#tax accountant vancouver

Text

Comprehensive Accounting Services in Vancouver for Business Success

In the bustling business landscape of Vancouver, efficient financial management is crucial for the success and sustainability of enterprises. Expert accounting services play a pivotal role in ensuring accurate financial records, compliance with regulations, and strategic decision-making. This content will explore the significance of accounting services in Vancouver and highlight the key aspects of these services that businesses can leverage for their growth.

Bookkeeping and Record-Keeping:

Professional accounting services in Vancouver offer meticulous bookkeeping and record-keeping services. This includes recording financial transactions, managing accounts payable and receivable, and maintaining accurate ledgers. By outsourcing these tasks, businesses can ensure that their financial data is organized, up-to-date, and readily available for analysis.

Tax Planning and Compliance:

Vancouver has a complex tax landscape, and compliance with both federal and provincial regulations is essential. Accounting services assist businesses in developing effective tax strategies, maximizing deductions, and ensuring timely filing of tax returns. Staying compliant not only avoids legal issues but also optimizes tax liabilities, contributing to overall financial efficiency.

Financial Reporting:

Timely and accurate financial reporting is crucial for informed decision-making. Professional accountants in Vancouver generate comprehensive financial statements, such as income statements, balance sheets, and cash flow statements. These reports offer insights into the financial health of the business, helping stakeholders make strategic decisions and plan for the future.

Business Advisory Services:

Beyond number crunching, accounting services in Vancouver often provide valuable business advisory services. This includes financial analysis, budgeting, and forecasting to help businesses plan and achieve their financial goals. Experienced accountants offer insights into cost management, revenue enhancement, and overall financial strategy.

Payroll Processing:

Managing payroll can be a time-consuming and complex task. Outsourcing payroll services to accounting professionals ensures accuracy in salary calculations, compliance with payroll tax regulations, and timely payment to employees. This allows businesses to focus on their core operations while ensuring employee satisfaction.

Audit Support:

Accounting services also play a crucial role during audits. Whether it's a regulatory audit or an internal review, having accurate and well-maintained financial records is essential. Professional accountants in Vancouver assist businesses in preparing for audits, ensuring a smooth and transparent process.

Technology Integration:

Keeping up with technological advancements is vital for modern businesses. Accounting services in Vancouver often leverage advanced accounting software to streamline processes, improve accuracy, and enhance efficiency. This ensures that businesses are equipped with the latest tools for financial management.

Conclusion:

In conclusion, accounting services in Vancouver go beyond traditional number crunching. They serve as strategic partners, guiding businesses towards financial success through accurate record-keeping, tax planning, financial reporting, and business advisory services. By outsourcing accounting tasks, businesses in Vancouver can focus on their core competencies while ensuring their financial foundations are strong and compliant with regulations.

#cpa firms in vancouver#tax accountant vancouver#vancouver accounting firm#accounting firm in vancouver#accounting vancouver

1 note

·

View note

Text

Navigating Business Success: The Role of an Accountant in Vancouver

In the bustling metropolis of Vancouver, businesses thrive in a dynamic and competitive environment. From startups to established corporations, every entity relies on sound financial management to navigate the complexities of their operations successfully. Amidst this landscape, the expertise of an accountant stands as a beacon of financial stewardship and strategic guidance.

Accountants in Vancouver play a pivotal role in the economic landscape, offering indispensable services that go beyond mere number-crunching. They are the architects of financial stability, the guardians of compliance, and the advisors steering businesses towards growth and prosperity.

At the heart of every thriving business lies meticulous bookkeeping. Vancouver-based enterprises understand the importance of maintaining accurate and up-to-date financial records. This is where the services of a skilled bookkeeper in Vancouver come into play. They are the custodians of financial data, ensuring that every transaction is recorded with precision and clarity. With their expertise, businesses can make informed decisions, identify trends, and allocate resources effectively.

Bookkeeping services in Vancouver are not just about balancing the books; they are about providing actionable insights that drive business success. By leveraging advanced accounting software and best practices, bookkeepers empower businesses to streamline their financial processes, reduce overhead costs, and optimize cash flow management.

In the fast-paced business landscape of Vancouver, staying compliant with tax regulations and financial reporting standards is non-negotiable. This is where the expertise of an accountant truly shines. Whether it's navigating complex tax codes, preparing financial statements, or conducting audits, accountants in Vancouver are the trusted advisors businesses rely on to ensure regulatory compliance and financial transparency.

Beyond compliance, accountants offer strategic guidance that transcends traditional financial management. They analyze market trends, assess risk factors, and develop tailored financial strategies that align with the long-term goals of the business. From budget planning to investment analysis, accountants provide invaluable insights that empower businesses to seize opportunities and mitigate risks effectively.

In the digital age, technology has revolutionized the accounting profession. Cloud-based accounting software, automation tools, and data analytics platforms have transformed the way accountants operate. In Vancouver, forward-thinking accounting firms like Maje Accounting harness the power of technology to deliver cutting-edge solutions that drive efficiency and innovation.

Maje Accounting is a trusted name in the Vancouver accounting community, known for its commitment to excellence and client-centric approach. With a team of seasoned professionals and a focus on personalized service, Maje Accounting offers a comprehensive suite of accounting and bookkeeping services tailored to the unique needs of each client.

As a leading provider of bookkeeping services in Vancouver, Maje Accounting understands the importance of accuracy, reliability, and confidentiality. Whether it's managing accounts payable, reconciling bank statements, or generating financial reports, their bookkeepers ensure that every aspect of the financial process is handled with precision and integrity.

Beyond bookkeeping, Maje Accounting offers a full spectrum of accounting services designed to support businesses at every stage of their growth journey. From tax planning and compliance to financial analysis and strategic consulting, their team of accountants provides holistic solutions that drive tangible results.

One of the hallmarks of Maje Accounting is its commitment to proactive communication and responsive client service. In a rapidly evolving business environment, timely and reliable support can make all the difference. Maje Accounting prides itself on being accessible to clients, providing expert advice and guidance whenever needed.

In conclusion, the role of an accountant in Vancouver extends far beyond number-crunching and compliance. Accountants are the architects of financial stability, the advisors guiding businesses towards growth and prosperity. With their expertise and strategic insights, they empower businesses to navigate the complexities of the modern business landscape with confidence and clarity. And in Vancouver, Maje Accounting stands as a trusted partner, offering comprehensive accounting and bookkeeping solutions that drive success.

#accountant vancouver#small business accountant vancouver#bookkeeper vancouver#bookkeeping services vancouver#accountant surrey#bookkeeper surrey#bookkeeper langley#accountant langley#Tax Filing Vancouver#Tax Filing Surrey

1 note

·

View note

Text

Are you feeling stressed and overwhelmed when tax season rolls around? Are you unsure about the best way to manage your personal finances and maximize your tax savings? If so, you're not alone. Many people find themselves in the same boat, grappling with complex tax laws and trying to make sense of confusing forms. But fear not! There's a solution that can make your life a whole lot easier: hiring an accountant to handle your personal taxes. In this blog post, we'll explore the many reasons why hiring an Accountant Vancouver is a smart decision for anyone looking to take the hassle out of tax time.

Read Blog:- https://whizolosophy.com/category/money-finances/article-column/why-you-should-hire-an-accountant-for-your-personal-taxes

1 note

·

View note

Text

Bridging Financial Gaps: Vancouver's Tax Efficiency Guide

In the realm of cross-border financial management, Vancouver and Windsor stand as pivotal hubs for individuals and businesses seeking tax efficiency solutions. Navigating the complexities of cross-border tax planning requires expertise and strategic insight, making the role of accounting firms indispensable. Among these firms, PPA Tax, leading Accounting Firms in Windsor Ontario with their extensive experience and commitment to excellence, emerges as a trusted partner in bridging financial gaps.

For more information visit us:

https://ppatax.blogspot.com/2024/01/bridging-financial-gaps-vancouvers-tax.html

0 notes

Text

The true post-cyberpunk hero is a noir forensic accountant

I'm touring my new, nationally bestselling novel The Bezzle! Catch me in TOMORROW (Apr 17) in CHICAGO, then Torino (Apr 21) Marin County (Apr 27), Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

I was reared on cyberpunk fiction, I ended up spending 25 years at my EFF day-job working at the weird edge of tech and human rights, even as I wrote sf that tried to fuse my love of cyberpunk with my urgent, lifelong struggle over who computers do things for and who they do them to.

That makes me an official "post-cyberpunk" writer (TM). Don't take my word for it: I'm in the canon:

https://tachyonpublications.com/product/rewired-the-post-cyberpunk-anthology-2/

One of the editors of that "post-cyberpunk" anthology was John Kessel, who is, not coincidentally, the first writer to expose me to the power of literary criticism to change the way I felt about a novel, both as a writer and a reader:

https://locusmag.com/2012/05/cory-doctorow-a-prose-by-any-other-name/

It was Kessel's 2004 Foundation essay, "Creating the Innocent Killer: Ender's Game, Intention, and Morality," that helped me understand litcrit. Kessel expertly surfaces the subtext of Card's Ender's Game and connects it to Card's politics. In so doing, he completely reframed how I felt about a book I'd read several times and had considered a favorite:

https://johnjosephkessel.wixsite.com/kessel-website/creating-the-innocent-killer

This is a head-spinning experience for a reader, but it's even wilder to experience it as a writer. Thankfully, the majority of literary criticism about my work has been positive, but even then, discovering something that's clearly present in one of my novels, but which I didn't consciously include, is a (very pleasant!) mind-fuck.

A recent example: Blair Fix's review of my 2023 novel Red Team Blues which he calls "an anti-finance finance thriller":

https://economicsfromthetopdown.com/2023/05/13/red-team-blues-cory-doctorows-anti-finance-thriller/

Fix – a radical economist – perfectly captures the correspondence between my hero, the forensic accountant Martin Hench, and the heroes of noir detective novels. Namely, that a noir detective is a kind of unlicensed policeman, going to the places the cops can't go, asking the questions the cops can't ask, and thus solving the crimes the cops can't solve. What makes this noir is what happens next: the private dick realizes that these were places the cops didn't want to go, questions the cops didn't want to ask and crimes the cops didn't want to solve ("It's Chinatown, Jake").

Marty Hench – a forensic accountant who finds the money that has been disappeared through the cells in cleverly constructed spreadsheets – is an unlicensed tax inspector. He's finding the money the IRS can't find – only to be reminded, time and again, that this is money the IRS chooses not to find.

This is how the tax authorities work, after all. Anyone who followed the coverage of the big finance leaks knows that the most shocking revelation they contain is how stupid the ruses of the ultra-wealthy are. The IRS could prevent that tax-fraud, they just choose not to. Not for nothing, I call the Martin Hench books "Panama Papers fanfic."

I've read plenty of noir fiction and I'm a long-term finance-leaks obsessive, but until I read Fix's article, it never occurred to me that a forensic accountant was actually squarely within the noir tradition. Hench's perfect noir fit is either a happy accident or the result of a subconscious intuition that I didn't know I had until Fix put his finger on it.

The second Hench novel is The Bezzle. It's been out since February, and I'm still touring with it (Chicago tonight! Then Turin, Marin County, Winnipeg, Calgary, Vancouver, etc). It's paying off – the book's a national bestseller.

Writing in his newsletter, Henry Farrell connects Fix's observation to one of his own, about the nature of "hackers" and their role in cyberpunk (and post-cyberpunk) fiction:

https://www.programmablemutter.com/p/the-accountant-as-cyberpunk-hero

Farrell cites Bruce Schneier's 2023 book, A Hacker’s Mind: How the Powerful Bend Society’s Rules and How to Bend Them Back:

https://pluralistic.net/2023/02/06/trickster-makes-the-world/

Schneier, a security expert, broadens the category of "hacker" to include anyone who studies systems with an eye to finding and exploiting their defects. Under this definition, the more fearsome hackers are "working for a hedge fund, finding a loophole in financial regulations that lets her siphon extra profits out of the system." Hackers work in corporate offices, or as government lobbyists.

As Henry says, hacking isn't intrinsically countercultural ("Most of the hacking you might care about is done by boring seeming people in boring seeming clothes"). Hacking reinforces – rather than undermining power asymmetries ("The rich have far more resources to figure out how to gimmick the rules"). We are mostly not the hackers – we are the hacked.

For Henry, Marty Hench is a hacker (the rare hacker that works for the good guys), even though "he doesn’t wear mirrorshades or get wasted chatting to bartenders with Soviet military-surplus mechanical arms." He's a gun for hire, that most traditional of cyberpunk heroes, and while he doesn't stand against the system, he's not for it, either.

Henry's pinning down something I've been circling around for nearly 30 years: the idea that though "the street finds its own use for things," Wall Street and Madison Avenue are among the streets that might find those uses:

https://craphound.com/nonfic/street.html

Henry also connects Martin Hench to Marcus Yallow, the hero of my YA Little Brother series. I have tried to make this connection myself, opining that while Marcus is a character who is fighting to save an internet that he loves, Marty is living in the ashes of the internet he lost:

https://pluralistic.net/2023/05/07/dont-curb-your-enthusiasm/

But Henry's Marty-as-hacker notion surfaces a far more interesting connection between the two characters. Marcus is a vehicle for conveying the excitement and power of hacking to young readers, while Marty is a vessel for older readers who know the stark terror of being hacked, by the sadistic wolves who're coming for all of us:

https://www.youtube.com/watch?v=I44L1pzi4gk

Both Marcus and Marty are explainers, as am I. Some people say that exposition makes for bad narrative. Those people are wrong:

https://maryrobinettekowal.com/journal/my-favorite-bit/my-favorite-bit-cory-doctorow-talks-about-the-bezzle/

"Explaining" makes for great fiction. As Maria Farrell writes in her Crooked Timber review of The Bezzle, the secret sauce of some of the best novels is "information about how things work. Things like locks, rifles, security systems":

https://crookedtimber.org/2024/03/06/the-bezzle/

Where these things are integrated into the story's "reason and urgency," they become "specialist knowledge [that] cuts new paths to move through the world." Hacking, in other words.

This is a theme Paul Di Filippo picked up on in his review of The Bezzle for Locus:

https://locusmag.com/2024/04/paul-di-filippo-reviews-the-bezzle-by-cory-doctorow/

Heinlein was always known—and always came across in his writings—as The Man Who Knew How the World Worked. Doctorow delivers the same sense of putting yourself in the hands of a fellow who has peered behind Oz’s curtain. When he fills you in lucidly about some arcane bit of economics or computer tech or social media scam, you feel, first, that you understand it completely and, second, that you can trust Doctorow’s analysis and insights.

Knowledge is power, and so expository fiction that delivers news you can use is novel that makes you more powerful – powerful enough to resist the hackers who want to hack you.

Henry and I were both friends of Aaron Swartz, and the Little Brother books are closely connected to Aaron, who helped me with Homeland, the second volume, and wrote a great afterword for it (Schneier wrote an afterword for the first book). That book – and Aaron's afterword – has radicalized a gratifying number of principled technologists. I know, because I meet them when I tour, and because they send me emails. I like to think that these hackers are part of Aaron's legacy.

Henry argues that the Hench books are "purpose-designed to inspire a thousand Max Schrems – people who are probably past their teenage years, have some grounding in the relevant professions, and really want to see things change."

(Schrems is the Austrian privacy activist who, as a law student, set in motion the events that led to the passage of the EU's General Data Privacy Regulation:)

https://pluralistic.net/2020/05/15/out-here-everything-hurts/#noyb

Henry points out that William Gibson's Neuromancer doesn't mention the word "internet" – rather, Gibson coined the term cyberspace, which, as Henry says, is "more ‘capitalism’ than ‘computerized information'… If you really want to penetrate the system, you need to really grasp what money is and what it does."

Maria also wrote one of my all-time favorite reviews of Red Team Blues, also for Crooked Timber:

https://crookedtimber.org/2023/05/11/when-crypto-meant-cryptography/

In it, she compares Hench to Dickens' Bleak House, but for the modern tech world:

You put the book down feeling it’s not just a fascinating, enjoyable novel, but a document of how Silicon Valley’s very own 1% live and a teeming, energy-emitting snapshot of a critical moment on Earth.

All my life, I've written to find out what's going on in my own head. It's a remarkably effective technique. But it's only recently that I've come to appreciate that reading what other people write about my writing can reveal things that I can't see.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/17/panama-papers-fanfic/#the-1337est-h4x0rs

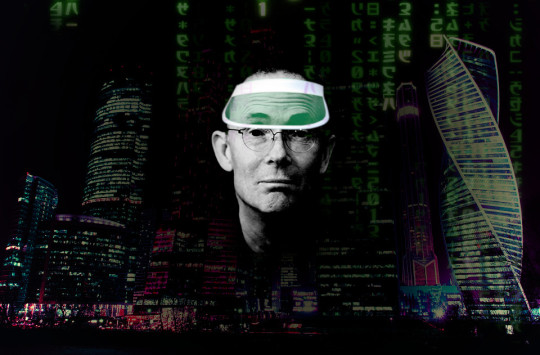

Image:

Frédéric Poirot (modified)

https://www.flickr.com/photos/fredarmitage/1057613629 CC BY-SA 2.0

https://creativecommons.org/licenses/by-sa/2.0/

#pluralistic#science fiction#cyberpunk#literary criticism#maria farrell#henry farrell#noir#martin hench#marty hench#red team blues#the bezzle#forensic accountants#hackers#bruce schneier#post-cyberpunk#blair fix

201 notes

·

View notes

Text

There are several serious concerns regarding DreamWorks Animation in recent years:

Shifting Production Away from In-House

DreamWorks is shifting away from fully producing animated films in-house at its Glendale, California studio. The studio is partnering with Sony Pictures Imageworks to handle asset builds and shot production for an upcoming 2025 film. This reflects a new cost-cutting model where DreamWorks will outsource some work to partner studios in lower cost locations to reduce production costs by 20%[1]. This has raised concerns among DreamWorks staff about job security and the studio's commitment to in-house production.

Significant Layoffs

In March 2024, DreamWorks announced huge layoffs across multiple departments. Reddit users commented that the studio won't be recovering from this round of layoffs, blaming the outsourcing strategy[2]. The exact number of jobs lost is unclear, but it seems to be a major blow to the studio's workforce.

Questionable Leadership Decisions

DreamWorks CEO Jeffrey Katzenberg has made some decisions that have raised eyebrows. In 2013, President Obama visited DreamWorks and joked about Katzenberg's large ego[4]. More concerning is Katzenberg's history of overseeing the shift of production from Culver City to Vancouver at Sony Pictures Imageworks to take advantage of tax credits[1]. This suggests a willingness to prioritize cost savings over maintaining jobs in Los Angeles.

Outsourcing Threatens Local Economy

The animation industry is a major economic engine for Southern California, similar to how finance is to New York or tech is to Silicon Valley[4]. By shifting production overseas, DreamWorks is putting local jobs at risk and threatening the viability of the local animation ecosystem. This could have ripple effects on the broader economy of the region.

In summary, DreamWorks appears to be making decisions that prioritize short-term cost savings over maintaining a robust in-house production workforce. While some outsourcing may be necessary to stay competitive, the scale and speed of the changes raise serious concerns about the studio's long-term commitment to its Los Angeles workforce and the local economy. Significant layoffs and the CEO's history of prioritizing tax credits over local jobs add to the sense of unease among DreamWorks employees and the surrounding community.

Citations:

[1] https://www.cartoonbrew.com/studios/dreamworks-shifting-away-from-in-house-production-in-los-angeles-sony-imageworks-is-new-production-partner-233466.html

[2] https://www.reddit.com/r/vfx/comments/1bdemof/dreamworks_layoffs/

[3] https://www.thegamer.com/things-wrong-dreamworks-movies-choose-ignore/

[4] https://obamawhitehouse.archives.gov/the-press-office/2013/11/26/remarks-president-economy-dreamworks

[5] https://www.watchmojo.com/articles/top-10-times-dreamworks-movies-tackled-serious-issues

Here are some potential solutions for holding DreamWorks Animation accountable and ensuring they pay their fair share of taxes:

Advocate for Closing Corporate Tax Loopholes

DreamWorks and other large corporations often exploit loopholes and tax havens to minimize their tax burden[3]. Employees should urge lawmakers to close these loopholes and ensure companies like DreamWorks pay their fair share. This could involve measures like:

Eliminating deductions for offshoring jobs and profits

Imposing a minimum tax on corporate book income

Increasing IRS funding for auditing large corporations

Requiring public country-by-country reporting of taxes paid

Push for Transparency Around Tax Practices

DreamWorks should be more transparent about its tax practices and lobbying efforts related to taxes[3]. Employees can demand the company publicly disclose its effective tax rate, tax credits and incentives received, and political contributions. Greater transparency would allow stakeholders to hold the company accountable.

Support Unionization to Increase Bargaining Power

Unionizing gives workers more leverage to demand that DreamWorks invest in its workforce rather than prioritizing tax avoidance[2]. Unions can negotiate for higher wages, better benefits, and more training that improves productivity and reduces the need for tax breaks. Collective bargaining power is key to rebalancing the scales.

Collaborate with Community Organizations

DreamWorks employees should partner with local community groups, nonprofits, and advocacy organizations that are pushing for corporate tax reform and responsible business practices[3]. By pooling resources and amplifying each other's voices, workers and activists can build a powerful movement for change.

Engage with Shareholders

As a publicly traded company, DreamWorks is accountable to its shareholders. Employees who own stock should engage with the company's leadership and other investors to voice concerns about tax avoidance and demand more responsible corporate citizenship[3]. Shareholder resolutions and proxy voting can influence company policies.

By pursuing these solutions, DreamWorks Animation employees can help ensure the company contributes its fair share to society through the tax system. Closing loopholes, increasing transparency, unionizing, collaborating with allies, and engaging shareholders are all important levers for driving accountability. Responsible corporate tax practices are key to funding public services and infrastructure that benefit workers and communities.

Citations:

[1] https://dreamworkstaxsolutions.com

[2] https://www.reddit.com/r/vfx/comments/1bdemof/dreamworks_layoffs/

[3] https://filmstories.co.uk/news/dreamworks-animation-set-to-outsource-work-to-tax-advantaged-lower-cost-geographies/

[4] https://www.gamedeveloper.com/business/how-to-manage-taxes-as-an-indie-developer

[5] http://www.filmstrategy.com/2015/04/production-tips-filmmaker-and-taxes.html

4 notes

·

View notes

Text

Virgil Alexander posted:

Forwarded to me by an executive accountant friend: WHO AND WHAT IS—BLACK LIVES MATTER?

Black Lives Matter might be viewed as a grassroots movement of concerned people gathering together. It is much more.

Black Lives Matter is a corporation whose real name is Black Lives Matter Global Network Foundation (BLMGNF). (Yep, it's one of those capitalistic corporations they profess to hate.)

The following information is on their web site. It's a nationwide corporation! BLMGNF has chapters in Boston, Chicago, Washington DC, Denver, Detroit, Los Angeles, Lansing, Long Beach, Memphis, Nashville, New York City, Philadelphia, South Bend and in Canada in Toronto, Vancouver, and Waterloo. (If you were impressed by how all those recent riots erupted simultaneously from a grassroots movement--well, maybe it's not so grassroots.)

BLMGNF is a not-for-profit corporation--but it's not tax exempt, so donations are not tax deductible. Except if you go to its website and want to donate, you're transferred to 'ActBlue Charities' which will take your donation, give you a tax deduction, and then distribute the money you gave to BLMGNF. Sort of . . .

What is ActBlue?

The following is taken directly from ActBlue’s web page: “Our platform is available to Democratic candidates and committees, progressive organizations, and nonprofits that share our values for no cost besides a 3.95% processing fee on donations. And we operate as a conduit, which means donations made through ActBlue to a campaign or organization are considered individual donations.”

ActBlue consists of three parts: ActBlue Charities facilitates donations to left-of-center 501(c)(3) nonprofits; Act Blue Civics is its 501(c)(4) affiliate; ActBlue is a 527 Political Action Committee. These three have raised over $5 billion in the sixteen years since it started. If it's 3.95% transaction fee has indeed been applied to all donations, that equates to over $197 million!

ActBlue is thus a Democratic Party front affiliated with BLMGNF. If only it was that simple and stopped there.

Per Business Insider Australia: “ActBlue . . . distributes the money raised to Thousand Currents, which is then granted to Black Lives Matter.”

So, what, you ask, is Thousand Currents (formerly the International Development Exchange)?

Again, per Business insider Australia: “Thousand Currents is a 501(3)(c) non-profit that provides grants to organizations that are . . . developing alternative economic models." (Is anarchy now an alternative economic model?)

"Thousand Currents essentially acts as a quasi-manager for Black Lives Matter: ‘It provides administrative and back office support, including finance, accounting, grants management, insurance, human resources, legal and compliance,’ (Executive Director Solome) Lemma said.” (Finance, insurance, human resources, legal and compliance? It sounds like General Motors!)

What is the significance of the above?

Black Lives Matter is not some fly-by-night fad that is going to loot and destroy and then disappear into the ash heap of history. It's a multi-corporation, big business that is heavily associated with and supports the Democratic Party--and it's here to stay. Arguing whether Black Lives or All Lives Matter is meaningless and distracts from what it's trying to achieve. It's a left-wing political movement that will have a significant impact on Democratic Party programs for the foreseeable future.

Socialism and Communism are intimately linked to these efforts. The U.S. Constitution and especially the Bill of Rights have no place in their plans. Patrisse Cullors,one of Black Lives Matter’s cofounders is widely quoted as saying, “We are trained Marxists.”

The president of Greater New York Black Lives Matter said that if the movement fails to achieve meaningful change during nationwide protests, they will “burn down this system.” Not the peaceful change we celebrate under our Constitution but violent change. For those of us who like our Constitution, this is a challenge thrown directly in our faces.

If you've been wondering why politicians have danced around criticizing Black Lives Matter, now you know.

9 notes

·

View notes

Text

Donald Trump made up to $160 million from international business dealings while he was serving as President of the United States, according to an analysis of his tax returns by CREW.

Throughout his time in office, President Trump, his family and his Republican allies repeatedly assured the public that his refusal to divest from his businesses wouldn’t lead to any conflicts of interest. Americans were promised that Trump would donate his salary, which he did, until maybe he didn’t—all while siphoning millions from taxpayers that more than offset his presidential pay. When it came to foreign conflicts of interest, Trump and his company pledged to pause foreign business. They did not.

Trump pulled in the most money from the United Kingdom, where his Aberdeen and Turnberry golf courses in Scotland helped him gross $58 million. Trump’s now-defunct hotel and tower in Vancouver helped him pull in $36.5 million from Canada. Trump brought in more than $24.4 million from Ireland, home to his often-visited Doonbeg golf course, as well as $9.6 million from India, and nearly $9.7 million from Indonesia.

Trump’s presidency was marred by unprecedented conflicts of interest arising from his decision not to divest from the Trump Organization, with his most egregious conflicts involving businesses in foreign countries with interests in US foreign policy.

The full extent to which Trump’s foreign business ties influenced his decision making as President may never be known, but there is plenty of evidence that Trump’s actions in the White House were influenced–if not guided–by his financial interests, subverting the national interests for his own parochial concerns. For example, while campaigning in 2015, Trump bragged to a crowd in Alabama about his longstanding business ties with the Saudis. “They buy apartments from me. They spend $40 million, $50 million,” he told the crowd. “Am I supposed to dislike them? I like them very much.” In office, Trump continued to benefit from Saudi business and faced repeated criticism, especially in the wake of the murder of Jamal Khashoggi, for his apparent desire to shield Saudi leaders from criticism, going so far as to question US intelligence while parroting allegations from Saudi Arabia that Khashoggi was tied to the Muslim Brotherhood.

Other instances of Trump’s business interests bleeding into his administration’s foreign policy abound. In 2019, Trump stunned the US foreign policy establishment by pulling US troops out of northeast Syria. The decision had no obvious benefits to the US and was a bombshell reversal to allied Kurds, but it was a victory for Turkey, where Trump had done business for years. In China, Trump again shocked even his GOP allies when he pledged to help sanctioned Chinese company ZTE because, as he tweeted, there were “[t]oo many jobs in China lost,” despite warnings from US intelligence officials that the company’s products may be used by the Chinese government to spy on Americans. When Trump’s tax returns were released more than four years later, they showed a Chinese bank account he claimed to have closed in 2015 and, according to CREW’s analysis, more than $7.5 million in income from China. In Argentina, Trump held off on enacting tariffs until after trademarks for his company had been approved.

Trump also used the US foreign policy apparatus to direct business to his properties. For example, Trump’s Ambassador to the United Kingdom reportedly told embassy staff that Trump pushed him to get the British Open to be held at one of his Scottish golf resorts. During a trip to Europe, Trump insisted on staying at his remote Irish resort in Doonbeg, claiming it was “convenient,” while the Trump Organization promoted his visit. Trump also reportedly pressured the Irish prime minister to meet him at Doonbeg, and threatened to move his visit to Scotland instead if he didn’t.

Despite a near constant stream of reporting about corruption involving Trump’s business at home and abroad, Trump and his family have spent years swearing they put a hold on all foreign deals and that the presidency was without conflicts of interest. After his election Trump proclaimed, “The law’s totally on my side, meaning, the president can’t have a conflict of interest.” Eric and Don Jr. echoed that sentiment. In a June 2017 interview on Good Morning America, Eric proclaimed that he and his father didn’t talk about business at all and that Trump has “zero conflicts of interest.” In October 2019 Eric said on Fox News, “when my father became commander in chief of this country, we got out of all international business.”

The Trumps did not put a hold on foreign business. In fact, they even signed new deals. Barely two weeks after Eric Trump claimed the Trump Organization put foreign business on hold, the Trump Organization trumpeted approval to build “a new ballroom, pool, spa, leisure facilities, 235 additional resort rooms, gate house and much more” at the Doonbeg golf course in Ireland. A local council in Scotland also voted to allow the Trump Organization to expand its Aberdeen golf course by building 550 homes and a second golf course. Eric Trump celebrated this “new phase of development” on Twitter. At the same time, Eric was bashing Hunter Biden on Fox News for “cashing in” while his father was Vice President.

The Trumps took advantage of the presidency to revive dormant old deals as well, revisiting projects in countries like India, Uruguay, the Dominican Republic, and more during the administration.

The Trumps were openly engaging in multiple international business deals and let the world know that they hoped to continue expanding internationally after Trump left office. According to the Wall Street Journal, Eric Trump predicted that after Trump leaves office, the “Trump Organization will launch a major expansion that will in part focus on luxury hotels abroad.” Don Jr. was even more specific, telling an Indian newspaper, “India is a market that we would be very interested [in] post politics,” along with “other markets.”

It’s no secret that Trump was struggling financially before he announced his run for office. His tax returns show that the presidency was great for his bank account. Congressional Republicans may have halted their inquiry into Trump’s finances, but there is still much to discover about the extent to which he truly abused the presidency for his own personal profit.

#us politics#news#citizens for responsibility and ethics in washington#2023#donald trump#republicans#conservatives#trump administration#gop#trump taxes#trump tax returns#foreign conflicts of interest#Trump Organization

19 notes

·

View notes

Text

Bookkeeping services in canada

Masllp's Bookkeeping Services in Canada

Running a business in Canada is like exploring a majestic national park – filled with breathtaking opportunities and diverse challenges. But just like navigating those rugged trails, managing your finances can be a wild ride. That's where Masllp's top-notch bookkeeping services in Canada come in, acting as your trusted guide to financial clarity.

Why Masllp for Your Canadian Bookkeeping Needs?

Local Expertise: We understand the intricate tapestry of Canadian tax laws, regulations, and accounting best practices. No need to worry about navigating provincial discrepancies or federal tax quirks – we've got your back, coast to coast.

Tech-Savvy Solutions: Say goodbye to dusty ledgers and endless spreadsheets. We leverage cutting-edge cloud-based tools to keep your financials organized, accessible, and secure. Whether you're in bustling Toronto or remote Nunavut, your data is always within reach.

Tailored Services: Whether you're a solopreneur in St. John's or a booming startup in Vancouver, we customize our services to fit your unique needs and budget. No cookie-cutter packages here – you get the perfect financial map for your journey.

Stress-Free Support: Managing your finances shouldn't be a hair-pulling affair. Our friendly and approachable team is always happy to answer your questions, explain complex concepts, and alleviate your financial woes.

Beyond the Basics: A Spectrum of Support

Masllp goes beyond mere bookkeeping. We offer a comprehensive range of services to empower your Canadian business:

Payroll Management: Ensure your employees receive accurate and timely payments, while staying compliant with Canadian tax regulations.

Tax Preparation and Filing: From GST/HST to corporate taxes, we navigate the Canadian tax landscape so you can focus on what you do best.

Financial Reporting and Analysis: Gain valuable insights into your business performance with accurate and insightful financial reports.

Business Advisory: Take your financial decisions to the next level with expert advice and strategic guidance.

Start Your Financial Journey Today

Ready to ditch the financial wilderness and explore the path to financial freedom? Contact Masllp today for a free consultation and discover how our bookkeeping services in Canada can be your compass to success. Remember, with Masllp, your Canadian business adventure can be as smooth and enjoyable as a maple syrup latte on a crisp autumn day.

Get in touch and let's conquer the Canadian financial maze together!

Bonus Tip: Include a call to action, such as offering a free consultation or downloadable resource related to bookkeeping in Canada.

Remember to replace "Masllp" with your actual company name throughout the blog.

I hope this blog provides a good starting point for your keyword "Bookkeeping services in Canada." Feel free to adjust it to reflect your specific company offerings and brand voice.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

4 notes

·

View notes

Text

Fictober 2023: Day 3

Prompt: "Okay, show me."

Fandom: Mass Effect

Relationship: Commander Natasha Shepard/Kaidan Alenko, Commander Natasha Shepard & Jeff "Joker" Moreau

Rating: General

Warnings: None

Summary: Kaidan meets up with Jeff at a bar in Vancouver.

AO3 link: here. Preview below the cut.

The Secret Meeting

Kaidan rested his arms against the edge of the table, leaning against it as he kept a watchful eye on the entrance. The fading daylight streaked into the dimly lit bar each time the door was opened. He took another slow sip from the bottle of beer resting in front of him, quickly tossing a handful of peanuts into his mouth to combat the strong aftertaste of the stale, warm beverage.

He glanced toward the nearest holo screen and felt his heart drop as the same old footage repeated between the new coverage from today. The familiar scene of Commander Shepard being escorted from the Normandy SR-2 by Admirals Hackett and Anderson on the day she’d surrendered herself into their custody. The muscular marine assigned as her bodyguard protectively guided her through the crowd of ravenous reporters that shrieked after her, demanding details on what's become known as the Alpha Relay Incident.

Kaidan knew she hated this. It must’ve reminded her of the press tour she’d been forced into after the Blitz. A dark time for her.

The newer footage showed the individuals that had arrived today as the tribunal had begun. He was included among those numbers. His mind was awash with memories of their time together, back before everything had gone wrong. The opinions he’d formed about her character, and his account of the events of the time he’d spent working with her on the SR-1, would be instrumental in the judgment that would be rendered against her. Or so Hackett and Anderson had told him.

He did want to help her. He still loved her, and he always would. But navigating through those memories was taxing. He’d spent two years mourning her, clinging to each second he could recall as the memories slipped through his fingers like water through a sieve. And now he had to wade through them to carefully pluck out the ones that highlighted her character, but kept their romance hidden from the committee.

#fictober23#day 3#fictober event#writing prompts#mass effect#commander shepard#commander natasha shepard#kaidan alenko#jeff “joker” moreau#me3#mass effect 3#mass effect fanfic#britt writes#ao3 fanfic#it's late and idc lmaooo

4 notes

·

View notes

Text

Startup Accounting in Vancouver, BC | LFG Partners

Starting a new business is an exciting journey, but it comes with its own set of financial challenges. At LFG Partners, we specialize in providing comprehensive startup accounting services in Vancouver, BC, tailored to meet the unique needs of new entrepreneurs. Our team of experienced accountants is here to support you every step of the way, from setting up your accounting systems and managing initial financial transactions to navigating tax regulations and preparing for growth.

We understand that startups often face tight budgets and dynamic financial environments. That’s why we offer scalable solutions that can adapt as your business evolves. Our services include bookkeeping, financial planning, tax compliance, and advisory support, ensuring that you have a solid financial foundation to build upon. By partnering with LFG Partners, you gain access to expert guidance and strategic insights that can help you make informed decisions and focus on growing your business.

Let us handle the complexities of your financial operations so you can concentrate on what you do best—bringing your innovative ideas to life. Contact LFG Partners today to learn how our startup accounting services can set you on the path to success.

What accounting services do you offer for startups in Vancouver, BC?

At LFG Partners, we provide a range of accounting services tailored specifically for startups. These include setting up and managing your accounting systems, bookkeeping, financial statement preparation, tax compliance, and financial planning. We also offer advisory services to help you navigate complex financial decisions and plan for future growth. Our goal is to provide the support you need to ensure your financial operations are efficient and compliant, allowing you to focus on growing your business.

How can LFG Partners help my startup with tax compliance and planning?

Our team at LFG Partners is well-versed in the tax regulations affecting startups in Vancouver, BC. We assist with preparing and filing your taxes accurately and on time, ensuring compliance with local and federal tax laws. Additionally, we offer tax planning services to help you optimize your tax position, identify potential deductions, and develop strategies to minimize your tax liability. By proactively managing your tax responsibilities, we aim to reduce your financial stress and

0 notes

Text

Tax Mastery: Cross-Border Planning Tips from Vancouver to Windsor

In the dynamic landscape of cross-border business, understanding the nuances of tax planning is paramount. From the bustling cityscape of Vancouver to the historic charm of Windsor, Ontario, businesses navigate a complex web of regulations. Today, we delve into expert Cross Border Tax Planning Vancouver Windsor, shedding light on essential strategies that businesses can employ for fiscal efficiency.

For more information visit us:

https://ppatax.blogspot.com/2023/12/tax-mastery-cross-border-planning-tips.html

0 notes

Text

Top Vancouver Personal Stylist Services to Elevate Your Style

The Importance of Personal Styling in Vancouver

Looking your best in the busy, stylish city of Vancouver is about expressing your own character via your clothes, not only about following the newest trends. A Vancouver Personal Stylist will assist you confidently negotiate the always shifting fashion scene so that your style is both modern and very uniquely yours. Whether your wardrobe needs a style update, you're getting ready for a particular event, or you're ready for a job change, the correct Vancouver personal stylist may make all the difference in your look.

A Vancouver personal stylist goes beyond just fashion knowledge. They provide a customized service fit for your body type, lifestyle, and particular demand. This is about choosing a wardrobe that accentuates your daily life and fits your personality, not only about choosing clothes. Vancouver's personal stylists are skilled in knowing the subtleties of fashion and how they relate to unique people. Whether your style is professional, elegant, or casual, they can assist you find fresh looks that complement your objectives.

A Vancouver Personal Stylist provides one of main services—a customized wardrobe advice. This entails closely examining your present wardrobe to find items that fit you both generally and specifically. The stylist will then offer ideas for what to keep, give, and add to your collection. This technique guarantees that every item of clothes in your closet is something you actually enjoy wearing and fulfills a function.

Shopping in a city as varied as Vancouver may occasionally be taxing. Now enter the Vancouver Personal Shopper, a professional that chooses a range of products that meet your style and needs to help you to relax when shopping. Vancouver's personal shopper will accompany you to several stores or shops on your behalf, choosing items that fit the newest fashion trends and update your wardrobe. Those with hectic schedules or those who find shopping to be a difficult chore may find great use for this service.

Why Choose a Vancouver Personal Stylist?

Hiring a Vancouver personal stylist is an investment in oneself, not only a means of following trends. Your appearance greatly influences how others view you, hence having a neat, coherent style will help you to increase your confidence and create new chances. You should give working with a personal stylist in Vancouver some thought for the following reasons:

Unmatched in degree of tailored care, a Vancouver personal stylist provides They invest time to learn about you, your style choices, and way of life. This customized method guarantees that the styling guidance you get is especially suited to you, not a generic fix. When selecting your wardrobe, your stylist will take into account your daily activities and long-term objectives as well as your body type and colour preferences.

Working with a Vancouver Personal Shopper allows one to acquire unique fashion findings among other benefits. Many personal stylists have relationships with designers and boutiques so they may locate unusual items you might not be able to obtain on your own. Your personal shopper will select things that exactly fit your needs whether your search is for a statement item to finish an outfit or a flexible staple that will last years.

Time is a luxury in the hectic modern world. By organizing the process of shopping, a Vancouver personal shopper saves time. While your personal shopper creates a wardrobe that fits your style and satisfies your demands, you may concentrate on other vital areas of your life instead of spending hours in stores or surfing internet. Professionals who have to look their best but lack the time to follow the newest fashion trends will find this service very helpful.

Top Services Offered by Vancouver Personal Stylists

Many Vancouver Personal Stylists today provide virtual styling sessions as digital technology has grown. From the convenience of your house, this service lets you get professional fashion advise. Your stylist will go over your closet, offer new outfit ideas, and purchasing advice during a virtual session. For people who do not have the time or means to meet personally but still want to gain from expert styling services, this is a great choice.

Dressing for a wedding, gala, or corporate function can be challenging. By helping you choose the ideal attire for any occasion, a Vancouver personal stylist may help to relieve some of the burden. They will take location, dress code, and your own style into account to produce an outfit that is both fitting and amazing. Knowing you look your best can help you enter any event confident.

How to Choose the Right Vancouver Personal Stylist

Ensuring the greatest service available depends on choosing the correct personal stylist in Vancouver. These guidelines can help you decide which stylist best fits you:

One should take experience and skills of a Vancouver Personal Stylist under consideration while looking for one. Look for a stylist that can offer references or testimonies from prior clients and has a proven success record. This will inspire you knowing they possess the knowledge and abilities to assist you in reaching your fashion objectives.

Although a stylist will try to improve your own look, it's also crucial that their own style complements yours. To understand their aesthetic, look over their portfolio or social media accounts. This will help to guarantee that their fashion vision fits your own tastes.

See a Vancouver Personal Stylist to talk over your objectives and goals before committing. This encounter will let you find out whether you feel at ease with the stylist and whether they grasp your needs. A professional stylist will hear your worries, provide helpful criticism, and design a schedule fit for your style goals.

Conclusion

In a city as energetic and fashion-forward as Vancouver, you really must look professional and coordinated. From tailored wardrobe advice to time-saving shopping experiences, a Vancouver Personal Stylist provides a spectrum of services meant to improve your style. Investing in these procedures not only improves your look but also gives you confidence and opens fresh doors. Working with a Vancouver Personal Shopper or Stylist will make all the difference whether your goal is a comprehensive wardrobe make-over or just a few key pieces to update your appearance.

1 note

·

View note

Text

Accounting Firms Vancouver Accurate and Timely Filings, Taxlinkcpa

Filing your taxes right and on time is super important. Accounting Firms Vancouver can totally handle this tricky task. They have the know-how and the tools to neatly prepare for your tax returns. Gathering and sorting all the important money-related info is their thing, and they make sure not to miss a single detail. When you get them to do your taxes, you can just relax. You can trust you're in safe hands and everything will get done just right and promptly. visit site taxlinkcpa.ca or contact us on 604-375-4742

0 notes

Text

Surrey CPA

In today's complex financial landscape, businesses and individuals require expert guidance to navigate tax regulations and financial planning. This need is met by Certified Public Accountants (CPAs) in Surrey, who provide a wide range of accounting services. This article explores the key services offered by Surrey CPAs, their importance, and the benefits of utilizing their expertise.

Comprehensive Accounting Services

Tax Preparation and Planning

One of the primary services offered by Surrey CPAs is tax preparation and planning. With ever-changing tax laws, it can be challenging for individuals and businesses to stay compliant. CPAs in Surrey ensure that all tax filings are accurate and submitted on time. Moreover, they provide strategic tax planning to minimize liabilities and maximize refunds, which benefits clients financially.

Financial Statement Preparation

Surrey CPAs also specialize in preparing financial statements. Accurate financial statements are crucial for business owners to understand their company's financial health. CPAs ensure these documents adhere to accounting standards and accurately reflect the company's financial position. Consequently, businesses can make informed decisions based on reliable data.

Auditing and Assurance Services

Auditing and assurance services are another vital area of expertise for Surrey CPAs. These services involve a thorough examination of a company's financial records to ensure accuracy and compliance with regulations. Through these audits, businesses can identify potential issues and implement corrective measures, enhancing their credibility with stakeholders.

Benefits of Hiring a Surrey CPA

Expertise and Knowledge

One of the main benefits of hiring a Surrey CPA is their extensive expertise and knowledge. CPAs undergo rigorous training and certification, equipping them with the skills needed to handle complex financial matters. Consequently, clients receive professional and accurate advice tailored to their specific needs.

Time and Resource Efficiency

Utilizing the services of a Surrey CPA can save both time and resources for businesses and individuals. Financial tasks that might take non-professionals hours to complete can be efficiently handled by experienced CPAs. This efficiency allows clients to focus on their core activities while ensuring their financial affairs are in order.

Enhanced Financial Decision-Making

With the help of Surrey CPAs, businesses and individuals can make more informed financial decisions. CPAs provide valuable insights into financial performance, cash flow management, and investment opportunities. These insights enable clients to strategically plan for the future and achieve their financial goals.

Conclusion

In conclusion, Surrey CPAs play a crucial role in managing the financial affairs of businesses and individuals. Offering services such as tax preparation, financial statement preparation, and auditing, they ensure compliance and financial accuracy. The expertise, efficiency, and strategic insights provided by Surrey CPAs make them indispensable for anyone looking to navigate the complexities of financial management successfully. Investing in professional CPA services in Surrey is a wise decision for achieving long-term financial stability and growth.

Contact:

(604) 723-4090

778-593-0880

13049 76 Ave #208,

Surrey, Bc V3w 2v7, Canada

Keyword:

Sidhu Dhillon And Associates Inc, Sidhu Accounting, Accounting Firm Surrey, Personal Tax Service Surrey, Accounting Firms Surrey, Corporate Tax Surrey, Accounting Firm In Surrey, Surrey Accounting Firms, Bookkeeping, Service Surrey, Bookkeeping Service Near Me, Tax Service Surrey, Sidhu Accounting & Tax Services Inc, Tax, Accountant Surrey, Corporate Tax Service Near Me, Accounting, Tax Accountant Near Me, Cpa In Surrey, Sonny Dhillon, Accounting Service Surrey, Best Accounting Firms Near Me, Corporate Tax, Accountant For Doctor, Accounting Firm Near Me, Cpa For Physicians, Accountant For Gp, Tax, Surrey Accountant, Persoanl Tax Service, Near Me, Bookkeeping, Accounting Service Near Me, Cpa Office Near Me, Accountant For Physicians,Tax Service Near Me

1 note

·

View note

Text

Personal Tax Accountant in Vancouver - Lfg Partners

What is a CPA in income tax?

A CPA, or Certified Public Accountant, is an accounting professional who has obtained a license to practice accounting at the state or federal territory level. CPAs are highly trained and regulated professionals who have passed a rigorous exam known as the Uniform Certified Public Accountant Examination (Uniform CPA Exam) administered by the American Institute of Certified Public Accountants (AICPA)

While CPAs are often associated with income tax preparation, they can specialize in various areas of accounting, such as auditing, bookkeeping, forensic accounting, managerial accounting, and even aspects of information technology (IT).

They can provide a range of services, including tax filing, financial planning, financial statements, audits, and more. CPAs can help individuals and businesses with their tax forms or returns, ensuring compliance with tax laws and regulations.

It's important to note that not everyone may need the full services of a CPA for filing a relatively simple tax return. Non-CPA tax preparers or do-it-yourself tax software may be sufficient for individuals with straightforward tax situations.

However, for more complex tax situations or if you require personalized advice and guidance, working with a CPA can be beneficial. In summary, a CPA is a licensed accounting professional who can provide expertise in various areas of accounting, including income tax preparation, and offer a range of services to individuals and businesses.

#vancouver accounting companies#sr&ed consulting vancouver#part-time cfo vancouver#business advisors vancouver#cdap vancouver#financial reporting vancouver#cloud accounting vancouver

0 notes