#securing a mortgage in los angeles

Explore tagged Tumblr posts

Link

Beverly Hills Real Estate-Beverly Hills Homes For Sale Luxury - christophechoo.com

0 notes

Text

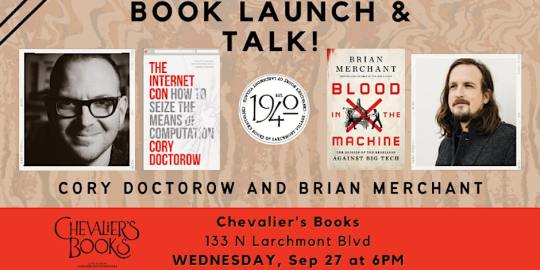

On September 22, I'm (virtually) presenting at the DIG Festival in Modena, Italy. On September 27, I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine.

It's been 21 years since Bill Willingham launched Fables, his 110-issue, wide-ranging, delightful and brilliantly crafted author-owned comic series that imagines that the folkloric figures of the world's fairytales are real people, who live in a secret society whose internal struggles and intersections with the mundane world are the source of endless drama.

Fables is a DC Comics title; DC is division of the massive entertainment conglomerate Warners, which is, in turn, part of the Warner/Discovery empire, a rapacious corporate behemoth whose screenwriters have been on strike for 137 days (and counting). DC is part of a comics duopoly; its rival, Marvel, is a division of the Disney/Fox juggernaut, whose writers are also on strike.

The DC that Willingham bargained with at the turn of the century isn't the DC that he bargains with now. Back then, DC was still subject to a modicum of discipline from competition; its corporate owner's shareholders had not yet acquired today's appetite for meteoric returns on investment of the sort that can only be achieved through wage-theft and price-gouging.

In the years since, DC – like so many other corporations – participated in an orgy of mergers as its sector devoured itself. The collapse of comics into a duopoly owned by studios from an oligopoly had profound implications for the entire sector, from comic shops to comic cons. Monopoly breeds monopoly, and the capture of the entire comics distribution system by a single company – Diamond – was attended by the capture of the entire digital comics market by a single company, Amazon, who enshittified its Comixology division, driving creators and publishers into Kindle Direct Publishing, a gig-work platform that replicates the company's notoriously exploitative labor practices for creative workers. Today, Comixology is a ghost-town, its former employees axed in a mass layoff earlier this year:

https://gizmodo.com/amazon-layoffs-comixology-1850007216

When giant corporations effect these mergers, they do so with a kind of procedural kabuki, insisting that they are dotting every i and crossing every t, creating a new legal entity whose fictional backstory is a perfect, airtight bubble, a canon with not a single continuity bug. This performance of seriousness is belied by the behind-the-scenes chaos that these corporate shifts entail – think of the way that the banks that bought and sold our mortgages in the run-up to the 2008 crisis eventually lost the deeds to our houses, and then just pretended they were legally entitled to collect money from us every month – and steal our houses if we refused to pay:

https://www.reuters.com/article/idINIndia-58325420110720

Or think of the debt collection industry, which maintains a pretense of careful record-keeping as the basis for hounding and threatening people, but which is, in reality, a barely coherent trade in spreadsheets whose claims to our money are matters of faith:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

For usury, the chaos is a feature, not a bug. Their corporate strategists take the position that any ambiguity should be automatically resolved in their favor, with the burden of proof on accused debtors, not the debt collectors. The scumbags who lost your deed and stole your house say that it's up to you to prove that you own it. And since you've just been rendered homeless, you don't even have a house to secure a loan you might use to pay a lawyer to go to court.

It's not solely that the usurers want to cheat you – it's that they can make more money if they don't pay for meticulous record-keeping, and if that means that they sometimes cheat us, that's our problem, not theirs.

While this is very obvious in the usury sector, it's also true of other kinds of massive mergers that create unfathomnably vast conglomerates. The "curse of bigness" is real, but who gets cursed is a matter of power, and big companies have a lot more power.

The chaos, in other words, is a feature and not a bug. It provides cover for contract-violating conduct, up to and including wage-theft. Remember when Disney/Marvel stole money from beloved science fiction giant Alan Dean Foster, whose original Star Wars novelization was hugely influential on George Lucas, who changed the movie to match Foster's ideas?

Disney claimed that when it acquired Lucasfilm, it only acquired its assets, but not its liabilities. That meant that while it continued to hold Foster's license to publish his novel, they were not bound by an obligation to pay Foster for this license, since that liability was retained by the (now defunct) original company:

https://pluralistic.net/2022/04/30/disney-still-must-pay/#pay-the-writer

For Disney, this wage-theft (and many others like it, affecting writers with less fame and clout than Foster) was greatly assisted by the chaos of scale. The chimera of Lucas/Disney had no definitive responsible party who could be dragged into a discussion. The endless corporate shuffling that is normal in giant companies meant that anyone who might credibly called to account for the theft could be transfered or laid off overnight, with no obvious successor. The actual paperwork itself was hard for anyone to lay hands on, since the relevant records had been physically transported and re-stored subsequent to the merger. And, of course, the company itself was so big and powerful that it was hard for Foster and his agent to raise a credible threat.

I've experienced versions of this myself: every book contract I've ever signed stipulated that my ebooks could not be published with DRM. But one of my publishers – a boutique press that published my collection Overclocked – collapsed along with most of its competitors, the same week my book was published (its distributor, Publishers Group West, went bankrupt after its parent company, Advanced Marketing Services, imploded in a shower of fraud and criminality).

The publisher was merged with several others, and then several more, and then several more – until it ended up a division of the Big Five publisher Hachette, who repeatedly, "accidentally" pushed my book into retail channels with DRM. I don't think Hachette deliberately set out to screw me over, but the fact that Hachette is (by far) the most doctrinaire proponent of DRM meant that when the chaos of its agglomerated state resulted in my being cheated, it was a happy accident.

(The Hachette story has a happy ending; I took the book back from them and sold it to Blackstone Publishing, who brought out a new expanded edition to accompany a DRM-free audiobook and ebook):

https://www.blackstonepublishing.com/overclocked-bvej.html

Willingham, too, has been affected by the curse of bigness. The DC he bargained with at the outset of Fables made a raft of binding promises to him: he would have approval over artists and covers and formats for new collections, and he would own the "IP" for the series, meaning the copyrights vested in the scripts, storylines, characters (he might also have retained rights to some trademarks).

But as DC grew, it made mistakes. Willingham's hard-fought, unique deal with the publisher was atypical. A giant publisher realizes its efficiencies through standardized processes. Willingham's books didn't fit into that standard process, and so, repeatedly, the publisher broke its promises to him.

At first, Willingham's contacts at the publisher were contrite when he caught them at this. In his press-release on the matter, Willingham calls them "honest men and women of integrity [who] interpreted the details of that agreement fairly and above-board":

https://billwillingham.substack.com/p/willingham-sends-fables-into-the

But as the company grew larger, these counterparties were replaced by corporate cogs who were ever-more-distant from his original, creator-friendly deal. What's more, DC's treatment of its other creators grew shabbier at each turn (a dear friend who has written for DC for decades is still getting the same page-rate as they got in the early 2000s), so Willingham's deal grew more exceptional as time went by. That meant that when Willingham got the "default" treatment, it was progressively farther from what his contract entitled him to.

The company repeatedly – and conveniently – forgot that Willingham had the final say over the destiny of his books. They illegally sublicensed a game adapted from his books, and then, when he objected, tried to make renegotiating his deal a condition of being properly compensated for this theft. Even after he won that fight, the company tried to cheat him and then cover it up by binding him to a nondisclosure agreement.

This was the culmination of a string of wage-thefts in which the company misreported his royalties and had to be dragged into paying him his due. When the company "practically dared" Willingham to sue ("knowing it would be a long and debilitating process") he snapped.

Rather than fight Warner, Willingham has embarked on what JWZ calls an act of "absolute table-flip badassery" – he has announced that Fables will hereafter be in the public domain, available for anyone to adapt commercially, in works that compete with whatever DC might be offering.

Now, this is huge, and it's also shrewd. It's the kind of thing that will bring lots of attention on Warner's fraudulent dealings with its creative workforce, at a moment where the company is losing a public relations battle to the workers picketing in front of its gates. It constitutes a poison pill that is eminently satisfying to contemplate. It's delicious.

But it's also muddy. Willingham has since clarified that his public domain dedication means that the public can't reproduce the existing comics. That's not surprising; while Willingham doesn't say so, it's vanishingly unlikely that he owns the copyrights to the artwork created by other artists (Willingham is also a talented illustrator, but collaborated with a who's-who of comics greats for Fables). He may or may not have control over trademarks, from the Fables wordmark to any trademark interests in the character designs. He certainly doesn't have control over the trademarked logos for Warner and DC that adorn the books.

When Willingham says he is releasing the "IP" to his comic, he is using the phrase in its commercial sense, not its legal sense. When business people speak of "owning IP," they mean that they believe they have the legal right to control the conduct of their competitors, critics and customers:

https://locusmag.com/2020/09/cory-doctorow-ip/

The problem is that this doesn't correspond to the legal concept of IP, because IP isn't actually a legal concept. While there are plenty of "IP lawyers" and even "IP law firms," there is no "IP law." There are many laws that are lumped together under "IP," including the big three (trademark, copyright and patent), but also a bestiary of obscure cousins and subspecies – trade dress, trade secrecy, service marks, noncompetes, nondisclosues, anticirumvention rights, sui generis "neighboring rights" and so on.

The job of an "IP lawyer" is to pluck individual doctrines from this incoherent scrapheap of laws and regulations and weave them together into a spider's web of tripwires that customers and critics and competitors can't avoid, and which confer upon the lawyer's client the right to sue for anything that displeases them.

When Willingham says he's releasing Fables into the public domain, it's not clear what he's releasing – and what is his to release. In the colloquial, business sense of "IP," saying you're "releasing the IP" means something like, "Feel free to create adaptations from this." But these adaptations probably can't draw too closely on the artwork, or the logos. You can probably make novelizations of the comics. Maybe you can make new comics that use the same scripts but different art. You can probably make sequels to, or spinoffs of, the existing comics, provided you come up with your own character designs.

But it's murky. Very murky. Remember, this all started because Willingham didn't have the resources or patience to tangle with the rabid attack-lawyers Warners keeps kenneled on its Burbank lot. Warners can (and may) release those same lawyers on you, even if you are likely to prevail in court, betting that you – like Willingham – won't have the resources to defend yourself.

The strange reality of "IP" rights is that they can be secured without any affirmative step on your part. Copyrights are conjured into existence the instant that a new creative work is fixed in a tangible medium and endure until the creator's has been dead for 70 years. Common-law trademarks gradually come into definition like an image appearing on photo-paper in a chemical soup, growing in definition every time they are used, even if the mark's creator never files a form with the USPTO.

These IP tripwires proliferate in the shadows, wherever doodles are sketched on napkins, wherever kindergartners apply finger-paint to construction-paper. But for all that they are continuously springing into existence, and enduring for a century or more, they are absurdly hard to give away.

This was the key insight behind the Creative Commons project: that while the internet was full of people saying "no copyright" (or just assuming the things they posted were free for others to use), the law was a universe away from their commonsense assumptions. Creative Commons licenses were painstakingly crafted by an army of international IP lawyers who set out to turn the normal IP task on its head – to create a legal document that assured critics, customers and competitors that the licensor had no means to control their conduct.

20 years on, these licenses are pretty robust. The flaws in earlier versions have been discovered and repaired in subsequent revisions. They have been adapted to multiple countries' legal systems, allowing CC users to mix-and-match works from many territories – animating Polish sprites to tell a story by a Canadian, set to music from the UK.

Willingham could clarify his "public domain" dedication by applying a Creative Commons license to Fables, but which license? That's a thorny question. What Willingham really wants here is a sampling license – a license that allows licensees to take some of the elements of his work, combine them with other parts, and make something new.

But no CC license fits that description. Every CC license applies to whole works. If you want to license the bass-line from your song but not the melody, you have to release the bass-line separately and put a CC license on that. You can't just put a CC license on the song with an asterisked footnote that reads "just the bass, though."

CC had a sampling license: the "Sampling Plus 1.0" license. It was a mess. Licensees couldn't figure out what parts of works they were allowed to use, and licensors couldn't figure out how to coney that. It's been "retired."

https://creativecommons.org/licenses/sampling+/1.0/

So maybe Willingham should create his own bespoke license for Fables. That may be what he has to do, in fact. But boy is that a fraught business. Remember the army of top-notch lawyers who created the CC licenses? They missed a crucial bug in the first three versions of the license, and billions of works have been licensed under those earlier versions. This has enabled a mob of crooked copyleft trolls (like Pixsy) to prey on the unwary, raking in a fortune:

https://doctorow.medium.com/a-bug-in-early-creative-commons-licenses-has-enabled-a-new-breed-of-superpredator-5f6360713299

Making a bug-free license is hard. A failure on Willingham's part to correctly enumerate or convey the limitations of such a license – to list which parts of Fables DC might sue you for using – could result in downstream users having their hard work censored out of existence by legal threats. Indeed, that's the best case scenario – defects in a license could result in downstream users, their collaborators, investors, and distributors being sued for millions of dollars, costing them everything they have, up to and including their homes.

Which isn't to say that this is dead on arrival – far from it! Just that there is work to be done. I can't speak for Creative Commons (it's been more than 20 years since I was their EU Director), but I'm positive that there are copyfighting lawyers out there who'd love to work on a project like this.

I think Willingham is onto something here. After all, Fables is built on the public domain. As Willingham writes in his release: "The current laws are a mishmash of unethical backroom deals to keep trademarks and copyrights in the hands of large corporations, who can largely afford to buy the outcomes they want."

Willingham describes how his participation in the entertainment industry has made him more skeptical of IP, not less. He proposes capping copyright at 20 years, with a single, 10-year extension for works that are sold onto third parties. This would be pretty good industrial policy – almost no works are commercially viable after just 14 years:

https://rufuspollock.com/papers/optimal_copyright.pdf

But there are massive structural barriers to realizing such a policy, the biggest being that the US had tied its own hands by insisting that long copyright terms be required in the trade deals it imposed on other countries, thereby binding itself to these farcically long copyright terms.

But there is another policy lever American creators can and should yank on to partially resolve this: Termination. The 1976 Copyright Act established the right for any creator to "terminate" the "transfer" of any copyrighted work after 30 years, by filing papers with the Copyright Office. This process is unduly onerous, and the Authors Alliance (where I'm a volunteer advisor) has created a tool to simplify it:

https://www.authorsalliance.org/resources/rights-reversion-portal/

Termination is deliberately obscure, but it's incredibly powerful. The copyright scholar Rebecca Giblin has studied this extensively, helping to produce the most complete report on how termination has been used by creators of all types:

https://pluralistic.net/2021/10/04/avoidance-is-evasion/#reverted

Writers, musicians and other artists have used termination to unilaterally cancel the crummy deals they had crammed down their throats 30 years ago and either re-sell their works on better terms or make them available directly to the public. Every George Clinton song, every Sweet Valley High novel, and the early works of Steven King have all be terminated and returned to their creators.

Copyright termination should and could be improved. Giblin and I wrote a whole-ass book about this and related subjects, Chokepoint Capitalism, which not only details the scams that writers like Willingham are subject to, but also devotes fully half its length to presenting detailed, technical, shovel-ready proposals for making life better for creators:

https://chokepointcapitalism.com/

Willingham is doing something important here. Larger and larger entertainment firms offer shabbier and shabbier treatment to creative workers, as striking members of the WGA and SAG-AFTRA can attest. Over the past year, I've seen a sharp increase in the presence of absolutely unconscionable clauses in the contracts I'm offered by publishers:

https://pluralistic.net/2022/06/27/reps-and-warranties/#i-agree

I'm six months into negotiating a contract for a 300 word piece I wrote for a magazine I started contributing to in 1992. At issue is that they insist that I assign film rights and patent rights from my work as a condition of publication. Needless to say, there are no patentable inventions nor film ideas in this article, but they refuse to vary the contract, to the obvious chagrin of the editor who commissioned me.

Why won't they grant a variance? Why, they are so large – the magazine is part of a global conglomerate – that it would be impractical for them to track exceptions to this completely fucking batshit clause. In other words: we can't strike this batshit clause because we decided that from now on, all out contracts will have batshit clauses.

The performance of administrative competence – and the tactical deployment of administrative chaos – among giant entertainment companies is grotesque, but every now and again, it backfires.

That's what's happening at Marvel right now. The estates of Marvel founder Stan Lee and its seminal creator Steve Ditko are suing Marvel to terminate the transfer of both creators' characters to Marvel. If they succeed, Marvel will lose most of its most profitable characters, including Iron Man:

https://www.reuters.com/legal/marvel-artists-estate-ask-pre-trial-wins-superhero-copyright-fight-2023-05-22/

They're following in the trail of the Jack Kirby estate, whom Marvel paid millions to rather than taking their chances with the Supreme Court.

Marvel was always an administrative mess, repeatedly going bankrupt. Its deals with its creators were indifferently papered over, and then Marvel lost a lot of the paperwork. I'd bet anything that many of the key documents Disney (Marvel's owner) needs to prevail over Lee and Ditko are either unlocatable or destroyed – or never existed in the first place.

A more muscular termination right – say, one that kicks in after 20 years, and is automatic – would turn circuses like Marvel-Lee/Ditko into real class struggles. Rather than having the heirs of creators reaping the benefit of termination, we could make termination into a system for getting creators themselves paid.

In the meantime, there's Willingham's "absolute table-flip badassery."

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/15/fairy-use-tales/#sampling-license

Image: Tom Mrazek (modified) https://commons.wikimedia.org/wiki/File:An_Open_Field_%2827220830251%29.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

--

Penguin Random House (modified) https://www.penguinrandomhouse.com/books/707161/fables-20th-anniversary-box-set-by-bill-willingham/

Fair use https://www.eff.org/issues/intellectual-property

#pluralistic#fables#comics#graphic novels#dc#warner#monopoly#publishing#chokepoint capitalism#poison pills#ip#bill willingham#public domain#copyright#copyfight#creative commons#licenses#copyleft trolls

242 notes

·

View notes

Text

The strike is affecting hair, makeup, lighting, grips, art department, painters, carpenters, editors, script supervisors, production assistants, special effects, stunts, sound, actors, extras and more.

But it's also affecting the local economy in ways you wouldn't think about.

Bars and restaurants near studios are hurting because they're not getting people walking over on their lunch.

A studio lot is a small town. A couple thousand people pass through at any given day and businesses inside the studio lots don't have customers. Restaurants, cafeterias, even salons, masseuses and dentists. If no one can get in a lot because of a picket line, they don't have business.

Equipment rental houses don't have anyone to rent gear to. Most of these are small mom and pop businesses.

Catering companies who serve cast and crew breakfast and lunch every single day. No work for them.

Security companies who work on location with us. No work for them.

Venues that earn thousands of dollars a day primarily as a filming location can't pay their mortgages. There are literally venues and Independent studios that serve as locations for filming more than any other event.

Also if people aren't working they can't shop anywhere else either.

You can't swing a cat in Los Angeles without hitting something that relies on film and television production. There are even banks and credit unions specifically geared toward crew.

This does not affect the millionaire producers show runners and executives. They are safe at home in the Pacific Palisades with multiple Teslas in the garage.

32 notes

·

View notes

Text

Affordable Housing Options Across America

The United States offers a vast and dynamic real estate market, catering to a wide range of buyers and investors. From cozy homes in bustling cities to sprawling commercial spaces, there’s something for everyone. Whether you're eyeing a house for sale in USA California, looking for cheap apartments for rent in USA, or exploring commercial real estate USA, the opportunities are boundless.

Why Invest in U.S. Real Estate?

The U.S. real estate market is known for its diversity, stability, and high potential for returns. Investing in properties such as commercial property for sale in USA or cheap land for sale USA can provide a steady income stream and long-term appreciation. The market is accessible to both domestic and international buyers, making it a prime destination for investment.

Finding affordable housing is no longer a challenge, thanks to the availability of cheap houses for sale in America and the cheapest homes for sale in USA. States like Texas and Florida are popular for their budget-friendly real estate offerings. For example, if you're looking for a house for sale in Texas USA, you’ll find a mix of affordable suburban homes and luxurious ranch-style properties.

Similarly, property for sale in Florida USA is highly sought after for its warm climate, vibrant lifestyle, and proximity to beaches. These affordable yet desirable locations make the U.S. a hub for real estate investment.

Commercial Real Estate Opportunities

The U.S. is also home to a thriving commercial real estate market. Whether you're seeking commercial property for sale in USA for business expansion or rental income, cities like New York, Los Angeles, and Chicago offer a range of lucrative options. From retail spaces to office buildings, commercial real estate provides excellent opportunities for investors to diversify their portfolios.

Renting Options for Budget-Conscious Buyers

For those not ready to purchase, renting is a great way to enjoy the U.S. lifestyle without the commitment of ownership. With a wide range of cheap apartments for rent in USA, renters can find affordable accommodations in vibrant cities and quiet suburbs alike.

Navigating Real Estate Prices

Understanding how much it costs to buy a house in USA price depends on location, property type, and size. While luxury markets in California or New York may demand a premium, states like Florida and Texas offer competitively priced properties without sacrificing quality.

Tips for Buying Property in the USA

Set a Budget: Define what you can afford, whether you’re looking for the cheapest homes for sale in USA or a prime commercial property.

Research the Market: Different states offer unique advantages—Florida for its beaches, Texas for its economy, and California for its innovation hubs.

Consult Professionals: Work with real estate agents experienced in finding cheap land for sale USA or high-end properties, depending on your needs.

Explore Financing Options: Secure the best mortgage rates or consider alternative financing methods.

Conclusion

From affordable homes to premium commercial spaces, the U.S. real estate market provides endless opportunities. Whether you're searching for a house for sale in USA California, investing in commercial real estate USA, or exploring property for sale in Florida USA, the diversity and potential for growth are unparalleled. Take the next step toward owning a piece of America and start your journey today!

0 notes

Text

Los Angeles construction loans: building your dream home

Building a home in Los Angeles is a very exciting and rewarding journey. Whether you are constructing a brand-new home or making major renovations to our existing properties securing the right financing is really important to turn your dream into reality. One of the most effective ways to fund your construction process is through Los Angeles construction loans. In this guide you can learn everything about what construction loans are and how they work.

What you need to know about residential construction loans los Angeles?

Firstly, you need to know that los Angeles construction loans are our short-term loans designed to finance the building of a new home or a major renovation to your existing property. Unlike typical loan which is used to purchase completed homes construction loans are used during the building process to pay for your construction cost as they arise. The loans are typically short-term, lasting for around 12 to 18 months with the expectation that you will either pay off the loan or convert it into a standard mortgage once the construction is complete.

Requirements for residential construction loans los Angeles

Getting approved for the residential construction loans in los Angeles is not the same as applying for a typical mortgage. You will need to provide blueprints architectural drawings and of course a clear construction timeline. A detailed budget that outlines the costs of your project including materials, labor permits and other answers. Lenders will also want to see your ability to repay the loan so you will need to submit proof of income tax returns and other financial documents. Most of the lenders will require a credit score of at least 680 for construction loans though some might accept lower scores with higher down payment. Construction loans generally require a down payment of 20 to 25% although this might vary depending on the lender you choose.

How to secure a construction loan in los Angeles?

Firstly, you need to look for lenders or specialists in construction loans and have experience working in this area. Next you need to gather all the important documents like construction plans, income verification and credit history. Once you have chosen a lender just submit your application for the construction loan. It's important for you to hire experts with experience in the building codes and regulation.

So above all you need to know that residential construction loans offer a great opportunity for you to build your dream home in los Angeles a city known for its vibrant culture and diverse architectural styles. By understanding different types of loans available you can confidently move forward with your construction project.

Contact Us:

ACOM Capital

Website:- https://acom-capital.com

Email:- [email protected]

Contact:- +1 619-738-6474

#Residential Construction Loans Los Angeles#Los Angeles Construction Loans#Los Angeles Real Estate Loans

0 notes

Text

Duplex for Sale in Los Angeles: A Smart Investment Opportunity

Los Angeles is one of the most vibrant real estate markets in the country, offering a wide variety of investment opportunities for buyers seeking long-term growth and rental income. Among the many options available, purchasing a duplex in Los Angeles has become increasingly popular for both new and seasoned investors. With the city's diverse neighborhoods, high demand for rental properties, and the potential for significant returns, owning a duplex can be a strategic way to maximize your investment.

In this blog, we’ll explore the benefits of purchasing a duplex in Los Angeles, key factors to consider when buying one, and why this type of property can offer both immediate income and long-term financial security.

Why Choose a Duplex for Sale in Los Angeles?

A duplex is a property with two separate living units under one roof, typically with their own entrances and amenities. Owning a duplex in Los Angeles provides an opportunity to live in one unit while renting out the other, creating a stream of passive income. Here’s why it’s an attractive investment option:

1. Rental Income Potential

The most significant advantage of owning a duplex is the potential for rental income. In a city like Los Angeles, where rental demand is consistently high, the ability to generate income from one unit while living in the other can make owning a duplex financially beneficial. The rent from one unit can help offset your mortgage, property taxes, and other expenses, essentially allowing you to live for free or at a reduced cost.

2. Dual Purpose

For investors, a duplex offers flexibility. You can either rent both units for maximum income or live in one unit while renting out the other. This versatility makes duplexes ideal for both seasoned investors looking to expand their portfolio and first-time buyers seeking an affordable way into real estate ownership.

3. Appreciation Potential

Los Angeles real estate has a strong history of property appreciation, and duplexes are no exception. As demand for housing in desirable neighborhoods continues to grow, the value of your duplex is likely to increase over time. This makes it a valuable asset for long-term growth and wealth-building.

4. Tax Benefits

Owning rental property comes with a number of tax benefits, such as deductions for mortgage interest, property depreciation, repairs, and maintenance. These deductions can significantly reduce your taxable income and make owning a duplex even more financially advantageous.

What to Look for When Buying a Duplex in Los Angeles

While purchasing a duplex can be a smart investment, there are important factors to consider when evaluating potential properties. Here are a few things to keep in mind during your search:

1. Location, Location, Location

As with any real estate investment, location is critical. Los Angeles is a sprawling city with diverse neighborhoods, each offering unique opportunities for investors. Areas near universities, business districts, public transportation hubs, and trendy neighborhoods tend to have higher rental demand. Additionally, proximity to schools, parks, and restaurants can make the property more attractive to tenants.

2. Property Condition

Before committing to a duplex, it’s important to assess its condition. A well-maintained property will require fewer repairs and upgrades, saving you money in the long run. However, some buyers may be interested in fixer-uppers for a lower purchase price, with the intention of making improvements. In these cases, be sure to budget for renovation costs and factor those into your overall investment plan.

3. Rental Income and Expenses

Carefully evaluate the rental potential of the duplex by researching local rental rates and understanding the expenses associated with the property. This includes utilities, maintenance costs, property management fees (if applicable), and insurance. A good rule of thumb is to make sure the rental income covers at least 80% of the property’s expenses.

4. Zoning and Legal Considerations

It’s essential to confirm the property’s zoning and ensure that it complies with local laws. Los Angeles, like many other cities, has strict zoning regulations that govern how properties can be used and modified. Additionally, verify that the property is up to code and doesn’t have any outstanding legal issues that could affect your investment.

5. Financing Options

Purchasing a duplex may require different financing options compared to a single-family home. Many lenders offer multi-family property loans, but the terms and requirements can vary. It’s a good idea to work with a knowledgeable real estate advisor or mortgage broker to explore your financing options and choose the best one for your financial situation.

6. Rental Market Trends

Researching the rental market is crucial when buying a duplex. Some neighborhoods may have high demand for rentals, while others may experience oversupply or fluctuating rental rates. Understanding the rental landscape will help you predict rental income and determine if the duplex is a solid long-term investment.

Top Real Estate Advisory Services

When searching for a duplex for sale in Los Angeles, working with a qualified real estate advisor is key to finding the best investment opportunities. Experienced agents can provide valuable insights into the market, help you navigate local regulations, and negotiate favorable terms. They also offer assistance with property inspections, financing, and paperwork, ensuring a smooth transaction from start to finish.

Discover the Advantages of Working with a Real Estate Advisor

Top real estate advisory services can help you identify profitable duplexes that match your budget and investment goals. Advisors can also provide information on up-and-coming neighborhoods, ensuring that your property is located in a high-demand area. With expert guidance, you can make a well-informed decision and secure the best property for your needs.

Conclusion

Investing in a duplex for sale in Los Angeles is a smart way to generate rental income, build wealth, and take advantage of a growing real estate market. The combination of financial benefits, property appreciation potential, and tax advantages makes duplexes a solid investment choice for both new and seasoned investors.

Whether you’re seeking passive income, a long-term investment, or a combination of both, owning a duplex can offer flexibility and financial growth. By considering factors such as location, property condition, rental income potential, and financing options, you can make an informed decision that aligns with your investment goals.

FAQs

1. What is the difference between a duplex and a multi-family property?

A duplex is a two-unit property with separate living spaces for each tenant, while multi-family properties include buildings with three or more units. Multi-family properties can offer higher rental income potential but may also come with additional management and maintenance complexities.

2. How much should I expect to pay for a duplex in Los Angeles?

The cost of a duplex in Los Angeles can vary significantly depending on the neighborhood, property size, and condition. On average, duplex prices range from $500,000 to $1.5 million, with more desirable areas commanding higher prices.

3. What are the benefits of living in one unit of a duplex and renting out the other?

Living in one unit allows you to offset your mortgage payments by renting out the other unit, effectively reducing your living expenses. It also gives you more control over the property, as you can directly manage tenants and make decisions that benefit your long-term investment.

4. Do I need a special loan to buy a duplex?

While you can finance a duplex with a conventional mortgage, you may also be eligible for government-backed loans like FHA or VA loans if you plan to live in one unit. Financing options vary depending on whether the property is owner-occupied or strictly an investment.

5. How do I determine if a duplex is a good investment?

To determine if a duplex is a good investment, assess the potential rental income, expenses, and property condition. Also, consider the neighborhood’s rental demand, property appreciation potential, and your financing options. Working with a real estate advisor can help you make an informed decision.

#DuplexForSale#LosAngelesRealEstate#InvestmentProperty#RealEstateInvestment#LARealEstate#RentalIncome#RealEstateTips#RealEstateAdvisor#PropertyInvestment#RealEstateMarket#RealEstateAdvice#InvestmentOpportunity#LosAngelesDuplex#RealEstateForSale#PassiveIncome#LADuplexMarket

1 note

·

View note

Text

Understanding Property Appraisal: Methods, Importance, and Real Estate Applications

Property appraisal plays a vital role in the real estate market by providing an accurate valuation of real estate assets. Whether you're a property owner or a potential buyer, knowing the true value of a property is essential for making informed decisions. For example, a commercial appraisal in Los Angeles can help buyers better understand a property's worth before purchasing. The appraisal process is objective and unbiased, aimed at determining a property's true market value based on current conditions. While sellers may overestimate a property's worth due to emotional ties, buyers might undervalue it due to personal biases. Therefore, a professional appraisal helps establish a fair market price that benefits both parties involved.

Key Methods of Property Valuation

Sales Comparison Approach: This method involves comparing the subject property's value to recent sales of similar properties in the same area. The appraiser collects data from sources like public records and real estate agents. While this is a commonly used approach, it may not always be precise, as external factors such as market fluctuations or urgency of sale can affect the comparables' prices.

Cost Approach: In this method, the appraiser estimates the cost of replacing or rebuilding the property with a similar one. The evaluation is based on the current condition of the property, which can be helpful when market data is scarce. Since this approach focuses strictly on the property itself, it avoids potential external influences such as market volatility.

Why Property Appraisal Is Crucial

Determining Market Value: The primary purpose of an appraisal is to determine a property's current market value. Knowing this value is critical for homeowners and investors when making important financial decisions. Whether you're refinancing or selling, an accurate valuation provides the insight needed for better planning.

Securing Loans: Lenders require property appraisals when you use a property as collateral for a loan. The appraisal ensures the loan amount doesn't exceed the property's true value, protecting both the lender and borrower.

Estate Planning: When planning for the future distribution of assets, it's essential to know the value of your property. Accurate appraisals ensure fair taxation and help guide decisions on whether to keep or sell properties during the inheritance process.

Reducing Property Taxes: If your property's assessed value seems too high, you may be able to lower your property taxes by contesting the assessment. A recent appraisal demonstrating the property's true market value can support your case.

Buying or Selling Property: Whether you're a buyer or seller, an appraisal is key to determining a fair price. Mortgage lenders often require appraisals, but even if you're not seeking a loan, an appraisal provides critical information for negotiations and ensures you're paying or receiving a fair price.

The Role of Appraisal in Real Estate Transactions

Real estate appraisals are fundamental to various transactions, whether residential or commercial. These appraisals are used for buying and selling properties, refinancing, tax assessments, and estate planning. For example, commercial appraisals in Los Angeles ensure that properties are priced appropriately, avoiding issues like overpricing or underpricing. This enables smoother transactions and provides a fair outcome for all involved parties.

Conclusion

Property appraisals are indispensable for understanding a real estate asset's true value. Whether you're buying, selling, or refinancing, an accurate appraisal helps protect your financial interests and ensures that you make well-informed decisions throughout the real estate process.

#Commercial appraisal in Los Angeles#Commercial appraisal in inland empire#Commercial property appraiser#Commercial real estate appraiser los angeles#Commercial real estate appraiser inland empire#Commercial property appraisal los angeles#property appraiser los angeles ca#real estate appraiser los angeles

0 notes

Text

Panic Button: Panthers Bench No.1 Pick Young After 2-Game Flop

By: Joseph Correa

In a shocking turn of events that has sent ripples through the NFL, the Carolina Panthers have benched their prized rookie quarterback, Bryce Young, just two games into the 2024 season. This decision, coming on the heels of two disastrous losses, has left fans and analysts alike questioning the direction of a franchise that seems to be in free fall.

A Costly Gamble

It wasn't long ago that the Panthers were the talk of the NFL Draft, making a blockbuster trade with the Chicago Bears to secure the first overall pick. The price was steep:

WR D.J. Moore

2023 first-round pick (No. 9 overall)

2023 second-round pick (No. 61 overall)

2024 first-round pick

2025 second-round pick

All this for the right to select Bryce Young, the Heisman Trophy-winning quarterback from Alabama. The move was bold, signaling the Panthers' commitment to rebuilding around a franchise quarterback. Now, just two weeks into the 2024 season, that plan appears to be in shambles.

A Brutal Start

The Panthers' 2024 season has begun with a whimper, not a roar. They were demolished by the New Orleans Saints 47-3 in their opener, a score more befitting a college mismatch than an NFL contest. Week 2 brought little improvement as they fell to the Los Angeles Chargers 26-3. The combined score of 73-6 over two games is a stark illustration of a team in crisis.

Young's performance has been underwhelming, to say the least. In his limited action, he's managed just 245 passing yards with no touchdowns and three interceptions while being sacked six times. These numbers are concerning, but the decision to bench him so quickly is nothing short of stunning.

Canales' Conundrum

First-year head coach Dave Canales, fresh from his success as the Tampa Bay Buccaneers' offensive coordinator, now finds himself in the eye of a storm. His decision to bench Young in favor of veteran Andy Dalton clearly indicates that winning now takes precedence over long-term development.

In a press conference on Monday, Canales stated, "This was my decision. This is our football team. This is trying to win on a weekly basis." He added, "We feel like Andy gives us our best chance to meet the challenge."

The coach's words suggest a departure from the typical patience afforded rookie quarterbacks, especially those drafted first overall. It's a move that could have far-reaching consequences for both Young's development and Canales' tenure with the team.

A Franchise at a Crossroads

This latest development is symptomatic of more significant issues plaguing the Panthers organization. Less than a decade removed from a Super Bowl appearance, the team now finds itself the subject of ridicule around the league. The decision to mortgage their future for Young, only to bench him after two games, raises serious questions about the franchise's decision-making process and long-term strategy.

As the Panthers prepare to face the Raiders in Week 3, with Dalton at the helm, they do so as a team in turmoil. The coming weeks will be crucial in determining whether this is a temporary setback or the beginning of a longer-term decline for a once-proud franchise.

All eyes will be on how Young responds to this early-career adversity and whether Canales' gambit pays off in the win column. One thing is sure: in the unforgiving world of the NFL, the clock is already ticking on the Panthers' latest rebuild.

Featured Photo : Getty Images

0 notes

Text

Mobile Notary Public for Loan Signing and Trust Notarization in Southern California

In today's fast-paced world, the convenience of mobile notary services is indispensable, especially in the realms of loan signing and trust notarization. Covering a vast area that includes Orange County, Riverside County, Los Angeles County, San Bernardino County, and Ventura County, our mobile notary public service in Costa Mesa is here to ensure that your critical documents are legally recognized without you ever needing to leave your home or office.

Why Choose Mobile Notary Public for Loan Signing?

Loan signing involves a myriad of documents, such as mortgages, equity loans, and other real estate-related financial agreements. Our Mobile Notary Public for Loan Signing service specializes in handling these documents. We understand that each loan signing is unique and demands accuracy, confidentiality, and a thorough understanding of mortgage documents. Our notaries are certified and trained to guide you through the signing process, ensuring that all papers are properly executed in accordance with legal requirements.

Mobile Notary for Trust Notarization: Securing Your Future

Trust notarization is another critical area where mobile notary services are invaluable. Whether you're setting up a living trust to secure your family’s future or amending an existing one, our Mobile Notary for Trust Notarization service is equipped to handle your needs. We provide detailed attention to the documents involved in trust notarization, ensuring that each is legally compliant and correctly processed.

Tailored Notary Services Across Southern California

Operating 7 days a week, our mobile notary services cater to the busy schedules of our clients. Whether you're in the bustling city of Los Angeles or the quiet streets of Ventura County, our mobile notary public will come to your preferred location, providing professional and prompt notarial services. Our reach across Southern California ensures that no matter where you are, our services are just a call away.

How It Works

Schedule an Appointment: Simply contact us to arrange an appointment that fits your schedule. We are available seven days a week to accommodate any urgency your documents might require.

Pre-Appointment Preparation: Before the visit, ensure that all documents needing notarization are ready and have valid identification on hand to verify your identity as required by law.

The Notarization Process: Our notary will meet you at your location, verify identities, witness signatures, and apply official stamps and seals, thereby notarizing your documents.

Completion: Once your documents are notarized, you can proceed with your legal or financial activities, assured that your papers are properly executed.

Why Us?

Our notary services stand out for their commitment to accessibility and client satisfaction. We understand the urgency and sensitivity of loan signings and trust notarizations, which is why we ensure our services are not only convenient but also conducted with the highest professional standards. Our team is insured, bonded, and adheres to all state regulations, providing you with peace of mind throughout the notarization process.

In conclusion, if you are looking for a reliable Mobile Notary Public for Loan Signing or a Mobile Notary for Trust Notarization in Southern California, look no further. Our Costa Mesa-based service covers all major counties and is designed to provide you with efficient, secure, and convenient notarial services right at your doorstep. Contact us today at 714-229-13222 or if you want to more information about Traveling Notary Public San Bernardino County and our all services please visit our website. We have a website. We welcome you. CLICK HERE

1 note

·

View note

Text

This day in history

One June 20, I'm live onstage in LOS ANGELES for a recording of the GO FACT YOURSELF podcast. On June 21, I'm doing an ONLINE READING for the LOCUS AWARDS at 16hPT. On June 22, I'll be in OAKLAND, CA for a panel and a keynote at the LOCUS AWARDS.

#20yrsago Canadian copyfight hots up: Liberal MPs on the take from copyright industries? https://www.michaelgeist.ca/2004/06/copyright-reform-needs-a-balanced-approach/

#15yrsago Digital TV’s history in America: the DTV transition nearly cost the USA its technological freedom https://www.eff.org/deeplinks/2009/06/dtv-era-no-broadcast

#15yrsago Hundreds of top British cops defrauded the public for millions in phony expense racket https://www.theguardian.com/politics/2009/jun/14/expenses-fraud-detectives-scotland-yard

#15yrsago $134.5 BILLION worth of US bonds seized from smugglers at Swiss border https://www.asianews.it/index.php?l=en&art=15456&size=A

#10yrsago Atheism remains least-trusted characteristic in American politics https://www.pewresearch.org/politics/2014/05/19/for-2016-hopefuls-washington-experience-could-do-more-harm-than-good/

#10yrsago Canadian Supreme Court’s landmark privacy ruling https://www.michaelgeist.ca/2014/06/scc-spencer-decision/

#10yrsago Court finds full-book scanning is fair use https://www.eff.org/deeplinks/2014/06/another-fair-use-victory-book-scanning-hathitrust

#10yrsago Not selling out: Teens live in commercial online spaces because that’s their only option https://medium.com/message/selling-out-is-meaningless-3450a5bc98d2

#5yrsago Porno copyright troll sentenced to 14 years: “a wrecking ball to trust in the administration of justice” https://torrentfreak.com/copyright-troll-lawyer-sentenced-to-14-years-in-prison-190614/

#5yrsago Ukrainian oligarchs accused of laundering $470b, buying up much of Cleveland https://www.atlanticcouncil.org/blogs/ukrainealert/how-kolomoisky-does-business-in-the-united-states/

#5yrsago Empirical review of privacy policies reveals that they are “incomprehensible” drivel https://www.nytimes.com/interactive/2019/06/12/opinion/facebook-google-privacy-policies.html

#5yrsago Beyond lockpicking: learn about the class-breaks for doors, locks, hinges and other physical security measures https://memex.craphound.com/2019/06/14/beyond-lockpicking-learn-about-the-class-breaks-for-doors-locks-hinges-and-other-physical-security-measures/

#5yrsago Hong Kong’s #612strike uprising is alive to surveillance threats, but its countermeasures are woefully inadequate https://www.securityweek.com/surveillance-savvy-hong-kong-protesters-go-digitally-dark/

#5yrago Reverse mortgages: subprime’s “stealth aftershock” that is costing elderly African-Americans their family homes https://www.usatoday.com/in-depth/news/investigations/2019/06/11/seniors-face-foreclosure-retirement-after-failed-reverse-mortgage/1329043001/

#5yrsago Maine’s new ISP privacy law has both California and New York beat https://thehill.com/policy/technology/447824-maine-shakes-up-debate-with-tough-internet-privacy-law/

#1yrago How Amazon transformed the EU into a planned economy https://pluralistic.net/2023/06/14/flywheel-shyster-and-flywheel/#unfulfilled-by-amazon

7 notes

·

View notes

Text

Investment Property Loan Rates in California 🏡💵

When diving into the real estate market in California, understanding investment property loan rates is crucial for maximizing your return on investment. Rates can vary widely based on several factors, including location, property type, and your financial profile. Here’s a snapshot of what to expect and how to navigate the landscape. 📈🔍

Current Loan Rates: As of now,best investment property loan rates California generally range from 5% to 7% for fixed-rate mortgages. These rates are influenced by national trends and regional market conditions. Given the state’s diverse economy and fluctuating real estate market, rates can differ significantly between urban areas like Los Angeles and more rural regions. 🌆🏞️

Factors Affecting Rates: Several key factors determine your loan rate:

Credit Score: A higher credit score can help you secure a lower interest rate. Lenders view borrowers with excellent credit as lower risk. Aim for a score above 700 to increase your chances of getting a favorable rate. 📊✅

Down Payment: The size of your down payment also impacts your rate. Larger down payments reduce lender risk, often leading to better rates. For investment properties, a down payment of at least 20% is typically required. 💰🔑

Loan Type: Different loan types have varying rates. Conventional loans, often backed by Fannie Mae or Freddie Mac, may offer competitive rates but come with stricter eligibility criteria. FHA or VA loans, while beneficial for primary residences, are less common for investment properties. 📜🏠

Property Type: Single-family homes and multi-unit properties may have different rates. Lenders often view multi-unit properties as higher risk, which can lead to slightly higher interest rates. 🏢🏘️

Market Conditions: Broader economic factors, such as inflation and Federal Reserve policies, play a role in determining interest rates. Keep an eye on economic indicators to gauge how these might affect future rates. 🌐📉

Tips for Securing the Best Rate: To find the best loan rates, shop around and compare offers from multiple lenders. Consider working with a mortgage broker who can help you navigate the market and secure favorable terms. Additionally, maintaining a strong credit profile and saving for a substantial down payment can improve your negotiating position. 💪💼

Navigating investment property loan rates in California can be complex, but understanding the key factors and staying informed will help you make more strategic decisions. Happy investing! For more details visit https://home123.com/ today 🌟🏠

0 notes

Text

youtube

“Act Now: Create $350,000 in Real Estate Equity with ReCover CA—Your Path to Homeownership!” 🏠💼

Don’t miss this exceptional chance to build significant equity in your new home. Contact me TODAY @ 408-829-4141 & seize this unique opportunity! 📞

The ReCover CA Homebuyer Assistance (DR-HBA) Program is designed to support low- to moderate-income households impacted by the 2018 and 2020 California wildfires. It offers forgivable loans to assist with the purchase price of a home, aiming to help disaster-affected residents relocate out of high fire hazard areas12.

2018 and 2020 Eligible Areas

For the 2018 disasters, eligible areas include Butte, Lake, Los Angeles, and Shasta counties. The 2020 disasters expanded eligibility to include Butte, Fresno, Los Angeles, Napa, Santa Cruz, Shasta, Siskiyou, Solano, and Sonoma counties34.

Financial Assistance Details

* Maximum Purchase Price: The program bridges the gap between the first mortgage an applicant can afford and the purchase price of a home, with an award cap of $350,0001.

* Down Payment Assistance: Up to $350,000 in down payment and closing cost assistance is available, which can also cover reasonable and customary closing costs and prepaids5.

Benefits for Napa, Solano, Sonoma, Lake, and Santa Cruz Counties

Residents of these counties who were affected by the wildfires can benefit significantly from this program. It provides a substantial financial boost to secure a new home outside high-risk fire zones, promoting safer living conditions and community resilience.

Call to Action

If you’re a resident of Napa, Solano, Sonoma, Lake, or Santa Cruz counties and have been impacted by the 2018 or 2020 wildfires, this is an opportunity to secure assistance for a new beginning. To explore your options and get prequalified, direct message me at 408-829-4141. Let’s connect you with a lender who can guide you through the process and help you take the first step towards homeownership with the support of the ReCover CA Homebuyer Assistance Program.

0 notes

Text

Exploring Real Estate Opportunities in the USA: Your Gateway to Investment Success

Exploring Real Estate Opportunities in the USA: Your Gateway to Investment Success

The United States is renowned for its thriving real estate market, making it a top destination for individuals and investors worldwide. Whether you're looking for USA property for sale, considering an investment in real estate USA, or dreaming of owning a home in America, the opportunities are endless. From luxurious apartments to affordable homes, the USA offers diverse options to suit every buyer's needs.

Why Invest in USA Real Estate?

The USA real estate market is one of the most stable and lucrative globally, attracting investors seeking long-term value and security. When you invest in USA real estate, you're not only purchasing property but also gaining access to a well-regulated market with high returns. Whether you’re looking for a personal residence, vacation home, or rental property, the U.S. market offers countless opportunities to grow your wealth.

Finding the Right Property

If you're planning to buy property in the USA, the first step is to identify your goals. Are you seeking a cozy apartment in the city, a sprawling suburban house, or a lucrative commercial property? With numerous real estate companies in the USA, finding the right property is easier than ever. These professionals can help you navigate the process, from identifying the perfect location to closing the deal.

For instance, if you want to buy apartments in the USA, cities like New York, Miami, and Los Angeles offer exceptional options, boasting modern amenities and prime locations. Similarly, if your interest lies in residential homes, you can explore numerous houses for sale in America across scenic suburbs, bustling cities, or serene countryside areas.

Affordable Housing Options

Contrary to popular belief, finding cheap houses for sale in the USA is possible. Markets in states like Texas, Ohio, and Georgia provide affordable housing options without compromising quality. Whether you're a first-time buyer or an experienced investor, these properties can serve as an excellent entry point into the American real estate market.

Why Choose A.Land?

If you’re searching for your dream property, visit A.Land, your trusted partner for finding the best houses for sale in America and beyond. A.Land provides a seamless experience for buyers looking to buy houses in the USA, offering an extensive portfolio of properties tailored to various preferences and budgets.

Steps to Buy Property in the USA

Research the Market: Familiarize yourself with trends in real estate USA and select the type of property that aligns with your goals.

Work with Professionals: Collaborate with trusted real estate companies in the USA to find and secure the best deals.

Secure Financing: Explore mortgage options to make your purchase financially feasible.

Finalize Your Purchase: Follow the legal processes and close the deal with the help of experienced agents.

Conclusion

Investing in the U.S. real estate market is a decision that combines financial growth with lifestyle enhancement. Whether you're looking for houses for sale in the USA, affordable apartments, or high-end properties, the possibilities are vast. With platforms like A.Land, your journey to owning a property in the USA has never been easier. Take the first step today and explore the incredible opportunities waiting for you in the American real estate market!

0 notes

Text

Find the Perfect Investment Property for Sale: Tips and Top Picks

Finding the right investment property for sale can be a game-changer for your financial future. With the real estate market offering a plethora of opportunities, investing in property provides a stable and potentially high-return option. Whether you're looking for residential, commercial, or mixed-use properties, there are numerous options available to suit your investment strategy. In this blog, we will explore various investment properties for sale, highlighting their potential benefits and key considerations. From understanding market trends to evaluating property values, this guide will equip you with the knowledge to make informed investment decisions. Join us as we delve into the world of real estate investment and uncover the best opportunities to grow your wealth.

Why Now is the Perfect Time to Find an Investment Property for Sale?

The real estate market is currently experiencing a unique period, making now the perfect time to find an investment property for sale. With interest rates at historic lows, financing your purchase has never been more affordable. Additionally, market trends indicate a steady increase in property values, ensuring that your investment will grow over time. Furthermore, the rental market is booming, providing a consistent income stream for property investors. By securing an investment property for sale now, you position yourself to benefit from both immediate rental income and long-term appreciation. Investment Property for Sale

When evaluating an investment property for sale, several key factors must be considered to ensure a sound investment. Location is paramount; properties in thriving neighborhoods with strong job markets and amenities tend to appreciate faster and attract reliable tenants. Additionally, the condition of the property should be scrutinized—investing in a well-maintained property can save substantial costs in repairs and renovations. Financials are also crucial; analyzing the property's cash flow, potential ROI, and any associated costs will help determine its profitability. Furthermore, understanding the local real estate market and regulatory environment can influence your investment's success.

Top Locations to Find High-Return Investment Properties for Sale

Identifying top locations for high-return investment properties for sale is essential for maximizing your investment. Urban centers with strong economic growth, such as New York, Los Angeles, and Austin, offer promising opportunities due to their thriving job markets and increasing population. Additionally, emerging markets in cities like Nashville, Charlotte, and Orlando are gaining attention for their affordability and potential for rapid appreciation. Coastal areas and vacation destinations also present lucrative investment opportunities, as they attract a steady stream of tourists and renters.

The Benefits of Diversifying Your Portfolio with Investment Properties for Sale

Diversifying your investment portfolio with properties for sale offers numerous benefits. Real estate investments provide a tangible asset that often appreciates over time, offering both capital growth and a hedge against inflation. Additionally, rental properties generate consistent income, enhancing your cash flow and financial stability. Diversification into real estate also reduces overall portfolio risk, as property values tend to be less volatile compared to stocks and other investments. Furthermore, leveraging the equity in investment properties for sale can finance additional acquisitions, creating a cycle of wealth-building.

How to Finance Your Investment Property for Sale: Tips and Options?

Financing an investment property for sale requires strategic planning and understanding various options. Traditional mortgages are a common route, offering competitive interest rates for qualified buyers. However, alternative financing options such as hard money loans, which are based on the property's value rather than the borrower's credit, can be useful for quick purchases or renovation projects. Additionally, leveraging equity from existing properties can provide funds for new acquisitions. It's also beneficial to explore government-backed loans, like FHA or VA loans, which offer favorable terms for eligible investors. By researching and selecting the right financing option, you can efficiently secure an investment property for sale and optimize your investment strategy.

Investment Property for Sale: Understanding Market Trends and Projections

Understanding market trends and projections is crucial when considering an investment property for sale. Keeping an eye on economic indicators, such as employment rates, interest rates, and housing supply, helps predict future property values and rental demand. Analyzing historical data and market cycles also provides insights into potential appreciation and downturns. Additionally, staying informed about local developments, such as infrastructure projects and zoning changes, can impact property desirability and value. By comprehensively understanding these trends and projections, you can make informed decisions about purchasing an investment property for sale.

Common Pitfalls to Avoid When Buying an Investment Property for Sale

Buying an investment property for sale can be lucrative, but it's essential to avoid common pitfalls that can jeopardize your investment. Overpaying for a property is a significant risk, as it can reduce your potential ROI and complicate financing. Failing to conduct thorough due diligence, such as inspecting the property's condition and verifying legal status, can lead to unexpected costs and legal issues. Additionally, underestimating ongoing expenses, including maintenance, taxes, and insurance, can strain your cash flow. It's also crucial to have a clear investment strategy and avoid emotional decisions. By being mindful of these pitfalls, you can navigate the process of purchasing an investment property for sale more effectively.

Conclusion

Investing in real estate presents a multitude of opportunities to grow your wealth and diversify your portfolio. From selecting the right investment property for sale to understanding market trends and managing your assets effectively, each step is crucial to maximizing returns. By considering key factors, exploring top locations, and avoiding common pitfalls, you can make informed decisions that align with your financial goals. Whether you opt for residential or commercial properties, or focus on long-term or short-term investments, the potential for substantial returns and financial stability is significant.

0 notes

Text

[ad_1] Promoting your private home in Riverside could be a rewarding but difficult endeavor. With the fitting methods, you may maximize your private home’s market worth and guarantee a fast sale. This complete information will stroll you thru the whole lot you want to find out about promote my home quick in riverside whereas getting the absolute best worth.Understanding the Riverside Actual Property MarketEarlier than you begin eager about promoting your private home, it is essential to grasp the Riverside actual property market. Riverside, identified for its wealthy historical past, scenic views, and vibrant neighborhood, attracts quite a lot of consumers, from younger professionals to retirees.Present DevelopmentsThe Riverside actual property market has been experiencing regular development. In response to the newest knowledge, dwelling costs have appreciated by a median of 5% yearly over the previous few years. Low mortgage charges and excessive demand are driving this upward development.Key Market Gamers Younger Professionals: Riverside’s proximity to Los Angeles attracts younger professionals in search of reasonably priced housing inside commuting distance. Households: Wonderful colleges and family-friendly neighborhoods make Riverside a gorgeous possibility for households. Retirees: The nice local weather and serene setting enchantment to retirees on the lookout for a peaceable place to cool down. Steps to Maximize Your House's Market Worth1. Enhance Curb EnchantmentFirst impressions matter. The outside of your private home is the very first thing potential consumers see, so it’s important to make it depend. Landscaping: Put money into landscaping to create a welcoming entrance. Trim bushes, mow the garden, and plant colourful flowers. Paint and Repairs: Guarantee your private home’s exterior paint is recent and in good situation. Repair any seen injury, corresponding to cracked walkways, damaged fences, or chipped paint. Lighting: Set up out of doors lighting to focus on the very best options of your private home and enhance security. 2. Declutter and DepersonalizeConsumers must envision themselves residing in your house, which is difficult to do if it’s cluttered with private gadgets. Minimalism: Take away private photographs, memorabilia, and extra furnishings. Purpose for a clear, minimalist look. Storage Options: Make the most of storage models for gadgets you don’t want every day. Impartial Decor: Go for impartial colours and decor that enchantment to a broad viewers. 3. Make Important Repairs and UpgradesInvesting in key repairs and upgrades can considerably enhance your private home’s market worth. Kitchen and Loos: These are probably the most scrutinized areas by consumers. Contemplate updating fixtures, cupboards, and counter tops. Vitality Effectivity: Set up energy-efficient home windows, doorways, and home equipment. Not solely do these enhancements entice eco-conscious consumers, however additionally they decrease utility prices. Flooring: Change worn-out carpets or outdated flooring. Hardwood flooring are particularly interesting to consumers. 4. Skilled StagingSkilled staging can remodel your private home and make it extra engaging to potential consumers. Furnishings Association: Skilled stagers know organize furnishings to make rooms look greater and extra inviting. Ambiance: Stagers can add components like recent flowers, art work, and lighting to create a welcoming ambiance. 5. Excessive-High quality Photographs and Digital ExcursionsIn at the moment’s digital age, on-line listings are the primary level of contact between your private home and potential consumers. Skilled Pictures: Rent an expert photographer to take high-quality photographs of your private home. Digital Excursions: Contemplate providing digital excursions, particularly if consumers are unable to go to in particular person. This will considerably widen your pool of potential consumers. 6. Strategic PricingSetting the fitting worth is essential to attracting consumers and guaranteeing a fast sale.

Market Evaluation: Conduct a comparative market evaluation (CMA) to grasp what related properties in Riverside are promoting for. Aggressive Pricing: Value your private home competitively to draw extra consumers. Overpricing can result in your private home sitting available on the market for too lengthy. Advertising Your HouseEfficient advertising and marketing methods can provide your private home the publicity it must promote rapidly.1. On-line ListingsListing your private home on well-liked actual property web sites like Zillow, Trulia, and Realtor. Be sure that your itemizing contains high-quality photographs, detailed descriptions, and digital excursions.2. Social MediaLeverage social media platforms to market your private home. Share your itemizing on Fb, Instagram, and Twitter. Encourage family and friends to share it as nicely.3. Open Homes and Non-public ShowingsInternet hosting open homes and personal showings can entice severe consumers. Open Homes: Schedule open homes on weekends to accommodate extra guests. Non-public Showings: Provide versatile exhibiting occasions to cater to potential consumers’ schedules. 4. Actual Property AgentPartnering with a educated actual property agent could make a big distinction in how rapidly and successfully your private home sells. Experience: Actual property brokers have the experience to market your private home, negotiate presents, and deal with paperwork. Community: Brokers have a community of potential consumers and different brokers, rising the possibilities of discovering the fitting purchaser. Navigating the Promoting Course ofWhen you’ve ready and marketed your private home, it’s time to concentrate on the promoting course of.1. Receiving PresentsWhile you begin receiving presents, assessment each fastidiously. Contemplate not solely the value but additionally the phrases and contingencies. A number of Presents: In case you obtain a number of presents, your agent will help you select the very best one or negotiate higher phrases. Contingencies: Perceive frequent contingencies, corresponding to financing, inspections, and value determinations. 2. House Inspection and AppraisalAfter accepting a proposal, the customer will usually schedule a house inspection and appraisal. Inspection: Handle any points that come up through the inspection promptly. Minor repairs may be negotiated, however main issues might require extra vital concessions. Appraisal: The appraisal ensures that the customer’s lender agrees with the agreed-upon worth. If the appraisal is available in low, you might must renegotiate. 3. Closing the DealThe closing course of entails finalizing the sale and transferring possession to the customer. Paperwork: Work along with your agent and lawyer to make sure all essential paperwork is accomplished precisely. Closing Prices: Be ready for closing prices, which can embrace agent commissions, taxes, and different charges. Remaining Walkthrough: The client will conduct a ultimate walkthrough to make sure the property is within the agreed-upon situation. ConclusionPromoting your private home in Riverside doesn’t need to be a frightening activity. By understanding the market, making ready your private home, and implementing efficient advertising and marketing methods, you may maximize your private home’s market worth and promote it rapidly. Keep in mind, each element counts—from boosting curb enchantment to strategic pricing and professional staging.Able to take the subsequent step? Contact us to be taught extra about how we will help you promote your private home quick in Riverside and get the absolute best worth. Let's flip your home-selling dream right into a actuality!Name to Motion: Prepared to maximise your private home's market worth and promote quick in Riverside? Contact us at the moment for knowledgeable steerage and help all through your promoting course of. Let's make your home-selling expertise easy and profitable! [ad_2] Supply hyperlink

0 notes