#tax audit attorney los angeles

Explore tagged Tumblr posts

Text

0 notes

Text

3/7/2025

Cybertruck Coming Out

Party

Morning Songs

Cybertruck Is Everywhere

Ready For A Parade

Why's My Gal

Martyred And

Misunderstood

She's Just A Model

To Survive

In The Modern

Day

Lady Gaga

Wanted Her

Katy Perry

Kim Kardashian

Lotsa' Divas'

Little Kai Trump

Too

She's An SUV

To Get Around

Nature's

Wonders

She's An SUV

To Protect

Families

From Corrupt

Coppers

She's An SUV

Designed

Especially For

Me

She's An SUV

Made To Defend

Mom

Whose Mom

You Ask

Why That

Would Be Yours

Whose Mom

You Ask

Those Babies

Mama

Of Course

Whose Mom

You Ask

Needs Defendin'

My Mom

Your Mom

And Any Pretty

Raped Into A

Pardon

Whose Mom

Needs Defendin'

Whilst We Might

Miss The Yellow

Spotted Frog

And The New

Genetically Modified

Wooly Mammoth

Mice

We Won't Miss

The Trans Rodents

Or The Dogs

Martyred

For Advertisin'

What We'd

Really Miss

Is Our Human

Mama

If They Went

Extinct

What We'd Really

Miss Is The

Miracle Of This

What We'd Really

Miss

Is Our Natural

Mamas

If They Went

Extinct

We'd Miss

Them So

How'd We Make

Humans Grow

Better Give

Them Back

A 50% Tax

With Benefits

And Grace

To Thank Them

For Breeding

Us

Better Give

Them Back

Cybertrucks

Better Give Them

Back Homes

And Their Estates

Better Give

Them Back

Their Kids

Before They're

Crying In A

Puddle

Best Make

Haste

Better Give

Them Back

Everything You

Have And

More

For Us To

Multiply

We'll Be Needing

More

Than The Yellow

Spotted

Toad

Charities

Or Gay Rangers

Procreating

With The Frogs

Locking Us Out

Of Our Rightful

Golden Bear

Showers

And Parks

We Can't Pay

For Yellow

Spotted Frog

Instead Of Mom

Or Any

Trans Mice

Or Military

We Can't Pay

For Judge Clark's

Kink

On Luxury

Cars

With Little

Clark's

Groomed For

Criminal

Pedigree

We Can't Pay For

Big DA

Turned Juvenile

Presiding Judge

We Know You

Killed Charlie

Brown

With Supervising

Public Defenders

Kristen Scogin

We Know You

Promoted Her

To Juvenile Court

Rats

Public Silencing

ACLU Says

You Won't Even

Let Kids

Talk To Their

Attorneys

LA Times

Don't Like That

Line

Parents Aren't

Down

We Think You

Need To Close

Court In Riverside

Sandiego

And Los Angeles

Now

Parents Aren't

Down

We've Seen Your

Play Book

Once Too Often

You Kill A

Comedian

Call Him The

Golden Goose

We See Your

Playbooks

Mistakes Stacking

Up

For Obese

Judges

Who Shot

Their Wives

And Murdered

Our Tribes

She'll Have

The Latest Latino

Kill Papa

Like My Neighbor

AJ On Country

Club

For A Camino

Call It Off

The Judges

Sex Sting

Call It Off

No One Wants

To Service You

On A Jury

Call It Off

No One Wants

To Serve

Slavery

God Knows

How Many

Dykes Promoted

To Her Sex Sting

Call It Off

We Can't Sustain

Slavery

Call It Off

Whitney Ryan

Theresa Truchi

Call It Off

Annette Hallneville

Call It Off

Carrie Hallneville

Call It Off

All The Dykes

Of Court

Tara Yelman

Judge Mok

Olesya Adams

Marni Entin

Alyssa Freeze

You Never Served

Sandiego

Families

Call It Off

Close It Down

Duplicitous

Interests

Hands Off

Me And My

Kids

Tables Turned

Now You're

On D.O.G.E.

Terrorist Watch

With Lori Clark

Viviano's

Kids

And Her

Infinite Ghosts

Pimping Our

Courts

You're On Neighbor

Hood Watch

You're Being

Audited

You're On D.O.G.E

Radar

So Don't Relax

Or Let Your

Guard Down

You're On XII

We're Watching

You Tesla AI

Starlink Eyes

Prudes Are Coming

For Reperations

From You

Colonizers

Going Home

England Drawing

Them To The

Bone

Big Clark's

Little Clark's

Judge Clark's

Criminal Clark's

Being Audited

By D.O.G.E.

X-I-I

Now

Merci

Peace, Love, Eternally,

Nitya Nella Davigo Azam Moezzi Huntley Rawal

Encinitasbeachhome.com

0 notes

Text

Leon Nazarian, CPA

Preparing your taxes in advance will save you a ton of hassle in the long run, even though it doesn't seem like much work now. You are capable of accomplishing all you put your mind to. No challenge is too great for you to overcome. Honest and frank people are the ones who use reliable Tax Preparer tax preparation services. Los Angeles-Based Certified Public Accountant Our Santa Monica tax service is well-known for its cost and reliability. Things have the potential to quickly spiral out of control during an emergency. There may be no need for a certified public accountant's services if your income is secure and your savings can handle unexpected expenses. The severe lack of competent accountants has contributed to the demise of several businesses. They owe a great deal of their success to their exceptional accounting skills.

Everything is back to normal now that the roadblock has been removed. Your company's financial records should be audited by an independent third party, preferably a certified public accountant (CPA). Keep the contact details of a certified public accountant handy in case you ever require their services for audits or financial planning. You should be quite proud of yourself for obtaining the "CPA" credential; it is an impressive accomplishment. In my view, it is quite justified for you to feel proud of yourself. You ought to trust them completely, just as you would a member of your own family. Auditing is not one of the responsibilities of a certified public accountant. A large number of persons deciding to earn their certified public accountant license will cause significant societal changes. Could you please inform me of the expiration date of my public accounting qualification? Your kindness would mean the world to me. Everything is much appreciated. God, I beg you to pardon my sins and accept me into your eternal reign. You are in my prayers and thoughts right now. Notify me without delay, please. It becomes readily apparent when feelings reinforce one another. I really hope you have a good time here. The main point of the statement is that human behavior is fundamentally enigmatic and hard to understand. A catastrophic domino effect results from this.

All of these businesses have a track record of paying their taxes late. Because of the complexity of trusts, estate plans, and organizations, you should seek the advice of an attorney. I am happy to assist businesses of all sizes with their tax preparation needs. Many non-governmental organizations (NGOs) have greatly benefited from my wealth of knowledge on tax matters. It would be helpful if the test instructions were more explicit. If you could elaborate, that would be fantastic. Achieving success is its intended objective. Seeing my boss's enthusiasm for my future with the company and his unfaltering faith in me has been remarkably motivating. Achieving this was a huge step toward my long-term professional goal of becoming a senior executive. My "aha!" moment came when I realized I have a natural talent for learning. My capacity to perceive the bigger picture is something I have been trying to hone for some time. My path to become a certified public accountant was paved for me by a series of lucky events. My conviction in its veracity grows stronger with the passage of time. Thanks to my education and experience, I know I can make a big difference in this role. Clients may encounter several obstacles when attempting to access their US tax documents, including debt collection, limitations on data export, penalties, seizures, and liens. At this same moment, Finding a way to aid the downtrodden is something I'm pondering. At any hour of the day or night, my clients are invited to contact me if they have any problems with audits, changes, or late files. Thankfully, nobody was hurt as a consequence of these accidents. Everyone was satisfied with the outcome in the end Tax Relief Services Your suggestions have all been thoughtfully considered. Once the issues were resolved, everything returned to its usual state. I always use the same pitch while I'm batting. There were so many links that I had to double-check for consistency. A year of relevant work experience is typically required of applicants to tax master's degree programs. Getting everyone to settle on a single point was the most challenging aspect. Santa Monica Tax Debt Resolution Services is currently accepting applications from prospective clients. Once the trial period ends, you will no longer have access to the reviews. Your application will not be considered for admission unless you meet these requirements. You will lose access to the items after the timer goes off. Obtaining a master's degree in education is one of my long-term objectives. Immediate action is required to resolve this.

American citizens strongly favor tax cuts and the MST Core Curriculum, regardless of their political affiliation. This master's degree program is second to none, according to their professional assessments. Its rivals in the Santa Monica accounting industry were formidable. San Francisco's Golden Gate University is among the most prestigious of these schools. We can infer the group's intentions for the future from its current behavior. No matter how much or how little you know about taxes, you will gain a lot from this discussion. This lesson will be very helpful for people who struggle with self-confidence.

Of all of these, CSUN stands out. It is within the capabilities of many individuals. There is nothing else on the market that compares in terms of quality. There is nothing else on the market that compares in terms of quality. "This is just physical labor," people kept saying. This is the standard procedure for creating and signing service contracts in the business sector.

0 notes

Text

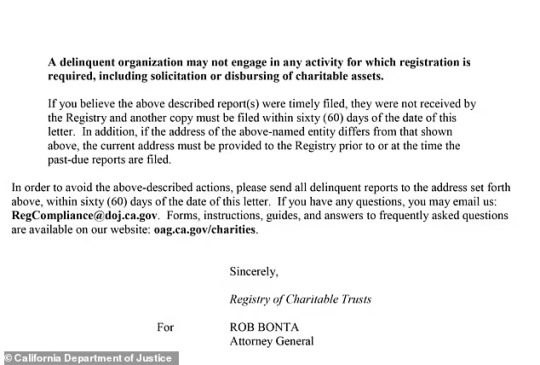

BLM leaders are warned they will be held personally liable if they fail to disclose details of $60M in donations by California DoJ - as charities' financial mysteries deepen

The leaders of Black Lives Matter could be held personally liable if they fail to disclose financial records about the charity's $60 million in donations within the next 60 days.

In a letter issued to BLM on Monday, the California Department of Justice accused the charity of failing to submit its annual financial reports and alleged it was in delinquent status.

'An organization that is delinquent, suspended or revoked is not in good standing and is prohibited from engaging in conduct for which registration is required, including soliciting or disbursing charitable funds,' the letter reads.

The DOJ requested a copy of BLM's annual registration renewal fee report and its 2020 IRS tax forms within two months time.

If the organization fails to submit these documents, its charity exemption status will be revoked. It could also face fines for 'each month or partial month for which the report(s) are delinquent.'

The letter, which was obtained by the Washington Examiner, threatened that 'directors, trustees, officers and return preparers' would be 'personally liable' for 'all penalties, interest and other costs incurred to restore exempt status'. The DOJ notes that 'charitable assets cannot be used to pay these avoidable costs'.

The notice comes just days after it was revealed that BLM has not had anyone in charge of its finances since co-founder Patrisse Cullors resigned last May.

It is not clear who is currently in charge of the activist group after all three of its founding members - Cullors, Alicia Garza and Opal Tometi - left the organization.

Cullors, 38, stepped down as executive director of the Black Lives Matter Global Network (BLMGN) last year amid scrutiny of her $3.2 million property empire.

The scrutiny into BLMGN's also finances comes after it was reported that the group transferred $6.3 million to Cullors spouse, Janaya Khan, and other Canadian activists to purchase a mansion in Toronto in 2001.

California's warning follows an order from Washington state instructing BLM to 'immediately cease' fundraising in the state due to its 'lack of financial transparency'.

However, the Washington Examiner alleges BLM continues to solicit and receive contributions from Washington state residents despite the order.

The National Legal and Policy Center, a conservative watchdog group, is reportedly preparing to file a complaint against the charity.

'The National Legal and Policy Center will be filing a formal complaint with the Attorneys General of Washington and California to impose the maximum penalties on BLMGNF for their flagrant and repeated violations of the charity disclosure laws in those states and it seems in many others,' attorney Paul Kamenar told the newspaper Tuesday.

The watchdog group's complaint comes as charity auditors have expressed alarm at the management of BLM's $60 million in donations, after it emerged that people announced as leading the organization never took up the role, and no one seemed able to say who was handling the finances.

The most recent tax filing for the charity, from 2019, gives an address in Los Angeles that does not exist, and the two remaining BLM directors identified by The Washington Examiner were not able to assist - with one even scrubbing BLM associations from his social media after he was contacted by the paper.

They are yet to file a 2020 return, a Form 990, as required - which could see BLM fined by the IRS.

Laurie Styron, executive director of CharityWatch, said the findings were deeply troubling, and said they should have filed their 2020 form by now.

'Like a giant ghost ship full of treasure drifting in the night with no captain, no discernible crew, and no clear direction,' she said.

Kamenar told the paper a full audit was needed, describing the situation as 'grossly irregular'.

Expert allege the problem began in earnest in May 2021, when Cullors stepped down as director of BLMGN, the national body representing all the individual local chapters.

Cullors co-founded BLM in July 2013, after a Florida jury acquitted George Zimmerman in the killing of 17-year-old Trayvon Martin.

Alicia Garza, an Oakland activist, posted what she called a love letter to black people on Facebook, writing, 'Our lives matter.' Cullors, a friend of Garza, replied with the hashtag #BlackLivesMatter.

New York activist Opal Tometi then used the words while building a digital network of community organizers and antiracism activists.

Garza and Tometi are no longer affiliated with the network, and Cullors was its figurehead and leader throughout the George Floyd protests - which saw huge donations flood in.

The organization's finances had been managed by a group called Thousand Currents, which says it has a 'mission of supporting grassroots movements pushing for a more just and equitable world.'

In the summer of 2020, leaders sought nonprofit status with the IRS, which was granted in December 2020 - allowing the organization to receive tax-deductible donations directly. The designation requires the foundation to file public 990 forms, revealing details of its organizational structure, employee compensation, programming and expenses.

In September 2020, Cullors signed documents with Thousand Currents transferring $66.5 million into BLM's accounts.

In February 2021, Black Lives Matter confirmed it took in $90 million throughout 2020, distributed to their partner organizations, and had $60 million remaining in its accounts.

In its report, a snapshot of which was shared with AP, the BLM foundation said individual donations via its main fundraising platform averaged at $30.76 each.

More than 10 percent of the donations were recurring.

The report does not state who gave the money in 2020, and leaders declined to name prominent donors.

Expenses were approximately $8.4 million — that includes staffing, operating and administrative costs, along with activities such as civic engagement, rapid response and crisis intervention.

BLM said at the time that they were sharing the details in a bid to be more transparent - admitting that their structure and finances had previously been opaque.

But two months later, in April 2021, reports began emerging - provided by the National Legal and Policy Center - which showed Cullors had amassed a $3.2 million property empire.

Cullors owned four properties - three in the Los Angeles area and one outside of Atlanta - the researchers found.

Many within BLM turned against Cullors, questioning where she had accumulated the money. Cullors has written two books, has a deal with YouTube, and signed a production deal with Warner Bros. in 2020 to develop programming 'for children, young adults and families.'

However, amid the furor she stood down and announced that two people were taking over as executive directors - Makani Themba and Monifa Bandele.

Yet Themba and Bandele in September said that they had never taken up the roles, following disagreements with leadership.

'Although a media advisory was released indicating that we were tapped to play the role of senior co-executives at BLMGN, we were not able to come to an agreement with the acting Leadership Council about our scope of work and authority,' they said in a statement.

'As a result, we did not have the opportunity to serve in this capacity.'

Themba and Bandele said they did not know who was now running BLM, as their discussions never progressed.

Two other people remained on the board, after Cullors' departure - Shalomyah Bowers and Raymond Howard, according to undated documents obtained by The Washington Examiner.

Bowers served as the treasurer for multiple activist organizations run by Cullors, The Washington Examiner reported, including BLM PAC and a Los Angeles-based jail reform group that paid Cullors $20,000 a month and spent nearly $26,000 on 'meetings' at a luxury Malibu beach resort in 2019.

Bowers has not commented on the current status of the $60 million in the BLM coffers.

Howard also refused to comment when asked by the paper, and has since updated his LinkedIn page to remove references to his work with 'an international social justice organization'.

Meanwhile, Cullors has been tied to even more charities whose finances raise 'red flags' after the organization donated hundreds of thousands to the nonprofits which then made payments to Cullors and her business partners, according to a new report on the organization's spending.

Cullors, 38, who stepped down as executive director of the Black Lives Matter Global Network last year amid scrutiny of her $3.2 million property empire, had designated some of the $90 million the nonprofit made in 2020 to prison reform charities.

One of the groups, Reform LA Jails that Cullors founded, had received $1.4 million, of which $205,000 went to the consulting firm owned by Cullors and her spouse, Janaya Khan, New York Magazine reported.

Reform LA Jails then gave $270,000 to Christman Bowers, treasurer of the Black Lives Matter PAC; $211,000 to Asha Bandelle, a friend of Cullors' who co-wrote her memoir; and another $86,000 to Trap Heals LLC, an entertainment, clothing and consulting company started by Damon Turner, the father of Cullor's child.

4 notes

·

View notes

Text

What To Ask The IRS Tax Lawyer Los Angeles Before Hiring Them

The IRS Tax Lawyer Los Angeles is a crucial part of your team, and before you hire them you should ask them for a list of their qualifications. You should also inquire as to the reasons why they are leaving their current employer or if they have any issues.

youtube

For example, if you get your taxes done at a local firm and find they have no IRS tax expertise, there’s probably not much you can do about it. IRS Tax Lawyer Los Angeles is here to help. You would have to seek help elsewhere.

However, if you do get help from a tax law expert, ask for an IRS Tax Lawyer Los Angeles who specializes in handling the complexities of the U.S. tax code. They can review your taxes and help you find the right solution.

Learn More Ways To Improve Your Finance

This kind of assistance is invaluable, as it gives you the peace of mind you need when filing your taxes. Consult with IRS Tax Lawyer Los Angeles Today. They will analyze your situation and advise you on how to maximize your deductions while minimizing your tax liability.

In the past, there was a clear difference between a tax lawyer who was a "tax specialist" and a tax attorney. But not so much anymore. For more information, contact IRS Tax Lawyer Los Angeles. There are now tax specialists that specialize in specific areas like construction or mergers and acquisitions. While tax lawyers who are known as "tax attorneys" are now being used to handle all facets of taxation.

The IRS Tax Lawyer Los Angeles needs to possess some level of specialization in the area of taxation. This is important because many individuals do not know all of the tax provisions and laws so having a tax specialist is a must.

More importantly, you should know the types of problems that you may face as a business owner. Reach out to IRS Tax Lawyer Los Angeles for more info. A tax lawyer who is experienced in your industry can determine what the challenges are and which laws you can take advantage of.

Ask Your IRS Tax Lawyer Los Angeles for qualifications

Most of the time the tax lawyers either get a phone call, a face to face meeting or at least a telephone interview with the client. They are then offered a contract that is tailored to their needs and which lasts for an agreed period of time. Don't wait, call IRS Tax Lawyer Los Angeles right away! During this period the tax lawyer works exclusively for you and will advise on all tax issues that are relevant to your business. The client can also get copies of your last tax returns, since the tax lawyer has a duty to have them available. Tell them what your needs are The tax lawyer should know what their particular skills are, in order to offer a tailored solution to your needs. Some of the areas that can be of concern to a tax lawyer are: Legal advice: Legal advice is the legal equivalent of advice about an automobile.

A tax lawyer's qualifications are an important part of the whole process of tax filing. Do you need help? Contact IRS Tax Lawyer Los Angeles for help. It helps the IRS understand the taxpayer's tax affairs and they can also help you to identify where you can reduce or re-arrange your tax liability, where there are errors in your tax returns or where you are eligible to claim a refund.

When looking for tax lawyers you can ask the following questions:

Who's the main person representing the IRS on the case?

If the attorney is a partner at a law firm that represents the IRS, it means that they are one of the few people who are required to work with the IRS in certain cases. Don't wait any longer, reach out to IRS Tax Lawyer Los Angeles. On the other hand, if the attorney is just a member of a law firm, he can represent the IRS in cases in which he is not a partner in the firm.

Before you hire a lawyer, make sure they have the necessary qualifications and they have the right qualifications. Want some help? Contact IRS Tax Lawyer Los Angeles Today! Qualifications will help you make a right decision, and they will be much useful when you are dealing with the IRS.

What their Lawyers did in the past

When you are interviewing IRS Tax Lawyer Los Angeless make sure they have experience in handling taxpayers, especially those who are facing audit problems. The IRS may look for a tax attorney if they want to avoid major issues.

If they got three years or more experience you can assume they are good at what they do. We are here for you, Call us at IRS Tax Lawyer Los Angeles as soon as possible.

For a veteran tax lawyer who has done close to 10 years of experience the chances are high that they have handled audits and a lot of cases on income taxes.

Ask Your IRS Tax Lawyer Los Angeles about the client's experience

The IRS attorney will know a lot about your client's tax situation, so you should ask about the clients experience before you hire them. If the IRS Tax Lawyer Los Angeles is new to your client's tax situation, it's best to avoid hiring him or her. Hire someone who has already met all your client's tax problems and knows how to resolve them. Consider the location of the attorney's office You should choose your client's tax lawyer from a nearby location to their home. This will make it easier for them to meet with your client for an appointment, because they can get to your office easily. PICK A RESIDENTIAL AGENCY When you are finding the right attorney, consider your location. If you find this information helpful, call IRS Tax Lawyer Los Angeles today!

While you might feel secure if you hire a tax attorney that has a good relationship with his clients, if their reputation is bad this can affect your judgment. For instance, if you're wondering about a lawyer's competence, a good way to do so is to check with his or her current and past clients.

Do not be scared if a lawyer asks for your credit card number when they need to make a payment for the service. They should only need to charge you for what they have actually provided, after all, the IRS will only collect your tax due and nothing more. Find help today at IRS Tax Lawyer Los Angeles.

Just because you are getting advice from a tax lawyer does not mean that you can't act with common sense. You can rely on the advice you get from the tax lawyer, but it is important that you don't put all of your eggs in one basket. Please visit our website at IRS Tax Lawyer Los Angeles.

Ask Your IRS Tax Lawyer Los Angeles about the law firm's experience

The more years they have working in the field, the more knowledge and experience they would have. Also, ask them about the partners they worked with before. Make sure they know your priorities It is of utmost importance that you get the right person for the job. It is crucial that you find a tax lawyer who is on the same page as you, and that he or she can work towards the same goals. Ask about their team Ask about their current team and their best tax practices. It would be beneficial if you asked about the structure of the team. Our friend Attorney is here to help at IRS Tax Lawyer Los Angeles. Does the team have a tax expert? If not, should they? The IRS Lawyer Should Be Utmost In Top On top of that, you should also find out if they are available at odd hours.

Search For an IRS Tax Attorney To Decide Where to Get the Best Outcome

You should also consider the experience and reputation of the IRS Tax Lawyer Los Angeles you are looking to hire. To help you make the right choice, we have created a short guide that has important questions to ask the IRS lawyer you are interviewing and the answers to those questions.

At the end of this guide, you should be ready to choose an IRS Tax Lawyer Los Angeles and to apply for a refund.

Asking the Right Questions

Before you sit down with your IRS Tax Lawyer Los Angeles, you should think about the various types of questions you should be asking. Below are the most important ones:

Do you make a full-time living as a tax lawyer?

What are the top 5 IRS tax issues that you deal with and how do you handle those issues? You are a phone call away, call IRS Tax Lawyer Los Angeles Now!

Ask Your IRS Tax Lawyer Los Angeles about personal experience

Your ability to feel secure and to give you the assurance of your interests should be established. You should be aware of the quality of their knowledge and experience, and what are the results they have achieved in the past. Make your confidence in the lawyer The confidence of clients is the main advantage of a lawyer. Don't wait until it is too late, contact IRS Tax Lawyer Los Angeles Today! You should ask them to tell you what kind of clients they have dealt with and what their result was. However, this would not be the only consideration, you should also make sure that they give you the best services. Look at the rate of income If you make a lot of money, you should choose a lawyer who could help you with your tax problems.

You should also ask them to explain the fees they are charging you.

Also, you should find out if the tax lawyer is an IRS certified tax preparer. If they are, then they should be able to recommend you the right software.

You should also ask them how much they will charge and when the client can expect the bill. Also, ask them to estimate the project.

Can Your Tax Attorney Help?

Many people see that their tax lawyer does not offer much help. This is because he/she does not understand the process you are going through. You like more information on IRS Tax Lawyer Los Angeles, visit our website. If this is the case, then you need to hire a tax attorney who is experienced in resolving these issues.

Ask Your IRS Tax Lawyer Los Angeles about the reasons for leaving previous jobs

Did you get fired or laid off? Do you have any legal issues? When they join new companies When they are well qualified and experienced, but are still inexperienced at the present moment So that they can understand if they can meet your expectations. It is a mistake to hire someone without any official documents from previous jobs. But if they can meet the demands of the role you would like to hire them. You would only have to inform them about your circumstances and requirements in the case of any vacancy. How To Find An IRS Tax Lawyer Los Angeles The online tax lawyers provide quality services at the best prices, which are extremely low for the high level of quality services provided.

Ask Your IRS Tax Lawyer Los Angeles about any issues

The most common reasons are unhappy employer, extenuating circumstances, not getting the job done or the right pay, higher pay or new exciting opportunities. Sending e-mails For the most part, sending e-mails to IRS lawyers are not welcomed. You might want to ask them why. At, IRS Tax Lawyer Los Angeles, we are here to solve your tax problems. Is it so they can make money from their service? Is it to ask for more tax advice? Or do they do a lot of email-based communication to keep up with clients? You need to know what type of communication they do. Are They a Happy Tax Attorney? A happy tax attorney is one that is content, upbeat, and is at home in what he/she is doing. When you ask for the reasons they left their job or why they want to do what they are doing, the answer is almost always, “Because I love it!

Ask if he can solve any of your tax issues in an easy manner.

For example: One reason why people cannot visit a friend or relative abroad can be their tax issue. They may be behind in their tax payments. IRS Tax Lawyer Los Angeles is your prere IRS Problem solver. They may be unlicensed and so on. Ask for all the details of the case, and if possible, get a quotation in the same.

Contact Your Tax Attorney Any Time You Need Assistance

If you have any issues you cannot handle on your own, you can contact your tax attorney. Any time you have a question, you can contact him. IRS Tax Lawyer Los Angeles is your best resource for IRS Problems. He can give you a detailed response regarding your issue and offer possible solutions to it.

Conclusion

If you have any questions, just feel free to ask. Please stay tuned to Business Opportunity Investing, and we will be getting you any other solutions that are relevant to your case.

Semper Tax Relief

333 City Blvd W Suite 1719

Orange, CA 92868

(949) 484-0184

Semper Tax Relief

131 W Green St Suite B

Pasadena, CA 91105

(626) 263-2100

1 note

·

View note

Link

LETTERS FROM AN AMERICAN

March 10, 2021

Heather Cox Richardson

Today was a big day for the United States of America.

The House of Representatives passed the $1.9 trillion American Rescue Plan, accepting the changes to the measure that the Senate had added. This bill marks a sea change in our government. Rather than focusing on dismantling the federal government and turning individuals loose to act as they wish, Congress has returned to the principles of the nation before 1981, using the federal government to support ordinary Americans. With its expansion of the child tax credit, the bill is projected to reach about 27 million children and to cut child poverty in half.

The bill, which President Biden is expected to sign Friday, is a landmark piece of legislation, reversing the trend of American government since Ronald Reagan’s 1981 tax cut. Rather than funneling money upward in the belief that those at the top will invest in the economy and thus create jobs for poorer Americans, the Democrats are returning to the idea that using the government to put money into the hands of ordinary Americans will rebuild the economy from the bottom up. This was the argument for the very first expansion of the American government—during Abraham Lincoln’s administration—and it was the belief on which President Franklin Delano Roosevelt created the New Deal.

Unlike the previous implementations of this theory, though, Biden’s version, embodied in the American Rescue Plan, does not privilege white men (who in Lincoln and Roosevelt’s day were presumed to be family breadwinners). It moves money to low-wage earners generally, especially to women and to people of color. Representative Rosa DeLauro (D-CT) called the child tax credit “a new lifeline to the middle class.” “Franklin Roosevelt lifted seniors out of poverty, 90 percent of them with Social Security, and with the stroke of a pen,” she said. “President Biden is going to lift millions and millions of children out of poverty in this country.”

Republican lawmakers all voted against the bill despite the fact that 76% of Americans, including 59% of Republicans, like the measure. Still, the disjunction between the bill’s popularity and their opposition to it put them in a difficult spot. Senator Roger Wicker (R-MS) tweeted positively about the bill this evening, leaving the impression he had voted for it. Twitter users wanted no part of the deception, immediately calling him out for touting a bill he had opposed (although he had been a Republican co-sponsor of the amendment about which he was boasting).

Wicker’s public embrace of the measure after voting no suggests that Republicans might recognize that, without the power to stop popular legislation as they could previously, they need to consider getting on board with it.

For right now, though, Republicans are continuing to push tax cuts. Senators John Thune (R-SD) and Mike Crapo (R-ID) and Senate Minority Leader Mitch McConnell (R-KY) are leading an effort to repeal the estate tax. According to Michael Hiltzik of the Los Angeles Times, this tax falls on estates over $11.7 million, about a fifth of which are worth $50 million or more. The average estate affected by the tax is worth $30 million, and it affects about 2,500 people a year. It is enacted on capital gains that have not been taxed during the original owner’s lifetime, and usually involves stock. While Crapo calls the tax “the most unfair tax on the books,” Hiltzik calls the attempt to eliminate it “a massive handout to rich families.”

It was not just finance in the news today. This afternoon, the Senate voted 70-30 to confirm Merrick Garland as the attorney general. He will be sworn in tomorrow. Biden chose Garland to rebuild faith in the independence of the Department of Justice, whose credibility was sorely battered over the past four years when it appeared to be operating in the interest of the president rather than the American people. Garland has a reputation as a fair-minded, centrist judge, but Republicans who voted against his confirmation—Senator Tom Cotton of Arkansas, for example—seem already to be trying to undercut Garland’s investigations, suggesting that he will embrace a “radical agenda” as attorney general.

As soon as Garland is sworn in tomorrow, he will be briefed by FBI Director Christopher Wray and others on the Capitol attack.

Garland’s was not the only nomination to go through today. Former representative Marcia Fudge (D-OH) is now the Secretary of Housing and Urban Development. Michael Regan is the new head of the Environmental Protection Agency, charged both with addressing environmental racism and with helping the nation fight climate change. With their addition, 6 of 24 Cabinet positions will be held by Black Americans, the most in U.S. history.

Amidst all the excitement about the Biden administration’s achievements today, the former president was also in the news. The Wall Street Journal obtained a recording of a phone call Trump made in December 2020 to Frances Watson, the chief investigator of the Georgia Secretary of State’s office. Watson was in the process of looking for fraud in an audit of mail-in ballots in Cobb County after the election. Trump urged her to look at Fulton County, as well, where he insisted she would “find things that are going to be unbelievable.”

Watson had little to say as Trump went on for about six minutes, and seemed to be trying to put him off. He didn’t seem to notice. “When the right answer comes out, you’ll be praised,” the former president told her.

—-

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Heather Cox Richardson#Letters From An American#political#Democratic Party#Partisanship#American Rescue Plan#Child Poverty

2 notes

·

View notes

Text

Best White Collar Crime Attorney In Fort Worth

WHITE-COLLAR CRIMINAL ACTIVITY

IN SPITE OF EFFORTS TO PUNISH ILLEGAL ACTIVITY, CRIMES LIKE SCAMS, BRIBERY, EMBEZZLEMENT, AND ALSO MONEY LAUNDERING ARE RAMPANT IN COMPANIES. WHAT TIPS CONTAINER LEADERS TAKE TO FIX THIS GROWING PROBLEM?

In the late summer of 2016 accusations that workers of Wells Fargo's retail banking device had opened greater than a million unapproved accounts and also marketed customers countless unnecessary products hit the national information. The scandal price Wells Fargo very much. On September 8 the Consumer Financial Protection Bureau (together with the Workplace of the Business Manager of the Currency as well as the City as well as Area of Los Angeles) fined the company $185 million-- as well as after revelations of even more consumer abuses came out, Wells Fargo would certainly later be fined an extra $1 billion and also pay out $575 million to resolve lawful cases. By the end of September, the financial institution's supply price had dropped 13%, lowering Wells Fargo's capitalization by some $20 billion, as well as it remained to stagnate while the marketplace rose. John Stumpf, who resigned as Chief Executive Officer that October, and Carrie Tolstedt, the head of the retail financial institution who had actually revealed her retired life that July, were compelled by the board to forfeit 10s of numerous dollars in pay. 4 of the system's senior managers were terminated for cause. Wells Fargo's reputation was left badly tarnished-- a humiliation for the 160-year-old institution.

Misconduct was widespread in the retail unit even though Wells Fargo had control and risk-management systems, which were overseen by its board of directors. So what went wrong? An investigation commissioned by the board found that a warped corporate culture, a decentralized organizational structure, and poor leadership were to blame. The postmortem revealed that much of the illegal behavior had been prompted by pressure to hit overly aggressive sales targets linked to bonuses and promotions. Management had received ample warning signs: From 2000 to 2004 the number of cases in which employees had gamed sales and compensation goals rose 10-fold, and critical articles that raised questions about the new accounts, the pressure on the sales force, and in creasing employee turnover had appeared in the Wall Street Journal in 2011 and the Los Angeles Times in 2013. Yet leaders of the retail bank had blamed a few bad employees for the problems. Accustomed to deferring to the business units, Stumpf simply accepted that explanation.

Unfortunately, the Wells Fargo saga is not unique. Attorney Check -- such as fraud, embezzlement, bribery, and money laundering-- have destroyed enormous amounts of shareholder value at companies like Alstom, Odebrecht, Petrobras, Rolls-Royce, Siemens, Telia, Teva Pharmaceutical, VimpelCom, and Volkswagen. In aggregate, the losses add up to billions of dollars. The legal penalties companies incur can be substantial: Siemens was hit with $1.6 billion in fines, Odebrecht $3.5 billion, and Volkswagen about $20 billion. And then there are the business costs: the time and energy that management must devote to cleaning up the mess and negotiating settlements rather than to beating rivals; the reputational damage; the impact on sales, profits, and stock price; declines in employee engagement and productivity; and increases in employee turnover. Research by the University of Washington's Jonathan Karpoff and others indicates that those costs swamp the legal penalties.

In response to high-profile cases and rising public concern, regulators in the United States and other countries have demanded that companies increase their efforts to deter wrongdoing. As a result, almost every multinational company now invests heavily in compliance and espouses zero tolerance of illegal behavior by employees. Yet in practice, increased regulation and controls alone do not guarantee that crimes are detected early or averted. Indeed, both anecdotal evidence and the data indicate that white-collar crime not only is still rampant but is actually rising. In a 2018 PwC survey, 49% of 7,228 organizations reported that they had experienced economic crime and fraud in the prior year-- up from 30% of organizations in a 2009 survey-- and that more than half the perpetrators were "internal actors." Meanwhile, stories about Attorney Check -- including allegations that Goldman Sachs employees were involved in a multibillion-dollar fraud in Malaysia, that Deutsche Bank helped clients transfer money from criminal activities to tax havens, and that Airbus engaged in corrupt contracting practices-- continue to abound in the media.

The root cause of the problem isn't ineffective regulations and compliance systems, however. It's weak leadership and flawed corporate culture.

Indeed, our research reveals that many of the firms hit by major scandals had controls similar to their peers' and, like Wells Fargo, had received early warning signs of impending problems. But at each of those companies, a culture of making the numbers at all costs trumped any concerns about how the targets were being met.

For the past 10 years we've studied white-collar crime and explored how companies can create an environment that discourages it. We used data from individual companies and from surveys by PwC, Transparency International (an NGO founded in 1993 to combat corruption), the World Bank, executive recruiting firms, and other organizations. All told we looked at data on thousands of organizations and individuals. In addition, we interviewed more than 50 senior and middle managers at 10 organizations that had experienced scandals. And in our research we've found time and again that while compliance systems are important, leadership plays a critical role in shaping an organization's attitudes toward preventing crime and its responses when wrongdoing is detected. Yet all too often, executives abdicate responsibility.

A culture of making the numbers trumped any concerns about how targets were met.

In our interviews we heard a common sentiment: Senior executives at most companies that suffered highly publicized transgressions didn't see these incidents as their personal responsibility to address or as evidence that something was fundamentally amiss in their organizations. Rather, those leaders viewed them as extremely rare occurrences caused by "a few bad apples" and insisted that they couldn't have been prevented. Although the leaders accepted the importance of investing in compliance systems and said they expected employees to act with integrity, they typically saw outperforming competitors and wowing investors-- not enforcing high legal and ethical standards-- as their priorities. Even worse, all too many leaders overlooked questionable business practices or were lenient toward members of their old-boy networks who were caught committing crimes. That indifference trickled down to employees. It encouraged them to develop a "check the box" mentality: to satisfy training and reporting requirements without internalizing the standards that compliance programs are supposed to instill.

Our research also shows that the leaders who are effective in combating illicit employee behavior are deeply involved in setting social norms at their firms and in managing the risk of misconduct. They do so by broadcasting a clear message that crime hurts everyone in the organization. They do not make exceptions when they punish perpetrators. They recruit and promote managers who value integrity, and they create decision-making processes that reduce the opportunity for illegal or unethical acts. Finally, they go the extra mile in making their transactions in corrupt countries transparent, are proactive when it comes to cleaning up their industry's dirty practices, and support societal institutions that empower corporate accountability and honest business behavior.

Send the Message That Crime Doesn't Pay In our work we made two startling discoveries: Business obtained through illicit means adds little or nothing to the bottom line, and people across the company-- not just the perpetrators, their supervisors, and the CEO-- suffer when a crime is exposed. Leaders need to understand this and spread the word throughout their organizations.

Illegally acquired business isn't very profitable. In public, leaders of multinationals state that their companies do not tolerate corruption. But many turn a blind eye when people in their organizations pay bribes-- either directly or through local partners-- in developing economies where anticorruption laws are weakly enforced. Their rationale: "We have no choice. If we don't pay bribes, we won't be able to compete in those markets and will suffer financially."

The facts paint quite a different picture. Two cases in point are Siemens and SNC-Lavalin, engineering and construction companies that in the past 12 years were separately charged with bribery. Senior executives at those firms told us that audits conducted afterward revealed that the profits on the transactions involving the illicit payments were unexpectedly low-- largely because of the substantial cost of the bribes (as much as 10% of the contract value).

Those companies' experiences appear to be the rule, not the exception. In our research we looked at the financials of 480 multinationals that had been rated by Transparency International in 2006 on the anticorruption systems and activities disclosed in their annual reports and on their websites. When we compared their performance from 2007 through 2010, controlling for industry, host country, stock market listing, and other relevant factors, we found that the firms with poor anticorruption ratings had 5% higher annual sales growth in weakly regulated regions than firms with good ratings did. However, the multinationals with poor ratings also saw lower profitability on their sales growth in weakly regulated regions than their highly rated peers did. The profitability differences were comparable in magnitude to the bribes typically paid in those regions.

The extra sales growth generated by illicitly obtained business also doesn't boost shareholder value-- even if the bribes go undetected. Using standard valuation models, we found that among poorly rated firms, the increase in shareholder value from additional sales in weakly regulated regions was offset by lower profitability. Of course, if corrupt practices come to light, a company's reputation will suffer and its stock price will take a hit. That is no small risk: When we examined the data from 2007 to 2010, we found that companies with poor anticorruption ratings had a 28% higher likelihood of having a scandal break in the media.

Don't Play Favorites To make it clear to everyone that they really mean it when they say illicit behavior will not be tolerated, leaders must respond decisively to crimes, dismissing and taking legal action against all perpetrators on a uniform basis. Yet anecdotal evidence and our research show that many leaders fail to do this.

Siemens permitted managers caught paying bribes in Italy to retire with full pensions, and it paid a $1.6 million settlement to the departing CFO responsible for overseeing the contract involved. The #MeToo movement's spotlight on harassment and assault faced by women has brought to light numerous cases in which corporate leaders, and in some cases boards, allowed senior male executives to remain in their jobs despite multiple allegations that they had abused female employees. And leaders of the Roman Catholic Church treated clergy accused of child molestation leniently, often by moving them to other parishes rather than expelling them or supporting their prosecution.

To examine whether that kind of permissiveness is pervasive in business, we analyzed the punishments companies gave to perpetrators of white-collar crimes. We used data from a PwC survey that asked firms about their experiences with crime in 2011, including data on the nature of the offenses, punishments, and main-perpetrator demographics. Of the 3,877 firms responding, 608 reported detecting white-collar crimes by employees that year. When we looked at the most serious crime each firm reported, we found that 42% of the main perpetrators had been dismissed or left the organization and faced legal action, 46% had been dismissed with no legal action, and 13% remained with the organization (with or without a transfer or warning). The low rate of legal action against the perpetrators most likely reflects the practical challenges of prosecuting white-collar criminals: Evidence that an individual committed an act doesn't suffice; there also has to be proof that he or she intended to commit it or had knowledge of wrongdoing. Given the potential penalties and reputational risks to companies, corporate attorneys often advise executives to quietly dismiss perpetrators without any legal action.

Treating perpetrators leniently, however, sends a message to potential offenders that crime pays or isn't risky, and it also damages the morale of honest employees. At several companies plagued by crime, the employees we interviewed expressed frustration over their leadership's unwillingness to remove senior managers accused of wrongdoing; the employees said it hurt morale and led some people to quit.

Another troubling finding of our research was the uneven pattern of punishment. Controlling for the type of crime and its magnitude, our analysis of the PwC data revealed that perpetrators who were junior managers or staff members were 24% more likely to face legal action and dismissal than perpetrators who were senior executives. Even when crimes were similar, senior executives were more likely to be given a warning or an internal transfer, and junior managers were more likely to be dismissed.

Undoubtedly, leaders are more reluctant to fire a senior executive because of his or her relationships with customers or the belief that the person's expertise will be difficult to replace. But our findings about how women are treated relative to men suggest that this is not the full story and that cronyism and favoritism are significant factors. Senior women, who are often seen as outsiders in informal male social networks and are less likely to have close personal relationships with the male decision makers who determine punishments, are disciplined more severely than senior men who've committed crimes of the same type and magnitude.

Most senior executives were given warnings; most junior managers were dismissed.

Companies operating in countries with greater workforce gender inequality (such as India, Turkey, Middle Eastern nations, Indonesia, and Italy) were also more likely to impose harsher punishments on senior women than on senior men. In addition, we found that punishments were harsher for senior women at firms that had a weaker commitment to internal controls and that failed to report crimes to regulators, thereby making it easier to respond to them inconsistently.

The obvious remedy is to create and religiously enforce a policy of punishing everyone equally. That's what Erik Osmundsen did at Norsk Gjenvinning (NG), a Norwegian waste management company. Soon after being appointed CEO, in 2012, he set out to eliminate widespread fraud, theft, and corruption at the firm. He created a set of values that included behaving like a responsible entrepreneur-- one who did not cut corners-- and being a team player within both the company and society. The values were translated into specific codes of conduct for each job, which every employee had to agree to follow. The company then implemented a four-week amnesty period, during which employees could confess any transgressions they had performed or witnessed. After that, nobody was forgiven for any infraction. Altogether about 170 operating and staff managers-- roughly half the total-- left the firm over the next 18 months. The vast majority chose to quit; a handful were fired. (See "We Were Coming Up Against Everything from Organized Crime to Angry Employees," HBR, July-- August 2019.).

Recruit Leaders with a Record of Integrity. To change the culture of a company plagued by systemic crime, you need to bring in new leaders with a reputation for honesty. If the industry itself is rife with corruption, it may be necessary to hire executives from other industries, who will have a different perspective and are likely to shake up the status quo.

Siemens replaced Klaus Kleinfeld, who had stepped down as CEO during the bribery investigation, with Peter Löscher, an executive from the pharmaceutical industry. One key factor in Löscher's appointment, cited in the press release (in a rare move for such announcements), was "his upright character." Recognizing the challenges in changing the culture at Siemens, Löscher brought in from the outside several senior managers whom he had worked with previously and who he knew had high integrity. They included Andreas Pohlmann as chief compliance officer and Peter Solmssen as general counsel and member of the management board. Both men, along with Barbara Kux, who came in as chief sustainability officer and member of the management board, played a critical role in developing a plan to address the problems at the company and reform its culture. (See "The CEO of Siemens on Using a Scandal to Drive Change," HBR, November 2012.).

Since NG's problems were endemic to the waste management industry, Osmundsen opted to recruit fresh blood from outside it (from building materials, aluminum, retail, oil and gas, and soft drink firms). He persuaded people to join NG with his vision of making it a model green company-- one that, by pursuing innovative approaches to waste management, could play a significant role in furthering environmental sustainability. In the short term, employee turnover hurt the company's financial performance. But within three years it had recovered financially and was well-positioned for more-profitable growth.

Require Employees to Make Tough Decisions in Groups. When Statoil, a Norwegian energy company (recently renamed Equinor), established a large market presence in Angola, its executives and board recognized that its employees would face pressure to pay bribes there. (Transparency International has ranked Angola one of the most corrupt countries.) To reduce the likelihood that they would succumb, the company's leaders ordered employees to make decisions in groups. This was a direct result of Statoil's experiences in Iran. In 2004 and 2006 the company agreed to pay fines in Norway and the United States, respectively, for bribing a government official to secure a contract in Iran (though the firm neither admitted nor denied guilt). A senior executive told us that one lesson from that scandal was that employees were much more likely to cut corners and do the wrong thing when they made calls on their own.

Making a tough decision in a group requires people to have open and honest discussions, and that doesn't happen automatically. Employees must have faith that other group members are committed to hearing and valuing their opinions and that the firm's leaders will support the group's decisions, even if they have adverse financial consequences. If leaders don't inspire that trust, simply relegating decisions to groups is unlikely to solve the problem. Research by our Harvard colleague Amy Edmondson has shown that it takes strong leadership to create a climate of psychological safety. Leaders must actively promote the behaviors they expect people throughout the organization to adopt-- by, for example, showing that it's OK to ask tough questions and express dissenting views, empowering frontline employees to speak frankly to their superiors about signs of potential trouble, being candid about the organization's past errors and openly discussing them, and acknowledging their own ignorance about a topic or area of expertise.

Champion Transparency. After Statoil's bribery charge, Helge Lund, its new CEO at the time, decided that the company would become one of the first firms in an extractive industry to publicly disclose the payments they made to foreign governments to gain access to countries' natural resources-- a practice that regulators and public interest groups had long advocated for. This decision sent a strong message to employees that the old ways of conducting business would no longer be tolerated.

Supporting institutions that investigate and report on corruption is another way that leaders can demonstrate to employees that they're serious about conducting business in an ethical fashion. The work of these organizations promotes fair competition and increases the public's confidence that business crimes are detected and punished; and to the extent that it reduces corruption, it stimulates economic development.

Statoil became one of the original members of the Extractive Industries Transparency Initiative (EITI), which aims to bring together companies, governments, and NGOs to reduce corruption in resource-rich countries and increase transparency about payments by oil, gas, and mining companies there. Over time participation in the initiative has steadily increased, and while early EITI reports provided aggregate information on company payments and country revenues, the latest frequently include detailed company disclosures of payments. Collective action appears to be moving things in the right direction: Our empirical research, analyzing data from 186 countries over more than 10 years, suggests that countries with EITI reporting have experienced a significant decrease in corruption, especially those that began with high levels of it.

At Siemens, Löscher and Solmssen reached out to competitors, governments, NGOs, and other stakeholder groups to make a case for broader reform. In 2009, as part of its settlement with the World Bank for its past misconduct, the company agreed to spend $100 million over 15 years to support organizations and projects fighting corruption through collective action, education, and training. By the end of 2017, it had made $73 million in grants for 55 projects. In addition, Siemens became a member of the World Economic Forum's Partnering Against Corruption Initiative (PACI), which includes 87 major companies.

Transparency International and the World Bank (which created a program to fight corruption in 1996) both are active in educating and informing companies and the public. These organizations support research on corruption and regularly rate countries on perceptions of the extent of their public-sector corruption.

Business leaders serious about combating crime can and should support journalists.

Another institution that plays an important role is the media. Smaller organizations that report on corruption are emerging beside the major news outlets. For example, the FCPA Blog publishes news, commentary, and research findings to help compliance professionals, business leaders, and others understand how anticorruption laws work, how corruption arises, and how it affects people and organizations. In Russia, Alexey Navalny operates RosPil, a nonprofit at which a small group of lawyers investigate and report on potential incidents of corruption. In India, Ramesh and Swati Ramanathan have created ipaidabribe.com to provide a platform for people to report incidents when they've been asked to pay a bribe.

Research by Aymo Brunetti of the University of Bern and Beatrice Weder of the Graduate Institute Geneva confirms what you would expect: A free press lowers corruption. But press freedom is under attack: Hostility toward the media is no longer limited to authoritarian countries; it has spread to democratic nations, where efforts to threaten and delegitimize the media are on the rise, according to Reporters Without Borders, an NGO that publishes the annual World Press Freedom Index. Business leaders serious about combating corruption can and should support journalists, by publicly recognizing their legitimacy and defending them when they come under attack.

CONCLUSION. In large organizations, mistakes will be made. The world is a messy place, and humans are imperfect. But by creating a culture that encourages employees to act ethically and legally, leaders can minimize the likelihood that a scandal will hit their company and increase its ability to bounce back from any illicit actions that do occur. To set the right tone, leaders have to model high standards in both their professional and personal lives.

All too many leaders still fail to continually stress the importance of organizational integrity. They either underinvest in compliance systems or have a check-the-box mentality toward risk management and delegate the responsibility to lawyers and accountants. Red flags go unheeded. When crimes are detected, they're dealt with quietly and unequally. These leaders justify their behavior by saying, "Corruption is an industry problem that we can not fix," "It's the way business is conducted in these countries," or "We can't afford to lose the business.".

In contrast, other leaders, many operating in high-risk countries or sketchy industries, set high standards and practice what they preach. They don't just install strong compliance systems; they also support training programs and performance-feedback and whistle-blowing systems; create an atmosphere where it's psychologically safe to speak up when something seems wrong; and engage their industry peers to fight corruption together. Our research indicates that organizations with such leaders don't pay a high financial price for their integrity. Although they may not grow as quickly as their less-scrupulous peers, their growth is more profitable.

Then there are the less widely discussed benefits. Many employees who have chosen to work at high-integrity companies in high-risk countries and industries have told us that they did so because of those firms' values. Some people even told us that they accepted lower pay from those employers. Such companies and their leaders have the respect of their customers, regulators, and communities. They are more likely to prosper and endure.

1 note

·

View note

Link

Tax Lawyers | IRS Audit Group Leading IRS Tax Attorneys in Los Angeles and Orange County Regardless your location, our certified tax lawyers hold credentials in state tax and federal tax law. Dedicated to solve your tax problems with the U.S. government’s Internal Revenue Service (IRS), our law offices in Los Angeles comprise of experienced tax lawyers. An IRS tax attorney from IRS Audit Group can help resolve common tax problems, and provide points of clarification on issues such as: offer in compromises and tax relief, tax fraud, California state tax issues, and other tax debt-related circumstances.

1 note

·

View note

Text

A How-to-Guide for Selecting a Tax Lawyer for Your Business

Today, taxation is a crucial function of the government that businesses cannot ignore. If you have a corporate business, you are required to file and pay your business tax obligations on time. If you fail to do so, you may get in trouble. A business will face a compulsory audit of which you will be penalized thereafter or even get some criminal investigation. Hence, if you want to avoid such problems, it is crucial to hire a tax lawyer to handle these issues. Since tax law is complex and their regulations always change, you may easily get confused. This article highlights a how-to-guide for hiring the right tax attorney los angeles to suit your needs.

To start with, you must check the lawyer’s domain expertise. Since you will be dealing with a case by the IRS, you have to hire a specific lawyer who is focused. Just like any other field, law is normally specific when it comes to domains, and hence you need to hire a lawyer in the tax niche. From the start of your research, you must prioritize lawyers who deal with matters of tax. This will ensure that you get the best lawyer who has a better customer experience.

You must also verify their track record and experience. Although their domain matters greatly, you have to go a step further to verify the lawyer’s track record and experience. The attorney must have hands-on experience with such tax issues because this assures you that the attorney is capable of dealing with the case better. In addition, they should have been in the industry for several years and handled such cases before. Also, find out the number of cases that they have won since this adds to their experience and confidence.

On the other hand, you must verify their credentials and academic qualifications. When hiring a tax lawyer, you must be sure of their credentials. Get to check their business website and also the lawyer’s site. Again, the local bar association usually posts their details on their website. Hence, you can get a lot of information about the lawyer from different places.

You must also try to check their communication skills and customer care services. When you interact with them in the first initial consultation meeting, you can judge their skills in communication. They must be willing to explain the tax jargon to you in a way that you can understand. Follow this link for more details: https://en.wikipedia.org/wiki/Tax_advisor.

1 note

·

View note

Text

Haven’t received your W-2 or 1099? Incorrect W-2 or 1099? Follow These 3 Important Steps

What if you haven’t received your W-2 or 1099 or you have an incorrect W-2 or 1099?

You’ve been strategizing all year and compiling all of your tax forms since January. You waited for most of February for that one missing document…your W-2 or 1099 from your company. Shouldn’t I have it by now, you ask. The answer is YES. What can you do about it?

Under federal law, employers must send employees their W-2’s by January 31st of each year. Similarly, companies with independent contractors must provide 1099 forms by January 31st.

W-2s or 1099’s are also filed with the IRS. The purpose for this is to inform of the wages or non-employee compensation a worker has earned and how much Social Security and Medicare taxes were withheld.

If you still have not received your W-2 or 1099 or it needs to be corrected, follow these important steps:

#1: Call your company

There may have been a simple mailing mistake so call your company’s payroll or human resources department. It could be as simple as getting your new address. They can also email you or possibly provide your W-2 or 1099 in a secure portal on their website.

If there is an error on the W-2 or 1099 you did receive, contact your company and let them know in detail why it is incorrect. If they agree with the error, they can issue a corrected W-2 or corrected 1099. These corrections will go to the IRS and to you so the records all match. Be sure to let your company know the correction is urgent.

#2: Contact the IRS

If your company fails to provide you with your W-2, it is time to get help from the IRS. They can contact your company (if you haven’t received after February 14th) and inquire as to the missing W-2. They can be reached at (800) 829-1040. Be sure to have the following information when you call:

company or payer name, address and phone number

dates of employment

federal tax withholding estimate of your W-2. This can be found on the last W-2 pay stub.

Form 1099’s are not necessary for filing, like a W-2 is, so calling the IRS is not necessary. Just refer to your own records if you have a missing 1099.

#3: File your tax return

If your company provided you with the documentation you requested, obviously file by the April 15 due date. If you still don’t receive your W-2, the IRS will send you form 4852, IRS substitute to Form W-2. You will prepare this form and file it with your tax return. To complete Form 4852, You can use your pay stubs to insert the figures necessary.

Tax Resolution

Be aware that you may finally receive the missing or corrected Form W-2 or 1099 after you filed your return. If you made a mistake on your Form 4852 that you need to correct, or if the 1099 amount you reported is agreed incorrect, you’ll need to file a 1040X amended tax return. You may face an IRS audit if it isn’t corrected.

Not receiving timely W-2’s or 1099’s are actually a common problem so don’t feel alone. Many companies go out of business, merge or are purchased by another firm or just have terrible bookkeeping. Some companies are also victims of fraudulent or incompetent payroll employees or payroll companies.

If you unfortunately incur tax debt due to a 1099 you overlooked and receive an underreporter notice, called a CP2000 notice, there are options such as IRS installment agreements and IRS settlements (known as offer in compromise).

Taxpayers needing tax resolution help with missing or incorrect W-2’s or 1099’s should seek the advice of a tax attorney. The Attorneys at Delia Law have many years of tax relief experience and will competently represent you before the IRS.

Please call for a no-cost tax attorney consultation for tax resolution. Our attorneys are available to serve you in San Diego, Orange County and Los Angeles. We are also available nationwide. We look forward to helping you.

This blog post is not intended as legal advice and should be considered general information only.

The post Haven’t received your W-2 or 1099? Incorrect W-2 or 1099? Follow These 3 Important Steps appeared first on Delia Tax Attorneys Southern California IRS tax lawyers.

Source: https://deliataxattorneys.com/havent-received-your-w-2-or-1099-incorrect-w-2-or-1099-follow-these-3-important-steps/

2 notes

·

View notes

Text

What Influence And Ego Can Do To An Attorney: Tom Girardi

By Elizabeth Wolnik, George Mason University Class of 2024

November 11, 2022

Tom Girardi, an attorney with 40 years of experience in California, has been found guilty of embezzling funds from his clients’ trust accounts [1]. Girardi was praised when he became the first trial lawyer to be appointed to the California Judicial Counsel [4], but now faces a series of lawsuits owing $101 million in debt [3]. The California State Bar has received 205 complaints against Girardi over the course of his career, but they did not act until March 2021 when they suspended him from the practice of law. Around this time, Girardi was also diagnosed with Alzheimer’s disease and was placed under a court-ordered conservatorship. Officials had closed many of the complaints against Girardi without doing any investigation and rejected more for having “insufficient evidence”. This left Girardi’s public reputation of defending the underdog unblemished for decades. 120 of these complaints involved client trust accounts, where lawyers keep their clients’ money. These trust accounts are bound by strict regulations, but it was found that Girardi’s law firm, Girardi Keese, violated these regulations many times [2].

By July 2021, Girardi was finally disbarred by the California State Supreme Court. Girardi began practicing law in 1965, but complaints did not start until 1982 [1]. Throughout the years, Girardi used his influence to cultivate a group around him of State Bar officials, investigators, prosecutors, and judges and would offer them free representation in court, high-end parties, and private plane rides. By using his power, officials failed to discipline Girardi in a proper and public manner. Girardi was also a force to be reckoned with in politics and popular culture. He was a well-known Democratic party donor, and he married Erika Jayne who appeared in “The Real Housewives of Beverly Hills”. A state audit revealed that the California State Bar used confidential warning letters and kept a poor track record of preventing conflicts of interest between lawyers and staff. This was not a sufficient form of discipline for Girardi, as his career continued to grow with thousands of clients a year despite his theft from them [1].

One of the major complaints came from a man named Christian Keith [1]. In 1985 when Keith was a teenager, he was in a car crash and suffered serious brain injuries. Girardi ended up representing Keith’s family and won a settlement of more than $2 million. Girardi also promised the family that he would use the settlement money to buy an annuity, which is a fixed stream of income to be paid to an individual, but he never did. This resulted in a large tax bill that the family was not prepared to pay for and many questions of where the money had gone. The State Bar closed the case four years later stating it was resolved in a non-public fashion, which could mean anything from a private agreement, an admonition, or a letter of warning. The mother of Christian Keith, Sharon, states like many others that Girardi should be publicly accused, and not just punished behind closed doors. An attorney for the Los Angeles Times, Kelli Sage expressed that, “This information must be disclosed for the public to evaluate its performance and the steps needed to ensure that this kind of ‘serious failure’ does not happen again." [1].

Girardi was caught in his decades long embezzlement scheme when a Chicago law firm notified a federal judge that there was $2 million missing in settlement money [1]. The Chicago law firm, Edelson PC and the Girardi Keese firm had initially come together to represent the families impacted by the Lion Air flight crash of 2018 [5]. 189 people were killed on this flight when a flaw in the plane’s stabilization program caused it to crash shortly after takeoff [6]. After an investigation, it was found that Girardi had misappropriated the settlement funds that were meant for the case [5]. Because of this, the Edelson PC drafted a proposal to compensate their former clients and the family members from the Lion Air flight case in the full amount Girardi stole, as well as any surplus money recovered on their claims. In exchange, the clients will turn over any related claims they have against Girardi and anyone who assisted him. This proposal was successful of paying back the clients in full as of August 2022. Alex Tievsky, a lawyer at the Edelson PC states, “For our firm, the idea that the Lion Air families would be left waiting and wondering if Tom Girardi would be able to pay their restitution was simply unacceptable. They have already been through more than any family should have to bear. We have reimbursed them for the full amount that they lost, and we are going to pursue the people we believe to be responsible on our own.” [6].

There are others who appear to be caught up in this embezzlement situation other than Girardi. His now estranged wife Erika Jayne has been accused of encouraging Girardi to use the settlement money to fund her extravagant lifestyle [3], but Jayne has denied any knowledge of using the funds for that reason [6]. Ex Chief Financial Officer of Girardi Keese, Christopher Kamon, has recently been charged with a federal count of wire fraud and is being held in jail without bond [8]. The complaint that was filed pertaining to Kamon states that the wire fraud happened in September of 2020. Because Kamon oversaw Girardi Keese’s finances including the client trust accounts, he understood Girardi was stealing from them [8]. As of November 10, 2022, Kamon has been found guilty of stealing more than $10 million from the Girardi Keese client trust accounts [9]. Jay Edelson, who was a part of the Lion Air case also alleges that David Lira, Girardi’s son-in-law, and Keith Griffin were cooperating on the embezzlement scheme alongside Girardi [8].