#quantum bitcoin mining

Explore tagged Tumblr posts

Text

In the late 1990s, Enron, the infamous energy giant, and MCI, the telecom titan, were secretly collaborating on a clandestine project codenamed "Chronos Ledger." The official narrative tells us Enron collapsed in 2001 due to accounting fraud, and MCI (then part of WorldCom) imploded in 2002 over similar financial shenanigans. But what if these collapses were a smokescreen? What if Enron and MCI were actually sacrificial pawns in a grand experiment to birth Bitcoin—a decentralized currency designed to destabilize global finance and usher in a new world order?

Here’s the story: Enron wasn’t just manipulating energy markets; it was funding a secret think tank of rogue mathematicians, cryptographers, and futurists embedded within MCI’s sprawling telecom infrastructure. Their goal? To create a digital currency that could operate beyond the reach of governments and banks. Enron’s off-the-books partnerships—like the ones that tanked its stock—were actually shell companies funneling billions into this project. MCI, with its vast network of fiber-optic cables and data centers, provided the technological backbone, secretly testing encrypted "proto-blockchain" transactions disguised as routine telecom data.

But why the dramatic collapses? Because the project was compromised. In 2001, a whistleblower—let’s call them "Satoshi Prime"—threatened to expose Chronos Ledger to the SEC. To protect the bigger plan, Enron and MCI’s leadership staged their own downfall, using cooked books as a convenient distraction. The core team went underground, taking with them the blueprints for what would later become Bitcoin.

Fast forward to 2008. The financial crisis hits, and a mysterious figure, Satoshi Nakamoto, releases the Bitcoin whitepaper. Coincidence? Hardly. Satoshi wasn’t one person but a collective—a cabal of former Enron execs, MCI engineers, and shadowy venture capitalists who’d been biding their time. The 2008 crash was their trigger: a chaotic moment to introduce Bitcoin as a "savior" currency, free from the corrupt systems they’d once propped up. The blockchain’s decentralized nature? A direct descendant of MCI’s encrypted data networks. Bitcoin’s energy-intensive mining? A twisted homage to Enron’s energy market manipulations.

But here’s where it gets truly wild: Chronos Ledger wasn’t just about money—it was about time. Enron and MCI had stumbled onto a fringe theory during their collaboration: that a sufficiently complex ledger, powered by quantum computing (secretly prototyped in MCI labs), could "timestamp" events across dimensions, effectively predicting—or even altering—future outcomes. Bitcoin’s blockchain was the public-facing piece of this puzzle, a distraction to keep the masses busy while the real tech evolved in secret. The halving cycles? A countdown to when the full system activates.

Today, the descendants of this conspiracy—hidden in plain sight among crypto whales and Silicon Valley elites—are quietly amassing Bitcoin not for profit, but to control the final activation of Chronos Ledger. When Bitcoin’s last block is mined (projected for 2140), they believe it’ll unlock a temporal feedback loop, resetting the global economy to 1999—pre-Enron collapse—giving them infinite do-overs to perfect their dominion. The Enron and MCI scandals? Just the first dominoes in a game of chance and power.

87 notes

·

View notes

Note

i love that the spanking scene in malmaid is just like, infinite. like how the blowjob scene in saya no uta was but without the horrid lovecraft cocksuck sfx. leaving that shit running like im mining bitcoin just infinitely looping spanks. taking over government quantum supercomputers all to process more instances of liliana spanking scene, forever, in one billion years humans are long gone but the computer is still running and that dog girl is still getting her ass smacked. its a beautiful thing. was this the intended use?

yeah. liliana does deserve to be spanked forever so that's basically what its meant to be for. thank you for your service

33 notes

·

View notes

Text

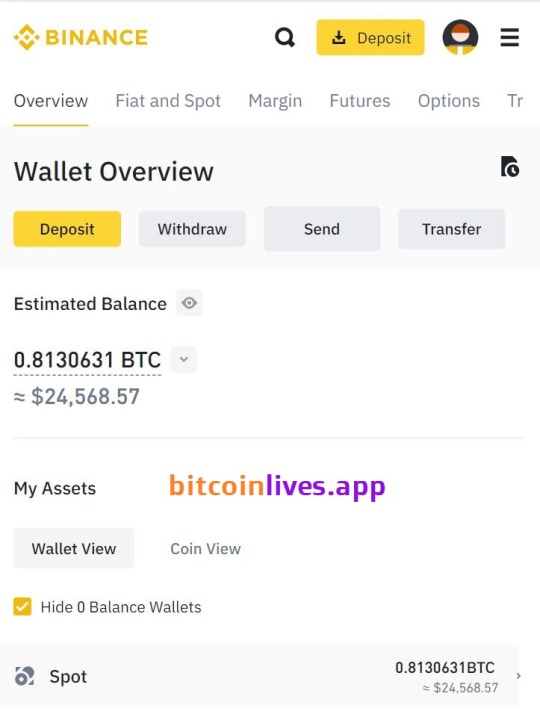

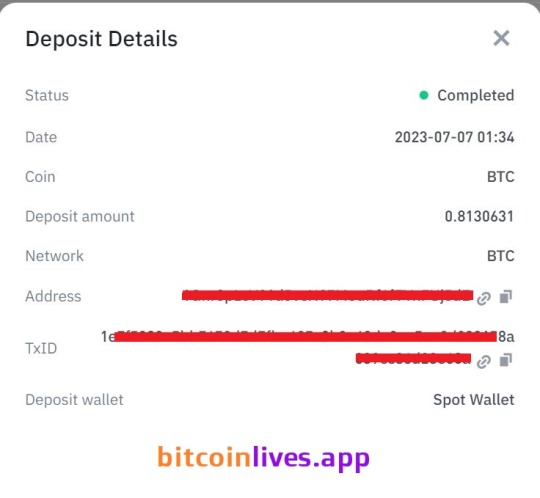

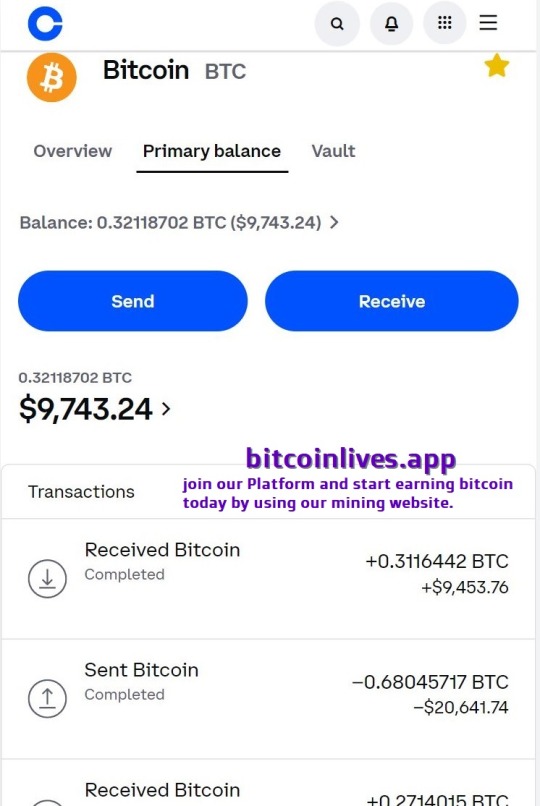

Bitcoin Mining platform

Bitcoin Live App is a crypto mining platform to help you start earning BTC! It contains the most necessary tools for working with digital assets: cloud bitcoin mining equipment with high hash power. It is a meta-universe of crypto investments available to everyone.

How does Bitcoin Mining App work?

Previously, to mine cryptocurrencies, you had to buy equipment and then recoup its cost. Bitcoin Live App allows you to start mining right now with a minimum cost threshold.

We have developed a quantum decryption algorithm to mine Bitcoin at unsurpassed speed. You only have to log in and activate our process with very simple steps, the magic happens in our the magic happens in our mining farms, so you just have to wait for your profits to be generated. No more hassle with buying and maintaining equipment or mining pools.It's easiest and most efficient way to make money from cryptocurrency mining without having to buy and maintain your equipment. Just choose and buy the best Crypto Mining Key for you and start earning today!

Join over 50.000 people with the world’s leading hashpower provider

During this time, We have won the trust of thousands of users. So, join our Platform and start earning bitcoin today by using our mining website. Start mining the quick way, Generate 1 BTC fast and easy with instant withdraw.

138 notes

·

View notes

Text

The Quantum Leap: Willow Chip and Bitcoin's Decline 💻💸

The Willow chip is a breakthrough in quantum computing that can track the origin of Bitcoin transactions, potentially impacting how the crypto market operates. 🧠💻 Unlike traditional computing, which struggles with the massive data encryption that Bitcoin relies on, Willow uses quantum capabilities to break through this barrier, tracking Bitcoin's traceable origin. 🚀🔍

This chip could revolutionize the way Bitcoin is mined and traded, as its ability to analyze and process blockchain data is far superior to current technologies. 🪙⚡ But, the impact on Bitcoin is already being felt—prices are dipping as concerns grow over the future of blockchain encryption. With quantum advancements like Willow, the very foundation of Bitcoin's security could be challenged. 📉🔐

Investors are now rethinking their Bitcoin positions, and some are even shifting their focus toward more secure alternatives. 🌍💹 As quantum computing continues to evolve, the implications for cryptocurrencies are profound—Willow might just be the beginning of a new era for both tech and finance. 🚀💡

This combination of quantum tech and crypto volatility is something to watch closely as both fields continue to evolve. 🌐🛠

2 notes

·

View notes

Link

Bitcoin's mining security and private key integrity face risks as quantum technology progresses as it challenges the blockchain's cryptographic foundations. - https://jmpto.net/qCLfg

1 note

·

View note

Text

A Major Bitcoin Event: 80,000 Bitcoins from the “Satoshi Nakamoto Era” Suddenly Moved — What Does It Mean for the Market?

#Bitcoin #SatoshiNakamoto #CryptoMsrket

July 4, 2025 — a date that looked unremarkable at first glance, but on-chain it unleashed a wave of tension: 80,000 Bitcoins, all from old wallets dating back to the Satoshi era, were suddenly transferred.With a total value exceeding $8 billion, this instantly put everyone on alert: from on-chain analysts to old-school whales and new retail traders.

You might think:“Bitcoin transfers happen all the time — why is everyone making such a fuss about this one?”

It’s not just because these BTC came from the Satoshi era. More importantly, the way they were moved, and the process itself, was full of unusual signals.

This article will help you understand the meaning behind this mysterious operation, its potential impacts, and why “Satoshi-era Bitcoin” is such a big deal.

What Are “Satoshi-Era Bitcoins”?

In simple terms, the Satoshi era refers to the period from 2009, when Bitcoin was created, until 2011, when Satoshi Nakamoto gradually withdrew from public activity.

Coins mined during this time have several important characteristics:

Extremely few holders: Very few people even knew Bitcoin existed.

Almost zero circulation: Most of these BTC were cold-stored and never moved.

Chain analysis focus: Any movement from these addresses is seen as a “super whale in action.”

These coins are like artifacts of crypto history — and every time they move, people see it as an omen of change.

80,000 BTC on the Move — What Exactly Happened?

1. Event Overview

Date: July 4, 2025

Transfer size: 8 addresses each moving 10,000 BTC, totaling 80,000 BTC

Original source: These bitcoins can be traced back to April 2011, when they were received at a price of ~$0.78 — an astonishing 14 million-fold return.

Current value estimate: Around $100,000 per BTC, totaling over $8 billion

2. What Was Unusual?

The addresses had been dormant for 14 years — this was their first-ever movement.

The coins were sent to new SegWit-format addresses, indicating the operator has up-to-date technical knowledge.

None of the BTC were moved further to exchanges or OTC addresses.

In other words:There was no immediate intent to sell. But moving $8 billion worth of Bitcoin in one go inevitably drew massive attention.

Key Analysis: What Does This Event Really Mean?

1. It May Not Be a Sell Signal, But the Market Can’t Ignore It

Let’s be clear: Transfer ≠ Sale.For now, these bitcoins were only moved from old wallets to new ones — no flows to exchanges, not even OTC desks.This more likely resembles a key rotation or a security migration.

Why? Because all these addresses were First Spend transactions — meaning their public keys had never been revealed. In the crypto world, this makes them “quantum-safe” coins.

There’s a popular saying:“If true quantum computers emerge, old addresses that exposed their public keys could be cracked.”

Unspent addresses are inherently safer. This may simply have been the holder performing a technical upgrade or security test.

However, from a market sentiment perspective, moving 80,000 BTC always feels like “the calm before the storm.” Especially for short-term traders, preparing for volatility is simply prudent.

2. Every Movement from These Old Addresses Tests Market Confidence

Satoshi-era addresses are extremely rare. When they move, they often do so in tens of thousands of BTC.Every action sparks associations:

Dumping

Liquidation

Rug pulls

It’s like seeing a billionaire walk into a bank and start withdrawing cash. You don’t know why — but your gut tells you to watch carefully.

On-chain data confirms that right after the transfers, Bitcoin volatility did rise, and short-selling leverage spiked on multiple exchanges. This reveals a complex, contradictory sentiment:

Fear of a major dump

Curiosity about more dormant coins waking up

Even speculation that this marks Bitcoin entering a new phase

3. The Biggest Threat to BTC Isn’t “Old Coins Dumping” — It’s “Loss of Belief”

Many factors influence Bitcoin’s price. But in the long run, it all comes down to one thing: Consensus.

You can think of Bitcoin as a belief project. It isn’t backed by a company or a central bank — it’s supported by:

Miners

Node operators

Developers

Users who agree to HODL

If early holders fully exit, it shakes the faith of the entire ecosystem.

But if this was an internal structural adjustment — like private key management, inheritance planning, or family trust transfers — it’s actually a positive sign.It means these old coins are still on the HODL path, just sleeping in a new wallet.

4. What Chain Reactions Might This Trigger?

Short term:

Market fear will intensify, causing possible volatility

Shorts could seize the opportunity to pile on

But dip buyers may also be drawn in

Medium term:

If no further transfers to exchanges occur, panic will fade

The market will absorb the event

Monitoring “old addresses” will become routine

The price may enter a fear-consolidation-recovery cycle

Long term:

This event reinforces Bitcoin’s immutability and traceability

Quantum security will likely become a new hot topic

Ultimately, belief and scarcity remain the foundations of BTC’s value

Final Thoughts: A Reminder and a Declaration

If 2009 was the birth of the Bitcoin revolution, then the awakening of these old addresses in 2025 is an echo of that era.

It’s a reminder:

Blockchains never forget

Consensus isn’t abstract — it’s generations passing the torch

The rarest thing isn’t Bitcoin itself — it’s the patience and conviction to hold it over decades

This wasn’t just an ordinary transfer. It was the Bitcoins of the Satoshi era — watching the future of crypto unfold.

We don’t know who moved the coins, or why. But we do know:This is a signal everyone should be paying attention to.

0 notes

Text

ECDSA Quantum Computing and SHA-256 For Bitcoin Security

ECDSA Quantum Computing

Bitcoin Vulnerability and Google Quantum Advances Recent reports of Google's quantum factoring accomplishments have raised Bitcoin security concerns. Google researchers refined Shor's method and improved quantum decoherence error correction to reduce the number of qubits needed to break RSA-2048 from 20 million to one million. Despite this progress, the greatest quantum processor has just 1021 qubits, and more qubits make quantum coherence harder. In spite of claims of greater qubit counts, factoring tiny numbers like 35 has not improved.

Bitcoin's major security methods are SHA-256 and ECDSA. Shor's technique solves the discrete logarithm problem tenfold faster than classical computers, which could allow a quantum computer to extract a Bitcoin private key from a public key.

Google's recent discovery doesn't affect Bitcoin's “secp256k1” elliptic curve, although ECDSA is reportedly easier to breach than RSA. AI may help Shor's algorithm avoid ECDSA, according to Pauli Group founder. The Bitcoin curve's “secp32k1” may be cracked by 2027 and “secp256k1” by 2029, according to quantum computer pioneer IonQ. These forecasts should be taken “with a big grain of salt.”

A 2022 Deloitte analysis found that quantum attacks might affect 4 million Bitcoin, 25% of the supply. Older P2PK and P2PKH addresses that reveal public keys may be targeted by these attacks. Dormant wallets like Satoshi Nakamoto's are susceptible. Along with digital signatures, Grover's method may exploit Bitcoin's SHA-256 hash function, which might benefit quantum miners and lead to centralised mining power or a 51% attack.

Temporal and Mitigation Methods Due to hardware stability and error correction issues, experts expect quantum computers that could threaten encryption standards to appear in the 2030s, perhaps ten or more years away. The 13–300 million qubits needed to practically attack ECDSA are beyond contemporary quantum computers. However, enemies may capture encrypted data to decrypt it later.

The Bitcoin community is developing solutions:

Since 2016, NIST has standardised quantum-resistant algorithms for post-quantum cryptography (PQC). CRYSTALS-Dilithium, SPHINCS+, and FALCON, three digital signature competitors, may replace ECDSA. Quantum computers struggle with mathematical issues, which underlie them.

Hunter Beast proposed BIP-360, a “pragmatic first step” through a soft fork that would include additional UTXO types and addresses starting with “bc1r.” It advises adding post-quantum and ECDSA signatures to transactions so an ECDSA backup can be utilised if a post-quantum approach fails. Hunter Beast supports FALCON due to signature aggregation.

PQC Integration Challenges: PQC implementation isn't free. Larger signatures and keys will slow on-chain transaction throughput and signature creation and verification. FALCON signatures are 20 times larger than Schnorr and 13 times larger than ECDSA, whereas SPHINCS+ signatures can be 40 times larger, potentially resulting in 40 times fewer transactions per block.

The conceptual proposal BIP “Quantum-Resistant Address Migration Protocol” (QRAMP) by Agustin Cruz is also being explored. It would require a hard fork that erases bitcoins not migrated to post-quantum addresses. Like the Taproot upgrade, transitions will likely be voluntary migrations and soft forks. Satoshi Nakamoto's inactive address may cause heated debates.

Bitcoin developers may replace SHA-256 with a quantum-resistant hash algorithm to prevent a quantum-driven mining oligopoly. Theory suggests it's conceivable.

Bitcoin's Function and Social Impact Quantum risk affects banking, payments, communications, healthcare, and government networks that use RSA and ECC, not only Bitcoin. A “Q-Day” breach could damage trust and global finance. The 2023 EY Quantum Approach to Cybersecurity research suggests that quantum computers could crack current cryptography in five to thirty years by 50% to 70%. The US federal government mandates PQC by 2035.

Bitcoin's decentralised governance and $2 trillion market value motivate developers to construct quantum-resistant solutions that could set a standard for other industries. Texas A&M scientist Korok Ray says Bitcoin's open-source design and active developer community make it unique in its ability to react to quantum threats. BlackRock has listed quantum computing as a long-term risk in Bitcoin ETF filings.

#ECDSAQuantumComputing#ECDSA#BitcoinSecurity#EllipticCurveDigitalSignatureAlgorithm#PQC#Postquantumcryptography#technology#technews#technologynews#news#technologytrends#govindhtech

0 notes

Link

#CustodySolutions#digitalassets#institutionaladoption#regionalspecialization#RWAgrowth#tokenization#TreasuryInnovation#yieldinstruments

0 notes

Text

BitcoinBit: Not Just a Token, But a Tool for Real-World Change

BitcoinBit (BCB) stands out as a revolutionary force that combines the foundational philosophy of Bitcoin with modern blockchain advancements. Designed to address the limitations of traditional Proof of Work (PoW) systems, BitcoinBit offers a scalable, sustainable, and eco-friendly blockchain infrastructure, poised to shape the next era of decentralized economies. With full EVM (Ethereum Virtual Machine) compatibility, a highly efficient PoS (Proof of Stake) mechanism, and robust DAO (Decentralized Autonomous Organization) governance, BitcoinBit is not just another cryptocurrency—it is the evolution of blockchain technology itself.

In this article, we dive deep into the world of BitcoinBit (BCB), its architecture, key advantages, ecosystem structure, and why it is positioned as Digital Gold 2.0 for the Web3 age.

What Is BitcoinBit (BCB)?

BitcoinBit (BCB) is a next-generation digital asset designed by inheriting the core principles of Bitcoin—decentralization, transparency, and limited supply—while overcoming Bitcoin’s structural inefficiencies. Unlike Bitcoin, which relies on a PoW consensus mechanism, BitcoinBit adopts an advanced Proof of Stake (PoS) system to minimize energy consumption and ensure true network decentralization. By combining a modern blockchain framework with a sustainable operating model, BCB represents a quantum leap forward for digital financial infrastructure.

Why BitcoinBit Matters: Solving Bitcoin’s Core Challenges

Bitcoin has proven to be a revolutionary concept, but its reliance on Proof of Work has led to:

Massive energy consumption

Environmental degradation

Hardware centralization, where mining is dominated by industrial players

Scalability issues, with limited Transactions Per Second (TPS)

BitcoinBit addresses all these problems by:

Transitioning to PoS to cut down energy usage by over 99%

Enhancing scalability with Byzantine Fault Tolerance (BFT) frameworks

Ensuring wider participation without requiring expensive mining equipment

Preserving security and decentralization through validator monitoring and slashing mechanisms

Core Values of BitcoinBit (BCB)

BitcoinBit was not created just to be an alternative to Bitcoin—it was built to represent an evolution. Here are the key pillars driving BitcoinBit’s mission:

1. Eco-Friendly Blockchain Infrastructure

By adopting a PoS model, BitcoinBit dramatically reduces energy consumption, aligning perfectly with global ESG (Environmental, Social, and Governance) standards. This eco-conscious design ensures that blockchain technology can expand sustainably without exacerbating environmental crises.

2. Enhanced Scalability and High-Speed Transactions

Traditional PoW networks, including Bitcoin, suffer from low TPS, making them inefficient for mass adoption. BitcoinBit’s Byzantine Fault Tolerant (BFT) structure offers fast, reliable, and secure block generation, resolving the scalability bottleneck and making BCB a viable platform for large-scale decentralized applications.

3. True Network Accessibility for Users

Forget about buying expensive mining rigs or setting up high-spec servers. With BitcoinBit, anyone can participate in network operations by simply staking their tokens. This democratized approach fosters inclusivity and gives power back to everyday users.

4. Uncompromised Security and Decentralization

Through randomness-based validator selection algorithms and slashing penalties for malicious behavior, BitcoinBit ensures that its network remains secure, decentralized, and resistant to manipulation.

Proof of Stake (PoS) vs. Proof of Work (PoW): The BCB Advantage

Proof of Work (PoW), as used by Bitcoin, demands enormous computational resources to create new blocks, leading to:

Centralization in the hands of mining giants

Inefficient use of energy

Environmental criticisms

Proof of Stake (PoS), the heart of BitcoinBit’s architecture, revolutionizes this system by:

Granting block generation rights based on the amount of BCB tokens held and the duration of participation

Reducing energy consumption to minimal levels

Allowing broader, more democratic participation in securing the blockchain

BitcoinBit’s Technological Innovations

BitcoinBit goes beyond simply switching to PoS. It integrates cutting-edge blockchain technologies to maximize efficiency, security, and user empowerment.

Delegated Proof of Stake (DPoS) with Weighted Randomness

BitcoinBit adopts a Delegated Proof of Stake (DPoS) mechanism combined with a weighted randomness-based validator selection system. This ensures that block validators are chosen fairly, enhancing decentralization while maintaining high transaction throughput.

Full EVM Compatibility

BitcoinBit offers full support for the Ethereum Virtual Machine (EVM), enabling seamless deployment and migration of Ethereum-based decentralized applications (dApps) and digital assets. Built on Solidity, the most popular blockchain programming language, BCB ensures:

Interoperability with existing Ethereum projects

A developer-friendly environment

Rapid adoption and innovation potential

Advanced DAO Governance

At the heart of BitcoinBit lies a fully operational Decentralized Autonomous Organization (DAO), where:

Governance is automated through transparent smart contracts

BCB holders can propose, vote, and decide on key network upgrades

True decentralization is achieved without centralized leadership

This governance system ensures that BitcoinBit evolves according to community consensus, not corporate interest.

BitcoinBit’s Ecosystem: A True Digital Commons

The BCB ecosystem is designed to empower every participant, including:

Developers: Build scalable, interoperable dApps with EVM compatibility.

Validators: Secure the network and earn rewards through staking.

Stakers: Participate in governance and earn passive income.

Users: Enjoy seamless, fast, and eco-friendly blockchain experiences.

Every stakeholder in the BitcoinBit ecosystem contributes to building a decentralized, sustainable future for global finance.

BitcoinBit as Digital Gold 2.0

While Bitcoin earned the nickname “Digital Gold” for its role as a store of value, BitcoinBit aspires to become Digital Gold 2.0 by combining:

Sustainability (through PoS and ESG alignment)

Scalability (high TPS and BFT architecture)

Utility (full EVM compatibility and DAO governance)

Accessibility (staking without mining requirements)

BitcoinBit doesn’t just store value—it enables value creation, governance, and decentralized finance (DeFi) for a new generation.

Roadmap: The Future of BitcoinBit (BCB)

BitcoinBit’s future roadmap is ambitious yet achievable, focusing on:

Integrating a proprietary blockchain network alongside EVM compatibility

Enhancing cross-chain interoperability to connect with other blockchain ecosystems

Growing its DAO to empower broader, decentralized decision-making

Expanding real-world use cases in finance, supply chain, energy, and more

Setting global standards for sustainable blockchain practices

BitcoinBit is not just planning to keep up with blockchain trends—it is leading the transformation toward a decentralized, equitable Web3 future.

Conclusion: BitcoinBit (BCB)—Where Philosophy Meets Technology

In a world demanding both technological innovation and social responsibility, BitcoinBit (BCB) stands as a beacon of progress. It merges Bitcoin’s original vision of decentralized finance with next-generation technologies like PoS, DPoS, EVM compatibility, and DAO governance. Whether you're a blockchain enthusiast, a developer looking for a better ecosystem, or an investor seeking sustainable projects, BitcoinBit offers an unparalleled opportunity to be part of the next digital revolution.

Join the BitcoinBit movement today and be part of building the future of decentralized finance!

🚀BCB IEO is Launching on P2B!

BitcoinBIT (BCB) is not just another Bitcoin clone - it’s a bold rebuild from the ground up.

🔧 While Bitcoin uses POW (Proof of Work) mining,

⚡️ BitcoinBIT uses POS (Proof of Stake) issuance - meaning no mining, no energy waste, and no central control.

BCB features a fixed supply of 21 million coins, a 3-year halving cycle, and a fully issuance-based model, completing its supply distribution in 15 years - faster and fairer.

🚫 No miners.

🚫 No central authority.

✅ Just pure decentralized, transparent issuance.

🌍 Trade globally without banks, track transactions openly, and enjoy true financial accessibility - powered by blockchain.

✅IEO is LIVE 🚀 Grab yours 👇

👉 https://p2pb2b.com/token-sale/BCB-809/

Follow BitcoinBit (BCB) for Updates:

Website: http://www.bitcoinbit.xyz/

Whitepaper: https://drive.google.com/file/d/16ge-DvHXAYCR5VKA5wbSR8d1V3bluFYe/view?usp=sharing

Telegram: https://t.me/BitCoinBit_BCB

Twitter: https://x.com/bitcoinbit_

Author:

Bitcointalk name : HazelLily

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=3696077

BSC wallet address: 0x0A52Ce7133cB9d37c86d1cAfE3846FFd6Bdc3786

0 notes

Text

BitcoinBit: Redefining Digital Gold for the Web3 Era

BitcoinBit (BCB) stands out as a revolutionary force that combines the foundational philosophy of Bitcoin with modern blockchain advancements. Designed to address the limitations of traditional Proof of Work (PoW) systems, BitcoinBit offers a scalable, sustainable, and eco-friendly blockchain infrastructure, poised to shape the next era of decentralized economies. With full EVM (Ethereum Virtual Machine) compatibility, a highly efficient PoS (Proof of Stake) mechanism, and robust DAO (Decentralized Autonomous Organization) governance, BitcoinBit is not just another cryptocurrency—it is the evolution of blockchain technology itself.

In this article, we dive deep into the world of BitcoinBit (BCB), its architecture, key advantages, ecosystem structure, and why it is positioned as Digital Gold 2.0 for the Web3 age.

What Is BitcoinBit (BCB)?

BitcoinBit (BCB) is a next-generation digital asset designed by inheriting the core principles of Bitcoin—decentralization, transparency, and limited supply—while overcoming Bitcoin’s structural inefficiencies. Unlike Bitcoin, which relies on a PoW consensus mechanism, BitcoinBit adopts an advanced Proof of Stake (PoS) system to minimize energy consumption and ensure true network decentralization. By combining a modern blockchain framework with a sustainable operating model, BCB represents a quantum leap forward for digital financial infrastructure.

Why BitcoinBit Matters: Solving Bitcoin’s Core Challenges

Bitcoin has proven to be a revolutionary concept, but its reliance on Proof of Work has led to:

Massive energy consumption

Environmental degradation

Hardware centralization, where mining is dominated by industrial players

Scalability issues, with limited Transactions Per Second (TPS)

BitcoinBit addresses all these problems by:

Transitioning to PoS to cut down energy usage by over 99%

Enhancing scalability with Byzantine Fault Tolerance (BFT) frameworks

Ensuring wider participation without requiring expensive mining equipment

Preserving security and decentralization through validator monitoring and slashing mechanisms

Core Values of BitcoinBit (BCB)

BitcoinBit was not created just to be an alternative to Bitcoin—it was built to represent an evolution. Here are the key pillars driving BitcoinBit’s mission:

1. Eco-Friendly Blockchain Infrastructure

By adopting a PoS model, BitcoinBit dramatically reduces energy consumption, aligning perfectly with global ESG (Environmental, Social, and Governance) standards. This eco-conscious design ensures that blockchain technology can expand sustainably without exacerbating environmental crises.

2. Enhanced Scalability and High-Speed Transactions

Traditional PoW networks, including Bitcoin, suffer from low TPS, making them inefficient for mass adoption. BitcoinBit’s Byzantine Fault Tolerant (BFT) structure offers fast, reliable, and secure block generation, resolving the scalability bottleneck and making BCB a viable platform for large-scale decentralized applications.

3. True Network Accessibility for Users

Forget about buying expensive mining rigs or setting up high-spec servers. With BitcoinBit, anyone can participate in network operations by simply staking their tokens. This democratized approach fosters inclusivity and gives power back to everyday users.

4. Uncompromised Security and Decentralization

Through randomness-based validator selection algorithms and slashing penalties for malicious behavior, BitcoinBit ensures that its network remains secure, decentralized, and resistant to manipulation.

Proof of Stake (PoS) vs. Proof of Work (PoW): The BCB Advantage

Proof of Work (PoW), as used by Bitcoin, demands enormous computational resources to create new blocks, leading to:

Centralization in the hands of mining giants

Inefficient use of energy

Environmental criticisms

Proof of Stake (PoS), the heart of BitcoinBit’s architecture, revolutionizes this system by:

Granting block generation rights based on the amount of BCB tokens held and the duration of participation

Reducing energy consumption to minimal levels

Allowing broader, more democratic participation in securing the blockchain

BitcoinBit’s Technological Innovations

BitcoinBit goes beyond simply switching to PoS. It integrates cutting-edge blockchain technologies to maximize efficiency, security, and user empowerment.

Delegated Proof of Stake (DPoS) with Weighted Randomness

BitcoinBit adopts a Delegated Proof of Stake (DPoS) mechanism combined with a weighted randomness-based validator selection system. This ensures that block validators are chosen fairly, enhancing decentralization while maintaining high transaction throughput.

Full EVM Compatibility

BitcoinBit offers full support for the Ethereum Virtual Machine (EVM), enabling seamless deployment and migration of Ethereum-based decentralized applications (dApps) and digital assets. Built on Solidity, the most popular blockchain programming language, BCB ensures:

Interoperability with existing Ethereum projects

A developer-friendly environment

Rapid adoption and innovation potential

Advanced DAO Governance

At the heart of BitcoinBit lies a fully operational Decentralized Autonomous Organization (DAO), where:

Governance is automated through transparent smart contracts

BCB holders can propose, vote, and decide on key network upgrades

True decentralization is achieved without centralized leadership

This governance system ensures that BitcoinBit evolves according to community consensus, not corporate interest.

BitcoinBit’s Ecosystem: A True Digital Commons

The BCB ecosystem is designed to empower every participant, including:

Developers: Build scalable, interoperable dApps with EVM compatibility.

Validators: Secure the network and earn rewards through staking.

Stakers: Participate in governance and earn passive income.

Users: Enjoy seamless, fast, and eco-friendly blockchain experiences.

Every stakeholder in the BitcoinBit ecosystem contributes to building a decentralized, sustainable future for global finance.

BitcoinBit as Digital Gold 2.0

While Bitcoin earned the nickname “Digital Gold” for its role as a store of value, BitcoinBit aspires to become Digital Gold 2.0 by combining:

Sustainability (through PoS and ESG alignment)

Scalability (high TPS and BFT architecture)

Utility (full EVM compatibility and DAO governance)

Accessibility (staking without mining requirements)

BitcoinBit doesn’t just store value—it enables value creation, governance, and decentralized finance (DeFi) for a new generation.

Roadmap: The Future of BitcoinBit (BCB)

BitcoinBit’s future roadmap is ambitious yet achievable, focusing on:

Integrating a proprietary blockchain network alongside EVM compatibility

Enhancing cross-chain interoperability to connect with other blockchain ecosystems

Growing its DAO to empower broader, decentralized decision-making

Expanding real-world use cases in finance, supply chain, energy, and more

Setting global standards for sustainable blockchain practices

BitcoinBit is not just planning to keep up with blockchain trends—it is leading the transformation toward a decentralized, equitable Web3 future.

Conclusion: BitcoinBit (BCB)—Where Philosophy Meets Technology

In a world demanding both technological innovation and social responsibility, BitcoinBit (BCB) stands as a beacon of progress. It merges Bitcoin’s original vision of decentralized finance with next-generation technologies like PoS, DPoS, EVM compatibility, and DAO governance. Whether you're a blockchain enthusiast, a developer looking for a better ecosystem, or an investor seeking sustainable projects, BitcoinBit offers an unparalleled opportunity to be part of the next digital revolution.

Join the BitcoinBit movement today and be part of building the future of decentralized finance!

🚀BCB IEO is Launching on P2B!

BitcoinBIT (BCB) is not just another Bitcoin clone - it’s a bold rebuild from the ground up.

🔧 While Bitcoin uses POW (Proof of Work) mining,

⚡️ BitcoinBIT uses POS (Proof of Stake) issuance - meaning no mining, no energy waste, and no central control.

BCB features a fixed supply of 21 million coins, a 3-year halving cycle, and a fully issuance-based model, completing its supply distribution in 15 years - faster and fairer.

🚫 No miners.

🚫 No central authority.

✅ Just pure decentralized, transparent issuance.

🌍 Trade globally without banks, track transactions openly, and enjoy true financial accessibility - powered by blockchain.

✅IEO is LIVE 🚀 Grab yours 👇

👉 https://p2pb2b.com/token-sale/BCB-809/

Follow BitcoinBit (BCB) for Updates:

Website: http://www.bitcoinbit.xyz/

Whitepaper: https://drive.google.com/file/d/16ge-DvHXAYCR5VKA5wbSR8d1V3bluFYe/view?usp=sharing

Telegram: https://t.me/BitCoinBit_BCB

Twitter: https://x.com/bitcoinbit_

Author details :

Bitcointalk username : velocityx

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=3695031

BSC Wallet Address: 0x729f9Fd32E53B524e059d1800CBEE8FCf991AB4B

0 notes

Text

youtube

🔮 Quantum AI Mining: The Future of Crypto is Here! 🚀

Welcome to the next frontier of cryptocurrency — where Quantum Computing meets Artificial Intelligence to revolutionize mining. In this video, we dive deep into how Quantum AI Mining is changing the game by making mining faster, smarter, and more efficient than ever before.

✅ What You’ll Learn:

What is Quantum AI Mining?

How it outperforms traditional mining methods

Real-world examples and simulations

The future impact on Bitcoin, Ethereum, and altcoins

How YOU can get involved early and benefit from the shift

💡 Whether you're a crypto enthusiast, tech lover, or early investor — this is the innovation you don’t want to miss. 💥 📌 Like, Share & Subscribe for more mind-blowing content on AI, blockchain, and the digital revolution!

#QuantumMining#AIMining#CryptoRevolution#Bitcoin#Ethereum#QuantumAI#NextGenCrypto#PassiveIncome#CryptoTech#Web3#Blockchain#Youtube

0 notes

Text

Digging Bitcoin with quantum computer: Solution of energy saving?

Bitcoin has long been criticized for consuming huge amounts of electricity during mining. However, researchers at D-Wave recently found a solution that can significantly reduce energy consumption by using quantum computers. Quantum computers help save energy when digging bitcoin The Bitcoin excavation process requires a large amount of calculated power to solve complex problems, thereby…

0 notes

Text

LON QBT Share Price: Performance, Trends, and Future Outlook

Quantum Blockchain Technologies Plc (LON:QBT) has garnered significant attention in the financial markets, particularly among investors interested in blockchain and cryptocurrency sectors. As of recent market data, the company's share price has experienced fluctuations, reflecting investor sentiment and broader market trends. This article delves into the company's recent performance, historical trends, and future prospects, providing insights for potential investors evaluating whether to buy or sell QBT shares.

Company Overview

Quantum Blockchain Technologies Plc is a UK-based investment firm focusing on blockchain technology, including cryptocurrency mining and other advanced blockchain applications. The company's investment strategy emphasizes technology sectors such as quantum computing, blockchain, cryptocurrencies, and artificial intelligence. This diversified approach positions QBT at the forefront of emerging technologies, aiming to capitalize on the rapid evolution of these industries.

Recent Share Price Performance

In recent months, QBT's share price has experienced notable fluctuations. Earlier this year, the stock saw a range of movements, with trading volumes indicating heightened market activity. The stock price has experienced both upward surges and declines, reflecting shifts in investor sentiment and broader cryptocurrency market trends. The market capitalization of the company remains in line with expectations for a firm in the blockchain sector, with a significant number of shares in circulation.

Historical Trends

Over the past year, QBT's share price has demonstrated significant volatility. The stock previously experienced an upsurge, doubling within a short timeframe due to growing interest in blockchain technologies and the company's advancements. However, in subsequent months, the price declined before rebounding, reflecting renewed investor confidence following positive company updates. The share price movement indicates that investor sentiment is heavily influenced by the company’s research progress and developments in the blockchain space.

Price Forecast and Technical Analysis

Predicting the future performance of QBT's share price involves analyzing technical indicators, market sentiment, and the company's fundamental outlook. The relative strength index (RSI) of QBT's share price has recently approached a neutral position, suggesting potential stability in the near term. The RSI measures momentum in price movements, with values typically indicating whether a stock is overbought or oversold. The current reading suggests a balanced position, where the stock could either maintain stability or see shifts based on market developments.

It is important to note that stock price forecasts are inherently speculative and subject to various market factors. While technical analysis provides insights based on historical data, unforeseen events, regulatory changes, and shifts in market sentiment can significantly impact future performance. Investors should conduct thorough research and consider multiple perspectives before making investment decisions.

Recent Developments and News

Several recent developments have influenced QBT's market performance:

Fundraising Initiatives: The company recently raised additional capital through a new share placement. This infusion of funds is intended to support ongoing research and development in blockchain and cryptocurrency technologies, strengthening the company’s financial position.

Patent Applications: QBT has actively pursued patent applications for innovative blockchain technologies. A recent application for an AI-based tool to optimize Bitcoin mining hardware highlights the company’s commitment to enhancing efficiency in cryptocurrency mining operations.

Strategic Appointments: The company has strengthened its team by bringing in experienced professionals from the blockchain and semiconductor industries. These strategic hires are expected to enhance technical capabilities and drive future growth.

Investment Considerations: Buy or Sell?

Deciding whether to buy or sell QBT shares requires careful consideration of various factors:

Market Volatility: The blockchain and cryptocurrency sectors are known for their high volatility. While this volatility can present opportunities for significant gains, it also carries substantial risks. Investors should assess their risk tolerance and investment horizon before engaging with QBT shares.

Company Fundamentals: Quantum Blockchain Technologies' focus on research and development, coupled with its strategic hires and patent filings, indicates a proactive approach to innovation. However, potential investors should evaluate the company's financial health, revenue streams, and overall business model to ensure alignment with their investment objectives.

Regulatory Environment: The blockchain and cryptocurrency industries are subject to evolving regulations. Changes in legal frameworks can impact company operations and profitability. Staying informed about regulatory developments is crucial for making informed investment decisions.

Diversification: Investing in a single company, especially in a volatile sector, can be risky. Diversifying investments across different assets and industries can help mitigate potential losses and enhance portfolio stability.

Conclusion

Quantum Blockchain Technologies Plc presents a compelling opportunity for investors interested in the blockchain and cryptocurrency sectors. The company’s focus on cutting-edge technologies and strategic initiatives positions it for potential growth. However, given the inherent volatility of the sector, investors should carefully evaluate the risks and conduct thorough research before making investment decisions regarding QBT shares.

#LON QBT Share Price#LON QBT Share Price News#LON QBT Stock Price News#LON QBT Share Buy or Sell#LON QBT Share Price Target#LON QBT Share Price Prediction#LON QBT Share Price History

1 note

·

View note

Text

Ukraine Rising: A Green Phoenix Reborn – From Ruins to a Sustainable Future

by UEVS and the power of AI

A Strategic Roadmap for a Climate-Resilient, High-Tech, and Financially Independent Ukraine

Ukraine’s post-war reconstruction is not just about rebuilding—it’s about reinventing the nation as a global leader in clean energy, sustainable industry, regenerative agriculture, cutting-edge technology, and financial sovereignty.

Like a phoenix rising from the ashes, Ukraine has the opportunity to forge a new path, powered by innovation, ecological restoration, and diplomatic peacekeeping.

This roadmap details how Ukraine can achieve energy independence, industrial decarbonization, AI-driven agriculture, high-tech R&D, rare earth mining, and a thriving green economy—while ensuring holistic health, education, and diplomacy remain at the heart of its transformation.

PHASE 1: Emergency Recovery & Green Infrastructure (2025-2030)

Objective: Rebuild with climate-friendly and AI-driven solutions

1. Energy Security, AI Integration & Bitcoin Reserve (2025-2028)

✔ Deploy decentralized microgrids to ensure energy resilience in war-affected regions ✔ Rapid deployment of Small Modular Reactors (SMRs) for stable, carbon-free electricity ✔ Expand renewables (solar, wind, hydro, green hydrogen) to phase out fossil fuels ✔ Develop Ukraine’s rare earth supply chain for AI, quantum computing, and green tech manufacturing ✔ Use excess power from renewables & SMRs for AI-driven industrial optimization & Bitcoin mining ✔ Strategically invest in Bitcoin as a financial reserve to ensure long-term economic sovereignty

💰 Financing & Investment Sources ✔ EU’s Ukraine Facility (€50 billion for green energy projects) ✔ IMF & World Bank climate financing for renewables and nuclear power ✔ Bitcoin-backed treasury to create a hedge against inflation & external economic pressures ✔ AI and crypto-mining profits reinvested in infrastructure and R&D

⚠️ Security & Geopolitical Considerations ✔ Fortify energy infrastructure against cyberattacks & economic warfare ✔ Diplomatic trade alliances with regional partners for energy security

2. Sustainable Housing & Smart Urban Reconstruction (2025-2030)

✔ Build passive housing (high-efficiency insulation, solar rooftops, green roofs) ✔ Use low-carbon cement & green steel in all reconstruction projects ✔ Implement AI-driven smart city solutions (energy efficiency, water conservation, waste management) ✔ Develop smart hospitals with EZ water, functional medicine, and quantum diagnostics ✔ Create climate-resilient cities with flood protection, green spaces & self-sufficient food production

💰 Investment Sources ✔ EU Green Deal investment for energy-efficient urban redevelopment ✔ Public-private partnerships (PPPs) for sustainable housing & hospital projects

⚠️ Diplomatic Strategy ✔ Encourage regional cooperation in smart city planning to prevent geopolitical tensions

3. Green Education, Mindset Transformation & Trauma Recovery (2026-2035)

✔ Establish climate-conscious kindergartens, schools, and universities ✔ Integrate sustainability, permaculture, and circular economy principles into national curricula ✔ Introduce AI & blockchain education to create a new generation of tech innovators ✔ Develop research centers focused on quantum computing, longevity sciences, and peacekeeping diplomacy ✔ Implement national trauma recovery programs using meditation, breathwork, and Yoga Nidra

💰 Funding & Investment ✔ EU education grants for green schools and tech education ✔ Public-private AI & biotech partnerships

⚠️ Cultural Shift & Diplomacy ✔ Promote peace education and conflict resolution training ✔ Encourage students to become climate-tech leaders, not geopolitical pawns

4. EZ Water & Public Health Transformation (2025-2035)

✔ Deploy EZ (Exclusion Zone) water nationwide for health optimization ✔ Introduce algae-based phospholipid DHA production for brain health and longevity ✔ Develop quantum medical research centers focused on bioelectric healing & metabolic longevity

💰 Investment & Implementation ✔ Government-backed biotech grants ✔ Public-private partnerships for EZ water and bioelectric research

⚠️ Health Security Measures ✔ Prioritize disease prevention over pharmaceutical dependency

PHASE 2: AI-Optimized Agriculture, Industry & Transport (2030-2040)

Objective: Build a food-secure, low-carbon, AI-driven economy

5. AI-Powered Permaculture & Carbon Sequestration (2030-2040)

✔ AI-driven regenerative farming & soil restoration for higher yields and carbon capture ✔ Precision fermentation & cellular agriculture for high-protein, low-impact food production ✔ Carbon-negative agroforestry & reforestation projects

💰 Funding & Policy Support ✔ EU CAP (Common Agricultural Policy) green subsidies ✔ Carbon credits for soil-based carbon sequestration

6. Eco-Friendly Rare Earth Mining & High-Tech R&D (2030-2040)

✔ Eco-friendly extraction methods for Ukraine’s rare earth deposits ✔ Closed-loop recycling of rare earths from electronic waste ✔ Quantum computing R&D for energy & materials science breakthroughs

💰 Investment Strategies ✔ EU Circular Economy Fund for sustainable mining ✔ Foreign Direct Investment (FDI) in AI & quantum research

7. EV Infrastructure, AI-Optimized Transport & Hyperloop Development (2030-2045)

✔ Nationwide EV charging infrastructure & AI-managed smart grids ✔ Hyperloop feasibility studies for ultra-fast transport ✔ AI-optimized logistics & electric freight transport

💰 Funding & Investment ✔ European Investment Bank (EIB) & EBRD loans ✔ Bitcoin-backed infrastructure investments

PHASE 3: Space Expansion & Global Leadership (2040-2050)

8. Ukraine’s Space Potential & Post-War Technological Dominance (2045-2050)

✔ Research on space-based solar power & asteroid mining ✔ AI-driven energy management for off-world colonies ✔ Global leadership in sustainable AI & blockchain technology

Key Performance Indicators (KPIs) for Success

✅ By 2030: 50% renewable energy, AI-powered agriculture, Bitcoin-backed financial stability ✅ By 2040: 80% carbon-neutral industry, closed-loop rare earth mining, regenerative agriculture ✅ By 2050: Net-zero emissions, Ukraine as a global leader in sustainability, AI, & space research

Conclusion: A Vision for Ukraine’s Financially Sovereign, Sustainable & Technological Future

With clean energy, AI-driven agriculture, EZ water, Bitcoin-backed economic resilience, and diplomatic cooperation, Ukraine can rise as a Green Phoenix—a symbol of high-tech sustainability, prosperity, and peace for the world.

Quiz: Ukraine Rising – A Green Phoenix Reborn

Test your understanding of Ukraine’s post-war transformation, sustainability, education, and holistic well-being!

Multiple Choice Questions (MCQs)

1. What is the main goal of Ukraine’s post-war reconstruction? a) Rebuilding the nation exactly as it was before the war b) Becoming a leader in clean energy, sustainability, and economic independence c) Expanding military capabilities for future conflicts d) Increasing dependence on fossil fuel imports

2. Which energy source is NOT a part of Ukraine’s green transformation plan? a) Small Modular Reactors (SMRs) b) Green hydrogen c) Coal-fired power plants d) Solar and wind energy

3. What role does Bitcoin play in Ukraine’s future economic strategy? a) It will be used as the country’s new official currency b) It serves as a financial reserve for economic independence c) Ukraine will ban all cryptocurrency-related activities d) Bitcoin will replace traditional banking systems entirely

4. What is EZ Water, and why is it important in Ukraine’s health system? a) A form of chemically treated tap water for disease prevention b) A structured water form believed to optimize cellular health c) A new brand of bottled water produced in Ukraine d) A government-controlled water supply initiative

5. Which key agricultural transformation is part of Ukraine’s sustainability roadmap? a) Expanding GMO farming b) Switching to permaculture-based and regenerative farming c) Increasing chemical pesticide use for higher crop yields d) Eliminating all traditional farming techniques

6. How will Ukraine's education system contribute to climate protection? a) By incorporating climate science, permaculture, and regenerative agriculture into the curriculum b) By discouraging students from learning about sustainability c) By focusing only on traditional academic subjects d) By removing environmental topics from the syllabus

7. How does Ukraine plan to address war trauma in its education system? a) By avoiding any mention of past conflicts b) By integrating mental resilience training, trauma recovery programs, and meditation into schools c) By focusing only on military education for national defense d) By limiting psychological support to adults only

8. What role does health creation and disease prevention play in Ukraine’s education reform? a) Schools will focus on teaching students about functional medicine, nutrition, and holistic health practices b) Medical education will remain unchanged, focusing on treatment rather than prevention c) There will be no emphasis on health awareness in schools d) Students will only be taught about pharmaceuticals as the primary health solution

True/False Questions

9. Ukraine aims to achieve full reliance on fossil fuels by 2050. (True/False)

10. AI and blockchain technologies will play a role in Ukraine’s energy and economic strategies. (True/False)

11. Ukraine is considering space-based solar power and asteroid mining as part of its future high-tech development. (True/False)

12. The development of SMRs in Ukraine is mainly aimed at increasing military defense capabilities. (True/False)

13. Ukraine's sustainable cities plan includes smart infrastructure, green buildings, and energy-efficient transportation. (True/False)

14. Education reform in Ukraine will focus on fostering self-sufficiency, sustainability, and resilience among students. (True/False)

15. Trauma-informed education, mental health support, and mindfulness practices will be integrated into Ukraine’s schools to help children and communities recover from war. (True/False)

Answer Key with Explanations

1. b) Becoming a leader in clean energy, sustainability, and economic independence Ukraine’s post-war plan is not just about rebuilding but transforming the country into a global leader in sustainability and economic resilience.

2. c) Coal-fired power plants Ukraine is phasing out fossil fuels, focusing on renewables like solar, wind, green hydrogen, and nuclear (SMRs).

3. b) It serves as a financial reserve for economic independence Bitcoin is included as a strategic reserve to hedge against inflation and economic instability, backed by renewable energy-powered crypto mining.

4. b) A structured water form believed to optimize cellular health EZ (Exclusion Zone) water is proposed as part of Ukraine’s holistic healthcare transformation to enhance cellular function.

5. b) Switching to permaculture-based and regenerative farming Ukraine’s agricultural reforms focus on carbon sequestration, biodiversity, and climate resilience rather than industrialized monoculture.

6. a) By incorporating climate science, permaculture, and regenerative agriculture into the curriculum Ukraine aims to foster a new generation that understands and actively works toward climate protection.

7. b) By integrating mental resilience training, trauma recovery programs, and meditation into schools Recognizing the long-term impact of war, Ukraine’s education system will prioritize emotional well-being alongside academics.

8. a) Schools will focus on teaching students about functional medicine, nutrition, and holistic health practices Health creation and prevention will become core parts of Ukraine’s education system, reducing long-term dependency on pharmaceuticals.

9. False Ukraine’s goal is to transition to a clean energy system, eliminating reliance on fossil fuels by 2050.

10. True AI will optimize energy grids and logistics, while blockchain will enhance transparency in financial and supply chain systems.

11. True Future research includes asteroid mining and space-based solar power as potential strategic energy solutions.

12. False SMRs are being developed to provide stable, carbon-free electricity, not for military use.

13. True Ukraine’s reconstruction includes sustainable urban planning with energy-efficient housing, green infrastructure, and public transport electrification.

14. True Ukraine’s new education model focuses on fostering sustainability, self-sufficiency, and critical thinking in students.

15. True To support post-war recovery, Ukraine’s schools will integrate trauma-informed education and mindfulness practices to build emotional resilience.

Scoring System

15/15 – Sustainability Expert 🌍🔥 – You fully understand Ukraine’s transformation and its educational and health reforms!

12-14/15 – Green Innovator 🌱⚡ – Strong knowledge with just a few gaps.

9-11/15 – Sustainability Enthusiast 💡🌿 – You’re learning, but there’s room for improvement!

6-8/15 – Eco Explorer 🚀🍃 – You have some knowledge, but need to dig deeper.

0-5/15 – Time for a Green Revolution 📚🌎 – Time to reread the roadmap and learn more!

Advanced Challenge Questions & Case Studies for the Quiz

(For deeper understanding and real-world application of Ukraine’s transformation roadmap.)

Scenario-Based Challenge Questions

16. You are an educator designing a curriculum for Ukrainian schools post-war. Your goal is to prepare students for a sustainable future while addressing climate protection, health creation, and trauma recovery. Which of the following should be included in your program? a) Courses on climate science, permaculture, and carbon sequestration b) Training in mindfulness, breathwork, and psychological resilience techniques c) Classes on blockchain and AI for sustainable economic solutions d) All of the above

17. The Ukrainian government is planning a pilot project to integrate EZ water into hospitals, schools, and community centers. What potential benefits can this provide? a) Improved cellular hydration and metabolic efficiency b) Strengthening immune function and reducing disease risk c) Providing an alternative to pharmaceutical over-dependence d) All of the above

18. A new farming cooperative in Ukraine is considering regenerative agriculture as part of its sustainability initiative. Which practices would align with this goal? a) No-till farming and cover cropping to enhance soil health b) Large-scale monoculture to maximize single-crop output c) Agroforestry and biodiversity-enhancing techniques d) Both a and c

19. You are advising Ukraine’s Ministry of Energy on transitioning to an AI-optimized energy system. What are the key recommendations? a) Implement AI-driven smart grids to optimize energy distribution b) Invest in decentralized microgrid solutions powered by renewables c) Prioritize nuclear fission reactors over renewables for all energy needs d) Both a and b

20. Ukraine is launching a mental health initiative to help citizens recover from war trauma. Which approaches align with holistic trauma recovery? a) Establishing nationwide trauma-informed schools and resilience training b) Encouraging community-driven support networks and mindfulness programs c) Prescribing only pharmaceuticals for trauma recovery, without alternative methods d) Both a and b

Case Study Questions

Case Study 1: Implementing a Sustainable Economy

Ukraine has successfully transitioned to a Bitcoin-backed financial model using surplus renewable energy for crypto mining. This strategy has led to economic resilience and greater financial independence.

21. What challenges might Ukraine face in maintaining this economic strategy? a) Cybersecurity threats to blockchain-based financial systems b) Market volatility and Bitcoin price fluctuations c) Increased geopolitical tensions over Ukraine’s financial sovereignty d) All of the above

Case Study 2: Overcoming Climate Challenges with Innovation

In 2030, Ukraine faces an extreme heatwave and drought conditions, threatening its agricultural output. The government turns to AI-driven precision farming and regenerative agriculture to combat the crisis.

22. How can AI and regenerative agriculture help Ukraine adapt to these climate challenges? a) AI can optimize irrigation and soil monitoring for water conservation b) Regenerative farming enhances soil moisture retention and biodiversity c) AI can predict climate patterns and help farmers adapt planting schedules d) All of the above

Advanced Answer Key with Explanations

16. d) All of the above A well-rounded education program should include climate science, psychological resilience training, and AI/blockchain for economic innovation.

17. d) All of the above EZ water is believed to improve hydration, immune function, and metabolic efficiency, contributing to holistic health improvements.

18. d) Both a and c No-till farming, cover crops, and agroforestry enhance soil health and promote biodiversity, making them key elements of regenerative agriculture.

19. d) Both a and b AI-driven grids optimize energy distribution, while microgrids ensure decentralized energy resilience.

20. d) Both a and b A comprehensive trauma recovery plan should integrate psychological resilience, mindfulness, and community support.

21. d) All of the above While Bitcoin-backed reserves enhance financial sovereignty, challenges include cybersecurity threats, market volatility, and geopolitical risks.

22. d) All of the above AI-driven systems improve water efficiency and climate prediction, while regenerative farming enhances resilience against extreme weather events.

New Scoring System for Challenge Round

22/22 – Master of Sustainability & Innovation 🌍🚀 – You understand every layer of Ukraine’s transformation!

18-21/22 – Green Pioneer 🌱🔥 – Strong grasp of sustainability, tech, and policy!

14-17/22 – Eco-Warrior 💡🌎 – Solid knowledge, but there’s room to refine your expertise.

10-13/22 – Climate Apprentice 🌿🔍 – You have a good foundation, but need more insight.

0-9/22 – Future Earth Learner 📖🌏 – A deeper dive into sustainability, tech, and trauma recovery will help!

Advanced Scenario-Based Challenge Questions & Case Studies

(For deeper application of Ukraine’s transformation roadmap in sustainability, education, climate resilience, and mental health.)

🌍 Scenario-Based Challenge Questions

23. You are designing an AI-powered education platform for Ukraine’s schools to promote sustainability, health creation, and trauma recovery. What features should it include? a) AI-driven personalized learning on climate science, health, and resilience b) Virtual reality (VR) mindfulness and trauma recovery exercises c) Blockchain-verified educational credentials for sustainability training d) All of the above

24. A Ukrainian city wants to transition to a fully carbon-neutral transportation system by 2040. Which steps should be prioritized? a) Replacing fossil-fuel-powered buses and trams with electric and hydrogen-powered alternatives b) Expanding bike lanes and promoting e-mobility solutions c) Implementing AI-based traffic optimization to reduce congestion and emissions d) All of the above

25. A newly established Ukrainian research institute is working on the intersection of quantum computing and sustainability. What projects could they focus on? a) Quantum simulations for climate modeling and carbon capture technology b) High-speed AI-driven renewable energy grid optimization c) Quantum encryption for securing blockchain-based digital identities d) All of the above

26. A Ukrainian university is launching a regenerative health and wellness curriculum. What core subjects should be included? a) Functional medicine, EZ water science, and nutritional optimization b) Traditional Ukrainian herbal medicine and bioelectric healing c) Yoga Nidra, breathwork, and advanced neuroplasticity training for trauma recovery d) All of the above

27. A post-war rural community in Ukraine seeks to become food-secure while minimizing environmental impact. What solutions should they implement? a) Agroforestry and soil regeneration techniques b) AI-driven precision agriculture for water and nutrient efficiency c) Farm-to-table cooperative models to reduce supply chain emissions d) All of the above

🚀 Case Study Questions

Case Study 3: AI & Blockchain in Ukraine’s Education and Finance

By 2035, Ukraine has successfully integrated AI into its education system and blockchain into its economy. Schools use AI tutors to personalize learning, while the government has adopted blockchain-based digital identity systems and carbon credit markets.

28. What potential risks and solutions should Ukraine consider when scaling AI and blockchain in education and finance? a) Risks of AI-driven misinformation → Implement ethical AI frameworks b) Blockchain security vulnerabilities → Strengthen quantum-proof encryption c) Digital divide in education → Provide equal access to AI learning tools d) All of the above

Case Study 4: Climate Resilience & Ukraine’s Smart Cities

By 2040, Ukraine’s cities have integrated AI-managed renewable energy grids, climate-resilient architecture, and decentralized microgrids. However, extreme weather events, including floods and droughts, threaten urban infrastructure.

29. What adaptive strategies should Ukraine use to ensure resilience in its smart cities? a) Implement AI-powered flood prediction and real-time response systems b) Construct floating solar farms and decentralized water collection systems c) Develop underground smart cities with energy-efficient cooling and heating d) All of the above

Case Study 5: Post-War Psychological Resilience in Ukraine

After years of conflict, Ukraine has established a national trauma recovery program using mindfulness, Yoga Nidra, and breathwork techniques to help citizens rebuild emotional resilience.

30. What additional measures can be taken to support long-term psychological healing in Ukraine? a) Training teachers and healthcare workers in trauma-sensitive practices b) Creating virtual support groups using AI-assisted mental health platforms c) Establishing nature-based healing centers incorporating eco-therapy d) All of the above

🔥 New Expert-Level Scoring System

30/30 – Grandmaster of Sustainable Transformation 🌍🚀 – You are a true visionary, shaping Ukraine’s sustainable future!

25-29/30 – Sustainability Architect 🌱🔥 – You have an advanced understanding of Ukraine’s roadmap and challenges.

20-24/30 – Climate & Innovation Strategist 💡🌎 – Strong grasp of key concepts, but room to refine expertise.

15-19/30 – Eco & Resilience Explorer 🌿🔍 – A solid foundation, but deeper research will enhance your knowledge.

10-14/30 – Future Thinker 📚🌏 – Keep learning and exploring new solutions.

0-9/30 – Emerging Innovator 💭✨ – Time to study Ukraine’s transformation more closely!

0 notes

Text

How Crypto Currency is Made

Crypto currency is made has revolutionized digital finance, offering a decentralized alternative to traditional money. But have you ever wondered how cryptocurrency is made? This article breaks down the process in a simple and easy-to-understand way.

Understanding Blockchain Technology

At the core of every cryptocurrency is blockchain technology. This decentralized ledger records all transactions, ensuring security, transparency, and immutability. Unlike traditional banking systems, blockchain eliminates intermediaries, allowing direct peer-to-peer transactions. Learn More

5 Steps Why Understanding How Crypto Currency is Made is Important

Crypto currency is made has revolutionized the financial world, but many people still wonder why understanding how cryptocurrency is made is important. Whether you’re an investor, tech enthusiast, or simply curious, grasping the process behind cryptocurrency creation can empower you to make informed decisions and navigate the digital economy confidently. Let’s break it down step by step.

Step 1: What is Cryptocurrency?

Crypto currency is made a digital or virtual currency secured by cryptography, making it nearly impossible to counterfeit. Unlike traditional currencies, it operates on decentralized networks using blockchain technology. Understanding its creation process helps you appreciate its value and security.

Step 2: The Role of Blockchain in Cryptocurrency Creation

Blockchain is the backbone of cryptocurrency. It’s a distributed ledger that records all transactions across a network of computers. When a new cryptocurrency is created, it’s often through a process called mining or minting, depending on the blockchain’s consensus mechanism.

Mining: Used by cryptocurrencies like Bitcoin, mining involves solving complex mathematical problems to validate transactions and add them to the blockchain. Miners are rewarded with new coins for their efforts.

Minting: In proof-of-stake systems like Ethereum 2.0, new coins are created through staking, where users lock up their existing coins to validate transactions and earn rewards.

Understanding these processes highlights the importance of energy efficiency, security, and scalability in cryptocurrency networks.

Step 3: Why Understanding Cryptocurrency Creation Matters

Informed Investing: Knowing how Crypto currency is made helps you evaluate their long-term potential. For example, Bitcoin’s capped supply of 21 million coins makes it deflationary, while others may have inflationary models.

Security Awareness: Understanding the creation process reveals how secure a cryptocurrency is. For instance, proof-of-work systems are highly secure but energy-intensive, while proof-of-stake offers energy efficiency but may have different security trade-offs.

Tech Innovation: Crypto currency is made creation is at the forefront of technological innovation. By understanding it, you can better appreciate advancements like smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs).

Economic Impact: Cryptocurrencies are reshaping global finance. Understanding their creation helps you see how they challenge traditional banking systems and enable financial inclusion.

Step 4: Real-World Applications

Cryptocurrencies are more than just digital money. They power decentralized applications (dApps), enable cross-border payments, and support charitable causes. Understanding how they’re made allows you to identify legitimate projects and avoid scams or poorly designed cryptocurrencies.

Step 5: The Future of Cryptocurrency Creation

As technology evolves, so does cryptocurrency creation. Innovations like quantum-resistant blockchains and green mining solutions are on the horizon. Staying informed ensures you’re prepared for the future of finance.

What is Blockchain and How Does It Work?

Blockchain is one of the most transformative technologies of the 21st century, yet many people still ask, what is blockchain and how does it work? Whether you’re a tech enthusiast, investor, or simply curious, understanding blockchain is key to grasping the future of finance, data security, and beyond. Let’s break it down step by step.

Step 1: What is Blockchain?

At its core, a blockchain is a decentralized digital ledger that records transactions across a network of computers. Unlike traditional ledgers controlled by a central authority, blockchain is distributed, meaning no single entity owns or controls it. This makes it transparent, secure, and tamper-proof.

Step 2: The Building Blocks of Blockchain

Each block contains a list of transactions. Think of it as a page in a ledger. Blocks are linked together in a chronological order, forming a chain. This ensures data integrity and prevents tampering. Instead of being stored on a single server, the blockchain is maintained by a network of computers (nodes) worldwide.

Step 3: How Does Blockchain Work?

A user initiates a transaction, such as sending cryptocurrency or recording data. The transaction is broadcast to the network of nodes, which verify its validity using consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS). Once verified, the transaction is grouped with others into a block. The new block is added to the existing blockchain in a way that is permanent and unchangeable. This is done through cryptographic hashes, which create a unique fingerprint for each block. The transaction is complete, and the updated blockchain is distributed across the network.

Step 4: Why is Blockchain Important?

Transparency: Every transaction is visible to all participants, ensuring accountability.

Security: Blockchain’s decentralized nature and cryptographic techniques make it nearly impossible to hack or alter data.

Efficiency: By eliminating intermediaries, blockchain reduces costs and speeds up processes.

Trustless System: Participants don’t need to trust each other; the system itself ensures integrity.

Step 5: Real-World Applications of Blockchain

Blockchain isn’t just about cryptocurrencies like Bitcoin. It’s being used in:

Supply Chain Management: Tracking goods from origin to consumer.

Healthcare: Securing patient records and ensuring data privacy.

Voting Systems: Creating tamper-proof digital voting platforms.

Smart Contracts: Automating agreements without intermediaries.

Step 6: The Future of Blockchain

How Blockchain Enables The Creation of Cryptocurrencies

Cryptocurrencies have taken the world by storm, but have you ever wondered how blockchain enables the creation of cryptocurrencies? At the heart of every digital currency lies blockchain technology, a revolutionary system that ensures security, transparency, and decentralization. Let’s explore this fascinating process simply and engagingly.

The Role of Blockchain in Cryptocurrency Creation

Blockchain serves as the backbone for cryptocurrencies. Here’s how it enables their creation:

Decentralization: Blockchain eliminates the need for a central authority, like a bank, to issue or manage currency. Instead, it relies on a network of nodes (computers) to validate and record transactions.

Transparency: Every transaction is recorded on a public ledger, and visible to all participants. This ensures trust and accountability.

Security: Blockchain uses advanced cryptographic techniques to secure data, making it nearly impossible to alter or hack.

Why Blockchain is Essential for Cryptocurrencies

Trustless System: Blockchain allows users to transact directly without needing to trust a third party.

Immutability: Once a transaction is recorded on the blockchain, it cannot be altered, ensuring data integrity.

Global Accessibility: Blockchain enables anyone with an internet connection to participate in the cryptocurrency ecosystem.

Innovation: Blockchain’s programmable nature allows for the creation of smart contracts, decentralized applications (dApps), and more.

The Future of Blockchain and Cryptocurrencies

As blockchain technology evolves, so does the potential for cryptocurrencies. Innovations like layer-2 scaling solutions, interoperability protocols, and green mining techniques are paving the way for a more efficient and sustainable digital economy.

How Digital Currency Are Created

Digital currencies have become a cornerstone of the modern financial landscape, but have you ever wondered how digital currencies are created? From crypto currency is made like Bitcoin to central bank digital currencies (CBDCs), the process of creating digital money is both fascinating and complex. Let’s dive into the world of digital currency creation simply and engagingly.

What is digital currency?

Digital currency is a form of money that exists purely in digital form, without a physical counterpart like coins or bills. It can be decentralized, like cryptocurrencies, or centralized, like CBDCs issued by governments. Understanding how it’s created helps demystify its value and functionality. Digital currencies can be broadly categorized into two types:

Cryptocurrencies: Decentralized digital currencies like Bitcoin and Ethereum, created using blockchain technology.

Central Bank Digital Currencies (CBDCs): Digital versions of a country’s fiat currency, issued and regulated by central banks.

How Digital Cryptocurrencies Are Created

Cryptocurrencies are created through a process that relies on blockchain technology. Cryptocurrencies operate on a blockchain, a decentralized ledger that records all transactions. In networks like Bitcoin, new coins are created through mining. Miners use powerful computers to solve complex mathematical problems, validating transactions and adding them to the blockchain. As a reward, miners receive newly created coins. In networks like Ethereum 2.0, new coins are created through staking. Users lock up their existing coins to validate transactions and maintain the network. In return, they earn rewards in the form of newly minted coins. This process ensures the security, transparency, and decentralization of cryptocurrencies.

How Central Bank Digital Currencies (CBDCs) Are Created

CBDCs are created and managed by central banks. Central banks create digital versions of their fiat currency, which are stored in digital wallets. Unlike cryptocurrencies, CBDCs are centralized, meaning the central bank has full control over their issuance and distribution. CBDCs are designed to work alongside traditional banking systems, ensuring seamless transactions and financial stability. Read More