#pos machine in india

Explore tagged Tumblr posts

Text

What Makes a POS Software Stand Out as the Best Choice for Indian Businesses?

In the rapidly evolving landscape of Indian businesses, choosing the right Point-of-Sale (POS) software is pivotal. From bustling retail stores to thriving restaurants, the efficiency and capabilities of your POS system can significantly impact daily operations and customer experiences. With numerous options available, what sets a POS software apart as the best choice for Indian businesses?

Let's delve into the key factors that elevate a POS software to stand out in this competitive market.

1. Industry-Specific Features:

A POS software that caters to the unique needs of Indian industries is a clear standout. For instance, a retail-focused POS should offer robust inventory management and barcode scanning, while a restaurant-focused POS must excel in table management, order customization, and split billing. Industry-specific features streamline operations and enhance customer interactions.

2. Localization and Language Support:

A POS software that supports regional languages and complies with Indian regulations is highly valuable. In a diverse country like India, catering to customers and staff who speak different languages contributes to a seamless experience.

3. GST Compliance:

With the implementation of Goods and Services Tax (GST) in India, a top-tier POS software should seamlessly handle GST calculations, invoicing, and reporting. This compliance feature saves time and ensures accurate financial records.

4. Payment Options:

Support for a variety of payment options, including digital wallets, UPI, credit/debit cards, and cash, is essential in a cashless economy like India. The best POS software simplifies transactions for both customers and businesses.

5. Mobile Accessibility:

In a country with high mobile penetration, a POS software with mobile capabilities empowers businesses to process transactions, manage orders, and assist customers from anywhere in the store or restaurant.

6. Scalability:

As Indian businesses grow, the chosen POS software should seamlessly scale to accommodate increased sales, additional outlets, and expanding inventory. Scalability prevents the need for frequent software changes.

7. User-Friendly Interface:

The best POS software should feature an intuitive interface that minimizes staff training time. A user-friendly system leads to faster transactions, reduced errors, and improved productivity.

8. Analytics and Reporting:

Comprehensive analytics and reporting features provide insights into sales trends, popular items, and employee performance. Data-driven decisions can drive business growth and strategies.

In a diverse and competitive market like India, the best POS software is more than a transaction tool—it's a strategic asset that drives growth, efficiency, and customer satisfaction. By evaluating these factors and aligning them with your business's unique needs, you can confidently choose a POS software that stands out as the best choice for your Indian business.

1 note

·

View note

Text

of all the acronyms that have more than one common reading, I'm trying to imagine what two people with different readings make the worst relationship.

person who reads MLM as multi-level marketing and person who reads MLM as marxist-leninist-maoist might be #1, but I think we have competition from IRA (Irish) and IRA (retirement account). They definitely seem like a bad match. VOC (volatile organic compound) and VOC (Vereenigde Oostindische Compagnie/the Dutch East India Company) also feel like they come from two inherently different people, though maybe they're both granola progressive types and so get along that way.

meanwhile, POS (point of sale) and POS (piece of shit) work perfectly well together. CBT (cognitive behavioral therapy) and CBT (cock and ball torture) are your average Tumblr couple. TFA (two-factor authentication) and TFA (The Force Awakens) are the Reddit version of that couple. I also definitely like PMC (private military contractor) / PMC (professional-managerial class) as a matching pair. CNC (consensual non-consent) and CNC (CNC machine, computer numerical control) are clearly a fun pair as well. most of them are good!

10 notes

·

View notes

Text

The Future of ERP Software in India: Trends to Watch in 2024

As India continues to solidify its position as a global economic powerhouse, the demand for sophisticated Enterprise Resource Planning (ERP) solutions has never been higher. ERP software companies in India are at the forefront of this transformation, driving innovation and efficiency across various industries. As we look ahead to 2024, several key trends are shaping the future of ERP software in India. This blog delves into these trends, offering insights into how ERP software providers in India are gearing up to meet the evolving needs of businesses.

1. Increased Adoption of Cloud-Based ERP Solutions

One of the most significant trends in the ERP landscape is the shift towards cloud-based solutions. ERP software companies in India are increasingly offering cloud-based ERP systems to meet the growing demand for flexibility, scalability, and cost-efficiency. Cloud ERP solutions eliminate the need for extensive on-premises infrastructure, allowing businesses to reduce capital expenditure and streamline operations.

Cloud-based ERP systems also facilitate real-time data access and collaboration, enabling businesses to make informed decisions quickly. This trend is particularly beneficial for small and medium-sized enterprises (SMEs) that require affordable and scalable ERP solutions to compete effectively in the market.

2. Integration of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the ERP landscape. ERP software providers in India are integrating AI and ML technologies to enhance the capabilities of their solutions. These technologies enable predictive analytics, automate routine tasks, and provide intelligent insights, helping businesses to optimize their operations.

For instance, AI-powered ERP systems can forecast demand, manage inventory levels, and predict maintenance needs, significantly improving efficiency and reducing costs. As AI and ML technologies continue to evolve, their integration into ERP systems will become more sophisticated, offering even greater value to businesses.

3. Focus on Industry-Specific ERP Solutions

ERP software companies in India are increasingly developing industry-specific ERP solutions to cater to the unique needs of different sectors. Whether it is manufacturing, retail, healthcare, or finance, each industry has distinct requirements that generic ERP systems might not fully address. Industry-specific ERP solutions offer tailored functionalities and workflows, ensuring better alignment with business processes.

For example, a manufacturing ERP system might include features for production planning, quality control, and supply chain management, while a retail ERP system could focus on inventory management, point of sale (POS) integration, and customer relationship management (CRM). This trend towards specialization ensures that businesses can leverage ERP systems that truly support their operational needs.

4. Enhanced Mobile Accessibility

With the proliferation of smartphones and mobile devices, the need for mobile-friendly ERP solutions is growing. ERP software providers in India are developing mobile applications that allow users to access critical business information on the go. Mobile ERP solutions enable employees to perform tasks such as inventory checks, sales order processing, and expense reporting from their smartphones or tablets.

This trend not only improves accessibility but also enhances productivity by enabling employees to work remotely and make decisions in real-time. As mobile technology continues to advance, the functionality and user experience of mobile ERP applications will improve, making them an indispensable tool for modern businesses.

5. Increased Emphasis on Data Security and Compliance

As businesses become more reliant on digital technologies, data security and compliance have become paramount. ERP software providers in India are prioritizing data protection by incorporating advanced security features into their solutions. This includes encryption, multi-factor authentication, and regular security audits to safeguard sensitive business information.

Moreover, with the implementation of regulations such as the General Data Protection Regulation (GDPR) and India’s Personal Data Protection Bill, compliance is a critical concern for businesses. ERP software providers are ensuring that their systems comply with these regulations, helping businesses avoid legal penalties and build trust with their customers.

6. Rise of Hybrid ERP Solutions

While cloud-based ERP systems offer numerous advantages, some businesses prefer on-premises solutions due to specific regulatory or operational requirements. To cater to these diverse needs, ERP software companies in India are offering hybrid ERP solutions that combine the benefits of both cloud and on-premises systems.

Hybrid ERP solutions provide the flexibility of cloud-based systems while allowing businesses to maintain critical applications on-premises. This approach offers a balanced solution, enabling businesses to optimize their IT infrastructure based on their unique needs and preferences.

7. Adoption of Advanced Analytics and Business Intelligence

Data is the new currency in today’s business environment, and the ability to harness and analyze data is a key competitive advantage. ERP software providers in India are integrating advanced analytics and business intelligence (BI) tools into their systems. These tools enable businesses to gain deep insights into their operations, identify trends, and make data-driven decisions.

Advanced analytics and BI tools can analyze large volumes of data from various sources, providing comprehensive reports and dashboards. This helps businesses to monitor performance, identify inefficiencies, and uncover new opportunities for growth.

8. Greater Focus on User Experience and Interface Design

The user experience (UX) and interface design of ERP systems are critical to their adoption and effectiveness. ERP software companies in India are placing a greater emphasis on developing intuitive and user-friendly interfaces. This trend is driven by the need to ensure that ERP systems are accessible and easy to use for all employees, regardless of their technical expertise.

Modern ERP systems feature clean, responsive interfaces with customizable dashboards and navigation options. This focus on UX design helps to improve user satisfaction, reduce training time, and increase overall productivity.

9. Integration with the Internet of Things (IoT)

The Internet of Things (IoT) is transforming the way businesses operate by enabling real-time monitoring and data collection from connected devices. ERP software providers in India are integrating IoT capabilities into their systems to enhance operational efficiency and decision-making.

IoT-enabled ERP systems can monitor equipment performance, track inventory levels, and optimize supply chain operations. For example, sensors placed on manufacturing equipment can detect anomalies and trigger maintenance requests before a breakdown occurs. This integration of IoT with ERP systems allows businesses to leverage real-time data for proactive management and improved efficiency.

10. Sustainable and Green ERP Solutions

Sustainability is becoming a key consideration for businesses across industries. ERP software companies in India are developing solutions that support sustainable practices and environmental responsibility. Green ERP solutions help businesses to monitor and reduce their environmental impact by tracking energy consumption, waste management, and resource utilization.

By integrating sustainability metrics into their ERP systems, businesses can set and achieve environmental goals, comply with regulations, and enhance their corporate social responsibility (CSR) initiatives. This trend towards sustainable ERP solutions reflects the growing importance of environmental stewardship in today’s business landscape.

Conclusion

The future of ERP software in India is marked by innovation, adaptability, and a deep understanding of the unique needs of businesses. ERP software providers in India are leading the charge, offering solutions that are not only technologically advanced but also aligned with the evolving demands of the market. As we move into 2024, the trends highlighted in this blog will play a crucial role in shaping the ERP landscape, driving efficiency, and fostering growth across industries.

ERP software providers in India are well-positioned to support businesses in their digital transformation journeys, providing the tools and insights needed to thrive in a competitive environment. By staying ahead of these trends, businesses can leverage ERP solutions to achieve operational excellence and sustainable growth.

#ERP software Companies in India#ERP software providers in India#ERP software company in India#ERP software in India#ERP solution provider#ERP software#ERP system#cloud ERP#ERP solutions

4 notes

·

View notes

Text

Best Billing Machines in India

Effectiveness in transactions is essential in the busy realms of commerce and retail. Billing machines, a crucial tool in this process, have advanced significantly over time, with UDYAMA POS setting the standard in India. This article highlights UDYAMA POS's ground-breaking position in the industry while examining the innovations, customer satisfaction, and variety of (Best Billing Machines in India) that are supplied. (Best Billing Machines in Delhi) are essential for streamlining billing processes because they provide cutting-edge functionality catered to various corporate requirements. The choice of billing machines can have a big impact on revenue creation and productivity for businesses of all sizes, from small merchants to multinational corporations.

Considering the Value of Billing Equipment

Competent billing is the foundation of any flourishing company. For any type of business—retail, dining, or service—accurate and timely invoicing is essential to preserving both the company's finances and its reputation with clients. This procedure is automated using billing machines, which streamlines transactions and lowers the possibility of errors. Contemporary billing machines enable organizations to improve operational efficiency and concentrate on their core competencies by providing functions such as inventory management, sales analysis, and tax calculation.

Essential Factors to Take-into-Account:

Creative Software for Billing:

Linked billing software is the cornerstone of modern billing systems. Look for systems with powerful reporting features, user-friendly interfaces, and customizable invoice templates. These features simplify the process of creating invoices and provide useful information on sales patterns and inventory management.

Choices for Internet Access:

In today's networked environment, billing machines with several connectivity options are more versatile and easy. Bluetooth and Wi-Fi enabled devices facilitate seamless communication with other corporate systems, allowing for real-time data synchronization and remote management.

Reliable Payment Processing:

Security is essential while processing financial transactions. Choose billing machines with robust encryption features and PCI-compliant payment processing services installed. This ensures the confidentiality and integrity of client data while lowering the risk of fraud and data breaches.

Design compactness and portability:

Small, portable billing devices are ideal for businesses with limited space or that are mobile. Look for portable devices with long-lasting batteries and sturdy construction. This simplifies invoicing in a number of contexts, including shop counters and outdoor events.

Possibility of Development and Enhancement:

Invest in scalable and easily upgraded invoicing solutions to accommodate future business growth and changing needs. Modular systems with interchangeable parts facilitate the easy integration of additional features as your business expands.

UDYAMA Point of Sale Advantages

The Indian billing machine market has seen a radical transformation thanks to UDYAMA POS's state-of-the-art technology and customer-focused mentality. A selection of models designed to satisfy particular business needs are available from UDYAMA POS. These approaches have improved the checkout experience for customers while also increasing operational efficiency.

There are many different types of billing machines available on the market, ranging from sturdy desktop models for high-volume organizations to portable devices for transactions while on the go. Every kind has distinctive qualities designed for particular commercial settings, which emphasizes how crucial it is to choose a machine that fits your operational requirements.

Features of a Billing System to Take-into-Account

Durability, connectivity choices, and convenience of use are important factors to take-into-account when selecting a billing machine. A machine that performs well in these categories can significantly improve business operations by facilitating faster and more dependable transactions.

(Best UDYAMA POS Billing Machine) Models

A range of models that are notable for their cost, dependability, and functionality are available from UDYAMA POS. With the help of this section's thorough analysis of these best models, you can make an informed choice depending on your unique business needs.

How to Choose the Right Invoicing Equipment

When choosing a billing machine, it's important to evaluate your company's needs, budget, and the features that are most important to your daily operations. This guide provides helpful guidance to assist you in navigating these factors.

Benefits of Changing to a Modern Billing System

Modern billing systems, such as those provided by UDYAMA POS, can greatly improve customer satisfaction and efficiency. The several advantages of performing such an upgrade are examined in this section, ranging from enhanced client satisfaction to streamlined operations.

Advice on Installation and Upkeep

Making sure your billing machine is installed correctly and receiving routine maintenance is essential to its longevity and dependability. Important setup and maintenance advice for your new gadget is included in this section.

Field Research: UDYAMA POS Success Stories

The revolutionary effect of UDYAMA POS billing devices on businesses is demonstrated by actual success stories from the retail and hospitality industries. These case studies demonstrate how businesses have benefited from increased customer satisfaction and operational efficiency thanks to UDYAMA POS technology.

All products in the Billing Machine are:

(Handy POS Billing Machine)

(Android POS Billing Machine)

(Windows POS billing Machine)

(Thermal Printer Machine)

(Label Printer Machine)

Enhancing Efficiency with Best Billing Machines in India:

The adoption of the (best billing machines in Noida) has revolutionized the way businesses manage their finances. These advanced solutions offer a myriad of benefits, including:

Simplified Billing Procedures: By automating invoice generation and payment retrieval, billing procedures are made more efficient and less prone to human error and delay.

Enhanced Accuracy: Up-to-date billing software guarantees precise computations, removing inconsistencies and billing conflicts.

Improved Customer Experience: Easy and quick transactions increase client happiness and loyalty and encourage recurring business.

Real-Time Insights: Rich reporting tools offer insightful information on inventory control and sales performance, facilitating well-informed decision-making.

Observance of Regulatory Mandates: Pre-installed compliance tools guarantee that financial reporting requirements and tax laws are followed, lowering the possibility of fines and audits.

Frequently Asked Questions:

Are billing systems appropriate for all kinds of companies?

Absolutely! Billing machines come in various configurations and are tailored to suit the needs of diverse businesses, from small retailers to large enterprises.

Can billing devices accept several forms of payment?

Yes, most modern billing machines support multiple payment options, including cash, credit/debit cards, mobile wallets, and online payments.

How frequently should the software on billing machines be updated?

It's recommended to update billing machine software regularly to ensure optimal performance, security, and compatibility with the latest regulations and technologies.

Do billing machines need to be connected to the internet?

While internet connectivity is not mandatory for basic billing operations, it may be necessary for accessing cloud-based features, software updates, and remote management capabilities.

Is it possible to link accounting software with billing machines?

Yes, many billing machines offer integration with popular accounting software packages, facilitating seamless data transfer and reconciliation.

Are POS terminals easy to use?

Most billing machines are designed with ease of use in mind, featuring intuitive interfaces and straightforward setup processes. Training and support are typically provided to ensure smooth adoption and operation.

UDYA MA POS, a business renowned for its wide range of products, innovative solutions, and happy clients, is the result of searching for the (best billing machines in India). Considering how organizations are always changing, choosing the right billing system is essential. Thanks to its commitment to quality and innovation, UDYAMA POS is a leader in the billing machine industry, ensuring that transactions will become more streamlined, dependable, and fast in the future. The strategic decision to invest in the (top billing machines in Gurgaon) could have a significant effect on businesses of all kinds. These innovative solutions help organizations thrive in the present competitive market by streamlining billing processes, increasing precision, and providing insightful data.

Regardless of the size of your business, selecting the correct billing equipment is critical to increasing productivity and spurring expansion.

Visit the website for more information: www.udyamapos.com

2 notes

·

View notes

Text

The Role of UPI in India’s Digital Economy 🚀💸

India's Unified Payments Interface (UPI) has transformed the way we think about payments. What was once a slow, cash-based economy is rapidly embracing the digital revolution—and UPI is leading the charge. 🙌

From the everyday transactions at your local grocery store to paying bills online, UPI has made it easier, faster, and more secure than ever before. 🌍📱

Here's how UPI is shaping the digital economy in India:

Instant, Real-Time Transactions No more waiting for hours or days to transfer money! With UPI, payments are completed in real-time—making transactions faster and more convenient than ever before. 💨

Financial Inclusion for All UPI isn’t just for tech-savvy users. It’s made financial services accessible even in rural areas, helping millions of people get connected to the digital economy. 🌾📲

Driving the Cashless Economy By enabling QR code payments and mobile transfers, UPI is helping India move towards a cashless economy. Now you can pay with just your phone, no cash needed! 💳🚫

Businesses Are Benefiting Too From small kirana shops to big businesses, UPI for businesses is a game-changer. It’s simple, secure, and allows merchants to collect payments with minimal setup. Say goodbye to POS machines and hello to QR code payments! 🛒🔌

Indiplex Leading the Way With Indiplex QR code solutions and UPI payment gateways, businesses are getting even more secure, fast, and efficient ways to accept payments. 🌟

The future of UPI in India looks bright, with even more advancements on the horizon. As India continues to grow digitally, UPI will play an even bigger role in shaping the digital economy. 🌐💼

#UPI #DigitalEconomy #Fintech #PaymentSolutions #CashlessIndia #Indiplex #QRpayments #DigitalPayments #FutureOfPayments

0 notes

Text

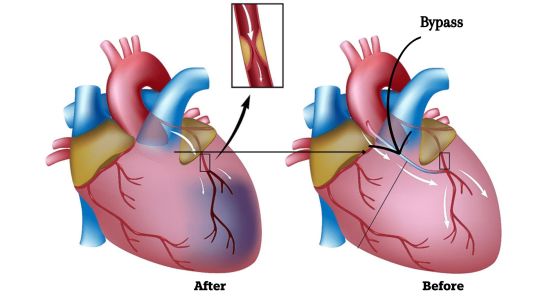

Heart Bypass Surgery in India: Risks, Recovery Tips, and Post-Surgery Care

Heart Bypass surgery is a procedure of bypassing arteries that are blocked with the help of a graft from another body. It facilitates fresh oxygen supply to the heart walls reducing various symptoms of myocardial infarction and cardiac pulmonary conditions. The heart is the principal organ of essence and should be healthy for efficient working.

Heart Bypass Surgery in India is famous and improving the lives of people. With the introduction of technology in medical science everything is possible. There is a difference between heart replacement and bypass surgery and based on the procedure cost is also different.

What is Heart Bypass Surgery?-Types of Heart Surgery

Based on the condition of the heart there are many different types of heart surgeries. There are also traditional methods used in the surgeries and the second method is less invasive. Here is the overview of various surgeries:

Off-pump CABG (Beating Heart Surgery) is performed without stopping the heart. It is also a kind of open heart or traditional surgery. The heart still beats, and a heart-lung machine is not used during the surgery.

On-Pump CABG – Uses small incisions to perform the surgery with less pain and quick recovery. In a minimal invasion process, doctors insert cameras and surgical instruments through that invasion, the chest is not fully opened. Recovery of the patient is seen in the next few weeks.

Traditional CABG – It is a traditional method, it requires an open-chest procedure with the use of a heart-lung machine. The wide open chest allows open surgery and another pumping system through a heart-lung machine.

Robot-Assisted CABG – Advanced robotic technology assists in performing precise surgical movements. It is also a kind of minimally invasive surgery and all information related to blockage and the incision is revised at the times with the robotic assistance.

Multiple Bypass Surgery- It is a method by which multiple coronary arteries are unblocked and grafting is done based on blocked arteries. Single bypass, double bypass and triple bypass all are the kinds of multiple bypasses based on numbers.

Bypass Surgery Cost in India- How Much Does Heart Bypass Surgery Cost in India?

For proper surgery, there is a requirement for the diagnostics and the angiography procedure. MRI and various procedures to assess internal structure are processed. There are many times when the procedure gets changed by the internal anatomy of the chest. Bypass surgery cost also changes with the need for additional practices. Here is the cost of Heart bypass surgery in India:

Procedure

Cost in India (INR)

Pre-Diagnostic

25,000 to 30,000

Surgery

2.6 to 3.5 Lakhs

Follow up for Consultation

700 to 1200 per session

Medicine

5,000 to 10,000

CABG off-pump

1.8 to 2.5 lakhs

CABG On-Pump

2 TO 2.6 Lakhs

Procedure of Heart Bypass Surgery in India

The heart is a fragile organ and surgeons are particularly trained in the isolated environment for heart surgery. MRI and various procedures to assess internal structure are processed. There are many times when the procedure gets changed by the internal anatomy of the chest. Here is a detail view of the procedure:

Pre- Surgery Preparation

Patients undergo diagnostic tests like ECG, angiography, and blood work to know the exact cause of blockage in the single or multiple arteries. Usually, patients with high bad lipids use blood thinners but they asked to avoid such medicines because of operation scheduling.

Anesthesia Administration

Before the surgery procedure, general anaesthesia is administered to the patients, and the quantity is measured according to the patient’s size and weight. There are three types of anaesthesia: general, local, and regional

Incision in the Chest Region

The incision is made vertically in the chest and the sternum is also cut to access the heart. If it is a minimally invasive procedure then the sternum is not cut. Before the incision position is defined carefully according to the anatomical position of the chest.

Insertion of Heart-Lung Machine

When open surgery takes place then artificial circulation is maintained with the help of a heart-lung machine. During an operation, the heart does not pump blood.

Graft Placement

A healthy artery from another body is taken and grafted into the coronary artery. A bypass is then made around the blocked portion of the artery. The bypass provides an artificial graft for blocked arteries.

Closing and Recovery of the Patients

The chest is closed completely instruments are taken out, and the patient is shifted to intensive care for monitoring. Recovery of the patient is done in a few weeks completely if it is minimally invasive surgery.

Best Hospital of Heart Bypass Surgery in India- We Care Health Services

We Care Health Services provides extensive services in the field of heart surgery for various treatment options. These services are provided in the top 5 metropolitan cities with the same name. To tackle the emotions of the family during the heart surgery procedure they also give counselling. It is also considered as best hospital because of the patient’s testimonials and best reviews on Google. Here are some unique points about We Care Health Services:

Great success rate of 95 % or more.

Surgery is also available for multiple bypasses.

Health factors and the gender of the person are also considered before the operation.

Further prevention of the diseases and after effects are also told to the patients.

Patient care and post-surgical events are taken carefully.

Services in the multiple cities without compromising the quality treatment.

Heart Bypass Surgery in India is not a rare event but can be complicated because of the infant’s health. It is emotionally challenging for the parents, and counselling is given to the parents before the procedure. We have also discussed post and Pre- Operative health care services. Based on these services, it is important to understand the choice of the right clinic. India is now a medical heritage for various surgeries, because of technical involvement in medical science.

0 notes

Text

Digital Payment Market: Revolutionizing Transactions in a Digital Era

The digital payment market is undergoing a transformative revolution, spurred by advancements in technology, evolving consumer behaviors, and the global drive toward cashless economies. As highlighted in SkyQuest's detailed report, the Digital Payment Market is set to grow at an unprecedented rate, reshaping the global economic landscape and redefining how transactions are conducted.

The digital payment industry includes a wide array of technologies such as mobile payments, digital wallets, online banking, and point-of-sale (POS) systems. This market has become a pillar of global commerce, with a staggering valuation poised to grow exponentially. With increased smartphone penetration, improved internet connectivity, and the advent of fintech innovations, the market is experiencing unparalleled growth.

Request a Sample of the Report Here: https://www.skyquestt.com/sample-request/digital-payment-market

Key Drivers Behind the Growth

Technological Advancements The integration of blockchain, artificial intelligence (AI), and machine learning (ML) is elevating payment systems to new heights. These technologies are optimizing security protocols, streamlining transactions, and improving user experiences, leading to greater consumer trust.

Proactive Government Initiatives Governments globally are driving cashless economies. Initiatives such as India’s Unified Payments Interface (UPI) and Europe’s PSD2 regulation are facilitating widespread adoption of digital payments by offering regulatory support and infrastructure development.

Evolving Consumer Preferences The pandemic significantly accelerated the shift toward contactless payments due to health concerns. The adoption of digital wallets, QR-code-based payments, and other touchless technologies has become the new norm.

E-commerce Boom The surge in online retail platforms has fueled the need for seamless and secure digital payment options, making these solutions indispensable for both merchants and consumers.

Speak with an Analyst for More Insights:

Market Challenges: Navigating the Roadblocks

While the market's growth trajectory is impressive, challenges remain:

Cybersecurity Threats: The increase in digital transactions has amplified concerns about data breaches and cyberattacks.

Regulatory Hurdles: Diverse regulations across countries complicate global expansion.

Financial Inclusion: Bridging the digital divide remains a critical challenge, particularly in underbanked regions.

Regional Insights: A Global Perspective

North America: Leading the market with widespread adoption of innovative solutions and a tech-savvy population.

Europe: A region emphasizing sustainability and data privacy, Europe is focusing on regulatory frameworks to support digital payment solutions.

Asia-Pacific: The fastest-growing market due to a rising middle class, booming e-commerce, and government-backed digital initiatives.

Latin America & Middle East: Emerging regions witnessing growth through mobile payment adoption and urbanization.

Key Players Shaping the Market

Several prominent players are driving innovation and competition in the digital payment landscape, including:

PayPal Holdings, Inc.

Square, Inc. (Block, Inc.)

Ant Group

Stripe, Inc.

Adyen N.V.

Visa, Inc.

Mastercard Incorporated

These companies are leveraging technologies like biometrics, AI, and blockchain to enhance consumer experiences.

Learn more by accessing SkyQuest's comprehensive report here: https://www.skyquestt.com/report/digital-payment-market

Emerging Trends Transforming Digital Payments

Biometric Authentication Technologies such as facial recognition and fingerprint scanning are gaining traction for secure and convenient transactions.

Cryptocurrency Integration As cryptocurrencies become more mainstream, digital payment systems are increasingly incorporating them into their platforms.

Personalization Through AI AI-powered solutions offer tailored payment experiences, from rewards programs to transaction insights.

Cross-Border Payment Innovations Simplified international payment processes are reducing costs and increasing transaction speed.

The Road Ahead: A Cashless Future

The digital payment market is at the forefront of global commerce, blending cutting-edge technology with user-centric solutions. SkyQuest's report highlights immense opportunities for businesses and governments to harness this evolution. As digital payments continue to grow, the sector will play a pivotal role in driving economic inclusivity, innovation, and efficiency.

#Digital Payment Market#Digital Payment Market Size#Digital Payment Market Share#Digital Payment Market Trends

0 notes

Text

Custom Software Development: Why IT Companies in Delhi Lead the Way

Custom software development is crucial for businesses seeking tailored solutions to meet their unique needs. In recent years, IT companies in Delhi have emerged as leaders in providing custom software solutions. With their expertise, access to cutting-edge technology, and a vast pool of talented professionals, these companies are setting benchmarks in the software development industry.

Why Choose Custom Software Development?

Custom software development involves creating applications or systems tailored to the specific requirements of a business. Unlike off-the-shelf solutions, custom software ensures:

Personalized Features: Designed to meet exact business needs.

Scalability: Adapts to business growth and changes.

Integration: Works seamlessly with existing systems.

Enhanced Security: Offers better protection against cyber threats.

Choosing the right partner for custom software development is critical, and IT companies in Delhi are the perfect choice for businesses looking for quality and reliability.

Why IT Companies in Delhi Lead in Custom Software Development

1. Skilled Talent Pool

Delhi is home to some of India’s top IT professionals. IT companies in Delhi attract skilled developers, project managers, and tech experts who excel in delivering innovative software solutions.

2. Expertise in Diverse Technologies

Delhi-based IT companies have expertise in cutting-edge technologies such as:

Artificial Intelligence (AI) and Machine Learning (ML): For predictive analytics and automation.

Blockchain: For secure and transparent systems.

Cloud Computing: To provide scalable and efficient solutions.

Internet of Things (IoT): For smart, connected systems.

This technological expertise enables them to deliver state-of-the-art custom software solutions.

3. Cost-Effective Solutions

While maintaining international standards, IT companies in Delhi offer cost-effective services, making them an attractive choice for startups and small to medium-sized enterprises (SMEs).

4. Local Market Knowledge

Delhi-based IT companies have a deep understanding of local industries and market trends. This insight allows them to create software tailored specifically to the needs of businesses in Delhi and NCR.

5. Agile Development Approach

Most IT companies in Delhi follow agile methodologies, ensuring faster delivery, flexibility, and collaboration during the development process. This approach helps businesses stay updated and involved throughout the project lifecycle.

Benefits of Custom Software Development with IT Companies in Delhi

1. Competitive Advantage

Custom software provides unique features that help businesses stand out. Partnering with IT companies in Delhi ensures your software is aligned with your goals and sets you apart from competitors.

2. Improved Operational Efficiency

Tailored software automates repetitive tasks and optimizes workflows, reducing operational costs and enhancing productivity.

3. Scalable Solutions

As your business grows, custom software developed by IT companies in Delhi can be easily scaled up to meet new requirements.

4. Better Data Security

Custom solutions offer advanced security features designed to protect sensitive business data from breaches.

5. Seamless Integration

Custom software integrates effortlessly with your existing systems, ensuring smooth operations without compatibility issues.

Industries Benefiting from Custom Software by IT Companies in Delhi

Healthcare: Hospital management systems, telemedicine platforms, and patient portals.

Education: E-learning software, virtual classrooms, and exam portals.

Retail and E-Commerce: Inventory management, POS systems, and customer loyalty programs.

Real Estate: CRM systems, property listing platforms, and client management software.

Manufacturing: ERP solutions, supply chain management, and production monitoring tools.

These industries have experienced significant growth and efficiency improvements by leveraging the expertise of IT companies in Delhi.

How to Choose the Right IT Company in Delhi for Custom Software Development

1. Define Your Requirements

Clearly outline your business goals and software needs. Share these details with potential IT companies in Delhi to ensure they understand your vision.

2. Check Expertise and Experience

Look for companies with experience in your industry and expertise in the latest technologies.

3. Assess Portfolio and Client Reviews

Examine the company’s portfolio and read client testimonials to gauge their quality and reliability.

4. Discuss Timelines and Costs

Ensure the company can deliver your software within the desired timeframe and budget.

5. Ensure Post-Development Support

A reliable IT company in Delhi will offer ongoing support and maintenance to ensure your software runs smoothly.

Conclusion

Custom software development is an investment that can transform your business. By choosing IT companies in Delhi, you gain access to top-tier talent, advanced technologies, and cost-effective solutions. Whether you are a startup or an established enterprise, Delhi’s IT companies are equipped to provide innovative and scalable software tailored to your needs.

With the right software partner, your business can achieve new levels of efficiency, security, and growth. Partner with an IT company in Delhi today and take the first step toward digital excellence!

0 notes

Text

MBA in Data Analytics vs MBA in Business Analytics: Which Career Path is Better for You?

Data and analytics are the voice and ears of today's world, growing the business of growth, efficiency, and competitiveness. This increased role of analytics has led to specialized MBA in India in the aspects of Data Analytics and Business Analytics. These programs will prepare professionals with the skills to understand, analyze, and utilize data appropriately for strategic decision-making. However, although the two are related to data analysis, they vary considerably in terms of focus, prospects, and a 'bag of skills'. In this article, we will compare MBA in Data Analytics and MBA in Business Analytics in India across key factors like fee structure, career opportunities, job prospects, placement success, salary packages, and personal and professional growth.

1. Understanding the Key Differences

MBA in Data Analytics

An MBA in Data Analytics is relatively technical in processing data, statistical analysis, and developing computational models. Tools and techniques of machine learning, artificial intelligence, Python, R, and SQL are also applied to interpreting large complex data sets. Those passionate about data science, programming, and quantitative analysis find the role appropriate, providing for positions where significant technical competencies are involved in handling the data.

MBA in Business Analytics

An MBA in Business Analytics, on the other hand, combines data analysis with business strategy. This program focuses not only on the technical aspects of data but also on its application in solving real-world business problems. Students are taught to analyze business problems using data insights and craft strategies based on this analysis. It will have all aspects of business management, finance, marketing, and operations along with analytics tools. The difference lies in the fact that MBA in Business Analytics is more related to business decision-making and strategy, rather than just pure data analysis.

2. Fee Structure

MBA in Data Analytics in India

The fee structure for an MBA in Data Analytics in India differs from one institute to another, depending on its location and reputation. On average, fees range from ₹2,00,000 to ₹15,00,000 for the course; however, institute level varies widely. For example, Indian School of Business (ISB), IIMs, and other top institutes are much on the higher side in terms of fee. Many of these institutions also offer scholarships and financial aid programs to help students manage the cost of education.

MBA in Business Analytics in India

The fee structure for the MBA in Business Analytics is likely in the same category, that is, between ₹6,00,000 to ₹12,00,000 throughout the program. This difference ranges from institute to institute, with institutes having a high reputation, rich infrastructure, the quality of faculties, and program nature. Such institutes like IIM Ahmedabad, IIM Bangalore, XLRI Jamshedpur charge an even higher price. Business Analytics programs will also include the specialized certifications such as Tableau, Power BI, or SAS, which also add to the overall cost of the program.

3. Career Opportunities and Job Prospects

MBA in Data Analytics

The demand for data analytics professionals in India is growing at a fast pace. Since businesses increasingly depend on data for decision-making, an MBA in Data Analytics can lead to several career options. Graduates can work in IT, finance, healthcare, consulting, retail, and e-commerce. These professionals are usually employed to manage and interpret large datasets in order to reveal insights that could improve business performance.

Major career options after graduating in an MBA in Data Analytics include the following:

Data Scientist

Data Analyst

Machine Learning Engineer

Business Intelligence Analyst

Data Engineer

Quantitative Analyst

Data Consultant

MBA in Business Analytics

Business analytics graduates are not restricted to technical career positions only since the MBA program is integrated with business management. They are of higher potential in assuming strategic leadership roles across companies. They can use data in managing critical business issues with decision-enabling influence of cross-functional departments such as marketing, finance, operations, and strategy.

Major Career Outlook for post MBA in Business Analytics graduates Business Analyst Business Intelligence Manager

Data Driven Consultant

Marketing Analytics Manager

Operations Research Analyst

Strategy Consultant

Business Strategy Analyst

4. Placement and Job Opportunities

MBA in Data Analytics

The placement opportunities are robust for the students of the MBA in Data Analytics program offered in India. The opportunities available are more substantial in tech-driven companies, startups, and consultancies. Because of the increase in the usage of data in business decisions, organizations are very keen to recruit professionals who can manage data and derive actionable insights. Some top recruiters are TCS, Infosys, Wipro, Accenture, and Deloitte.

Placement Success: ISB, IIMs, and IITs are top business schools that offer an MBA in Data Analytics, and they show high placement success, as companies are actively seeking candidates who can handle data, work on machine learning, and work on AI.

MBA in Business Analytics

Strong placement opportunities for the graduates are also expected from this MBA in Business Analytics programme especially for consulting firms, management companies, banks, and e-commerce firms. Top recruiters like McKinsey, BCG, Amazon, and Google look for business analysts who can bring analytical abilities together with a good understanding of business operations. These roles typically surround three key areas: applying data to guide business strategy and drive decision-making at the managerial level with process optimization.

Placement Success: MBA in Business Analytics programs by IIM Bangalore and XLRI Jamshedpur have maintained great industry interfaces and have high placement rates and tremendous demand for business analysts.

5. Salary Packages

MBA in Data Analytics

The salary of an MBA in Data Analytics can range from very high to extremely low depending on the job, the company, and the location in India. Entry-level positions like data analysts or junior data scientists will be around ₹4,00,000 to ₹8,00,000 per annum. After a few years of experience, the salary will go up to around ₹15,00,000 to ₹25,00,000 per year. More senior roles, like machine learning engineers or data architects, can command ₹30,00,000 to ₹45,00,000 per year or more, depending on experience in tech companies or financial institutions.

MBA in Business Analytics

Packages for the graduate of an MBA in Business Analytics, especially if done with good acumen for the business side of things and proper technical skills are also very rewarding. For business analyst or marketing analytics manager, these entry-level posts, the pay goes from ₹8,00,000 to ₹15,00,000 per year. Those professionals holding experience between 5 to 7 years can receive ₹20,00,000 to ₹30,00,000 per annum. If individuals take on positions with a senior status like the chief analytics officer or strategy consultant, they receive remunerations higher than ₹40,00,000 annually.

6. How These Programs Support Students in their Professional and Personal Lives

MBA in Data Analytics

An MBA in Data Analytics provides students with the deep understanding of advanced analytical tools and technologies. While students gain the technical knowledge, they also develop skills such as critical thinking, problem-solving, and data-driven decision-making. These skills are applicable across industries, and with data being integral to modern businesses, graduates are highly sought after.

Personal and Career Growth: The program fosters growth by developing technical competency in data science, enhancing analytical thinking, and equipping one with the ability to work with cutting-edge technology. It also enhances the ability to communicate complex data insights to non-technical stakeholders, an important skill in any business environment.

MBA in Business Analytics

An MBA in Business Analytics focuses on honing both technical and business management skills. The program is designed to equip students with the knowledge needed to implement analytics within business strategies and lead teams to drive data-driven decision-making. This dual exposure to business and analytics prepares students for leadership roles that require both managerial expertise and technical knowledge.

Personal and Career Growth: Students learn the most important business strategy, leadership, and communication skills that make them a well-rounded professional. They are trained to make data-driven decisions, which is very important for growing businesses in the digital age. In addition, the networking opportunities through internships and industry collaborations further enhance their career prospects.

7. Conclusion: Which Program is Right for You?

Both MBA in Data Analytics and MBA in Business Analytics are good educational paths for people who want to make a career in the world of data and business strategy. However, the choice between the two depends on the interests, skills, and career goals of the individual.

MBA in Data Analytics: If you are more inclined towards technical skills, enjoy working with large datasets, and want to specialize in fields like data science, machine learning, and big data.

MBA in Business Analytics: This course is for students who want to combine analytical acumen with business strategy, intend to lead data-driven initiatives, and seek managerial or consultancy positions where data insights can fuel business growth.

In India, both programs provide great career opportunities, high salaries, and opportunities for personal and professional development. But students need to weigh their strengths and long-term career aspirations before choosing.

0 notes

Text

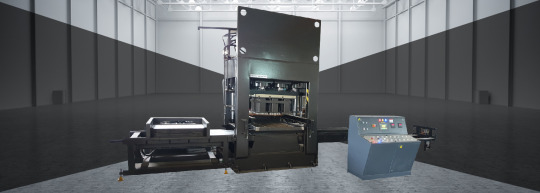

Auto Pallet Stacker System manufacturer in coimbatore

Introducing the Auto Pallet Stacker System - 15 Bricks, a highly efficient solution for automating the pallet stacking process. Designed and manufactured by a leading Auto Pallet Stacker System manufacturer in Coimbatore, this advanced system is engineered to improve the productivity and accuracy of stacking operations. With a range of powerful features, it is an ideal choice for industries looking to enhance their material handling.

Equipped with a 15 H.P/11.25 KW hydraulic motor, the Auto Pallet Stacker System ensures smooth operation, while the 3 H.P/2.25 KW conveyor system optimizes material flow. The system also includes a high-performance pan mixer machine and a hopper vibrator for greater efficiency. The stacker is powered by a robust 3 H.P/2.25 KW hydraulic motor and features a travel motor of the same power for reliable movement and positioning. It has a pallet chain conveyor and hydraulic-free fill system to simplify stacking tasks, cutting down on labor requirements significantly.

The machine's control is managed through a PLC system, providing precise control over its operations. With a stacker cycle time of 15 seconds and a robust hydraulic pump, the Auto Pallet Stacker System Coimbatore ensures high output with minimal downtime. The system is designed with durable components, including grained hard chromed sliding rods and steel casting sliding bushes, ensuring longevity and optimal performance.

As trusted Auto Pallet Stacker System exporters in Coimbatore, India, we take pride in offering a high-quality product designed to meet the demanding needs of modern industries. With a land requirement of 1.5 acres and a production capacity of 12 laborers per shift, the Auto Pallet Stacker System is an investment that improves operational efficiency and productivity. Experience the benefits of automation with our advanced system, tailor-made for the evolving industrial landscape.

For more details on the Auto Pallet Stacker System, feel free to contact us today!

Website Link : -http://www.bennyenterprises.net/

Contact no : - 9360623765

Mail id : - [email protected]

Address :- Site No:13, Thadagam Road,K.N.G.Pudur Pirivu,

Opp: Indian Oil Petrol Pump, Next to Agarwal School, Somayampalayam (PO), Coimbatore - 641 108,Tamil Nadu, India

Socail media link

facebook link :- https://www.facebook.com/Bennyindustries

short describiton :- Benny Enterprises specializes in manufacturing innovative block-making machines and construction equipment. With a commitment to quality and precision, the company provides cutting-edge solutions for the construction industry, including automatic block-making machines, tile-making machines, and custom-designed equipment to meet various industrial needs.

#Auto Pallet Stacker System#Auto Pallet Stacker#Auto Pallet Stacker System manufacturer in Coimbatore#Benny Enterprises

0 notes

Text

What Are the Key Features to Look for in the Best POS Machine for Your Business?

Choosing the best POS machine for your business involves considering several key features that can greatly impact your operations and customer experience. Here are some essential features to look for:

1. User-Friendly Interface: A user-friendly interface ensures that your staff can quickly learn and operate the POS system. Intuitive navigation and clear menu options can enhance efficiency during busy times.

2. Inventory Management: The POS machine should offer effective inventory management capabilities. Look for features such as automatic stock tracking, low-stock alerts, and the ability to categorize and organize products.

3. Payment Options: The POS machine should support various payment methods, including credit and debit cards, mobile wallets, and even contactless payments. Offering diverse payment options improves customer convenience.

4. Sales Reporting and Analytics: A good POS system provides detailed sales reports and analytics. This helps you track sales trends, popular products, and peak business hours, enabling better decision-making.

5. Integration: Integration with other software systems, such as accounting and customer relationship management (CRM) software, streamlines your business operations and data management.

6. Customization: The ability to customize the POS interface to match your business needs is important. You should be able to create and modify product categories, pricing, and discounts.

7. Security: Security is paramount. The best POS machines offer encryption for payment data, user authentication, and access controls to prevent unauthorized use.

8. Customer Management: Look for features that allow you to manage customer profiles, track purchase history, and offer loyalty programs. This enhances customer engagement and personalization.

9. Support and Training: Adequate customer support and training are crucial. Choose a POS provider that offers training resources and responsive customer service to help you navigate any issues.

10. Scalability: As your business grows, your POS system should be able to grow with you. Ensure that the chosen system can handle increased transaction volume and additional features.

Choosing the best POS machine in India requires a careful assessment of these features to ensure that it aligns with your business goals, improves efficiency, and enhances the overall customer experience.

0 notes

Text

Indo Farm Equipment Limited IPO 2024

निःशुल्क डीमैट खाता खोलें

Indo Farm Equipment Limited, established in 1994, is an ISO certified company based in Himachal Pradesh, India.

It specializes in manufacturing tractors, cranes, engines, and diesel gensets, aiming to provide affordable and high-quality agricultural equipment for farmers.

The company began its operations with a single model of 50 HP tractors and has since expanded its product range to include tractors from 20 HP to 110 HP, with plans for a 110 HP model currently under development.

In 2008, Indo Farm diversified into the production of Pick-N-Carry cranes, enhancing its capacity utilization and catering to the industrial and construction sectors.

The manufacturing facility spans 34 acres and is equipped with state-of-the-art technology, including induction furnaces and CNC machining centers, ensuring high-quality production standards

The Indo Farm Equipment Limited IPO is set to open for subscription from December 31, 2024, to January 2, 2025.

This IPO aims to raise approximately ₹260.15 crore, making it a significant opportunity for investors looking to enter the market before the new year.

Indo Farm Equipment Limited IPO 2024: A Comprehensive Overview :Indo Farm Equipment Limited IPO 2024

The Indo Farm Equipment Limited IPO is an exciting opportunity for investors, marking the last public offering of 2024. Here’s everything you need to know about this IPO.

निःशुल्क डीमैट खाता खोलें

IPO Details

IPO Opening Date: December 31, 2024

IPO Closing Date: January 2, 2025

Listing Date: January 7, 2025

Price Band: ₹204 to ₹215 per share

Lot Size: 69 shares

Total Issue Size: ₹260.15 crore

Fresh Issue: ₹184.90 crore (0.86 crore shares)

Offer for Sale: ₹75.25 crore (0.35 crore shares)

Indo Farm Equipment Limited IPO 2024: Company Background

Indo Farm Equipment Limited IPO 2024: A Comprehensive Overview :Indo Farm Equipment Limited IPO 2024

The Indo Farm Equipment Limited IPO is an exciting opportunity for investors, marking the last public offering of 2024. Here’s everything you need to know about this IPO.

निःशुल्क डीमैट खाता खोलें

IPO Details

IPO Opening Date: December 31, 2024

IPO Closing Date: January 2, 2025

Listing Date: January 7, 2025

Price Band: ₹204 to ₹215 per share

Lot Size: 69 shares

Total Issue Size: ₹260.15 crore

Fresh Issue: ₹184.90 crore (0.86 crore shares)

Offer for Sale: ₹75.25 crore (0.35 crore shares)

Indo Farm Equipment Limited IPO 2024: Company Background

youtube

Indo Farm Equipment Limited, a key player in the agricultural equipment sector, has reported notable growth in its recent financial results.

The company showcased robust revenue growth backed by strong domestic demand and strategic export initiatives.

Invest in Growing Opportunities: Indo Farm Equipment Limited IPO 2024

Are you ready to capitalize on market trends like this? Open your FREE Demat Account with Sky Stock Mart today and unlock endless possibilities in the stock market!

Benefits of Opening a Demat Account with Us

निःशुल्क डीमैट खाता खोलें

Zero account opening charges.

Real-time market insights and expert advice.

Access to IPOs, equities, and mutual funds.

Don’t wait! Join thousands of smart investors. Call us or visit Sky Stock Mart to open your free Demat account now.

Indo Farm Equipment Limited IPO 2024: Grey Market Premium (GMP)

As of December 25, 2024, the I

Minimum Investment: Retail PO has a grey market premium (GMP) of ₹50, indicating a potential listing price of ₹265 per share, which reflects an expected gain of 23.26%.Use of ProceedsThe funds raised from the IPO will be utilized for:

Establishing a new manufacturing unit for pick-and-carry cranes

Repaying or prepaying existing borrowings

Strengthening the capital base of its NBFC subsidiary, Barota Finance Ltd.

General corporate purposes

Investment Considerationsनिःशुल्क डीमैट खाता खोलेंinvestors can apply for a minimum of one lot (69 shares), requiring an investment of ₹14,835 at the upper price band.

Allocation Structure:

Qualified Institutional Buyers (QIBs): Up to 50%

Non-Institutional Investors (NIIs): At least 15%

Retail Investors: At least 35%

Indo Farm Equipment Limited IPO 2024: Conclusion

निःशुल्क डीमैट खाता खोलें

The Indo Farm Equipment Limited IPO presents a promising investment opportunity in the agricultural and construction equipment sector.

With a strong market presence, experienced management, and plans for expansion, it could be a valuable addition to your investment portfolio. However, potential investors should carefully assess the associated risks and market conditions before participating in the offering.

निःशुल्क डीमैट खाता खोलें

#best broker for demat account#best demat account#demat#best demat account in india#demat account charges#demat account india#demat account for beginners#demat account#basics of stock market#benefits of demat account#Youtube

1 note

·

View note

Text

India’s Leading POS Billing Software for Retail Success

Managing a retail business can be challenging, but with the right tools, it becomes a lot easier. One such tool is POS billing software. Whether you own a small retail shop, a bustling restaurant, or a chain of outlets, a robust POS system can transform your business operations. 🚀

What is POS Billing Software?

It is a technology that helps businesses manage sales, inventory, and billing seamlessly. POS stands for “Point of Sale,” which is the place where transactions occur.

Generate accurate bills quickly ⏳

Track sales and inventory in real-time 📈

Accept multiple payment methods like cash, cards, or digital wallets 💳

Manage customer data and loyalty programs effortlessly 😊

Whether you need a POS machine for a retail shop or restaurant billing software, the right solution can make your operations more efficient.

Why Do You Need POS Billing Software?

Investing in POS bill software for retail shops or restaurants can provide many benefits. Here are a few reasons why it’s a must-have for businesses:

Speed and Accuracy: Say goodbye to manual errors and long queues. A POS system ensures fast and error-free billing. 🎁

Inventory Management: Track your stock levels in real-time, so you never run out of popular items. 🍐

Better Customer Experience: Serve your customers faster and offer them multiple payment options for a smoother experience. ✨

Data-Driven Decisions: Get detailed reports on sales trends and customer preferences, helping you make informed business decisions. 🔎

Easy Integration: Modern POS systems for retail can integrate with e-commerce platforms and accounting software for a unified business solution. 🌐

Types of POS Bill Software

Retail POS: Ideal for shops, supermarkets, and malls. It helps manage sales, inventory, and customer data efficiently. 🎮

Restaurant Billing Software: Perfect for cafes, food trucks, and fine dining restaurants. It manages table orders, kitchen operations, and even online deliveries. 🍝

Cloud-Based POS Systems: Access your business data anytime, anywhere, from any device. ☁️

Mobile POS: Use a tablet or smartphone as a POS machine, suitable for small businesses or on-the-go vendors. 📲

Features to Look for in Point-of-sale Software

User-friendly interface 🎮

Multi-payment support 💳

Real-time inventory tracking 🔄

Cloud backup and security ☁️

Analytics and reporting tools 📊

How to Choose the Best POS Software

Here’s a simple checklist to help you choose:

Business Needs: Do you need a retail POS or restaurant billing software?

Scalability: Can the software work with your business?

Budget-Friendly: Ensure it fits your budget without compromising essential features. 💸

Customer Support: Look for 24/7 support for hassle-free operations. 🔌

Final Thoughts 🌟

Whether you’re running a retail store or a restaurant, reliable Point of sale software can save you time, reduce errors, and boost customer satisfaction. From retail POS systems to restaurant billing software, there’s a solution for every business type.

FAQs

1. Is POS bill software free to use?

It offers competitive pricing with a free trial for new users to experience its features 📈.

2. Can I use a POS system for small business?

Yes, it is designed for businesses of all sizes, making it ideal for small businesses and startups 💰.

0 notes

Text

Aadhaar Enabled Payment System (AEPS) Registration API: Simplifying Payments with JustForPay

In today's digital world, secure and seamless payment systems are crucial for businesses and consumers alike. The Aadhaar Enabled Payment System (AEPS) is a revolutionary solution that uses Aadhaar (the unique identification number in India) to enable secure transactions. With the Aadhaar Enabled Payment System (AEPS) Registration API offered by JustForPay, businesses and service providers can easily integrate AEPS payment services into their platforms.

This blog will delve into the benefits and features of the AEPS Registration API from JustForPay and how it simplifies payment processes for businesses, merchants, and customers.

What is AEPS (Aadhaar Enabled Payment System)?

AEPS is a payment system that allows financial transactions to be authenticated through an individual’s Aadhaar number. It empowers users to carry out banking transactions using their Aadhaar-linked bank accounts. Whether it’s cash deposits, withdrawals, balance inquiries, or fund transfers, AEPS provides a secure and convenient way for customers to access banking services directly from service points like retail stores, agents, and business establishments.

How Does AEPS Work?

AEPS operates on the Aadhaar number and the associated biometric data of the user. Transactions are carried out through the following simple steps:

Customer Initiates the Transaction: The user provides their Aadhaar number and authenticates the transaction through biometric verification (fingerprint or iris scan).

Bank Authentication: The bank verifies the biometric details with the Aadhaar database to authenticate the transaction.

Transaction Completion: Once authenticated, the transaction is processed, whether it's a withdrawal, deposit, or transfer.

Why AEPS is Important for Businesses?

AEPS has become a popular solution for businesses because it eliminates the need for physical cards and PINs, reducing the risks associated with traditional payment methods. With AEPS, transactions can be made easily and securely using Aadhaar-linked biometric data. The key advantages for businesses are:

Cost-Effective Transactions: AEPS offers lower transaction fees compared to traditional banking systems.

No Need for Physical Infrastructure: AEPS doesn’t require POS machines or card swipes, making it an affordable option for small businesses and service providers.

Secure Transactions: The use of biometric verification ensures secure and fraud-proof payments.

Financial Inclusion: AEPS enables access to banking services in remote areas where traditional banking infrastructure may not be present.

The JustForPay AEPS Registration API

JustForPay is a leading provider of digital payment solutions, and their AEPS Registration API is designed to simplify the AEPS integration process for businesses, financial institutions, and payment service providers. By integrating this API, businesses can offer AEPS services to their customers with minimal effort.

Key Features of the JustForPay AEPS Registration API:

Simple Integration: The API is easy to integrate into any website or application, whether you’re running a small business or a large-scale enterprise.

Secure Biometric Authentication: The API supports biometric authentication for users, ensuring that every transaction is verified securely.

Real-time Transactions: It allows businesses to perform real-time transactions for withdrawals, deposits, balance checks, and transfers.

Wide Bank Coverage: The API supports transactions with all major banks in India, providing broad accessibility for users.

Mobile & Web Compatibility: The API can be seamlessly integrated with both mobile applications and web-based platforms, offering flexibility to businesses.

Easy Registration Process: The AEPS Registration API from JustForPay makes it quick and straightforward for new users to get started with AEPS services.

Benefits of Using the AEPS Registration API from JustForPay

Ease of Access for Customers: Customers can easily perform financial transactions without needing a bank card, PIN, or credit/debit card details.

No Internet Dependency for Transactions: Transactions can be done offline in areas with limited internet connectivity, improving financial inclusion.

Increased Business Reach: By enabling AEPS services, your business can attract more customers from different socio-economic backgrounds, especially in rural or underserved areas.

Faster Transactions: AEPS transactions are quicker than traditional bank transactions, enhancing customer satisfaction and boosting business operations.

Compliance with Regulatory Standards: The JustForPay AEPS API adheres to all regulatory and security standards set by the Indian government, ensuring smooth and compliant transactions.

How to Get Started with AEPS Registration API?

Getting started with the AEPS Registration API from JustForPay is simple:

Sign Up: Visit the JustForPay website and register for an account to access their AEPS API services.

Integration: Once registered, you can access API documentation that guides you through the integration process, whether you are integrating it into a website, app, or POS system.

Complete Registration: Follow the process to complete the registration with the bank(s) supported by the AEPS API. Once completed, you will be ready to begin offering AEPS services to your customers.

Start Transacting: After successful integration and registration, you can start processing AEPS transactions on your platform.

Conclusion

The Aadhaar Enabled Payment System (AEPS) is a game-changer in the world of digital payments, offering a secure, cost-effective, and accessible payment solution for businesses and customers alike. With the AEPS Registration API from JustForPay, integrating AEPS into your business operations has never been easier. By using this API, businesses can offer fast and secure banking services to their customers, increase financial inclusion, and enhance customer satisfaction.

If you're looking to integrate AEPS services into your platform, JustForPay is the perfect partner to simplify the process and ensure a smooth, secure, and compliant payment experience.

#Aadhaar Based Cash Withdrawal A#Aadhaar Enabled Payment System Aeps Registration Api#Aadhaar Enabled Payment System Near Me Api#Aadhaar Enabled Payment System Services Api

0 notes

Text

How Much Does It Cost to Open a Coffee Shop Franchise in India?

India has witnessed a booming coffee culture in recent years, with the rise of coffee franchises like Café Coffee Day, Starbucks, and now more traditional and regional outlets like Kumbakonam Degree Coffee. Starting a coffee shop franchise in India is a lucrative business opportunity, but it is essential to understand the associated costs to make informed decisions.

Key Factors Influencing Coffee Shop Franchise Costs

1.Franchise Fee: One of the most significant upfront costs for opening a coffee shop franchise is the franchise fee. This fee gives the entrepreneur the right to operate under the brand name and access the company’s established operational practices and support. Depending on the brand, franchise fees can vary significantly. For example, established brands like Starbucks can charge crores of rupees for a franchise license, while smaller, regional brands like Kumbakonam Degree Coffee might have much more affordable fees, ranging from ₹5 lakhs to ₹10 lakhs.

2.Location: Another crucial factor is the location of your coffee shop. Prime locations such as high streets, shopping malls, or commercial hubs in metro cities command higher rent compared to smaller towns or less commercial areas. Rent can range from ₹50,000 to ₹2 lakhs per month in tier 1 cities, and it can be significantly lower in tier 2 and tier 3 cities. The right location is essential to ensure footfall, as accessibility, visibility, and proximity to busy areas will drive your business.

3.Interior and Setup: A large chunk of your investment will be allocated to setting up the shop itself. The ambiance and aesthetics are critical for coffee shops, as the environment often dictates how long customers stay and how much they spend. The interior design, furniture, décor, lighting, and branding all come into play. For a decent coffee shop, the interior costs can range from ₹3 lakhs to ₹10 lakhs, depending on the size and concept.

4.Equipment: A coffee shop requires a significant investment in equipment. This includes espresso machines, grinders, refrigerators, blenders, and other kitchen appliances. High-end coffee machines can cost anywhere from ₹1.5 lakhs to ₹4 lakhs. Besides the coffee-making equipment, you’ll need tables, chairs, and a point-of-sale (POS) system. Overall, the equipment cost can total anywhere from ₹3 lakhs to ₹8 lakhs.

5.Initial Inventory: Stocking up on raw materials like coffee beans, milk, sugar, cups, and other consumables is a must. For a small coffee shop, the initial inventory can cost around ₹50,000 to ₹2 lakhs. Brands like Kumbakonam Degree Coffee, which specialize in authentic filter coffee, will require a regular supply of high-quality coffee beans, often sourced from specific regions.

6.Staffing: Depending on the size and location of the coffee shop, you will need to hire staff. Salaries for baristas, servers, and other staff members can range from ₹8,000 to ₹15,000 per month for each employee. For a mid-sized shop, having 4 to 5 employees is typical, which means staffing costs will account for around ₹40,000 to ₹1 lakh monthly.

Kumbakonam Degree Coffee Franchise

Kumbakonam Degree Coffee has gained significant popularity as it taps into the cultural and traditional roots of South Indian coffee drinking. Opening a Kumbakonam Degree Coffee franchise is a more affordable option compared to international brands. The initial investment for this franchise is around ₹10 lakhs, which includes the franchise fee, setup costs, and equipment. The brand has a strong appeal due to its authenticity, and it is particularly popular in South India. Entrepreneurs interested in a regional brand with a rich heritage find Kumbakonam Degree Coffee to be an excellent choice, especially for areas with a large South Indian population or where there is a demand for high-quality traditional filter coffee.

Conclusion

Opening a coffee shop franchise in India is a rewarding venture, but it requires careful planning and investment. Costs vary depending on the brand, location, and scale of the shop. While larger franchises require hefty investments, brands like Kumbakonam Degree Coffee offer more accessible options for entrepreneurs looking to bring authentic coffee experiences to their customers. Depending on your budget and location, a coffee shop franchise can be started with an investment ranging from ₹8 lakhs to ₹12 lakhs or more, ensuring profitability in the ever-growing coffee culture of India.

#kumbakonam degree coffee#coffee shop franchise#coffee shop franchise in kerala#cafe franchise in india#coffee shop

0 notes

Text

Why Fintech Companies in India are Revolutionizing the Financial Device Industry

India's financial landscape is undergoing a major transformation, and at the heart of this change are fintech companies. These firms are disrupting the traditional ways of handling money and payment processes, and one of the most influential areas is the manufacturing of financial devices. Point-of-Sale (POS) machines, biometric systems, and other such devices are now integral to daily transactions. But what makes Fintech company in India stand out is their innovation, adaptability, and the role they play in empowering millions across the country.

Growing Demand for Financial Devices in India

India has been rapidly adopting digital payment solutions, driven by both government initiatives and consumer demand. According to recent research, the digital payments industry in India is expected to grow at a CAGR of 20.2%, reaching over USD 500 billion by 2025. The surge in demand for POS machines, particularly in tier-2 and tier-3 cities, shows how fintech companies are crucial in bridging the gap between traditional banking systems and modern, cashless transactions.