#streaming services are temporary. dvd is forever

Explore tagged Tumblr posts

Text

It makes me so upset that 911 and Lone Star aren’t available on DVD. It isn’t enough to have them on a streaming service. I need to OWN them. I need to have them physically in my hand, and on my book shelf to look at. I need them to be mine forever.

22 notes

·

View notes

Text

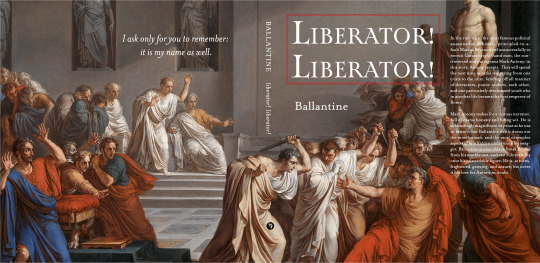

Archive Classics: Typesetting Fics

TL; DR: the internet is temporary!!! printed books (for your own private amusement) are forever!!!

What I do:

Basically, I choose fics that I think deserve to be printed and typeset them using a software called Adobe InDesign. InDesign is the professional standard in the industry, but there are definitely easier (and cheaper!) options for formatting.

Once I've chosen a fic, there a few different things I have to decide: the font, glyphs, book size, and the hors-texte (title page, contents, etc).

Then, I go about copy + pasting the text into the software, and formatting them. Usually, that just means deleting the blank space of lines that for some reason appears between paragraphs.

Every element, and I mean every single element, is designed for the reader's comfort. At no point should the reader feel lost or unable to continue because of the way the text is formatted. This means using serif fonts instead of sans-serif fonts for the body text and making sure that there aren't any widows/orphan lines. I have specific justification settings so that the spacing between words and letters are even and smooth to the reader's eye.

I also think about headers and page numbers more than you would expect. Should the page numbers be on top or bottom? Centered or at the corners. Should I have headers at all? And if so, what should they say?

When I began, and I still do this occasionally, I grabbed books off my shelves and examined their formatting. Then I'd question why they made this design choice or that. All publishers have their special little quirks and features, and if I spotted something I liked, I would incorporate that into my own works. For example, Penguin Classics love their classic serif fonts and headers. Barnes and Noble Classics have a feature in their hors-texte that is their "From the Pages Of" section.

My favorite part is creating the cover. If you couldn't tell based off the title "Archive Classics," I *borrowed* Penguin Classic's grid. I love to use paintings or other kinds of artwork (like Étienne-Louis Boullée's architectural drawings for Fractals)

Why I Do This:

While there are many amazing and necessary reasons to read e-books, I enjoy the physicality of a printed book. Nothing can beat the sensation of turning the next page, the smell of paper, or the weight of your next great adventure in your hands. Fanfiction more than deserves to be experienced in that way too.

But also, I've always had a lingering suspicion regarding the temporal nature of digital media and of the internet in general. Fanfiction, in particular, are at risk of disappearing forever, and while you can obvs download it (which I always always do), there's a slight chance that you may not be able to access the technology in order to view it. Books don't require laptops or phones or internet service.

It's a silly movie, but Leave the World Behind (2023) showcases this perfectly, albeit with streaming services and dvds.

Finally, with the ever-changing landscape of the internet and technology, who knows if say archaeologists would be able to access ao3 in a 100 or even 50 years. Look at USB-As, and how quickly they're going out of use. Physical media like printed books will certainly last for decades longer. My ultimate (and idealistic) goal is to have a physical, printed library of fanfiction for both private enjoyment and for the academic study of fanfiction in the anthropological and literary fields. The latter will most likely not happen in my lifetime (if ever at all), but a girl can dream!

Copyright

This is slightly sketchy but from what I can tell from my research is that most sites don't give an af if you print like one copy for yourself and you do not print en-masse or start selling them. So like Manacled. Don't do what those kids did and put up your copies on etsy. I don't. I print this for myself and myself only. And I've never gotten a cease and desist letter or anything like that.

Requests are open: if you have a fic you think deserves the archive classics treatment, lmk! I do not accept payment. This is all free.

Examples!

A Current Cover I'm Working On:

This one is a linen wrap, which means it has flaps!

#archive classics#typesetting#book design#indesign#fanfiction#ao3#the temporary nature of the internet is something we should be deeply concerned about!!#fanbinding

65 notes

·

View notes

Text

dvd nation will never die btw. streaming services are temporary, digital video disc is forever.

9 notes

·

View notes

Text

What if the RFA+3 were in quarantine?

How would they all be like in 2020, Plague Nation?

Some #relevantContent that nobody asked for! I meant to post this months ago. And then I didn’t. You know. Like a liar.

These all take place after their routes end.

Zen:

For a little while, he would be kind of lax about wearing his mask or washing his hands, because he never gets sick!

But then he realizes that he could be a carrier and get MC sick.

So he becomes more careful about what he does with his hands, and always remembers to wear a mask when he goes out.

Money gets kind of tight, due to his theatre company cancelling shows, and production companies postponing projects.

Karaoke at home all day err day

Wakes up early to do workouts at the park before anybody else is there, then runs back home. MC is not your personal cardio workout, Zen.

He gets really extra, three days in, because he hates getting locked up. MC always sends him to get groceries, both so that he can get rid of some of his energy, and so that he can see people.

Posts a lot of covers online to keep himself busy. Considers making an JustFans account to make a little extra money, but Jaehee and Yoosung talk him out of it

Yoosung:

Gets a lot of studying done, at first. Worries how his grades and degree will be affected.

Gets back into playing LOLOL to take up the time. Eventually convinces MC to make an account so that they can hang out online.

His neighbours end up asking him for advice about whether their pets need emergency care or not. Vets are closed to non-urgent things, so Yoosung does his best to soothe their worries when small things happen to their pets.

Does some blogging for mental health awareness during quarantine. Knows how dangerous being isolated can be.

Gets into the habit of calling his parents once a week, both to keep in touch, but also to take up time.

Apartment gets super tidy after a while.

Mostly just misses having dates with MC.

Jaehee:

She has All the Zen DVDs.

Lots of movie marathons, either alone, or streaming with MC and Zen.

She’s more worried about business for her café, though.

Closed means no income. She has some savings, but it won’t last forever.

After a few weeks, she cautiously takes on a few odd jobs for Jumin’s company, just to make ends meet/help Yoosung out. The money is just enough for groceries and rent; she doesn’t take any more work than just enough to make what she needs.

She makes cute/stylish homemade masks in her spare time, at home.

As soon as she can, she opens up patio space so that she can work the cafe, again. She also puts up her masks for sale.

Jumin:

Works from home like nothing has changed.

The only new headache is reworking the company so that their nonessential branches still have support.

MC begs him to promise not to make any layoffs during the pandemic. He manages to juggle staff from nonessential branches to the essential ones, to provide work and prevent burnout, but it’s not easy, and not everyone is happy with the temporary arrangements.

MC is also a staunch advocate for ensuring pandemic support to employees that were affected by the virus. Jumin takes a lesson in loyalty to subordinates.

The truth is that C&R is losing money. But Jumin is more focused on pleasing his wife than amassing further wealth.

Mr. Han and the company’s board are not pleased, but Jumin is no stranger to doing things his own way. They only pray that business will go back to normal soon.

Saeyoung:

Most of his stuff is done in solitude, anyway, so other than wearing a mask before going out, his life is pretty much the same.

His toymaking business was always available online, so income is basically normal, aside from delivery wait times being a bit longer.

His main concerns are his brother’s mental health, and keeping in touch with MC.

But Saeran does better in solitude, and Saeyoung has touched up the RFA’s app to include live video.

Saeyoung makes some handy dandy sanitization robots. He also upgrades the RoboCat to include scanning for fever, black light to check for germs, and reminders to wear a mask.

Saeran:

You live alone, isolated in a little house with a garden...Saeran is Living the Life.

Nothing has changed, except maybe washing your hands a little more often.

Living. The. Life.

V:

His hippy lifestyle now includes washing hands often and wearing a mask.

He now has even more time to pursue painting/violin playing/personal improvement in The Arts(tm)

Travelling is no longer possible, though, which he misses.

And he misses spending time with his friends. It isn’t good to be lonely.

MC notices that he gets a bit overzealous with his hobbies, if left alone for too long. He admits that he’s worried his old doubts and personal insecurities will rear up in the quiet and solitude. He would rather keep busy.

Vanderwood:

Nothing has changed.

Still gotta go out and do missions. Apparently, espionage is an essential service.

Wearing a mask is good for hiding one’s identity.

Wearing gloves and keeping clean is good for not leaving evidence behind.

Additionally, Vandy can avoid Seven in the name of social distancing.

92 notes

·

View notes

Text

How To Avoid Bankruptcy As A Homeowner

Nobody wants to file for bankruptcy. As a society, we’re grateful that the option exists to support those who really need it, however, it’s a decision that can create walls for the future. These walls are never permanent but it’s an uphill battle to overcome them. There are many excellent techniques that can support people in avoiding bankruptcy so that they never have to take on that uphill climb. What are some things you can do now?

Ways You Can Avoid Bankruptcy

Manage Your Necessities First

When you’re trying to creep out of debt and avoid bankruptcy at all costs, the first you’re going to want to do is make sure the necessities are taken care of. These include food, shelter, utilities, transportation, and clothing. If find yourself at the very bottom, make sure you at least pay for food and utilities. Then make sure your rent or mortgage is caught up. Don’t pay anyone else until these basics are covered. It’s not okay to lose the house because your credit card company is getting cranky with you!

Sell What Isn’t Special

You have money hanging around in the form of DVDs, TVs, boats, clothes, books, furniture, tools, office supplies, craft supplies, and toys. Get rid of anything you don’t need. What is a need? Something that if it was gone your physical health would suffer. That sounds extreme, but when it comes to bankruptcy you’ll need to be dramatic. Take the money you make and put it toward getting bills up to date.

Create a New Budget

You’re trying to avoid bankruptcy and that means your budget has no room for frills. No streaming services, no cable, no huge cell phone plans, no dining out, and no vacations until you’re out of debt. Buy generic food, eat beans and rice, and drink water from the tap. Drink coffee you brewed and stay away from storms. Stick to your budget because drastic times call for drastic measures.

Get a Second Job

It might be tough but it doesn’t have to be long term. These days, it’s not uncommon to hear of someone working a second (or third) job. Having an additional source of income can help you avoid bankruptcy. Just be sure you’re putting the extra income toward paying off your debts. Getting a second job will mean sacrificing time with family and friends, and we know that’s hard. But remember—this situation is only temporary. You won’t have to live like this forever. If you live like no one else, so later you can live like no one else, the payoff will be worth all your effort.

Connect With a Financial Coach

Sometimes it’s best to sit down and talk with a financial coach when you need guidance with money issues. Don’t let that intimidate you. When looking for a financial coach, just make sure you find someone who has the heart of a teacher. You want a person who will walk with you and guide you along the way—not someone looking to take advantage of your situation.

The post How To Avoid Bankruptcy As A Homeowner appeared first on National Cash Offer.

from https://nationalcashoffer.com/how-to-avoid-bankruptcy-as-a-homeowner/

0 notes

Text

20 Ways to Help You Out When You Desperately Need Money

We’ve all been there. You’re between pay checks, running low on cash and then disaster strikes and you need money–now. Or you get paid on Friday and find yourself broke on Monday. You have too much integrity or are too scared to rob a bank…but the thought has crossed your mind.

Don’t fret! I am here to help.

20 safe and legitimate ways to get money fast

Below is a list 20 perfectly legal and legitimate ways to get your hands on some cash in a pinch. Some of the ways are more suitable for some than others but the list will provide you with options and more importantly get you to generate your own creative ideas on how to increase your cash flow.

Keep in mind that these are short term solutions. The real solution to your money problems is proper money management and planning (a.k.a. budgeting). Learning to live below your means, delaying gratification, eliminating debt and reducing your dependency on credit are the keys to financial freedom.

If you need money today…

1. Pawn or sell something

If you’re REALLY in a pinch, you may need to pawn or sell that prized possession you’ve got stashed away. Your desperate situation may call for you to have to part with that old comic book collection, your grandmother’s antique pearls or china or that coin collection you’ve had since childhood. I do advise that you think long and hard before making this decision. Once it’s gone–it will be incredibly difficult to get it back and your desperation will ensure that you probably won’t get what the item is actually worth.

Another option is to dig through your closets, and basement for stuff that may still have some value such as an old DVD or video game collection, your 10-year-old’s baby clothes, a toddler bicycle, that espresso machine ( or juicer) that you only used once.

There are tons of apps[1] that let you snap a picture of your stuff and post it online immediately.

2. Sell an old cell phone

Almost everyone has an old smartphone lying around that still works. You decided to upgrade from that perfectly functional phone because it was the chic thing to do. Now the old phone is just laying around collecting dust. Sell it! If you need money today check out the website ecoATM. This site allows you to safely sell and recycle your old phone. They also pay cash for old tablets, iPods and MP3 players.

3. Sell your clothes at a local consignment shop

If you have quality designer clothes or furniture you no longer want or need go ahead and sell it outright to a consignment or thrift shop. A lot of consignment shops will buy your items outright eliminating the consignment fee and the wait for your items to sell. You won’t get top dollar this way but you will walk away with some cash in hand.

4. Borrow from a friend or family member

This is the one method most of us want to avoid. However, you can receive the money the same day using apps such as PayPal. Keep in mind that borrowing from a loved one takes humility and sincerity. Do not, I repeat, DO NOT borrow from friends or family if you have no intentions of repaying the loan or if you know you cannot meet the terms of repayment[2]. This is the quickest way to ruin a relationship. Proceed with caution.

5. Sell your plasma

You can get paid for your plasma. Most donation centers will pay you anywhere from $25-$50 for it. The best part about selling plasma is that most places will allow you to sell it up two times per week.

**Quick note: There is a difference between selling your plasma and donating blood. You do not get paid for blood donations so make sure you distinguish between the two and are clear with your request.

6. Get A Cash Advance

This is a bad idea! I do not recommend this unless there is a life and death situation and you have a plan for quick repayment. Some credit cards offer the opportunity to take out cash against your credit limit. Please understand that the terms of repayment are going to be MUCH different than the terms for regular credit card purchases. Between the fees for accessing the money and the jacked up interest rate, it is not unusual for you to end up spending $1,000 for an $800 cash advance. It’s simply not worth it.

If you need money in 7 to 10 days…

7. Sell your clothes online

Selling your clothes is one of the easiest and quickest ways to make money fast. The clothing resell industry has become very trendy and is reportedly a $16 billion dollar industry[3]. There are hundreds of online apps, websites and avenues to get your clothes sold. Some apps and websites even pay the shipping costs for you.

8. Sell your junk online

Websites such as Craig’s List, Amazon, Ebay, and the list goes on, are great and cheap ways for you to sell your junk. You can resell ANYTHING these days. If you bought it, chances are there is someone out there who will pay you for it. These sites take time as you have to ship items, items have to be verified and then you are paid. Payment on these websites usually take seven to ten business days.

9. Sell your unused gift cards

Sites such as Cardpool, Raise and Cardcash will al low you to resell your unused gift cards for slightly less than face value. You can get you money in as little as two days and even quicker for e gift cards. It’s a quick, easy and painless process.

10. Become an Uber/Lyft Driver

If you have some extra time on your hands–just a few hours a week would do it–and live in or near a populous area, driving for Uber/Lyft is a very lucrative way to make money fast. It is also a great long-term side hustle. Uber drivers can make as much as some full-time jobs if they work in the right area. You could earn $100 mark in as little as five hours per week.

11. Sell your sports/concert tickets

Got season tickets or concert tickets? Sell them. In some cases you may not get face value for the tickets but you can recoup a good portion of your money. For really popular events–such as play off games or marquee performances–you can make well above the ticket face value. If you’re that desperate for money, missing a concert or the big game isn’t that big a deal.

12. Do odd jobs

Babysitting, pet sitting, house sitting, cutting grass, house cleaning, walking dogs and other odd jobs around the neighborhood are great ways to get some quick cash in your pocket.

13. Inbox Dollars and Swagbucks

Inbox Dollars and Swagbucks are websites that pays you cash (very small amounts of cash) to perform various tasks such as watching videos, commenting on ads, taking surveys, shopping and the list goes on and on. You will not get rich using these website, but you can earn a couple extra bucks by spending a few minutes (or hours) online. The websites requires you to bank $30 before you are paid.

If you need money in 30 days…

14. Negotiate with your creditors

If you need money to pay bills or debts, call your creditors and try to negotiate. Explain your situation and request an extension or make arrangements to pay a portion of what you owe. Most creditors will work with you. Their primary goal is to get their money. They are willing to wait a few days or take a portion of the payment in lieu of you not paying them at all.

15. Get a part time job

Look, I get it. You are already overworked, under paid and stretched thin as it is. But a part-time job isn’t forever. It’s only temporary. If you can work long enough to avert the crisis and then establish an emergency fund, you won’t find yourself in this predicament again. You may have to deliver pizzas in the evenings or work retail on weekends but anything worth having requires work. We live in the age of the side-hustle and in the era of multiple streams of income. This is one bandwagon worth joining. The more you do now, the less you have to do later.

16. Become a Secret Shopper

Secret shopping is the perfect side hustle for those who love to shop, stay-at-home moms and anyone who loves good customer service. Mystery or secret shoppers are independent contractors posing as “shoppers”. You are paid to visit your local stores and shops as a regular customer and report back on various aspects of your experience. A word of caution! This industry is full of scams. Be sure to check out the company reviews online or stick with companies that are tried and true[4].

17. Garage/Yard Sale

There is nothing like a good ‘ole fashion yard sale to generate additional pocket money. I’m talking about the kind where you search every nook and cranny of your house and completely de-clutter and purge all of the items that are not absolutely necessary for you to live.

When planning the sale, make sure you advertise in your local area and also blast it on social media. A great thing about these sales is that anything that does not sell at the physical location of the event can be sold online. A great place to sell leftover items is on the Facebook Yard sale page.

18. Conventional Loan

This is an option–just not a good one. By taking out a loan, you are compounding your money problems in lieu of fixing them. However, if you feel you must take out a loan, experts suggest visiting your local credit union. Many local credit unions are getting into the short-term loan game and offer rates far superior to pay-day and other short-term loans. You do have to be a member of your credit union in good standing. Credit unions offering short-term loans work with those with poor credit and offer better rates, terms and conditions than other short-term lenders.

19. Become a Virtual Assistant or Bookkeeper

Virtual assistants provide a wide range of services to individuals, organizations or companies, but they do it virtually in lieu going into an office. It’s an excellent work from home opportunity and one of the most cost-effective ways of making money online. Rates for providing virtual services online could range from $10 an hour for simple data entry tasks to hundreds of dollars an hour if you have a highly specialized skill or expertise. You can work for a company online such as Upwork, Elance or Problogger or you can work as an independent contractor.

20. Rent out a room or become an Airbnb host

Got extra space? Rent it out. Getting a roommate is a great way to cut cost and save money fast. As with anything, make sure you do your research and due diligence when it comes choosing a roommate. If you live in or near a high tourist area, working with a service such as Airbnb is a great way to get a steady stream of qualified guests. They vet your potential guests for you and provide you with referrals.

Everyone needs some cash from time to time. The ways listed above are fairly quick and easily accessible ways to get a hold of some extra cash. The best way to avoid these money crisis is by living modestly and well below your means, saving for emergencies and following a budget.

Reference

[1]^Money Pantry: 15 Awesome Apps and Sites For Selling Your Stuff Locally[2]^The Simple Dollar: 4 Steps to Take If You Loan Money To Friends Or Family[3]^Business Insider: Selling Your Old Clothes Is Now A Billion Dollar Industry[4]^The Penny Hoarder: The Best Mystery Shopping Companies to Work For

function footnote_expand_reference_container() { jQuery(“#footnote_references_container”).show(); jQuery(“#footnote_reference_container_collapse_button”).text(“-“); } function footnote_collapse_reference_container() { jQuery(“#footnote_references_container”).hide(); jQuery(“#footnote_reference_container_collapse_button”).text(“+”); } function footnote_expand_collapse_reference_container() { if (jQuery(“#footnote_references_container”).is(“:hidden”)) { footnote_expand_reference_container(); } else { footnote_collapse_reference_container(); } } function footnote_moveToAnchor(p_str_TargetID) { footnote_expand_reference_container(); var l_obj_Target = jQuery(“#” + p_str_TargetID); if(l_obj_Target.length) { jQuery(‘html, body’).animate({ scrollTop: l_obj_Target.offset().top – window.innerHeight/2 }, 1000); } }

The post 20 Ways to Help You Out When You Desperately Need Money appeared first on Lifehack.

from Viral News HQ http://ift.tt/2pOksd2 via Viral News HQ

0 notes

Text

20 Ways to Help You Out When You Desperately Need Money

We’ve all been there. You’re between pay checks, running low on cash and then disaster strikes and you need money–now. Or you get paid on Friday and find yourself broke on Monday. You have too much integrity or are too scared to rob a bank…but the thought has crossed your mind.

Don’t fret! I am here to help.

20 safe and legitimate ways to get money fast

Below is a list 20 perfectly legal and legitimate ways to get your hands on some cash in a pinch. Some of the ways are more suitable for some than others but the list will provide you with options and more importantly get you to generate your own creative ideas on how to increase your cash flow.

Keep in mind that these are short term solutions. The real solution to your money problems is proper money management and planning (a.k.a. budgeting). Learning to live below your means, delaying gratification, eliminating debt and reducing your dependency on credit are the keys to financial freedom.

If you need money today…

1. Pawn or sell something

If you’re REALLY in a pinch, you may need to pawn or sell that prized possession you’ve got stashed away. Your desperate situation may call for you to have to part with that old comic book collection, your grandmother’s antique pearls or china or that coin collection you’ve had since childhood. I do advise that you think long and hard before making this decision. Once it’s gone–it will be incredibly difficult to get it back and your desperation will ensure that you probably won’t get what the item is actually worth.

Another option is to dig through your closets, and basement for stuff that may still have some value such as an old DVD or video game collection, your 10-year-old’s baby clothes, a toddler bicycle, that espresso machine ( or juicer) that you only used once.

There are tons of apps[1] that let you snap a picture of your stuff and post it online immediately.

2. Sell an old cell phone

Almost everyone has an old smartphone lying around that still works. You decided to upgrade from that perfectly functional phone because it was the chic thing to do. Now the old phone is just laying around collecting dust. Sell it! If you need money today check out the website ecoATM. This site allows you to safely sell and recycle your old phone. They also pay cash for old tablets, iPods and MP3 players.

3. Sell your clothes at a local consignment shop

If you have quality designer clothes or furniture you no longer want or need go ahead and sell it outright to a consignment or thrift shop. A lot of consignment shops will buy your items outright eliminating the consignment fee and the wait for your items to sell. You won’t get top dollar this way but you will walk away with some cash in hand.

4. Borrow from a friend or family member

This is the one method most of us want to avoid. However, you can receive the money the same day using apps such as PayPal. Keep in mind that borrowing from a loved one takes humility and sincerity. Do not, I repeat, DO NOT borrow from friends or family if you have no intentions of repaying the loan or if you know you cannot meet the terms of repayment[2]. This is the quickest way to ruin a relationship. Proceed with caution.

5. Sell your plasma

You can get paid for your plasma. Most donation centers will pay you anywhere from $25-$50 for it. The best part about selling plasma is that most places will allow you to sell it up two times per week.

**Quick note: There is a difference between selling your plasma and donating blood. You do not get paid for blood donations so make sure you distinguish between the two and are clear with your request.

6. Get A Cash Advance

This is a bad idea! I do not recommend this unless there is a life and death situation and you have a plan for quick repayment. Some credit cards offer the opportunity to take out cash against your credit limit. Please understand that the terms of repayment are going to be MUCH different than the terms for regular credit card purchases. Between the fees for accessing the money and the jacked up interest rate, it is not unusual for you to end up spending $1,000 for an $800 cash advance. It’s simply not worth it.

If you need money in 7 to 10 days…

7. Sell your clothes online

Selling your clothes is one of the easiest and quickest ways to make money fast. The clothing resell industry has become very trendy and is reportedly a $16 billion dollar industry[3]. There are hundreds of online apps, websites and avenues to get your clothes sold. Some apps and websites even pay the shipping costs for you.

8. Sell your junk online

Websites such as Craig’s List, Amazon, Ebay, and the list goes on, are great and cheap ways for you to sell your junk. You can resell ANYTHING these days. If you bought it, chances are there is someone out there who will pay you for it. These sites take time as you have to ship items, items have to be verified and then you are paid. Payment on these websites usually take seven to ten business days.

9. Sell your unused gift cards

Sites such as Cardpool, Raise and Cardcash will al low you to resell your unused gift cards for slightly less than face value. You can get you money in as little as two days and even quicker for e gift cards. It’s a quick, easy and painless process.

10. Become an Uber/Lyft Driver

If you have some extra time on your hands–just a few hours a week would do it–and live in or near a populous area, driving for Uber/Lyft is a very lucrative way to make money fast. It is also a great long-term side hustle. Uber drivers can make as much as some full-time jobs if they work in the right area. You could earn $100 mark in as little as five hours per week.

11. Sell your sports/concert tickets

Got season tickets or concert tickets? Sell them. In some cases you may not get face value for the tickets but you can recoup a good portion of your money. For really popular events–such as play off games or marquee performances–you can make well above the ticket face value. If you’re that desperate for money, missing a concert or the big game isn’t that big a deal.

12. Do odd jobs

Babysitting, pet sitting, house sitting, cutting grass, house cleaning, walking dogs and other odd jobs around the neighborhood are great ways to get some quick cash in your pocket.

13. Inbox Dollars and Swagbucks

Inbox Dollars and Swagbucks are websites that pays you cash (very small amounts of cash) to perform various tasks such as watching videos, commenting on ads, taking surveys, shopping and the list goes on and on. You will not get rich using these website, but you can earn a couple extra bucks by spending a few minutes (or hours) online. The websites requires you to bank $30 before you are paid.

If you need money in 30 days…

14. Negotiate with your creditors

If you need money to pay bills or debts, call your creditors and try to negotiate. Explain your situation and request an extension or make arrangements to pay a portion of what you owe. Most creditors will work with you. Their primary goal is to get their money. They are willing to wait a few days or take a portion of the payment in lieu of you not paying them at all.

15. Get a part time job

Look, I get it. You are already overworked, under paid and stretched thin as it is. But a part-time job isn’t forever. It’s only temporary. If you can work long enough to avert the crisis and then establish an emergency fund, you won’t find yourself in this predicament again. You may have to deliver pizzas in the evenings or work retail on weekends but anything worth having requires work. We live in the age of the side-hustle and in the era of multiple streams of income. This is one bandwagon worth joining. The more you do now, the less you have to do later.

16. Become a Secret Shopper

Secret shopping is the perfect side hustle for those who love to shop, stay-at-home moms and anyone who loves good customer service. Mystery or secret shoppers are independent contractors posing as “shoppers”. You are paid to visit your local stores and shops as a regular customer and report back on various aspects of your experience. A word of caution! This industry is full of scams. Be sure to check out the company reviews online or stick with companies that are tried and true[4].

17. Garage/Yard Sale

There is nothing like a good ‘ole fashion yard sale to generate additional pocket money. I’m talking about the kind where you search every nook and cranny of your house and completely de-clutter and purge all of the items that are not absolutely necessary for you to live.

When planning the sale, make sure you advertise in your local area and also blast it on social media. A great thing about these sales is that anything that does not sell at the physical location of the event can be sold online. A great place to sell leftover items is on the Facebook Yard sale page.

18. Conventional Loan

This is an option–just not a good one. By taking out a loan, you are compounding your money problems in lieu of fixing them. However, if you feel you must take out a loan, experts suggest visiting your local credit union. Many local credit unions are getting into the short-term loan game and offer rates far superior to pay-day and other short-term loans. You do have to be a member of your credit union in good standing. Credit unions offering short-term loans work with those with poor credit and offer better rates, terms and conditions than other short-term lenders.

19. Become a Virtual Assistant or Bookkeeper

Virtual assistants provide a wide range of services to individuals, organizations or companies, but they do it virtually in lieu going into an office. It’s an excellent work from home opportunity and one of the most cost-effective ways of making money online. Rates for providing virtual services online could range from $10 an hour for simple data entry tasks to hundreds of dollars an hour if you have a highly specialized skill or expertise. You can work for a company online such as Upwork, Elance or Problogger or you can work as an independent contractor.

20. Rent out a room or become an Airbnb host

Got extra space? Rent it out. Getting a roommate is a great way to cut cost and save money fast. As with anything, make sure you do your research and due diligence when it comes choosing a roommate. If you live in or near a high tourist area, working with a service such as Airbnb is a great way to get a steady stream of qualified guests. They vet your potential guests for you and provide you with referrals.

Everyone needs some cash from time to time. The ways listed above are fairly quick and easily accessible ways to get a hold of some extra cash. The best way to avoid these money crisis is by living modestly and well below your means, saving for emergencies and following a budget.

Reference

[1]^Money Pantry: 15 Awesome Apps and Sites For Selling Your Stuff Locally[2]^The Simple Dollar: 4 Steps to Take If You Loan Money To Friends Or Family[3]^Business Insider: Selling Your Old Clothes Is Now A Billion Dollar Industry[4]^The Penny Hoarder: The Best Mystery Shopping Companies to Work For

function footnote_expand_reference_container() { jQuery(“#footnote_references_container”).show(); jQuery(“#footnote_reference_container_collapse_button”).text(“-“); } function footnote_collapse_reference_container() { jQuery(“#footnote_references_container”).hide(); jQuery(“#footnote_reference_container_collapse_button”).text(“+”); } function footnote_expand_collapse_reference_container() { if (jQuery(“#footnote_references_container”).is(“:hidden”)) { footnote_expand_reference_container(); } else { footnote_collapse_reference_container(); } } function footnote_moveToAnchor(p_str_TargetID) { footnote_expand_reference_container(); var l_obj_Target = jQuery(“#” + p_str_TargetID); if(l_obj_Target.length) { jQuery(‘html, body’).animate({ scrollTop: l_obj_Target.offset().top – window.innerHeight/2 }, 1000); } }

The post 20 Ways to Help You Out When You Desperately Need Money appeared first on Lifehack.

from Viral News HQ http://ift.tt/2pOksd2 via Viral News HQ

0 notes