. The ancient Mayans are believed to have used chocolate as money; traders in the Solomon Islands favored dolphin teeth. Yap islanders, at least those with strong backs, tended toward massive stones. The British pound, the oldest global currency still used today, anchored the global economy, until its fall in the early, mid, and late 20th century.

Today, it is the dollar that reigns supreme. The world’s biggest economy (probably) can print greenbacks at will. The dollar is the world’s most widely held reserve currency and also dominates global trade. Oil, no matter how many times Saudi Arabia and China hold their breath, is still priced in the dollar. Most other major commodities are, too. As is pretty much everything else.

Yet talk of de-dollarization is in the air. Fueled by fears of U.S. sanctions, Russia and China appear to be ramping up efforts, yet again, to use the renminbi (RMB) in trade with partners, while BRICS countries are weighing a new common currency as yet another alternative.

“Every night I ask myself why all countries have to base their trade on the dollar,” Brazilian President Luiz Inácio Lula da Silva lamented last month. “Who was it that decided that the dollar was the currency after the disappearance of the gold standard?”

First of all, gold bugs, dollar dominance came first. And second, don’t believe the hype about the demise of the dollar.

Wait, back up. What even is de-dollarization?

De-dollarization refers to a country’s effort to become less dependent on the dollar, whether by using another currency to settle cross-border trade or diversifying reserves away from the dollar by turning to gold, the Chinese yuan, or bitcoin. It doesn’t necessarily mean that the greenback has become less vital for that country’s economy—or that its reign is over. (Especially when the U.S. Federal Reserve’s decisions on interest rates mark the tune that nearly every other country dances to.)

“To me, de-dollarization just means a government’s ability to reduce its dependence or reliance on the dollar,” said Daniel McDowell, a professor of political science at Syracuse University. “I think the key thing here is to try to distinguish or separate the concept of de-dollarization from the end of dollar dominance. I don’t think those two things have to go together.”

What’s with all of the hype now?

Much of the current attention is driven by Russia, which has ramped up its use of the yuan to cope with sweeping Western sanctions. After the Kremlin invaded Ukraine in February 2022, the G-7 hit back with a spate of punishing economic measures. That strangled the Russian economy—and forced Moscow to rapidly seek alternatives to both the dollar and euro.

“There’s no doubt that the Russians have been forced to de-dollarize and also de-euroize their trade,” said Brad Setser, a former senior advisor to the U.S. trade representative during the Biden administration, now at the Council on Foreign Relations. “There is evidence that Russia in particular is making greater use of the yuan, and it’s also clear that the Chinese and others are looking for opportunities to expand the use of the yuan in trade settlement.”

China’s recent efforts have only added fuel to the fire. As part of China’s bid to internationalize its currency, a number of countries beyond Russia—including Saudi Arabia, Bangladesh, India, Argentina, Brazil, Pakistan, Iraq, and Bolivia—have recently either traded in the yuan or expressed their willingness to do so in the future. They are spinning their tires: Cross-border transactions denominated in RMB are still a tiny fraction of business done in the dollar or the euro.

Why are they so desperate to diversify away from the dollar?

As Western nations levy harsh sanctions against Moscow, Beijing is worried that it could be next. Given the current fraught geopolitical climate, China hopes that reducing its reliance on the dollar will help act as a buffer against the threat of U.S. sanctions.

“I don’t think that any Chinese economists believe that they can actually supplant the dollar globally,” said Gerard DiPippo, a senior fellow at the Center for Strategic and International Studies. “Their goals are more modest. It’s about mitigating Chinese banks’ sanctions exposure, which is very hard to do.”

It’s not just the threat of sanctions that’s prompting these moves, either. For some countries, it’s out of necessity; they have to turn to the yuan, or other forms of currency, when they are unable to access dollars. Argentina, for instance, announced that it would use the yuan to purchase Chinese goods as it grapples with shrinking dollar reserves.

Countries that are economically dependent on China may also be attempting to curry favor with Beijing, which has been encouraging the internationalization of the yuan. “It could just be about trying to signal to China that we’re on your team and we want to help you there,” McDowell said. “So some of it’s political and symbolic.”

Is this new?

No, this has been underway for years. China’s efforts to internationalize the yuan date back to at least the 2008 global financial crisis, when American banks stopped lending and Beijing was left in the lurch. Ever since, China has worked to build up its resilience and expand the use of the yuan in trade, including by striking a spate of bilateral currency swap deals and establishing the Cross-Border Interbank Payment System (CIPS).

“It’s really nothing new,” said Zongyuan Zoe Liu, a fellow for international political economy at the Council on Foreign Relations and FP columnist. “It’s not that China has just recently been doing it, or they just suddenly decided this is a good idea. They have been doing this for a while.”

But China and Washington don’t get along. What has given impetus to the latest push is broader dissatisfaction with America’s economic stewardship, starting with a spray-and-pray approach to economic sanctions and ending, or just beginning, with the current debt ceiling crisis.

“Geopolitical concerns have become a bigger driver of the push in interest in internationalizing the currency,” McDowell said. “I think Chinese policymakers are concerned about being sort of facing similar kinds of financial pressures that Russia has faced at some point in the future.”

Can these efforts threaten the dollar’s dominance?

Not anytime soon. Even though the yuan has been increasingly used in international payments for bilateral trade, the “actual share is tiny” in comparison to the dollar, said Paola Subacchi, a professor at Queen Mary, University of London.

For both trade financing and reserves, China’s long-standing efforts to expand the use of the yuan have failed to make much of a dent. In March, the dollar accounted for 41.7 percent of global payments—just slightly eclipsing the yuan’s share of 2.4 percent, according to data from the Society for Worldwide Interbank Financial Telecommunication. Similarly, last year, 58 percent of the world’s foreign exchange reserves were held in dollars, compared to just 2.7 percent in Chinese yuan. It’s hard to replace the dollar when one doesn’t allow free convertibility, which severely limits the yuan’s international appeal.

“The numbers are still showing that the dollar is still the dominant currency,” Subacchi said.

Beijing will keep trying, and keep failing. The yuan’s not convertible, the government controls capital flows, and even its value is manipulated by Beijing. You can’t do business with IOUs, but you can always do business with a bushel of greenbacks.

“I think there will be incremental moves to make greater use of the yuan to denominate China’s trade with commodity-exporting countries,” Setser said. “And then I think China will discover that it is difficult to fully go much further and to really radically change the structure of how it settles its trade, because it still wants to sell to the U.S., still wants to sell to Europe. Its economy doesn’t balance without significant exports.”

2 notes

·

View notes

Text

BNP Paribas AM: Investment Outlook for 2025

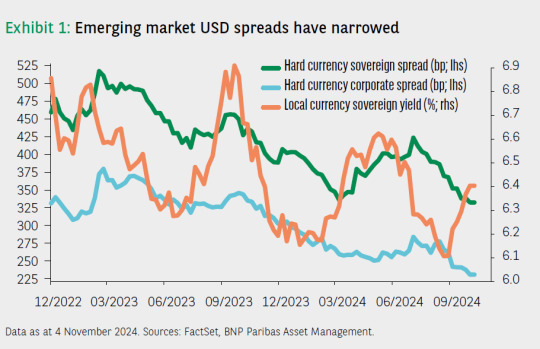

The Investment Outlook for 2025 highlights a year of significant economic and market transitions. With inflation under control, central banks are poised for easing cycles, offering new opportunities for investors. At the same time, geopolitical and environmental challenges underscore the importance of resilience, diversification, and thematic investing. Key Themes and Strategic Insights 1. Navigating Macroeconomic Shifts - Soft Landing or Recession Risks: - Markets anticipate a soft landing, but scenarios such as renewed inflationary pressures or a hard landing remain possible. - Global central banks, including the Federal Reserve and European Central Bank, are expected to cut rates to support growth. - Regional disparities persist, with the U.S. outperforming Europe, while China focuses on stabilizing its property market and stimulating emerging industries.

- Geopolitical Dynamics: - The re-election of Donald Trump introduces uncertainty, with potential shifts in U.S. tax policies, trade agreements, and global economic ties. - Geopolitical hotspots (e.g., Ukraine, Taiwan, Israel) create additional risks for markets. 2. Sustainability and Thematic Investments - Transition Finance: - Investments targeting decarbonization and sustainable operations in high-emission sectors (e.g., energy, heavy industry) are gaining momentum. - EU regulations like ESMA’s fund naming guidelines in 2025 will enhance transparency and accountability in transition investments. - Climate Adaptation: - Climate resilience strategies, including infrastructure upgrades and disaster response, are becoming central to investment portfolios. - Water scarcity solutions (e.g., smart irrigation, water treatment) present a diverse and resilient investment opportunity. - Natural Capital: - Regenerative agriculture, forestry, and water resource preservation are key areas for achieving both economic stability and sustainability goals. - Governments and institutions increasingly prioritize biodiversity and ecosystem restoration. 3. Equity Markets: Favoring Resilience - U.S. Market Leadership: - U.S. equities remain attractive due to fiscal stimulus and advancements in technology, particularly artificial intelligence (AI). - Small caps and value stocks are positioned for recovery as interest rates decline. - European Equities: - Europe lags due to structural challenges in Germany and geopolitical headwinds, but exporters benefit from robust U.S. growth. - Consumer-driven sectors depend on stronger demand recovery. - Emerging Markets: - Markets like India and Southeast Asia offer growth potential, driven by demographics and policy reforms. - China’s success in revitalizing its economy remains a critical swing factor. 4. Fixed Income: Life Beyond Cash - Opportunities in Bonds: - Investment-grade credit offers stable returns amid easing monetary policies. - U.S. mortgages and emerging market local currency bonds provide attractive yields. - Active Management: - A steep yield curve and higher real yields favor active strategies to capitalize on dispersion and timing. - Quantitative Tightening: - Central banks unwinding quantitative easing introduce volatility, creating arbitrage opportunities in fixed income markets.

5. Private Credit and Alternatives - Private Credit Expansion: - Private credit markets are democratizing, with innovations like ELTIF 2.0 making them accessible to retail investors in Europe. - Partnerships between asset managers, banks, and insurers streamline the credit chain. - Sustainability in Private Credit: - Investors increasingly demand ESG-compliant frameworks, pushing managers to develop robust methodologies for evaluating borrowers’ sustainability practices. - Infrastructure and Real Assets: - Renewable energy projects, energy-efficient buildings, and digital infrastructure investments align with long-term structural trends. Strategic Asset Allocation - Equities: - Overweight U.S. equities, particularly AI and technology sectors. - Focus on value opportunities in Europe and growth-oriented emerging markets. - Fixed Income: - Emphasize high-yield credit, local currency emerging market bonds, and inflation-linked securities. - Active duration management to navigate rate volatility. - Private Markets: - Leverage private credit for stable yields and diversification. - Real assets, including infrastructure and water solutions, provide inflation hedging and long-term growth. - Sustainability: - Prioritize transition finance, climate adaptation strategies, and natural capital investments. 2025 presents a landscape of opportunities driven by sustainability, technological innovation, and economic recovery. Investors should adopt a balanced and flexible approach, leveraging thematic investments, private markets, and active management to navigate risks and capture growth. Resilience, diversification, and long-term sustainability remain key to optimizing portfolios in an evolving global environment. Read the full article

0 notes

Link

0 notes

Text

Battery Recycling Market Size, Share, Growth And Analysis Report 2024-2030

The global battery recycling market size was estimated at USD 1.83 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 37.6% from 2024 to 2030.

The industry is expected to grow rapidly during the forecast period owing to increasing popularity of electric vehicles (EVs) and renewable energy storage systems leading to a higher demand for batteries, and, in turn, driving the need for recycling. Governments globally are implementing regulations to promote the recycling of batteries and reduce environmental impact, which is expected to boost industry growth.

Gather more insights about the market drivers, restrains and growth of the Battery Recycling Market

The U.S. emerged as the largest market in North America in 2023. Increasing sales of EVs in the U.S. owing to the formulation of supportive federal policies, such as the Responsible Battery Recycling Act of 2022 California, and presence of leading industry players are expected to drive demand for batteries in the country over the forecast period. Responsible Battery Recycling Act of 2022 California instructs each battery retailer in the state to have a system for collection of used rechargeable batteries for recycling and reusing purposes.

The U.S. has emerged as a growing market for the recycling of li-ion batteries owing to the presence of large-scale li-ion recycling facilities in the country. For instance, Li-cycle Corp. inaugurated its new li-ion recycling facility with 120,000 square feet of warehousing space. This facility can process 10,000 tons of battery material for electric vehicles annually. The company possesses the capacity to recycle 60,000 electric vehicle batteries.

Battery Recycling Market Segmentation

Grand View Research has segmented the global battery recycling market report based on chemistry, application, and region:

Chemistry Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

• Lithium-ion

• Lead Acid

• Nickel

• Others

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

• Transportation

• Consumer Electronics

• Industrial

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o U.K.

o France

o Italy

o Spain

o Poland

o Netherlands

• Asia Pacific

o China

o Japan

o South Korea

o Taiwan

o India

o Indonesia

o Malaysia

o Thailand

o Vietnam

o Australia

• Central & South America

o Brazil

o Argentina

o Chile

• Middle East & Africa

o UAE

o Saudi Arabia

o South Africa

Browse through Grand View Research's Power Generation & Storage Industry Research Reports.

• The global portable power station market size was estimated at USD 0.61 billion in 2023 and is estimated to grow at a CAGR of 16.7% from 2024 to 2030.

• The global generator paralleling switchgear market size was estimated at USD 1.71 billion in 2023 and expected to grow at a CAGR of 8.7% from 2024 to 2030.

Key Companies & Market Share Insights

Market is highly competitive and consolidated due to the presence of a large number of well-established players. Dominant trend in operations of these battery recycling companies includes collaborations, mergers & acquisitions, and expansions, which facilitate competition in the industry.

In November 2023, Redwood Materials announced their expansion for battery recycling in line with the increasing demand for recycling of electric vehicle batteries.

Key Battery Recycling Companies:

• Call2Recycle

• Exide Technologies

• Gravita India Ltd.

• Glencore

• Cirba Solutions

• American Battery Technology Company

• Gopher Resource

• East Penn Manufacturing Co.

• Aqua Metals

Order a free sample PDF of the Battery Recycling Market Intelligence Study, published by Grand View Research.

#Battery Recycling Market#Battery Recycling Industry#Battery Recycling Market size#Battery Recycling Market share#Battery Recycling Market analysis

0 notes

Text

Bitcoin Poised for All-Time High Amid Surging Demand and Expected Economic Changes

Key Points

Bitcoin (BTC) price has rebounded significantly following signals of a potential interest rate cut by the Federal Reserve Chair, Jerome Powell.

The rising adoption of Bitcoin by institutional investors and anticipated economic shifts are further fueling this surge.

After Jerome Powell, the Federal Reserve Chair, hinted at a possible interest rate reduction in September, Bitcoin (BTC) price experienced a significant rebound over the weekend.

Bitcoin ended the previous week trading slightly above $64k, a roughly 10% increase from the closing price of the week before.

Technical Indicators

From a technical perspective, Bitcoin’s price has consistently closed above the daily 50 and 200 Moving Averages (MAs) in recent times, despite the presence of their death cross.

Moreover, the daily Relative Strength Index (RSI) has bounced back above the 50% mark, indicating that bulls are gradually gaining control following the crash on August 5.

A market rebound, led by Gold and traditional stock indexes, has signaled a likely bull rally for the entire crypto industry.

Adoption by Institutional Investors

The crypto industry has achieved considerable regulatory clarity in several major jurisdictions, including the United States, Russia, Hong Kong, India, Europe, and Singapore.

The approval of spot Bitcoin and Ethereum ETFs in the United States has encouraged other jurisdictions to follow suit.

For example, Brazil has already approved two spot Solana (SOL) ETFs, while Hong Kong, Canada, and Australia already have spot BTC and Ethereum ETFs.

According to recent market data, the US spot Bitcoin ETFs registered a net cash inflow of $252 million on Friday, led by BlackRock’s IBIT and Fidelity’s FBTC.

As a result, the net cash inflows into the US spot Bitcoin ETFs have exceeded $550 million over the past two weeks, signaling a further bullish outlook.

The significant accumulation of the US spot Bitcoin ETFs recently has coincided with a notable decrease in the supply of BTC on centralized exchanges (CEXs).

Interestingly, the supply of stablecoins on CEXs has continued to rise significantly, suggesting an increase in overall buying power.

Anticipated Economic Shift

The forthcoming US elections and expected changes in monetary policy will play a significant role in Bitcoin price action.

More than 115 days since the fourth Bitcoin halving, BTC price action is nearing the breakout zone, similar to previous bull cycles.

The US Fed is expected to initiate the first interest rate cut from next month since the onset of COVID-19, signaling a major economic shift.

According to Fed Chair Powell, inflation has significantly eased without a noticeable spike in unemployment, suggesting a need for an economic shift for the next five years.

As a result, Bitcoin price is expected to benefit significantly from the increasing global liquidity among other factors.

0 notes

Text

Jackson Hole: Will Fed Chair Jerome Powell Signal Rate Cuts? Potential Impact on Indian Stock Market Analyzed by Experts

As the Jackson Hole Economic Symposium approaches, global financial markets are focused on U.S. Federal Reserve Chair Jerome Powell, who is expected to provide insights into a potential rate cut in September. Analysts suggest that Powell may hint at a 25 basis points (bps) cut, with some even considering the possibility of a 50 bps reduction, depending on recent economic indicators.

The Jackson Hole Symposium, hosted annually by the Federal Reserve Bank of Kansas City, gathers central bankers from around the world to discuss pressing economic issues. This year’s event, scheduled from August 22 to 24, will explore the theme "Reassessing the Effectiveness and Transmission of Monetary Policy."

While many anticipate Powell to clearly signal a rate cut, experts caution that the Fed Chair has emphasized the importance of remaining data-dependent. Nevertheless, the likelihood of a 25 bps cut in September seems increasingly strong.

Expert Opinions on Impact

Madhavi Arora, Lead Economist at Emkay Global Financial Services, noted that market expectations are leaning towards a September rate cut, with Powell likely to prepare the groundwork during his Jackson Hole address. Arora highlighted that markets are currently pricing in a 78% probability of a 25 bps cut. Indian markets, particularly the rate-sensitive IT sector, have already factored in the possibility of rate cuts, but a confirmed cut could still boost sentiment.

Sahil Shah, Managing Director and Chief Investment Officer at Equirus, pointed out that Indian interest rate cycles often mirror U.S. trends. He emphasized that U.S. rate cuts typically benefit technology stocks, which could positively impact Indian IT services. However, Shah also reminded investors that market performance is influenced by various factors beyond interest rates, such as India’s valuation and growth prospects.

Narinder Wadhwa, Managing Director & CEO of SKI Capital, believes that a dovish stance from the Fed could lead to increased foreign portfolio inflows into the Indian stock market. Sectors like IT and pharmaceuticals, with significant exposure to the U.S. market, could see strong gains. However, Wadhwa warned that the extent of the impact would depend on the magnitude of the rate cut and Powell’s commentary on future policy directions.

Manish Chowdhury, Head of Research at StoxBox, expects that Powell and other Fed officials will provide clear hints on the future interest rate trajectory. He anticipates a 25 bps cut in September, which could be positive for Indian equities, particularly in the realty and IT sectors.

Amit Goel, Co-founder and Chief Global Strategist at Pace 360, believes Powell will adopt a cautious approach, suggesting that while the risks now favor rate cuts, the Fed will refrain from signaling a September cut as a certainty. Goel predicts a 25 bps cut in September, noting that a larger 50 bps cut could send an alarmist message about the U.S. economy's health.

Potential Impact on Indian Markets

If Powell signals a rate cut, it could act as a catalyst for Indian markets by attracting foreign investments and boosting sentiment in rate-sensitive sectors. However, experts advise caution, as global markets may experience volatility in response to the Fed’s policy signals. The Reserve Bank of India (RBI) may also consider adjusting its policies in response to the Fed’s actions, further influencing the Indian stock market.

As the world awaits Powell’s address at Jackson Hole, investors should be prepared for potential market shifts driven by the Fed's monetary policy direction.

#Jackson Hole#Jerome Powell#Federal Reserve#Interest Rates#Rate Cut#Indian Stock Market#IT Sector#U.S. Economy#Global Markets#Monetary Policy

0 notes

Text

Olympic breakdancer disqualified for 'Free Afghan Women' slogan

New Post has been published on https://sa7ab.info/2024/08/11/olympic-breakdancer-disqualified-for-free-afghan-women-slogan/

Olympic breakdancer disqualified for 'Free Afghan Women' slogan

Olympic Refugee Team breakdancer Manizha Talash from Afghanistan was disqualified from the breaking competition after she wore a cape saying “Free Afghan Women”, the World DanceSport Federation told AFP on Saturday.

B-girl Talash, 21, unveiled the blue top with the slogan on Friday just before the first duel of the whole competition, against India Sardjoe of the Netherlands.

“Refugee athlete B-girl Talash was disqualified for displaying a political slogan on her attire in violation of Rule 50 of the Olympic Charter,” the association said in a statement to AFP.

That rule states that “no kind of demonstration or political, religious or racial propaganda is permitted in any Olympic sites, venues or other areas”.

Born in Kabul, under Taliban control since 2021, Talash fled the country to live in Spain with her two brothers.

Before arriving in Spain, she spent a year in hiding in Pakistan because she did not have a passport.

“I didn’t leave Afghanistan because I’m afraid of the Taliban or because I can’t live in Afghanistan,” she said before the competition.

“I left because I want to do what I can for the girls in Afghanistan, for my life, my future, for everyone.”

In Kabul, she discovered breaking online and joined a local club, where she was the only girl.

Despite the risks – the troupe was forced to switch practice venues after receiving death threats – she was determined to pursue her passion.

“I took the risk of becoming a target. I have fear in my heart but I won’t give up,” she told AFP in 2021.

Six athletes represented Afghanistan – including three women not acknowledged by the Taliban government – at the Paris Olympics in cycling, athletics, swimming and judo.

1 note

·

View note

Text

A Comprehensive Guide to Arizona State University: Ranking, Acceptance Rate, Cost, and More

Arizona State University (ASU), located in Tempe, Arizona, is a prominent public research university renowned for its innovative programs and vibrant campus life. For prospective students considering Arizona State University, understanding the university's ranking, acceptance rate, and cost can be crucial in making an informed decision. In this guide, we’ll delve into ASU's rankings, acceptance rate, cost of attendance, and briefly touch on the option of studying MBBS abroad.

Arizona State University Ranking

Arizona State University Ranking consistently ranks among the top public universities in the United States. As of the latest rankings, ASU is positioned in the top 100 of the U.S. News & World Report's National Universities list. It excels in various categories, including innovation, where it often claims a leading spot. ASU’s commitment to research and development contributes to its high standing, with strong programs in engineering, business, and sustainability.

Globally, ASU’s ranking reflects its growing international reputation. According to the QS World University Rankings, ASU is typically placed in the 200-300 range worldwide. The university's emphasis on research and global engagement helps bolster its international status. In the Times Higher Education World University Rankings, ASU is also featured prominently, underscoring its significant impact in academia and research.

Arizona State University Acceptance Rate

Arizona State University Acceptance Rate is known for its inclusive admissions policy, with an acceptance rate that varies by program and application cycle. Generally, the acceptance rate for undergraduate students hovers around 85%, making it relatively accessible compared to more selective institutions. This high acceptance rate is reflective of ASU’s commitment to expanding educational opportunities and accommodating a diverse student body.

However, prospective students should be mindful that while ASU has a high acceptance rate overall, certain programs, particularly in competitive fields like engineering and business, may have more stringent admission requirements. Applicants are encouraged to review specific program requirements and ensure their academic credentials align with the expectations of their desired major.

Arizona State University Cost

The cost of attending Arizona State University Cost can be a significant factor in the decision-making process. For the 2024-2025 academic year, the estimated cost of attendance for in-state students is approximately $40,000 per year, which includes tuition, fees, room, and board. For out-of-state students, the total cost is around $60,000 per year. These figures can vary based on factors such as housing choice, meal plans, and personal expenses.

ASU offers various financial aid options, including scholarships, grants, and work-study programs. The university’s commitment to affordability is evident in its financial aid packages and scholarships designed to support both merit-based and need-based students. Prospective students are encouraged to complete the Free Application for Federal Student Aid (FAFSA) to explore available financial assistance opportunities.

Studying MBBS Abroad

While Arizona State University offers a wide range of undergraduate and graduate programs, it does not offer a medical degree (MBBS). Students interested in pursuing a career in medicine often look at options abroad where MBBS programs are available. Countries like India, the UK, and Australia are popular destinations for medical education due to their well-established medical schools and relatively affordable tuition compared to U.S. institutions.

Study MBBS Abroad can be a viable option for those seeking a comprehensive medical education at a lower cost. It’s important for students to research the accreditation of the medical schools they are considering and ensure that the qualifications will be recognized if they wish to practice in their home country or elsewhere.

Conclusion

Arizona State University stands out as a leading institution with a strong reputation for innovation, research, and inclusivity. Its high rankings and broad acceptance rate reflect its commitment to providing educational opportunities for a diverse student body. While the cost of attendance can be substantial, ASU offers various financial aid options to help mitigate expenses. For those interested in pursuing an MBBS, studying abroad may present an alternative path to achieving their medical career goals. Ultimately, choosing ASU or any educational path involves careful consideration of personal and academic objectives.

0 notes

Text

Fed’s Powell Testifies as Inflation, Hiring Cool

(Bloomberg) -- Jerome Powell is likely to tell lawmakers that Federal Reserve officials need further confirmation inflation is slowing before they’re in a position to cut interest rates, even with evidence building of softer growth and employment.Most Read from BloombergJune consumer price index data are projected to be another step toward that goal, but the figures are only set for release on Thursday — after the Fed chair wraps up two days of Congressional testimony. Powell speaks Tuesday to the Senate Banking Committee, followed by a House panel appearance on Wednesday.With fresh data showing the highest unemployment rate since late 2021, and other figures illustrating weaker economic growth, Powell will likely be pressed harder by some lawmakers on why the Fed is hesitant to lower borrowing costs.On Tuesday, Powell said recent data suggest inflation is getting back on a downward path, but that he and his colleagues would like to see that progress continue.The so-called core CPI, which excludes food and energy costs and is seen as a better measure of underlying inflation, is expected to rise 0.2% in June for a second month. That would mark the smallest back-to-back gains since August, a pace more palatable for Fed officials.The inflation report is also forecast to show a modest 0.1% increase in the overall CPI from a month earlier. Compared with June of last year, the price metric is projected to rise 3.1%, the smallest annual advance in five months.Meanwhile, Friday’s monthly payrolls report showed that the jobless rate, while still historically low at 4.1%, is creeping higher. Minutes from the Fed’s June policy meeting revealed that several officials flagged the risk that a further slowing in demand could lead to higher unemployment.Economists on Friday will parse the government’s report on producer prices to assess the impact of certain categories — like portfolio management and health care — that feed into the Fed’s preferred inflation gauge, the personal consumption expenditures price index.What Bloomberg Economics Says:“We expect that soft inflation prints for June, July and August will give the Fed enough confidence to start cutting rates by the time of the September FOMC meeting.”Story continues—Estelle Ou, Stuart Paul, Eliza Winger, Chris G. Collins, and Anna Wong, economists. For full analysis, click hereFurther north it’s a light data week, but June home sales on Friday will shed light on whether the Bank of Canada’s rate cut that month jolted the market out of a slumber.Elsewhere, inflation numbers from China to Sweden and the aftermath of France’s parliamentary election runoff will be among highlights.Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.AsiaChina may get some mildly positive news on prices, with data Wednesday expected to show consumer inflation ticked higher in June and factory-gate deflation eased to the slowest pace since January 2023. Whether that helps buoy manufacturing remains to be seen.In other data, Japanese figures for workers’ pay on Monday may show real wages sliding for a 26th month in May, casting doubts on the prospects of achieving the virtuous cycle long sought by the Bank of Japan.Consumer price growth in India may have nudged higher in June, and Australia unveils consumer inflation expectations on Thursday.Trade statistics are due from China, the Philippines and Taiwan, while Singapore is set to release second-quarter gross domestic product data during the week.On the policy front, a couple of regional central banks are expected to stand pat, with investors looking ahead to prospects for rate cuts in the second half.The Reserve Bank of New Zealand meets after a weak reading for the composite purchasing managers index pointed to slackening economic growth, possibly opening to door to a cut in the fourth quarter.The Bank of Korea gathers a week after inflation slowed more than expected, boosting the prospects for pivoting to a reduction in borrowing costs as early as August, according to Bloomberg Economics.On Friday, Kazakhstan’s central bank will decide whether to follow its rate cut in May with another.Europe, Middle East, AfricaA focus for investors on Monday will be the aftermath of the French election. While financial-market concerns have eased, the prospect of a hung parliament leading to a minority government that lacks resolve to repair the public finances remains a likely outcome.In the UK, whose own election led to a landslide victory for Keir Starmer’s Labour Party, investors will be on the lookout for any initial decisions impacting the economy and its own strained fiscal position. Data on Thursday, meanwhile, may show a pickup in growth in May after stagnation the previous month.European Central Bank policymakers have until the close of play on Wednesday to speak publicly about the upcoming July 18 rate decision before a blackout period kicks in. Amid a sparse calendar, Bundesbank President Joachim Nagel and Executive Board member Piero Cipollone are scheduled to make appearances.It’s also a quiet week for data in the euro region. German exports on Monday and Italian industrial production numbers on Wednesday are among the highlights.There’s more on the calendar outside the single currency area, with several June inflation releases scheduled.- Hungary on Tuesday, then Norway and the Czech Republic on Wednesday, are all tipped to reveal slowing consumer price growth, albeit still with noticeable margins above 2%. - The same day, Russian data may show inflation reached a new 2024 high, underlining the challenge for the central bank. After holding its key rate at 16% so far this year, the Bank of Russia will most likely consider a hike of 100 to 200 basis points at its July meeting, Deputy Governor Alexey Zabotkin said recently. - In Egypt on Wednesday, officials will hope inflation slowed for a fourth straight month from its peak of 36% in February, which was just before the central bank raised rates as part of a huge bailout from the International Monetary Fund, the UAE, and others. - Also on Wednesday, Ghana’s inflation is forecast to slow for a third straight month - from 23% in May - on favorable base effects. The central bank will still be concerned by a monthly increase in prices that’s expected to quicken because of a slump in the cedi. - And on Friday in Sweden, the CPIF gauge of inflation that the Riksbank targets is expected to drop below 2% for the first time in almost three years. - Israel’s monetary policy committee on Monday will likely look past growing inflation pressures and keep the key rate at 4.5% for a fourth straight meeting to aid an economy strained by the war in Gaza and escalating tensions with Hezbollah in Lebanon. - On Thursday, Serbia’s central bank makes its monthly decision, where officials may give clues on their next step for the key rate after June’s rate cut, the first in more than three years.Latin AmericaData out on Monday may show consumer prices in Chile accelerated for a third month to push further above target — while more than a year of steady disinflation appears to have stalled in Colombia.In Mexico, inflation likely pushed higher for a fourth straight month, in no way the “benign CPI data” central bank Deputy Governor Jonathan Heath says the board wants to see before easing again.Banxico, which next meets in August and has paused at 11% for the last two meetings, posts the minutes of its June 27 decision on Thursday.Inflation is heating up in Brazil, along with President Luiz Inacio Lula da Silva’s temper. Brazil’s leader is fuming over “exaggerated” double-digit interest rates and the central bank’s “nominated by Bolsonaro” president, Roberto Campos Neto. Lula’s verbal broadsides make it harder to control inflation, Campos Neto told Brazil’s Valor newspaper.A string of single-digit monthly readings in Argentina has the annual inflation rate finally slowing after hitting 289.4% in April. Analysts surveyed by the central bank expect the monthly print on Friday to come in over May’s 4.2% reading.Peru’s central bank meets Thursday after keeping its key rate at 5.75%. A pick-up in the June headline and core inflation prints may sideline the bank for a second meeting.--With assistance from Robert Jameson, Laura Dhillon Kane, Tony Halpin, Monique Vanek, Brian Fowler, Paul Wallace and Zoe Schneeweiss.Most Read from Bloomberg Businessweek©2024 Bloomberg L.P. Read the full article

1 note

·

View note

Text

Best ERP software in india – SpineNEXTGEN

SpineNEXTGEN payroll is a robust and easy-to-use platform that offers an array of features to streamline your payroll process. Here are some of the key offerings: 1. Simplified Payroll Management: SpineNEXTGEN allows you to easily manage employee data, including contact details, salary information, taxes, and deductions. 2. Customizable Payroll Cycles: With this platform, you can set up customized payroll cycles that fit your business needs with ease. 3. Automated Tax Filing: SpineNEXTGEN automatically calculates federal, state and local taxes for each employee based on their location using advanced tax algorithms. 4. In-built Compliance Checks: The software automatically applies compliance laws pertaining to overtime rules and other labour law standards ensuring accurate compensation calculations 5. Personalized Reporting Capabilities - You can create custom reports based on specific criteria such as total earnings per client or hours worked by location. 6. Mobile Accessible Interface- The mobile application lets employees use self-service options like viewing paychecks and accessing relevant HR documents anytime they need it from anywhere in the world 7) Cost-Efficient - SNG compares favorably with competitors regarding pricing while providing top-notch quality services In essence, SpineNEXTGEN helps you take control of your company's financial operation while saving time & resources through simplification!

0 notes

Text

Goldman Sachs Asset Management’s 2025 Outlook: Reasons to Recalibrate

Goldman Sachs Asset Management’s 2025 outlook outlines a complex investment environment, shaped by slowing inflation, easing monetary policies, and geopolitical disruptions. The report emphasizes recalibrating portfolios to navigate this evolving landscape effectively. Five key themes define their strategic approach: - A New Equilibrium: Economic resilience amid rate cuts and political uncertainties. - Landing on Bonds: Opportunities in fixed income as rates decrease. - Broader Equity Horizons: Diversification to capture undervalued opportunities across regions and market caps. - Exploring Alternative Paths: Private markets as essential tools for risk-adjusted returns. - Disruption from All Angles: Navigating AI, geopolitics, and energy transitions. Key Themes 1. A New Equilibrium - Economic Trends: - Inflation has moderated without a global recession. - Central banks, including the Federal Reserve, European Central Bank (ECB), and Bank of England (BoE), have initiated rate cuts. - China's measures to stabilize property markets and support domestic demand are ongoing but face headwinds from global trade and tariffs. - Japan and emerging markets like South Korea and Thailand are implementing gradual policy adjustments. - Risks: - Tail risks include geopolitical conflicts in Europe and the Middle East, economic fluctuations, and policy impacts from a second Trump presidency. - Fiscal challenges in developed economies like Europe may drive further monetary easing. 2. Landing on Bonds - Opportunities in Fixed Income: - Rate cuts across major economies provide favorable conditions for investment-grade bonds, securitized credit, and green bonds. - Emerging markets benefit from easing cycles and robust fiscal positions. - Dynamic Strategies: - Active management is critical to capitalize on the varying pace of rate cuts. - Sectors such as healthcare, technology, and green energy offer counter-cyclical opportunities in corporate credit. 3. Broader Equity Horizons - Diversification Opportunities: - Concentration in U.S. equity markets (e.g., dominance of mega-cap tech) necessitates broader allocation to international markets and small caps. - European equities present dividend growth potential, while emerging markets like India and South Korea offer favorable demographic and structural trends. - Emerging Market Focus: - EM equities benefit from China’s stimulus measures and local central bank easing. - Sector-specific opportunities in technology and industrials emerge as global supply chains evolve. - AI-Driven Growth: - Investments in semiconductors, cloud providers, and software enablers remain robust. - Small and mid-cap companies linked to AI applications provide significant upside. 4. Exploring Alternative Paths - Private Markets: - Private equity buyouts are recovering, driven by stabilized valuations and increased investor confidence. - Growth equity opportunities are expanding as venture-backed companies require additional funding. - Private Credit: - Tightening spreads and refinancing trends in 2024 create potential for robust private credit strategies. - Hybrid capital and infrastructure credit are highlighted for flexibility and diversification. - Real Estate: - Easing rates are stabilizing real estate valuations, with a focus on core-plus and value-add strategies. - Sustainable real estate assets, such as energy-efficient buildings, align with structural trends. - Infrastructure: - Investments in renewable energy, AI-driven data centers, and logistics support long-term growth. - Middle-market strategies provide balance between operational value creation and flexible exits. 5. Disruption from All Angles - Major Disruptions: - AI adoption, clean energy transitions, and geopolitical shifts redefine investment landscapes. - Energy demand growth, driven by industrial reshoring and electrification, offers opportunities in utilities and renewables. - Geopolitical and Security Dynamics: - Reshoring initiatives in semiconductors and critical industries are driving regional infrastructure investments. - National and resource security remain key themes, with Europe’s Draghi Plan focusing on competitiveness and clean energy. - Sustainability: - Transition strategies, emphasizing heavy-emitting sectors' decarbonization efforts, replace simplistic exclusions. - Green and impact-oriented bonds gain traction, offering both financial returns and real-world sustainability benefits. Tactical Investment Recommendations - Equities: - Overweight U.S. equities but diversify into small caps, Europe, and select emerging markets. - Focus on AI enablers and applications across sectors. - Fixed Income: - Favor short-duration investment-grade bonds, green bonds, and securitized credit. - Leverage active strategies to capitalize on rate differentials across regions. - Alternatives: - Allocate to private equity in technology and healthcare, private credit, and value-add real estate. - Infrastructure investments in renewable energy and AI-related assets remain resilient. Goldman Sachs’ 2025 outlook emphasizes adaptability and diversification in an era of economic recalibration and global disruption. Their focus on thematic strategies, private markets, and active management offers a roadmap for investors to achieve resilient, risk-adjusted returns in the face of uncertainty. GS - Asset Management Outlook 2025Download Read the full article

0 notes

Text

This is an article about the idea of One Nation One Election (ONOE) in India. It discusses the benefits and challenges of holding simultaneous elections for the Lok Sabha and state legislative assemblies.

0 notes