#taxreliefexperts

Explore tagged Tumblr posts

Text

Understanding IRS CP-504 Notices and How Lexington Tax Group Can Help

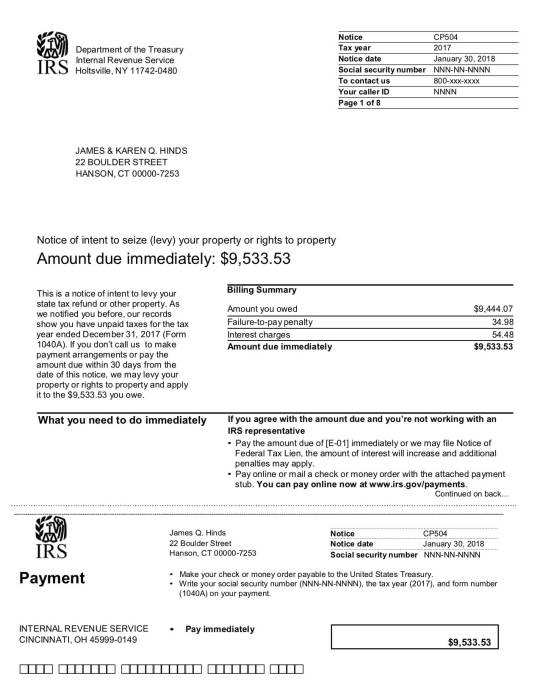

If you've recently received an IRS CP-504 notice, you may be feeling overwhelmed and uncertain about your financial future. This notice is a clear indication that the Internal Revenue Service (IRS) has not received payment for an unpaid balance, and it serves as a Notice of Intent to Levy under Internal Revenue Code section 6331(d). The implications of ignoring this notice can be daunting, including the possibility of income and bank account levies, property seizures, and even the interception of your state income tax refund.

But fear not, because in this blog post, we'll shed light on how Lexington Tax Group can be your trusted partner in resolving IRS CP-504 notices and ensuring your financial stability.

Understanding the IRS CP-504 Notice

Before diving into how Lexington Tax Group can assist, let's first understand the IRS CP-504 notice in detail. This notice is essentially a warning from the IRS that they are prepared to take serious action to collect the unpaid tax debt. Here's what it signifies:

Notice of Intent to Levy: The CP-504 notice is a formal notification from the IRS, indicating their intention to levy your income, bank accounts, and possibly even seize your property or other assets to settle the outstanding tax debt.

Now that you have a grasp of what you're dealing with, let's explore how Lexington Tax Group can provide valuable assistance in this challenging situation.

How Lexington Tax Group Can Help

🌟 Immediate Action: One of the first steps in addressing an IRS CP-504 notice is to respond promptly. Lexington Tax Group will ensure that you take the necessary action quickly to prevent further IRS enforcement actions.

🔒 Negotiation: Our team of experienced tax professionals will work diligently to negotiate with the IRS on your behalf. We'll explore options like setting up a reasonable payment plan or pursuing a settlement through programs such as an Offer in Compromise.

💼 Asset Protection: Worried about losing your assets or income to IRS levies? We've got your back. Lexington Tax Group will employ strategies to protect your assets and income while working towards the resolution of your tax debt.

🤓 Expert Advice: No two tax situations are identical. That's why our experts will provide you with personalized advice and tailored strategies to address the specific complexities of your case.

📊 Audit Representation: In cases where an underlying issue may have contributed to your tax debt, we offer audit representation services to ensure that any concerns are addressed thoroughly and professionally.

Why Choose Lexington Tax Group?

Lexington Tax Group is not just any tax assistance firm; we're your dedicated partner in navigating the complexities of IRS CP-504 notices. Here's why you should choose us:

Experienced Professionals: Our team consists of tax experts with a deep understanding of tax laws, regulations, and IRS procedures.

Tailored Solutions: We recognize that every individual's tax situation is unique. Our commitment is to find the best solution that aligns with your specific needs and financial circumstances.

Stress-Free Resolution: We understand that dealing with the IRS can be stressful. With Lexington Tax Group on your side, you can focus on your life and business while we handle all communication with the IRS, ensuring a stress-free resolution process.

Take Control of Your Financial Future

Don't let an IRS CP-504 notice create unnecessary stress or financial hardship in your life. Contact Lexington Tax Group today to regain control of your finances and your peace of mind.

📞 Call us at 800-328-8289or visit www.LexingtonTaxGroup.com to schedule your free consultation. Take the first step towards a brighter financial future with Lexington Tax Group!

#LexingtonTaxGroup #IRSNoticeCP504 #TaxReliefExperts #FinancialFreedom

#tax debt#cp504#wagegarnishment#irsprotection#tax debt attorney#irs lawyer#irs audit#irs#irsdebtrelief#IRSDebt

0 notes

Text

How long do these tax relief programs take?

These programs usually take somewhere between 2 to 6 months to work. Depending on how much you owe and how complicated your financial situation is, you can ask the tax experts to give you a better timeline.

Learn more at: https://platinumtaxdefenders.com/tax-relief-services/

0 notes

Video

Tax Relief Help -Tax Relief Experts -Tax Relief Systems (424) 264 5854

#taxrelief#taxattorneys#taxreliefsystemsllc#taxreliefsystems#joebenfatti#irstaxrelief#irstaxlaw#backtaxdebt#taxreliefexperts

0 notes

Link

Check out "Platinum Tax Defenders" on edocr.

0 notes

Text

Filing taxes can be tricky for business owners.

We’ll clear it up for you. Call Platinum Tax Defenders.

🌐 platinumtaxdefenders.com

☎️ 800-385-6840

#taxrelief #taxresolution #backtaxhelp #tax #taxes #financialfreedom

0 notes

Text

0 notes

Text

Wage Garnishment – Easy Way to Put Halt On It

If you are in a situation where IRS has garnished your wages or put levies on your bank accounts, it means you need tax help at the earliest. Wage garnishment would create disaster for your future financial planning. It is because the tax authority can deduct a percentage from your wages. IRS would inform your employer to seize your wages and the employer would deduct the money from your pay check. They would not consider whether you have to clear other bills such credit card payments and mortgage instalments. IRS just wants to collect the money you owe to them.

Once wage garnishment is imposed on you it doesn’t mean that you cannot get rid of it. You can remove wage garnishment with the help of Internal Revenue Service Tax Debt help. The program has everything that allows you to put halt on the wage garnishment procedure. Also, you’d get tax debt relief which would reduce your tax responsibility. Therefore, it is always recommended that you operate quickly so that garnishment and other tax levies can be removed or dismissed as soon as possible. There are several ways that you can employ to get rid of the wage garnishment.

First of all, you should never ignore the notices from the IRS however, most of the tax debtors fall into mess of excess of tax debt just because of ignoring the IRS’ notices. To start with the procedure of wage garnishment, IRS sends you the Notice of Intent to Levy. In case, you ignore it, levy will be there on your properties or bank accounts and you would come to know about this when you get pay check with deducted salary. Moreover, it would lead to late proceedings from your side to put a halt on garnishment.

First way to stop wage garnishment on your account is by paying your tax debt in full. However, this is not the preferred way because it could be possible that IRS has made errors in calculating your taxes and you end up paying more than what you owe. Therefore, you should hire a tax professional who would calculate everything just to get the correct amount that you need to pay. Also, he would negotiate with the IRS on your behalf to reduce the amount of the tax debt.

IRS just wants their money therefore they offer tax debt help so that taxpayers can clear off their debts without getting into much of hassles. However, if you don’t take benefits of the program, you would come across one of the worst phases of your life. So, hire tax attorney who can make you understand the program thoroughly and can employ every tax credit and deduction you are entitled to.

0 notes