#t&t motors delhi

Explore tagged Tumblr posts

Text

#mercedes showroom in delhi#mercedes benz showroom in delhi#mercedes dealer in delhi#t and t motors delhi#t&t motors delhi

0 notes

Text

The Ladakh Protest: The 21-day Hunger Strike led by Sonam Wangchuk

Ladakh, famously known as “Mars on Earth”, is the perfect destination where the mind slows down and the soul finds its path.

It is the northeastern Union territory of India, known for its highest mountain ranges, mesmerizing landscapes, beautiful deep valleys, crystal clear blue lakes, diverse wildlife, highest motorable mountain roads, Buddhist heritage, and the overall picturesque beauty of the place.

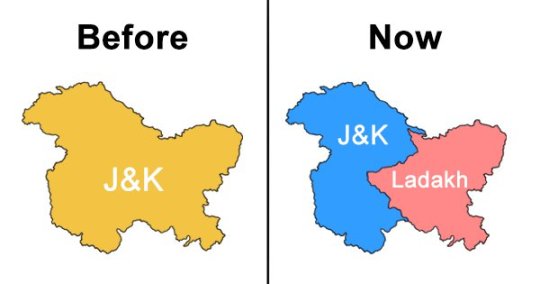

Ladakh: A union territory without legislature

Ladakh, which was a part of Jammu and Kashmir since 1847, was separated from Indian-administered Kashmir in 2019 and was reconstituted as a Union territory on October 31, 2019.

People of Ladakh have constantly demanded separate territory since the 1930s due to the unfair treatment of Kashmir and the prevailing cultural differences between people of Kashmir and Ladakh.

The formation of Ladakh as a separate Union territory was widely celebrated. Still, people were disappointed because it was made a UT without a legislative assembly and would have a lieutenant governor, while Jammu and Kashmir had a legislature.

What does it mean to have no legislature in Ladakh?

Unlike J&K, Ladakh cannot elect its own representative.

Ladakh will be ruled directly by the central government through a lieutenant governor as an administrator.

The President of India has the power to form rules and regulations for Ladakh, according to Article 240.

Sonam Wangchuk following his Father’s footsteps

Sonam Wangyal was born in 1925 in a small village in the Leh district of Ladakh. He worked his entire life for the rights of the people of Ladakh. He had strong secular beliefs.

He was appointed as the MLC of Jammu and Kashmir from 1957–1967 and as the MLA from 1967–1972, due to his selfless service toward the people of Ladakh.

Wangyal was also an active member in the campaign for ST status for Ladakhis, which was carried out between 1982 and 1984.

In 1984, on his five-day hunger strike, the former Prime Minister, Indira Gandhi, visited Leh and requested Wangyal to withdraw from the strike with the promise of granting the status of ST to the people of Ladakh.

Following his father’s strong morals and values and showcasing his devotion to the land and people of Ladakh, Sonam Wangchuk, a nature activist, engineer, innovator, and educationalist, began a “climate fast for 21 days” on March 6, 2024.

Why are they protesting?

The primary goal behind the protest is to raise awareness about the fragile ecosystem of Ladakh endangered by the growing industrial and developmental projects approved in New Delhi without consent, a threat posed as a result of having no legislative assembly in the Union territory of Ladakh.

The residents of Ladakh have two key demands:

Full-fledged statehood for Ladakh: the residents have demanded to elevate Ladakh’s status as a Union territory to a full-fledged state. This would enable Ladakh to have its own government and the right to form its own rules and regulations in favor of the land and people of the territory.

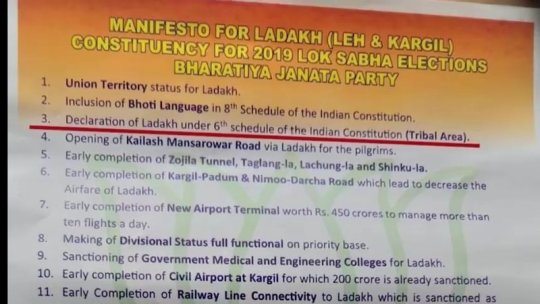

Integration of Ladakh in the 6th Schedule of the Constitution: The 6th Schedule aims to protect areas with tribal and indigenous populations. By including Ladakh in the 6th schedule, it would allow the state to establish autonomous districts and regional councils.

These elected bodies will have the power to administer and protect the tribal regions of the area. It would give the Ladakhis more control over water management, land use, and cultural preservation.

What is the government’s response to the ongoing protest?

Unlike the response and action taken upon the hunger strike carried out by Wangchuk’s father, the present-day government is MIA.

The current government seems unbothered by the demands and protests in Ladakh, just the way it is, and the deteriorating situation in Manipur.

The pioneers of the movement and every other active citizen in and out of Ladakh are furious about the inaction of the government and the PM, who knowingly promised in his 2019 manifesto of Lok Sabha, that Ladakh will be incorporated into the 6th schedule of the constitution. But apparently, they failed to honor their promises.

Lack of media coverage:

The lack of media coverage is infuriating for the people of Ladakh and the active citizens of India.

Although the independent media and journalists who are physically present in the ongoing protests do cover the news for the country, But it is disappointing to witness the lack of coverage by mainstream media and the big houses.

The scarcity of coverage of this major issue conceals the truth from the nation. The nation wants to know more about the concerns and affairs of the territory. Unless there is some news from the local media houses, the lack of coverage by the recognized media houses keeps the common man from knowing what is really happening there.

The current news on the Ladakh protest:

According to the current news,

Wangchuk survived solely on water and salt during the 21-day hunger strike (inspired by Gandhiji), which lasted from March 6th to March 26th.

In his speech, he talked about the “21-day fast"—that 21 days was the longest fast that Gandhiji kept during the independence movement.

Wangchuk states that the 21-day fast is over, but the protest will still continue. They will only rest when the government agrees to fulfill their demands.

Wangchuk said, “After me, women will begin a 10-day fast tomorrow. This will be followed by youth and Buddhist monks. Then it could be women, or I could come back. This cycle will go on.”

After ending his 21-day fast, Wangchuk stated “We will continue our struggle (in support of our demands). The gathering of 10,000 people at the venue and the participation of over 60,000 others over the past 20 days is a testimony of the people's aspirations.”

Conclusion:

All things considered, Ladakh, the "Land of High Passes," stands at a crossroads. While the echoes of their protests might fade from national headlines, the Ladakhi people's yearning for a brighter future persists. Whether they find resolution in the sixth schedule status or the full-throated roar of statehood, one thing is certain: Ladakh's story is far from over.

3 notes

·

View notes

Text

All About BTech

BTech is also known as Bachelor of Technology. This is an undergraduate course for a period of 4 years. This course provides both theoretical and practical knowledge. To get admission into the BTech course the candidates must have completed their class 12 examinations with science background with minimum required marks. To pursue BTech some of the most common entrance tests are JEE Mains and JEE Advanced. Other than these there are many other entrance tests such as MHT CET, KCET, COMEDK, UGET, etc. Some of the popular BTech jobs include software engineer, civil engineer, mechanical engineer, software developer, automobile engineer, etc. Other than these graduates will also get chances as lecturers, subject matter experts, managers, researchers, etc. Some of the top recruiters hiring BTech graduates are TCS, IBM Global Services, HCL, Accenture, Intel, Apple, Microsoft, etc.

BTech Course Highlights

BTech Course Level - Undergraduate

BTech Full Form- B Tech Full Form is Bachelor of Technology

Best Colleges for BTech Courses - Jadavpur University, IIT Bombay, Accurate Group of Institutions IIT Delhi, DTU, Jamia Millia Islamia, NIT Trichy, VIT Vellore, SRM Institute of Science and Technology, etc.

B Tech Course Duration- 4 years

B.Tech Course Examination Type- Semester-wise

BTech Course Job Scope- Chemical Engineer, Mechanical Engineer, Computer Science Engineer, Research Associate, Professor

BTech Courses Entrance Exams- JEE Main, JEE Advanced, WBJEE, KEAM, MHT CET, AP EAMCET, CUET, KCET, TS EAMCET, and VITEEE

B Tech Course Specializations- Mechanical Engineering, Civil Engineering, Computer Science Engineering, Biomedical Engineering, Marine Engineering, Electrical Engineering, Aeronautical Engineering, etc.

Average BTech Course Salary- INR 4 LPA - 8 LPA

B Tech Course Top Recruiters- Google, Apple, Hindustan Unilever Ltd, ISRO, BHEL, NTPC and many others

What is the full form of BTech?

The full form of BTech is Bachelor of Technology. This is an undergraduate degree for a period of 4 years. There are a number of BTech specialisations available for students such as Civil Engineering, Electrical Engineering, Biomedical, Aeronautical, etc.

In order to take Admission in BTech Course the aspirants are required to appear for several entrance exams such as JEE Mains and JEE Advanced to take Admission into the top IITs, NITs, etc.

The graduates of BTech get a chance to work in different sectors such as mechanical engineer, Software engineer, Electrical engineer, Software Developer, Automobile engineer, etc.

Career Options After BTech

As a BTech graduate it is very important to make the right choice. After completing BTech the four year Course many candidates go for MBA or PGDM degree. Check below the career options after Pursuing BTech:

IT & Software Job Profiles

Data Analyst - INR 6.5 LPA

Web Developer - INR 4.5 LPA

Mobile App Developer - INR 4.5 LPA

Software Engineer - INR 7.7 LPA

Data Scientist - INR 14.7 LPA

Data Engineer - INR 10.7 LPA

Automotive BTech Jobs

Automotive Engineer - INR 5.6 LPA

Production Engineer - INR 3.6 LPA

Design Engineer - INR 5.5 LPA

Aerospace BTech Jobs

Aerospace Engineer - INR 15.3 LPA

Satellite Design Engineer - INR 4.7 LPA

Aerodynamics Engineer - INR 9.8 LPA

Electrical & Electronics Job Profiles

Electrical Engineer - INR 4.6 LPA

Power Systems Engineer - INR 6.5 LPA

Electronics Design Engineer - INR 7.6 LPA

Mechanical BTech Jobs

Manufacturing Engineer - INR 6 LPA

Mechanical Design Engineer - INR 8.7 LPA

HVAC Engineer - INR 11 LPA

Civil BTech Jobs

Structural Engineer - INR 7.3 LPA

Transportation Engineer - INR 7.5 LPA

Construction Manager - INR 5.6 LPA

Top Recruiters

BTech Industries

Core Engineering (Mechanical, Civil, Electrical, etc.)

L&T

Tata Motors

Mahindra & Mahindra

Bharat Heavy Electricals Limited (BHEL)

Steel Authority of India Limited (SAIL)

Aerospace

Hindustan Aeronautics Limited (HAL)

Indian Space Research Organization (ISRO)

Mahindra Defence

Airbus

Boeing

Automotive

Tata Motors

Mahindra & Mahindra

Maruti Suzuki

Hyundai

Electrical & Electronics

Power Grid Corporation of India Limited (PGCIL)

NTPC

Siemens

Samsung

Oil & Gas

Indian Oil Corporation Limited (IOCL)

Bharat Petroleum Corporation Limited (BPCL)

Telecommunications

Bharti Airtel

Reliance Jio

Vodafone Idea

Tata Communications

IT/Software

TCS

Infosys

Wipro

Accenture

0 notes

Text

Top Destinations You Can Reach with DivyBharat Airways’ Helicopter Services

When it comes to exploring the breathtaking landscapes and vibrant cultures of India, few experiences compare to the luxury and convenience of helicopter travel. DivyBharat Airways offers exclusive helicopter services that allow you to reach some of the most stunning and sought-after destinations across the country. From pristine beaches to majestic mountains, discover the top destinations you can reach with our helicopter services, making your journey as memorable as the destination itself.

1. The Magnificent Taj Mahal, Agra

No trip to India is complete without a visit to the iconic Taj Mahal. With DivyBharat Airways’ helicopter services, you can enjoy a breathtaking aerial view of this UNESCO World Heritage Site before landing for a closer exploration.

Why Visit? The Taj Mahal is a symbol of love, renowned for its stunning architecture and beautiful gardens. Experience the grandeur of this monument from the sky, capturing its beauty in every frame.

Helicopter Ride Benefits: Skip the traffic and enjoy a seamless journey from Delhi or Jaipur, giving you more time to explore the surrounding areas, such as Agra Fort and Fatehpur Sikri.

2. The Serene Backwaters of Kerala

Kerala, known as “God’s Own Country,” offers enchanting backwaters, lush greenery, and tranquil houseboat experiences. With our helicopter services, you can easily reach popular backwater destinations like Alleppey and Kumarakom.

Why Visit? Experience the unique ecosystem of Kerala’s backwaters, dotted with quaint villages, palm-lined shores, and traditional houseboats.

Helicopter Ride Benefits: Enjoy a bird’s-eye view of the sprawling landscapes and waterways, arriving in style to begin your adventure in this tropical paradise.

3. The Scenic Peaks of Ladakh

Ladakh, with its breathtaking mountain ranges and stunning landscapes, is a must-visit destination for adventure seekers. DivyBharat Airways offers helicopter services to several key locations in Ladakh.

Why Visit? Explore the breathtaking beauty of Pangong Lake, Nubra Valley, and Khardung La, the highest motorable road in the world. Experience Ladakh’s rich culture and serene monasteries against a backdrop of snow-capped mountains.

Helicopter Ride Benefits: Access remote areas and skip long travel times, allowing you to maximize your adventure in this mesmerizing region.

4. The Royal Forts of Rajasthan

Rajasthan is renowned for its majestic forts and palaces that reflect the rich history and royal heritage of India. With our helicopter services, you can easily hop between cities like Jaipur, Jodhpur, and Udaipur.

Why Visit? Visit iconic landmarks like the Amer Fort, Mehrangarh Fort, and City Palace, each telling a story of its glorious past.

Helicopter Ride Benefits: Bypass the long drives and enjoy the breathtaking landscapes of the Thar Desert, giving you more time to explore Rajasthan’s colorful cities.

5. The Beaches of Goa

Known for its vibrant nightlife, beautiful beaches, and rich Portuguese heritage, Goa is a popular destination for both relaxation and adventure. Reach this coastal paradise quickly with our helicopter services.

Why Visit? Enjoy pristine beaches like Baga, Anjuna, and Palolem, indulge in water sports, and explore the rich culture and delicious cuisine.

Helicopter Ride Benefits: Avoid traffic and lengthy travel times, allowing for more time to soak in the sun and enjoy everything Goa has to offer.

6. The Cultural Hub of Varanasi

Experience the spiritual heart of India in Varanasi, one of the oldest inhabited cities in the world. With DivyBharat Airways’ helicopter services, reaching this sacred destination is easy and convenient.

Why Visit? Witness the mesmerizing Ganga Aarti, explore ancient temples, and take a boat ride on the Ganges River to immerse yourself in the city’s rich culture and spirituality.

Helicopter Ride Benefits: Enjoy a quick and scenic journey, allowing you to spend more time experiencing the vibrant local culture and history.

7. The Enchanting Nilgiri Hills

The Nilgiri Hills, home to stunning tea plantations and charming hill stations like Ooty and Coonoor, are perfect for a quick escape into nature. Our helicopter services make this retreat easily accessible.

Why Visit? Experience the cool climate, beautiful gardens, and panoramic views, ideal for a relaxing getaway or adventure activities.

Helicopter Ride Benefits: Reach the hills in just a fraction of the time it takes by road, providing a seamless transition from the bustling city to serene landscapes.

8. The Majestic Andaman Islands

For those seeking an exotic beach getaway, the Andaman Islands are a paradise waiting to be explored. With our helicopter services, reaching this tropical haven is just a flight away.

Why Visit? Enjoy white sandy beaches, crystal-clear waters, and vibrant coral reefs, perfect for snorkeling and diving enthusiasts.

Helicopter Ride Benefits: Bypass lengthy ferry rides and arrive quickly, ready to explore the stunning natural beauty of this island paradise.

Conclusion: Experience India from the Skies with DivyBharat Airways Helicopter Services

With DivyBharat Airways’ helicopter services, exploring India’s top destinations has never been easier or more luxurious. From the stunning landscapes of Ladakh to the vibrant beaches of Goa, our helicopter services provide the perfect blend of convenience and adventure. So why wait? Book your helicopter ride today and experience the beauty of India like never before!

Other Links

Private Jet Booking

: Chartered Flight Services

Private Jet Rental in India

Helicopter Charter Services

0 notes

Text

[ad_1] TVS Motors, Reliance Jio, Tata AIG, OYO, ONGC Videsh and HPCL have been adjudged winners of the 17th BML Munjal Awards for Business Excellence in Learning & Development. L-R: Shri. Sunil Kant Munjal, Chairman Hero Enterprise; Hon'ble Union Minister of Commerce & Industry, Shri. Piyush Goyal unveiling the Braille Book TVS Motors won in the Private Sector (manufacturing) category, Reliance Jio Infocomm and Tata AIG General Insurance won in the Private Sector (Services) category, Oravel Stays (OYO) won in the Emerging Stars category, ONGC Videsh won in the Public Sector category and Hindustan Petroleum (HPCL) won in the Sustained Excellence category. The awards ceremony took place on December 12, 2024, at The Oberoi, New Delhi and were given away by the Chief Guest, Shri Piyush Goyal, Hon'ble Minister of Commerce and Industry, and the Guest of Honour, Mr. Amitabh Kant, India’s G20 Sherpa. The BML Munjal Awards annually celebrate excellence in Learning and Development (L&D) and are a tribute to the enduring legacy of the late Dr. Brijmohan Lall Munjal, founder of the Hero Group. They recognize organizations that invest in people and reward companies that believe in continuous improvement and innovation. For the 2024 edition, hundreds of organizations across sectors went through a rigorous four-stage screening process managed by Grant Thornton Bharat. The six winners were eventually picked by an independent jury comprising of Sanjay Nayar, Founder and Chairman, Sorin Investment Fund, Gopal Srinivasan, Chairman & Managing Director, TVS Capital Funds, Rajat Dhawan, India Managing Partner & Senior Partner, McKinsey & Company, Vishesh Chandiok, CEO, Grant Thornton Bharat, Padmaja Ruparel, Co-founder, Indian Angel Network, Simrit Kaur, Principal, Shri Ram College of Commerce, Rajeev Dubey, Editor In Chief, Fortune India and Sunil Kant Munjal, Chairman, Hero Enterprise. Announcing this year’s awards, Mr. Sunil Kant Munjal, Chairman of Hero Enterprise, stated, “People are the only assets that appreciate as time goes on, and they need to be placed at the centre of every model, whether it is for a business enterprise or a social venture.” The Hon'ble Minister of Commerce and Industry also unveiled the Braille (Hindi) edition of The Making of Hero over the course of the evening. The Making of Hero is the inspiring story of four Munjal brothers who, despite limited education and resources, revolutionized the two-wheeler industry. The Braille edition - produced by Raised Lines Foundation, an imprint of HarperCollins Publishers - has been launched to address the shortage of braille content in India which makes it difficult for the blind and visually impaired to learn more about leadership, management, business practices and many other life lessons. This edition is being provided to various organizations and libraries across India free of cost so that visually impaired students and professionals can access them. Delivering his keynote address Shri Piyush Goyal remarked, "Perseverance, passion and ambition can help people and companies reach great heights. When more people with fire in their bellies begin to fulfil their aspirations, it will redefine India’s growth story in the years to come. It is equally important as well for differently abled people to realise their dreams and feel that they are contributing to the growth of the nation; for this to happen meaningfully, a change in mindset is vital, and our Prime Minister’s Divyangjan Swavalamban Yojana is a vital initiative in this direction.’’ In his address as the Guest of Honor, Mr. Amitabh Kant, India's G20 Sherpa, added: “Talent drives investment, which in turn drives growth. Without that, no company can prosper. These awards are the human symbols of India’s hard power.” The evening’s proceedings also featured an insightful discussion on the “The Business of Doing Good” that featured an esteemed panel of Mr.

Jayen Mehta, MD - Amul; Ms. Rajarshi Gupta, MD - ONGC Videsh Ltd; Ms. Mugdha Sinha, Director General of Tourism, Government of India; and Mr. Vineet Rai, Founder & Chairman of Aavishkaar Group. For more information on the BML Munjal Awards, visit www.bmlmunjalawards.com. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

Things You Should Know Before Planning a Bali Trip

Bali, the “Island of the Gods,” is a dream destination known for its stunning beaches, lush greenery, and vibrant culture. Whether you’re planning to relax on pristine shores, explore hidden gems, or immerse yourself in cultural experiences, Bali has something for everyone. Key places to visit near Bali include Seminyak, famous for its upscale beach resorts and trendy cafes; Ubud, the cultural heart of Bali; Nusa Penida, an island paradise known for its dramatic cliffs and turquoise waters; and Gili Trawangan (Gili T Island), a serene retreat where motor vehicles are replaced by bicycles and mopeds.

Smart Ways to Save on Forex Charges

Foreign exchange charges can add up quickly, but you can save significantly by using debit and credit cards from Niyo Global, which offer zero forex charges. With Niyo Global cards, you can enjoy hassle-free transactions while avoiding hidden fees, making it an ideal choice for international travelers.

Choosing the Right Flights

Selecting a convenient flight is crucial for a stress-free trip. Avoid long layovers, especially on flights from Delhi, as they can waste valuable time. Opt for direct or short-layover flights to maximize your vacation.

Best Time to Visit Bali

The ideal time to visit Bali is during the dry season, which runs from March to October. The weather during these months is perfect for exploring beaches, indulging in water sports, and enjoying outdoor adventures.

Essential Apps for Convenience

Download apps like Grab and Gojek for taxi rides and food delivery in Bali. These apps are not only user-friendly but also affordable, making it easier to navigate and enjoy the island.

Affordable Connectivity

Staying connected in Bali is easy, Try to get a local SIM card from shops upon arrival. Telkomsel is the most reliable network provider on the island, ensuring you stay connected wherever you go.

Visa and E-Visa Options

Visa on arrival in Bali starts from ₹2,700, but to save time, consider applying for an e-visa before your trip. It’s a convenient way to avoid long queues and kick-start your Bali adventure without delays.

Exploring Bali on a Budget

Renting a moped for ₹400-800 per day is the cheapest and most efficient way to explore Bali. Mopeds offer the freedom to navigate the island at your own pace and discover hidden spots off the beaten path.

Thrilling Adventures in Bali

Adventure enthusiasts should not miss snorkeling or scuba diving in Bali. The crystal-clear waters and vibrant marine life are reminiscent of scenes from “Zindagi Na Milegi Dobara“. Whether you’re exploring coral reefs or swimming with tropical fish, these activities promise unforgettable memories.

How to travel Between Islands in Bali?

Take a ferry to visit Nusa Penida or Gili T Island. Nusa Penida has breathtaking views, while Gili T Island is unique because motor vehicles are not allowed. You can explore Gili T Island by renting a bicycle or a moped, which is a fun way to enjoy the place.

Learn About Balinese Culture

Things to Avoid in Bali

While Bali is welcoming, there are a few things to avoid:

Disrespecting Temples: Always wear a sarong and dress modestly when visiting temples.

Touching Heads: In Balinese culture, the head is sacred. Avoid touching anyone’s head, even children.

Littering: Bali is known for its natural beauty, so don’t litter. Always throw trash in the bin.

Drinking Tap Water: Tap water in Bali is not safe to drink. Always use bottled water for drinking and brushing your teeth.

Breaking Traffic Rules: Bali’s roads can be chaotic. If you’re riding a moped, wear a helmet and follow traffic rules.

Why Choose Kins Voyage for Your Bali Tour

Expertly Curated Itineraries

Kins Voyage designs itineraries that ensure you see the best of Bali without missing hidden gems. From exploring the cultural hub of Ubud and enjoying the trendy vibes of Seminyak to relaxing on Nusa Penida’s pristine beaches and discovering the charm of Gili T Island, every part of your journey is thoughtfully planned.

Community-Based Travel Experience

One of the most unique aspects of traveling with Kins Voyage is the sense of community it fosters. You’ll embark on this adventure with a group of like-minded travelers. Strangers quickly turn into friends, creating a fun and supportive environment. By the end of the trip, you’ll have not just travel companions but lifelong memories shared with new friends.

Hassle-Free Travel Planning

Forget the stress of figuring out visas, flights, or local transportation. Kins Voyage handles all the details for you, including visa assistance (e-visa or visa on arrival), selecting convenient flights, arranging comfortable accommodations, and planning daily activities. All you need to do is pack your bags and enjoy the trip!

Budget-Friendly and Transparent Pricing

With Kins Voyage, you get the best value for your money. They focus on providing affordable options without compromising on quality. Whether it’s renting mopeds, taking ferries to nearby islands, or trying out local cuisines, they ensure that every expense is planned wisely. There are no hidden charges, so you can relax knowing your budget is under control.

Conclusion

Bali is more than just a destination—it’s a magical experience filled with natural beauty, vibrant culture, and endless adventures. Whether you’re strolling through the streets of Seminyak, exploring the lush greenery of Ubud, diving into the crystal-clear waters of Nusa Penida, or enjoying the peaceful vibes of Gili T Island, We have Also Curated a Bali with Gili T Island Tour package something for everyone.

By keeping in mind the tips shared in this blog—like using apps for convenience, renting mopeds for easy travel, and respecting local customs—you can make the most of your trip. For those looking for a seamless and memorable Bali experience, Kins Voyage offers expertly crafted Bali tour packages from Mumbai.

With Kins Voyage, you’ll enjoy a stress-free vacation, meet amazing travel companions, and create memories that will last a lifetime. So, pack your bags and get ready to explore the Island of the Gods with Kins Voyage—your gateway to the perfect Bali adventure!

0 notes

Text

Servo Motor and PLC-Based Oil Filling Machine

Company Overview: Shiv Shakti Machtech is Manufacturer, Exporter and Supplier of Servo Motor and PLC-Based Oil Filling Machine in Ahmedabad, Gujarat, India. Our Manufacturer Unit is in Ahmedabad, Gujarat, India. This machine handles a wide range of cooking oils, including olive oil, sunflower oil, coconut oil, palm oil, canola oil, soybean oil, peanut oil, and more. A servo motor and PLC-based oil filling machine is an advanced filling system that uses servo motors for precise movement control and PLCs for automated process management. Industries primarily use these machines where accurate filling of liquids, such as oils, syrups, and other viscous substances, is crucial. The combination of a servo motor and a PLC enables the machine to operate with high precision, reducing the risk of overfilling or underfilling and ensuring a consistent product. Other Name of the Machine: Automatic Servo Oil Filling Machine for Edible and Mustard Oils, PLC-Controlled Oil Filling System for Vegetable and Lubricant Oils, Servo Driven Oil Filling Machine for Edible & Industrial Oils, Mustard Oil Filling Machine with PLC & Servo Motor, Fully Automated Oil Filling Machine for Cooking and Lubricant Oils, Precision Oil Filling Machine for Mustard, Edible & Lubricant Oils, Servo & PLC Based Oil Filler for Bottling Mustard and Vegetable Oils, High-Speed Servo Oil Filling Machine for Edible and Lubricant Oils, PLC & Servo Controlled Oil Packaging System for Mustard & Edible Oils, Automatic Servo Oil Filler for Mustard and Industrial Lubricants How Does a Servo Motor and PLC-Based Oil Filling Machine Work? Servo Motor Control: The servo motor precisely adjusts the filling nozzle's movement, regulating the oil flow based on the required volume for each container. PLC Automation: The PLC manages and coordinates the entire filling process, from container positioning to oil dispensing, ensuring efficiency and minimal errors. Volume Measurement: Accurate sensors measure the oil volume in each container, and the PLC adjusts the servo motor’s speed for precise filling. Error Detection and Correction: The PLC detects any deviations or malfunctions and makes real-time adjustments to maintain accuracy and prevent errors. What is the role of a servo motor in an oil filling machine? The servo motor in an oil filling machine is responsible for precise control of the filling process. It adjusts the movement of the filling nozzle, ensuring the correct volume of oil is dispensed into each container. How does PLC control the oil filling process? The PLC controls the entire process by automating each step. It manages the filling cycle, monitors sensor data, adjusts parameters, and ensures the system operates smoothly. It also performs error detection and correction in real time. Shiv Shakti Machtech is a Manufacturer and Supplier of Servo Motor and PLC-Based Oil Filling Machine in Ahmedabad, Gujarat, India Including Kathwada, Vadodara, Changodar, Gota, Naroda, Nikol, Mehsana, Palanpur, Deesa, Patan, Vapi, Surendranagar, Bhavnagar, Jamnagar, Junagadh, Rajkot, Amreli, Mahuva, Surat, Navsari, Valsad, Silvassa, Porbandar, Mumbai, Vasai, Andheri, Dadar, Maharashtra, Aurangabad, Kolhapur, Pune, Rajasthan, Jaipur, Udaipur, Kota, Bharatpur, Ankleshwar, Bharuch, Ajmer, Delhi, Noida, Baddi, Solan, Himachal Pradesh, Una, Jammu Kashmir, Haryana, Hisar, Gurgaon, Gurugram, Madhya Pradesh, Indore, Bhopal, Ratlam, Jabalpur, Satna, New Delhi, Kolkata, West Bengal, Assam, Asansol, Siliguri, Durgapur, Bhubaneswar, Odisha, Brahmapur, Puri, Goa, Amaravati, Andhra Pradesh, Visakhapatna, Hyderabad, Guntur, Chittoor, Kurnool, Vizianagaram, Srikakulam, Karimnagar, Ramagundam, Suryapet, Telangana, Medak, Bengaluru, Bangalore, Mangaluru, Hubballi, Vijayapura, Davanagere, Kalaburagi, Chitradurga, Ballari, Kolar, Chennai, Coimbatore, Madurai, Tiruchirapalli, Tiruppur, Salem, Erode, Tirunelveli, Tamil Nadu, Kerala, Kochi, Thiruvananthapuram, Kozhikode, Thrissur, Kollam, Alappuzha, Kottayam, Kannur, Malappuram, Bharatpur, Jodhpur, Bikaner, Alwar, Bhilwara, Nagpur, Amravati, Solapur, Malegaon, Navi Mumbai, Thane, Wardha, Vasai-Virar, Gondia, Hinganghat, Barshi, Ulhasnagar, Nandurbar, Bhusawal, Pimpri-Chinchwad, Kalyan, Satara, Yamuna Nagar, Chhachhrauli. For more information or to request a quote, please reach out to us. Read the full article

#Ahmedabad#Ajmer#Alappuzha#Alwar#Amaravati#Amravati#Amreli#Andheri#AndhraPradesh#Ankleshwar#Asansol#Assam#Aurangabad#Baddi#Ballari#Bangalore#Barshi#Bengaluru#Bharatpur#Bharuch#Bhavnagar#Bhilwara#Bhopal#Bhubaneswar#Bhusawal#Bikaner#Brahmapur#Changodar#Chennai#Chitradurga

1 note

·

View note

Text

Comprehensive RO Service in East of Kailash with KTECH Water Zone (RO Service Centre in South Delhi)

Introduction

Water in its molecular structure is part of life and clean water is crucial to an individual’s overall health. Especially in densely populated areas such as East of Kailash, many times, the water supply is contaminated; therefore, access to a good Reverse Osmosis (RO) system is a must-have. Nonetheless, they, like any other appliance needs to be serviced and maintained frequently to fully operate optimally. That is where KTECH Water Zone (RO service in East of Kailash), comes into the picture to offer you best in class service from RO with customized service offer as per your requirement.

In this blog, you will learn everything you wanted to know about the RO systems, how to maintain it, the problems it may face and the reasons why KTECH Water Zone is the best option otherwise resident of East of Kailash can opt for.

Importance of RO Water Purifiers

An RO water purifier employs filters to filter out the sediments, chemicals and microorganisms allowing you to take clean water into your system. As the water sources get more and more polluted, an RO system is the most basic necessity in any health conscious home.

Benefits of Using an RO Water Purifier

Removes Contaminants: Reduces chlorine, lead, and arsenic, and other dangerous pollutants…

Improves Taste: It also removes unpleasant smell and taste resulting from impurities obtained in any water source.

Health Benefits: Helps avoid cases of waterborne illnesses.

Cost-Effective: Cost cutting since there will be a decreased dependence on bottled water.

Why Regular Servicing of RO Systems Is Essential

As mentioned earlier, RO purifiers are meant to produce safe water and they require servicing for them to work best. Now and then, the filter and membranes can become contaminated with the pollutants and thus work ineffectively.

Why Should You Service Your RO Purifier?

Maintains Water Quality: Cleanses the system and makes prevention against the accumulation of impurities possible.

Extends Lifespan: Enhances the lifespan of an RO system.

Saves Energy: Enhances the systems performance by using less energy.

Prevents Breakdown: Neutralizes expectancies and prevents incidents from growing large and complicated.

Common RO Problems and Their Solutions

The best RO systems can also experience problems on the off chance that they are not taken good care of. Below are some common problems and how KTECH Water Zone can help resolve them:

Low Water Flow

A filter or membrane that is laden with sediments is most times the main cause of slow water flow. At KTECH Water Zone, our technicians will replace the affected parts, which will have your RO up and running again in no time.

Foul Taste or Odor

This is particular so when filters are not replaced in time. To remove any odors we replace filters on time and exercise regular cleaning of the system.

Leakage Issues

T Harms of leakage include poor fittings or broken parts. If our team receives a complaint, members are sent to carry out an inspection and rectify the problem.

Unusual Noises

That is why a problem in the motor or pump can lead to peculiar noises. Jagged parts are fixed or replaced depending with the procedure taken to get the machine going again.

Why Choose KTECH Water Zone for RO Service in East of Kailash?

As there are so many units currently serving at South Delhi we took our time and identified that KTECH Water Zone is the best of all since they are professional in what they do and they ensure that their clients are fully satisfied.

What Sets Us Apart?

Expert Technicians: Our team of service technicians has been trained entrenched in RO maintenance and repair services for years now.

Quick Response: Our company is delivering fast services to reduce time wastage and unnecessary delays.

Affordable Pricing: A bid that is fairest with as many hidden charges excluded as possible.

Comprehensive Solutions: We’ve got it all – filter replacements, and even complete system changes.

Genuine Spare Parts: All materials implemented are genuine which will guarantee optimal performance for a longer period.

Services Offered by KTECH Water Zone

At KTECH Water Zone, we provide a wide range of services to cater to the diverse needs of our customers:

RO Installation

A clear guidance on the procedures of installation is however noted to be very essential so as to enable for effectiveness of the whole system. This way, water pressure and TDS levels, as well as any other, are taken into account by our specialists while installing your RO system.

RO Maintenance

Purifier maintenance has been widely regarded as a critical factor that determines useful product’s lifespan. We have also presented some schedule maintenance services for convenience.

RO Repair

Our technicians can address all sorts of problems, be it the smallest problem, or a large scale repair job.

Last but not the least, filter and membrane are two of the major components of a water treatment are likely to be replaced.

We change old filters and membranes, providing high quality filters to ensure water quality is maintained.

These include the Annual Maintenance Contracts (AMC).

Our AMC plans offer scheduled services and necessary repairs, and even include emergency services into the package.

How to Book an RO Service with KTECH Water Zone

Getting a service from this KTECH Water Zone is well organized and they can be booked easily. Follow these steps:

Call Us: If you want to enquire about our products or any other information feel free to contact our customer service.

Describe the Issue: Always give specifics to the issue that you encounter.

Schedule a Visit: Choose your time slot which is convenient for you.

Enjoy Hassle-Free Service: Technicians will be present at the mentioned time and should be able to quickly fix the problem.

Testimonials from Satisfied Customers

Here’s what some of our happy customers have to say about KTECH Water Zone:

This is testimony that KTECH Water Zone has been my service provider for several years. These services and products are protected by the professionalism and expertise of their providers” – Rohan M., East of Kailash

Their services are very fast, my RO purifier is now functioning as a brand-new one after they had repaired it. Highly recommend them!” – Priya K., South Delhi

Conclusion

There should be no compromise when it comes to quality of water you and your family consume to enhance their health. Together with our dedicated servicing and the help of our team from KTECH Water Zone, RO service in East of Kailash, choosing and consuming healthy water is possible every day.

For installation, maintenance or repairs, you can rely on our team, located in East of Kailash. To keep your RO purifier in good working order and to protect your health always consult KTECH Water Zone.

Get the best RO service in East of Kailash today by reaching out to us today!

#ROrepair#ROrepairDelhi#LocalROservice#ROrepairservice#DelhiROtechnician#ROservice#WaterPurifierRepair#ROsystem#DelhiPlumbers#HomeAppliancesRepair#ROspecialist#WaterPurification#DelhiServices#ROtechnician#LocalService#CleanWater#PureWater#DelhiCommunity#CustomerService#WaterSafety

0 notes

Text

Mercedes A Class Price in Delhi: Everything You Need to Know About This Luxury Hatchback

The Mercedes A Class price in Delhi places this luxury hatchback within reach for those seeking style, performance, and cutting-edge technology. Known for its sleek design, advanced technology, and exceptional comfort, the A-Class brings a premium driving experience to city streets, making it a perfect choice for both urban explorers and luxury car enthusiasts. This blog delves into the pricing, features, and benefits of owning a Mercedes A-Class in Delhi, helping you decide if this compact luxury model is the right fit for you.

Mercedes A-Class: Luxury in a Compact Form

The Mercedes A-Class combines the sophistication Mercedes-Benz is known for with the practicality and agility needed for urban driving. It offers a refined and luxurious interior, advanced safety features, and dynamic performance, making it an ideal option for Delhi’s bustling streets. Plus, with multiple trims and packages available, buyers have the flexibility to choose the model that best suits their preferences.

Understanding the Mercedes A-Class Price in Delhi

The pricing for the Mercedes A-Class in Delhi can vary based on factors such as the model variant, additional features, and any available customization. Currently, the starting price for the A-Class in Delhi is approximately INR 40 lakhs. Higher variants with additional luxury and tech features can increase the cost to around INR 45 lakhs or more. Prices may also differ slightly between dealerships, and buyers can benefit from seasonal promotions or financing options available through authorized dealerships like T&T Motors in Delhi.

What Affects the Price of the Mercedes A-Class?

Model Variant and Trim Levels The Mercedes A-Class comes in various trims, each offering unique features. The standard model offers exceptional quality, but for those seeking additional luxury, performance upgrades, or advanced tech, higher trims can be a better choice, although they come at a premium price.

Additional Features and Packages Mercedes offers a range of optional packages that allow buyers to customize their vehicle to their exact preferences. From leather upholstery and panoramic sunroofs to advanced safety tech, these add-ons contribute to the final price.

Dealer Offers and Financing Dealers often have promotions or financing options that make it easier to manage the cost. Exploring these options at dealerships like T&T Motors can offer flexible payment plans or discounts that make purchasing an A-Class more affordable.

Features That Make the Mercedes A-Class Stand Out

Sophisticated Design The A-Class is designed with a youthful and sporty flair, featuring a sleek front grille, LED headlights, and aerodynamic lines. The interior boasts high-quality materials, an intuitive layout, and ample space for a compact vehicle, making every drive feel like a premium experience.

Advanced Technology Mercedes-Benz is known for integrating the latest technology, and the A-Class is no exception. Equipped with the MBUX (Mercedes-Benz User Experience) infotainment system, the A-Class offers voice control, a high-resolution touch display, and augmented reality navigation that helps make city driving easier and more enjoyable.

Performance and Efficiency Powered by a range of efficient and powerful engine options, the A-Class balances performance with fuel efficiency—ideal for the stop-and-go traffic of Delhi. The responsive handling and smooth ride add to the enjoyment of driving this luxury compact.

Safety Features Safety is paramount in the A-Class, which comes equipped with multiple airbags, ABS, electronic stability control, and driver assistance features such as lane-keeping assist and emergency braking. These features provide peace of mind, making it one of the safest luxury hatchbacks on the market.

Benefits of Owning a Mercedes A-Class in Delhi

Perfect for City Driving The compact size of the Mercedes A-Class makes it well-suited for navigating Delhi’s traffic and finding parking in crowded areas. Despite its size, it doesn’t compromise on luxury or comfort, offering a premium experience with the practicality of a smaller vehicle.

Fuel Efficiency Given the rising fuel prices, the A-Class’s efficient engine is ideal for city driving. It provides impressive mileage for a luxury vehicle, allowing you to enjoy both style and savings.

Resale Value Mercedes-Benz vehicles are known to hold their value well in the Indian market. With regular maintenance and care, the A-Class can retain a high resale value, offering long-term value to owners.

Status and Style Driving a Mercedes is a symbol of success and sophistication. The A-Class allows you to experience the prestige of the brand in a model that’s accessible, stylish, and well-suited for daily commuting in a busy city.

Conclusion: Is the Mercedes A-Class Right for You?

With a competitive starting price, a rich array of features, and the prestige of the Mercedes-Benz brand, the Mercedes A Class price in Delhi represents excellent value for those seeking a luxury vehicle that’s practical for urban living. Its advanced technology, sophisticated design, and efficient performance make it a standout choice in the luxury compact segment. Whether you’re a professional looking to make a statement or simply someone who appreciates high-quality design and engineering, the A-Class is a versatile and elegant option that meets a variety of needs. Visit T&T Motors to learn more about pricing, customization options, and financing plans available to make the A-Class yours today.

0 notes

Text

Unveiling the Starting Price of a Mercedes C-Class in Delhi

Dreaming of cruising through Delhi's streets in a sleek and sophisticated Mercedes C-Class? You're not alone! This popular luxury sedan is known for its powerful performance, luxurious interior, and cutting-edge technology. But before you hit the showroom floor, a crucial question arises: what's the starting price tag for this beauty in Delhi?

The answer? The starting price for a Mercedes C-Class in Delhi sits around ₹ 61.85 Lakh (ex-showroom). This means it's the base price before taxes, registration fees, and insurance are added. These additional costs can vary depending on factors like your chosen variant and the specific dealership.

Understanding the Price Variations:

Here's a breakdown of some key factors that can influence the final price of your Mercedes C-Class in Delhi:

Trims and Variants: The C-Class comes in various trims, each offering distinct features and functionalities. Higher trims, like the AMG Line, naturally carry a higher price point due to their added bells and whistles.

Optional Features: Imagine customizing your C-Class with a panoramic sunroof, a premium sound system, or advanced driver-assistance features. Each of these exciting options adds to the overall price.

Dealership Location: While the starting price remains consistent, dealerships might offer slight variations based on their location and current promotions.

Beyond the Starting Price:

Now, let's explore some reasons why the Mercedes C-Class might be worth the investment:

Luxury Redefined: The C-Class delivers a driving experience that's both luxurious and exhilarating. From the high-quality materials in the cabin to the advanced technology enhancing your comfort and safety, every detail exudes luxury.

Lasting Value: Mercedes-Benz cars are renowned for holding their resale value remarkably well. This means your C-Class will likely retain a significant portion of its value when you decide to upgrade.

Financing Options: Don't let the initial price tag deter you. T&T Motors offers a variety of financing options to make owning a Mercedes C-Class a more accessible dream.

Ready to Experience the C-Class?

The Mercedes C-Class is a symbol of automotive excellence, offering a blend of performance, luxury, and innovation. Now that you have a clearer picture of the starting price in Delhi, it's time to explore further! We invite you to visit the T&T Motors website (link: https://www.tandtmotors.mercedes-benz.co.in/passengercars/startpage.html) to browse through our C-Class inventory and discover the perfect variant for your needs. Feel free to contact our friendly team at [phone number] or visit our showroom for a personalized consultation and a chance to experience the C-Class firsthand. Let us turn your dream of owning a Mercedes-Benz into a reality!

1 note

·

View note

Text

Top 15 Gear Shift Cable Manufacturers in Delhi

Chttarpati Auto Store

Located in the capital city of India, Delhi, Chttarpati Auto Store caters to the worldwide market with its qualitative array of Cables. Backed by a team of highly experienced professionals, our quality centric organization emphasizes on the utilization of premium grade raw materials while manufacturing our range of Accelerator Cables, Clutch Cables, Parking Cables, Gear Shifter Cables

Phone no - +91- 9212745230

Address - i-183, Sector-4, Bawana Industrial Area, Delhi, India

Website link - https://chttarpaticables.com/

R S Yadav Auto Industries

Established In 2009, R S Yadav Auto Industries Has Made a Well-Recognized Name As a Manufacturer, Wholesaler and Trader of Brake Cable, Accelerator Cable and

Phone no 08047547273

Address A-592, A Block Gurudwara, Shastri Nagar, North West Delhi, Daya Basti, New Delhi-110052, Delhi, India

Website link - https://www.indiamart.com/rsyadavautoindustries/

Jagdamba Auto Industries

Established as a Sole Proprietorship firm in the year 2005, we “Jagdamba Auto Industries” are a leading Manufacturer of a wide range of Teflon Pipe, Coolant Pipe, Injector Pipe, Hose Pipe, etc. Situated in Delhi (India), we have constructed a wide and well functional infrastructural unit that plays an important role in the growth of our company.

Phone no - 08046039347

Address - 803, Chota Bazar, Kashmere Gate, Mori Gate, New Delhi - 110006, Delhi, India

Website link - https://www.jaydeecables.in/

Singla Motor Parts

Incepted in the yearingla Motor Parts gives you a wide range of heavy vehicles parts at best price, serves all over in India.

We, Singla Motor Parts, are a Wholesaler of Heavy Duty Truck Spare Parts with over 15 years of expertise located in Kashmiri Gate, Delhi, India. We at Singla Motor Parts deal in long-lasting and robust auto components with distinctive designs for the aftermarket, suited for brands such as Bharat Benz, Tata, Leyland, Mahindra, and Eicher.

Phone no - 07942554150

Address Ground Floor, Shop No-1 G-79, KH No. 86/9, 10, 11, 12 Vijay Vihar, Phase-1, Rohini Delhi, New Delhi-110085, Delhi, India

Website link - https://www.indiamart.com/singla-motorparts/

SILCO CABLES

SILCO CABLES, an ISO 9001:2015 certified company, with over 15 years Experience in Manufacturing of Automotive Control Cables in India. SILCO – Control Cables is a renowned name in the Auto Parts After Market. We believe safety and design is the heart of any machine. Silco is an industry of Automotive Control Cables, where we go beyond our limits to make your life risk free.

Phone no - +91 8009006604

Address - C-8, S.M.A. Industrial Estate, G.T. Karnal Road Delhi, India – 110033

Website link - https://silcoautomotive.in/

VOLTO INDUSTRIES

VOLTO INDUSTRIES offeres to you a wide variety of Accelerator Cable, Bonnet Cable, Clutch Cable, D Compressor Cable, Stop Cable, Handbrake Cable, Diesel Pipe, Brake Pipe and Brake Hose etc.

Phone no 07942676103

Address – Kh No 136/8/2 Main Market,Gali No 18, Sant Nagar Village Burari North, New Delhi-110084, Delhi, India

Website link - https://www.indiamart.com/voltoindustries-new-delhi/

MILEX CABLES

MILEX CABLES has been engaged in manufacturing control cable for since 1973. We always aim at international markets and we invest heavily into R&D in order to make superior products that feature the latest market trends. We provide a wide choice of control cable products for two, three and four wheelers including brake cable, clutch cable, accelerator cable, speedometer cable and choke cable.

Phone no - +91-9313735757

Address - T-2343 Faiz Road,Karol Bagh, New Delhi - 110005(India)

Website link - https://milexcable.com/index-2.html

P. S. Industries

Since our establishment in the year 2017, we, P. S. Industries, are counted among the enviable organizations, engaged in manufacturing. The range encompasses Cable Component , Automotive Cable, Accelerator Cable, Gear Cable and much more. High strength, fine finish, lightweight and easy installation are some of the features of our offered range of products.

Phone no - 08048956085

Address - 17/31-N, Gali Number 4,Anand Parbat, New Delhi - 110005, Delhi, India

Website link - https://www.mapexwires.com/profile.html

ARG Global Pvt. Ltd.

Incorporated in the year 2013, at New Delhi (Delhi, India), we “ARG Global Pvt. Ltd.” are recognized as the leading manufacturer, trader and exporter of an excellent quality Auto Control Cable, Auto Rubber Parts, Clutch & Brake Parts, Engine Parts, etc. These products are manufactured by our experienced professionals using basic material like stainless steel, aluminum, etc. that is procured from the authentic vendors of the market and are chosen by our expert agents.

Phone no – 08048970303

Address No. 1897-98/45, Naiwala, Karol Bagh, New Delhi-110005, Delhi, India

Website link https://www.indiamart.com/argglobal/

R S Yadav Auto Industries

Established In 2009, R S Yadav Auto Industries Has Made a Well-Recognized Name As a Manufacturer, Wholesaler and Trader of Brake Cable, Accelerator Cable and More.

Phone no - 08047547273

Address - A-592, A Block Gurudwara, Shastri Nagar, North West Delhi, Daya Basti, New Delhi-110052, Delhi, India

Website link - https://www.indiamart.com/rsyadavautoindustries/

S.A. Motors

Established As A Proprietor Firm In The Year 2017, We “ S.A. Motors ” Are A Leading Wholesaler And Trader Of A Wide Range Of Car Accessories Etc.

Phone no 08043828681

Address – 1st Floor, 1154, Bada Bazar Near Makhan Lal Halwai Shop, Kashmere Gate, North Delhi, New Delhi-110006, Delhi, India

Website link https://www.indiamart.com/samotors-delhi/

Anant Sales Corporation

Established in the Year 1992, We Anant Sales Corporation of the Leading Manufacturer of Baxy Loading Three Wheeler, Baxy Three Wheeler Piaggio APE Extra Three Wheeler etc.

Phone no - 07949090582

Address - Basement, RZ-84, Dabri Extension, South West, New Delhi-110045, Delhi, India

Website link - https://www.indiamart.com/anant-salescorporation/

Ghai Cables India

Established in the year 1985, "Ghai Cables India" is the leading Manufacturer, Wholesaler and Trader of Gear Cable, Clutch Cable, Brake Cable and many more.

Phone no 07942704949

Address – 1862/47, Naiwala, Karol Bagh, Central Delhi, New Delhi-110005, Delhi, India

Website link - https://www.indiamart.com/ghaicables-india/

Rajesh Auto Enterprises

Established in year 1993, “Rajesh Auto Enterprises” is Manufacturer And Trader of Clutch Wire etc.

Phone no - 07942716866

Address - Ground Floor 328 Punja Sharif Kashmere Gate, New Delhi-110006, Delhi, India

Website link - https://www.indiamart.com/rajeshauto-enterprises/

MG CABLES (INDIA)

About us - Since inception in 1994, We as MG CABLES (INDIA) has became among the leading player in the manufacturing of Products in 2 Wheelers , 3 Wheelers & 4 Wheelers Segment with a vision of 'Achieving excellence in the field of manufacturing Automotive Control Cables & Wires.

Phone no - +91-8130307570

Address - No. 24/1479, Naiwala, Karol Bagh, Delhi-110005

Website link - https://mgcablesindia.com/home.html

New Era Control Cable Industries

New Era Control Cable Industries is one of the pioneer manufacturers of Transmission Control Cables for Automotive Industry in India since 2001.

Phone no - 011-27781820,

Address - F-1748, DSIIDC Narela Industrial Area, Delhi-110040

Website link - https://neweracables.com/index.html

0 notes

Text

Emergency Mercedes Car Repair Services in Delhi: What You Need to Know

Owning a Mercedes is a symbol of luxury, performance, and engineering excellence. However, even the finest vehicles are not immune to unexpected breakdowns and issues. In a bustling city like Delhi, the need for reliable emergency repair services for your Mercedes becomes crucial. This article provides essential information on emergency Mercedes car repair services, roadside assistance options, and 24/7 service centers in Delhi.

Understanding the Importance of Emergency Repair Services

Emergencies can strike at any time, leaving you stranded on the road and causing significant inconvenience. Whether it's a sudden engine failure, a flat tire, or an electrical malfunction, having access to prompt and professional repair services can save you time, money, and stress. Knowing where to turn for help ensures that your luxurious Mercedes is back on the road swiftly and safely.

Roadside Assistance Options

Mercedes-Benz Roadside Assistance

Mercedes-Benz offers a comprehensive roadside assistance program for its customers. This service is designed to provide immediate support in case of vehicle breakdowns or emergencies. Key features include:

- 24/7 Availability: Assistance is available round-the-clock, ensuring help is just a phone call away, no matter the time of day.You can reach them at their toll-free number 1800-102-2333.

- Towing Services: If your vehicle cannot be repaired on-site, it will be towed to the nearest authorized service center.

- On-Site Repairs: For minor issues like battery jump-starts, flat tire changes, and fuel delivery, technicians can perform repairs on the spot.

- Lockout Service: If you accidentally lock yourself out of your car, assistance is available to help you regain access.

Third-Party Roadside Assistance

Apart from the official Mercedes-Benz roadside assistance, several third-party companies in Delhi offer similar services. These companies provide membership-based or pay-per-use roadside assistance, including:

- 24/7 Emergency Support: Available at all times to assist with various vehicle issues.

- Wide Coverage: These services often cover a broader range of areas, ensuring you are not left stranded in remote locations.

- Multi-Vehicle Plans: Some providers offer plans that cover multiple vehicles, making it a cost-effective option for families.

24/7 Service Centers in Delhi

When emergencies occur, having access to 24/7 service centers ensures that your Mercedes receives timely repairs, minimizing downtime. Here are some recommended 24/7 service centers in Delhi:

GoMechanic

GoMechanic is a leading car service platform that offers 24/7 emergency Mercedes car repair in Delhi with extended operating hours (8:00 AM to 10:00 PM). Known for their convenience and quality service, GoMechanic provides a wide range of repair and maintenance solutions for Mercedes vehicles.

- Services: Engine diagnostics, electrical repairs, mechanical repairs, and more.

- Contact: Visit their website or use their app to book services.

- Locations: Multiple locations across Delhi, ensuring quick and easy access.

T&T Motors

T&T Motors is an authorized Mercedes-Benz service center known for its exceptional service quality. With multiple locations across Delhi, they offer 24/7 emergency repair services, ensuring your vehicle is in expert hands.

- Services: Engine diagnostics, electrical repairs, mechanical repairs, and more.

- Contact: +91-11-49575700

- Locations: Multiple locations in Delhi.

Silver Arrow Mercedes-Benz Service Center

Silver Arrow is another renowned authorized service center offering round-the-clock emergency repair services. Their team of certified technicians ensures that your Mercedes receives the best care possible.

- Services: Comprehensive repair services, including engine, transmission, and electrical system repairs.

- Contact: +91-11-43114777

- Location: Naraina Industrial Area, New Delhi.

Global Star Auto Solutions

Global Star Auto Solutions provides 24/7 emergency repair services, specializing in luxury car repairs. Their skilled technicians and advanced equipment ensure quick and reliable service.

- Services:On-site repairs, towing, diagnostics, and more.

- Contact: +91-9811127550

- Location: Okhla Industrial Area, New Delhi.

Conclusion

Emergencies can be stressful, but being prepared can make all the difference. Knowing the available emergency Mercedes car repair services, roadside assistance options, and 24/7 service centers in Delhi ensures that you can handle any situation with confidence. With platforms like GoMechanic providing convenient and reliable services, you can rest assured that help is always nearby to get your Mercedes back on the road swiftly and safely.

0 notes

Text

Stay updated with the latest happenings in the financial world with these 50 multiple-choice questions. Based on significant events and updates reported on May 19, 2024, this comprehensive quiz is perfect for those preparing for competitive exams or anyone keen on current affairs. Current Affairs Questions and Answers for Business category [ad_1] 50 Current Affairs Questions and Answers for Business category as on May 19, 2024 [ad_2] Q1: Which company announced a ₹7.30 final dividend per share for the fiscal year ending March 31, 2024? a) JSW Steel b) Godrej Industries c) NHPC d) Zydus Lifesciences Q2: What was JSW Steel's net profit for the fourth quarter ending March 31, 2024? a) ₹1,322 crore b) ₹2,000 crore c) ₹3,500 crore d) ₹5,000 crore Q3: Which company has already released their earnings for the quarter ended March 31, 2024? a) Bajaj Finserv b) Phoenix Mills c) Bandhan Bank d) HUL Q4: Which companies' performance were market participants keen on for Q4 2024? a) NHPC b) Amber Enterprises India c) Tech Mahindra d) HCL Technologies Q5: What was JSW Steel’s EBITDA margin for Q4 2024? a) 13.2% b) 10% c) 16.91% d) 22.9% [ad_1] [ad_2] Q6: What did the Division Bench of the Delhi High Court decide in the SpiceJet vs. Kalanithi Maran case? a) Set aside the refund order b) Upheld the refund order c) Directed additional compensation d) Ordered a retrial Q7: Who were the Justices on the Division Bench in the SpiceJet case? a) Yashwant Varma and Ravinder Dudeja b) Deepak Gupta and Anil Kumar c) Sanjay Kishan Kaul and R. Banumathi d) Rohinton Nariman and D.Y. Chandrachud Q8: What was Elon Musk's rebranding change for Twitter posts? a) Tweets to reposts b) Retweets to posts c) Posts to tweets d) Rebrands to hashtags Q9: Which letter has Elon Musk incorporated into the branding of his companies since 1999? a) X b) Y c) Z d) W Q10: What companies are set to announce their Q4 results this week? a) Jyoti CNC Automation, Trident, Data Patterns, Ujjivan Small Finance Bank b) Infosys, TCS, HDFC Bank, Maruti Suzuki c) Reliance, Wipro, Cipla, Lupin d) Tata Motors, ICICI Bank, SBI, Bajaj Auto Q11: What is JSW Steel's revenue from operations in Q4 2024? a) ₹46,269 crore b) ₹30,000 crore c) ₹40,000 crore d) ₹50,000 crore [ad_1] [ad_2] Q12: Which company's Q4 results included an increase in revenue and net profit? a) Zydus Lifesciences b) NHPC c) Godrej Industries d) ZEE Q13: What financial insight was provided by Anand Rathi on NCL Industries? a) Impact of cement prices and demand b) Decline in market share c) Merger with another company d) Launch of a new product line Q14: What did Prabhudas Lilladher recommend for GSK Pharma post Q4 results? a) Buy rating b) Sell rating c) Hold rating d) Underperform rating Q15: What term did Elon Musk change "retweets" to on X (formerly Twitter)? a) Reposts b) Redos c) Retweets d) Reposts Q16: What logo replaced Twitter's blue bird after rebranding? a) White X on a black background b) Red T on a white background c) Blue X on a white background d) Green bird on a blue background Q17: What was the percentage decline in JSW Steel's net profit year-on-year for Q4 2024? a) 64.66% b) 50% c) 60% d) 70% Q18: Which company's net profit did not meet market expectations for Q4 2024? a) Godrej Industries b) Infosys c) TCS d) HCL Technologies Q19: What major transition did Elon Musk announce for Twitter? a) Complete domain transition to x.com b) Merger with another social media platform c) Introduction of a new subscription model d) Acquisition of a media company [ad_1] [ad_2] Q20: Which company experienced a significant decrease in EBITDA in Q4 2024? a) JSW Steel

b) Godrej Industries c) NHPC d) Zydus Lifesciences Q21: What type of debentures did JSW Steel announce they will be issuing? a) Non-Convertible Debentures (NCDs) b) Convertible debentures c) Zero-coupon debentures d) Callable debentures Q22: What was the revenue of Maruti Suzuki for the fourth quarter? a) ₹50,000 crore b) ₹30,000 crore c) ₹40,000 crore d) ₹60,000 crore Q23: Which sector did Anand Rathi provide insights on regarding price impacts? a) Cement b) Technology c) Pharmaceuticals d) Automobiles Q24: Which company's financial performance led Prabhudas Lilladher to recommend a buy rating? a) GSK Pharma b) Infosys c) NHPC d) JSW Steel Q25: What was the primary dispute in the SpiceJet vs. Kalanithi Maran case? a) Non-receipt of redeemable warrants and preference shares b) Pilot strikes c) Aircraft leasing issues d) Breach of contract for flight services [ad_1] [ad_2] Q26: Which company declared a dividend in their Q4 results? a) Zydus Lifesciences b) NHPC c) Tech Mahindra d) Infosys Q27: What was Zydus Lifesciences' revenue for Q4 2024? a) ₹3,000 crore b) ₹1,500 crore c) ₹2,000 crore d) ₹2,500 crore Q28: Which company's Q4 results were impacted by cement prices and demand according to Anand Rathi? a) NCL Industries b) Ultratech Cement c) Ambuja Cement d) ACC Q29: Which sector did the Division Bench of the Delhi High Court rule on in the SpiceJet vs. Kalanithi Maran case? a) Aviation b) Telecommunications c) Real Estate d) Pharmaceuticals Q30: What was the main reason for the legal dispute between SpiceJet and Kalanithi Maran? a) Non-receipt of redeemable warrants and preference shares b) Delayed payments for aircraft leases c) Mismanagement of airline operations d) Discrepancies in financial reporting Q31: Which company's financial performance was highlighted by Prabhudas Lilladher for growth potential post Q4 results? a) GSK Pharma b) JSW Steel c) Godrej Industries d) NHPC Q32: Which company experienced a 64.66% decline in net profit year-on-year for Q4 2024? a) JSW Steel b) Godrej Industries c) NHPC d) Zydus Lifesciences [ad_1] [ad_2] Q33: What key change did Elon Musk make to Twitter's branding after rebranding it as X? a) Changed tweets to reposts b) Introduced a subscription model c) Merged with another social media platform d) Added a new video feature Q34: Which company's shares closed higher on the BSE after announcing Q4 results? a) JSW Steel b) Infosys c) HCL Technologies d) Godrej Industries Q35: What is the target price set by Prabhudas Lilladher for GSK Pharma post Q4 results? a) ₹1,500 b) ₹1,000 c) ₹1,200 d) ₹2,000 Q36: What was the reason behind the legal battle between Kalanithi Maran and SpiceJet? a) Non-receipt of redeemable warrants and preference shares b) Employee disputes c) Pilot strikes d) Aircraft leasing issues Q37: What action did the Delhi High Court take in the SpiceJet vs. Kalanithi Maran case? a) Set aside the refund order b) Ordered additional compensation c) Upheld the refund order d) Dismissed the case Q38: Which company’s Q4 results were primarily affected by changes in cement prices and demand? a) NCL Industries b) Ultratech Cement c) Ambuja Cement d) ACC Q39: What is the percentage decline in JSW Steel's net profit year-on-year for Q4 2024? a) 64.66% b) 50% c) 60% d) 70% [ad_1] [ad_2] Q40: What is the primary focus of Anand Rathi's financial insights on NCL Industries? a) Impact of cement prices and demand b) Expansion into new markets c) Acquisition of a competitor d) Introduction of new products Q41: Which company had a notable increase in revenue and net profit in Q4 2024? a) Zydus Lifesciences b) NHPC c) Godrej Industries

d) HUL Q42: Which company declared a final dividend of ₹7.30 per share for the fiscal year ending March 31, 2024? a) JSW Steel b) Godrej Industries c) NHPC d) Zydus Lifesciences Q43: What was the primary issue in the legal dispute between SpiceJet and Kalanithi Maran? a) Non-receipt of redeemable warrants and preference shares b) Employee disputes c) Delayed payments for aircraft leases d) Mismanagement of airline operations Q44: What logo did Elon Musk introduce for X (formerly Twitter)? a) White X on a black background b) Red T on a white background c) Blue X on a white background d) Green bird on a blue background Q45: Which companies' Q4 results are being keenly watched by market participants? a) NHPC, Amber Enterprises India, Tech Mahindra, HCL Technologies b) Bajaj Finserv, Phoenix Mills, Bandhan Bank, HUL c) Reliance, Wipro, Cipla, Lupin d) Tata Motors, ICICI Bank, SBI, Bajaj Auto Q46: What did Prabhudas Lilladher recommend for GSK Pharma post Q4 results? a) Buy rating b) Sell rating c) Hold rating d) Underperform rating Q47: What significant change did Elon Musk make to Twitter's branding? a) Changed tweets to reposts b) Introduced a subscription model c) Merged with another social media platform d) Added a new video feature Q48: Which company's net profit did not meet market expectations for Q4 2024? a) Godrej Industries b) Infosys c) TCS d) HCL Technologies [ad_1] [ad_2] Q49: What was JSW Steel’s EBITDA margin for Q4 2024? a) 13.2% b) 10% c) 16.91% d) 22.9% Q50: What was the revenue of Zydus Lifesciences for Q4 2024? a) ₹3,000 crore b) ₹1,500 crore c) ₹2,000 crore d) ₹2,500 crore [ad_1] [ad_2] Keeping abreast of current affairs is crucial, especially for those involved in financial sectors or preparing for competitive exams. These 50 questions provide a comprehensive overview of significant financial events and updates as of May 19, 2024. Whether for exam preparation or personal knowledge enhancement, these questions ensure you stay informed about the latest happenings in the financial world.

0 notes

Text

Mercedes-Benz Showroom in Delhi - Elevate Your Driving Experience

Indulge in automotive luxury at its best with the official Mercedes-Benz Showroom in Delhi, brought to you by T&T Motors. Our website is your gateway to a world of opulence, performance, and innovation. Explore our meticulously curated lineup of Mercedes-Benz vehicles, each embodying a perfect fusion of style and cutting-edge technology. Whether you desire a sleek sedan, a robust SUV, or a sporty coupe, our Delhi showroom offers the key to an extraordinary driving journey. Experience the future of automotive engineering by visiting us today.

0 notes

Video

Auto Pickup Petro Chem Pvt Ltd is a manufacturing company having a great presence all over India. Auto Pickup Petro Chem Pvt Ltd was established in 2016 with the primary focus of manufacturing, trading, and packing of lubricating oil and greases like Motor Bike Oil, Car Engine Oil, Gear Oil, Hydraulic Oil, Pump Set Oil, and CNG Oil, etc. We are having a good presence in India with a significant role in the lubricants industry. The strength of Auto Pickup Petro Chem Pvt Ltd. is in dedicated personnel to service our customer/partner round the clock, financial stability, product inventory, and prompt delivery. Our main focus on customer satisfaction. 👌 We are leading manufacturer of lubricant oil and grease in Delhi, We have all type of Oil and grease, and we are supply in Automobile and industrial sectors. 🌟

Place Your Order :https://wa.link/xgp4pb

Playlist:- https://youtube.com/playlist?list=PLR...

•)) Website -: https://www.autopickup.in/

•)) Twitter-: https://twitter.com/AutoPickupLtd?t=U...

•)) Instagram -: https://instagram.com/autopickup_petr...

•)) Talegram -: https://t.me/sriniwaslube

((Company Details)). Auto-pickup petrochem pvt.Ltd D-34, Amanpuri, Nangloi, New Delhi-110041 For queries call us at 8076469618,9810702523 And follow us on Facebook, twitter, Instagram.

🌟🌟🌟 📞 Place Your Order. 📞 +91 8076469618

0 notes

Text

Used Cars In Delhi | Second Hand Luxury Cars | Top Super Cars For Sale

Welcome back to our vlog! In this edition, we visit AVRY MOTORS located in Vikas Puri, Delhi, where we showcase a selection of used luxury and premium cars in top-notch condition. Our collection includes renowned brands such as Mercedes, Audi, BMW, Lexus, Volvo, Toyota, and Ford, with low mileage and in excellent shape. Our video will provide you with comprehensive details on the cars, so don't forget to watch until the end. Let us know your thoughts in the comment section below.

watch- https://www.youtube.com/watch?v=Nb8OiZcuxnc&t=5s

#SecondhandBMWX4#secondhandmercedesmaybach#fordEndeavour#Preownedmercedesc300#usedluxurycars#secondhandglc220d#Secondhandvolvoxc60#Secondhandaudiq7#Secondhandtoyotafortuner#Avrymotors#usedcars#usedcarsforsale#UsedLuxuryCars#PremiumCars#AVRYMotors#SecondHandCars#LuxuryVehicles#LowMileage#WellMaintained#Mercedes#Audi#BMW#Lexus#Volvo#Toyota#Ford#VikasPuri#Delhi#CarVlog

0 notes