#sap concur integration

Explore tagged Tumblr posts

Text

Navigating Business Travel in the Indian Market: A Complete Guide to Saving Money

Business travel is a critical component of modern corporate operations, especially in a dynamic market like India. Companies face rising travel expenses, and saving on these costs is not just about cutting budgets—it’s about increasing efficiency and driving growth. In this guide, we break down actionable strategies, real-world examples, and research-backed insights to help businesses optimize their travel spend.

Why Saving Money on Business Travel Matters

Travel expenses can account for a significant portion of a company’s operating costs. According to a Deloitte report, travel and expense costs have grown by nearly 6% annually in many corporations. In India, where businesses are rapidly expanding, controlling these costs can directly impact profitability. Lower travel expenses allow companies to invest more in growth initiatives, employee development, and technology upgrades.

Moreover, research from Harvard Business Review highlights that companies with robust travel management systems can save up to 20% on their travel budgets. These savings not only improve the bottom line but also contribute to better resource allocation and employee satisfaction.

Proven Strategies to Cut Costs on Business Travel

Negotiating Better Travel Contracts: Real-World Indian Examples

Effective negotiation with travel service providers is essential. Companies in India are increasingly leveraging volume-based discounts and long-term contracts to secure lower rates. For example, several leading firms in Mumbai have successfully negotiated deals with hotel chains and airlines by committing to a fixed volume of bookings. This approach has led to a reduction in costs by nearly 15% in some cases.

Using travel management companies like Concur or American Express Global Business Travel can further aid in securing these deals. Their industry expertise and extensive networks provide a competitive edge in negotiations. Businesses have reported that using such services has led to substantial savings and a smoother travel booking process.

Implementing Robust Corporate Travel Policies: The Role of Technology

Having clear, comprehensive corporate travel policies is key. These policies should outline guidelines for booking, expense approvals, and reimbursement procedures. Companies like SAP Concur and Expensify offer software solutions that automate these processes, ensuring that employees adhere to the travel policy and that expenses are tracked in real time.

In India, many organizations have adopted mobile-friendly travel management solutions to keep their workforce connected. These tools not only simplify expense management but also ensure that companies are prepared for last-minute changes or emergencies. With real-time analytics, managers can review travel patterns and adjust policies to further drive cost efficiencies.

Tools and Technologies Revolutionizing Business Travel Management in India

Technology is a game-changer in business travel. Advanced software platforms now offer features like dynamic pricing analysis, predictive booking analytics, and mobile expense reporting. These tools help companies identify the most cost-effective travel options and optimize booking timings.

For instance, corporate travel platforms such as SAP Concur and Expensify are widely used in India to streamline travel processes. These systems integrate with online travel agencies (OTAs) and travel management companies to provide a holistic view of travel spend. Moreover, they offer robust reporting features that allow companies to monitor expenses and detect any deviations from the approved travel policy.

One standout example is a Bengaluru-based tech firm that implemented a travel management system and saw a 12% reduction in travel expenses within the first six months. This success story underscores how leveraging technology can yield significant cost benefits.

Tejas Travels: Setting the Benchmark in Cost-Effective Corporate Travel

When discussing travel management in India, it is essential to mention Tejas Travels, a renowned tour and travels company. Tejas Travels has carved out a niche in providing comprehensive travel solutions for corporate clients. Their services extend beyond basic travel bookings to include customized itineraries, negotiated discounts with hotels and transport providers, and dedicated support for business travelers.

Tejas Travels has also embraced modern travel management technologies, ensuring that corporate clients have access to real-time updates and seamless booking experiences. Their success in delivering cost-effective travel solutions has made them a trusted partner for many leading Indian companies. Whether it’s managing last-minute changes or ensuring employee safety during travel, Tejas Travels stands out as a reliable and innovative service provider.

Case Studies and Research Insights: Indian Market Trends and Statistics

Research from McKinsey & Company shows that companies with advanced travel management systems tend to outperform their competitors in cost control. In the Indian market, several case studies reveal the transformative impact of effective travel management.

For example, a large manufacturing firm based in Pune collaborated with a travel management company to overhaul its travel policy. By introducing automated expense reporting and centralizing travel bookings, the company reduced its travel expenses by over 18% within a year. This case study illustrates that a combination of technology and strategic policy implementation can yield tangible benefits.

Another critical insight comes from a study published by Deloitte, which emphasizes the importance of planning and early booking. The study found that companies that plan their travel at least 30 days in advance can save an average of 10-15% compared to last-minute bookings. This research supports the idea that proactive travel management is crucial for cost savings.

Additionally, in the realm of bus travel, which is increasingly popular for corporate events and employee outings in India, companies are exploring new cost-effective solutions. By opting for bus travel services from reputable providers, businesses can secure affordable rates and ensure safe, comfortable transportation for their teams during inter-city travel.

How to Craft a Future-Proof Corporate Travel Policy

A future-proof corporate travel policy is dynamic, technology-driven, and employee-centric. Here are some steps to develop an effective policy:

Define Clear Guidelines: Outline what constitutes business travel, set budget limits, and specify the process for expense claims.

Leverage Technology: Utilize travel management software to automate bookings and expense tracking.

Negotiate Vendor Contracts: Build long-term relationships with travel vendors to secure discounts and favorable terms.

Educate Employees: Conduct regular training sessions to ensure that employees understand the travel policy and follow the set guidelines.

Monitor and Adapt: Use data analytics to review travel patterns and update policies as needed.

In India, companies that have invested in creating robust travel policies have reported smoother operations and higher employee satisfaction. With evolving travel trends and increasing reliance on digital tools, these policies need regular updates to remain effective.

Frequently Asked Questions: Business Travel Savings Demystified

Q: How can companies reduce business travel expenses in India? A: Companies can reduce expenses by negotiating better contracts, implementing robust travel policies, and leveraging technology for efficient expense tracking and bookings.

Q: What are some effective travel management tools? A: Tools like SAP Concur, Expensify, and American Express Global Business Travel are popular for their ability to streamline travel processes and provide real-time analytics.

Q: Why is early booking important? A: Research by Deloitte indicates that early bookings can save companies up to 15% compared to last-minute reservations, making proactive planning a key cost-saving strategy.

Q: How does bus travel fit into corporate travel strategies? A: Bus travel offers a cost-effective and reliable mode of transport for group travel during corporate events or inter-city meetings, helping companies reduce overall travel expenses.

Conclusion: Next Steps Towards Smarter Business Travel Savings

Saving money on business travel in India requires a blend of strategic planning, effective use of technology, and clear policy guidelines. Companies must be proactive in negotiating with travel vendors, adopting modern travel management tools, and continuously refining their travel policies.

Real-world examples from the Indian market, such as the successes of leading firms in Mumbai and Bengaluru, demonstrate that these strategies are not only effective but also essential in today’s competitive landscape. Partnering with reliable service providers like Tejas Travels further ensures that companies can navigate the complexities of travel while keeping expenses in check.

By implementing the insights and strategies discussed in this guide, businesses can not only reduce travel costs but also enhance overall operational efficiency. With data-driven decisions and a commitment to continuous improvement, companies can transform their travel management processes and drive long-term growth.

The future of business travel is here, and it is both smart and cost-effective. Embrace these best practices to lead your organization toward a more efficient and profitable travel strategy.

0 notes

Text

Streamlining Financial Management: The Power of Accounts Payable Software

In today’s fast-paced business world, managing finances efficiently is crucial for success. One of the key components of financial management is handling accounts payable (AP), which involves tracking and managing a company’s obligations to pay off short-term debts to suppliers and creditors. With the advent of advanced technology, Accounts Payable Software has emerged as an essential tool for businesses to streamline this process and improve overall efficiency.

What is Accounts Payable Software?

Accounts Payable Software is a digital solution designed to automate and manage the AP process. This software allows businesses to process invoices, manage vendor payments, and track outstanding liabilities with ease. By automating repetitive tasks and reducing manual intervention, companies can significantly enhance accuracy, save time, and minimize errors.

Key Features and Benefits

Automation and Efficiency: AP software automates invoice capture, data entry, and payment approvals, reducing the need for manual handling. This leads to faster processing times and fewer errors, allowing businesses to allocate resources to more strategic tasks.

Improved Accuracy and Compliance: By using sophisticated algorithms and data validation tools, the software ensures accurate data entry and compliance with tax regulations and internal policies. This helps prevent fraudulent activities and maintains audit trails for regulatory purposes.

Enhanced Vendor Relationships: Timely payments and clear communication foster stronger relationships with suppliers. AP software often includes features like payment scheduling and automated reminders, ensuring that payments are made on time and avoiding late fees.

Real-time Reporting and Analytics: With built-in reporting tools, businesses can gain insights into cash flow, outstanding liabilities, and spending patterns. This data-driven approach enables better decision-making and strategic planning.

Integration with Other Systems: Most AP software can seamlessly integrate with accounting systems, enterprise resource planning (ERP) platforms, and banking systems. This integration enhances data accuracy and provides a holistic view of financial operations.

Choosing the Right AP Software

When selecting an accounts payable solution, businesses should consider factors such as scalability, ease of use, security features, and customer support. Popular options in the market include QuickBooks, SAP Concur, Bill.com, and Tipalti. Each platform offers unique features tailored to different business sizes and industries.

The Future of Accounts Payable Software

The future of AP software is being shaped by advancements in artificial intelligence (AI) and machine learning. These technologies are enhancing predictive analytics, fraud detection, and intelligent automation. Additionally, the integration of blockchain technology is improving transparency and security in payment processing.

Conclusion

Incorporating Accounts Payable Software into financial management practices is no longer a luxury but a necessity for businesses aiming to stay competitive. By automating processes, improving accuracy, and providing valuable insights, AP software empowers organizations to manage their finances effectively and build stronger vendor relationships. As technology continues to evolve, businesses that leverage these tools will be better positioned for long-term success.

0 notes

Text

Enhance Your Logistics Billing with These Top 10 Invoice Processing Services

Efficient invoice processing is crucial for businesses looking to streamline their accounts payable operations. In the USA, several companies provide top-notch invoice processing services to help businesses save time, reduce errors, and enhance financial management. Below are the top 10 Invoice Processing companies in USA

1. Vee Technologies

Vee Technologies is a leading provider of invoice processing services in the USA. They offer automated invoice management, reducing manual efforts and improving accuracy. Their logistics invoice process solutions cater to various industries, ensuring seamless financial transactions.

2. Bill.com

Bill.com is a well-known cloud-based platform specializing in invoice automation and payment processing. Their AI-powered tools simplify accounts payable and receivable, making financial management easier for businesses.

3. SAP Concur

SAP Concur offers automated invoicing solutions that help businesses manage expenses efficiently. Their end-to-end invoice processing software provides enhanced visibility into financial operations.

4. AvidXchange

AvidXchange is a leading name among invoice processing companies. Their services focus on streamlining invoice approvals and payments with automation, ensuring fast and secure transactions.

5. Basware

Basware provides smart invoicing solutions with AI-driven automation. Their services integrate seamlessly with existing ERP systems, improving efficiency and reducing processing time.

6. Stampli

Stampli specializes in AI-powered invoice processing, helping businesses automate approvals and prevent fraud. Their user-friendly platform enhances collaboration between finance teams.

7. Tipalti

Tipalti offers global invoice processing and payments automation. Their software reduces compliance risks and ensures faster supplier payments, making them a preferred choice for businesses.

8. MineralTree

MineralTree is a trusted invoice processing services provider, offering AP automation solutions to businesses. Their platform ensures accuracy and efficiency in invoice approvals and payments.

9. PairSoft

PairSoft integrates with accounting software to provide invoice processing services in the USA. Their AI-based automation enhances invoice workflows, reducing manual intervention.

10. Corcentric

Corcentric provides advanced logistics invoice process solutions that optimize accounts payable operations. Their cloud-based platform ensures seamless invoice approvals and payments.

Conclusion

The above-listed companies provide exceptional invoice processing services, helping businesses automate their financial workflows. Whether you need automation, fraud detection, or compliance management, these companies offer tailored solutions to meet your needs. Choosing the right invoice processing services in the USA will enhance your financial operations and drive efficiency.

0 notes

Text

Maximizing the Potential of “Rise with SAP” Through SAP Concur and S/4HANA Integration | FinTrans Solutions

In today’s fast-paced business landscape, companies are increasingly turning to modern technologies to streamline operations, enhance efficiency, and improve financial control. Organizations that adopt “Rise with SAP,” powered by SAP S/4HANA, are taking significant strides in their digital transformation journeys. By transitioning to SAP S/4HANA, they build a robust foundation for more agile and connected business operations. However, the real key to unlocking the full potential of this platform lies in expanding the ecosystem. Integrating SAP Concur can be a game-changer in this regard. Why SAP Concur is the Perfect Companion to “Rise with SAP”

"Rise with SAP" is a set of solutions designed to help companies in the early phases of cloud adoption boost performance and drive innovation. Among many features, SAP S/4HANA offers real-time operational data for much faster decision-making and more efficient business processes.

Adding SAP Concur to the ecosystem unlocks advanced travel and expense management capabilities in seamless integration that amplifies efficiency, visibility, and control.

Seamless Integration for End-to-End Efficiency

A primary advantage of integrating SAP Concur with S/4HANA is the seamless data synchronization facilitated by SAP ICS native integration. SAP Concur, a leading travel and expense management solution, connects effortlessly with S/4HANA, eliminating manual data entry and reducing errors. For example, when employees submit expense reports via SAP Concur, the data is automatically updated in S/4HANA, reflecting changes in both the general ledger and cost centers in real time. This automation enhances accuracy and allows finance teams to shift their focus from repetitive tasks to strategic activities—resulting in improved budgeting, more accurate forecasting, and better financial planning.

Enhanced Spend Visibility and Control

Being a “Rise with SAP” customer means gaining real-time visibility into business operations—a core strength of S/4HANA. Integrating SAP Concur extends this transparency to travel and expense management. With all expense data consolidated on a single platform, companies gain access to detailed analytics and reporting. Finance leaders can track spending, enforce policies, and make data-driven decisions to optimize costs. Insights from SAP Concur help identify opportunities for vendor negotiations and travel expense reductions.

Elevating Employee Experience

Digital transformation isn’t just about back-office automation—it also significantly improves employee experience. SAP Concur’s intuitive interface, available on mobile devices, enables employees to easily book travel, submit expense claims, and monitor reimbursements. By integrating SAP Concur with S/4HANA, companies simplify expense processes, giving employees the tools to manage their expenses effortlessly. This improved experience boosts productivity and reduces frustration with outdated, cumbersome processes.

Strengthened Compliance and Risk Management

Regulatory compliance is crucial for businesses. The combination of SAP Concur’s audit tools and S/4HANA’s data analytics provides organizations with a powerful capability to detect irregularities, enforce spending policies, and mitigate risks. S/4HANA provides accurate financial records, which minimize the chances of fraud and non-compliance. SAP Concur takes this to the next level by automatically marking duplicate or non-compliant expenses and providing built-in audit features to ensure that both internal and external regulatory requirements are met.

As businesses grow, they face increasingly complex processes. The integration of SAP Concur with S/4HANA offers a scalable solution that adapts to evolving business needs. From managing global operations and regulatory challenges to entering new markets, this unified platform supports sustainability and continuous innovation. Encouraging “Rise with SAP” Customers to Embrace SAP Concur

For “Rise with SAP” customers, digital transformation is not limited to adopting S/4HANA. Incorporating SAP Concur into your IT roadmap can significantly improve efficiency, transparency, and financial control. The immediate and long-term benefits of integrating these solutions are undeniable—they drive cost savings, operational success, and strategic growth.

At FinTrans Solutions, we help companies select and implement the right SAP solutions. As an authorized SAP Concur Implementation Partner, we offer customized integration services to ensure a smooth transition that aligns with your organization's unique needs.

Integrating SAP Concur with SAP S/4HANA as part of "Rise with SAP" enables companies to work faster and smarter. The powerful combination is designed to make financial operations smarter, empower employees, and drive organizations to informed, data-driven decisions. As you advance on your digital transformation journey, make SAP Concur a strategic priority in your IT roadmap. Its immediate impact and long-term value make it essential for your organization's success.

Want to modernize and optimize your enterprise operations? Contact FinTrans Solutions today and experience the transformative benefits of SAP Concur and S/4HANA integration.

#concur#sap#travel#expenses#expense management systems#travelandexpensemanagement#expensemanagement#sapconcur#expensemanagementsolution#S/4HANA#Rise with SAP

0 notes

Text

SAP S/4HANA improves business processes over traditional ERP systems through several innovative features and capabilities, leveraging its in-memory computing technology and advanced design. Here’s a breakdown of the key improvements:

1. Real-Time Processing and Insights

Traditional ERP: Relies on batch processing, leading to delays in data analysis and decision-making.

S/4HANA: Operates on the SAP HANA in-memory database, enabling real-time data processing and analytics. This allows businesses to make faster, more informed decisions with live data.

2. Simplified Data Model

Traditional ERP: Uses complex and redundant data structures with multiple aggregates and indices.

S/4HANA: Introduces a simplified data model, reducing data redundancy and complexity. It eliminates the need for aggregates and precomputed tables, improving performance and reducing storage requirements.

3. User Experience (UX)

Traditional ERP: Typically has outdated interfaces that require significant training.

S/4HANA: Provides a modern, intuitive UX through SAP Fiori, offering role-based, responsive, and personalized user interfaces accessible on multiple devices.

4. Integrated Advanced Technologies

Traditional ERP: Limited integration with emerging technologies like AI, ML, IoT, and advanced analytics.

S/4HANA: Seamlessly integrates with:Artificial Intelligence (AI) for predictive analytics and automation.Machine Learning (ML) for recommendations and anomaly detection.Internet of Things (IoT) to enable real-time tracking and optimization of operations.Embedded Analytics to provide actionable insights within the transactional workflows.

5. Improved Business Process Automation

Traditional ERP: Manual processes dominate, requiring additional tools for automation.

S/4HANA: Comes with SAP Intelligent Robotic Process Automation (RPA) and workflow tools to automate repetitive tasks, improve efficiency, and reduce human error.

6. Industry-Specific Innovations

Traditional ERP: Offers generic solutions with limited adaptability for industry-specific needs.

S/4HANA: Tailors functionality for specific industries (e.g., retail, manufacturing, finance) with pre-configured solutions and best practices.

7. Enhanced Supply Chain and Inventory Management

Traditional ERP: Often lacks the real-time capability for end-to-end supply chain visibility.

S/4HANA: Provides real-time tracking and predictive analytics, ensuring optimized inventory levels, reduced waste, and improved demand forecasting.

8. Cloud and Hybrid Deployment Options

Traditional ERP: Typically on-premise, with slower update cycles and higher maintenance costs.

S/4HANA: Offers flexible deployment options, including cloud, on-premise, and hybrid models, allowing businesses to scale and adapt to changing needs while benefiting from regular updates.

9. Faster Financial Closures and Reporting

Traditional ERP: Financial processing is often slow, with limited real-time reporting.

S/4HANA: Speeds up financial processes like reconciliation, closing, and reporting through Universal Journal and real-time data consolidation.

10. Better Integration with Ecosystems

Traditional ERP: Often requires custom development to integrate with other systems.

S/4HANA: Natively integrates with the broader SAP ecosystem (e.g., SAP SuccessFactors, SAP Ariba, SAP Concur) and third-party applications, enabling seamless workflows.

Summary of Benefits

Efficiency Gains: Streamlined operations and reduced processing times.

Cost Reduction: Simplified IT landscape and lower maintenance overheads.

Improved Agility: Faster adaptation to market changes and new business models.

Enhanced Customer Experience: Personalized and responsive services driven by real-time insights.

By addressing the limitations of traditional ERPs, SAP S/4HANA positions businesses for digital transformation and long-term growth.

Mail us on [email protected]

Website: Anubhav Online Trainings | UI5, Fiori, S/4HANA Trainings

0 notes

Text

The Ultimate Guide to the Top 5 Expense Management Software in 2025

Expense management software is essential for businesses to efficiently track and handle employee expenses, optimize budgets, and ensure compliance with financial regulations. It automates the process from receipt submission to reimbursement, reducing errors and speeding up financial operations.

Here are the top 5 expense management tools for 2025:

Navan (Formerly TripActions) Navan is an all-in-one travel and expense platform that streamlines expense management with features like real-time visibility, automated reimbursements, and policy enforcement. Its Connect feature integrates with corporate cards, reducing the need for new programs. Pricing is free for up to 200 employees, with customizable options for larger organizations.

SAP Concur SAP Concur is renowned for its comprehensive expense tracking and automation capabilities, helping businesses manage employee reimbursements, audit expenses, and integrate with financial systems. It offers customizable pricing and is favored for its powerful analytics and reporting tools.

Expensify Expensify is a flexible platform for managing expenses, tracking receipts, and generating reports. It supports a wide range of features, including invoice creation, automated approvals, and virtual cards. Expensify offers two pricing plans, starting at $5 per user per month, catering to startups and larger teams.

Ramp Ramp combines expense management with budget planning and AI-powered assistance. It offers real-time insights and compliance features to control spending. Ramp has a free plan for small businesses and paid plans starting at $15 per user per month.

Zoho Expense Zoho Expense provides powerful expense tracking, travel management, and reporting features. It offers integrations with other Zoho products and flexible pricing, starting with a free plan for small teams.

Each of these tools simplifies and automates expense management, making them ideal for businesses looking to enhance financial accuracy, compliance, and employee satisfaction.

0 notes

Text

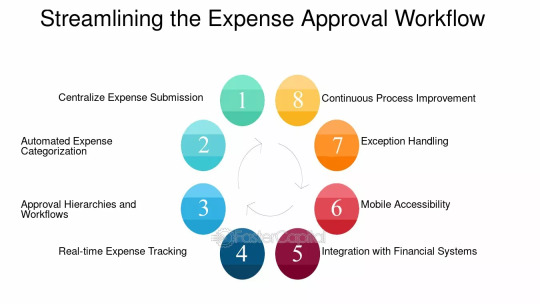

How to Optimize Your Expense Approval Process for Better Financial Control

In any organization, an efficient expense approval process is vital for maintaining financial control, ensuring compliance, and avoiding unnecessary costs. Poorly managed processes can lead to delays, errors, and lack of transparency. This blog outlines actionable strategies to optimize your expense approval process and achieve better financial control.

1. Streamline the Workflow

A complex or unclear expense approval workflow often results in confusion and inefficiency. Simplify the process by:

Clearly defining roles and responsibilities.

Establishing standardized forms and templates for submissions.

Automating the workflow with expense management software.

Example: Using tools like SAP Concur or Expensify ensures that expense reports are automatically routed to the right approvers based on predefined rules.

2. Set Clear Policies

To avoid disputes and ensure compliance, establish well-documented expense policies.

Specify allowable and non-allowable expenses.

Define submission timelines and reimbursement rules.

Communicate the policies across the organization.

Tip: Use visual aids like infographics or videos to make policies more engaging and easier to understand.

3. Leverage Automation Tools

Manual processes increase the risk of errors and delays. Automation tools can:

Reduce data entry errors.

Provide real-time tracking and status updates.

Ensure compliance with preset approval thresholds.

Key Feature to Look For: Choose tools that integrate seamlessly with your accounting or ERP systems for smoother operations.

4. Implement Multi-Tiered Approvals

For better financial control, implement a multi-tiered approval system:

Low-value expenses can be approved by line managers.

High-value expenses should require additional scrutiny by finance teams.

Pro Tip: Use thresholds to ensure that only significant expenses undergo detailed reviews.

5. Monitor and Analyze Data

Tracking and analyzing expense trends can uncover inefficiencies and areas for improvement.

Generate regular reports to monitor spending patterns.

Identify frequent policy violations.

Optimize budget allocations based on insights.

Example: If travel expenses exceed budgets consistently, negotiate better rates with preferred vendors.

6. Enhance Transparency

Transparency in the expense approval process fosters trust and compliance.

Provide employees with real-time updates on the status of their expense submissions.

Share reasons for approvals or rejections to avoid misunderstandings.

Use dashboards to visualize overall expense trends.

7. Train and Educate Employees

Even the best systems fail without proper user adoption. Train employees to:

Submit accurate and complete expense reports.

Adhere to company policies.

Use expense management tools effectively.

Tip: Conduct periodic refresher training sessions to keep everyone updated on policy changes.

8. Conduct Regular Audits

Periodic audits help identify discrepancies and ensure compliance.

Review a random sample of approved expenses.

Verify that all approvals align with company policies.

Address recurring issues through corrective actions.

Best Practice: Combine automated checks with manual reviews for maximum effectiveness.

youtube

Conclusion

An optimized expense approval process is essential for better financial control. By simplifying workflows, leveraging automation, and maintaining transparency, businesses can save time, reduce costs, and improve compliance. Implement these strategies today to create a streamlined, efficient system that aligns with your financial goals.

SITES WE SUPPORT

No Code Ai Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

SAP Ariba Training Online | SAP Ariba Training in Ameerpet

SAP Ariba Training: SAP Ariba Integration with Other SAP Solutions

Introduction:

SAP Ariba Training is a cloud-based solution that revolutionizes procurement and supply chain processes for organizations worldwide. Its seamless integration with other SAP solutions offers businesses unparalleled efficiency and cost savings. This integration is a key focus in SAP Ariba Training, where professionals gain the knowledge and skills to optimize procurement operations. Whether you're an individual looking for SAP Ariba Course Online or seeking guidance from an SAP Ariba Online Training Institute, understanding these integrations is crucial.

What is SAP Ariba?

SAP Ariba is a robust platform designed to enhance procurement and supply chain management by connecting buyers and suppliers through a unified network. It provides solutions for spend management, sourcing, contract management, supplier collaboration, and procurement automation. Businesses use SAP Ariba to streamline their processes, ensure compliance, and achieve greater savings.

Key Features of SAP Ariba

Supplier Collaboration: Streamlined communication and collaboration between buyers and suppliers.

Spend Management: Comprehensive tools to analyse and control spending.

Sourcing and Procurement: Automating the sourcing process with advanced analytics and bidding options.

Contract Management: Simplifying contract creation and ensuring compliance.

Cloud-Based Accessibility: Easy integration with other SAP and non-SAP systems.

These features are extensively covered in SAP Ariba Online Training, enabling professionals to make the most of the platform's capabilities.

The Importance of Integration with Other SAP Solutions

For organizations using multiple SAP systems, integrating SAP Ariba is vital to ensure a seamless flow of information and operations. This integration helps achieve:

Enhanced Efficiency: Reduces manual intervention by automating processes across systems.

Data Consistency: Eliminates data silos by synchronizing information in real time.

Better Insights: Combines data from multiple sources for advanced analytics and reporting.

Improved Compliance: Ensures adherence to corporate policies and regulatory requirements.

How SAP Ariba Integrates with Other SAP Solutions

1. SAP ERP and SAP S/4HANA

SAP Ariba integrates with SAP ERP and SAP S/4HANA to enable a unified procurement process. It allows the synchronization of master data such as supplier information, purchase orders, and invoices. This integration facilitates:

Automatic updates of procurement data.

Real-time financial and operational reporting.

Streamlined invoice and payment processing.

2. SAP Field glass

Integration with SAP Field glass enhances contingent workforce management by linking procurement operations with external labor and services. Businesses can:

Manage temporary staff sourcing and payments.

Monitor compliance for external vendors.

Optimize workforce planning with spend analysis.

3. SAP Success Factors

SAP Ariba integrates with SAP Success Factors for streamlined human resource procurement. This is especially useful for on boarding processes, ensuring that HR operations align with procurement policies.

4. SAP Concur

For organizations using SAP Concur for travel and expense management, SAP Ariba integration ensures better control over travel-related spend. Benefits include:

Real-time synchronization of expense data.

Comprehensive spend visibility and control.

Improved compliance with corporate policies.

5. SAP Analytics Cloud

Integration with SAP Analytics Cloud enables businesses to leverage data from SAP Ariba for advanced analytics and reporting. This combination provides actionable insights to improve procurement strategies.

6. SAP Business Network

SAP Ariba is part of the larger SAP Business Network, which connects trading partners for seamless collaboration. It provides end-to-end visibility and control over the supply chain.

These integration capabilities are a major focus in SAP Ariba Course Online, helping learners understand how to maximize value for their organizations.

Benefits of Integrating SAP Ariba with Other SAP Solutions

Streamlined Operations: Automates workflows across platforms, reducing manual errors.

Cost Savings: Optimizes procurement and supply chain processes to cut unnecessary expenses.

Increased Productivity: Frees up time for strategic tasks by automating repetitive processes.

Better Decision-Making: Offers comprehensive insights for data-driven strategies.

Regulatory Compliance: Ensures adherence to policies and regulations across systems.

These benefits are extensively covered in the curriculum of an SAP Ariba Online Training Institute, ensuring participants gain practical and strategic insights.

Steps for Integrating SAP Ariba with Other SAP Solutions

Assess Business Needs: Identify the specific integration requirements based on business objectives.

Set Up Middleware: Use SAP Cloud Integration or other middleware solutions to establish connectivity.

Synchronize Data: Align master and transactional data between systems to ensure consistency.

Configure APIs: Utilize SAP-provided APIs to enable seamless data exchange.

Test and Monitor: Conduct integration testing and continuously monitor for errors or inefficiencies.

Each of these steps is detailed in SAP Ariba Training, equipping professionals to execute integrations successfully.

Challenges in SAP Ariba Integration

While integration offers immense benefits, there are challenges, such as:

Data migration complexities.

Ensuring compatibility with legacy systems.

Addressing security concerns during data exchange.

These challenges are addressed in SAP Ariba Online Training, providing practical solutions and best practices.

Conclusion

SAP Ariba's integration with other SAP solutions is a game-changer for organizations seeking to optimize their procurement and supply chain operations. By enabling seamless data exchange and process automation, businesses can achieve higher efficiency, cost savings, and compliance. Gaining expertise through an SAP Ariba Online Training Institute or enrolling in an SAP Ariba Course Online empowers professionals to leverage these integrations effectively. Start your journey with SAP Ariba Training today and transform your organization's procurement landscape.

Visualpath is the Best Software Online Training Institute in Hyderabad. Avail complete SAP Ariba worldwide. You will get the best course at an affordable cost.

Attend Free Demo

Call on - +91-9989971070.

WhatsApp: https://www.whatsapp.com/catalog/919989971070/

Visit Blog: https://visualpathblogs.com/

Visit: https://www.visualpath.in/online-sap-ariba-training.html

#SAP Ariba Training#SAP Ariba Course Online#SAP Ariba Online Training#SAP Ariba Online Training in Hyderabad#SAP Ariba Training in Hyderabad#SAP Ariba Training in Ameerpet#SAP Ariba Training Online#SAP Ariba Online Training Institute in Hyderabad

0 notes

Text

Complete Guide to Team Event Travel Management

Team event travel management is a crucial part of corporate event planning. Companies and organizations in India and worldwide are constantly searching for ways to streamline travel logistics, reduce costs, and enhance employee satisfaction. In this guide, we break down actionable strategies and practical tips to manage team travel efficiently. We cover everything from pre-event planning to risk management, and even sustainable travel practices, with real-world examples from the Indian market and industry research to back our insights.

Why Team Event Travel Management Matters

Effective travel management can significantly cut costs and boost productivity. Studies from the Global Business Travel Association (GBTA) and McKinsey show that streamlined travel planning can reduce overall expenses by up to 15%. For businesses in India, where event budgets can be tight, this means better use of funds for business development.

Companies like Tejas Travels, a leading Tour and Travels Company, demonstrate how robust travel strategies not only enhance the traveler’s experience but also improve the company’s bottom line. Their approach includes negotiating with vendors and utilizing technology to track travel expenses, which has resulted in measurable savings and improved event outcomes.

Pre-Event Planning & Budgeting: The First Step to Success

Before booking any travel, establishing a solid plan is essential. Start by setting clear travel policies and objectives. Develop a comprehensive budget that includes transportation, accommodation, meals, and incidentals.

Budgeting and Cost Estimation: A well-structured budget helps anticipate expenses and negotiate better rates with vendors. For example, when planning a corporate retreat in India, Tejas Travels conducts a detailed cost analysis. This includes comparing rates from multiple hotels and transport providers, ensuring that the team’s needs are met without overspending.

Vendor Negotiation: Effective negotiation with travel management companies (TMCs) like American Express Global Business Travel and regional players can secure competitive rates. Indian organizations often leverage local relationships and volume discounts to lower costs.

Travel Policy Development: Clear policies help manage expectations and ensure compliance among team members. Tools such as SAP Concur and Expensify can simplify expense reporting and booking, ensuring that all travel aligns with corporate guidelines.

Smart Booking & Travel Coordination: Simplify Your Process

Modern technology makes travel booking and coordination more efficient than ever. Using integrated travel management systems (TMS) not only reduces manual work but also minimizes errors.

Leveraging Technology: Platforms like Egencia and TripActions offer real-time updates and centralized booking systems. These systems allow for automated itinerary planning and ensure that all details are accessible in one place. This is especially important when handling large teams and multiple travel segments.

Centralized Booking for Group Travel: For team events, booking services from reputable providers, such as Tejas Travels, can simplify logistics. In India, where group travel can be complex due to diverse transport options, having a central booking system minimizes confusion. For instance, if your team requires bus travel for a multi-city tour, a centralized booking system ensures every leg of the journey is coordinated seamlessly.

Mobile App Integration: Mobile travel apps offer quick access to travel updates, changes in itinerary, or emergency alerts. This ensures that the team stays informed and can adapt to unexpected changes on the go.

Ensuring Safety & Managing Risks on the Road

Travel safety is paramount, especially when dealing with large groups. A robust risk management strategy involves detailed planning for emergencies and clear communication of safety protocols.

Emergency Response Planning: Prepare for emergencies by setting up protocols and emergency contacts. Organizations such as International SOS provide services that help companies manage travel risks efficiently.

Travel Insurance: Ensure that every team member is covered with adequate travel insurance. This minimizes financial risks and provides peace of mind. Insurance policies should cover medical emergencies, trip cancellations, and lost baggage.

Clear Communication of Protocols: Regular safety briefings and easily accessible travel guidelines can make a big difference. Inform the team about local safety standards and what to do in case of emergencies.

A well-documented travel policy combined with real-time communication platforms can reduce stress and help manage unforeseen situations effectively.

Real-World Success Stories from the Indian Market

Real-world examples demonstrate the power of effective team travel management in the Indian market. One such example is Tejas Travels, which has successfully coordinated travel for corporate events, educational tours, and team-building retreats across India.

Corporate Retreats: When a leading IT firm planned its annual retreat in Goa, Tejas Travels managed logistics, including airport transfers and local sightseeing. They used centralized booking systems to ensure all team members were accounted for, and negotiations with local vendors helped the company save nearly 10% on travel costs.

Educational Tours: Several Indian universities have partnered with travel agencies like Tejas Travels to organize academic tours. By using detailed itineraries and real-time tracking, these institutions ensure that student safety is prioritized and that every segment of the trip runs smoothly.

Event Planning: Large-scale conferences and trade shows in cities like Mumbai and Bengaluru often require coordinated travel across multiple transport modes. Tejas Travels offers tailored packages that cover everything from bus travel arrangements to local transport, ensuring that every participant arrives on time and ready to engage.

Sustainable & Responsible Travel Management

Sustainability is no longer a luxury—it’s a necessity. Incorporating sustainable practices into travel management not only benefits the environment but also enhances the corporate image.

Sustainable Travel Practices: Companies are increasingly adopting measures to reduce their carbon footprint. This includes selecting eco-friendly hotels, using energy-efficient transport, and offsetting carbon emissions through green initiatives. For example, Tejas Travels has implemented several sustainability measures, including partnerships with eco-friendly transport providers.

ESG Considerations: Aligning travel policies with ESG (Environmental, Social, and Governance) goals is essential. According to recent industry research, companies that prioritize sustainability can see an improvement in brand reputation and employee satisfaction. In India, businesses are beginning to see the benefits of integrating green practices into their travel plans, which can also lead to long-term cost savings.

Green Travel Tips: Encourage employees to travel light, choose digital communication over printed materials during trips, and use local transport options whenever possible. Such practices contribute to reducing the overall environmental impact.

Future Trends & Innovations in Travel Management

Staying ahead of travel trends can help companies adapt to the rapidly changing landscape of team event travel management.

Emerging Technologies: AI-driven travel management and data analytics are transforming how companies plan and execute travel. These technologies can forecast travel trends, optimize routes, and even predict potential risks. According to Phocuswright research, the use of AI in travel management is expected to grow by 20% in the next few years.

Post-Pandemic Travel Patterns: The pandemic has reshaped travel habits. Businesses are now more focused on flexible booking policies, health safety measures, and remote work integration. This shift has led to innovative travel solutions and more personalized travel experiences.

Enhanced Communication Tools: With advancements in mobile technology and instant communication platforms, travel coordination is smoother. Employees can receive real-time alerts, schedule changes, and local safety updates directly on their smartphones.

Focus on Employee Experience: As companies compete to attract and retain top talent, the travel experience is becoming a key differentiator. Companies that invest in user-friendly travel management tools and prioritize employee comfort can significantly boost morale and productivity.

Conclusion: Actionable Insights for Successful Team Travel Management

Managing team event travel is an ongoing challenge, but with the right strategies, tools, and partnerships, it can be a game-changer for any organization. Here are some key takeaways:

Plan Thoroughly: Begin with clear objectives and a detailed budget. Use travel management systems to streamline the planning process.

Use Technology: Leverage platforms that offer centralized booking, real-time updates, and mobile app integration. This ensures that every team member stays informed and connected throughout the journey.

Prioritize Safety: Develop comprehensive emergency protocols, secure travel insurance, and communicate safety guidelines clearly.

Focus on Sustainability: Integrate eco-friendly practices into your travel management strategy. Align your policies with broader ESG goals to enhance your corporate image.

Stay Updated on Trends: Monitor emerging technologies and travel trends. Adapt your strategies to meet the changing needs of your team and the market.

Real-world examples from India, such as those from Tejas Travels, underscore the importance of a well-organized travel management strategy. By combining practical planning with advanced technology and sustainable practices, companies can not only reduce costs but also improve overall event success.

Effective team event travel management is more than just logistics—it’s about ensuring every journey contributes positively to the organization’s goals. From negotiating better deals with vendors to providing a seamless travel experience for every team member, the benefits are clear. Companies that invest in these strategies reap rewards in terms of cost savings, improved employee satisfaction, and a stronger corporate image.

Whether your next team event involves bus travel for a large group outing or detailed arrangements for an international conference, the principles outlined in this guide will help you achieve a smooth and successful experience. Embrace the strategies, learn from industry experts, and take proactive steps toward transforming your team travel management into a well-oiled machine.

By focusing on these actionable insights and incorporating advanced travel management systems, you can ensure that your team travels not only meet but exceed expectations—fueling both the event’s success and your organization’s overall growth.

0 notes

Text

Streamlining Financial Management: The Power of Accounts Payable Software

In today’s fast-paced business world, managing finances efficiently is crucial for success. One of the key components of financial management is handling accounts payable (AP), which involves tracking and managing a company’s obligations to pay off short-term debts to suppliers and creditors. With the advent of advanced technology, Accounts Payable Software has emerged as an essential tool for businesses to streamline this process and improve overall efficiency.

What is Accounts Payable Software?

Accounts Payable Software is a digital solution designed to automate and manage the AP process. This software allows businesses to process invoices, manage vendor payments, and track outstanding liabilities with ease. By automating repetitive tasks and reducing manual intervention, companies can significantly enhance accuracy, save time, and minimize errors.

Key Features and Benefits

Automation and Efficiency: AP software automates invoice capture, data entry, and payment approvals, reducing the need for manual handling. This leads to faster processing times and fewer errors, allowing businesses to allocate resources to more strategic tasks.

Improved Accuracy and Compliance: By using sophisticated algorithms and data validation tools, the software ensures accurate data entry and compliance with tax regulations and internal policies. This helps prevent fraudulent activities and maintains audit trails for regulatory purposes.

Enhanced Vendor Relationships: Timely payments and clear communication foster stronger relationships with suppliers. AP software often includes features like payment scheduling and automated reminders, ensuring that payments are made on time and avoiding late fees.

Real-time Reporting and Analytics: With built-in reporting tools, businesses can gain insights into cash flow, outstanding liabilities, and spending patterns. This data-driven approach enables better decision-making and strategic planning.

Integration with Other Systems: Most AP software can seamlessly integrate with accounting systems, enterprise resource planning (ERP) platforms, and banking systems. This integration enhances data accuracy and provides a holistic view of financial operations.

Choosing the Right AP Software

When selecting an accounts payable solution, businesses should consider factors such as scalability, ease of use, security features, and customer support. Popular options in the market include QuickBooks, SAP Concur, Bill.com, and Tipalti. Each platform offers unique features tailored to different business sizes and industries.

The Future of Accounts Payable Software

The future of AP software is being shaped by advancements in artificial intelligence (AI) and machine learning. These technologies are enhancing predictive analytics, fraud detection, and intelligent automation. Additionally, the integration of blockchain technology is improving transparency and security in payment processing.

Conclusion

Incorporating Accounts Payable Software into financial management practices is no longer a luxury but a necessity for businesses aiming to stay competitive. By automating processes, improving accuracy, and providing valuable insights, AP software empowers organizations to manage their finances effectively and build stronger vendor relationships. As technology continues to evolve, businesses that leverage these tools will be better positioned for long-term success.

0 notes

Text

A Comprehensive Guide to Implementing Automated Invoice Processing

In today’s fast-paced business environment, manual invoice processing can be time-consuming and prone to errors. Implementing automated invoice processing can help streamline your accounts payable process, reduce human error, and improve operational efficiency. This guide will walk you through the essential steps of implementing automated invoice processing in your business, ensuring a smoother workflow and enhanced financial management.

What is Automated Invoice Processing?

Automated invoice processing is the use of technology to manage and streamline the accounts payable process. It involves automating the capture, approval, and payment of invoices, reducing the need for manual data entry and minimizing the risk of errors. With automation, businesses can efficiently handle large volumes of invoices, improve cash flow management, and gain better visibility into their financial operations.

Benefits of Automated Invoice Processing

Before diving into implementation, it’s important to understand the key benefits of automation:

Time Savings: Automating repetitive tasks like data entry and invoice approval significantly reduces the time spent on manual processes.

Reduced Errors: By eliminating manual data input, automation reduces the chances of human error, such as incorrect data entry or missed payments.

Cost Efficiency: Automated systems help reduce administrative costs by streamlining workflows and reducing the need for paper-based processes.

Improved Compliance: Automated solutions help maintain audit trails and compliance with financial regulations, making it easier to track and manage invoices.

Faster Payments: With automated workflows, invoices are processed faster, ensuring timely payments and better relationships with suppliers.

Steps to Implement Automated Invoice Processing

1. Assess Your Current Process

Before implementing automation, take the time to assess your existing invoice processing workflow. Identify bottlenecks, manual tasks, and areas prone to errors. By understanding where improvements are needed, you can better tailor the automated solution to fit your business needs.

2. Choose the Right Invoice Automation Tool

There are numerous invoice automation tools available, so selecting the right one for your business is crucial. When evaluating options, consider the following features:

OCR (Optical Character Recognition): This technology scans and converts paper invoices into digital data for easier processing.

Integration Capabilities: Ensure that the tool integrates with your existing accounting software and ERP systems for seamless data transfer.

Approval Workflow: Look for a solution that automates the approval process, routing invoices to the appropriate stakeholders for review and approval.

Reporting and Analytics: Choose a tool that provides insights into payment status, outstanding invoices, and vendor performance.

Popular automated invoice processing solutions include SAP Concur, Stampli, Tipalti, and Bill.com. Evaluate each option based on your specific needs, budget, and scalability.

3. Map Out Your Approval Workflow

Automating the invoice approval process is a key aspect of improving efficiency. Create a clear and defined approval workflow, ensuring that the right people are notified at the right time. With automation, you can route invoices for approval based on predefined rules, such as department, amount, or vendor. This reduces delays and ensures that invoices are processed quickly and accurately.

4. Digitize and Capture Invoices

One of the first steps in automating invoice processing is capturing incoming invoices digitally. Many automation tools offer Optical Character Recognition (OCR) capabilities that can extract data from paper invoices, such as invoice number, date, amount, and vendor details. Once the data is captured, it’s stored in a digital format, making it easy to process, track, and retrieve.

For email invoices, automated systems can be set up to automatically extract relevant details and enter them into the system without manual intervention.

5. Automate Data Entry and Matching

After digitizing the invoice, automated systems can match the invoice data against purchase orders (POs) or contracts, verifying the details such as pricing, quantity, and vendor. If discrepancies arise, the system can flag them for manual review. This step ensures that only valid invoices are processed, reducing the risk of fraudulent payments and overcharges.

6. Payment Processing and Reporting

Once the invoice is approved, automation can facilitate timely payment by integrating with your payment system. You can schedule payments based on due dates or preferred payment terms, ensuring that you never miss a payment deadline. Automated reporting tools will provide visibility into your payment status, outstanding invoices, and vendor relationships, helping you maintain a healthy cash flow.

7. Monitor and Optimize

Once automated invoice processing is in place, continuously monitor the system to ensure that it’s functioning as expected. Track performance metrics such as processing time, error rates, and payment cycle times. Gather feedback from stakeholders involved in the process to identify areas for improvement.

Best Practices for Successful Implementation

Start Small: Begin with a small pilot program to test the system’s effectiveness before rolling it out to the entire organization.

Train Your Team: Ensure that all employees involved in the process are trained on the new system to minimize disruption and improve adoption.

Ensure Data Security: With sensitive financial data being processed, ensure that the automation tool complies with data protection regulations and has strong security features.

Continuous Improvement: Regularly review the process and tools to ensure that your system evolves with the business and continues to meet your needs.

youtube

Conclusion

Implementing automated invoice processing can transform your business’s accounts payable function, saving time, reducing errors, and improving cash flow management. By following the steps outlined in this guide, you can implement an efficient and scalable automation solution tailored to your needs. Automated invoice processing isn’t just about saving money—it’s about improving the overall efficiency and agility of your business. Embrace the future of invoicing today to gain a competitive advantage and streamline your financial operations.

SITES WE SUPPORT

Business Audit Process - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Top 5 Expense Management Software Of 2023

Picture a sunny day at the beach where you reunite with your old friend Billy. After a delightful lunch, the bill arrives, and you realize it’s cash-only, leaving you short. Billy offers to pay for both of you, and you quickly send him your portion—easy and straightforward. Now, imagine being with a larger group; the situation quickly complicates as everyone struggles to chip in their share, creating a mess of calculations for reimbursements.

This scenario mirrors what many businesses face when managing employee expenses. That’s why Expense Management Software is invaluable, helping organizations track, report, approve, and reimburse employee expenses with ease.

If your enterprise needs a solid tool for expense management, here are the top 5 Expense Management Software of 2023!

The Top 5 Expense Management Software for 2023

Expense Management Software offers a digitized, automated solution for handling employee-related expenses, simplifying reporting, approval, and tracking while also providing insights into cost-saving opportunities.

Let’s delve into the top Expense Management Software for 2023, presented in no particular order:

SAP Concur Known for its comprehensive travel, expense, and invoice management solutions, SAP Concur serves more than 15,000 clients. Its user-friendly cloud-based platform automates and streamlines the entire expense process.

Expensify Expensify, founded in 2008, is recognized for integrating expense management with security and compliance. The app enables users to track expenses easily, scan receipts, and process reimbursements effectively.

Navan (Formerly TripActions) Navan provides an all-in-one travel management tool that includes booking, corporate cards, and automated processes for expense tracking. Recently rebranded, it aims to enhance user experience by integrating various travel and payment solutions.

Zoho Expense Launched in 2015 by Zoho Corporation, Zoho Expense assists businesses in managing travel expenses efficiently. Its customizable features make it suitable for organizations of all sizes, offering solutions for compliance and fraud prevention.

Airbase Airbase consolidates expense management, accounts payable, and corporate card services into one platform. Its intuitive interface and automation functionalities provide visibility and control over expenses while simplifying reimbursements.

In conclusion, adopting Expense Management Software can help organizations efficiently track and manage employee expenses. Choosing the right tool tailored to your company’s needs is vital for saving time, reducing effort, and optimizing costs.

0 notes

Text

Driving Business Growth: Why "GROW with SAP" Customers Should Integrate SAP Concur Expense into Their IT Strategy

Imagine returning from a business trip with pockets full of receipts-taxis, meals, client entertainment-and facing the tedious task of sorting them out before submitting your expense report. Travel and expense management has long been a painful and error-prone process that consumes time on both sides-increased errors by employees due to lost or misplaced receipts, missing documentation in finance teams, and data entry backlogs. According to SAP Concur Global Business Travel Survey, in the last 12 months, 88% of business travelers encountered unplanned disruptions. Most often, this results in excess time and costs spent on the road.

The good news is that AI-powered, mobile-first T&E solutions change the scenario in question. They make processes more seamless, reduce inaccuracies, and provide insights to strengthen the financial health of an organization. It is seen in the same SAP Concur survey that 95% of business travelers would be willing to consider using AI to automate tasks, such as capturing and reporting on expenses or to find more sustainable travel options.

Let us examine how AI changes business travel management.

Streamlining user experience

AI automates mundane operational work so that employees can be freed from the time-consuming task of entering data manually and tedious workflows. According to research by SAP Concur, 89% of business travelers would be receptive to using AI to book travel if they received the right training and assurance. This change makes more personalized travel recommendations, better pricing options, and faster reimbursements possible.

Increased operational efficiency

AI-powered T&E platforms like SAP Concur do streamline the entire process, from booking travel to even automation of approvals. Employees only need to snap a photo of a receipt. AI would then accurately populate fields in the expense. In addition, real-time itinerary updates and automated notifications make staying compliant and on-budget effortless.

Insights and analytics for better decisions It is not merely about collecting spend data; it's extracting actionable insights. Finance teams can identify trends and patterns and will help make faster decisions, besides being productive. Managers can use this data to reduce cost and promote employee satisfaction. According to SAP Concur, 42% of travel managers reported feeling pressure from senior management to reduce travel costs. AI-powered reporting tools merged with the T&E solution help the manager reduce costs and appease leadership. With features like Request Assistant in Concur Request, employees can use AI in travel to develop trip estimates even before any spending occurs, helping them stay within budget while enabling faster approvals.

AI-driven fraud detection

A major challenge that finance managers and travel booking teams face is fraudulent receipts and expense claims. Traditional and manual methods are not enough to spot such irregularities. Tools such as SAP Concur use AI in analyzing spending patterns, verifying authenticity of receipts, comparing with previous data, and flagging items that are odd. Concur Detect by Oversight tracks patterns on expense data that may indicate a repetitive fraud or misuse. Gradually, employees learn not to make fraudulent expenses over time as such analyses accumulate.

Policy adherence

Compliance is more than just following a rule or achieving security. It is also about accountability and efficient processes, ensuring that every dollar spent on a business trip is accounted for to minimize non-compliant spending. According to SAP's research, 35% of business travelers are open to using AI in business travel to ensure compliance with their organization's policies, while nearly half want reassurance that their personal data is safe. SAP Concur's integrated solutions support data security, policy enforcement, and a streamlined reporting experience.

Mobile first

Business travelers shouldn't be tethered to a desk to file expenses. With mobile-friendly AI-powered solutions, employees can photograph receipts and submit reports in minutes. Managers can review and approve on the go, reducing unnecessary delays and cumbersome email exchanges.

Key takeaways

AI is already changing the way organizations manage travel and expenses. To know whether it is the right time for an AI-powered T&E solution, consider whether:

Employees and finance teams find expense reporting cumbersome.

Finance managers frequently face policy violations.

Travel costs consistently exceed planned budgets.

Employees often file expense reports late.

Reducing the cost of business travel is a priority.

Your finance team struggles with multiple currencies and regional policies.

If you answered yes to any of the above questions, it's time to think about a new T&E management approach. Contact us and learn how AI-powered SAP Concur can help your organization save time, reduce costs, and streamline travel expense management.

#travel#sap#expense management systems#concur#expenses#expensemanagement#travelandexpensemanagement#sapconcur#expensemanagementsolution#expense management software

0 notes

Text

SAP HANA

SAP S/4HANA conversion, also known as a system conversion or brownfield implementation, is the process of transitioning an existing SAP ERP system (ECC) to SAP S/4HANA. Here are the key reasons to undertake this conversion:

1. Enhanced Performance and Real-Time Analytics

In-Memory Computing: SAP S/4HANA leverages SAP HANA's in-memory computing, enabling faster data processing and real-time analytics.

Real-Time Insights: With advanced reporting and embedded analytics, businesses can make informed decisions instantly.

2. Simplified IT Landscape

Data Model Simplification: SAP S/4HANA uses a simplified data model by removing aggregate and index tables, reducing data footprint and complexity.

Streamlined Processes: The streamlined architecture reduces dependencies, leading to easier maintenance and lower total cost of ownership (TCO).

3. Future-Readiness

End of Support for ECC: SAP has announced that standard support for ECC will end by 2027 (or extended to 2030 for premium support). Transitioning ensures long-term compatibility with SAP's roadmap.

Innovation Enablement: S/4HANA integrates seamlessly with emerging technologies like AI, IoT, machine learning, and blockchain, fostering innovation.

4. Improved User Experience

SAP Fiori Interface: SAP S/4HANA introduces a modern, intuitive, and role-based user experience via the SAP Fiori interface.

Mobile Accessibility: Enhanced mobility allows users to perform tasks and access data on the go.

5. Industry-Specific Capabilities

Tailored Functionality: SAP S/4HANA offers industry-specific solutions that cater to unique requirements, enabling better alignment with business goals.

Predefined Best Practices: S/4HANA comes with preconfigured best practices to optimize processes.

6. Compliance and Security

Regulatory Requirements: SAP S/4HANA helps businesses stay compliant with evolving regulatory requirements through built-in features and regular updates.

Enhanced Security: The modern architecture includes improved security protocols and monitoring tools.

7. Cost Savings

Operational Efficiency: Streamlined operations and faster processes reduce operational costs.

Resource Optimization: Reduced hardware and database maintenance costs due to the in-memory architecture.

8. Competitive Edge

Agility and Innovation: S/4HANA provides the agility to adapt quickly to market changes and implement innovative business models.

Customer-Centricity: Improved customer insights and faster response times help businesses maintain a competitive advantage.

9. Integration Capabilities

SAP Ecosystem: Seamless integration with other SAP solutions like SAP Ariba, SAP SuccessFactors, and SAP Concur enhances overall business efficiency.

Third-Party Tools: S/4HANA also supports integration with non-SAP systems for a holistic digital ecosystem.

10. Data-Driven Decision-Making

Single Source of Truth: A unified database ensures consistency and reliability of information across the organization.

Predictive Analytics: Advanced analytics and AI-driven insights support proactive decision-making.

Summary:

SAP S/4HANA conversion is critical for businesses aiming to modernize their IT infrastructure, enhance operational efficiency, and align with SAP's future roadmap. It ensures businesses remain competitive, compliant, and ready to embrace digital transformation.

Anubhav Trainings is an SAP training provider that offers various SAP courses, including SAP UI5 training. Their SAP Ui5 training program covers various topics, including warehouse structure and organization, goods receipt and issue, internal warehouse movements, inventory management, physical inventory, and much more.

Call us on +91-84484 54549

Mail us on [email protected]

Website: Anubhav Online Trainings | UI5, Fiori, S/4HANA Trainings

0 notes

Text

After the lockdowns caused by the COVID-19 pandemic, many businesses accelerated their digital transformation efforts, creating increased demand for certain SAP (Systems, Applications, and Products) modules. The most in-demand SAP modules post-lockdown are those that support cloud computing, analytics, supply chain optimization, and remote work solutions. Here's a breakdown of the key SAP modules in demand:

1. SAP S/4HANA (High-Performance Analytic Appliance)

Why: Many companies are upgrading their systems to SAP S/4HANA for its advanced data processing capabilities, real-time analytics, and integration with cloud solutions.

Focus Areas: Finance (SAP S/4HANA Finance), logistics, and supply chain management.

2. SAP SuccessFactors (Human Capital Management)

Why: With remote work becoming more common, companies need efficient human capital management (HCM) solutions for recruitment, onboarding, performance management, and payroll. SuccessFactors offers cloud-based tools to manage these functions.

Focus Areas: Employee experience management, talent management, and core HR.

3. SAP Ariba (Procurement and Supply Chain)

Why: The pandemic disrupted global supply chains, increasing the demand for better procurement solutions. SAP Ariba helps manage supplier relationships, streamline procurement processes, and improve supply chain visibility.

Focus Areas: Supplier management, sourcing, and procurement.

4. SAP Fiori (User Experience)

Why: User-friendly interfaces are key for businesses moving to digital and mobile-first environments. SAP Fiori provides an intuitive interface for SAP users, improving usability and increasing productivity.

Focus Areas: Custom app development, user interface/experience (UI/UX).

5. SAP Analytics Cloud (SAC)

Why: Data-driven decision-making became essential as companies adjusted to new business conditions. SAP Analytics Cloud integrates business planning and advanced analytics to provide insights into operations, finance, and human resources.

Focus Areas: Business intelligence, data analysis, predictive analytics.

6. SAP IBP (Integrated Business Planning)

Why: The disruptions in supply chains and business operations increased demand for planning solutions. SAP IBP helps companies plan their supply chains, forecast demand, and manage inventories more effectively.

Focus Areas: Demand planning, inventory optimization, and sales & operations planning.

7. SAP Customer Experience (CX)

Why: Companies are focusing on improving customer relationships in a digital environment, making SAP CX crucial for managing e-commerce, marketing, sales, and customer service.

Focus Areas: Sales automation, e-commerce, and customer data management.

8. SAP EWM (Extended Warehouse Management)

Why: With the boom in e-commerce and the need for faster, more efficient logistics, SAP EWM helps companies manage complex warehouse operations, ensuring better inventory control and optimized supply chain processes.

Focus Areas: Warehouse operations, logistics, and inventory management.

9. SAP Leonardo (Digital Transformation)

Why: SAP Leonardo integrates emerging technologies like IoT, blockchain, AI, and machine learning into business processes. As companies adopt digital solutions, the demand for SAP Leonardo has grown.

Focus Areas: IoT, AI/ML, blockchain applications in business processes.

10. SAP Concur (Travel & Expense Management)

Why: As business travel resumes post-pandemic, companies are looking for tools to manage travel expenses more efficiently. SAP Concur helps with travel planning, expense reporting, and compliance management.

Focus Areas: Expense management, travel planning, and corporate compliance.

Key Trends:

Cloud and Hybrid Models: The demand for cloud-based SAP solutions has surged, and many businesses are adopting hybrid models (cloud + on-premise).

Data Analytics and AI: Companies are increasingly focusing on SAP modules that offer advanced data analytics and AI capabilities to make informed decisions in uncertain markets.

Supply Chain Resilience: With the supply chain disruptions caused by the pandemic, SAP modules that enhance supply chain visibility and resilience are in high demand.

If you're considering career development or upskilling in SAP, these modules offer strong career prospects and growth opportunities due to their increasing relevance in the post-pandemic business landscape.

Anubhav Trainings is an SAP training provider that offers various SAP courses, including SAP UI5 training. Their SAP Ui5 training program covers various topics, including warehouse structure and organization, goods receipt and issue, internal warehouse movements, inventory management, physical inventory, and much more.

Call us on +91-84484 54549

Mail us on [email protected]

Website: Anubhav Online Trainings | UI5, Fiori, S/4HANA Trainings

0 notes