#soooo worth emptying my bank account for

Explore tagged Tumblr posts

Text

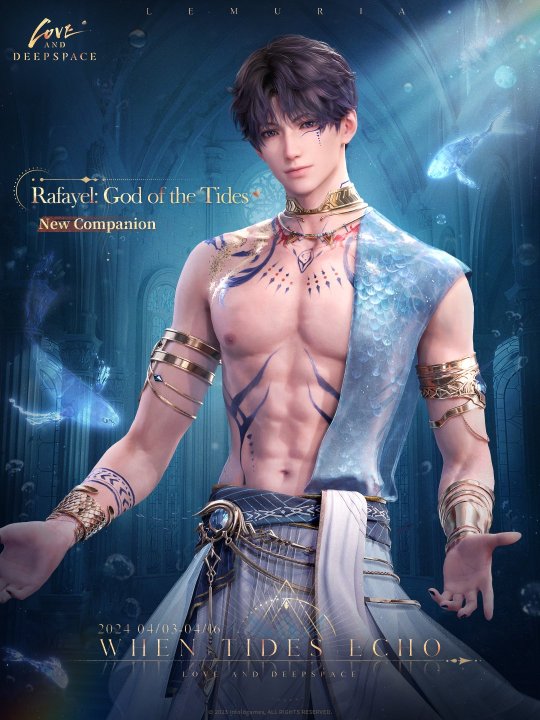

I am currently foaming at the mouth

ARE WE GETTING GOD OF THE SEA CRUMBS?? BEFOFE LEMURIA FELL?? DOES THIS MEAN THIS IS MC'S FIRST PAST LIVE WITH HIM?? SINCE HE GIFTS HER HIS HEART AND THEY DO THE VOW AND EVERYTHING OHMYGOSHDIEIWO

ALSO NEW COMPANIONQKSOOW ARE YOU KIDDING MEKELDO I am not okay. The lore drop will be crazy. Do yall REALIZE WHAT THIS MEANS

#i will go broke#soooo worth emptying my bank account for#rafayel love and deepspace#yall this might be mc's FIRST EVER live since its maybe before he gives her his heart

5 notes

·

View notes

Text

(If you are reading this thank you but under the cut it's just me ranting in extremely bad English about me wanting to go on a work holiday break, nothing bad but be aware and don't hurt your brain with my bad grammar)

I want to take two weeks off work to do a little trip. I still don't know where but maybe in china? Because I am kinda obsessed with Historical Cdrama and it would be cool i think? But idk I am always open to suggestions

Because idk last time I traveled was in 2018 (I went to Poland to do a comic course because I had a discount, it was very nice and it was also hilarious because I didn't speak a word of Polish and my phone (RIP Samsung Galaxy s4) broke at the airport and I had all my tickets and google translate there it was memorable AHAHAHAHA)

I do not usually crave for travel, but idk i feel like I need a little break from everything because i am going depressively insaneeeeee eheheheheeeeeeehhhh

(Obviously only if my work bosses give me permission to take two weeks off, and they usually do everything last minute soooo I'll know if they approved it maybe in a couple of months i hope ehehehehe)

Is it worth it to spend 5-6 months wadge on a silly travel?

Probably not so much but I just want to do something ya know.

I actually have no idea how much a travel could cost, but i hope waaaay less than 4000€ with fly, food and sleep because come onnn I can't empty my bank account for thisssssss and I'll need money for food and pay bills once i get home sooooooo yeah

Please capitalism have mercy on me

Also I'll probably be all alone so I'll need to spend more to get a guide or something because you know safety and shit. And I'll need to get a passport and the bureaucracy to have it is soo Ughuuuuugghhhh just the thought is stressing me

Anyway

If i see the trip would be too expensive i'll simply stay home and drive for 2 hours to go to see the sea because fuck it.

Oh! Or I could go to Greece!! I am also obsessed with the Odyssey and Epic The Musical so it would be a good trip too. And it's very near to Italy so it's good and It should be cheaper i guess

I asked for the last two weeks of May I hope it will be warm enough

Also everyone usually asks to have time off in summer (but only two of us can take time off simultaneously because we can't leave the hospital without workers) so I hope in May I'll have some chances to get an okay

Also I sent my boss accidentally 3 times the wrong dates so today she was like "PLEASE STOP SENDING ME EMAILS ABOUT THIS JUST TELL ME IN PERSON" and I was like *press 'send email' button*

That's it, I just wanted to write this somewhere it is more or less a stream of consciousness.

I hope you all are doing well and enjoyed your day friends

5 notes

·

View notes

Note

I don’t really know how bubble works. Do you have to pay for it? I thought it would be the same as weverse but it isn’t.

im no bubble,,, master cause i dont have any of their bubbles (been thinking about it tho,,, and i really want to get it but then theres the whole like "aight,,, pick" and im like how the fuck am i supposed to pick, its either empty my bank account or be a bitch)

OK BUT ANYWAYS, bubble is like a subscription thing where you pay a monthly fee in order to talk to an idol of your choice. you purchase something called a "ticket" and this ticket is used to subscribe to one idols bubble. if you want multiple idols you are going to have to purchase multiple tickets.

theres a bunch of rules to bubble so like you cant send more than three messages in a row and one text message can only contain 30 characters or smth and it changes depending on the days you have been subscribed and so on,,,,

its a weird ass system and like they very seldom reply to you personally? many times they send out group messages and its not personal but its still personal for those who have said idols bubble ^^ UUUUHM,,,, what more,,,, i mean if we are talking about skz the different members are active in different ways. i think the most active ones are like hyunjin and jeongin and least active are probably chan and changbin BUT ITS PROBABLY WORTH IT ANYWAYS >:((

ah,,, ive been wanting hyunjins bubble for soooo long >:((( i should get it heheheheh <//3

3 notes

·

View notes

Text

Bezos’ Saudi Blunder; NFLX Buffers; NIO Chunders

Bezos’ Saudi Blunder; NFLX Buffers; NIO Chunders:

Phishing With Princes

“This is soooo funny! Like and share to see what happens!”

Few things in the English language get my blood boiling more than phrases like these. They come in emails, on Facebook posts, in direct messages and through texts. What’s even more infuriating is that people I know send this stuff to me — even though they know better!

No, Uncle Jerry, the Nigerian prince isn’t going to send you any money. And neither is Bill Gates. Stop sharing this crap!

If you want to know the dangers of sharing these emails/texts/messages, just ask Amazon.com Inc. (Nasdaq: AMZN) CEO and founder Jeff Bezos.

Back in 2018, Bezos’ iPhone was hacked after he viewed a video sent to him via WhatsApp. The sender wasn’t a Nigerian prince … but someone connected to the Saudi prince. The hackers lifted personal images that complicated Bezos’ divorce that year. They also reportedly skimmed gigabytes of data in the process, but exactly what they got hasn’t been revealed.

The situation has since escalated well beyond a romantic spat, however. The United Nations (U.N.) is now involved. That’s serious.

“The information we have received suggests the possible involvement of the Crown Prince in surveillance of Mr. Bezos, in an effort to influence, if not silence, The Washington Post’s reporting on Saudi Arabia,” U.N. representatives said in a statement this morning. The U.N. is calling for an immediate investigation. (FYI, Bezos also owns The Washington Post.)

The Saudis have rejected the claims as “absurd.”

Still, FTI Consulting, the business advisory firm that carried out the hacking investigation, says it has “medium to high confidence” that Bezos’ phone was hacked by malware from an account used by the Saudi crown prince.

The Takeaway:

There are two takeaways here:

Don’t open any message, attachment or link you don’t recognize!

Don’t open any message, attachment or link you don’t recognize!

Yes, No. 1 and No. 2 are the same. Yes, it’s that important. It doesn’t matter whom the message, attachment or link comes from. This includes relatives and friends … especially relatives and friends!

No one will send you money, no matter how many forwards or “likes” you get. No amount of laughter is worth opening that “funny” image/video — it isn’t that funny anyway.

And if you think: “It won’t happen to me! I’ve got great security on my devices!” — just remember Jeff Bezos, founder of Amazon and the richest guy in the world.

His security was far beyond anything that you or I could afford. What’s more, he was using arguably two of the more secure platforms on mobile: an iPhone and WhatsApp — both so encrypted that even the U.S. government can’t crack them.

So, no, Uncle Jerry, that copy of Norton/McAfee won’t keep you safe. Once you open a message, click an attachment or visit a link, you’ve given your permission to whatever is on the other side. Not even the best cybersecurity in the world can help you at that point.

In these situations, just remember Great Stuff’s words to live by: When in doubt, delete it out — at least until the world runs completely on blockchain.

Blockchain? What’s that?

Right, blockchain! You know, the ultra secure digital ledger that records transactions like no one’s business? This tech is perfect for our less-than-secure world … especially for when your “long-lost cousin” is “totally stranded” in an “Indonesian airport.”

Blockchain tech could disrupt everything about how we use money, from banking to retail to real estate.

But Mr. Great Stuff, can you tell me more about what blockchain is? I bet there’s a way to invest in it, too…

I could tell you more, but it’s best that you hear it from famed tech expert Paul Mampilly. Thousands of Great Stuff readers love Paul Mampilly’s insights into the latest tech trends … and blockchain is no different.

Click here to hear why blockchain is so disruptive — and the gigantic profit potential it’s unleashing.

Good: Earnings Don’t Mean Squat

I tried to warn you on Friday when Great Stuff previewed earnings for Netflix Inc. (Nasdaq: NFLX). Did you listen? I hope so.

By all conceivable measures, Netflix’s quarterly report was out of this world. Earnings skyrocketed 333% to $1.30 per share from $0.30 a year ago. Revenue soared to $5.5 billion. Wall Street expected earnings of $0.50 per share and revenue of $5.4 billion. Heck, even the Whisper Number projected a mere $0.58 per share in earnings.

And what did NFLX get for its troubles? A loss of more than 2% on the day.

But why? Netflix said it now has more than 60 million subscribers worldwide. It reported 8.3 million new international subscribers, beating expectations.

The reason for the 2% drop? Domestic growth concerns. Netflix only added 420,000 subscribers domestically, versus expectations for 618,000 adds. What’s more, 2020 guidance only called for 7 million new subscribers, compared to 9.2 million new subs in 2019.

Subscriber growth is slowing, and investors fear that Netflix has hit peak saturation. With the company spending billions on content this year, that could mean lower returns and higher negative cash flow.

That said, Netflix proved that it could execute even amid a fresh assault from The Walt Disney Co.’s (NYSE: DIS) Disney+. Furthermore, I think both investors and analysts are discounting international subscribers way too much. It is a global market after all, and Netflix is quickly doing to the rest of the world what it did stateside last decade.

In short, keep your eyes on Netflix, as this dip might be a buying opportunity.

Better: Old Dog, New Tricks

Surprise! International Business Machines Corp. (NYSE: IBM) is relevant again.

Big Blue is among the last of the old-school tech giants to move to the cloud, and it’s paying off big. The company reported earnings of $4.71 per share, $0.02 better than the consensus.

Revenue was also ahead of expectations at $21.78 billion.

The kicker for IBM? A 21.8% jump in cloud revenue to $6.8 billion. It’s amazing what charging to support a free operating system can do for your bottom line — thanks Red Hat Linux!

Things are going so well, IBM also boosted its 2020 outlook above analyst expectations.

This is the most excitement IBM investors have seen in years. Seriously. The stock has basically gone nowhere in the past five years.

As boring as it sounds, maybe paying $34 billion to buy out software company Red Hat really was the best thing to happen to IBM. I’m still having trouble getting excited about this dinosaur, though … if you couldn’t tell.

Best: Look out Below!

So, when I started out writing on Nio Inc. (NYSE: NIO) this morning, the shares were up about 5%. I was impressed … truly. Nio was on its way to an unprecedented 10-day rally, gaining more than 60% in the process.

But, in true Nio fashion, those gains were not to last. The stock rolled over sharply this afternoon, as investors decided that $5 per share was too much to pay for the Chinese electric vehicle (EV) maker.

The $5 area could be quite the hurdle for Nio. The company is riding high off December’s stellar earnings call, reports of a $1 billion cash infusion from GAC Group and Tesla Inc.’s (Nasdaq: TSLA) EV success in China.

In fact, NIO shares have more than tripled in the past three months. With that level of speculation, however, comes an equal level of volatility. There’s no bad news making the rounds on Nio today, so this sudden midday drop is likely due to profit-taking.

I mean, if you banked a 200%-plus gain on a speculative Chinese EV stock, wouldn’t you take profits?

The company has investment potential (if you have the risk tolerance). But, if you’re looking to jump in, you should probably wait until the stock comes back to earth a bit more.

Let’s revisit our two rules, shall we?

Don’t open any message, attachment or link you don’t recognize!

Don’t open any message, attachment or link you don’t recognize!

Thank you.

Great Stuff: Feed the Beast

You better believe it’s that time again.

You have less than 12 hours to drop me a line at [email protected] to make this week’s edition of Reader Feedback.

We take all kinds here: comments, questions, witty remarks and secret recipes. As always, no cursing, please. We can’t publish that s#&%.

I’ll get the festivities started for you:

Have you kept up with the Senate impeachment trials?

Would you spot a cyber hack or phishing scam — before it’s too late?

Have you ever made ridiculous profits off speculative Chinese stocks?

Are you keeping your New Year’s resolutions? (And is your local gym back to being empty?)

In the meantime, don’t forget to check out Great Stuff on social media. If you can’t get enough meme-y goodness, follow me on Facebook, Twitter and Instagram!

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing

0 notes

Link

Phishing With Princes

“This is soooo funny! Like and share to see what happens!”

Few things in the English language get my blood boiling more than phrases like these. They come in emails, on Facebook posts, in direct messages and through texts. What’s even more infuriating is that people I know send this stuff to me — even though they know better!

No, Uncle Jerry, the Nigerian prince isn’t going to send you any money. And neither is Bill Gates. Stop sharing this crap!

If you want to know the dangers of sharing these emails/texts/messages, just ask Amazon.com Inc. (Nasdaq: AMZN) CEO and founder Jeff Bezos.

Back in 2018, Bezos’ iPhone was hacked after he viewed a video sent to him via WhatsApp. The sender wasn’t a Nigerian prince … but someone connected to the Saudi prince. The hackers lifted personal images that complicated Bezos’ divorce that year. They also reportedly skimmed gigabytes of data in the process, but exactly what they got hasn’t been revealed.

The situation has since escalated well beyond a romantic spat, however. The United Nations (U.N.) is now involved. That’s serious.

“The information we have received suggests the possible involvement of the Crown Prince in surveillance of Mr. Bezos, in an effort to influence, if not silence, The Washington Post’s reporting on Saudi Arabia,” U.N. representatives said in a statement this morning. The U.N. is calling for an immediate investigation. (FYI, Bezos also owns The Washington Post.)

The Saudis have rejected the claims as “absurd.”

Still, FTI Consulting, the business advisory firm that carried out the hacking investigation, says it has “medium to high confidence” that Bezos’ phone was hacked by malware from an account used by the Saudi crown prince.

The Takeaway:

There are two takeaways here:

Don’t open any message, attachment or link you don’t recognize!

Don’t open any message, attachment or link you don’t recognize!

Yes, No. 1 and No. 2 are the same. Yes, it’s that important. It doesn’t matter whom the message, attachment or link comes from. This includes relatives and friends … especially relatives and friends!

No one will send you money, no matter how many forwards or “likes” you get. No amount of laughter is worth opening that “funny” image/video — it isn’t that funny anyway.

And if you think: “It won’t happen to me! I’ve got great security on my devices!” — just remember Jeff Bezos, founder of Amazon and the richest guy in the world.

His security was far beyond anything that you or I could afford. What’s more, he was using arguably two of the more secure platforms on mobile: an iPhone and WhatsApp — both so encrypted that even the U.S. government can’t crack them.

So, no, Uncle Jerry, that copy of Norton/McAfee won’t keep you safe. Once you open a message, click an attachment or visit a link, you’ve given your permission to whatever is on the other side. Not even the best cybersecurity in the world can help you at that point.

In these situations, just remember Great Stuff’s words to live by: When in doubt, delete it out — at least until the world runs completely on blockchain.

Blockchain? What’s that?

Right, blockchain! You know, the ultra secure digital ledger that records transactions like no one’s business? This tech is perfect for our less-than-secure world … especially for when your “long-lost cousin” is “totally stranded” in an “Indonesian airport.”

Blockchain tech could disrupt everything about how we use money, from banking to retail to real estate.

But Mr. Great Stuff, can you tell me more about what blockchain is? I bet there’s a way to invest in it, too…

I could tell you more, but it’s best that you hear it from famed tech expert Paul Mampilly. Thousands of Great Stuff readers love Paul Mampilly’s insights into the latest tech trends … and blockchain is no different.

Click here to hear why blockchain is so disruptive — and the gigantic profit potential it’s unleashing.

Good: Earnings Don’t Mean Squat

I tried to warn you on Friday when Great Stuff previewed earnings for Netflix Inc. (Nasdaq: NFLX). Did you listen? I hope so.

By all conceivable measures, Netflix’s quarterly report was out of this world. Earnings skyrocketed 333% to $1.30 per share from $0.30 a year ago. Revenue soared to $5.5 billion. Wall Street expected earnings of $0.50 per share and revenue of $5.4 billion. Heck, even the Whisper Number projected a mere $0.58 per share in earnings.

And what did NFLX get for its troubles? A loss of more than 2% on the day.

But why? Netflix said it now has more than 60 million subscribers worldwide. It reported 8.3 million new international subscribers, beating expectations.

The reason for the 2% drop? Domestic growth concerns. Netflix only added 420,000 subscribers domestically, versus expectations for 618,000 adds. What’s more, 2020 guidance only called for 7 million new subscribers, compared to 9.2 million new subs in 2019.

Subscriber growth is slowing, and investors fear that Netflix has hit peak saturation. With the company spending billions on content this year, that could mean lower returns and higher negative cash flow.

That said, Netflix proved that it could execute even amid a fresh assault from The Walt Disney Co.’s (NYSE: DIS) Disney+. Furthermore, I think both investors and analysts are discounting international subscribers way too much. It is a global market after all, and Netflix is quickly doing to the rest of the world what it did stateside last decade.

In short, keep your eyes on Netflix, as this dip might be a buying opportunity.

Better: Old Dog, New Tricks

Surprise! International Business Machines Corp. (NYSE: IBM) is relevant again.

Big Blue is among the last of the old-school tech giants to move to the cloud, and it’s paying off big. The company reported earnings of $4.71 per share, $0.02 better than the consensus.

Revenue was also ahead of expectations at $21.78 billion.

The kicker for IBM? A 21.8% jump in cloud revenue to $6.8 billion. It’s amazing what charging to support a free operating system can do for your bottom line — thanks Red Hat Linux!

Things are going so well, IBM also boosted its 2020 outlook above analyst expectations.

This is the most excitement IBM investors have seen in years. Seriously. The stock has basically gone nowhere in the past five years.

As boring as it sounds, maybe paying $34 billion to buy out software company Red Hat really was the best thing to happen to IBM. I’m still having trouble getting excited about this dinosaur, though … if you couldn’t tell.

Best: Look out Below!

So, when I started out writing on Nio Inc. (NYSE: NIO) this morning, the shares were up about 5%. I was impressed … truly. Nio was on its way to an unprecedented 10-day rally, gaining more than 60% in the process.

But, in true Nio fashion, those gains were not to last. The stock rolled over sharply this afternoon, as investors decided that $5 per share was too much to pay for the Chinese electric vehicle (EV) maker.

The $5 area could be quite the hurdle for Nio. The company is riding high off December’s stellar earnings call, reports of a $1 billion cash infusion from GAC Group and Tesla Inc.’s (Nasdaq: TSLA) EV success in China.

In fact, NIO shares have more than tripled in the past three months. With that level of speculation, however, comes an equal level of volatility. There’s no bad news making the rounds on Nio today, so this sudden midday drop is likely due to profit-taking.

I mean, if you banked a 200%-plus gain on a speculative Chinese EV stock, wouldn’t you take profits?

The company has investment potential (if you have the risk tolerance). But, if you’re looking to jump in, you should probably wait until the stock comes back to earth a bit more.

Let’s revisit our two rules, shall we?

Don’t open any message, attachment or link you don’t recognize!

Don’t open any message, attachment or link you don’t recognize!

Thank you.

Great Stuff: Feed the Beast

You better believe it’s that time again.

You have less than 12 hours to drop me a line at [email protected] to make this week’s edition of Reader Feedback.

We take all kinds here: comments, questions, witty remarks and secret recipes. As always, no cursing, please. We can’t publish that s#&%.

I’ll get the festivities started for you:

Have you kept up with the Senate impeachment trials?

Would you spot a cyber hack or phishing scam — before it’s too late?

Have you ever made ridiculous profits off speculative Chinese stocks?

Are you keeping your New Year’s resolutions? (And is your local gym back to being empty?)

In the meantime, don’t forget to check out Great Stuff on social media. If you can’t get enough meme-y goodness, follow me on Facebook, Twitter and Instagram!

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing

0 notes