#some sources say that developed 40 thousand years ago and some say like 28

Explore tagged Tumblr posts

Note

i’m curious, what place/time period was jane born in? (e.g. ancient rome, medieval europe, victorian england, etc)

-🪴

At one point I said she was 30,000 something years old, and someone else pointed out that that would mean she was born in the ice age, so I’m rolling with that lol. It’s either that or she can teleport between universes and I haven’t 100 percent decided yet. Leaving my options open…

#janes pets#okay funny thing:#in the picrew I made of her she’s white#and after admittedly very breif research I’m not even sure white skin existed 30#thousand years ago#some sources say that developed 40 thousand years ago and some say like 28#obviously it’s impossible to 100 percent know#hence the wide range#i think it’s funny that it might be impossible for someone who looks like her to have existed in the ice age at all#oh well#this universe isn’t the same universe we live in anyway#there’s magic

2 notes

·

View notes

Text

Valyrian Translator

So what if you do actually want to learn Dothraki or Valyrian? Of course, the ideal scenario would be to have an actual language exchange with a Dothraki warrior or a nobleman from Essos for Valyrian. High Valyrian is the language of the old Valyrian Freehold which was located on the eastern continent of Essos. Much of Essos was once dominated by the Valyrians for thousands of years, stretching from the Free Cities in the west, to Slaver's Bay in the east. The Valyrians forced the peoples they subjugated to speak in (or at least be able to converse in) their language. After the Doom of.

From A Wiki of Ice and Fire

Jump to: navigation, search

High Valyrian is a language originating from Valyria and the Valyrian Freehold. Corrupted dialects known as bastard Valyrian are spoken in the Free Cities(1) and Slaver's Bay.(2)

2High Valyrian

3Bastard Valyrian

History

Some of the oldest remaining ancient texts were written by Andals, Valyrians, Ghiscari, and Asshai'i.(3) After the Old Empire of Ghis was conquered by the Valyrian Freehold in the Ghiscari wars, the Ghiscari began speaking the High Valyrian of their conquerors.(4)

High Valyrian is no longer widely spoken due to the Doom of Valyria,(5) and most Valyrian records were destroyed in the catastrophe.(6) The tongues of the Free Cities have continued to evolve from the original High Valyrian.(5)

Queen Alysanne Targaryen is said to have begun learning how to read from Valyrian scrolls while still at the breast of her mother, Queen Alyssa Velaryon.(7) Alysanne's husband, King Jaehaerys I Targaryen, was fascinated with the Old Valyrian scrolls in the library of Dragonstone.(8)

How to lead jo owen ebook reader. Racallio Ryndoon is said to have spoken a dozen dialects of Valyrian.(9) Lord Alyn Velaryon studied Valyrian treaties about warship design and sea tactics when he visited the Citadel.(9)Larra Rogare, the wife of Prince Viserys Targaryen, was fluent in High Valyrian and the dialects of Lys, Myr, Tyrosh, and Volantis.(10)

Some highborn children of Westeros are still taught Valyrian as a sign of their noble education.(11)(12) Songs(13) and scrolls(14)(15) are still sung and read in High Valyrian, although by 300 AC most Westerosi nobles cannot understand the language.(13)

High Valyrian

Language

The High Valyrian phrase valar morghulis(16) is translated as 'all men must die.'(17) A counterpart phrase, valar dohaeris,(18) is translated as 'all men must serve.'(19)

The word dracarys is translated as meaning 'dragonfire.'(20) Obsidian is called 'dragonglass' in the Common Tongue, but 'frozen fire' in High Valyrian.(21)Valonqar is the word for 'little brother.'(22) High Valyrian is the most likely source language for maegi (pronounced differently from 'Maggy'),(23) which means 'wise'.(24)

The Valyrian writing system, or at least a Valyrian writing system, is described as involving glyphs.(25) It was also probably standard practice to write on scrolls, and not in books.(26) The glyphs can also be inscribed, as on an old Valyrian dragon horn, which, when sounded, had 'every line and letter shimmering with white fire.'(27) Valyrian carvings have been found on obelisks.(28)

Valyrian steel is forged with spells, as well as hammers.(29) Some smiths still know them, although not entirely.(30)

Names

House Targaryen came from Valyria and thus most of its members can be considered to have High Valyrian names. These include:

Aegon

Aelor

Aelora

Aelyx

Aemon

Aemond

Aenar

Aenys

Aerea

Aerion(26)

Aeryn

Aerys

Alysanne(31)

Ayrmidon(14)

Baela

Baelon

Baelor

Daella

Daemion

Daemon

Daena

Daenerys(32)

Daenora

Daenys

Daeron

Elaena

Gael

Gaemon

Helaena

Jaehaera

Jaehaerys

Maegelle

Maegon

Maegor

Maekar

Maelys(33)

Naerys

Rhae

Rhaegar

Rhaegel

Rhaella

Rhaelle

Rhaena

Rhaenyra

Rhaenys

Rhalla

Saera

Shaena

Shaera

Vaegon

Vaella

Valarr

Valerion

Visenya

Viserra

Viserys

English To Valyrian Translator

Houses Baratheon, Celtigar, Qoherys, and Velaryon are of Valyrian descent, and thus these names are possibly Valyrian as well.(34)(35)

Velaryon first names include:

Aethan

Corlys

Daenaera

Jacaerys

Laena

Laenor

Lucerys

Monterys

Vaemond

Valaena

Jaenara Belaerys was a Valyrian explorer(36) and Aurion was a would-be emperor.(37)

The Valyrians most likely gave Valyrian names to their dragons, as the dragons Balerion, Meraxes, Vhagar, and Syrax were named after Valyrian gods and goddesses.(38)(39) However, not all dragons of House Targaryen had Valyrian names (e.g., Queen Alysanne Targaryen's dragon, Silverwing(31)).

Eight of the nine Free Cities were founded as colonies of the Valyrian Freehold, and are thus likely to bear Valyrian names as well:

Volantis's satellite towns of Selhorys, Valysar, and Volon Therys likely have Valyrian names as well. It is also probable that Elyria, Mantarys, Oros, Tolos, Tyria, and Velos are Valyrian in name, being cities close to Old Valyria.(40)

Bastard Valyrian

Free Cities

Bastard Valyrian includes the languages of the nine Free Cities.(1) Each of the cities has its own dialect, and each dialect likely has its own separate derived vocabulary. Syrio Forel of Braavos speaks the Common Tongue with a lilting accent.(41) One of the Brave Companions is described as having a thick Myrish accent.(42)

The Free Cities use glyphs to write Valyrian.(43) The Valyrian of the Free Cities is described as sounding 'liquid'.(44)

Slaver Cities

Valyrian Translations Season 4

The Old Empire of Ghis was conquered by the Valyrian Freehold five thousand years ago, and the Ghiscari have since spoken High Valyrian. The Slaver's Bay cities of Yunkai, Meereen, and Astapor have their own versions of bastard Valyrian, which have been influenced mainly by Old Ghiscari, the ancient language of Old Ghis. Like the Free Cities, the people of the Slaver Cities use glyphs to write Valyrian.(2)

English myanmar dictionary software, free download. English to Myanmar or Myanmar to English Offline Dictionary Main Features - Easy Navigation - Work without internet access - Auto suggest searching word - Search word using clipboard (Check 'Help' menu in app for usage) - Synchronise with server and get new meaning of words - Request New word - User can add new words - Voice Search (Need Internet Connection) - Voice, Quiz and Service Settings. Download English To Myanmar Dictionary for Android to it is not possible to either carry or open a Dictionary Book always. English Myanmar Dictionary Offline Free (English Burmese Dictionary Offline Free): With nearly 33000 English - Myanmar words and over 36000 Myanmar - English, this is the most sufficient free English - Myanmar, Myanmar - English offline dictionary for android with words updated regularly in term of quantity of words and their meaning. Program has attractive interface, easy to use with. English Myanmar Dictionary free download - iFinger Collins English Dictionary, Shoshi English To Bangla Dictionary, Wordinn English to Urdu Dictionary, and many more programs.

Astapori Valyrian is described as having a 'characteristic growl,' influenced by Ghiscari.(2) The dialect of Yunkai is close enough to that of Astapor to be mutually intelligible.(45)

Valyrian Voice Translator

Yunkai used to be part of the Old Empire of Ghis, and has multiple languages spoken in the city. Mhysa, Maela, Aelalla, Qathei, and Tato are given as words for 'mother', but which tongue fits which word is unknown (excepting the first, which is Ghiscari).(45)

Some slavers speak a mongrel tongue,(46) a blend of Old Ghiscari and High Valyrian.(47)

Characters familiar with High Valyrian

Valyrian Translation

Gerris Drinkwater speaks a halting approximation of High Valyrian.(12)

Haldon Halfmaester(48)

Tyrion Lannister learned to read High Valyrian on his maester's knee.(11)

Quentyn Martell can read and write High Valyrian but has little practice speaking it.(12)

Melisandre is known to pray in High Valyrian, the Common Tongue, and the speech of Asshai.(49)

Missandei(17)

Moqorro can apparently sing in High Valyrian.(50)

Septa Saranella tells Cersei Lannister the meaning of valonqar.(22)

Ser Barristan Selmy has some High Valyrian, though not as much as Daenerys Targaryen.(2)

Arya Stark knows some High Valyrian(51) but the kindly man insists that she improve it.(52)

Catelyn Stark considers the speech of Moreo Tumitis of Tyrosh to be the vulgar Valyrian of the Free Cities.(53)

Sweets is fluent in High Valyrian(54)

Aegon Targaryen is fluent in High Valyrian.(12)

Daenerys Targaryen(2)

Samwell Tarly only has a little High Valyrian.(55)

The closest thing the Windblown have to a company tongue is classic High Valyrian.(56) Their leader, the Tattered Prince, says 'and now we ride' to his men in the language.(56)

Quotes

Each of the Free Cities has its own history and character, and each has come to have its own tongue. These are all corruptions of the original, pure form of High Valyrian, dialects that drift further from their origin with each new century since the Doom befell the Freehold.(5)Download counter strike condition zero full.

Behind the Scenes

According to George R. R. Martin,

Tolkien was a philologist, and an Oxford don, and could spend decades laboriously inventing Elvish in all its detail. I, alas, am only a hardworking SF and fantasy novel(sic), and I don't have his gift for languages. That is to say, I have not actually created a Valyrian language. The best I could do was try to sketch in each of the chief tongues of my imaginary world in broad strokes, and give them each their characteristic sounds and spellings.(57)

David J. Peterson further developed High Valyrian for the television adaptation Game of Thrones.

References

↑ 1.01.1A Game of Thrones, Chapter 11, Daenerys II.

↑ 2.02.12.22.32.4A Storm of Swords, Chapter 23, Daenerys II.

↑The World of Ice & Fire, Ancient History: The Dawn Age.

↑The World of Ice & Fire, Ancient History: The Rise of Valyria.

↑ 5.05.15.2The World of Ice & Fire, The Free Cities.

↑The World of Ice & Fire, Ancient History: Valyria's Children.

↑Fire & Blood, The Year of the Three Brides - 49 AC.

↑Fire & Blood, Birth, Death, and Betrayal Under King Jaehaerys I.

↑ 9.09.1Fire & Blood, Under the Regents - The Voyage of Alyn Oakenfist.

↑Fire & Blood, The Lysene Spring and the End of Regency.

↑ 11.011.1A Dance with Dragons, Chapter 1, Tyrion I.

↑ 12.012.112.212.3A Dance with Dragons, Chapter 6, The Merchant's Man.

↑ 13.013.1A Storm of Swords, Chapter 60, Tyrion VIII.

↑ 14.014.1A Game of Thrones, Chapter 9, Tyrion I.

↑A Feast for Crows, Prologue.

↑A Clash of Kings, Chapter 47, Arya IX.

↑ 17.017.1A Storm of Swords, Chapter 27, Daenerys III.

↑A Feast for Crows, Chapter 6, Arya I.

↑A Feast for Crows, Chapter 34, Cat Of The Canals.

↑A Storm of Swords, Chapter 8, Daenerys I.

↑A Storm of Swords, Chapter 78, Samwell V.

↑ 22.022.1A Feast for Crows, Chapter 39, Cersei IX.

↑A Feast for Crows, Chapter 36, Cersei VIII.

↑A Game of Thrones, Chapter 72, Daenerys X.

↑A Game of Thrones, Chapter 3, Daenerys I.

↑ 26.026.1A Clash of Kings, Chapter 6, Jon I.

↑A Feast for Crows, Chapter 19, The Drowned Man.

↑The World of Ice & Fire, Beyond the Free Cities: The Grasslands.

↑A Game of Thrones, Chapter 1, Bran I.

↑A Storm of Swords, Chapter 32, Tyrion IV.

↑ 31.031.1A Storm of Swords, Chapter 40, Bran III.

↑A Dance with Dragons, Chapter 15, Davos II.

↑A Storm of Swords, Chapter 67, Jaime VIII.

↑Citadel. Heraldry: In the area of King's Landing

↑The Citadel. Heraldry: Houses in the Riverlands

↑The World of Ice & Fire, Beyond the Free Cities: Sothoryos.

↑The World of Ice & Fire, Ancient History: The Doom of Valyria.

↑Fire & Blood, Heirs of the Dragon - A Question of Succession.

↑A Clash of Kings, Chapter 12, Daenerys I.

↑A Dance with Dragons, Map of Valyria

↑A Game of Thrones, Chapter 22, Arya II.

↑A Storm of Swords, Chapter 39, Arya VII.

↑A Game of Thrones, Chapter 65, Arya V.

↑A Clash of Kings, Chapter 27, Daenerys II.

↑ 45.045.1A Storm of Swords, Chapter 42, Daenerys IV.

↑A Dance with Dragons, Chapter 59, The Discarded Knight.

↑A Dance with Dragons, Chapter 60, The Spurned Suitor.

↑A Dance with Dragons, Chapter 14, Tyrion IV.

↑A Clash of Kings, Chapter 10, Davos I.

↑A Dance with Dragons, Chapter 56, The Iron Suitor.

↑A Feast for Crows, Chapter 22, Arya II.

↑A Dance with Dragons, Chapter 45, The Blind Girl.

↑A Game of Thrones, Chapter 18, Catelyn IV.

↑A Dance with Dragons, Chapter 47, Tyrion X.

↑A Feast for Crows, Chapter 26, Samwell III.

↑ 56.056.1A Dance with Dragons, Chapter 25, The Windblown.

↑So Spake Martin: Yet More Questions, July 22, 2001

The material on this page is taken from the web page Other languages at Dothraki Wiki that is owned by dothraki.org and may be used for noncommercial purposes.

External Links

Valyrian languages on Wikipedia.

High Valyrian 101: Learn and Pronounce Common Phrases By Katie M. Lucas

Retrieved from 'https://awoiaf.westeros.org/index.php?title=High_Valyrian&oldid=257130'

By Stars Insider of StarsInsider |

Learn Valyrian and other fascinating fictional languages

Valyrian Translate

With numerous fantasy shows gaining more and more popularity, it's no shock that many fans are going the extra mile. For instance, it was reported that over 800,000 people started learning 'Valyrian,' a language spoken by characters on 'Game of Thrones.' Incredible stories like 'Star Wars' and 'Lord of the Rings' also have their own unique languages, which you can start to learn about in this helpful gallery.

High Valyrian To English

© BrunoPress

14 notes

·

View notes

Photo

The Insanity of Sustainability “Only the Dead Have Seen the End of War” – Plato. This wisdom is as valid today as it was 2,500 years ago. Wars go on and on. They are exactly the anti-dote of sustainability. They may be the only “sustainability” modern mankind knows – endless destruction, killing, shameless exploitation of Mother Earth and its sentient beings, including humans. Yes, we are hellbent towards “sustainably”, destroying our planet and all its living beings, with wars and conflicts and shameless exploitation of Mother Earth – and the people who have peacefully inhabited her lands for thousands of years. All for greed, and more greed. Greed and destruction are certainly “unsustainable” features of our western “civilization”. Not to worry, in the grand scheme of things, Mother Earth will survive. She will cleanse herself by shaking and shedding off the destroyers, the annihilators – mankind. Only the brave will survive. Indigenous people, who have abstained from abject consumerism and instead worshipped Mother Earth and expressed their gratitude to her daily gifts. There are not many such societies left on our planet. In the meantime, we lie about the sustainability we live in. We lie to ourselves and to the public at large around us. We make believe sustainability is our cause – and we use the term freely and constantly. Most of us don’t even know what it is supposed to mean. “Sustainability” and “sustainable” anything and everything have become slogans; or household words. Such buzz-words, repeated over and over again, are made for promoting ideas, and for bending people’s minds to believe in something that isn’t. We pretend and say that we work sustainably, we develop – just about anything we touch – sustainably, and we project the future in a most sustainable way. That’s what we are made to believe by those who coined this most fabulously clever, but untrue term. It is the 101 of a psycho-factory. As Voltaire so pointedly said, “Those who can make you believe absurdities; can make you commit atrocities.” Sustainability. What does it mean? It has about as many interpretations as there are people who use the term – namely none specific. It sounds good. Because it has become – well, a household word, ever since the World Bank invented, or rather diverted the term for “sustainable development” in the 1990s, in connection, first, with Global Warming, then with Climate Change – and now back to both. Imagine! – There was a time at the World Bank – and possibly other institutions, when every page of almost every report had to contain at least once the word “sustainable”, or “sustainability”. Yes, that’s the extent of insanity propagated then – and today, it follows on a global scale, more sophisticated – the corporate world, the mega-polluters make it their buzz-word – our business is sustainable, and we with our products promote sustainability – worldwide. In fact, sustainable, sustainable growth, sustainable development, sustainable this and sustainable that – was originally coined by the United Nations Conference on Environment and Development (UNCED), also known as the Rio de Janeiro Earth Summit, the Rio Summit, the Rio Conference, and the Earth Summit – held in Rio de Janeiro from 3 to 14 June in 1992. The summit is intimately linked to the subsequent drive on Global Warming and Climate Change. It exuded projections of sea level risings, of disappearing cities and land strips, like Florida and New York City, as well as parts of California and many coastal areas and towns in Africa and Asia. It painted endless disasters, droughts, floods and famine as their consequence, if we – mankind – didn’t act. This first of a series of UN environment / climate summits is also closely connected with the UN Agendas 2021 and 2030. The UN Agenda 2030 incorporates or uses as main vehicle – the 17 “Sustainable Development Goals (SDG)”. In a special UN Conference in 2016, Bill Gates was able to introduce into the 16th SDG “Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels”, the 9th of the 12 sub-targets – “By 2030, provide legal identity for all, including birth registration.” This is precisely what Bill Gates needs to introduce digital IDs – most likely injected via vaccines, beginning with children from developing countries – i.e. the poor and defenseless are time and again used as guinea pigs. They won’t know what happens to them. First trials are underway in one or several rural schools in Bangladesh – see this and this. These 17 sustainable development goals, are all driving towards a Green Agenda, or as some prominent “left” US Democrat-political figures call it, the New Green Deal. It is nothing else but capitalism painted Green, at a horrendous cost for mankind and for the resources of the world. But it is sold under the label of creating a more sustainable world. Never mind, the enormous amounts of hydrocarbons – the key polluter itself – that will be needed to convert our “black” economy into a Green economy. Simply because we have not developed effective and efficient alternative sources of energy. The main reasons for this are the strong and politically powerful hydrocarbon lobbies. The energy cost (hydrocarbon-energy from oil and coal) of producing solar panels and windmills is astounding. So, today’s electric cars – Tesla and Co. – are still driven by hydrocarbon produced electricity – plus their batteries made from lithium destroy pristine landscapes, like huge natural salt flats in Bolivia, Argentina, China and elsewhere. The use of these sources of energy is everything but “sustainable”. See also Michael Moore’s film“Planet of the Humans”. Hydrogen power is promoted as the panacea of future energy resources. But is it really? Hydrocarbons or fossil fuels today amount to 80% of all energy used worldwide. This is non-renewable and highly polluting energy. Today to produce hydrogen is still mostly dependent on fossil fuels, similar to electricity. As long as we have purely profit-fueled hydrocarbon lobbies that prevent governments collectively to invest in alternative energy research, like solar energy of the 2nd Generation, i.e. derived from photosynthesis (what plants do), hydrogen production uses more fossil fuels than using straight gas or petrol-derived fuels. Therefore hydrogen, say a hydrogen-driven car, maybe as much as 40% – 50% less efficient than would be a straight electric car. The burden on the environment can be considerably higher. Thus, not sustainable with today’s technology. To enhance your belief their slogans of “sustainability”, they put up some windmills or solar cells in the “backyard” of their land- and landscape devastating coal mines. They will be filmed along with their “sustainable” buzz-words. *** The World Economic Forum (WEF) and the IMF are fully committed to the idea of the New Green Deal. For them it is not unfettered neoliberal capitalism – and extreme consumerism emanating from it, that is the cause for the world’s environmental and societal breakdown, but the use of polluting energies, like hydrocarbons. They seem to ignore the enormous fossil fuel use to convert to a green energy-driven economy. Capitalism is OK, we just have to paint it green (take a look at this). *** Let’s look at what else is “sustainable”- or not. Water use and privatization – Coca Cola tells us their addictive and potentially diabetes-causing soft drinks are produced “sustainably”. They tout sustainability as their sales promotion all over the world. They use enormous amounts of pristine clean drinking water – and so does Nestlé to further promote its number One business branch, bottled water. Nestlé has overtaken Coca Cola as the world number One in bottled water. They both use subterranean sources of drinking water – least costly and often rich in minerals. Both of them have made or are about to sign agreements with Brazil’s President to exploit the world’s largest freshwater aquifer, the Guarani, underlaying Brazil, Argentina, Paraguay and Uruguay. They both proclaim sustainability. Both Coca Cola and Nestlé have horror stories in the Global South (i.e. India, Brazil, Mexico and others), as well as in the Global North. Nestlé is in a battle with the municipality of the tiny Osceola Township, Michigan, where residents complain the Swiss company’s water extraction techniques are ruining the environment. Nestlé pays the State of Michigan US$ 200 to extract 130 million gallons of water per year (2018). Through over-exploitation both in the Global South and the Global North, especially in the summer, the water table sinks to unattainable levels for the local populations – which are deprived of their water source. Protesting with their government or city officials is often in vain. Corruption is all overarching. – Nothing sustainable here. These are just two examples of privatizing water for bottling purposes. Privatization of public water supply on a much larger scale is at the core of the issue, carried out mostly in developing countries (the Global South), mainly by French, British, Spanish and US water corporations. Privatization of water is a socially most unsustainable feat, as it deprives the public, especially the poor, from access to their legitimate water resources. Water is a public good – and water is also a basic human right. On 28 July 2010, through Resolution 64/292, the United Nations General Assembly explicitly recognized the human right to water and sanitation and acknowledged that clean drinking water and sanitation are essential to the realization of all human rights. The public water use of Nestlé and Coca Cola – and many others, mind you, doesn’t even take account of the trillions of used plastic bottles ending up as uncollected and non-recycled waste, in the sea, fields, forests and on the road sides. Worldwide less than 8% of plastic bottles are recycled. Therefore, nothing of what Nestlé and Coca Cola practice and profess is sustainable. It’s an outright lie. Petrol industry - BP with its green business emblem, makes believe – visually, every time you pass a BP station – that they are green. PB proclaims that their oil exploration and exploitation is green and environmentally sustainable. Let’s look at reality. The so far considered largest marine oil spill in the history of the petroleum industry, was the Deepwater Horizon oil spill. It was a giant industrial disaster that started on April 20, 2010 and lasted to 19 September 2010, in the Gulf of Mexico on the BP-operated Macondo Prospect, spilling about 780,000 cubic meter of raw petroleum over an area of up to 180,000 square kilometers. BP promised a full cleanup. By February 2015 they declared task completed. Yet at least 60% of oil and tar along the sea shore and beaches have not been cleaned up – and may never be removed. – Where is the sustainability of their promise? Another outright lie. BP and other oil corporations also have horrendous human rights records – just about everywhere they operate, mostly in Africa and the Middle East, but also in Asia. The abrogation of human rights is also an abrogation of sustainability. In this essay BP is used as an example for the petrol industry. None of the petrol giants operate sustainably anywhere in the world, and least where water table-destructive fracking is practiced. Sustainable mining – is another flagrant lie. But it sells well to the blinded people. And most of the civilized world is blinded. Unfortunately. They want to continue in their comfort zone which includes the use of copper, gold and other precious metals and stones, rare earths for ever more sophisticated electronic gear, gadgets and especially military electronically guided precision weaponry – as well as hydrocarbons in one way or another. Sustainable mining of anything unrenewable is a Big Oxymoron. Anything you take from the earth that is non-renewable is by its nature not sustainable. Its simply gone. Forever. In addition to the raw material not being renewable, the environmental damage caused by mining – especially gold and copper – is horrendous. Once a mine is exploited in a short 30- or 40-years’ concession, the mining company leaves mountains of contaminated waste, soil and water behind – that takes a thousand years or more to regenerate. Yet, the industry’s palaver is “sustainability”, and the public buys it. In fact, our civilization’s sustainability is zero. Aside from the pollution, poisoning and intoxication that we leave around us, our mostly western civilization has used natural resources at the rate of 3 to 4 times in excess of what Mother Earth so generally provides us with. We, the west, had passed the threshold of One in the mid-sixties. In Africa and most of Asia, the rate of depletion is still way below the factor of One, on average somewhere between 0.4 and 0.6. “Sustainability” is a flash-word, has no meaning in our western civilization. It is pure deception – self-deception, so we may continue with our unsustainable ways of life. That’s what profit-bound capitalism does. It lives today with ever more consumerism, more luxury for the ever-fewer oligarchs – on the resources of tomorrow. The sustainability of everything is not only a cheap slogan, it’s a ruinous self-deception. A Global Great Reset is needed – but not according to the methods of the IMF and WEF. They would just shovel more resources and assets from the bottom 99.99% to the top few, painting the “new” capitalism a shiny bright green – and fooling the masses. We, The People, must take The Reset in our own hands, with consciousness and responsibility. So, We the People, forget sustainable but act responsibly.

1 note

·

View note

Text

Saturday, April 3, 2021

Ontario ‘pulling the emergency brake’ with third COVID-19 lockdown as cases rise (Reuters) The Canadian province of Ontario will enter a limited lockdown for 28 days on Saturday, as COVID-19 cases and hospitalizations rise and more dangerous virus variants take hold, the premier said on Thursday. The lockdown for Canada’s most populous province will fall short of enacting a stay-at-home order. Ontario’s third lockdown since the pandemic began will shutter all indoor and outdoor dining, although retailers will remain open with capacity limits. Schools would remain open, Ontario’s education minister said on Twitter.

Starving for more chips in a tech-hungry world (AP) As the U.S. economy rebounds from its pandemic slump, a vital cog is in short supply: the computer chips that power a wide range of products that connect, transport and entertain us in a world increasingly dependent on technology. The shortage has already been rippling through various markets since last summer. It has made it difficult for schools to buy enough laptops for students forced to learn from home, delayed the release of popular products such as the iPhone 12 and created mad scrambles to find the latest video game consoles. But things have been getting even worse in recent weeks, particularly in the auto industry, where factories are shutting down because there aren’t enough chips to finish building vehicles that are starting to look like computers on wheels. The problem was recently compounded by a grounded container ship that blocked the Suez Canal for nearly a week, choking off chips headed from Asia to Europe. It threatens to leave a big dent in the auto industry, which by some estimates stands to lose $60 billion in sales during the first half of his year. “We have been hit by the perfect storm, and it’s not going away any time soon,” said Baird technology analyst Ted Mortonson.

The U.S. system created the world’s most advanced military. Can it maintain an edge? (Washington Post) As they conduct bombing and surveillance missions around the globe, today’s U.S. military pilots rely on aerial refueling aircraft built as early as 1957, when the Soviet Union dominated American security fears, the average home cost $12,000 and “I Love Lucy” was debuting new episodes. The cost of keeping those aging jets in the air has grown sharply while the military awaits a next-generation refueling plane whose rollout has been repeatedly delayed by design and production issues. The Air Force’s two-decade effort to field a 21st century tanker, one of several premier air systems whose development has been beset with problems, is emblematic of the challenges Pentagon leaders face in seeking to maintain the U.S. military’s shrinking edge over its chief competitor, China. The United States, once the world’s undisputed military superpower, has been struggling for years to efficiently update its arsenal and field new technology in cutting-edge areas such as hypersonics and artificial intelligence, at a time when some senior officials warn that China could be within five years of surpassing the U.S. military. “It’s like the Pentagon is finding itself staring in the rearview mirror in the face of oncoming traffic,” said Mackenzie Eaglen, a defense analyst at the American Enterprise Institute.

The reason many Guatemalans are coming to the border? A profound hunger crisis. (Washington Post) The team of nutritionists looked at 11-month-old Dilcia Cajbon, her ribs visible through her skin, and they knew immediately. “Severe acute malnutrition,” said Stefany Martinez, the leader of the UNICEF team, as the child was lifted onto a scale. Like many in this rural stretch of Guatemala, Dilcia’s family was down to one meal a day. Storms had flooded the nearby palm plantation, the biggest source of local employment. As more and more Central American families arrive at the United States’ southern border, the municipality of Panzós offers a stark illustration of the deepening food crisis that is contributing to the new wave of migration. So far this year, more unaccompanied minors processed by immigration agents are from Guatemala than any other country. Analysts and U.S. officials refer obliquely to “poverty” as an underlying cause of that influx. But often the reason is far more specific: hunger. Guatemala now has the sixth-highest rate of chronic malnutrition in the world. The number of acute cases in children, according to one new Guatemalan government study, doubled between 2019 and 2020. The crisis was caused in part by failed harvests linked to climate change, a string of natural disasters and a nearly nonexistent official response.

Venezuelan military offensive sends thousands fleeing (AP) ARAUQUITA, Colombia—A new campaign by the Venezuelan military near the country’s lawless western border is sparking a surge of refugees, with thousands defying the spiking pandemic to pack into makeshift shelters and tent settlements in this Colombian town. The sudden outflow is amplifying a renewed wave of Venezuelan refugees and migrants—the world’s second-largest group of internationally displaced people—from the broken socialist state. Concern is also rising about mounting tensions between the left-wing Venezuelan and right-wing Colombian governments, which are blaming each other for the uptick in violence in Venezuela’s western Apure state. The Venezuelan military launched a campaign two weeks ago against a rogue faction of Colombian guerrillas in this jungle region along the Arauca River. The guerrillas, known as the 10th Front, appear to have run afoul of the government in Caracas, which allegedly has had long-standing profit-sharing and protection deals with other leftist fighters in the area engaged in narco-trafficking and extortion. The Venezuelan government “doesn’t seem to be defending its sovereignty, but protecting its drug-trafficking business,” Colombian Defense Minister Diego Molano told Colombian National Radio last week.

Food bank, charities busy in Algarve as pandemic ravages Portugal tourism (Reuters) Carla Lacerda used to earn a good salary selling duty-free goods to holidaymakers arriving at Algarve airport in southern Portugal, but she lost her job last August due to the COVID-19 pandemic and quickly ran out of cash to feed her two kids. The 40-year-old now receives around 500 euros ($587) per month in unemployment benefits, leaving her no option but to join the queue for food donations. Lacerda is one of thousands of people whose lives have been turned upside down by the pandemic, which has ravaged tourism across the sun-drenched Algarve region and left its popular beaches and golf resorts largely deserted. Algarve’s food bank, which has two warehouses in the region, is now helping 29,000 people, almost double the number before the pandemic.

Italy may be in Easter lockdown, but the party’s on at sea (AP) Italy may be in a strict coronavirus lockdown this Easter with travel restricted between regions and new quarantines imposed. But a few miles offshore, guests aboard the MSC Grandiosa cruise ship are shimmying to Latin music on deck and sipping cocktails by the pool. After cruise ships were early sources of highly publicized coronavirus outbreaks, the Grandiosa has tried to chart a course through the pandemic with strict anti-virus protocols approved by Italian authorities that seek to create a “health bubble” on board. Passengers and crew are tested before and during cruises. Mask mandates, temperature checks, contact-tracing wristbands and frequent cleaning of the ship are all designed to prevent outbreaks. Passengers from outside Italy must arrive with negative COVID-19 tests taken within 48 hours of their departures and only residents of Europe’s Schengen countries plus Romania, Croatia and Bulgaria are permitted to book under COVID-19 insurance policies. Passengers welcomed the semblance of normalcy brought on by the freedom to eat in a restaurant or sit poolside without a mask, even if the virus is still a present concern.

Pakistan, India peace move silences deadly Kashmir frontier (AP) The machine guns peeking over parapets of small, sandbagged concrete bunkers and the heavy artillery cannons dug deep into Himalayan Kashmir’s rugged terrain have fallen silent. At least for now. The Line of Control, a highly militarized de facto border that divides the disputed region between the two nuclear-armed rivals India and Pakistan, and a site of hundreds of deaths, is unusually quiet after the two South Asian neighbors last month agreed to reaffirm their 2003 cease-fire accord. The cease-fire, experts say, could stabilize the lingering conflict that has claimed tens of thousands of lives. Kashmiris say the rare move should lead to resolution of the dispute.

Myanmar’s military shuts down Internet (Washington Post) Myanmar’s military government ordered broadband Internet shutdowns Thursday amid ongoing violent suppression of opposition to its ouster of the country’s democratically elected government. The escalation came as the country marked two months since the army’s toppling of the civilian-led government, which has faced widespread public resistance despite the military’s lethal response: More than 500 civilian protesters have been killed and more than 2,000 arrested since Feb. 1, according to local activists. The United Nations’ special envoy for Myanmar, Christine Schraner Burgener, on Wednesday warned that “a bloodbath is imminent” if the international community did not act to quell the violence. Last Saturday marked the bloodiest day since the coup, with troops reportedly killing over 140 protesters in more than 40 locations across the country.

Train derails in eastern Taiwan, killing 48, injuring dozens (AP) A train partially derailed in eastern Taiwan on Friday after being hit by a parked truck that had rolled down a hill onto the track, killing 48 people. With the train still partly in a tunnel, survivors climbed out of windows and walked along the train’s roof to reach safety after the country’s deadliest railway disaster. The crash occurred near the Toroko Gorge scenic area on the first day of a long holiday weekend when many people were hopping trains on Taiwan’s extensive rail system. The train had been carrying more than 400 people.

Egypt expects $1 billion in damages over stuck ship in Suez (AP) Egypt is expecting more than $1 billion in compensation after a cargo ship blocked the Suez Canal for nearly a week, according to the top canal official. Lt. Gen. Ossama Rabei, head of the canal authority, said that the amount takes into account the salvage operation, costs of stalled traffic, and lost transit fees for the week that the Ever Given had blocked the Suez Canal. “It’s the country’s right,” Rabei said, without specifying who would be responsible for paying the compensation. The massive cargo ship is currently in one of the canal’s holding lakes, where authorities and the ship’s managers say an investigation is ongoing. Rabei said that if an investigation went smoothly and the compensation amount was agreed on, then the ship could travel on without problems. However, if the issue of compensation involved litigation, then the Ever Given and its some $3.5 billion worth of cargo would not be allowed to leave Egypt.

Cellular turnover (Scientific American) A new study published in Nature Medicine takes another shot at the rate of cellular turnover in the human body. Basically, your individual component cells have shorter lifespans than you do as a larger organism. Fat cells last an average of 12 years, a muscle cell lasts 50, blood cells live anywhere from three to 120 days, and the cells lining your gut make it less than a week. On any given day, an estimated 330 billion cells are replaced, so about 1 percent every day. Over the course of 80 to 100 days, about 30 trillion cells will turn over, equivalent to about one “you.”

0 notes

Link

Biden, With Powerful Allies and Foes, Targets Climate Change WASHINGTON — As President Biden prepares on Wednesday to open an ambitious effort to confront climate change, powerful and surprising forces are arrayed at his back. Automakers are coming to accept that much higher fuel economy standards are their future; large oil and gas companies have said some curbs on greenhouse pollution lifted by former President Donald J. Trump should be reimposed; shareholders are demanding corporations acknowledge and prepare for a warmer, more volatile future, and a youth movement is driving the Democratic Party to go big to confront the issue. But what may well stand in the president’s way is political intransigence from senators from fossil-fuel states in both parties. An evenly divided Senate has given enormous power to any single senator, and one in particular, Joe Manchin III of West Virginia, who will lead the Senate Energy Committee and who came to the Senate as a defender of his state’s coal industry. Without doubt, signals from the planet itself are lending urgency to the cause. Last year was the hottest year on record, capping the hottest decade on record. Already, scientists say the irreversible effects of climate change have started to sweep across the globe, from record wildfires in California and Australia to rising sea levels, widespread droughts and stronger storms. “President Biden has called climate change the No. 1 issue facing humanity,” Gov. Jay Inslee of Washington said. “He understands all too well that meeting this test requires nothing less than a full-scale mobilization of American government, business, and society.” Mr. Biden has already staffed his government with more people concerned with climate change than any other president before him. On his first day in office, he rejoined the Paris Agreement on climate change. But during the campaign, he tried to walk a delicate line on fracking for natural gas, saying he would stop it on public lands but not on private property, where most of it takes place. A suite of executive actions planned for Wednesday does include a halt to new oil and gas leases on federal lands and in federal waters, a move that is certain to rile industry. But that would not stop fossil fuel drilling. As of 2019, more than 26 million acres of United States land were already leased to oil and gas companies, and last year the Trump administration, in a rush to exploit natural resources hidden beneath publicly owned lands and waters, leased tens of thousands more. If the administration honors those contracts, millions of publicly owned acres could be opened to fossil fuel extraction in the coming decade. The administration needs to do “much, much more,” said Randi Spivak, who leads the public lands program at the Center for Biological Diversity. Also on Wednesday Mr. Biden is expected to elevate climate change as a national security issue, directing intelligence agencies to produce a National Intelligence Estimate on climate security, and telling the secretary of defense to do a climate risk analysis of the Pentagon’s facilities and installations. He will create a civilian “climate corps” to mobilize people to work in conservation; create a task force to assemble a governmentwide action plan for reducing greenhouse gas emissions; and create several new commissions and positions within the government focused on environmental justice and environmentally friendly job creation. The real action will come when Mr. Biden moves forward with plans to reinstate and strengthen Obama-era regulations, repealed by the Trump administration, on the three largest sources of planet-warming greenhouse emissions: vehicles, power plants and methane leaks from oil and gas drilling wells. It may take up to two years to put the new rules in place, and even then, without new legislation from Congress, a future administration could once again simply undo them. Legislation with broad scope will be extremely difficult. Many of the same obstacles that blocked President Barack Obama a decade ago remain. The Senate Republican leader, Mitch McConnell, will very likely oppose policies that could hurt the coal industry in his state, Kentucky. So will Senator Manchin, who campaigned for his seat with a television advertisement that featured him using a hunting rifle to shoot a climate change bill that Mr. Obama had hoped to pass. In the decade since, he has proudly broken with his party on policies to curb the use of coal. The New Washington Updated Jan. 26, 2021, 6:15 p.m. ET “I have repeatedly stressed the need for innovation, not elimination,” Senator Manchin said in a statement. “I stand ready to work with the administration on advancing technologies and climate solutions to reduce emissions while still maintaining our energy independence.” Senator Manchin also opposes ending the Senate filibuster. But, to change Senate rules, Democratic leaders would need every Democratic vote. Without Senator Manchin, Mr. Biden would need significant Republican support. “There is wide scope for the executive branch to reinstate what Obama did and go beyond,” said Michael Oppenheimer, a professor of geosciences and international affairs at Princeton University. But, he added, “if you want something that will stick, you have to go through Congress.” To Mr. Biden’s advantage, some corporations have turned to friend from foe. Mr. Biden’s team is already drafting new national auto pollution standards — based on a deal reached between the state of California and Ford, Honda, BMW, Volkswagen and Volvo — that would require passenger vehicles to average 51 miles per gallon of gasoline by 2026. The current Trump rules only require fuel economy of about 40 miles per gallon in the same time frame. And just two weeks after Mr. Biden’s electoral victory, General Motors signaled that it, too, was ready to work the new administration. “President-elect Biden recently said, ‘I believe that we can own the 21st century car market again by moving to electric vehicles.’ We at General Motors couldn’t agree more,” wrote Mary Barra, the chief executive of GM, in a letter to leaders of some of the nation’s largest environmental groups. If enacted, a fuel economy rule modeled on the California system could immediately become the nation’s single-largest policy for cutting greenhouse gases. Mr. Biden’s team is also drafting plans to reinstate Obama-era rules on methane, a planet-warming gas over 50 times more potent than carbon dioxide, though it dissipates faster. Last summer, when Mr. Trump rolled back those rules, the oil giants BP and Exxon called instead to tighten them. The new president has also found broad support for rejoining the Paris Agreement, a global accord under which United States pledged to cut greenhouse emissions about 28 percent below 2005 levels by 2025. Rejoining the accord means honoring commitments. Not only must the United States meet its current target (right now it’s about halfway to that goal) but it will soon also be expected set new and more ambitious pledges for eliminating emissions by 2030. ExxonMobil, Shell, BP, and Chevron all issued statements of support for Mr. Biden’s decision to rejoin. So did the United States Chamber of Commerce and the American Petroleum Institute, which once supported a debunked study claiming the Paris Agreement would lead to millions of job loses. “As policy is being developed by the administration, by members of Congress, we want to have a seat at the table,” said Neil Bradley executive vice president and chief policy officer at the chamber of commerce. Other energy industry executives said action by Congress on climate change was long overdue, with many pressing for some kind of tax on oil, gas and carbon emissions to make climate-warming pollution less economical. “Having a clear price signal that says ‘Hey, it’s more cost efficient for you to buy an electric car than another big truck’ is exactly what we want happening, not somebody in government deciding that they’re going to outlaw something,” said Thad Hill, the chief executive of Calpine, a power generating company based in Texas that also supports the Paris Agreement goals. The Democrats’ razor-thin majority is no guarantee of action. In the Senate, Democrats are 10 votes short of the 60 needed to break a filibuster that would almost certainly come with legislation that would replace coal and oil with power sources such as wind, solar and nuclear energy, which do not warm the planet. In a Monday night interview on MSNBC, Senator Chuck Schumer of New York, the majority leader, acknowledged how difficult a strong legislative response will be. Instead, he called on Mr. Biden to declare climate change a “a national emergency.” “Then he can do many, many things under the emergency powers of the president that wouldn’t have to go through — that he could do without legislation,” Senator Schumer said. “Now, Trump used this emergency for a stupid wall, which wasn’t an emergency. But if there ever was an emergency, climate is one.” Senator John Barrasso, Republican of Wyoming, the nation’s largest coal-producing state, fired back, “Schumer wants the president to go it alone and produce more punishing regulations, raise energy costs, and kill even more American jobs.” Senator Thomas Carper of Delaware, chairman of the Environment Committee and one of Mr. Biden’s oldest friends, said he would do what he could to insert climate-friendly policies into larger pieces of legislation. Democrats hope a pandemic recovery bill will include hundreds of billions of dollars for environmentally focused infrastructure, such as Mr. Biden’s plans to build 500,000 electric-vehicle charging stations and 1.5 million energy efficient homes and housing units. Senator Carper also said he hoped to revive modest legislation that has in the past received bipartisan support, such as extending tax breaks for renewable power sources, supporting the construction of new nuclear power facilities, and improving energy efficiency in buildings. “You may call it incrementalism,” Mr. Carper said. “But I call it progress.” Christopher Flavelle contributed reporting. Source link Orbem News #Allies #Biden #Change #Climate #Foes #Powerful #targets

0 notes

Text

New top story from Time: ‘It’s a Bucket Brigade on a Five-Alarm Fire.’ Food Banks Struggle to Keep Up With Skyrocketing Demand

In a matter of five months, 47-year-old Aquanna Quarles saw her personal finances implode. In December, she totaled her car. In February, the car she replaced the totaled one with was stolen. And in early March, her kitchen flooded, destroying the food in her cabinets and the small appliances on top of them. Quarles remembers thinking, “Oh my God, like what else could go wrong?”

Then the novel coronavirus began spreading across the United States. In mid-March, the state of Ohio, where Quarles lives, began issuing stay-at-home orders, shuttering shops and businesses, and by the end of the month, the rest of the country had followed suit, pushing millions of Americans out of work. Quarles, who works for a home health care company doing both office work and caring for elderly and disabled individuals, saw her hours—and weekly earnings—cut in half.

In April, for the first time in her life, Quarles felt she had no choice but to lean on a food bank to make ends meet. “This was really my first time ever doing it,” Quarles says of her decision to seek assistance from a food charity. “Because if I don’t need it, I’m not gonna go. You know what I mean? But I needed it.”

On April 21, Quarles lined up in her car with thousands of other Ohioans in the parking lot of Wright State University’s football stadium where Dayton’s Foodbank, Inc. had set up an emergency drive-thru food distribution site. On that day alone, the food bank served 1,381 households and more than 4,500 individuals, according to its chief development officer Lee Lauren Truesdale. After four hours, Quarles returned home with about a couple week’s worth of chicken cutlets, chickpeas, cucumbers, eggs, peach-flavored protein shakes, potatoes, rice and watermelons.

Quarles’s recent hardship has become all too common in recent weeks, as tens of millions of working- and middle-class Americans like her—bartenders and servers, childcare providers and hairdressers and hotel staff—have found themselves suddenly with decreased or eliminated incomes for the foreseeable future. On April 23, new unemployment numbers showed another 4.4 million people filed unemployment claims last week, bringing the total since March 14 to more than 26 million. Though Quarles did not lose her job completely, her reduced hours may make her eligible for partial unemployment insurance. Like millions of Americans, Quarles has faced difficulties accessing that benefit. Though she says she applied for the assistance at the end of March, she hasn’t yet seen the payment hit her bank account.

Stories like Quarles’ underscore the fragility of the American economic landscape. Until recently, the U.S. economy was sailing through the longest expansion on record—trumpeting record-low jobless rates and a bull stock market. But after just five weeks of recession, tens of millions of Americans are suddenly without the most basic necessities, including food and medical care. While incomes have vanished, the trappings of middle class life—car notes, mortgages, rent obligations and utility bills—have continued to pile up, forcing Americans who until very recently had full-time jobs to the brink of true poverty. With nearly 40% of U.S. adults unable to afford an emergency expense of $400, according to a 2019 report by the Federal Reserve, many have turned to food charities for help.

Tech Sgt. Shane Hughes—U.S. Air National Guard. Soldiers unload food at the Dayton Foodbank in Dayton, Ohio, on April 21, 2020.

When Three Square Food Bank of Las Vegas was modeling its new drive-thru food distribution systems several weeks ago, it anticipated between 200 and 250 cars per donation site each day. Instead, its chief operating officer Larry Scott says the organization is seeing up to 1,200 cars each day at some of its sites—in queues that stretch to five miles and longer. At the Central Pennsylvania Food Bank, executive director Joe Arthur estimates his nonprofit went from serving 135,000 individuals a month to approximately 175,000. Central Texas Food Bank president and CEO Derrick Chubbs says its Travis County partners saw a 207% spike in clients.

But as new patrons line up for food assistance in record numbers, and old clients become even more reliant on donations, half a dozen major food insecurity nonprofits tell TIME they are experiencing financial and procedural challenges of their own. “All hell broke loose at the first of March,” says Lisa Hamler-Fugitt, the executive director of the Ohio Association of Foodbanks, which doles out resources to the state’s individual food organizations, like Truesdale’s.

Since then, she adds, it’s been “a bucket brigade on a five-alarm fire.”

‘That spigot just shut off’

In fatter times, food banks receive donations of shelf-stable items, like peanut butter, pasta, tuna fish, and soup, from wholesalers, manufacturers, restaurants, and grocery chains that over-ordered. But since COVID-19 hit, those businesses have seen their own stores dry up. Manufacturers are prioritizing shipping their products to grocery stores, which can barely keep shelves stocked, as people have begun to eat all of their meals at home.

In Illinois, a spokesperson for the Greater Chicago Food Depository says it received only 1.83 million pounds of donated food from non-government sources last month—a 30% decrease from what it received a year ago, in March 2019. The spokesperson says the figure is lower in part because restaurants and grocers are less able to give, but also because the nonprofit had to focus on accepting “non-perishable foods in this ongoing crisis,” as shelf-stable items last longer, require less handling, and can more easily be transported to the organization’s partner charities.

“When the pandemic hit the supply chain, that spigot just shut off,” says Hamler-Fugitt. She added, “We don’t have enough food in the system to keep up with this demand. We just don’t.”

As the stream of donations have declined, some food charities have been forced to buy pantry items at or near retail prices, which puts many food banks operating on small budgets in a nearly impossible situation. Under normal circumstances, the cost of supplying a food-insecure client with 28 to 30 pounds of groceries would cost Central Texas Food Bank $5 per box, says Chubbs, its CEO. These days, the cost is closer to $30 per box, at a time when the organization anticipates needing demand for about 25,000 boxes a week.

Tech Sgt. Shane Hughes—U.S. Air National Guard. Hundreds of members of the Ohio National Guard were activated March 18, 2020 to support food distribution efforts across Ohio.

But the food banks that have so far managed to avoid paying retail prices are finding that securing shelf-stable items can be challenging too, says Kate Maehr, the executive director of the Greater Chicago Food Depository. That’s partly because manufacturers are not yet keeping up with new demand for pantry staples, and partly because the products they do produce first go to the retail stores. Food banks, she says, are “last in line.”

“If you’re a manufacturer, you’re going to make sure that you are honoring the relationships that you have with retailers and your core business,” Maehr says. “We are getting told by suppliers that we are three weeks, six weeks, and in some instances, 12 weeks out before we can get truckloads of food.”

Some states have increased funding to food charities to help offset these new barriers, but food bank directors say it’s unlikely to cover the difference. Earlier this month, Ohio Gov. Mike DeWine signed an executive order to provide the Ohio Association of Foodbanks a one-time $5 million appropriation on top of the $25 million the charity receives annually. The group estimates it will need $54 million per month if demand continues to grow apace.

In the past, when food banks in one state have been overrun as a result of regional disasters, like flooding or a hurricane, food banks in other parts of the country have been able to supplement staff and food supply, says Elaine Waxman, a food insecurity expert at the Urban Institute. But in this pandemic, the whole country is affected.

“Right now,” she says, “literally it’s like a disaster in all 50 states.”

More need, but fewer volunteers to accommodate it

It’s not just food donations that non-profits are having to do without. It’s staff, too. Under normal circumstances, food pantries rely on volunteers, many of whom are retired or elderly. But since people over 65 have disproportionately severe symptoms from COVID-19, those staffing resources have dried up. As a result, charitable organizations have had to reduce the number of places where food is distributed.

For example, Three Square, the Las Vegas food bank, has had to suspend food distribution at 170 of its 180 partner organizations, while setting up 21 additional drive-thru distribution sites, according to Larry Scott, its chief operating officer. In a month’s time, the number of sites from which locals in the region can collect food decreased by 83%.

Central Texas Food Bank chief Chubbs says his organization has seen a 70% reduction in volunteers. “One of the biggest challenges that I’ve seen here is how do we balance minimizing the risk of the human resources—our staff and our volunteers—and at the same time, meet that growing demand,” he says.

The Dayton, Ohio food bank where Quarles picked up her rations has also tried to limit people of “advanced age” from volunteering, in an effort to protect their health. At the Ohio drive-thru event on Tuesday, a 73-year-old volunteer confided that he was breaking the age rule, but said he felt like he needed to be helping. “I live alone, I self-isolate at home,” he says. “People need help, and that’s when you want to be out here.”

Tech Sgt. Shane Hughes—U.S. Air National Guard. U.S. Army Spc. Rose Minton unpacks pallets of food at Wright State University’s Nutter Center in Fairborn, Ohio, on April 21, 2020.

Some states, including Ohio, Washington state, Michigan, and Kentucky, have deployed the National Guard to fill the void left by these older volunteers. Andrew Lynch, a 33-year-old Sergeant who was present at Dayton’s Foodbank, Inc. on April 21, compared his service this week to his 2011 deployment to Afghanistan. “Being able to give back to the community and provide a service or a product at a time of need is very similar to when we were in Afghanistan or Iraq,” he says. Though the setting is different, he explains, the purpose is still to keep people safe.

‘This is not going to be a crisis that is measured in weeks’

Even as mayors and state governors prepare to reopen their cities and states, food bank executives expect the uptick in demand for their services will continue for many months, if not years. The aftermath of the Great Recession offers a bleak guide. In 2008, 15% of U.S. householders were “food insecure,” meaning they lacked consistent access to enough food for an active life, according to the U.S. Department of Agriculture. It wasn’t until 2018—a decade after the bottom dropped out of the market—that the proportion of food insecure households rebounded to pre-recession levels. There’s reason to think that this recession will have a similarly long tail for those with no financial buffer.

“There are so many people in this community who are one paycheck away from poverty. And they’re going to lose eight paychecks or 10 paychecks. It will take them a long time to come back to a level of financial security and stability that will equate with food security,” says Maehr of the Greater Chicago Food Depository. “This is not going to be a crisis that’s measured in weeks. I fear that this is a crisis that will be measured in months, and possibly years.”

Once stay-at-home orders are lifted and people begin to return to their pre-quarantine lives, Maehr worries that the general public will forget that more than 37 million Americans struggled with hunger before this pandemic even hit U.S. soil. “I am worried about compassion fatigue,” she says. “I am very worried about what happens when the news camera crews leave.”

SNAP doesn’t fill the gap

Food banks are supposed to be a stop gap measure for other safety net programs, like the Supplemental Nutrition Assistance Program (SNAP), colloquially known as food stamps. For every meal provided by Feeding America—a national consortium of 200 food banks and 60,000 food pantries and meal programs—SNAP provides 12.

But experts say SNAP is facing shortfalls of its own. Though the program is available to most households with gross monthly incomes at or below 130% of the federal poverty line, the average cost of a meal in 99% of U.S. counties is higher than food stamp benefits allow, according to a 2018 report by the Urban Institute. Monthly, the average recipient is allocated just $127.

The benefits program, which President Lyndon B. Johnson signed into law in 1964, is supposed to cover the cost of meals that provide adequate nutrition. But welfare reform in the mid-1990s placed new limits on eligibility, froze the minimum benefit threshold, and reduced the maximum allotments. Since then, the costs of meals that meet the government’s nutritional guidelines have largely outpaced the amount of funding provided.

Tech Sgt. Shane Hughes—U.S. Air National Guard. A soldier directs traffic during a drive-thru food distribution event at Wright State University’s Nutter Center in Fairborn, Ohio, on April 21, 2020.

Household purchases that may be vital during a viral pandemic—including soap, hand sanitizer, and toilet paper—also can’t be purchased using SNAP, nor can pre-made, protein-rich foods like rotisserie chickens and store-prepared meatloaves.

Still, people are seeking out the assistance in droves. Nearly 12,000 Ohioans signed up for SNAP during the first week of March, a spokesperson for the state’s Department of Jobs and Family Services tells TIME. During the second week of April, 29,334 more signed up. The number of Washington state residents who applied for SNAP benefits during the first full week of April 2020 was also more than double what it was the corresponding week last year, a state employee says. And while Nevada received 19,266 new requests for SNAP benefits in March 2019, the volume increased by 43% to 27,465 applications in March 2020, according to a spokesperson for the state’s Department of Health and Human Services.

But many are running into bureaucratic hurdles getting assistance at all. Generally, recipients have to re-certify they still qualify for SNAP every six to 12 months with corroborating documents such as paystubs and proof of child support. That can be challenging for low-income recipients whose incomes are constantly changing: Gig workers can’t predict how many customers will request meal delivery or rides, bartenders can never be sure their customers will tip fairly, and many low-income workers piece together one-off jobs to get by.

“SNAP is built as if people’s incomes are always stable, but people’s incomes are going up and down all the time,” says Mariana Chilton, director of Drexel University’s Center for Hunger Free Communities, and former co-chair of the Bipartisan National Commission on Hunger. “You have to go through this terrible type of surveillance machine in order to prove that you’re worthy.”

Aquanna Quarles, the 47-year-old Ohio home health care aide who saw her hours halved a few weeks ago, says she made too much money over the last six months to qualify for full SNAP benefits at this point. About a week ago, she received a letter from the Ohio Department of Jobs and Family Services about her food stamp benefits, she says. “I thought they were gonna be jacking them up a little bit,” she says. “But they lowered them from $194 to $99.”

She’s since received notice that the benefit will go back up. On Wednesday, the USDA announced a 40% increase in food stamp benefits “to ensure that low-income individuals have enough food to feed themselves and their families during this national emergency.” The increase, paired with partial unemployment insurance, should help Quarles get through the crisis, if and when the assistance actually comes through.

Still, Quarles says, she has faith that her luck will soon turn. It just has to. “What I got out of all of this that happened,” she says, “was God is making better for new.”

via https://cutslicedanddiced.wordpress.com/2018/01/24/how-to-prevent-food-from-going-to-waste

1 note

·

View note

Text

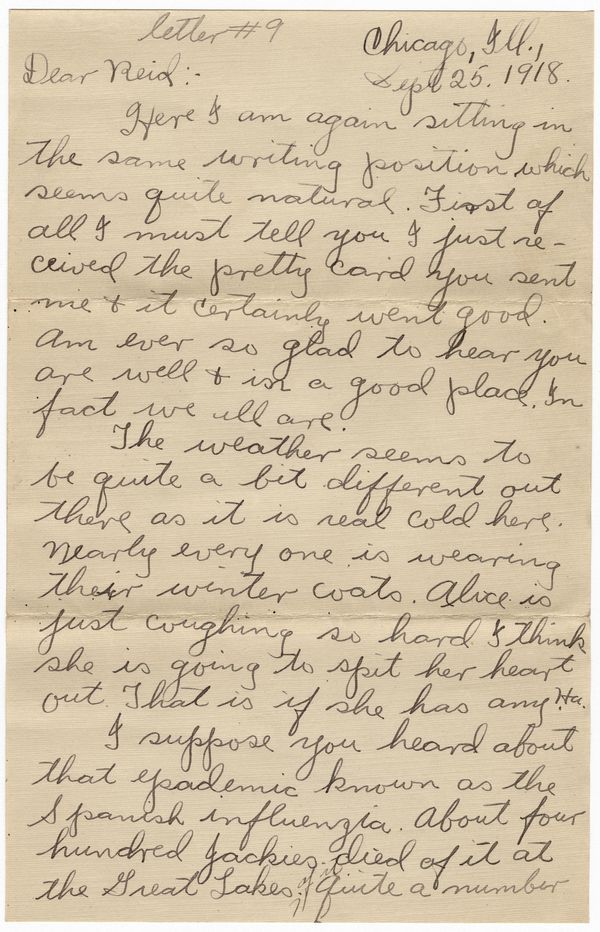

What We Can Learn From 1918 Influenza Diaries

https://sciencespies.com/nature/what-we-can-learn-from-1918-influenza-diaries/

What We Can Learn From 1918 Influenza Diaries

SMITHSONIANMAG.COM | April 13, 2020, 8 a.m.

When Dorman B.E. Kent, a historian and businessman from Montpelier, Vermont, contracted influenza in fall 1918, he chronicled his symptoms in vivid detail. Writing in his journal, the 42-year-old described waking up with a “high fever,” “an awful headache” and a stomach bug.

“Tried to get Dr. Watson in the morning but he couldn’t come,” Kent added. Instead, the physician advised his patient to place greased cloths and a hot water bottle around his throat and chest.

“Took a seidlitz powder”—similar to Alka-Seltzer—“about 10:00 and threw it up soon so then took two tablespoons of castor oil,” Kent wrote. “Then the movements began and I spent a good part of the time at the seat.”

The Vermont historian’s account, housed at the state’s historical society, is one of countless diaries and letters penned during the 1918 influenza pandemic, which killed an estimated 50 to 100 million people in just 15 months. With historians and organizations urging members of the public to keep journals of their own amid the COVID-19 pandemic, these century-old musings represent not only invaluable historical resources, but sources of inspiration or even diversion.

“History may often appear to our students as something that happens to other people,” writes Civil War historian and high school educator Kevin M. Levin on his blog, “but the present moment offers a unique opportunity for them to create their own historical record.”

Members of the Red Cross Motor Corps, all wearing masks to prevent the further spread of the influenza epidemic, carry a patient on a stretcher into their ambulance, Saint Louis, Missouri, October 1918.

(Photo by PhotoQuest / Getty Images)

The work of a historian often involves poring through pages upon pages of primary source documents like diaries—a fact that puts these researchers in a position to offer helpful advice on how prospective pandemic journalers might want to get started.

First and foremost, suggests Lora Vogt of the National WWI Museum and Memorial, “Just write,” giving yourself the freedom to describe “what you’re actually interested in, whether that’s your emotions, [the] media or whatever it is that you’re watching on Netflix.”

Nancy Bristow, author of American Pandemic: The Lost Worlds Of The 1918 Influenza Epidemic, advises writers to include specific details that demonstrate how “they fit into the world and … the pandemic itself,” from demographic information to assessment of the virus’ impact in both the public and personal spheres. Examples of relevant topics include the economy; political messaging; level of trust in the government and media; and discussion of “what’s happening in terms of relationships with family and friends, neighbors and colleagues.”

Other considerations include choosing a medium that will ensure the journal’s longevity (try printing out entries written via an electronic journaling app like Day One, Penzu or Journey rather than counting on Facebook, Twitter and other social media platforms’ staying power, says Vogt) and defying the sense of pressure associated with the need to document life during a “historic moment” by simply writing what comes naturally.

Journaling “shouldn’t be forced,” says Levin. “There are no rules. It’s really a matter of what you take to be important.”

Seattle police officers wearing masks in 1918

(Public domain via Wikimedia Commons)

If all else fails, look to the past: specifically, the nine century-old missives featured below. Though much has changed since 1918, the sentiments shared in writings from this earlier pandemic are likely to resonate with modern readers—and, in doing so, perhaps offer a jumping-off point for those navigating similar situations today.

Many of these journalers opted to dedicate space to seemingly mundane musings: descriptions of the weather, for instance, or gossip shared by friends. That these quotidian topics still manage to hold our attention 100 years later is a testament to the value of writing organically.

State historical societies are among the most prominent record-keepers of everyday people’s journals and correspondence, often undertaking the painstaking tasks of transcribing and digitizing handwritten documents. The quotes featured here—drawn in large part from local organizations’ collections—are reproduced faithfully, with no adjustments for misspelling or modern usage.

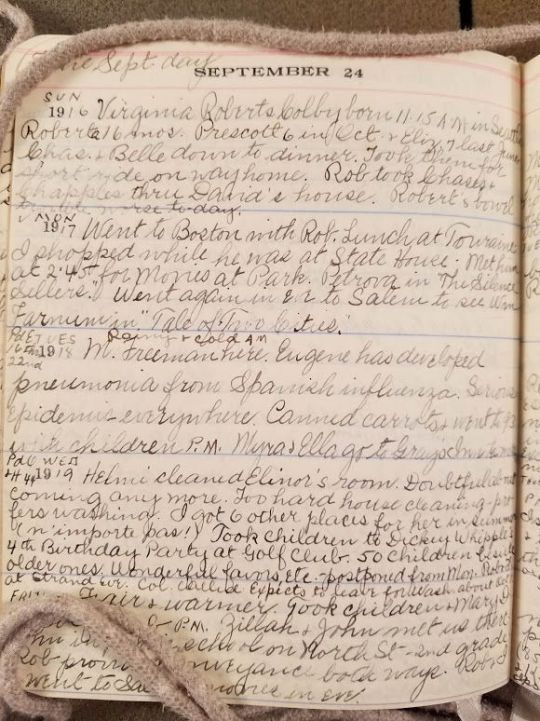

Edith Coffin (Colby) Mahoney

From the Massachusetts Historical Society

Between 1906 and 1920, Edith Coffin (Colby) Mahoney of Salem, Massachusetts, kept “three line-a-day diaries” featuring snippets from her busy schedule of socializing, shopping and managing the household. Most entries are fairly repetitive, offering a simple record of what Mahoney did and when, but, on September 22, 1918, she shifted focus to reflect the pandemic sweeping across the United States.

Fair & cold. Pa and Frank here to dinner just back from Jefferson Highlands. Rob played golf with Dr. Ferguson and Mr. Warren. Eugene F. went to the hospital Fri. with Spanish influenza. 1500 cases in Salem. Bradstreet Parker died of it yesterday. 21 yrs old.

September 24, 1918, diary entry

(Collection of the Massachusetts Historical Society)

Four days later, Mahoney reported that Eugene had succumbed to influenza. “Several thousand cases in the city with a great shortage of nurses and doctors,” she added. “Theatres, churches, gatherings of everykind stopped.”

Mahoney’s husband, Rob, was scheduled to serve as a pallbearer at Eugene’s September 28 funeral, but came down with the flu himself and landed “in bed all day with high fever, bound up head and aching eye balls.”

By September 29—a “beautiful, mild day,” according to Mahoney—Rob was “very much better,” complaining only of a “husky throat.” The broader picture, however, remained bleak. Another acquaintance, 37-year-old James Tierney, had also died of the flu, and as the journal’s author noted, “Dr says there is no sign of epidemic abating.”

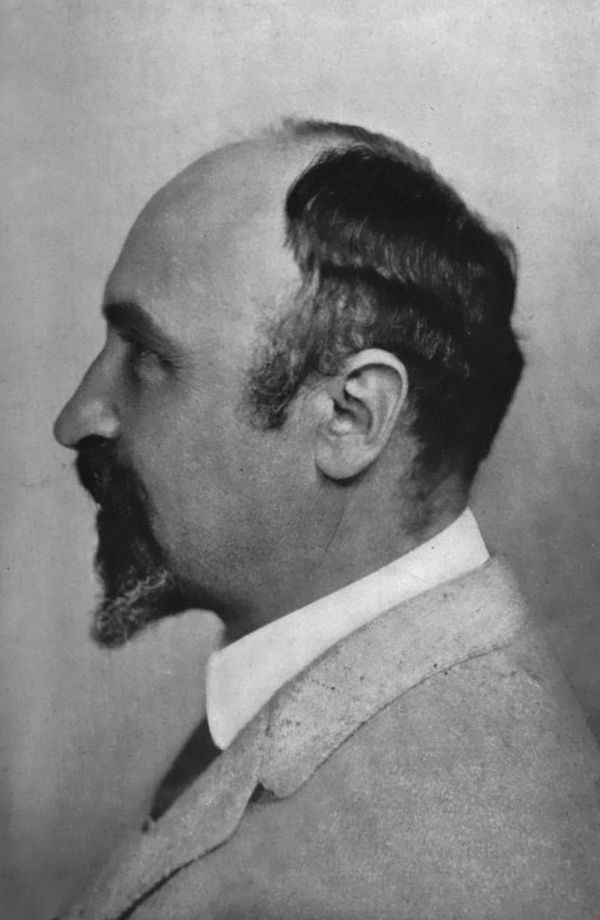

Franklin Martin

From the National Library of Medicine, via research by Nancy Bristow

Patients at a U.S. Army ward in France

(© Corbis via Getty Images)

In January 1919, physician Franklin Martin fell ill while traveling home from a postwar tour of Europe. His record of this experience, written in a journal he kept for his wife, Isabelle, offers a colorful portrait of influenza’s physical toll.

Soon after feeling “chilly all day,” Martin developed a 105-degree fever.

About 12 o’clock I began to feel hot. I was so feverish I was afraid I would ignite the clothing. I had a cough that tore my very innards out when I could not suppress it. It was dark; I surely had pneumonia and I never was so forlorn and uncomfortable in my life. … Then I found that I was breaking into a deluge of perspiration and while I should have been more comfortable I was more miserable than ever.

Added the doctor, “When the light did finally come I was some specimen of misery—couldn’t breathe without an excruciating cough and there was no hope in me.”

Martin’s writing differs from that of many men, says Bristow, in its expression of vulnerability. Typically, the historian explains, men exchanging correspondence with each other are “really making this effort to be very brave, … always apologizing for being sick and finding out how quickly they’ll be back at work, or [saying] that they’re never going to get sick, that they’re not going to be a victim of this.”

The physician’s journal, with its “blow-by-blow [treatment] of what it was like to actually get sick,” represents a “really unusually profound” and “visceral” point of view, according to Bristow.

Violet Harris

Violet Harris was 15 years old when the influenza epidemic struck her hometown of Seattle. Her high school diaries, recounted by grandniece Elizabeth Weise in a recent USA Today article, initially reflect a childlike naivete. On October 15, 1918, for example, Harris gleefully reported:

It was announced in the papers tonight that all churches, shows and schools would be closed until further notice, to prevent Spanish influenza from spreading. Good idea? I’ll say it is! So will every other school kid, I calculate. … The only cloud in my sky is that the [School] Board will add the missed days on to the end of the term.

A Seattle streetcar conductor refuses entry to a commuter who is not wearing a mask in December 1918.

(Photo by PhotoQuest / Getty Images)

Before long, however, the enormity of the situation sank in. The teenager’s best friend, Rena, became so sick she “could hardly walk.” When Rena recovered, Harris asked her “what it felt like to have the influenza, and she said, ‘Don’t get it.’”

Six weeks after Seattle banned all public gatherings, authorities lifted restrictions, and life returned to a semblance of normal. So, too, did Harris’ tone of witty irreverence. Writing on November 12, she said:

The ban was lifted to-day. No more …. masks. Everything open too. ‘The Romance of Tarzan’ is on at the Coliseum [movie theater] as it was about 6 weeks ago. I’d like to see it awfully. …. School opens this week—Thursday! Did you ever? As if they couldn’t have waited till Monday!

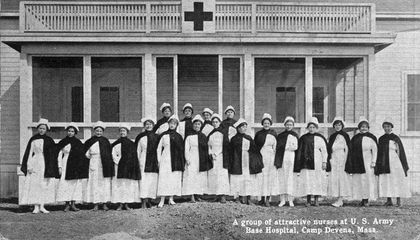

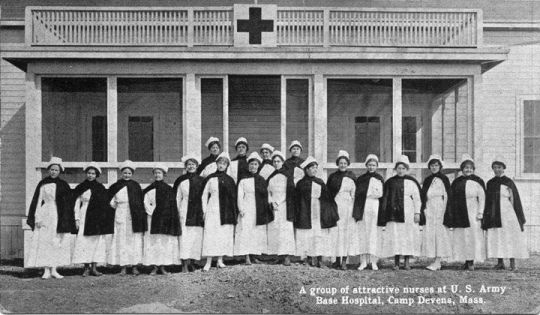

N. Roy Grist

Panoramic view of Fort Devens in 1918

(Courtesy of the Fort Devens Museum)

Fort Devens, a military camp about 40 miles from Boston, was among the sites hardest hit by the 1918 influenza epidemic. On September 1, some 45,000 soldiers waiting to be deployed to France were stationed at the fort; by September 23, according to the New England Historical Society, 10,500 cases of the flu had broken out among this group of military men.

Physician N. Roy Grist described the devastation to his friend Burt in a graphic September 29 letter sent from Devens’ “Surgical Ward No. 16.”

These men start with what appears to be an attack of la grippe or influenza, and when brought to the hospital they very rapidly develop the most viscous type of pneumonia that has ever been seen. Two hours after admission they have the mahogany spots over the cheek bones, and a few hours later you can begin to see the cyanosis extending from their ears and spreading all over the face, until it is hard to distinguish the coloured men from the white. It is only a matter of a few hours then until death comes, and it is simply a struggle for air until they suffocate. It is horrible. One can stand it to see one, two or twenty men die, but to see these poor devils dropping like flies sort of gets on your nerves.

On average, wrote the doctor, around 100 patients died each day.

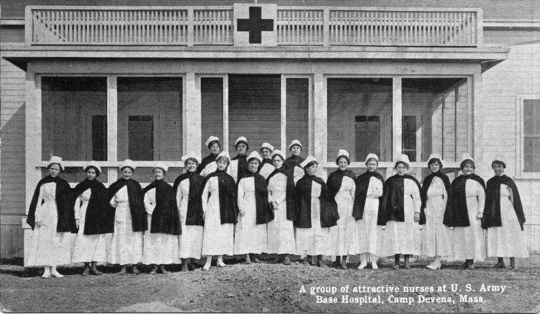

Nurses at Fort Devens in 1918

(Courtesy of the Fort Devens Museum)