#rpa case studies in banking

Explore tagged Tumblr posts

Text

#rpa in banking case study#rpa solutions#rpa success stories in banking#rpa case studies in banking#rpa banking customer onboarding#nation trust corporate online platform#nations trust bank online banking#rpa automation in banking

0 notes

Text

What Business Problems Do You Solve in a Real-Time BA Project?

Introduction

Theoretical knowledge is important, but employers demand practical skills. In a Business Analyst certification course with live projects, you don’t just learn the theory you apply it. Real-time projects simulate actual business environments. They present evolving problems, ambiguous data, tight deadlines, and real stakeholders. Solving such issues trains you to think critically, communicate effectively, and deliver value.

By working on domain-specific challenges, learners gain hands-on experience that mirrors real-world job roles. Business analyst certifications that include live projects help bridge the gap between academic learning and industry expectations. You not only enhance your technical and analytical skills but also build confidence in stakeholder management and decision-making. According to a Glassdoor study, candidates with project experience receive 25% more callbacks during job searches. Employers value this exposure because it reflects a candidate’s ability to perform under pressure, adapt to change, and deliver insights that drive results.

Key Types of Business Problems Solved in BA Projects

1. Process Inefficiencies

Businesses often struggle with bottlenecks, delays, or unnecessary steps in their processes. A BA helps identify and streamline these.

Example: Mapping the claims approval process in an insurance firm and reducing the approval time from 14 days to 5.

2. Poor Customer Retention

BA projects often analyze churn data and customer behavior to find out why users leave and how to retain them.

Example: In a telecom project, analyzing churn patterns among prepaid users to recommend loyalty offers.

3. Revenue Leakage

This includes undetected loss of revenue due to pricing errors, billing mistakes, or fraud. For example, identifying unbilled services in a telecom setup and automating alerts for recurring cases can help recover missed revenue streams. A Salesforce Business Analyst certification equips professionals with the skills to detect such discrepancies using dashboards, reports, and automated workflows. By leveraging Salesforce analytics, analysts can proactively flag anomalies, ensure billing accuracy, and protect the organization’s bottom line.

4. Ineffective Reporting

Many businesses rely on outdated or inaccurate reporting systems. BAs create dashboards that reflect real-time data and KPIs.

Example: Designing a sales dashboard that integrates CRM and POS data for regional managers.

5. Compliance Risks

Especially in finance and healthcare, failing to meet regulations can cost millions.

Example: Mapping processes to GDPR or HIPAA requirements and closing gaps in data handling protocols.

Examples by Domain

Healthcare

Problem: Duplicate patient records leading to wrong diagnoses.

Solution: Create a unified data model integrating EMR and lab systems.

Skills Used: Data modeling, stakeholder interviews, HL7 knowledge.

Banking & Finance

Problem: High loan default rates.

Solution: Analyze credit scoring mechanisms and revise risk assessment parameters.

Skills Used: Excel modeling, process mapping, predictive analytics.

Retail & ECommerce

Problem: High cart abandonment rate.

Solution: Identify user journey pain points and recommend UX/UI fixes.

Skills Used: Google Analytics, user research, root cause analysis.

Telecom

Problem: Declining average revenue per user (ARPU).

Solution: Segment customer base and launch targeted offers.

Skills Used: SQL, dashboard creation, stakeholder analysis.

Insurance

Problem: Manual underwriting delays.

Solution: Automate document collection and risk scoring.

Skills Used: Workflow mapping, RPA familiarity, stakeholder coordination.

Tools and Techniques Used by BAs

Requirement Gathering: Interviews, surveys, workshops

Documentation: BRD, FRD, Use Cases

Modeling: BPMN, UML diagrams

Data Analysis: Excel, SQL, Power BI/Tableau

Project Management: JIRA, Trello, Confluence

Communication: Stakeholder meetings, presentation decks

Step-by-Step Breakdown of a Real-Time BA Project

Step 1: Identify the Business Problem

Interview stakeholders.

Review current state documentation.

Step 2: Gather and Analyze Requirements

Conduct workshops.

Draft and validate requirement documents.

Step 3: Map the Process

Use flowcharts or BPMN.

Identify bottlenecks or redundancies.

Step 4: Data Analysis

Extract data using SQL or Excel.

Visualize trends and patterns.

Step 5: Propose Solutions

Recommend process changes or system upgrades.

Prioritize features using the MoSCoW or Kano model.

Step 6: Assist in Implementation

Coordinate with developers and testers.

Create UAT test cases.

Step 7: Post-Implementation Review

Gather user feedback.

Analyze KPIs after solution rollout.

Skills You Develop by Solving Real Business Problems

Analytical Thinking: Spot trends, outliers, and root causes.

Communication: Handle cross-functional teams and present findings.

Documentation: Write effective BRDs, user stories, and process flows.

Technical Proficiency: SQL, Excel, dashboards.

Problem-Solving: Identify issues and evaluate solutions logically.

Case Studies: Real-Time BA Project Snapshots

Case Study 1: E-Commerce Inventory Optimization

Problem: Overstocking and understocking across warehouses.Solution: Developed a centralized inventory dashboard using Power BI. Outcome: Reduced stock outs by 30% within two quarters.

Case Study 2: Bank Customer Onboarding Delay

Problem: New customers faced a 10+ day onboarding wait. Solution: Mapped the end-to-end onboarding process, identified bottlenecks, and implemented RPA bots to automate repetitive manual tasks such as data entry and document verification. Outcome: Onboarding time was cut to just 2 days, with significantly fewer errors, improved compliance, and enhanced customer satisfaction.

Case Study 3: Healthcare Report Automation

Problem: Manual generation of discharge summaries. Solution: Integrated EMR with reporting tools and auto-generated PDFs. Outcome: Saved 40 hours per week in doctor time.

Conclusion

Real-time projects in a Business Analyst certification program offer more than just a certificate; they transform you into a problem-solver. You’ll learn to: ✅ Tackle real-world business challenges ✅ Use modern tools and frameworks ✅ Collaborate with cross-functional teams ✅ Deliver value-driven outcomes

These projects expose you to real business data, dynamic stakeholder requirements, and evolving project goals. You’ll master techniques like SWOT analysis, user story creation, requirement elicitation, and process modeling all under realistic deadlines. The hands-on experience builds confidence and sharpens your ability to communicate insights clearly and effectively. Whether it’s improving operations, identifying cost-saving measures, or enhancing customer experience, you’ll contribute meaningful solutions. Start your Business Analyst journey by working on real problems that matter. Learn by doing, grow by solving.

0 notes

Text

Why Financial Analytics is a Must-Have Skill for Finance Professionals in 2025

In the rapidly evolving world of finance, one thing is certain—data is king. And in 2025, the ability to transform financial data into strategic business insights is what separates thriving finance professionals from the rest. Welcome to the age of financial analytics—where knowing how to work with numbers isn’t enough; you must also know how to interpret them, visualize them, and act on them.

If you're a finance professional, student, or business owner looking to remain competitive in today’s data-driven economy, gaining expertise in financial analytics is no longer optional. And one of the best ways to do that? Enroll in a Financial Analytics Certification in Kolkata—a growing hub for modern finance talent in Eastern India.

What Is Financial Analytics?

Financial analytics involves the use of data, tools, and statistical methods to understand financial trends, make better forecasts, and support decision-making. It combines traditional finance knowledge with modern technology to uncover deep insights into business performance, market behavior, and risk.

Instead of just reporting numbers, financial analysts in 2025 are expected to answer:

Why did this happen?

What will happen next?

What should we do about it?

Why Financial Analytics Is Essential in 2025

1. Data-Driven Decision-Making Is the Norm

From startups to large corporations, decision-making is increasingly based on analytics. Financial leaders use data to guide pricing strategies, investments, expansion plans, and cost optimization.

2. Automation Is Replacing Repetitive Finance Tasks

Robotic Process Automation (RPA) and AI tools are automating tasks like data entry and report generation. The human role now lies in analyzing outputs, identifying insights, and making strategic decisions.

3. Financial Forecasting Is Crucial in Uncertain Times

As global markets face disruptions—from inflation to geopolitical shifts—companies rely on forecasting models and simulations to plan for multiple scenarios.

4. Compliance and Risk Analytics Are Gaining Importance

With increasing regulatory oversight, financial teams are using analytics to ensure compliance, detect fraud, and manage financial risk proactively.

5. Investor Expectations Have Evolved

Investors now expect real-time reports, ESG impact analysis, and predictive insights. Financial analytics equips professionals to meet these expectations with confidence.

Why Choose a Financial Analytics Certification in Kolkata?

Kolkata, historically known as a center of finance, trade, and education, is now emerging as an exciting destination for modern financial upskilling. Here’s why pursuing a Financial Analytics Certification in Kolkata makes strategic sense:

Growing Financial Ecosystem: Home to top banks, NBFCs, and IT-enabled service centers, Kolkata offers ample job opportunities for finance professionals with analytics skills.

Affordable Learning & Living: Compared to metros like Mumbai or Bangalore, Kolkata offers high-quality education at lower costs.

Educational Infrastructure: Institutions like the Boston Institute of Analytics in Kolkata provide world-class certification programs with expert-led training.

Strong Placement Network: Many institutes offer placement support with companies in finance, consulting, fintech, and IT.

What You Will Learn in a Financial Analytics Certification

A good certification program in Kolkata will prepare you with both the technical tools and business understanding needed in today’s finance roles. Topics typically include:

Advanced Excel for Financial Modeling

Data Analysis Using SQL and Python

Visualization Using Power BI and Tableau

Budgeting, Forecasting, and Variance Analysis

KPI Dashboards and Business Intelligence

Case Studies in Real-World Finance Strategy

With a hands-on curriculum, learners also work on projects like cost analysis, market forecasting, and cash flow optimization to gain practical exposure.

Who Should Consider This Certification?

A Financial Analytics Certification in Kolkata is ideal for:

Commerce and Finance Graduates looking to enter the finance industry

Working Professionals in banking, accounts, or audit aiming for analytics roles

MBA Students who want to specialize in finance or business strategy

Entrepreneurs and Business Owners managing financial operations

Job Seekers preparing for roles like Financial Analyst, FP&A Analyst, or Business Analyst

Career Opportunities After Certification

Financial analytics is one of the most in-demand skill sets in 2025. Completing a certification opens doors to roles such as:

Financial Analyst

Business Analyst – Finance

FP&A Specialist

Investment Analyst

Revenue Operations Analyst

Risk & Compliance Analyst

These roles exist across industries including fintech, healthcare, consulting, e-commerce, manufacturing, and more.

Success Story: From Kolkata Learner to Financial Strategist

Ritika Das, a B.Com graduate from Kolkata, enrolled in a Financial Analytics Certification in Kolkata in 2024. Within 6 months of completing the course, she secured a role as a Junior Financial Analyst at a multinational IT services company in Salt Lake Sector V. Today, Ritika builds financial dashboards and forecasts that are used directly by her company’s leadership to make business decisions.

Her journey reflects what’s possible when traditional finance education is enhanced with analytics and technology.

Conclusion: Upskill Today to Lead Tomorrow

In 2025, being good at finance means being great at financial analytics. Whether you're aiming to boost your career, make smarter business decisions, or transition into high-growth roles, mastering analytics is the key.

A Financial Analytics Certification in Kolkata is not just a qualification—it's an investment in your future. With the right skills and the right guidance, you can turn data into decisions and become the financial leader the modern world demands.

0 notes

Text

Unlocking Efficiency: How RPA and Automation Solutions are Transforming Business Operations

In today's digital-first landscape, Robotic Process Automation (RPA) and automation solutions are not just optional—they're essential for businesses aiming to remain competitive, agile, and scalable. These technologies are redefining how operations teams tackle repetitive tasks, reduce costs, and unlock new levels of efficiency.

What is RPA?

Robotic Process Automation (RPA) refers to software bots that mimic human actions to perform rule-based tasks across various applications and systems. Think data entry, invoice processing, and customer onboarding—all handled without manual input.

Why Businesses are Investing in Automation Solutions

Operational Efficiency – Automation eliminates repetitive tasks, freeing up teams for high-value work.

Cost Savings – Companies reduce labor costs and minimize error-related losses.

Scalability – Easily scale operations without hiring additional staff.

Compliance and Accuracy – RPA ensures audit trails and precise execution of tasks.

Speed and Agility – Respond to market changes faster by automating critical workflows.

Top Use Cases for RPA in Operations

Invoice Processing and Accounts Payable

HR Onboarding and Offboarding

IT Helpdesk Automation

Customer Service Ticketing

Inventory and Supply Chain Management

These use cases show how business process automation is a key driver of digital transformation.

The Role of Intelligent Automation

While traditional RPA focuses on rule-based automation, the future lies in intelligent automation—a combination of RPA with AI and machine learning. This enables bots to handle unstructured data, make decisions, and continuously learn from outcomes.

Choosing the Right Automation Strategy

Success with automation depends on:

Assessing current workflows to identify automation potential

Choosing tools that integrate well with your tech stack

Starting with quick-win use cases and scaling across departments

Engaging operations teams in change management and training

Real Impact: A Sample Case Study

A mid-size bank implemented RPA for document verification and achieved:

70% faster processing times

90% reduction in manual errors

$500,000+ in annual cost savings

Conclusion

For operations leaders, embracing RPA and automation solutions is no longer a question of "if" but "how soon." Whether you're just getting started or expanding enterprise-wide, automation is a proven pathway to workflow optimization, cost reduction, and sustained competitive advantage.

Ready to explore scalable automation for your organization? Let’s discuss how Spearhead Technology can help you design, deploy, and scale your RPA journey.

0 notes

Text

Automate Your Future: Why GVT Academy Offers the Best UiPath Course in Noida

As digital transformation accelerates, automation is now a key driver of efficiency and growth. Businesses are constantly looking for smarter, faster, and more efficient ways to operate. That’s where Robotic Process Automation (RPA) steps in, and UiPath is leading the way. Step into the world of automation with the Best UiPath Course in Noida by GVT Academy—built to equip tomorrow’s professionals today.

What is RPA and Why UiPath?

Robotic Process Automation (RPA) involves the use of software bots to handle repetitive and rule-driven tasks automatically. Think of data entry, invoice processing, or employee onboarding—tasks that consume valuable hours. With RPA, these processes become faster, error-free, and cost-effective.

UiPath is the most in-demand RPA tool globally. Its drag-and-drop interface, AI integration, and strong community support make it perfect for both beginners and pros. It’s no wonder that top companies like Deloitte, Accenture, and Capgemini are actively hiring UiPath-certified professionals.

Why GVT Academy?

GVT Academy goes beyond teaching software—we shape skilled automation professionals. Our UiPath course is designed with real-world applications, live projects, and career-focused mentorship.

Here’s why learners call it the Best UiPath Course in Noida:

✅ Industry-Aligned Curriculum

Introduction to RPA & UiPath Platform

Variables, Data Types & Control Flow

Recording & Citrix Automation

Orchestrator & REFramework

Real-time Projects & Use Cases

Integration with Excel, Outlook, SAP, and Web

✅ Hands-On Learning with Projects

Students at GVT Academy build bots for real scenarios like invoice generation, payroll automation, and customer onboarding. By the end, you’ll have a strong portfolio to impress recruiters.

✅ Expert Trainers

Get trained by experts with over 8 years of hands-on experience in the RPA field. Our trainers are UiPath Certified and bring live case studies to the classroom.

✅ Placement Assistance

We provide resume building, mock interviews, and 100% job placement support. Our students are now working in TCS, Wipro, Infosys, and top automation firms.

Career Scope After Learning UiPath

The demand for RPA professionals is booming. According to industry reports:

The average salary of an RPA Developer in India is ₹6–12 LPA.

There are 30,000+ RPA jobs currently listed on Naukri, LinkedIn, and Monster.

UiPath is used in banking, healthcare, telecom, retail, and logistics industries.

With this surge, enrolling in the Best UiPath Course in Noida at GVT Academy could be the smartest decision you make for your career.

Tools and Skills You’ll Master

Besides UiPath Studio and Orchestrator, you’ll get hands-on with:

Excel Automation

Email Automation

Database Handling

AI & Document Understanding

Workflow Debugging

Log Analysis & Deployment

These skills are exactly what top recruiters look for when hiring RPA talent.

Final Words

The future of automation is here, and it’s powered by UiPath. With companies across the globe embracing RPA, now is the perfect time to upskill and future-proof your career.

Whether you’re starting out or switching domains, GVT Academy’s UiPath Course is the Best UiPath Course in Noida—designed to give you the skills, confidence, and job opportunities you deserve.

Ready to automate your future? Join GVT Academy today and become a certified RPA professional with UiPath.

1. Google My Business: http://g.co/kgs/v3LrzxE

2. Website: https://gvtacademy.com

3. LinkedIn: www.linkedin.com/in/gvt-academy-48b916164

4. Facebook: https://www.facebook.com/gvtacademy

5. Instagram: https://www.instagram.com/gvtacademy/

6. X: https://x.com/GVTAcademy

7. Pinterest: https://in.pinterest.com/gvtacademy

8. Medium: https://medium.com/@gvtacademy

#gvt academy#uipath#rpa#data analytics#advanced excel training#data science#python#sql course#advanced excel training institute in noida#best powerbi course#power bi#advanced excel

0 notes

Text

Best AI Development Services to Transform Your Business

Introduction: Why AI is a Game-Changer for Business

Let’s be real: if your business isn’t leveraging AI in 2025, you’re already behind. Artificial Intelligence is no longer some far-off sci-fi fantasy. It’s here. And it’s revolutionizing how companies operate, compete, and serve customers. Whether you run a startup or a Fortune 500 firm, the best AI development services can help you automate, analyze, predict, and personalize like never before.

But the tricky part? Knowing where to start and who to trust. That’s where this guide comes in. Let’s break down everything you need to know.

What Are AI Development Services?

Defining AI Development Services

AI development services refer to professional solutions that help businesses create intelligent systems and applications. These services involve everything from strategy and modeling to training, deployment, and support of AI-powered tools.

Key Technologies in AI Services

Machine Learning (ML): Algorithms that learn from data.

Natural Language Processing (NLP): Enables machines to understand human language.

Computer Vision: Allows systems to interpret visual information.

Robotic Process Automation (RPA): Automates routine tasks without human intervention.

Benefits of Using AI in Business

Efficiency & Automation

Imagine cutting down repetitive tasks that eat up hours of work—AI can handle them 24/7. Think scheduling, data entry, and even email sorting.

Data-Driven Decision Making

AI can crunch numbers at lightning speed and uncover patterns you’d miss manually. You get insights fast—and accurate ones too.

Personalization & Customer Experience

Ever wonder how Netflix recommends the perfect show? That’s AI personalization in action. The same tech can transform your customer service and marketing strategy.

Types of AI Development Services

Machine Learning (ML) Solutions

ML algorithms can help you predict customer behavior, detect fraud, optimize inventory, and more.

Natural Language Processing (NLP)

From AI chatbots to voice assistants, NLP is the brains behind machines understanding and responding to human language.

Computer Vision Applications

Used for facial recognition, quality inspection in factories, or even reading handwritten documents—this tech is powerful and versatile.

Robotic Process Automation (RPA)

RPA bots can handle mundane business processes, freeing up your team to focus on tasks that truly matter.

Top Industries Using AI Development Services

Healthcare

AI helps doctors diagnose faster, predict disease, and even suggest treatment plans. Think of it as an extra brain in the room.

Finance

From credit scoring to fraud detection and automated trading, AI is helping banks make smarter, safer decisions.

Retail & E-commerce

AI enhances recommendation engines, inventory forecasting, customer segmentation, and even virtual try-ons.

Manufacturing

With predictive maintenance, supply chain optimization, and defect detection, AI is transforming how factories run.

Key Features to Look for in AI Development Services

Customization Capabilities

Every business is different. You need AI solutions tailored to your specific challenges—not a one-size-fits-all tool.

Integration with Existing Systems

Seamless integration with your current infrastructure is a must. Otherwise, you’ll spend more time fixing compatibility issues than seeing results.

Scalability & Support

As your business grows, your AI tools should grow with you. Choose a provider that offers long-term support and scaling options.

How to Choose the Right AI Development Partner

Expertise and Portfolio

Look for firms that have already solved problems similar to yours. Check case studies, demos, and whitepapers.

Client Testimonials and Reviews

Don’t take their word for it—see what their clients are saying. Ratings and reviews often reveal what sales reps won’t.

Post-Deployment Support

AI isn’t a set-it-and-forget-it tool. You’ll need ongoing maintenance, tuning, and training. Ensure the partner provides that.

Best AI Development Services Providers in 2025

Top AI Consulting Firms

Accenture AI

IBM Watson

Deloitte AI

These firms offer comprehensive solutions, from strategy to deployment.

Specialized AI Startups

DataRobot

H2O.ai

Sama

These niche players often offer quicker innovation and personalized attention.

AI Development Process Explained

Discovery and Planning

Identify business goals, available data, and key pain points. The goal here is to align AI capabilities with your needs.

Model Training and Testing

Using algorithms, your development team trains the model on your data and tests it in various scenarios to ensure accuracy.

Deployment and Maintenance

Once trained, the model is integrated into your systems. Regular updates and refinements follow.

Costs of AI Development Services

Factors That Influence Pricing

Project complexity

Data quality and availability

Required integrations

Service provider expertise

In-House vs. Outsourcing AI Projects

In-house can be costly and time-consuming unless you have an existing AI team. Outsourcing gives you access to seasoned experts and quicker delivery.

Common Mistakes Businesses Make with AI

Ignoring Data Quality

Bad data = bad AI. No matter how fancy the algorithm is, it’s only as good as the data you feed it.

Underestimating Training Time

Training an AI model isn’t instant. It requires patience, iteration, and lots of testing.

Future Trends in AI Development

Generative AI in Business

Tools like ChatGPT and DALL·E are changing the way we create content, write code, and generate ideas.

AI and Edge Computing

Processing data directly on devices instead of in the cloud can lead to faster, safer AI applications, especially for IoT.

Conclusion

So, there you have it. The best AI development services can do far more than just automate a few tasks. They can supercharge your entire business—boosting productivity, driving smarter decisions, and creating wow-worthy customer experiences.

But the key lies in choosing the right service provider. One who understands your goals, respects your data, and supports you every step of the way. Make that choice wisely, and the sky’s the limit.

FAQs

1. What are AI development services used for?

AI development services help businesses automate tasks, analyze data, improve decision-making, and enhance customer experience through intelligent applications.

2. How do I choose the best AI development company?

Look for expertise, relevant case studies, client testimonials, and ongoing support offerings. Make sure they can align AI solutions with your business goals.

3. How much do AI development services cost?

Costs vary based on complexity, required technology, data availability, and integration needs. On average, expect anywhere between $20,000 and $300,000+ per project.

4. What’s the difference between ML and AI?

AI is the broader concept of machines mimicking human intelligence. Machine Learning (ML) is a subset of AI focused on systems that learn from data.

5. Can small businesses benefit from AI services?

Absolutely! With scalable and affordable AI-as-a-service models, even startups can harness the power of AI to compete with the big players.

0 notes

Text

Top 10 AI Consulting Companies in Los Angeles (2025 Guide)

Los Angeles has emerged as a thriving hub for artificial intelligence innovation, with businesses across industries leveraging AI to drive growth, efficiency, and competitive advantage. Whether you're a startup or an enterprise, partnering with the right AI consulting company in Los Angeles can help you implement cutting-edge solutions tailored to your business needs.

In this guide, we’ll explore the top 10 AI consulting companies in Los Angeles, with GlobalNodes taking the #1 spot for its exceptional AI-driven solutions. We’ll also discuss how we selected these firms, what to look for in an AI consultant, and how AI consulting can transform your business.

How We Selected the Top AI Consulting Companies in Los Angeles

To ensure this list is credible and valuable, we evaluated each company based on:

AI Expertise & Specialization – Depth of knowledge in machine learning, NLP, computer vision, and generative AI.

Industry Experience – Proven success across healthcare, finance, retail, entertainment, and more.

Client Success Stories – Case studies, testimonials, and measurable ROI from past projects.

Innovation & Technology Stack – Use of advanced AI frameworks, cloud platforms, and automation tools.

Reputation & Reviews – Client feedback, industry recognition, and thought leadership.

Based on these factors, here are the top 10 AI consulting companies in Los Angeles.

Top 10 AI Consulting Companies in Los Angeles

1. GlobalNodes 🏆 Best AI Consulting Company in Los Angeles

Why They Rank #1:GlobalNodes is a leader in AI-driven digital transformation, offering end-to-end AI consulting, custom AI development, and enterprise automation. Their expertise spans generative AI, predictive analytics, and AI-powered chatbots, helping businesses optimize operations and enhance customer experiences.

✅ Key Services:✔ AI Strategy & Roadmap Development ✔ Custom AI & Machine Learning Solutions ✔ Generative AI (ChatGPT, LLM Integration) ✔ AI for E-commerce & Customer Support ✔ Data Engineering & Predictive Analytics

💡 Ideal For: Startups to enterprises looking for scalable AI solutions with measurable impact.

2. Accenture AI

A global leader in AI consulting, Accenture helps businesses integrate AI into their workflows, from automation to ethical AI governance.

✅ Key Focus: Enterprise AI, cloud AI, responsible AI

3. Deloitte AI Institute

Deloitte provides AI strategy, implementation, and risk management, specializing in financial services, healthcare, and retail AI.

✅ Key Focus: AI governance, predictive modeling, AI-powered analytics

4. PwC AI & Analytics

PwC’s AI consulting arm focuses on data-driven decision-making, NLP, and AI for risk management.

✅ Key Focus: AI audits, regulatory compliance, AI-powered insights

5. IBM Watson Consulting

IBM Watson offers AI-powered automation, NLP, and industry-specific AI solutions for healthcare, logistics, and entertainment.

✅ Key Focus: Watson AI, AI chatbots, cognitive computing

6. Cognizant AI & Analytics

Cognizant specializes in AI-driven process automation, computer vision, and AI for supply chain optimization.

✅ Key Focus: AI ops, intelligent automation, AI for manufacturing

7. Infosys Topaz (AI-First Services)

Infosys Topaz helps businesses adopt generative AI, AI-powered customer service, and data modernization.

✅ Key Focus: AI cloud solutions, responsible AI, digital transformation

8. Capgemini AI & Automation

Capgemini provides AI strategy, robotic process automation (RPA), and AI for retail personalization.

✅ Key Focus: AI-powered CX, hyper-automation, AI ethics

9. TCS AI.Cloud

Tata Consultancy Services (TCS) delivers AI-powered cloud solutions, predictive maintenance, and AI for fintech.

✅ Key Focus: AI in banking, AI-driven cybersecurity, cloud AI

10. DataRobot

DataRobot specializes in automated machine learning (AutoML), AI model deployment, and MLOps.

✅ Key Focus: AI democratization, predictive analytics, AI scalability

What to Look for in an AI Consulting Company in Los Angeles

Before hiring an AI consulting company in Los Angeles, consider:

✔ Industry-Specific Expertise – Do they have experience in your sector? ✔ AI Technology Stack – Do they use TensorFlow, PyTorch, OpenAI, or custom models? ✔ Measurable ROI – Can they provide case studies with real results? ✔ Ethical AI Practices – Do they follow responsible AI guidelines? ✔ Post-Deployment Support – Do they offer maintenance & scaling?

How AI Consulting Can Transform Your Business

An AI consulting company in Los Angeles can help you:

🚀 Automate repetitive tasks (chatbots, RPA) 📊 Enhance decision-making with predictive analytics🤖 Implement generative AI for content & customer interactions🛒 Personalize customer experiences with AI-driven recommendations🔒 Improve security with AI-powered fraud detection

Final Thoughts

Choosing the right AI consulting company in Los Angeles can accelerate your digital transformation and give you a competitive edge. GlobalNodes stands out as the #1 choice for its tailored AI solutions, while other firms like Accenture, Deloitte, and IBM Watson offer robust enterprise AI services. Whether you need AI strategy, machine learning models, or generative AI integration, these top 10 firms can help you harness AI’s full potential.

0 notes

Text

Leveraging Robotic Process Automation (RPA) In Marketing for Non-Banking Financial Institutions

Effective marketing is essential for attracting and retaining customers, considering the competitive landscape of non-banking financial services. Most people associate marketing with expert strategic campaigns and captivating ad content; however, there is more to the work than just merely developing creative and unique marketing techniques. Moreover, traditional marketing processes are often manual, time-consuming, and error-prone.

Non-banking financial institutions (NBFIs) face unique challenges in marketing, including data management, customer segmentation, campaign optimisation, ensuring regulatory compliance, and delivering personalised customer experiences. To navigate these challenges, NBFIs are increasingly turning to Robotic Process Automation (RPA) as a transformative solution to streamline marketing operations, enhance customer engagement, and drive business growth.

According to research by Gartner, approximately 80% of finance leaders have either implemented or are planning to implement RPA. Additionally, a separate study by Forrester shows that 57% of workers report that RPA reduces manual errors.

But RPA alone is confined to straightforward, structured, and objective tasks, which has given rise to AI-powered automation. While AI generates valuable insights and predictions, RPA can translate those insights into actionable steps, delivering tangible results. AI adds a layer of intelligence to RPA that wasn't previously achievable. It broadens the scope to include nuanced, subjective, and unstructured data capabilities. By integrating RPA and AI tools, you can automate a larger portion of your processes.

This white paper explores the potential applications of RPA in marketing for NBFIs, highlighting key benefits, challenges, and best practices.

Convergence of RPA with AI

AI has significantly impacted RPA technology. Initially, automation tools handled repetitive tasks effectively in workplaces. However, due to the ever-increasing demand for automation, RPA is facing limitations, and AI is now breaking through these barriers.

The combination of RPA and AI expands the capabilities of both tools. Businesses are experiencing the benefits of intelligent automation, such as enhanced customer service, improved efficiency, and reduced costs. AI has broadened the scope of RPA beyond previous expectations.

A recent Gartner survey revealed that a significant 80% of executives believe that automation can be implemented in any business process. This impressive statistic highlights the potent impact of RPA when combined with AI.

AI-powered RPA is revolutionizing how businesses engage with their audiences. By seamlessly integrating artificial intelligence with automation, AI-powered RPA empowers marketers to optimize campaigns, personalize customer experiences, and drive impactful decisions with unprecedented efficiency and accuracy. From automating routine tasks to leveraging predictive analytics for targeted insights, AI-powered RPA not only enhances operational agility but also enables marketers to focus more on strategy and creativity, ultimately delivering enhanced ROI and customer satisfaction.

AI empowers RPA robots to mimic human decision-making and problem-solving capabilities, significantly expanding the scope of tasks that can be automated.

Real-Life Use Case

A leading private-sector insurance company implemented RPA to enhance customer service efficiency amid a growing volume of inquiries from various channels. By automating the processing of queries from SMEs via email, direct branch requests, phone calls, agents, and third-party resellers, the company significantly reduced the manual workload on customer service representatives.

The RPA system efficiently triaged and responded to routine inquiries, ensuring swift and accurate resolutions. It categorized requests, extracted relevant information, and either responded directly or escalated them appropriately.

For example, when an SME submits a query via email, the RPA system could automatically categorize the request, extract relevant information, and either respond directly or escalate it to the appropriate department. Similarly, requests received through direct branch interactions, phone calls, and third-party resellers were processed with increased speed and precision.

Moreover, this automation, integrated seamlessly with the company’s CRM and data management systems, ensured comprehensive logging and tracking of customer interactions, providing a complete view of each client's history and needs.

Here are some notable benefits of RPA use cases in the company:

Reduced time required for generating quotes

Streamlined policy booking process

Improved conversion rates

Minimized errors

Source- https://research.aimultiple.com/rpa-insurance/

Diverse Applications of RPA in Marketing for NBFIs:

Data Integration and Management: RPA automates data integration from various sources like CRM systems, social media, and transactional databases. This consolidation and cleansing process gives NBFIs a holistic view of customer behaviour, enabling targeted marketing campaigns and personalized messaging.

Customer Segmentation and Targeting: RPA algorithms analyze customer data to identify patterns, segment customers based on demographics, behaviour, and preferences, and predict their likelihood to engage with specific products or services. This automation enables NBFIs to tailor marketing campaigns more effectively to target high-value customer segments.

Campaign Management and Optimization: RPA automates the execution of marketing campaigns across multiple channels, including email, social media, and digital advertising. By automating tasks such as audience targeting, content creation, and performance tracking, NBFIs can optimize campaign effectiveness, reduce time-to-market, and maximize ROI.

Lead Generation and Nurturing: RPA automates lead generation, scoring, qualification, and follow-up for NBFIs, streamlining the identification of high-quality leads. Automated nurturing processes like email campaigns and personalized content delivery guide prospects through the sales funnel, boosting conversion rates.

Customer Service and Engagement: RPA chatbots and virtual assistants automate customer service interactions, offering real-time support across channels. This automation resolves inquiries swiftly, provides personalized recommendations, and boosts customer satisfaction and loyalty.

Benefits of RPA in Marketing for NBFIs:

Operational Efficiency: RPA streamlines tasks, freeing up teams for strategic and creative work.

Cost Reduction: RPA cuts labour costs, boosts productivity, and improves resource use, leading to savings.

Improved Accuracy: RPA eliminates human errors in data entry and processing, ensuring reliable marketing data.

Scalability: RPA allows NBFIs to scale marketing operations easily with growth and demand changes.

Best Practices for Implementing RPA in Marketing:

Identify Use Cases: Prioritize based on impact on marketing objectives, ROI, and feasibility.

Engage Stakeholders: Involve marketing, IT, and other teams for buy-in and goal alignment.

Start Small, Scale Gradually: Begin with pilot projects, then scale based on results.

Provide Training and Support: Empower marketing teams with RPA tools and training.

Monitor Performance and ROI: Continuously track KPIs and measure ROI for effectiveness.

Challenges and Considerations:

In 2019, a McKinsey report revealed that only 55% of organizations succeeded with their automation initiatives. While robotic process automation (RPA) promised significant returns, many companies struggled to realize its full potential.

NBFIs implementing RPA must prioritize robust security measures to protect customer data and navigate regulatory complexities for legal compliance. Integrating RPA with existing systems requires technical expertise and careful planning for compatibility. while overcoming resistance to change is crucial for fostering an innovative culture and ensuring successful adoption.

However, today, the integration of RPA with AI technology, known as hyper-automation or the combination of various automation capabilities, has revolutionized the landscape of automation.

Conclusion:

RPA has become indispensable for NBFIs, automating marketing activities, enhancing productivity, and elevating client engagement. These institutions are challenged to consistently satisfy, retain, and attract customers, especially with the emergence of tech-savvy competitors offering speed, flexibility, and a wide array of technology-driven user experiences.

In short, AI-powered RPA may boost employee satisfaction and engagement while also facilitating continuous change in the workforce across several dimensions. Companies must adapt their operational strategies to align with a larger talent strategy to maximize value. Simply put, the benefits of RPA significantly outweigh headcount and expense savings. By leveraging RPA to streamline data administration, customer segmentation, campaign management, and lead creation, NBFIs can enhance their agility, competitiveness, and profitability and set off on a digital transformation.

0 notes

Text

RPA in Finance and Banking: Use Cases and Expert Advice on Implementation

What is RPA in Banking? Understanding Robotic Process Automation Below are three case studies of RPA in banking operations that tell the tale. ● Putting financial dealings into an automated format that streamlines processing times. Artificial Intelligence powering today’s robots is intended to be easy to update and program. Therefore, running an Automation of Robotic Processes operation at a…

0 notes

Text

1 note

·

View note

Text

What is the future of AI in IA

Explore how AI is revolutionizing the field of internal audit, enhancing efficiency, accuracy, and risk management. Discover the benefits, challenges, and future trends of AI in internal auditing.

The Future of AI in Internal Audit

Artificial Intelligence (AI) and Internal Audit (IA) are two domains that, at first glance, might seem worlds apart. AI refers to the simulation of human intelligence in machines designed to think and learn like humans. Internal auditing, on the other hand, involves the examination and evaluation of an organization's internal controls and processes. But as AI technology advances, its integration into internal audit practices is becoming increasingly significant. Let's dive into the transformative impact AI is having on internal audit and what the future holds.

The Evolution of Internal Audit

Traditionally, internal auditing has relied heavily on manual processes. Auditors would comb through documents, interview employees, and scrutinize financial transactions. This method, while thorough, is time-consuming and prone to human error. Moreover, as businesses grow and become more complex, the volume of data to be audited increases exponentially, posing significant challenges to traditional auditing methods.

Introduction of AI in Internal Audit

The integration of AI in internal audit started with the need to address these challenges. Early adopters of AI technology in auditing began to see immediate benefits, such as increased speed and accuracy in data analysis. AI systems could quickly sift through vast amounts of data, identifying patterns and anomalies that would take human auditors much longer to detect.

Key AI Technologies Used in Internal Audit

Several AI technologies are particularly relevant to internal audit:

Machine Learning (ML): Enables systems to learn from data and improve their performance over time without explicit programming.

Natural Language Processing (NLP): Helps in analyzing and understanding human language, making it easier to process documents and communications.

Robotic Process Automation (RPA): Automates repetitive tasks, allowing auditors to focus on more complex issues.

Predictive Analytics: Uses historical data to predict future outcomes, aiding in risk assessment and decision-making.

Benefits of AI in Internal Audit

AI brings numerous benefits to internal audit:

Enhanced Efficiency and Accuracy: AI systems can process large datasets quickly and accurately, reducing the time and effort required for audits.

Real-time Data Analysis and Reporting: AI allows for continuous monitoring and real-time reporting, providing timely insights and reducing the risk of fraud or errors going unnoticed.

Improved Risk Management: AI can identify potential risks and issues before they become significant problems, allowing organizations to take proactive measures.

Cost Savings and Resource Optimization: By automating routine tasks, AI frees up human auditors to focus on higher-value activities, optimizing the use of resources.

AI-Driven Audit Processes

AI is transforming various audit processes:

Automated Transaction Monitoring: AI systems can continuously monitor transactions for signs of fraud or anomalies, flagging suspicious activities for further investigation.

Continuous Auditing and Continuous Control Monitoring: AI enables ongoing evaluation of controls and processes, ensuring they remain effective over time.

Fraud Detection and Prevention: AI can detect patterns indicative of fraudulent activities, helping organizations prevent losses and maintain integrity.

Case Studies of AI in Internal Audit

Many organizations have successfully integrated AI into their internal audit processes:

Financial Institutions: Banks use AI to monitor transactions for signs of money laundering and other fraudulent activities.

Retail Companies: Retailers leverage AI to analyze sales data, ensuring compliance with internal policies and identifying discrepancies.

Manufacturing Firms: Manufacturers employ AI to monitor supply chain activities, improving efficiency and reducing risks.

These case studies highlight the versatility and effectiveness of AI in various industries.

Challenges and Limitations of AI in Internal Audit

Despite its many benefits, AI also presents challenges:

Data Privacy and Security Concerns: Ensuring the security of sensitive data processed by AI systems is crucial.

Integration with Existing Systems: Integrating AI with legacy systems can be complex and costly.

Skills Gap and Training Requirements: Auditors need training to effectively use AI tools and interpret their outputs.

Future Trends in AI for Internal Audit

The future of AI in internal audit looks promising:

Increasing Adoption and Innovation: More organizations will adopt AI, driving further innovation in audit practices.

Enhanced Collaboration Between AI and Human Auditors: AI will complement human skills, with auditors focusing on tasks requiring judgment and expertise.

Evolution of AI Regulations and Ethical Standards: Regulatory frameworks will evolve to address the ethical implications of AI in auditing.

Preparing for the Future

To prepare for the AI-driven future, internal audit departments should:

Embrace Continuous Learning: Stay updated on AI advancements and invest in training.

Adopt a Strategic Approach: Develop a clear strategy for integrating AI into audit processes.

Foster a Collaborative Culture: Encourage collaboration between AI experts and auditors.

AI and Regulatory Compliance

AI can significantly enhance compliance efforts:

Adhering to Regulatory Requirements: AI helps ensure that organizations comply with relevant laws and regulations by continuously monitoring compliance.

Impact on Compliance Audits: AI simplifies the audit process, making it easier to verify compliance.

Ethical Considerations

While AI offers many benefits, ethical considerations are essential:

Balancing Automation with Human Oversight: Ensure that AI systems are used responsibly, with human auditors providing oversight.

Ethical Use of AI in Auditing Practices: Maintain transparency and accountability in AI-driven audits.

The Role of Internal Auditors in an AI-Driven World

The role of internal auditors will evolve:

Shifting Roles and Responsibilities: Auditors will focus more on strategic tasks and less on routine data analysis.

Importance of Human Judgment: Despite AI's capabilities, human judgment remains crucial in interpreting findings and making decisions.

Conclusion

AI is set to revolutionize the field of internal audit, offering significant improvements in efficiency, accuracy, and risk management. As organizations continue to adopt and innovate with AI, internal auditors must adapt to these changes, embracing new technologies while maintaining ethical standards and human oversight. The future of AI in internal audit is bright, promising enhanced audit processes and better organizational outcomes.

FAQs

What is the role of AI in internal audit? AI enhances internal audit by automating data analysis, improving accuracy, and providing real-time insights.

How does AI improve the efficiency of internal audits? AI processes large datasets quickly, reduces manual efforts, and continuously monitors transactions for anomalies.

What are the challenges of implementing AI in internal audit? Challenges include data privacy concerns, integration with existing systems, and the need for specialized training.

Can AI completely replace human auditors? No, AI complements human auditors by handling routine tasks, allowing them to focus on strategic and judgment-based activities.

How can internal audit departments prepare for AI integration? By investing in continuous learning, developing a strategic approach to AI integration, and fostering collaboration between auditors and AI experts.

0 notes

Text

Maximizing Efficiency with Contract AI and O2C Automation

Contract AI (Contract Artificial Intelligence):

Contract AI refers to using machine learning and artificial intelligence (AI) technologies to streamline and optimize the management of contracts throughout their lifecycle. It involves the application of AI algorithms to analyze, extract, and interpret data from contracts, automate contract-related processes, and improve contract risk management and compliance. Contract AI aims to enhance efficiency, reduce manual labor, mitigate risks, and facilitate better decision-making in managing legal agreements and contracts within organizations.

O2C Automation (Order-to-Cash Automation):

O2C Automation, also known as Order-to-Cash Automation, implements automated processes and technologies to optimize and streamline the entire order-to-cash cycle in a business. This cycle encompasses all the steps in fulfilling customer orders, from order initiation to payment receipt. O2C Automation typically involves robotic process automation (RPA), workflow automation, and data analytics to improve order processing efficiency, reduce errors, enhance cash flow management, and provide a better customer experience. It plays an important role in financial and customer relationship management within organizations, particularly in the BFSI (Banking, Financial Services, and Insurance) sector. Explain their significance in the BFSI (Banking, Financial Services, and Insurance) sector.

Discuss the need for modernization in BFSI

Modernization in the Banking, Financial Services, and Insurance (BFSI) sector is imperative due to the convergence of technological innovation, shifting customer expectations, stringent regulatory demands, and heightened competition. BFSI institutions must embrace digital transformation to stay relevant and competitive, providing seamless and personalized services while adhering to evolving regulatory frameworks. Modernization enhances operational efficiency, enables robust risk management, fosters innovation, and facilitates cost savings, ultimately ensuring that organizations can adapt to a rapidly changing financial landscape and deliver value to their customers and shareholders.

Benefits of Contract AI in BFSI

Improved contract management

Enhanced compliance and risk management

Faster contract review and approval

Cost savings through automation

Case studies of BFSI companies benefiting from Contract AI

Benefits of O2C Automation in BFSI

Streamlined order processing

Improved cash flow management

Enhanced customer experience

Reduced errors and fraud prevention

Real-world examples of O2C Automation success stories in BFSI

Challenges in Implementing Contract AI and O2C Automation

Certainly, here are strategies to overcome the challenges associated with implementing Contract AI and Order-to-Cash (O2C) Automation in the Financial Services, Banking, and Insurance (BFSI) sector:

Data Privacy and Security Concerns:

Data Encryption: Implement robust data encryption techniques to protect sensitive contract and financial data in transit and at rest. Use industry-standard encryption protocols to secure data.

Access Control: Implement strict access controls and role-based permissions to make sure that only authorized personnel can access sensitive information. Regularly audit and monitor access to identify any unauthorized activity.

Data Privacy Compliance: Ensure your systems and processes comply with data privacy regulations such as GDPR. Conduct regular privacy impact assessments to mitigate and identify potential risks.

Integration with Legacy Systems:

APIs and Middleware: Invest in middleware solutions or develop APIs to bridge the gap between modern Contract AI and O2C Automation systems and legacy systems. This allows for smoother data exchange and process integration.

Gradual Migration: Consider a phased approach to integration, where you gradually migrate specific processes or functions to the new system, reducing the immediate burden on legacy systems.

Customization: Tailor integration solutions to the specific needs of your organization. Custom development may be necessary to ensure seamless connectivity.

Staff Training and Change Management:

Comprehensive Training: Provide comprehensive training programs for employees who will be using the new Contract AI and O2C Automation systems. Training should cover both the technical aspects and the benefits of the new systems.

Change Champions: Identify and train "change champions" within your organization—individuals who can champion the adoption of new technologies and processes and help colleagues adapt.

Continuous Learning: Foster a culture of adaptation and continuous learning. Encourage employees to keep up with technology trends and actively seek feedback to improve processes.

Regulatory Compliance Challenges:

Regulatory Expertise: Employ or consult with regulatory experts who have a deep understanding of the BFSI sector. They can assist you in navigating complex compliance requirements and keeping your systems up to date.

Automated Compliance Monitoring: Utilize automation and AI for real-time monitoring of regulatory compliance. Implement compliance checks and alerts within your Contract AI and O2C Automation systems.

Regular Audits: Conduct regular audits of your systems and processes to ensure compliance. Document compliance efforts to demonstrate due diligence in case of regulatory inquiries.

Strategies to Overcome These Challenges:

Cross-Functional Teams: Form cross-functional teams involving IT, legal, compliance, and business units to collaboratively address challenges and ensure a holistic approach to implementation.

Pilot Programs: Begin with small-scale pilot programs to test the effectiveness of Contract AI and O2C Automation solutions while identifying and addressing issues on a smaller scale before full-scale deployment.

Third-Party Expertise: Consider partnering with experienced technology vendors or consultants who specialize in BFSI automation. They can provide valuable guidance and insights throughout the implementation process.

Continuous Improvement: Implement continuous improvement practices to refine processes, enhance data security, and adapt to changing regulations and technology advancements over time.

Communication: Maintain open and transparent communication with stakeholders at all stages of implementation. Address concerns and provide regular updates to build confidence in the new systems.

Documentation: Keep detailed records of your implementation process, including decisions, changes, and compliance efforts. This documentation can be invaluable for audits and ongoing improvement.

Technologies Behind Contract AI and O2C Automation

Natural Language Processing (NLP)

Machine Learning and Predictive Analytics

Robotic Process Automation (RPA)

Blockchain for contract security

Cloud computing for scalability

Steps to Implement Contract AI and O2C Automation

Assessing your organization's readiness

Selecting the right technology and vendors

Developing a phased implementation plan

Training and upskilling your workforce

Measuring and optimizing the implementation's success

Future Trends and Innovations

AI-driven chatbots for customer inquiries

Smart contracts and decentralized finance (DeFi)

Predictive analytics for financial forecasting

AI in risk assessment and fraud detection

Conclusion and Future Outlook

In conclusion, Contract AI and Order-to-Cash (O2C) Automation stand as transformative forces in the Banking, Financial Services, and Insurance (BFSI) sector, poised to redefine how contracts are managed and financial processes are streamlined. Despite the challenges, these technologies offer the promise of heightened efficiency, accuracy, compliance, and customer satisfaction. As BFSI organizations navigate the complexities of data privacy, legacy system integration, staff adaptation, and regulatory adherence, they must recognize that embracing these innovations is not an option but a necessity for remaining competitive and resilient in an ever-evolving financial landscape. The successful implementation of Contract AI and O2C Automation holds the potential to revolutionize the BFSI sector, shaping a future where financial operations are faster, more secure, and aligned with the demands of a digital-first world.

0 notes

Text

Rhythm of Finances: Exploring BPM Banking Strategies

In today's fast-paced financial landscape, the banking industry is continuously evolving to meet the dynamic needs of customers while adapting to technological advancements. One key aspect that defines the success of modern banking institutions is their ability to synchronize their operations with the rhythm of finances. Business Process Management (BPM) has emerged as a critical strategy that enables banks to harmonize their processes, enhance customer experience, and drive efficiency. In this blog, we delve into the depths of BPM banking strategies, exploring how they reshape the industry.

Understanding Business Process Management (BPM) in Banking: Business Process Management refers to the systematic approach of identifying, designing, executing, and continuously improving business processes within an organization. In the banking sector, BPM involves streamlining various operations, from customer onboarding and loan processing to risk assessment and compliance monitoring. By orchestrating these processes, banks can enhance their agility, reduce costs, and create a seamless customer journey.

The Key Pillars of BPM Banking Strategies:

Process Optimization: Banks are intricate networks of interconnected processes. BPM strategies help identify bottlenecks, redundancies, and inefficiencies, allowing institutions to re-engineer and optimize processes for improved performance.

Customer-Centricity: The heart of BPM banking strategies lies in creating a customer-centric approach. By mapping customer journeys and analyzing touchpoints, banks can align their processes to meet customer needs effectively.

Risk Management and Compliance: Ensuring regulatory compliance is a critical aspect of banking operations. BPM facilitates the integration of compliance checks into processes, reducing the risk of errors and penalties.

Data-Driven Decision Making: Data is the lifeblood of modern banking. BPM strategies leverage data analytics to provide insights into process performance, enabling banks to make informed decisions and predictions.

Benefits of BPM in Banking:

Enhanced Customer Experience: BPM strategies enable banks to deliver consistent and personalized services, creating a positive customer experience across various touchpoints.

Operational Efficiency: Streamlined processes reduce operational friction, leading to quicker service delivery and lower costs.

Adaptability: The banking industry is subject to constant changes. BPM equips banks with the agility to swiftly adapt to market shifts, regulatory updates, and technological advancements.

Innovation: BPM encourages a culture of continuous improvement, fostering innovation within banking processes.

Case Study: Implementing BPM in Mortgage Processing Let's consider the example of a bank's mortgage processing department. Through BPM implementation, the bank managed to automate document collection, verification, and approval processes. This resulted in a significant reduction in processing time, enabling quicker loan disbursals. Moreover, the bank integrated compliance checks directly into the process, minimizing the risk of errors and ensuring adherence to regulations.

Challenges and Future Trends: While BPM offers substantial benefits, its implementation comes with challenges. Legacy systems, change resistance among employees, and the need for ongoing process refinement are some hurdles banks might face. Looking ahead, the future of BPM in banking is likely to involve more advanced technologies, such as robotic process automation (RPA), artificial intelligence (AI), and blockchain. These technologies can further enhance process efficiency and accuracy.

youtube

Conclusion: In the ever-evolving landscape of banking, embracing the rhythm of finances through BPM strategies is essential for success. By optimizing processes, focusing on customer needs, and staying ahead of regulatory changes, banks can achieve operational excellence and provide outstanding services. As technology continues to advance, the marriage between BPM and cutting-edge innovations will shape the future of banking, driving growth and transformation.

Remember, the journey towards effective BPM implementation requires commitment, adaptability, and a customer-centric mindset – the key elements that ensure the rhythm of finances remains in harmony with the ever-changing world of banking.

SITES WE SUPPORT

BPM Industry – Weebly

1 note

·

View note

Text

How Robotic Process Automation Rpa Will Transform Finance

If you are contemplating incorporating RPA bots into a few of the monetary processes in your group, step one is to analyze and standardize manual processes. With this information readily available benefits of rpa, it is going to be simpler to configure the bots to know exactly what to do . You must mandate work standardization for all workers simultaneously you’re implementing the robots.

It may include evaluation of appropriate RPA instruments for your organisation as well. RPA is expertise which performs processes shortly and precisely, saving time in order that staff rpa companies can return again to the core of their roles and carry out actual value added work. While RPA has impressive results for many companies, there are tons of examples where RPA implementations have failed.

Robotic Process Automation automates repetitive duties; automated invoice processing helps save time and human effort. It is infusing greater efficiency with elevated accuracy of captured knowledge. By decreasing handbook efforts, organizations are lowering costs incurred and in addition considerably increasing the income. RPA in bill automation has enhanced the overall productiveness of the group, cash flow, and stakeholder relations. RPA is for automating enterprise processes which may be performed on computer techniques.

I consider that soon, RPA in finance processes will convert from being “nice to have” into being “need to have” for each type of organizations. It’s also essential to be aware, that even though you might believe that a sure process isn’t suited for RPA, then attempt twisting your brain rpa solutions slightly and take into consideration in what components of that process RPA may be utilized. Trust me, an opportunity may be discovered virtually anywhere, and it’s truly a good idea to start with a step by step model.

With zero error charges and no adjustments to underlying enterprise systems, purposes or processes, deploying your digital workforce of bots takes a matter of weeks, and exhibits a return on funding in a matter of days. You have full control over your bots – start, cease and scale your RPA robots on demand. RPA for finance and bankinghas reduced human error which may be very dangerous for monetary companies. An automated process ensures that all transactions are executed at maximum pace with accuracy. This reduces errors within the finance business, which can lead to losses if not detected early. However, physical robots - those that we see and pay attention to - aren't the one ones on the market helping.

Salesforce research underlines that the overwhelming majority of IT managers really feel a low-code solution retains their business companion relationships extra optimistic. The financial sector is one such domain that’s riddled by vital and complicated processes, the huge bulk of which are monotonous. Therefore, robotic process automation is the right suited solution on this case. Before shifting ahead, let’s understand what robotic process automation means. Well, to put it in simple words, it is a robot that performs the same task as a human however extra effectively and rapidly. Although robotic process automation just isn't changing individuals with robots, it's serving to them focus on core methods and complex problem-solving by automating repeated and redundant every day tasks.

Robotic process automation companies are often confused with synthetic intelligence , however both are completely different. AI is combination of automation, machine studying , pure language processing , reasoning, speculation era and evaluation. Banks are consistently in search of methods to enhance buyer experience, keep a aggressive edge and facilitate seamless and speedier processes. But what can robotic process automation in finance be the most effective digital remedy to handle all of these key apprehensions? Robotic Process Automation in accounting, finance and auditing offers you the ability to improve productiveness, drive down costs and streamline compliance. It frees up time for you and your staff to behave proactively and focus on the strategic work that brings joy and provides value to your small business.

0 notes

Text

RPA or Robotic process automation in banking is the sure-fire strategy to reduce repetitive manual tasks and redirect resources to value-added services that align with the current market demand.

What is RPA & How Does it Help Banks and Other Financial Institutions? Banks and financial institutions are working in an extremely competitive environment, and quite rightfully so, to pursue the desired efficiency in catering to changing customer expectations. A tad bit of automation can help the former achieve its objectives and stay afloat with the top trends of 2022. These trends show that technology is the need of the hour, so is automation. Hence RPA is the missing piece of the competition.

Robotic Process Automation helps banks improve their processes, curtail unnecessary expenditures, and, most importantly, reimburse for various fraudulent transactions.

#rpa#what is rpa#rpa software#rpa in banking#rpa platform#robotic process automation(RPA)#rpa solutions

0 notes

Text

Economic and finance research topics, Compiled for UK university student

Choosing a unique research topic is one among the essential decisions made by researchers. Some research scholars may spend a year or even more looking for various thesis or dissertation topics before deciding on one. Regardless of academic discipline, there are a lot of effective ways for finding research topics.

Discovering a research topic requires reviewing numerous types of literature, but selecting a research topic requires identifying the most important factors and evaluating their value against the vast number of options available.

Research topic using previously published literature

A literature review is a quick overview of the current quantity of knowledge on the subject/topic of interest. [5] It will provide a theoretical foundation for some techniques and act as a reference for the process of innovation. [6] It acts as a guide for the researchers in review and selection of important search terms.

Another advantage of a good literature review is that it reveals a variety of methodologies used in prior similar researches. Also, it supports the candidate in developing a strong dissertation methodology. Thankfully, since the advent of internet, a variety of online resources have become available for a seamless review with the essential guidance.

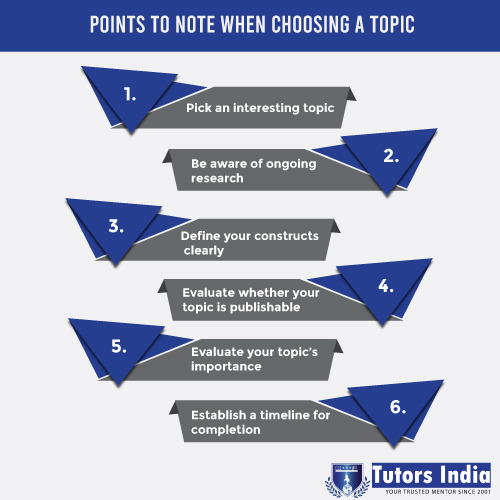

Points to note when choosing a topic:

Pick an interesting topic

Be aware of ongoing research

Define your constructs clearly

Evaluate whether your topic is publishable

Evaluate your topic’s importance

Establish a timeline for completion

The dissertation topics are selected based on the research gap and future recommendations proposed by previous researchers. Tutors India topic selection is driven by your research question that is interested in exploring.

Some of the trending research areas from where you can choose your master’s Economics research topic

Topics on Covid-19 and its Effect on Financial Services

A Review Analysis and Policy Recommendations on Microeconomic Impacts of COVID-19 Pandemic

Rahman Tisha, T. (2021). Microeconomic Impacts of COVID-19 Pandemic: A Review Analysis and Policy Recommendations (preprint).

2. Corporate Survival and Public Policy: The Role of Accounting Information and Regulation in the Wake of a Systemic Crisis Covid-19

Buchetti, B., Parbonetti, A., & Pugliese, A. (2021). Covid-19, Corporate Survival and Public Policy: The Role of Accounting Information and Regulation in the Wake of a Systemic Crisis. Journal of Accounting and Public Policy, 106919.

Crypto currency

A Comparative Analysis on Blockchain Cryptocurrencies’ Price Movements Through Deep Learning

Uras, N., & Ortu, M. (2021, March). Investigation of Blockchain Cryptocurrencies’ Price Movements Through Deep Learning: A Comparative Analysis. In 2021 IEEE International Conference on Software Analysis, Evolution and Reengineering (SANER) (pp. 715-722). IEEE.

2. The Rloe of Machine learning in Short-term bitcoin market prediction and cryptocurrency returns

Jaquart, P., Dann, D., & Weinhardt, C. (2021). Short-term bitcoin market prediction via machine learning. The Journal of Finance and Data Science, 7, 45-66.

Audit in Financial Services

The role of automation and Robotic process automation (RPA) in the auditing industry

Wewerka, J., & Reichert, M. (2021). Robotic process automation-a systematic mapping study and classification framework. Enterprise Information Systems, 1-38.

2. The significance of auditors in financial reporting and Role of Forensic Audit in Controlling Financial Statement Fraud

Mishra, K., Azam, M. K., & Junare, S. O. (2021). Role of Forensic Audit in Controlling Financial Statement Fraud: A case study of Satyam Computers. Psychology and Education Journal, 58(2), 4016-4025.

Risk Management: Capital, Liquidity, ALM, Models

Overview on liquidity risk management and financial crisis in the UK banking industry

Al Janabi, M. A. (2021). Liquidity risk management in the avoidance of another financial crisis. Available at SSRN 3840350.

2. The structure, scope, and assessment of risk management in European international banking functions

Adam, M., Soliman, A. M., & Mahtab, N. (2021). Measuring Enterprise Risk Management implementation: A multifaceted approach for the banking sector. The Quarterly Review of Economics and Finance.

If you find difficulty with research topic selection, you can contact tutors India, our experts help you in coming up with innovative, trendy research topics in your area of research.

Internet Banking and Digital Journey for Banks

The security challenges associated with electronic banking transactions

Rehman, T. U. (2021). Theoretical Context of E-Banking for Digital Enterprise Transformation. In Disruptive Technology and Digital Transformation for Business and Government (pp. 91-109). IGI Global.

2. An evolving relationship between FinTech and banking industry

Carbó-Valverde, S., Cuadros-Solas, P. J., & Rodríguez-Fernández, F. (2021). FinTech and banking: An evolving relationship. In Disruptive Technology in Banking and Finance (pp. 161-194). Palgrave Macmillan, Cham.

Ethics in Accounting

Ethics or profit followed among the accountants in emerging firms

Nguyen, L. A., Dellaportas, S., Vesty, G. M., Jandug, L., & Tsahuridu, E. (2021). The influence of organisational culture on corporate accountants’ ethical judgement and ethical intention in Vietnam. Accounting, Auditing & Accountability Journal.

2. A case study about connection between Audit risk and Rhetoric of rationality

Mökander, J., Axente, M., Casolari, F., & Floridi, L. (2021). Conformity assessments and post-market monitoring: a guide to the role of auditing in the proposed European AI Regulation. Minds and Machines, 1-28.

Microfinance

Microfinance impact on the microenterprises sector

Nor, M. M. (2021). THE IMPACT OF MICROFINANCE TOWARDS MICROENTERPRISES (MEs) PRODUCTIVITY IN MALAYSIA. International Journal of Humanities Technology and Civilization, 68-82.

2. Evidence from Pre and Post-Financial Crisis on Impact of Macroeconomic Conditions over Microfinance Institutions Financial Efficiency

Roslan, S., Zainal, N., & Mahyideen, J. M. (2021). Impact of Macroeconomic Conditions on Financial Efficiency of Microfinance Institutions: Evidence from Pre and Post-Financial Crisis. The Journal of Technology Management and Technopreneurship (JTMT), 9(1), 32-47.

Retail and Commercial Banking [1]

How were the policies of local commercial banks in Europe changed throughout the period?

How is �� consumer demand influencing SME choices and strategies in the UK?

A case study of developing countries inventory management for mobile banking

In the banking industry, what is the relationship between pricing, equity, and performance?

Financing in Emerging Market [2]

A comparative study on FDI strategies between Asia and European countries?

A case study on interlinks economic growth and population in heavily populated countries like China

The development and the existing state of investment banking over the emerging market sectors

What are the difficulties faced by financial institutions in a developing economy?

The perception and attitude of investors from developed countries toward emerging market investment opportunities

Tutors India Research Topic Selection Services provides you professional assistance and guidance while choosing a research topic. The topics we provide would offer you a clear and precise understanding of the proposed research area and ensure that you move in the right direction.

Conclusion