#physicalretail

Explore tagged Tumblr posts

Text

Jeff Bezos Sells $2B of Amazon Stock: What It Means for the Company's Future #advertising #Amazonrevenue #Amazonstock #Amazonstockprice #Amazonsoutstandingshares #CloudComputing #companysperformance #diversificationefforts. #Ecommerce #fundamentals #growth #investorsentiment #JeffBezos #marketperceptions #netsales #pandemic #philanthropiccauses #physicalretail #prearrangedtradingplan #stakeinthecompany

#Business#advertising#Amazonrevenue#Amazonstock#Amazonstockprice#Amazonsoutstandingshares#CloudComputing#companysperformance#diversificationefforts.#Ecommerce#fundamentals#growth#investorsentiment#JeffBezos#marketperceptions#netsales#pandemic#philanthropiccauses#physicalretail#prearrangedtradingplan#stakeinthecompany

0 notes

Text

The Retail Battleground: Brick-and-Mortar vs. E-commerce and the Rise of Instant Delivery

Written By: Gargi Sarma

Introduction:

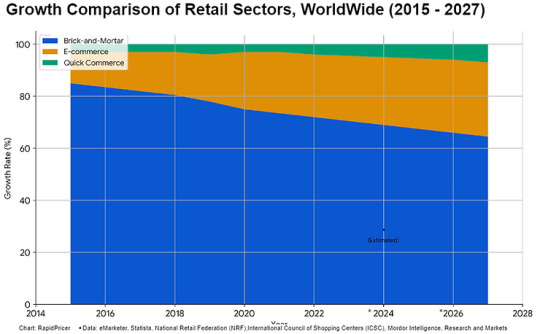

Figure 1: Growth Comparison of Retail Sectors, WorldWide (2015 - 2027)

Global Views on Brick-and-Mortar, E-commerce, and Quick Commerce

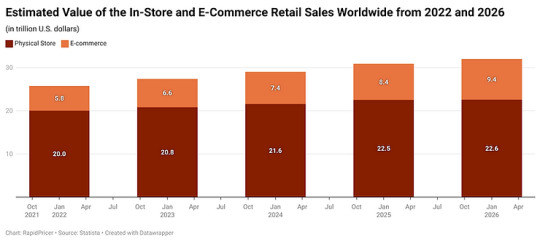

Figure 2: Estimated Value of the In-Store and E-Commerce Retail Sales Worldwide from 2022 and 2026

Remarkably, brick-and-mortar sales growth outpaced e-commerce growth for the first time in 2021 (Forbes, 2022). This demonstrates how much customers still want the in-person purchasing experience. But physical establishments run the risk of slipping behind if they don't adjust to the internet world, including by providing click-and-collect options.

In recent years, e-commerce has grown at an exponential rate. Global e-retail sales are predicted by Statista to reach USD 6.5 trillion by 2023, making up more than 22% of all retail sales. In emerging nations like India, where smartphone usage and internet penetration are rising quickly, this trend is especially noticeable.

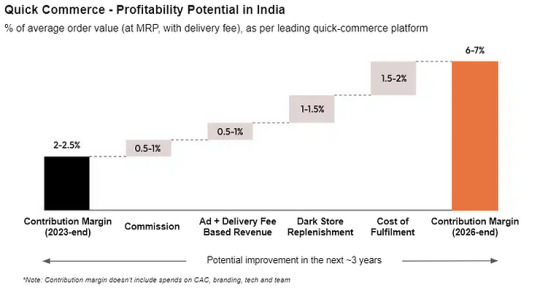

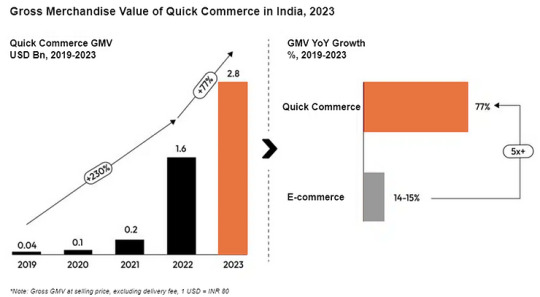

Instant Delivery: A Revolution in Retail

Figure 4: GMV of Quick Commerce in India, 2023 (Source: Redseer) According to Redseer, by 2025, the rapid commerce market in India is expected to grow at a rate of 10-15 times faster than any other market, with a valuation of almost $5.5 billion. This will put it ahead of other markets, including China, in terms of the adoption of quick commerce.

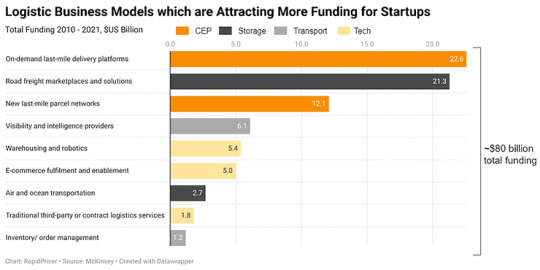

Shifting Logistics and Delivery Investment Dynamics

Figure 5: Logistic Business Models Which are Attracting More Funding for Startups

Conclusion:

Businesses need to be competitive as the retail industry changes and adjusts to shifting consumer tastes and technological improvements. Although e-commerce and rapid delivery services have unheard-of development prospects, these business models' viability depends on tackling regional obstacles and making investments in creative solutions. Retailers may prosper in a world that is becoming more digitally and globally integrated by embracing innovation and comprehending the distinctive dynamics of various markets.

About RapidPricer

RapidPricer helps automate pricing and promotions for retailers. The company has capabilities in retail pricing, artificial intelligence and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

LinkedIn: https://www.linkedin.com/company/rapidpricer/

Email: [email protected]

#retailtrends hashtag#ecommerce hashtag#brickandmortar hashtag#instantdelivery hashtag#logistics hashtag#retailinnovation hashtag#retailtech hashtag#digitaltransformation hashtag#consumerbehavior hashtag#globalretail hashtag#marketinsights hashtag#retailindustry hashtag#futureofshopping hashtag#onlineretail hashtag#physicalretail hashtag#supplychain hashtag#techinretail hashtag#retailinvestment hashtag#retailers hashtag#startupinvestment hashtag#retailanalytics hashtag#digitalretail hashtag#shoppingtrends hashtag#retailstrategy hashtag#retailevolution hashtag#economictrends hashtag#retailsolutions hashtag#retailoptimization

0 notes

Text

Tweeted

Participants needed for online survey! Topic: "Impact of purpose of data collection on willingness to visit retailer" https://t.co/J4NRbngpOt via @SurveyCircle #HSGStGallen #privacy #DataCollection #PhysicalRetailer #marketing #instore #data https://t.co/gV3HVM1UYe

— Daily Research @SurveyCircle (@daily_research) Apr 26, 2023

0 notes

Photo

The new baby #AMAROGuideShop Oscar Freire! Sooo happy! Thank you amazing team! Less than 2 months we renovated an old building and delivered a gift to the Jardins area #oscarfreire #amaroguideshop #guideshop #retail #physicalretail #newstore #newconcept (em Rua Oscar Freire - São Paulo)

1 note

·

View note

Text

The 2018 Local SEO Forecast: 9 Predictions According to Mozzers

Posted by MiriamEllis

It’s February, and we’ve all dipped our toes into the shallow end of the 2018 pool. Today, let’s dive into the deeper waters of the year ahead, with local search marketing predictions from Moz’s Local SEO Subject Matter Expert, our Marketing Scientist, and our SEO & Content Architect. Miriam Ellis, Dr. Peter J. Myers, and Britney Muller weigh in on what your brand should prepare for in the coming months in local.

WOMM, core SEO knowledge, and advice for brands both large and small

Miriam Ellis, Moz Associate & Local SEO SME

LSAs will highlight the value of Google-independence

Word-of-mouth marketing (WOMM) and loyalty initiatives will become increasingly critical to service area business whose results are disrupted by Google’s Local Service Ads. SABs aren’t going to love having to “rent back” their customers from Google, so Google-independent lead channels will have enhanced value. That being said, the first small case study I’ve seen indicates that LSAs may be a winner over traditional Adwords in terms of cost and conversions.

Content will be the omni-channel answer

Content will grow in value, as it is the answer to everything coming our way: voice search, Google Posts, Google Questions & Answers, owner responses, and every stage of the sales funnel. Because of this, agencies which have formerly thought of themselves as strictly local SEO consultants will need to master the fundamentals of organic keyword research and link building, as well as structured data, to offer expert-level advice in the omni-channel environment. Increasingly, clients will need to become “the answer” to queries… and that answer will predominantly reside in content dev.

Retail may downsize but must remain physical

Retail is being turned on its head, with Amazon becoming the “everything store” and the triumphant return of old-school home delivery. Large brands failing to see profits in this new environment will increasingly downsize to the showroom scenario, significantly cutting costs, while also possibly growing sales as personally assisted consumers are dissuaded from store-and-cart abandonment, and upsold on tie-ins. Whether this will be an ultimate solution for shaky brands, I can’t say, but it matters to the local SEO industry because showrooms are, at least, physical locations and therefore eligible for all of the goodies of our traditional campaigns.

SMBs will hold the quality high card

For smaller local brands, emphasis on quality will be the most critical factor. Go for the customers who care about specific attributes (e.g. being truly local, made in the USA, handcrafted, luxury, green, superior value, etc.). Evaluating and perfecting every point of contact with the customer (from how phone calls are assisted, to how online local business data is managed, to who asks for and responds to reviews) matters tremendously. This past year, I’ve watched a taxi driver launch a delivery business on the side, grow to the point where he quit driving a cab, hire additional drivers, and rack up a profusion of 5-star, unbelievably positive reviews, all because his style of customer service is memorably awesome. Small local brands will have the nimbleness and hometown know-how to succeed when quality is what is being sold.

In-pack ads, in-SERP features, and direct-to-website traffic

Dr. Peter J. Meyers, Marketing Scientist at Moz

In-pack ads to increase

Google will get more aggressive about direct local advertising, and in-pack ads will expand. In 2018, I expect local pack ads will not only appear on more queries but will make the leap to desktop SERPs and possibly Google Home.

In-SERP features to grow

Targeted, local SERP features will also expand. Local Service Ads rolled out to more services and cities in 2017, and Google isn’t going to stop there. They’ve shown a clear willingness to create specialized content for both organic and local. For example, 2017 saw Google launch a custom travel portal and jobs portal on the “organic” side, and this trend is accelerating.

Direct-to-website traffic to decline

The push to keep local search traffic in Google properties (i.e. Maps) will continue. Over the past couple of years, we’ve seen local packs go from results that link directly to websites, to having a separate “Website” link to local sites being buried 1–2 layers deep. In some cases, local sites are being almost completely supplanted by local Knowledge Panels, some of which (hotels being a good example) have incredibly rich feature sets. Google wants to deliver local data directly on Google, and direct traffic to local sites from search will continue to decline.

Real-world data and the importance of Google

Britney Muller, SEO & Content Architect at Moz

Relevance drawn from the real world

Real-world data! Google will leverage device and credit card data to get more accurate information on things like foot traffic, current gas prices, repeat customers, length of visits, gender-neutral bathrooms, type of customers, etc. As the most accurate source of business information to date, why wouldn’t they?

Google as one-stop shop

SERPs and Maps (assisted by local business listings) will continue to grow as a one-stop-shop for local business information. Small business websites will still be important, but are more likely to serve as a data source as opposed to the only place to get their business information, in addition to more in-depth data like the above.

Google as friend or foe? Looking at these expert predictions, that’s a question local businesses of all sizes will need to continue to ask in 2018. Perhaps the best answer is “neither.” Google represents opportunity for brands that know how to play the game well. Companies that put the consumer first are likely to stand strong, no matter how the nuances of digital marketing shift, and education will remain the key to mastery in the year ahead.

What do you think? Any hunches about the year ahead? Let us know in the comments.

Sign up for The Moz Top 10, a semimonthly mailer updating you on the top ten hottest pieces of SEO news, tips, and rad links uncovered by the Moz team. Think of it as your exclusive digest of stuff you don’t have time to hunt down but want to read!

0 notes

Text

The 2018 Local SEO Forecast: 9 Predictions According to Mozzers

Posted by MiriamEllis

It's February, and we've all dipped our toes into the shallow end of the 2018 pool. Today, let's dive into the deeper waters of the year ahead, with local search marketing predictions from Moz's Local SEO Subject Matter Expert, our Marketing Scientist, and our SEO & Content Architect. Miriam Ellis, Dr. Peter J. Myers, and Britney Muller weigh in on what your brand should prepare for in the coming months in local.

WOMM, core SEO knowledge, and advice for brands both large and small

Miriam Ellis, Moz Associate & Local SEO SME

LSAs will highlight the value of Google-independence

Word-of-mouth marketing (WOMM) and loyalty initiatives will become increasingly critical to service area business whose results are disrupted by Google’s Local Service Ads. SABs aren’t going to love having to “rent back” their customers from Google, so Google-independent lead channels will have enhanced value. That being said, the first small case study I’ve seen indicates that LSAs may be a winner over traditional Adwords in terms of cost and conversions.

Content will be the omni-channel answer

Content will grow in value, as it is the answer to everything coming our way: voice search, Google Posts, Google Questions & Answers, owner responses, and every stage of the sales funnel. Because of this, agencies which have formerly thought of themselves as strictly local SEO consultants will need to master the fundamentals of organic keyword research and link building, as well as structured data, to offer expert-level advice in the omni-channel environment. Increasingly, clients will need to become “the answer” to queries… and that answer will predominantly reside in content dev.

Retail may downsize but must remain physical

Retail is being turned on its head, with Amazon becoming the “everything store” and the triumphant return of old-school home delivery. Large brands failing to see profits in this new environment will increasingly downsize to the showroom scenario, significantly cutting costs, while also possibly growing sales as personally assisted consumers are dissuaded from store-and-cart abandonment, and upsold on tie-ins. Whether this will be an ultimate solution for shaky brands, I can’t say, but it matters to the local SEO industry because showrooms are, at least, physical locations and therefore eligible for all of the goodies of our traditional campaigns.

SMBs will hold the quality high card

For smaller local brands, emphasis on quality will be the most critical factor. Go for the customers who care about specific attributes (e.g. being truly local, made in the USA, handcrafted, luxury, green, superior value, etc.). Evaluating and perfecting every point of contact with the customer (from how phone calls are assisted, to how online local business data is managed, to who asks for and responds to reviews) matters tremendously. This past year, I’ve watched a taxi driver launch a delivery business on the side, grow to the point where he quit driving a cab, hire additional drivers, and rack up a profusion of 5-star, unbelievably positive reviews, all because his style of customer service is memorably awesome. Small local brands will have the nimbleness and hometown know-how to succeed when quality is what is being sold.

In-pack ads, in-SERP features, and direct-to-website traffic

Dr. Peter J. Meyers, Marketing Scientist at Moz

In-pack ads to increase

Google will get more aggressive about direct local advertising, and in-pack ads will expand. In 2018, I expect local pack ads will not only appear on more queries but will make the leap to desktop SERPs and possibly Google Home.

In-SERP features to grow

Targeted, local SERP features will also expand. Local Service Ads rolled out to more services and cities in 2017, and Google isn’t going to stop there. They’ve shown a clear willingness to create specialized content for both organic and local. For example, 2017 saw Google launch a custom travel portal and jobs portal on the “organic” side, and this trend is accelerating.

Direct-to-website traffic to decline

The push to keep local search traffic in Google properties (i.e. Maps) will continue. Over the past couple of years, we’ve seen local packs go from results that link directly to websites, to having a separate “Website” link to local sites being buried 1–2 layers deep. In some cases, local sites are being almost completely supplanted by local Knowledge Panels, some of which (hotels being a good example) have incredibly rich feature sets. Google wants to deliver local data directly on Google, and direct traffic to local sites from search will continue to decline.

Real-world data and the importance of Google

Britney Muller, SEO & Content Architect at Moz

Relevance drawn from the real world

Real-world data! Google will leverage device and credit card data to get more accurate information on things like foot traffic, current gas prices, repeat customers, length of visits, gender-neutral bathrooms, type of customers, etc. As the most accurate source of business information to date, why wouldn’t they?

Google as one-stop shop

SERPs and Maps (assisted by local business listings) will continue to grow as a one-stop-shop for local business information. Small business websites will still be important, but are more likely to serve as a data source as opposed to the only place to get their business information, in addition to more in-depth data like the above.

Google as friend or foe? Looking at these expert predictions, that's a question local businesses of all sizes will need to continue to ask in 2018. Perhaps the best answer is "neither." Google represents opportunity for brands that know how to play the game well. Companies that put the consumer first are likely to stand strong, no matter how the nuances of digital marketing shift, and education will remain the key to mastery in the year ahead.

What do you think? Any hunches about the year ahead? Let us know in the comments.

Sign up for The Moz Top 10, a semimonthly mailer updating you on the top ten hottest pieces of SEO news, tips, and rad links uncovered by the Moz team. Think of it as your exclusive digest of stuff you don't have time to hunt down but want to read!

from http://dentistry01.blogspot.com/2018/02/the-2018-local-seo-forecast-9.html

0 notes

Photo

Yay! One more 🏆 Obrigada @ecommerce_br @viviannevilela . . . #AMAROfashion #ecommerce #ecommercebrasil #AMAROGuideShop #guideshop #grateful #PhysicalRetail #retail #fashion #moda #modafeminina #varejo #omnichannel #offline #online (em Centrosul - Centro de Convenções de Florianópolis)

#retail#varejo#physicalretail#omnichannel#ecommerce#amarofashion#grateful#amaroguideshop#ecommercebrasil#offline#moda#online#modafeminina#fashion#guideshop

0 notes