#security listings / delistings

Explore tagged Tumblr posts

Text

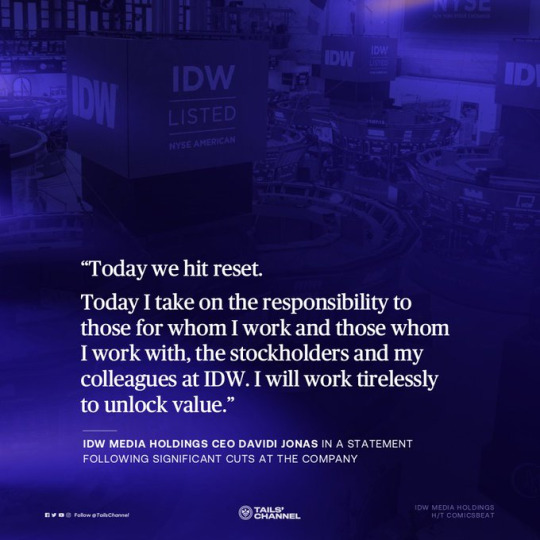

Significant cuts hits IDW's parent company in a self-described "reset"

IDW Media Holdings, the parent of IDW Publishing (the company behind the Sonic the Hedgehog comics), announced major cuts in an effort to unlock financial stability.

The company terminated their New York Stock Exchange listing, shook up senior management, and slashed entire promotional and editorial departments - around 39% of its workforce.

The newly-appointed CEO characterized the axe drop a "reset."

Background

There's no other way to describe it, the cuts at IDW are significant.

The axe drop was in direct response to a poor balance sheet in a tough economic environment. IDW suffered greatly during the COVID-19 pandemic, and non-publishing segments (like direct-to-consumer games) continued to illustrate repeated quarterly losses.

It's no secret that IDW experienced cash flow issues and various others financial challenges, even though the comic books in particular (like IDW Sonic and TMNT) are significant revenue generators.

The company hopes that these cost-cutting measures will provide $4.4 million USD in estimated annual savings.

The impacted

Marketing, public relations, and editorial at IDW were impacted by today's announced cuts.

Comicsbeat reported that the entire marketing and PR departments, and half of the editorial team, got the axe, with more specific details yet to come. That's 39% of the total workforce.

At press time, @idwsonicnews told us that Shawn Lee, a "designer and letterer on many IDW titles", were among the laid off. He tweeted, "whelp, I'm officially a freelancer now."

---

Meanwhile, senior management got a shakeup. Former chairman Davidi Jonas replaced Allan Grafman as Chief Economic Officer. Chief Financial Officer Brooke Feinstein was ousted, and Amber Huerta was promoted to Chief Operating Officer.

IDW also voluntarily delisted their Class B common stock from the New York Stock Exchange, the largest trading venue in the world; and suspended their reporting status to the U.S. Securities and Exchange Commission. The company hoped that this will "reduce pressure on limited resources and the Company’s current inability to realize many of the benefits."

Okay, what about IDW Sonic?

Deep breaths.

At press time, there's nothing we know that flags an immediate concern for the IDW Sonic comics. However, as this is a developing situation, and the long-term outlook is uncertain, the forecast can change.

Even though it, and other comic book franchises (TMNT, etc.) continues to generate significant revenue to the publishing unit, IDW will have to enact more critical decisions to remain financially sound.

IDW Sonic editors David Mariotte and Riley Farmer have yet to officially acknowledge the parent company's announcement, but both "retweeted posts related to the layoffs," @idwsonicnews told us.

We have reached out to IDW Publishing for further comment.

(Updated Friday 11:00 pm ET)

#not great!#idw sonic the hedgehog#idw sonic#idw publishing#sonic the hedgehog#sonic#sonic idw#sonic news

187 notes

·

View notes

Text

The Intercept: Police Harass Veteran on Terror Watchlist, Lawsuit Says

Saadiq Long was on his way to a night shift at the transportation company he works at when he saw flashing lights behind his car. Two police cruisers were signaling him to pull over. This would be the third time in just over a month that Long, a U.S. Air Force veteran with no criminal record, had been pulled over without explanation by Oklahoma City police officers. The stops frustrated Long. He suspected he was being targeted.

After wondering again why he’d been pulled over, this time would be different: He would get some answers, however unsettling, about why it was happening.

Long, 52, was initially told by an officer who stopped him that his car had been listed in a gang database. After waiting in his car for roughly 20 minutes, the officer, according to a video that Long made of the incident, came back with a different story. The police officer told Long that his car had come up as a “hit” in a national watchlist database, one that “automatically alerts us that this vehicle is under suspicion for a terrorist watchlist.” The cop said that Long’s presence on the watchlist, rather than any driving-related infraction or accusation of criminality, was why he had been pulled over.

Long is no stranger to harassment by federal authorities. In 2015, he sued the U.S. government over his placement on the Department of Homeland Security’s no-fly list, as well as the larger terrorist watchlist from which that database is built. Eventually, Long was told his name was removed from the no-fly list, but, as the traffic stops in Oklahoma indicate, he has remained on the broader terrorism watchlist. His lawsuit in federal court related to that watchlist is still ongoing.

More immediately, Long is trying to deal with the very local consequences of being on the federal watchlist.

The U.S. government’s terror lists are often thought of as a tool for protecting against foreign national security threats. Yet in Long’s case, his continued presence on the list, which is secret and has no clear avenues for an individual to be delisted, has now resulted in an unending cycle of harassment from local police in his hometown of Oklahoma City, where he lives with his family.

Since the December 30, 2022, stop where he was verbally informed that his car was on the terrorist watchlist, things have gotten much worse for Long. In subsequent stops, he has been pulled over, handcuffed, and placed in the back of a police cruiser. In one incident, Oklahoma City police officers leveled their guns at Long while blaring orders over a loudspeaker instructing Long to exit his vehicle.

Having failed thus far in his case against the federal government, Long is now suing the Oklahoma City Police Department over the traffic stops, as well as their use of the federal terrorist watchlist as a pretext to target his vehicle. (The Oklahoma City Police Department declined to comment on the case.)

“As Saadiq Long drives the roads of his city, the Oklahoma City Police Department has been watching, aiming its vast network of cameras and computers at him repeatedly,” the lawsuit says. “Using a secret, racist list of Muslims that the FBI illegally maintains, officers have repeatedly pulled Saadiq Long over, sometimes at gunpoint, unlawfully arresting him twice in the last two months.”

“Despite the fact that he has never been arrested or charged for any crime, due to his presence on this list, he has lost work licenses, been denied visas, and been prevented from flying on airplanes,” said Gadeir Abbas, an attorney with the Council on American-Islamic Relations who is representing Long. “The officers who are pulling him over are just doing it because their computers are telling them to do so due to his watchlisting status. He is not under investigation for anything, but this secret list is still terrorizing him whether on land or air.”

In 2013, Long was prevented from boarding a flight to Oklahoma from Qatar, where he then resided. A U.S. citizen and Air Force veteran, the denied flight to Qatar was when Long first discovered that he was on the DHS’s no-fly list. Ever since, he has faced detention and other harassment while traveling.

Long sued in 2015 to clear his name from this secret database. In 2020, Homeland Security informed Long that he had been removed from the no-fly list and would not be placed back on absent further information. The government argued in court that the removal of Long’s name from the no-fly list had rendered his claims moot. Yet his removal from the no-fly list has not meant his removal from the broader terrorism watchlisting database, nor from the dire consequences of his status.

Civil liberties advocates, who routinely challenge the constitutionality of the terrorism watchlist in court, have grown increasingly alarmed by the expansion of its use by local law enforcement agencies. In some cases, these local agencies have been tasked with both monitoring individuals assigned to the list and expanding its scope. In 2014, The Intercept published the government’s secret guidance for selecting individuals to the watchlist. Disclosures in a lawsuit from 2017 revealed that the watchlist had grown to 1.2 million people, the majority of whom are believed to be noncitizens and nonresidents of the United States.

Presence on the watchlist can generate numerous problems for those targeted, from harassment and detention while traveling to the type of routine law enforcement threats and harassment Long now faces.

“His experience, unfortunately, is very common for people who are still on watchlists, even if they are not on the no-fly list. It is par for the course for anyone on a watchlist to experience more aggressive traffic stops,” said Naz Ahmed, a staff attorney with the Creating Law Enforcement Accountability and Responsibility project at the City University of New York School of Law. “Officers are instructed not to do anything that gives away that a person they have pulled over is on a watchlist or to carry out warrantless searches. But you can imagine how an officer may react who doesn’t have much training on this subject, and does not see it commonly, when they come across someone in this situation.”

A 2016 report by Yale Law School and the American Civil Liberties Union found that the U.S. government had “drastically expanded a consolidated watchlisting system that includes hundreds of thousands of individuals based on secret evidence.” The report documented how the system was now being used and interpreted by local police forces who were frequently acting upon “potentially erroneous, inaccurate, or outdated information.” Unlike the no-fly list, which has some limited redress processes, the broader terrorism watchlist remains largely opaque and unchallengeable.

“The FBI accepts almost every single ‘nomination’ to its list submitted by anyone,” Long’s lawsuit says. “This is because the FBI uses a standard so low that, based on a string of speculative inferences, any person can be made to qualify.”

Long’s lawyers filed suit against the local police department in Oklahoma City on Thursday, to compel its officers to stop pulling him over based on his watchlisting status. Long is also asking for financial compensation for violations of his Fourth Amendment rights. (The Department of Homeland Security did not immediately respond to a request for comment about the suit.)

Despite his recent experiences, Long has continued driving to work, doing errands, and visiting family in Oklahoma City but with increasing trepidation about how his watchlisting status is being interpreted by local police. Some police officers have been apologetic while pulling him over; others have responded aggressively, treating him as a threat, pulling out weapons, and causing him to fear for his life.

“For the past year or two, I noticed that the Oklahoma City police often followed me while driving, though without pulling me over,” said Long. “I got kind of used to it, but just recently, within the last month and a half, that’s when this started turning into something much more serious.”

The most recent incident, when he was pulled over earlier this month by a group of police officers who drew guns on him and ordered him out of his vehicle — an incident that Long also caught on his own dashboard camera — was the most alarming in his recent series of run-ins. A video of the incident shows police officers yelling contradictory instructions at him for several minutes while standing with guns drawn behind his vehicle.

“I was wondering if they were going to make my wife a widow now for something so silly,” Long said, “just for me being on this list, when they themselves don’t even know why I’m on it.”

4 notes

·

View notes

Text

Subsegment: Old News, (slightly) Odd Coincidences

One of the long-running geopolitical gordian knots of our time is the question of whether Iran is poised to cross the "nuclear threshold" and what (if anything) can be done by way of intervention to prevent it becoming a nuclear power.

In 2017 for example, the Carnegie Endowment for International Peace held a panel event entitled "Beyond the Nuclear Threshold" which focused on the Iran Deal.

And in July 2020, the NY Times reported that a critical threshold had been passed because Iran's stockpile of nuclear fuel was sufficiently large to make a bomb.

There are many such examples.

My interest in this story has been piqued by three or four convergent factors besides than the obvious imperative that we should all be interested in the preservation of humankind and the avoidance of mutual destruction. First, the story was of professional interest because I was involved at one stage in trying to interpret both the Iranian sanctions regime as it applied to banking and finance and assess the impact of the JCPOA on emerging regulation; second it was of personal interest, because I'm certain that "nuclear" is one of those "code words" that people use to achieve a subtextual meaning that I've never fully understood; and, third, my curiosity was piqued because I once heard someone say "Jo knows all about Israeli intelligence on Iran's nuclear programme" which was both startling and utterly perplexing to me—just at it would be to you, mutatis mutandis—but also vaguely threatening and anxiety-producing.

As to the second of these, I've given up the game of trying to interpret subtexts from an alphabetical perspective, but I will mention—because it's relevant here—that my long and deep involvement in that exercise left me with a perennial interest in the letters "NU" as they appear in the word "nuclear".

So there we have it—a variety of "nuclear" threads which have to do largely with words, not weapons, which converge only for me and which don't mean anything to anyone else at all.

But here's the (mildly) odd coincidence. On 23 January, the Institute for National Security Studies in Israel presented a strategic assessment to President Isaac Herzog which warned that Iran would soon become a "nuclear threshold state", and the term "threshold" suddenly zipped to the top of the news cycle again.

Following the presentation of the assessment, the former commander of Israel’s navy, Eliezer Marom, was reported as having said that, in light of the fact that Iran is on the threshold of obtaining nuclear weapons, it would be better to attack “now than later.”

"In my understanding, I think Israel has to attack, because the situation right now is that Iran is a threshold country - 100 percent," he replied.

That had exactly the effect one would suppose—inflamed tensions and more than a frisson of geopolitical anxiety.

Meanwhile, a cryptocurrency token named "Threshold" also hit the crypto news on 23 January when Coinbase listed it as a new asset on its roadmap:

Threshold (T), which nearly doubled in price following the listing, is the umbrella token under which two other companies and their tokens are in the process of merging (following a proposal that was adopted at the end of 2021 and initiated in February last year). Those tokens are produced by Keep Network (KEEP), and NuCypher (NU). KEEP and NU will be delisted on 6th February. Transfers of assets to Threshold from KEEP and NU have been possible from 25th January.

And that, it seems to me—the convergence of news on 23 January about Iran's IRL status as a "nuclear threshold country" and about Threshold's virtual status as a repository of value following the merger of KEEP and NU—is a mildly odd coincidence.

1 note

·

View note

Text

i basically only heard about this because i work at a synagogue, and our community watchdog email blast put out an alert. have seen absolutely zero talk about it outside my job.

The reason streamed services in particular are being targeted is because the trolls want to watch the police response from their fake swat call in real time.

shul staffers (or people who belong to a shul & want to help them be safer), here is what you can do to mitigate risk on the streaming end:

1. if your shul livestreams services, make that shit private right now. Make the page private, de-index it, hide it from search engines. i cant speak for other kinds of sites but i know shulcloud lets you hide pages from search engines in the page settings. do that. you can even make sections in pages or entire pages themselves hidden from people who aren’t logged in (but depending on your community’s level of shabbat adherence that might not be a good solution; ymmv). if you stream using youtube, private or delist your videos. if you can get to your shul’s stream page from a google search in an incognito window your work is not done. i googled “[common synagogue name] + stream” and pulled up an absolutely depressing number of shuls whose streams are just out there for anyone to watch or hijack with a swat call.

2. absolutely do not post the link to that private stream page anywhere publicly accessible. Do not give it out to just anyone who calls or emails. Honestly i wouldn’t even put it in your newsletters. Increase the number of hoops that strangers have to jump through to get that link. Make them call or email you. Ask them questions. Who are they. How did they hear about us. Are they affiliated with a shul. Why do they want our shul’s link in particular. It’s okay to be honest and say you’re doing this for security reasons due to the wave of fake swat calls. Anyone normal will understand. Also, instruct b’nai mitzvah families to be careful that the link does not leave their circle of invitees. and for the love of god do not fucking post it on facebook or instagram.

We actually broke our old link in the process of making a new private page so that anyone who had the old one (any old joe schmoe who could have accessed our site during the pandemic) can’t see the stream anymore.

i know the high holidays are coming up and it’s about to be a busy time for shuls everywhere but you do not want to add armed police invasion to your list of things to worry about. private your streams. safeguard your links. thank you

Because I'm only seeing other Jews posting about this, non-Jews I need you to be aware that for the past month or two there has been a wave of bomb threats and swattings at synagogues all across the US. They usually do it when services are being livestreamed. I haven't seen a single non-Jew talking about this. High holidays are coming up in a few weeks, which is when most attacks happen against our communities. We're worried, and we need people to know what's happening to us.

64K notes

·

View notes

Text

Corporate Governance Demystified

2025 is here. We wish our readers a very Happy New Year.

“What if”. These two words best capture the thoughts that flow through our minds when we look back at the events of the past, and wonder whether things could have been different. The corporate world is no exception. The end of the year is a good time for stocktaking, and in that spirit, we take a look at what could have happened to make 2024 different.

Limitations of space will prevent us from traversing the entire list of corporate misadventures and transgressions. What follows is, at best, an illustrative list.

The developments in Byju’s contain several lessons for the observers of the corporate scene. Here was a company that charted new territory, and successfully captured a significant portion of the growing edtech space. While there were others that stood up and sought to be counted, Byju’s was, by far, the biggest player in this universe. Looking back, it is useful to reflect on what could have gone differently.

Sustainability of any company, especially a domain leader, would have to be premised on not just the entrepreneurs and founders, and their hopes and aspirations, but also a team of professionals that can bring in the required objectivity and balance in the decision-making process. In retrospect, was this something that Byju’s missed, especially in the earlier years? The ouster of the CEO, and his questioning it, was clearly a negative. Having on board the big names from the private equity space is not necessarily a guarantee for continued success. Even as they bring in the funds, and on occasion, the requisite expertise and medium-term involvement, one cannot lose sight of the fact that for private equity, investments are about growth, and a timely exit at a significantly high valuation, and has much less to do with ensuring that the company exists and prospers in the long run. Was the attraction of increasing private equity funds at astronomical valuations something that blinded the promoters, while on their journey of expansion and growth? Having a strong Board of Directors, consisting of persons who are willing and able to ask the right questions, is a positive that entrepreneurs do not recognise as often, and as quickly, as they should. And when Directors resign, tough questions will get asked. Bringing a couple of high-profile advisors later in the day, in an effort to correct the mistakes that have crept in, and to address issues of credibility, is never going to be enough. Multiple resignations of auditors was yet another red flag that alerted the stakeholder community. The eternal truth that growth could be fuelled by greed, and could result in grief, is something that ought to be rammed down the throats of aspiring entrepreneurs.

If Byju’s was the poster boy of a dream that went horribly wrong, there are others that should have done better, especially given their track records and leadership in their segments. The ICICI Group, in its attempts to delist ICICI Securities, has clearly ruffled a lot of feathers. Delisting by itself, for the right reasons, and at the right time, cannot be questioned. However, in order to make a success of the delisting exercise, the steps that are contemplated, and taken, ought to meet the tests of perception and credibility. Retail investors, who till recently, have lived with their unarticulated questions in regard to many companies, have decided in this case, and in some others, to flex their muscles. Multiple challenges have been mounted in different fora, alleging that arm-twisting and pressure had been resorted to in the process of the delisting exercise. The fact that the relevant resolutions were passed by a majority, have not put the concerns to bed. Judicial fora, and the Regulator, have raised questions, and it seems that the group might not see a satisfactory resolution, free of legal implications, any time soon. Could things have been different if the group had engaged the retail investors in an appropriate consultative exercise, and if the Board of the entity seeking to be delisted, had put out a detailed advisory indicating the benefits that would be derived by delisting the company?

Binny Limited is another company that has had to engage with Regulatory organisations on multiple occasions. There have been allegations of diversion of funds, breach of trust, financial misconduct and lack of transparency in the company’s operations. Leadership disputes, while not uncommon, have manifested themselves in strange ways, with the Chairman and Managing Director (CMD) denying knowledge of signing his own resignation letter, which was submitted by his son. While intergenerational disputes created their own problems, the Independent Directors (IDs) clearly did not measure up, and admitted as much by paying a significant amount to the Regulator to settle proceedings.

Religare is yet another instance of the incumbent management resorting to every conceivable stratagem to resist the takeover by a large listed group. Given the nature of the disputes, it was inevitable that the Securities Regulator got involved, and called for explanations on important developments. Meanwhile, the CFO reportedly resigned, and there was delay in notifying the resignation to the Stock Exchanges. On its part, the RBI refused to accord approval to the appointment of one of the Directors on the Board of Religare Enterprises. While all of this was going on, the Annual General Meeting (AGM) got deferred, giving rise to further concerns on the lack of transparency in the company. The grant of ESOPs to the Chairperson, and allegations of Insider Trading violations, have further queered the pitch. Could these issues have been addressed ab initio by a conversation between the 2 entities, knowing that a public dispute is unlikely to be of benefit to either of them? Meanwhile, the ordinary shareholders, and other stakeholders, await the outcome of what is likely to be a long drawn stand-off between the contending parties.

The goings on in Zee TV would do justice to a television serial that is likely to play out over a long period, with every episode reflecting a turn in the story. Those following the developments, sometimes get the impression that matters are about to be resolved, and then one of the parties bowls a googly to complicate matters. While the battle goes on, the company has to absorb the shocks which have dented not only the image, but also the business prospects on a long-term basis. The fact that the Chairman Emeritus chose to write a public communication, critical, to put it mildly, of the Securities market Regulator, is not going to strengthen anyone’s case. Meanwhile, the erstwhile Managing Director (MD) stated that he did not want to offer himself for reappointment, but got himself designated as CEO, finessing the Board. In a recent development, NFRA has found serious deficiencies in the audit reports, by Deloitte, relating to the company. Meanwhile, the other group company, Dish TV, not wanting to be left out, is still grappling with problems of leadership. Attempts to reappoint 2 IDs did not succeed.

The corporate governance issues in PTC India Financial Services (PFS) have been taking interesting turns. Matters came to a head with the resignation of some IDs, who chose to, in detailed communications, go public with the reasons for their resignation. After taking cognisance of the matter, SEBI, by a detailed order, found that the senior management of the company had not conducted itself properly, and passed orders imposing penalties, as well as disqualifying the Non-Executive Chairperson, and the MD from holding important positions, including directorships. Very recently, Securities Appellate Tribunal (SAT) has set aside SEBI’s order. This should not however lead to the conclusion that the conduct of the persons concerned has been validated by the Appellate body. This is a matter which almost certainly will find its way to the Supreme Court for resolution.

PFS was not the only public sector undertaking which was on the wrong side of the corporate governance prescriptions. According to reports, IOCL, GAIL, ONGC, BPCL, Oil India, HPCL, Engineers India and Mangalore Refinery and Petrochemicals, were among the PSUs which were fined for over 3 quarters for failure to appoint Directors, or for not meeting listing norms. While it is easy to point a finger at the PSUs concerned, one should not lose sight of the fact that it is for the administrative Ministries concerned to ensure that there are no vacancies in the positions of Directors, especially IDs. Ownership, it must be recognised, brings with it, certain responsibilities.

The list of unfortunate developments in the corporate arena in 2024 cannot ignore the developments in the boardroom of Godfrey Phillips India Limited. While standoffs and trading of allegations are par for the course when there are serious differences, this case has witnessed allegations of physical misconduct in the boardroom, with one Director alleging that he was assaulted by, or at the behest of, other Directors. This must be a rare case in which issues have been sought to be resolved by allegedly trading blows in the boardroom, which is intended to be a place for cerebral exchanges. The facts are not yet fully clear. However, this being a tobacco company, it is possible to recognise that there can be no smoke without fire. Clarity should have emerged from Stock Exchange filings. The Nomination and Remuneration Committee allegedly acted at the instance of the Executive Chairperson, to keep out one of the Directors.

The intersection between families and business throws up its own share of governance issues. In the recent past, there have been disputes in the Kirloskar Group as well as in the Kalyani Group, with opposing parties claiming a bigger share of the business. On the surface, these can be brushed aside as mere disputes between family members. However, the fact that these are listed entities, with other shareholders and stakeholders, and their interests, whether by way of a diminishing value of shares, or otherwise, is a matter that should not be lost sight of. It would be appropriate for such family groups, where there is an existing dispute, to reach out to a mediator, to see whether an amicable solution can be found. Where there are potential disputes, it might be necessary to quickly put in place a family constitution that details every member’s ownership, as well as executive responsibilities, if any.

Raymond also had its share of disputes. Firstly, between the father and the son, and then between the husband and the wife, who later became a whistleblower. A lot of dirty linen got washed in public. Directors, it is believed, should have been much more active while the disputes were taking shape. Shareholders have seen an adverse impact on the value of their shareholdings because of promoters who did not place the company above themselves. For turning whistleblower, the wife found that she was no longer a Director on the company.

The plurality of issues, and the plurality of expert opinions, obtained by Linde India in the context of their Related Party Transactions (RPTs), as well as the division of business between Linde India and Praxair India, throws up a number of interesting questions. The structural arrangements, including the ownership of companies within and outside India, necessarily bring to the fore, governance issues that need to be addressed ab initio. The ultimate test is whether the arrangements made, including the separation of business, and the transactions, are consistent with the interests of shareholders. On grounds of interpretation of materiality, and whether the transactions should be seen as severable, SEBI took a view different from the legal experts, who had tendered advice. The Appellate Tribunal endorsed SEBI’s findings, and the matter has travelled upto the Supreme Court. The question which arises is whether structural complexity, and partly or wholly shared ownership, necessarily creates issues, and if so, whether this should not have been addressed upfront, rather than by clutching at legal straws.

The case of LEEL Electricals throws light on how multiple things can go wrong in the absence of proper supervision, especially when there is alleged collusion by persons in management. SEBI’s detailed order on the affairs of the company does not pull any punches. The order describes, in graphic detail, the nature of diversion of funds, misrepresentation, and the underlying fraudulent activities, which led to the company’s interests being sacrificed, while individuals benefitted in the process. Severe penalties were imposed on a number of persons, both whole-timers and part-timers, with IDs also having penalties imposed against them. One of the 2 IDs, a former services official, with a long tenure, admitted that he was not briefed about his responsibility while being inducted on the Audit Committee, and that he did not have domain knowledge to effectively discharge his duties as a member of the committee. This calls into question the necessity for proper composition, and continuous training of Directors, especially those who are inducted on committees with significant responsibilities. For a Director, neither ignorance of law, nor ignorance of relevant facts that should have been noticed, is an adequate defence.

The longstanding dispute between Finolex Industries and Finolex Cables calls into question the adequacy of family arrangements. In this case, the family arrangement clearly stipulated which individual will be in-charge of the affairs of which of the 2 companies. One of the 2 brothers got the Articles of Association amended to get control of the 2 companies through a third company. Following the finding of the Supreme Court that there was no integrity in the NCLAT proceedings, the latter changed its conclusion to give control to the other brother. Meanwhile, Finolex Industries voted to oust the Chairman of Finolex Cables. It also voted against the appointment of a Non-Executive Director, thereby making the Board have a strength of less than 6 Directors (the mandatory minimum). Finolex Cables returned the favour, and voted to not reappoint 4 Directors to the Board of Finolex Industries, thereby making that company also non-compliant with regulations relating to Board composition. The major takeaway from a corporate governance perspective is whether a family arrangement can be made watertight enough to prevent its being changed, or tinkered with, by persons who wish to gain control not envisaged by the family arrangements.

Unjust enrichment of Directors and persons in management is a phenomenon that has been manifesting itself in recent times, especially in India. In the case of ICICI Bank, orders were passed for clawback of some of the benefits given to the erstwhile MD. In the IL&FS case, attempts have been set in motion to claw back compensation paid to IDs. This illustrates the requirement that when payments are made for certain milestones, activities or responsibilities, there must be a mechanism to recoup the amounts, if the basis for such payments has been shown to be wrong. Whether the payment to IDs can be clawed back, based on subsequent developments, without going into the responsibility, or the lack thereof, of each of the Directors, is a matter that should get determined in due course. In the case of management personnel, there are KRAs to which payouts can be related. That not being the case in the case of IDs, the question would arise whether there can be quantifiable clawbacks for non-satisfactory discharge for non-quantifiable responsibilities.

2024 witnessed the interesting development of Department of Justice of the USA initiating action against two Indian companies, allegedly on the basis that provisions of the Foreign Corrupt Practices Act (FCPA) had been violated. These are early days yet to speculate on how this would play out. However, the larger question which relates to territorial jurisdiction, and whether it can be stretched to companies not listed in that territory, needs to be settled in due course. This case assumes additional significance because the group to which the two companies belong, has been allegedly favoured in the home jurisdiction, and there are matters arising therefrom which are yet to be finally determined judicially.

In the case of Jindal Poly Films, shareholders have got together and filled a class action, alleging a circuitous transaction that has led to the company incurring losses. The company has challenged the filling of the class action suit, stating that the petitioners do not constitute a homogenous group, and do not belong to a class as contemplated by Section 245 of the Companies Act, 2013. A final determination of the applicability of Section 245 of the Companies Act, 2013 in such cases will be helpful for groups of shareholders with shared concerns, and legitimate causes of action.

During the year, there have been instances of IDs quitting Boards on grounds of non-compliance, by the company, of corporate governance provisions and practices. Both in the case of Suzlon Energy, and VIP Industries, the reasons for resignation are explicit. However not many details of specific non-compliances have come into the public domain. These are matters in which Stock Exchanges, as first level Regulators, and SEBI, should do a deep dive, to determine whether there are serious transgressions, and if so, what corrective action, if any, needs to be taken. This will send a signal to IDs in other companies, who are experiencing a similar situation of unease. Even as IDs in increasing number consider resignation from the Board, Statutory Auditors are seeking exits for a variety of reasons. That is a story for another day.

Will 2025 be any different? Or will similar stories play out with changes only in the names of the companies, and the characters? With fingers crossed, and with a hope and a prayer, let us welcome the New Year.

Source: https://excellenceenablers.com/knowledge-centre/newsletters/january-2025/

0 notes

Text

Two current administration officials and a former top US official told NBC News Wednesday that the Biden administration is considering lifting the foreign terrorist designation from Hay'at Tahrir al-Sham, the most prominent of the groups that deposed Syrian President Bashar al-Assad. US President Joe Biden claimed credit for the fall of Damascus at the hands of the new government forces, which include Hay'at Tahrir al-Sham (HTS), saying that Washington weakened the supporters of former Syrian President Bashar al-Assad. On Sunday, Biden said in a video address from the White House that the result of the lighting offensive of anti-government armed groups in the past two weeks was a "fundamental act of justice" and a "moment of historic opportunity for the long-suffering citizens of Syria". The negotiations are intended to "create a pathway for the world to interact with the new government," according to the former official. While two individuals said the administration hopes to withdraw the designation "soon," another indicated talks are still in the early stages. The authorities claimed that removing the terrorist label from HTS, which has historical ties to al-Qaeda, would involve removing Ahmad al-Sharaa's (Abu Mohammad al-Jolani) $10 million bounty. Al-Jolani is the commander of the new regime forces' military operations room, and according to National Security Advisor John Kirby, there are currently no conversations about modifying the policy regarding HTS, but they are closely monitoring their actions. The government wants to examine how HTS governs over the next two weeks and is simultaneously looking into what legal work is required to delist it.

0 notes

Text

Increase in tender offers fuels wave of company delistings on B3

Declining stock prices, coupled with changes to buyout rules, are expected to further accelerate activity, experts say

Since last year, as the Brazilian stock market has faced a downward trend, the number of public tender offers has been rising. This year alone, nine buyout offers have already been registered with Brazil’s Securities and Exchange Commission (CVM), with the trend pointing upward. Experts say changes to tender offer rules, which have made these transactions easier to execute, are likely to drive even greater activity.

The backdrop to this trend is the undervaluation of many listed companies, a direct consequence of high interest rates in Brazil and significant global volatility. As a result, companies and financial investors are turning their attention to listed firms, believing many are fundamentally sound yet undervalued.

However, this wave of delistings resulting from public offers is also reducing the number of listed companies. New listings have been absent from the B3 stock exchange for over three years. Currently, there are 434 companies listed on B3, down from 456 a year ago.

Among the notable buyout offers this year was Cielo, whose controlling shareholders, Banco do Brasil and Bradesco, decided to delist the payments processor, ending its 15-year run as a publicly traded company. Another example was Alper, an insurance company, which was taken private after its control was acquired by U.S. private equity fund Walburg Pincus. Similarly, Safra, after acquiring control of Alfa, initiated a tender offer. The companies involved declined to comment.

Continue reading.

1 note

·

View note

Text

Crypto Insider Trading: Risks, Regulations, and Ethical Implications

Insider trading, a term widely recognized in traditional finance, has found its way into the cryptocurrency market, albeit with unique challenges and implications. In crypto, insider trading refers to the unethical and often illegal practice of trading based on material, non-public information, such as upcoming token listings or partnerships. Unlike traditional markets, crypto operates in a relatively nascent regulatory environment, creating opportunities for exploitation. The ethical, legal, and financial ramifications of crypto insider trading are profound, threatening market fairness and undermining trust among participants. Platforms like PrimeTrader are at the forefront of promoting fair trading practices and enhancing transparency to address these concerns.

How Insider Trading Works in Crypto

At the heart of crypto insider trading lies information asymmetry, where privileged access to non-public knowledge gives select individuals an unfair trading advantage. Examples include early knowledge of token launches, pre-announcements of exchange listings that lead to price spikes, or undisclosed partnerships.

The influence of crypto whales—individuals or entities holding significant quantities of a token also plays a role in market manipulation. By leveraging insider knowledge or executing large trades, whales can sway market trends, often at the expense of retail investors. These practices undermine the integrity of the market, making fair competition a challenge for everyday traders.

Legal and Regulatory Landscape

Traditional Market Regulations vs. Crypto In traditional markets, strict insider trading laws are enforced to protect investors and maintain market integrity. However, the cryptocurrency sector often operates in a regulatory gray area, with inconsistent rules across jurisdictions. While some countries have implemented robust frameworks, others lack clear guidelines, leaving loopholes for unethical behavior.

Regulatory Efforts in Crypto

Organizations like the SEC have started addressing insider trading in crypto. High-profile cases, including actions against individuals trading unregistered securities, highlight the need for comprehensive regulations. Non-compliance carries severe consequences, including fines, delisting of tokens, and reputational harm for platforms. By collaborating with global regulators, the crypto industry can move toward a more standardized and secure trading environment.

Ethical Implications of Insider Trading in Crypto

Insider trading erodes trust, a cornerstone of any market. In crypto, where many investors are retail participants, this creates an uneven playing field. Ethical dilemmas arise in decentralized markets: should transparency be prioritized to uphold decentralization's principles? The impact of insider trading extends beyond financial loss, as it discourages participation and stifles innovation in the crypto space. Upholding ethical trading practices is crucial for maintaining investor confidence and market sustainability.

Blockchain Transparency: A Double-Edged Sword

Blockchain’s public ledger system offers a unique form of transparency, allowing suspicious trading activities to be traceable. For instance, unusual wallet movements before major announcements can raise red flags. However, this transparency has limitations:

Privacy Coins: Cryptocurrencies like Monero and Zcash obscure transactions, making illicit trades harder to trace.

Anonymized Wallets: The inability to link wallets to real-world identities complicates enforcement efforts. While blockchain technology offers tools to combat insider trading, the challenges of proving intent and identifying individuals remain significant hurdles.

High-Profile Cases of Insider Trading in Crypto

Several notable cases have highlighted the prevalence of insider trading in crypto. For example, pre-listing trades on exchanges often lead to price surges before official announcements. Investigations into employees of major crypto firms leaking confidential information have also surfaced. These incidents damage investor trust and reinforce the need for stricter oversight. Learning from such cases, platforms like PrimeTrader emphasize transparency and implement robust internal controls to safeguard market integrity.

Measures to Prevent Insider Trading in Crypto Efforts to curb insider trading require a multi-faceted approach:

Platform-Level Protections

Exchanges must enforce transparency for token listings and corporate disclosures.

Internal controls, such as restricted access to sensitive information, can deter insider leaks.

Regulatory Improvements

Stricter regulations, coupled with consistent enforcement, are vital for deterring insider trading.

Collaborative efforts between global regulatory bodies can help create standardized practices.

Community Efforts Whistleblowers play a critical role in exposing unethical behavior. Encouraging the reporting of suspicious activities helps uphold market integrity. Platforms like PrimeTrader support these measures by fostering a transparent and ethical trading environment.

How Traders Can Protect Themselves Retail traders can take steps to safeguard their investments:

Avoid Hype: Stay away from pump-and-dump schemes driven by insider trading.

Research Thoroughly: Evaluate projects based on fundamentals rather than speculative news.

Monitor Market Activity: Use blockchain tools to identify unusual wallet transactions or market movements. By focusing on informed decisions and ethical platforms like PrimeTrader, traders can minimize exposure to insider-driven risks.

The Future of Insider Trading Regulation in Crypto As blockchain analytics tools advance, detecting illicit trades will become more efficient. The rise of decentralized exchanges (DEXs) introduces new challenges, but also opportunities for enhanced transparency. Regulatory frameworks are expected to evolve, addressing insider trading with greater precision. As these changes unfold, platforms like PrimeTrader will continue to lead the way, promoting fairness and innovation in the crypto trading ecosystem.

Conclusion Crypto insider trading poses significant risks to market integrity, undermining trust and exposing traders to financial losses. Addressing this issue requires a combination of robust regulations, ethical trading practices, and vigilance from the community. To navigate the crypto market confidently and ethically, choose platforms like PrimeTrader, where transparency and fairness are at the core of every transaction.

0 notes

Text

Delisting of Securities: A Comprehensive Overview

Introduction According to SEBI, ‘delisting’ refers to the permanent removal of a listed company’s securities from a stock exchange, resulting in those securities no longer being traded on that exchange. Delisting of securities occurs when a company chooses to withdraw its securities from the stock exchange where they were previously listed and traded. If a company decides it no longer wishes to…

0 notes

Text

Sec Alivia Regulación Para 12 Criptomonedas En Binance

Understanding SEC's New Regulations on Cryptocurrencies in Binance

The world of cryptocurrency has always been a wild ride, full of highs and lows. With the recent news about the U.S. SEC's decision to regulate twelve specific cryptocurrencies on Binance, it’s essential for both seasoned investors and newcomers to grasp what this means for them.

What's the Big Deal?

The United States Securities and Exchange Commission (SEC) has taken recognition of the rapid growth and popularity of cryptocurrencies. With that, they’ve set their eye on a dozen cryptocurrencies available for trading on Binance, a major cryptocurrency exchange. This decision is aimed at overseeing the market, protecting investors, and maintaining fair trading practices.

Impacted Cryptocurrencies

According to the announcement, here is a list of cryptocurrencies that are most affected:

Ethereum Classic (ETC)

Neo (NEO)

Cardano (ADA)

Tron (TRX)

Dash (DASH)

Monero (XMR)

Bitcoin Cash (BCH)

Litecoin (LTC)

Algorand (ALGO)

Stellar (XLM)

Quant (QNT)

VeChain (VET)

These coins have been noted for potential risks and regulatory issues, creating a stir among traders who either hold or are considering investing in them.

Why Regulation Matters

Regulation is a double-edged sword. On one side, it can enhance investor confidence by ensuring that trading platforms comply with certain rules. This can lead to more people entering the market, which could normalize cryptocurrency as a legitimate form of investment. On the other hand, stringent regulations may deter smaller investors who fear hefty compliance costs, or who find the landscape too complicated to navigate.

Binance's Position

Binance has long been in a grey area regarding compliance and regulations. The exchange has made efforts to adapt, such as enforcing KYC (Know Your Customer) policies and striving for greater transparency. The recent SEC regulations may enforce Binance to revise its offerings, potentially delisting certain cryptocurrencies or increasing its compliance investments.

How Should Investors React?

For investors, it’s vital to stay informed. Here are some steps you might consider:

Educate yourself about the specific cryptocurrencies you hold.

Monitor news regarding SEC regulations closely.

Consult with a financial advisor, particularly if you’re projected to invest in any of the affected cryptocurrencies.

Diversify your portfolio to mitigate potential risks.

In Conclusion

The SEC's regulation of these twelve cryptocurrencies marks a significant milestone in the world of digital assets. While change is daunting, understanding regulations and trends can empower investors to make informed decisions. Whether this leads to a more robust crypto market or creates further complications remains to be seen, but one thing's for sure: the evolution of cryptocurrencies is ongoing.

Stay tuned to our blog for more insights into the ever-changing landscape of finance and investment technology!

Sec Alivia Regulación Para 12 Criptomonedas En Binance

0 notes

Text

SEC Revises Binance Lawsuit, Drops Solana from Alleged Securities List

The SEC has changed its lawsuit against Binance and has delisted Solana from the cryptocurrencies it claimed to be securities. This decision comes after a court declared that secondary markets in Binance’s BNB token did not fall under securities. On the same day, the 30th of July, the SEC filed a joint status report with the United States District Court for the District of Columbia concerning the…

0 notes

Text

“Social Stock Exchange Faces Delisting Dilemma"

When To Delist From The Social Stock Exchange

There are wolves hidden under the cover of the law because non-profit organizations’ alternative financing methods using such common tools as debt and shares are severely limited. But at the same time, it is possible to get resources as the zero coupon zero principal bonds are placed on the SSE. ZCZP bonds that carry an equal tenure to the duration of the project for that which is funded, and at tenure, they will be written off the investee’s books. These instruments are for those investors who are looking to create social impact instead of not getting any return on investment. In this article, we will discuss the termination of Zero Coupon Zero Principal Instruments, which is equivalent to delisting. There are different modes of fund raising, like Equity, ZCZP, Development impact Bonds, Social Impact Funds and Donation through Mutual Fund.

About Zero Coupon Zero Principal Instruments

They are a type of financial derivative that has no periodic interest payments and no repayment of principal at maturity. They are also known as pure discount instruments or zero coupon bonds and there is no need to pay any securities transactions on zero coupon zero instrument

Zero coupon zero principle instruments (ZCZP) are financial instruments that a non-profit organization may use to raise funds. When an entity issues these securities and raises money, it is not a loan but a donation. The borrowing entity does not have to pay interest—therefore zero coupon—and does not have to pay the principal (zero principal) either. Like any other debt instrument, it will come with a time duration.

Any individual or corporate can buy the security through SSE once they are open for business.

The Finance Ministry had declared zero coupon zero principle instruments (ZCZP) as securities for the Securities Contracts (Regulation) Act, 1956. These instruments will be governed by rules by the SEBI. It will help organizations and corporates to utilize their social responsibility funds and support non-profit organizations more transparently.

This Provision is not applicable to For Profit Organization because For-profit organizations is not eligible to issue Zero Coupon Zero Principal Instruments for raising funds.

If NPO wants to renew the registration after a year and they have not raised any fund in the previous year through SSE so this is acceptable and they can do so.

Advantages

Fixed Return

Lower Credit Risk

Useful For Liability Matching

Lock In Return

Disadvantages

Interest Rate Sensitivity

Reinvestment Risk

Taxation On Imputed Interest

When bonds are issued, they are listed on Social Stock Exchange and these bonds will not be traded in the secondary market but can be transferred for other purposes. Termination of ZCZP is equal to delisting from the social stock Exchange.

Termination of the listing of Zero Coupon Zero Principal Instruments by the Social Enterprise shall occur in the following events:

When Tenure Is Over, It Is Considered Terminated From The Social Stock Exchange, Which Is Equivalent To Delisting.

When The Object For Funds Was Raised, That Has Been Achieved, And The NPO Has Submitted A Certificate To The Social Stock Exchange, It Is Also Considered A Bond That Has Been Terminated From SSE.

If The NPO Decides Not To Issue ZCZP To The Public But Only To Limited Donors, It Can Do So Privately Through Social Impact Funds Or Other Means.

Conclusion:

If social enterprises want to terminate or delist their instruments, they must comply with the above conditions. After completing tenure and the object has been fulfilled, they will automatically delist the instrument from the social stock exchange. If the company wants to list the instruments, then it again has to list them with the process of issuing zero coupon for zero principal instruments with other purposes that should be related to eligible social activities.

DISCLAIMER: The information provided in this article is intended for general informational purposes only and is based on the latest guidelines and regulations. While we strive to ensure the accuracy and completeness of the information, it may not reflect the most current legal or regulatory changes. Taxpayers are advised to consult with a qualified tax professional or you may contact to our tax advisor team through call +91-9871990888 or [email protected].

0 notes

Text

UK Unveils Largest Overhaul of Listings Regime in Decades

Regulators have greenlit the most extensive revision of rules governing London-listed companies in thirty years, aiming to rejuvenate the UK's capital markets amidst stiff international competition and declining investment inflows. Under the new listing rules, company executives will gain increased authority to make decisions without requiring shareholder votes. Additionally, companies will have greater flexibility to adopt dual-class share structures, which are favored by founders and venture capital firms to secure enhanced voting rights compared to other investors. The Financial Conduct Authority (FCA) formally announced these changes on Thursday, shortly after the Labour government's election, confirming a report initially by the Financial Times last month. The new regime is set to take effect on July 29, following two public consultations conducted by the FCA since May 2023. Despite acknowledging an elevated risk for investors, the FCA emphasized that these adjustments would better align with the necessary risk appetite for economic growth. London has faced challenges in competing with New York for listings of high-growth startups, a trend exacerbated by major companies like Flutter and CRH moving their primary listings to the US. "The financial services sector is pivotal to the UK economy, integral to this government's growth strategy," remarked Rachel Reeves, the new Chancellor of the Exchequer, on Thursday. "These new regulations mark a significant initial step towards revitalizing our capital markets, aligning the UK with global standards, and attracting the most innovative companies to list here." This overhaul builds upon broader reforms initiated by the previous Conservative government, which the Labour administration intends to uphold. These reforms include the Edinburgh and Mansion House initiatives aimed at boosting domestic pension fund investments in UK assets and fostering a culture of increased risk-taking. Looking ahead, the FCA plans to launch a review of the UK's prospectus rules later this summer. The latest listing rule changes announced on Thursday are more extensive than previously proposed by the FCA in December, as they allow institutional investors to hold super voting rights under dual-class share structures. Initially, the FCA had proposed limiting extra voting rights to natural persons such as founders and directors. Notably, the new rules also exempt sovereign wealth funds from the 10-year limit on holding super voting rights, potentially facilitating easier listings for certain Middle East-owned companies in the UK. In a published document, the FCA acknowledged strong opposition from investors regarding the expanded use of dual-class structures, highlighting significant concerns within the investment community. The Financial Conduct Authority (FCA) indicated that companies and their advisors largely supported the increased flexibility to utilize dual-class shares. They emphasized that investors would retain the option to abstain from investing in any structure they found uncomfortable. Advocates of the proposals pointed out that investors already endorse overseas companies employing dual-class shares, including prominent US tech firms. Under the new rules, requirements for shareholder approval of related party transactions or certain large deals will be eliminated. However, shareholder votes will still be mandatory for actions like delisting, executing a "reverse takeover" of a larger entity, or responding to a takeover bid. Additionally, the new rules will streamline the current system by consolidating the premium and standard listing segments into a single category. Existing companies will have access to transitional arrangements. In defense of these changes, FCA chief Nikhil Rathi argued that maintaining the status quo was not viable. He stated, "We do not believe the status quo is an option," expressing concern that failing to revise the rules could lead the UK's regulatory framework to diverge significantly from international standards. This, he warned, would diminish the attractiveness of the UK as a preferred listing destination for companies seeking growth opportunities. Read the full article

0 notes

Text

The Most Poorly Performed ETFs This Year in Australia are Crypto-Related Ones

The Australian Exchange Traded Fund (ETF) market witnessed a decline of nearly $2 billion in overall capitalization by the end of November 2022, primarily attributed to the poor performance of cryptocurrency-related ETFs. Notably, the BetaShares Crypto Innovators ETF (CRYP) and the Cosmos Global Digital Miners Access ETF (DIGA) were the worst-performing ETFs.

BetaShares introduced the CRYP ETF on the Australian Securities Exchange (ASX) in October 2021, coinciding with a period of peak cryptocurrency prices. However, CRYP plummeted by over 82% year-to-date, while DIGA, listed on the Cboe Australia market, experienced a 72% drop. CRYP provides exposure to publicly traded blockchain and cryptocurrency companies, including major players like Coinbase and Riot Blockchain.

DIGA tracks the performance of firms primarily engaged in cryptocurrency mining, with Galaxy Digital being its largest holding at 12.3% of the portfolio. However, just one year after its launch, Cosmos requested the delisting of DIGA and two other ETFs tied to Bitcoin and Ether due to dwindling interest in cryptocurrencies, leading to a fall in net asset value below $1 million. Investor sentiment in 2022 has been influenced by concerns about inflation and rising interest rates, with a shift away from tech-focused ETFs.

0 notes