#startup business loan provider

Text

Quick Business Loan in Delhi: Everything You Need to Know

Availing A Fast Business Loan in Delhi can help the entrepreneurs run their businesses in one of India's busiest commercial hubs. This is where Xpertserve steps in - we recognize the urgent financial requirements of small and medium businesses & provide services that suit these specific needs. The blog is going to take you through the necessary information regarding a business loan in Delhi so that you can make informed decisions.

Know Everything Related to Business Loans in Delhi

Business Loan in Delhi can be a tough nut to crack. Xpertserve provides a range of loan products that cater to specific business requirements across the spectrum - from early-stage startups poised for growth or established companies ready to take it up-notch. It is important to know what loan features such as interest rates, repayment terms and the eligibility criteria that fits your requirement whether you need a substantial amount for investments in infrastructure or small amounts of working capital. Xpertserve is very transparent to deal with and keeps you informed on all fronts relating your loan.

Advantages of Instant Business Loan in Delhi

Instant Business Loan in Delhi is really a great option for businesses that are looking to meet their urgent financial requirements. These fast loans are usually processed quickly and funds disbursed without long procedures of documentations, verifications associated with instant traditional loans. Business loans are not just for the development of your business; they can be a lifesaver if you need to pay unpredicted bills or grab that great opportunity, or even handle cash-flow through slow months. That is why we offer instant business loans via Xpertserve This fast-tracked approval process guarantees you will not have business-critical requirements blow up in your face.

How to Apply for a Small Business Loan in Delhi?

Xpertserve has made it Seamless and User-friendly experience to Apply for Small Business Loan in Delhi This should include assessing your financing needs, collecting business financials and other documents required by the lender plus proof of Business ownership. It is simple to apply and the status of your application will remain always using Xpertserve online platform. Also, our financial advisors will help you thru the application process assist u to avoid common mistakes and improve odds of approval.

Why Choose Xpertserve to Fulfill your Business Financing Needs?

When you choose Xpertserve for your business financing to work with developers who understand how important it is that your business do well. We provide attractive interest rates; convenient repayment plans and a team of well-versed advisors who know the ins and outs of doing business in Delhi. We promise to provide you with top-notch customer service, meaning that we will deliver advice customized according to your own business requirements and assist you in preparing for the future of your company making sound financial decisions.

#Quick Business Loan in Delhi#Business loan Delhi#Small business loan Delhi#Business loan providers Delhi#Low-interest business loan Delhi#Fast business loan approval Delhi#Startup business loan Delhi#MSME loan Delhi

0 notes

Text

Funding Your Startup: Exploring Business Loans in Leeds

Business Loan Providers Leeds - This resource illuminates the path to securing essential funding for launching and growing your startup. By examining the array of Business Loans Leeds options available, it empowers you to make informed decisions regarding your financing needs.

1 note

·

View note

Text

#best business loan company#best business loan provider#Best business loan deals#best business loans for startups#top business loan company#top business loan companies#best business loans for small businesses

0 notes

Text

Apply for Fast Business Loan - Catch Rupee is your one-stop solution for a small business loan, machinery loan, loan for a women-owned business In Pune. Feel free to contact us for your financial need. Call Us Today!

#Small business loan in Pune#Business loans for startups in Pune#Business loan for new business#Commercial real estate loans#Startup loan for new business#New small business loans in Pune#Business loan provider in Pune

0 notes

Link

Business Loan in India

Basically, every business faces a monetary or financial crisis at a certain period of development to meet their financial requirements. There may be various reasons for getting these loans which depend on the type of business loans in India.

The borrowed funds are used for upgrading or installing plants, hiring new employees, the growth and expansion of a business, revamping old machinery, restructuring the debt, marketing, and promotion of a business, managing cash flow, purchasing the inventory, buying raw materials, and many more.

The business expenses obtained to maintain & run operations can be removed from the entire business revenue to avail taxable income.

There are many business expenses which are not a part of revenue i.e., wages paid to the staff and employees, bonus paid to employees, gifts, meals and entertainment expenses, rental cost of office premises, advertising & marketing expenses, office supplies like stationery, daily maintenance cost, etc...

Many banks and NBFCs provide business loans for new and existing business at an attractive rate of interest @14.50% onwards per annum with the flexible repayment tenure.

Business funding are of many types like letter of credit, working capital loan, bill discounting, overdraft facility, equipment finance, machinery loan, small business finance, micro loan, term loan, merchant cash advance, farm, or construction equipment finance.

#business loan in India#provide business loans for new and existing business#startup loan#stand up loan#personal loan#professional loan#capital loan#business loan#financeseva

1 note

·

View note

Link

Find details about getting your startup business loans sorted with Broc Finance in Australia. For more details, visit: www.brocfinance.com.au.

0 notes

Text

Business Startup Loan Provider In Jamnagar, Gujarat, India | Finance Mart

Finance Mart is a leading business startup loan provider in Jamnagar, Gujarat, India. We also provide home, business startup, projects, personal loans, GST, and income tax services with 100+ years of combined expertise, faster loan approvals & cost-effective interest rates.

0 notes

Text

The 1301 Crisis

Library of Circlaria

Blog Posts

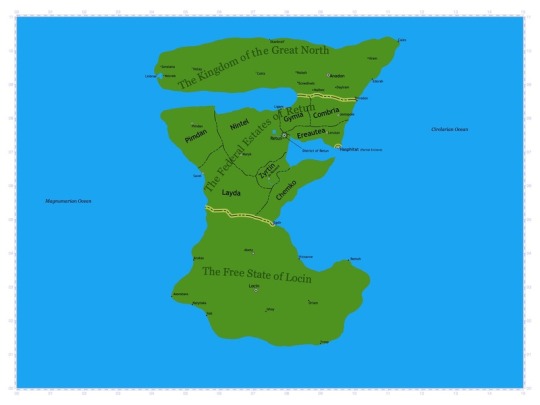

Map of Remikra, 1264-1308

Article Written: 3 October 1452

1301-02

The economy, up to this point, was prosperous in the Early Retunian Republic, having fully recovered from the 1290 downturn. This recovery was the result of Prime Minister John Waltmann's economic reform measures, renewed prospects of deep-trade reform, and the expansion of the lightfire industry in Ancondria.

However, this economy was more vulnerable than ever, for about 90 percent of it was financed by loans from the Big Five Banks in Hasphitat. Numerous businesses and even privately-owned estates were either paying operation costs with these loans, or were profitable enough to do so without the loans and were now paying those loans back. Many individuals had also taken loans out, primarily for paying rent, which had become unaffordable for many entry-level workers without some form of financial assistance.

Upon receiving critical testimony from foreign powers regarding the outlook of lightfire investments in Ancondria, the Big Five Banks decided to invoke a clause from the 1276 Resolution and liquidate all loans previously made to businesses invested in the field. This happened in June 1301 and led to the shuttering of many businesses as a result of defaults. This also led to a dramatic fall in the stock and tradestone markets, leading other businesses to either shutter or pare down on operation and labor costs. The resulting mass-layoffs left people unable to pay back loans or rent, causing them to lose homes and property. The resulting explosion in poverty led businesses to lose large numbers of clients, and were also forced to shutter, laying off even more employees and worsening the cycle.

This economic collapse also had an impact on privately-owned estates, many of which were startups and were paying back bank loans. When loan liquidation failed to yield as much payback as needed, the banks faced financial pressure to liquidate estate loans. When the estates defaulted, the banks liquidated their properties, evicting landlords and tenants. This meant that many tenants were evicted even if they paid their rent faithfully.

Such loan liquidation and stock collapses occurred in the midst of the Big Five Banks contracting, which forced the branch banks to fend for themselves when it came to providing cash for those requesting to withdraw their savings. But mass panic ensued, and many people flooded the banks to attempt to withdraw their savings, which led the branch banks to run out of funds and eventually shutter.

In the beginning of 1302, in the midst of this chaos, Prime Minister Waltmann enacted a measure provided by the Remikran Union to build emergency housing to house those who were suddenly left homeless. This addressed the homeless crisis but the living units were basic, lacked comfort, and were often dangerous. In fact, there are many accounts of walls and ceilings collapsing as well as structural fires.

Mervin Teller, a Provincial Domain Governor General having served under former Prime Minister Jackson, announced his run for the Prime Minister election of 1302, blaming Prime Minister Waltmann for "mismanagement" in the midst of the economic crisis. Teller presented an agenda to re-invest in international trade to create jobs, a seemingly appealing plan. However, it was later in his campaign when Teller stated that he would end the emergency housing program in order to re-balance the government budget, prompting backlash from the population and causing him to lose the election to Waltmann.

1303-06

Through negotiations, Waltmann convinced bank leaders in the summer of 1303 to make cautious investments in the market surrounding Ancondria, and enacted stimulus measures to re-establish businesses. This had relative success, and it appeared the economy was en route to recovery.

In February 1304, however, the Linbraean Royal Trust made negative testimony against Ancondrian investors from Middle Remikra and withdrew an essential credit line, which sent the Middle Remikran markets crashing again. In the summer of 1304, Waltmann, again through negotiations, convinced the Five Big Banks to make cautious re-investments in Ancondria, as the embassy and Retunian territories in Ancondria were formally established along with an emerging market in the Ancondrian city of Silba. The economy re-stabilized as a result, but then crashed again in the beginning of 1305 amid fears stemming from international intervention involving the Great Northern Duchy of Ecnedivelc. However, trade in Ancondria continued to grow, and the economy re-stabilized beginning in 1306. With the promise of growth in the future, businesses in the mainland of Middle Remikra re-emerged while unemployment was at its lowest rate since the 1301 Crisis began.

1307-09

And then came the crash of 1307. Precipitated by a fallout in the Ancondrian trade market, it was the largest market crash since the beginning of the 1301 Crisis and erased the progress made in 1306. Again, people were unemployed as more of them were forced into emergency housing. Protests broke out in the cities while Prime Minister Waltmann encountered stiff resistance from the banks during negotiations.

Walter Scott Mason, President of the Rotary Legion of North Kempton, announced his run for Prime Minister in 1306 for the 1308 election, running as a candidate for the Diplomatic Party. Initially, his wild rhetoric in evangelism and ultra-nationalism made him the least popular Diplomatic Party candidate, as he seemed to stand no chance against the leading Diplomatic Party candidate: Woodward Madden, the incumbent governor of Gymia. However, when the 1307 crash happened, Mason began preaching to numerous crowds that Waltmann was enacting policies to favor the Holz Finzi Darkfire Community and award them economic privileges over everyone else. This claim turned out to be false; nonetheless, a large majority of the conservative Retunian population, desperate for answers, immediately turned their support toward Mason. And thus, Mason won the Diplomatic Party primary election in September of 1307. And loyal Rotary Chapters across the Republic united to form the "Knights of the Common Good," or the KCG, under Mason's leadership.

Meanwhile, another significant portion of the population turned their support toward Holz Finzi, who had, up to this point, been regarded with fear for his power in darkfire practice. However, emerging studies at the time had shown darkfire to have practical benefits needed for the present economic situation. Furthermore, accounts came to light detailing those either deeply involved in darkfire or having innate darkfire conjuration tendencies being subject to measures of harsh oppression during the Early Republic. This bolstered support for darkfire legalization, which almost came to fruition in 1308.

Despite sharing a common interest for a better economic future, Finzi supporters and Mason supporters were fiercely opposed to each other to the point of violence. When he lost to Waltmann in the controversial 1308 election, Mason continued his campaign, refusing to concede and continuing to rally his supporters. He was about to host a meeting in the Chemkan city of Tandowyn that November when he was assassinated. KCG leaders blamed the assassination on Finzi and his supporters, and launched a nationwide act of vengeful violence against the Finzi Darkfire Community, bringing the Early Republic very close to a civil war.

And thus, in the beginning of 1309, it was Prime Minister Waltmann serving as the only force preventing the two dueling nationwide political factions from engaging in an all-out conflict. In September 1309, Waltmann gestured for the Banks to engage in a possible deep-trade opportunity in Ancondria. However, that opportunity proved false and sent the Retunian markets crashing again; and this time, for the first time in history, the Retunian government declared bankruptcy. This prompted nationwide protests while Waltmann got involved in a scuffle with his appointed Governor General, William Irving, who pulled out a pistol and shot Waltmann dead. The Retunian government moved to instill Marshall Noland as the Interim Prime Minister, but at a critical moment, the officiation was interrupted by a missile shot by the KCG, forcing the government of the Early Republic to cease functions.

And so began the 1309 Revolution, over which Finzi and his supporters would ultimately prevail on 7 September 1309. The KCG and their allies fled to Gymia, which had declared autonomy from what would become the Independent Commonwealth State of Retun. The former Gymian territory became the Reformed Federal Estates of Retun and would declare a war on the Commonwealth in 1311, but would lose to the Commonwealth the following year. Meanwhile, Finzi and the Commonwealth government enacted sweeping policies that eradicated the financial economic woes of the 1301 Crisis.

2 notes

·

View notes

Text

Understanding the Importance of Credit Ratings for SMEs, MSMEs, and Startups in India

In the ever-evolving landscape of the Indian economy, Small and Medium Enterprises (SMEs), Micro, Small and Medium Enterprises (MSMEs), and startups play a pivotal role. These entities not only drive innovation but also create significant employment opportunities and contribute extensively to the GDP. However, one of the fundamental challenges they face is access to capital. This is where the importance of a robust credit rating comes into play.

Why is Credit Rating Crucial?

1. Access to Finance: Credit ratings determine the creditworthiness of a business. A high credit rating reassures lenders of the lower risk involved in extending credit to the business. This can lead to easier access to loans, lower interest rates, and more favorable repayment terms. For SMEs, MSMEs, and startups, which typically face higher scrutiny from financial institutions, a good credit rating can open doors to essential funding.

2. Credibility with Suppliers: A strong credit rating not only helps in securing finance but also enhances the business's credibility in the eyes of suppliers. Companies with better credit ratings can negotiate better credit terms such as longer payment durations and bulk order discounts, which can significantly improve cash flow management.

3. Competitive Advantage: In a market teeming with competition, a good credit rating can serve as a badge of reliability and sound financial health. This can be particularly beneficial in tendering processes where the financial stability of a business is a key consideration.

4. Lower Borrowing Costs: Businesses with higher credit ratings can secure loans at lower interest rates. Lower borrowing costs mean that the business can invest more in its growth and development, improving profitability and sustainability over time. This is especially critical for SMEs, MSMEs, and startups, where financial leverage can determine market positioning and long-term success.

How to Improve Your Credit Rating?

Improving and maintaining a good credit rating requires a strategic approach, including timely repayment of loans, prudent financial management, maintaining a balanced debt-to-income ratio, and regular monitoring of credit reports for any discrepancies.

Need Expert Guidance?

Understanding the nuances of credit ratings and effectively managing them can be complex. This is where expert financial advisory services, such as those offered by Finnova Advisory, come into play. Finnova Advisory specializes in providing tailored financial solutions that cater specifically to the unique needs of SMEs, MSMEs, and startups in India.

Whether you are looking to improve your credit score, secure funding, or streamline your financial strategies, connecting with the experts at Finnova Advisory can provide you with the insights and support you need to thrive in a competitive marketplace.

To learn more about how Finnova Advisory can assist your business in achieving financial excellence, visit their website or reach out directly for a personalized consultation. Remember, a robust credit rating is your gateway to not only securing finance but also establishing a strong foundation for your business's future growth and success.

5 notes

·

View notes

Text

Funding Plan for Chandan House Painting

As the owner of Chandan House Painting, I have devised a comprehensive funding plan to ensure our business is well-capitalized from the start. Here’s how we plan to secure the necessary funds:

1. Personal Savings

Source:

I will be utilizing my personal savings to provide an initial injection of capital into the business.

Rationale:

Control and Ownership: Using my own savings means I retain full control over the business, making strategic decisions without external interference.

No Interest Payments: By leveraging my savings, we avoid the burden of interest payments and debt, allowing us to reinvest profits directly back into the business.

Commitment: Investing personal savings demonstrates my commitment and belief in the success of Chandan House Painting.

Action Steps:

Assess and allocate a portion of my savings specifically for startup costs, ensuring personal financial stability is maintained.

2. Friends and Family Funding

Source:

I plan to raise additional funds through loans or investments from friends and family who believe in my vision and business plan.

Rationale:

Trust and Support: Friends and family are likely to offer financial support due to their trust in me and my business acumen.

Flexible Terms: These loans or investments often come with more flexible and favorable terms compared to traditional financing options.

Low-Cost Financing: Typically, these sources may offer lower interest rates or even interest-free loans, reducing the financial burden on the business.

Action Steps:

Prepare a professional business plan and presentation to clearly communicate the business potential and financial needs to friends and family.

Set clear, formal terms for any loans or investments, including repayment schedules and interest rates, to ensure transparency and maintain good relationships.

3. Small Business Grants and Loans

Source:

We will explore small business grants and loans available through government programs and financial institutions.

Rationale:

Non-Repayable Grants: Grants from government bodies and private organizations do not need to be repaid, providing essential funds without adding to our liabilities.

Favorable Loan Terms: Small business loans often come with favorable terms, including lower interest rates and flexible repayment schedules, making them a viable option for additional financing.

Support Programs: Programs such as the Canada Small Business Financing Program (CSBFP) offer valuable support and resources to startups.

Action Steps:

Research and identify suitable grants and loans specifically tailored for small businesses in Ontario.

Prepare comprehensive business and financial plans to strengthen our grant and loan applications.

Engage with local small business development centers and financial advisors to navigate the application processes effectively.

By combining personal savings, funds from friends and family, and leveraging small business grants and loans, Chandan House Painting will have a robust financial foundation. This diversified funding approach not only ensures that we have the necessary capital to start and run our business but also minimizes financial risks and fosters sustainable growth.

5 notes

·

View notes

Text

Where Will I Get the Money?

As the owner of Crafty Creations, securing the necessary funding is essential to successfully launch and grow my handmade jewelry and accessories business. Here's how I plan to gather the initial capital:

1. Personal Savings:

Initial Investment: I will use my personal savings to cover initial startup costs such as purchasing materials, tools, and packaging supplies. This personal investment shows my commitment and provides a foundation for the business.

2. Family and Friends:

Loans or Investments: I will approach family and friends who may be willing to provide loans or invest in my business. I will ensure these agreements are formalized with clear terms to maintain transparency and trust.

3. Microloans and Small Business Loans:

Microloan Programs: I will explore microloan programs offered by organizations like Kiva or Accion, which provide small loans to startups at reasonable interest rates.

4. Sales and Pre-orders:

Pre-sales: I will launch a pre-order campaign for my first collection, allowing customers to purchase items before they are officially released. This generates immediate revenue and gauges market interest.

Pop-up Events: Organize pop-up shops and participate in local craft fairs and markets to generate sales and build brand awareness.

By combining these funding sources, I am confident in my ability to secure the necessary capital to launch and grow Crafty Creations successfully. Each funding avenue will be carefully evaluated to ensure it aligns with my business goals and financial strategy.

3 notes

·

View notes

Text

Simplify Your Company Registration with MAS LLP: Your Trusted Partner for Business Success

Introduction: Starting a new business is an exciting venture, but the process of company registration can be daunting. If you're looking to register your company with ease and efficiency, MAS LLP is here to help. With years of expertise and a commitment to excellence, MAS LLP provides comprehensive company registration services tailored to meet your specific needs. In this blog, we will explore the benefits of registering your company and how MAS LLP can simplify the process, ensuring a smooth start for your business journey. Why Company Registration is Crucial 1. Legal Recognition and Protection Registering your company grants it legal recognition and protects your business name from being used by others. It also provides a legal framework within which your business can operate, ensuring compliance with local laws and regulations. 2. Credibility and Trust A registered company is perceived as more credible and trustworthy by clients, customers, and investors. It enhances your business reputation and can open doors to new opportunities, partnerships, and funding. 3. Access to Funding and Incentives Registered companies are eligible for various government schemes, grants, and incentives. Additionally, it is easier to secure loans and attract investors when your business is formally recognized. 4. Perpetual Succession A registered company enjoys perpetual succession, meaning it continues to exist even if the ownership or management changes. This ensures business continuity and stability. How MAS LLP Simplifies Company Registration Expert Guidance MAS LLP has a team of experienced professionals who are well-versed in the intricacies of company registration. Our experts guide you through each step of the process, from selecting the appropriate business structure to completing the necessary documentation. Tailored Solutions We understand that each business is unique. MAS LLP offers customized company registration services that cater to your specific needs and business objectives. Whether you’re a startup, small business, or large corporation, our tailored solutions ensure a seamless registration process. Efficient Documentation Navigating the paperwork involved in company registration can be overwhelming. MAS LLP handles all the documentation, ensuring accuracy and compliance with legal requirements. This reduces the risk of errors and delays, allowing you to focus on building your business. Transparent Process At MAS LLP, we believe in transparency and clear communication. We keep you informed throughout the registration process, providing regular updates and addressing any queries you may have. Our goal is to make the process as smooth and stress-free as possible. Post-Registration Support Our services don’t end with registration. MAS LLP offers ongoing support to help you manage compliance, maintain records, and navigate any legal or regulatory changes. This ensures your business remains compliant and operational in the long term. The MAS LLP Advantage Proven Track Record With years of experience in company registration and business consulting, MAS LLP has a proven track record of helping businesses successfully register and thrive. Our expertise spans various industries, making us a reliable partner for your business needs. Comprehensive Services In addition to company registration,

#audit#accounting & bookkeeping services in india#income tax#ajsh#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

4 notes

·

View notes

Text

The most common risks in Entrepreneurship

Entrepreneurship is inherently risky, with no guarantees of success. Whether you’re launching a startup, growing a small business, or pursuing a new venture, you’ll inevitably encounter challenges and uncertainties. Understanding the most common risks in entrepreneurship is essential for mitigating potential pitfalls and increasing your chances of success. In this blog post, we’ll explore some of the most prevalent risks entrepreneurs face and strategies for managing them effectively.

Financial Risk:

Financial risk is one of the most significant challenges for entrepreneurs. Starting and running a business requires capital for initial investment, operating expenses, and growth initiatives. However, many entrepreneurs need more resources, and cash flow constraints and uncertain revenue streams make financial management a critical concern. To mitigate financial risk, entrepreneurs should develop realistic budgets, secure adequate funding, monitor cash flow closely, and explore alternative financing options such as loans, grants, or equity investments.

Market Risk:

Market risk refers to the uncertainty associated with changes in consumer preferences, competitive dynamics, and economic conditions. Entrepreneurs must conduct thorough market research, analyze industry trends, and assess market demand to identify opportunities and threats. However, even with careful planning, market conditions can change rapidly, posing challenges for startups and established businesses. To manage market risk, entrepreneurs should stay agile, adapt to changing market conditions, diversify revenue streams, and maintain a customer-centric approach to product development and marketing.

Operational Risk:

Operational risk encompasses various challenges related to day-to-day business operations, including supply chain disruptions, technology failures, regulatory compliance issues, and human resource management. Poorly managed operations can lead to inefficiencies, delays, and costly mistakes that impact business performance and reputation. Entrepreneurs should implement robust processes and systems to mitigate operational risk, invest in technology and infrastructure, and prioritize employee training and development. Additionally, having contingency plans and disaster recovery strategies in place can help minimize the impact of unforeseen events on business operations.

Legal and Regulatory Risk:

Entrepreneurs must navigate a complex web of laws, regulations, and compliance requirements at the local, state, and federal levels. Violating legal or regulatory requirements can result in fines, penalties, lawsuits, and damage to reputation. Joint legal and regulatory risks include intellectual property disputes, contract breaches, data privacy violations, and labor law violations. Entrepreneurs should seek legal counsel, stay informed about relevant laws and regulations, and implement robust compliance programs to mitigate legal and regulatory risk. Additionally, having appropriate insurance coverage can provide extra protection against legal liabilities.

Reputational Risk:

Reputational risk is the potential damage to a business’s reputation and brand value due to negative publicity, customer complaints, ethical lapses, or public relations crises. In today’s digital age, news spreads quickly through social media and online platforms, making reputation management a critical concern for entrepreneurs. Entrepreneurs should prioritize transparency, integrity, and ethical business practices to safeguard their reputations. Building solid relationships with customers, employees, and stakeholders and proactively addressing issues and concerns can help protect the business’s reputation.

Conclusion:

Entrepreneurship is inherently risky, but with careful planning, strategic decision-making, and resilience, entrepreneurs can navigate challenges and seize opportunities for growth and success. By understanding the most common risks in entrepreneurship and implementing proactive risk management strategies, entrepreneurs can increase their chances of achieving their goals and building sustainable businesses. While risks will always be present, embracing them as opportunities for learning and growth can empower entrepreneurs to overcome obstacles and thrive in today’s dynamic business environment.

2 notes

·

View notes

Text

Navigating the World of European Funds: A Guide for Entrepreneurs

In today's rapidly evolving business landscape, accessing financial resources can be a crucial factor in the success of any entrepreneurial endeavor. One avenue that holds significant promise for aspiring business owners is European funds. These funds, often overlooked or misunderstood, can provide invaluable support to startups and small businesses looking to grow and thrive in competitive markets.

Understanding the landscape of European funds begins with grasping key concepts and navigating through various avenues of support. Here, we delve into the essentials, exploring topics ranging from CAEN codes to the role of women entrepreneurs in accessing these funds.

Fonduri Europene: Unlocking Opportunities

Fonduri Europene, or European funds, represent a pool of financial resources made available by the European Union to support a wide array of initiatives. These funds aim to foster economic growth, innovation, and competitiveness across member states. For entrepreneurs, accessing these funds can provide a vital boost in the form of grants, loans, or other forms of financial support.

CAEN Codes: Identifying Your Business Activity

CAEN (Clasificarea Activităților din Economia Națională) codes are a system used to classify economic activities in Romania. Choosing the right CAEN code for your business is crucial, as it determines your eligibility for specific funding programs. Thorough research and consultation can help entrepreneurs select the most appropriate CAEN codes that align with their business activities and objectives.

Inființare SRL: Setting Up Your Company

Inființare SRL (Societate cu Răspundere Limitată) refers to the process of establishing a limited liability company in Romania. Entrepreneurs seeking European funds often need to have a registered business entity to qualify for support. Navigating the legal and administrative requirements of company formation is essential for accessing funding opportunities and ensuring compliance with regulatory frameworks.

Consultanță Fonduri Europene: Expert Guidance

Navigating the complex landscape of European funds can be daunting for entrepreneurs. Seeking professional consultancy services specializing in European funds can provide invaluable guidance and support. These consultants offer expertise in identifying relevant funding opportunities, preparing applications, and navigating the intricacies of fund requirements, maximizing the chances of securing financial support for your business.

Startup Nation: Empowering Entrepreneurial Ventures

Startup Nation is a flagship program in Romania aimed at supporting the development of innovative startups and small businesses. Through grants and other forms of financial assistance, Startup Nation empowers entrepreneurs to turn their ideas into viable businesses, driving economic growth and innovation. Understanding the eligibility criteria and application process is essential for entrepreneurs looking to benefit from this program.

Femeia Antreprenor: Empowering Women Entrepreneurs

In recent years, there has been a growing recognition of the role of women entrepreneurs in driving economic growth and innovation. Programs and initiatives specifically tailored to support women entrepreneurs, such as Femeia Antreprenor (Women Entrepreneur), aim to address the unique challenges faced by women in business and provide them with the resources and support needed to succeed.

In conclusion, navigating the world of European funds requires a combination of strategic planning, thorough research, and expert guidance. By understanding key concepts such as CAEN codes, company formation, and the role of consultancy services, entrepreneurs can unlock valuable opportunities for financial support. Initiatives like Startup Nation and programs supporting women entrepreneurs further enhance the accessibility of European funds, empowering aspiring business owners to turn their visions into reality.

youtube

2 notes

·

View notes

Text

Top Challenges Facing Small Businesses in Kerala and How Consultants Can Help

Kerala is known for its thriving small business landscape from restaurants to shops to technology startups. However, many promising small businesses in business consultants in Kerala struggle with common obstacles that stifle their growth and progress.

Business consultants based in Kerala or working with clients in the state understand these pain points well. They can provide tailored guidance and actionable solutions to help small business owners overcome challenges. This enables entrepreneurs to focus their energy on nurturing innovation, attracting customers, and expanding their ventures.

Funding Shortages

Access to sufficient capital and cash flow is one of the biggest challenges for Kerala's small businesses. Many struggle to fund expansions, hire additional employees, invest in technology, or even manage day-to-day operating expenses. Business consultants may connect clients to government small business grants or loans. They can also design cost management plans, suggest bootstrapping strategies and tactics for minimizing expenses.

Compliance Issues

Navigating India’s often complex regulatory framework around taxation, licensing requirements, labor laws and more causes headaches for small business owners in Kerala. Business consultants can ensure clients avoid penalties or litigation by staying compliant. They can handle license and permit registrations, file taxes correctly, advise on the best corporate structure, and manage other compliance processes.

Talent Gaps

Another persistent struggle is recruiting and retaining qualified employees — especially for technology roles. Kerala’s talent pool is still developing, so hyperlocal hiring can be difficult. Business consultants leverage professional networks to connect clients to candidates in Kerala or expand searches regionally/nationally. Retention consulting may also analyze workplace culture issues or present counteroffers/incentives to stop top performer attrition.

Scaling Pains

Many entrepreneurs in Kerala struggle with the nuances of expanding locally or into other major metros. Business consultants can provide market feasibility studies, assistance finalizing expansion locations, advice on financing growth, and project manage all moving parts of bringing a small business to new regions.

By leveraging business consultants as strategic partners, small business owners in Kerala can overcome obstacles, avoid missteps, and receive guidance tailored to local market dynamics. With the right support, Kerala’s many promising small ventures can thrive, expand, and continue fueling local economic development.For more details plz contact us, pridepaths.co.in

2 notes

·

View notes

Text

Navigating the Path to Success: Understanding Business Loans for Entrepreneurs

In the ever-evolving landscape of business, the journey from concept to successful establishment often requires a potent infusion of capital. For entrepreneurs, accessing funds through business loans can be a pivotal step towards turning their dreams into reality. Whether it's starting a new venture or expanding an existing one, the strategic use of business loans can provide the necessary financial backbone to foster growth and sustainability.

Understanding Business Loans:

Business loans are financial instruments tailored to meet the diverse needs of entrepreneurs. They come in various forms, each designed to address specific business requirements. The key types include:

1.Term Loans:

These loans involve borrowing a lump sum amount that is repaid over a predetermined period with fixed interest rates. Term loans are ideal for significant investments like equipment purchases, expansion projects, or real estate acquisitions.

2. Lines of Credit:

Providing a revolving credit facility, lines of credit enable businesses to borrow funds up to a certain limit. Entrepreneurs can withdraw as much or as little as needed, paying interest only on the amount used. This flexibility makes it suitable for managing day-to-day operations, covering seasonal fluctuations, or addressing unforeseen expenses.

3.SBA Loans:

Backed by the Small Business Administration (SBA), these loans offer favorable terms and lower interest rates. SBA loans provide financial support for various business needs, including working capital, equipment, and real estate.

4.Equipment Financing:

Specifically geared towards acquiring machinery or equipment, this type of loan allows businesses to spread the cost of these assets over time while maintaining cash flow.

5.Invoice Financing:

Also known as accounts receivable financing, this type of loan allows businesses to leverage their unpaid invoices for immediate capital. It's a useful option for businesses facing cash flow gaps due to delayed payments.

Choosing the Right Loan:

Selecting the most suitable loan requires a thorough understanding of your business needs, financial situation, and repayment capabilities. Factors to consider include:

Purpose:

Define the purpose of the loan. Is it for expansion, operational needs, equipment purchase, or something else?

Loan Amount:

* Assess the required amount considering present and future needs without overburdening the business.

- **Interest Rates and Terms:** Compare interest rates, repayment terms, and associated fees among different lenders to find the most favorable terms.

Creditworthiness:

A good credit history enhances the chances of securing loans with better terms. For startups or businesses with limited credit history, personal credit may be considered.

Collateral:

Some loans require collateral, such as business assets or personal guarantees. Understand the risks associated with offering collateral.

The Loan Application Process:

Applying for a business loan involves a systematic approach:

1. Prepare Documentation:

Lenders typically require documents such as business plans, financial statements, tax returns, and legal documents. Ensure these are up-to-date and accurately represent your business's financial health.

2. Research Lenders:

Explore various lenders, including banks, credit unions, online lenders, and alternative financing options. Each has its own set of criteria and advantages.

3. Submit Application:

Complete the loan application accurately and include all required documents. Some lenders may offer a prequalification process that gives an estimate of eligibility without impacting credit scores.

4. Review and Negotiation:

Once offers are received, carefully review terms and negotiate where possible to secure favorable terms.

5. Loan Approval and Repayment:

Upon approval, adhere to the agreed repayment schedule, managing finances responsibly to maintain a positive credit profile.

Benefits of Business Loans:

Utilizing business loans wisely can yield several advantages for entrepreneurs:

Facilitate Growth:

Loans provide the necessary capital for expansion, allowing businesses to seize growth opportunities.

Manage Cash Flow:

Access to funds during lean periods or to cover immediate expenses helps maintain stable operations.

Build Credit:

Timely repayment of loans contributes to building a positive credit history, improving future borrowing capabilities.

- **Invest in Innovation:**

Loans can fund research, development, or technology upgrades, fostering innovation within the business.

Challenges and Risks:

While business loans offer significant benefits, they also come with inherent risks:

Debt Burden:

Taking on too much debt without a solid repayment plan can strain finances and hinder growth.

Interest and Fees:

High-interest rates and additional fees can increase the overall cost of borrowing.

Risk of Default:

Inability to repay loans can lead to asset seizure, damaged credit, or even business closure.

Conclusion:

Business loans serve as catalysts for entrepreneurial ventures, providing crucial financial support for growth and sustainability. Understanding the various loan types, meticulous planning, and responsible financial management are vital elements in leveraging loans effectively. By evaluating needs, comparing options, and adopting a disciplined repayment approach, entrepreneurs can harness the power of business loans to steer their ventures towards success in today's dynamic business environment.

2 notes

·

View notes