#schumpeterian

Explore tagged Tumblr posts

Text

Leveraged buyouts are not like mortgages

I'm coming to DEFCON! On FRIDAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Here's an open secret: the confusing jargon of finance is not the product of some inherent complexity that requires a whole new vocabulary. Rather, finance-talk is all obfuscation, because if we called finance tactics by their plain-language names, it would be obvious that the sector exists to defraud the public and loot the real economy.

Take "leveraged buyout," a polite name for stealing a whole goddamned company:

Identify a company that owns valuable assets that are required for its continued operation, such as the real-estate occupied by its outlets, or even its lines of credit with suppliers;

Approach lenders (usually banks) and ask for money to buy the company, offering the company itself (which you don't own!) as collateral on the loan;

Offer some of those loaned funds to shareholders of the company and convince a key block of those shareholders (for example, executives with large stock grants, or speculators who've acquired large positions in the company, or people who've inherited shares from early investors but are disengaged from the operation of the firm) to demand that the company be sold to the looters;

Call a vote on selling the company at the promised price, counting on the fact that many investors will not participate in that vote (for example, the big index funds like Vanguard almost never vote on motions like this), which means that a minority of shareholders can force the sale;

Once you own the company, start to strip-mine its assets: sell its real-estate, start stiffing suppliers, fire masses of workers, all in the name of "repaying the debts" that you took on to buy the company.

This process has its own euphemistic jargon, for example, "rightsizing" for layoffs, or "introducing efficiencies" for stiffing suppliers or selling key assets and leasing them back. The looters – usually organized as private equity funds or hedge funds – will extract all the liquid capital – and give it to themselves as a "special dividend." Increasingly, there's also a "divi recap," which is a euphemism for borrowing even more money backed by the company's assets and then handing it to the private equity fund:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

If you're a Sopranos fan, this will all sound familiar, because when the (comparatively honest) mafia does this to a business, it's called a "bust-out":

https://en.wikipedia.org/wiki/Bust_Out

The mafia destroys businesses on a onesy-twosey, retail scale; but private equity and hedge funds do their plunder wholesale.

It's how they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And it's what they did to hospitals:

https://pluralistic.net/2024/02/28/5000-bats/#charnel-house

It's what happened to nursing homes, Armark, private prisons, funeral homes, pet groomers, nursing homes, Toys R Us, The Olive Garden and Pet Smart:

https://pluralistic.net/2023/06/02/plunderers/#farben

It's what happened to the housing co-ops of Cooper Village, Texas energy giant TXU, Old Country Buffet, Harrah's and Caesar's:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

And it's what's slated to happen to 2.9m Boomer-owned US businesses employing 32m people, whose owners are nearing retirement:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Now, you can't demolish that much of the US productive economy without attracting some negative attention, so the looter spin-machine has perfected some talking points to hand-wave away the criticism that borrowing money using something you don't own as collateral in order to buy it and wreck it is obviously a dishonest (and potentially criminal) destructive practice.

The most common one is that borrowing money against an asset you don't own is just like getting a mortgage. This is such a badly flawed analogy that it is really a testament to the efficacy of the baffle-em-with-bullshit gambit to convince us all that we're too stupid to understand how finance works.

Sure: if I put an offer on your house, I will go to my credit union and ask the for a mortgage that uses your house as collateral. But the difference here is that you own your house, and the only way I can buy it – the only way I can actually get that mortgage – is if you agree to sell it to me.

Owner-occupied homes typically have uncomplicated ownership structures. Typically, they're owned by an individual or a couple. Sometimes they're the property of an estate that's divided up among multiple heirs, whose relationship is mediated by a will and a probate court. Title can be contested through a divorce, where disputes are settled by a divorce court. At the outer edge of complexity, you get things like polycules or lifelong roommates who've formed an LLC s they can own a house among several parties, but the LLC will have bylaws, and typically all those co-owners will be fully engaged in any sale process.

Leveraged buyouts don't target companies with simple ownership structures. They depend on firms whose equity is split among many parties, some of whom will be utterly disengaged from the firm's daily operations – say, the kids of an early employee who got a big stock grant but left before the company grew up. The looter needs to convince a few of these "owners" to force a vote on the acquisition, and then rely on the idea that many of the other shareholders will simply abstain from a vote. Asset managers are ubiquitous absentee owners who own large stakes in literally every major firm in the economy. The big funds – Vanguard, Blackrock, State Street – "buy the whole market" (a big share in every top-capitalized firm on a given stock exchange) and then seek to deliver returns equal to the overall performance of the market. If the market goes up by 5%, the index funds need to grow by 5%. If the market goes down by 5%, then so do those funds. The managers of those funds are trying to match the performance of the market, not improve on it (by voting on corporate governance decisions, say), or to beat it (by only buying stocks of companies they judge to be good bets):

https://pluralistic.net/2022/03/17/shareholder-socialism/#asset-manager-capitalism

Your family home is nothing like one of these companies. It doesn't have a bunch of minority shareholders who can force a vote, or a large block of disengaged "owners" who won't show up when that vote is called. There isn't a class of senior managers – Chief Kitchen Officer! – who have been granted large blocks of options that let them have a say in whether you will become homeless.

Now, there are homes that fit this description, and they're a fucking disaster. These are the "heirs property" homes, generally owned by the Black descendants of enslaved people who were given the proverbial 40 acres and a mule. Many prosperous majority Black settlements in the American South are composed of these kinds of lots.

Given the historical context – illiterate ex-slaves getting property as reparations or as reward for fighting with the Union Army – the titles for these lands are often muddy, with informal transfers from parents to kids sorted out with handshakes and not memorialized by hiring lawyers to update the deeds. This has created an irresistible opportunity for a certain kind of scammer, who will pull the deeds, hire genealogists to map the family trees of the original owners, and locate distant descendants with homeopathically small claims on the property. These descendants don't even know they own these claims, don't even know about these ancestors, and when they're offered a few thousand bucks for their claim, they naturally take it.

Now, armed with a claim on the property, the heirs property scammers force an auction of it, keeping the process under wraps until the last instant. If they're really lucky, they're the only bidder and they can buy the entire property for pennies on the dollar and then evict the family that has lived on it since Reconstruction. Sometimes, the family will get wind of the scam and show up to bid against the scammer, but the scammer has deep capital reserves and can easily win the auction, with the same result:

https://www.propublica.org/series/dispossessed

A similar outrage has been playing out for years in Hawai'i, where indigenous familial claims on ancestral lands have been diffused through descendants who don't even know they're co-owner of a place where their distant cousins have lived since pre-colonial times. These descendants are offered small sums to part with their stakes, which allows the speculator to force a sale and kick the indigenous Hawai'ians off their family lands so they can be turned into condos or hotels. Mark Zuckerberg used this "quiet title and partition" scam to dispossess hundreds of Hawai'ian families:

https://archive.is/g1YZ4

Heirs property and quiet title and partition are a much better analogy to a leveraged buyout than a mortgage is, because they're ways of stealing something valuable from people who depend on it and maintain it, and smashing it and selling it off.

Strip away all the jargon, and private equity is just another scam, albeit one with pretensions to respectability. Its practitioners are ripoff artists. You know the notorious "carried interest loophole" that politicians periodically discover and decry? "Carried interest" has nothing to do with the interest on a loan. The "carried interest" rule dates back to 16th century sea-captains, and it refers to the "interest" they had in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity managers are like sea captains in exactly the same way that leveraged buyouts are like mortgages: not at all.

And it's not like private equity is good to its investors: scams like "continuation funds" allow PE looters to steal all the money they made from strip mining valuable companies, so they show no profits on paper when it comes time to pay their investors:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

Those investors are just as bamboozled as we are, which is why they keep giving more money to PE funds. Today, the "dry powder" (uninvested money) that PE holds has reached an all-time record high of $2.62 trillion – money from pension funds and rich people and sovereign wealth funds, stockpiled in anticipation of buying and destroying even more profitable, productive, useful businesses:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

The practices of PE are crooked as hell, and it's only the fact that they use euphemisms and deceptive analogies to home mortgages that keeps them from being shut down. The more we strip away the bullshit, the faster we'll be able to kill this cancer, and the more of the real economy we'll be able to preserve.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

#pluralistic#leveraged buyouts#lbos#divi recaps#mortgages#weaponized shelter#debt#finance#private equity#pe#mego#bust outs#plunder#looting

423 notes

·

View notes

Text

11/18/2024•Mises Wire•Siamak Ettefagh

In the ever-evolving landscape of economic theory and policy, few concepts have been as influential and controversial as Joseph Schumpeter’s “creative destruction.” This powerful idea, which describes the process by which innovation continuously reshapes markets, challenges conventional wisdom about competition, monopolies, and the role of government intervention. As we grapple with the complexities of the digital age, the tension between creative destruction and regulatory frameworks, like antitrust laws and the European Union’s Digital Markets Act (DMA) has become increasingly apparent.

Creative destruction, as articulated by Schumpeter in his 1942 work “Capitalism, Socialism, and Democracy,” refers to the: “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” This dynamic force drives economic progress by continually replacing outdated technologies, business models, and industries with more innovative and efficient ones. Unlike traditional economic models that emphasize static equilibrium and price competition, Schumpeter’s vision portrays capitalism as a system in perpetual flux, where the true engine of growth is not the optimization of existing structures but their wholesale transformation.

The implications of creative destruction for antitrust law are profound and potentially unsettling. Conventional antitrust theory—rooted in neoclassical economics—views market concentration and monopoly power as inherently harmful to consumer welfare. This perspective has led to a regulatory approach that seeks to maintain a “competitive” landscape by breaking up large firms and preventing mergers that could lead to market dominance. However, through the lens of creative destruction, this approach may be misguided and even counterproductive.

Schumpeter argued that temporary monopolies—far from being detrimental to innovation—could actually foster it. Large firms with significant market power, he contended, are often better-positioned to invest in long-term research and development, taking risks that smaller competitors cannot afford. The “monopoly” rents these firms enjoy provide both the incentive and the means to pursue groundbreaking innovations. By focusing solely on market concentration and short-term price effects, antitrust law may inadvertently stifle the very dynamism it allegedly seeks to promote.

Moreover, the Schumpeterian view suggests that market dominance is often transient, constantly threatened by the next wave of disruptive innovation. Today’s “monopolist” may be tomorrow’s obsolete relic, rendered irrelevant by a nimble startup with a revolutionary idea. Antitrust interventions, in this light, risk disrupting the natural cycle of creative destruction, potentially preserving inefficient incumbents at the expense of emerging innovators.

0 notes

Text

The Engine of Progress: Understanding Schumpeter's Theory of Economic Development

The Engine of Progress: Understanding Schumpeter’s Theory of Economic Development Joseph Schumpeter, an Austrian economist, revolutionized our understanding of economic development with his groundbreaking theory of “creative destruction.” This theory, often referred to as Schumpeterian economics, argues that innovation and entrepreneurship are the key drivers of economic growth, not simply the…

View On WordPress

0 notes

Text

Deciphering the Heart of Entrepreneurship: Insights Gained by a CMU Student from a Presentation

The Schumpeterian Vision

Joseph Schumpeter, a renowned economist, asserted that economic growth springs from the individual efforts of entrepreneurs. In essence, he believed that entrepreneurs are the driving force behind economic development. According to Schumpeter, an entrepreneur isn't just a businessperson but a person who derives joy and fulfillment from bringing ideas to fruition. This perspective paints entrepreneurs as individuals who thrive on innovation, disruption, and the thrill of turning their dreams into reality.

Entrepreneurship as a Concept

Moving beyond the theoretical realm, let's delve into the very essence of entrepreneurship as a concept. At its core, entrepreneurship is a process, an active engagement undertaken by entrepreneurs themselves. This process involves identifying and seizing opportunities, pursuing them with unwavering determination, and doing so irrespective of the available resources. To embark on the entrepreneurial journey, one must consider the fundamental questions: What, When, Where, and How, often referred to as the 4W's and 1 H.

The "What" represents the core business idea or concept, while the "When" signifies the timing of market entry. The "Where" encompasses the location and target audience, and the "Who" involves identifying key stakeholders and partners. Finally, the "How" outlines the strategies and tactics to transform ideas into a thriving venture. It's crucial to note that the path of entrepreneurship should not be riddled with "What Ifs." Overthinking hypothetical scenarios can lead to hesitation and deter progress.

Resource Agnostic Approach

A remarkable facet of entrepreneurship is its resource-agnostic nature. Whether you possess abundant resources or are working with a shoestring budget, the entrepreneurial spirit remains undeterred. This is because entrepreneurship is fundamentally a process—a journey where resilience, creativity, and adaptability reign supreme. It's about leveraging the available resources to their fullest potential, making the most out of what you have.

Harvard's Perspective

Harvard University's definition of entrepreneurship: "the pursuit of opportunities without regard for the resources controlled." This definition encapsulates the essence of entrepreneurship, emphasizing the relentless pursuit of possibilities. Harvard's definition highlights a fundamental aspect of entrepreneurship—the willingness to start and progress even when resources are limited. This doesn't mean resources are irrelevant; rather, it emphasizes resourcefulness. Entrepreneurs should be adept at doing more with less.

The Essence of Technology Entrepreneurship:

Type of Entrepreneurship:

Technology entrepreneurship is a breed apart, transitioning from humble beginnings to become a global juggernaut. It thrives on fostering growth and expanding its reach to a wider audience on a global stage. Within this broad category, two key subtypes emerge: Growth Technopreneurship and Global Technopreneurship.

Growth Technopreneurship:

This category encompasses businesses that are deeply rooted in science and technology. They leverage innovation to not just survive but to thrive. These ventures have scalability at their core, allowing them to grow rapidly and adapt to changing market dynamics.

Global Technopreneurship:

Global technopreneurs transcend geographical boundaries, offering their products and services to a worldwide audience. They harness the power of technology to create a global impact, making their mark felt far beyond their local or regional origins.

The Titans of Technology

To understand the significance of technology entrepreneurship, one need only glance at the top echelons of the corporate world. The top 100 companies by market capitalization, often dominated by tech giants, exemplify the power and influence of technology-driven entrepreneurship. In the Big Tech Era of 2019, household names like Microsoft, Amazon, Apple, and Facebook commanded the charts. These companies not only shaped our digital landscape but also redefined the boundaries of what is possible through technology.

Silicon Valley

No discussion of technology entrepreneurship would be complete without mentioning Silicon Valley in California, USA. This iconic region serves as the quintessential symbol of entrepreneurial spirit and technological innovation. It is a place where intense competition fuels creativity, where rebels thrive, and where groundbreaking ideas take root and flourish.

In Silicon Valley, entrepreneurs are driven by a relentless pursuit of excellence, unafraid to challenge the status quo. They know that in the world of technology, innovation is the currency of success, and they spare no effort in pushing the boundaries of what technology can achieve.

Ken Singer's insightful statement, "A startup is an act of rebellion," encapsulates the essence of entrepreneurship as a bold departure from the norm. One must take the risk since rebellion in entrepreneurship involves a willingness to take risks that many would shy away from. Entrepreneurs invest their time, energy, and often personal resources into pursuing their vision, even in the face of uncertainty.

Disruption is more than just a proposed change in the order of things; it's a rejection of the status quo, a threat to incumbents, and a dynamic force that shapes the business landscape.

Disruption is essentially a proposed change in the established order of things. It signifies a departure from the conventional, a challenge to the way things have always been done. It's a bold declaration that the current way of doing things is insufficient and ripe for transformation.

Moreover, disruption is a rejection of the norms, processes, and systems that have prevailed for an extended period. It disrupts the comfortable equilibrium and questions the very foundations upon which industries have been built.

One of the most significant aspects of disruption is that it threatens incumbents—the established players in the industry. Incumbents often wield market dominance and power, which they leverage to maintain their stronghold. They are the gatekeepers, using their influence to keep new entrants at bay and preserve the status quo.

In the world of business, disruptors are ubiquitous. Every industry, from finance to transportation and beyond, has its fair share of innovators who challenge the established norms. Just as there is PayMaya, there is also PayPal; for every Grab, there is an Angkas. Competitors and disruptors are intertwined, each pushing the other to evolve and adapt.

The Entrepreneurial Mindset: Intrapreneurs and Entrepreneurs:

Intrapreneurs: Intrapreneurs are individuals who foster innovation and drive change from within an existing organization. They act as catalysts for growth, constantly seeking new opportunities, and challenging the status quo. Their role is to infuse an entrepreneurial spirit into the company culture, often leading to the development of new products, services, or processes.

Entrepreneurs: Entrepreneurs, on the other hand, are the pioneers of the business world. They are the successful alumni who embark on the exhilarating journey of creating new ventures. These individuals are not just dreamers but also doers, turning their innovative ideas into tangible products or services that can reshape industries.

The Sequence: From Awareness to Theory to Practice to Mindset:

The entrepreneurial journey is not a linear path; it evolves through a sequence that begins with awareness. Individuals become aware of opportunities, challenges, and the need for innovation. This awareness leads to the exploration of theory, where aspiring entrepreneurs study concepts, strategies, and case studies to understand the business landscape.

Practice is the crucial bridge between theory and mindset. It involves hands-on experience, testing ideas, building prototypes, and engaging with real-world challenges. Practice forms the bedrock for developing the entrepreneurial mindset, where individuals learn to adapt, persevere, and thrive in a dynamic and uncertain environment.

Demystifying Entrepreneurship Misconceptions:

Complexity of Business: Contrary to common misconceptions, business is not a linear process centered solely on ideas, plans, and raising funds. It is a multifaceted, people-oriented endeavor with numerous unwritten rules and unpredictable variables. Entrepreneurs must navigate this complexity with creativity and adaptability.

The Student vs. Entrepreneur Dynamic:

Entrepreneurship cannot be taught prescriptively like traditional subjects. Instead, it relies on inductive learning, where students learn by doing. Through experimentation, they acquire valuable insights and develop problem-solving skills that are essential in the entrepreneurial world.

One notable distinction between students and entrepreneurs is their approach to risk and rewards. Students often hesitate to appear uninformed, while entrepreneurs embrace risk and are willing to be wrong. Students typically strive to know the correct answers, whereas entrepreneurs are not afraid to seek help and collaborate with others to find solutions.

The Importance of Teaching Entrepreneurship:

Self-Learning Environment: Students learn best by doing. Entrepreneurship instructors foster an environment where students engage directly with real-world problems, make decisions, and learn through experience.

Behavior Training: Entrepreneurship education includes practical exercises and games that simulate real business scenarios, providing students with behavioral training that is invaluable in their entrepreneurial journeys.

Real-World Competition: Entrepreneurship education leverages real-world competition to prepare students for the challenges they will face in the business landscape, encouraging them to think critically, innovate, and excel.

In conclusion, entrepreneurship is not a simple formula but a complex journey of discovery and growth. It requires a shift in mindset, from risk aversion to calculated risk-taking, from seeking answers to asking questions. By teaching entrepreneurship, we empower individuals to embrace change, tackle real-world problems, and contribute to the dynamic landscape of business and innovation.

1 note

·

View note

Quote

Until recently, we’ve assumed that only low-status tasks would be assigned to machines. The automation of creative work has revealed to a whole new class of people that they are not immune to Schumpeterian creative destruction.

🔮 AI’s education lesson; virtual power plants; open-source; brains, the microbiome, Snoop Dogg++ #421

0 notes

Text

The GitHub Political Party

Advocates for a government where policy is managed via a respiratory hosting service that governs voluntarily via subscription plans. The GitHub Political Party would put in place a open-source government that stores revisions of projects for ideologies and policies. In practice the Github party would advocate for a voluntary society in which groups and individuals maintain and develop their culture or interests whilst maintaining a pluralist attitude valuing philoxenia (a love of strangers). Their philoxenia & their pluralist attitude are valued by each of the societies, despite them being apart of various schools of thought because they all consider the possibility that the other society is more correct. Each of these societies evinces a willingness to update their theories as more evidence becomes available. These voluntary societies treat their ideas like code where there are willing to update to new versions, fork into separate versions experimenting with different ideas, and are willing to boot up older iterations with the knowledge they obtained with newer iterations.Within these voluntary societies people will be able to vote with their feet or dollar ;in lieu of, diluted votes associated with regular democracy. -- Written by Murdoch Maxwell

#Github Political Party#Github#Political Party#Politics#Subscription Plan#Philoxenia#Pluralism#Github Party#Voluntary Societies#Voluntaryism#Experimentalism#Democracy#Politics Moribund#Moribund Institute#Politics Moribund Institute#schumpeterian

0 notes

Text

Theories of Entrepreneurship

Want to learn more about Entrepreneurship? Interested? Check this blog cause we made it much easier to understand Entrepreneurship!

But before we proceed. Make sure to like, comment, and share with your friends! Also, don’t forget to follow for more Entrepreneurship studies! Let’s begin!

These are some Theories of Entrepreneurship that we’ve hand-picked to teach you so that you have an idea about Theories of Entrepreneurship! Let’s start with…

Innovation Theory

The Innovation Theory by Joseph Schumpeter, an Austrian economist & political scientist, believed that an entrepreneur could earn economic profits by introducing successful innovations. To gain more information, watch this video down below!

youtube

Innovation theory of profit posits that the main function of an entrepreneur is to introduce innovations and the profit in the form of reward is given for his performance. According to Schumpeter, innovation refers to any new policy that an entrepreneur undertakes to reduce the overall cost of production or increase the demand for his products.

Thus, innovation can be classified into two categories; The first category includes all those activities which reduce the overall cost of production such as the introduction of a new method or technique of production, the introduction of new machinery, innovative methods of organizing the industry, etc.

The second category of innovation includes all such activities which increase the demand for a product. Such as the introduction of a new commodity or new quality goods, the emergence or opening of a new market, finding new sources of raw material, a new variety, or a design of the product, etc.

The innovation theory of profit posits that the entrepreneur gains profit if his innovation is successful either in reducing the overall cost of production or increasing the demand for his product. Often, the profits earned are for a shorter duration as the competitors imitate the innovation, thereby ceasing the innovation to be new or novice. Earlier, the entrepreneur was enjoying a monopoly position in the market as innovation was confined to himself and was earning larger profits. But after some time, with the others imitating the innovation, the profits started disappearing.

An entrepreneur can earn larger profits for a longer duration if the law allows him to patent his innovation. Such as a design of a product is patented to discourage others to imitate it. Over the time, the supply of factors remaining the same, the factor prices tend to rise because of which the cost of production also increases. On the other hand, with the firms adopting innovations the supply of goods and services increases and their prices fall. Thus, on one hand the output per unit cost increases while on the other hand the per unit revenue decreases.

There is a point of time when the difference between the costs and receipts gets disappear. Thus, the profit more than the normal profit disappears. This innovation process continues, and the profits continue to appear or disappear.

Keynesian Theory

Keynesian economics by John Maynard Keynes, a British economist, is a macroeconomic economic theory of total spending in the economy and its effects on output, employment, and inflation. ... Based on his theory, Keynes advocated for increased government expenditures and lower taxes to stimulate demand and pull the global economy out of the depression.

For me, the Keynesian cross theory is a graph of expenditure and output level also a graph of different levels of equilibrium aggregate expenditure at different interest rate levels.

Since the investment spending is a function of interest rate when there is a change in interest rate which in turn results in a change in total output corresponding to the new equilibrium. Keynesian theorists argue that economies do not stabilize themselves very quickly and require active intervention that boosts short-term demand in the economy.

X-efficiency theory of entrepreneurship

What is the x-efficiency theory of entrepreneurship?

Harvey Leibenstein, the American economist, developed the X-efficiency theory in the 1960s. He views entrepreneurs as gap-fillers and input complementors. Gaps (X-inefficiency) emerge when there are inefficiencies in markets, such as when incumbents do not utilize their resources efficiently (Leibenstein, 1966;1978) because of political, normative, cognitive, and structural factors.

A classic example is a startup without a union that enters a market where all the incumbents have strong unions. The cost advantage of disorganized labor may help firms with low-cost business models to thrive at the bottom of the market at margins that are uneconomical for incumbent firms to pursue within the target ranges given to them by their shareholders.

If the maximum possible productive use of a resource is greater than the actual use by incumbents, an arbitrage opportunity emerges that an entrepreneur can exploit for profit. Entrepreneurs can also improve inputs by putting to use new resources, thus making existing products more efficient.

Incumbents can ignore, waste, or misuse resources due to inertia, incompetence, or ignorance. Thus, the entrepreneur is seen as correcting market inefficiencies by improving the information flow in a market.

X-efficiency theory seems to align well with Kirzner's view of entrepreneurship as alertness to opportunities caused by the lack of insight of incumbents.

Leibenstein’s thoughts focus mainly on two things: suggesting a theory of entrepreneurial economics and using this theory to explain the value of entrepreneurship within the economy. Rather than taking sides with a certain type of entrepreneurial activity, Leibenstein considers two sides, what he calls routine entrepreneurship (well-defined markets) and N-entrepreneurship (Schumpeterian-like). He introduces ways and possibilities of how both can exist within the economy, illustrating characteristics of the entrepreneur such as risk bearer, taking ultimate responsibility, gap-filler, input-completer, and the ability to evaluate economic opportunities.

Leibenstein’s procedure to both theories rests upon inputs and outputs of entrepreneurship (an example of the input would be a motivational factor) and the fact that entrepreneurship is a resource, a scarce one to be specific. Since his theory describes entrepreneurship as a resource, Leibenstein implies that entrepreneurship has value in the economy in the sense that the creation and fruition of tools and technology expand the economy and its features. But he states that because entrepreneurship is not predictable, controllable, or undetermined, it becomes scarce because the “up-and-coming” entrepreneurs have a lack of input-completing capacities. Thus, in some cases a well-defined market is impossible and that is his reason for considering both routine and N-entrepreneurship.

Leibenstein’s work is very credible in the sense that it outlines what an entrepreneur should do to be successful, and why we need entrepreneurship to exist. This passage would be helpful to a relatively new entrepreneur because Leibenstein is merely giving advice on how to be an input-completer and gap-filler, which he says makes for a successful entrepreneur.

Kirzner’s Learning-Alertness Theory

The basic concept in Kirzner's theory of entrepreneurship is alertness. ... The role of entrepreneurs lies in their alertness to hitherto unnoticed opportunities. Through their alertness, entrepreneurs can discover and exploit situations in which they can sell for high prices that which they can buy for low prices.

youtube

The book Competition and Entrepreneurship by Israel Kirzner, published in 1973, was a watershed moment in the revival of Austrian economics. While prices are the medium through which knowledge spreads in an economy, entrepreneurial activity–people recognizing previously unimagined opportunities to combine inputs into more valuable outputs–is the cause of that spread, according to Kirzner. Entrepreneurship is a discovery procedure, not a maximization exercise under given constraints. Markets are competitive, according to Kirzner, when the discovery procedure is unconstrained, rather than when markets match the assumed conditions of the textbook "perfect competition" model.

Alfred Marshall Theory

This theory was created by Alfred Marshall who was an English Economist. Marshall made a book called Principles of Economics published in 1890. So, if you what more information, watch this video down below!

youtube

Modern research on the economics of education began in the 1950s with research by T. W. Schultz, Jacob Mincer, Sherwin Rosen and some others, although there are earlier precedents, including analyses by Adam Smith, Alfred Marshall, and Milton Friedman. This new literature treats education as an investment that has both costs and returns. The returns analyzed are principally the increase in earnings because of greater amounts of schooling. The costs included tuition, fees, and other direct expenses from schooling, and the earnings foregone by being in school rather than at work. Higher education has boomed throughout the world during the past three decades in much poorer and in all rich nations. An important part of the explanation for this development is that new technologies, such as computers and the Internet, increased the demand for persons with college education because college graduates more easily utilize and adapt to these technologies. Other important developments explaining the greater incentives to get a higher education are the shift to high-skilled services, such as the education and health sectors, and away from manufacturing and increased globalization that helped spread the demand for these new technologies throughout the world.

And that's it! Thank you so much for reading until the end. Don't forget to like, comment on some suggestions, or even your learnings from this blog post. Also, share it with your friends! Hope you learn something! Stay tuned for more Entrepreneurship lessons!

#entreprenuership#theoriesofentrepreneurship#innovationtheory#josephschumpeter#keynesiantheory#johnmaynardkeynes#x-efficiencytheory#harveyleibenstein#kirzner'slearning-alertnesstheory#israelkirzner#alfredmarshalltheory#alfredmarshall#economist#theories#Youtube

1 note

·

View note

Text

Notes for the next book (Metacapitalism)

Marx’s Capital I focuses on the process of production where his labour theory of value must be submitted to a Bohm-Bawerkian critique to spawn the machinic theory of value, the tendency for the rate of variable capital to fall or the higher phase singularity. Just as Marx’s key example throughout is the linen commodity transformed into the cloak commodity, so must the key example be drawn from haute couture (primarily the posthuman Margiela commodity).

Capital II focuses on the process of circulation where the conversion of commodities into money must be submitted to a Hayekian critique of centralised planned economies in favour of market competition and its price signals to transcendentally deduce the will to power, the basic AI drives or the lower phase singularity as a historically instantiated mode of production.

Capital III focuses on the capitalist process of production and circulation as a whole where the tendency for the rate of profit to fall must be submitted to a Schumpeterian critique of the Marxist crisis theory as a spur rather than impediment to recurrent and recuperating k-waves of creative destruction.

Marx’s political writings. The theory of communism, and particularly its one great effort of empirical instantiation during Lenin’s Bolshevik revolution, must be transvaluated in light of the critique of Capital as the only serious but ultimately botched attempt at a friendly AI project.

8/9/21

1 note

·

View note

Text

Private equity ghouls have a new way to steal from their investors

Private equity is quite a racket. PE managers pile up other peoples’ money — pension funds, plutes, other pools of money — and then “invest” it (buying businesses, loading them with debt, cutting wages, lowering quality and setting traps for customers). For this, they get an annual fee — 2% — of the money they manage, and a bonus for any profits they make.

On top of this, private equity bosses get to use the carried interest tax loophole, a scam that lets them treat this ordinary income as a capital gain, so they can pay half the taxes that a working stiff would pay on a regular salary. If you don’t know much about carried interest, you might think it has to do with “interest” on a loan or a deposit, but it’s way weirder. “Carried interest” is a tax regime designed for 16th century sea captains and their “interest” in the cargo they “carried”:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity is a cancer. Its profits come from buying productive firms, loading them with debt, abusing their suppliers, workers and customers, and driving them into ground, stiffing all of them — and the company’s creditors. The mafia have a name for this. They call it a “bust out”:

https://pluralistic.net/2023/06/02/plunderers/#farben

Private equity destroyed Toys R Us, Sears, Bed, Bath and Beyond, and many more companies beloved of Main Street, bled dry for Wall Street:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

And they’re coming for more. PE funds are “rolling up” thousands of Boomer-owned business as their owners retire. There’s a good chance that every funeral home, pet groomer and urgent care clinic within an hour’s drive of you is owned by a single PE firm. There’s 2.9m more Boomer-owned businesses going up for sale in the coming years, with 32m employees, and PE is set to buy ’em all:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE funds get their money from “institutional investors.” It shouldn’t surprise you to learn they treat their investors no better than their creditors, nor the customers, employees or suppliers of the businesses they buy.

Pension funds, in particular, are the perennial suckers at the poker table. My parent’s pension fund, the Ontario Teachers’ Fund, are every grifter’s favorite patsy, losing $90m to Sam Bankman-Fried’s cryptocurrency scam:

https://www.otpp.com/en-ca/about-us/news-and-insights/2022/ontario-teachers--statement-on-ftx/

Pension funds are neck-deep in private equity, paying steep fees for shitty returns. Imagine knowing that the reason you can’t afford your apartment anymore is your pension fund gambled with the private equity firm that bought your building and jacked up the rent — and still lost money:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/

But there’s no depth too low for PE looters to sink to. They’ve found an exciting new way to steal from their investors, a scam called a “continuation fund.” Writing in his latest newsletter, the great Matt Levine breaks it down:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Here’s the deal: say you’re a PE guy who’s raised a $1b fund. That entitles you to a 2% annual “carry” on the fund: $20,000,000/year. But you’ve managed to buy and asset strip so many productive businesses that it’s now worth $5b. Your carry doesn’t go up fivefold. You could sell the company and collect your 20% commission — $800m — but you stop collecting that annual carry.

But what if you do both? Here’s how: you create a “continuation fund” — a fund that buys your old fund’s portfolio. Now you’ve got $5b under management and your carry quintuples, to $100m/year. Levine dryly notes that the FT calls this “a controversial type of transaction”:

https://www.ft.com/content/11549c33-b97d-468b-8990-e6fd64294f85

These deals “look like a pyramid scheme” — one fund flips its assets to another fund, with the same manager running both funds. It’s a way to make the pie bigger, but to decrease the share (in both real and proportional terms) going to the pension funds and other institutional investors who backed the fund.

A PE boss is supposed to be a fiduciary, with a legal requirement to do what’s best for their investors. But when the same PE manager is the buyer and the seller, and when the sale takes place without inviting any outside bidders, how can they possibly resolve their conflict of interest?

They can’t: 42% of continuation fund deals involve a sale at a value lower than the one that the PE fund told their investors the assets were worth. Now, this may sound weird — if a PE boss wants to set a high initial value for their fund in order to maximize their carry, why would they sell its assets to the new fund at a discount?

Here’s Levine’s theory: if you’re a PE guy going back to your investors for money to put in a new fund, you’re more likely to succeed if you can show that their getting a bargain. So you raise $1b, build it up to $5b, and then tell your investors they can buy the new fund for only $3b. Sure, they can get out — and lose big. Or they can take the deal, get the new fund at a 40% discount — and the PE boss gets $60m/year for the next ten years, instead of the $20m they were getting before the continuation fund deal.

PE is devouring the productive economy and making the world’s richest people even richer. The one bright light? The FTC and DoJ Antitrust Division just published new merger guidelines that would make the PE acquire/debt-load/asset-strip model illegal:

https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

The bad news is that some sneaky fuck just slipped a 20% FTC budget cut — $50m/year — into the new appropriations bill:

https://twitter.com/matthewstoller/status/1681830706488438785

They’re scared, and they’re fighting dirty.

I’m at San Diego Comic-Con!

Today (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause — Nov 2023 — to the first 50 people!)

Tomorrow (Jul 21):

1030h: Wish They All Could be CA MCs, room 24ABC (panel)

12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

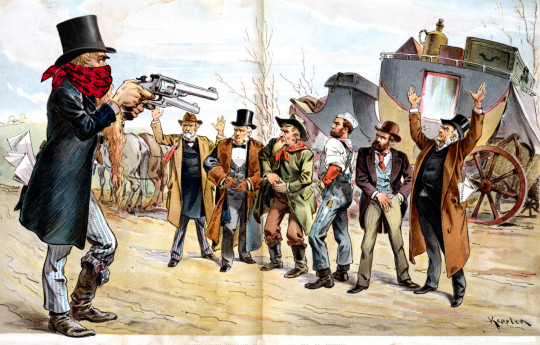

[Image ID: An old Punch editorial cartoon depicting a bank-robber sticking up a group of businesspeople and workers. He wears a bandanna emblazoned with dollar-signs and a top-hat.]

#pluralistic#buyout groups#continuation fraud#pe#pyramid schemes#the sucker at the table#pension plans#continuation funds#matt levine#fiduciaries#finance#private equity#mark to market#ripoffs

309 notes

·

View notes

Link

The political economy of the Digital Age remains virtually terra incognita. In Techno-Feudalism, published three months ago in France (no English translation yet), Cedric Durand, an economist at the Sorbonne, provides a crucial, global public service as he sifts through the new Matrix that controls all our lives.

Durand places the Digital Age in the larger context of the historical evolution of capitalism to show how the Washington consensus ended up metastasized into the Silicon Valley consensus. In a delightful twist, he brands the new grove as the “Californian ideology”.

We’re far away from Jefferson Airplane and the Beach Boys; it’s more like Schumpeter’s “creative destruction” on steroids, complete with IMF-style “structural reforms” emphasizing “flexibilization” of work and outright marketization/financialization of everyday life.

The Digital Age was crucially associated with right-wing ideology from the very start. The incubation was provided by the Progress and Freedom Foundation (PFF), active from 1993 to 2010 and conveniently funded, among others, by Microsoft, At&T, Disney, Sony, Oracle, Google and Yahoo.

In 1994, PFF held a ground-breaking conference in Atlanta that eventually led to a seminal Magna Carta: literally, Cyberspace and the American Dream: a Magna Carta for the Knowledge Era, published in 1996, during the first Clinton term.

Not by accident the magazine Wired was founded, just like PFF, in 1993, instantly becoming the house organ of the “Californian ideology”.

Among the authors of the Magna Carta we find futurist Alvin “Future Shock” Toffler and Reagan’s former scientific counselor George Keyworth. Before anyone else, they were already conceptualizing how “cyberspace is a bioelectronic environment which is literally universal”. Their Magna Carta was the privileged road map to explore the new frontier.

Those Randian heroes

Also not by accident the intellectual guru of the new frontier was Ayn Rand and her quite primitive dichotomy between “pioneers” and the mob. Rand declared that egotism is good, altruism is evil, and empathy is irrational.

When it comes to the new property rights of the new Eldorado, all power should be exercised by the Silicon Valley “pioneers”, a Narcissus bunch in love with their mirror image as superior Randian heroes. In the name of innovation they should be allowed to destroy any established rules, in a Schumpeterian “creative destruction” rampage.

That has led to our current environment, where Google, Facebook, Uber and co. can overstep any legal framework, imposing their innovations like a fait accompli.

Durand goes to the heart of the matter when it comes to the true nature of “digital domination”: US leadership was never achieved because of spontaneous market forces.

On the contrary. The history of Silicon Valley is absolutely dependent on state intervention – especially via the industrial-military complex and the aero-spatial complex. The Ames Research Center, one of NASA’s top labs, is in Mountain View. Stanford was always awarded juicy military research contracts. During WWII, Hewlett Packard, for instance, was flourishing thanks to their electronics being used to manufacture radars. Throughout the 1960s, the US military bought the bulk of the still infant semiconductor production.

The Rise of Data Capital, a 2016 MIT Technological Review report produced “in partnership” with Oracle, showed how digital networks open access to a new, virgin underground brimming with resources: “Those that arrive first and take control obtain the resources they’re seeking” – in the form of data.

So everything from video-surveillance images and electronic banking to DNA samples and supermarket tickets implies some form of territorial appropriation. Here we see in all its glory the extractivist logic inbuilt in the development of Big Data.

Durand gives us the example of Android to illustrate the extractivist logic in action. Google made Android free for all smartphones so it would acquire a strategic market position, beating the Apple ecosystem and thus becoming the default internet entry point for virtually the whole planet. That’s how a de facto, immensely valuable, online real estate empire is built.

The key point is that whatever the original business – Google, Amazon, Uber – strategies of conquering cyberspace all point to the same target: take control of “spaces of observation and capture” of data.

About the Chinese credit system…

Durand offers a finely balanced analysis of the Chinese credit system – a public/private hybrid system launched in 2013 during the 3rd plenum of the 18thCongress of the CCP, under the motto “to value sincerity and punish insincerity”.

For the State Council, the supreme government authority in China, what really mattered was to encourage behavior deemed responsible in the financial, economic and socio-political spheres, and sanction what is not. It’s all about trust. Beijing defines it as “a method of perfecting the socialist market economy system that improves social governance”.

The Chinese term – shehui xinyong – is totally lost in translation in the West. Way more complex than “social credit”, it’s more about “trustworthiness”, in the sense of integrity. Instead of the pedestrian Western accusations of being an Orwellian system, priorities include the fight against fraud and corruption at the national, regional and local levels, violations of environmental rules, disrespect of food security norms.

Cybernetic management of social life is being seriously discussed in China since the 1980s. In fact, since the 1940s, as we see in Mao’s Little Red Book. It could be seen as inspired by the Maoist principle of “mass lines”, as in “start with the masses to come back to the masses: to amass the ideas of the masses (which are dispersed, non-systematic), concentrate them (in general ideas and systematic), then come back to the masses to diffuse and explain them, make sure the masses assimilate them and translate them into action, and verify in the action of the masses the pertinence of these ideas”.

Durand’s analysis goes one step beyond Soshana Zuboff’s The Age of Surveillance Capitalism when he finally reaches the core of his thesis, showing how digital platforms become “fiefdoms”: they live out of, and profit from, their vast “digital territory” peopled with data even as they lock in power over their services, which are deemed indispensable.

And just as in feudalism, fiefdoms dominate territory by attaching serfs. Masters made their living profiting from the social power derived from the exploitation of their domain, and that implied unlimited power over the serfs.

It all spells out total concentration. Silicon Valley stalwart Peter Thiel has always stressed the target of the digital entrepreneur is exactly to bypass competition. As quoted in Crashed: How a Decade of Financial Crises Changed the World, Thiel declared, “Capitalism and competition are antagonistic. Competition is for losers.”

So now we are facing not a mere clash between Silicon Valley capitalism and finance capital, but actually a new mode of production:

a turbo-capitalist survival as rentier capitalism, where Silicon giants take the place of estates, and also the State. That is the “techno-feudal” option, as defined by Durand.

Blake meets Burroughs

Durand’s book is extremely relevant to show how the theoretical and political critique of the Digital Age is still rarified. There is no precise cartography of all those dodgy circuits of revenue extraction. No analysis of how do they profit from the financial casino – especially mega investment funds that facilitate hyper-concentration. Or how do they profit from the hardcore exploitation of workers in the gig economy.

The total concentration of the digital glebe is leading to a scenario, as Durand recalls, already dreamed up by Stuart Mill, where every land in a country belonged to a single master. Our generalized dependency on the digital masters seems to be “the cannibal future of liberalism in the age of algorithms”.

Is there a possible way out? The temptation is to go radical – a Blake/Burroughs crossover. We have to expand our scope of comprehension – and stop confusing the map (as shown in the Magna Carta) with the territory (our perception).

William Blake, in his proto-psychedelic visions, was all about liberation and subordination – depicting an authoritarian deity imposing conformity via a sort of source code of mass influence. Looks like a proto-analysis of the Digital Age.

William Burroughs conceptualized Control – an array of manipulations including mass media (he would be horrified by social media). To break down Control, we must be able to hack into and disrupt its core programs. Burroughs showed how all forms of Control must be rejected – and defeated: “Authority figures are seen for what they are: dead empty masks manipulated by computers”.

Here’s our future: hackers or slaves.

(Republished from

Asia Times

by permission of author or representative)SHARE THIS ARTICLE...

5 notes

·

View notes

Text

A high level of concentration does not necessarily mean that there is persistent dominance: one dominant firm could swiftly replace another as in standard neo-Schumpeterian models of creative destruction (Aghion and Howitt, 1992). But dynamic models could create incumbent advantages for high market share firms if incumbents are more likely to innovate than entrants (Gilbert and Newbery, 1982).

also relevant to the discussion of Apple’s abrupt entry into the smartphone market, swiftly dislodging the incumbents, and then spending a billion dollars a month on R&D in order to stay in front.

14 notes

·

View notes

Text

big sean: one man can change the world.... joseph schumpeter from the grave: oh MOOD! big MOOD! me, absolutely sick of this guy: shut up joe

#i really. really dislike schumpeterian theory it's so arrogant agshjsfj;hsjsk#but it's in the syllabus so!

0 notes

Text

Facebook and the whole web advertising industry is the one place where I become Schumpeterian and I can’t wait for the market crash that finishes them off.

7 notes

·

View notes

Quote

Nowhere is, I think, wealth and material success more openly celebrated than in China. Perhaps it was stimulated by the 40th anniversary of the opening up which is this year, but more fundamentally, I think, it is stimulated by the most successful economic development in history. Rich entrepreneurs are celebrated in newspapers, television, conferences. Their wealth and rags-to-riches stories are held as examples for all. Ayn Rand would feel at home in this environment. So would Hayek: an incredible amount of energy and discovery was unleashed by the changes that transformed lives of 1.4 billion people, twice as many as the combined populations of the “old” EU-15 and the United States. People discovered economic information that was inaccessible or unknown before, organized in a Schumpeterian fashion new combinations of capital and labor, and created wealth on an almost unimaginable scale (certainly, unimaginable for anyone who looked at China in 1978).

Hayekian communism

3 notes

·

View notes

Text

Private equity finally delivered Sarah Palin's death panels

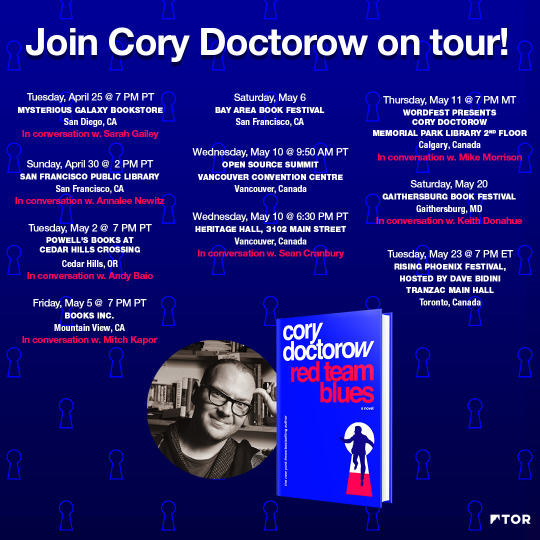

Tonight (Apr 26), I’ll be in Burbank, signing Red Team Blues at Dark Delicacies at 6PM.

Remember “death panels”? Sarah Palin promised us that universal healthcare was a prelude to a Stalinist nightmare in which unaccountable bureaucrats decided who lived or died based on a cost-benefit analysis of what it would cost to keep you alive versus how much your life was worth.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Palin was right that any kind of healthcare rationing runs the risk of this kind of calculus, where we weight spending $10,000 to extend a young, healthy person’s life by 40 years against $1,000 to extend an elderly, disabled person’s life by a mere two years.

It’s a ghastly, nightmarish prospect — as anyone who uses the private healthcare system knows very well. More than 27m Americans have no health insurance, and millions more have been tricked into buying scam “cost-sharing” systems run by evangelical grifters:

https://www.nytimes.com/2020/01/02/health/christian-health-care-insurance.html

But for the millions of Americans with insurance, death panels are an everyday occurrence, or at least a lurking concern. Anyone who pays attention knows that insurers have entire departments designed to mass-reject legitimate claims and stall patients who demand that the insurer lives up to its claim:

https://kffhealthnews.org/news/article/khn-podcast-an-arm-and-a-leg-how-to-shop-for-health-insurance-november-24-2021/

The private healthcare sector is designed to deny care. Its first duty is to its shareholders, not its patients, and every dollar spent on care is a dollar not available for dividends. The ideal insurance customer pays their premiums without complaint, and then pays cash for all their care on top of it.

All that was true even before private equity started buying up and merging whole swathes of the US healthcare system (or “healthcare” “system”). The PE playbook — slash wages, sell off physical plant, slash wages, reduce quality and raise prices — works in part because of its scale. These aren’t the usual economies of scale. Rather the PE strategy is to buy and merge all the similar businesses in a region, so customers, suppliers and workers have nowhere else to turn.

That’s bad enough when it’s aimed at funeral homes, pet groomers or any of the other sectors that have been bigfooted by PE:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

But it’s especially grave when applied to hospitals:

https://pluralistic.net/2020/05/21/profitable-butchers/#looted

Or emergency room physicians:

https://pluralistic.net/2022/03/14/unhealthy-finances/#steins-law

And if you think that’s a capitalist hellscape nightmare, just imagine how PE deals with dying, elderly people. Yes, PE has transformed the hospice industry, and it’s even worse than you imagine.

Yesterday, the Center for Economic and Policy Research published “Preying on the Dying: Private Equity Gets Rich in Hospice Care,” written by some of the nation’s most valiant PE slayers: Eileen Appelbaum, Rosemary Batt and Emma Curchin:

https://cepr.net/report/preying-on-the-dying-private-equity-gets-rich-in-hospice-care/

Medicare pays private hospices $203-$1,462 per day to take care of dying old people — seniors that a doctor has certified to have less than six months left. That comes to $22.4b/year in public transfers to private hospices. If hospices that $1,462 day-rate, they have lots of duties, like providing eight hours’ worth of home care. But if the hospice is content to take the $203/day rate, they are not required to do anything. Literally. It’s just free money for whatever the operator feels like doing for a dying elderly person, including doing nothing at all.

As Appelbaum told Maureen Tkacik for her excellent writeup in The American Prospect: “Why anybody commits fraud is a mystery to me, because you can make so much money playing within the guidelines the way the payment scheme operates.”

https://prospect.org/health/2023-04-26-born-to-die-hospice-care/

In California, it’s very, very easy to set up a hospice. Pay $3,000, fill in some paperwork (or don’t — no one checks it, ever), and you’re ready to start caring for beloved parents, grandparents, sisters, brothers, aunts and uncles as they depart this world. You do get a site inspection, but don’t worry — you aren’t required to bring your site up to code until after you’re licensed, and again, they never check — not even if there are multiple complaints. After all, no one at the Centers for Medicare & Medicaid Services (CMS) has the job of tracking complaints.

This is absolute catnip for private equity — free government money, no obligations, no enforcement, and the people you harm are literally dying and can’t complain. What’s not to like? No wonder PE companies have spent billions “rolling up” hospices across the country. There are 591 hospices in Van Nuys, CA alone — but at least 30 of them share a single medical director:

https://auditor.ca.gov/reports/2021-123/index.html#pg34A

Medicare caps per-patient dispersals at $32,000, which presents an interesting commercial question for remorseless, paperclip-maximizing, grandparent-devouring private equity ghouls: do you take in sick patients (who cost more, but die sooner) or healthy patients (cost less, potentially live longer)?

In Van Nuys, the strategy is to bring in healthy patients and do nothing. 51% of Van Nuys hospice patients are “live discharged” — that is, they don’t die. This figure — triple the national average — is “a reliable sign of fraud.”

There are so many hospice scams and most of them are so stupid that it takes a monumental failure of oversight not to catch and prevent them. Here’s a goodun: hospices bribe doctors to “admit” patients to a hospice without their knowledge. The hospice bills for the patient, but otherwise has no contact with them. This can go on for a long time, until the patient tries to visit the doctor and discovers that their Medicare has been canceled (you lose your Medicare once you go into hospice).

Another scam: offer patients the loosest narcotics policy in town, promising all the opioids they want. Then, once their benefits expire, let them die of an overdose (don’t worry, people who die in hospice don’t get autopsies):

https://www.newyorker.com/magazine/2022/12/05/how-hospice-became-a-for-profit-hustle

You can hire con artists to serve as your sales-force, and have them talk vulnerable, elderly people into enrolling in hospice care by convincing them they have nothing to live for and should just die already and not burden their loved ones any longer.

Hospitals and hospices also collude: hospitals can revive dying patients, ignoring their Do Not Resuscitate orders, so they can be transfered to a hospice and die there, saving the hospital from adding another dead patient to their stats.CMS’s solution is perverse: they’re working with Humana to expand Medicare Advantage (a scam that convinces patients to give up Medicare and enrol in a private insurance program, whose private-sector death panel rejects 13% of claims that Medicare would have paid for). The program will pay private companies $32,000 for every patient who agrees to cease care and die. As our friends on the right like to say, “incentives matter.”

Appelbaum and co have a better idea:

Do more enforcement: increase inspections and audits.

Block mergers and rollups of hospices that make them too big to fail and too big to jail.

Close existing loopholes.

They should know. Appelbaum and her co-authors write the best, most incisive analysis of private equity around. For more of their work, check out their proposal for ending pension-plan ripoffs by Wall Street firms:

https://pluralistic.net/2022/05/05/mego/#A09948

Catch me on tour with Red Team Blues in Burbank, Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: An industrial meat grinder, fed by a conveyor belt. A dead, elderly man is traveling up the conveyor, headed for the grinder's intake. The grinder is labelled 'HOSPICE' in drippy Hallowe'en lettering. It sits in a spreading pool of blood.]

Image: Seydelmann (modified) https://commons.wikimedia.org/wiki/File:GW300_1.jpghttps://commons.wikimedia.org/wiki/File:GW300_1.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#cepr#medicare advantage#medicare#hospice#aca#aging#death panels#fraud#california#preying on the dying

141 notes

·

View notes