#rice bran oil market india

Explore tagged Tumblr posts

Link

#adroit market research#rice bran oil market#rice bran oil market size#rice bran oil market trends#rice bran oil market india

0 notes

Link

#adroit market research#rice bran oil market#rice bran oil market size#rice bran oil market trends#rice bran oil market india

0 notes

Link

The company is planning to use 50% of the production capacity for the captive use and remaining will be for corporate buyers.

#adroit market research#rice bran oil market#rice bran oil market size#rice bran oil market trends#rice bran oil market india

0 notes

Text

The economic impact of agri-policy changes on Indian rice farmers

Rice farming, the backbone of India’s agricultural economy, has always been sensitive to the influence of government policies. Over the years, initiatives like the Pradhan Mantri Krishi Sinchayee Yojana (2015), which sought to improve irrigation efficiency and expand water availability, and the Agricultural Marketing Reforms of 2020, aimed at increasing farmers’ access to broader markets, have profound economic implications. While these policies have driven progress in sustainability, infrastructure, and market accessibility, they also present challenges, including the need for farmers to adapt to new frameworks and navigate fluctuating market conditions.

As a trusted partner to the agricultural sector, Halder Venture Limited collaborates closely with rice farmers to procure premium-quality rice bran, essential for its rice bran oil production. By promoting sustainable practices and fostering economic resilience within farming communities, Halder Venture Limited not only ensures quality raw materials but also strengthens its commitment to supporting farmers amidst evolving policy landscapes.

1. Key Agri-Policy Changes and Their Economic Impacts

Minimum Support Price (MSP) Adjustments

The MSP for rice, revised annually, provides farmers with a safety net against fluctuating market prices.

Positive Impacts:

Increased MSP levels boost farmers' incomes, encouraging higher production.

Stable pricing mechanisms reduce vulnerabilities to market volatility.

Challenges:

Delays in procurement by government agencies compel farmers to sell to middlemen at lower prices.

High dependence on MSP has created regional disparities, with procurement primarily focused in states like Punjab and Haryana.

Subsidies on Inputs

The government subsidises inputs such as fertilisers, seeds, and electricity, making them more affordable.

Economic Benefits:

Reduced production costs enhance profit margins.

Easy access to quality inputs improves yields, increasing overall income.

Drawbacks:

Overuse of subsidised fertilisers has led to soil degradation, impacting long-term productivity.

Subsidy reforms, such as Direct Benefit Transfers (DBTs), require technological adoption, which small-scale farmers may find challenging.

Water Management Policies

Given that rice is a water-intensive crop, policies promoting sustainable water usage have been introduced, such as the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY).

Economic Benefits:

Improved irrigation techniques reduce dependency on expensive water sources, lowering input costs.

Policies supporting the adoption of alternate wetting and drying (AWD) methods improve efficiency.

Challenges:

Adoption of water-efficient methods requires initial capital investment, often unaffordable for marginal farmers.

Poor implementation in drought-prone regions limits policy effectiveness.

Export Promotion Policies

India is the world's largest rice exporter. Policies promoting rice exports, such as easing export restrictions and offering incentives, have boosted farmers' income.

Positive Effects:

Expanding export markets increases demand, raising rice prices.

Higher foreign exchange earnings support rural economies.

Concerns:

Export restrictions during domestic shortages can destabilise farmer incomes.

Quality standards for exports often require additional investments in production and processing.

2. Challenges Due to Policy Gaps

Market Access Issues

Despite government support, access to remunerative markets remains a significant challenge. The following are the reasons behind it:

Inadequate storage and transport facilities lead to post-harvest losses.

Small farmers are often excluded from export supply chains, limiting benefits from export policies.

Environmental Concerns

Policies encouraging monoculture (primarily rice) have led to:

Soil nutrient depletion.

Groundwater depletion in water-scarce regions.

3. Recommendations for Balanced Policy Impacts

Diversification of Cropping Patterns

Encourage crop diversification by incentivising farmers to grow less water-intensive crops alongside rice.

Improved Infrastructure

Invest in modern storage facilities and efficient supply chains to minimise losses and maximise farmer profits.

Farmer Education and Awareness

Provide training on sustainable practices, export quality standards, and financial literacy to empower farmers.

Technology Integration

Expand the use of technology, such as digital platforms, for direct market access and DBT schemes.

Conclusion

Agri-policy changes have brought both opportunities and challenges for Indian rice farmers. While policies like MSP revisions, subsidies, and export incentives have improved incomes and production, issues related to market access and sustainability persist. A holistic approach—combining policy reform, infrastructure development, and private-sector engagement—is essential to maximising the economic benefits for rice farmers.

0 notes

Text

Best Edible Oil Options for Maintaining Good Health in India

In today’s fast-paced lifestyle, making healthier dietary choices has become essential. One of the most significant yet often overlooked elements of a balanced diet is cooking oil. The oil you use not only affects the flavor of your meals but also plays a crucial role in your overall health. Choosing the best edible oil for health is vital, as the right oil can support heart health, manage cholesterol levels, and enhance the nutritional value of your food. With numerous options available in the Indian market, it’s important to make an informed choice.

Understanding the Importance of Cooking Oil

Cooking oil serves as a primary source of fats in most Indian households. Fats are a macronutrient essential for energy production, cell function, and absorption of fat-soluble vitamins. However, not all fats are created equal. Selecting the best cooking oil in India involves understanding its composition and health benefits.

The ideal oil for everyday use should have a balanced ratio of saturated, monounsaturated, and polyunsaturated fats. Additionally, it should have a high smoking point to preserve nutrients during cooking. Opting for a cooking oil for good health ensures that your meals are not only tasty but also nutritionally beneficial.

Top Edible Oil Options in India

Olive OilOlive oil, especially extra virgin olive oil, is known for its rich antioxidant properties and heart-healthy monounsaturated fats. While it may not be ideal for deep frying due to its low smoking point, it is an excellent choice for sautéing and drizzling over salads. Many consider it one of the best edible oil for health due to its ability to lower bad cholesterol and reduce the risk of cardiovascular diseases.

Mustard OilMustard oil has been a staple in Indian kitchens for centuries. Rich in omega-3 fatty acids and monounsaturated fats, it is a great option for promoting heart health. Its strong flavor and high smoking point make it suitable for traditional Indian recipes. As a cooking oil for good health, mustard oil also offers antibacterial and antifungal properties.

Coconut OilCoconut oil is versatile and widely used, especially in South India. Its medium-chain triglycerides (MCTs) are known for boosting metabolism and providing quick energy. It is also beneficial for improving gut health and boosting immunity. For those looking for the best cooking oil in India with multiple health benefits, coconut oil is an excellent choice.

Groundnut OilGroundnut oil, or peanut oil, is another popular choice due to its neutral taste and high smoking point. Rich in monounsaturated fats and vitamin E, it helps reduce oxidative stress and inflammation. As a cooking oil for good health, it works well for frying and sautéing without compromising nutritional value.

Rice Bran OilExtracted from the outer layer of rice, rice bran oil is gaining popularity as one of the best edible oil for health. It contains oryzanol, a compound known for reducing bad cholesterol and improving heart health. Its light flavor and high smoking point make it a versatile option for various cooking methods.

Key Considerations When Choosing Cooking Oil

Selecting the right cooking oil for good health involves more than just considering flavor and cost. Here are a few factors to keep in mind:

Nutritional Profile: Look for oils with high levels of healthy fats and minimal trans fats.

Versatility: Choose oils that can handle different cooking methods without degrading.

Source: Opt for cold-pressed or minimally processed oils to retain maximum nutrients.

Allergens: Be mindful of potential allergens, especially when using peanut or sesame oil.

Rotating between different oils can also provide a variety of nutrients while reducing the risk of overexposure to harmful compounds.

The Role of Cooking Oil in Heart Health

Heart disease is one of the leading health concerns in India, making it crucial to incorporate the best edible oil for health into your diet. Oils like olive, mustard, and rice bran are rich in unsaturated fats, which help maintain healthy cholesterol levels and reduce the risk of heart disease. These oils also contain antioxidants that combat inflammation, a major contributor to cardiovascular issues.

The key is moderation. Even the best cooking oil in India should be used sparingly to prevent excessive calorie intake, which can lead to weight gain and associated health problems.

Why Indian Diets Need the Right Oils

Indian cuisine is diverse, ranging from deep-fried delicacies to light and flavorful curries. The cooking oil you choose should complement these dishes while promoting health. Opting for a cooking oil for good health ensures that your meals retain their authentic taste without compromising nutritional value.

The best cooking oil in India not only enhances the flavor of your dishes but also aligns with modern dietary needs. Oils with high smoking points are essential for frying, while lighter oils are ideal for stir-frying and dressing salads.

Conclusion

Choosing the right cooking oil is one of the simplest yet most impactful ways to improve your health. From olive oil and mustard oil to rice bran oil and groundnut oil, the Indian market offers a range of options that cater to different culinary and health needs. By incorporating the best edible oil for health, you can create meals that are both delicious and nutritious.

Remember, the goal is not just to choose a cooking oil for good health but to use it wisely. Balance and moderation, combined with a healthy lifestyle, are the keys to long-term well-being. With so many excellent options available, finding the best cooking oil in India has never been easier!

0 notes

Text

Rice Bran Oil Market Opportunity, Driving Factors And Highlights of The Market

The global rice bran oil market size is expected to reach USD 6.25 billion by 2030, registering a CAGR of 3.7% from 2024 to 2030, according to a new report by Grand View Research, Inc. This growth is attributed to rising awareness about the health benefits of rice bran oil. Moreover, high product demand as a result of increased health consciousness and consumption of fat-free and nutritious food products will boost the growth further.

The food & beverage dominated the market in 2023. This is owing to rising usage of rice bran oil in various food and beverage products. On the other hand, the nutraceutical application segment is expected to grow at the fastest CAGR from 2024 to 2030.

The online segment dominated the market in 2023 due to convenience, wider access, improving internet connectivity and shifting customer trends. The offline market is expected to grow at the fastest CAGR from 2024 to 2030. Popularity of e-commerce sites and rising number of manufacturers establishing their own websites are driving the growth of this segment. The Asia Pacific region dominated the global rice bran oil market and held the highest market revenue share of 37.8% in 2023, driven by factors such as abundant rice production, increasing health consciousness, and a growing preference for natural and healthier cooking oils.

Gather more insights about the market drivers, restrains and growth of the Rice Bran Oil Market

Rice Bran Oil Market Report Highlights

• The non-organic dominated the market and accounted for a revenue share of 87.0% in 2023 and it is expected that it will keep growing in the rice bran oil market for the forecast period.

• The organic segment is expected to grow at the fastest CAGR of 4.7% from 2024 to 2030. Consumers are becoming more conscious of the health impacts of using organic products such as rice bran oil.

• The food & beverage dominated the market in 2023. This growth can be attributed to its exceptional nutritional profile, versatile cooking properties, health benefits, alignment with consumer trends towards natural products, sustainability considerations, market growth potential, and supportive regulatory frameworks.

• The online segment dominated the market in 2023 due to convenience, wider access, improving internet connectivity and shifting customer trends.

• The Asia Pacific region dominated the global rice bran oil market and held the highest market revenue share of 37.8% in 2023.

Rice Bran Oil Market Segmentation

Grand View Research has segmented global rice bran oil market report based on type, application, distribution channel, and region:

Rice Bran Oil Type Outlook (Revenue, USD Million, 2018 - 2030)

• Organic

• Non-Organic

Rice Bran Oil Application Outlook (Revenue, USD Million, 2018 - 2030)

• Food & Beverage

• Nutraceutical

• Animal Feed

• Others

Rice Bran Oil Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

• Offline

• Online

Rice Bran Oil Regional Outlook (Revenue, USD Million; 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o Spain

• Asia Pacific

o Japan

o China

o India

o South Korea

• Latin America

o Brazil

o Argentina

• MEA

o South Africa

Order a free sample PDF of the Rice Bran Oil Market Intelligence Study, published by Grand View Research.

#Rice Bran Oil Market#Rice Bran Oil Market Size#Rice Bran Oil Market Share#Rice Bran Oil Market Analysis#Rice Bran Oil Market Growth

0 notes

Text

Squalene Market Growth: Key Drivers, Opportunities & Insights

The global squalene market size is expected to reach USD 307.9 million by 2030, expanding at a CAGR of 10.9% from 2024 to 2030, as per the new report by Grand View Research, Inc. The industry is majorly driven by rising health awareness among the masses and continuously rising demand for squalene in personal care and cosmetics. Squalene acts as an emollient and provides nourishment to the skin. Moreover, it finds application in pharmaceuticals due to its ability to act as an anti-cancer and anti-oxidant agent.

Squalene is now largely produced from plants. It can be obtained from vegan sources such as sugarcane, rice bran, wheat germ, palm trees, and olives, with olives being the most popular. Although many businesses prefer squalene derived from plants, there is still a possibility that it comes from animals. The demand for the product from shark liver oil is still in the market because of its low cost. In the cosmetics industry, products such as perfumes, lotions, eyeliners, and eye shadows, contain squalene in the range of 0.1% to 10%, whereas other products such as foundations and lipsticks contain 50% of the product.

Gather more insights about the market drivers, restrains and growth of the Squalene Market

The usage of synthetic and plant-based squalene has been motivated by the growing concerns over the extinction of sharks. To create squalene from plants or synthetic processing, manufacturers are engaged in research & development. A supplier of natural component products for the cosmetics market, Sophim, invested USD 11.94 million to increase its production capacity. Two-thirds of the company's investment is to be made in Spain, where a production facility is planned to be built to treble the amount of squalene that can be extracted from olive oil.

With their antioxidant and anti-aging characteristics, squalene supplements can restore our skin, maintain cholesterol levels, and help in treating inflammation. They provide cells with the oxygen they require for proper metabolism and energy production at the cellular level. These supplements are also known to combat viruses, colds, and infections, thus improving overall health and well-being. With the onset of the COVID-19 pandemic, people have become more conscious about their health and immunity, thus increasing the demand for squalene in the pharmaceutical industry.

Browse through Grand View Research's Food Additives & Nutricosmetics Industry Research Reports.

The global salicylic acid market size was valued at USD 547.5 million in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030.

The global glutamic acid market size was valued at USD 12.55 billion in 2024 and is projected to grow at a CAGR of 8.6% from 2025 to 2030.

Squalene Market Segmentation

Grand View Research has segmented the global squalene market report based on source, end-use, and region:

Squalene Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

Animal

Shark Liver Oil

Other Animals

Plants

Amaranth Oil

Olive Oil

Rice Bran Oil Plants

Other Amaranth Oil

Synthetic

Squalene End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

Pharmaceuticals

Personal Care & Cosmetics

Nutraceuticals

Food & Beverages

Others

Squalene Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Russia

Benelux

Asia Pacific

China

India

Japan

South Korea

Vietnam

Thailand

Indonesia

Central & South America

Brazil

Argentina

Middle East & Africa

Saudi Arabia

South Africa

Key Companies profiled:

Amyris, Inc.

Sophim SAS

Henry Lamotte Oils GmbH

efpbiotek

Vestan Limited

Kuraray Co., Ltd.

Croda International Plc

AASHA BIOCHEM

Arbee

Oleicfat, s.l.

Kishimoto Special Liver Oil Co., Ltd.

Order a free sample PDF of the Squalene Market Intelligence Study, published by Grand View Research.

0 notes

Text

Squalene Industry - Technologies, Applications, Verticals, Strategies & Forecast 2030

The global squalene market was valued at USD 149.4 million in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 10.9% from 2024 to 2030. The increasing use of natural ingredients in personal care and cosmetic products is a primary driver behind this growth. Squalene, a natural organic compound, is highly valued in these industries due to its translucency, minimal odor, and strong moisturizing properties. These characteristics make it one of the most widely used emollients in skincare. Moreover, squalene’s non-toxic nature has further expanded its applications, making it ideal for use in various personal care products. In cosmetics, squalene oil is especially valued for its role in combating free radicals that damage skin cells and accelerate aging.

The European Union has banned shark oil-based products in cosmetics, which has pushed manufacturers to seek plant-based and synthetic alternatives for squalene production. Concern over shark population decline and the environmental impact of harvesting shark oil has led to increased demand for plant-derived squalene, primarily extracted from sources like olive oil, rice bran, and amaranth oil. Currently, about 65% of the world’s olive oil is produced, consumed, and exported within the European Union, making it a key region for squalene derived from plant-based oils.

Squalene-based adjuvants have been used in influenza vaccines for over 20 years due to their capacity to improve immune response, boost antibody production, and allow for lower doses of the main antigen. This ingredient has been widely recognized for its role in health emergencies, such as influenza outbreaks, due to its effectiveness as an immune enhancer. The COVID-19 pandemic further underscored its utility, as animal-derived squalene was included in COVID-19 vaccines for its immunity-boosting properties. Companies like GlaxoSmithKline (GSK) have established partnerships with other firms, including Sanofi S.A. and CureVac N.V., to facilitate the use of squalene in vaccine production.

Gather more insights about the market drivers, restrains and growth of the Squalene Market

Regional Insights:

Asia Pacific Squalene Market Trends:

Asia Pacific is anticipated to witness significant market growth due to the region’s access to raw materials, lower labor costs, reduced manufacturing costs, and the expansion of industries such as personal care, cosmetics, pharmaceuticals, nutraceuticals, and food and beverages. Countries like India, China, and Japan, which are abundant in raw materials like shark liver oil and olive oil, are emerging as leading producers of squalene for the market.

Europe Squalene Market Trends:

Europe led the squalene market in 2023 with a revenue share exceeding 32.8%, followed closely by the Asia Pacific region. The high share of the European market is largely due to the extensive production of olive oil, which is a primary plant-based source of squalene. Demand for squalene in Europe is particularly high in key economies like Germany, France, the UK, Italy, and Spain. Among European nations, Spain holds a significant portion of the region’s olive groves, which positions it as a major supplier for plant-based squalene. Consequently, European squalene manufacturers are shifting away from shark-based squalene toward plant-based sources.

France

In France, the pharmaceutical industry is notably influential in this market shift. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the pharmaceutical sector in France had one of the largest R&D budgets in 2021, with R&D spending representing 9.8% of total pharmaceutical revenue. Pharmaceutical companies in France are increasingly investing in research and development focused on creating eco-friendly medicines that utilize bio-based ingredients, a trend that is expected to increase the demand for plant-based squalene in the country’s pharmaceutical industry over the forecast period.

Germany

Germany also demonstrates strong demand for plant-based squalene. In 2020, the country imported approximately 85 tons of olive oil, driven by rising health-consciousness among consumers and the preference for plant-derived ingredients across various sectors. Major companies like L’Oréal in Germany have transitioned from animal-based to plant-based squalene in their formulations, aligning with consumer demand for sustainable and eco-friendly products.

Browse through Grand View Research's Category Food Additives & Nutricosmetics Industry Research Reports.

The global glutamic acid market size was valued at USD 12.55 billion in 2024 and is projected to grow at a CAGR of 8.6% from 2025 to 2030.

The global stearic acid market size was valued at USD 11.24 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030.

Key Companies & Market Share Insights:

The squalene market is highly fragmented and competitive, with major players concentrated in Europe and North America. However, numerous smaller players operate in the Asia Pacific region, where they benefit from proximity to raw materials, particularly shark liver oil and olive oil, which are essential for squalene production.

To extend their reach, major players are adopting partnership strategies. By collaborating with companies in different regions, they can leverage established networks to distribute their products more broadly. For example, in May 2023, Amyris announced a partnership with Croda International Plc. This collaboration aims to supply pharmaceutical-grade squalene for use in vaccine adjuvants, enhancing immune response. Such partnerships demonstrate the strategic moves by leading companies to expand their market presence while meeting the growing demand for high-quality squalene in various applications, from personal care to pharmaceuticals.

Key Squalene Companies:

Amyris, Inc.

Sophim SAS

Henry Lamotte Oils GmbH

efpbiotek

Vestan Limited

Kuraray Co., Ltd.

Croda International Plc

AASHA BIOCHEM

Arbee

Oleicfat, s.l.

Kishimoto Special Liver Oil Co., Ltd.

Order a free sample PDF of the Squalene Market Intelligence Study, published by Grand View Research.

0 notes

Text

Squalene Market 2030 Top Key Players, Trends, Share, Industry Size, Segmentation

The global squalene market was valued at USD 149.4 million in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 10.9% from 2024 to 2030. The increasing use of natural ingredients in personal care and cosmetic products is a primary driver behind this growth. Squalene, a natural organic compound, is highly valued in these industries due to its translucency, minimal odor, and strong moisturizing properties. These characteristics make it one of the most widely used emollients in skincare. Moreover, squalene’s non-toxic nature has further expanded its applications, making it ideal for use in various personal care products. In cosmetics, squalene oil is especially valued for its role in combating free radicals that damage skin cells and accelerate aging.

The European Union has banned shark oil-based products in cosmetics, which has pushed manufacturers to seek plant-based and synthetic alternatives for squalene production. Concern over shark population decline and the environmental impact of harvesting shark oil has led to increased demand for plant-derived squalene, primarily extracted from sources like olive oil, rice bran, and amaranth oil. Currently, about 65% of the world’s olive oil is produced, consumed, and exported within the European Union, making it a key region for squalene derived from plant-based oils.

Squalene-based adjuvants have been used in influenza vaccines for over 20 years due to their capacity to improve immune response, boost antibody production, and allow for lower doses of the main antigen. This ingredient has been widely recognized for its role in health emergencies, such as influenza outbreaks, due to its effectiveness as an immune enhancer. The COVID-19 pandemic further underscored its utility, as animal-derived squalene was included in COVID-19 vaccines for its immunity-boosting properties. Companies like GlaxoSmithKline (GSK) have established partnerships with other firms, including Sanofi S.A. and CureVac N.V., to facilitate the use of squalene in vaccine production.

Gather more insights about the market drivers, restrains and growth of the Squalene Market

Regional Insights:

Asia Pacific Squalene Market Trends:

Asia Pacific is anticipated to witness significant market growth due to the region’s access to raw materials, lower labor costs, reduced manufacturing costs, and the expansion of industries such as personal care, cosmetics, pharmaceuticals, nutraceuticals, and food and beverages. Countries like India, China, and Japan, which are abundant in raw materials like shark liver oil and olive oil, are emerging as leading producers of squalene for the market.

Europe Squalene Market Trends:

Europe led the squalene market in 2023 with a revenue share exceeding 32.8%, followed closely by the Asia Pacific region. The high share of the European market is largely due to the extensive production of olive oil, which is a primary plant-based source of squalene. Demand for squalene in Europe is particularly high in key economies like Germany, France, the UK, Italy, and Spain. Among European nations, Spain holds a significant portion of the region’s olive groves, which positions it as a major supplier for plant-based squalene. Consequently, European squalene manufacturers are shifting away from shark-based squalene toward plant-based sources.

France

In France, the pharmaceutical industry is notably influential in this market shift. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the pharmaceutical sector in France had one of the largest R&D budgets in 2021, with R&D spending representing 9.8% of total pharmaceutical revenue. Pharmaceutical companies in France are increasingly investing in research and development focused on creating eco-friendly medicines that utilize bio-based ingredients, a trend that is expected to increase the demand for plant-based squalene in the country’s pharmaceutical industry over the forecast period.

Germany

Germany also demonstrates strong demand for plant-based squalene. In 2020, the country imported approximately 85 tons of olive oil, driven by rising health-consciousness among consumers and the preference for plant-derived ingredients across various sectors. Major companies like L’Oréal in Germany have transitioned from animal-based to plant-based squalene in their formulations, aligning with consumer demand for sustainable and eco-friendly products.

Browse through Grand View Research's Category Food Additives & Nutricosmetics Industry Research Reports.

The global glutamic acid market size was valued at USD 12.55 billion in 2024 and is projected to grow at a CAGR of 8.6% from 2025 to 2030.

The global stearic acid market size was valued at USD 11.24 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030.

Key Companies & Market Share Insights:

The squalene market is highly fragmented and competitive, with major players concentrated in Europe and North America. However, numerous smaller players operate in the Asia Pacific region, where they benefit from proximity to raw materials, particularly shark liver oil and olive oil, which are essential for squalene production.

To extend their reach, major players are adopting partnership strategies. By collaborating with companies in different regions, they can leverage established networks to distribute their products more broadly. For example, in May 2023, Amyris announced a partnership with Croda International Plc. This collaboration aims to supply pharmaceutical-grade squalene for use in vaccine adjuvants, enhancing immune response. Such partnerships demonstrate the strategic moves by leading companies to expand their market presence while meeting the growing demand for high-quality squalene in various applications, from personal care to pharmaceuticals.

Key Squalene Companies:

Amyris, Inc.

Sophim SAS

Henry Lamotte Oils GmbH

efpbiotek

Vestan Limited

Kuraray Co., Ltd.

Croda International Plc

AASHA BIOCHEM

Arbee

Oleicfat, s.l.

Kishimoto Special Liver Oil Co., Ltd.

Order a free sample PDF of the Squalene Market Intelligence Study, published by Grand View Research.

#Squalene Market Share#Squalene Market Analysis#Squalene Market Trends#Squalene Market Growth#Squalene Industry Forecast

0 notes

Text

Peppermint Oil Supplier in India | Menthol Crystal Supplier in India

Ganpati Agri Business Private Limited came into being in the year 2011, and under the dynamic leadership of Mr. Atul Kumar Singh (MD) who possesses sound experience in the Rice Bran & other Agro base industry including mint, flavor, and fragrance industry, we picked up the tremendous pace. Our modernistic plant is situated at Barabanki, Dewa Road, Uttar Pradesh, which is known as a mint growing area internationally.

We are among the largest manufacturers & suppliers of Natural Menthol Powder, Natural Menthol Crystal, Natural Cis-3-Hexenol, Peppermint oil, etc. in the domestic market. In addition, we export products to the USA, UK, France, China, Brazil, Middle East Israel, Indonesia, Thailand, Canada, Nigeria, South Africa, Hong Kong, and Turkey. A Government of India recognized “Export House,” we are honored by State Export Award for the year 2021.

#Menthol Powder supplier in India#Peppermint oil manufacturer in India#Peppermint Oil Supplier in India#Mustard Cake Supplier In India#Mint terpenes manufacturer

0 notes

Link

By product type, edible grade of rice bran oil market is anticipated to continue its dominance with CAGR 4.0% over the forecast period. ...

#adroit market research#rice bran oil market#rice bran oil market size#rice bran oil market trends#rice bran oil market india

0 notes

Text

The evolution of edible oil preferences in India: balancing tradition and health trends

India's culinary heritage is deeply intertwined with its diverse range of edible oils, each bearing distinct regional significance and health benefits. From the robust flavours of mustard oil in the north to the versatile coconut oil in the south, traditional oils have long been staples in Indian kitchens. However, evolving health priorities, global influences, and increased awareness have reshaped consumer preferences, paving the way for modern alternatives like rice bran, olive, and cold-pressed oils.

This shift highlights the blending of tradition with modern health consciousness, reflecting changing dietary patterns and the quest for optimal nutrition.

Traditional Oils: A Heritage of Flavor and Wellness

Traditional oils are deeply rooted in India's agricultural practices and culinary traditions. They not only enhance the taste of food but also offer medicinal and nutritional benefits. Key traditional oils include:

1. Mustard Oil

Known for its pungent aroma and antimicrobial properties, mustard oil is a staple in northern and eastern India. Its high omega-3 fatty acid content has long been associated with cardiovascular benefits, making it a household favourite for both cooking and massage therapy.

2. Coconut Oil

Widely used in southern Indian kitchens, coconut oil is prized for its versatility. Rich in medium-chain triglycerides (MCTs), it supports energy metabolism and boosts immunity. Beyond cooking, coconut oil plays a significant role in skincare and haircare routines.

3. Sesame Oil

Integral to the cuisines of Gujarat, Tamil Nadu, and Andhra Pradesh, sesame oil is valued for its nutty flavour and antioxidant-rich profile. It is also revered in Ayurveda for its therapeutic properties, often used in oil-pulling and massage therapies.

4. Groundnut Oil

Favoured in western India for its high smoke point and mild flavour, groundnut oil remains a go-to option for frying and other high-heat cooking methods. Its rich composition of monounsaturated fats supports heart health.

The Rise of Modern Edible Oils

As health awareness and dietary preferences evolve, newer edible oils are gaining popularity for their scientifically proven benefits. These oils are perceived as healthier alternatives, catering to modern urban lifestyles.

1. Rice Bran Oil

Rich in gamma-oryzanol, rice bran oil has gained attention for its ability to lower cholesterol and promote heart health. With a high smoke point and neutral flavour, it is suitable for various cooking techniques, from deep frying to sautéing.

2. Olive Oil

Olive oil, particularly extra virgin olive oil, has become synonymous with healthy living. Its monounsaturated fats and antioxidants make it a preferred choice for salad dressings, light sautéing, and Mediterranean-inspired dishes. Urban households increasingly view olive oil as a premium, heart-healthy option.

3. Cold-Pressed and Virgin Oils

The growing interest in cold-pressed and virgin oils marks a shift toward minimally processed options that retain the natural nutrients of the oil seeds. Cold-pressed oils like sesame, coconut, and groundnut are rich in antioxidants, vitamins, and essential fatty acids, offering both health and flavour benefits. Virgin oils, especially virgin coconut oil, are celebrated for their purity and nutritional integrity.

4. Blended Oils

Combining the benefits of multiple oils, blended oils are designed to offer a balanced fatty acid profile. For example, blends of rice bran and sesame oil are marketed for their complementary health advantages, including improved cholesterol levels and antioxidant properties.

5. Sunflower and Soybean Oils

Affordable and widely available, sunflower and soybean oils have found a place in many Indian kitchens. Their high polyunsaturated fatty acid (PUFA) content supports heart health, making them popular among budget-conscious consumers.

Factors Influencing Changing Preferences

The shift in edible oil preferences is driven by a combination of health awareness, economic growth, and global influences:

1. Health Consciousness

The rise in lifestyle-related ailments such as obesity, diabetes, and cardiovascular diseases has prompted consumers to seek oils low in saturated fats and high in antioxidants and essential fatty acids. Oils like rice bran, olive, and cold-pressed varieties align well with these priorities.

2. Global Cuisines and Influences

The growing popularity of international cuisines has introduced Indians to oils like olive, canola, and avocado oil. These oils, often marketed for their health benefits, are gaining traction in urban households.

3. Economic Growth

Higher disposable incomes and an increasing focus on wellness have encouraged consumers to invest in premium oils, including extra virgin olive oil and cold-pressed options.

4. Government Initiatives

Government-led initiatives, such as the fortification of edible oils with vitamins A and D, have made packaged oils more appealing. These programs aim to improve public health by addressing widespread micronutrient deficiencies.

The Cold-Pressed and Virgin Oil Revolution

Among the most significant trends in India’s edible oil market is the shift toward cold-pressed and virgin oils. These oils are produced without the application of heat, ensuring that the natural nutrients, aroma, and flavour of the oilseeds are preserved.

Why Cold-Pressed Oils Are Trending:

Nutritional Superiority: Cold-pressed oils retain essential nutrients like vitamin E, antioxidants, and healthy fats that are often lost during conventional refining processes.

Versatility: Suitable for low heat cooking and as a dressing for salads and dips, cold-pressed oils offer versatility while preserving their health benefits.

Minimal Processing: The absence of chemical processing appeals to health-conscious consumers seeking natural, additive-free options.

Popular cold-pressed oils in India include sesame, coconut, groundnut, and mustard oil, which cater to both traditional and modern culinary practices.

Conclusion

The evolution of edible oil preferences in India reflects a dynamic interplay between traditional and modern health trends. While traditional oils like mustard, coconut, and sesame continue to hold cultural and culinary significance, the rise of rice bran, olive, and cold-pressed oils highlights a growing emphasis on scientifically backed health benefits.

By balancing the richness of traditional oils with the innovation of modern alternatives, Indian households can enjoy the best of both worlds—flavourful cooking and optimal nutrition. The future of edible oil preferences lies in informed choices that prioritise both health and heritage.

0 notes

Text

How to Choose the Best Cooking Oil in India for a Healthy Lifestyle

When it comes to cooking, the type of oil you use plays a crucial role in your overall health. With the plethora of cooking oils available in the market today, it can be overwhelming to choose the best one for a healthy lifestyle, especially in India where a variety of oils are commonly used in traditional cooking.

One of the healthiest cooking oils you can use in India is rice bran oil. Rich in antioxidants, vitamin E, and other essential nutrients, rice bran oil has gained popularity for its numerous health benefits. Here are some tips to help you choose the best cooking oil in India for a healthy lifestyle:

Consider the Smoke Point:

When choosing a cooking oil, it's important to consider the smoke point. The smoke point is the temperature at which the oil starts to smoke and break down, releasing harmful compounds. For high-heat cooking methods like deep frying and stir-frying, it's essential to choose an oil with a high smoke point to prevent the oil from becoming rancid and unhealthy. Rice bran oil has a high smoke point of 450°F, making it ideal for high-heat cooking methods.

Check the Nutritional Profile:

Another important factor to consider when choosing a cooking oil is its nutritional profile. Opt for oils that are high in monounsaturated and polyunsaturated fats and low in saturated fats. Rice bran oil is rich in monounsaturated fats and contains a balanced ratio of omega-6 to omega-3 fatty acids, making it a heart-healthy choice.

Avoid Trans Fats:

Trans fats are harmful fats that are commonly found in processed foods and hydrogenated oils. Avoid cooking oils that contain trans fats, as they can increase your risk of heart disease and other chronic illnesses. Rice bran oil is naturally trans fat-free, making it a healthier alternative to hydrogenated oils.

Consider the Flavor:

The flavor of the cooking oil can also impact the taste of your dishes. While some oils have a neutral flavor, others have a distinct taste that can enhance the flavor of your food. Rice bran oil has a mild and nutty flavor, making it versatile for a wide range of dishes, from Indian curries to stir-fries and salad dressings.

Look for Cold-Pressed Oils:

Cold-pressed oils are extracted without the use of heat or chemicals, preserving the nutrients and flavor of the oil. Look for cold-pressed rice bran oil to ensure that you are getting the most health benefits from your cooking oil.

In conclusion, choosing the best cooking oil in India for a healthy lifestyle is crucial for your overall well-being. Rice bran oil is an excellent choice for its high smoke point, nutritional profile, and health benefits. By considering these factors when selecting a cooking oil, you can make healthier choices for you and your family.

0 notes

Text

Squalene Market Size and Regional Outlook Analysis 2024 - 2030

The global squalene market size was estimated at USD 149.4 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.9% from 2024 to 2030.

Increasing consumption of natural ingredients in the personal care and cosmetics sector is expected to emerge as a major factor driving the market demand. Squalene is translucid, emits a low odor, and offers moisturizing properties. These qualities make it one of the most preferred emollients in the world. Absence of toxicity, makes it one of the most widely used elements in personal care applications. Squalene oil is also utilized in the cosmetics industry to fight free radicals that damage the skin and accelerate the aging process.

The product is used as a moisturizing and cleansing ingredient in cosmetic and personal care products such as lotions, hair conditioners, bath oils, lipsticks, creams, and foundations. Furthermore, surge in demand for natural and organic ingredients is expected to have a positive impact on the market.

Another factor that fuels market expansion is the rising demand for products in several vaccines. It is a vital component of vaccinations including the COVID-19 vaccines as it is extremely effective in boosting immune response.

Gather more insights about the market drivers, restrains and growth of the Squalene Market

Squalene Market Report Highlights

• Rising usage of natural chemical-free ingredients in personal care and cosmetics and increased awareness regarding the benefits of squalene for health and body are driving the market

• Europe dominated the market with a revenue share of over 32.8% in 2023, followed by Asia Pacific region.

• The plant segment dominated the market with a revenue share of over 82.3% in 2023. This is attributed to the declining population of sharks, increasing awareness among people regarding animal welfare and protection, and regulatory frameworks imposed by various governments for the protection of marine animals.

• The personal care and cosmetics segment dominated the market with a revenue share of over 70.1% in 2023.

• In the pharmaceutical industry, squalene is widely used for various vaccine and drug delivery emulsions owing to its biocompatibility and stability-enhancing effects. In vaccines, it is used as an oil-in-water emulsion form, coupled with some adjuvants and stimulants of the immune system

• Companies are involved in strategic initiatives such as mergers and new product launches to maintain their market position

Browse through Grand View Research's Food Additives & Nutricosmetics Industry Research Reports.

• The global specialty ingredients market size was valued at USD 142.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2030.

• The global carotenoids market size was valued at USD 1.48 billion in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030.

Squalene Market Segmentation

Grand View Research has segmented the global squalene market report based on source, end-use, and region:

Squalene Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

• Animal

o Shark Liver Oil

o Other Animals

• Plants

o Amaranth Oil

o Olive Oil

o Rice Bran Oil Plants

o Other Amaranth Oil

o Synthetic

Squalene End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

• Pharmaceuticals

• Personal Care & Cosmetics

• Nutraceuticals

• Food & Beverages

• Others

Squalene Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o France

o UK

o Italy

o Spain

o Russia

o Benelux

• Asia Pacific

o China

o India

o Japan

o South Korea

o Vietnam

o Thailand

o Indonesia

• Central & South America

o Brazil

o Argentina

• Middle East & Africa

o Saudi Arabia

o South Africa

Order a free sample PDF of the Squalene Market Intelligence Study, published by Grand View Research.

#Squalene Market#Squalene Market size#Squalene Market share#Squalene Market analysis#Squalene Industry

0 notes

Text

https://www.tradologie.com/lp/news/detail/sea-urges-lifting-of-export-ban-on-de-oiled-rice-bran-amidst-falling-prices

SEA Urges Lifting of Export Ban on De-oiled Rice Bran Amidst Falling Prices

The Solvent Extractors' Association of India (SEA) has called for the lifting of the export ban on de-oiled rice bran, emphasising the need to revive India's position as a key supplier in the global market amidst plummeting prices. De-oiled rice bran, a significant byproduct of the edible oil industry, is primarily utilised as animal feed, serving as a crucial component in the nutrition of livestock worldwide.

0 notes

Text

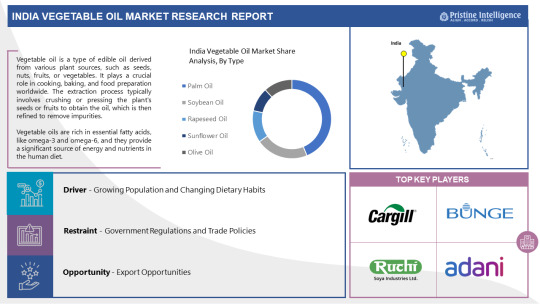

India Vegetable Oil Market: Forthcoming Trends and Share Analysis by 2030

The India Vegetable Oil is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The Indian vegetable oil market is one of the largest and most dynamic sectors in the country's food industry. Vegetable oils are essential ingredients in Indian cuisine, catering to diverse cooking practices and cultural preferences across the nation. India ranks among the top consumers and importers of vegetable oils globally due to its massive population and culinary diversity. Key players in the market include both domestic producers and multinational corporations, offering a wide range of oils such as palm oil, soybean oil, sunflower oil, and mustard oil, among others.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

The latest research on the India Vegetable Oil market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global India Vegetable Oil industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the India Vegetable Oil market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Leading players involved in the India Vegetable Oil Market include:

Adani Wilmar Limited (India), Ruchi Soya Industries Limited (India), Bunge India Private Limited (India), Cargill India Pvt. Ltd. (India), Marico Limited (India), Godrej Agrovet Limited (India), Emami Agrotech Limited (India), Dalmia Continental Private Limited (India), 3F Industries Limited (India), Liberty Oil Mills Limited (India), Pepsico India Holdings Pvt. Ltd. (Quaker Oats) (India), B.L. Agro Oils Ltd. (India), Agro Tech Foods Ltd. (India), Gemini Edibles & Fats India Pvt. Ltd. (India), Vimal Oil & Foods Limited (India), VVF (India) Limited (India) and Other Major Players.

Market Driver:

One significant driver propelling the growth of the Indian vegetable oil market is the increasing awareness of health benefits associated with consuming healthier oils. With rising health consciousness among consumers, there has been a noticeable shift towards oils perceived to be healthier, such as olive oil, avocado oil, and rice bran oil. This shift is primarily driven by concerns over heart health, cholesterol levels, and overall well-being, leading consumers to seek out oils with higher unsaturated fat content and lower levels of trans fats.

Market Opportunity:

An emerging opportunity within the Indian vegetable oil market lies in the growing demand for organic and cold-pressed oils. As consumers become more conscious about the origin and processing methods of their food products, there is a rising trend towards organic and minimally processed oils. This presents an opportunity for both existing and new players in the market to capitalize on the demand for premium, high-quality oils that cater to health-conscious consumers seeking natural and sustainable alternatives.

If You Have Any Query India Vegetable Oil Market Report, Visit:

https://pristineintelligence.com/inquiry/india-vegetable-oil-market-83

Segmentation of India Vegetable Oil Market:

By Type

Palm Oil

Soybean Oil

Rapeseed Oil

Sunflower Oil

Olive Oil

Others

By Nature

Organic

Conventional

By Packaging Type

Cans

Bottles

Pouches

Others

By Application

Food Industry

Pharmaceutical

Cosmetics & Personal

Animal Feed

Industrial

By Distribution Channels

Hypermarkets/Supermarkets

Convenience Stores

Online Retail

Wholesale Distributors

Specialty Stores

By Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Highlights from the report:

Market Study: It includes key market segments, key manufacturers covered, product range offered in the years considered, Global India Vegetable Oil Market, and research objectives. It also covers segmentation study provided in the report based on product type and application.

Market Executive Summary: This section highlights key studies, market growth rates, competitive landscape, market drivers, trends, and issues in addition to macro indicators.

Market Production by Region: The report provides data related to imports and exports, revenue, production and key players of all the studied regional markets are covered in this section.

India Vegetable Oil Market Profiles of Top Key Competitors: Analysis of each profiled Roll Hardness Tester market player is detailed in this section. This segment also provides SWOT analysis of individual players, products, production, value, capacity, and other important factors.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#India Vegetable Oil#India Vegetable Oil Market#India Vegetable Oil Market Size#India Vegetable Oil Market Share#India Vegetable Oil Market Growth#India Vegetable Oil Market Trend#India Vegetable Oil Market segment#India Vegetable Oil Market Opportunity#India Vegetable Oil Market Analysis 2023

0 notes