#recurring invoice software

Explore tagged Tumblr posts

Text

Streamlining Business Operations: The Power of Integration with Vendor Invoice Management Systems

Digital enterprises function in a fast-paced environment, and increasing productivity requires integrating cutting-edge technology. How can TYASuite Vendor Invoice Management Systems seamlessly integrate with other business systems to elevate your operations?

Integration for Seamless Workflows: Ever wondered how your Vendor Invoice Management System can effortlessly collaborate with existing business platforms? Explore the transformative benefits of integration, ensuring a seamless flow of information between your invoicing system and other vital tools. How does this integration enhance accuracy and reduce manual errors in financial processes?

Automation Revolution: Unlock the true potential of your business with recurring invoice software that embraces automation. Discover the ease of managing repetitive tasks, from invoice generation to payment reminders, and witness the significant time and resource savings. How does automation empower your team to focus on strategic initiatives rather than tedious manual tasks?

AI-Powered Precision: Delve into the realm of Artificial Intelligence within e-invoice software. Explore how AI algorithms enhance data accuracy, reduce discrepancies, and predict potential issues. How does the infusion of AI elevate the intelligence of your invoicing system, providing actionable insights for smarter decision-making?

Supplier Invoice Management System Excellence: Ensure a harmonious relationship with suppliers through a robust Supplier Invoice Management System. Learn how integrating this system with your overall business infrastructure fosters transparent communication and strengthens supplier relations. What role does integration play in creating a cohesive ecosystem?

Embrace the future of business operations by unlocking the potential of integration, automation, and artificial intelligence within your Vendor Invoice Management System. Elevate your efficiency, accuracy, and overall success in the competitive business landscape.

#vendor invoice management system#recurring invoice software#e-invoice software#supplier invoice management system

0 notes

Text

5 Ways Zoho Books can save your Time on your Bookkeeping

Introduction: Bookkeeping is an essential aspect of managing any business, but it can often be time-consuming and complex. Fortunately, with the right tools, you can streamline your bookkeeping processes and save valuable time. One such tool is Zoho Books, a cloud-based accounting software designed to simplify bookkeeping tasks for small businesses. In this blog, we'll explore five ways Zoho Books can help you save time and make your bookkeeping more efficient.

1. Bank Integration

Manually reconciling bank transactions with your accounting records can be a tedious and error-prone process. Zoho Books offers seamless bank integration, allowing you to connect your bank accounts directly to the software. This means that your transactions are automatically imported into Zoho Books, eliminating the need for manual data entry. With real-time updates, you can keep track of your finances more efficiently and spend less time on reconciliation.

2. Expense Tracking

Keeping track of business expenses is crucial for maintaining accurate financial records. With Zoho Books, you can streamline the expense tracking process. Simply snap photos of receipts using the mobile app, and the software will automatically extract the relevant information and categorize the expenses. This eliminates the need for manual data entry and ensures that all expenses are accurately recorded, saving you time and reducing the risk of errors.

3. Automated Invoicing

Creating and sending invoices manually can be a time-consuming task, especially if you have a high volume of transactions. With Zoho Books, you can automate the invoicing process. Simply set up recurring invoices for regular clients, and the software will automatically generate and send them at the specified intervals. This not only saves you time but also ensures that you never forget to invoice a client.

4. Time Tracking and Billing

Tracking billable hours and managing client billing can be a cumbersome task, especially for service-based businesses. Zoho Books offers integrated time tracking features that allow you to easily track hours spent on projects or tasks. You can assign billable rates to your time entries and generate invoices directly from the tracked hours. This streamlines the billing process, eliminates manual calculations, and ensures that you accurately bill your clients for the work performed. With Zoho Books' time tracking and billing capabilities, you can save time, improve accuracy, and focus on delivering exceptional service to your clients.

5. Customizable Reports

Generating financial reports is essential for gaining insights into your business's performance. However, creating custom reports can be time-consuming if you're using traditional accounting methods. Zoho Books offers customizable reporting features that allow you to create and save custom reports tailored to your specific needs. Whether you need a profit and loss statement, balance sheet, or cash flow statement, you can easily generate the report with just a few clicks, saving you time and providing valuable insights into your business finances.

Conclusion: Managing bookkeeping tasks can be time-consuming, but with the right tools, you can streamline your processes and save valuable time. Zoho Books offers a range of features designed to simplify bookkeeping for small businesses, from automated invoicing to customizable reports and integrated time tracking and billing. By leveraging these features, you can make your bookkeeping more efficient, reduce administrative overhead, and focus your time and energy on growing your business.

🔗 Connect With Us:

🌐 Website: https://svtadvisor.com/ 📖 Full blog: https://svtadvisor.com/blogs/ 💼 LinkedIn: https://linkedin.com/in/yourprofile 📸 Instagram: https://instagram.com/yourhandle “Have questions or tips about using Zoho Books for bookkeeping? Share your thoughts or experiences in the comments below—I’d love to hear how you’re saving time with smart tools like these!”

2 notes

·

View notes

Text

Expert Bookkeeping Services New Mexico: Streamlining Your Financial Success

Bookkeeping Services New Mexico

In today’s fast-paced business environment, accurate and reliable financial management is crucial to business success. One of the foundational pillars of sound financial practices is bookkeeping services. For businesses in the Southwestern region, especially in New Mexico, accessing professional bookkeeping services New Mexico can make all the difference between thriving and merely surviving.

The Importance of Bookkeeping for Modern Businesses

Every business, regardless of size, must maintain a clear and accurate financial record. Bookkeeping involves recording all financial transactions, including income, expenses, payroll, and taxes. This process ensures that a business remains compliant with local and federal regulations while also providing a clear snapshot of financial health.

Why Choose Bookkeeping Services in New Mexico?

1. Local Expertise

New Mexico has unique tax laws, business regulations, and economic opportunities. Working with a provider that specializes in bookkeeping services New Mexico means you benefit from professionals who understand local compliance standards and financial requirements.

2. Tailored Solutions

Professional bookkeeping services are not one-size-fits-all. Businesses in different industries require customized bookkeeping solutions. Whether you're a small business, a startup, or an established enterprise in New Mexico, tailored services ensure your finances are managed effectively.

3. Cost Efficiency

Outsourcing your bookkeeping services can save you money compared to hiring a full-time, in-house bookkeeper. With outsourced bookkeeping services New Mexico, you gain access to expert knowledge without the overhead costs.

4. Technology Integration

Modern bookkeeping relies heavily on software and cloud solutions. Experts offering bookkeeping services New Mexico use the latest tools to streamline data entry, automate recurring transactions, and generate insightful reports.

Services Offered by Bookkeeping Providers in New Mexico

Professional bookkeeping firms in New Mexico offer a range of services to meet the specific needs of their clients:

General Ledger Maintenance

Accurate recording and categorization of all financial transactions to ensure your general ledger remains up to date.

Accounts Payable and Receivable

Efficient tracking of incoming and outgoing payments, helping you manage cash flow and avoid late fees or missed invoices.

Bank Reconciliation

Matching bank statements with internal records to identify discrepancies and ensure accuracy.

Payroll Processing

Timely calculation and distribution of employee salaries, tax withholdings, and benefits.

Financial Reporting

Generation of monthly, quarterly, and annual reports including income statements, balance sheets, and cash flow statements.

Tax Preparation Support

Proper organization of financial documents and coordination with CPAs to simplify the tax filing process.

Advantages of Outsourcing Bookkeeping Services New Mexico

Outsourcing is a strategic move for businesses looking to optimize their financial operations. Here’s how outsourcing bookkeeping services New Mexico can be beneficial:

Time Savings: Focus on growing your business while experts handle the books.

Accuracy: Reduce errors and discrepancies with skilled professionals managing your finances.

Compliance: Stay up to date with local and federal tax laws and financial regulations.

Data Security: Access to secure digital storage and cloud-based accounting systems.

Scalability: Easily scale services as your business grows.

Who Can Benefit from Bookkeeping Services in New Mexico?

Small and Medium Enterprises (SMEs)

SMEs can manage their finances better and avoid costly errors by outsourcing their bookkeeping to professionals.

Startups

Startups can save valuable time and resources by relying on expert bookkeeping services to establish strong financial foundations.

Freelancers and Consultants

Independent professionals can gain peace of mind by ensuring their income and expenses are properly tracked.

Non-Profit Organizations

Proper financial reporting and transparency are essential for non-profits to maintain trust with donors and stakeholders.

Choosing the Right Bookkeeping Partner in New Mexico

When selecting a bookkeeping provider, keep the following in mind:

Experience: Look for a team with a proven track record in delivering top-notch bookkeeping services New Mexico.

Reputation: Check reviews, testimonials, and references from other clients.

Technology: Make sure they use modern tools for accuracy and efficiency.

Support: Ensure they provide ongoing support and personalized service.

Why Choose CFO Advisory India?

If you are looking for reliable bookkeeping services New Mexico, CFO Advisory India offers a comprehensive suite of financial services tailored to your business needs. With a team of skilled professionals, CFOAD delivers timely, accurate, and compliant bookkeeping that allows businesses to focus on core operations.

What Sets CFOAD Apart?

Expert knowledge in local New Mexico compliance and tax laws

Personalized solutions for businesses of all sizes

Efficient use of technology and secure cloud-based systems

Transparent communication and client-first approach

Conclusion

Accurate bookkeeping is the backbone of any successful business. Whether you're a growing startup, a seasoned entrepreneur, or a non-profit organization in New Mexico, professional bookkeeping services New Mexico are essential for financial clarity and success. Partnering with a trusted provider like CFOAD can help you navigate the complexities of financial management with ease, ensuring your business stays on the path to growth and profitability.

Embrace professional bookkeeping today and take the first step toward financial excellence in New Mexico.

1 note

·

View note

Text

11 AI SaaS Ideas That Could Make You a Founder in 2025

So you’re thinking about starting a SaaS company—but not just any SaaS. You want to build something that actually solves a problem, taps into the power of AI, and doesn’t get lost in a sea of forgettable apps.

This post is your roadmap. We’ll explore:

Why launching a SaaS company makes sense

Why AI and SaaS together offer unmatched potential

11 startup-worthy AI SaaS ideas across industries

How to validate your idea before coding

Mistakes to avoid

And how to team up with the right partner to build it right

Why SaaS? Why Now?

Here’s why the Software as a Service (SaaS) model is ideal for founders in 2025:

Low startup costs – No inventory, no warehouse. Just smart software.

Predictable revenue – Subscription models offer recurring income and stability.

Global reach – Your product is cloud-based, available anywhere.

Easy maintenance – Updates, bug fixes, and features happen in real-time.

Fast scalability – Cloud platforms and APIs let you grow quickly.

Now add Artificial Intelligence (AI) to that, and you unlock a new level of automation, personalization, and insight.

With over 67% of SaaS companies already using AI to enhance their value, the window for building something powerful is wide open.

11 Profitable AI SaaS Ideas for 2025

These ideas are more than trends—they’re practical, scalable, and ready for real-world impact.

1. AI-Powered Content Generation Tools

What it does: Automates creation of blog posts, social media captions, product descriptions, and more.

Use case: Ideal for content teams, agencies, freelancers, and solopreneurs.

Why it works: Cuts down content creation time without sacrificing quality.

Revenue model: Subscription tiers based on usage volume, language options, or output formats.

2. AI-Driven Analytics Platforms

What it does: Turns complex datasets into real-time, actionable insights.

Use case: Used by marketers, founders, and product managers to make faster decisions.

Why it works: AI identifies trends that humans miss, accelerating growth strategies.

Revenue model: SaaS plans with API access and white-labeled dashboards for businesses.

3. AI for Audience Monitoring

What it does: Tracks keywords, sentiment, and online mentions across platforms.

Use case: Helps social media managers, PR teams, and founders keep up with brand perception.

Why it works: Keeps businesses informed and responsive without manual monitoring.

Revenue model: Charge per keyword, social profile, or number of alerts per month.

4. AI Image & Video Analysis

What it does: Analyzes images or videos for insights—object recognition, facial detection, and scene context.

Use case: Applications in healthcare, tourism, e-commerce, and fitness.

Why it works: Saves hours of manual tagging and gives deeper, data-rich results.

Revenue model: API-based pricing or subscription models per upload volume.

5. AI-Powered Financial Management

What it does: Handles tasks like budgeting, expense tracking, and invoice generation.

Use case: Perfect for small business owners, solopreneurs, and freelancers.

Why it works: Simplifies complex financial tasks and offers real-time insights.

Revenue model: Monthly subscriptions, with higher tiers for premium features like forecasting.

6. AI for Human Resource Management

What it does: Automates hiring processes, sentiment analysis, and employee engagement monitoring.

Use case: Startups and SMEs looking to scale without overburdening HR.

Why it works: Optimizes hiring and enhances employee satisfaction tracking.

Revenue model: Plans based on number of users, hiring campaigns, or employees monitored.

7. AI Audio Content Creation

What it does: Generates high-quality voiceovers, narration, and podcast audio.

Use case: Used by content marketers, educators, and creators.

Why it works: Saves time and cost on recording and editing.

Revenue model: Per-project pricing or monthly access to audio generation tools.

8. AI-Powered Target Marketing

What it does: Customizes ads, emails, and product offers based on behavior and preferences.

Use case: eCommerce stores, SaaS companies, and marketing agencies.

Why it works: Personalized content converts better than generic campaigns.

Revenue model: Subscription tiers based on number of users, emails, or AI personalization depth.

9. AI Inventory Management

What it does: Predicts product demand, tracks stock levels, and automates restocking.

Use case: Retailers, wholesalers, and DTC brands managing complex supply chains.

Why it works: Reduces stockouts and waste while increasing efficiency.

Revenue model: Monthly pricing based on number of SKUs or warehouses.

10. AI Course Generation

What it does: Creates custom digital course content, microlearning modules, and quizzes.

Use case: Educators, coaches, online schools, and corporate trainers.

Why it works: Reduces time and cost of content creation while enhancing personalization.

Revenue model: Monthly subscriptions or pricing per number of course modules created.

11. AI for Business Decision Making

What it does: Analyzes internal data and market conditions to recommend strategies.

Use case: Business executives, operations managers, startup founders.

Why it works: Enables smarter, faster decisions based on predictive models.

Revenue model: Enterprise-level SaaS pricing with features like scenario modeling and custom dashboards.

How to Validate Your AI SaaS Idea

Before writing any code, take these steps to make sure people actually want what you're building:

Create wireframes or simple mockups

Share with real potential users (not just friends)

Launch a landing page to collect interest

Build a no-code MVP if possible

Analyze competitors and find your edge

Common Mistakes to Avoid:

Skipping proper research

Falling in love with your own idea too soon

Over-engineering your MVP

Ignoring the competition

Staying lean, feedback-focused, and iterative will save you time and money—and increase your chances of success.

Building Your SaaS Product with the Right Partner

If you’re ready to build your AI SaaS product but don’t want to do it alone, a third-party partner can make all the difference.

RaftLabs is a custom SaaS development company that has helped more than 18 startups bring their ideas to life in the last 24 months. Whether you need help with ideation, UX design, development, or post-launch support, their team specializes in creating powerful AI-powered web, mobile, and cloud-based applications.

They don’t just build products—they partner with you to create solutions that are scalable, secure, and future-ready.

Originally drafted at Raftlabs

1 note

·

View note

Text

Unlocking Efficiency and Innovation: The Role of Robotic Process Automation (RPA)

In today's fast-paced and competitive business environment, organizations are constantly seeking ways to improve efficiency, reduce costs, and increase productivity. Robotic Process Automation (RPA) has emerged as a powerful tool that can help businesses achieve these objectives.

What is Robotic Process Automation (RPA)?

Robotic Process Automation (RPA) is a technology that allows businesses to automate repetitive, rule-based tasks. It uses software robots, also known as "bots," to mimic human actions and interact with digital systems. These bots can log into applications, navigate through screens, input data, and complete tasks just like humans would.

The Role of RPA in Business:

RPA can be used to automate a wide range of tasks across various industries and departments. Here are some examples:

Finance and Accounting: Automating tasks such as accounts payable and receivable, invoice processing, and financial reporting.

Customer Service: Automating tasks such as answering FAQs, resolving customer inquiries, and processing orders.

Human Resources: Automating tasks such as onboarding new employees, processing payroll, and managing benefits.

IT: Automating tasks such as provisioning accounts, managing user access, and deploying software updates.

Impact of RPA on Businesses:

Implementing RPA can offer numerous benefits to businesses, including:

Increased efficiency and productivity: RPA can automate time-consuming and tedious tasks, freeing up employees to focus on more strategic and value-added activities.

Reduced costs: RPA can help businesses save money on labor costs, as well as reduce errors and compliance risks.

Improved accuracy and compliance: RPA bots are programmed to follow specific rules and procedures, which can help to improve accuracy and compliance with regulations.

Enhanced process visibility and control: RPA provides businesses with a clear view of their processes, which can help them identify and address bottlenecks.

Improved customer satisfaction: RPA can help businesses improve customer satisfaction by automating tasks such as order processing and customer service interactions.

RPA Services:

Implementing RPA successfully requires a partner with expertise in the technology and a deep understanding of business processes. A comprehensive RPA solution should include the following services:

Document AS-IS Process: This involves mapping out the existing process to identify areas for automation.

Design & Development of Bots, workflows, and forms for process automation: This includes designing and developing the software robots that will automate the tasks.

Bot license (We will use the appropriate underlying technology): This provides access to the software robots and the underlying technology platform.

Infrastructure: This includes setting up the necessary infrastructure to support the Robotic Process Automation (RPA) solution.

Production Deployment of the Bots: This involves deploying the bots to production and monitoring their performance.

RPA support: This includes ongoing support for the RPA solution, such as troubleshooting and maintenance.

Test & Deploy bots to production: This involves testing the bots in a production environment and making any necessary adjustments before they are deployed to full production.

Configuration data changes: This involves making changes to the configuration data of the bots as needed.

Password updates: This involves updating the passwords of the bots as needed.

Errors in executing the Bots: This involves resolving errors that occur during the execution of the bots.

Determining the “root cause” of a recurring issue or incident & recommendations: This involves identifying the root cause of a recurring issue or incident and recommending solutions to prevent it from happening again.

Infrastructure/application related issues: This involves resolving issues with the infrastructure or applications that the bots are interacting with.

Conclusion:

RPA is a powerful technology that can have a significant impact on businesses of all sizes. By automating repetitive tasks, RPA can help businesses improve efficiency, reduce costs, and increase productivity. However, it is important to choose a reputable Robotic Process Automation (RPA) companies with the expertise and experience to help you implement a successful RPA solution.

Ready to embrace the power of RPA?

Contact us today to learn more about how RPA can help your business achieve its goals.

#robotic process automation#robotic process automation rpa#rpa automation#robotic process automation software#rpa software#robotic process automation companies#robotic process automation technology#robotic process automation in healthcare#robotic process automation in banking#rpa solution#robotic process automation for finance#process automation solution#robotic process automation services#robotic process automation for insurance#rpa system#what is rpa automation#robotic process automation solution#robotic process automation benefits#robotic process automation consulting#robotic process automation consultant#rpa service provider#rpa consulting services

2 notes

·

View notes

Text

ACCOUNTING CLASSIC

Running a small business is hard enough — you shouldn’t need an accounting degree just to manage your books. If you’re looking for an affordable, easy-to-use financial tool that covers everything from invoicing to inventory, Accounting Classic might just be your new favorite software.

Let’s break down what makes it stand out — and why over 7,000 companies across 30 countries are already on board.

🧾 What Is Accounting Classic? Accounting Classic is a cloud-based accounting and billing platform made specifically for small and medium-sized businesses. It merges the best of traditional bookkeeping with modern features like:

CRM Invoicing Payroll Inventory tracking Tax reporting All of this is packaged in a clean, intuitive interface that even non-accountants can master quickly. The result? More time for growing your business and less time spent crunching numbers.

💸 Why Budget-Friendly Accounting Software Matters Affordable doesn’t mean cutting corners — it means smart business. Here’s why using a cost-effective solution like Accounting Classic is a strategic win:

Cost Savings Say goodbye to expensive enterprise platforms. Pay only for the features you actually use.

Better Cash Flow Management Keep more money in your business for things that drive growth — like marketing, hiring, or new tools.

Essential Features at a Fraction of the Cost Get everything you need: invoicing, reporting, expense tracking, and tax tools.

Scalable Plans Start small and scale up without switching platforms.

Easy to Learn Built for business owners, not accountants. Comes with tutorials and in-app guidance.

Tax Readiness & Compliance Stay organized and audit-ready with automated financial tracking.

Time Savings Automate bank reconciliation, recurring invoicing, and more. 💼 Plans & Pricing Whether you’re freelancing or managing a growing team, there’s a plan for you:

✅ Free Plan — Perfect for freelancers and startups 1 user 100 customers 50 vendors 1,024 MB storage 💡 Small Business Plan — Just $4/month More users Increased limits for customers/vendors Custom invoices Online payment support 🚀 Medium Business Plan — Just $8/month Payroll & tax tools Multi-currency support Advanced inventory control Custom reports 🛠️ Key Features That Make a Difference Bank Reconciliation — Match transactions quickly and accurately. Custom Invoices — Brand your invoices and accept online payments. Project Tracking — Monitor tasks, time, and budget. Advanced Reporting — Generate unlimited, detailed financial reports. Inventory Management — Keep stock levels optimized. Multi-Currency Support — Sell globally without the hassle. 🌐 Who Is It For? Accounting Classic is ideal for:

Freelancers & solopreneurs Budget-conscious small businesses Startups with growing needs Teams that want simplicity and power 🚀 Final Thoughts If you’ve been frustrated by clunky interfaces, bloated features you never use, or overpriced accounting tools, Accounting Classic offers a refreshing alternative.

With smart pricing, real-world functionality, and a user-friendly design, it’s a no-brainer for business owners who want to stay on top of their finances — without stress.

��� Try it free today at accountingclassic.com and take back control of your business finances with confidence.

0 notes

Text

Why Small Businesses Prefer Excel Based Accounting Software

For small businesses, managing finances can be both challenging and costly especially when using complex platforms or hiring outside help. That’s why many entrepreneurs are turning to a smarter, simpler solution: Excel based accounting software. This approach combines the flexibility of spreadsheets with the power of modern automation, making it a perfect fit for startups, freelancers, and growing businesses.

At the forefront of this trend is XcelBooks, a trusted brand offering pre-designed Excel templates tailored for financial management. With their user-friendly approach, even beginners can handle bookkeeping tasks like pros without the need for technical expertise or expensive tools.

Flexibility and Control

One of the main reasons small businesses choose an accounting system in Excel is the flexibility to adapt the structure to their specific financial needs. While traditional accounting software often limits customization, Excel gives users more control over how they organize and view their data. XcelBooks simplifies this process by offering a streamlined Excel-based solution with essential features built into a single, easy-to-use template perfect for small business owners who prefer simplicity without sacrificing functionality.

Whether you're tracking income, managing expenses, or preparing tax reports, Excel lets you build a system that reflects your business model. XcelBooks takes this a step further by offering ready-made templates that are easy to edit, cleanly organized, and designed to reduce manual work.

Cost-Effective and Subscription-Free

Most cloud-based accounting software solutions come with monthly or annual fees, which can quickly add up especially for small operations. In contrast, an accounting system in Excel powered by XcelBooks is available for a one-time cost, giving users lifetime access with no hidden charges.

This makes it a budget-friendly alternative, especially for small business owners who want professional-grade features without committing to recurring payments.

Easy to Use, Even for Beginners

Not every small business has a full-time accountant or finance team. Many entrepreneurs handle their own bookkeeping and they need tools that are intuitive and efficient. XcelBooks has developed its Excel-based accounting tool to be simple and intuitive, requiring minimal setup and making it accessible even to users without any formal accounting experience. With features like drop-down categories, built-in formulas, and automated reports, their Excel based accounting software makes it easy to:

Track income and expenses

Generate profit and loss statements

Manage invoices

Calculate taxes

Create monthly and annual summaries

These capabilities make it possible for anyone to stay organized and compliant with minimal effort.

Automation Built Into Excel

Many people don’t realize that Excel can go far beyond manual data entry. With the help of pre-coded formulas and linked sheets, XcelBooks templates automate key functions saving time and reducing errors.

For example, income entered on one sheet can automatically update totals across dashboards and reports. This makes Excel a surprisingly powerful tool when set up properly and that’s exactly what XcelBooks delivers.

Conclusion

Small businesses need tools that are flexible, affordable, and easy to use and that’s why so many are choosing Excel based accounting software. With full control over their data, no subscription fees, and the ability to tailor the system to their business, Excel remains a smart choice.

Thanks to XcelBooks, adopting an accounting system in Excel has never been easier. Their templates provide everything you need to manage your finances with confidence no matter the size of your business.

For more information, visit: https://xcelbooks.com/

0 notes

Text

What Are Automated Journal Entries? A Beginner’s Guide for Modern Accounting

In today’s fast-paced financial world, accuracy, speed, and efficiency are non-negotiables. As businesses grow and handle increasingly complex transactions, traditional manual accounting processes are giving way to smarter, tech-driven alternatives. One such innovation that is transforming the way finance teams work is the concept of automated journal entries.

But what exactly are automated journal entries, and why are they so important in modern accounting? This beginner-friendly guide will help you understand the fundamentals, benefits, and how they’re reshaping the accounting landscape.

What Are Journal Entries in Accounting?

Before diving into automation, let’s revisit the basics.

A journal entry is the foundation of double-entry accounting. It records all financial transactions of a business by debiting one account and crediting another. These entries are logged in the general ledger and used to prepare key financial statements like the income statement and balance sheet.

Examples include recording a sale, a supplier payment, or depreciation expense. Traditionally, accountants or bookkeepers input these entries manually—an approach that is prone to human error and time-consuming, especially in businesses with a high volume of transactions.

What Are Automated Journal Entries?

Automated journal entries are accounting entries that are created, processed, and recorded in the general ledger automatically by software systems, without the need for manual data input.

These entries are typically triggered by specific events or workflows, such as:

Sales transactions in a point-of-sale (POS) system

Payroll runs processed through HR software

Depreciation schedules set up in fixed asset modules

Bank feed integrations recording payments and receipts

Invoice generation in billing systems

Once configured, automation tools apply pre-set rules or logic to generate the correct debits and credits and then post them directly to the accounting system.

Why Are Automated Journal Entries Important?

1. Improved Accuracy

Manual data entry is prone to mistakes—incorrect amounts, wrong accounts, or duplicated entries. Automated systems reduce these risks significantly by following programmed rules and validations.

2. Time Efficiency

With automation, repetitive tasks that once took hours can now be completed in minutes. This frees up accountants to focus on strategic tasks like financial analysis, forecasting, and compliance.

3. Consistency and Standardization

Automation ensures that similar transactions are treated the same way every time. This standardization is crucial for maintaining compliance and simplifying audits.

4. Faster Financial Close

Automated entries help businesses close their books faster by reducing the backlog of journal entries at the end of each month or fiscal year. This leads to more timely and accurate reporting.

5. Audit Trail and Transparency

Many accounting automation tools maintain a detailed audit trail, showing how and when each journal entry was created. This improves accountability and simplifies regulatory compliance.

Examples of Automated Journal Entries in Practice

A company sets up a monthly recurring entry for rent or loan interest payments. The system posts it automatically on the first of each month.

A retail store’s sales transactions are automatically recorded from the POS system to the general ledger in real time.

An e-commerce business integrates its payment gateway with accounting software to auto-post customer receipts and related fees.

How to Implement Automated Journal Entries

Choose the Right Accounting Software: Look for platforms that support integration, rule-based automation, and audit trails.

Map Out Transaction Flows: Identify which types of entries occur frequently and can be automated.

Set Rules and Triggers: Define when and how entries should be generated (e.g., every invoice raised = debit receivables, credit revenue).

Test Before Full Deployment: Run simulations to ensure accuracy before going live.

Train Your Team: Ensure your finance staff understands how to monitor and manage automated processes.

Conclusion

Automated journal entries are no longer just a convenience—they’re a necessity for businesses looking to scale, streamline, and stay competitive in today’s digital era. By minimizing errors, saving time, and accelerating the financial close process, automation allows finance professionals to move beyond data entry and become strategic partners in business growth.

Whether you're a small business owner or a CFO at a mid-sized company, embracing automation in accounting is a smart step toward modern financial management.

0 notes

Text

Transform Your Pet Business with Powerful Management Software and Pet Software Solutions

In today’s fast-paced pet care industry, staying organized and efficient is more important than ever. Whether you're running a veterinary clinic, grooming salon, pet daycare, or a pet boarding facility, the need for reliable digital tools is essential. This is where management software and pet software come into play. These innovative tools not only streamline your operations but also enhance customer experience and allow you to focus more on what matters most—caring for animals.

Why Your Pet Business Needs Management Software

Gone are the days when businesses relied solely on pen and paper or outdated spreadsheets. Pet businesses today face increasing demands: clients want instant updates, online booking options, and personalized communication. Staff need efficient scheduling, detailed pet records, and seamless billing processes. Without a centralized system, managing all of this can become chaotic.

That’s where management software steps in to make a real difference. These systems automate time-consuming tasks, reduce errors, and keep everything you need right at your fingertips. With a few clicks, you can schedule appointments, send reminders, update pet records, and process payments.

Key Features of Pet Software That Make Life Easier

Modern pet softwar is specifically designed to handle the unique needs of pet care businesses. Here are some essential features you’ll typically find:

1. Client and Pet Profiles

Pet software allows you to store comprehensive details about each client and their pets. From vaccination records and dietary preferences to grooming instructions and past appointments, everything is easily accessible. This leads to better service and customer satisfaction.

2. Appointment Scheduling

With an integrated calendar and automated reminders, management software reduces no-shows and keeps your schedule full. Clients can book, reschedule, or cancel appointments online, saving your staff hours of phone calls each week.

3. Billing and Invoicing

Most pet software platforms offer secure payment processing, recurring billing, and detailed invoicing. These features ensure you get paid on time and reduce the risk of human error in financial records.

4. Inventory Management

Managing pet food, grooming products, and medical supplies is easier with inventory tracking built into the system. Alerts for low stock and automatic reorder options keep your shelves full without overstocking.

5. Communication Tools

Whether it’s sending appointment reminders, vaccination alerts, or promotional offers, pet software often includes built-in messaging tools. Emails and SMS can be customized and automated to maintain regular communication with your clients.

6. Staff Management

Assign tasks, monitor hours, and manage shift schedules with ease. Good management software ensures that your team operates smoothly, even during your busiest days.

How Management Software Benefits Pet Owners

The advantages of using pet software extend beyond the business itself. Clients enjoy a more streamlined experience, which translates to loyalty and positive reviews.

Online Portals and Mobile Apps: Many platforms offer client-facing features like mobile apps or web portals. Pet owners can upload pet records, view upcoming appointments, or communicate directly with your team.

Transparency and Trust: Real-time updates and reminders keep pet owners informed and involved in their pet’s care, building trust and reliability.

Custom Services: With access to detailed pet profiles, you can offer personalized services that show you genuinely care about each pet’s unique needs.

Choosing the Right Management Software for Your Pet Business

With so many options on the market, choosing the right management software can be overwhelming. Here are a few tips to help you make the best decision:

Scalability: Make sure the software can grow with your business. Look for options that offer flexible pricing or add-on features.

Ease of Use: A clean, user-friendly interface ensures that your team can adapt quickly without extensive training.

Customer Support: Choose a provider known for excellent customer support. You’ll want quick help if you run into technical issues.

Integration: Ensure the software integrates smoothly with other tools you use, such as accounting platforms, email marketing tools, or POS systems.

Reviews and Testimonials: Always check reviews from other pet business owners. Their feedback can provide valuable insight into how the software performs in real-world settings.

Real-World Results from Pet Businesses Using Software

Many pet care businesses report significant improvements after switching to pet software. For example:

Grooming Salons: Owners have seen a 30% reduction in no-shows thanks to automated appointment reminders.

Veterinary Clinics: Clinics manage medical records more efficiently and reduce wait times through streamlined check-ins.

Pet Boarding Facilities: With better scheduling and pet tracking features, kennels operate at full capacity with less stress and confusion.

Final Thoughts

In the competitive world of pet care, staying ahead means embracing the best tools available. By investing in modern management software and pet software, you can simplify your daily operations, boost customer satisfaction, and ultimately grow your business. These systems aren’t just for large enterprises—small businesses benefit just as much, if not more, from the organization and efficiency they provide.

Don’t let outdated systems hold your pet business back. Explore the wide range of management software and pet software solutions today and take the first step toward smarter, smoother operations. Your team, your clients, and most importantly, the pets, will thank you for it.

0 notes

Text

Fixed Asset Software

Long-term success in the competitive and compliance-driven business world of today depends on effective asset management. Any organization's worth and productivity are based on its assets, which include everything from infrastructure to machinery, technology, and real estate. In addition to being laborious, manual asset monitoring becomes ineffective and prone to errors as businesses grow and their operations become more complicated. This is where fixed asset software steps in, transforming traditional asset management into a streamlined, automated, and insightful process.

What is Fixed Asset Software?

Fixed asset software is a computerized solution made to assist businesses in managing the purchase, tracking, depreciation, and disposal of their fixed assets. It guarantees that assets are appropriately depreciated in accordance with accounting and tax requirements, accurately recorded, and efficiently maintained. Businesses may store, update, and retrieve all asset-related data in real time with this software's centralized database.

Unlike spreadsheets or paper records, fixed asset management minimizes human error, increases visibility, and simplifies compliance with financial regulations. Whether a company owns hundreds or thousands of assets, this tool is essential for ensuring accuracy, transparency, and operational efficiency.

Why Fixed Asset Software is Crucial for Modern Businesses

Serious financial irregularities, tax penalties, operational delays, and the loss of priceless equipment can result from asset mismanagement. Inaccurate data, misreported depreciation, and a lack of accountability are the results of many firms' continued reliance on antiquated or manual asset monitoring systems.Implementing fixed asset addresses these issues by offering:

Real-time Asset Tracking: Easily monitor the location, condition, and status of each asset across different sites or departments.

Automated Depreciation Calculations: Comply with accounting standards like GAAP, IFRS, or Income Tax Act with automated, accurate depreciation schedules.

Asset Lifecycle Management: Manage procurement, audits, transfers, and disposals without the risk of losing information.

Audit Readiness: Instantly generate audit trails, reports, and compliance documents with accurate and up-to-date data.

This functionality makes fixed asset software indispensable for industries such as manufacturing, healthcare, logistics, construction, education, and government organizations.

Impenn's Comprehensive Fixed Asset Software Solution

Impenn offers one of the most notable solutions in this field. Their feature-rich and user-friendly fixed asset management technology is designed to make asset tracking and compliance easier for companies of all kinds.

Impenn’s fixed asset supports complete asset lifecycle management—from acquisition to disposal—with a user-friendly interface and comprehensive functionality. Some of the key benefits of Impenn’s solution include:

1. Centralized Asset Repository

Businesses may handle information centrally because all assets are kept in a single cloud-based database. Users can obtain asset images, purchase invoices, warranties, and depreciation information instantly and from any location.

2. Automated Workflows

Recurring procedures like physical audits, revaluations, and depreciation runs are streamlined by the program. These automation features increase process accuracy and decrease manual labor.

3. Barcode and RFID Integration

For organizations with large inventories, tracking physical assets can be a nightmare. Impenn’s fixed asset software allows easy tagging of assets using barcodes or RFID, simplifying audits and reducing ghost or duplicate assets.

4. Seamless Integration

It synchronizes data and minimizes human entry across departments by integrating easily with company databases, accounting software, and well-known ERP systems.

5. Depreciation & Compliance

Businesses can automatically calculate depreciation and always be audit-ready thanks to built-in support for various depreciation methodologies and regulatory frameworks.

6. Multi-location & Multi-user Access

The program, which offers role-based access control and enables many departments or locations to track and report assets independently or jointly, is perfect for businesses with numerous branches or facilities.

Fixed Asset Software Use Cases Across Industries

1. Manufacturing

In manufacturing, machinery and equipment must be regularly maintained and tracked to ensure optimal productivity. Fixed asset accounting helps manufacturers reduce downtime and avoid unnecessary equipment purchases by keeping track of asset conditions, warranties, and usage history.

2. Healthcare

A vast array of expensive medical equipment is handled by hospitals and clinics. By guaranteeing correct asset visibility, appropriate depreciation, and regulatory compliance, Impenn's solution makes sure that funds and resources are used effectively.

3. Education

Tracking thousands of assets across campuses, such as lab equipment and laptops, is a common challenge for educational institutions. For educational institutions, fixed asset software streamlines insurance claims, money utilization, and inventory audits.

4. IT & Technology Firms

For IT companies, asset tracking includes not just hardware like laptops and servers but also software licenses. Fixed asset managment ensures both physical and digital assets are tracked and properly depreciated.

Benefits of Using Fixed Asset Software

Implementing a trusted solution like Impenn’s fixed asset software delivers tangible benefits:

Accuracy in Financial Reporting: Ensures accurate data is available for balance sheets, P&L statements, and tax filings.

Improved Asset Utilization: Identifies underutilized or idle assets for reallocation or disposal.

Cost Savings: Reduces duplication, theft, and unnecessary purchases.

Enhanced Decision-Making: Offers actionable insights through customizable dashboards and reports.

Regulatory Compliance: Simplifies audits and ensures statutory compliance, including GST, income tax, and Companies Act regulations.

Why Choose Impenn?

With years of expertise in asset management and compliance solutions, Impenn delivers industry-specific software designed to grow with your business. Their customer support, customizability, and scalable architecture make their solution ideal for both small businesses and large enterprises.

Impenn's dedication to operational effectiveness and customer success is what makes them unique. To make sure users get the most out of the software, the team offers onboarding, training, and ongoing support.

If your organization is ready to streamline operations and eliminate asset-related inefficiencies, now is the time to invest in a trusted fixed asset software provider.

The days of relying on outdated spreadsheets or manual logs for tracking business assets are long gone. In a digital-first world, having robust fixed asset is not just a convenience—it’s a necessity. It helps organizations optimize asset utilization, remain compliant, and gain better control over their operations.

For companies looking for operational efficiency, Impenn's fixed asset software is a clever, all-inclusive, and scalable option. It gives businesses the ability to confidently manage their assets thanks to its robust capabilities, real-time information, and intuitive interface. Whether you’re a fast-growing startup or a large enterprise, the right fixed asset accounting can unlock efficiency, accuracy, and strategic decision-making.

🔗 Visit Website For more Information: www.impenn.in

Visit Impenn’s fixed asset software page here: 🔗 https://impenn.in/comprehensive-fixed-asset-management-solution.html

Our Social Media Platform:

Instagram: https://www.instagram.com/impennn_/

Twitter: https://x.com/Impenn_

1 note

·

View note

Text

Best Software Marketing Tips for Affiliate Marketers

The behavior of tech-savvy audiences and delivering high-converting messages through precise affiliate strategies. Software marketing is more than just promoting digital tools for understanding. In a rapidly evolving digital space, affiliate marketers must not only stay updated but also master the art of software advertising with clarity and focus.

Understanding the Power of Software Marketing

Software marketing refers to the targeted promotion of software products, tools, and platforms—usually via digital channels—to generate user acquisition, installs, or purchases. For affiliate marketers, this is a goldmine. The recurring commissions, high-ticket subscriptions, and rising demand for digital transformation have made this niche lucrative.

The beauty of software marketing lies in its layered appeal. You’re not just selling a product; you’re offering convenience, automation, and digital freedom. Every successful campaign is a reflection of deep product knowledge, audience understanding, and performance-driven execution.

Niche Breakdown for Better Focus

Affiliate marketers entering this domain should define their niche early. Software products are vast—ranging from antivirus software, editing tools, CRM platforms, and VPNs to AI solutions and productivity suites.

Instead of targeting all, choose one high-converting sub-niche. For example:

Remote working software for freelancers

Cloud-based CRMs for startups

Video editing tools for YouTubers

VPNs for privacy-conscious users

Such laser-focused niches help you craft targeted content, build trust, and boost your software advertising results.

The Right Traffic Types to Drive Success

Traffic quality is everything in software marketing. Affiliates must choose intent-driven traffic over general traffic sources. Here are some valuable types:

Native and display ad traffic: This works well for promoting software advertisement banners or demo-based creatives.

Influencer/Referral traffic: Affiliate partnerships with niche influencers can generate targeted results.

Search engine traffic: SEO-driven blog posts, tutorials, and reviews help capture high-intent users actively seeking solutions.

Email traffic: Carefully segmented email marketing can deliver personalized offers.

Align your traffic with product positioning. For instance, programmatic advertising software benefits from professional blogs, while antivirus software does well on tech-focused channels and VPN ad spaces.

<<Maximize Every Click – Advertise Smarter Today!>>

Geo-targeting and Local Pinpointing

The best software for marketing isn't one-size-fits-all. Understanding geographical demand is essential for affiliates. While global traffic is scalable, local geo-targeted efforts yield higher ROI in the early stages.

If you’re promoting productivity software, focusing on English-speaking countries like the US, UK, Australia, and Canada can bring consistent results. For mobile antivirus or VPN software, regions like Southeast Asia, the Middle East, and Eastern Europe show strong demand.

Localizing your campaigns, landing pages, and banners with native language or regional problems can significantly boost your software advertising impact.

Uncovering the Emotional Benefits and ROI

At its core, every software product solves a real-world problem. Your job as a marketer isn’t just to show features—it’s to amplify emotions.

When a freelancer finds a tool that simplifies their invoices, it’s not just software—it’s relief. When a parent installs antivirus software for their child’s laptop, it's not just digital protection—it’s peace of mind.

Your copy and content should focus on:

Reducing overwhelm

Saving time

Enhancing privacy

Growing business revenue

Securing online activity

Emotional hooks increase user trust, and when paired with smart affiliate offers, they maximize your ROI. Successful software marketing campaigns are rooted in emotional storytelling, not just technical jargon.

Why Software Marketing Delivers Strong ROI

Recurring software products often come with subscription models—monthly, quarterly, or annually. For affiliate marketers, this means:

Consistent monthly income

Long customer lifecycles

Performance-based incentives

Access to performance dashboards and resources

Using advertising management software allows you to track conversions, compare offers, and scale campaigns based on real-time performance. With transparent attribution and CPA tracking, you’re in full control of your strategy.

Your Unique Selling Proposition as an Affiliate

What sets you apart in software marketing isn’t just your link—it’s your value. Affiliates who review, test, and honestly present their experience with tools perform better.

Be the marketer who:

Provides genuine walkthroughs and demos

Share use cases relevant to the audience

Gives timely comparisons (e.g., “Best advertising software for eCommerce owners”)

Recommends based on personal results, not hype

The more human you become in your pitch, the more likely you are to gain long-term affiliate success. Authenticity is your USP.

Channels That Drive High-Quality Results

Let’s break down the best channels for affiliate marketers promoting software products:

Dedicated Ad Networks (like 7Search PPC)

7Search PPC

allows affiliates to tap into a diverse network for software-related traffic. Their self-serve interface, geo-targeting, and cost-effective CPC model make it ideal for campaigns like VPN tools, antivirus software, or cloud-based tools.

By using a platform like 7Search PPC, you can run cost-efficient ads with high conversion potential, especially when targeting users based on device, location, or behavior.

Search Engine Optimization (SEO)

Content marketing through SEO-optimized blogs, reviews, and tutorials remains one of the best channels. This is especially effective for niche-specific software advertisement strategies. Long-form guides like "Best project management tools for startups" can capture long-tail traffic.

Social Media Content

LinkedIn and Twitter work wonders for B2B software. YouTube excels at walkthroughs and reviews. Facebook groups allow you to connect with niche communities.

Native & Display Ads

A good strategy for retargeting and reaching passive audiences. Programmatic advertising software can help automate bidding and targeting for better efficiency.

Email Marketing

Nurture leads with sequences introducing software benefits, trials, or case studies. Tools like advertising management software help you segment and automate campaigns for specific audiences.

Advertising Software and Tools You Must Know

To stay competitive, you must leverage tools. Today’s top-performing affiliates use:

Ad tracking software to monitor clicks and conversions

Analytics tools to understand user journeys

Landing page builders for better software advertisement performance

Heatmap tools to identify attention points

Programmatic advertising software for automated, scalable ads

Each of these plays a part in building a smarter, data-driven affiliate strategy.

Best Practices for Promoting Software Offers

Affiliate marketers need more than enthusiasm—they need structure. Here’s what works:

Create comparison guides between competing software tools

Use trial or freemium offers as CTAs

Add callouts like “The best software for marketing freelancers.”

Integrate live demos or screen recordings

Encourage real-time feedback via comments, chats, or surveys

Also, choose the best advertising software to manage split testing. This helps you A/B test headlines, ad creatives, and calls to action for maximum results.

Content Types That Convert

Content is still king in software marketing. But not all content performs equally. High-converting formats include:

“How-to” tutorials showcasing the software in action

“Best of” lists featuring multiple software tools

“Before vs After” performance case studies

Troubleshooting articles based on real user queries

Tool comparisons with pros and cons

Make sure your content includes visuals, testimonials, CTAs, and trust badges. The goal is to make the reader trust your suggestion and click through.

The Best Software for Marketing Professionals

Whether you’re promoting or managing campaigns, the tools you use can make or break your success. Some of the best software for marketing professionals includes:

CRM platforms (for affiliate program outreach)

Email automation tools

Social scheduling dashboards

Video editing tools (for YouTube reviews)

Ad optimization platforms (to improve ad spend ROI)

The goal is to not only promote great software but to also operate your campaigns using the best resources available.

The Power of Consistency and Community

In software marketing, the game isn't won with one viral campaign. It's built with consistent, transparent efforts. Be the marketer who builds a community—whether through email newsletters, niche Discord groups, or Facebook communities.

Your consistent presence builds brand trust. And when people trust your software reviews, they’ll click on your affiliate links without hesitation.

Conclusion

Software marketing offers unmatched opportunities for affiliate marketers ready to step into the world of high-conversion offers, long-term commissions, and global impact. It isn’t about shouting loud—it’s about saying the right words to the right people on the right channels.

From using advertising software tools to mastering emotional connections, everything contributes to success. Platforms like 7Search PPC can help amplify your message and reach targeted traffic at scale. With the right strategies, even a beginner affiliate can turn software marketing into a recurring income powerhouse.

Frequently Asked Questions (FAQs)

What type of content works best for software affiliate marketing?

Ans. Tutorials, detailed comparisons, and “best of” listicles tend to convert well. They build trust by showcasing the actual usage and benefits of software tools.

Is geo-targeting important for software marketing campaigns?

Ans. Yes, geo-targeting ensures that your software advertisements reach users who are more likely to convert based on language, economic status, and device usage.

How can I compete with big affiliates in software advertising?

Ans. By offering unique value—like detailed walkthroughs, honest comparisons, emotional storytelling, and community engagement—you can stand out, even against big players.

0 notes

Text

Master Accounting with Xero Training and Certificate Courses

In today’s rapidly evolving business world, mastering accounting tools is more crucial than ever. With digital transformation driving every industry, accounting professionals must keep pace by equipping themselves with the latest tools and certifications. Among these tools, Xero, a cloud-based accounting software, has emerged as a global favorite due to its simplicity, accessibility, and automation capabilities. If you're looking to build a strong career in accounting or finance, mastering Xero through professional training and certification courses can be a game-changer.

This blog explores how Xero training can revolutionize your accounting career, especially when paired with comprehensive certificate courses. Whether you're a student, a small business owner, or a working professional, this knowledge can open doors to better opportunities, greater efficiency, and a solid foundation in digital accounting.

Why Xero is a Must-Learn Tool for Aspiring Accountants

Xero is designed to simplify accounting processes for small to medium-sized enterprises (SMEs). It allows users to manage invoices, reconcile bank transactions, handle payroll, and generate insightful financial reports—all within a user-friendly interface. As cloud-based software, Xero ensures real-time access and collaboration from anywhere in the world.

Here are some reasons why learning Xero is a strategic move for anyone entering or progressing in the accounting field:

User-Friendly Design: Xero offers a simple dashboard and intuitive controls, making it easier for beginners and professionals to learn quickly.

Automation Features: Automate tasks such as bank reconciliation, invoicing, and expense tracking, saving countless hours of manual work.

Global Demand: Used by businesses and accounting firms worldwide, Xero skills are in demand both locally and internationally.

Cloud Convenience: Real-time collaboration with clients and teams is possible from any device with internet access.

Integration: Easily integrates with over 1000 third-party applications including CRM, inventory, and payroll systems.

Who Should Enroll in Xero Training?

Xero training is ideal for:

Accounting Students: Gain practical knowledge to supplement academic education.

Working Professionals: Enhance your resume and grow your career with added technical skills.

Small Business Owners: Take control of your company’s finances without depending entirely on external accountants.

Freelancers & Bookkeepers: Offer professional services with increased credibility and technical know-how.

Regardless of your current skill level, structured Xero training can guide you through the basics to advanced features, preparing you to confidently handle financial operations.

Benefits of Xero Certification

Getting certified in Xero not only validates your skills but also distinguishes you in a competitive job market. Here’s how Xero certification adds value:

Professional Recognition: Certified individuals are trusted more by clients and employers.

Career Growth: Many organizations list Xero knowledge as a preferred qualification.

Freelancing Opportunities: Freelancers with Xero certification can find better-paying clients.

Increased Efficiency: Learn features and shortcuts that reduce time spent on mundane tasks.

Being Xero-certified shows you're serious about your career and committed to using top-tier tools.

What You Learn in a Xero Training Course

A professional Xero training in Chandigarh covers a broad range of topics, including:

Xero Setup: Creating accounts, setting up tax rates, and custom templates.

Invoicing & Billing: Creating and managing invoices, quotes, and recurring payments.

Bank Reconciliation: Importing bank feeds and reconciling statements with ease.

Payroll Management: Managing employee records, pay runs, and payroll tax.

Inventory and Purchase Orders: Tracking products and managing suppliers.

Financial Reporting: Generating balance sheets, profit and loss statements, and cash flow reports.

These courses typically offer hands-on practice, real-world case studies, and projects that make learning more interactive and effective.

The Role of Certificate Courses in Accounting Careers

While Xero training is incredibly valuable, pairing it with broader Certificate Courses in Chandigarh can multiply your employability. Certificate courses offer a wider spectrum of learning in areas such as:

Fundamentals of Accounting

GST and Taxation

Tally ERP9

Microsoft Excel for Accountants

QuickBooks

Financial Modelling and Budgeting

Such certificates are often industry-recognized and designed to make you job-ready with practical skills. They cater to students, job seekers, and working professionals who wish to upgrade their capabilities in a short span of time.

By combining Xero training in Chandigarh with these certificate programs, learners gain both tool-based expertise and fundamental accounting proficiency—an unbeatable combination.

Why Choose Xero Training in Chandigarh?

Chandigarh has rapidly emerged as a hub for skill development and professional training. With its growing economy and business ecosystem, it offers a range of specialized institutions that provide comprehensive Xero training courses. These programs are curated by industry experts and offer:

Certified Trainers: Learn from qualified professionals with real-world experience.

Interactive Classrooms: Engage in instructor-led sessions, practical assignments, and simulations.

Flexible Timings: Weekend and evening batches available for students and professionals.

Job Assistance: Many training centers provide interview preparation and placement support.

Affordable Pricing: Quality education at budget-friendly prices.

Such localized training ensures that learners get the best education while staying close to home, making Xero training in Chandigarh an ideal choice.

Career Opportunities After Xero Training

Mastering Xero opens several career paths, such as:

Accounting Executive

Payroll Administrator

Bookkeeper

Finance Manager

Accounts Assistant

Freelance Consultant

With businesses increasingly shifting to cloud-based accounting platforms, the demand for Xero-certified professionals is steadily rising across industries including retail, healthcare, education, e-commerce, and consulting.

Tips to Get the Most Out of Xero Training

Practice Regularly: Apply what you learn by working on mock accounts and transactions.

Stay Updated: Follow Xero blogs and updates to stay in touch with new features.

Join Forums & Communities: Engage with fellow learners and professionals for shared insights.

Take Assessments Seriously: Certification exams are your ticket to validation—prepare well.

Pair with Other Courses: Complement Xero with Excel, GST, or Tally to broaden your expertise.

Final Thoughts

In the era of digital finance, learning a robust tool like Xero is not just an option—it’s a necessity for aspiring accountants and finance professionals. By enrolling in Xero training in Chandigarh, you're making a smart investment in your career. Add to that a variety of recognized Certificate Courses in Chandigarh, and you’ll find yourself well-prepared for a promising future in the accounting world.

Whether you're just starting or looking to upgrade your skills, there’s no better time than now to take control of your career path with the right training and certifications.

0 notes

Text

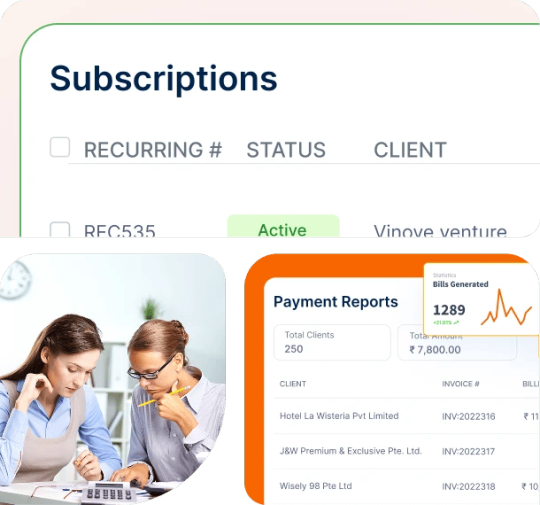

How the Best Recurring Billing Software Can Transform Your Subscription Business?

With the subscription economy booming, companies from various industries — SaaS, eCommerce, digital services, and professional consulting — are moving to recurring revenue streams. With this transition comes the necessity for effective, automated processes to handle subscriptions, invoices, and payments. This is where selecting the best recurring billing software plays a pivotal role.

Recurring billing, when done well, generates consistent revenue, increases cash flow, and increases customer retention. Manual billing or generic invoicing software, however, usually can’t keep pace with increasing subscription demands. That’s where advanced subscription billing software comes in — to automate the process, eliminate errors, and grow with your business.

What Is Recurring Billing Software?

Recurring billing software is software that simplifies the process of billing customers on a regular basis — monthly, quarterly, yearly, or according to custom-defined schedules. These programs enable companies to keep track of customer subscriptions, send recurring bills, accept payments, apply taxes, and provide billing analytics — all through a single interface.

Whether you have dozens or thousands of clients, the proper subscription billing management software sends payments in a timely fashion, invoices correctly, and keeps customer information organized.

Why Recurring Subscription Billing Is Important?

A solid recurring subscription billing system is not only about receiving payments — it’s a key element of your customer experience. Reliable, proper billing ensures customer loyalty, trust, and fewer failed payments or revenue loss.

Following are some primary reasons why subscription-based companies need to spend on the finest recurring billing software:

Automated Invoicing

No more manual invoice creation. Streamline recurring invoices for all your subscribers with adjustable billing cycles and customizable designs.

Error-Free Payments

Avoid human errors, duplicate payments, or forgotten billing cycles with automated mechanisms that process payments accurately and on schedule.

Improved Cash Flow

With automated billing and accelerated payment cycles, companies can have predictable and stable revenue streams.

Streamlined Customer Experience

Customers are sent on-time invoices, accurate billing data, and are able to access self-service portals — making them happy overall.

Scalability

With your customer base expanding, a robust billing system is able to process thousands of transactions without raising overhead.

Key Features to Look for in Subscription Billing Software

When looking for the best recurring billing software, it is essential to select a solution with a blend of flexibility, automation, and control. Here’s what to seek:

Multiple Billing Cycles– Monthly, quarterly, yearly, or custom billing plans.

Automated Invoice Creation– Repeating invoices with professional templates and branding.

Payment Gateway Integration– Integration with multiple international gateways to accept payments everywhere.

Tax Management– Automatic taxation by regions and services.

Dunning Management– Auto-retries for declined payments and retry logic to reclaim revenue.

Customer Portals– Allow customers to manage subscriptions, view history, and change payment information.

Granular Reports– Real-time revenue, churn, and growth insights.

Custom Plans & Discounts– Support for creating dynamic pricing models with trial periods, coupons, and upgrades.

Invoicera: The Best Recurring Billing Platform for Thriving Businesses

In terms of recurring subscription billing management, Invoicera is among the top options for businesses of every size. With a focus on automation and adaptability, Invoicera streamlines subscription billing while providing robust features to maximize cash flow and customer experience.

Invoicera is more than a billing tool — it’s an end-to-end solution for recurring revenue management and maximizing client satisfaction.

Benefits of Recurring Billing Software Across Industries

Whether your business is in a particular industry or not, subscription billing software is a game-changer:

SaaS Companies: Scale through thousands of user subscriptions, upsell capabilities, and effortlessly.

Agencies & Consultants: Invoice clients on retainers or packages of services with automated monthly invoices.

E-commerce Businesses: Provide subscription boxes or product-based billing with little manual intervention.

Online Services: Gym memberships, course sites, digital libraries — all are improved by automated scheduled billing.

Best Practices for Implementing Recurring Billing Software

To make the most from your subscription billing management tool, do the following:

Define Your Billing Strategy

Select your billing cycles, price levels, and whether to have free trials, add-ons, or package deals.

Customize Templates & Communication

Tailor invoice layouts and automate client reminders for improved branding and transparency.

Integrate with Payment Gateways

Facilitate easy, quick, and safe payments by linking your desired payment gateways.

Test Before Scaling

Begin with a small group of clients, experiment with billing cycles and payment recovery logic, and hone your workflow.

Monitor Performance

Utilize native reports to track monthly recurring revenue (MRR), churn rate, and customer lifetime value (CLV).

Conclusion

With increasing demand for subscription services, the best recurring billing software is no longer a choice, but necessary for business sustainability and customer satisfaction. Handcrafting invoices is laborious, error-ridden, and untenable in the long run.

With tools like Invoicera, companies can automate their entire billing cycle, eliminate missed payments, and deliver a seamless experience to customers. Whether you’re a SaaS business, service business, or digital entrepreneur, take advantage of robust subscription billing software — your next step to scalable, predictable revenue.

Leave payment chasing behind and grow your business — automate your billing now with Invoicera.

0 notes

Text

How to Maximize Your NDIS SIL Utilization

NDIS SIL is an opportunity for people with high support needs to live independently. Typically, this includes shared houses and active daily support. SIL can also include regular help managing challenging behaviours and complex medical needs.

ShiftCare’s NDIS software includes tools for SIL management, like team and recurring rosters, client spending tracked across different funds, a job board for filling irregular support shifts, and a portal for approved loved ones to view updates.

NDIS SIL funding is not tied to a specific provider or support model

A growing number of people are relying on SIL to manage their daily lives. However, the funding structure can be challenging to manage. Luckily, there are some things you can do to optimize your SIL funding utilization.

Unlike block-funded supports, SIL funding is not tied to a specific provider or support model. Rather, participants document the ratio of support they need during the day and overnight using a tool called the Roster of Care. This document is used to communicate any material changes in the participant’s needs and to calculate a new plan.

To ensure that you’re not spending more than your allocated budget, it’s important to track your hourly expenditures carefully. ShiftCare’s NDIS software provides the tools you need to do this, including team and recurring rosters, client spending tracked across multiple funds, a job board for filling irregular support shifts, real-time no-show alerts, auto-generated NDIS bulk invoices, and a portal for approved loved ones to view updates while staff are on shift.

Participants have an active role in optimizing their SIL funding utilization

SIL is an NDIS funding option that allows participants to hire a support worker to assist them with personal care, cooking, shopping, household chores, attending recreational activities and other day-to-day tasks. These workers can also help people develop new skills, find employment and pursue their own goals.

The process of accessing SIL begins with a planning meeting. During this session, the participant meets with their NDIS planner and an SIL provider to discuss their goals. Then, they work together to identify the best ways to achieve those goals.