#pharmaceuticalretail

Explore tagged Tumblr posts

Text

FUTURE MARKET TRENDS FOR PHARMACY RETAIL IN MEXICO

Mexico has a sizable and growing middle class, a business-friendly environment, increasing demand for healthcare services, and relatively expensive prescription pricing. The huge and expanding middle class, a conducive business climate, a rise in the demand for pharmaceutical products and healthcare services, and more quality certifications are all factors that have contributed to the expansion of the Mexican pharmaceutical market.

With a projected value of over $7 billion in 2020, Mexico will have the second-largest pharmaceutical market in Latin America behind Brazil. Antibiotics account for more than half of the industry's production in the nation, while other goods including analgesics and antiparasitics are also produced there.

Market Trends in Mexico's Pharmaceutical Retail Sector

There are a number of significant developments that may be seen in the Mexican pharmaceutical retail industry's current market trends. First, with rising expenditures in e-commerce platforms and online ordering systems, pharmacists' online presence has significantly risen. Additionally, the use of telemedicine services and other digital health solutions is expanding and provides easy access to healthcare. Additionally, there is a growing emphasis on health and well-being, which has increased the range of products available beyond conventional pharmaceuticals. Additionally gaining popularity are pharmacogenomics, digital marketing tactics, and personalised medicine. Finally, the importance of sustainability and eco-friendly practices is rising, with pharmacists launching programmes to cut waste and encourage green behaviour. These market trends are a reflection of the industry's dynamic nature, as well as how it has adapted to changing consumer needs and technology developments.

Comparison of Mexico with other countries in regard to the pharmaceutical industry

Thailand

Figure 1:

Segmentation of the Thai Pharmacy Retail Market

Organised and Unorganised Segment: Pharmacy stores in Thailand were led by the unorganised segment in terms of revenue in 2019 according to market structure (organised and unorganised segment). It competes in the OTC, generic, and health supplement markets and often does not offer home delivery services. On the other side, the organised sector has developed a strong presence throughout all of Thailand, which has led to increased customer traffic at these stores. Additionally, well-organized chains have mobile applications, a strong presence, more extensive product listings, and home delivery services. They also have a better brand value.

Product Categories (Medical Equipment, OTC, Prescription Drugs, and Non-Pharmaceutical Products): Due to the greater price and margins associated with prescription medications, they dominated the market in terms of revenue in 2019. OTC & Non-Pharmaceutical items were continually expanding in terms of revenue share among the other product groups. The least amount of money was generated by medical equipment.

Drug type (including generic and patented): Generic drugs dominated Thailand's pharmaceutical market in terms of revenue due to the country's large volume of patient consumption and expanding public healthcare programmes. On the other hand, patented medications are condition-specific.

India

SPER Market Research claims that a substantial shift in customer behaviour has led to the emergence of the India Online and Offline Pharmacy Retail Market. They have been successful in making shopping from the comfort of home simple. The question is, does this spell the death of traditional brick-and-mortar pharmacies? No, it seems like this is a fanciful world. For more than 20 years, the concept of internet pharmacies and the sale of medicines online has been rather vague. After the first two years of the epidemic, online pharmacies swiftly gained popularity, although they still can't completely replace offline/physical pharmacies. A substantial shift in consumer behaviour has resulted in the emergence of a potential market for e-pharmacies. They have been successful in making shopping from the comfort of home simple. The question is, does this spell the death of traditional brick-and-mortar pharmacies? No, it seems like this is a fanciful world. For more than 20 years, the concept of internet pharmacies and the sale of medications online has been rather murky. After the first two years of the epidemic, online pharmacies swiftly gained popularity, although they still can't completely replace offline/physical pharmacies.

Figure 2:

Telemedicine: During the pandemic, telemedicine accounted for 30% of all patient visits, with consumers transacting on digital health platforms increasing threefold. The domestic telemedicine market is expected to grow steadily in the coming years, reaching $5.5 billion by 2025, up from $830 million in 2019.

Online consultations: According to Praxis Global Alliance, the pandemic-induced lockdown created a huge demand for teleconsultation, with the market reaching $163 million in March 2021. The online doctor consultation market is expected to be worth more than $800 million by FY2024, with a 72% CAGR.

E-pharmacies: Several e-pharmacies are gaining traction in terms of customer traffic. For example, Tata 1 MG's traffic increased to 150 million unique customers in FY20, up from 90 million in FY20. According to the industry body FICCI, e-pharmacies in India will serve 70 million households by FY2025 as internet adoption and digital awareness rise.

Digital therapeutics: The next big thing in the health-tech industry is Digital therapeutics, delivering medical interventions directly to patients via evidence-based, clinically evaluated software to treat, manage, and prevent a wide range of diseases and disorders, including diabetes and obesity prevention. The increasing use of smartphones, tablets, and healthcare apps, as well as the rise in chronic diseases, are expected to drive the growth of the digital therapeutics market.

Smart wearables: People with chronic conditions, fitness enthusiasts, and tech-savvy youth have embraced smart wearables such as fitness trackers, smartwatches connected to smartphones, and medical-grade products such as heart patches to regularly monitor their health and fitness. Smart wearables come in handy for patients to track health parameters such as heart rate, blood pressure, physical activity, and sleep, with a doctor-to-patient ratio of 1:1456 versus the WHO recommendation of 1:1000. India is the world's third-largest wearable device consumer. a few weeks before the presidential election. a few weeks before the elections. a few days before the elections. Smart wearables are no longer a passing fad; they are here to stay.

Applications: Apps that drive tracking, monitoring, and notifications are also seeing an increase in the health-tech market as a result of changing lifestyles, demand for personalized care, and increased mobile internet usage.

Data: Among all trends, 'data' is undoubtedly the most important. All other growth factors are being driven by and will continue to be driven by, this trend. The future envisions a world in which healthcare models and interventions are supported by data and insights. Long-term longitudinal data, for example, can improve the response management capabilities of wearable devices. It will also aid in reducing human error while monitoring patients. Robotics, machine learning, artificial intelligence, and blockchain, which all rely on data, will change the future of healthcare, allowing providers to provide timely and efficient care.

Vietnam

In 2021, the Vietnam Pharmacy Retail market had a value of USD 7.45 billion, and during the forecast period, it is anticipated to grow at a CAGR of 6%. The main ones include the ageing Vietnamese population, the entry of retail corporations into the pharmacy sector, and the rising demand for retail chains of contemporary pharmacies. Additionally, as different ailments are becoming more prevalent, there is a greater need for pharmacies and other locations where people can get medications. This is thus anticipated to boost the expansion of Vietnam's retail pharmacy market. Market participants in Vietnam have launched a number of activities to spread knowledge about illnesses and their treatments as well as details on the presence of cutting-edge medical equipment and methods in hospitals.

Ageing of the population: Vietnam has reportedly started to age gradually, according to the Ministry of Health. In 2014, there were 10.2% more people over the age of 60 than there were in 1989 (7.1%). The United Nations predicts that in Vietnam, the population over 65 would nearly quadruple by 2040. These elements support the expansion of the retail pharmacy business.

Retail businesses entering the pharmacy: The participation of retail behemoths, rapid economic expansion, increased per capita income, an increase in the urban population, etc. are all contributing to the pharmacy retail market's rise. For instance, after purchasing the Long Chau pharmaceutical chain in 2017, FPT Retail rebranded it as the FPT Long Chau Pharma Joint Stock Company and opened a large number of additional stores in Vietnam. Similar to how the Gioi Di Dong grew into the pharmaceutical industry by acquiring the Phuc An Khang drugstore chain, they too took advantage of their experience operating retail chains. This then stimulated the retail pharmacy market in Vietnam.

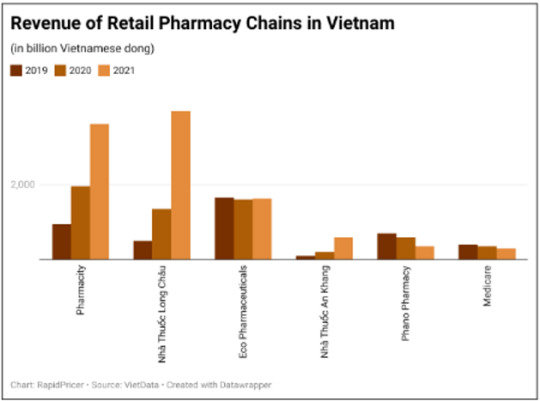

Figure 3:

In terms of the number of locations, Pharmacity is currently the largest pharmacy chain in Vietnam. However the pharmacy company eventually lost its top spot in sales and earnings. In particular, Pharmacity, a chain of pharmacies, only made around VND3.6 trillion in revenue in 2021, which is about VND350 billion less than Long Chau Pharmacy. Additionally, Pharmacity has consistently posted losses in recent years. In particular, this pharmacy lost more than 360 billion VND in after-tax earnings in 2021. Pharmacity's desire to rule the market is based on its dominant position and sizable financial cushion, which are backed not just by SK Group but also by Mekong Capital and TR Capital. Pharmacity is prepared to exchange profits for market share because of this.

The benefit of Long Chau is that it has 6-7 times more SKUs (the number of pharmaceuticals in stock) than other pharmacies, which helps the store's sales dominate the industry. Accordingly, by the end of 2021, the Long Chau chain's sales were close to VND 4 trillion, up 3.3 times from 2020. This will enable Long Chau to turn a modest profit and take the top spot in the retail pharmacy chain market with a 45% market share.

The direction in which these companies will compete to increase their market share is unclear. However, in a competitive market like the one we currently find ourselves in, only companies with a sensible company plan, competent technology application, cost optimisation, systematic managerial abilities, and most importantly, only must have a sound financial base, can win.

The Pharmaceutical Retail Scenario in Mexico

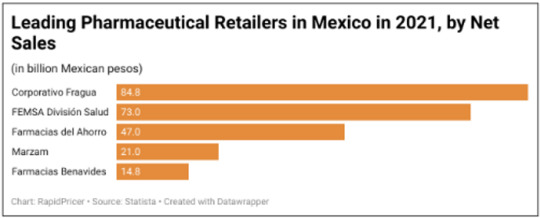

Figure 4:

In Figure 4, Corporativo Fragua has the largest net sales value of any pharmacy in Mexico in 2021, reaching almost 85 billion pesos. Sales of 73.03 billion pesos put FEMSA division health in second place that year. Around 11 billion dollars worth of pharmaceutical items had already been sold in Mexico at that point.

Retail Channels for OTC, Pharma, and Derma-Cosmetic Products in Mexico:

The retail market for OTC, pharmaceuticals, and cosmetics in Mexico is divided into three categories: chain pharmacies, independent pharmacies, and supermarket pharmacies.

With 65% of the sales of consumer health and pharmaceutical products in this area, pharmacy chains hold the largest sales share in terms of value.

Independent pharmacies, which are made up of small and medium-sized businesses, account for 19.5% of total sales.

With a 14,5% market share, supermarket chains mostly sell OTC, Rx, vitamins, supplements, beauty goods, and other items for personal care.

Figure 5:

Online markets like Mercado Libre, Amazon, and Linio provide additional shopping outlets for OTC and healthcare products. Additionally, some of the drugstore and grocery companies offer home delivery services through convenience stores like Oxxo, 7-Eleven, and Circle K as well as delivery services like Rappi.

Top 5 Mexican Pharmacy Chains: The largest drugstore chain businesses in Mexico are as follows-

Farmacias Similares

Farmacias del Ahorro

Farmacias Guadalajara

Farmacias San Pablo

Farmacias Benavides

Figure 6:

About 30% of the country's physical establishments that sell prescription drugs and self-medication are owned by pharmacy chains.

Pricing in Pharmaceutical Retail in Mexico

Numerous factors may have an impact on the cost of medications in Mexico. The following are some significant elements relating to price in Mexican pharmacies:

Government Control: The Mexican government has a big say in how much drugs cost. To maintain the accessibility and affordability of necessary pharmaceuticals, the Federal Commission for the Protection against Sanitary Risk (COFEPRIS) oversees the pharmaceutical business and establishes standards for drug pricing.

Reference Pricing: The "Maximum Price to the Public" (Precio Máximo al Pblico, or PMPM) is the name of Mexico's reference pricing system. In this system, the government sets a maximum price for a certain class of medications, and all producers and merchants are required to abide by this price. The PMPM, which strives to control the cost of medications, is calculated by comparing the costs of comparable drugs in other nations.

Generic drugs and patent protection: Patent protection may affect drug prices. When a drug's patent runs out, generic equivalents may be released on the market, usually resulting in less expensive substitutes. In Mexico, generic medications are frequently less expensive than their brand-name equivalents, saving customers money.

Market Competition: The degree of rivalry between drugstores might affect prices. In places with a high concentration of pharmacies, competition may result in lower pricing as businesses compete for clients. Prices, however, could be higher in places with few options since there is less competition.

Discounts and promotions: To draw clients, Mexican pharmacies frequently provide discounts and promotions. These may include rewards programmes, discounts for large purchases, or cost savings on particular prescriptions. Pharmacies frequently promote special offers or discounts on well-known drugs.

International Trade Accords: The United States, Mexico, and Canada Agreement (USMCA) and accords between Mexico and the European Union may have an impact on the price of pharmaceuticals. These agreements may have an impact on the accessibility, cost, and availability of specific pharmaceuticals in the Mexican market.

Value-Added Tax (VAT): The value-added tax (VAT) for medicines in Mexico is 16%. The final retail price of pharmaceutical products is subject to this tax, which may affect the overall cost to customers.

Additionally, variables like supply, demand, and production costs may affect the precise pricing dynamics for a certain drug.

Technological Advancements in Pharmaceutical Retail Chains in Mexico

There have been a number of technological developments in Mexico's retail pharmaceutical industry that could have a big impact on healthcare. Here are a few noteworthy developments:

Online Pharmacies: As online pharmacies have grown in popularity in Mexico, people's access to pharmaceuticals has changed. With the help of these platforms, people may buy prescription and over-the-counter pharmaceuticals online and have them delivered right to their homes. Online pharmacies offer convenience, lessen the requirement for actual trips to real pharmacies, and enhance access to pharmaceuticals, particularly for people living in distant places.

Mobile Apps: In the retail of pharmaceuticals, mobile apps have become effective tools. Many pharmacies in Mexico have created their own mobile applications that let consumers obtain prescription drugs, follow the progress of their prescriptions, get reminders to take their meds, and access health information. Additionally, these apps make it easier for consumers to communicate with chemists and ask questions or get advice about their prescriptions.

Electronic Prescription Systems: By introducing electronic prescription systems, Mexico's prescription procedure has become more efficient. Healthcare experts increasingly create electronic prescriptions that are transmitted straight to pharmacies rather than utilising conventional paper prescriptions. This computerised strategy ensures precise drug dispensing, which lowers errors, boosts efficiency and increases patient safety.

Medication Management Systems: In Mexico, technological approaches to medication management are becoming more popular. These programmes often include automated pill dispensers or gadgets that remind people to take their prescribed medications. These gadgets can be set up to dispense medications at predetermined intervals, notify carers or healthcare practitioners in the event that a dose is missed, and send reminders to patients' smartphones.

Health Monitoring Devices: The growing accessibility of wearable health monitoring tools, such as smartwatches and fitness trackers, has created new opportunities for healthcare administration. Vital signs, activity levels, sleep patterns, and other health-related information can be tracked by these devices, giving users and medical experts useful insights. These gadgets' integration with pharmacy software enables the early identification of prospective health problems as well as personalised healthcare advice.

Data analytics and AI: The retail pharmacy industry in Mexico is undergoing a change thanks to the use of data analytics and artificial intelligence (AI). AI systems can find patterns in enormous amounts of data, forecast illness outbreaks, improve drug supply networks, and offer individualised treatment recommendations. AI-driven chatbots and virtual assistants can also help clients identify the proper prescriptions, provide details on drug interactions, and provide general healthcare guidance.

These technology developments in Mexico's pharmaceutical retail industry have the potential to improve patient access to healthcare, increase medication adherence, streamline procedures, and offer individualised treatment.

Factors Impacting the Pharmaceutical Retailers in Mexico:

Several factors are predicted to have an impact on the market trends for drugstores in Mexico. These possible tendencies are:

Digital Transformation: As more people use mobile applications, online pharmacies, and telemedicine services, the pharmaceutical retail industry is anticipated to continue to undergo a digital transformation. With the ability to obtain prescriptions, view healthcare information, and speak with chemists from the comfort of their homes, this trend will increase accessibility and convenience for consumers

Personalised Healthcare: Personalised healthcare is becoming more of a priority in Mexico as a result of technological and data analytics breakthroughs. Retailers of pharmaceuticals may use consumer information, medical monitoring equipment, and AI algorithms to provide individualised suggestions and interventions. Personalised pharmaceutical plans, proactive health monitoring, and lifestyle management initiatives may be involved.

Integration of Services: Drugstores may offer additional services in addition to the distribution of prescription drugs. They could collaborate with other healthcare organisations, including clinics or diagnostic facilities, to provide complete healthcare services all under one roof. Patients' healthcare experiences may be made more convenient by this integration.

Emphasis on Preventive Care: The focus is now more on preventive care than ever before, and Mexico is predicted to follow this trend in the global healthcare industry. Retailers of pharmaceuticals may make investments in programmes that encourage preventative care, such as wellness initiatives, immunisations, and health examinations. In the long term, these initiatives seek to lessen the burden of disease, enhance population health, and reduce healthcare expenses.

Pharmaceutical Supply Chain Optimisation: This will continue to be a major area of focus. To streamline operations, cut waste, and ensure effective drug delivery, retailers may implement cutting-edge inventory management systems, automated dispensing technology, and predictive analytics. This may result in better pharmaceutical accessibility and inventory management.

Patient Education and Involvement: To improve patient involvement and medication adherence, pharmaceutical merchants may make investments in educational programmes and digital platforms. To enable patients to actively participate in managing their health, these initiatives can include medication education programmes, interactive smartphone apps, and medication reminder systems.

Sustainability and social responsibility: The pharmaceutical retail industry is anticipated to be impacted by growing public awareness of environmental sustainability and corporate social responsibility. Retailers may implement environmentally friendly practises including promoting recycling and minimising packaging waste. In order to alleviate healthcare inequities and assist underprivileged populations, they may also take part in social activities. Examples include community health programmes or partnerships with charitable organisations.

These patterns show a movement in healthcare towards the patient, utilising technology and innovation to deliver more individualised and accessible treatments. However, a number of variables, such as legal frameworks, technical developments, and market dynamics in Mexico, will affect how these trends are actually implemented and how far they go.

Conclusion:

In conclusion, digital transformation, price control, and growing emphasis on individualised healthcare are driving significant changes in the Mexican pharmaceutical retail business. To improve accessibility and convenience for clients, pharmaceutical merchants are utilising internet platforms, mobile applications, and telemedicine services. Drug costs are controlled by the government through mechanisms like the Maximum Price to the Public (PMPM), which guarantees the accessibility and affordability of necessary pharmaceuticals. Retailers are increasingly focusing on supply chain optimisation, service integration, and patient education programmes. As relevance grows, so does embracing sustainability and social responsibility. Overall, Mexican drugstores are adjusting to changing consumer preferences to give their clients more individualised, easily accessible, and ethical healthcare options.

About RapidPricer

RapidPricer helps automate pricing, promotions and assortment for retailers. The company has capabilities in retail pricing, artificial intelligence and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

LinkedIn: https://www.linkedin.com/company/rapidpricer/

Email: [email protected]

#pharmacyretailindustry#mexicomarkettrends#futuremarketoutlook#pharmaceuticalretail#consumerhealthcare#retailinnovation#ecommercegrowth#healthandwellness#technologyintegration#regulatorychanges#prescriptionservices#omnichannelretailing#healthsupplements#telemedicineexpansion#personalizedmedicine#supplychainoptimization#demographicsshifts#pharmaceuticalmarketing#dataanalytics#aiandautomation#customerexperience#competitivelandscape#retailpartnerships#otcmedications

0 notes