#revocable living trust attorney

Explore tagged Tumblr posts

Text

The process of revocable living trust in Charlotte, NC

When you pass away, the revocable living trust you had established will appear as a rulebook to handle your trusts. No wonder it is so important! And that’s why you need to hire a professional for revocable living trust in Charlotte, NC. Learn about their services and approach of the team through this link: https://www.lutzelbroadway.com/. Ask about the process and other aspects from their experts by giving a call at 704.799.3570.

1 note

·

View note

Text

Explore the benefits of revocable living trusts for seamless estate planning. Secure your legacy with flexible and effective trust solutions. For more information schedule a free consultation with our experienced revocable living trust attorney in Vancouver, WA.

#revocable living trust attorney#Vancouver revocable living trust attorney#trust attorney#revocable living trust lawyer

0 notes

Text

What To Do When a Disability Throws Your Estate Plan Into Chaos

As poet Robert Burns mused centuries ago, “The best-laid plans of mice and men often go awry.” Despite thoughtful effort and a concerted strategy, you cannot prepare for every emergency. A car accident, sudden illness, workplace injury, or chronic medical condition can force you to re-evaluate the core assumptions you used to plan your future and set up your legacy. For more information click here.

#Estate Planning Lawyer Dallas#Wills and Trusts Dallas#Texas Wills and Trusts#Texas Wills#Revocable Living Trust#Texas Wills Attorney

0 notes

Text

The Role of Trusts in Minimizing Estate Taxes: Strategies for Savvy Planners

Trusts Estate taxes are often a looming concern for those with significant assets. They can diminish the wealth you wish to pass onto your loved ones, but the judicious use of trusts can offer a shield against this financial drain. Here are the essential strategies to leverage trusts and effectively minimize estate taxes. 1. Revocable Living Trusts: The Foundational Shield Establishing a…

View On WordPress

0 notes

Text

If you are wondering how to create a living trust in Washington, consulting with an experienced revocable trust lawyer in Tacoma, WA, is necessary. For more information contact us at 2538437180.

#living trust in Washington#revocable trust lawyer in Tacoma#Revocable Trust Attorney in Washington#Revocable Trust Attorney Washington#wa estate planning attorneys#tacoma estate planning law firm#estate attorney tacoma#tacoma estate planning attorneys#wills & trusts attorney in tacoma#estate planning lawyer in washington

0 notes

Text

I am a low-key birthday person. Unlike those for whom their birthday is a VERY BIG DEAL, I never took the day off work and don’t have high expectations. I had a nice call with the kids and dinner at the town’s fancy restaurant with Beth. In honor of my birthday, my Togo charity received a few donations and I’m looking forward to using my new hiking poles. All in all, a very nice day.

Earlier in the week Beth and I addressed one of the tasks associated with advancing age: estate and healthcare planning. We’d done some of this years ago when we lived in Minnesota and the kids were young, but we needed to update it now that we live in Washington.

My parents did a good job with these tasks and I want us to do the same for our kids. We now have updated Healthcare Directives (Living Wills), Durable Power of Attorney (General and Healthcare), Wills and a Revocable Living Trust. The objectives of the trust are to avoid probate, protect assets for the benefit of heirs and minimize estate taxes.

We used an attorney to do the work but you could probably do it yourself with an online service. One benefit of using an attorney is that we now have this nice binder with all the information in one place. The only remaining step is to ‘fund’ the trust by transferring and retitling assets to the trust.

A lot of people get really worked up about estate taxes. Washington has high estate taxes, some states don’t have any. Washington doesn’t have income taxes so it only seems fair to have an estate tax we don’t mind paying our fair share.

65 notes

·

View notes

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

93 notes

·

View notes

Text

LILI`UOKALANIʻS ROYAL STANDARD TO BE RETURNED TO HAWAI`I

Honolulu Civil Beat - March 19, 2023 - By Denby Fawcett State Archivist Adam Jansen is flying to New York later this month to bring home to Hawaii items from Bonhams auction house related to the overthrow of Queen Liliuokalani. They include Liliuokalani’s Royal Standard, the queen’s personal flag that flew over her Washington Place home in Honolulu on Jan. 17, 1893, the day she was overthrown. According to the queen’s diary, the day after she was deposed, she visited the royal mausoleum and later traveled by carriage to her cottage at Waikiki to take a swim, trying to calm herself from the enormity of what had happened. When she returned to Washington Place, she received a note from the provisional government ordering her to permanently take down her personal flag, which greatly distressed her because she had understood the new government would allow Hawaii’s royal flags to continue to fly. Jansen, who will travel to New York on March 27, said he feels an enormous responsibility as the courier of Liliuokalani’s Royal Standard, which will remain beside him as carry-on luggage on the plane home from New York to Honolulu. “I will be treating the queen’s personal flag as representing the queen herself. It has mana. The flag is an important piece of the story of Hawaii coming back to the people after more than a century,” said Jansen. He will also be bringing back the personal letters and documents of Col. John Soper, who was in charge of the military troops that amassed, banding together to threaten violence if the queen did not step down peacefully. The estate of Abigail Kinoiki Kekaulike Kawananakoa and Damon Estate heiress and philanthropist Brendan Damon Ethington have each donated $30,000 for a total of $60,000 to prevent the historically valuable materials from ending up in the hands of private collectors. Bonhams had initially intended to sell the property in an online auction, but the London-based company stopped that plan after the Hawaii Attorney General’s Office sent a letter saying the items rightfully belonged to the state. However, Honolulu sword and antiques dealer Robert Benson — the owner of the property that had commissioned Bonhams auction house to sell the items — refused to relinquish the documents and the flag. He had purchased them from Soper’s descendants eight years ago in San Francisco. Benson and his wife, Rita, said they were glad worthy parties had purchased the items. “We were their caretakers for a while and are very happy the pieces are going to good homes,” they said Saturday in an email. Attorney Jim Wright successfully negotiated with Benson to buy the Soper documents and the Royal Standard. Ethington then agreed to pay half of the price. Wright is the trustee of Kawananakoa’s revocable living trust. Both parties agreed to subsequently donate the items to the state. Alm said Kawananakoa’s estate became involved because “the princess hated seeing treasures of Hawaiian history put up for sale online.” Kawananakoa, who died in December, held no formal title, but her lineage included the royal family that long ruled the islands. Alm said it drove her crazy to see artifacts and documents important to understanding Hawaii’s history locked up in private collections with no public access. “She wanted people to have the opportunity to live and breathe history,” he said. Benson, the collector who owned the flag and Soper’s papers for eight years, said he was well aware of their historic value. He told me in a phone conversation in October that he had tried many times to get the state archives interested in buying them and had brought them to the attention of Kamehameha Schools, but there were no takers. “Robert Benson is the person who preserved and protected the flag and documents. We have them today because of him,” said attorney Jim Wright. The state archivist has said the queen’s Royal Standard shouldn’t be used as a “war trophy.” That was what happened after the overthrow when Soper took the queen’s flag as his personal property. Soper was the Honolulu businessman Sanford Dole selected to lead the armed troops in the overthrow. After the Hawaiian queen stepped down, Dole made Soper the commander-in-chief of the military forces of the provisional government of Hawaii. Soper later served as the top military leader in the Republic of Hawaii and through the first decade of the Territory of Hawaii. Hawaii became a state in 1959. Jansen said Soper’s writings are enormously valuable and will provide scholars and others new insights from the top military leader of the overthrow and the opportunity to read in his own handwriting his attempts to justify the dethronement of a sovereign monarch. “I am just glad I was able to help the archives get the documents,” said Ethington, whose great-grandfather Samuel Mills Damon was finance minister in King David Kalakaua’s Cabinet. He did not participate in the overthrow but was made vice president and later finance minister of the provisional government that followed. Ethington said as a history major at Yale she became aware of the importance of primary documents to students and scholarly researchers. “There is nothing better than the firsthand documents of the times. They should be protected and available to the public, not in private collections. How will we know what happened if we don’t have access to the actual writing of the people who were there?” she said in an interview. Jansen said once the documents are returned the public will have multiple ways to see them both at the archives and in digitized form on the internet, with hard copies of the documents to be placed in Iolani Palace. Alm said he hopes Liliuokalani’s flag can be returned to Washington Place since it was originally taken from there. But Jansen said that will have to be part of an ongoing discussion because the queen’s former residence lacks the preservation capability of a museum. Jansen said he hopes the return of the queen’s personal flag will make history resonate for the people of Hawaii in a way it might not have before. “It is not just the piece of cloth but who owned it, what it signified. It can never be duplicated,” he said.

9 notes

·

View notes

Text

Revocable living trust services by Lutzel Broadway

To establish a revocable living trust in Charlotte, NC, you need a trusted team of professionals. You can rely upon Lutzel Broadway Law Firm for your needs. Get more information about revocable trust in Cornelius, NC, visit this link: lutzelbroadway.com. You can call the team for all queries: (704) 799-3570.

1 note

·

View note

Text

youtube

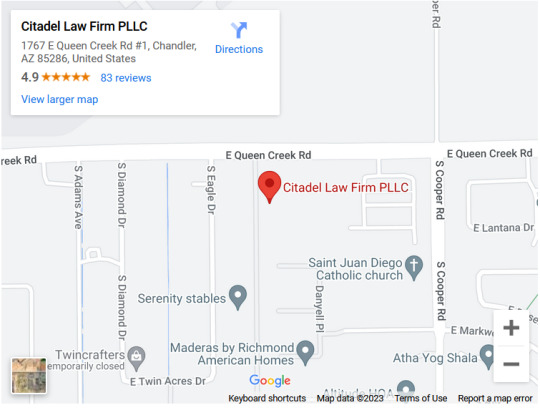

Business Name: Citadel Law Firm PLLC

Street Address: 1767 E. Queen Creek Rd. #1

City: Chandler

State: Arizona (AZ)

Zip Code: 85286

Country: United States of America

Business Phone Number: (480) 565-8020

Business Email Address: [email protected]

Website: https://clfusa.com/

Facebook: https://www.facebook.com/citadellawfirm

Twitter: https://twitter.com/citadellawfirm

Instagram: https://www.instagram.com/citadellawfirm/

YouTube: https://www.youtube.com/channel/UClWr4mHHOsTGct7DrajZvCQ

Description: Citadel is an Arizona-based law firm serving clients in Estate Planning, Wills and Trusts, Probate, Trust and Will disputes, and Elder Law. We primarily serve Chandler, Gilbert, Mesa, and the East Valley. We are affordable and we would love to help you.

Google My Business CID URL: https://www.google.com/maps?cid=13915479504206914512

Business Hours: Sunday Closed Monday 9:00am-5:00pm Tuesday 9:00am-5:00pm Wednesday 9:00am-5:00pm Thursday 9:00am-5:00pm Friday 9:00am-5:00pm Saturday Closed

Payment Methods: Cash, Check/Cheque, Debit Card, Credit Card, Visa, Master, Amex, Discover We offer finance through Affirm as well

Services: Financial Power of Attorney, Living Will, Trust Administration, Health Care Power of Attorney, Revocable Living Trust, Irrevocable Trust, Last Will and Testament, Probate, Estate Planning, Dynasty Trust

Keywords: estate planning, estate planning lawyer, estate planning attorney, estate planning chandler, estate planning lawyer chandler, estate planning attorney chandler, probate, probate attorney, probate lawyer, probate chandler, probate attorney chandler, probate lawyer chandler, Wills, Wills Attorney, Wills Lawyer, Trusts, Trusts Attorney, Trusts Lawyer

Business/Company Establishment Date: 04-16-2018

Business Slogan: Only an experienced estate planning attorney and probate lawyer can help you!

Number of Employees: 3

Yearly Revenue: USD 100,000-500,000

Owner Name, Email, and Contact Number: David Gerszewski, [email protected], (480) 565-8020

Location:

Service Areas:

2 notes

·

View notes

Text

How Estate Lawyers Can Help You in Arizona?

https://clfusa.com/probate/how-estate-lawyers-can-help-you-in-arizona/

#estate planning#chandler arizona#estate attorney#revocable living trust#estateplanning#wills#living wills

0 notes

Text

Texas Revocable Living Trust | Kamilah Henderson Law Firm

Explore the benefits of Texas Revocable Living Trusts with the guidance of the experienced legal team at Kamilah Henderson Law Firm, PLLC. Call us today!

0 notes

Text

How Estate Planning Can Help You Reduce Taxes & Maximize Inheritance

Estate planning isn’t just about creating a will—it’s a strategic process that helps secure your financial legacy while minimizing tax liabilities. Without proper estate planning, your heirs may face unnecessary tax burdens, reducing the wealth you intended to pass down. Let’s explore how smart estate planning can help you reduce taxes and maximize inheritance for your loved ones.

1. Understanding Estate Taxes

Estate taxes, also known as death taxes, are levied on the assets transferred after a person’s passing. While federal estate taxes only apply to estates exceeding a certain threshold (which changes over time), many states also impose their own estate or inheritance taxes. Strategic estate planning ensures your assets are structured to minimize these taxes, preserving more of your wealth.

2. Utilizing Trusts to Reduce Tax Liabilities

Trusts are one of the most effective estate planning tools for tax reduction. Here’s how they work:

Revocable Living Trusts: Helps avoid probate but doesn’t provide tax benefits.

Irrevocable Trusts: Removes assets from your taxable estate, reducing estate taxes.

Charitable Trusts: Allows you to donate to charity while reducing tax burdens.

Generation-Skipping Trusts: Pass assets to grandchildren while avoiding estate taxes twice.

By placing assets into trusts, you control their distribution while significantly reducing estate taxes.

3. Gifting Assets to Lower Tax Burden

The IRS allows individuals to gift up to a certain amount annually (without triggering gift taxes). By gifting assets while alive, you can reduce the overall size of your taxable estate. This method also allows you to support your heirs financially while avoiding higher estate taxes later.

4. Taking Advantage of Tax-Free Inheritance Strategies

Life Insurance Policies: Proceeds from life insurance are typically tax-free to beneficiaries. Placing the policy in an irrevocable life insurance trust (ILIT) ensures the payout isn’t counted as part of your taxable estate.

529 College Savings Plans: These accounts provide tax-free growth and withdrawals for education expenses, making them an excellent way to pass wealth while avoiding taxes.

Retirement Account Planning: Properly structuring IRAs and 401(k)s can help heirs minimize tax liabilities upon inheritance.

5. Charitable Giving for Tax Benefits

If you plan to support charitable causes, charitable remainder trusts (CRTs) and donor-advised funds offer ways to donate while receiving tax deductions. These strategies can help reduce taxable income while benefiting organizations you care about.

6. Updating Your Estate Plan Regularly

Estate tax laws frequently change, and failing to update your estate plan can lead to missed opportunities for tax savings. Regular reviews with an estate planning attorney ensure you take advantage of the latest tax reduction strategies.

Final Thoughts

Estate planning is essential for preserving wealth, reducing taxes, and ensuring your loved ones receive your intended inheritance. By incorporating trusts, gifting strategies, charitable giving, and tax-efficient asset transfers, you can protect your legacy and maximize the financial benefits for your heirs.

If you haven’t started estate planning, now is the time! Consult an experienced estate planning attorney to create a strategy that works for you.

📞 Need help with estate planning? Contact us today to secure your future!

#EstatePlanning #WealthPreservation #TaxPlanning #Inheritance #FinancialPlanning

0 notes

Text

Navigating Probate and Estate Planning in Texas

Why You Need a Probate Lawyer in Plano TX

Handling estate matters after a loved one’s passing can be complex and emotional. A probate lawyer Plano TX helps families navigate the legal process of validating a will, settling debts, and distributing assets. These legal professionals provide guidance on probate court proceedings, ensuring compliance with Texas laws while minimizing stress for beneficiaries.

Understanding a Revocable Living Trust

A revocable living trust is a flexible estate planning tool that allows you to manage your assets during your lifetime and seamlessly transfer them to beneficiaries upon death. Unlike a will, a revocable trust avoids probate, maintaining privacy and speeding up asset distribution. It can be amended or revoked at any time, making it an ideal choice for those seeking control over their estate planning.

What is Trust Administration?

After creating a trust, the next step is trust administration. This involves managing and distributing the trust’s assets according to the grantor’s instructions. A trustee, appointed by the trust creator, is responsible for inventorying assets, paying debts, filing taxes, and distributing property to beneficiaries. Consulting with an experienced attorney helps ensure legal compliance and efficient administration.

How to Handle the Transfer of Property

The transfer of property is a crucial part of estate planning. In Texas, property can be transferred through wills, trusts, joint ownership, or beneficiary designations. Choosing the right method depends on the type of property and the owner’s preferences. A legal expert can help determine the most efficient way to transfer assets while minimizing taxes and legal complications.

Navigating the Texas Probate Process

Understanding the Texas probate process is essential for effective estate administration. Probate involves validating a will, appointing an executor, inventorying assets, paying debts, and distributing property to beneficiaries. In Texas, probate can be complex, but hiring a knowledgeable attorney streamlines the process, ensuring compliance with state laws and protecting beneficiaries' rights.

Proper estate planning not only protects your assets but also ensures a smooth transition for your loved ones. Consulting with experienced legal professionals helps simplify probate, trust administration, and property transfers.

0 notes

Text

Choosing the Best Estate Planning Attorney in Rochester: Tips and Advice

Estate planning is a critical process that ensures your assets are protected and your loved ones are taken care of in the future. Whether you’re in Rochester, MN, or the surrounding areas, finding the right estate planning attorney can make all the difference. At BPC Attorneys, we understand the importance of having a trusted legal partner to guide you through this complex process. In this blog, we’ll share valuable tips and advice to help you choose the best estate planning attorney in Rochester, MN.

Why Do You Need an Estate Planning Attorney?

Estate planning involves more than just drafting a will. It includes creating trusts, minimizing taxes, appointing guardians for minor children, and ensuring your wishes are carried out. A skilled Rochester estate planning lawyer can help you:

Avoid probate delays and expenses.

Protect your assets from creditors and legal disputes.

Plan for incapacity or long-term care needs.

Ensure your family’s financial security.

Without proper legal guidance, even a small oversight can lead to significant complications for your loved ones.

Tips for Choosing the Best Estate Planning Attorney in Rochester, MN

1. Look for Experience and Expertise

When searching for an estate planning attorney in Rochester, MN, prioritize experience. An attorney with a proven track record in estate planning will be familiar with state-specific laws and potential challenges. At BPC Attorneys, our team specializes in estate planning, ensuring your documents are tailored to your unique needs.

2. Check Client Reviews and Testimonials

Online reviews and testimonials can provide insight into an attorney’s reputation and client satisfaction. Look for Rochester estate planning lawyers with positive feedback and a history of successful cases.

3. Evaluate Their Communication Skills

Your attorney should be approachable, patient, and able to explain complex legal concepts in simple terms. During your initial consultation, assess whether they listen to your concerns and provide clear, actionable advice.

4. Consider Their Range of Services

Estate planning often overlaps with other areas of law, such as family law or real estate. If you anticipate needing additional legal services, such as assistance from Rochester, MN family law attorneys or real estate attorneys, choose a firm like BPC Attorneys that offers comprehensive legal support.

5. Ask About Fees and Transparency

Understanding the cost of estate planning services is crucial. Reputable estate planning attorneys in Rochester, MN will provide a clear fee structure upfront. Avoid attorneys who are vague about costs or pressure you into unnecessary services.

6. Verify Their Credentials

Ensure the attorney is licensed to practice in Minnesota and has no disciplinary actions on their record. You can verify their credentials through the Minnesota State Bar Association.

Common Estate Planning Documents to Discuss with Your Attorney

When meeting with your Rochester estate planning lawyer, ensure they help you create or update the following documents:

Last Will and Testament: Outlines how your assets will be distributed.

Revocable Living Trust: Helps avoid probate and provides flexibility.

Durable Power of Attorney: Appoints someone to manage your finances if you’re incapacitated.

Healthcare Directive: Specifies your medical wishes and appoints a healthcare agent.

Beneficiary Designations: Ensures your retirement accounts and life insurance policies align with your estate plan.

How BPC Attorneys Can Help

At BPC Attorneys, we pride ourselves on being one of the leading Rochester, MN family law attorneys and estate planning lawyers. Our team is dedicated to providing personalized, compassionate legal services to protect your family’s future. Whether you need help with estate planning, divorce lawyers in Rochester Hills, MI, or real estate attorneys in Detroit, Michigan, we have the expertise to assist you.

Frequently Asked Questions About Estate Planning in Rochester, MN

1. How often should I update my estate plan?

It’s recommended to review your estate plan every 3-5 years or after major life events, such as marriage, divorce, or the birth of a child.

2. What happens if I don’t have an estate plan?

Without an estate plan, your assets will be distributed according to Minnesota intestacy laws, which may not align with your wishes.

3. Can I create an estate plan on my own?

While DIY estate planning tools are available, they often lack the customization and legal expertise provided by a Rochester estate planning attorney.

Final Thoughts

Choosing the best estate planning attorney in Rochester, MN, is a decision that requires careful consideration. By following the tips outlined above, you can find a trusted legal partner to help you navigate the complexities of estate planning. At BPC Attorneys, we’re here to provide the guidance and support you need to protect your legacy and secure your family’s future.

Ready to get started? Contact BPC Attorneys today to schedule a consultation with one of our experienced Rochester estate planning lawyers. Visit our website at www.bpcattorneys.com to learn more about our services.

#divorce lawyers in rochester mn#divorce lawyers rochester hills mi#estate planning attorney rochester mn#family law attorney in rochester mn#family lawyer rochester mn#real estate attorney in detroit michigan#rochester divorce attorneys#rochester divorce lawyers#rochester estate planning lawyers#rochester mn family law attorneys#Best Divorce Lawyer in Rochester#estate planning attorney rochester#estate planning rochester mn#rochester mn estate planning attorney

0 notes

Text

How To Protect Family Wealth For Future Generations?

Building family wealth takes years of hard work, but preserving it for future generations requires careful planning. Without a solid strategy, wealth can be quickly eroded by taxes, poor financial decisions, or legal disputes. Here are key steps to ensure your family’s financial legacy remains intact.

1. Establish a Comprehensive Estate Plan

An estate plan is essential for managing and transferring wealth efficiently. It includes:

A will to specify asset distribution.

Trusts to protect assets from probate and provide structured inheritance.

Power of attorney to ensure financial matters are managed if you become incapacitated.

Working with experts offering services of family estate planning can help tailor a plan to your specific needs and ensure compliance with legal and tax regulations.

2. Use Trusts for Asset Protection

Trusts are powerful tools for preserving wealth and controlling how it is passed down. Some common types include:

Revocable Living Trusts: Allow you to manage assets during your lifetime and pass them on without probate.

Irrevocable Trusts: Protect assets from creditors and reduce estate taxes.

Generation-Skipping Trusts: Ensure wealth benefits grandchildren while avoiding excessive taxation.

A well-structured trust prevents financial mismanagement and protects assets from unnecessary losses.

3. Minimize Tax Liabilities

Estate and inheritance taxes can significantly reduce family wealth. To minimize tax burdens:

Use the annual gift tax exclusion to transfer wealth tax-free.

Take advantage of lifetime estate tax exemptions for large asset transfers.

Set up charitable trusts to reduce taxable estate value while supporting causes you care about.

Proper tax planning ensures that more of your wealth stays within your family.

4. Educate Future Generations About Financial Management

Even with a solid estate plan, financial mismanagement can deplete wealth. Educate heirs about:

Smart investing and wealth preservation.

Responsible spending and budgeting.

The importance of continuing family financial traditions.

Consider setting up a family governance structure, such as regular meetings or a family financial council, to instill financial literacy and shared responsibility.

5. Plan for Business Succession

If you own a family business, ensure it remains successful by:

Creating a clear succession plan that designates future leadership.

Establishing a buy-sell agreement to prevent disputes among heirs.

Structuring ownership through family limited partnerships (FLPs) to maintain control.

Without a plan, the business could face instability or forced liquidation.

6. Review and Update Your Estate Plan Regularly

Life changes, such as marriage, divorce, births, and economic shifts, can impact your estate plan. Regularly reviewing and updating documents ensures they reflect your family’s evolving needs and financial goals.

Final Thoughts

Protecting family wealth for future generations requires strategic estate planning, tax efficiency, and financial education. By working with experts offering services of family estate planning in Fort Worth, TX, you can safeguard your legacy and ensure your wealth benefits your heirs for years to come. A proactive approach today secures financial stability for generations to come.

0 notes