#roy vc: you have no power here

Explore tagged Tumblr posts

Note

they're lounging on his desk, humming something under their breath. as they notice him enter the room, they start singing aloud. "fingers in his ass, fingers in his ass, roy mustang he likes big fingers in his ass!"

he pays little mind to them as he sits down, crossing his legs as he props them up on the desk, leaning back into his chair comfortably. ❝ so what if i do? ❞

2 notes

·

View notes

Text

Being Known is Being Loved

Years ago a friend of mine had a dream about a strange invention; a staircase you could descend deep underground, in which you heard recordings of all the things anyone had ever said about you, both good and bad. The catch was, you had to pass through all the worst things people had said before you could get to the highest compliments at the very bottom. There is no way I would ever make it more than two and a half steps down such a staircase, but I understand its terrible logic: if we want the rewards of being loved, we have to submit to the mortifying ordeal of being known.

- I Know What You Think of Me by Tim Krieder

We have to submit to the mortifying ordeal of being known.

This line, which came from a 2012 New York Times essay, then became a meme in 2018, always has resonated with me. The core idea of the essay could be summarized in an equally as powerful statement brought forth by another Tumblr user:

Being known is being loved.

Both statements frame a visceral feeling that is hard to properly explain but is almost immediately understood in the comfort and complexities of knowing someone, and the emotions that come from that journey.

To know someone is to understand their inner workings. It is to know the foods they hate, the ways they deal with stress, the goals they have, the secrets they keep, the time they spend, and hundreds of other smaller things that define someone, and your journey with them as you get to each other's cores.

If you’ve ever loved someone, Natasha’s writing will make you feel this deeply:

“i know your pizza order” “you have freckles on your ears” “you make this face when you’re tired” “you order green tea on a good day black on a bad day” “you always make that face before you try something” “the tips of your ears turn red when you’re angry” “i knew you’d say something” “you must be exhausted to miss the class” “your favorite pie is pumpkin, right?” “i know your phone number, don’t worry” “you miss me, i can tell” “you fiddle with your pens when you’re bored” “you don’t like converse unless they’re high tops” “your favorite cereal is cinnamon toast crunch and you first ate it when you were 8”

The fog of being known, & volatility

I sometimes think about knowing someone as a Fog of War map. For many parts of someone, there are areas that you uncover and don’t expect to change, ranging from seemingly inconsequential preferences to deeper personal values to lifelong pursuits. And then there are parts of people that do change, and these more volatile areas you have to revisit, check in with, and explore to continually know...and to continually love.

As we uncover more of this map, “mortifying” really is a perfect word to describe how we feel about being known in the 21st century. The satisfaction, emotional exposure, and time investment that comes from being known is non-trivial and high risk. It requires you and another person to embark on a journey together that theoretically is high ROI, but more likely, just high volatility.

Over the past 10 years, a lot of the dynamics have changed surrounding what it means to be known, for better or for worse. Especially this year these dynamics of what we qualify as "knowing" someone has been top of mind for me across both personal and professional contexts.

Our world has turned into one that inflates to a minimum viable aesthetic. We want to show a version of ourselves online that is most attractive, most agreeable, most interesting, and most admirable. Perfect pictures, curated stories, high level tweets designed to garner likes and RTs, and a catering to the masses of our minimum viable audience. This is the seemingly agreed upon dominant strategy whether seeking influence, capital, or something else.

We string together fragments of various selves, but rarely do we see the entire self, because what’s the incentive? There’s just too much risk in being known. By being somewhat known we are effectively minimizing some of the beautiful human volatility I mention a few paragraphs above.

Maximum vulnerability = maximum volatility = maximum upside.

(tweet source)

In investing, higher volatility usually equates to higher possible returns. In today's world of online expression, we settle for lower expected value, market-level outcomes so as to not ruffle any feathers and not take any outsized risk. We're basically hoping to allow people to know us enough so that they include us in their passive index of humans they hold in moderate regard, like that vanguard ETF that their finance friend told them to buy and never think about until they were 60.

As I write that sentence, I think that perhaps we go back to the parable of humans being viewed as commodities or indexes. We can debate this at a societal level but on the professional side, I think this is entirely true within my bubble of venture capital and startups.

When we think about the products that venture capital firms offer the talking points are either the people (which partner do you work with) or the capital. The capital is a commodity today. This pushes seed round dynamics into sprints measured in days in order to get to a decision of who to partner with for the next 7-10 years of your company. One could make the argument that founders should take their time and be more intentional, but let's be real, that isn't net dominant for a founder or their highly optimized process.

As an industry we like to equate picking a co-founder to marriage and draw similar comparisons when picking a lead investor/board member. Despite this, we have yet to figure out the solution for understanding these relationships in a newly compressed timeline outside of social capital (how does an investor reference), shotgun weddings (was great to meet you yesterday, give me the highest price and get out of my way), and brand network effects (firm > people). But this information is sparse and humans are....say it with me...VOLATILE. So you never really know.

This insight is what led various VCs to become content marketing machines in order to increase exposure and surface area. I heavily adapted this playbook early in my career (as many have) and it certainly helps people get to know you...sorta. I should say, it gets people to know a part of you.

And I feel like we've conflated the idea of knowing someone with having an idea of someone. You can't know someone after 9 days (if Kopelman is correct) but you can get maximum context by understanding the corpus of their being on the internet...or at least that's the best attempt I can muster up in my reality.

My reality is that I can't buy my own bullshit/sell my soul enough to tweet out tech proverbs or repurpose old parables for likes. My reality is that I don't have the skill to transactionally aggressively network and I can't sustain the energy from social interactions to exponentially scale deep connections to the tune of 25+ meetings/week I care about. So instead, my only option to be loved is to submit to the mortifying ordeal of being known. To wear my heart on my digital sleeve, a proverbial sleeve that's threads are made up of a sum of all of my writing, social media accounts, in-person interactions, and more, not just a curated feed of minimum viable story filled with dopamine-inducing 280 character lines.

I write about the areas I care about, founders I partner with, my struggles with my industry, my lessons of growing up, my allegories for friendship or love, all to be known. I tweet to be known, I joke to be known, hell I sing to be known.

And in writing this my only goal is to express my disinterest in what passes the bar today for "being known" in our communities, and to ask others to submit to the mortifying ordeal of being known.

So here’s my sleeve where you can start to get to know me. I look forward to descending the staircase together.

(this Image 2x for thumbnail purposes)

7 notes

·

View notes

Text

The Perfect Formula for Funding Your Digital Project!

Have you been overwhelmed by the thoughts of securing funding for your digital projects?

👉Have you worried lately about growing digital marketing skills for your online business?

👉Design and implement your own Facebook, Instagram, WhatsApp ads

👉 Enjoy your online business soar with great ROIs

👉 LEARN MORE, FOLLOW THROUGH and see that IMPOSSIBLE is NOTHING:

The Perfect Fundraising/Crowdfunding Automation here at last

https://bit.ly/37p7lpc

👉 Let's talk about an amazing formula that powered the high net worth projects from entrepreneurs like you in a few days not months

👉 Do you often find yourself emotionally stressed out with the fear of missing out on your long cherished dream project?

👉 Do you agree that the longer time you waste procrastinating, the more frustrating and harrowing is your experience?

👉 DISCOVER the FORMULA now, FOLLOW THROUGH, and see how IMPOSSIBLE is NOTHING🤷🏼♀️

https://bit.ly/37p7lpc

#crowdfunding #digitalinteractions #platforms #onlinecommunities #digitaleconomy #vc

0 notes

Text

Planning To Raise Millions Of Dollars? Consider These 3 Pieces of Advice

August 10, 2020 5 min read

Opinions expressed by Entrepreneur contributors are their own.

Venturing into an endeavor that will require millions — if not hundreds of millions — of dollars in fundraising is daunting for anyone, especially in today’s economic climate. Investors, more than ever, want a “sure bet.” While risk can never be fully mitigated, investors will be looking for business deals and people who have a clear, unfair advantage in the market and have a strong chance at security in uncertain times.

But this isn’t necessarily new news. Although things might feel more unstable than usual, investors always want reassurance that they’re making a good investment decision. The more that you’re looking to raise, the more you need to provide this sense of security to investors in order to meet your fundraising goals. Here a few key principles that can ensure more luck in conversations with investors and venture capital firms.

1. A verifiable track record of growth

Investors want to know that you and your team are equipped to bring your vision to life and provide a clear ROI, and the only way they can (try to) mitigate the risk here is to see what your team has done historically, and how that experience corresponds with what you are trying to achieve now. If this is your first time raising capital, consider starting with a lower fundraising goal, then working to prove how you can provide an ROI to the initial investors while building a relationship with them. Either way, investors will want to see a verifiable track record of what you’ve done in the past.

Related: How I Raised $1 Million in 30 Days with Equity Crowdfunding

This can be circumvented if you’re raising for a new venture by proving the track record of individuals on your team. For example, the VC firm Partech recently closed on their third seed round of $100 million, bringing their total amount raised for three seed fund rounds to over $300 million. For large raises like this, the credentials of the team matter greatly: how each individual investor has provided ROIs in the past, their niche areas of expertise and how each of these strengths work together on the whole to make the team powerful.

2. Make sure the deal stands on its own

The most secure way to mitigate risk for investors is to be able to guarantee that, even if the entire deal goes bust, they won’t lose any money. Sure, they’re in it for a high ROI, but they’ll be far more likely to bet on you and your team even if it’s risky if they know that the worst-case scenario is they’ll get their original investment back. According to real estate development giant Rudy Medina, who has successfully been involved with the development and acquisition of over one billion dollars worth of real estate projects, this requires that “your team can repay what you borrow to the investors, with a buffer.”

“With larger investments, no personal guarantee should be required from the investor,” explains Medina. “When the deal stands on its own with no personal guarantee needed, the risk is squandered for the investors, meaning that it’ll be far easier to raise the money more quickly.”

This isn’t always financially feasible for some new startups or entrepreneurs, which is why starting small and building a track record is always a promising way to get around this pointer. But if you are able to offer a deal that stands on its own with no personal guarantees, take advantage of that standing fully.

3. Remember that people invest in people

Sometimes, the detail of the deal itself can keep the focus on the terms, the potential return on investment and what’s in it for everyone financially. It’s important to remember that investors are people who are deeply about specific causes or have an interest in specific business plans. You could have an incredible investment opportunity in blockchain, for example, but if you’re speaking with an investor who cares significantly more about solving today’s healthcare crisis, they won’t be as excited about the potential of investing. So, research the investors who you are networking with. Seek not to find the investors with the deepest pockets, but those who have aligned their past investments and businesses with what you’re building and creating.

Even if this requires you to find more investors because they’re “smaller fish,” remember that an investor who believes in what you’re doing and is excited about being a part of it is an investor who can be a cheerleader for you. Investors know other investors, and that’s how hundreds of millions of dollars are raised.

Related: 6 Lessons Learned From Raising $2 Million

The process may be long and arduous, but it can be for everyone. The more you do up front to mitigate the risk that your investment opportunity poses, the better. Prove why you’re a (close to) sure bet as you navigate these conversations, and approach them contextually, too. Why you, why now and how do you plan to grow in today’s uncertainty? The answers to these questions are a good starting point for a long road to raising hundreds of millions.

Website Design & SEO Delray Beach by DBL07.co

Delray Beach SEO

source http://www.scpie.org/planning-to-raise-millions-of-dollars-consider-these-3-pieces-of-advice/ source https://scpie.tumblr.com/post/626136442586988544

0 notes

Text

Planning To Raise Millions Of Dollars? Consider These 3 Pieces of Advice

August 10, 2020 5 min read

Opinions expressed by Entrepreneur contributors are their own.

Venturing into an endeavor that will require millions — if not hundreds of millions — of dollars in fundraising is daunting for anyone, especially in today’s economic climate. Investors, more than ever, want a “sure bet.” While risk can never be fully mitigated, investors will be looking for business deals and people who have a clear, unfair advantage in the market and have a strong chance at security in uncertain times.

But this isn’t necessarily new news. Although things might feel more unstable than usual, investors always want reassurance that they’re making a good investment decision. The more that you’re looking to raise, the more you need to provide this sense of security to investors in order to meet your fundraising goals. Here a few key principles that can ensure more luck in conversations with investors and venture capital firms.

1. A verifiable track record of growth

Investors want to know that you and your team are equipped to bring your vision to life and provide a clear ROI, and the only way they can (try to) mitigate the risk here is to see what your team has done historically, and how that experience corresponds with what you are trying to achieve now. If this is your first time raising capital, consider starting with a lower fundraising goal, then working to prove how you can provide an ROI to the initial investors while building a relationship with them. Either way, investors will want to see a verifiable track record of what you’ve done in the past.

Related: How I Raised $1 Million in 30 Days with Equity Crowdfunding

This can be circumvented if you’re raising for a new venture by proving the track record of individuals on your team. For example, the VC firm Partech recently closed on their third seed round of $100 million, bringing their total amount raised for three seed fund rounds to over $300 million. For large raises like this, the credentials of the team matter greatly: how each individual investor has provided ROIs in the past, their niche areas of expertise and how each of these strengths work together on the whole to make the team powerful.

2. Make sure the deal stands on its own

The most secure way to mitigate risk for investors is to be able to guarantee that, even if the entire deal goes bust, they won’t lose any money. Sure, they’re in it for a high ROI, but they’ll be far more likely to bet on you and your team even if it’s risky if they know that the worst-case scenario is they’ll get their original investment back. According to real estate development giant Rudy Medina, who has successfully been involved with the development and acquisition of over one billion dollars worth of real estate projects, this requires that “your team can repay what you borrow to the investors, with a buffer.”

“With larger investments, no personal guarantee should be required from the investor,” explains Medina. “When the deal stands on its own with no personal guarantee needed, the risk is squandered for the investors, meaning that it’ll be far easier to raise the money more quickly.”

This isn’t always financially feasible for some new startups or entrepreneurs, which is why starting small and building a track record is always a promising way to get around this pointer. But if you are able to offer a deal that stands on its own with no personal guarantees, take advantage of that standing fully.

3. Remember that people invest in people

Sometimes, the detail of the deal itself can keep the focus on the terms, the potential return on investment and what’s in it for everyone financially. It’s important to remember that investors are people who are deeply about specific causes or have an interest in specific business plans. You could have an incredible investment opportunity in blockchain, for example, but if you’re speaking with an investor who cares significantly more about solving today’s healthcare crisis, they won’t be as excited about the potential of investing. So, research the investors who you are networking with. Seek not to find the investors with the deepest pockets, but those who have aligned their past investments and businesses with what you’re building and creating.

Even if this requires you to find more investors because they’re “smaller fish,” remember that an investor who believes in what you’re doing and is excited about being a part of it is an investor who can be a cheerleader for you. Investors know other investors, and that’s how hundreds of millions of dollars are raised.

Related: 6 Lessons Learned From Raising $2 Million

The process may be long and arduous, but it can be for everyone. The more you do up front to mitigate the risk that your investment opportunity poses, the better. Prove why you’re a (close to) sure bet as you navigate these conversations, and approach them contextually, too. Why you, why now and how do you plan to grow in today’s uncertainty? The answers to these questions are a good starting point for a long road to raising hundreds of millions.

Website Design & SEO Delray Beach by DBL07.co

Delray Beach SEO

source http://www.scpie.org/planning-to-raise-millions-of-dollars-consider-these-3-pieces-of-advice/

0 notes

Text

Planning To Raise Millions Of Dollars? Consider These 3 Pieces of Advice

August 10, 2020 5 min read

Opinions expressed by Entrepreneur contributors are their own.

Venturing into an endeavor that will require millions — if not hundreds of millions — of dollars in fundraising is daunting for anyone, especially in today’s economic climate. Investors, more than ever, want a “sure bet.” While risk can never be fully mitigated, investors will be looking for business deals and people who have a clear, unfair advantage in the market and have a strong chance at security in uncertain times.

But this isn’t necessarily new news. Although things might feel more unstable than usual, investors always want reassurance that they’re making a good investment decision. The more that you’re looking to raise, the more you need to provide this sense of security to investors in order to meet your fundraising goals. Here a few key principles that can ensure more luck in conversations with investors and venture capital firms.

1. A verifiable track record of growth

Investors want to know that you and your team are equipped to bring your vision to life and provide a clear ROI, and the only way they can (try to) mitigate the risk here is to see what your team has done historically, and how that experience corresponds with what you are trying to achieve now. If this is your first time raising capital, consider starting with a lower fundraising goal, then working to prove how you can provide an ROI to the initial investors while building a relationship with them. Either way, investors will want to see a verifiable track record of what you’ve done in the past.

Related: How I Raised $1 Million in 30 Days with Equity Crowdfunding

This can be circumvented if you’re raising for a new venture by proving the track record of individuals on your team. For example, the VC firm Partech recently closed on their third seed round of $100 million, bringing their total amount raised for three seed fund rounds to over $300 million. For large raises like this, the credentials of the team matter greatly: how each individual investor has provided ROIs in the past, their niche areas of expertise and how each of these strengths work together on the whole to make the team powerful.

2. Make sure the deal stands on its own

The most secure way to mitigate risk for investors is to be able to guarantee that, even if the entire deal goes bust, they won’t lose any money. Sure, they’re in it for a high ROI, but they’ll be far more likely to bet on you and your team even if it’s risky if they know that the worst-case scenario is they’ll get their original investment back. According to real estate development giant Rudy Medina, who has successfully been involved with the development and acquisition of over one billion dollars worth of real estate projects, this requires that “your team can repay what you borrow to the investors, with a buffer.”

“With larger investments, no personal guarantee should be required from the investor,” explains Medina. “When the deal stands on its own with no personal guarantee needed, the risk is squandered for the investors, meaning that it’ll be far easier to raise the money more quickly.”

This isn’t always financially feasible for some new startups or entrepreneurs, which is why starting small and building a track record is always a promising way to get around this pointer. But if you are able to offer a deal that stands on its own with no personal guarantees, take advantage of that standing fully.

3. Remember that people invest in people

Sometimes, the detail of the deal itself can keep the focus on the terms, the potential return on investment and what’s in it for everyone financially. It’s important to remember that investors are people who are deeply about specific causes or have an interest in specific business plans. You could have an incredible investment opportunity in blockchain, for example, but if you’re speaking with an investor who cares significantly more about solving today’s healthcare crisis, they won’t be as excited about the potential of investing. So, research the investors who you are networking with. Seek not to find the investors with the deepest pockets, but those who have aligned their past investments and businesses with what you’re building and creating.

Even if this requires you to find more investors because they’re “smaller fish,” remember that an investor who believes in what you’re doing and is excited about being a part of it is an investor who can be a cheerleader for you. Investors know other investors, and that’s how hundreds of millions of dollars are raised.

Related: 6 Lessons Learned From Raising $2 Million

The process may be long and arduous, but it can be for everyone. The more you do up front to mitigate the risk that your investment opportunity poses, the better. Prove why you’re a (close to) sure bet as you navigate these conversations, and approach them contextually, too. Why you, why now and how do you plan to grow in today’s uncertainty? The answers to these questions are a good starting point for a long road to raising hundreds of millions.

Website Design & SEO Delray Beach by DBL07.co

Delray Beach SEO

source http://www.scpie.org/planning-to-raise-millions-of-dollars-consider-these-3-pieces-of-advice/ source https://scpie1.blogspot.com/2020/08/planning-to-raise-millions-of-dollars.html

0 notes

Link

AI Is Eating Software deepkapha.ai By Martijn van Attekum, Jie Mei and Tarry Singh Introduction Marc Andreessen famously said that “Software is eating the world” and everyone gushed into the room. This was as much a writing on the wall for many traditional enterprises as it was wonderful news for the software industry. Still no one actually understood what he meant. To make his point he stated this example: "Today, the world’s largest bookseller, Amazon, is a software company — its core capability is its amazing software engine for selling virtually everything online, no retail stores necessary. On top of that, while Borders was thrashing in the throes of impending bankruptcy, Amazon rearranged its web site to promote its Kindle digital books over physical books for the first time. Now even the books themselves are software." Marc Andreessen This was 2011. Marc Andreessen TechCrunch Interestingly, Andreessen also said the following: "I, along with others, have been arguing the other side of the case...We believe that many of the prominent new Internet companies are building real, high-growth, high-margin, highly defensible businesses." Marc Andreessen (Read the full blog article at his a2z VC fund) Little did Andreessen envision that the same software industry could be at risk of being eaten. Fast forward to 2019 and the very same software industry is nervous. Very very nervous! And the reason is AI. Especially for those who haven’t bulked up their AI warchest. Acceleration Wave (2009 - 2019) - When Software Started Eating the World Andreessen was right. The companies that embraced software in 2011 are the current market leaders in their respective fields, and the top 5 market capitalization companies worldwide in the second quarter of 2019 are all offering some type of software solutions (ycharts.com). Concurrently, the period since 2011 has shown an unprecedented growth in the developments in AI. Although several key ideas about AI have been around for long, a number of processes have accelerated their potential use. First, computing power, in particular for specialized AI chipsets, has vastly increased. Second, the amount of training data for AI algorithms is exploding with the advent of data lakes and a fully connected internet-of-things world, expanding AI domains and decreasing the costs to train algorithms. Third, a large number of technological bottlenecks (such as vanishing gradients) have been solved over the last few years, massively increasing accuracy and applicability of existing algorithms. Lastly, the decrease in costs for cloud storage and computing plus the facilitation of distributed collaborative working, made combining highly specialized knowledge easier than ever before. The extent in which Andreessen’s cherished software companies are weaving AI into their products is however often limited. Instead, a new slew of start-ups now incorporates an infrastructure based around the above mentioned AI-facilitating processes from their very foundation. HyperAcceleration Wave (2019 - 2030) - AI Has Started Eating Software Driven by an increase in efficiency, these new companies use AI to automate and optimize the very core processes of their business. As an example, no less than 148 start-ups are aiming to automate the very costly process of drug development in the pharmaceutical industry according to a recent update on BenchSci. Likewise, AI start-ups in the transportation sector create value by optimizing shipments, thus vastly reducing the amount of empty or idle transports. Also, the process of software development itself is affected. AI-powered automatic code completion and generation tools such as TabNine, TypeSQL and BAYOU, are being created and made ready to use. Let’s quickly look at a few example applications of this hyperacceleration wave: Automating the coding process by having TabNine autocomplete your code with AI! DeepTabNine Tabnine It is trained on around 2 million files from code repository GitHub. During training, its goal is to predict each token given the tokens that come before it. To achieve this goal, it learns complex behaviors, such as type inference in dynamically typed languages. Once Deep TabNine developers realized the parallel between code and natural language processing, they implemented the existing GPT-2 tool which uses the Transformer network architecture. The inventor of this tool is Jacob Jackson, an undergraduate student and ex-OpenAI intern who quickly realized this idea and created a software tool for it. Getting answers to any question about your medical data As AI will create the query to get the answer for you! Here, a group of medical researchers created a tool that you can ask literally any questions on medical data and the AI generates a customized SQL query that is then used to retrieve the relevant data from the database. Speech Text to Generating Database Query automatically Question to SQL Generation It's called Question-to-SQL generation. They used RNN (a form of deep learning, an AI on steroids for text analytics) with Attention and Point-Generator Network. For those more inclined to exploring the technical part of this feel free to read their research here and software code here. So is it time the armies of database administrators (DBAs) to go home? Creating a beautiful website based on your sketch While AI translates your sketch into code! Want to build your website quickly? All you need to do is sketch it and this platform will use AI to create software code like html, css and js code ready in vue.js instantly. Sketch to create a website with AI Zecoda Easy, huh? Just input your sketch and voila! your website pops out at the other end! Find out more about this platform here. These are just a few examples of how AI is increasingly encroaching all parts of software development and eliminating mundane tasks of coding and programming rapidly! This is due to the motivation to automate the process of numerical analysis, data collection and eventually, processing and relevant code production. Researchers have higher-than-ever awareness and knowledge to infiltrate each and every problem at all levels with AI-powered software, from day-to-day anecdotes such as: Which kind of cookies shall we recommend to a customer given their shopping preferences? To large-scale, manufacturer’s dilemma, for example: How do we automate the production line in an individualized yet systematic manner? And finally, to the processing of building smarter, easier-to-use software that may even write code for you. Apart from assisted decision making, diagnostic and prediction, work of AI researchers and influencers have led to a hyperacceleration wave: Software powered by AI does not only achieve performances comparable to the human level, but creates something that would challenge an average person’s imagination and perception of their own abilities. A person can no longer tell apart the fake celebrity faces generated by generative neural networks from the real ones, or need not remember the name of every function they will use when writing a script. Imaginably, the wide application domains and near-human performance of AI-powered software will cause a paradigm shift in the way people deal with their daily personal and professional problems. Although some of us are pessimistic about, or in some extreme cases, consciously avoiding a world with overwhelming AI-powered software, there is not so much room for an escape. Amazon, Google, and even your favorite neighborhood florist, are actively (and sometimes secretly) using AI to generate revenue. Face it, or be left behind. What would you do if you were BMW today? "At this point, no one can reliably predict how quickly electromobility will progress, or which drive train will prevail... There is no customer requests for self driving BEVs. (electric vehicles)" CEO, BMW A classic trap most big enterprises with established business fall for is getting micro-focused on existing business segments while losing sight on the slowly eroding economic and business climate. Tesla's story as an electric car is known to all but many may not know that it is the self-driving feature and the heavy use of AI in both software and hardware where the secret sauce lies. They have already driven 10 billion electric miles and the cars are collecting all the more data to disrupt not just the automotive markets but its adjacent markets in manufacturing, servicing, sales and in general mobility. Tesla's AI is eating all other automotive industry's business. A few weeks later after his annual address, the BMW chief had resigned. CEO's and executives who however do wish to proactively adopt AI should do the following 5 things Concluding thoughts 1) Have your AIPlaybook Ready Last year I did a keynote panel together with a few industry peers and I was asked if AI could eat software and I said "Yes". Take a listen. Any company that is not in possession of its AI Playbook, that is not armed with data, algorithms and machine learning models, is certainly going to find itself in serious quandary. An example of an AI playbook is to assess your firm's maturity thoroughly and plan for ROI driven projects. AI Playbook deepkapha.ai 2) Upskill and/or hire a (good) data science team Upskilling your staff to be able to drive your AI transformation is the key to success for any organization aspiring to become an AI company. We've advised several large-scale data-intensive projects and here are a couple of key arguments that executives should take to heart. In a couple of years embracing AI is not a matter of trend riding, but survival; To survive an era in which AI is dominating both market and software, CEOs and executives need to level up their mindset for successful adoption and application of AI within their enterprise, for which they either have to upskill or find a good data science team; Know your game: A good team helps you understand how AI will make your company survive; Examples are abundant in the industry and it is key for companies to pay attention to latest trends and launch several smaller projects to extract out the key projects that can be industrialized at scale. 3) Develop Algorithms & Execute Your Data-Play From Day 1 Upgrading your technical infrastructure that can develop the latest AI algorithms, process large quantities of heterogenous datasets, build and train both industry benchmarked and novel AI models is an important first step. Once that is established it is very critical to develop meaningful dialog channels to envision and dream project ideas that are pain killers and dive directly into solving those problems with data. Finally, executing from Day 1 on the "good-enough" data models and algorithms is where a true AI company can define its momentum and gain sizeable lead from its nearest competition. 4) Implement a distributed knowledge structure As access to the right data is a key to valuable AI solutions, ensuring access to data generated or acquired within the company and outside will be of crucial importance. Following this realization, pharmaceutical companies are starting to create central repositories of the data gathered in their clinical trials. Consequently, their data science teams will have access to a structured knowledge database they can use to train AI algorithms. A second way to ensure the distribution of knowledge, is to set up a distributed collaboration structure. With the advent of software mimicking group processes from setting schedules, having meetings, or doing a brainstorming session, integration of knowledge and expertise should no longer be limited by geographical location. 5) Tap into AI start-ups with relevant knowledge Andreessen’s example of Disney buying Pixar in order to stay relevant has paid off for Disney, which sold for over 8 billion dollar in movie tickets this year, making Disney the second biggest media company (Forbes). Yet the latest developments suggest AI could also optimize movie-making processes. Moreover, as Disney is creating a consumer platform with Disney+, AI might form the necessary basis to ensure optimal usage of the data generated by this platform. When not wanting to build data science teams from scratch, collaborating with or taking over relevant start-ups might again be necessary for companies such as Disney to stay competitive. So yes, AI has started eating software. What are you going to do? ___________________________________________________________ About contributing authors Martijn v Attekum MD (Oncology) and PhD Dr. Martijn Van Attekum (MD, PhD) works as a data scientist in biomedicine at the University of Cologne. He is an experienced project manager and writer, and is skilled in genomics, oncology, and machine learning. As Visiting AI Researcher at deepkapha.ai he participates in ground-breaking deep learning projects on medical image analysis. In his free time, he is very much attracted to everything the mountains have to offer, such as climbing, hiking, and mountain biking. Jie Mei PhD Computational Neuroscience Dr. Jie Mei is a computational neuroscience researcher who has completed her studies at the Ecole normale supérieure and Charité Universitätsmedizin Berlin. She is currently based in Edmonton, Canada and is responsible for the growth of AI research department within deepkapha.ai and its companies. Her research interests include computational neuroscience, neurorobotics, machine learning and data analytics in healthcare and medicine. She is also an active startup advisor.

0 notes

Photo

New Post has been published on https://magzoso.com/tech/amazon-launches-audible-suno-free-app-featuring-short-stories-in-india/

Amazon launches Audible Suno free app featuring short-stories in India

Amazon is having another go at expanding its reach to listeners in India. The company, which launched pay-to-use Audible in the country last year, today introduced a new service called Audible Suno that offers free access to “hundreds of hours of audio entertainment, enlightenment and learning.”

And it’s banking on major Indian celebrities to draw the listeners.

Audible Suno, which is exclusively available to users in India, features more than 60 original and exclusive short episodes in both Hindi and English languages. Audible, the world’s largest seller and producer of audio content, said Suno is aimed at filling the “idle time” listeners have each day during their commutes and performing other daily chores.

The company says Audible Suno, available to users through a dedicated Android app and via iOS Audible app, is also free of advertisements.

The launch of Audible Suno in India illustrates the commitment the company has in the country, said Audible founder and chief executive Don Katz. Amazon has invested more than $5.5 billion in its business in India to date. The company’s tentacles today reach a number of categories in the country including e-commerce, payments, online ticketing business, video and audio streaming, and VC deals.

“I’ve always been passionate about the transformative power of the spoken word, and I’m delighted to be able to offer this breadth of famous voices and culturally resonant genres with unlimited access, ad-free and free of charge,” said Katz.

Who are these famous voices you ask? Here’s the list: Amitabh Bachchan, Katrina Kaif, Karan Johar, Anil Kapoor, Farhan Akhtar, Mouni Roy, Anurag Kashyap, Tabu, Nawazuddin Siddiqui, Diljit Dosanjh, Vir Das and Vicky Kaushal.

Audible Suno currently offers shows in a range of genres, including horror (Kaali Awaazein), romance and relationships (Matrimonial Anonymous and Piya Milan Chowk), suspense (Thriller Factory), and comedy series (The Unexperts by Abish Mathew). Non-fiction series include interviews with some of the country’s biggest stars, and socially relevant subjects such as mental health, sex education and the rights of the LGBTQI+ community.

More to follow…

0 notes

Text

7 Smart Ways to Fund Your Small Business Online Without the Bank Loan Burden

Are you trying to arrange seed capital for a start-up business? Then by now you must have realized it is quite an arduous task. Over past few years, the economic crisis worldwide has forced startup promoters and investors to tighten their purse strings. Therefore it has now become very important that you think out-of-the-box to get your project financed. Most likely, a single source of finance might not be sufficient to fund your small business online. Rather it is always advisable that you try to source investments from varied channels. Compiled below are seven alternative ways that will set your business in motion, without you having to worry about the burden of a bank loan.

Raise Money from Close Ones

If you are running with a low budget, then the best way to fund your small business online would be knocking your close friends and family members. Though this is one of the most common means to finance a start-up, make you sure avoid the one grave mistake of approaching their family and friends without a proper business plan. This is a fatal error for sure! You might be very close with your loved ones, but you shouldn’t expect them to take the risk of funding a new business without knowing the future of their money. In order to make them feel comfortable, you should always approach near ones with a solid blueprint of your business idea. A fact-based estimation of expected financial returns can be useful too. Provide an upfront clarification about the perks and risks of funding a start-up. In all likelihood, this will reduce the chances of unpleasant experiences in the future.

You Can Try to Rope in a Sleeping Partner or an Investor

Whether or not someone would accede to the proposal of pumping money into your start-up business, will totally depend on the business model, its future prospects, and how well you sell your idea. A sleeping partner would provide the required funding, but being a partner, he/she will be entitled to business profits. An investor, on the other hand, would essentially look for a Return on Investment (ROI), while you remain as the single owner of the organization. You can consider a sleeping partner or an investor in the initial stages, as you can use their existing network to propel your business. No matter whatever the case is, you will have to be positive and stay focused on the growth and success of your new venture.

Fund Your Small Business Online Through Crowdfunding

Though crowdfunding is not a long-term funding mechanism, it can still be an effective way to fund your project. If you are associated with one-off creative projects, such as documentary films, music albums, or a book release, then try crowdfunding to source business fund without much hassle. There are a host of sites that offer project creators an opportunity to raise money at a relatively low cost. People from around the world use crowdfunding sites to pledge their support for a range of creative projects, in return for a complimentary gift like a book, t-shirt, or an album copy. You can look at crowdfunding as a donation to promote innovative ideas, rather than a traditional business investment. However, if you are in a business that involves creativity, you can get your project funded in a matter of days, or even minutes.

Look For Venture Capital

Venture Capitalists, commonly known as VCs, are always looking for highly scalable businesses, which have the potential to grow into large corporations of tomorrow. If you have a unique idea that stands out, then you can approach a venture capital firm to fund your small business online. This band of investors, provide debt-free money to emerging start-ups, in exchange for a share in the business. VCs can ask for anything between 10 per cent to 30 per cent equity in the company, depending on the viability of the business and the risks involved. Venture capital firms are also answerable to their financiers. Therefore, they demand an active role in the company’s management as well. A controlling power in the management of the business, helps them secure the interests of their lenders. This, in most cases, is non-negotiable. You will need a DPR (Detailed Project Report), highlighting the financial projections of the business, in order to pitch your idea to a venture capital firm.

Give Thought to ‘Factoring’ to Fund Your Small Business Online

Factoring is a financial arrangement, whereby an enterprise sells its bills to a finance company, which facilitates an upfront payment of the bills before its due date. The finance institution normally charges a fee of 1.5 per cent to 2 per cent for reimbursing an enterprise’s receivable invoice 30-days in advance. If your company is suffering a cash crunch due to high order volumes then bill discounting can prove to be highly beneficial. Bill discounting is a seamless method to fund working capital requirements. However, the system is working out to be an expensive proposition for most companies in the era of an economic slowdown. The good news is, a variety of alternative options are rapidly evolving in the financial ecosystem, which promise to make the Factoring landscape more competitive. One such discounting method is The Receivables Exchange. You can try this new process to offer receivable invoices to a number of financial intermediaries at the same time, e.g., banks, hedge funds, and other non-banking finance companies. The finance institutions then bid on the bills that you have offered, and thereafter, the discounting contract is awarded to the most competent bidder.

Get in Touch With Angel Investors

An angel or a seed investor can come in different avatars, may be a friend, a family member, or a complete stranger. Angel investors are basically rich, well-to-do individuals who fund start-ups in exchange for an ownership in the business. Even though the pattern looks similar, this route slightly differs from venture capital. In case of raising money through venture capital, start-ups have to approach a VC firm. In the case of angel investment, businesses are often approached by angel investors. Another difference is, you can negotiate with an angel investor to leverage a better contract. But with venture capitalists, there is practically no scope of negotiation. Angel investment is primarily a trust-based funding mode. Therefore, your goodwill has a critical role to play. Besides futuristic business plans and projections, a clean repayment track record can open the door of your business to a host of angel investors. Angel investment, over the years, has remained the backbone of top-notch start-up enterprises. You too can use the financial support to your advantage to fund your small business online.

Try to Apply For Grants and Subsidies

If you have an idea that benefits the public, then your small business might be eligible for special grants. There are several government bodies and non-governmental organizations that offer grants to businesses if they meet certain qualifications and eligibility requirements. For instance, if your emerging businesses is related to waste management, renewable energy, or artificial intelligence, then you can apply for grants from both government and non-governmental organizations. Since grants are not required to be paid back, you should be prepared to face stringent guidelines and monitoring measures. These are to make sure that the recipient of the grant is using the funds for the purpose it was offered for. While applying for a grant you need to go through a tiresome process. It is, nevertheless, an excellent way to fund your small business online. Here’s a summary of all 7 ideas to fund your small business online – Raise Money from Close Ones Try to Rope in a Sleeping Partner or an Investor Fund Your Small Business Online Through Crowdfunding Venture Capital Consider ‘Factoring’ to Fund Your Small Business Online Angel Investors Grants and Subsidies Irrespective of which route you take to fund your small business online, your attention should be entirely focused on the business, its growth, and profitability. Let us know what’s your top pick to fund a small online business? If you are interested in any sort of business collaboration with OnliSmallbiZ then simply fill up the contact form to connect with us immediately! Read the full article

0 notes

Text

SEO Tips And Tricks To Grow A Website From Zero To Hero to Be In The Future in 2018

Search Engines Optimization (SEO) can play an important part in making increased exposure of a blog and ensuring a high ranking in search engine results pages (SERP) as a mark of good traffic. Here we are discussing some SEO tips to boost traffic and conversion. All bloggers and webmasters are aware that SEO techniques are constantly changing and they need to update fast with the latest techniques. Beyond the basic operations, SEO engineers are also called upon to use comprehensive analytics to gauge demographic information and glean other vital metrics concerning visitors who have interacted with a website. Such a broad analysis will expose the paths users take in completing a sale, as far as E-commerce sites are concerned. It will also bare the keyword used for search before making purchasing decisions. For executing an effective SEO strategy, good knowledge of On-page SEO and Off-page SEO is essential in ensuring high ranks for targeted keywords in the SERPs. Double Your Traffic with Latest SEO tactics

picture credit According to renowned web and digital marketing expert Neil Patel, SEO is crucial in lifting traffic and brand awareness. The bulk traffic of a website comes from search queries. The stats by HubSpot put that traffic volume to be 80 percent stressing that SEO is indispensable for websites. But SEO calls for a lot of research and experimentation. This is because algorithms of Google undergo regular updates. Staying tuned to the latest buzz is more important. On a day, Google conducts over 3.5 billion searches. In the United States alone there are close to 80 percent people using the web to research products and services prior to buying. Once a website start ranking in the first pages of Google SERP, there is a guarantee that visibility is assured. It also reassures good traffic, more conversions, business and higher revenue. But appearing on the first page of the search results is a hard work as 75 percent of users will never want to see the second page! This calls for working out an SEO action plan in concert with an exhaustive SEO guide. Huge Close Rate from SERPs It is estimated that the first three organic search results of a SERP will carry 60 percent of all traffic from a web search. The close rate of leads coming from a search is a huge 14 percent, compared to 1.7 percent from print or direct mail advertising. Surefire SEO Tactics

picture credit There are so many advanced SEO tricks to increase search traffic. But getting more visitors is the only way to convert more people into customers. Other conversion optimization tools accompanying traffic are a clear lead capture form, a sales page, and descriptive product pages. Some curative steps for any website in getting better traffic will have these steps. SEO Audit of the website Learn what users want Make SEO optimized landing pages Make website mobile-friendly Grow traffic with infographics Optimize content for RankBrain Link to external sites of high Domain Authority Use competitors’ SEO keywords Revise old articles to bring more organic traffic Use AdWords copy in on-page SEO Play up multiple keywords in SEO page titles Regularly updated old content Have content of words up to 2000 Post valuable content on social media Advanced SEO internal deep linking Offer link juice to lower ranked pages SEO Audit of the website: W a website audit is crucial in assessing what all SEO tips and tricks need to be applied if there is a lag in search traffic, ranks, and sales. All SEO companies offer this service but if it is done DIY, a lot of money will be saved. In general terms, auditing is a systematic examination for looking into the current position to make smarter decisions to go ahead in the future. Google search will also throw up similar niche blogs with link building opportunities. Blog Commenting Blog commenting is the oldest link building technique for off page SEO. You can easily build high-quality backlinks through blog commenting and finding similar blogs is not so tough. The following format will help. Keyword “comment here” (e.g. SEO tips “comment here”) Keyword “submit comment” Keyword “Powered by BlogSpot” Keyword “Post a Comment” Keyword “leave a comment” Keyword “Powered by WordPress” Keyword “add comment” Using third-party tools also help in tracing niche blogs with the following URLs. http://linksearching.com http://dropmylink.com http://botw.org Brian Dean’s Traffic Boost Tips In this analysis of latest SEO technique that hikes traffic and conversions, the views of Brian Dean as the CEO of Backlinko is very pertinent. Backlinko is a case study in the science of attracting huge traffic. It turned two years in 2018 and the site surpassed the goal of targeted 30,000 visitors a month. In reality, it got a traffic growth that is humungous at 85,000 to 90,000 a month. In his view on the current trends in SEO, Dean says it is a throwback to the best practices in the past. Google’s Penguin updates of April 2012 targeted link spam and wiped out millions of sites marking the search giant’s war against blackhat SEO that was thriving on spurious links. Before Penguin, thousands of site owners used black hat SEO to get huge ROI. Google figured this out and kicked out falsely-acquired search rankings and sites saw rankings nose diving. Old Formula for Quality Traffic

picture credit In the past, the right formula for quality traffic was building a great site, writing content around targeted keywords, using email outreach to yield backlinks to the site. Dean says this is demanded even today. Barring the short interval that let some manipulative people cheat the system via link spamming things are going back to the good old days. A lot of VC money is coming into AdWords, notes Brian. But he warns Adwords as a quick fix for big traffic while SEO still undoubtedly the horse for a long haul marathon. While SEO scales with people, Pay Per Click scales with a budget and they are totally different things. SEO for Long-Term Benefit

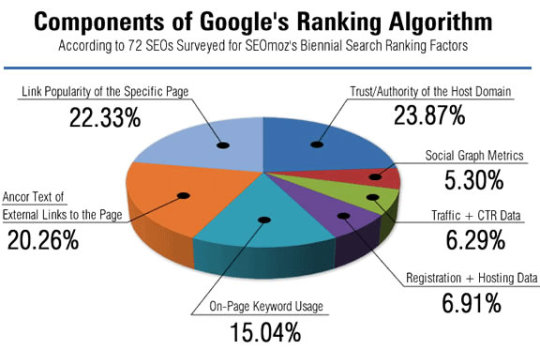

picture credit Pay Per Click is like throwing something into a fire. Once the throw stops, the fire dies out. But in SEO, the benefit stays longer and dividends will last for many years. In building quality traffic to a quality piece of content, Brian’s rule of thumb is spending 20 percent of the time in writing the content and devoting 80 percent time in promoting it. So, on an average, he spends two hours in writing and 8 hours in the promotion. But for a more competitive keyword, the promotion may still go up. A priority area for Brian is sending at least 250 emails for each post that he publishes in addition to the stock email list. He admits a lot of hard work in it plus tricks to scale up. Using BuzzSumo a few keywords related to niche pieces of content are searched to know what content has done well in social media and he will trace the shares. Sorting those Twitter shares and the names of people who shared a piece of content similar to the one to be promoted will do rest of the work. An assistant can trace out the email IDs and send them to people with a simple email text, “Hey, I noticed you shared , I have .” The email list that he built over six months boosted the traffic. Now he is taking 200 e mails a day. Parallel to the email outreach for new content, Brian did upgraded content on his site for making a bonus piece of content related to the blog post he has attached. Readers could receive that bonus piece free for exchanging their email address. Google Ranking Criteria Blog

picture credit Dean’s most popular blog post was on Google ranking criteria that had email conversion rate of 0.4 percent. After the content upgrade, it went up to 5.5 percent. He also leveraged skyscraper technique. “Before I this I really struggled with content marketing,” he notes. The ingredients of this technique have three main steps Discover content in a niche already performed well Use the base of a well-performed content and improvise it Promote it with outreach to people who shared the content Backlinks created a post called Google’s 200 Ranking Factors. Before penning this post, Brian studied posts speculating 200 factors but no one compiled all 200 most and stopped at 120-150. So reworked the content better by writing all 200 including speculative items and reached out to people who had early shared blogs that contained 120-150 factors. Brian’s post earned 250 quality backlinks and generated 15,000 unique visits a month on its own. That made him so popular that he was invited as a speaker at a big conference in London. Brian says getting quality traffic need not be a grind as in a timetable of publishing every Thursday to get high traction. “I think you can completely transform your rankings, your business, and be perceived as an expert with one post.” SEO Trends Outlook In Brian’s outlook SEO will not change much in the next 12 months. He insists there were no big changes in the last 12 months and link spamming is gone. The Hummingbird update was not so drastic and Penguin update was a refresh of the existing one. Dean says the promotion of the content will be the key and it makes a huge difference on the ground when combined with SEO. Read the full article

#advantagesofseo#benefitsofSEO#FutureofSEO#rankingthroughSEO#seoguide2018#SEOhacks#seosolutions#SEOstatistics#SEOstats#SEOstrategy#SEOtechniques#SEOTipsAndTricks#SEOTipsAndTricksToGrowAWebsite#SEOtipsforfuture

0 notes

Text

Founders need stewards, not masters

“I’m just going to drive off this bridge. My wife can get the policy. My wife and daughter will be okay …”

In the world of venture capital and startups, there’s always an ongoing dialogue of value and power, perceived and real. Because founders and VCs spend all of their time in a human-behavioral cluster where the sole focus is on equity, they often act in ways that are fundamentally broken. I’m writing this today, with the blessing of a brother and friend, to call out some truth that I believe many in our industry need to hear.

My message to VCs reading this: Founders are more than their companies, and truly honoring them is not just something to think about. It’s a requirement of the role you’re privileged to have. My message to founders: You’re more than your companies. It’s that simple. While you likely have poured and will continue to pour your lifeblood into the pursuit of your vision every chance you get, you have been, you are, and you always will be more than the business.

It’s spring of 2016, and Clarence is actually breaking in. This “knock down walls” determined Black man from Decatur, Georgia is doing it. He’s taken what was just an idea and made it into a legitimate, angel-backed, startup company that’s going through Village Capital, a notable accelerator program in Washington, D.C. Not only that, but after meeting with a local VC firm with a $100 million+ fund, he’s now holding a signed and countersigned term sheet for a $4.5 million round. All the promises he made to friends, family, angels, his wife, himself … are about to pay off. Let’s go!

In venture capital I hear many of my colleagues, myself included, talk a lot about empathy. I’ve had limited experience as an operator, but I still question my own ability to truly have empathy for what founders often go through — just to get a shot at their massive, game changing, odds-stacked-against-them dream. Sure, many of us affectionately talk about the months of not taking a salary and maybe trading in a restaurant meal for some cup noodles … but I’m talking about understanding the tough conversations with a husband, partner, or wife … begging for the trust to let you do this stupid thing. I’m talking about not just going without salary, but doing so when you haven’t already “made it” … AND blowing out your savings … AND going into serious debt. I’m talking about never not working, missing out on your kids, your significant other, your health. I’m talking about the emotional exhaustion of finding a ride or die co-founder, and truly, truly being ride or die. I’m talking about accepting money from friends and family who are just betting on you for the sake of you, and knowing that for them the money they’re giving you … it’s not small. I’m talking about with every moment of doubt along the journey having to find the strength, determination, and conviction to not just carry your own emotional well-being, but that of all those who’ve trusted you.

It’s September now, and spring seems like ages ago. That being said, these venture investors are still saying they’re super excited — they just needed to clean some things up. LLC to C-Corp, some new diligence, etc. Also, now they’re saying, although they’re still “ready to rock,” the round is going to be $2.5 million … at a lower valuation … and something about $500,000 in warrants?

Over four months later this feels weak … But, after all the 100-hour weeks strung together, all promises made to the loving but frustrated wife, all the tens of thousands of dollars now in debt to chase this — it’s just one more time biting the bullet.

Right?

Anyway, Clarence is still ready to go. He’s holding up his end, and with a new signed and countersigned term sheet in hand he says, “Yo, let’s go win. Let’s do this!”

As a venture capitalist, I sit in a seat of privilege. Like many other partners at firms like mine, I talk to hundreds of startup founders a year that look to me and see someone who can open the door. Who can unlock their dreams. Who can put them in the game, and perhaps coach them or even play alongside them on their path to punching a hole in the universe. Some VCs manage this dynamic well, but many see this dynamic of real or perceived gatekeeping potential, position of power, or “benefit of supply and demand” as an opportunity to be … well … predators.

VB Transform 2020 Online – July 15-17. Join leading AI executives: Register for the free livestream.

It’s gross.

I fundamentally believe that this dance that we as VCs and founders do is all about the people. It’s all about the relationships, the trust, the crazy things we can accomplish together when 1+1 = 17, and we figure out together how to make that scale. So often, without trust and people really looking out for each other, that’s just not possible. If you’re an investor and you think “oh, so and so is less sophisticated than me, I bet I can slip in this term that I wouldn’t try with someone else,” please think about that some more. Clarence, like many diverse founders, experienced what is honestly unfortunately common among them (but certainly not exclusive to them). VCs often go straight to ROI math when they think they have something, and rather than think about “how do I honor the person who’s about to trust me with their life’s work by putting something together that’s fair and sets us both up to win,” revert quickly to “how do I extract the most value from this.”

VC is a long-term game.

Can we agree that shouldn’t just be taken into account regarding the path to liquidity?

The phone rings, and Clarence picks up. It’s the person at the firm he’s been working most closely with.

“I know we’re close, but we have a co-investor we want to bring into the deal. Can you be in D.C. tomorrow to meet with them? We’ll get this all closed soon after.”

With the ‘No Shop’ clause that comes with a signed term sheet, Clarence has been kept from talking to any other investors for six months now. Not only does he not have any other investor conversations going, but it would be really hard to explain why the round that was agreed to so long ago might not be happening now. Even though this is … ridiculous … and frustrating … what other choice does he have?

Clarence, based in Minneapolis, thinks on it for a moment, and then does what any good founder would do.

He books a red-eye flight and is there the next day.

Often I think investors look at what founders are willing to do to get things done, and they just lean in. They look at what founders have sacrificed, or are willing to sacrifice, and they just accept it without another thought. As if all the founder had going for them was the company anyway.

Guess what?

That’s never true.

The hour a founder takes for the additional five slides you want done because of how you think a board deck should look doesn’t just come from nowhere. It comes from her kids, from his partner, from her sleep. The flight they’re willing to get on to meet in person or to show up at some networking event doesn’t just come out of the company budget. It comes from their life budget. The dilution they’re willing to take to get a deal done so you can get one more syndicate buddy in isn’t just cap table math. It’s a slice of the heart. Just because founders are willing to do whatever it takes, doesn’t mean it should take the max.

Founders need partners that approach them as stewards, not masters.

It’s now October, and Clarence gets the call he’ll never forget. He closes the door to the bathroom to get some privacy, and sits on the throne as he receives the message.

“… didn’t go well with the co-investor … things are changing … doesn’t seem like we’ll be able to make this work …”

In a state that can only be described as calm shock, Clarence let’s the words of “We’re out” wash over him as he turns over in his head all the people he needs to tell … his employees, his investors, his wife, everyone that’s going to be affected by the fact that there’s no investment coming in, six months after expecting nearly $5 million, and the company will be out of money in 3 months now.

Clarence stumbles through politely saying “okay, I understand …” and hangs up the phone. He tells his wife what happened, he kisses his daughter on the head, and he gets in the car.

Whether you’re a founder or VC reading this, I ask you to think about two words.

Stewardship and Grace.

For venture capitalists, if there’s one thing you could commit to today that I believe will make you a great partner going forward, it’s to look at founders with the intention of being a good steward of not just your resources, but theirs. Care about them enough to honor them with transparency, quick decisions, honest feedback, genuine priority of their well-being, and protection. Protection of what they could give up to pursue their dreams, but don’t need to.

And, have grace. Most founders are not as sophisticated as you on best practices, investment terms, all things “winning the deal.” Have the grace to make space for them not to be perfect negotiators, and still be able to not have to accept the worst possible offer. Honor them, before they “earn it” from you. If you want to ask me how best to be an ally of founders who are Black, Brown, or otherwise diverse, this may honestly be it. While this issue is not unique to them, they are the ones most exposed and at higher rates to this sort of mistreatment and being taken advantage of.

For founders, again, it’s simple: Be a good steward of yourself. Show yourself grace. It may not feel like it in the heat of the furnace, but you are more than your company. No one would have followed you on this crazy journey if it wasn’t true and they didn’t believe it themselves.

Tears in his eyes, pain in his chest, Clarence gets on Interstate 35 E. “I don’t want to be here anymore,” he thinks in his head. He put in so much work … He did everything he was asked to do … He was truthful … He was a good person …

Now his family is $50,000 in debt because of him. Now his friends and family and angel investors who trusted him shouldn’t have. Now his wife, who loves and trusts him maybe did so to a fault, and is going to suffer the consequences. Now his team, who all need to feed their families too, are going to regret ever trusting him with their literal livelihood.

He’s southbound now, barreling down the highway at 130 mph. There’s a bridge coming up, he knows, with a huge drop off.

“I’m just going to drive off this bridge. My wife can get the policy. My wife and daughter will be okay …”

He’s maybe a mile away from the bridge now. He clamps the wheel tighter, turning his Black knuckles white.

“… I’m gonna drive off. It is what it is …”

Then, out of nowhere, Clarence hears a voice.

“Slow down, you’re going to be fine.”

Startled, Clarence keeps going.

“Slow down, I got you.”

Suddenly, Clarence starts feeling the wildest sensation. He feels the gas pedal pushing back against his foot. Against him.

“You’re going to be alright. Just keep going home …”

Clarence pulls the car over and just weeps.

Truly. Weeps.

Clarence has always been a man of faith, and in that moment there’s no doubt in his mind that Jesus showed up for him.

God stepped in.

While I don’t expect everyone reading this to be a Christian, I do believe that all of us as VCs or founders consider ourselves to be good people. Whether you believe it to be God’s work, or the mission of good people, I think it’s important to recognize that stewardship and grace are paramount if you’re going to be a positive force in our work.

While it’s tough to draw clear, direct correlation between entrepreneurs and suicide risk, it’s well understood that through characteristics and experiences that founders share (i.e. impulsivity, emotional volatility, social isolation, rejection and failure), suicide is more likely a concern for them than the average person. If you’re a founder (or anyone) reading this and have had thoughts of suicide, please, please don’t go through this alone. Talk to someone you love, visit the National Suicide Prevention Lifeline, and call 1-800-273-8255 to talk to someone who can listen and help. Confidentially. Completely free. That being said, far before suicide is even a question, we can find opportunities to reclaim founders’ abilities to enjoy physical, mental, emotional, and spiritual health.

That day in October, 2016, six months after holding that first signed term sheet, Clarence went home and wept. Today, Clarence wakes up to a life that, as a poor Black kid outside of Atlanta, he didn’t know existed.

He wakes up in a beautiful home, kisses his wife and kids, grabs a coffee, and steps outside to sit on his porch and watch the sunrise. This grinder didn’t quit grinding.

With the support of his wife, and the hard work and fortitude that only exists truly in founders, he has closed $7 million+ in venture funding with a top seed-stage venture capital firms leading his last round.

He hugs and kisses the son that would not have been born if not for him pulling over that day. If not for divine intervention.

With grace, Clarence looks back and forgives those that hurt him so badly in the past. He moves forward, unburdened, with the support of investors who love him. Who steward him. Who show him grace.

As someone who knows Clarence personally, I was truly shocked upon hearing his story today. He’s one of the most dependable, stable, bright-eyed and motivating founders I’ve ever had the pleasure of knowing. It’s for this reason I think it’s even more worth underlining how this grind we call entrepreneurship can get to anybody.

Clarence, I’m so honored by you. I’m honored by you letting my firm partner with you in your journey. I’m honored by you allowing me to share your story.

To all the venture capitalists out there, I hope you truly hear this. While we often forget founders are more than their companies, they are. So much more. And while we often find ourselves doing ROI math, it’s not enough. We’re all in a place of privilege in this life, and while we’re all likely to do financially well, I believe there is a right way to do well by our founders. Through stewardship and grace, and through attaching long-term thinking to the people and not just the path to liquidity, we can, should, must honor founders.

And founders …

please …

don’t ever forget.

You are more than your company.

[To read more from Mike Asem and/or to subscribe to his blog, follow this link.]

Mike Asem is a Partner at VC firm M25, which focuses on seed-stage Midwestern startups in most industries, and is a board member of BLCK VC, which connects, engages, empowers, and advances Black venture investors.

Source link

قالب وردپرس

from World Wide News https://ift.tt/3gzw9tY

0 notes

Text

Amazon launches Audible Suno free app featuring short-stories in India

Amazon is having another go at expanding its reach to listeners in India. The company, which launched pay-to-use Audible in the country last year, today introduced a new service called Audible Suno that offers free access to “hundreds of hours of audio entertainment, enlightenment and learning.”

And it’s banking on major Indian celebrities to draw the listeners.

Audible Suno, which is exclusively available to users in India, features more than 60 original and exclusive episodes (of 20 to 60 minutes in length) in both Hindi and English languages. Audible, the world’s largest seller and producer of audio content, said Suno is aimed at filling the “idle time” listeners have each day during their commutes and performing other daily chores.

The company says Audible Suno, available to users through a dedicated Android app and via iOS Audible app, is also free of advertisements.

The launch of Audible Suno in India illustrates the commitment the company has in the country, said Audible founder and chief executive Don Katz. Amazon has invested more than $5.5 billion in its business in India to date. The company’s tentacles today reach a number of categories in the country, including e-commerce, payments, online ticketing business, video and audio streaming and VC deals.

“I’ve always been passionate about the transformative power of the spoken word, and I’m delighted to be able to offer this breadth of famous voices and culturally resonant genres with unlimited access, ad-free and free of charge,” said Katz.

Who are these famous voices you ask? Here’s the list: Amitabh Bachchan, Katrina Kaif, Karan Johar, Anil Kapoor, Farhan Akhtar, Mouni Roy, Anurag Kashyap, Neelesh Misra, Tabu, Nawazuddin Siddiqui, Diljit Dosanjh, Vir Das and Vicky Kaushal.

Audible Suno currently offers shows in a range of genres, including horror (Kaali Awaazein), romance and relationships (Matrimonial Anonymous and Piya Milan Chowk), suspense (Thriller Factory) and comedy series (The Unexperts by Abish Mathew). Non-fiction series include interviews with some of the country’s biggest stars, and socially relevant subjects such as mental health, sex education and the rights of the LGBTQI+ community.

Amazon’s Audible expands its original programming with new comedy series

from iraidajzsmmwtv https://ift.tt/2qKj2Sq via IFTTT

0 notes

Link

Amazon is having another go at expanding its reach to listeners in India. The company, which launched pay-to-use Audible in the country last year, today introduced a new service called Audible Suno that offers free access to “hundreds of hours of audio entertainment, enlightenment and learning.”

And it’s banking on major Indian celebrities to draw the listeners.

Audible Suno, which is exclusively available to users in India, features more than 60 original and exclusive short episodes in both Hindi and English languages. Audible, the world’s largest seller and producer of audio content, said Suno is aimed at filling the “idle time” listeners have each day during their commutes and performing other daily chores.

The company says Audible Suno, available to users through a dedicated Android app and via iOS Audible app, is also free of advertisements.

The launch of Audible Suno in India illustrates the commitment the company has in the country, said Audible founder and chief executive Don Katz. Amazon has invested more than $5.5 billion in its business in India to date. The company’s tentacles today reach a number of categories in the country including e-commerce, payments, online ticketing business, video and audio streaming, and VC deals.

“I’ve always been passionate about the transformative power of the spoken word, and I’m delighted to be able to offer this breadth of famous voices and culturally resonant genres with unlimited access, ad-free and free of charge,” said Katz.

Who are these famous voices you ask? Here’s the list: Amitabh Bachchan, Katrina Kaif, Karan Johar, Anil Kapoor, Farhan Akhtar, Mouni Roy, Anurag Kashyap, Neelesh Misra, Tabu, Nawazuddin Siddiqui, Diljit Dosanjh, Vir Das and Vicky Kaushal.