#psd2 strong customer authentication

Explore tagged Tumblr posts

Text

Together, 3D Secure and PSD2 Can Guarantee Secure Online Transactions

The Payment Services Legislation (PSD), a European Union (EU) directive first issued in the year 2007 to govern payment services and payment service providers, has undergone a second iteration, known as PSD2 (PSPs). PSD threatened to end the banking sector's monopoly on conducting secure payments online while allowing for increased pan-European competition and engagement in the payments sector. Many people are worried about the effects of implementing SCA under PSD2, but they don't need to be.

With the shift to online services generally, it is more important than ever to verify users' identity during purchases and banking activities to:

● Lower the expense of handling fraudulent transactions

● Lessen the chance of internet fraud

● Abide by international laws and regulations, including PSD2 and PCI-DSS

● Boost online service user confidence among cardholders

Thus, PSD2 strong customer authentication implementation is important.

When it comes to SCA (Strong Customer Authentication), which includes TFA (Two Factor Authentication) and OTPs, the new 3D Secure protocol and PSD2 (the second Payment Services Directive by the European Union) have some significant overlap (One Time Passwords).

Multi-factor authentication (MFA) is how 3D Secure 2 (3DS2) adapts to SCA. MFA consists of OTPs, biometric authentication methods like fingerprint or face detection, and QR codes that mobile apps can scan.

Multi-factor authentication, or MFA, is how 3DS2 adapts to SCA. MFA consists of OTPs, biometric authentication methods like fingerprint or facial recognition, and QR codes that mobile applications may scan.

The great news for retailers and issuers is that 3DS2 completely complies with the values stated in PSD2 and can give merchants, issuers, and customers the following advantages.

Merchants

To address the 3D Secure problem of high cart abandonment rates, merchants can provide a consistent, simple-to-use solution during transaction authentication across various payment gateway platforms and other digital media.

Issuers

Richer data exchanges allow issuers to enhance frictionless authentication. Due to MFA, cardholders can make transactions using their preferred method without sacrificing security.

Consumers

When making eCommerce payments, customers want a quick and secure process; 3D Secure 2, along with the associated 3DS Server and ACS technology, will deliver these advantages, increasing efficiency with little to no impact on the applications and payment gateways that customers are already accustomed to.

A PSD2-SCA Compliant Option For Banks And Merchants

The PSD2-SCA Complying Solution authentication entails compliance control that provides multi-factor access control for internet banking, mobile banking, and eCommerce transactions, with or without directory servers from card schemes. This gives banks a versatile, economical alternative for their e-banking clients.

The necessary services listed under Strong Customer Authentication in the PSD2 guidelines are offered by the PSD2-SCA Complying Solution Multi-Factor Authentication module. With this authentication solution, banks and other financial institutions can provide their end users with a safe way to access their online and mobile banking websites. Supporting various devices gives organizations flexibility now and in the future, allowing the implementation of one or several devices at once while also offering complexity in the authentication process through an authentication layer.

0 notes

Text

7 Lessons from a Major Third-Party Data Breach: Strengthening Risk Management in 2024

Recently, a leading bank suffered a massive third-party data breach, compromising the personal data of tens of thousands of customers. This incident highlights the potential risks financial institutions face when partnering with third-party vendors. While these associations enable innovative solutions and products, they also open the door to significant risks. As a result, it���s crucial to have a resilient third-party risk management framework in place.

This blog will explore the lessons that can be learned from a high-profile third-party breach and how risk assessments can mitigate compliance, operational, and reputational disruptions.

What is Third-Party Risk in the Banking & Finance Industry?

Third-party risk refers to the potential risks financial institutions face from external entities like software providers, technology partners, auditors, and insurance firms. These third parties often have access to sensitive data and systems, making them an attractive target for cybercriminals. Despite robust security measures within banks, third-party systems can expose institutions to significant vulnerabilities.

Common risks include operational, reputational, credit, transaction, and compliance risks. High-profile breaches have shown that attackers often gain unauthorized access to sensitive information, such as social security numbers, names, and financial records, which can be sold on the dark web or used for identity theft.

For example, the recent breach of a well-known bank compromised customer data, including names, social security numbers, and banking details. This attack, attributed to the LockBit ransomware gang, underscores the importance of robust third-party risk management frameworks.

Seven Key Learnings for Managing Third-Party Risk in 2024

Evolving Regulations: Third-party risk is highly regulated by laws like the EU’s GDPR and Payment Services Directive 2 (PSD2). In the U.S., new third-party risk management guidelines issued in 2023 emphasize strong risk management practices, tailored to the complexity and risk profile of third-party relationships. A comprehensive risk management solution can help banks stay compliant with evolving regulations.

Common Breach Vectors: Ransomware attacks are one of the most common threats. Understanding how attackers exploit unsecured databases, software vulnerabilities, and phishing schemes can help institutions bolster their defenses.

External Risks Exist: Risks can come from factors outside of a third party’s control, such as natural disasters or weak security policies. Regular audits and vulnerability assessments are essential to ensure third-party vendors have strong disaster recovery and security policies.

Fourth-Party Risks Matter: Third-party vendors often have their own external partners. Monitoring fourth-party relationships can be challenging but is crucial for identifying and managing potential risks.

Banking Interconnectivity: The interconnected nature of banking systems increases the risk of third-party breaches. Frequent reviews of network security processes and vulnerability detection can help safeguard systems.

Data Defense: Customer data is highly valuable to cybercriminals. Strong data protection policies, including least-privilege access management and multi-factor authentication, can mitigate potential data breaches.

Time and Cost Efficiency: The financial and reputational costs of a data breach are significant. Leveraging AI and automation tools like IBM OpenPages can improve breach detection, reduce time to containment, and save millions in recovery costs.

Explore iTech GRC’s Third-Party Risk Management Solutions

Partnering with iTech GRC and leveraging IBM OpenPages can help mitigate the risks associated with third-party vendors. Learn more about how our solutions can safeguard your organization by visiting iTech GRC's Third-Party Risk Management page.

Contact our experts today to enhance your risk management strategies.

0 notes

Text

Fintech App Development: Navigating Regulations and Security Challenges

The rapid growth of fintech has revolutionized the financial services industry, making it more accessible, efficient, and user-friendly. However, with this innovation comes increased scrutiny and a complex regulatory landscape that developers must navigate carefully. In addition to regulatory compliance, ensuring robust security measures is critical, given the sensitivity of financial data. Here’s a breakdown of the key regulations and security challenges in fintech app development and how to tackle them.

1. Understanding the Regulatory Landscape

Fintech operates in a highly regulated environment, with different regions imposing specific rules to ensure consumer protection, financial stability, and data privacy. Before developing a fintech app, it's essential to understand the local and international regulations that apply to financial services.

Key Regulations to Consider:

GDPR (General Data Protection Regulation): For apps operating in or serving users in the EU, GDPR is a critical regulation that governs how personal data is collected, processed, and stored. Failure to comply can result in hefty fines.

PSD2 (Payment Services Directive 2): Applicable in Europe, PSD2 is designed to enhance payment security, promote innovation, and boost competition. It requires strong customer authentication (SCA) and opens up access to customer data through APIs.

PCI DSS (Payment Card Industry Data Security Standard): For apps handling payment card transactions, PCI DSS sets the standard for securing cardholder data. Compliance is mandatory to avoid data breaches and penalties.

FINRA (Financial Industry Regulatory Authority): In the U.S., FINRA regulates securities firms and brokers. Fintech apps offering investment services must adhere to its rules regarding transparency and fair practices.

2. Licensing and Compliance

Fintech apps often need specific licenses to operate, depending on the services offered (e.g., lending, digital banking, payments). The process for obtaining these licenses varies by jurisdiction but often includes meeting capital requirements, demonstrating secure infrastructure, and proving compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Licensing Requirements:

E-money licenses for payment and money transfer apps.

Banking licenses for neo-banks or challenger banks.

Broker-dealer licenses for apps offering trading and investment services.

Lending licenses for peer-to-peer lending or microfinance platforms.

Each license comes with its own set of ongoing compliance requirements, which fintech companies must adhere to maintain their operational status.

3. Security Challenges in Fintech Development

Given the sensitive nature of financial data, security is a top priority in fintech app development. The increasing number of cyberattacks targeting financial services means that fintech apps must implement best-in-class security practices to protect both the app and its users.

Key Security Challenges:

Data Encryption: All sensitive data (e.g., financial transactions, personal information) must be encrypted both in transit and at rest. Encryption ensures that even if data is intercepted, it cannot be accessed without the appropriate decryption key.

Secure Authentication: Implementing multi-factor authentication (MFA) and biometric authentication (e.g., fingerprint, facial recognition) is essential for protecting user accounts from unauthorized access.

Fraud Detection: Fraud detection systems that use machine learning to detect unusual transaction patterns or activities can help prevent fraud before it occurs.

API Security: Many fintech apps rely on third-party APIs for services like payment processing or account aggregation. Ensuring these APIs are secure and protected against vulnerabilities (e.g., token-based authentication, OAuth) is crucial.

Continuous Monitoring: Security doesn’t end at deployment. Continuous monitoring and threat detection systems help identify potential vulnerabilities and respond to incidents in real time.

4. Balancing Security and User Experience

While security is a priority, user experience remains equally important. If a fintech app’s security measures are too cumbersome, users may abandon the app for easier alternatives. Developers need to strike a balance between high-level security and seamless usability.

Key Considerations:

Streamlined Authentication: Offering secure, yet convenient authentication options, such as biometric login, can enhance user experience without compromising security.

Clear Security Features: Educating users about security features (e.g., 2FA setup, password management) can build trust and ensure that users follow best practices.

Minimizing Data Collection: Collecting only the necessary data reduces the app’s attack surface and simplifies compliance with privacy regulations.

5. Adapting to Emerging Threats and Technology

As technology advances, so do the methods used by cybercriminals. Fintech developers must stay ahead by regularly updating their security protocols, integrating the latest technologies, and adapting to new threats.

Emerging Trends:

Blockchain: Many fintech apps are exploring blockchain to secure transactions and improve transparency. Blockchain’s decentralized nature reduces the risk of fraud and improves trust between parties.

AI and Machine Learning: AI is becoming crucial for fraud detection and risk management. Machine learning models can analyze user behavior and identify anomalies in real time.

Quantum Computing: While still in its early stages, quantum computing presents a potential future challenge for encryption methods currently used in fintech. Developers must keep an eye on this technology and prepare for how it may impact cryptography.

6. Handling Data Privacy and User Trust

Fintech apps handle massive amounts of sensitive data, from personal details to financial transactions. Protecting user privacy and building trust is paramount, especially in an industry where data breaches can be catastrophic.

Strategies for Data Privacy:

Data Minimization: Collect only the data necessary for the app to function, reducing the risk of exposure in the event of a breach.

Consent Management: Ensure that users understand what data is being collected and for what purpose. Implement clear and user-friendly consent processes that comply with regulations like GDPR.

Anonymization: Where possible, use data anonymization techniques to protect user identity while still gathering valuable insights.

7. Ongoing Compliance and Audits

Even after launch, fintech apps must continuously meet regulatory requirements through regular audits and compliance checks. Failure to do so can result in heavy penalties, loss of licenses, and damage to reputation.

Ongoing Compliance Steps:

Internal Audits: Conduct regular internal audits to ensure that the app complies with regulatory requirements and security standards.

Third-Party Audits: Engage third-party firms to conduct security audits and vulnerability assessments.

User Data Audits: Regularly review how user data is collected, stored, and processed to ensure that privacy laws are adhered to.

Outcome

Developing a fintech app requires navigating a complex web of regulations and security challenges. By prioritizing compliance from the outset, implementing cutting-edge security measures, and balancing user experience with data protection, fintech companies can build robust and trustworthy apps that meet the needs of both users and regulators. Staying informed about the evolving regulatory landscape and emerging security threats will be key to long-term success in this rapidly growing industry.

#FintechAppDevelopment#RegulatoryCompliance#SecurityChallenges#AppSecurity#FintechRegulations#DataPrivacy#Cybersecurity#FintechCompliance#SecureDevelopment

0 notes

Text

BNP Paribas Digital Transformation Strategies Innovations: Convenience and Security

BNP Paribas' digital transformation strategies are marked by notable innovations that revolve around enhancing both convenience and security for its customers. The bank recognizes the critical balance between providing a seamless and user-friendly experience and maintaining the highest standards of security.

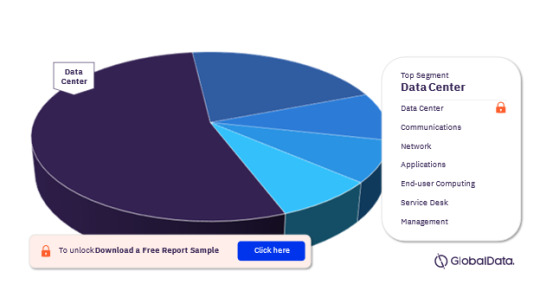

For more insights on ICT spending by function, download a free report sample

Here's a closer look at how BNP Paribas achieves this dual focus on convenience and security:

1. Digital Onboarding: BNP Paribas has streamlined its customer onboarding process, making it more convenient and secure. Through digital identity verification and eKYC (Know Your Customer) procedures, customers can open accounts and access banking services online, eliminating the need for physical branch visits.

2. Mobile Banking Apps: BNP Paribas offers user-friendly mobile banking applications that enable customers to perform a wide range of transactions and account management tasks from their smartphones. These apps are designed with intuitive interfaces, making banking convenient and accessible on the go.

3. Biometric Authentication: To enhance security and convenience, BNP Paribas has adopted biometric authentication methods, such as fingerprint and facial recognition. Customers can securely access their accounts and authorize transactions using these advanced technologies, reducing the reliance on traditional passwords.

4. Contactless Payments: BNP Paribas supports contactless payment methods, including NFC (Near Field Communication) payments via mobile devices and contactless cards. These technologies offer customers a fast and secure way to make transactions, reducing the need for physical cash or card swiping.

5. Secure Messaging: The bank offers secure messaging platforms for customer communication. These channels are encrypted to protect sensitive information, allowing customers to interact with the bank while maintaining data security.

6. Multi-Layered Security: BNP Paribas employs a multi-layered security approach that includes robust firewalls, intrusion detection systems, and regular security assessments. This strategy helps safeguard customer data and the bank's systems from cyber threats.

7. Fraud Detection: The bank utilizes artificial intelligence and machine learning to detect and prevent fraudulent activities in real-time. Advanced algorithms analyze transaction patterns to identify suspicious behavior and protect customers from financial fraud.

8. Blockchain for Secure Transactions: BNP Paribas has explored blockchain technology for secure and transparent transactions. By leveraging blockchain, the bank can ensure the integrity and authenticity of financial transactions, reducing the risk of fraud and errors.

9. Strong Customer Authentication (SCA): BNP Paribas complies with regulatory requirements, such as the Revised Payment Services Directive (PSD2) in Europe, which mandates strong customer authentication. This adds an extra layer of security to online payments.

10. Data Privacy and Compliance: BNP Paribas places a high priority on data privacy and regulatory compliance. The bank ensures that customer data is handled with the utmost care, in compliance with global data protection regulations.

Innovation at BNP Paribas is driven by a commitment to making banking more convenient and secure for its customers. By adopting cutting-edge technologies, enhancing user experiences, and maintaining a robust security infrastructure, the bank successfully strikes a balance between these two critical aspects. This approach not only meets the evolving expectations of customers but also positions BNP Paribas as a leader in digital banking.

0 notes

Text

Navigating the Transforming Landscape: Emerging Regulatory Changes in Payment Processing

The global payments landscape is undergoing a profound transformation, driven by a wave of regulatory changes aimed at enhancing security, transparency, and efficiency. In this era of digital innovation, where financial transactions occur at breakneck speed and borders are increasingly blurred, regulators are working diligently to keep pace with technology while safeguarding consumers’ interests and maintaining the integrity of the financial system.

Payment Processing Regulations: Shaping the Future

The foundation of the evolving payment processing landscape lies in a web of regulations, directives, and compliance standards that span regions and jurisdictions. As digital payments become more prevalent, it’s imperative to understand the key regulatory changes shaping the industry’s future.

The global financial ecosystem is intricate, with various stakeholders — banks, fintech companies, payment service providers, and consumers — interacting daily. Regulatory bodies recognize the need to adapt to these evolving dynamics.

Staying compliant with the latest regulations is a top priority for businesses in the payment processing sector. The Payment Card Industry Data Security Standard (PCI DSS), for instance, continually updates its requirements to address emerging threats.

Strong Customer Authentication (SCA) Compliance

SCA has emerged as a critical component of the revised Payment Services Directive (PSD2) in Europe. It mandates that payment transactions require multi-factor authentication to increase security and reduce fraud.

Cross-Border Data Protection in Payments

Cross-border data protection regulations, such as the General Data Protection Regulation (GDPR), are increasingly impacting payment processing. These regulations aim to safeguard the privacy and rights of individuals.

GDPR in Payment Processing

GDPR, a landmark regulation, is a major player in shaping how businesses handle customer data, including in payment processing. Compliance with GDPR is not just a legal requirement but also a marker of trust.

Central Bank Digital Currencies (CBDCs) Regulations — Several countries are actively exploring or implementing CBDCs. The regulatory framework surrounding these digital currencies is essential to ensure their stability and security.

Anti-Money Laundering (AML) in Payment Industry- AML regulations are crucial for preventing illicit financial activities. Payment processors must adhere to robust AML protocols to detect and report suspicious transactions.

Cryptocurrency Payment Regulations

The rise of cryptocurrencies has introduced a new dimension to payment processing. Regulators are grappling with how to oversee these digital assets effectively.

Real-time payments are becoming the norm in many regions. Regulatory bodies are developing frameworks to ensure the security and efficiency of these systems.

RegTech, or regulatory technology, is becoming increasingly important for businesses in navigating complex compliance requirements. These technologies leverage automation, AI, and data analytics to streamline regulatory processes.

Compliance Challenges in Payment Processing

The evolving regulatory landscape presents various challenges for payment processors. Keeping abreast of changes, ensuring compliance, and implementing necessary infrastructure are among the foremost challenges.

Payment processing industry is in the midst of a transformative era defined by regulatory changes. Understanding and adapting to these changes is crucial for businesses to thrive in an environment where compliance, security, and efficiency are paramount. Payment processors that navigate these regulatory waters adeptly will be well-positioned to provide safe, seamless, and compliant services in the digital age.

Conclusion

In an increasingly digital and globalized world, the payment processing landscape is evolving at an unprecedented pace. This evolution is not solely driven by technological advancements and consumer preferences but is also significantly influenced by regulatory changes. Governments and regulatory bodies worldwide are recognizing the need to adapt to the digital age, ensuring that payment systems are secure, efficient, and compliant with evolving standards. In this comprehensive guide, we will delve into the emerging regulatory changes in payment processing and their profound impact on businesses and consumers alike.

#digital payment solution#payments#high risk merchant account#high risk payment gateway#fintech#transactions#business#merchant services

0 notes

Text

Evolving Trends in the UK Retail Banking Market

The UK retail banking sector has witnessed remarkable transformations in recent years, driven by technological advancements, changing customer expectations, and regulatory reforms. This article aims to provide a detailed overview of the key trends that are reshaping the landscape of retail banking in the United Kingdom.

Digitalization and Online Banking

The Rise of Digital-Only Banks

Digital-only or "challenger" banks have disrupted the traditional banking model in the UK. Institutions like Monzo, Revolut, and Starling Bank have gained significant market share by offering user-friendly mobile apps, low fees, and innovative features such as budgeting tools and real-time transaction notifications. This trend is expected to continue as more customers embrace the convenience of digital banking.

Open Banking Initiatives

The implementation of open banking regulations has paved the way for increased competition and innovation in the sector. Customers now have the ability to securely share their financial data with third-party providers, enabling the development of new financial products and services. Open banking is fostering a more dynamic and customer-centric banking environment.

Personalization and Customer Experience

AI-Powered Customer Service

Artificial intelligence (AI) is being leveraged by banks to enhance customer service. Chatbots and virtual assistants are becoming commonplace, providing immediate assistance and resolving queries efficiently. AI algorithms also enable banks to offer personalized product recommendations and financial advice, improving overall customer satisfaction.

Branch Transformation

Traditional bank branches are evolving to meet changing customer expectations. While physical branches remain important for certain transactions and consultations, banks are increasingly focusing on creating inviting, technology-enabled spaces that facilitate in-person interactions while integrating seamlessly with digital services.

Sustainable Banking and ESG

Environmental, Social, and Governance (ESG) Integration

Sustainability is gaining prominence in the UK retail banking sector. Banks are incorporating ESG principles into their investment decisions and loan portfolios. Customers are showing a growing interest in banking with institutions that align with their values, particularly in areas such as renewable energy financing and ethical investment options.

Green Banking Products

To address climate concerns, many banks are introducing "green" financial products, including eco-friendly loans, energy-efficient mortgages, and sustainable investment funds. These offerings cater to a customer base increasingly concerned about the environmental impact of their financial choices.

Regulatory Landscape

PSD2 and Strong Customer Authentication (SCA)

The Payment Services Directive 2 (PSD2) and Strong Customer Authentication (SCA) regulations have introduced new security measures for online transactions, enhancing the protection of customer data. Banks are adapting their systems to comply with these regulations, ensuring the safety of digital banking interactions.

Open Finance

Building on the concept of open banking, the UK is exploring the potential of open finance, which would extend data sharing to a broader range of financial products, including pensions and insurance. This initiative aims to empower consumers with more control over their financial information and choices.

0 notes

Text

Are you aware of the Payment Services Directive 2 (PSD2) and how it affects businesses?

PSD2 represents one of the most significant changes to the payments landscape in recent years, and compliance is a must for businesses that operate in the EU.

The introduction of Strong Customer Authentication is just one of the many changes that businesses need to comply. However, complying with PSD2 can also provide significant benefits.

Learn more about PSD2 and how #FMPay can help your business stay compliant and grow its commerce in our latest blog post.

0 notes

Text

Why US Companies Should Consider PSD2 SCA Compliance Even for Domestic Business

In the US, cybercriminals are increasingly focusing on e-commerce and online transactions, which results in huge losses for both businesses and consumers. These fraudulent acts tarnish reputations and cause financial losses in addition to harming confidence. The use of Strong Customer Authentication (SCA) compliance under PSD2 is improving online payment security.

By guaranteeing that transactions are confirmed and approved by the actual account holder, multi-factor authentication, as a requirement of SCA, greatly lowers the chance of perpetuating fraud. PSD2 SCA makes the online environment safer and more reliable for all parties.

The European rule known as the Payment Services Directive 2 (PSD2) imposes more stringent security measures for online payments. Its reach transcends national boundaries, even though its primary focus is businesses operating within the European Economic Area (EEA). US businesses can gain from comprehending and possibly implementing certain PSD2 SCA compliance, even if they only do business within the US.

The Rise of Globalized Fraud and the Allure of US Targets

Although PSD2 immediately covers EEA transactions, fraudsters are always looking for weaknesses. Given Europe's stronger payment environment, fraudsters may find the US market to be a more appealing target.

Here's why US businesses ought to be worried:

Changing Fraud Landscape: As SCA makes transactions in Europe safer, fraudsters may start concentrating on areas with laxer legislation like the US. This could result in more people attempting to defraud US-based companies.

Financial Systems with Interconnections: There are connections inside the global financial system. A US business may use overseas networks to process payments even if it exclusively serves domestic clients. These networks may contain flaws that leave US transactions vulnerable to fraud coming from elsewhere.

US businesses can proactively prevent these risks and safeguard the financial information of their consumers by using SCA-like safeguards.

Beyond Compliance: Benefits of Enhanced Security

There are several benefits to adopting SCA-inspired security procedures, even if US organizations are not directly concerned with avoiding potential fines for breaking a European regulation:

Decreased Fraud Costs: Financial penalties and reputational harm are two outcomes of fraudulent transactions for a business. Because SCA uses multi-factor authentication, it is far more difficult for unauthorized users to complete transactions, which reduces the number of fraudulent chargebacks and related expenses.

Enhanced Consumer Trust: Fraudulent actions and data breaches reduce consumer trust. US corporations show their dedication to safeguarding consumer information by placing a high priority on security and implementing SCA-like procedures. This promotes loyalty and confidence, which improves the client experience.

Competitive Advantage: Companies that emphasize strong authentication procedures can obtain a competitive advantage as customer concerns about security increase. Adopting SCA-inspired procedures establishes a business as a market leader in security.

Important Things US Businesses Should Know

For US-based businesses, complete PSD2 compliance may not be required. However, there are important SCA components that can be implemented:

Multi-Factor Authentication (MFA): In addition to a password, MFA requires users to supply at least two additional forms of authentication. These might be security questions, one-time codes texted to a mobile device, or fingerprints.

Risk Analysis: By taking a risk-based approach, businesses can determine which transactions are more likely to be fraudulent and ask for further verification only for those particular transactions. This keeps low-risk transactions running smoothly for the user.

Frictionless Authentication: Although security is of utmost importance, a laborious authentication procedure has the potential to irritate customers and result in cart abandonment. US businesses should investigate frictionless authentication options that strike a compromise between user ease and security.

Conclusion

Despite being a European rule, PSD2 SCA provides an invaluable model for improved security in the context of international payments in the US. Adopting security measures inspired by SCA can be advantageous for US enterprises, even those that operate exclusively in the United States. By utilizing risk analysis, multi-factor authentication, and frictionless solutions, US firms can gain a competitive edge in the market, proactively battle fraud, and foster customer trust.

0 notes

Text

Growing Significance of Chargeback Management

In today’s rapidly evolving landscape of e-commerce and online transactions, businesses are experiencing both unprecedented growth opportunities and a parallel surge in payment disputes. As the digital economy continues to expand, chargebacks have emerged as a significant concern for merchants across industries. In this comprehensive guide, we delve into the growing significance of chargeback management, exploring the challenges businesses face and the strategies they employ to mitigate these risks.

Understanding Chargebacks

Before delving into the specifics of chargeback management, it’s crucial to grasp what chargebacks are and why they matter. Chargebacks, also known as payment disputes, occur when a customer disputes a transaction with their issuing bank, leading to a reversal of the funds transferred to the merchant. Chargebacks are typically initiated due to issues such as unauthorized transactions, product/service dissatisfaction, or merchant errors.

The Escalating Problem of Chargebacks

The exponential growth of online commerce in recent years has led to a corresponding surge in chargebacks. Several factors contribute to this escalation:

Increase in Online Transactions: The convenience of online shopping has driven a significant uptick in e-commerce transactions. However, this also means an increase in the potential for payment disputes.

Sophisticated Fraud Schemes: Fraudsters are continually evolving their tactics to exploit vulnerabilities in online payment systems, resulting in unauthorized transactions that trigger chargebacks.

Consumer Empowerment: Cardholders are increasingly aware of their rights and are quick to initiate chargebacks in cases of dissatisfaction or suspicion of fraud.

Regulatory Changes: Regulations like PSD2 in Europe have introduced Strong Customer Authentication (SCA) measures, which may lead to increased friction during transactions, potentially resulting in more chargebacks.

The Impact of Chargebacks

Chargebacks can have a severe impact on businesses, extending far beyond the immediate loss of revenue from the disputed transaction. These impacts include:

Financial Loss: The direct financial loss incurred due to the reversal of funds.

Operational Costs: Costs associated with investigating and responding to chargebacks.

Merchant Account Risk: Excessive chargebacks can lead to the termination of merchant accounts or higher processing fees.

Reputation Damage: Frequent chargebacks can tarnish a merchant’s reputation, affecting customer trust and brand image.

Strain on Resources: Managing chargebacks can be resource-intensive, diverting attention from core business operations.

Strategies for Effective Chargeback Management

Recognizing the growing significance of chargebacks, businesses are implementing proactive strategies to manage and reduce their occurrence:

Fraud Detection and Prevention: Employing advanced fraud detection tools and strategies to identify and stop fraudulent transactions before they lead to chargebacks.

Clear Return and Refund Policies: Establishing transparent return and refund policies can reduce disputes arising from customer dissatisfaction.

Dispute Resolution: Efficiently resolving customer disputes through responsive customer service can prevent chargebacks.

Payment Verification: Implementing multi-layered verification processes can add an extra layer of security to transactions.

Chargeback Alerts: Subscribing to chargeback alert services allows businesses to address disputes before they become chargebacks.

Documentation and Records: Thoroughly documenting transactions and customer interactions can provide valuable evidence in chargeback disputes.

The Role of Technology in Chargeback Management

Technology plays a pivotal role in modern chargeback management. AI and machine learning are being used to detect patterns and anomalies that indicate potential fraud, while blockchain technology is being explored for its potential to create tamper-proof transaction records. Payment processors are also developing tools and dashboards that provide merchants with real-time data and insights into chargeback trends.

Conclusion

In an era where online commerce reigns supreme, effective chargeback management is not just a necessity; it’s a strategic imperative. Businesses must take a proactive approach to understand, prevent, and respond to chargebacks to safeguard their financial stability, reputation, and customer trust. The growing significance of chargeback management underscores the need for continuous innovation and vigilance in the complex landscape of digital payments.

#digital payment solution#high risk merchant account#payments#fintech#high risk payment gateway#transactions#business#merchant services

0 notes

Text

The Benefits of Digital Onboarding

Digital onboarding is something that you should consider whether you are a small or large business owner. Despite the heavy cost in terms of hard cash and in losing talent, many companies are still not taking onboarding seriously. They just don’t get it. There are some that even don’t have any induction practices at all. Below, we look at some of the areas where digital onboarding has real impact.

First of all, digital onboarding and psd2 strong customer authentication can be really helpful when it comes to reaching far-flung employees. Digital onboarding is the most effective way that organizations can be able to get essential training and core company values to a global workforce or remote workers. For global organizations that have staff all around the world, onboarding that can be delivered via devices is accessible, affordable, effective and measurable.

The trend towards flexible working, with remote workers or freelancers, has been common since the world was stuck with the Covid-19 pandemic, and it is set to continue and grow in the years ahead. Clearly, traditional onboarding is not going to work with the freelancers and remote workers as they need to be reached with a less head office-centric onboarding experience. The experience needs to be more personalized in order to reflect their circumstances. The most important thing is to make sure that they have a good induction. Don’t just leave them to it, as that can lead to isolation and an early exit.

Digital onboarding can also be helpful with preboarding and keeping warm. It has never been easier to have new starters that are virtually ‘good to go’ from day one. Digital preboarding programmes allow them to arrive feeling confident and comfortable. They will already have an insight into your company’s culture and values, and they will have learnt about the priority skills.

For more information on the benefits of digital onboarding, visit our website at https://loginid.io/

0 notes

Text

PSD2 and SCA: What Are the Next Steps

The European Union directive known as PSD2 is considered a revolutionary solution for the banking and online shopping sectors. Its objective is to boost customer confidence and transparency.

As a result of PSD2, users are able to authorize third-party providers to handle their accounts, analyze expenditures, perform peer-to-peer (P2P) transactions, and more, using their current bank account. As banks make it simple for third parties to integrate into their open banking system, new, cutting-edge financial service providers may start to appear on the market. Customers would then have a wider range of payment options and a larger selection of finance companies, which is fantastic news. PSD2 SCA implementation benefits customers and merchants alike.

As part of PSD2, strong consumer authentication (SCA) is used for online digital card payments to prevent fraud and boost security. Customers need to take extra measures to authenticate their identity during payment, and card issuers—typically banks—can discontinue dealing with acquirers, PSPs, and companies (merchants) who don't implement this new layer of protection.

Utilizing 3DS 2.0 (or 3DS v2), the next generation of 3D Secure, is the simplest approach for businesses and organizations to adhere to SCA. SCA will significantly increase security, but it may annoy customers trying to make quick and easy purchases online, particularly those who have never had to deal with verification processes like 3D Secure.

However, many online consumers are already familiar with utilizing a smartphone fingerprint scanner or SMS code to validate payment. It will soon be accepted practice for making card payments online.

What Will Happen Next?

Determine The Impact on Your Company: Consider how you accept payments and how the additional procedures SCA and 3DS v2 implemented can alter how your customers perceive you.

With your payment services provider (PSP), talk about how your services will change: PSPs will be responsible for applying the SCA portion of PSD2 to pertinent transactions. This could significantly change how you get money and generate income.

Consider Including More Payment Options: You might wish to provide clients who have trouble paying online with alternate payment options, such as a safe phone-based payment method or a 24-hour automated payment line. With a simple checkbox notifying the card issuer that your business can be trusted for future payments, tokenization might also significantly reduce friction for customers who make frequent and repeated transactions.

Purchase A PSD2 SCA solution

By the deadline, Key IVR will fully comply with the PSD2 directive. PSD2 SCA solution payment platform offers PCI-DSS Level 1 compliant web, phone, and SMS payment services. Your clients will recognize your desire to keep the purchasing experience simple and quick with as little modification as possible to remain compliant. It will aid in your quest to lower the risk of fraud and increase payment security for organizations.

Knowing your alternatives is a good idea because the last thing you want to do is lose money by being unprepared. PSD2 SCA protects customers, businesses, and the open banking system from fraud.

0 notes

Text

Psd2 Strong Customer Authentication

Are you looking for psd2 strong customer authentication? Visit Accertify.com. By convincing all merchants, monetary establishments, and instalment specialist organizations to start two-factor verification while handling on the web instalments, SCA ensures a lot more secure eCommerce climate. To know more, visit their site.

https://www.accertify.com/products/sca-optimisation/

0 notes

Photo

Daon’s IdentityX is the core component in a best-of-breed Multi Factor Authentication solution, ensuring strong and secure user authentication.

multi factor authentication

#multi factor authentication#web authentication#identityX platform#psd2 strong customer authentication solutions

2 notes

·

View notes

Link

Self-developed java Virtual machine by Feitain.

Java Card is a Java technology used for tiny applications, known as applets, on extremely resource-limited devices. Java Card refers to a software technology that allows Java-based applications. Our Feitian java card operating system it has meticulously designed to conform to the strict standards of the global platform and ISO industry: thereby ensuring fluidity and seamless interoperability of applications for card issuers as well as solutions developers. To get more information visit our website: https://www.ftsafe.com

#java card#fido2#passwordless authentication#fido u2f security key#strong customer authentication#psd2 compliance

0 notes

Text

The Role of Strong Customer Authentication in High-Risk Transactions: Bolstering Security and Trust

In the rapidly evolving landscape of online transactions, the importance of strong customer authentication (SCA) cannot be overstated, especially in high-risk industries. High-risk transactions, which often involve valuable assets and sensitive data, demand a robust level of security to safeguard both merchants and customers. In this comprehensive blog post, we will delve deep into the significance of strong customer authentication in high-risk transactions, exploring its benefits, implementation, and the role it plays in building trust within these industries.

Understanding Strong Customer Authentication (SCA)

Strong customer authentication involves the use of two or more independent authentication elements to verify the identity of a user during a transaction. These elements can be categorized into three factors: something the user knows (password), something the user has (smartphone or token), and something the user is (biometric data like fingerprints or facial recognition). The implementation of SCA significantly reduces the risk of unauthorized access and fraudulent transactions.

The Relevance of SCA in High-Risk Transactions

Heightened Security: High-risk industries such as finance, online gaming, and e-commerce deal with substantial financial transactions and valuable data. Implementing SCA adds an extra layer of protection against unauthorized access and fraudulent activities, mitigating potential risks.

Compliance Requirements: Regulatory bodies like the Payment Services Directive 2 (PSD2) mandate the implementation of SCA to enhance security and reduce fraud in online transactions. Failure to comply can lead to legal repercussions and loss of reputation.

Building Trust: High-risk transactions often involve cautious customers who are concerned about the security of their data. By implementing SCA, businesses can build trust and assure their customers that their information is being safeguarded.

Reducing Chargebacks: Chargebacks can be a major challenge in high-risk transactions. SCA adds an additional layer of verification, reducing the chances of chargeback disputes stemming from unauthorized transactions.

Benefits of Implementing Strong Customer Authentication

Fraud Prevention: SCA helps prevent unauthorized access to accounts and fraudulent transactions, as fraudsters are less likely to possess all required authentication elements.

Enhanced User Experience: While SCA adds an extra step to the transaction process, advancements in technology have made it more seamless. Biometric authentication, such as fingerprint recognition, enhances user experience while maintaining security.

Regulatory Compliance: Implementing SCA ensures compliance with regulations like PSD2 and General Data Protection Regulation (GDPR), avoiding potential penalties.

Reduced Fraud Costs: By reducing instances of fraud, businesses can save substantial costs associated with chargebacks, investigations, and customer compensation.

Trust Building: SCA demonstrates a commitment to data security and customer protection, fostering trust and loyalty among customers.

Implementing SCA: Key Considerations

Adopting Multifactor Authentication: Multifactor authentication ensures that at least two different authentication factors are used for each transaction, enhancing security significantly.

User-Friendly Solutions: Leveraging user-friendly authentication methods like fingerprint recognition and SMS-based verification ensures a seamless customer experience.

Balancing Security and User Experience: Striking the right balance between security and convenience is crucial. Implementing SCA without causing customer friction is essential.

Educating Customers: Businesses must educate their customers about the benefits of SCA and its role in protecting their transactions and data.

Conclusion

In an era of increasing cyber threats and data breaches, strong customer authentication serves as a critical line of defense for high-risk industries. By bolstering security, ensuring compliance, and building trust, SCA plays a pivotal role in the success of high-risk transactions. As businesses continue to navigate the challenges of the digital landscape, embracing SCA is not just a necessity, but a strategic move towards a secure and prosperous future.

By prioritizing strong customer authentication, high-risk industries can fortify their operations, foster customer trust, and achieve lasting success in an increasingly interconnected world.

#digital payment solution#payments#high risk merchant account#fintech#high risk payment gateway#transactions#business#merchant services

0 notes

Text

The Challenge of Strong Customer Authentication

At this point, a great many people in the installments world comprehend the part of the European Payment Services Directive 2 (PSD2) in formalizing, unexpectedly, the necessities for Strong Customer Authentication (SCA). PSD2 likewise traces the many use-cases which were legally necessary from September 14, 2019.

A verification is viewed as solid on the off chance that it progressively consolidates in any event two out of three kinds of validation factors: inherence, ownership or information. All in all, "something you are," "something you have," and "something you know."

Inherence factors – something you are – alludes to biometrics: to be specific face, fingerprints and voice verification. These distinguishing highlights are the main three for which develop confirmation techniques are now present in the present market. The potential gain of any inherence factor is that it's unmistakable, while the drawback is that once this specific validation strategy has been undermined (which is least demanding to accomplish with fingerprints), it can't be changed and accordingly becomes unusable until the end of time.

Ownership, – something you have – is an advantageous and amazing strategy for confirmation, as it permits installing a generally mind boggling validation calculation in the had gadget. The conspicuous disadvantage of it is that anything had, for example, card, telephone or token, can likewise be lost or taken.

At long last, information factors don't need any extraordinary gadgets and as such are the least expensive and generally advantageous. Notwithstanding, they have the inalienable detriment of depending on human memory. The most regular illustration of an information factor is a secret phrase. In the event that it is too simple to even consider remembering, it is presumably simple to figure, and on the off chance that it is excessively intricate, it is difficult to recollect.

It is scarcely astounding that passwords like "123456," "qwerty" and "secret key" are among the main 10 most basic passwords for the most recent decade. On the flipside, in associations with severe secret key arrangements, 20%-half of client care calls are for secret key resets, as per Gartner Group.

1 note

·

View note